- What is Valutrades?

- Valutrades Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

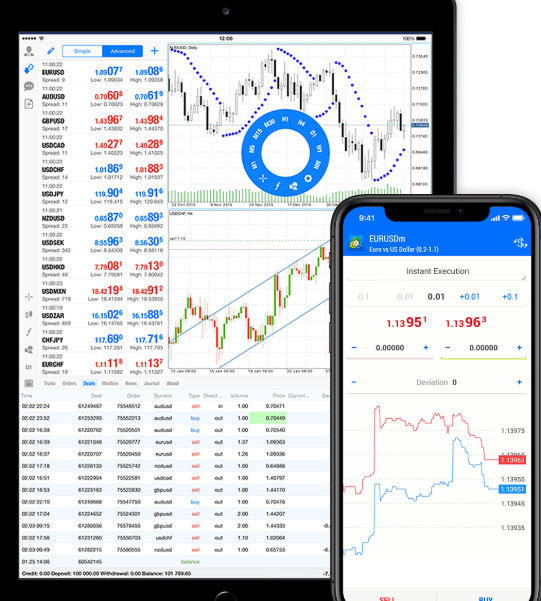

- Trading Platforms and Tools

- Trading Instruments

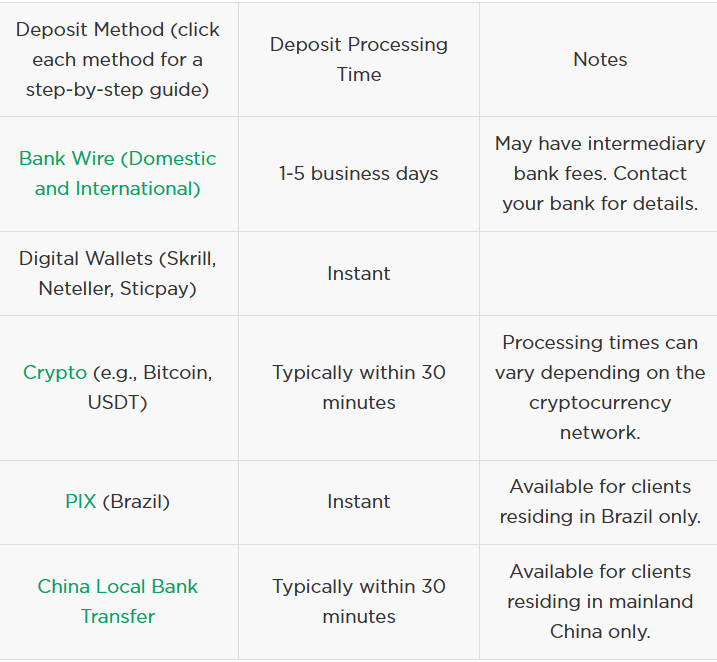

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Valutrades Compared to Other Brokers

- Full Review of Broker Valutrades

Overall Rating 4.4

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.2 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.1 / 5 |

What is Valutrades?

Valutrades is a Forex and CFD trading provider for beginner to advanced traders allowing access to more than 80 major, minor, and exotic Forex currency pairs, CFDs on equity indices, and commodities.

Based in London, UK, Valutrades enables technology-driven ECN execution, as well as offers fair trading conditions, including free VPS, spreads from 0.0 pips, etc. In addition, there is a negative balance protection to protect clients from money losses.

Along with the retail clients’ offering, the company has a variety of partnership programs.

Valutrades Pros and Cons

Valutrades is a regulated broker with a low-risk Forex trading environment. The account opening is smooth and easy; also, there is a good range of trading products and trading technology with ECN accounts. Various options to deposit or withdraw funds are available.

For the cons, there is no 24/7 customer support, and the overall proposal might be better for traders with experience.

| Advantages | Disadvantages |

|---|

| Regulated broker with a strong establishment | No 24/7 customer support |

| FCA license and overseeing | |

| Competitive trading costs and spreads | |

| MT4 and MT5 trading platforms | |

| ECN trading environment | |

Valutrades Features

We have reviewed the broker and its overall offerings to see how the broker aligns with the trading expectations of its clients. After testing different aspects of Vlutrade’s offerings, we have compiled a list of the main aspects of trading with the broker for the clients to have a better understanding of what to expect.

Valutrades Features in 10 Points

| 🗺️ Regulation | FCA, FSAS |

| 🗺️ Account Types | Standard, ECN |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, CFDs, Indices, Commodities |

| 💳 Minimum deposit | No minimum deposit |

| 💰 Average EUR/USD Spread | 0.2 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | USD, EUR, GBP |

| 📚 Trading Education | Educational support with numerous materials and updated information |

| ☎ Customer Support | 24/5 |

Who is Valutrades For?

We have tested different aspects of the broker to see who can benefit from Valutrades the most. Overall, we have concluded that the broker offers favorable services that can be suitable for traders of different experience levels and various strategies. Based on our findings and financial expert opinions, Valutrades is good for the following:

- ECN trading

- Traders from UK

- International traders

- Beginners

- Professional trading

- Advanced traders

- Investors

- CFD and currency trading

- Traders who prefer MT4 and MT5 trading platforms

- NDD/STP execution

- Competitive spreads and fees

- EA/Auto trading

- Good learning and research materials

Valutrades Summary

Valutrades is a reliable broker with a technology-driven strategy and fair offerings to its clients. The broker uses ECN connectivity to the liquidity providers, which ensures the true pricing strategy.

Valutrades is also trustworthy since it is regulated by one of the leading world authorities, FCA, while complying with all necessary requirements for operations. The broker offers ECN spreads starting from 0.0 pips and has no minimum deposit requirement. This enables almost any trader to invest and start trading without much input.

55Brokers Professional Insights

With over a decade in the market, Valutrades has expanded its offerings and global exposure, offering favorable and advanced conditions that would meet the needs of a large scope of traders especially being one of the UK regulated Broker with secure trading environment provided.

Valutrades offers a good range of financial asset classes with low trading costs and great diversification. Access to the market through the popular MT4 and MT5 platforms allows traders to experience innovative and flexible approaches to elevate their trading styles and opportunities. Mainly traders who prefer spread based trading via its Standard account and commission-based ECN account. Clients are allowed to access higher leverage ratios of up to 1:500 via the international branch, so if you look for this opportunity check that your account opened under relevant regulations. The customer support team delivers dedicated and prompt assistance 24/5 through multiple channels. At last, one of the advantages of trading with Valutrades is its no minimum deposit requirement for its accounts.

Consider Trading with Valutrades If:

| Valutrades is an excellent Broker for: | - Experienced traders

- ECN trading

- CFD and currency trading

- Those who prefer Meta Trader platforms

- High-frequency trader

- Investors

- Clients from UK

- International traders |

Avoid Trading with Valutrades If:

| Valutrades is not the best for: | - Beginner traders

- Those who prefer fixed spreads

- Traders looking for extensive range of instruments

- Traders looking for platforms other than MT4/MT5 |

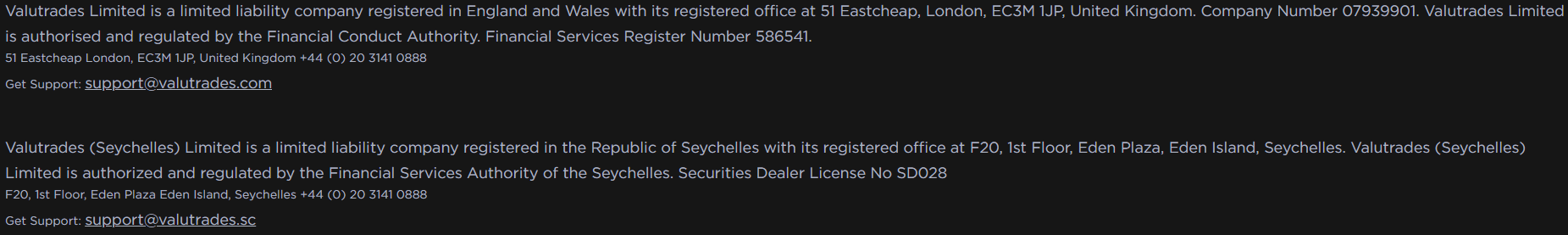

Regulation and Security Measures

Score – 4.5/5

Valutrades Regulatory Overview

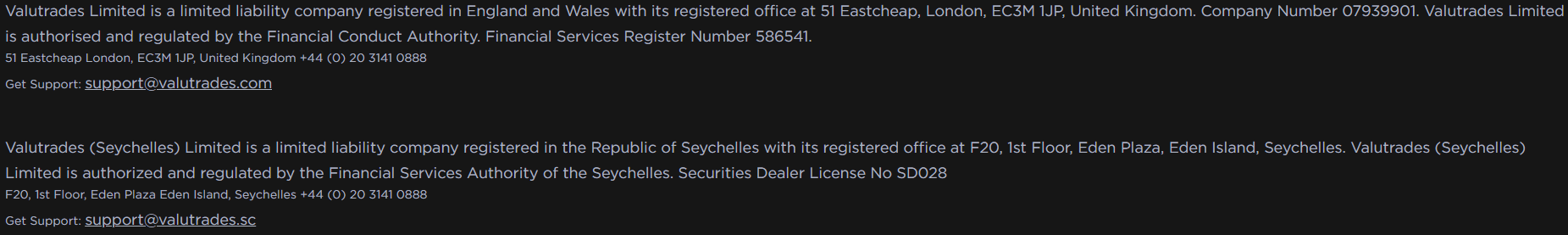

Valutrades is regulated in the UK by the Financial Conduct Authority (FCA) as a licensed financial services provider.

According to the regulations, Valutrades is subject to various restrictions on how to operate the trading process. Therefore, strict client money segregation rules and conditions are applied to every transaction it performs. The FCA license ensures adherence to stringent rules and following guidelines imposed by the authority.

- Valutrades also operates an offshore entity, being regulated by the Financial Services Authority of the Seychelles, holding a Securities Dealer License with the SD028 license number. Although we recommend exercising caution with offshore brokers, Valutrades’ FCA license ensures a safe and protected trading environment. However, conditions from entity to entity might be different.

How Safe is Trading with Valutrades?

Clients’ funds are held separately from the company accounts and not used in the course of the company business. In addition, all deposits are covered up to a maximum of 85,000 GBP under the Financial Services Compensation Scheme.

- Valutrades also provides its clients with negative balance protection to guarantee that they will never lose more than they have in their accounts.

- The cutting-edge security ensures that clients’ data remains protected at all times.

Consistency and Clarity

Valutrades is a reliable broker with good trading conditions and transparency. The broker offers a range of trading services with competitive conditions and a safe environment. With over a decade of presence in the market, Valutrades has gained clients from more than 182 countries. The clients’ base and loyalty increase annually, giving the broker more exposure in the global market.

The broker has also gained recognition from industry leaders many times, earning awards for its top-notch services. Reviews from real customers also indicated a reliable environment the broker creates, coupled with great trading conditions, dedicated customer support through multiple channels, and transparency of fees.

All in all, the consistency in the broker’s operations and the clarity of the offerings make the broker a favorable solution for those who are looking for advanced trading and new opportunities.

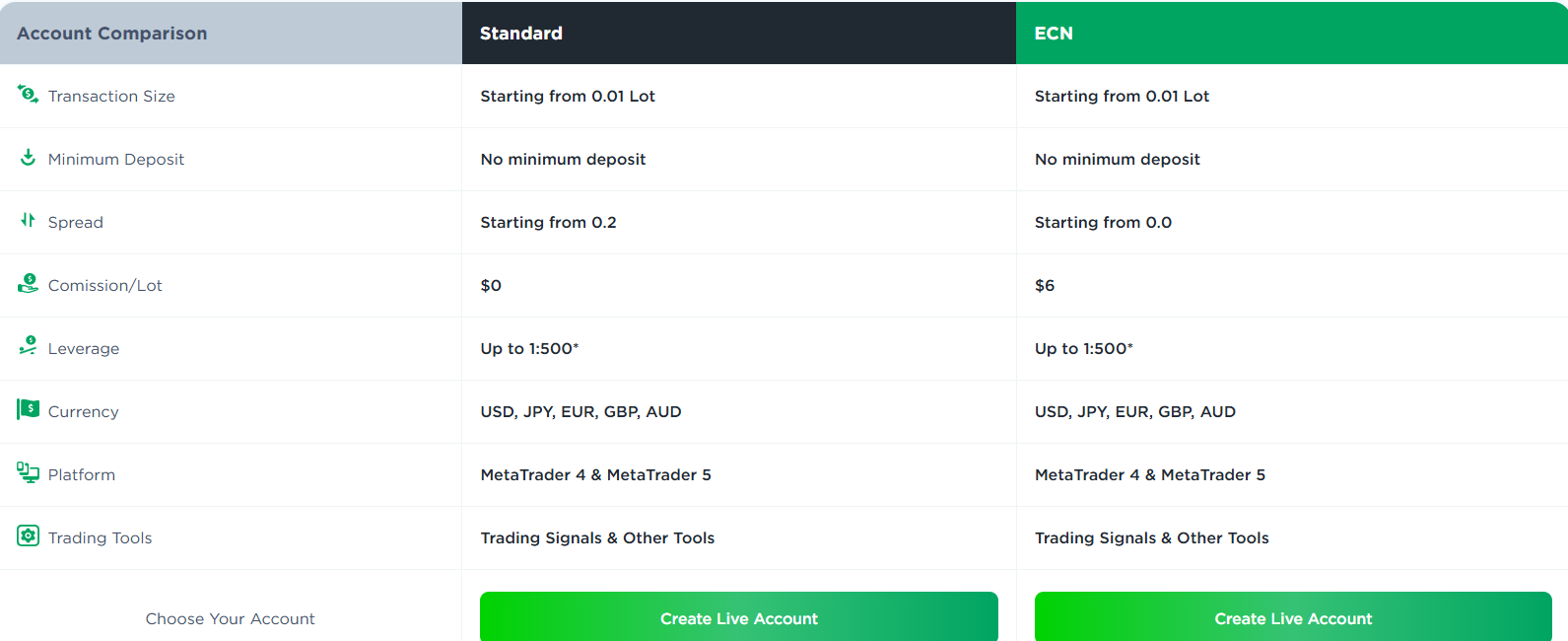

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Valutrades?

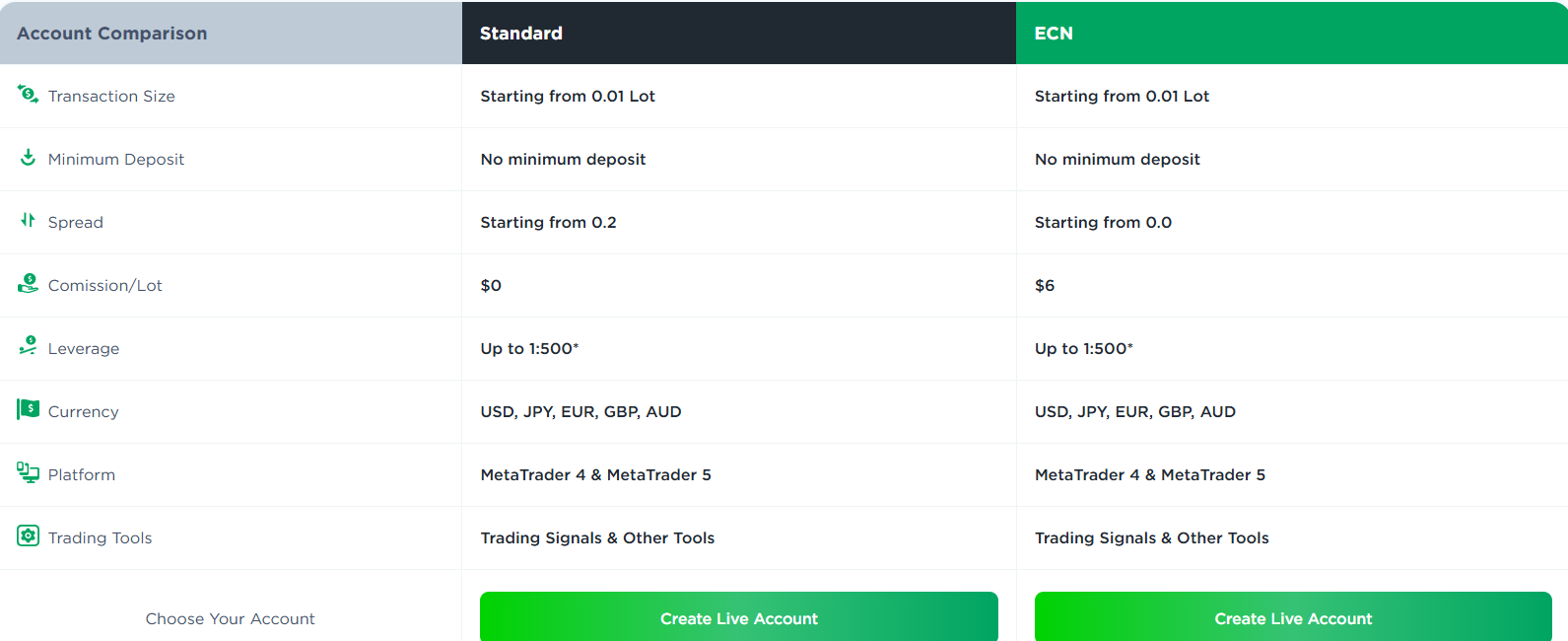

Valutrades offers two distinct account types—Standard and ECN. The standard account is spread-based, and all costs are integrated into spreads. In contrast, the ECN account has tight spreads and fixed commissions. Both accounts enable leverage up to 1:500. Clients registered under the UK entity need to enter the Client Area to activate 1:500 leverage. Valutrade supports MT4 and MT5 platforms regardless of the account type. Also, there is no minimum deposit requirement to start trading. We found that Standard and ECN accounts have many common features, enabling the same favorable conditions for profitable trading. There are a few differences that are mostly based on the fee structure:

- The Standard Account has a spread-based structure: all trading-related charges are included in spreads, with no additional transaction fees. The average spread for the EUR/USD pair is 0.2 pips.

- The ECN trading account has super low spreads and a fixed commission.

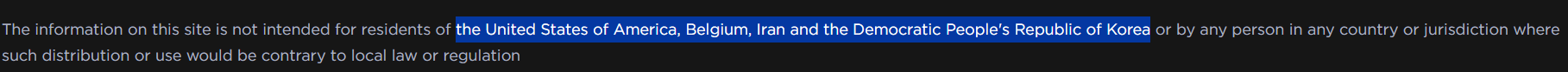

Regions Where Valutrades is Restricted

Valutrades is a global broker with a presence in more than 180 countries, enabling residents of different regions and countries to enter the Forex market with a trusted broker and safe environment. However, there is a small list of countries from which the broker doesn’t accept clients. This restriction is on the grounds of regulatory limitations.

- The United States of America

- Belgium

- Iran

- The Democratic People’s Republic of Korea

Cost Structure and Fees

Score – 4.5/5

Valutrades Brokerage Fees

Valutrades fees are built into spreads and commissions based on the account type.The broker also charges swaps or rollover fees for positions open for longer than a day. We noticed that Valutrades offers low spreads and average fixed commissions, making the offering transparent and clear. Users can find detailed information on spreads on the broker’s website.

Based on our findings, Valutrades offers tight and some of the lowest spreads in the market. The average spread for EUR/USD for the Standard account is 0.2 pips. For that ECN account, spreads start from 0 pips and are combined with fixed commissions that are more appealing for experienced traders.

Valutrade has a fixed commission for its ECN account. The broker charges spreads from 0 pips with a fixed $6 commission per round. This fee structure is better suited for advanced traders who are looking for very tight spreads with fixed transaction fees that make the offering more predictable.

- Valutrades Rollover / Swap Fees

Valutrades also charges swap fees for the positions held overnight. The swaps can be long and short for each instrument. We have found that for the EUR/USD pair, the long swap is -8.11, while the short swap is 2.08. However, swaps depend on market changes and volatility and are changeable. The broker constantly updates its swap information.

How Competitive Are Valutrades Fees?

Valutrades offers a clear and transparent fee structure with two distinct account types based on spreads and commissions. The spreads the broker offers are very low compared to the market average. The commission fee is average, offering $3 per round per trade. The good thing about the broker is that all the trading-related costs are available on the broker’s website. Traders can find information on spreads, commissions, and swaps for each instrument. This way it is possible to learn all the costs beforehand.

We have also found the average spreads the broker charges for gold (0.22 pips). For the USOilCash+, the target spread is 0.022 too, considered competitive in the industry. Swap fees are also mentioned in detail, and as we have found, they are always updated so better check the official site for current rates.

| Asset/ Pair | Valutrades Spread | Land-FX Spread | RoboForex Spread |

|---|

| EUR USD Spread | 0.2 pips | 0.9 pips | 1.3 pips |

| Crude Oil WTI Spread | 0.022 pips | 1.5 pips | 6.1 cents |

| Gold Spread | 0.22 pips | 2.0 pips | 1.8 pips |

Valutrades Additional Fees

As we have found, Valutrades does not charge fees for deposits and withdrawals. Anyway, it is advisable to be careful as there might be certain fees from the side of the payment provider.

- Valutrades does not charge an inactivity fee either.

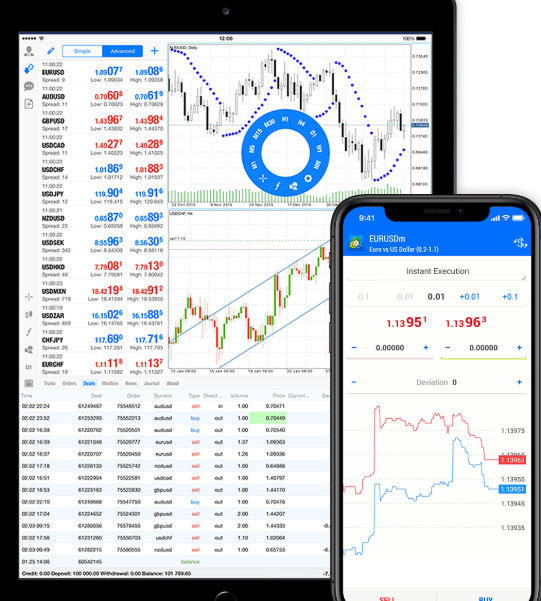

Score – 4.5/5

Valutrades provides traders with two advanced trading platforms, MetaTrader 4 and MetaTrader 5, as well as FIX API. They are both available via desktop and mobile. MT4 and MT5 trading platforms are among the most efficient trading platforms worldwide. Based on our findings, they provide traders with the option to trade manually or automatically, with a variety of analytical tools, indicators, charts, and many other comprehensive settings and tools.

| Platforms | Valutrades Platforms | OneRoyal Platforms | Trade.com Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platform | No | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

Valutrades Web Platform

Based on our research, Valutrades does not offer trading through a web platform. Traders can either download the desktop version for Mac and Windows or trade through the mobile app.

Valutrades Desktop MetaTrader 4 Platform

Valutrades offers its clients the ability to conduct trades through the globally recognized MT4 platform. The platform can be easily downloaded for Mac or Windows. The platform is suitable for both beginner and professional traders. It combines ease of use with advanced features and tools. Traders can use a good range of detailed analytical tools, user-friendly trading technologies, trading signals, different trading orders, comprehensive charts, and manual and automated tools.

Valutrades Desktop MetaTrader 5 Platform

The MT5 platform is the elevated version of the MT4 platform, with more advanced tools and features that bring trading to a new level. It is a comprehensive multi-asset terminal with an all-inclusive trading offering. The platform includes unique and exclusive tools and features more suitable for professional traders who want to push their limits and explore the market further. Traders can access advanced charts, exclusive analytical tools, and popular technical indicators such as Bollinger Bands, Moving Averages, and RSI.

Valutrades MobileTrader App

The Valutrades app gives traders absolute flexibility to enter their accounts from anywhere in the world. The app provides 24/5 access to the market. Clients have access to forex, commodities, and indices trading, benefiting from the most essential tools and features for profitable trading. Traders get real-time trading signals, access to charts, and other advanced tools.

Main Insights from Testing

Testing has confirmed that Valutrades’ trading platforms are well-equipped with the most essential and advanced tools, enabling clients to experience trading to the fullest. Despite the innovative and advanced platforms, they have a simple interface and offer easy navigation. Clients can also benefit from mobile trading, enjoying the same features and opportunities the desktop platform grants, without the need to be at the computers all the time.

Trading Instruments

Score – 4.2/5

What Can You Trade on the Valutrades Platform?

Valutrades trading instruments include Forex trading on more than 80 major, minor, and exotic currency pairs, CFDs on Indices, and Commodities. Through its ECN accounts, the broker offers competitive pricing and spreads from 0 pips.

- As we have revealed, the overall instrument offering and asset classes are limited. The broker offers CFD-based trading, restricting clients from access to long-term investments.

Main Insights from Exploring Valutrades Tradable Assets

Valutrades offers all the essential tradable products with very low spreads and reasonable commissions. However, Valutrade offers only a few asset classes, narrowing the scope of diversification. Besides, all instruments are CFD-based, which limits the opportunity for traditional investments. Traders do not have access to stocks, ETFs, bonds, and other essential instruments.

However, we noticed an extensive range of Forex pairs available, which is considerably more than most brokers offer. All in all, with Valutrades, clients have access to all the essential tradable products, but there is not much chance for versatility.

Leverage Options at Valutrades

Leverage trading enables traders to trade bigger sizes, and maximize their gains. However, traders should carefully learn how to use this tool, since leverage may work in reverse as well.

Valutrades’ leverage is offered according to the FCA and FSAS regulations:

- UK traders can use low leverage up to 1:30 for Forex instruments, 1:20 for minor currencies, and 1:10 for commodities.

- Since Valutrades serves an entity through Seychelles, international traders with an opened account under FSAS jurisdiction may use up to 1:500 leverage.

- Clients from the UK who want access to higher leverage should enter the Client Area for more opportunities.

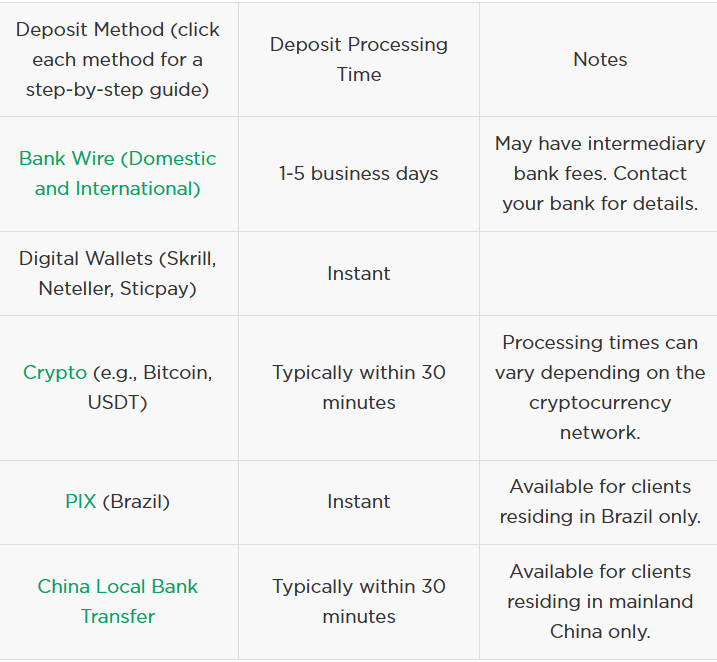

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Valutrades

Valutrades funding options include the most common methods, which offer both bank transfers or card payments and e-wallets, and more. Fees are either none or very small, also allowing you to benefit from various account-based currencies, yet deposit options vary on each entity.

Valutrades offers the following payment methods:

- Credit/Debit cards

- Bank wire

- Skrill

- Neteller

- Union Pay

- Giropay

Minimum Deposit

Valutrades requires no minimum deposit to start trading with either of its account types. Nevertheless, always make sure on a trading instrument you are planning to trade, as various assets require different margins, and you will need to make a certain amount of deposit if you want to have a profitable start.

Withdrawal Options at Valutrades

For withdrawals, the broker offers the same payment methods as for deposits. There are no fees for deposits and the first three withdrawals each month.

- All withdrawals are processed within 24 working hours from the time the request is initiated.

- To withdraw funds, clients need to log into their accounts, select the ‘Withdraw Funds’ option in the menu tab, and enter the amount they want to withdraw.

Customer Support and Responsiveness

Score – 4.6/5

Testing Valutrades Customer Support

Valutrades provides 24/5 customer support with Live Chat and WhatsApp. The broker also provides a phone number and an email address as a means of contact.

- The broker has an FAQ section that covers many trading-related questions, from account opening to more complex questions.

- Also, the broker is social and is active through multiple platforms, including IG, FB, LinkedIn, X, and YouTube.

Valutrades Contacts

We have tested Valutrades customer support and were satisfied with the broker’s promo responses and assistance. Clients can find support through different methods.

- WhatsApp chat is a quick way to get answers. Clients get prompt responses and easy solutions to their issues, which is essential in the quick-paced trading environment.

- Another quick way to get answers is the live chat that is available 24/5. Clients need to select the category that best suits their needs and specify the main requirement.

- Another convenient option to direct your questions is using the provided email address. UK clients can send their questions to support@valutrades.com. Valutrades Seychelles clients can use the support@valutrades.sc email address.

- At last, the broker provides a phone number if customers want to connect with the support team directly: +44 (0) 20 3141 0888.

Research and Education

Score – 4.2/5

Research Tools Valutrades

Valutrades’ research and educational sections are not very comprehensive. However, traders have access to a few useful research tools and educational resources. The research tools can be accessed through the client area.

Valutrades offers the following research tools for more insight into the market:

- Clients get the latest signals on price movements for various trading products based on the analysis of trusted market providers.

- The Top Mover enables users to get insights into volatile products or products with price fluctuations. This information can be essential for traders presenting trading opportunities for traders.

- The open position ratio is an important tool for gaining more insights into the market sentiment.

- The pivot point identifies potential support and resistance levels for specific instruments.

Education

The educational resources are quite limited. The broker offers a blog with articles on different trading-related topics. The FAQ section is also informative, guiding clients to start trading with success.

- Also, the Valutrades YouTube channel includes multiple videos that help traders navigate the platform, open and fund accounts, employ different strategies, etc., in different languages.

Is Valutrades a Good Broker for Beginners?

Valutrades is a broker with good conditions and quality services. Different aspects of trading with the broker are high standards, providing very low spreads, reasonable commissions, advanced trading platforms, no minimum deposit requirement, and other beneficial offerings. However, the broker does not have a comprehensive education, which might be a drawback for beginner traders looking for extensive assistance and guidance.

Portfolio and Investment Opportunities

Score – 3.8 /5

Investment Options Valutrades

Valutrades is not a favorable broker for long-term investments. The range of instruments is limited, narrowing the chance of portfolio diversification. Besides, all the instruments are CFD-based, which enables traders to speculate on the instrument price rather than owning it. Valutrades does not offer share or stock trading, which is a drawback for traditional investment enthusiasts.

- Valutrades offers an alternative option for investments, allowing access to MAM accounts. With Valutrades, clients can trade for their traders directly from their existing MT4 account through the Multi-Account Manager.

- However, we didn’t find any evidence about PAAM accounts, which the broker most likely does not offer.

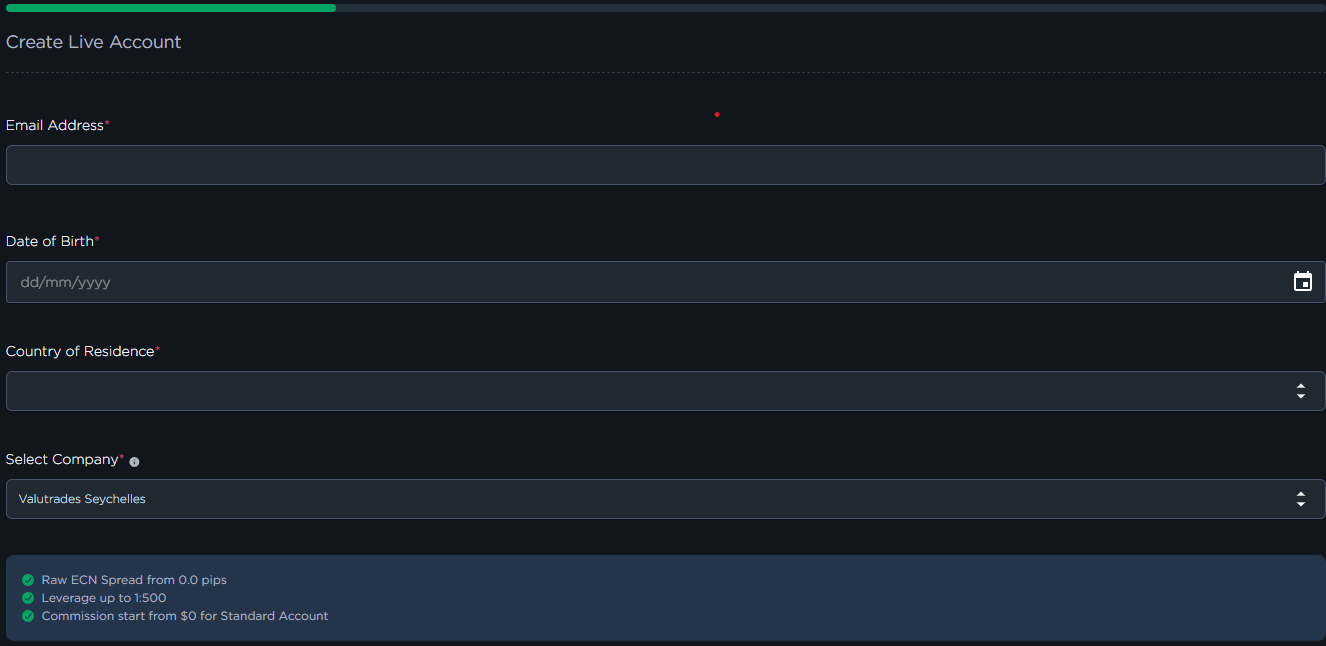

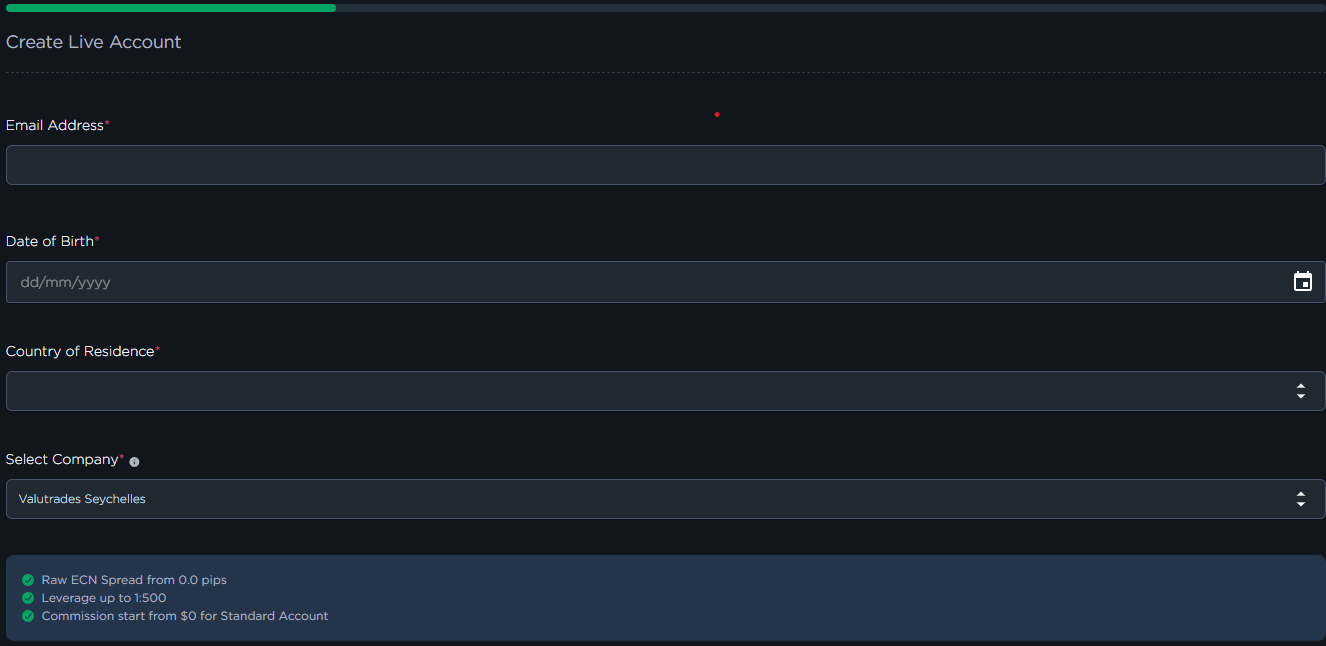

Account Opening

Score – 4.6/5

How to Open a Valutrades Demo Account?

To practice your trading skills without risking any capital, you can open a demo account with Valutades. The demo account registration process is simple and quick, consisting of the following steps:

- Go to the broker’s official website and choose the “Create Demo Account” option.

- Fill out the registration form, providing your name, phone number, email address, residency, etc.

- Choose between a standard and an ECN account, account currency, trading platform, leverage, and the virtual money amount.

- Provide a demo account password.

- Input the text provided.

- You will receive an email with your demo account credentials.

- Use them to enter your account and start practicing.

How to Open a Valutrades Live Account?

Opening an account with Valutrades is quite easy. You should follow the opening account page and proceed with the guided steps:

- Select and Click on the “Create Live Account” option.

- Enter the required personal data (Name, email, phone number, etc.).

- Choose account specifications.

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

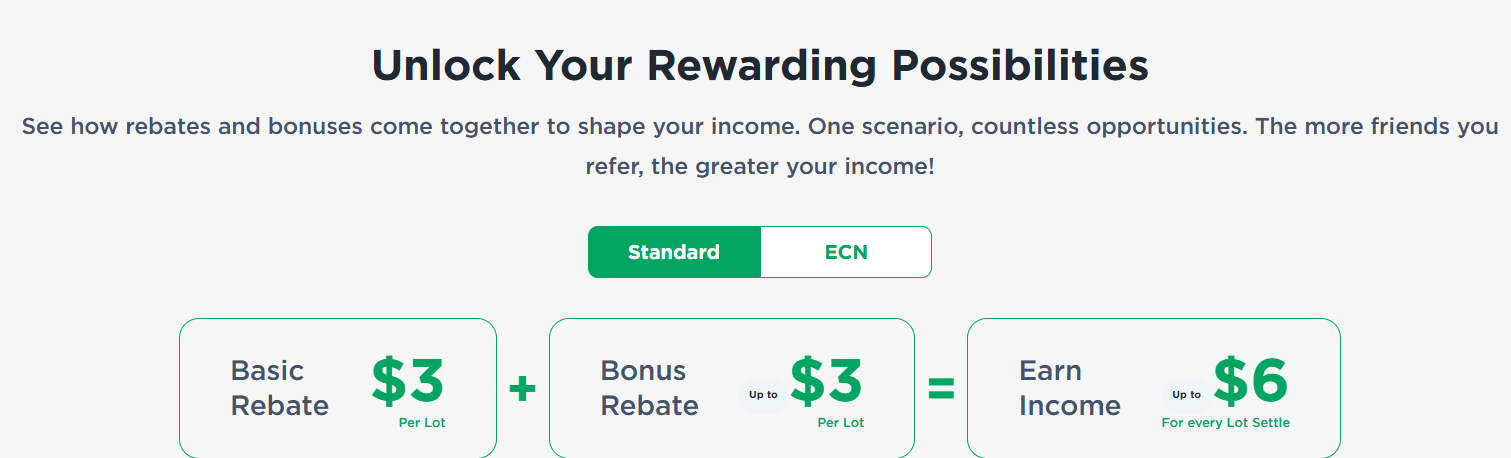

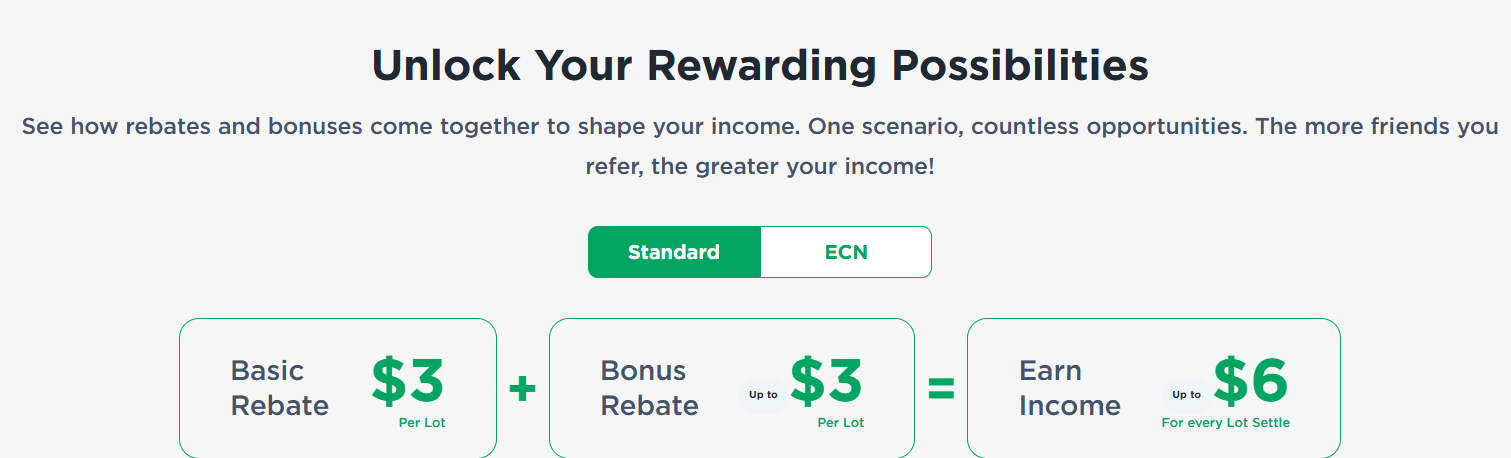

Score – 4.1/5

All the tools and features of Valutrades are already included in the broker’s platforms. We managed to find a few additional tools that might positively impact the trading outcome:

- The Economic Calendar is an essential tool that informs clients about the upcoming events in the market, enabling them to make informed decisions.

- The broker has an affiliate program that enables traders to get bonuses for referrals. Traders should open a live account, register in the affiliate program, and share the affiliate links with friends. They will earn commissions from each client’s transactions.

Valutrades Compared to Other Brokers

We have completed the research on Valutrades, testing its different aspects, and now we compare it to other good-standing brokers in the market to see how the broker’s offerings stand out.

Valutrades is regulated by one of the most respected authorities in the market—FCA. The license by FCA ensures reliability and fair practices. We have reviewed other brokers with FCA licenses, such as Markets.com and Forex.com. The brokers also hold licenses from other well-regarded authorities, ensuring further safety.

As we have found, Valutrades offers the most popular retail platforms, MT4 and MT5. XS has a similar offering, while Tradeview and Axi enable access to other popular or proprietary platforms. We have also researched Valutrades’ costs to see that the broker has one of the lowest offerings in the market with spreads starting from 0.2 pips. Another broker with low trading fees is Tradeview with average spreads of 0.3 pips.

However, Valutrades has limited tradable products, being behind almost all the brokers we have compared it with. Forex.com has the best offering in terms of trading instruments, offering over 6,000 products. Also, Valutrades lacks education and research, providing only basic resources. Forex.com, on the other hand, offers excellent education, standing out as a favorable choice for beginner traders.

| Parameter |

Valutrades |

Markets.com |

Forex.com |

XS |

Axi |

Xtrade |

Tradeview |

| Spread Based Account |

Average 0.2 pip |

Average 1 pip |

Average 1.3 pips |

Average 1.1 pips |

Average 1.2 pips |

Average 2 pips |

Average 0.3 pips |

| Commission Based Account |

0.0 pips +$3 |

For Stocks Only ($1 per $1,000 trade) |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $7 |

No commissions, based on fixed spreads |

0.0 pips + $2.5 |

| Fees Ranking |

Low/Average |

Average |

Average |

Average |

Average |

Average |

Low/ Average |

| Trading Platforms |

MT4, MT5 |

Markets.com Web, MT4, MT5, TradingView, Markets.com Social Trade App |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, Axi Trading App, Axi Copy Trading App |

Xtrade WebTrader |

MT4, MT5, cTrader |

| Asset Variety |

100+ instruments |

2,200+ instruments |

6000+ instruments |

1000+ instruments |

220+ instruments |

1,000+ instruments |

200+ instruments |

| Regulation |

FCA, FSAS |

CySEC, FCA, ASIC, FSCA, FSC, FSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, FCA, CySEC, DFSA, FSA |

FSC, FSCA |

MFSA, CIMA, FSC, FS |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Basic |

Good |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

No minimum deposit |

$100 |

$100 |

$0 |

$0 |

$250 |

$1000 |

Full Review of Broker Valutrades

Valutrades is a well-regulated broker, holding a license from the well-regarded FCA of the UK. The broker offers ECN spreads starting from 0.0 pips, as well as no minimum deposit requirement, enabling even cost-conscious traders to open an account without substantial investments. The broker has excellent global exposure, offering its services to residents of over 182 countries.

Valutrades offers MT4 and MT5 platforms, equipped with advanced trading tools, charts, and analyzing capacity. The broker offers 2 account types with spread-based and commission-based fee structures. The spreads for the Standard account start from 0.2 pips and include all trading costs. The commission-based account has a transaction fee of $3 per side.

The broker’s customer support is also on a good level, providing multiple options for communication and dedicated service. The only drawback we revealed about trading with Valutrades is its lack of an education section. The limited offering will not allow beginner traders to gain essential knowledge and skills, so they will either need to find a broker with a better education section or alternative sources of educational materials.

All in all, Valutrades is a trustworthy broker with a safe trading environment and favorable conditions that will meet the needs of many traders.

Share this article [addtoany url="https://55brokers.com/valutrades-review/" title="Valutrades"]

Eu não consigo sacar nessa corretora