- What is Traders Trust?

- Traders Trust Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

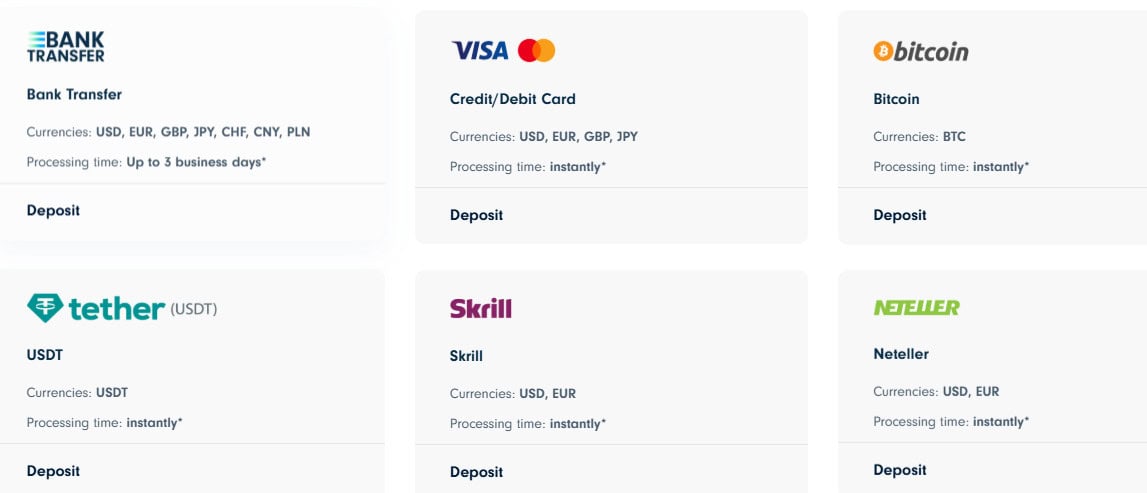

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

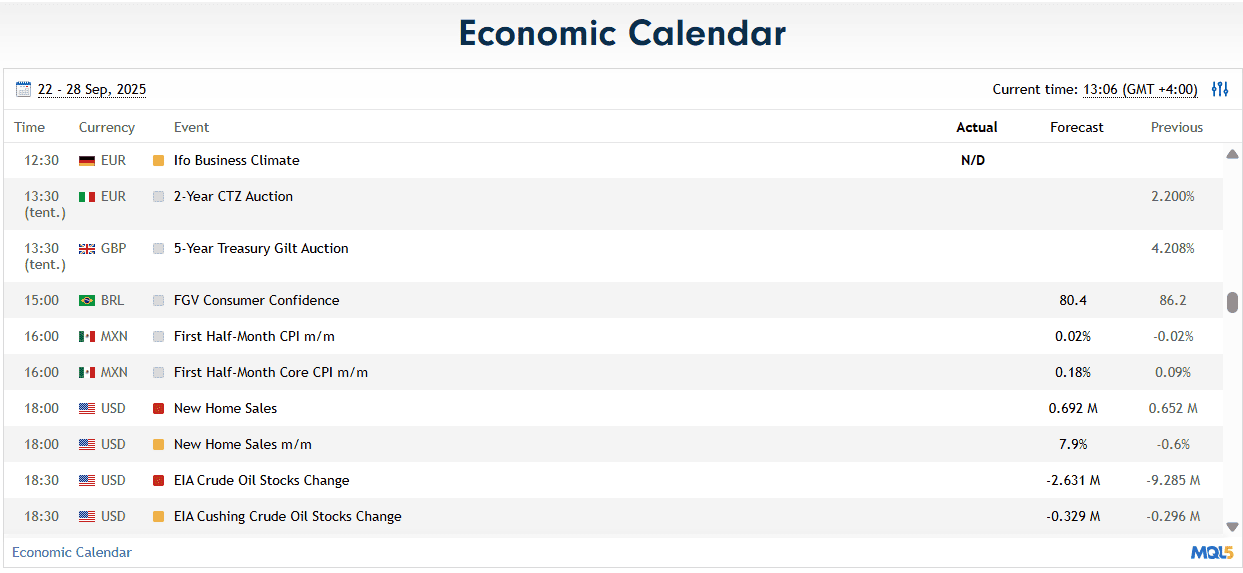

- Research and Education

- Portfolio and Investment Opportunities

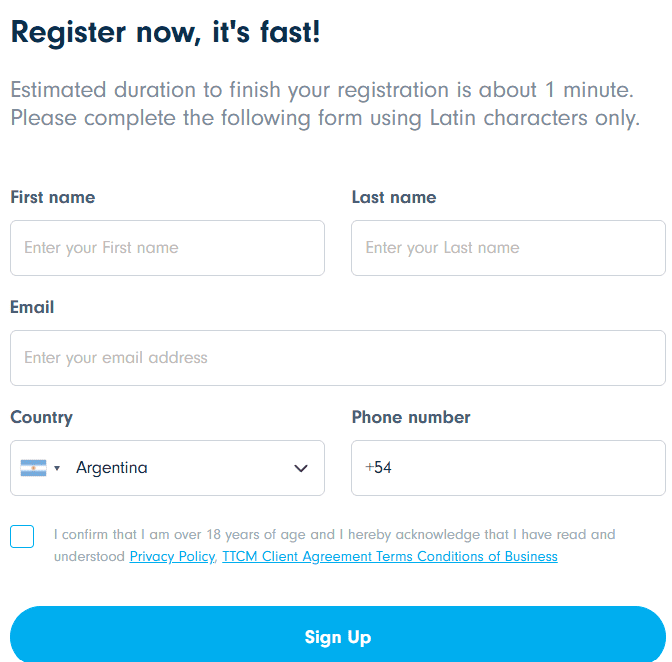

- Account Opening

- Additional Tools And Features

- Traders Trust Compared to Other Brokers

- Full Review of Broker Traders Trust

Overall Rating 4.3

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.6 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is Traders Trust?

Traders Trust is a Forex trading brokerage firm that provides online trading services to retail and institutional clients and offers access to a range of financial instruments, including Forex, CFDs, Indices, Metals, Stocks, Crypto, and Oils.

Based on our research, the broker is regulated and authorized by the reputable European regulatory body CySEC. Additionally, the firm has an entity in Seychelles and is under the oversight of the Financial Services Authority (FSA).

Overall, the firm provides a competitive trading environment and a diverse range of financial products through the advanced trading platform.

Traders Trust Pros and Cons

As we found, the broker has advantages and disadvantages that are important for traders to consider. On the positive side, Traders Trust offers competitive trading solutions, a low minimum deposit requirement, and access to the well-known MetaTrader 4 platform. Additionally, the company stands out for its competitive trading fees, allowing users to execute trades at favorable terms.

For the cons, there is no 24/7 customer support available. Additionally, the platform lacks educational materials, affecting the depth of market information available to users. Moreover, the broker lacks a top-tier license, which could be a concern for traders who prioritize brokers with higher regulatory credentials. However, trading under CySEC regulation is considered safe enough.

| Advantages | Disadvantages |

|---|

| European license and oversight | No 24/7 customer support |

| MT4 trading platform | Limited learning materials |

| Good trading conditions | No top-tier license |

| Competitive pricing | |

| Professional trading | |

| Low minimum deposit | |

| STP/ECN execution | |

Traders Trust Features

According to our research, Traders Trust includes trustworthy solutions with competitive prices, which is an advantage for all levels of traders. The selection of trading instruments with competitive trading spreads is an attractive proposal to traders. We have listed the main aspects of trading with the broker below for a quick check:

Traders Trust Features in 10 Points

| 🗺️ Regulation | CySEC, FSA |

| 🗺️ Account Types | Classic, Pro, VIP, Islamic accounts, MAM accounts |

| 🖥 Trading Platforms | MT4 |

| 📉 Trading Instruments | Forex, CFDs, Indices, Metals, Stocks, Crypto, and Oils |

| 💳 Minimum deposit | €50 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, JPY, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is Traders Trust For?

We have carefully reviewed Traders Trust’s proposal and found that it is a suitable broker for clients at different levels and with various trading needs. The broker is especially favorable for the following:

- European traders

- International traders

- Currency trading

- Beginners

- Advanced traders

- STP/ECN execution

- Competitive spreads and fees

- EA/Auto trading

- Good trading tools

Traders Trust Summary

Traders Trust is a reliable Forex trading broker that offers competitive trading conditions, a diverse range of trading products, and low pricing. Additionally, the availability of the popular MT4 trading platform contributes to a versatile trading experience.

Although the educational resources are limited, the broker’s commitment to accessibility and customer support enhances its overall appeal.

Overall, we found that the firm provides a reliable trading environment; however, we advise traders to research and evaluate whether the company’s offerings suit their specific trading requirements.

55Brokers Professional Insights

With our thought Traders Trust broker provides competitive fees, a reliable and stable trade environment which is an advantage for all levels of traders and might be suitable for European traders, large-scale traders and beginners alike. Since, broker holds a license from the CySEC and FSA, it offers services to both European and international traders, so is available to almost any resident from various countries. However, at the moment of our research the European entity does not accept new clients, which might change at any moment so we advise monitoring this in case you are interested to sign in for trading.

As for the trading conditions themselves, Traders Trust offers several account types, tailored for different traders, including Islamic account and MAM accounts, providing its clients with more benefits and opportunities. Trades are conducted on the MT4 platform, the most widely choice worldwide, yet if you prefer a newer platform, better seek for another Broker. Also, instrument availability is over 200 products across multiple markets, which is not an extensive offering, yet it still allows a medium level of diversity.

Additionally, Traders Trust’s clients can engage in copy trading, exploring more investment possibilities, which is a plus for diversification. What we do like is that the broker offers an impressive research section, yet the education section is limited, while Clients can also benefit from multiple promotions and programs that Broker provides on time basis.

Yet, last but an important point to consider is the difference between the entities, as trading conditions and safety measures vary drastically from one jurisdiction to another.

Consider Trading with Traders Trust If:

| Traders Trust is an excellent Broker for: | - European traders

- Global traders

- Beginners and Professionals

- MT4 platform enthusiasts

- Copy traders

- Islamic traders

- Clients looking for the MAM account features

- CFD and Currency traders

- Clients looking for high leverage opportunities |

Avoid Trading with Traders Trust If:

| Traders Trust is not the best for: | - Clients prioritizing top-tier regulations

- Traditional Investors

- Traders looking for a good selection of platforms

- Clients searching for extensive range of instruments

- Beginner traders looking for extensive educational materials

- Traders prioritizing 24/7 customer support |

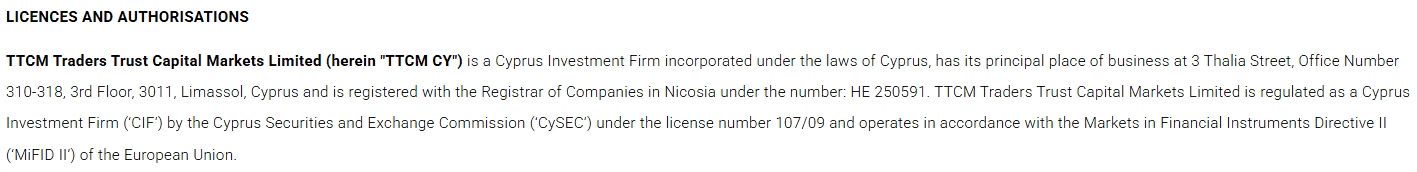

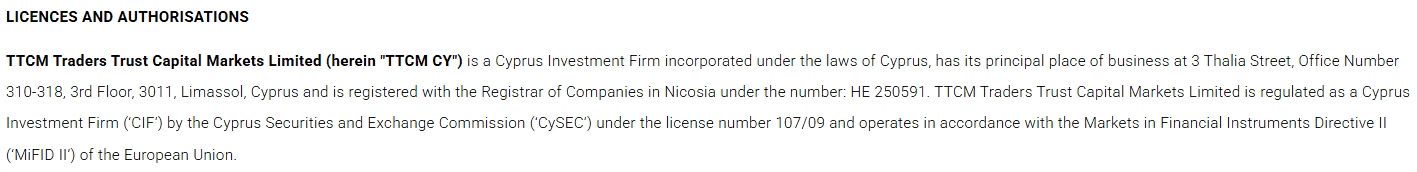

Regulation and Security Measures

Score – 4.3/5

Traders Trust Regulatory Overview

Traders Trust is authorized by the reliable Cyprus Securities and Exchange Commission (CySEC). The regulatory authority imposes strict rules and regulations to ensure high standards in the financial industry. The broker’s commitment to compliance with industry standards is evident through its regulation under a respected European authority.

However, the broker also holds an offshore license from the Financial Services Authority of Seychelles. Therefore, before engaging in trading activities, traders should carefully consider and understand the differences while trading in different jurisdictions.

- Another essential point for European clients is that at the moment of our research, the broker does not accept new clients, and traders can only open new accounts under the international entity.

How Safe is Trading with Traders Trust?

According to our findings, the broker implements different measures to protect its trading accounts. These typically include regulatory oversight and compliance with applicable rules and regulations. The firm also maintains fund protection mechanisms to keep client funds separate from the broker’s operational funds.

- However, conduct thorough research and carefully examine the broker’s documentation, legal agreements, and policies. It will provide a comprehensive understanding of the specific trading protections offered by the platform, as trading conditions can vary across jurisdictions.

Consistency and Clarity

Founded in 2009, Traders Trust offers a promising trading opportunity for different clients worldwide. The broker has been consistent in its services, ensuring transparency and reliability. Adhering to strict regulatory rules, Traders Trust is a beneficial choice for traders prioritizing consistent and time-proven opportunities.

Based on our research, Traders Trust constantly improves its services and expands its client base. However, feedback from clients is mixed, pointing out both positive aspects and areas for improvement. Among positive aspects are reasonable fees, an advanced platform, and a dedicated customer support. Among the negative points we found are concerns with delayed withdrawals and platform limitations.

- Another essential point is the difference in conditions based on the entity. Also, the broker informs that currently, the European traders cannot open new accounts, which is another serious point for consideration.

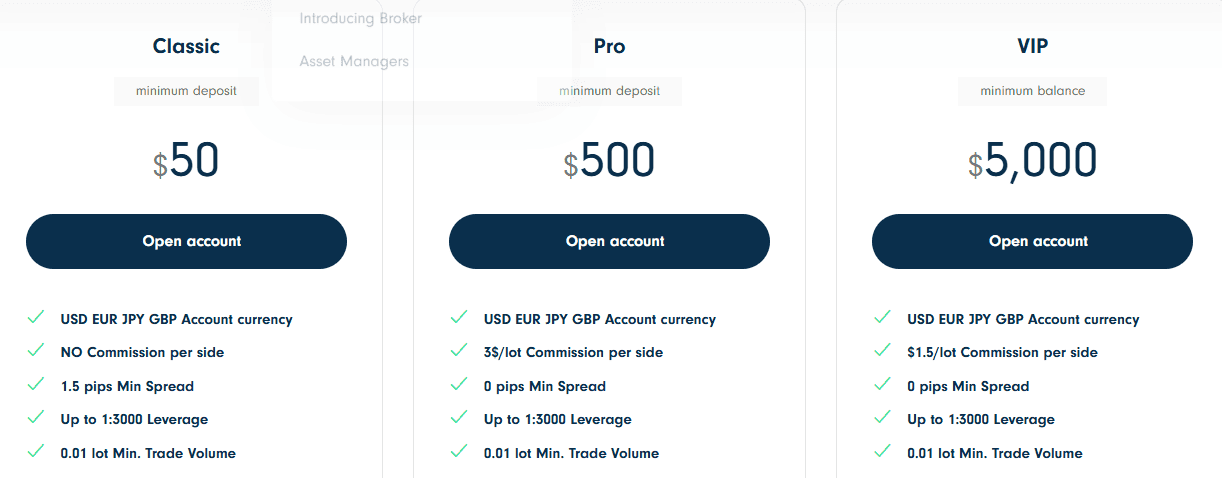

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Traders Trust?

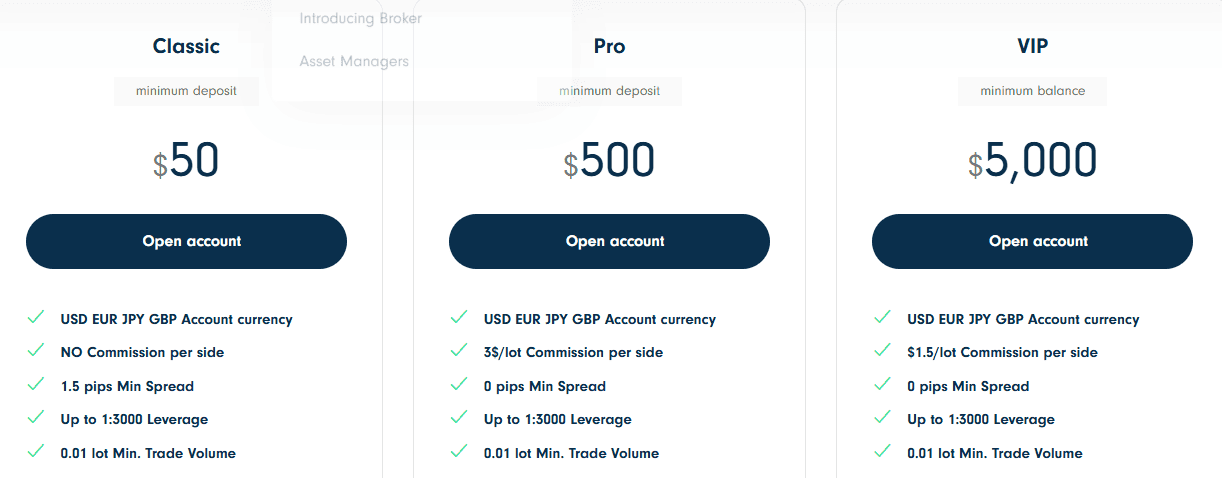

Our research revealed that the broker offers a variety of account types tailored to meet the diverse needs of traders. These include Classic, Pro, and VIP accounts, each with various features and benefits.

Additionally, the platform provides Demo accounts, allowing traders to practice and familiarize themselves with the platform and market conditions before committing real funds. The broker also offers Islamic accounts for its Muslim clients. The availability of the MAM account is another advantage the broker provides.

- The Classic account has a minimum deposit requirement of $50. It is a spread-based account with an average spread of 1.5 pips.

- The Pro account has a higher deposit requirement, starting from $500. The Pro account is a commission-based account, with a $3 fee per side per lot. The spreads for this account start from 0 pips, based on the instrument.

- The VIP account is a better fit for professional clients, requiring a high initial deposit of $5.000. It is another commission-based account, with lower fees of $1.5 per side per lot. The commissions are combined with spreads from 0 pips.

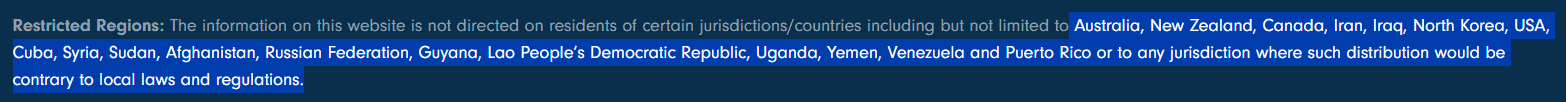

Regions Where Traders Trust is Restricted

Based on our research, Traders Trust delivers its services to European clients due to its CySEC regulation and to international traders due to its FSA license. However, there are still regulatory restrictions, and in a few countries, the broker’s services are unavailable:

- Australia

- New Zealand

- Canada

- Iran

- Iraq

- North Korea

- USA

- Cuba

- Syria

- Sudan

- Afghanistan

- Russian Federation

- Guyana

- Lao People’s Democratic Republic

- Uganda

- Yemen

- Venezuela

- Puerto Rico

Cost Structure and Fees

Score – 4.5/5

Traders Trust Brokerage Fees

After examining the firm’s fee offering, we found that Traders Trust imposes various fees associated with trading activities, including spreads, commissions, and overnight financing charges.

The spreads can vary depending on the instrument and the account type selected, with tighter spreads typically offered to higher-tier accounts.

Based on our test trade, the firm provides competitive tight spreads, with an average spread of 0.1 pips for the EUR/USD currency pair in the Forex market for the commission-based account. For the Classic account, the average spread is 1.5 pips.

However, spreads can vary based on market conditions, volatility, and liquidity; thus, we recommend consulting the broker’s website or contacting customer support for detailed information on the spreads they offer for specific instruments and account types.

- Traders Trust Commissions

Traders Trust offers two commission-based accounts with different conditions. The Pro account offers very low spreads combined with commissions of $3 per side per lot. The VIP account offers more competitive conditions with $1.5 commissions per side per lot, combined with spreads from 0 pips.

How Competitive Are Traders Trust Fees?

Our research has revealed transparent trading costs. The broker reveals the trading fees for each instrument on its website, making the trading charges predictable. The fees depend on the account type and the instrument.

The spread-based account offers average spreads, while the commission-based accounts apply spreads from 0 pips, based on the instrument. The commission-based account has reasonable commissions.

Our impression of the broker’s fee structure and costs is positive. Another essential reminder to traders is to check trading conditions based on the entity.

| Asset/ Pair | Traders Trust Spread | WH SelfInvest Spread | Fxview Spread |

|---|

| EUR USD Spread | 1.5 pips | 1 pip | 0.2 pips |

| Crude Oil WTI Spread | 0.05 | 2.5 | 0.02 |

| Gold Spread | 1.4 | 1 | 0.16 |

Traders Trust Additional Fees

We have found that if the account is not active for over six months, the broker will charge a monthly inactivity fee of $25. We found that the broker does not apply deposit fees. However, Traders Trust applies withdrawal fees based on the funding method used.

- The broker also applies short and long swaps for the positions held overnight. The broker provides the swap fees for each instrument on its website.

Score – 4.2/5

Traders Trust provides the widely used MT4 trading platform, available via desktop, web, and mobile devices, offering a seamless trading experience across different devices.

The platform allows access to advanced charting and analysis tools, with algorithmic trading capabilities.

| Platforms | Traders Trust Platforms | WH SelfInvest Platforms | Fxview Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Traders Trust Web Platform

Traders Trust offers its clients web trading with straightforward access to its platform. The web version of the platform is easily compatible with all browsers. The web platform does not require installations or downloads, allowing high flexibility and functionality. They also include all the fundamental tools and features, and enable deep analysis.

Traders Trust Desktop MetaTrader 4 Platform

We found that the broker offers a comprehensive suite of trading tools to enhance the trading experience. These tools include technical indicators, charting capabilities, and expert advisors (EAs) for automated trading strategies. Traders can access a wide range of analysis tools to conduct thorough market analysis and make informed trading decisions.

Additionally, MT4 offers a customizable interface, allowing traders to tailor their trading environment to their preferences and trading strategies.

Traders Trust Desktop MetaTrader 5 Platform

During our research, we noticed that Traders Trust does not offer the popular and more advanced MT5 platform. For many traders, the lack of the MT5 platform is a drawback, especially for more professional clients who prioritize the availability of innovative and extensive features.

However, the MT4 platform is a favorable choice for various clients, ensuring a positive trading experience.

Traders Trust MobileTrader App

The broker’s MT4 platform is also available for mobile trading. The mobile platform provides real-time market data, advanced charting, and smooth trade execution. The capacity to trade on the go is essential for many traders, as the flexibility of the mobile platforms is what most clients prefer. The platform allows access to the open positions from anywhere, ensuring that clients never miss profitable trading opportunities.

Main Insights from Testing

We have tested and researched the broker’s available platform options to determine how they accommodate their clients. Overall, the availability of the MT4 platform ensures smooth and fast trading. It provides access to great tools and features, offering in-depth analysis capabilities, excellent trading conditions, and reliability. Access through the desktop, web, and mobile versions allows clients to choose the most convenient option for trades.

However, clients looking for more advanced platforms, such as MT5, cTrader, or TradingView, will need to look for another broker with a similar proposal.

AI Trading

We found that Traders Trust does not offer fully AI-powered services. However, it still allows automation of trades. Those traders who prefer full automation are advised to consider other brokers, as many already include full automation features in their proposals.

Trading Instruments

Score – 4.3/5

What Can You Trade on the Traders Trust Platform?

Traders Trust provides access to popular trading instruments, such as Forex, CFDs, Indices, Metals, Oils, and Stocks. Traders from the international entity also have the opportunity to participate in cryptocurrency trading.

The available instruments are based on CFDs, allowing clients to only speculate on price movements. We found that the broker is not the best choice for long-term trading and does not support traditional investments.

Main Insights from Exploring Traders Trust Tradable Assets

Based on our research, Traders Trust offers tradable products across a good range of financial assets, allowing clients to explore the market. The broker offers over 40 major, minor, and exotic currency pairs. Traders can also access some of the most popular commodities, such as gold, silver, oil, natural gas, etc. The broker also offers popular indices and stocks based on CFDs. Additionally, through the international entity, clients can engage in cryptocurrency trading with access to Bitcoin, Litecoin, Ethereum, Ripple, etc.

The overall offering of the broker’s tradable products exceeds 200 instruments, which allows for measured diversification of trades.

Leverage Options at Traders Trust

Leverage is a valuable tool that allows traders to enter the market with limited capital. However, users should understand that it can result in substantial gains or losses. Therefore, have a comprehensive understanding of how leverage operates and its potential consequences before engaging in any trading activities involving leverage.

Traders Trust’s leverage is offered according to CySEC and FSA regulations:

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- International traders may use higher leverage up to 1:3000, so understanding the implications and risks associated with leverage is crucial before making decisions about its use in trading.

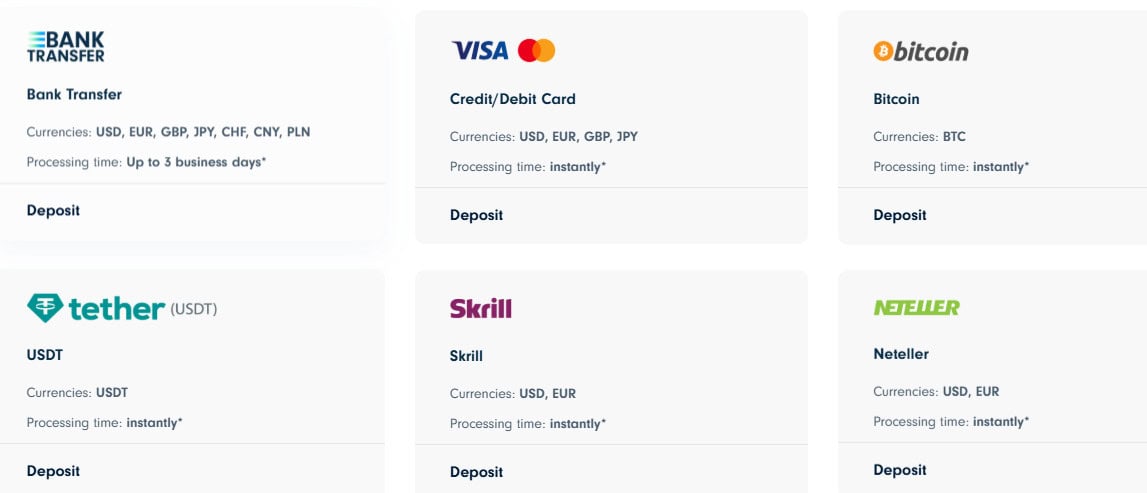

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Traders Trust

Per our research, the broker offers multiple funding methods to facilitate deposits and withdrawals for its clients. These methods include bank wire transfers, credit/debit card payments, and popular e-wallet services such as Skrill and Neteller. We also found that there are no transaction fees for any of the deposit methods.

However, the availability of specific funding methods may vary depending on the client’s location and regulatory requirements.

Minimum Deposit

For Traders Trust, the minimum deposit requirements vary depending on the account type. For the Classic account, the minimum deposit is €50.

For the Pro account, a higher minimum deposit of €500 is required, and for the VIP account, the minimum deposit is as high as €5,000. These minimum deposit amounts ensure accessibility for traders across different experience levels and investment capabilities.

Withdrawal Options at Traders Trust

Based on our analysis, the platform facilitates withdrawals through various methods, including bank wire transfers, credit/debit cards, and e-wallet services. Clients can conveniently request withdrawals through their trading accounts, with processing times typically varying depending on the chosen withdrawal method and associated regulatory requirements. For most methods, however, the withdrawal processing time is one working day. The minimum withdrawal amount is €50.

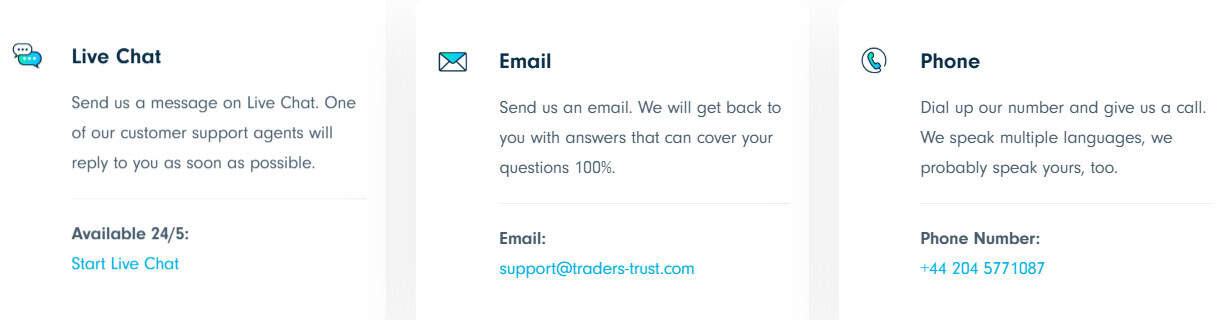

Customer Support and Responsiveness

Score – 4.5/5

Testing Traders Trust’s Customer Support

The broker offers 24/5 customer support via live chat, email, and phone lines. The support team experts assist with any technical issues, analysis recommendations, general inquiries, and more.

- We found that the broker’s FAQ section provides essential answers to the most common questions that clients encounter while trading.

Contacts Traders Trust

Based on our analysis, Traders Trust offers reliable and quality customer assistance to its clients worldwide. The broker offers several channels of communication, so that clients can choose the most suitable option:

- Live chat enables clients to find quick and efficient answers to urgent trading-related questions. Generally, traders prefer to contact the broker through a live chat due to its easy accessibility.

- Traders Trust also provides an email address for different requests, questions, and complaints: support@traders-trust.com.

- Clients can also contact the support team by using the provided phone number: +44 204 5771087.

- Another good point is that Traders Trust is active on social platforms, providing market updates and various company news. The broker can be reached through the following platforms: Facebook, Instagram, YouTube, LinkedIn, X, and TikTok.

Research and Education

Score – 4.2/5

Research Tools Traders Trust

Traders Trust includes extensive analytical and research tools on its platform. Additionally, clients have access to the following research tools:

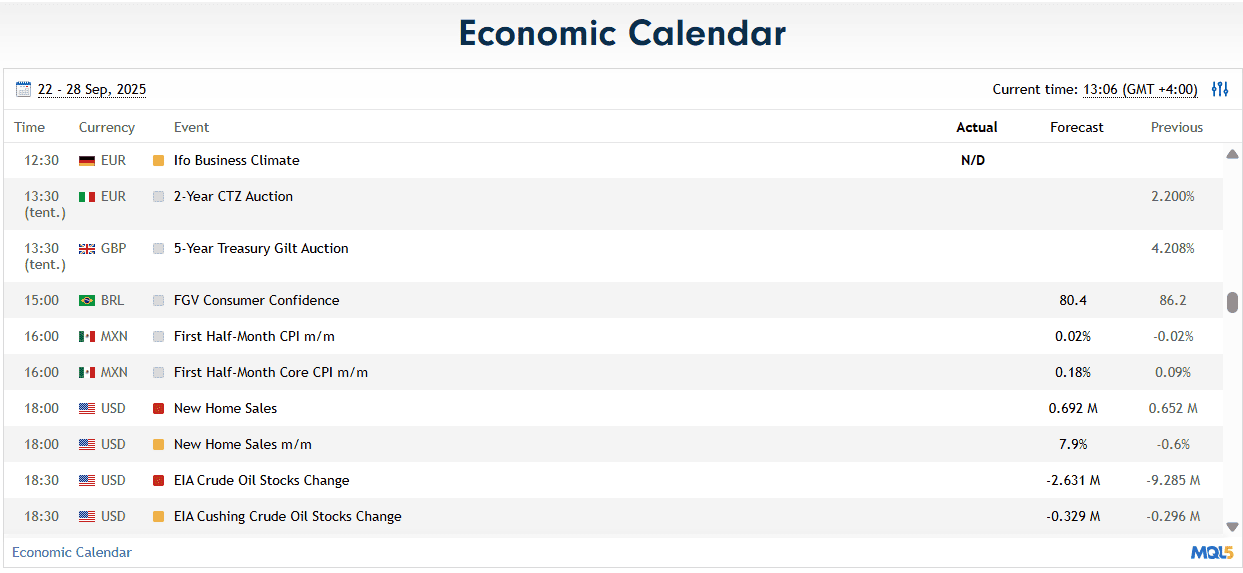

- The Economic Calendar provides essential market updates on the upcoming events and economic changes. Its availability allows clients to make informed decisions based on professional insights.

- Clients can also access historical data for more insights and to spot long-term trends, tendencies, and patterns.

- Traders Trust clients can also access various calculators right from the website. The broker provides a margin, swap, profit/loss, and pip calculators.

Education

We found that Traders Trust does not provide any educational materials. Traders cannot access educational resources, including tutorials, webinars, and interactive courses, aimed at both novice and experienced traders.

Is Traders Trust a Good Broker for Beginners?

Based on our research of Traders Trust, we revealed the following. Traders Trust offers several account types with different fee structures, an advanced trading platform available through the web, desktop, and mobile versions, and attractive features, along with a reliable environment. Traders also have access to various analytical tools, including calculators, an economic calendar, and historical data. The broker, however, lacks an education section, which is a negative point for novice traders. Yet, the availability of a demo account and a low minimum deposit requirement make the broker a good fit for inexperienced traders who want to start small.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options Traders Trust

The available range of Traders Trust instruments is over 200. Our research revealed that the offering concentrates on Forex pairs and CFDs. Clients can also access global indices, stocks, essential commodities, and a few stablecoins and altcoins. However, some will find the proposal limiting, as traditional investors and long-term traders are unable to engage in stock investment or own actual assets.

- Our further research showed that the broker offers alternative investment options, including copy trading. It allows clients to copy the trades of professionals and gain profits.

- Traders Trust also offers MAM accounts, another attractive option for alternative investments.

Account Opening

Score – 4.6/5

How to Open a Traders Trust Demo Account?

Those new to trading can open a demo account with Traders Trust and practice their skills with virtual funds and no risk. After gaining confidence and skills, clients can switch to a live trading account.

To open a demo account, clients should follow the steps below:

- Go to the broker’s website and select the “Demo account” option.

- Register with the broker by providing personal information.

- Select the account preferences, including the base currency, account type, leverage, and others.

- Download the platform.

- Receive the account credentials through the provided email.

- Sign in to the demo account and start practicing with virtual money.

How to Open a Traders Trust Live Account?

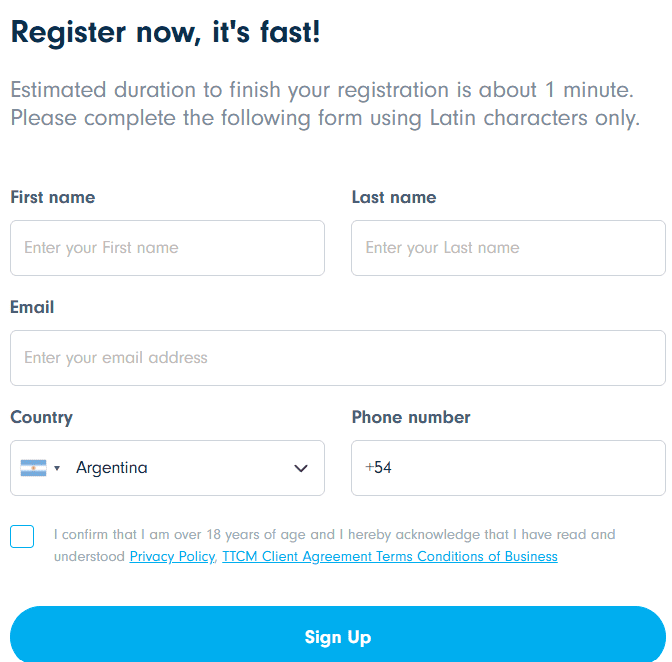

Opening an account with the broker is an easy process, as clients can log in and register with Traders Trust within minutes.

Just following the opening account or sign-in page, clients can proceed with the guided steps:

- Select and click on the “Register” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify personal data by uploading documentation (proof of address and ID).

- Complete the electronic quiz to confirm previous trading experience.

- Once the account is activated and proven, follow with the money deposit.

Score – 4.2/5

Traders Trust offers a few additional features and tools, enabling traders to maximize their trading experience.

- The free VPS allows traders to execute orders at lightning speed manually or through EAs.

- The Refer a Friend feature rewards its clients for each referral of the broker to their friends. For each referral, clients get $100. As soon as the friend trades at least three lots on FX or Metals through the Classic account in 30 days, the reward will be unlocked.

- Through the Loyalty Program, clients can earn monthly cash rewards of up to 3%, based on their monthly net deposits

Traders Trust Compared to Other Brokers

As a final step, we have compared Traders Trust to other brokers with similar offerings. Regarding regulation, the broker holds licenses from the respected CySEC and the international FSA. On the other hand, other brokers we reviewed offer better safety measures. For instance, Think Markets holds licenses from FCA, ASIC, FSCA, FSA, JFSA, CIMA, FSC, DFSA, and FMA, in addition to its CySEC license, ensuring an increased level of protection.

As to the trading platforms, Traders Trust offers the MT4 platform via web, desktop, and mobile app. All other competitors we reviewed also include the popular MT4 platform. However, we noticed that most of them include the more advanced MT5 platform and other advanced options. Further, the instrument offering of Traders Trust is over 200, which is a modest number, especially compared to RoboForex’s 12,000 available products.

At last, Traders Trust offers a few research tools, including an economic calendar and calculators. There are no available educational resources with the broker, whereas Blueberry Markets includes extensive educational resources, enabling novice traders to access a wide selection of educational materials.

| Parameter |

Traders Trust |

Blueberry Markets |

RoboForex |

Exness |

FXORO |

HFM |

ThinkMarkets |

| Spread-Based Account |

From 1.5 pips |

Average 1 pip |

Average 1.3 pip |

From 0.2 pips |

Average 2 pips |

Average 1 pip |

From 0.4 pips |

| Commission-Based Account |

0.0 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $4 |

0.0 pips + $3.5 |

No commissions |

0.0 pips + $3 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Average |

Average |

Low |

Average |

Low/ Average |

Average |

| Trading Platforms |

MT4 |

MT4, MT5, Web Trader |

MT4, MT5, R StocksTrader |

MT4, MT5 |

MT4, Mobile app |

MT4, MT5, HFM App |

MT4, MT5, ThinkTrader , TradingView |

| Asset Variety |

200+ instruments |

300+ instruments |

12,000+ instruments |

200+ instruments |

130+ Instruments |

500+ instruments |

4000+ instruments |

| Regulation |

CySEC, FSA |

ASIC, VFSC |

FSC |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

CySEC, FSA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

FCA, ASIC, FSCA, FSA, CySEC, JFSA, CIMA, FSC, DFSA, FMA |

| Customer Support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Limited |

Excellent |

Good |

Fair |

Excellent |

Good |

Excellent |

| Minimum Deposit |

$50 |

$100 |

$10 |

$10 |

$100 |

$0 |

$50 |

Full Review of Broker Traders Trust

We researched various aspects of Traders Trust to find that the broker is a reliable and trustworthy option for Forex trading. Its CySEC license ensures adherence to strict rules, making it a safe broker for European clients. Its FSA regulation ensures its global reach. However, the broker mentions on its European website that it is not currently accepting new clients.

The broker offers competitive trading fees based on the account and the traded instrument. It offers spread-based and commission-based fee structures, allowing clients a choice. Trades are conducted on the web, desktop, or app versions of the popular MT4 platform. There are no other platform options with Traders Trust. Traders Trust offers an economic calendar, calculators, and trading history, ensuring informed decisions. The availability of a free VPS enhances the trading experience.

The overall number of available instruments across Forex, CFDs, Indices, Metals, Stocks, Crypto, and Oils is 200. The broker also offers alternative options for investment, including copy trading and MAM accounts.

As we found, Traders Trust does not offer educational materials. There are only a few research tools available. Yet the broker has a demo account, allowing novice clients to practice and gain skills. The minimum deposit requirement is low, starting at €50 for the Classic account.

The broker also includes promotions and bonuses, such as a loyalty program, a Refer a friend feature, and other opportunities, to encourage its clients.

Share this article [addtoany url="https://55brokers.com/traders-trust-review/" title="Traders Trust"]