- What is Trading 212?

- Trading 212 Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Trading 212 Compared to Other Brokers

- Full Review of Broker Trading 212

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

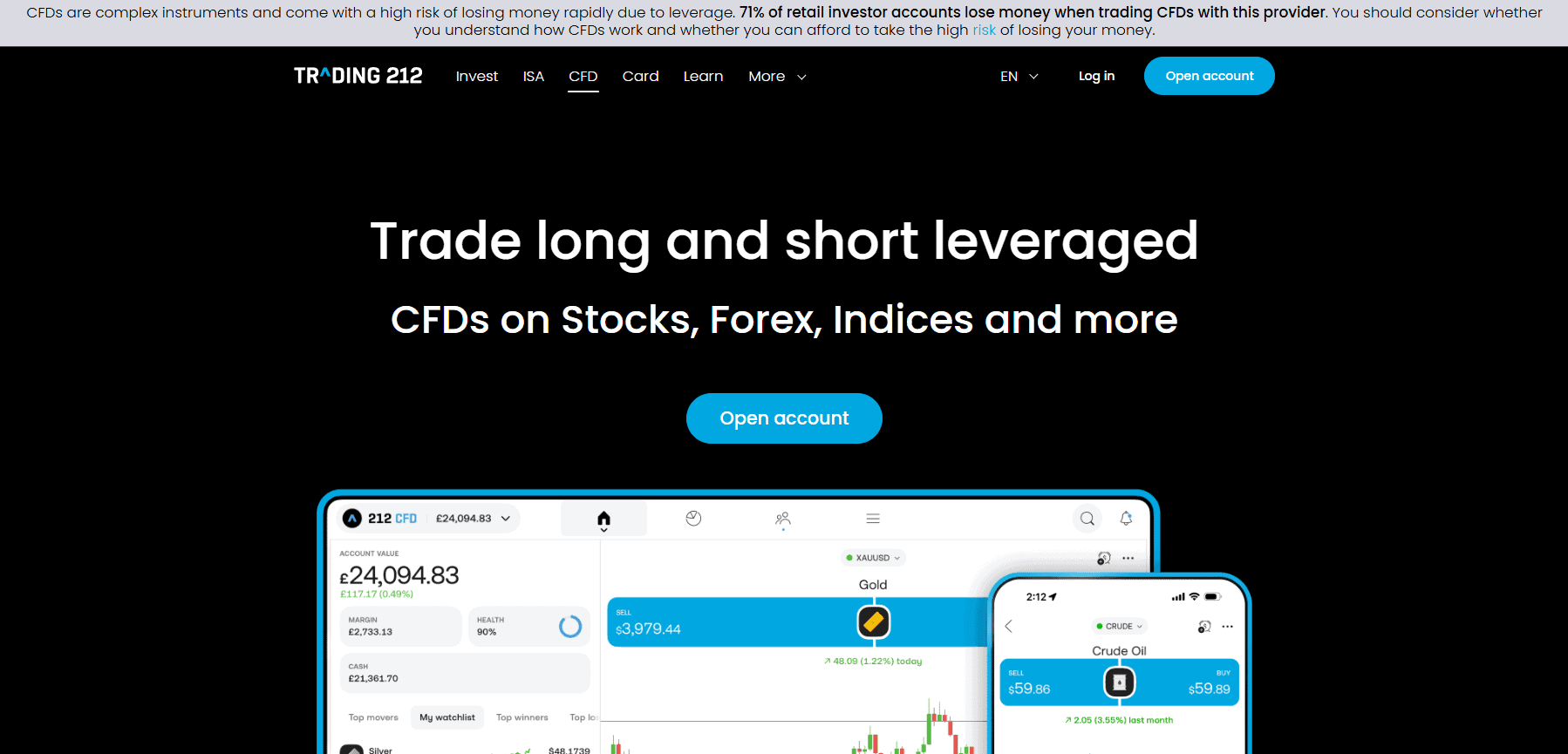

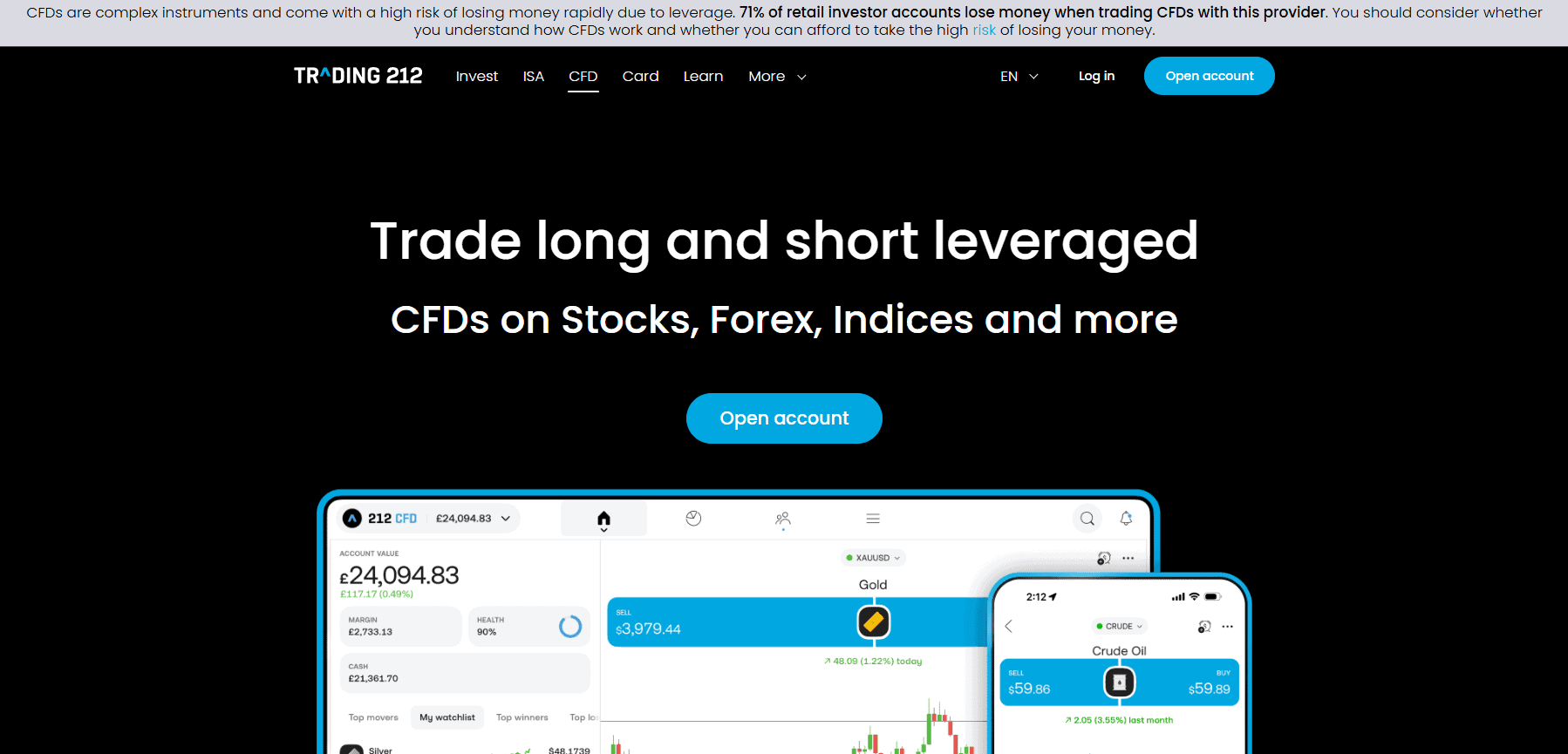

What is Trading 212?

Trading 212 is a multi-regulated Forex and CFD broker offering CFDs on Stocks, Forex, Indices, and more to traders with good solutions and a technology-based base.

- Since its launch as a brokerage company in 2004 with headquarters in the UK, the broker has walked the path of strong growth, and at the beginning, it served offices in Bulgaria. It has become one of the biggest and most popular platforms, as well as operating numerous world clients and supporting direct service lines worldwide.

Trading 212 is also known for its zero-commission stock trading service in the UK and Europe, which unlocks the stock market for millions of people to trade.

Trading 212 Pros and Cons

Trading 212 has a solid background and good regulation from the top-tier FCA. The broker provides a great environment and a good education section. The platform is very well designed and packed with professional tools, and the instrument range is very wide, including cryptocurrencies.

For the Cons, the proposal and platform might suit more advanced traders or professionals with larger trading. Also, its global availability can vary depending on the client’s region, which may limit access for some users.

| Advantages | Disadvantages |

|---|

| Recognized and regarded broker worldwide | Platform and general offering may be more suitable for professional or bigger-size traders |

| Strictly regulated by the reputable FCA in the UK | Conditions vary based on the entity |

| Wide range of instruments available including Forex and CFDs | |

| UK and European clients | |

| Australian traders | |

| Client protection | |

| Competitive trading conditions

| |

| Professional platform with advanced tools | |

Trading 212 Features

Trading 212 is a reputable broker with a good platform and favorable conditions. The broker places significant importance on the performance of execution, focusing on high speeds for all clients’ orders, within the limitations of technology and communications links.

Trading 212 Features in 10 Points

| 🏢 Regulation | FCA, ASIC, BFSC, CySEC |

| 🗺️ Account Types | Brokerage, ISA, GIA Accounts |

| 🖥 Trading Platforms | Proprietary platform |

| 📉 Trading Instruments | ETFs, Cryptocurrencies, CFDs on Forex, Commodities, Stocks, and Indices |

| 💳 Minimum Deposit | $1 |

| 💰 Average EUR/USD Spread | 1.4 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | GBP, USD, EUR |

| 📚 Trading Education | Educational articles |

| ☎ Customer Support | 24/7 |

Who is Trading 212 For?

Trading 212 is designed for users who want an easy-to-use platform with fast execution and straightforward tools. Overall, it is a good choice for those who want a simple and user-friendly experience. Based on our findings and Financial Expert Opinions, Trading 212 is Good for:

- Beginners

- Professional Trading

- Advanced traders

- Currency and CFD trading

- Low spread trading

- Tight spreads

- UK and European traders

- Variety of strategies

- Australian traders

- Good customer support

- Competitive conditions

Trading 212 Summary

Overall, Trading 212 is a user-friendly broker known for its simplicity, fast execution, and low entry barriers. It offers a clean interface, accessible tools, and a smooth mobile experience, making it suitable for different users.

With a wide range of instruments, flexible order types, and commission-free conditions in some areas, the platform focuses on convenience and accessibility rather than complex, professional-level features.

Overall, the firm provides a balanced and efficient environment for traders who want a straightforward and reliable experience.

55Brokers Professional Insights

Trading 212 stands out for its highly accessible, intuitive platform and strong focus on simplicity, making it easy for users to enter and navigate the markets.

The broker combines fast execution, transparent pricing, and a wide range of tradable instruments, creating a versatile environment suitable for different trading styles. Its clean design, mobile-first approach, and built-in risk-management tools further enhance the overall experience.

While it may not offer the advanced features or professional-grade platforms preferred by high-level traders, Trading 212 distinguishes itself by delivering a streamlined, efficient, and user-friendly service that appeals to a broad retail audience.

Consider Trading with Trading 212 If:

| Trading 212 is an excellent Broker for: | - Need a well-regulated broker․

- Offering a range of popular instruments.

- Secure environment.

- Providing competitive conditions.

- UK and European trading.

- Various strategies allowed.

- Currency trading.

- Offering a variety of account types.

- Beginners and professional traders.

- Australian traders.

- Who prefer 24/7 customer service.

- Investment solutions.

- Learning resources. |

Avoid Trading with Trading 212 If:

| Trading 212 might not be the best for: | - Who prefer well-known platforms.

- Looking for broker with access to VPS Hosting.

- Prefer MAM/PAMM trading.

- Offering Copy trading features. |

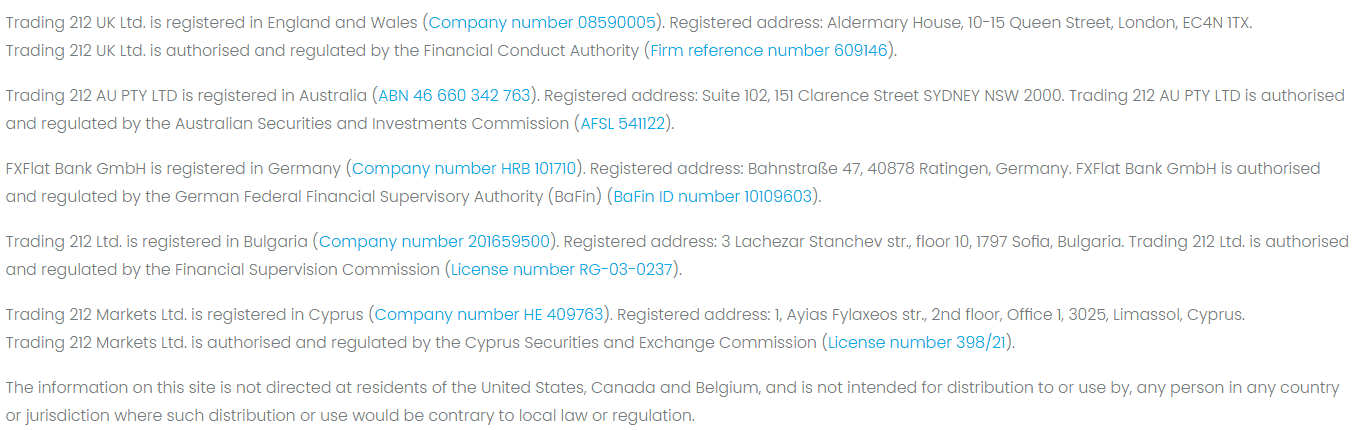

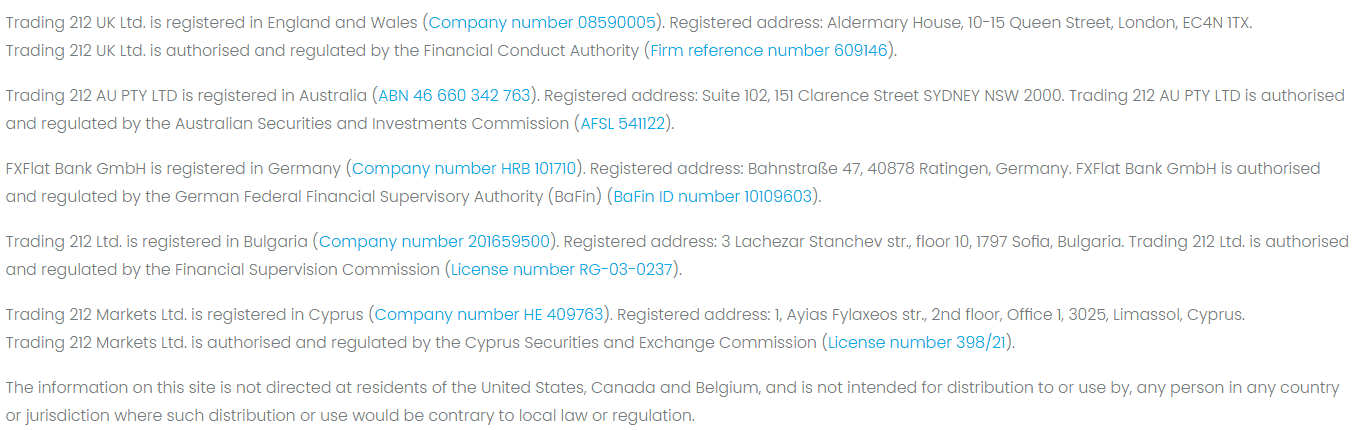

Regulation and Security Measures

Score – 4.7/5

Trading 212 Regulatory Overview

Trading 212 operates under a multi-jurisdiction regulatory framework, ensuring strong oversight across its global services. Trading 212 UK Ltd. is registered in the UK and authorized by the Financial Conduct Authority (FCA). It also holds a regulation from the Australian ASIC, another top-tier regulator known for strict supervision.

In addition, the broker is overseen by the Bulgarian Financial Supervision Commission and the European CySEC, further strengthening compliance standards and regulatory protections for clients across various regions.

How Safe is Trading with Trading 212?

The clients’ funds are compliant with regulations and are kept separately in segregated bank accounts. Meanwhile, along with the FCA set of rules, the Financial Services Compensation Scheme (FSCS) and the Investors Compensation Fund (ICF) in Bulgaria cover the clients’ funds in the unlikely event of Trading 212 default.

This means that every trader will be compensated if the company fails and is eligible to get compensation of up to GBP 85.000 through the UK entity and the ICF Bulgaria compensation of up to EUR 20.000.

Consistency and Clarity

The broker demonstrates solid consistency as a broker, supported by a long-standing operational presence and a generally positive reputation among clients. Its strong regulatory framework, transparent pricing model, and user-friendly platform contribute to favorable scores across many industry reviews.

User feedback highlights advantages such as ease of use, fast execution, and low entry barriers, while also noting drawbacks like limited advanced tools or occasional execution concerns during high volatility.

The broker’s credibility is further reinforced by industry recognition, awards, and active engagement within the trading community, including educational initiatives and social activities that strengthen its public presence.

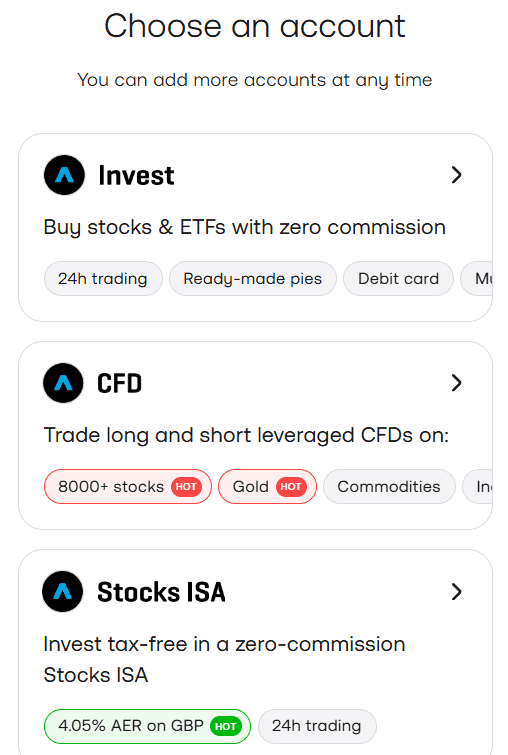

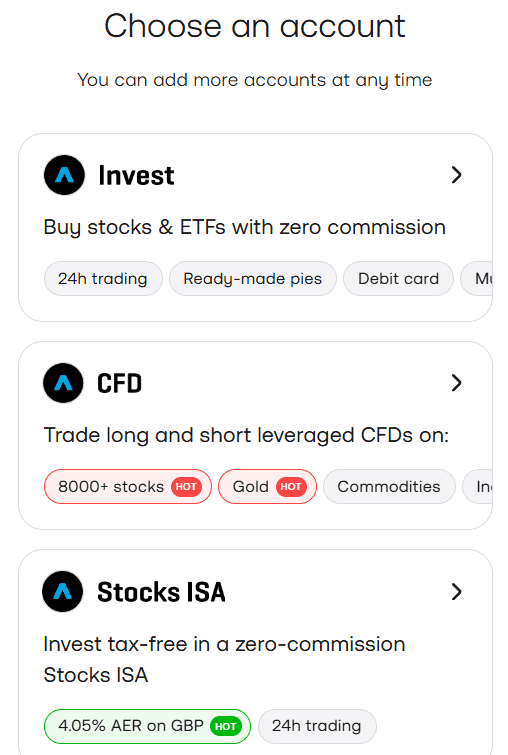

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Trading 212?

Trading 212 provides three account types to fit different trading and investing needs. Users can open a standard brokerage account for regular investing or trading across a wide range of instruments. For UK residents, there’s also a tax-efficient ISA (Individual Savings Account) option. Additionally, general investment accounts (GIA) are available for investors who want the flexibility of investing outside of tax-sheltered structures.

At the very beginning, and to familiarize yourself with the Trading 212 platform, you may sign up for a Free Demo Account and further select suitable Live account conditions.

Brokerage Account

Trading 212’s Brokerage Account is for both new and intermediate traders, offering access to a wide range of instruments. It features a user-friendly platform, competitive spreads, and commission-free trading on many instruments.

The account has a very low minimum deposit of just $1, allowing users to start trading with minimal capital while benefiting from fast execution, flexible order types, and portfolio management tools.

Regions Where Trading 212 is Restricted

Trading 212 does not provide services in certain jurisdictions due to regulatory restrictions and compliance requirements. Residents of the following countries are not eligible to open accounts:

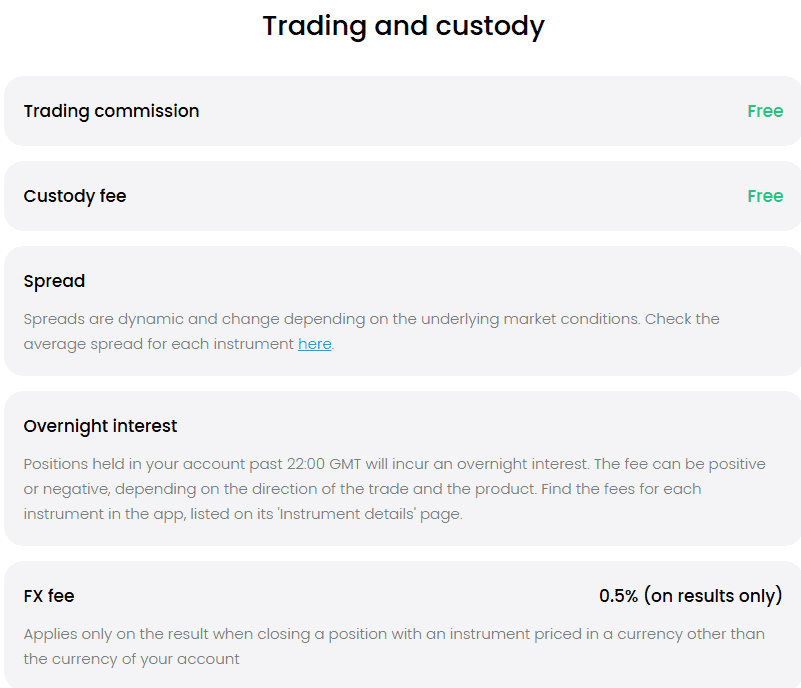

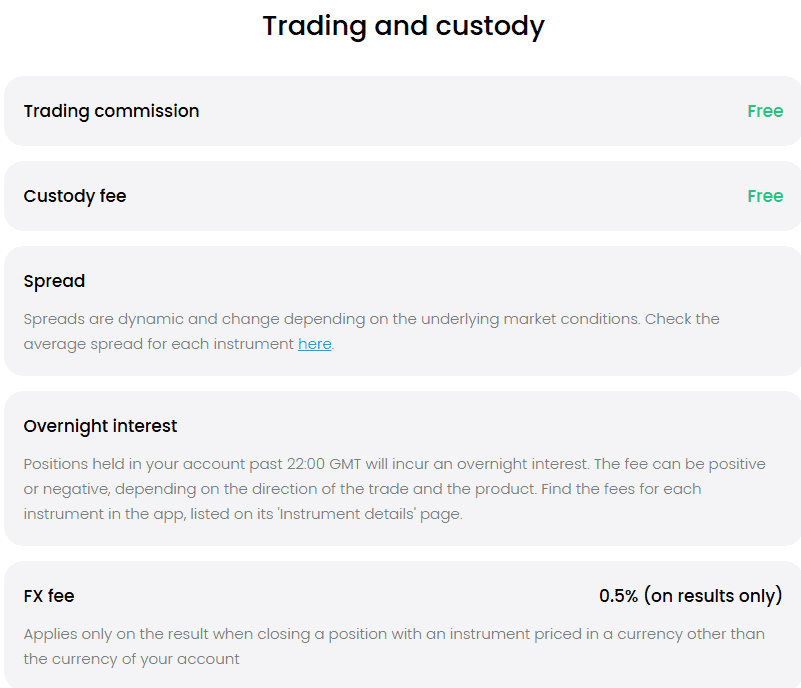

Cost Structure and Fees

Score – 4.5/5

Trading 212 Brokerage Fees

Trading 212’s brokerage fees are generally competitive and transparent, which is one of the platform’s key appeals. For CFDs, costs are typically built into the bid-ask spread rather than separate fees, and there are no hidden inactivity charges.

Some minor fees may apply for specific services, such as currency conversion or overnight financing on leveraged positions, but overall, the fee structure is straightforward and designed to keep costs low for both casual investors and active traders.

Trading 212 offers variable spreads that adjust with market conditions, providing users with competitive pricing across major currency pairs and other instruments.

On popular currency pairs like EUR/USD, the average spread is 1.4 pips, offering a reasonable cost structure for day traders and beginners. While spreads may widen during high-volatility periods or major news events, Trading 212 generally maintains transparent and stable pricing suitable for a broad range of strategies.

Trading 212 does not charge any commissions on CFDs, as all costs are built into the spread. This commission-free structure makes CFD trading straightforward, with no additional per-trade fees added to orders.

- Trading 212 Rollover / Swaps

The broker applies rollover fees for positions held overnight, reflecting the interest rate differential between the currencies or instruments traded.

These fees can be either positive or negative, depending on the direction of the trade and the underlying rates. Swap rates are clearly displayed in the platform, allowing traders to anticipate holding costs and manage positions effectively.

How Competitive Are Trading 212 Fees?

Trading 212’s fees are generally considered competitive within the retail trading space, especially for users looking for low‑cost access to markets.

The broker’s fee structure is straightforward, with no hidden charges or complex tiered pricing. While costs like spreads, overnight financing, and currency conversion still apply, the overall fee levels are accessible for a wide range of clients, from casual investors to more active participants.

| Asset/ Pair | Trading 212 Spread | Interstellar FX Spread | Purple Trading Spread |

|---|

| EUR USD Spread | 1.4 pips | 1 pip | 1.3 pips |

| Crude Oil WTI Spread | 0.03 | 6.8 | 0.03 |

| Gold Spread | 1.05 | 0.8 | 0.09 |

| BTC USD Spread | 0.08 | 50 | - |

Trading 212 Additional Fees

In addition to costs like spreads and financing charges, Trading 212 applies a few additional fees that traders should be aware of. These include overnight financing fees on leveraged positions, currency conversion charges when instruments are denominated in a different currency than your account, and occasional administrative or regulatory fees depending on your region.

While these charges are generally transparent and clearly outlined in the broker’s fee schedule, they can still impact overall costs, especially for positions held over longer periods or for users frequently converting between currencies.

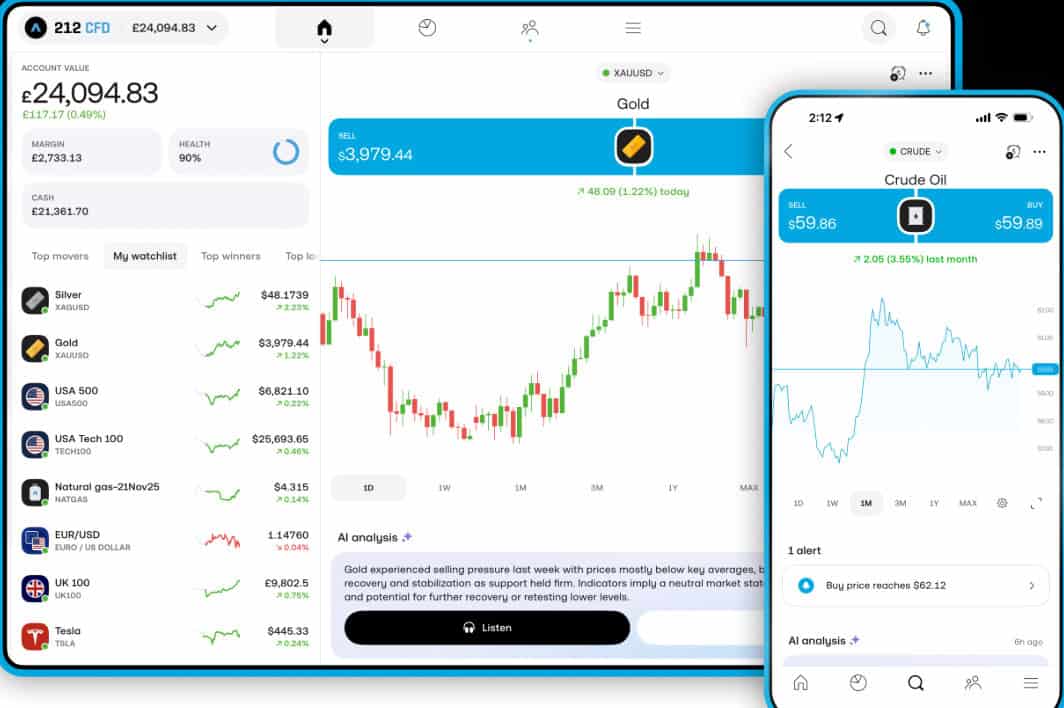

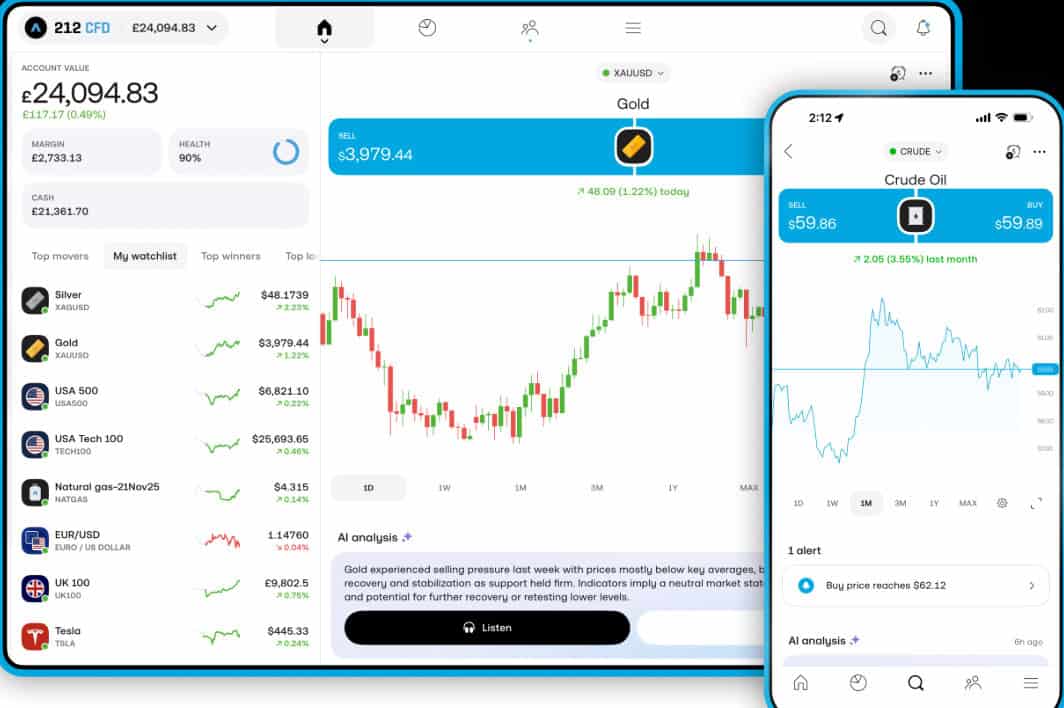

Trading Platforms and Tools

Score – 4.4/5

To suit users’ needs with the most convenient technology, Trading 212 has chosen to offer a single proprietary platform. The platform provides a full variety of proposed instruments with an easy, user-friendly interface.

Trading Platform Comparison to Other Brokers:

| Platforms | Trading 212 Platforms | Interstellar FX Platforms | Purple Trading Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | Yes |

| Own Platforms | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Trading 212 Web Platform

There is no need to download the platform, as users can access it through any computer browser using its web-based capabilities.

The platform was developed to make the trading process smooth while still providing all the necessary tools for analysis, charting, and monitoring. It also includes a built-in economic calendar and a real-time news feed.

Overall, the platform has a clean and intuitive design, offering a good experience for both market analysis and trading. Charting is clear and easy to follow, and all essential tools for placing and managing orders are readily accessible.

Main Insights from Testing

Testing Trading 212’s proprietary web platform revealed a clean, intuitive, and user-friendly interface. The platform provides clear charting, essential analysis tools, and easy order management, all accessible directly through a browser without downloading software.

Additional features like a built-in economic calendar and real-time news feed enhance the experience, making market monitoring and decision-making straightforward and efficient.

Trading 212 Desktop MetaTrader 4 Platform

Trading 212 does not offer the MetaTrader 4 platform. Users should rely on Trading 212’s proprietary web and mobile platforms for trading, as MT4 is not available.

Trading 212 Desktop MetaTrader 5 Platform

Similarly, the broker does not provide the MetaTrader 5 platform. All trading is conducted through the broker’s own web-based or mobile platforms, with no support for MT5.

Trading 212 MobileTrader App

Another great feature of the company is its trading applications that bring the freedom to trade anywhere. Free and simple-to-use apps suitable for iPhone and Android devices.

The broker’s apps feature almost the same advanced experience as the web platform version. In addition, the app was nominated as the best mobile app in the UK because of its emphasis on intuitive design and its powerful performance.

AI Trading

Trading 212 has begun integrating AI-based tools into its platform, offering features like AI-powered market and portfolio analysis to help users gain insights into trends, sentiment, risks, and fundamentals for selected instruments.

This AI analysis tool generates summaries of market data and portfolio performance, though it is currently experimental and meant for informational purposes rather than as personalized financial advice.

While the broker does not support fully automated trading or AI-driven execution bots on live accounts, these emerging AI features reflect Trading 212’s effort to incorporate intelligent analysis into the user experience.

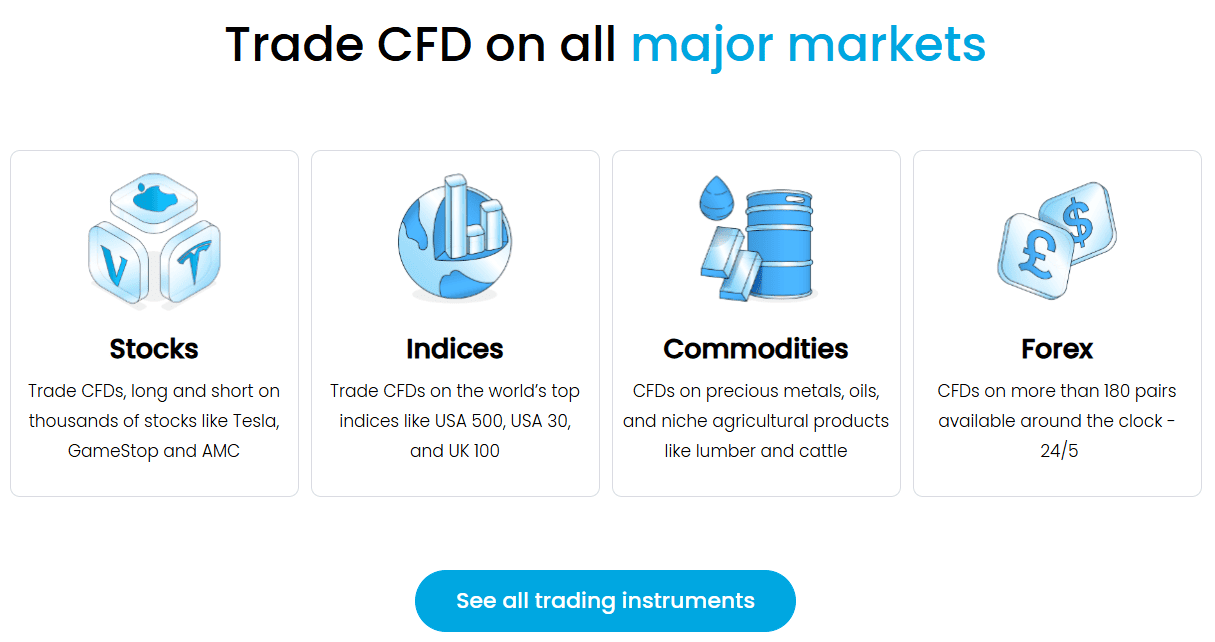

Trading Instruments

Score – 4.7/5

What Can You Trade on Trading 212’s Platform?

You can trade a wide range of instruments on Trading 212, with over 13,000 assets available. This includes various CFDs, stocks, ETFs, Forex pairs, indices, cryptocurrencies, and commodities, giving users a variety of options to diversify within a single platform.

Main Insights from Exploring Trading 212’s Tradable Assets

Exploring Trading 212’s tradable assets shows that the platform provides a broad and diverse market selection, allowing users to access thousands of instruments across different sectors and regions.

The wide availability ensures clients of all experience levels can find suitable opportunities, whether they prefer long-term investing or short-term trading. Overall, the asset range adds strong flexibility and supports varied portfolio-building strategies.

Leverage Options at Trading 212

Leverage, known as a loan given by the broker to the trader, enables users to trade a larger size than their initial invested capital. The multiplier significantly increases the potential of gains, yet it works in reverse; that is why traders should use leverage smartly.

- European and UK clients are eligible to use low leverage up to 1:30 for major currency pairs.

- Australian clients can also use a maximum leverage of 1:30.

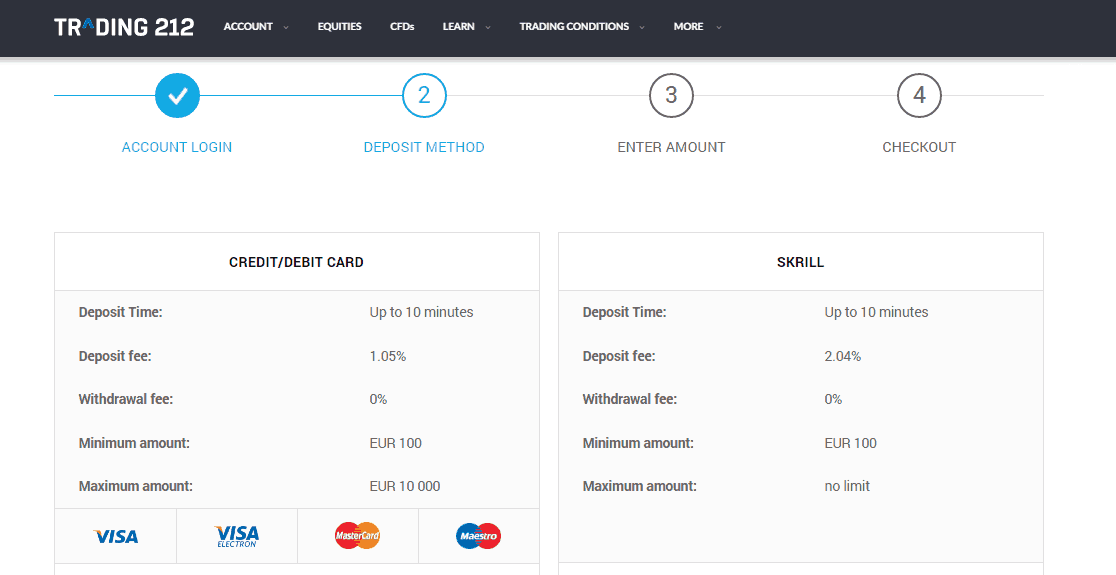

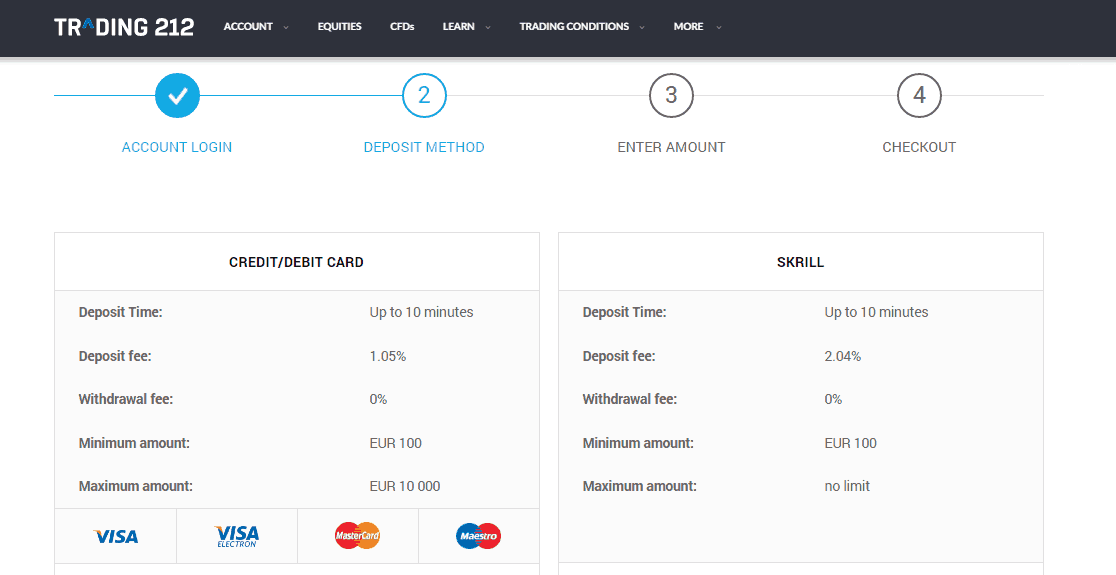

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Trading 212

Trading 212 offers a range of funding methods; however, availability may vary depending on your region and regulatory requirements, so check which options are supported for your specific location.

- Credit/Debit cards

- Bank wire

- Skrill

- PayPal

- Dotpay

- Giropay

- Apple/Google Pay, and more

Trading 212 Minimum Deposit

The broker’s minimum deposit is $1, making it a suitable option for both beginners and users with different account sizes.

Yet, be sure to verify deposit fee terms, as depending on the method of payment and the currency of your account, there is a deposit fee between 0.7% and 3.5% applied.

Withdrawal Options at Trading 212

Trading 212 withdrawal fee is 0%, which means there are no charges for withdrawal. In addition, we found that the broker’s withdrawal option via Bank Wire or Skrill is eligible for the bank/Skrill fees requested by the service provider itself.

The withdrawal methods are actually the same ones as deposit options, while withdrawal is also typically processed by the same method as the deposit was made, due to regulatory rules.

Customer Support and Responsiveness

Score – 4.5/5

Testing Trading 212’s Customer Support

Trading 212 offers reliable 24/7 customer service through phone lines, email, contact forms, and its help center. You can be confident that you will receive not only friendly guidance but also accurate, high-quality answers delivered promptly and professionally.

Contacts Trading 212

The broker can be reached via email at info@trading212.com for general inquiries. For phone support, the UK line is +44 20 3769 9897, which handles general questions and complaints.

Additionally, users can access help through the platform’s contact form or help center, ensuring multiple ways to get assistance quickly and efficiently.

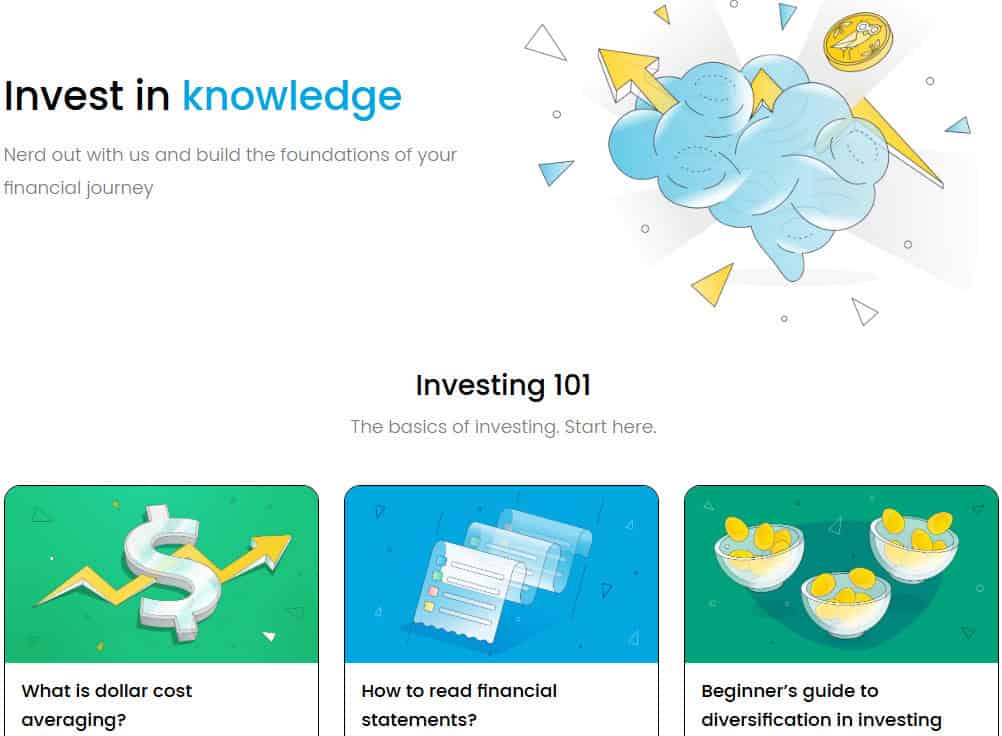

Research and Education

Score – 4.4/5

Research Tools Trading 212

Trading 212 provides a range of research tools across both its website and platform, helping users stay informed and make better decisions.

- The platform includes price alerts, advanced charting, technical indicators, and a built-in news feed with real-time market updates.

- On the website, users can access market analyses, educational articles, an economic calendar, and ongoing market insights. While the tools are more streamlined than deeply advanced, they offer everything most retail traders need for daily analysis and effective trade planning.

Education

The broker offers a well-structured educational section designed to support traders at all experience levels. Its resources include educational articles, guides, and platform walkthroughs that explain key trading concepts and platform features in a simple, practical way.

The content covers topics such as market basics, risk management, and strategies, giving learners a solid foundation to improve their skills.

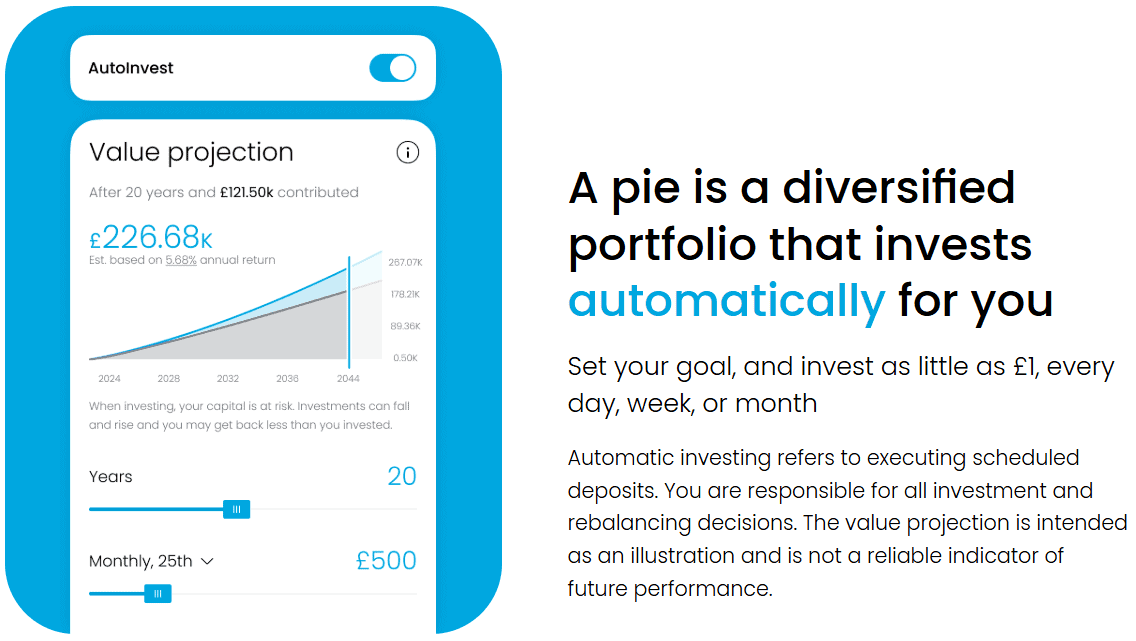

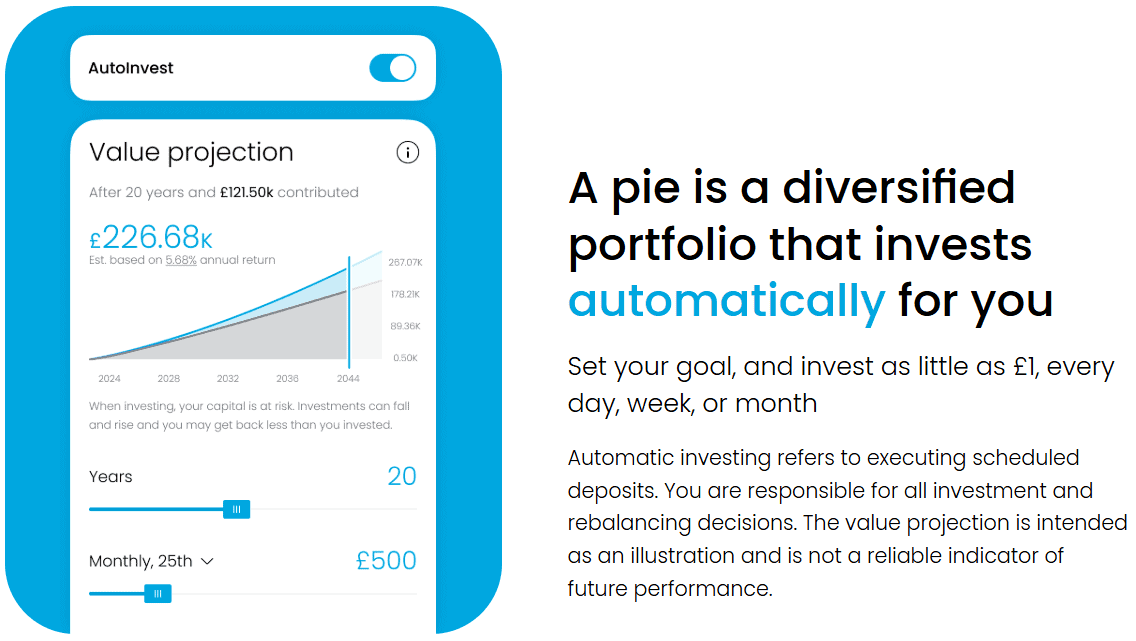

Portfolio and Investment Opportunities

Score – 4.5/5

Trading 212 offers accessible investment opportunities through its Invest and ISA accounts, giving users a simple way to build long-term portfolios.

Traders can choose from a wide selection of stocks and ETFs, fractional shares, and commission-free investing. The ISA account also provides a tax-efficient way to grow investments for eligible UK clients.

Account Opening

Score – 4.4/5

How to Open Trading 212 Demo Account?

Opening a demo account with Trading 212 is simple and quick. New users can sign up through the broker’s website or mobile app by creating an account with basic personal details.

Once registered, they can switch to Practice Mode, which instantly provides virtual funds to explore the platform and test strategies in a risk-free environment.

The demo account mirrors real market conditions, allowing users to familiarize themselves with the interface, tools, and order execution before moving to a live account.

How to Open Trading 212 Live Account?

Opening an account with Trading 212 is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.3/5

Trading 212 offers a few additional tools and features that enhance the overall experience beyond standard research functions.

- The platform includes AutoInvest, a tool that allows users to automate portfolio building with pies and scheduled contributions.

- It also offers AI-powered investment insights and smart filtering options that help users discover relevant assets more efficiently. Features like fractional investing and customizable watchlists provide added flexibility, while the mobile app ensures seamless access and management of accounts on the go.

Trading 212 Compared to Other Brokers

Compared with its competitors, Trading 212 stands out for its strong regulatory framework, easy accessibility, and beginner-friendly setup.

While many brokers require higher initial deposits or focus on advanced platforms like MT4 and MT5, the broker provides a simple proprietary platform and a very low entry barrier, making it attractive for newcomers and casual traders.

Its range of available instruments is broader than many standard CFD providers. In terms of fees, Trading 212 remains competitive, especially with its commission-free structure, though some competitors may offer tighter spreads or more specialized account types for professional traders.

Overall, Trading 212 is positioned as an accessible, well-regulated broker with user-friendly tools, while competitors may appeal more to highly active or platform-focused traders.

| Parameter |

Trading 212 |

Purple Trading |

Ultima Markets |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1.4 pips |

Average 1.3 pips |

Average 1 pip |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.5% FX conversion fee |

0.3 pips + $2.5 per side |

0.0 pips + $2.5 per side |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Average |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

Proprietary Platform and Apps |

MT4, MT5, cTrader |

MT4, MT5, MT4 WebTrader, Mobile App |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

13,000+ instruments |

200+ instruments |

250+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FCA, ASIC, BFSC, CySEC |

CySEC, FSA |

FCA, CySEC, FSC |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/7 |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Good |

Good |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

$1 |

$100 |

$50 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker Trading 212

Trading 212 is a well-established online broker known for its accessible environment, strong regulatory oversight, and user-friendly proprietary platform.

It offers a wide selection of instruments for both short-term trading and long-term investing, supported by fast account setup, low entry requirements, and commission-free pricing for many products.

The platform delivers a clean interface, solid research tools, and useful features such as fractional investing, automated portfolio building, and educational resources for developing traders.

With consistent customer support and a reliable operating history, Trading 212 provides a balanced trading and investing experience suitable for a broad range of users.

Share this article [addtoany url="https://55brokers.com/trading-212-review/" title="Trading 212"]

I WANT TO DOWNLOAD THE PLATFORM