- What is Wealthsimple?

- Wealthsimple Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Wealthsimple Compared to Other Brokers

- Full Review of Broker Wealthsimple

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is Wealthsimple Invest?

Wealthsimple is a Canadian financial firm offering Stock trading and investment services, along with a variety of financial planning options. The platform enables investors to trade a diverse range of financial products, including stocks, ETFs, options, and cryptocurrencies.

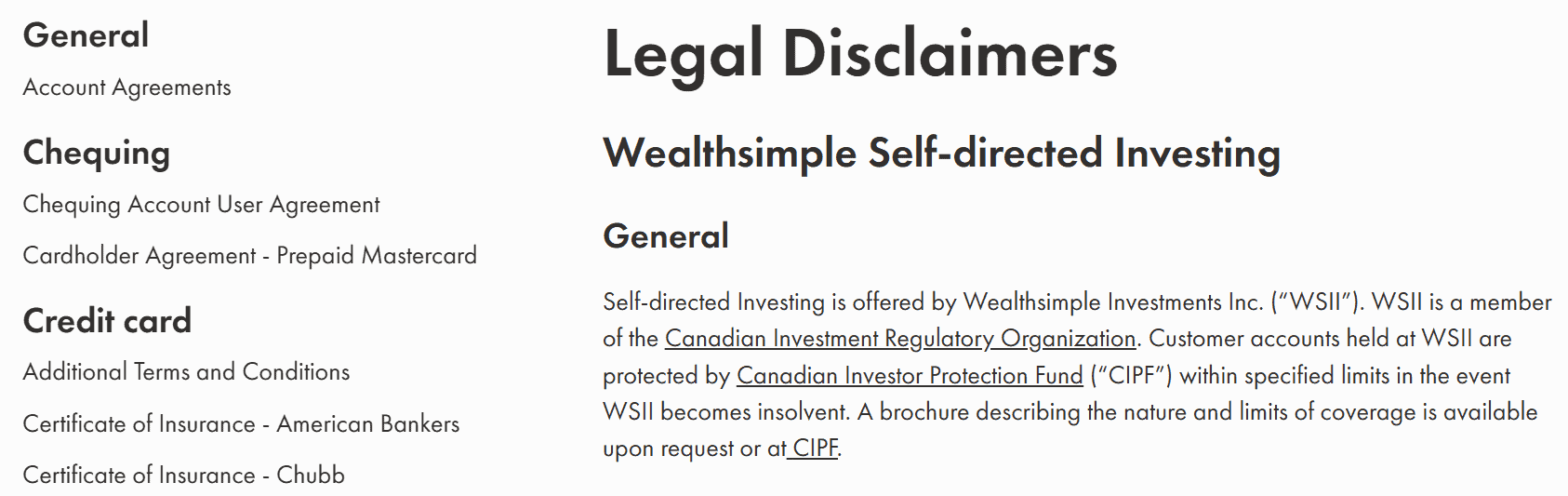

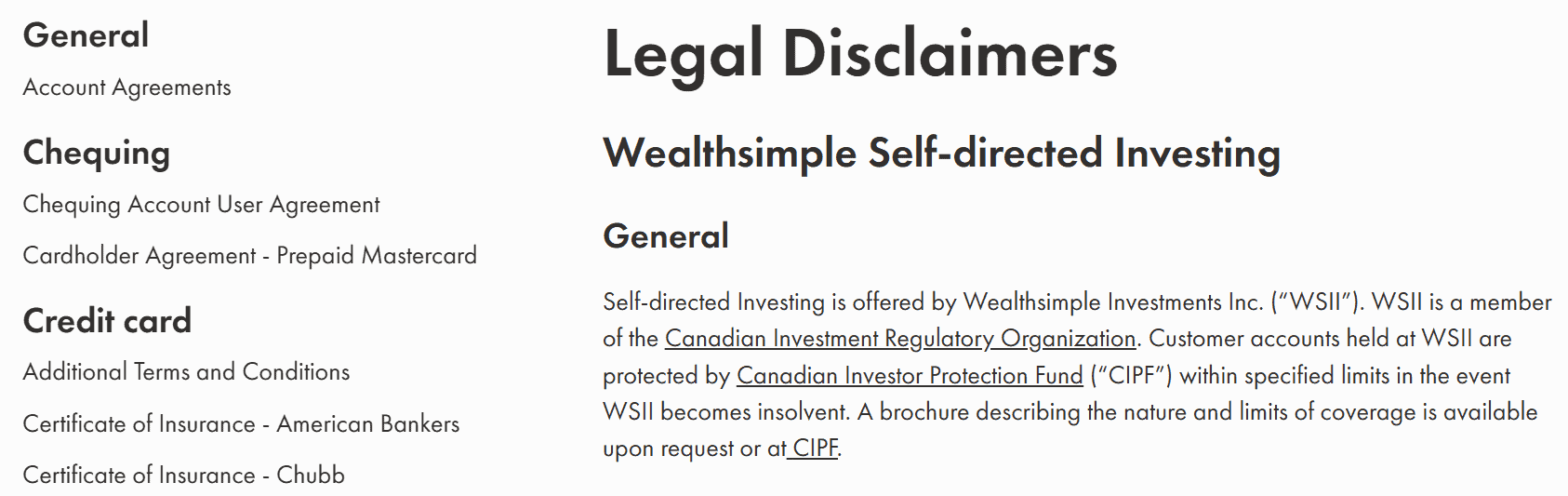

The broker is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and is a member of the Canadian Investment Regulatory Organization (CIRO). These organizations ensure strict compliance with regulatory standards and help safeguard investors’ assets.

Overall, Wealthsimple focuses on providing automated, low-cost investment solutions for individuals seeking a hands-free approach to portfolio management.

Is Wealthsimple Stock Broker?

Yes, Wealthsimple operates as a Stock Trading broker. The firm offers automated investment solutions through its robo-advisory service and allows users to build and manage diversified portfolios based on their financial goals and risk tolerance.

Wealthsimple Pros and Cons

The broker has several advantages, including its user-friendly interface, commission-free trading on stocks and ETFs, and automated investment solutions. The platform caters to both beginners and experienced investors, offering diverse financial products.

For the cons, it has more limited investment options compared to some traditional brokers. Additionally, the platform has simplified education and research tools, potentially affecting the depth of market information available to users.

| Advantages | Disadvantages |

|---|

| IIROC regulation and oversee | No 24/7 customer support |

| Secure investing environment | Limited investment products |

| Self-directed investing | No paper trading or demo account |

| User-friendly interface | Limited education and research materials |

| Low minimum deposit requirement | |

| Competitive trading conditions | |

| Cost-effective | |

Wealthsimple Features

The broker provides competitive investment solutions, a user-friendly trading platform, and low-cost brokerage fees. An overview of its primary features is provided below:

Wealthsimple Features in 10 Points

| 🏢 Regulation | IIROC |

| 🗺️ Account Types | Registered Retirement Savings Plan (RRSP), Tax-Free Savings Account (TFSA), First Home Savings Account (FHSA), Chequing, and more accounts |

| 🖥 Trading Platforms | Wealthsimple App |

| 📉 Trading Instruments | Stocks, ETFs, Options, Cryptos |

| 💳 Minimum Deposit | $1 |

| 💰 Average Stock Commission | From $0 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | USD, CAD |

| 📚 Trading Education | Insights, Guides, Articles |

| ☎ Customer Support | 24/7 |

Who is Wealthsimple For?

Wealthsimple is best suited for individuals who want a simple, affordable, and accessible way to invest. It caters to beginners who may be new to the markets, as well as more experienced investors seeking a low-maintenance, automated approach. Based on our findings, Wealthsimple is Good for:

- Canadian traders

- Investing

- Stocks and Options trading

- Professional trading

- Advanced traders

- Self-Directed Investing

- Competitive trading conditions

- Supportive customer service

Wealthsimple Summary

In conclusion, Wealthsimple stands out as a user-friendly trading platform offering a range of financial services. The platform’s emphasis on simplicity, transparency, and low fees makes it an attractive option for both novice and experienced investors.

While the educational resources may be somewhat limited, the broker’s commitment to accessibility and customer support contributes to its overall appeal.

Overall, we found that Wealthsimple provides a reliable investment environment. However, we recommend conducting thorough research to assess whether the broker’s offerings align with your specific needs.

55Brokers Professional Insights

Wealthsimple stands out as a user-friendly platform with simple investing process for traders with or without experience, offering automated portfolio management backed by advanced technology so is a right choice of Broker for either manual or auto trade.

One of its key strengths we mark at the WealthSimple is its commitment to low-cost investing, with some of the lowest account minimums and competitive fees for almost all offered instruments and features, all in all making Broker attractive to most audience.

In addition, Wealthsimple emphasizes responsible and diversified investment strategies, catering to investors with specific values and preferences. Its seamless integration of digital tools, transparent pricing, and strong customer support position the platform as a trusted choice for individuals seeking a straightforward yet advanced approach to building wealth.

Consider Trading with Wealthsimple If:

| Wealthsimple is an excellent Broker for: | - Need a well-regulated broker.

- Competitive trading conditions.

- Stock Trading and Investment.

- Secure trading environment.

- Professional trading.

- Canadian traders.

- Beginner and intermediate investors.

- Offering popular financial products.

- Looking for broker with 24/7 customer support.

- Low fees and commissions.

- Diversified investors.

|

Avoid Trading with Wealthsimple If:

| Wealthsimple might not be the best for: | - Need a broker with trading services worldwide.

- Investors who prefer robust educational resources.

- Investors who want access to a broader range of assets like futures or complex derivatives.

|

Regulation and Security Measures

Score – 4.5/5

Wealthsimple Regulatory Overview

Wealthsimple is a reliable Stock broker that follows the strict rules and guidelines established by Canadian IIROC. This Top-Tier regulation safeguards client assets and provides low-risk trading.

How Safe is Trading with Wealthsimple?

Wealthsimple is a legitimate and regulated investing firm. It is authorized by a reliable Canadian authority and has a good reputation in the financial market.

Wealthsimple Canada emphasizes customer trading protection through various measures. The firm is a member of the Canadian Investor Protection Fund (CIPF), which offers protection in case the brokerage faces financial insolvency. This means that eligible clients may be compensated up to specified limits in the unlikely event of the platform’s insolvency.

The platform strives to prioritize the security and protection of its customers’ assets, contributing to a secure trading environment.

Consistency and Clarity

Wealthsimple has built a strong reputation in the financial services industry by maintaining consistency, transparency, and client trust since its establishment in 2014. Backed by regulatory oversight in Canada, the broker has earned credibility as a reliable platform for both beginner and experienced investors.

Trader reviews often highlight the ease of use, straightforward fee structure, and innovative features, while some note limitations in asset variety and advanced tools.

Wealthsimple’s commitment to clarity is further reinforced by its public recognition, having received multiple awards for innovation and customer service. Beyond finance, the company actively engages in social initiatives, including sponsorships and community-driven programs, which reflect its broader commitment to making investing inclusive and impactful.

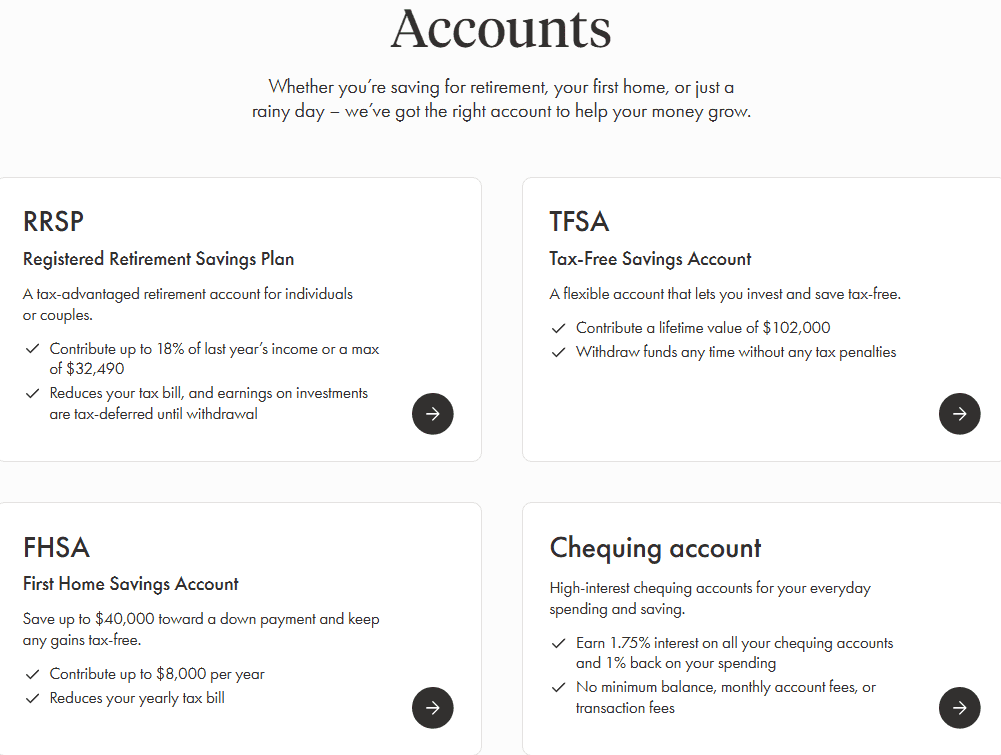

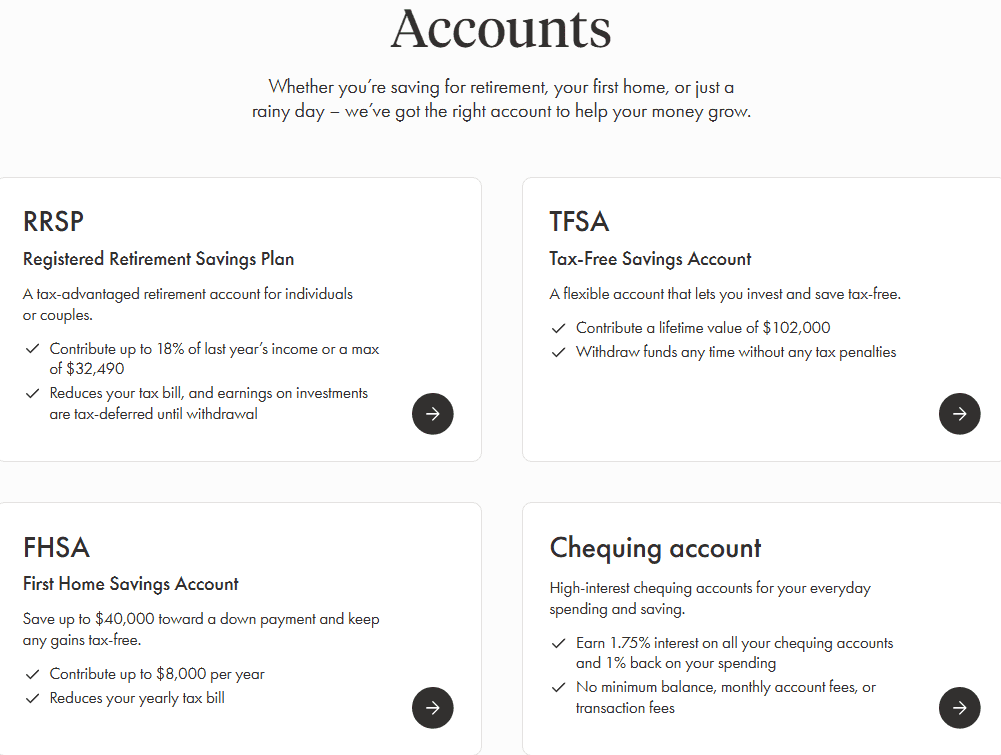

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Wealthsimple?

The broker offers a range of account types to suit diverse financial needs. These include account types such as the Registered Retirement Savings Plan (RRSP), Tax-Free Savings Account (TFSA), First Home Savings Account (FHSA), Chequing Account, and more.

TFSA Account

The Tax-Free Savings Account with Wealthsimple is one of the firm’s most popular choices, offering investors the ability to grow their money tax-free while maintaining full flexibility on withdrawals.

The firm requires a low minimum deposit amount of $1 to open a TFSA, making it highly accessible for new investors. Whether through Wealthsimple Invest’s automated portfolios or Wealthsimple Trade’s platform, the TFSA account provides a simple and cost-effective way to save and invest for any financial goal.

Regions Where Wealthsimple is Restricted

Wealthsimple is currently available only to Canadian investors. Individuals residing outside of Canada cannot open accounts, as the platform’s services are restricted to Canadian residents due to regulatory and operational requirements.

Cost Structure and Fees

Score – 4.7/5

Wealthsimple Brokerage Fees

The firm is known for its transparent fee structure, offering competitive pricing across its various services. The broker charges a management fee based on the total assets under management.

While Wealthsimple aims to keep its fees competitive, traders should review the detailed fee information for each service to ensure a clear understanding of the costs associated with their investment and trading activities.

The broker is known for its commission-free model, allowing users to buy and sell different products without incurring traditional commissions. This fee structure is particularly appealing to investors looking to minimize transaction costs.

As fees and commissions can be subject to change, traders should check the broker’s official website or contact customer support for the latest and most accurate information regarding trading commissions.

- Wealthsimple Exchange Fee

Wealthsimple charges some exchange and regulatory fees, which are typically applied per trade and are passed directly to the user. While generally minimal, they vary depending on the type of security and the exchange where it is traded.

These fees ensure compliance with market regulations and help maintain the integrity of trading activities.

- Wealthsimple Rollover / Swaps

Wealthsimple does not directly offer traditional Forex trading, so concepts like rollover or swap fees are generally not applicable to its standard investment accounts.

For self-directed trading of stocks and ETFs, there are no overnight financing or swap charges. However, for investors using margin through Wealthsimple Trade, interest may apply on borrowed funds, which functions similarly to a cost for holding leveraged positions overnight.

How Competitive Are Wealthsimple Fees?

Wealthsimple is considered highly competitive in terms of its fee structure. The platform charges no commissions on stock and ETF trades and offers low management fees for its automated portfolios, typically ranging from 0.4% to 0.5% annually.

While small regulatory and exchange fees still apply, these are standard across the industry. Compared to traditional brokers with higher commissions and account minimums, the broker provides a cost-effective and transparent way to invest, making it attractive for those seeking simple, low-cost investing solutions.

| Asset/ Pair | Wealthsimple Commission | Zerodha Commission | Upstox Commission |

|---|

| Stocks Fees | From $0 | From ₹20 | From ₹20 |

| Fractional Shares | Yes | No | No |

| Options Fees | From $2 | From ₹20 | From ₹20 |

| ETFs Fees | From $0 | From ₹10 | From ₹20 |

| Free Stocks | Yes | No | No |

Wealthsimple Additional Fees

In addition to standard trading and management fees, Wealthsimple charges a few additional fees depending on the account type and services used. These include fees for wire transfers, currency conversion, and margin interest for borrowed funds.

While most everyday transactions, such as buying and selling stocks or ETFs, are commission-free, users should be aware of these occasional costs. Overall, Wealthsimple keeps additional fees minimal and transparent, ensuring that most investors can manage their portfolios without unexpected charges.

Trading Platforms and Tools

Score – 4.5/5

Wealthsimple provides a user-friendly trading experience through its mobile app. Designed for simplicity and functionality, the app allows investors to execute trades seamlessly from their mobile devices.

The convenience of mobile access enhances the overall user experience, making it easy for both novice and experienced investors to manage their portfolios on the go.

Trading Platform Comparison to Other Brokers:

| Platforms | Wealthsimple Platforms | Zerodha Platforms | Upstox Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Wealthsimple Web Platform

Wealthsimple primarily focuses on its mobile app, which provides a smooth and user-friendly experience for trading, portfolio management, and account monitoring.

While a web platform is available, it offers more limited functionality, mostly allowing users to view their accounts and perform basic management tasks.

Wealthsimple Desktop MetaTrader 4 Platform

Wealthsimple does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support CFD trading, typically associated with MT4.

Wealthsimple Desktop MetaTrader 5 Platform

Wealthsimple does not support MetaTrader 5 either. The firm does not provide access to advanced platforms like MT5, maintaining its focus on its mobile platform.

Wealthsimple MobileTrader App

The Wealthsimple app is a user-friendly and intuitive platform designed to provide a seamless experience for investors. Available for mobile devices, the app allows users to effortlessly trade stocks, ETFs, options, and cryptocurrencies.

The app is accessible to both beginners and experienced investors, providing a convenient way to manage and monitor their portfolios on the go.

Main Insights from Testing

Testing the Wealthsimple app reveals a platform that is intuitive, fast, and user-friendly. The app provides easy navigation between accounts, portfolios, and trading options, with clear visuals and performance summaries.

Features like automated investing, recurring contributions, and real-time notifications enhance convenience, while occasional minor limitations, such as fewer advanced tools, reflect its focus on simplicity over professional-level trading.

AI Trading

Wealthsimple does not offer AI-powered trading. However, the platform uses artificial intelligence services for support and engagement, including chatbots and AI voice agents like Willow.

These AI tools assist users with general inquiries, account guidance, and basic navigation, but they do not make investment decisions or execute trades

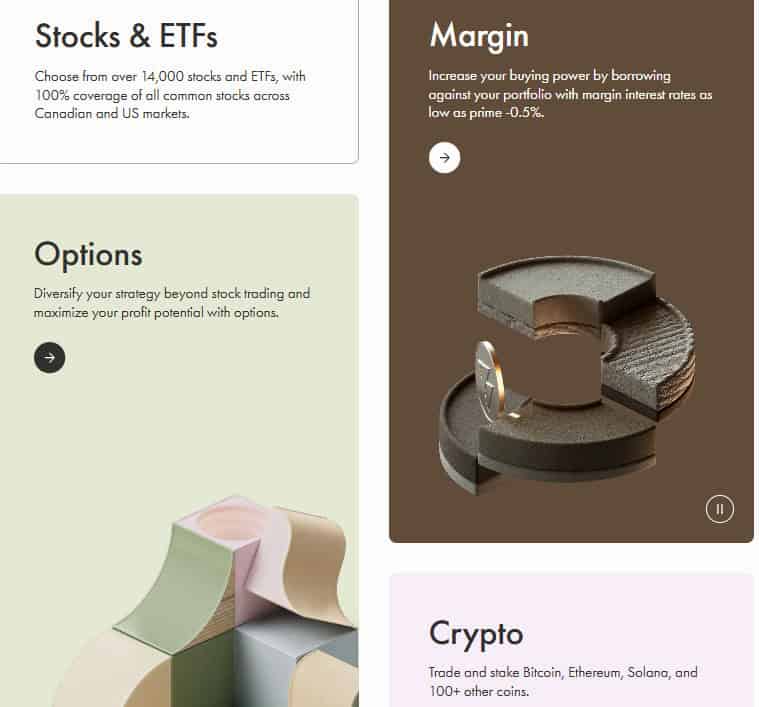

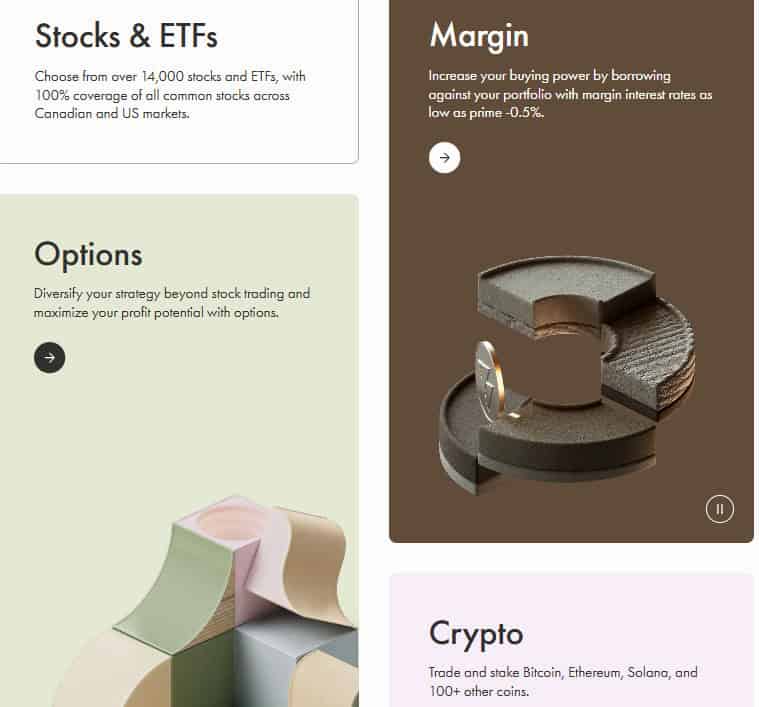

Trading Instruments

Score – 4.6/5

What Can You Trade on Wealthsimple’s Platform?

Through the platform, traders can buy and sell Stocks, ETFs, Options, and Wealthsimple Crypto without incurring traditional commissions.

This selection of instruments provides users with the flexibility to create diversified portfolios or engage in more specialized investment strategies.

Main Insights from Exploring Wealthsimple’s Tradable Assets

Wealthsimple offers a user-friendly platform with a diverse range of tradable assets, catering to both traditional and digital investors. While it provides broad access to markets and flexible trading options, it focuses on simplicity and accessibility rather than advanced or niche investment products.

Overall, the platform is well-suited for investors looking for an easy and straightforward way to manage their portfolios.

Margin Trading at Wealthsimple

Wealthsimple offers margin trading through its non-registered margin accounts, allowing investors to borrow funds to amplify their buying power.

Interest rates are competitive, with CAD rates starting at 4.95% and USD rates at 7.5%, depending on your client tier. The platform provides tools like a margin health tracker and the option to link a Tax-Free Savings Account to your multiplier account for increased buying power.

However, margin trading carries significant risk, including the potential for margin calls if your account value declines below required levels. Investors should understand these risks and use margin cautiously.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Wealthsimple

The broker supports multiple funding methods to provide flexibility for users. Investors can fund their Wealthsimple accounts through bank transfers, including linking their bank accounts for seamless deposits and withdrawals. The platform also accepts fund transfers from other financial institutions.

Additionally, users can contribute to their Cash accounts through various means, such as direct deposits, and use the associated Wealthsimple Cash Card for spending.

Wealthsimple Minimum Deposit

The broker has an exceptionally low minimum deposit requirement of just $1. This minimal threshold allows investors to open and fund their accounts with ease, promoting accessibility for a diverse range of users.

Withdrawal Options at Wealthsimple

The broker facilitates easy withdrawals for investors, allowing them to access their funds when needed. Users can initiate withdrawals through the platform, and the processing time may vary based on the withdrawal method, typically taking a few business days for the funds to reach their designated accounts.

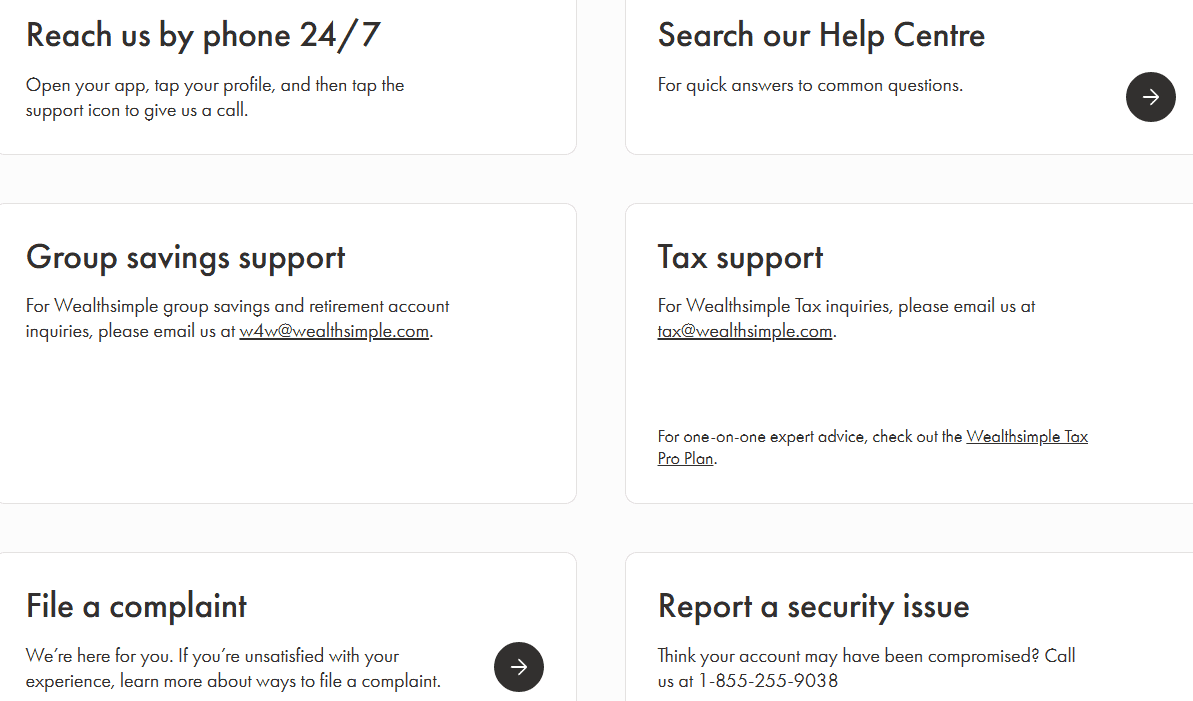

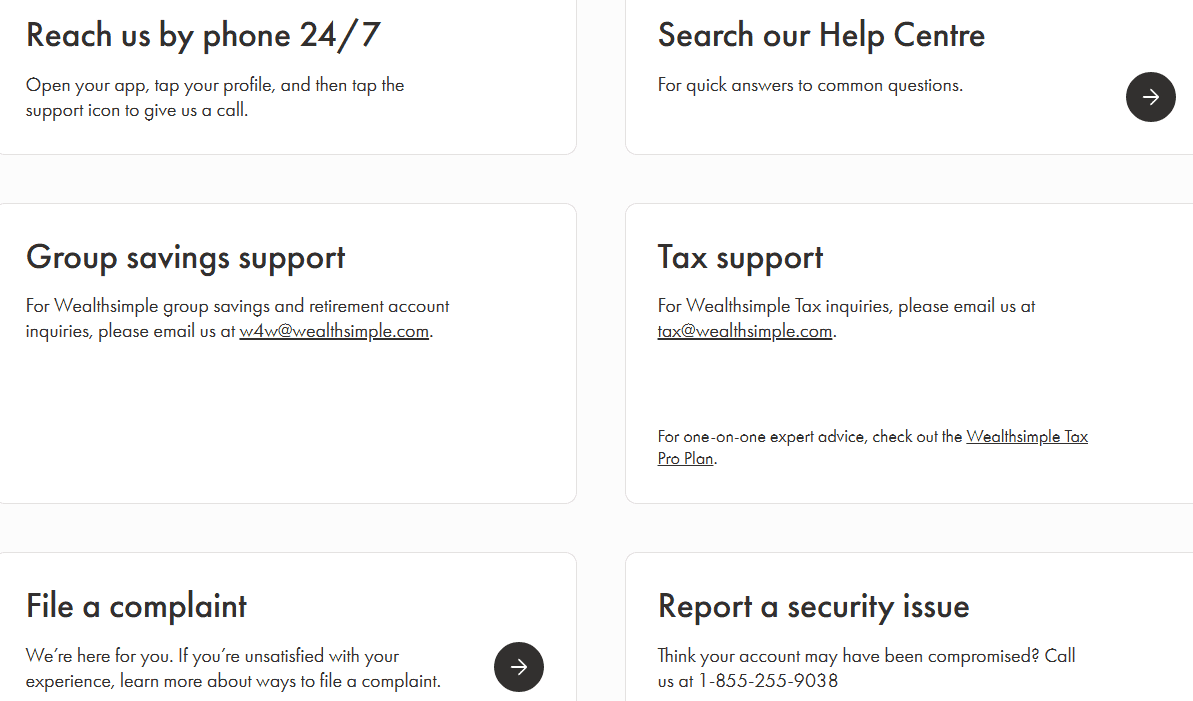

Customer Support and Responsiveness

Score – 4.6/5

Testing Wealthsimple’s Customer Support

The broker offers 24/7 customer support to assist traders with inquiries and support needs. Users can reach out to the support team through various channels, including email, phone, and live chat.

The platform aims to offer responsive assistance to address user concerns, ensuring a positive and supportive experience for its investors.

Contacts Wealthsimple

You can contact Wealthsimple through several channels. Phone support is available 24/7 via the app, while general inquiries can be sent to w4w@wealthsimple.com, tax questions to tax@wealthsimple.com, and privacy concerns to privacy@wealthsimple.com.

For security issues or suspected account compromises, call 1-855-255-9038 immediately. Additionally, a 24/7 chat feature is available on the Wealthsimple website and app for quick assistance.

Research and Education

Score – 4.4/5

Research Tools Wealthsimple

Wealthsimple provides basic research tools within its platform and mobile app, primarily designed for casual investors.

- Users can access fundamental data such as stock prices, historical performance charts, and basic financial metrics. However, the platform lacks advanced research features like in-depth financial statements, analyst ratings, or comprehensive screening tools.

Education

The broker provides articles, insights, and guides covering topics like investment strategies, financial planning, and understanding different asset classes. However, the extent of Wealthsimple’s educational content may be relatively limited compared to some other financial platforms.

Users looking for more comprehensive educational materials should consider additional resources or dedicated educational platforms to enhance their understanding of various financial concepts.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options Wealthsimple

Wealthsimple offers a range of investment options to suit various investor preferences. Investors can engage in commission-free trading of stocks and ETFs, providing flexibility for those who prefer to manage their own portfolios.

For those seeking a more hands-off approach, Wealthsimple Managed Investing offers personalized portfolios tailored to individual risk tolerances and financial goals, including options like TFSA, RRSP, and RESP accounts.

Additionally, the firm provides access to cryptocurrency trading and cash management services, allowing users to diversify their investments and manage their finances within a single platform.

Account Opening

Score – 4.5/5

How to Open Wealthsimple Demo Account?

Wealthsimple does not provide a demo or paper trading account. Investors should open a live account to explore the available tools and features.

How to Open Wealthsimple Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or Wealthsimple login page and proceed with the guided steps:

- Select and click on the “Sign Up” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

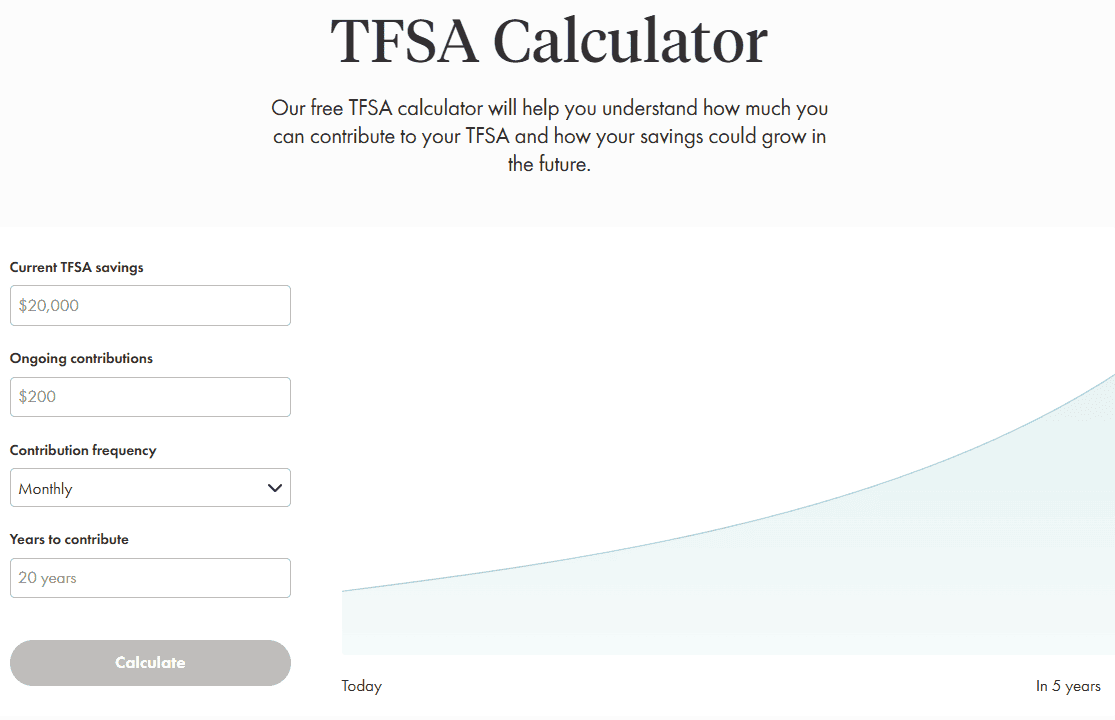

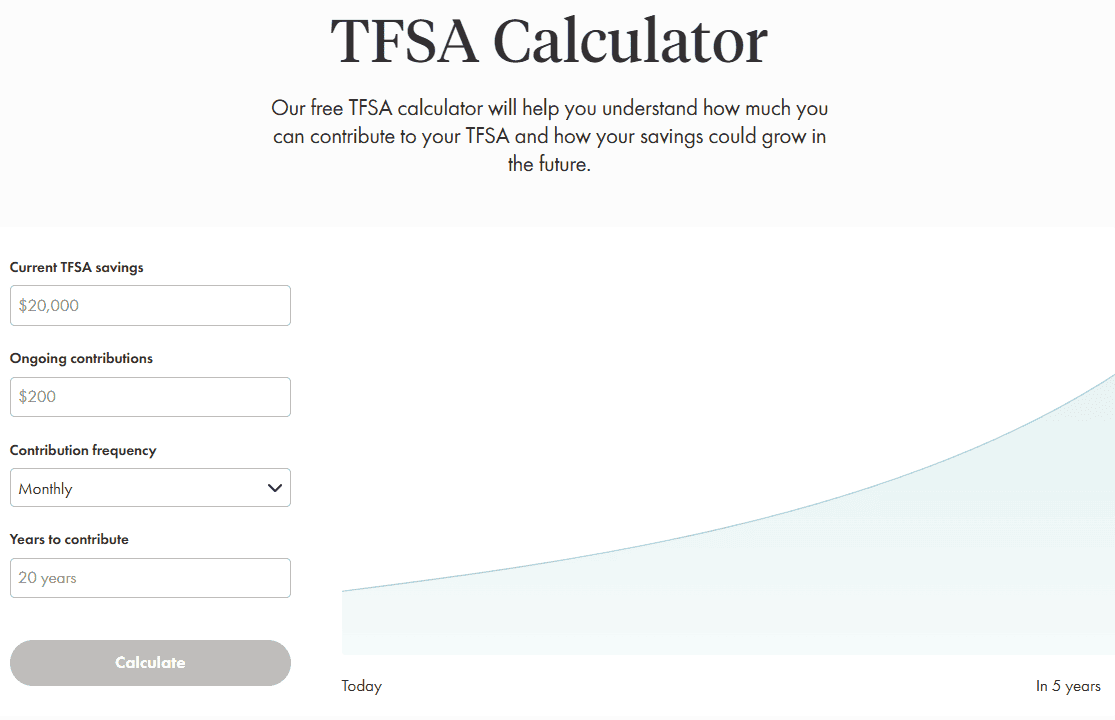

Additional Tools and Features

Score – 4.4/5

Wealthsimple offers a suite of financial planning tools designed to help users make informed decisions about their investments and savings.

- These include calculators for TFSA, RRSP, Retirement, and Fees, allowing users to estimate potential growth, understand contribution limits, and compare costs.

- Additionally, the platform provides a Canada Income Tax Calculator to help users estimate their tax obligations and refunds based on their income and deductions.

Wealthsimple Compared to Other Brokers

Wealthsimple stands out among its competitors for offering a low-cost, beginner-friendly trading experience with a strong focus on accessibility and simplicity.

Unlike some brokers that cater to advanced or professional traders with complex tools and extensive asset variety, Wealthsimple emphasizes an intuitive platform, primarily via its mobile app, suitable for casual investors.

While it provides a solid range of investment options, including stocks, ETFs, options, and cryptocurrencies, other brokers may offer broader asset classes such as futures or structured products. In terms of regulation and trust, the firm is fully compliant with Canadian authorities, similar to how major international brokers adhere to their respective regulatory bodies.

Customer support is robust and widely available, and the platform offers useful educational resources, though competitors with a more professional focus may provide deeper research and analytics tools.

Overall, Wealthsimple is ideal for those prioritizing ease of use, low fees, and a streamlined investing experience over advanced features.

| Parameter |

Wealthsimple |

Upstox |

Interactive Brokers |

Zerodha |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures E-mini contracts not available / Stock Commission from $0 |

Futures E-mini contracts not available / Stock Commission from ₹20/$0,24 |

$0.85 |

Futures E-mini contracts not available / Stock Commission from ₹20/$0,24 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low/Average |

Low |

Low/Average |

Low |

Average |

Low |

| Trading Platforms |

Wealthsimple App |

Upstox Pro Web, Mobile, NEST Desktop, Upstox Developer Trading Platforms, TradingView |

TWS, IBKR WebTrader, Mobile |

Kite |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, ETFs, Options, Cryptos |

Stocks, Mutual Funds, Bonds, Commodities, Futures, Options, ETFs, Currencies |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Direct Mutual Funds, Futures, Options, ETFs, IPO (Initial Public Offering), Securities, Bonds, Commodities |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds, and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

IIROC |

SEBI |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEBI |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/7 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Excellent |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$1 |

$0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Wealthsimple

Wealthsimple is a Canadian investment platform that offers a range of services tailored to both beginner and passive investors. It provides commission-free trading, allowing users to buy and sell stocks and ETFs without incurring fees.

For those seeking a more hands-off approach, the firm offers automated portfolio management with personalized ETF-based portfolios, including options for socially responsible investing. Additionally, Wealthsimple offers tax filing services through Wealthsimple Tax, providing users with an easy-to-use platform for preparing and filing their taxes.

The platform is known for its user-friendly interface, making investing accessible to individuals with varying levels of experience. While it may not offer the advanced trading tools found on some other platforms, Wealthsimple’s focus on simplicity and transparency makes it a compelling choice for investors looking to manage their finances efficiently.

Share this article [addtoany url="https://55brokers.com/wealthsimple-review/" title="Wealthsimple"]