- What is XPro Markets?

- XPro Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- XPro Markets Compared to Other Brokers

- Full Review of Broker XPro Markets

Overall Rating 4.1

| Regulation and Security | 4.1 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.2 / 5 |

| Trading Platforms and Tools | 4 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 3.6 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 3.5 / 5 |

What is XPro Markets?

XPro Markets is a Forex and CFD trading broker that offers traders access to a variety of trading instruments, including Forex, CFDs, indices, stocks, cryptocurrencies, metals, commodities, and shares.

Based on our research, the broker is headquartered in South Africa and holds a license from the reputable FSCA authority. As a South African broker, XPro Markets provides its services to clients across the African region.

In general, the firm is known for its reliability, offering competitive trading conditions and efficient execution of trades through the Webtrader platform.

XPro Markets Pros and Cons

Per our findings, the broker presents both pros and cons that are important to consider. On the positive side, XPro Markets offers competitive trading conditions, a low minimum deposit requirement, and access to the advanced Webtrader platform. Additionally, the firm ensures 24/7 customer support and provides a variety of funding options.

For the cons, the broker lacks a top-tier license and operates under a single regulatory body, which could be a drawback for some traders seeking accounts with multiple regulatory authorities. However, trading under a South African entity is considered safe enough. Moreover, the availability of research and educational resources is limited, so novice traders might better look for more suitable offerings.

| Advantages | Disadvantages |

|---|

| Good trading conditions | No additional and top-tier license |

| FSCA regulation and oversight | Not comprehensive education and research |

| Webtrader platform | No demo account |

| Low minimum deposit | |

| 24/7 customer support | |

| Funding methods | |

XPro Markets Features

According to our analysis, XPro Markets provides a reliable trading environment with competitive fees, making it an attractive option for traders of all levels. The broker offers access to an advanced Webtrader platform that allows users to trade well-known trading instruments. Here we are listing a short visual for all the aspects of trading with XPro Markets:

XPro Markets Features in 10 Points

| 🗺️ Regulation | FSCA |

| 🗺️ Account Types | Classic, Silver, Gold, Platinum, VIP accounts |

| 🖥 Trading Platforms | Webtrader |

| 📉 Trading Instruments | Forex, CFDs, Indices, Stocks, Cryptos, Metals, Commodities, Shares |

| 💳 Minimum deposit | $250 |

| 💰 Average EUR/USD Spread | 2.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | EUR, USD, GBP, JPY, AUD |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/7 |

Who is XPro Markets For?

Based on our findings, XPro Markets is a reliable and favorable broker that meets different trading needs and expectations. It is especially good for the following:

- Traders from South Africa and the African Region

- Traders who prefer the MT4 trading platform

- Currency trading

- Beginners

- Advanced traders

- NDD execution

- Competitive prices

- 24/7 customer support

- Good trading tools

XPro Markets Summary

XPro Markets is a reliable Forex trading broker that offers competitive trading solutions, efficient execution, and access to the efficient Webtrader platform.

However, potential drawbacks include a sole regulatory authority and a less extensive educational offering, which may not be ideal for beginner traders.

Overall, we found that the firm provides a reliable trading environment, yet we advise potential clients to conduct research and evaluate whether the broker’s offerings suit their specific trading requirements.

55Brokers Professional Insights

Although XPro Markets has been operating only since 2022, it has managed to establish itself as a reliable broker with a trustworthy trading environment. Even so for some traders conditions might not fit. XPro Markets offers a good range of trading accounts, offering different trading conditions and fees to meet various trading expectations, while spreads depend on the trading accounts and the instrument traded. We find trading quotes mainly in line with the market average but at times little higher for certain instruments.

The good thing about the broker is the availability of a wide range of financial assets, with overall access to 160+ tradable products. Trades are conducted on WebTrader, providing easy access, a simple interface, and advanced tools and features. Another advantage of the broker is its 24/7 dedicated support via different options and presence on different social media platforms.

Consider Trading with XPro Markets If:

| XPro Markets is an excellent Broker for: | - Beginner traders

- Advanced clients

- Traders who prefer the NDD execution

- Currency and CFD traders

- Cryptocurrency traders

- Traders prioritizing 24/7 support

- Clients preferring the WebTrader platform |

Avoid Trading with XPro Markets If:

| Avoid Trading with XPro Markets If: | - Traders looking for very low prices

- Clients who want access to different trading platforms, including MT4/MT5

- Clients looking for top-tier regulation

- International clients

Clients who prefer instant demo account access |

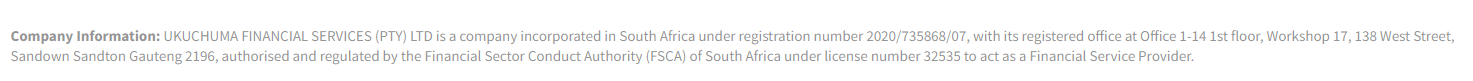

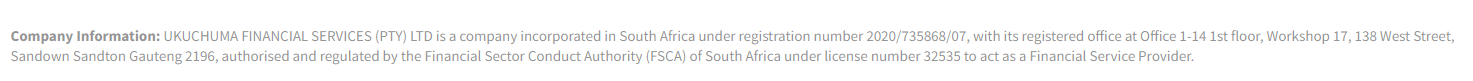

Regulation and Security Measures

Score – 4.1/5

XPro Markets Regulatory Overview

XPro Markets is a regulated company authorized by the FSCA in South Africa, which suggests a level of credibility and adherence to certain industry standards. Even though it is not regulated by top-tier regulation, compliance with the regulatory rules set by FSCA, a rather respected regulatory body in the Forex trading market, enhances the safety and confidence of clients who choose to trade with the broker. However, we recommend conducting your research, reviewing customer feedback, and considering personal factors before engaging with the broker.

How Safe is Trading with XPro Markets?

According to our findings, FSCA plays a good role in enforcing regulatory compliance within the financial services industry, especially for Africa Trading. The regulatory body ensures the security of clients’ funds by requiring the segregation of funds from company accounts. This practice prevents the use of client funds for operational purposes, adding an extra layer of protection for clients.

However, we suggest conducting thorough research, including reading user reviews and considering other factors, to assess the broker’s reputation and legitimacy.

Consistency and Clarity

We have reviewed the broker’s consistency of practices and clarity in the proposal to estimate XPro Markets’ overall reliability. Since 2022, the broker has provided regulated and strictly overseen services to its clients. It has been consistent in enhancing its services and providing better opportunities. However, we have noticed that when it first started, the broker also offered the popular MT4 platform, while at present, trades can be conducted only through the broker’s Webtrader platform.

Another important factor that is essential to consider is the broker’s notice about counterfeiting activities when other parties operate using the broker’s name, providing doubtful services, and approaching clients with questionable offers. Thus, the broker urges its clients to be careful and alert.

At last, XPro Markets’ customer feedback includes many negative reports, primarily on insufficient withdrawals, aggressive sales tactics, etc.

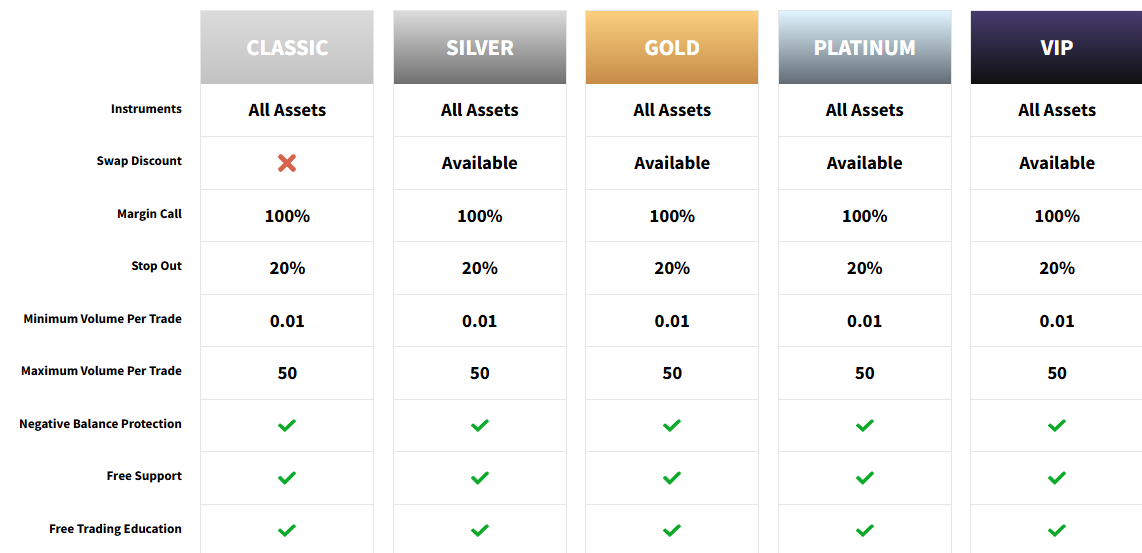

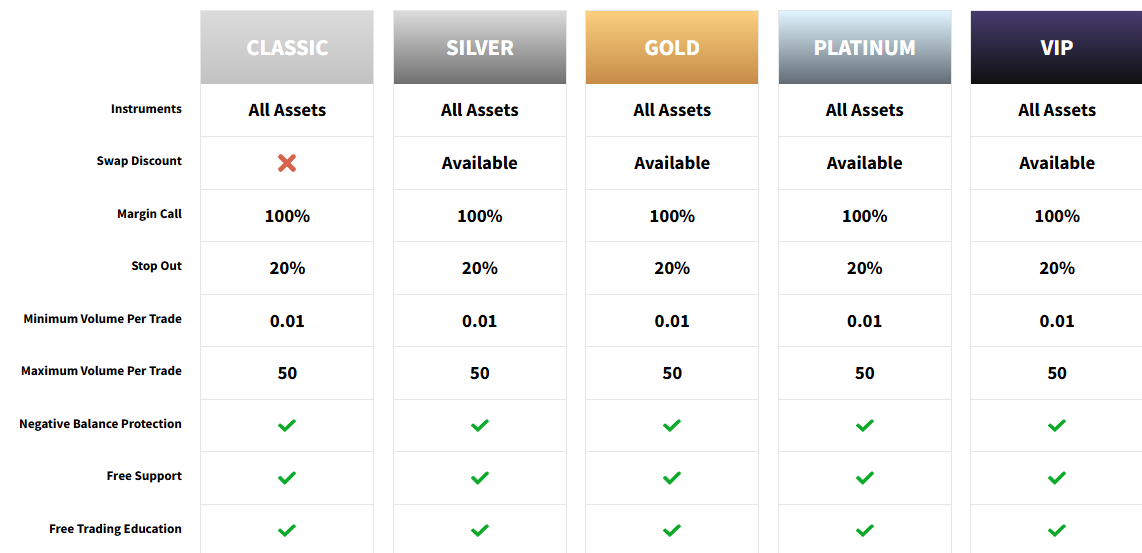

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with XPro Markets?

Per our research, the broker offers Classic, Silver, Gold, Platinum, and VIP accounts that might suit the needs of different traders. The initial deposit required for all account types is $250. The leverage for all the account types is up to 1:400. The accounts are spread-based with 0 % commissions. Spreads vary based on the account type and the instrument traded.

The broker also offers a swap discount for all the account types, except for the Classic account. Clients can access free trading education and 24/7 customer support.

- The Classic account is ideal for beginner traders. The Silver account is suitable for traders looking for swap-free options. The Gold account is a better fit for intermediate clients, while the Platinum account is for advanced traders who prefer premium features and conditions. At last, the VIP account is for high-volume professional traders.

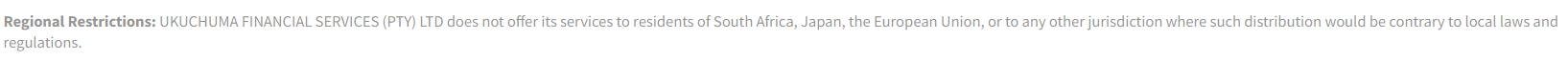

Regions Where XPro Markets is Restricted

Due to regulatory restrictions, XPro Markets mentions a few regions where its services are unavailable. The services of the broker are unavailable to residents of countries of the European Union. This restriction is also true for Japan.

Cost Structure and Fees

Score – 4.2/5

XPro Markets Brokerage Fees

After examining the broker’s fee offering, we found that XPro Markets provides competitive pricing for the majority of trading services. The broker offers a spread-based structure for all its account types. The fees usually depend on the account type and the instrument traded. Overall, the broker’s fees are transparent and in line with the market average.

However, we urge traders to carefully review the broker’s fee structure and terms and conditions to gain a comprehensive understanding of the associated fees and their potential impact on trading operations.

Based on our test trade, the broker provides competitive spreads, with an average spread of 2.5 pips for the EUR/USD currency pair in the Forex market. The Gold spread for the Classic account is 2.8 pips. Spreads for higher volume account types are lower. For the Platinum account, the EUR/USD pair is 1.4 pips, and for the VIP account, even lower, starting at 0.9 pips.

XPro Markets offers its trading costs based on spreads. There are no commissions for any of its five account types.

How Competitive Are XPro Markets’ Fees?

Based on our research, XPro Markets offers competitive and transparent fees. The broker publicly discloses the applicable spreads for its most popular trading instruments for each account type.

Spreads for the Classic account are a little on the higher side, with an average of 2.5 pips. All the trading costs are already included in the spreads. The higher the account volume, the lower the spreads.

However, spreads can also vary based on market conditions, volatility, and liquidity, so consult the broker’s website or contact customer support for detailed information on the spreads they offer for specific instruments and account types.

| Asset/ Pair | XPro Markets Spread | StarTrader Spread | Doo Prime Spread |

|---|

| EUR USD Spread | 2.5 pips | 1.3 pips | 1.1 pips |

| Crude Oil WTI Spread | 2.8 pips | 1 | 3 |

| Gold Spread | 2.8 pips | 1 | 1 |

XPro Markets Additional Fees

There are a few additional fees included in the overall trading costs. Additional non-trading fees are common in trading.

- XPro Markets charges swap fees for the positions held overnight. Usually, swaps are changeable, as they depend on different market conditions. We recommend that traders check the updated swaps by contacting the broker’s customer support team.

- The broker also imposes withdrawal fees based on the chosen funding method.

- XPro Markets’ other non-trading fee is the inactivity fee imposed for accounts that have been dormant for a month or more. The exact fee amount is not publicly mentioned, so clients should check with the broker to receive updated information.

Score – 4/5

Traders have access to the broker’s Webtrader platform while trading at XPro Markets. The platform offers a wide range of features, including technical indicators, user-friendly interfaces, advanced charting tools, and extensive trading capabilities, which are suitable for various trading strategies.

| Platforms | XPro Markets Platforms | StarTrader Platforms | Doo Prime Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

XPro Markets Web Platform

We found that the broker’s Webtrader offers users a seamless and user-friendly experience for buying and selling assets. With its intuitive design, real-time market data, advanced technologies, and comprehensive set of tools, the platform empowers traders with quick decision-making capabilities, thereby enhancing their overall trading experience. Traders can use over 30 analytical tools, access 10,000+ markets, enjoy one-click trading, and have control of open and closed positions. Besides, the platform does not require any downloads or installations, ensuring quick, flexible, and easy access to the account.

XPro Markets Desktop MetaTrader 4/5 Platforms

Based on our research, the broker previously included the MT4 platform in its proposal. However, at present, traders can conduct their trades only through the Webtrader platform. On the one hand, the platform ensures flexibility and ease of use; on the other hand, clients are limited to a single web option. MT4 and MT5 enthusiasts will likely find XPro Markets’ trading platform unsatisfactory.

XPro Markets MobileTrader App

XPro Markets does not offer a mobile app. It can be restricting for traders who prefer to access their trades through their phones and monitor them wherever they are. Although the web platform’s availability ensures a good level of flexibility, it still does not provide the same level of accessibility to the platform as the mobile app does.

Main Insights from Testing

Based on our experience with XPro Markets, the broker’s WebTrader platform offers great analytical tools and features to ensure a positive trading experience. However, whereas many other brokers offer the web platform as just another option, for XPro Markets, it is the only way to access the market. Many traders will find this limiting, especially those acquainted with the popular MT4/MT5 platforms, cTrader, or TradingView.

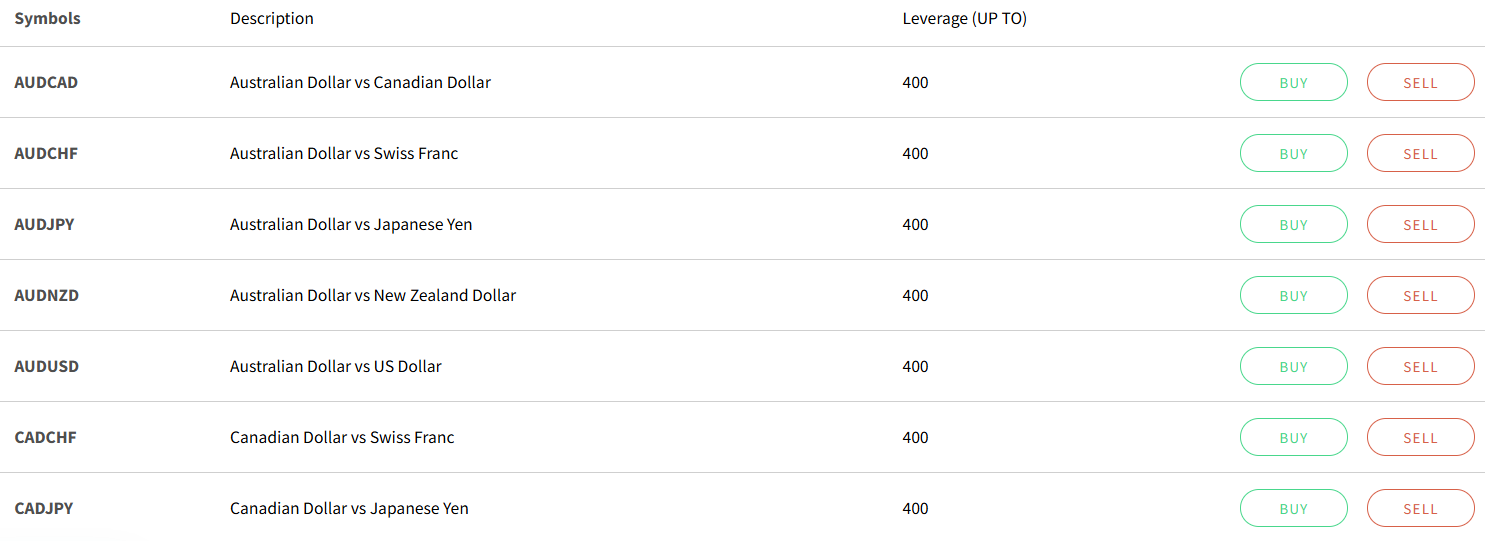

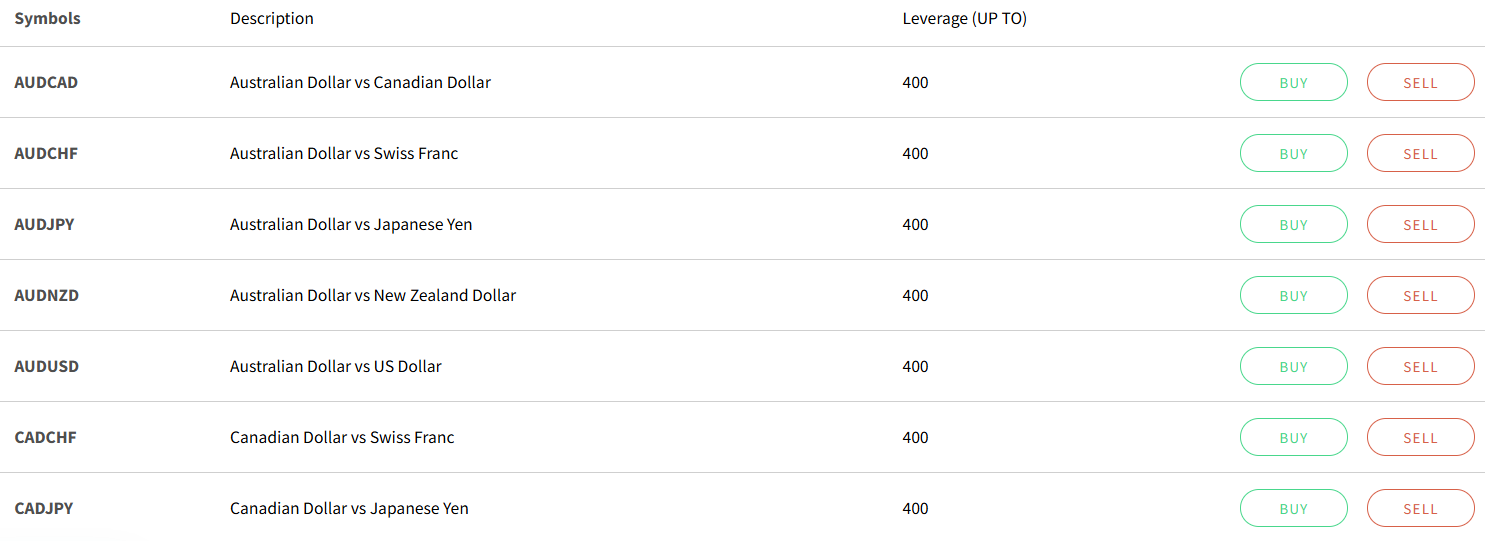

Trading Instruments

Score – 4.3/5

What Can You Trade on the XPro Markets Platform?

XPro Markets provides access to popular trading instruments, such as Forex, CFDs, Indices, Cryptos, Metals, Commodities, and Shares. The broker enables traders to diversify their portfolios and participate in various markets according to their individual preferences and trading strategies.

With XPro Markets, traders can diversify their portfolios by 45+ currency pairs, the most popular commodities, and global indices with competitive prices and favorable trading conditions.

Main Insights from Exploring XPro Markets Tradable Assets

XPro Markets offers a good diversity of tradable products across a wide range of financial markets. The diversity enables clients to explore the market and expand their portfolios.

Clients have access to 45 major, minor, and exotic Forex pairs. They can also access popular metals like gold and silver and enjoy diversity by trading different commodities like cotton, sugar, cocoa, corn, and more. Besides, XPro Markets enables access to popular cryptos, including Bitcoin, Ethereum, Litecoin, Ripple, and Dogecoin. At last, traders can engage in stock trading on CFDs, accessing such popular names as Apple, Instagram, Nike, etc. However, trading stocks through CFDs does not allow traders to own shares and make traditional investments.

Leverage Options at XPro Markets

Leverage is a useful tool that enables traders to enter the market with limited capital. However, traders should have a comprehensive understanding of how leverage works and its possible consequences before engaging in any trading activities that involve leverage.

XPro Markets leverage is offered according to the FSCA regulation:

- Trades from South Africa can use low leverage up to 1:30 for major currency pairs.

- However, the website states the potential for higher leverage of up to 1:400, so understanding the implications and risks associated with leverage is crucial before making decisions about its use in trading.

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at XPro Markets

Per our research, the broker offers a variety of payment methods for traders to deposit funds into trading accounts. However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved. Traders can deposit in a range of currencies, such as EUR, USD, CHF, and GBP. The funding methods include:

- Wire Transfers

- Credit/Debit cards

- and E-wallets

Minimum Deposit

To open a live trading account with the broker, clients need to deposit $250 as an initial deposit amount for all trading accounts.

Withdrawal Options at XPro Markets

Based on our analysis, the withdrawal process takes from 8 to 10 business days, however, it may differ depending on the bank. The minimum withdrawal amount depends on the method used. For a credit card, the minimum amount is $10, while for a wire transfer, the minimum is $100. The broker reserves the right to charge withdrawal fees. The fees depend on circumstances, like the method used and other conditions.

Customer Support and Responsiveness

Score – 4.6/5

Testing XPro Markets Customer Support

The broker offers 24/7 customer support via live chat, email, phone lines, and social media channels. Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

- The broker also has an informative FAQ section with answers to the most common and essential trading-related questions.

Contacts XPro Markets

XPro Markets stands out for its 24/7 dedicated customer support. Traders can find help through multiple channels by choosing the most convenient option for communication.

- The live chat support provides traders with 24/7 quick and detailed answers. This is the fastest way to prompt answers and solutions to the issues traders face while trading.

- Clients can also send their requests and questions via email. The provided email address is support@xpromarkets.com.

- Also, clients who prefer to directly connect with the support team members can use one of the available phone numbers: +27870948672 or +27101573383.

- At last, XPro Markets is active on social media, providing updates on the financial markets and on the company’s activities through IG, Facebook, LinkedIn, YouTube, and Twitter.

Research and Education

Score – 4.2/5

Research Tools XPro Markets

The research tools and features with XPro Markets are primarily available through the broker’s Webtrader platform. It provides good charting and analytical tools to assist in efficient trading. Separately, traders can also access a few additional tools via the broker’s website.

- The Economic Calendar is one of the most essential and sought-after tools among traders. It helps traders be aware of the upcoming market changes and events, and make informed decisions based on the provided updates.

- The all-inclusive chart analysis widget assists traders in monitoring their trades and getting updates on the ever-changing market. To access the feature, users need to open an account with the broker.

Education

The broker offers learning materials through its Trading Central, which provides access to independent research and leading analysis data to support traders’ investment strategies. However, it lacks in offering seminars and webinars. For traders seeking more comprehensive educational resources, we suggest exploring other brokers that provide a broader range of learning opportunities.

Is XPro Markets a Good Broker for Beginners?

Based on our research, XPro Markets can be a fit for beginner traders. It offers a simple and easy-to-use web platform that beginner traders will find easy to navigate. Besides, the good range of account types enables traders to choose the account that will meet their needs the most. Besides, the availability of the demo account is another advantage that will allow novice traders to get trading knowledge before transitioning into live trading.

The minimum deposit for all account types is $250, which is considered a favorable requirement for cost-conscious traders. Also, upon opening an account, traders can access Trading Central and enjoy a range of educational materials.

Portfolio and Investment Opportunities

Score – 3.6/5

Investment Options XPro Markets

XPro Markets offers access to a range of financial assets, with access to 160 tradable products in total. Clients can trade Forex, cryptocurrency, commodities, metals, shares, and indices. However, the broker’s proposal is based on CFDs, limiting the opportunity for long-term investments and access to real stocks.

We have also checked if the broker offers alternative investment options. However, the broker does not announce the availability of MAM, PAMM accounts, or copy trading.

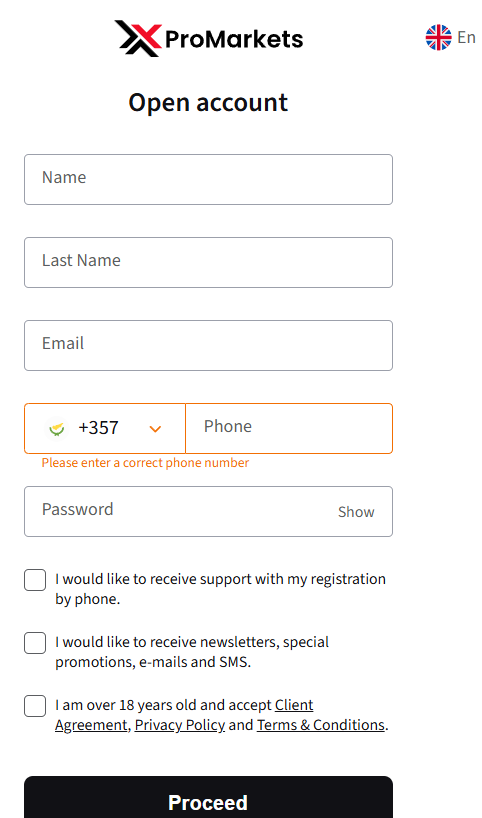

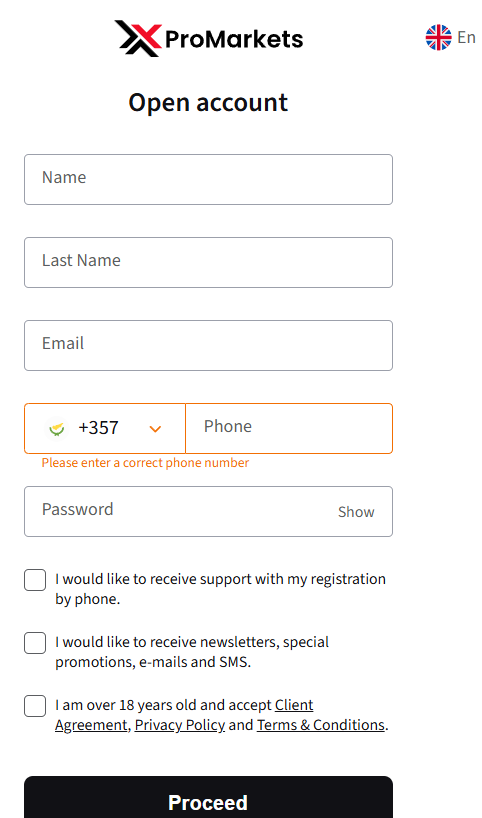

Account Opening

Score – 4.6/5

How to Open an XPro Markets Demo Account?

XPro Markets offers a demo account to its clients to polish their trading skills and gain confidence in trading before switching to live trading. To open a demo account, traders first need to register with the broker. Here are the main steps to follow:

- Visit the broker’s official website and start creating an account.

- Fill out the registration form with personal data (name, email, phone number).

- Receive the verification email or sms to verify the account.

- When verified, enter the account.

- From the dashboard, select the demo account option.

- Start practicing.

How to Open an XPro Markets Live Account?

As we have found, opening an account with the broker is quite an easy process, as you can log in and register with XPro Markets within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Create Account” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Score – 3.5/5

The broker includes useful tools in its trading platform, enabling traders to access innovative and advanced features for profitable trading. In its research and education section, XPro Markets also offers an economic calendar, chart analysis, and Trading Central, which we have already discussed separately.

Yet, there are no additional offerings traders can use for portfolio management, copy trading, or investment opportunities to take their experience to another level.

XPro Markets Compared to Other Brokers

As part of the broker’s assessment, it is also important to compare XPro Markets’ offerings with those of other brokers in the market. When measuring the broker’s safety based on the regulation, XPro Markets offers strictly overseen services and a reliable environment. However, brokers like IC Markets and XM hold licenses from the top-tier FCA and ASIC, ensuring an added layer of security.

When we compared the trading platforms, it was evident that XPro Markets lacks in this aspect. It only offers the WebTrader platform, limiting clients’ choice to the browser-based option. Most brokers we reviewed offer the popular MT4 or MT5 platforms and other additional options. Deriv, for instance, stands out for the impressive range of platform choices, including Deriv MT5, Deriv cTrader, Deriv X, Deriv Trader, Deriv Bot, Deriv GO, and SmartTrader. Besides, the instrument range is modest as well, with about 160 tradable products across different financial assets. XPro Markets offers only a spread-based fee structure with average spreads and no commissions. On the other hand, HFM and FXPrimus offer both spread- and commission-based structures with lower spreads and fixed commissions.

At last, XPro Markets provides good education and research sections, providing traders with Trading Central, Economic Calendar, and Chart Analysis. However, XM offers excellent educational resources, which stand out among other brokers.

| Parameter |

XPro Markets |

Deriv |

XM |

HFM |

FXPrimus |

IC Markets |

FXTM |

| Spread-Based Account |

Average 2.5 pips |

Average 0.5 pips |

1.6 pips |

Average 1 pip |

From 1.5 pip |

From 1 pip |

Average 1.5 pips |

| Commission-Based Account |

No commissions |

0.0 pips + $0.05 |

Only on Shares Account |

0.0 pips + $3 |

0.0 pips + $2.5 |

0.0 pips + $3.50 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

| Trading Platforms |

WebTrader |

Deriv MT5, Deriv cTrader, Deriv X, Deriv Trader, Deriv Bot, Deriv GO, SmartTrader |

MT4, MT5, XM WebTrader |

MT4, MT5, HFM App |

MT4, MT5, WebTrader |

MT4, MT5, cTrader |

MT4, MT5 |

| Asset Variety |

160+ instruments |

200+ instruments |

1,000+ Instruments |

500+ instruments |

200+ instruments |

1,000+ instruments |

1,000+ instruments |

| Regulation |

FSCA |

MFSA, Labuan FSA, BVI FSC, VFSC |

ASIC, CySEC, FSC, DFSA |

FCA, DFSA, FSCA, FSA, CMA, FSC |

CySEC, VFSC |

ASIC, CySEC |

FCA, FSC, CMA |

| Customer Support |

24/7 |

24/7 |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

| Educational Resources |

Good |

Good |

Excellent |

Good |

Basic |

Good |

Good |

| Minimum Deposit |

$250 |

$5 |

$5 |

$0 |

$15 |

$200 |

$200 |

Full Review of Broker XPro Markets

In conclusion, XPro Markets is a good broker with reliable regulatory oversight from the South African FSCA. The broker offers a transparent and secure trading experience with good trading conditions and average costs.

With 5 trading accounts offering different trading conditions and opportunities, XPro Markets meets the needs of beginner to experienced traders. The average spread for the Classic account is 2.5 pips, including all the trading costs. The broker offers only a spread-based fee structure, not favorable for those who prefer fixed commissions for each trade. As to the trading platform, traders can conduct trades on the broker’s WebTrader platform. It used to offer an MT4 platform as well, yet at present, the web platform is the only option. Although web trading allows traders flexibility and ease of access to their positions, the lack of other platform options might be a disadvantage for many.

The good thing about the broker is its 24/7 dedicated customer support through multiple channels. It also includes an education and research section, as well as a demo account to practice trades or try different strategies. Another advantage is the relatively low initial deposit of $250.

All in all, XPro Markets provides regulated and trustworthy services to clients of different levels and trading volumes. Those who find XPro Markets’ proposal meeting their trading expectations can open an account and start their trading journey with the broker.

Share this article [addtoany url="https://55brokers.com/xpro-markets-review/" title="XPro Markets"]