- What is Windsor?

- Windsor Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

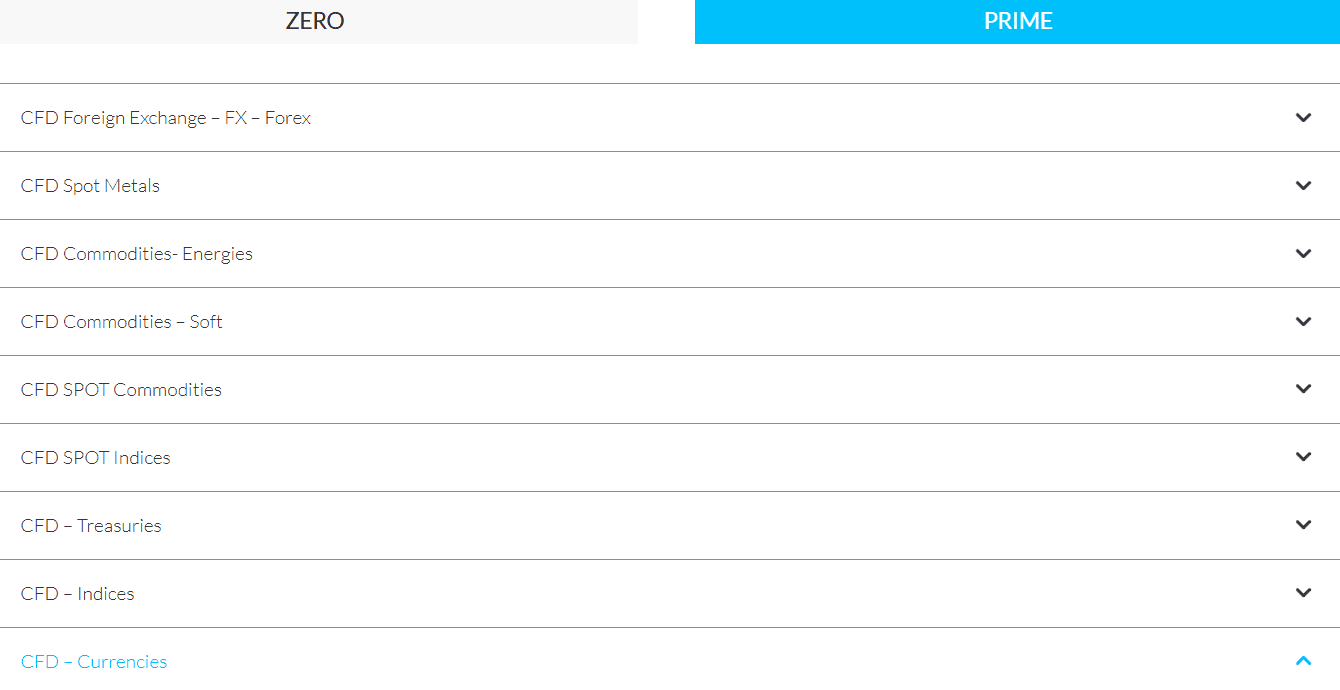

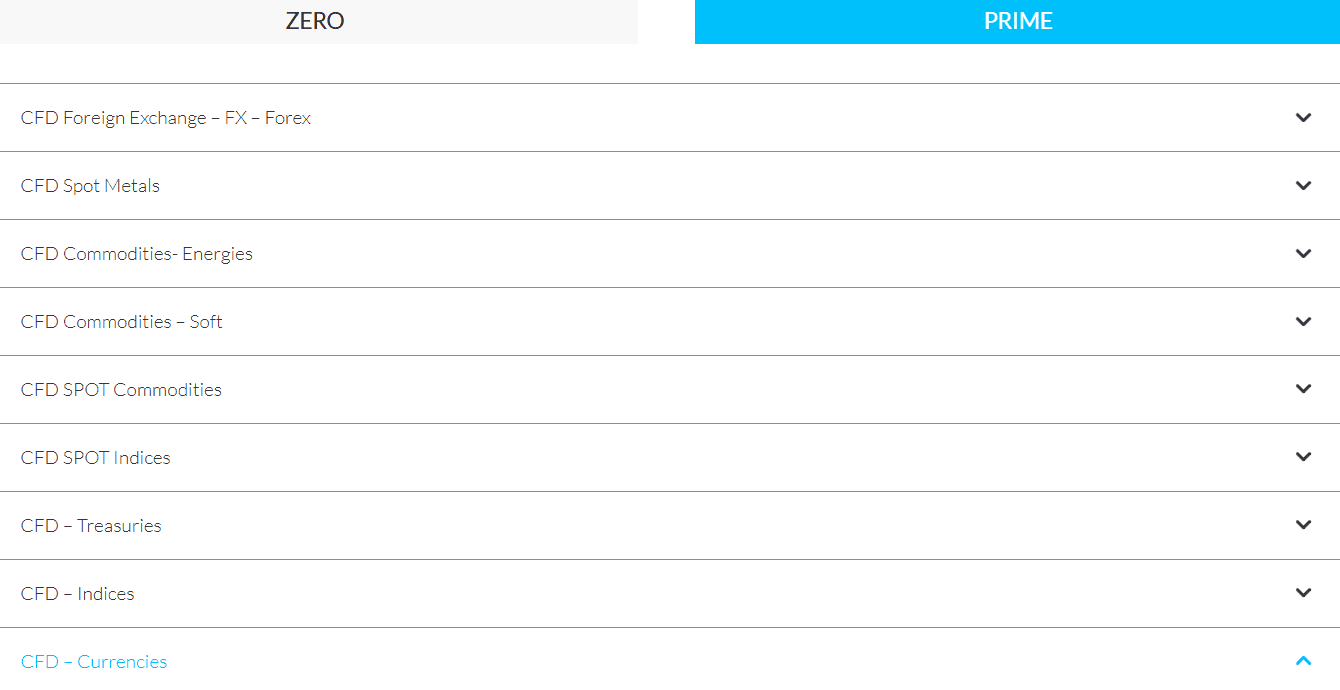

- Trading Instruments

- Deposit and Withdrawal Options

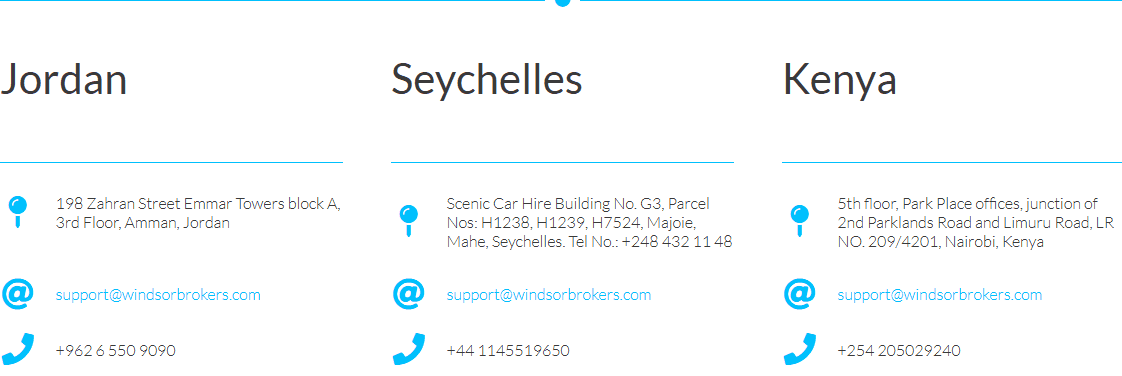

- Customer Support and Responsiveness

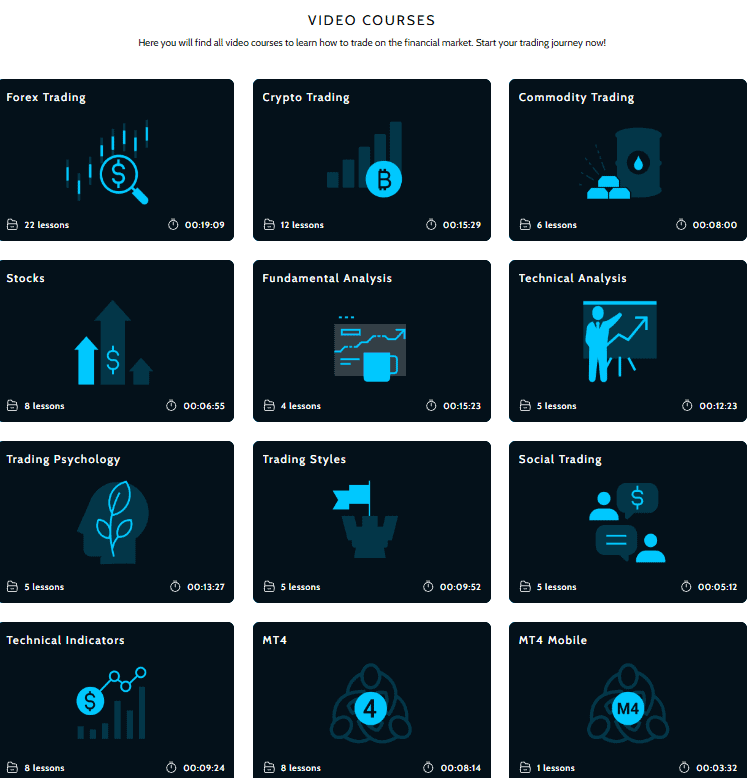

- Research and Education

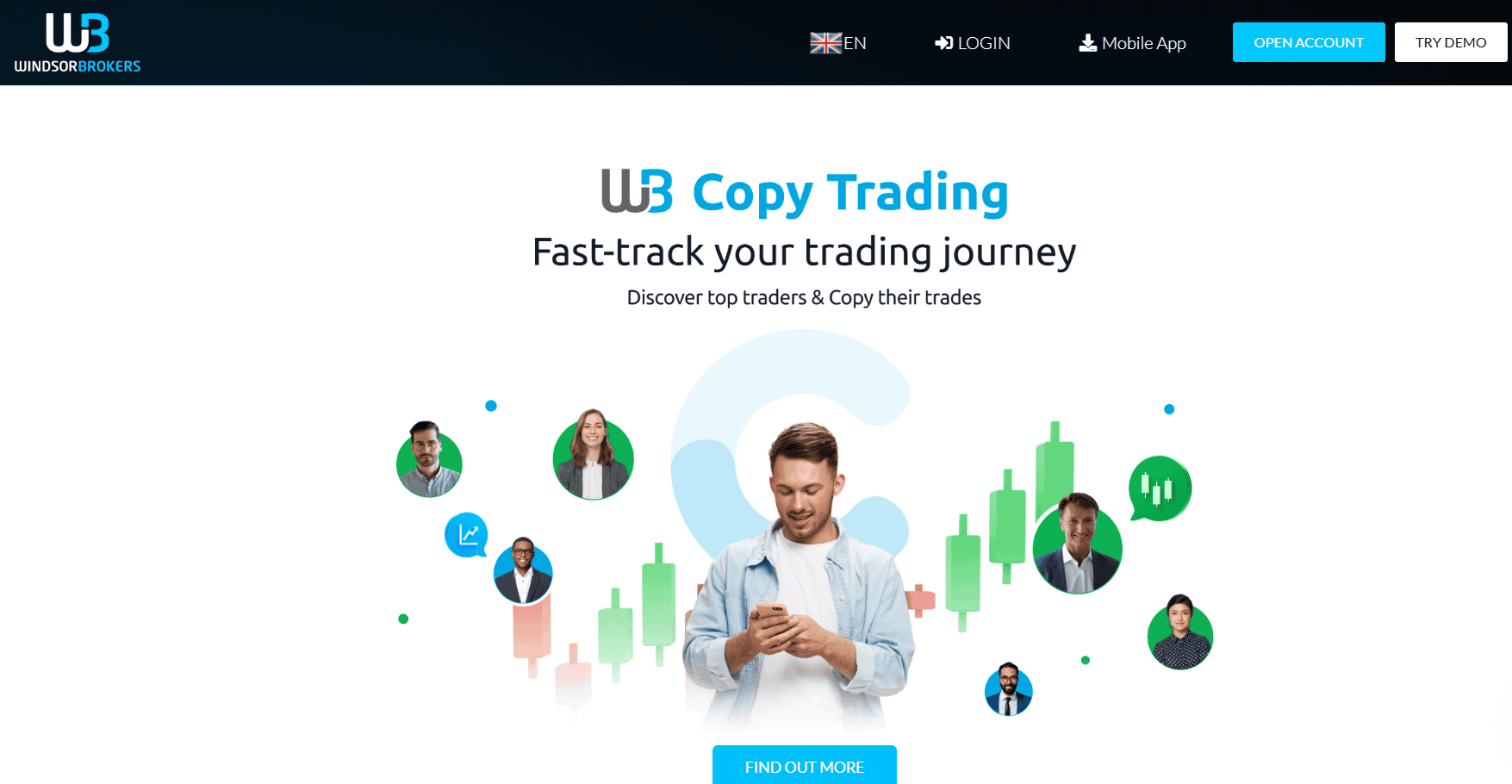

- Portfolio and Investment Opportunities

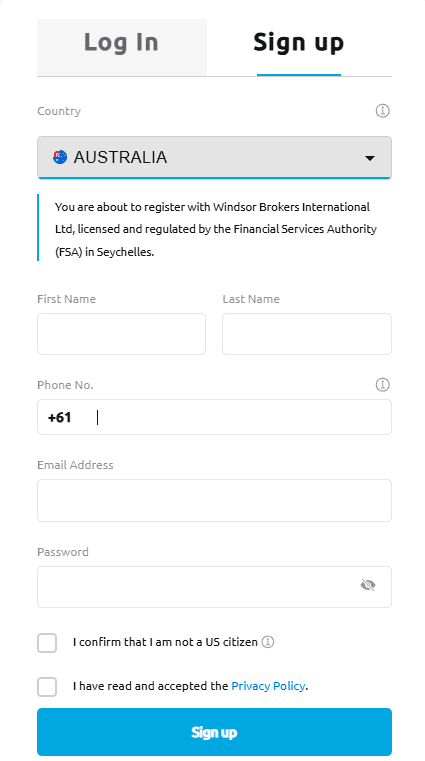

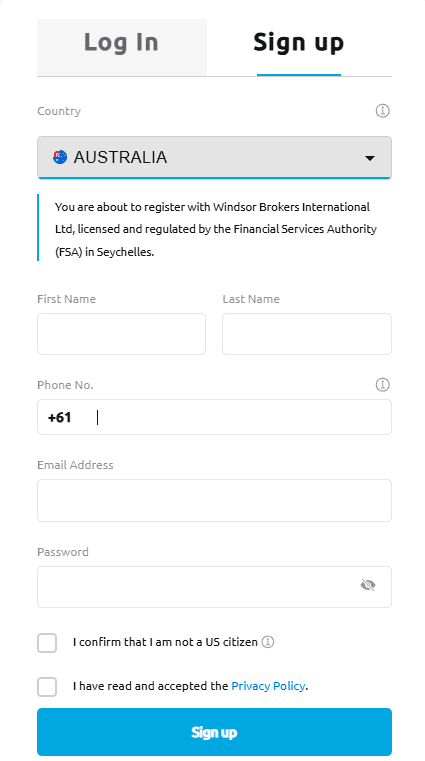

- Account Opening

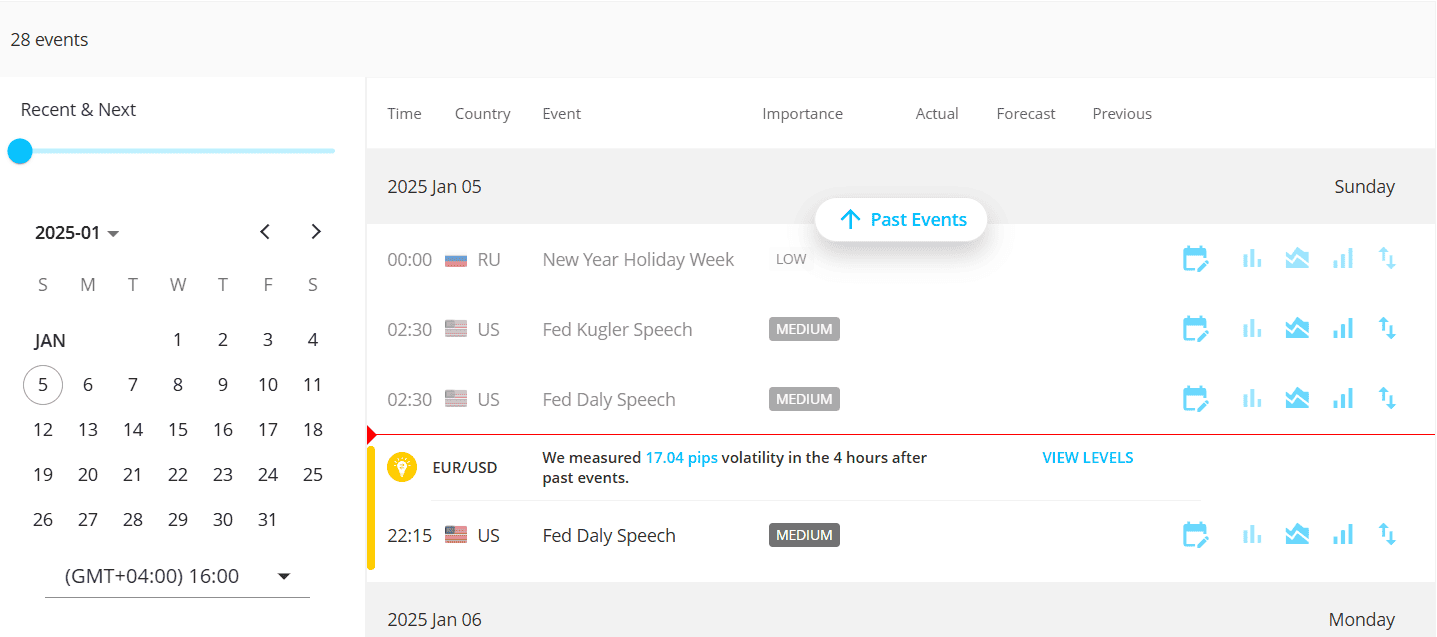

- Additional Tools And Features

- Windsor Compared to Other Brokers

- Full Review of Broker Windsor

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4 / 5 |

What is Windsor?

Windsor Brokers was established back in 1988 and is one of the region’s longest-serving brokers, known for its reliability, regulatory compliance, and customer-centric approach. The broker offers a range of trading instruments, including forex, commodities, indices, shares, and CFDs, through the popular MetaTrader 4.

Windsor Brokers offers its financial services to clients in over 80 countries, including Thailand, Indonesia, South Africa, Dubai, Kenya and Jordan. The services offered are suitable for traders of different levels, with great education for beginners and access to advanced features for more experienced traders.

Windsor Brokers Pros and Cons

Based on the research, our experts concluded that Windsor is a reliable broker with a good reputation, various account types and pricing built into commission or spreads, advanced platforms, and professional education.

On the negative side, Windsor does not provide 24/7 support and Standard account spreads might be higher than the industry average. Besides, the broker offers only the MT4 platform, which can be limiting for clients who prefer more advanced platforms.

| Advantages | Disadvantages |

|---|

| Multiply regulated broker with a strong establishment | Only Forex and CFDs

|

| Wide range of trading Global expansion including Australia, Asia, MENA, Africa regions and Europe | No 24/7 support

|

| Competitive trading conditions | |

| Numerous industry awards | |

Windsor Features

With tight regulation and one of the longest-existing brokers in the market, Windsor has been operating since 1988. It is a good-standing broker that offers trustworthy services and great features and tools for a profitable trading experience. Here you can see all the essential aspects of trading with Windsor Brokers in one place:

Windsor Brokers Features in 10 Points

| 🗺️ Regulation and License | CySEC, FSC, JSC, FSA, CMA |

| 🗺️ Account Types | Prime, Zero |

| 🖥 Trading Platforms | MT4, WB App, |

| 📉 Trading Instruments | Forex CFDs, Indices, Commodities, Cryptocurrencies, Shares, Energies, Futures, Metals, Bonds, ETFs |

| 💳 Minimum deposit | $50 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | AUD, USD, GBP, EUR |

| 📚 Education | Videos, Webinar, eBooks, Glossary |

| ☎ Customer Support | 24/5 |

Who is Windsor For?

Based on Our findings and Financial Expert Opinions Windsor Brokers is focused on providing secure and diversified trading by continuously enhancing its offerings. Here is where Windsor Brokers excels:

- Professional Traders

- EAs running

- Traders who prefer the MT4 platform

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

- Traders who prefer a wide range of trading products

- High leverage available

- Traders who prioritize good education and research

Windsor Summary

Our experts consider Windsor Brokers one of the oldest brokerage companies. The broker’s seamless trading offering and established smooth trading operational process have earned it a good reputation in the market. With competitive access to the market, technical improvements, and great solutions, the broker offers not only a popular MT4 platform, but also quality customer support, additional tools and features, and advanced education.

55Brokers Professional Insights

Windsor Brokers is among the oldest companies and is pioneer in Trading business, thus providing a solid regulatory structure and favorable conditions suitable for vast range of trading appetites. The variety of tradable instruments makes it an excellent choice for diversification, as Broker also characterized by competitive trading conditions, with mostly average spreads and leverage of up to 1:1000.

Windsor Brokers is suitable for both retail and professional traders with its two account types tailored for different trading needs. Beginners benefit from the user-friendly platform, free webinars, glossary, detailed videos, and daily market analysis, while experienced traders can benefit from advanced tools, including algorithmic trading, and complex strategies. All in all, Windsor Brokers’ rich education, dedicated customer support, and secure trading environment make it a reliable choice for every trader who prioritizes a professional approach and good market conditions.

Consider Trading with Windsor If:

| Windsor is an excellent Broker for: | - Beginner traders

- Professionals who look for complex strategies

- Who need access to a wide range of trading instruments

- Traders prioritizing security and tight regulations

- Those who prefer the MT4 platform

- Cost-Conscious clients

- Clients looking for high leverage opportunities

- Traders looking for Copy Trading opportunities |

Avoid Trading with Windsor If:

| Windsor is not the best for: | - Users preferring MT5 or other advanced platforms

- Clients looking for a 24/7 support

- Investors looking for traditional stock ownership or Real Futures Trading

|

Regulation and Security Measures

Score – 4.4/5

Windsor Regulatory Overview

Initially, Windsor Brokers was licensed and regulated by the Financial Services Commission (“FSC”) of Belize, which is an offshore zone. Yet, Windsor Brokers Ltd has also gained a license from the Cyprus Securities and Exchange Commission which also makes the broker EEA-authorized and MiFID-compliant to deliver trading solutions within Europe. In addition, Windsor is registered to provide legal trading services in Jordan opening opportunities for Muslim Traders to engage in Forex with Islamic Accounts.

While we never recommend trading with offshore or non-licensed brokers, since their registration offshore is very poor and therefore risky, additional regulation from other reputable authorities changes the status to a safe one. In simple words, it means that the broker puts significant effort into complying with regulations while all necessary ways of protection are submitted and followed.

How Safe is Trading with Windsor?

Windsor Brokers also takes a few safety measures to protect its clients’ funds. The clients’ money is always held in segregated accounts, in top-tier banks, along with data protection and a secure trading environment.

- Besides, WB Trade EU Ltd is a member of the ICF. The latter makes sure to compensate clients in case the broker fails in its operations.

Consistency and Clarity

When speaking of consistency, Windsor really stands out in this respect, as the broker has been around since 1988, providing a trustworthy environment and good conditions that meet the expectations of different clients. Through the years, Windsor has expanded both its geographical locations and the services it offers. Its License from CySEC ensures safety and security, confirming the trust of traders even further. Besides, the variety of awards Windsor has received proves that the broker has provided good conditions over the past years. The broker’s development is evident: before the broker mainly operated in Europe and now is one of the truly global brokers with great coverage of regions.

However, going through the real feedback from traders, we came across mixed reviews. Among the positive feedback reflecting on the tight regulation, access to a good range of instruments, and dedicated customer service, there are also complaints about withdrawal issues traders face. Although each experience is unique, we still recommend traders consider both positive and negative reviews and decide if it is worth signing with the broker.

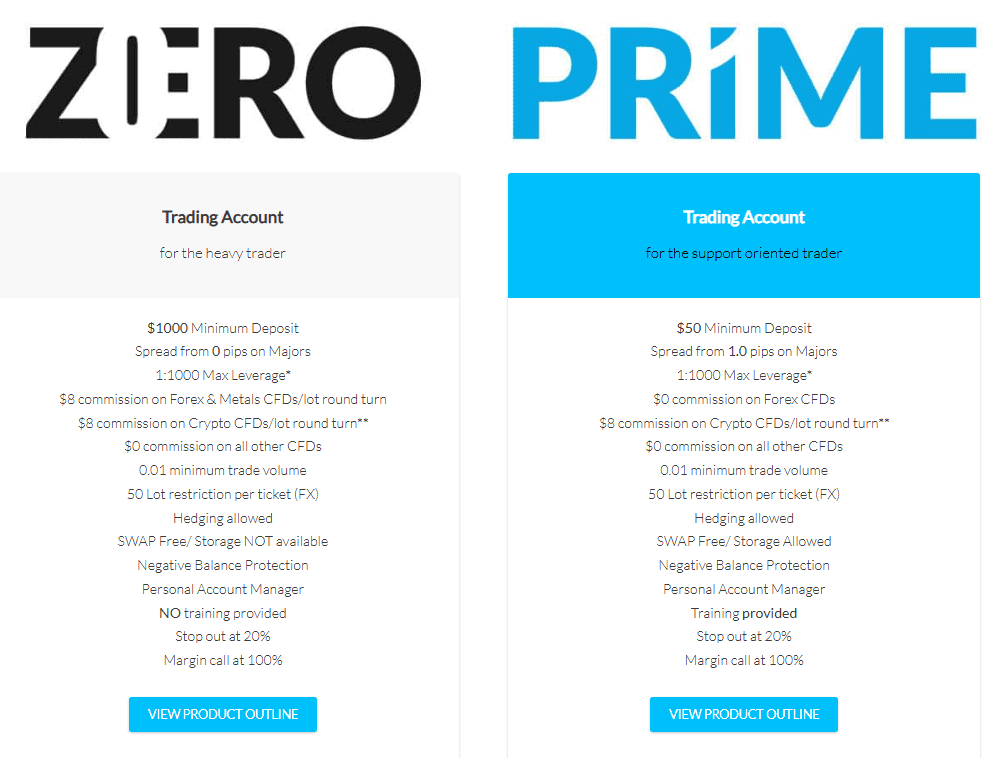

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Windsor?

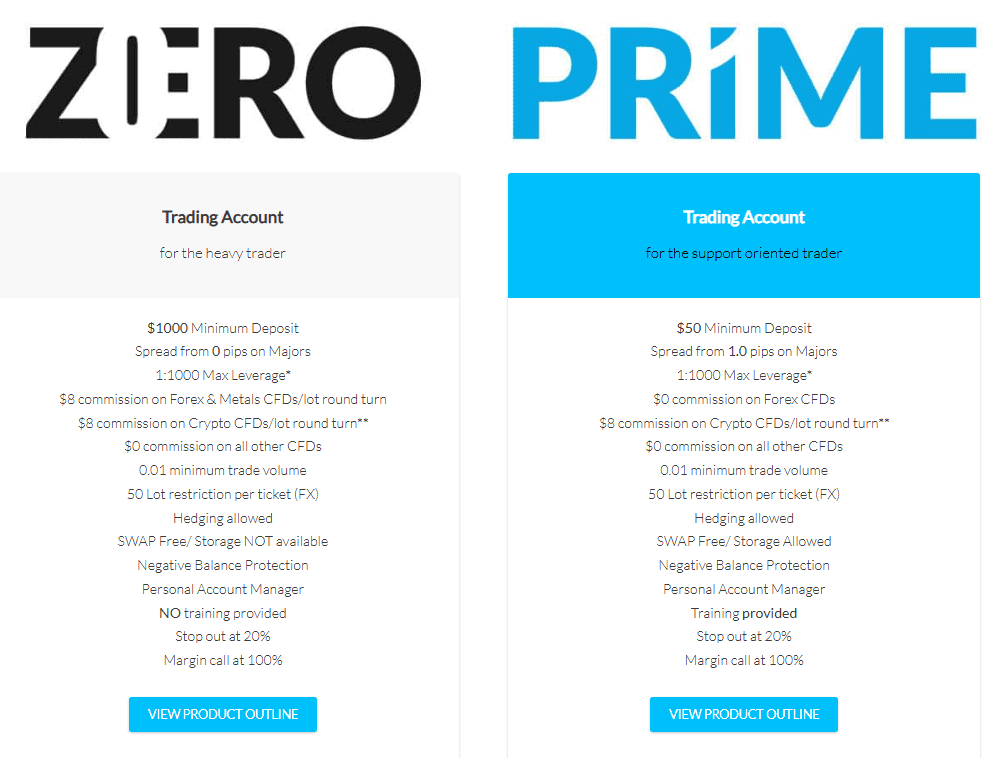

Windsor Brokers offers a choice between two account types – Prime and Zero, divided according to the trading size clients will operate. What is also great is that accounts feature negative balance protection, multilingual customer support, and other benefits that bring numerous benefits to the trading process. The leverage for both account types is the same, up to 1:1000. Clients should be careful, as the conditions may be different based on the entity to which they open their account.

Prime Account

The Windsor Prime trading account is suitable for traders of all levels. With a $50 minimum deposit, it provides competitive spreads that start at 1 pips. The commissions differ based on the instrument traded. The account also includes swap-free options and provides negative balance protection.

Zero Account

The Zero Account is for experienced traders who look for precision and cost efficiency. To open an account clients need to make a $1000 minimum deposit. The account also applies spreads from just 0 pips and commissions applicable for certain instruments.

Regions Where Windsor is Restricted

Although Windsor is available globally, extending its services constantly, there are still a handful of countries the broker does not offer its services to, due to regulatory restrictions. Here is the list of countries for your attention:

- The United States

- Malaysia

- Europe

- UK

- Cuba

- Iran

- Myanmar

- Ukraine

- Russia

- North Korea

Cost Structure and Fees

Score – 4.4/5

Windsor Brokerage Fees

At Windsor Brokers fees differ based on the chosen account type. Both of the accounts offer an integrated structure of spreads and commissions. The costs are also based on the traded instrument, and, of course, on the entity traders are registered with.

We found that the spreads are in line with the market average, starting from 1 pips for the Prime account and 0 pips for the Zero account. The spread for the EUR/USD pair is 1.5 pips, For Gold, the typical spreads are 0.2 pips, and for Crude Oil, from 0.03 pips.

Commissions at Windsor are applied for both of its account types however, they are applied differently, and customers should be careful not to get lost.

The Prime account does not charge commissions for Forex pairs and all other instruments. However, there is a $8 commission on Crypto CFDs per round turn.

The Zero Account applies a $8 commission per round turn for Forex pairs on CFDs, Metals, and Cryptocurrencies. No commissions are applied to all other instruments.

- Windsor Rollover / Swap Fees

Windsor Brokers also includes swap fees in its common charges. For the EUR/USD pair, the long swaps are -7.600, while the applied cost is 1.600 for the short swaps. For each instrument the swap fee is different.

How Competitive Are Windsor Fees?

Our investigation of Windsor’s fee structure revealed competitive and transparent fees that are mostly in line with the market average. Spreads are based on the account types and the instrument traded. This is also true about the commissions. Both of the account types have commissions for certain assets that the broker clearly mentions.

Also, conditions and fees can differ based on the entity with which the account is registered. This is another point to consider as the costs can differ from one entity to another.

| Asset | Windsor Brokers Spread | Octa Spread | Pepperstone Spread |

|---|

| EUR USD Spread | 1.5 pip | 0.8 pips | 1 pips |

| WTI Crude Oil Spread | 0.03 pips | 6 pips | 2.4 pips |

| Gold Spread | 0.02 pips | 2.8 pips | 0.15 pips |

Windsor Additional Fees

As for the additional fees, our research shows that Windsor does not incur an inactivity fee, which may be beneficial, especially for traders who choose to remain inactive for a certain period. However, we found that the broker at its own discretion might not cover the payment fees of withdrawals with either no or minimum trading.

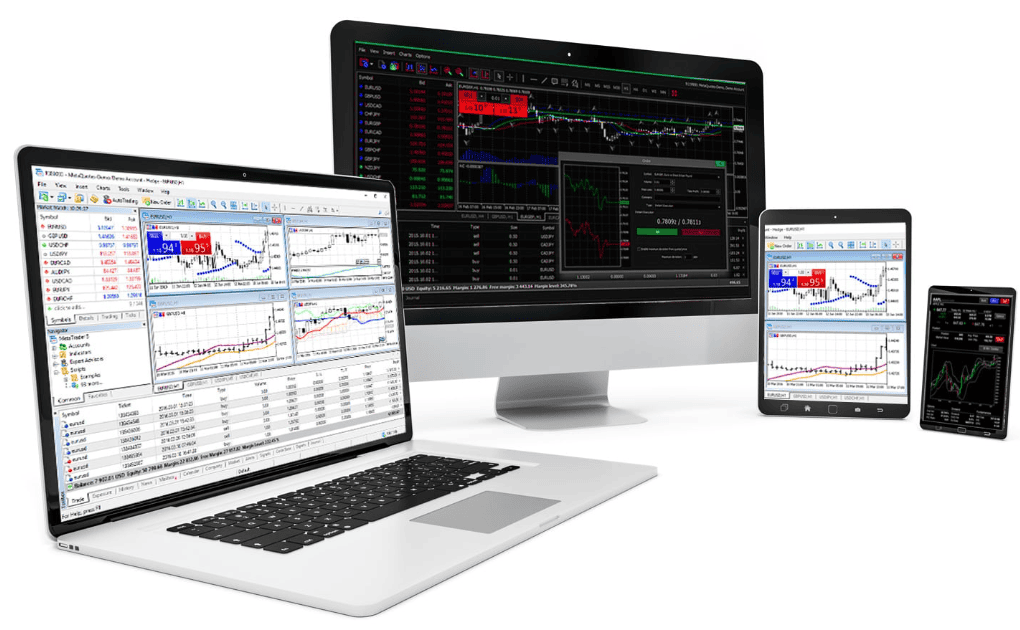

Score – 4.3/5

Windsor chooses the industry-leading platform MT4, an ideal choice for traders of any level through its charting functions and number of indicators for any strategy. The algorithmic trading functions also made the platform user-friendly and dynamic. The multi-device functionality enables traders access via desktop, WebTrader, and Mobile/ Tablet applications.

| Platforms | WIndsor | Pepperstone | XM |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| Own Platform | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Windsor Web Platform

The broker’s MT4 WebTrader enables traders to have effortless access to the platform anytime, and anywhere, without downloads and installations. Compatible with various devices, and operating systems, Windsor’s Webtrader ensures accessibility and provides advanced features including, advanced charting tools, one-click trading, and support for 3 chart types and 9 timeframes. Also, traders have access to the account history, enabling clients access to their trading activities. In short, the web trader is a great solution, especially for those, who value ease and flexibility, and use all the basic tools the platform provides.

Windsor Desktop MetaTrader 4 Platform

Windsor offers only the MT4 trading platform, one of the most popular trading platforms in the industry, with strong charting, a vast range of technical indicators, and advanced algorithmic trading capabilities. Furthermore, the Expert Advisors allow automatic performance optimization of trading strategies. All in all, a user-friendly interface, robust security, multi-device compatibility, and 50 inbuilt technical indicators, make MT4 a perfect choice for those traders who wish to enhance the efficiency and effectiveness of their trading.

Windsor Desktop MetaTrader 5 Platform

As was already mentioned, Windsor only offers the MT4 platform to conduct trades. The newer variant, MT5, with its more advanced features and tools, is unavailable, which might be a downside for more advanced traders who prefer a diversity of platforms, innovative features, and more complex strategies.

Main Insights from Testing

The results of testing reveal an advanced MT4 trading platform equipped with the most essential tools for favorable trading. The broker also enables its clients access to Windsor’s MetaTrader 4 MultiTerminal, which allows traders to access all their accounts from one place. Besides, clients have a choice of entering the platform through a desktop platform, web trader, or mobile, which gives more flexibility and choice. However, many clients might find the absence of the MT5 platform a disadvantage, as it is an enhanced version of the MT4 platform, with more advanced opportunities.

Windsor MobileTrader App

Trading through the app allows traders more flexibility and dependency, enabling them to trade from anywhere they wish. This also does not restrict clients from leading profitable trades, as they have access to most of the essential tools, including 30 technical indicators, 3 chart types, 9 timeframes, and full access to the trading history.

Trading Instruments

Score – 4.5/5

What Can You Trade on the Windsor Platform?

When it comes to instruments, Windsor has quite an impressive offering that includes a good range of currency pairs, the leading global CFD Indices, a good range of commodities with spreads on the lower side, and other trading assets that will allow traders to diversify their trading experience and explore more markets. The full offering of Windsor Brokers includes:

- Forex CFDs

- Indices

- Commodities

- Cryptocurrencies

- Shares

- Energies

- Futures

- Metals

- Bonds

- ETFs

Main Insights from Exploring Windsor Tradable Assets

Windsor Brokers provides access to over 600 instruments for trading across various asset classes, including Forex, metals, commodities, indices, shares, and ETFs. Traders gain access to a truly good variety of instruments ranging from 45 Forex pairs to such popular cryptocurrencies, as Bitcoin, Ethereum, and Litecoin, also, enabling access to Exchange Traded Funds including QQQ ETF & IWM ETF.

However, all the products are merely based on CFDs. This might be restricting for traders looking for real investments in stocks and shares. Thus our recommendation is to consider both the advantages the broker offers in terms of instruments and the possible limitations. Also, clients need to consider the difference in offering based on the entity.

Leverage Options at Windsor

While trading with Windsor Brokers you are able to operate with powerful leverage, which may increase potential gains through its possibility to multiply initial balances. Yet, it is essential to learn how to use multiplier correctly, as leverage may increase your potential losses as well.

- Windsor offers high leverage levels, such as 1:200, 1:400, or 1:500, and even up to 1:1000 for professional traders or retailers that trade with a global entity of Windsor.

- Or, a lower level of maximum 1:30 for European residents since CySEC along with ESMA restricts usage of high leverage.

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at Windsor

Windsor offers multiple methods for funding the account. Traders can deposit money throughCredit Cards, e-wallets, and wire transfers. However, due to the regulatory differences, some funding methods might not be available based on the entity.

Minimum Deposit

The minimum deposit with Windsor Brokers is $50 for its Prime account. This is a good offering, as most other brokers have a $100 or even higher initial funding requirement. However, for its professional Zero account, the initial deposit is $1,000.

Withdrawal Options at Windsor

Withdrawal Options and deposit methods include Card payments and e-wallets, which process with a 3% fee, while Bank transfers may occur with different fees according to the institution and the region. For Visa and Master cards, processing is on the same day.

- Deposits by Credit Card must be withdrawn back to the same Card. The same is true for e-wallets.

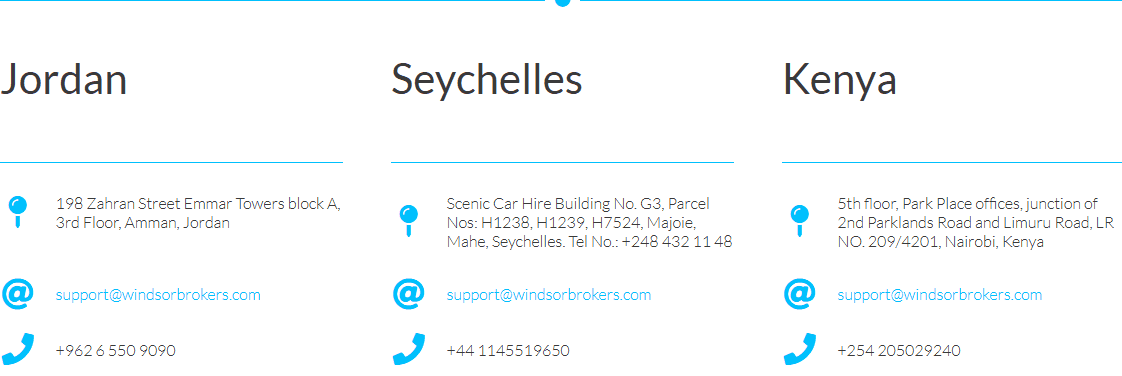

Customer Support and Responsiveness

Score – 4.4/5

Testing Windsor Customer Support

Our testing showed that Windsor offers dedicated multilingual customer service, and provides relevant answers. Live chat, email, and phone communication are also available to help traders with whatever they need.

- The broker also has a Help Center, that includes the most common questions about trading with Windsor.

- Also, Windsor is social and traders can find the broker through FB, IG, Linkedin, and YouTube, where it shares most of its updates.

Contacts Windsor

Windsor provides email and phone communication, based on its registered regions – Kenya, Jordan, and Seychelles. The email address is the same for all the regions – support@windsorbrokers.com while phone enquires are made via +962 6 550 9090 for Jordan, +44 1145519650 for Seychelles, and +254 205029240 for Kenya.

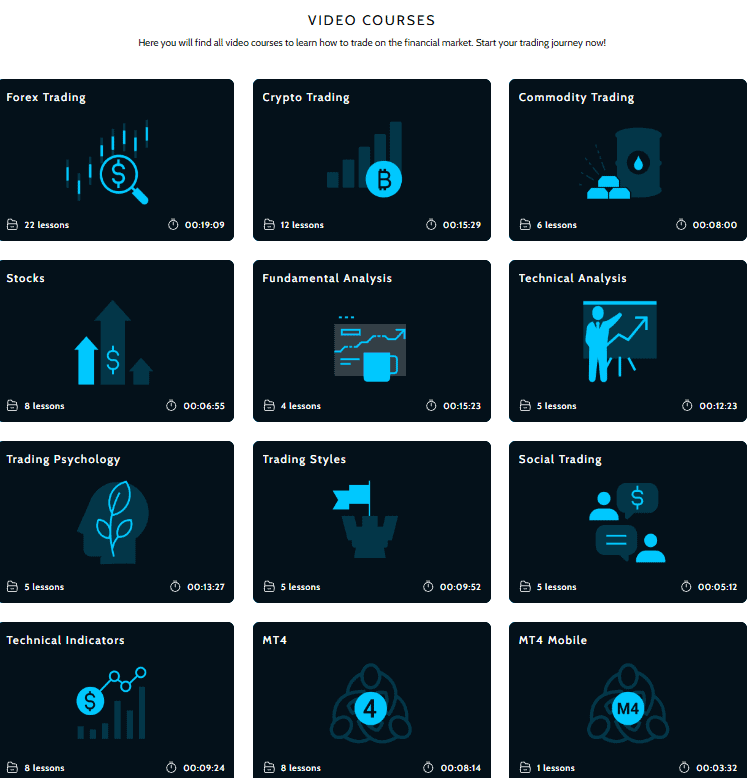

Research and Education

Score – 4.5/5

Research Tools Windsor

Windsor provides good market analysis to help traders be informed of the market movements and make informed decisions. The technical analysis is provided by leading specialists in the market and includes trading ideas, technical outlook, and the latest market news.

- Trading ideas examine market price movements and trends, support, and resistance levels by using charts on all major currency pairs. This provides crucial information on each instrument.

- Technical outlook again includes important data on the market, assisting traders in making well-considered decisions. In addition, market news also keeps traders informed of the latest happenings and changes in the fast-paced environment.

Education

As for education, Windsor offers a variety of comprehensive educational tools to enhance traders’ knowledge. The education section includes webinars, educational videos, a glossary, and eBooks.

- Webinars provide traders with additional knowledge on the forex market, how to navigate, give more market insight, and help traders dive into various strategies to take trading to a more advanced level.

- The glossary section is essential, especially for beginners who need guidance and explanations on every step in trading. Sometimes complex terms can bewilder traders, thus trading glossary can be very helpful.

- Windsor’s eBook collection is quite impressive, providing materials on different instruments, strategies, and the overall market.

- The broker’s video gallery is also impressive, being comprised of different educational videos suitable both for beginner traders and more experienced ones.

Is Windsor a Good Broker for Beginners?

Based on our overall research and emphasis on the education and research sections, we find Windsor a suitable broker for beginners, with its good analysis and helpful educational materials. Webinars, educational videos, and glossaries are essential tools for beginner traders to gain more insight into the markets and obtain experience. Besides the low minimum deposit option, with a demo account accessibility, make the broker even more beginner-friendly.

Portfolio and Investment Opportunities

Score – 3.8 /5

Investment Options Windsor

For traders who are specifically interested in the diversification of their portfolios and exploring more investment options, Windsor might not be the best match. The broker provides its trading products predominantly based on CFDs, which means traditional investments are not available. Besides, the investment options through PAMM and MAM accounts are not an option either, as for the moment the broker does not provide them.

- Windsor, however, does provide Copy Trading, allowing investors to automatically copy the trading activity of advanced traders. This way traders can diversify their trades and get more exposure to the market.

Account Opening

Score – 4.5/5

How to Open a Demo Account?

Demo account opening with Wondsor is a quick and seamless process, with no complications and difficulties. Traders need to follow the following steps for a quick start:

- Choose the “Try Demo’ on the broker’s website

- Fill in the required details ( name, email address, phone number, etc.)

- Choose the preferred account settings (account type, leverage, etc.)

- Receive a verification email via mail and verify the account

- After, download the trading platform using the provided login credentials

- Start trading

How to Open a Windsor Live Account?

Opening a live account with Windsor does not differ much from the demo account opening. The difference is that for the live account, the broker will ask for more documents and will require stricter ways of identity verification. Here are the main steps:

- Enter the broker’s website and choose the ‘Open Account’ option

- Fill in the required form, and confirm that you are not a US citizen

- Create a password

- Receive a verification email and use the credentials to verify your account

- Complete your profile by providing your address, trading experience

- Fill in the trading expectation questions

- Read the client account agreement and confirm

- Then select the trading conditions such as currency and leverage

- Upload documentation (proof of identity and proof of address)

- After the provided information is processed your account will be confirmed

Score – 4/5

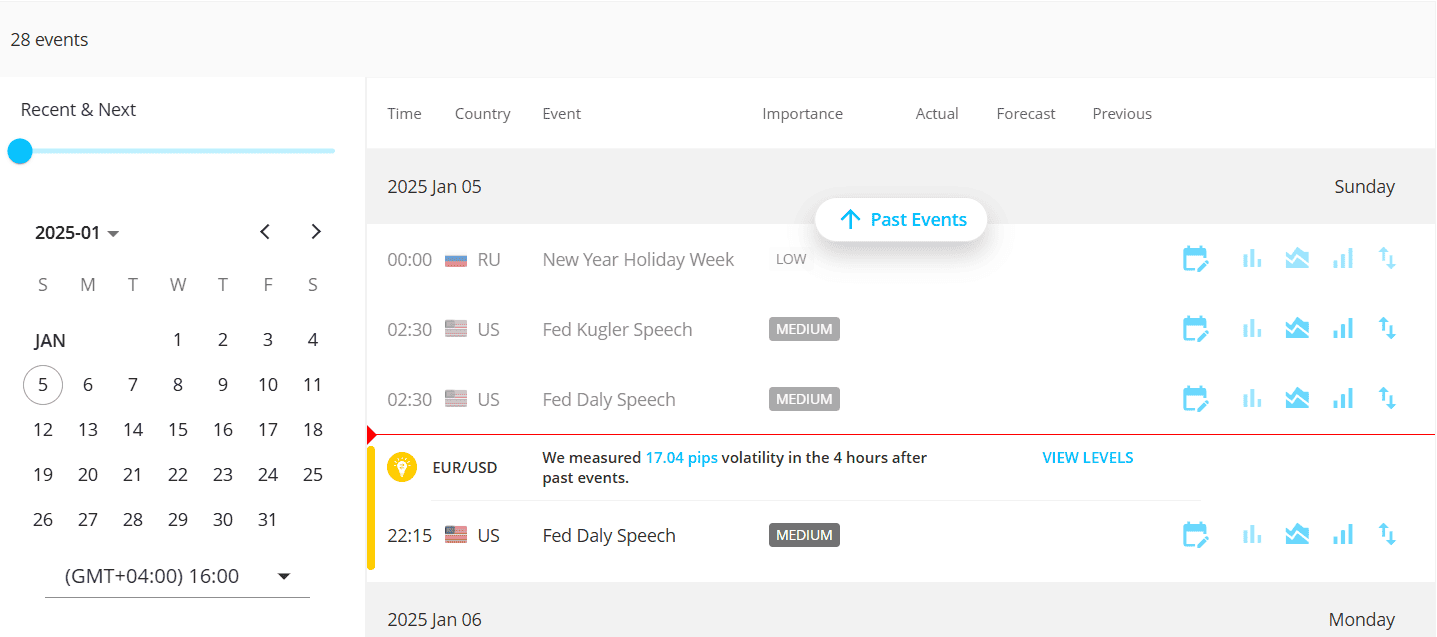

We found that most of the broker’s tools and features are already integrated into its trading platform. There are a few additional features that traders can use for a more advanced experience. Below see the main additional features provided:

- Economic Calendar is a useful tool to keep up to date with all the upcoming economic releases and events all over the world. The good point is that Windsor’s Economic Calendar is automatically updated during live announcements to provide traders with the essential changes that may affect their trading course.

- Through its trading Calculators traders are able to measure the possible profit or loss of a trade based on the account’s base currency, opening/closing trade price, and the trade size.

- A $30 welcome bonus traders can receive by signing into the Portal, clicking on ‘Promotions’, and requesting the bonus. Traders will need to read the conditions on the bonus and click agree.

Windsor Compared to Other Brokers

We have compared Windsor Brokers to several other well-regulated brokers with good standing, to see where it stands and if the conditions it offers are in line with the market. We found that Windsor is a multi-regulated broker with licenses from CySEC and other authorities, providing transparency and safety of trades. However, there are still brokers like Admiral Markets that are more tightly regulated. Still, the broker provides more safety measures when compared to RoboForex and BlackBull Markets.

Another aspect is Windsor’s fee structure. We found that the spreads and commissions are mostly in line with the market, maybe a little higher when compared to Admiral Markets and Exness. As for the trading platforms, Windsor’s offering is a little limiting with only the MT4 platform, while FP Markets and Pepperstone offer a better variety of platforms, including MT5, cTrader, TradingView, etc.

When it comes to education, Windsor, with its webinars, video tutorials, and eBooks, is a better offering than Exness or Eightcap. All in all, Windsor has both advantages and disadvantages when compared to others, and clients need to consider both before choosing Windsor as their broker.

| Parameter |

Windsor |

Pepperstone |

RoboForex |

Exness |

FP Markets |

Admiral Markets |

Eightcap |

| Spread Based Account |

Average 1.5 pips |

From 1 pip |

Average 1.3 pip |

From 0.2 pips |

From 1 pip |

From 0.6 pips |

Average 1 pip |

| Commission Based Account |

0.0 pips + $4 |

0.0 pips + $3.5 |

0.0 pips + $4 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Low/Average |

Average |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

MT4 |

MT4, MT5, cTrader, TradingView |

MT4, MT5, R StocksTrader |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, Admiral Markets app |

MT4, MT5, TradingView |

| Asset Variety |

600+ instruments |

Over 1,200 instruments instruments |

12,000+ instruments |

200+ instruments |

10,000+ instruments |

8000+ instruments |

800+ instruments |

| Regulation |

CySEC, FSC, JSC, FSA, CMA |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FSC |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

ASIC, SCB, CySEC, FCA |

| Customer Support |

24/5 support |

24/7 |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Excellent |

Excellent |

Good |

Fair |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$50 |

$0 |

$10 |

$10 |

$100 |

$1 |

$100 |

Full Review of Broker Windsor

Windsor Brokers is considered one of the oldest and largest brokerage companies. With tight regulation and advanced market conditions, traders can rely on an efficient and enhanced trading experience. With access to the MT4 platform, over 600 trading instruments supported, and solid customer support for its customers, Windsor Brokers is a good choice for beginners and professional traders, catering to the needs of novice traders with excellent education and low fees and to the expectations of advanced traders by providing access to EAs and various complex trading strategies.

In other words, Windsor Brokers is a good option for traders in search of a reliable and multifunctional broker. The company has extensive experience, together with strong trading solutions and quality service, good standing in the market, and global reach.

Share this article [addtoany url="https://55brokers.com/windsor-brokers-review/" title="Windsor Brokers"]

I came across this broker today but just as I was about to do business with them especially on their copy trading I came across users comments which has put me off. I give Windsor less than 1 Star. Beware!

Scam, you will never receive any profits made from the $30 Bonus. please don’t work with them

Scam, you will never receive any profits made from the $30 Bonus.

Windsor is a scam they just rejected my withdrawal.

They are a scam broker, after requesting a withdrwal today, they claimed my account is not activated and later sent me this We would like to inform you that as per the Terms and Conditions of the $30 Promotion, kindly note that a client may not use the name and/or registration data (including but not limited to IP address, email address, telephone number, physical address, utility bill etc.) of another participant in the $30 Promotion.

Therefore, this email serves to notify you that the $30 credit in your account and any profit or loss derived from that will be cancelled as of immediate effect.

Please refer to the Terms and Conditions of this promotion for further details.

Regards,

Windsor Brokers Team

Also went thru the same terminated as soon as i wanted to withdraw scam please do not throw away ur money with this broker

This is scam scam broker don’t belive their bonus 100000% scam

They did the same to me

Big scam of the year,,,I made 90$. Profit they approved my account on making a withdrawal request they terminated my account be aware of the real scam on this platform, am not paid to spread bad new about this platform that a victim of this scam even after doing much effort to meet all the requirements they don’t mind at all,,all they got do is to terminate my account

Windsor is a SCAM people💔 FIND OTHER BROKERS TO TRADE FOR, LIKE XM

XM is not good either

Do not waste your time with them.I got the 30$ bonus as a new client fulfilled all conditions and then tried to withdraw.They said I needed to be approved.I got approved.Then tried to withdraw again and they sent me an email to terminate my account.Then i traded again with the still functioning account.I tried to withdraw again then they sent me an email that i should fund my account.Their live chat agents are shitty as they can ever be.Unresponsive as fuck.If you need proof whatsapp me on +254718610451 i have all screenshots and chat transcripts.

Scam scam,never ever try to use their bonus,all they do is to collect your profit once you trade and make profit..SCAM BROKER.

Windsor is a scam all the positive reviews it’s them posting it.. DONT FALL FOR IT WINDSOR NEEDS TO BE REPORTED AND CLOSED DOWN

Its a very competitive time in Foreign exchange market. There are also so many retail Brokers in the industry now & maximum of them are very much new,even less than 3 years old. Where “Windsor Broker”s is counting 30+ years. I recently experienced them. Their tradings platforms & tools are so up to date that I got totally no lag to execute any trade. Its even better than many of the renowned brokers like ICmarkets/FBS/Exness. They have a very clear support center. I must say its very trusted & good broker.

That is because you work for them bs

It’s SCAM, DON’T waste your time and effort on this. I claimed $30 bonus and when I profited and wanted to withdraw my money they cancelled the account. I didn’t break any rules but they will look for anything to steal your money.

Scam Broker this one, I made $89 profit with the $30 bonus and when I tried to withdraw it, they terminated the account.

Hi…

I am Mahesh my account number was 224305 I opened their promotion bonus account and claimed $30 after trading for few day I decided to make a Withdrawal of $60 to check withdrawal process.

I was told my account needs to be Approved then I can make a withdrawal through my Portal but to my surprise I was informed that my account is terminated. So you see how they are just fooling around and making us to waste our time and energy.

Note: Stay away from Windsor SCAM broker

I fell for the same scam from WindSCAM Broke-ASS.

I’m in that situation right now. It’s sad.

Same like that this scam I am also fooled by windsor

It is true, as we speak, it happened to me. 514287. I ask the rule i broke, they don’t know. Been trading 2 months with the bonus, but apparently my account was not approved, so they had to approve after i make the withdraw