- What is Trade Republic?

- Trade Republic Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Trade Republic Compared to Other Brokers

- Full Review of Broker Trade Republic

Overall Rating 4.6

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Trade Republic?

Trade Republic is a Germany-based online investment firm operating in Europe, providing a platform for investors to trade a variety of financial products such as stocks, shares, ETFs, bonds, derivatives, and Trade Republic crypto.

The platform primarily serves clients across several European nations, such as Germany, Belgium, Austria, France, Spain, Italy, and more. It operates under the authorization and supervision of the German Federal Financial Supervisory Authority (BaFin) and Bundesbank, ensuring strict compliance with regulatory standards.

Overall, Trade Republic focuses on providing commission-free or low-cost trading services. It is known for its user-friendly mobile app that allows retail investors to buy and sell stocks without traditional commission fees. The platform aims to simplify the investing process, making it accessible to a wide range of users.

Is Trade Republic Stock Broker?

Yes, Trade Republic is a Stock Broker. It is a Neobrokerage firm that provides a platform for individuals to buy and sell stocks. The company focuses on low-cost trading solutions and is known for its user-friendly trading platform, making stock trading accessible to a broad audience.

Trade Republic Pros and Cons

The firm offers several benefits, including commission-free investment, which makes it cost-effective for clients. The user-friendly mobile app provides a seamless and accessible platform for buying and selling stocks, appealing to a wide range of users. Additionally, the top-tier regulatory oversight from BaFin enhances the overall security of the investment experience.

For the cons, its primary focus on stock trading means that it has a more limited range of available financial instruments compared to some traditional brokers. Additionally, the platform may have more simplified research and analysis tools compared to traditional brokers, potentially affecting the depth of market information available to users. Also, the absence of 24/7 customer support might be a drawback for those who prefer round-the-clock assistance.

| Advantages | Disadvantages |

|---|

| European regulation and oversee | No 24/7 customer support |

| Competitive investment conditions | Limited education and research materials |

| €0 minimum deposit | No paper trading or demo account |

| User-friendly mobile app | Limited investment products |

| Secure investing environment | |

| European traders | |

| Accessibility | |

| Cost-effective | |

| No hidden charges | |

Trade Republic Features

Trade Republic offers traders an intuitive interface, a popular selection of tradable assets, and competitive pricing. Below is a comprehensive list of its key features:

Trade Republic Features in 10 Points

| 🏢 Regulation | BaFin, Bundesbank |

| 🗺️ Account Types | Standard Account |

| 🖥 Trading Platforms | Trade Republic Mobile App |

| 📉 Trading Instruments | Stocks, Shares, ETFs, Bonds, Derivatives, Crypto |

| 💳 Minimum Deposit | €0 |

| 💰 Average Stock Commission | From €1 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | EUR |

| 📚 Trading Education | Articles, Guides |

| ☎ Customer Support | 24/5 |

Who is Trade Republic For?

Trade Republic generally appeals to investors seeking a combination of accessibility, transparency, and a collaborative investment environment. Based on our findings and Financial Expert Opinions, Trade Republic is Good for:

- European traders

- Investing

- Stock Trading

- Fractional Shares

- Low fees

- Advanced traders

- Professional trading

- Good trading tools

- Competitive conditions

Trade Republic Summary

In conclusion, Trade Republic stands out for its commitment to providing a commission-free and user-friendly trading experience through its mobile app. The platform caters to investors looking for simplicity and accessibility in stock, ETF, bond trading, and more.

While it may lack extensive educational resources and some advanced features, its transparent fee structure and emphasis on cost-effective trading make it an appealing choice for those seeking a straightforward approach to investment. However, traders should be aware of potential revenue models, such as payment for order flow, and stay informed about any updates to the platform’s offerings.

55Brokers Professional Insights

Trade Republic stands out in the European financial market as a mobile-first broker that combines low-cost investing with a clean, user-friendly interface designed for simplicity and accessibility.

Regulated in Germany and backed by major institutional investors, the broker offers commission-free trading on a range of assets, including stocks, ETFs, bonds, derivatives, and cryptocurrencies, with just a €1 flat external fee per trade.

Additionally, Trade Republic provides fractional shares, savings plans starting from €1, and interest on uninvested cash, making long-term wealth building accessible to a broader audience.

Consider Trading with Trade Republic If:

| Trade Republic is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- Competitive fees.

- Secure trading environment.

- Offering popular financial products.

- Looking for firm with a long history of operation and strong establishment.

- Stock Trading and Investment.

- Professional trading.

- European investors.

|

Avoid Trading with Trade Republic If:

| Trade Republic might not be the best for: | - Advanced or high-frequency traders.

- Margin trading.

- Who require multiple account types.

- Looking for broker with 24/7 customer support.

- Need a broker with trading services worldwide.

- Investors who prefer robust educational resources. |

Regulation and Security Measures

Score – 4.6/5

Trade Republic Regulatory Overview

Trade Republic is a reliable Stock trading broker that follows the strict rules and guidelines established by the European BaFin and Bundesbank, which safeguard client assets and provide low-risk Stock trading.

How Safe is Trading with Trade Republic?

Trade Republic is a legitimate and trustworthy investing company for traders looking to invest and manage their assets. It is regulated by the Top-Tier European authority and has a good reputation and integrity in the financial market.

The firm provides customer trading protection through adherence to financial regulations and oversight by the German BaFin and Bundesbank. These regulatory bodies ensure that the platform operates within established standards, promoting transparency and safeguarding the interests of users.

Additionally, investor protection measures may include safeguards against unauthorized access, secure transaction protocols, and adherence to industry best practices for data security.

Consistency and Clarity

Trade Republic has built a solid reputation as a transparent broker, particularly within the European market. Regulated by BaFin and operating under strong EU financial directives, the broker consistently scores high for security, user experience, and affordability in industry reviews.

Trader feedback frequently praises its intuitive mobile app, low-cost trading model, and ease of use for long-term investing, although some users highlight limitations such as a lack of advanced trading tools, desktop access, or diverse asset classes.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Trade Republic?

The firm primarily offers a single type of account, known as the Standard Investment account. This account allows users to trade a variety of financial instruments, depending on the platform’s available offerings.

The focus is on providing a straightforward and accessible trading experience for retail investors through a user-friendly mobile app.

Standard Account

Trade Republic Standard Account offers a simple, accessible, and cost-effective entry into investing for retail traders across Europe. With no minimum deposit requirement, users can start investing with as little as €1, making it ideal for beginners and long-term savers.

The account allows commission-free investing in thousands of stocks, ETFs, bonds, cryptocurrencies, and derivatives, with only a flat €1 external settlement fee per trade.

Regions Where Trade Republic is Restricted

Trade Republic is available in select European countries, and its services are strictly tied to the user’s country of residence, making it restricted for individuals outside these supported regions or those who relocate.

Below is a list of regions where the broker is either restricted or entirely unavailable:

- Argentina

- Australia

- Bulgaria

- Canada

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Hungary

- Malta

- Mexico

- Norway

- Poland

- Romania

- Sweden

- Switzerland

- UAE

- UK

- Ukraine

- USA

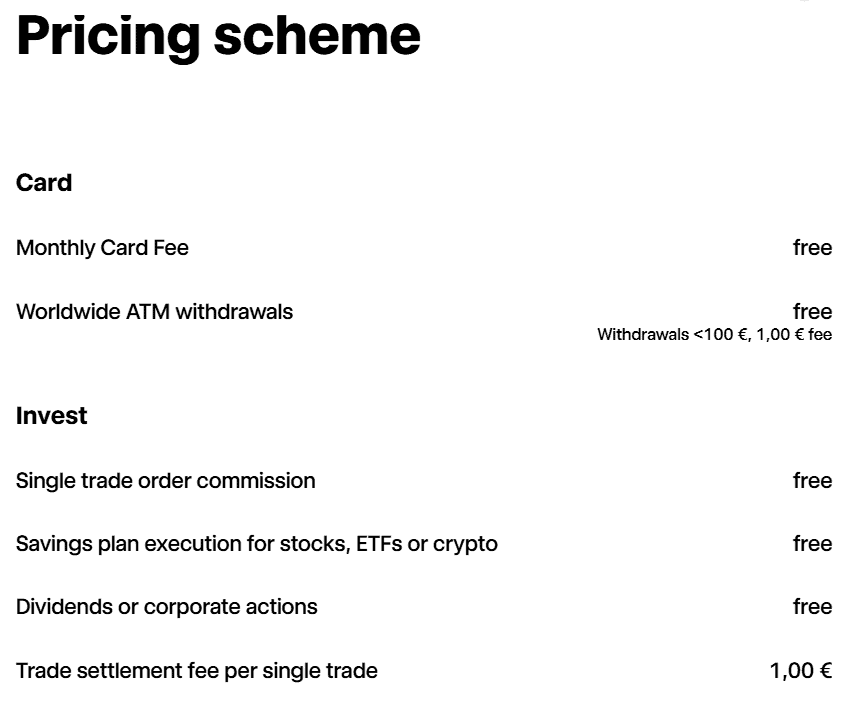

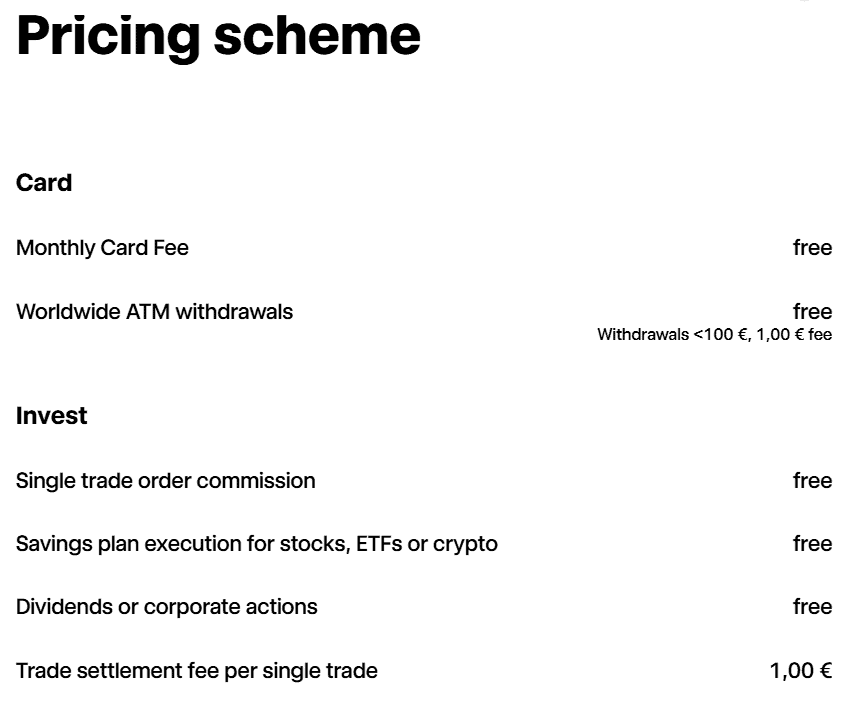

Cost Structure and Fees

Score – 4.7/5

Trade Republic Brokerage Fees

The firm is known for its transparent and straightforward fee structure. However, while there may be no explicit commission charges, Trade Republic may generate revenue through other means, such as payment for order flow.

For specific details on fees, including any charges associated with other financial instruments or potential updates to the fee structure, check the official website or contact customer support for the most accurate and up-to-date information.

- Trade Republic Commissions

Trade Republic is recognized for its commission-free trading approach, enabling traders to engage in stock transactions without incurring traditional commission fees. This model enhances the platform’s appeal to cost-conscious investors seeking a budget-friendly trading experience.

However, trading commissions and fees can change over time and may vary based on the specific investments and market conditions. Therefore, traders should review the platform’s fee details for a comprehensive understanding of the costs associated with their investments.

- Trade Republic Exchange Fee

Trade Republic applies certain exchange and regulatory fees tied to trading activities. These include small regulatory levies and exchange-specific fees, such as those from the German stock exchange or derivatives markets.

While the core trading cost is a flat €1 per transaction, these additional charges may apply depending on the asset type and venue, but are typically minor.

- Trade Republic Rollover / Swaps

The broker does not offer margin trading or leverage, which means clients do not pay traditional swap or rollover fees on overnight stock, ETF, bond, crypto, or standard listed derivative positions.

It functions as a cash-only broker, positions are not held on borrowed capital, and so there is no interest charge for holding them overnight.

- Trade Republic Additional Fees

Trade Republic keeps fees low and transparent; however, there are some additional charges to note. Instant deposits via Apple Pay or Google Pay incur a small fee, especially for amounts under €1,000.

ATM withdrawals under €100 may also have a €1 fee. While most services like custody, dividends, and SEPA transfers are free, special requests, such as on-demand account documents or paper-based transfers, can result in extra charges.

How Competitive Are Trade Republic Fees?

Trade Republic’s fee structure is highly competitive, especially for European retail investors. There are no account maintenance fees, and most services are included at no cost.

While some minor additional charges apply, the overall pricing model is clear, low-cost, and ideal for cost-conscious traders and long-term investors alike.

| Asset/ Pair | Trade Republic Commission | Nutmeg Commission | Public Commission |

|---|

| Stocks Fees | From €1 | Management fee of 0.75% per annum on the first £100,00 | From $0 |

| Fractional Shares | Yes | Yes | $5 |

| Options Fees | - | - | From $0 |

| ETFs Fees | €1 | 0.17% - 0.32% per year | $0 |

| Free Stocks | Yes | No | Yes |

Trading Platforms and Tools

Score – 4.4/5

Trade Republic provides a user-friendly and accessible trading platform primarily through its mobile app. The app is designed to offer a seamless experience for investors to trade stocks, ETFs, bonds, and other financial instruments.

While it may not have the extensive features of some desktop platforms, the mobile app’s simplicity aligns with the broker’s focus on making investing easy for a broad audience.

Users can conveniently execute trades, monitor portfolios, and access market information on the go, enhancing the flexibility and convenience of their trading experience.

Trading Platform Comparison to Other Brokers:

| Platforms | Trade Republic Platforms | Degiro Platforms | MEXEM Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Trade Republic Web Platform

Trade Republic does not offer a traditional web-based trading platform. All trading activities are conducted exclusively through its mobile app, focusing on simplicity and ease of use for mobile-first investors.

Trade Republic Desktop MetaTrader 4 Platform

The broker does not support MetaTrader 4. It operates independently with its proprietary infrastructure and does not integrate third-party trading platforms like MT4.

Trade Republic Desktop MetaTrader 5 Platform

Trade Republic does not offer MetaTrader 5 access. It provides a streamlined trading experience solely through its mobile application, without desktop-based or advanced trading terminals like MT5.

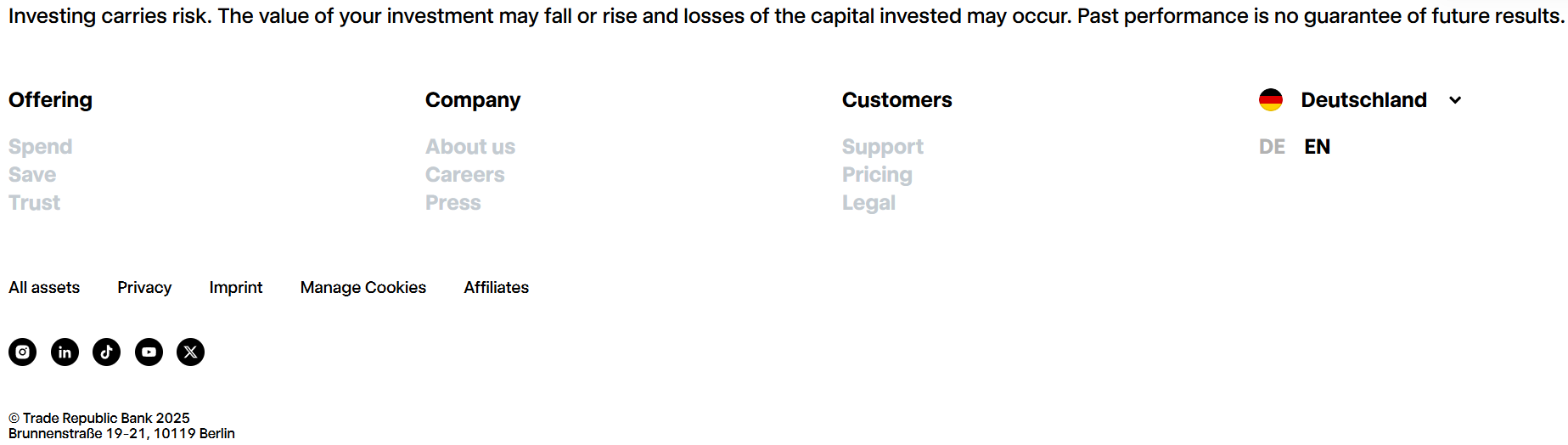

Trade Republic MobileTrader App

The broker’s mobile app serves as a central hub for users to engage in commission-free trading with ease. Known for its user-friendly interface, the app provides a streamlined experience for buying and selling stocks, ETFs, bonds, and more.

With features like real-time market data, portfolio tracking, and a simple order execution process, the Trade Republic app empowers investors to manage their portfolios conveniently from their mobile devices, making it a popular choice for those seeking accessibility and flexibility in their trading activities.

Main Insights from Testing

The Trade Republic mobile app offers a clean, intuitive interface that’s easy to navigate, even for beginners. During testing, the app performed smoothly with quick order execution, real-time market data, and seamless access to savings plans and portfolio tracking.

While it lacks advanced charting tools or technical indicators, its simplicity, stability, and ease of use make it a solid choice for long-term investors and casual traders.

AI Trading

Trade Republic does not currently support AI trading or automated strategies. The platform is designed for manual trading only, with no access to algorithmic tools, trading bots, or integration with platforms like MetaTrader or TradingView.

Traders looking for AI-powered or automated trading tools will find Trade Republic limited in this area.

Trading Instruments

Score – 4.5/5

What Can You Trade on Trade Republic’s Platform?

Trade Republic offers a range of trading products, primarily focusing on commission-free trading, including stocks, Trade Republic ETF, bonds, derivatives, and cryptocurrencies.

While the emphasis is on simplicity and accessibility for retail investors, the specific range of trading products may evolve, so check the broker’s official website or contact customer support for the latest and most accurate information on available assets and financial instruments.

Main Insights from Exploring Trade Republic’s Tradable Assets

Exploring Trade Republic’s tradable assets reveals a focus on simplicity and accessibility, catering primarily to long-term investors and those new to trading.

The platform emphasizes cost-effective investing with commission-free trading and a wide selection of instruments to diversify portfolios. While it may not offer complex derivatives or niche markets, its asset availability is well-aligned with its goal of making investing affordable for everyday users.

Margin Trading at Trade Republic

Trade Republic does not offer margin trading. It is primarily focused on commission-free stock trading, targeting a simple and user-friendly experience for retail investors.

However, for the most accurate and current information about the firm’s offerings, including the multiplier or margin trading, we recommend checking the official website or contacting its customer support directly.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Trade Republic

The platform offers a few funding methods to facilitate deposits into user accounts. Common funding methods include bank transfers and direct debits. Traders can link their bank accounts to transfer funds securely.

However, the availability of payment methods may be subject to specific terms and conditions outlined by the firm. Therefore, traders should check the platform’s official documentation or contact customer support for the most accurate and up-to-date information on payment options.

Trade Republic Minimum Deposit

Trade Republic does not have a specific minimum deposit requirement. The platform is known for its accessibility and lack of a mandatory minimum deposit, making it convenient for a wide range of investors.

Withdrawal Options at Trade Republic

The firm allows investors to make withdrawals from their accounts through a straightforward process. They can initiate withdrawals via the Trade Republic app, and the platform typically provides a secure and efficient method for users to access their funds when needed.

Customer Support and Responsiveness

Score – 4.5/5

Testing Trade Republic’s Customer Support

The firm’s customer support is available 24/5 through email communication and a comprehensive FAQ section to address frequently asked questions. The platform aims to offer responsive assistance to address user concerns, ensuring a positive and supportive experience for its investors.

Contacts Trade Republic

You can contact Trade Republic mainly through the in-app support chat, which starts with a chatbot and may escalate to a human agent. For general inquiries, email service@traderepublic.com.

In emergencies like a lost device or card, call their 24/7 hotline at +49 322 13232813.

Research and Education

Score – 4.4/5

Research Tools Trade Republic

Trade Republic offers a set of built-in research tools, both through its website and mobile app.

- Integrated charts with basic analysis capabilities, including candlestick or line view across multiple timeframes and key indicators like moving averages, RSI, and MACD.

- Built-in news feed delivers real-time company updates, market commentary, and actions.

- Additionally, users can view performance metrics for realized/unrealized gains, asset allocation, and fee overviews. Periodic reports are auto-generated, and interactive dashboards help monitor portfolio health

Education

The firm does not have an extensive array of educational resources directly integrated into its platform. While the platform offers an intuitive interface for trading, traders seeking educational materials may need to look beyond the platform for in-depth learning resources.

However, as the platform primarily targets investors and professional traders, we do not see this as a major drawback, considering that the broker provides a wider range of advanced trading products.

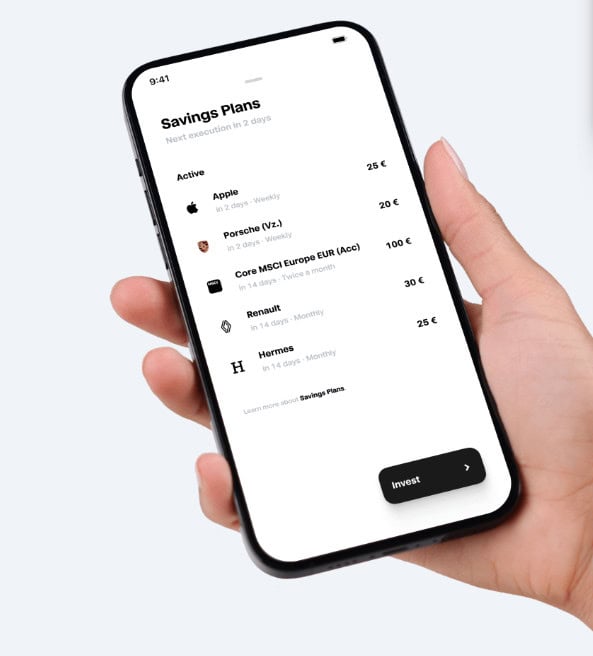

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options Trade Republic

Trade Republic offers a range of investment solutions tailored for long-term investors. Users can invest in stocks, ETFs, and savings plans with low-cost structures and no minimum investment amount for fractional shares.

The platform emphasizes simplicity and accessibility, allowing investors to automate their contributions through savings plans and build diversified portfolios over time. While advanced trading tools are limited, Trade Republic is well-suited for those seeking convenient and cost-efficient ways to grow their wealth steadily.

Account Opening

Score – 4.4/5

How to Open Trade Republic Demo Account?

Trade Republic does not provide a demo or paper trading account. Investors should open a live account to explore the available tools and features.

How to Open Trade Republic Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or Trade Republic login page and proceed with the guided steps:

- Select and click on the “Log in” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to its core research tools, Trade Republic offers several helpful features designed to enhance the user experience.

- These include real-time price alerts, push notifications for market movements, and an intuitive savings plan setup.

- Users also benefit from simplified tax reporting with automatically generated tax statements.

While it lacks in-depth charting or technical analysis tools, the platform focuses on ease of use and practical features for everyday investors.

Trade Republic Compared to Other Brokers

Compared to other brokers, Trade Republic stands out for its simplicity, low-cost structure, and mobile-first approach, making it especially appealing to beginners and casual investors.

While it does not support advanced instruments like futures or options trading, its commission model remains competitive, especially for stock and ETF trading. In contrast, brokers like Interactive Brokers and MEXEM offer a broader range of tradable assets and sophisticated platforms tailored to experienced traders.

Others, like TD Ameritrade and Webull, combine advanced features with strong educational resources. However, Trade Republic’s minimal interface and low barrier to entry make it a solid option for those seeking a streamlined and cost-effective investing experience.

| Parameter |

Trade Republic |

MEXEM |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from €1 |

$0.85 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Low/Average |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

Trade Republic Mobile App

|

Client Portal, Desktop TWS, Mobile TWS, MEXEM Lite |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, Shares, ETFs, Bonds, Derivatives, Crypto |

Stocks, Bonds, ETFs, Options, Futures, Warrants, Mutual Funds, Forex, Metals |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

BaFin, Bundesbank |

CySEC, FCA, AFM, FSMA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Limited |

Good |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

€0 |

€0.1 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Trade Republic

Trade Republic is a German-based Stock broker designed for simplicity, affordability, and accessibility. It offers commission-free trading on a wide range of financial instruments, including stocks, ETFs, bonds, derivatives, and cryptocurrencies, primarily through its user-friendly mobile app.

Regulated by BaFin and the Bundesbank, the platform ensures a secure trading environment for European investors. Trade Republic is ideal for cost-conscious users who prefer a straightforward interface, though it may lack the depth of research tools and educational content found.

With no minimum deposit required and transparent pricing, it is well-suited for both beginner and long-term investors seeking a mobile-first experience.

Share this article [addtoany url="https://55brokers.com/trade-republic-review/" title="Trade Republic"]