- What is XTrend?

- XTrend Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- XTrend Compared to Other Brokers

- Full Review of Broker XTrend

Overall Rating 4.2

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.2 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.1 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.3 / 5 |

| Additional Tools and Features | 4 / 5 |

What is XTrend?

XTrend is a Forex and CFD trading company that offers a diverse range of trading instruments across various asset classes, including Forex, CFDs, Commodities, Indices, Shares, Precious Metals, Energies, and Cryptocurrencies.

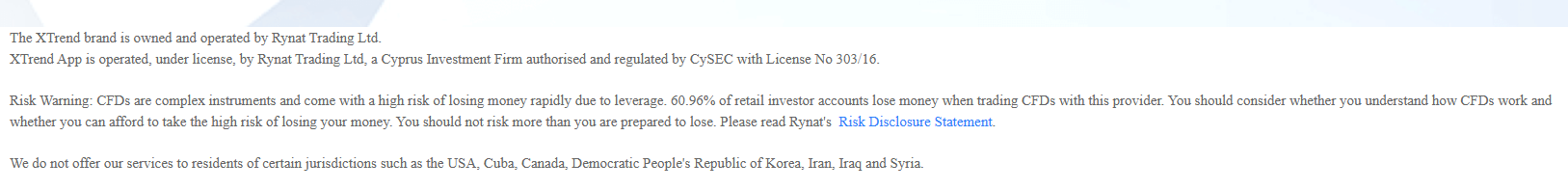

Based on our research, the broker is headquartered in Cyprus and is regulated and authorized by the reputable European regulatory body CySEC. Additionally, the firm has a presence in South Africa and is licensed by the well-known FSCA authority.

Overall, the broker provides competitive trading conditions and a diverse range of trading products through the advanced trading platform.

XTrend Pros and Cons

Per our findings, the firm has both advantages and disadvantages that are important for traders to consider. For the pros, the broker offers a competitive trading environment, a low minimum deposit requirement, as well as access to a range of trading instruments. The firm also provides comprehensive educational materials and resources.

For the cons, there is no 24/7 customer support available. Additionally, the broker lacks a top-tier license, which could be a concern for traders who prioritize brokers with higher regulatory credentials. However, trading under CySEC and FSCA is considered safe enough.

| Advantages | Disadvantages |

|---|

| European license and oversight | No 24/7 customer support |

| Good trading conditions | No demo account |

| Low minimum deposit | No top-tier license |

| Professional trading | |

| Competitive pricing | |

| Learning materials | |

| Trading Instruments | |

XTrend Features

According to our analysis, XTrend provides reliable trading solutions with competitive fees, which is an advantage for all levels of traders. Moreover, the broker’s extensive selection of trading instruments with competitive spreads presents an appealing proposition to traders. Here you can see a list of the main aspects of trading that XTrend offers:

XTrend Features in 10 Points

| 🗺️ Regulation | CySEC, FSCA |

| 🗺️ Account Types | A single account |

| 🖥 Trading Platforms | XTrend PC and Mobile Trading Apps |

| 📉 Trading Instruments | Forex, CFDs, Commodities, Indices, Shares, Precious Metals, Energy, Cryptocurrencies |

| 💳 Minimum deposit | $50 |

| 💰 Average EUR/USD Spread | 0.2 pips |

| 🎮 Demo Account | No |

| 💰 Account Base currencies | EUR, USD, GBP, AUD |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 22/7 |

Who is XTrend For?

Based on our findings, XTrend offers favorable services to traders of different levels and trading expectations. The broker can be good for the following:

- European traders

- Traders from South Africa and the African Region

- Currency trading

- Professional trading

- Investing

- Beginners

- Advanced traders

- Competitive spreads and fees

- Good education and trading tools

XTrend Summary

XTrend is a reliable brokerage firm that provides access to a diverse range of trading instruments across multiple markets. With its competitive trading conditions, efficient execution, and educational resources, the broker aims to provide a well-rounded trading experience.

Overall, we found that the firm provides a safe trading environment and competitive conditions. It allows traders access to an advanced platform, a copy trading feature, and a good education section. However, we advise traders to conduct their research and evaluate whether the broker’s offerings suit their specific trading requirements.

55Brokers Professional Insights

XTrend is a reliable broker that provides regulated services to clients from about 170 countries. The broker has been awarded by influential organizations and publications and recognized as the best mobile broker for two consecutive years. XTrend’s services target different trading levels, from beginners to professionals. As a trading platform, the broker offers XTrend Speed—an advanced mobile platform equipped with analysis capabilities and advanced features. With XTrend, traders have access to Forex pairs, commodities, cryptocurrencies, global indices, and European, US, and HK shares. The broker also offers copy trading as an alternative investment opportunity.

We found the XTrend education section quite comprehensive, providing novice traders with basic and investment knowledge, access to tutorial videos, and a glossary. Besides, traders have access to useful research tools, including the Economic Calendar, trading ideas, charts, and market news.

All in all, XTrend is a trustworthy option to engage in trading. Its CySEC and FSCA licenses ensure adherence to strict laws and guidelines. However, the broker operates two entities, and the conditions can differ.

Consider Trading with XTrend If:

| XTrend is an excellent Broker for: | - Beginner traders

- Advance clients

- Mobile traders

- Copy traders

- CFD and Currency traders

- Novice clients looking for good education

- Investors

- Traders from the African Region

- European clients |

Avoid Trading with XTrend If:

| XTrend is not the best for: | - MT4 and MT5 enthusiasts

- Diverse asset access

- Clients looking for 24/7 customer support

- Clients looking for robust charting and analysis capabilities |

Regulation and Security Measures

Score – 4.3/5

XTrend Regulatory Overview

XTrend is authorized by the well-regarded Cyprus Securities and Exchange Commission (CySEC) and the FSCA in South Africa. These regulatory authorities impose strict rules and regulations to ensure high standards in the financial industry. Thus, XTrend is a legitimate and regulated broker that follows the necessary regulations for offering Forex trading services. Compliance with the regulatory rules set by FSCA and European authorities enhances the safety and confidence of traders who choose to trade with the broker.

Additionally, the company does not offer services in offshore zones, emphasizing its commitment to operating within regulated jurisdictions and providing transparency to traders.

How Safe is Trading with XTrend?

According to our findings, XTrend implements various measures to protect its trading accounts. These typically include regulatory oversight and ensuring compliance with applicable rules and regulations. The firm also maintains fund protection mechanisms to keep client funds separate from the broker’s operational funds.

However, conduct thorough research and carefully examine the broker’s documentation, legal agreements, and policies. This will provide a comprehensive understanding of the specific trading protections offered by the broker, as trading conditions can vary across jurisdictions.

Consistency and Clarity

XTrend has been operating since 2018, providing trustworthy and transparent services to clients worldwide. The broker mentions the constant increase in its client base, which is surely due to the broker’s consistent practices and clear offerings. XTrend’s dedication to reliable services is confirmed by a range of awards, including in the category of the best mobile broker and others.

When we looked for real client experience, we found that the reviews vary among users. There is a substantial amount of positive feedback, pointing out the broker’s comprehensive educational resources, easy-to-use app, and advanced trading tools, including the copy trading feature. The negative reviews often mention the insufficient withdrawal process and dissatisfaction with the broker’s customer service.

It is essential to consider others’ experiences, yet we urge traders to conduct their research to see how the broker meets their expectations.

Account Types and Benefits

Score – 4.2/5

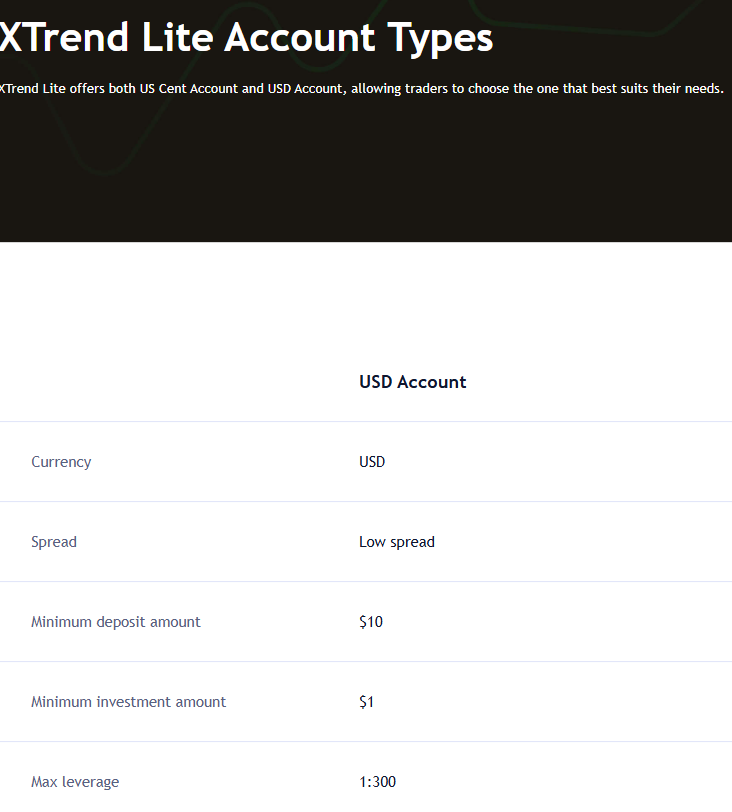

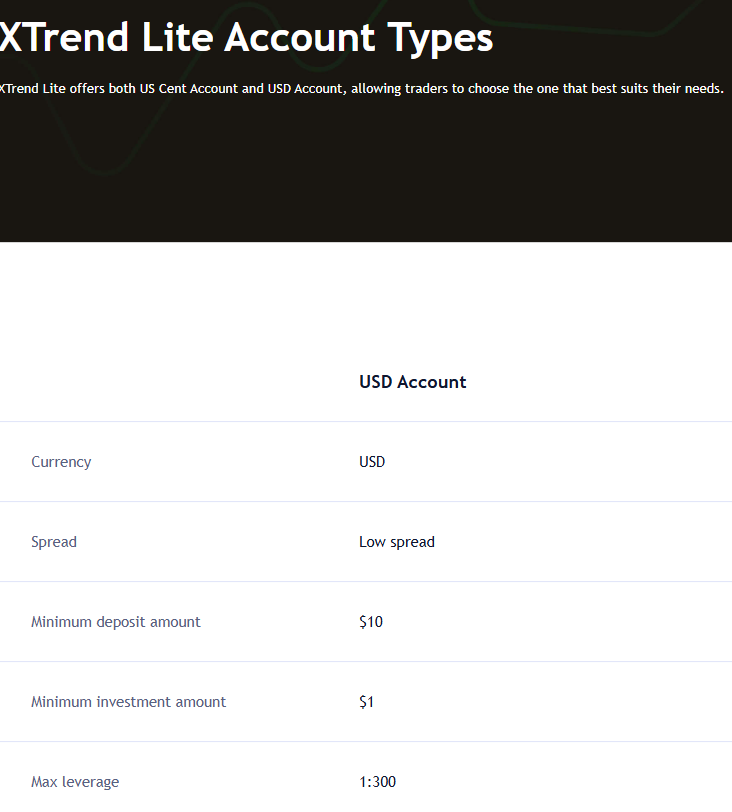

Which Account Types Are Available with XTrend?

The availability of the account types depends on the entity. In any case, we have found that the broker offers a single account under the CySEC entity. On the other hand, under the FSCA, clients can open an XTrend Lite or an XTrend Speed account. The initial deposit to open an account with the broker is $50. The available leverage for the account types is 1:300. If traders open an account under the CySEC entity, the leverage will be up to 1:30. The broker enables access to over 600 tradable products across a good variety of financial assets.

- We strongly recommend that traders consider the differences in account types and overall trading conditions between the entities.

Regions Where XTrend is Restricted

Due to regulatory restrictions, XTrend does not offer its services to certain countries. Remember that the availability of the region also depends on the XTrend jurisdiction you open an account.

Here are the main restricted countries:

- Afghanistan

- Albania

- United States

- Bahamas

- Barbados

- Belarus

- Belgium

- Botswana

- Burkina Faso

- Burundi

- Cambodia

- Canada

- China

- Cyprus

- North Korea

- Democratic Republic of Congo

- Ghana

- Gibraltar

- Iceland

- Iran

- Jamaica

- Jordan

- Mali

- Mongolia

- Morocco

- Mozambique

- Myanmar

- Nicaragua

- Pakistan

- Panama

- Senegal

- Sudan

- Syria

- Tanzania

- Trinidad and Tobago

- Uganda

- Ukraine

- Venezuela

- Yemen

- Zimbabwe

- Rusia

Cost Structure and Fees

Score – 4.4/5

XTrend Brokerage Fees

After examining the broker’s fee offering, we found that XTrend provides competitive pricing for the majority of trading services. The broker incurs both spreads and commissions, with all the charges either on the low side or in line with the market average. However, as the broker operates under two entities, the trading costs may differ based on the jurisdiction. It is essential to check the costs before engaging with the broker.

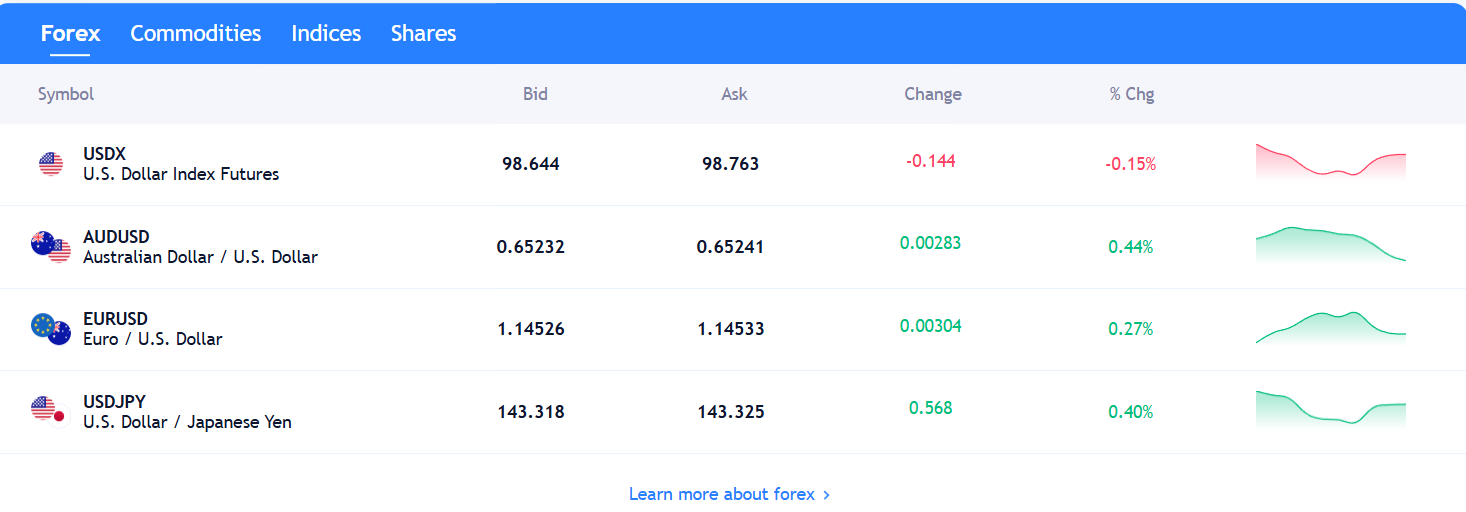

Based on our test trade, the broker provides competitive spreads, with an average spread of 0.2 pips for the EUR/USD currency pair in the Forex market.

However, spreads can vary based on the instrument traded, market conditions, volatility, and liquidity, so consult the broker’s website or contact customer support for detailed information on the spreads they offer for specific instruments and account types.

XTrend also applies commissions for each trade. We have found that in addition to spreads, the broker applies $0.04 per 100 units for the popular EUR/USD pair. The commission rate depends on the instrument. For Gold, the commission is $0.04 per unit. We recommend checking all the applicable fees on the broker’s website by visiting the Trading Specifications section. All transaction fees are publicly disclosed, thus, clients can find the most up-to-date information.

How Competitive Are XTrend Fees?

Based on our test trades, XTrend trading costs are quite competitive, offering clients low spreads and reasonable commissions. The spreads start from 0.2 pips and are combined with transaction fees. As we have found, transaction fees are not fixed and are based on the instrument traded.

The good thing about the broker’s fees is transparency: all the costs are publicly available on the broker’s website, and clients can find the specific prices based on the instrument. The commissions generally start from $0.04 and can be as high as $0.60 per transaction (UK Oil).

Another important notice is that XTrend operates under two entities, and the trading charges differ from one jurisdiction to another.

| Asset/ Pair | XTrend Spread | Errante Spread | OCBC Securities Spread |

|---|

| EUR USD Spread | 0.2 pips | 1.5 pips | 0.9 pips |

| Crude Oil WTI Spread | 0.024 | 1 | 3 |

| Gold Spread | 0.07 | 1 | 1 |

XTrend Additional Fees

Like any other broker, XTrend imposes a few additional non-trading fees, included in the overall costs. The broker imposes withdrawal fees, and additional charges may be applicable during trading activities as well. For Visa and Master cards, the withdrawal fees comprise 3.50%. There are no deposit fees.

So, carefully review the broker’s fee structure and terms and conditions to gain a comprehensive understanding of the associated fees and their potential impact on trading operations.

Score – 4/5

XTrend provides trading experience through its dedicated trading platforms, catering to both desktop and mobile users. Traders can seamlessly engage in market activities using the XTrend PC application, offering a comprehensive set of tools and features for macOS and Windows.

| Platforms | XTrend Platforms | Errante Platforms | OCBC Securities Platforms |

|---|

| MT4 | No | Yes | No |

| MT5 | No | Yes | No |

| cTrader | No | Yes | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

XTrend Web Platform

XTrend Speed Tradin App is available in multiple options, including via a web browser. Accessing trading accounts via the app is comfortable, making trading more accessible and available. All the trading tools and features and tools are available, enabling clients to have a full trading experience.

XTrend Desktop MetaTrader 4/5 Platforms

Based on our research, XTrend does not offer any of the popular retail platforms, such as MT4 and MT5. Although the broker offers an advanced app, equipped with innovative tools and features, many traders will find the lack of alternative platforms restricting. At last, even though trading through a mobile app is a great advantage, it is still not good when it is the only choice.

XTrend MobileTrader App

The XTrend Mobile Trading Apps empower users to stay connected and trade on the go, ensuring flexibility and convenience through a range of functionalities accessible on smartphones and tablets.

We found that traders have access to a diverse set of trading tools designed to enhance their analytical capabilities and decision-making processes. These tools provide real-time market data, advanced charting features, and technical analysis indicators, enabling users to conduct in-depth assessments of market trends and potential investment opportunities.

Main Insights from Testing

Based on our thorough research, XTrend offers an advanced trading app with great trading capabilities. Traders can benefit from great flexibility and versatility. However, despite the platform’s advantages, a single mobile app cannot be satisfactory for all types of traders. We strongly advise the XTrend potential clients to consider the limitations when it comes to trading platforms and make sure that the offering matches their expectations.

Trading Instruments

Score – 4.4/5

What Can You Trade on the XTrend Platform?

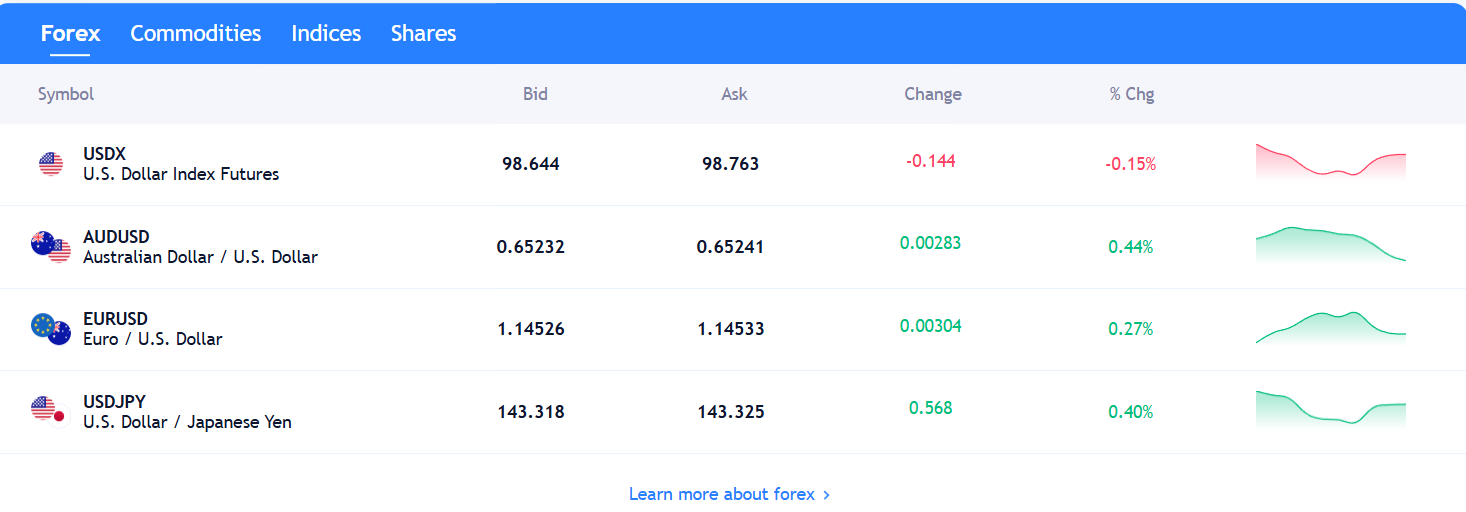

XTrend provides access to popular trading instruments, such as Forex, CFDs, Commodities, Indices, Shares, Precious Metals, Cryptocurrencies, and Energy. The broker enables access to over 600 tradable products, allowing clients to expand their portfolios and participate in various markets according to their individual preferences and trading strategies.

Clients can access a good range of Forex pairs, including major, minor, and exotic ones. Through the CySEC entity, clients can also engage in cryptocurrency trading, accessing such popular products as Bitcoin, Ethereum, Dogecoin, Litecoin, and more.

Main Insights from Exploring XTrend Tradable Assets

With access to more than 600 trading instruments across the major assets, XTrend enables traders to have a good variety and diversity, expanding their trading capabilities. Traders can choose from a list of currency pairs, global indices, shares on CFDs, and cryptocurrencies. Besides, clients can trade gold, silver, and UK and US oil with tight spreads and favorable conditions.

- Based on our findings, the broker also suggests an XTrend Pro platform where traders can engage in real stock trading. This traditional investment opportunity enables traders to make long-term investments and own shares. However, trading possibilities depend on the jurisdiction under which the account is opened. We strongly advise traders to carefully view the conditions and availability of products under each entity before opening an account.

Leverage Options at XTrend

Leverage is a useful tool that enables traders to enter the market with limited capital. However, its use can lead to either substantial profits or losses. As such, traders should have a comprehensive understanding of how leverage works and its possible consequences.

XTrend leverage is offered according to CySEC and FSCA regulations:

- European and South African traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- However, the website states the potential for higher leverage of up to 1:300, so understanding the implications and risks associated with leverage is crucial before making decisions about its use in trading.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at XTrend

Per our research, the broker offers a variety of payment methods for traders to deposit funds into trading accounts, including Wire Transfers, Credit/Debit cards, and E-wallets like Skrill, Neteller, PayPal, etc. However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved. It is essential to remember that the availability of funding methods also depends on the entity.

- As we have found, XTrend does not apply any deposit fees.

Minimum Deposit

To initiate a live trading account with the broker, traders are required to make an initial deposit of $50. Yet again, the minimum deposit requirement can vary from entity to entity.

Withdrawal Options at XTrend

Based on our analysis, the withdrawal process is both convenient and swift. The withdrawal process might take 3-5 working days, depending on your bank.

- Although the broker does not apply any deposit fees, there are still withdrawal fees to be considered. For Visa and Master cards, the withdrawal fees comprise 3.50%.

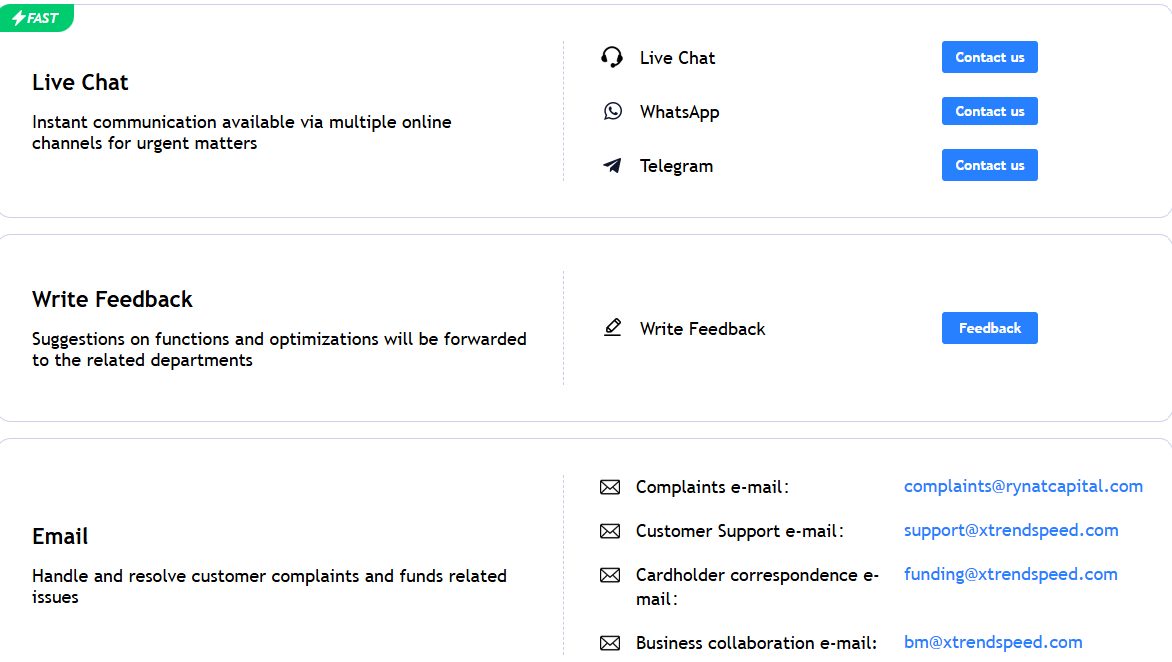

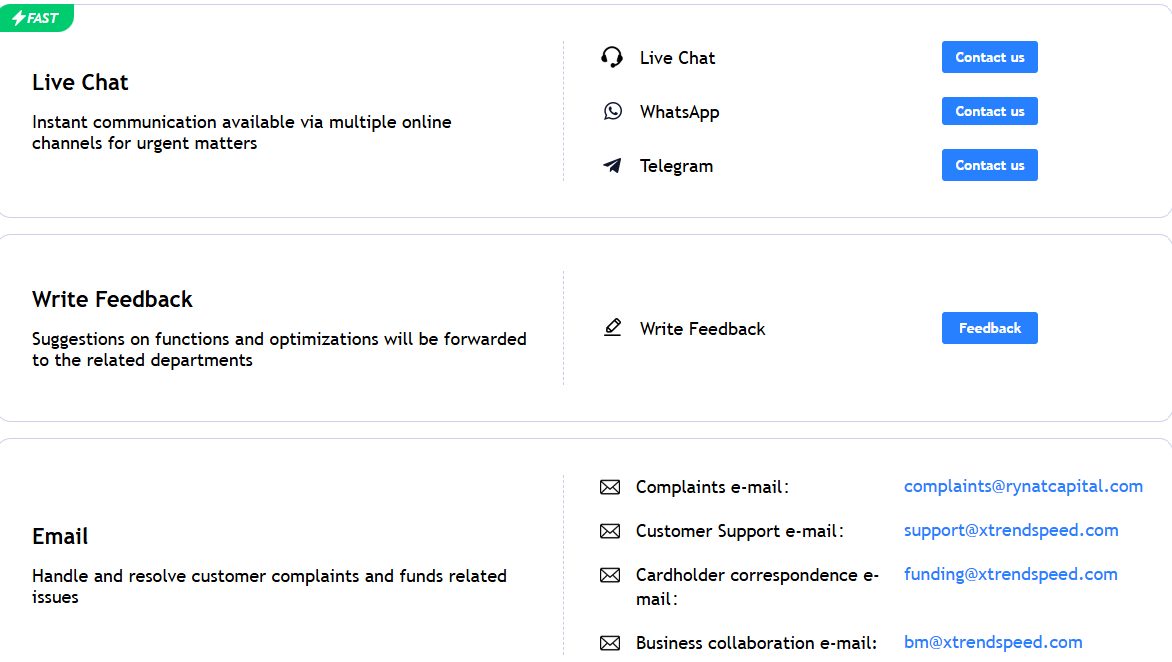

Customer Support and Responsiveness

Score – 4.6/5

Testing XTrend Customer Support

XTrend offers 22/7 customer support via live chat, email, phone line, and social media channels. Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

- The broker also has an FAQ section, where traders can find answers to the most essential trading-related questions, including how to open an account, how to deposit or withdraw funds, and more.

Contacts XTrend

XTrend provides decent customer support through different channels, enabling traders to choose the most suitable option.

- The live chat is great for clients looking for quick answers and solutions. The answers are mostly quick and detailed.

- The WhatsApp connection is another great option for quick messages and calls. Communication through WhatsApp makes the broker easier to reach and the issues quicker to solve.

- Clients can also connect with the XTrend support team through Telegram.

- The broker also provides email addresses separately for complaints, support, business cooperation, and cardholder correspondence. For general support, traders can use the following email address: support@xtrendspeed.com.

- At last, XTrend is social, providing recent updates, market information, and company news on Facebook, Twitter, LinkedIn, and YouTube.

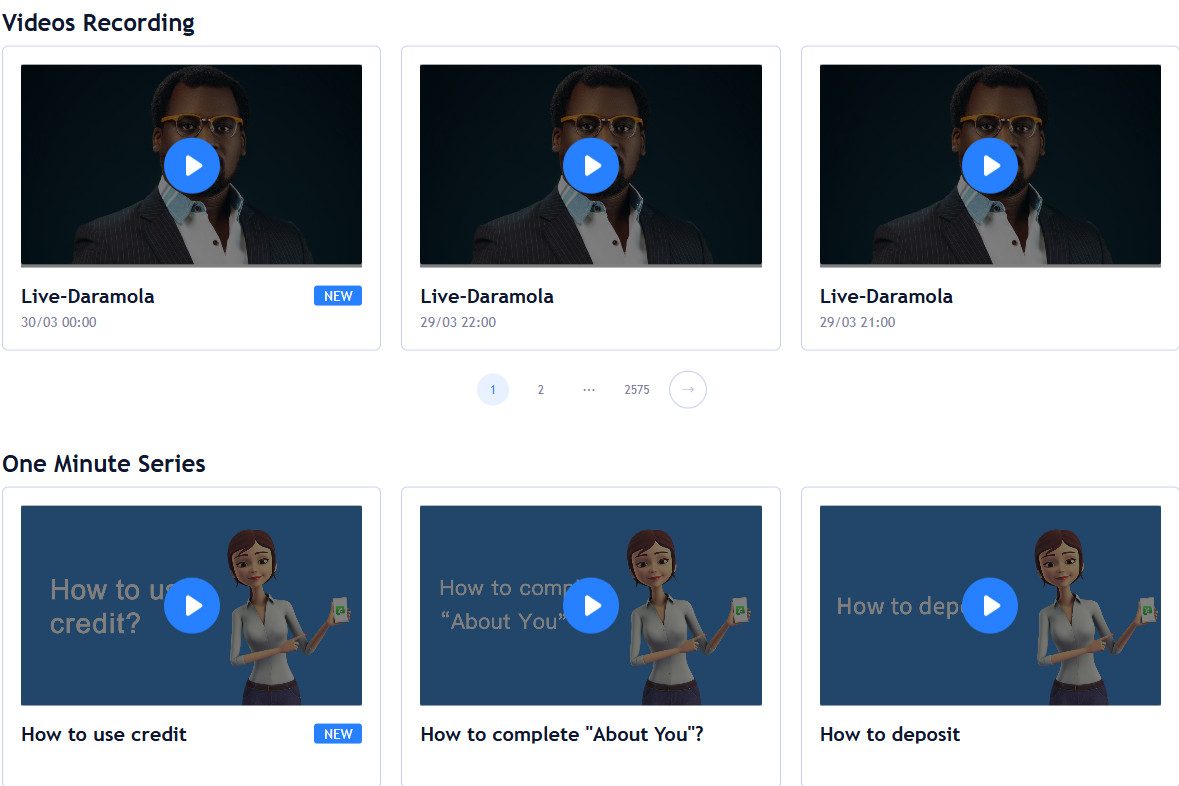

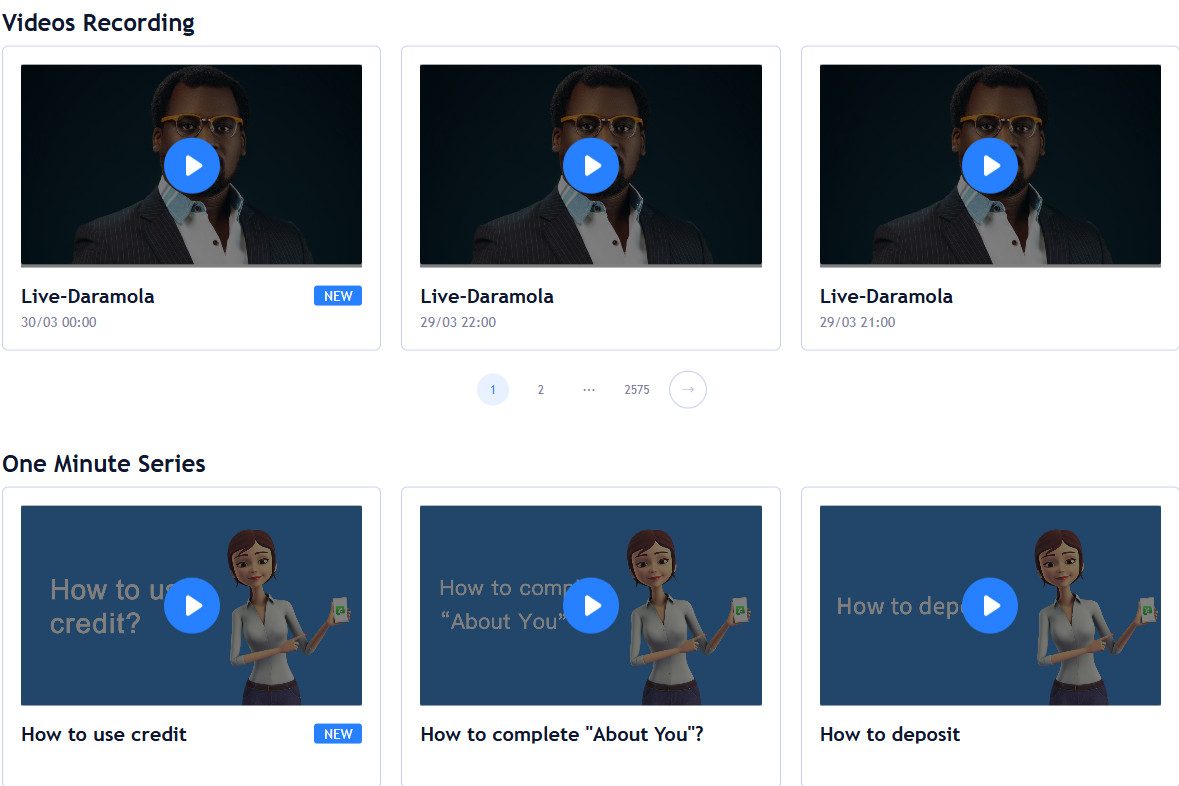

Research and Education

Score – 4.1/5

Research Tools XTrend

Aside from the trading tools and features integrated into the broker’s platform, XTrend offers a few additional research and analytical capabilities to enhance the trading experience.

- The economic calendar is one of the most demanded tools to uncover upcoming market changes and events. Based on the calendar, traders can make informed decisions.

- The trading ideas provided by XTrend provide traders with essential information on Forex, commodities, metals, indices, and shares.

- Market News is another important section, keeping traders updated and aware of the market changes. By being aware, traders can make better decisions and reach better trading outcomes.

Education

XTrend offers a variety of educational materials such as tutorials, videos, interactive courses, blogs, etc. These resources cover topics like market analysis, trading strategies, risk management, and more.

- Access to one-minute and longer educational videos is a great way to enhance trading knowledge and acquire new skills.

- The Basic Knowledge section provides traders with information on the most essential trading aspects.

- The trading glossary simplifies the complicated trading terms, enabling clients to have an easier grasp of the market vocabulary.

Is XTrend a Good Broker for Beginners?

Based on our experience with the broker, XTrend can be a good start for novice traders. It offers a low minimum deposit requirement, good trading conditions, competitive fees (often lower than average), and an advanced mobile platform, also available through desktop and web versions. Besides, clients have access to a selection of trading instruments, ensuring good diversity. However, the broker does not offer a demo account, which is not a very favorable point for beginner traders. Yet, the educational and research resources are not bad, providing traders with guidance and knowledge. All in all, we recommend traders consider the broker’s proposal to see how it fits them.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options XTrend

XTrend offers a range of trading instruments that exceeds 600 products in total. The availability of instruments depends on the entity. As we have found, under the FSCA license, traders can access Forex, commodities, indices, and shares on CFDs. The website under the CySEC entity also offers access to cryptocurrencies.

- Also, XTrend offers a Pro platform, offering access to real stocks. This way, clients can engage in traditional investments and own shares of popular US, EU, and HK stocks.

- In addition, XTrend offers a copy trading feature, an alternative to investing by mirroring the successful trades of advanced traders.

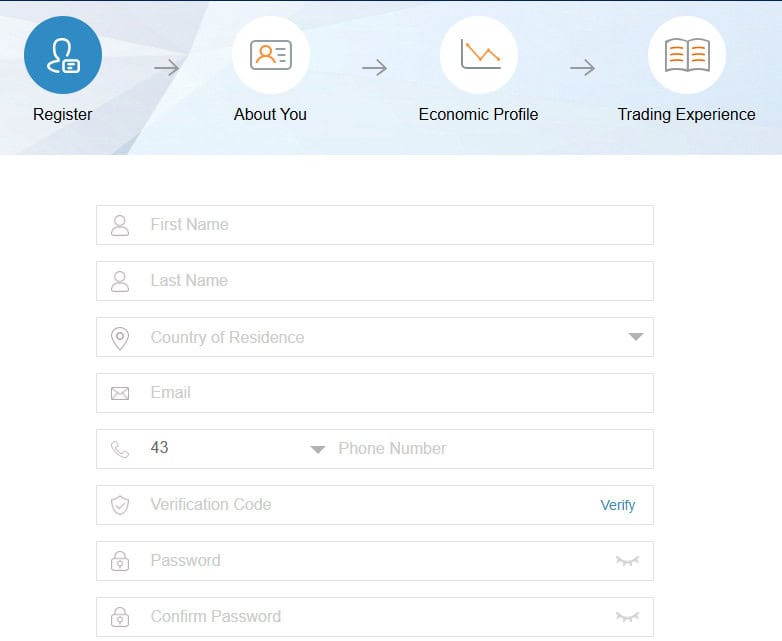

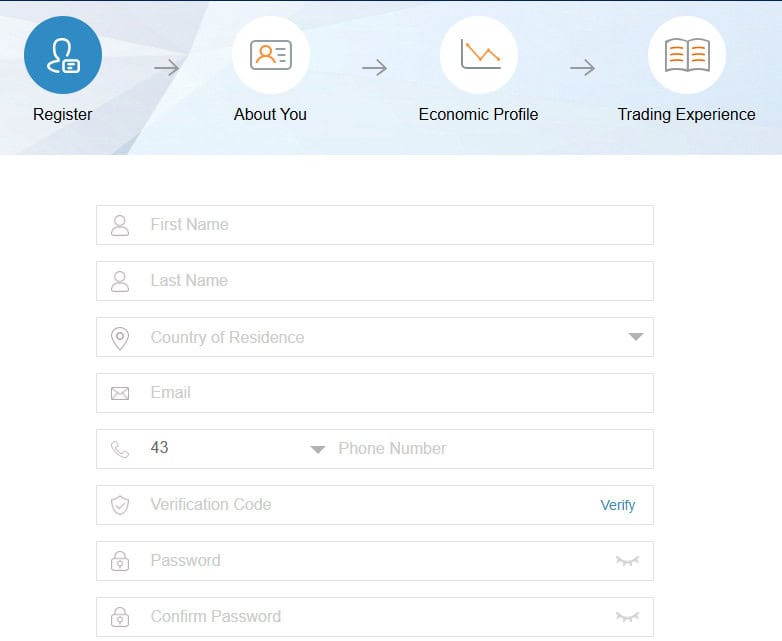

Account Opening

Score – 4.3/5

How to Open an XTrend Demo Account?

As we have found, at present, XTrend does not offer a demo account. The absence of a demo account may be a disadvantage for beginner traders who need to practice and gain skills before engaging in real trading.

How to Open an XTrend Live Account?

Opening an account with a broker is quite an easy process, as you can log in and register with XTrend within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Create an Account” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Score – 4/5

Overall, XTrend offers good trading tools and features integrated into its trading platform. Besides, through its research and education sections, traders have access to market news, an economic calendar, and trading ideas. Also, XTrend offers an Invite a Friend feature, allowing traders to get rewards.

- The Invite a Friend feature enables traders to get up to $1,000 for invitees after 90 days of registration. The more qualified the invitees are, the more credits traders get.

XTrend Compared to Other Brokers

We have also compared XTrend to other well-respected brokers in the market. This comparison helps us see where exactly the broker stands.

Our comparison of brokers starts with regulatory oversight. As previously mentioned, XTrend holds licenses from CySEC and the FSCA, ensuring the security of its practices and adherence to strict laws. FP Markets, as our research showed, also holds licenses from CySEC and FSCA. In addition, the broker is regulated by CMA and ASIC, ensuring extra protection and security measures.

We reviewed XTrend’s trading costs and compared them to other brokers to see how competitive they are. With spreads starting from 0.2 pips, the broker’s offering is similar to Exness’s charges. However, whereas Exness offers fixed commissions of $3.5 per side per trade, XTrend’s commissions vary between $0.04 and $0.60 per trade and are based on the asset class.

When it comes to the trading platform availability, the broker offers an advanced mobile app. While the availability of a mobile app ensures great flexibility and versatility, many other brokers, such as Pepperstone, Eightcap, and FP Markets, offer an impressive range of platforms, including mobile versions. The education section of XTrend is good, with videos, a trading glossary, investment knowledge, and more. Yet, Fortrade and Admiral Markets have a more impressive section of educational resources. Besides, they also have a demo account, which XTrend does not offer at present.

| Parameter |

XTrend |

Fortrade |

Pepperstone |

Exness |

FP Markets |

Admiral Markets |

Eightcap |

| Spread-Based Account |

Average 0.2 pips |

Average 2 pips |

From 1 pip |

From 0.2 pips |

From 1 pip |

From 0.6 pips |

Average 1 pip |

| Commission-Based Account |

0.0 pips + from $0.04 to $0.60 per trade |

No commission |

0.0 pips + $3.5 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Average |

Low/Average |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

XTrend PC and Mobile Trading Apps |

Fortrader Platform, MT4 |

MT4, MT5, cTrader, TradingView |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, Admiral Markets app |

MT4, MT5, TradingView |

| Asset Variety |

600+ instruments |

300+ instruments |

Over 1,200 instruments |

200+ instruments |

10,000+ instruments |

8000+ instruments |

800+ instruments |

| Regulation |

CySEC, FSCA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

ASIC, SCB, CySEC, FCA |

| Customer Support |

22/7 support |

24/5 support |

24/7 |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Good |

Excellent |

Excellent education and research |

Fair |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$50 |

$100 |

$0 |

$10 |

$100 |

$1 |

$100 |

Full Review of Broker XTrend

Concluding our review, we can say that the broker is a favorable choice for traders who prioritize safety and efficiency in trading.

The first advantage of XTrend is its adherence to CySEC and FSCA regulations; authorities are known for their strict guidelines.

The trading charges align with the market standard, with spreads starting from 0.2 pips and commission fees based on the specific trading instrument. The broker offers more than 600 tradable products to ensure a diversity of trades and the ability to expand portfolios. Professional traders can also access real stocks, engaging in traditional investments.

The trades are conducted on the broker’s XTrend Speed mobile platform, which is also available through desktop and web browsers. The advanced tools and features make the platform a favorable tool for conducting trades. However, the platform’s availability is limited. Nevertheless, XTrend offers a copy trading feature, enabling traders to engage in alternative investments by copying successful trades.

The broker offers dedicated 22/7 customer support through multiple channels. The education section is satisfactory, including useful materials for beginners and advanced clients. However, XTrend does not have a demo account, which can be a drawback for many.

At last, XTrend operates under two entities. This means the trading conditions may vary. We recommend that traders conduct thorough research or contact the support team to find detailed information on the supported services.

Share this article [addtoany url="https://55brokers.com/xtrend-review/" title="XTrend"]