- What is Robinhood?

- Robinhood Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

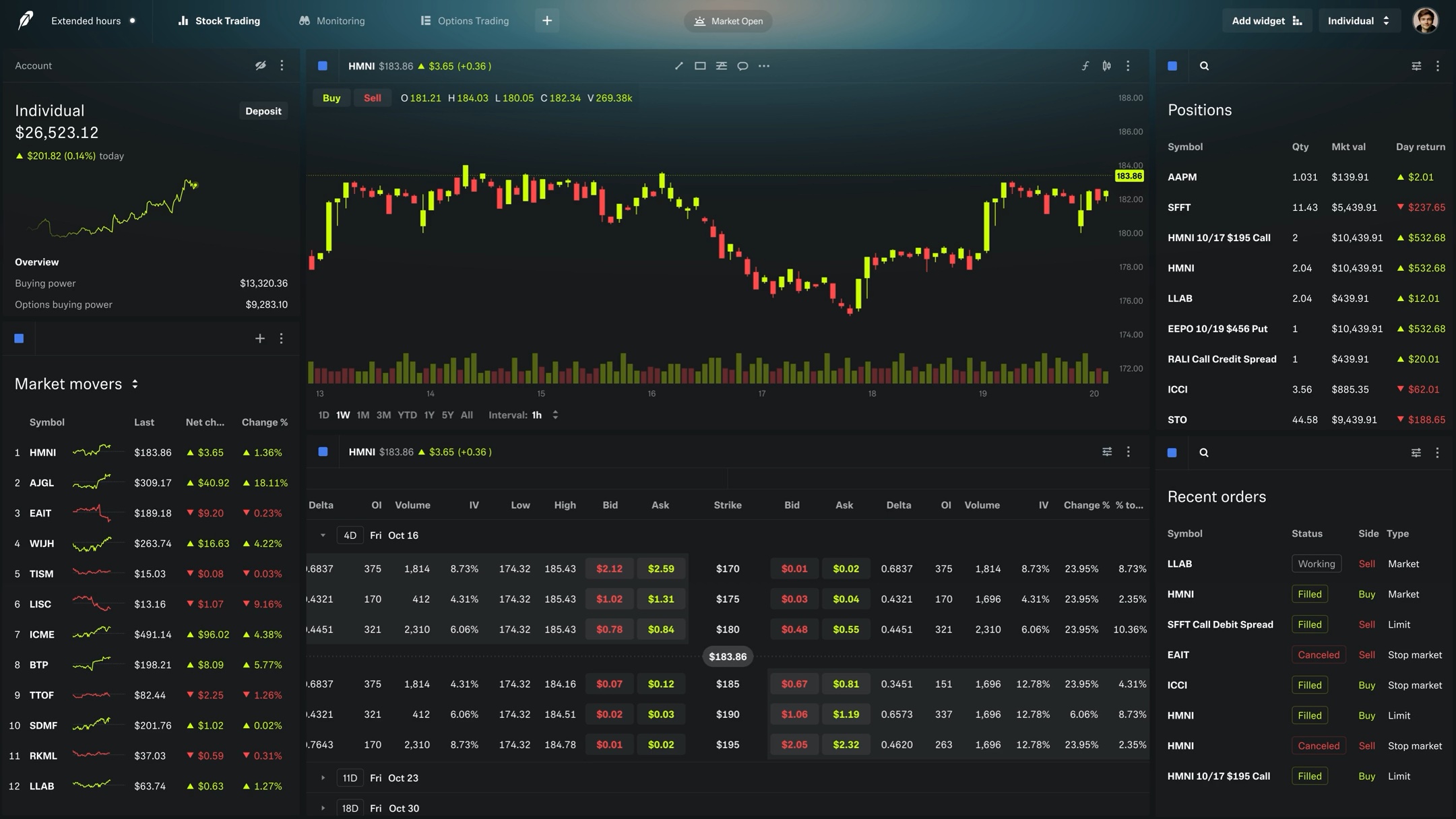

- Trading Platforms and Tools

- Trading Instruments

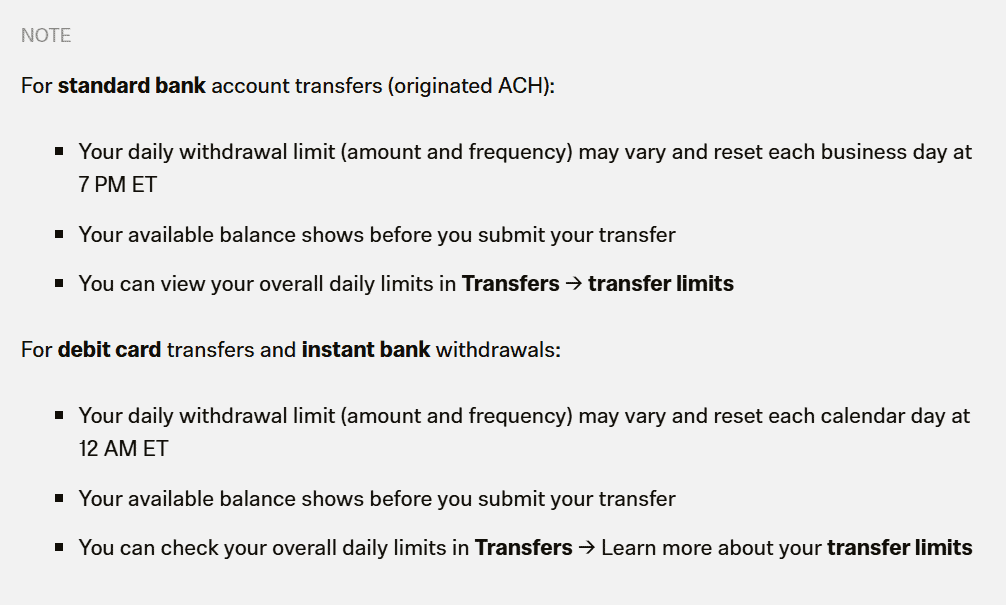

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

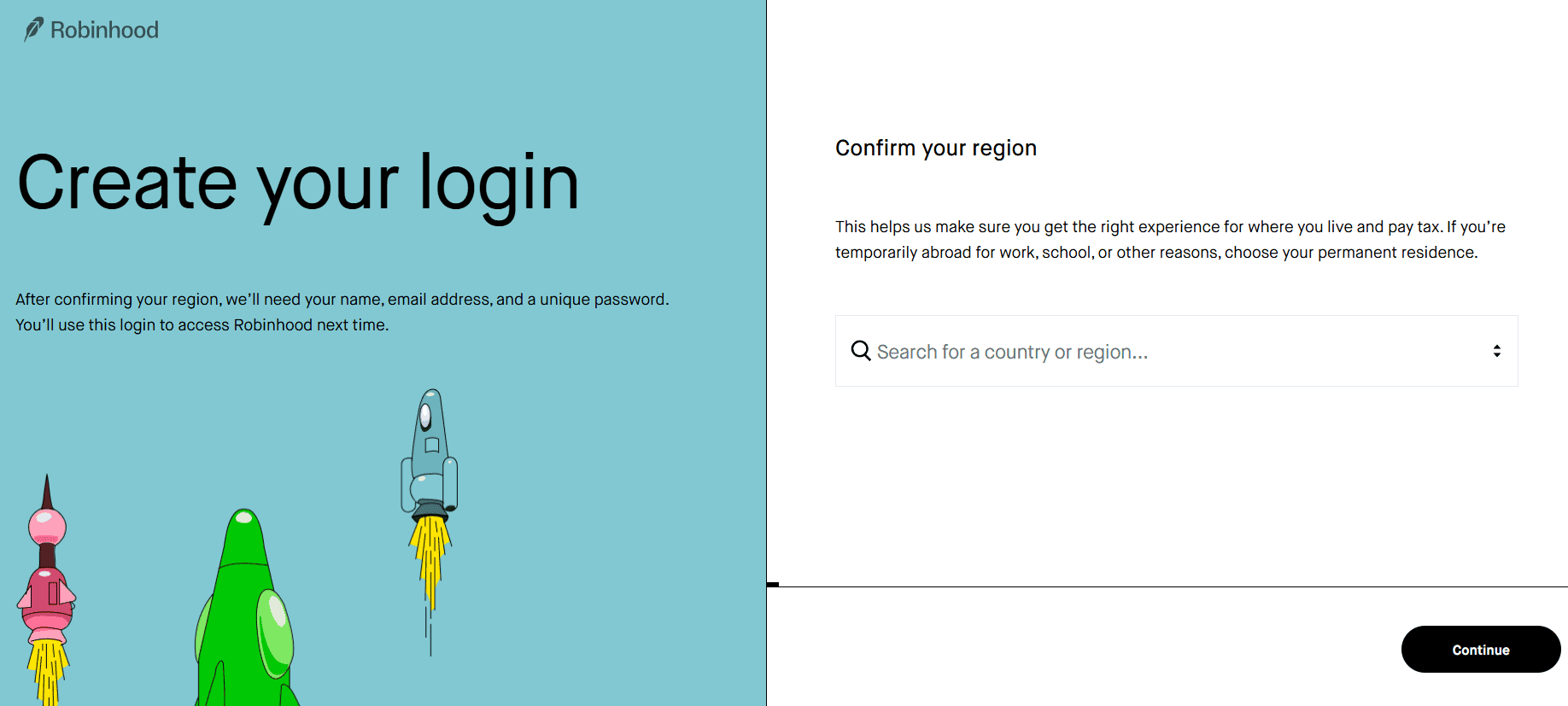

- Account Opening

- Additional Tools And Features

- Robinhood Compared to Other Brokers

- Full Review of Broker Robinhood

Overall Rating 4.6

| Regulation and Security | 4.8 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.8 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.7 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Robinhood?

Robinhood is an innovative broker offering commission-free investing and exchange trading of stocks, ETFs, options, and cryptocurrencies, headquartered in California, US.

Since its establishment in 2013, the broker has walked a path of constant development and has become one of the preferred trading providers in the US.

The Robinhood app and user-friendly web-based platform have made it popular among both experienced and novice investors, providing them with easy access to the stock market and other investment opportunities.

Is Robinhood Stock Broker?

Yes, Robinhood is a popular Stock and Option trading brokerage company. It gained popularity for its user-friendly interface and commission-free trading for stocks, options, cryptocurrencies, and exchange-traded funds (ETFs).

Robinhood Pros and Cons

Based on our research, Robinhood is a good and reliable broker offering exceptional conditions for trading with zero commissions and instant deposits. The broker is highly regulated and provides a secure trading environment.

As for the cons, the broker does not offer FX and CFDs, also the platform is basic with a poor educational section. Also, the funding methods are limited, too.

| Advantages | Disadvantages |

|---|

| Highly regulated by SEC and FCA | No demo account |

| Real Stock and Cryptocurrency Trading | Poor educational sector |

| Zero Commissions | Limited funding methods |

| Long history of operation and strong establishment | |

| Access to Real Futures | |

| 24/7 support | |

| Instant deposits | |

| Broker Listed on NASDAQ | |

Robinhood Features

Robinhood is one of the world’s leading brokers, offering exceptional service and trading conditions for traders, offering real stock and crypto trading with commissions free of charge. The broker offers a popular range of investment products, allowing to use of margin trading to maximise the return on investments. Below is a comprehensive list of its key features:

Robinhood Features in 10 Points

| 🏢 Regulation | SEC, CFTC, NFA, SIPC, FINRA, FCA |

| 🗺️ Account Types | Instant, Cash, Gold, IRAs Accounts |

| 🖥 Trading Platforms | Robinhood Web Platform, Robinhood Legend |

| 📉 Trading Instruments | Stocks, ETFs, Options, Futures, Cryptocurrency |

| 💳 Minimum Deposit | $0 |

| 💰 E-mini and Standard Contract | $0.75 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | Investing Basics |

| ☎ Customer Support | 24/7 |

Who is Robinhood For?

Robinhood is suitable for individual investors who are looking for a simple, low-cost way to access the financial markets. More experienced traders may also be interested in Robinhood Gold’s premium features, including margin trading, professional research, and enhanced data tools. Based on our findings and Financial Expert Opinion, Robinhood is Good for:

- Real Futures Trading

- Real Stock Trading

- Investing

- US Traders

- UK Traders

- Beginner Traders

- Professional trading

- Advanced traders

- Cryptocurrency exchange trading

- Zero Commission Trading

- Technical Analysis

Robinhood Summary

Based on our Robinhood Review, we revealed that the broker is reliable with a good reputation and has quite a competitive offering for trading. It is a good choice for a well-regulated broker that offers zero-commission trading; in fact, it is one of the few brokers that offer zero commissions on cryptocurrencies. The broker also offers instant transfers, making it possible to deposit or withdraw within a few seconds.

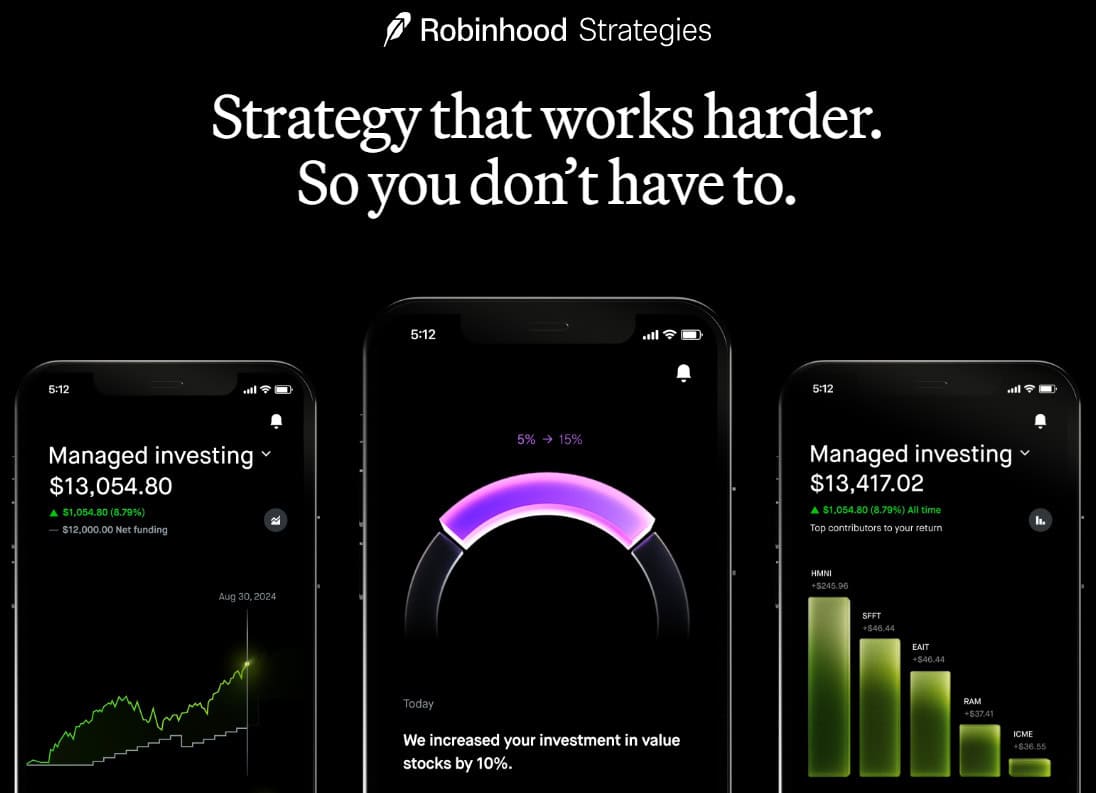

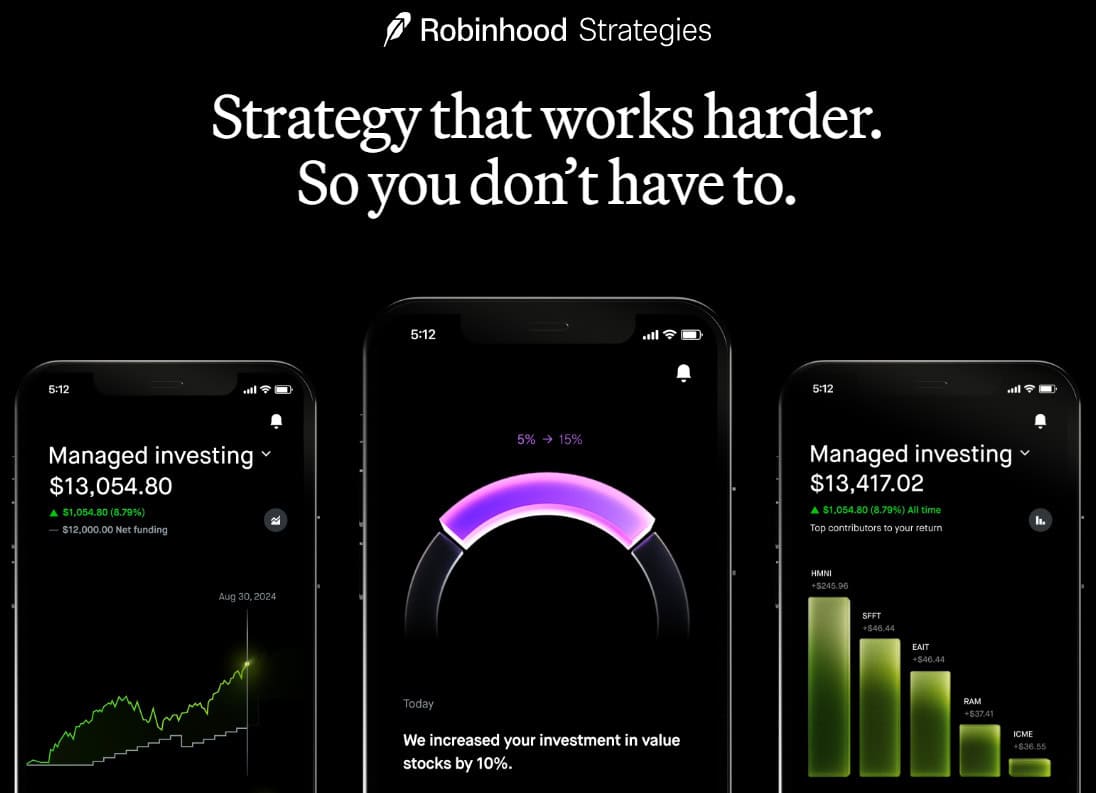

The platform also offers Robinhood Strategies, which provide tailored, expert-managed portfolios, along with recurring investments and orders that allow investors to automatically invest in stocks and ETFs through Robinhood Financial and trade cryptocurrencies via Robinhood Crypto, allowing users to set and manage their investments flexibly.

55Brokers Professional Insights

Robinhood combines accessibility with cutting-edge technology and is one of most trusted and popular Stock Brokers in US, which makes it a standout platform for all types of investors from small investing size to the largest portfolios. There are many reasons why RobinHood is great for Stock trading, beyond its no-commission structure, the broker offers a good range of assets, including stocks, ETFs, options, cryptocurrencies, futures, etc.

The platforms are well-packed and with good technology based on proprietary web and mobile app and the Robinhood Legend desktop platform, suitable for more advanced users where various advanced tools are included. Notable features include real-time market data, interactive charts, customizable watchlists, and especially good are fractional shares, allowing traders to invest with as little as $1 which makes Broker very customer friendly. For investors who need more advanced tools, Robinhood Gold provides premium offerings such as margin trading, Level II market data from Nasdaq, Morningstar research, and extended-hours trading, overall we find all at the very good level.

However, the readers should consider some drawbacks we mentioned too, as well as the trader experience fit. The broker lacks a good education section, so very beginners might be confused. Also, some experienced brokers can find the platform missing some important analytical tools, which you may need.

Consider Trading with Robinhood If:

| Robinhood is an excellent Broker for: | - Suitable for professional traders and investors.

- Need a well-regulated broker.

- Stock Trading and Investment.

- Secure trading environment.

- Good trading tools and trading technology.

- Real Futures Trading.

- Beginner investors looking for commission-free trading.

- For US and UK trading.

- Offering popular trading products.

- Need broker with no minimum deposit requirement.

- Looking for broker with Top-Tier licenses.

- Need a broker Listed on NASDAQ.

|

Avoid Trading with Robinhood If:

| Robinhood might not be the best for: | - Investors who prefer robust educational resources.

- Looking to trade CFDs, Forex, or Bonds.

- Need broker providing industry-known trading platforms.

- Prefer diverse funding methods. |

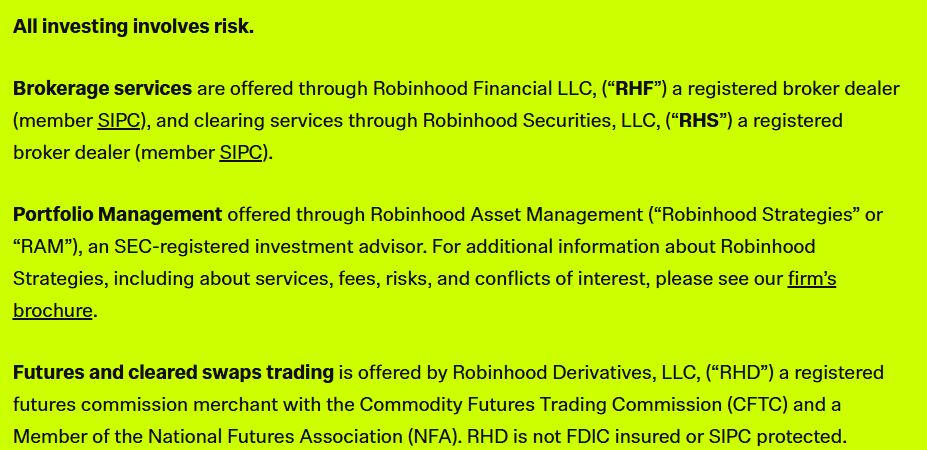

Regulation and Security Measures

Score – 4.8/5

Robinhood Regulatory Overview

Robinhood is a regulated broker with its trading name used by Robinhood Securities LLC, which is regulated by the world-respected federal regulator, the SEC (The U.S. Securities and Exchange Commission), and the self-regulatory organization FINRA (The Financial Industry Regulatory Authority).

Robinhood Derivatives, LLC is also registered with the Commodity Futures Trading Commission (CFTC) and is a member of the National Futures Association (NFA).

Additionally, Robinhood U.K. Ltd is regulated by the UK FCA, allowing the firm to legally operate and offer services in the UK.

How Safe is Trading with Robinhood?

Robinhood is a safe broker as it is regulated by major regulatory organizations, such as the SEC and FINRA, and is also a member of SIPC.

As a FINRA member, Robinhood LLC falls under the US investor protection scheme through SIPC. The limit for the compensation from the SIPC is $500,000, including a $250,000 cash limit.

Consistency and Clarity

Robinhood has established a strong presence since its launch in 2013, known for its commission-free trading model. The platform has attracted millions of users, often praised for its smooth mobile app and ease of use.

However, trader reviews also highlight concerns, particularly regarding customer service delays, platform outages during high-volatility periods, and limited product offerings for advanced investors.

Despite these drawbacks, Robinhood remains a prominent investing broker, having received industry recognition such as Forbes’ Fintech 50 and Time’s 100 Most Influential Companies. The firm has also expanded its public presence through social initiatives and sponsorships.

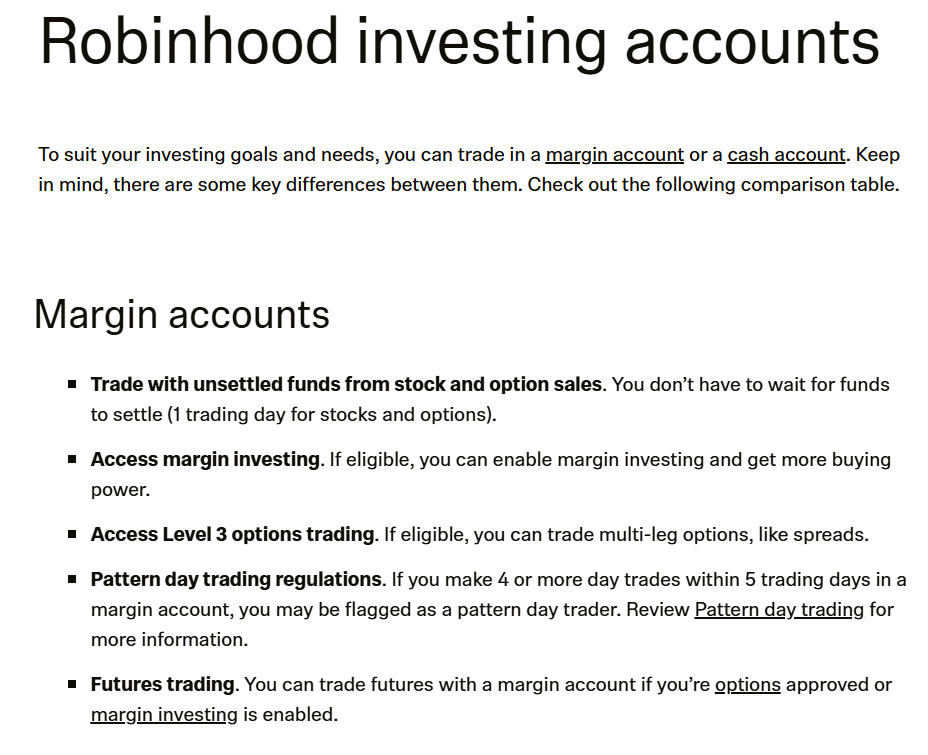

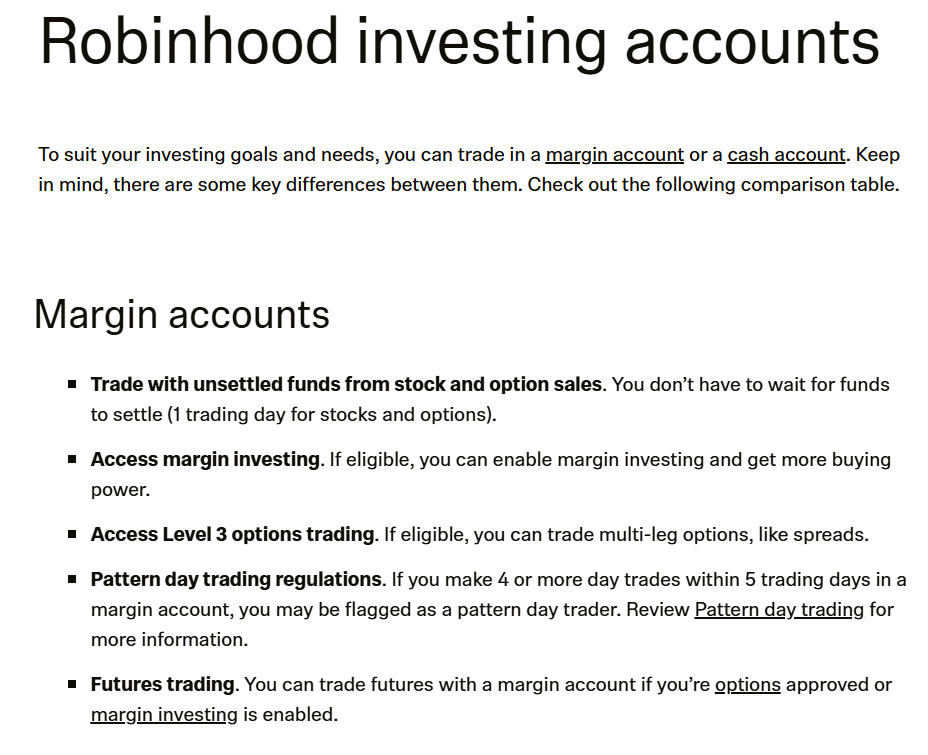

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Robinhood?

Robinhood offers a variety of account types to match the different investor needs. The standard account type is a Robinhood Instant account, which is a margin brokerage account that allows for instant deposits and limited margin trading.

For those who prefer a non-margin approach, Cash accounts are available, letting investors trade without the use of margin or instant settlement features. Users can also upgrade to Robinhood Gold, which provides enhanced margin access, professional research, and larger instant deposits.

Additionally, the broker supports retirement accounts, including both Traditional and Roth IRAs. However, Robinhood does not offer a demo account or paper trading, which may be limiting for those who want to practice strategies without risking real capital.

Margin Account

Margin accounts on Robinhood allow traders to borrow funds to increase their buying power. This type of account enables features like instant deposits and margin trading, meaning investors can leverage their trades but also take on additional risk.

Traders should have a minimum portfolio value of $2,000 before they can access margin investing. This account is suitable for traders comfortable with borrowing to amplify their investments.

Cash Account

Cash accounts are brokerage accounts where traders can only trade using the money they have deposited and fully settled. There is no minimum deposit requirement for opening a Cash account, making it ideal for beginners or more conservative investors who want to avoid margin risks.

Regions Where Robinhood is Restricted

Robinhood is not available in many regions due to legal and regulatory restrictions. Certain laws prohibit account access in specific countries, while Robinhood has also made risk-based decisions to restrict its services in others.

The following is a list of regions where Robinhood is restricted:

- Belarus

- Cuba

- Iran

- Myanmar

- North Korea

- Russia

- Sudan

- South Sudan

- Syria

- Ukraine

- Venezuela

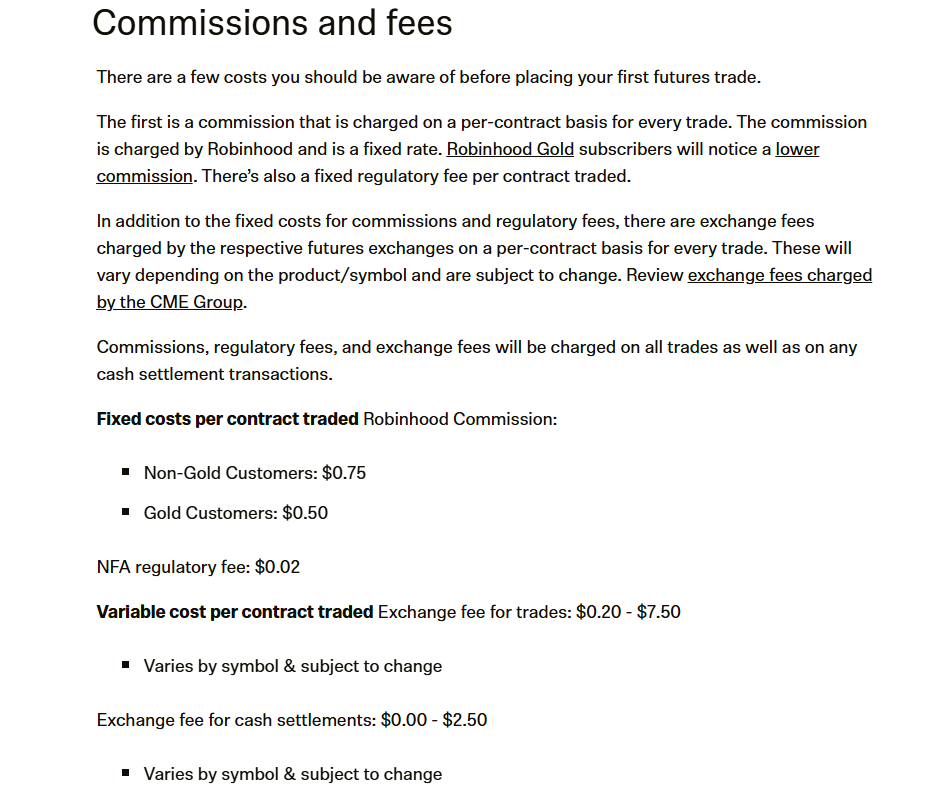

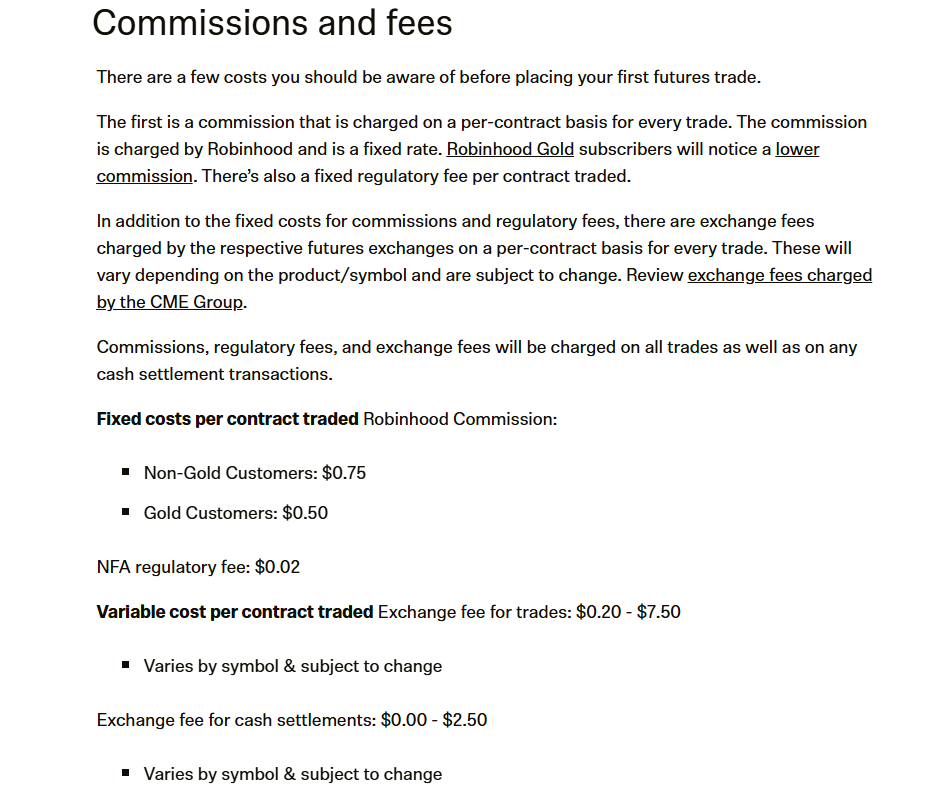

Cost Structure and Fees

Score – 4.8/5

Robinhood Brokerage Fees

Robinhood Fees are free of commission regardless of the type of account you are transferring from. This means that users can execute trades in stocks, options, ETFs, and cryptocurrencies without incurring traditional trading commissions.

When it comes to options trading, Robinhood does not charge a per-contract fee. There is also no account opening, withdrawal, account maintenance, or inactivity fees.

- However, self-regulatory organizations (SROs) such as the Financial Industry Regulatory Authority (FINRA) charge Robinhood a small fee for sell orders. They charge these fees for all sell orders, regardless of the brokerage. Robinhood passes these fees to its customers and remits them to the applicable SROs.

While the broker does not charge trading commissions, it may generate revenue through other means, such as interest on uninvested cash balances and premium subscription services like Robinhood Gold.

Robinhood offers zero-commission trading on US stocks, ETFs, and options, which is very attractive for cost-conscious investors. The broker also offers crypto trading with no commission fees through Robinhood Crypto.

The firm offers competitive pricing for futures trading as well, with fixed costs per contract that vary based on account type. Non-Gold customers are charged $0.75 per contract, while Gold subscribers enjoy a reduced rate of $0.50 per contract.

In addition, there is an NFA regulatory fee of $0.02 per contract.

Robinhood passes along required exchange and regulatory fees to traders, though it does not mark them up. FINRA’s Trading Activity Fee is $0.000166 per share and $0.00279 per contract.

For futures trading, exchange fees vary depending on the contract but are set by the relevant exchange, such as the CME Group, and are typically bundled with Robinhood’s transparent per-contract pricing.

- Robinhood Rollover / Swaps

Robinhood does not charge traditional rollover or swap fees, as it does not offer Forex trading or CFDs, where such fees are common. However, for futures trading, contracts have fixed expiration dates.

To maintain a position beyond a contract’s expiration, traders need to manually close the expiring contract and open a new one. This rollover incurs standard trading costs, including per-contract commissions and applicable exchange and regulatory fees.

- Robinhood Additional Fees

Robinhood keeps trading costs, however, users should be aware of additional charges that may apply. For instance, instant withdrawals to a debit card or bank account carry a 1.75% fee, with a $1 minimum and $150 maximum per transaction.

Futures trading comes with fixed per-contract fees, and Robinhood Gold, offering access to margin trading and premium features, with a cost of $5 per month. Other potential fees include regulatory charges, outgoing transfer fees, and service-related costs.

How Competitive Are Robinhood Fees?

Robinhood’s fee structure is highly competitive compared to traditional brokerage firms, especially for beginner and cost-conscious investors. Additionally, the broker does not charge account maintenance, inactivity, or platform fees, which makes it an attractive choice for those looking to minimize trading costs.

While premium features and some advanced services come with fees, the overall cost structure remains favorable.

| Fees | Robinhood Fees | PhillipCapital Fees | TastyTrade Fees |

|---|

| Broker Fee - E-mini and Standard Contract | $0.75 | $0.25 | |

| Exchange Fee | Defined by Exchange | Defined by Exchange | Defined by Exchange |

| Trading Platform Fee | No | Yes | No |

| Data Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average/ Low | Low |

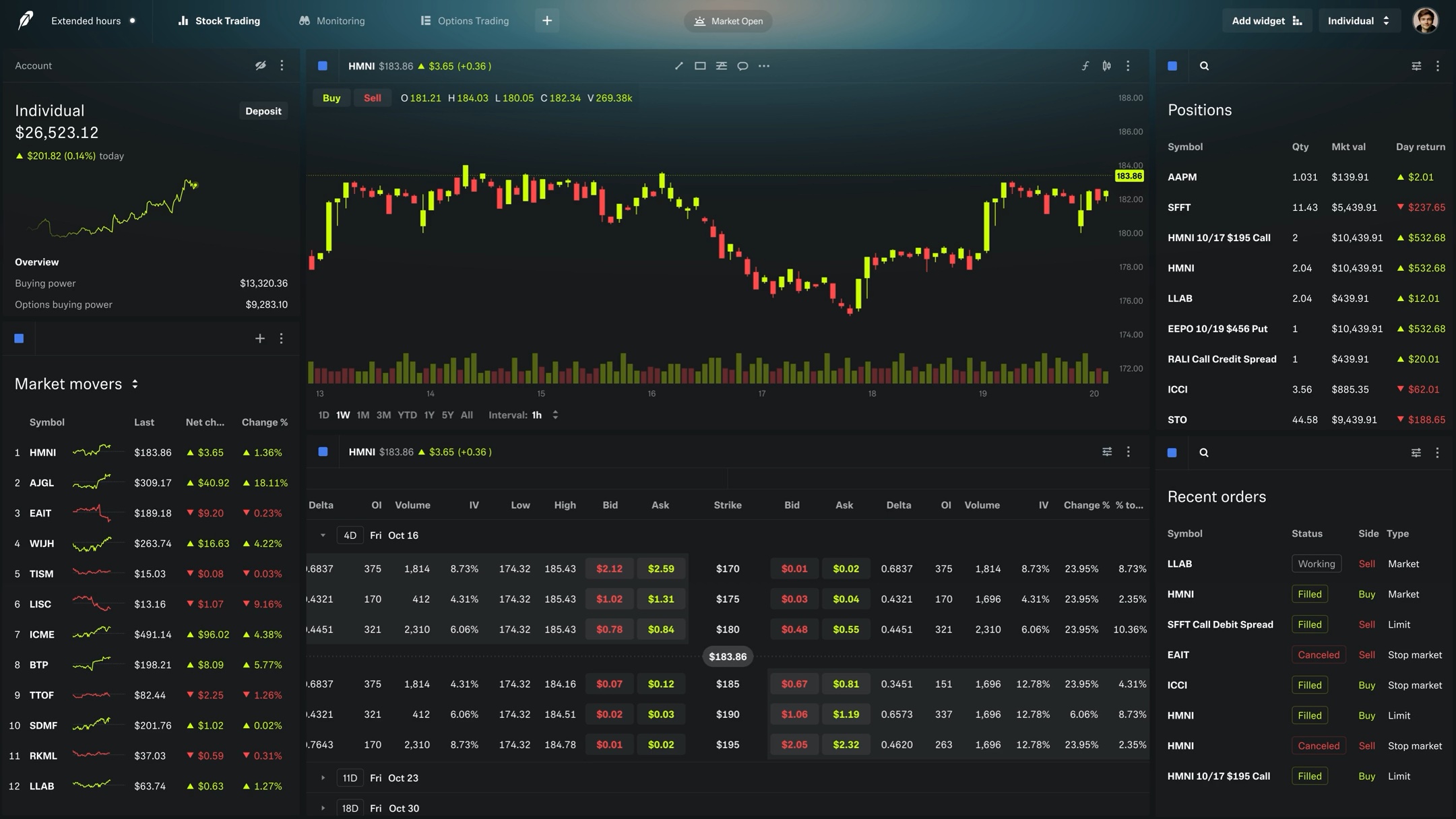

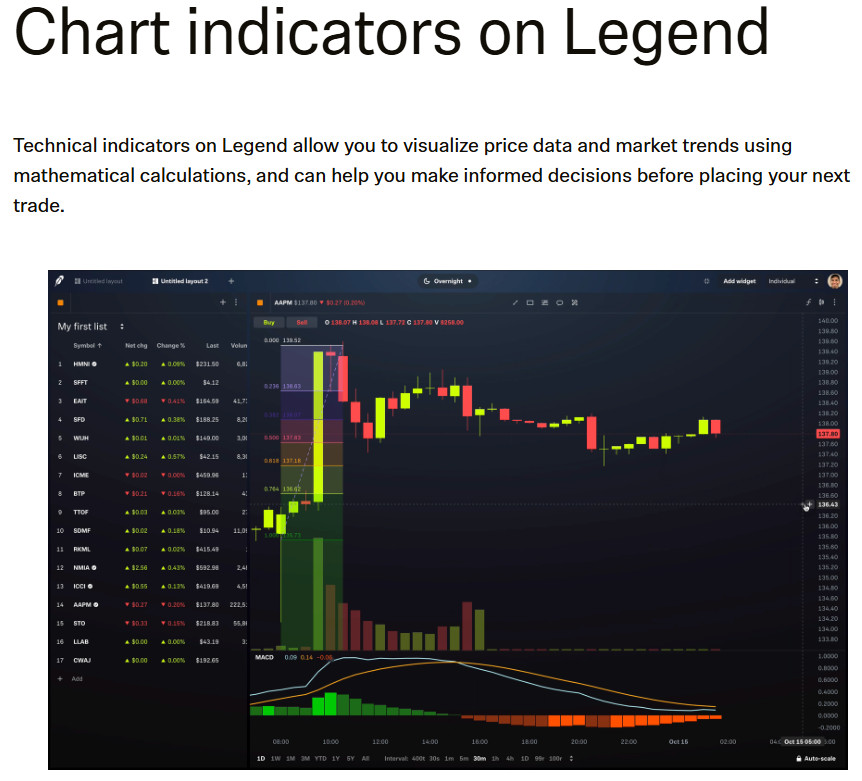

Trading Platforms and Tools

Score – 4.5/5

Robinhood offers a proprietary trading platform available through the web and mobile, with a simple design and intuitive navigation. It focuses on the core basics of investments, making it a poor choice for investors seeking more sophisticated platforms.

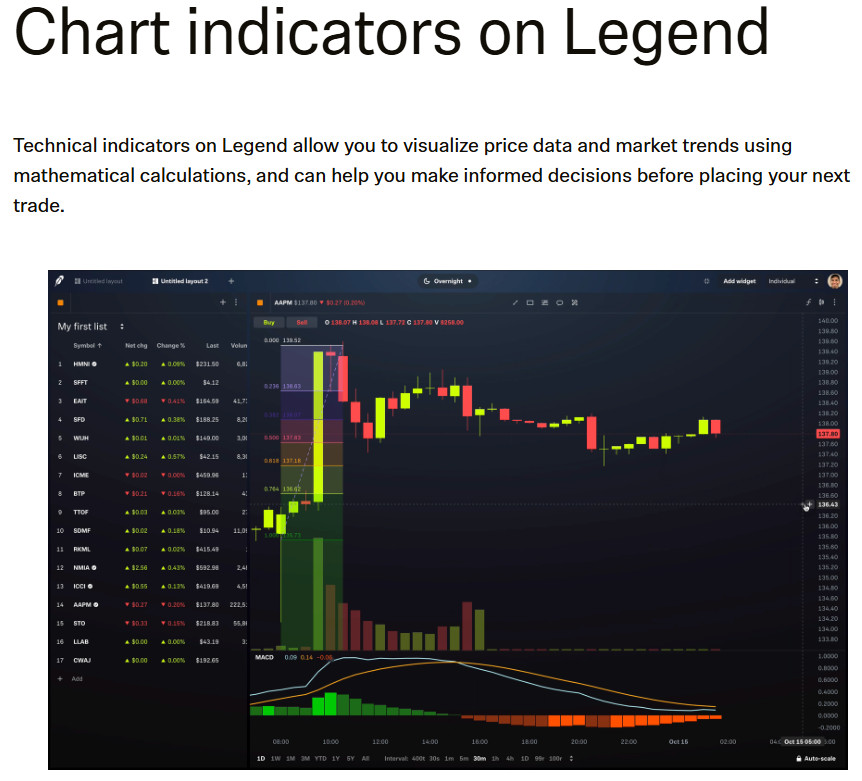

For traders looking for advanced features and detailed insights, the Robinhood Legend proprietary desktop platform offers a more powerful and customizable trading experience, with access to advanced charting tools, real-time data, multi-monitor support, and faster execution speeds.

Trading Platform Comparison to Other Brokers:

| Platforms | Robinhood Platforms | PhillipCapital Platforms | TastyTrade Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Robinhood Web Platform

Robinhood provides a powerful, but simple and easy-to-use web trading platform with research and discovery tools. The expansive research and discovery tools are aimed at making every trader a better-informed investor.

There are many cool advanced features on the web platform, including Analyst Ratings, News and Fundamentals, Collections of Stocks, and more.

Robinhood Desktop MetaTrader 4 Platform

Robinhood does not currently support the MetaTrader 4 platform. Since Robinhood primarily focuses on commission-free trading, it does not integrate with third-party trading platforms like MT4. Yet if you still prefer MT4, you need to consider another Broker.

Robinhood Desktop MetaTrader 5 Platform

Similar to MT4, Robinhood does not provide access to MT5. Robinhood maintains its proprietary platforms and app, which are designed for simplicity and accessibility.

Robinhood MobileTrader App

Mobile trading platform is also equipped with plenty of features, including customizable alerts, a news feed, candlestick charts, and the ability to listen live to earnings calls. It is available for both iOS and Android devices.

Main Insights from Testing

The Robinhood mobile app delivers a smooth, beginner-friendly trading experience with a clean and intuitive interface. The app offers essential features like real-time quotes, customizable watchlists, notifications, and basic charting tools. Overall, it is well-suited for simple investing and quick trade execution.

Trading Instruments

Score – 4.7/5

What Can You Trade on Robinhood’s Platform?

Robinhood trading instrument range includes over 10,818 securities, including Stocks, ETFs, Options, Futures, and Cryptocurrencies. The broker provides a great selection of exchange-traded assets with $0 commissions and instant depositing. However, one drawback is that the firm does not offer FX and CFD trading.

The broker offers a selection of popular cryptocurrencies for trading on its platform. While the exact list may vary by region and time, some of the commonly available cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and more.

Main Insights from Exploring Robinhood’s Tradable Assets

Robinhood is one of the few brokers that allows commission-free crypto trading, and this trading opportunity earns some extra points. Moreover, Robinhood traders can buy some of the cryptos directly in their stock trading accounts.

Robinhood Crypto sources liquidity (the availability of assets) from multiple trading venues to allow traders to receive competitive pricing.

Margin Trading at Robinhood

The brokerage offers a feature called Margin Trading, enabling traders to borrow funds from Robinhood, which they can then use to boost their investment potential and purchase securities. This increased buying capacity is determined by the specific assets held in the trader’s brokerage account.

Additionally, there is a service called “Robinhood Gold” that provides traders with a multiplier. Leverage allows traders to control a larger position using a smaller portion of their capital.

- To provide context on Robinhood margin rates, the broker applies an interest rate of up to 5.75% on margin balances up to $50,000.

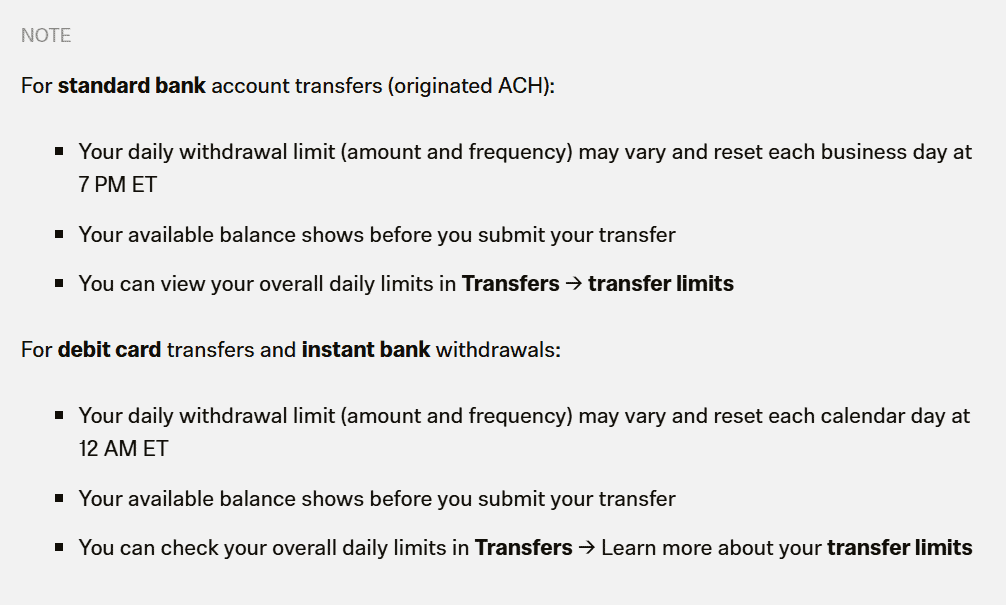

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at Robinhood

Robinhood Funding methods are quite limited, offering only debit cards or bank transfers to deposit money. Credit cards or e-wallet payments are not supported. The broker made it a bit easier and faster with the Instant Deposit feature. It gives traders immediate access to $1,000 after they initiate a deposit.

Also, with Robinhood Gold, they can get even bigger Instant Deposits, up to $50,000, depending on their brokerage account balance and status.

Robinhood Minimum Deposit

There is no minimum deposit requirement, again due to the tailored solutions Robinhood provides.

Withdrawal Options at Robinhood

Robinhood’s withdrawal is done only through Debit Cards and Bank Wire. Also, the broker mentions that the client is responsible for all charges occurring upon the money transfer, which are generally around $25.

To withdraw money from Robinhood, you need to find the transfers section in your account, then find your bank account or debit card, and enter the amount you would like to withdraw. Then press “Confirm” to initiate the withdrawal.

Once the transfer is initiated, the bank withdrawal could take 5 business days to happen. Withdrawal time could be shorter depending on your bank. However, a debit card or an instant transfer withdrawal typically takes 10-30 minutes, but might take longer depending on your bank.

Customer Support and Responsiveness

Score – 4.5/5

Testing Robinhood’s Customer Support

Robinhood’s customer support may not be the most comprehensive, but their service makes up for it with speedy and attentive responses. While email and social media are available as the only communication channels, there also exist some in-app request options that provide assistance available 24/7.

Contacts Robinhood

For assistance with account access issues, users can email support@robinhood.com. Additionally, to report scams or phishing attempts, users are encouraged to contact report@robinhood.com.

Clients can reach out via phone at (650) 761-7789 as a general inquiries line.

Research and Education

Score – 4.4/5

Research Tools Robinhood

Robinhood offers a range of research tools across its web and mobile platforms for both beginner and experienced investors.

- Traders can use stock screeners to filter securities based on various criteria.

- The platform provides real-time market data, customizable watchlists, and technical indicators, which help to make informed decisions.

- For those looking for more advanced features, Robinhood Legend, the broker’s desktop platform, offers enhanced charting capabilities, multi-monitor support, and faster execution speeds, catering to active traders.

- Additionally, Robinhood is developing AI-driven tools like Robinhood Cortex, which aims to deliver real-time analysis and insights to help investors navigate the markets more effectively.

Education

Robinhood Education section offers a limited range of resources. There is a Robinhood Learn section that offers hundreds of digestible articles on the basics of Robinhood investing, investing lingo, and market trends.

Is Robinhood a good broker for beginners?

Based on our research, Robinhood is good for beginners, given that the platform is user-friendly and easy to use. Also, the broker has zero commissions, which is another great advantage. However, poor education can be a major drawback for beginners, so we recommend using third-party education providers.

Portfolio and Investment Opportunities

Score – 4.7/5

Investment Options Robinhood

Robinhood offers a variety of investment options that make it suitable for building a long-term investment portfolio. Users can access US stocks, ETFs, and options, with the added flexibility of fractional shares to support portfolio diversification, even with smaller capital.

The platform also provides traditional and Roth IRA accounts for retirement investing. Overall, Robinhood is a good option for investors focused on portfolio growth without high fees.

Account Opening

Score – 4.4/5

How to Open Robinhood Demo Account?

Robinhood does not provide a demo or paper trading account, so users cannot practice trading with virtual funds on the platform.

How to Open Robinhood Live Account?

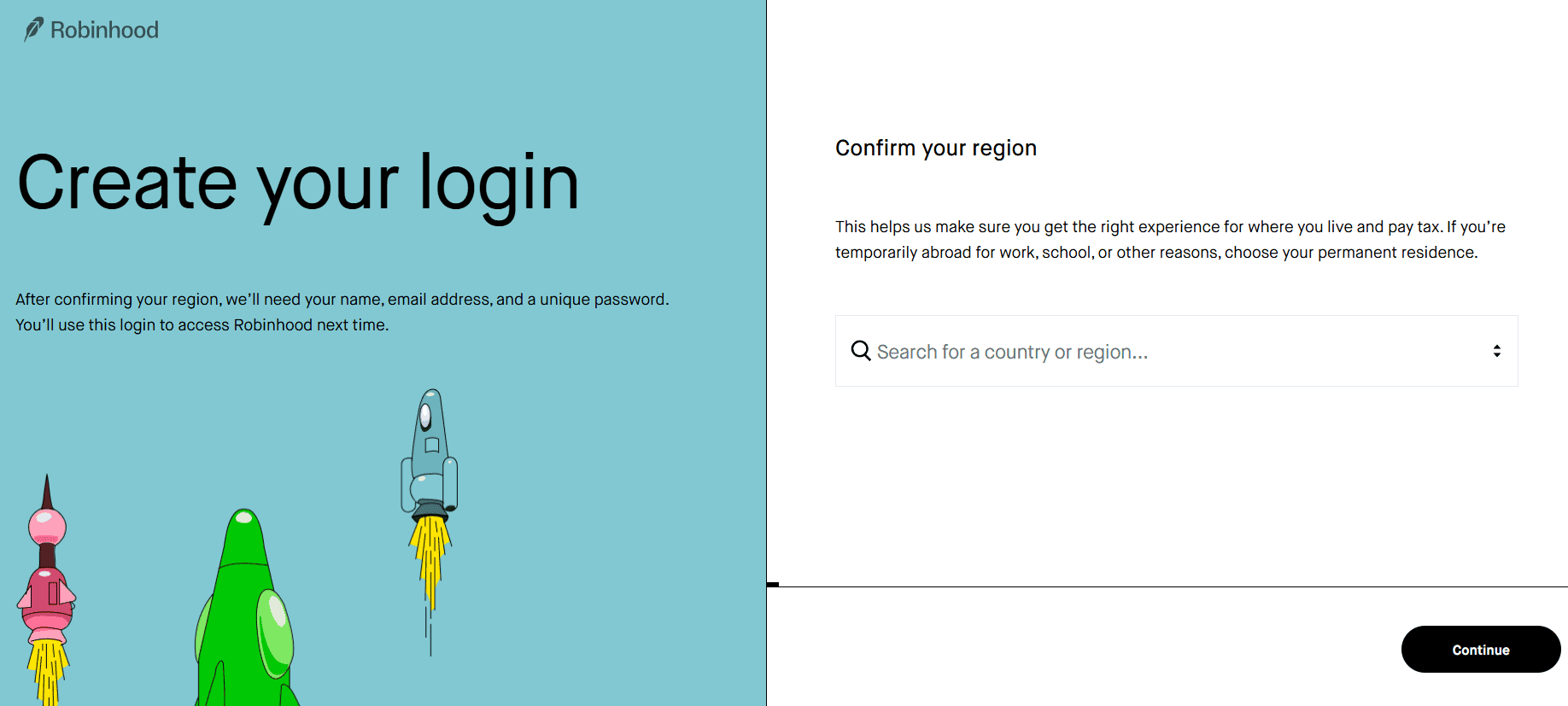

Opening an account with a broker is considered quite an easy process, as you can log in and register with Robinhood within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Sign Up” page.

- Enter the required personal data (country of residence, name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to the broker’s main research tools, Robinhood provides additional solutions to support users in managing and growing their investments.

- One standout is Robinhood Strategies, which offers expert-managed, personalized portfolios tailored to individual risk profiles and financial goals.

- For everyday spending, the Robinhood Cash Card links investing and banking, allowing users to earn bonuses and invest spare change.

Robinhood Compared to Other Brokers

Compared to other major brokerage platforms, Robinhood stands out as a cost-effective and beginner-friendly option with a focus on simplicity and accessibility. While it offers fewer advanced trading tools and educational resources than some of its competitors, it positions itself with its user-friendly platforms, particularly the Robinhood Web Platform and the more advanced Robinhood Legend.

In terms of asset variety, Robinhood provides stocks, ETFs, options, futures, and cryptocurrency, though it may not match the broader range of instruments offered by other diversified brokers. Regarding fees, Robinhood is highly competitive, taking into account its commission-free trading on most of its trading products.

However, traders who need more in-depth research tools, Forex and CFDs trading, or advanced trading platforms may find better fits with brokers like Interactive Brokers or TD Ameritrade. Robinhood’s regulation by Top-Tier US and UK authorities ensures a secure trading environment, and its 24/7 customer support further adds to its reliability for beginner and active traders.

| Parameter |

Robinhood |

AvaFutures |

Interactive Brokers |

TD Ameritrade |

NinjaTrader |

E-Trade |

WeBull |

| Broker Fee – Futures E-mini and Standard Contract |

$0.75 |

$0.49 |

$0.85 |

$1.50 |

$1.29 |

$1.50 |

$1.50 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Low |

Low |

Average |

Average |

Average |

Average |

| Trading Platforms |

Robinhood Web Platform, Robinhood Legend |

MT5 |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Proprietary NinjaTrader Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform |

| Asset Variety |

Stocks, ETFs, Options, Futures, Cryptocurrency |

Futures |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs , Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Futures, Forex, Options, Equities, Stocks |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, ETFs, OTC, ADRs, Crypto, Forex, Shares, Futures |

| Regulation |

SEC, CFTC, NFA, SIPC, FINRA, FCA |

ASIC, MiFID, Bank of Ireland, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

NFA, CFTC |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, ASIC, SFC, MAS |

| Customer Support |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Limited |

Excellent |

Excellent |

Good |

Good |

Good |

Excellent |

| Minimum Deposit |

$0 |

$100 |

$100 |

$0 |

$400 |

$0 |

$0 |

Full Review of Broker Robinhood

Robinhood is a US-based, well-known Stock trading broker that offers access to a range of investment products, including stocks, ETFs, options, futures, and cryptocurrencies.

Traders can choose between cash and margin accounts, and retirement account options such as IRAs are also available. Robinhood provides a proprietary web and mobile interface, along with the Robinhood Legend desktop platform.

Regulated by the SEC and FINRA, and protected by SIPC in the US, Robinhood maintains a solid level of security. However, educational content and research tools are somewhat limited, making it more suitable for self-directed investors who prefer simplicity and cost efficiency over advanced analytics.

Share this article [addtoany url="https://55brokers.com/robinhood-review/" title="Robinhood"]