- What is Eurotrader?

- Eurotrader Pros and Cons

- Is Eurotrader Safe or a Scam?

- Leverage

- Accounts

- Instruments

- Fees

- Spreads

- Deposits and Withdrawals

- Trading Platform

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, regulations and licenses, fees, spreads, platforms, customer service, and placed traders to see trading conditions and give expert opinions about Eurotrader.

What is Eurotrader?

Eurotrader is a Forex and CFD trading broker, offering traders access to a variety of trading instruments, including Forex, CFDs, Cryptos, Indices, Commodities, and Shares.

Based on our research, the broker is headquartered in Cyprus and is regulated and authorized by the reputable European regulatory body CySEC. Additionally, the company possesses a license from the reputable FSCA authority. It also has a presence in Mauritius and Seychelles, being authorized by FSC and FSA respectively. Moreover, the broker holds a top-tier FCA (UK) license, however, the regulatory authority indicates some restrictions on the firm’s financial activities.

In general, the broker offers competitive trading conditions and efficient execution of trades through the advanced MetaTrader trading platforms.

Eurotrader Pros and Cons

Per our findings, the broker presents both pros and cons that are important to consider. On the positive side, Eurotrader offers competitive trading conditions, a low minimum deposit requirement, and access to the well-known MT4 and MT5 trading platforms. Additionally, the firm provides comprehensive learning materials and tutorials, enabling clients to make informed trading decisions.

For the cons, there is no 24/7 customer support available. Also, the brokerage offers a restricted range of financial instruments and markets for traders compared to other Forex trading brokers.

| Advantages | Disadvantages |

|---|

| European license and oversee | No 24/7 customer support |

| FCA regulation | Limited trading products |

| Good trading conditions | |

| Low minimum deposit | |

| Advanced trading platforms | |

| Competitive pricing | |

| Education | |

| Professional trading | |

Eurotrader Review Summary in 10 Points

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation | CySEC, FCA, FSCA, FSC, FSA |

| 🖥 Platforms | MT4, MT5 |

| 📉 Instruments | Forex, CFDs, Cryptos, Indices, Commodities, Shares |

| 💰 EUR/USD Spread | 0.10 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | $50 |

| 💰 Base currencies | EUR, USD, GBP |

| 📚 Education | Provided |

| ☎ Customer Support | 24/5 |

Overall Eurotrader Ranking

According to our analysis, Eurotrader provides reliable trading solutions with competitive pricing, which is an attractive option for all levels of traders. Moreover, the broker offers access to advanced trading platforms that allow users to trade well-known financial products.

- Eurotrader Overall Ranking is 7.8 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry-leading brokers.

| Ranking | Eurotrader | XTrend | Errante |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advanatges | Trading Conditions | Trading Instruments | Trading Fees |

Eurotrader Alternative Brokers

After considering multiple factors such as trading features, regulatory compliance, spreads, trading instruments, and user reviews, we have conducted an analysis and compiled a list of potential broker alternatives to Eurotrader.

Is Eurotrader Safe or Scam?

No, Eurotrader is not a scam. The broker is trustworthy ensuring a low-risk trading environment. It is authorized and regulated by the top-tier FCA in the UK, as well as by the well-regarded Cyprus Securities and Exchange Commission (CySEC) and FSCA in South Africa.

Is Eurotrader Legit?

Yes, Eurotrader is a legit and regulated brokerage firm that holds the necessary licenses and follows regulations for offering Forex trading services. The broker’s compliance with industry standards is assured by its regulation under reputable authorities which ensure compliance with established financial regulations and industry standards.

However, the broker is regulated in offshore zones as well. Therefore, you should conduct your research, including reading user reviews and considering other factors, to assess the broker’s reputation and legitimacy.

See our conclusion on Eurotrader Reliability:

- Our Ranked Eurotrader Trust Score is 7.9 out of 10 for good reputation and services provided. However, we recommended conducting your research, reviewing customer feedback, and considering personal factors before deciding to engage with the broker.

| Eurotrader Strong Points | Eurotrader Weak Points |

|---|

| Investors Compensation Fund (ICF) | Trading via offshore zone |

| Account balance protection | |

| Professional trading environment | |

Customer Trading Protection

According to our findings, Eurotrader adheres to certain industry standards and compliance requirements, which include client fund protection and segregation from company funds. Moreover, the broker offers additional protections, such as negative balance protection, which ensures that clients do not incur losses exceeding their account balance.

However, conduct thorough research and carefully examine the firm’s documentation, legal agreements, and policies. This will provide a comprehensive understanding of the specific trading protections offered by the broker, as trading conditions can vary across jurisdictions.

Eurotrader Leverage

Leverage can be beneficial for traders as it enables them to enter the market with a smaller initial investment. However, they should possess a comprehensive understanding and the associated risks before participating in leveraged trading.

Eurotrader leverage is offered according to CySEC, FCA, FSCA, FSC, and FSA regulations:

- European, South African, and UK traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- International traders may use higher leverage up to 1:1000, so understanding the implications and risks associated with leverage is crucial before making decisions about its use in trading.

Account Types

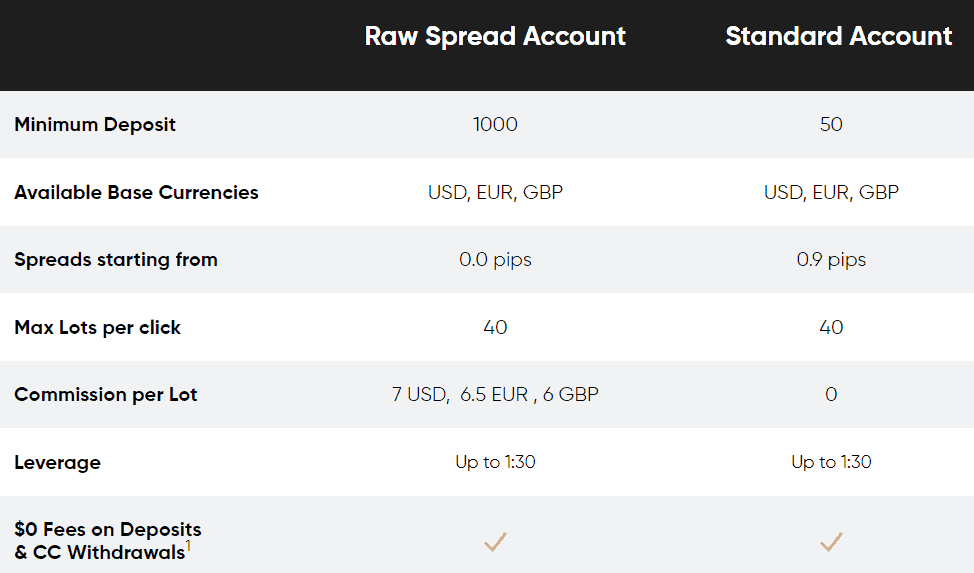

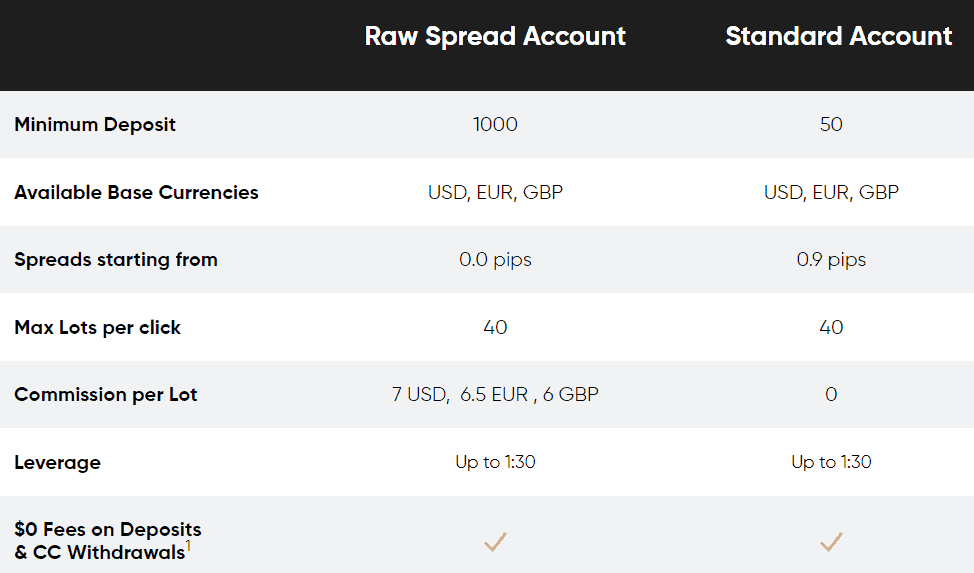

Per our research, the broker offers Raw Spread and Standard Accounts tailored to meet the needs of traders. The initial deposit requirement for a Standard account is $50. Additionally, international entities offer Swap-Free accounts for religious purposes.

| Pros | Cons |

|---|

| Low minimum deposit | None |

| Swap-Free and Demo accounts | |

| Fast and easy account opening | |

Opening Eurotrader Trading Account

Opening an account with a broker is quite an easy process, as you can log in and register with Eurotrader within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Register” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

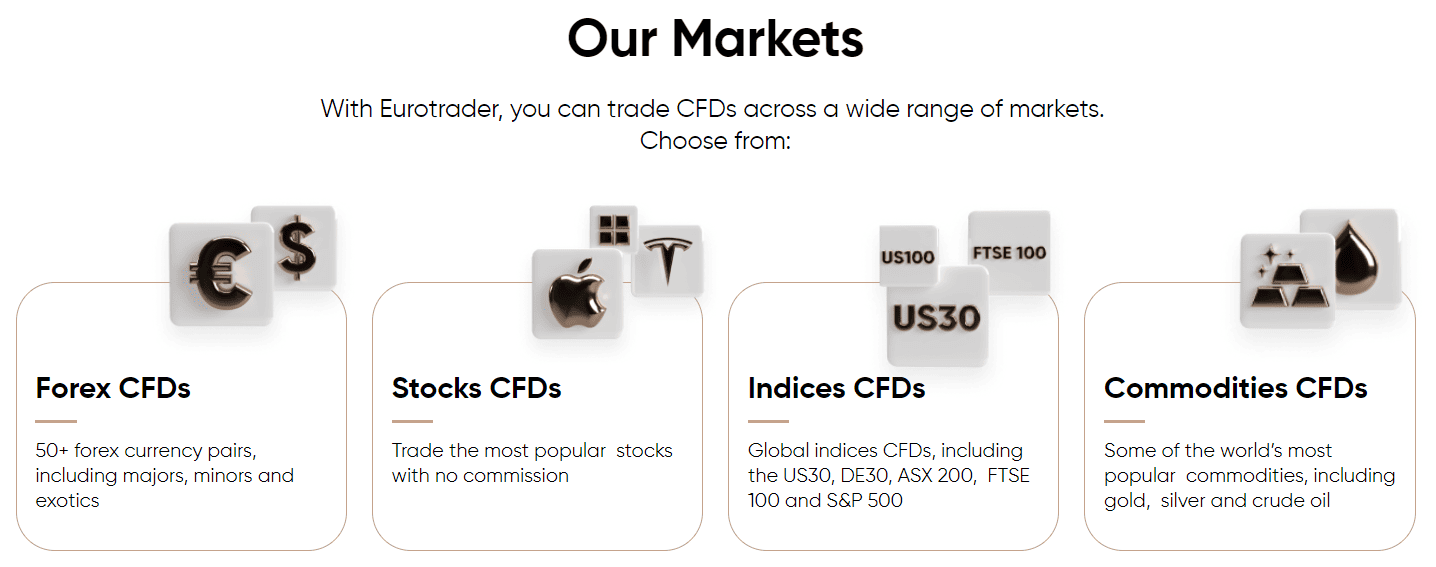

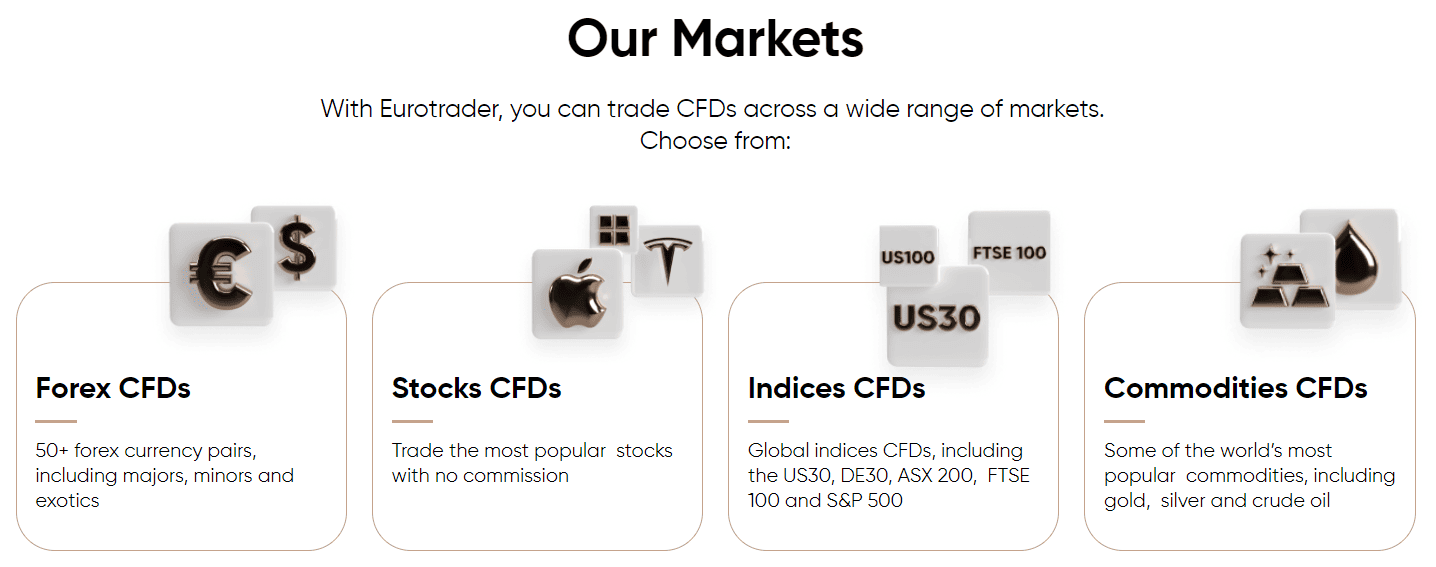

Trading Instruments

Eurotrader provides access to popular trading instruments, such as Forex, CFDs, Cryptos, Indices, Commodities, and Shares. The firm enables traders to diversify their portfolios and participate in various markets according to their individual preferences and trading strategies.

- Eurotrader Markets Range Score is 7.5 out of 10 for popular trading product selections. On the other hand, we found that some popular asset classes are not available to trade.

Eurotrader Fees

After examining the broker’s fee offering, we found that Eurotrader provides competitive pricing for most trading services. The broker does not impose deposit and withdrawal fees, however, additional charges may be applicable during trading activities as well.

So, carefully review the broker’s fee structure and terms and conditions to understand the associated fees and their potential impact on trading operations.

- Eurotrader Fees are ranked low with an overall rating of 8.5 out of 10 based on our testing and compared to over 500 other brokers.

| Fees | Eurotrader Fees | XTrend Fees | Errante Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | Yes | No |

| Inactivity fee | No | No | Yes |

| Fee ranking | Low | Low/Average | Low/Average |

Spreads

Based on our test trade, the broker provides competitive spreads with an average spread of 0.10 pips for the EUR/USD currency pair in the Forex market.

However, spreads can vary based on market conditions, volatility, and liquidity, so consult the broker’s website or contact customer support for detailed information on the spreads they offer for specific instruments and account types.

- Eurotrader Spreads are ranked low or average with an overall rating of 8.5 out of 10 based on our testing comparison to other brokers. We found Forex spread lower than the industry average of 1.2 pips and the spreads for other instruments are competitive too.

| Asset/ Pair | Eurotrader Spread | XTrend Spread | Errante Spread |

|---|

| EUR USD Spread | 0.10 pips | 0.2 pips | 1.5 pips |

| Crude Oil WTI Spread | 0.02 | 0.3 | 1 |

| Gold Spread | 0.15 | 1 | 1 |

Deposits and Withdrawals

Per our research, the broker offers a variety of payment methods for traders to deposit funds into trading accounts including Wire Transfers, Credit/Debit cards, and E-wallets. However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved.

- Eurotrader Funding Methods we ranked good with an overall rating of 8 out of 10. Fees are low, and you can also benefit from various account-based currencies.

Here are some good and negative points for Eurotrader funding methods:

| Advantage | Disadvantage |

|---|

| Fast digital deposits | None |

| Variety of funding methods | |

Eurotrader Minimum Deposit

To open a live trading account with the broker, clients need to deposit $50 as an initial deposit amount for the Standard account type.

Eurotrader minimum deposit vs other brokers

|

Eurotrader |

Most Other Brokers |

| Minimum Deposit |

$50 |

$500 |

Eurotrader Withdrawals

Based on our analysis, the withdrawal process is both convenient and swift. Additionally, the broker does not charge fees for the withdrawal of funds.

Withdraw Money from Eurotrader Step by Step:

To initiate a withdrawal fund from your trading account, the brokerage firm provides a set of typical steps that can be followed:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with the requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

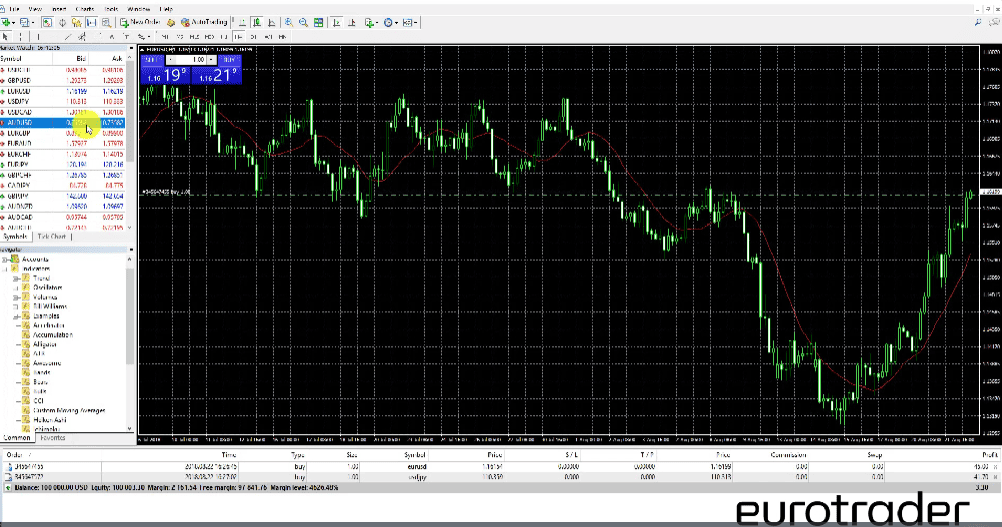

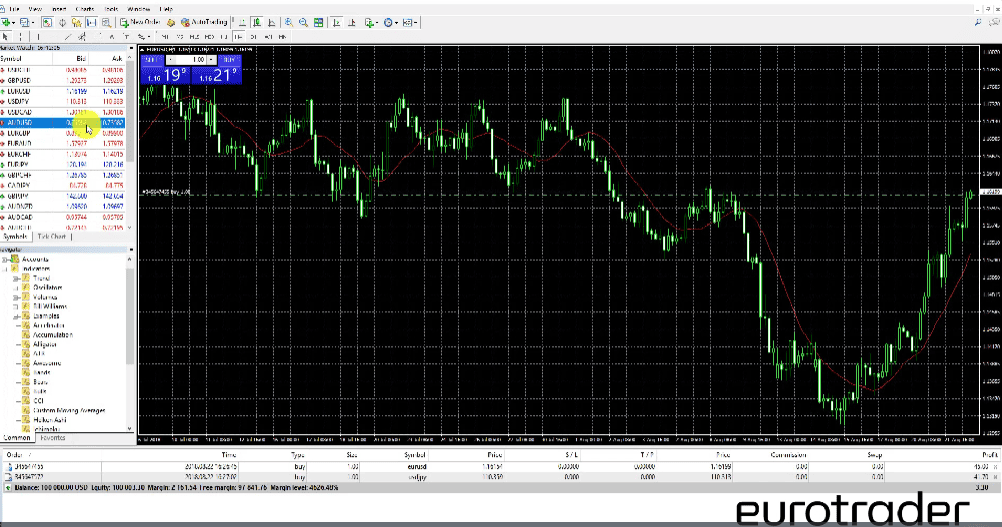

Trading Platforms

At Eurotrader, you can trade through the advanced MT4 and MT5 trading platforms which are known for their strong features, intuitive interface, advanced charting tools, and extensive trading capabilities.

Additionally, they are accessible on desktop, web, and mobile devices, allowing traders to select the option that suits their individual trading preferences and strategies.

- Eurotrader Platform is ranked good with an overall rating of 8.9 out of 10 compared to over 500 other brokers. We mark it as good since it offers advanced trading platforms and mobile apps.

| Platforms | Eurotrader Platforms | XTrend Platforms | Errante Platforms |

|---|

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Trading Tools

We found that the broker provides a variety of advanced charting tools, analytical technologies, trading signals, technical indicators, and other tools which is an advantage to any trader. Moreover, MetaTrader platforms offer automated trading capabilities, empowering traders to detect market movements and improve their market entry and stop-loss strategies.

Customer Support

The broker offers 24/5 customer support via live chat, email, and phone line. Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

- Customer Support in Eurotrader is ranked good with an overall rating of 7.9 out of 10 based on our testing. The support team is responsive during working days, ensuring efficient assistance.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Phone support, email, live chat | No 24/7 customer support |

| Supportive customer service | |

| Quick responses | |

Eurotrader Education

In the end, the broker offers a variety of learning materials such as platform tutorials, video courses, eBooks, an economic calendar, etc. These resources are all designed to enhance the knowledge and skills of traders.

- Eurotrader Education ranked with an overall rating of 8 out of 10 based on our research. We found that the broker offers good learning materials suitable for all levels of users to enhance their trading knowledge.

Eurotrader Review Conclusion

In summary, Eurotrader is a trustworthy Forex trading broker that offers competitive trading conditions, efficient execution, and low trading fees. The broker provides popular MetaTrader trading platforms, which are equipped with advanced features and tools suitable for various levels of traders. Additionally, traders have access to a wide range of educational materials that support them in expanding their knowledge and staying informed about the market.

Overall, we found that the firm provides a good trading environment, however, there are drawbacks as well, such as trading within offshore zones and the absence of 24/7 customer support. Therefore, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

Based on Our findings and Financial Expert Opinions Eurotrader is Good for:

- European traders

- International traders

- Currency trading

- Professional trading

- Swap-Free Trading

- Beginners

- Advanced traders

- Competitive spreads and fees

- Good education and trading tools

- EA/Auto trading

Share this article [addtoany url="https://55brokers.com/eurotrader-review/" title="Eurotrader"]