- What is Rakuten?

- Rakuten Trading Pros and Cons

- Is Rakuten safe or a scam?

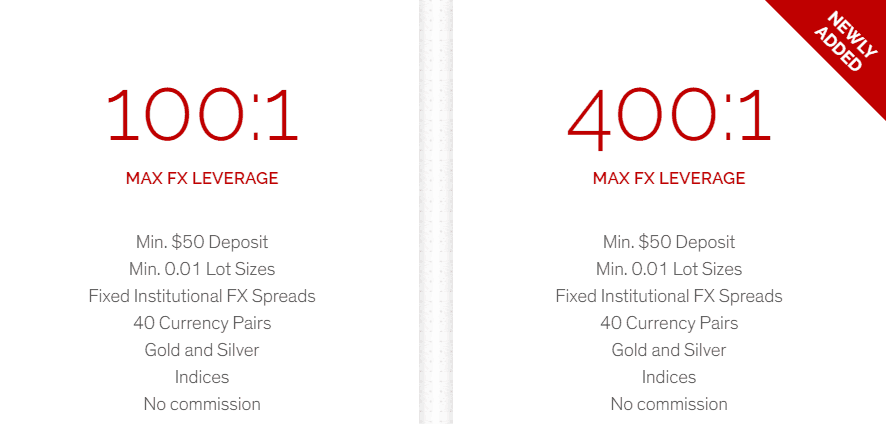

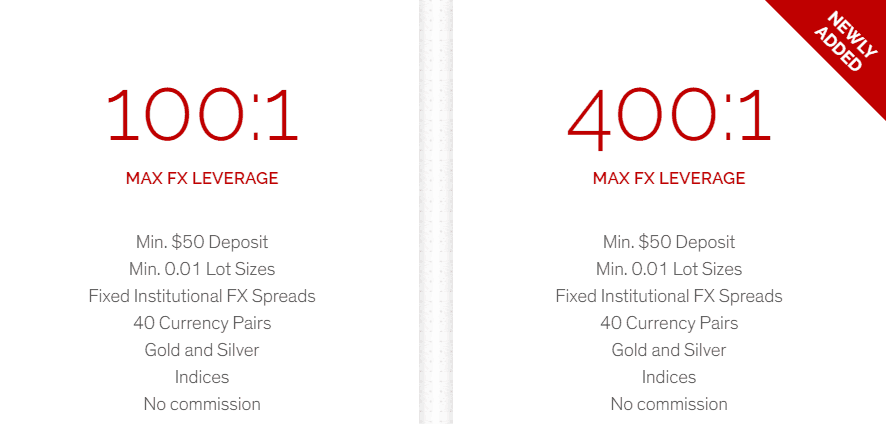

- Leverage

- Accounts

- Market Instruments

- Fees

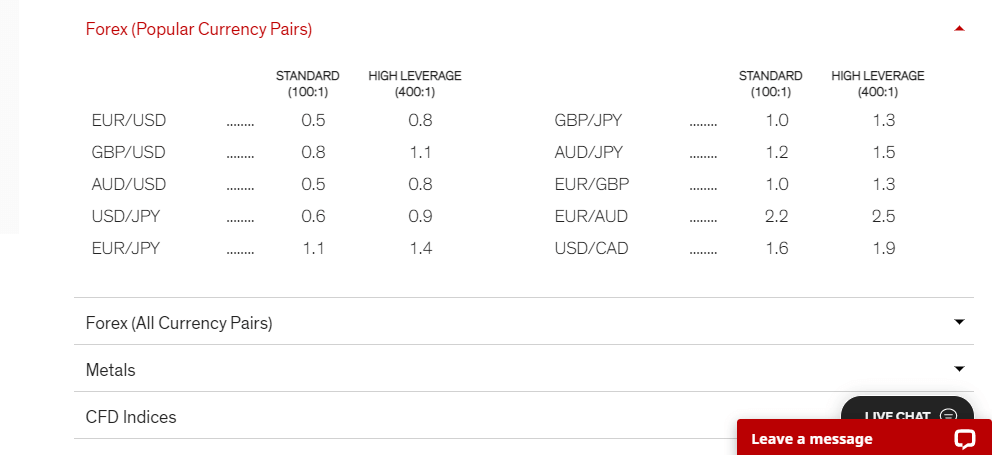

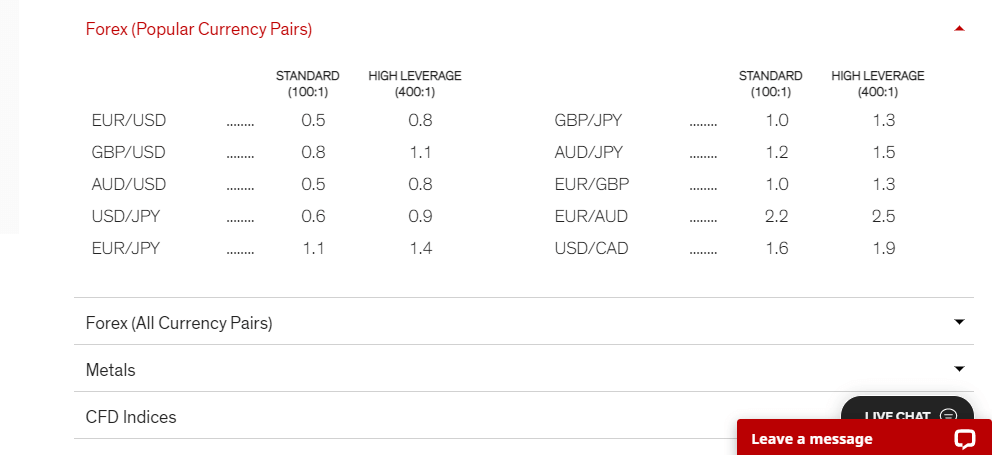

- Spreads

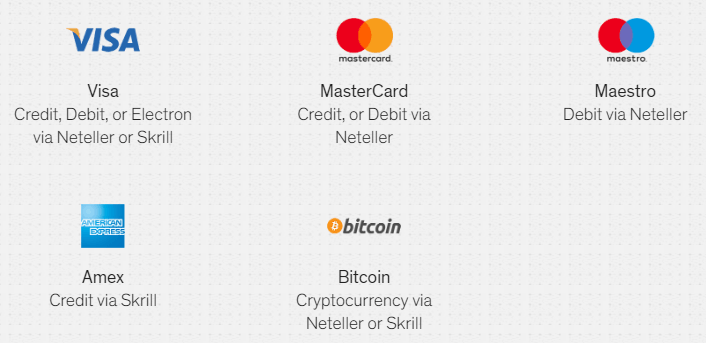

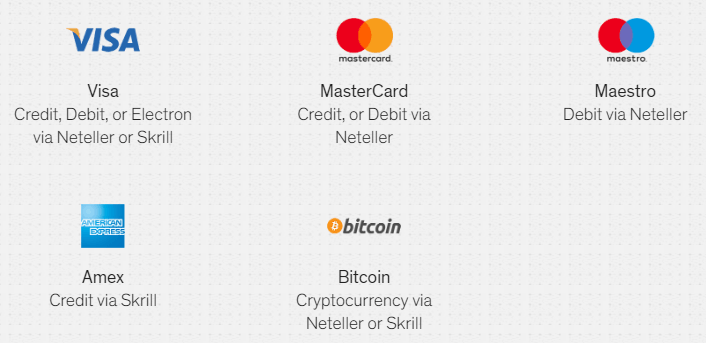

- Deposits and Withdrawals

- Trading Platform

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years experience in Forex Trading check trading offerings, fees, platforms, verified regulations, contacted customer service and placed trades to see trading conditions and give expert opinion about Rakuten

What is Rakuten?

Rakuten Securities is an online broker that provide financial derivatives such as margin forex and CFD. It is headquartered in Japan with subsidiaries in Australia, HK, Malaysia etc. Rakuten Securities Australia is authorized by the Australian Securities and Investments Commission (ASIC) .

- Rakuten is one of the leading internet services companies with businesses in e-commerce, travel, banking, securities, e-money, marketing, and more.

- Rakuten Group is expanding globally and currently performs operations throughout Asia, Europe, the Americas, and Oceania.

The company headquarters is located in Tokyo, Japan while branching out into Hong Kong, Malaysia, and Australia. While the financial services Rakuten Securities launched in 1999 since then its grown involved into a large brokerage firm with a comprehensive range of trading opportunities and available assets.

Is Rakuten a good broker?

Ever since and until now, Rakuten is one of the major online brokers in Japan and across Asia servicing over 2.6 million clients. Also, the company continuously enhances its structure and include even more possibilities to offer and greater option for investors, which is always a benefit. Thus in 2016, the broker partnered with FXCM while further acquiring FXCM Asia ltd.

Rakuten Pros and Cons

Rakuten has Long years of operation and an excellent reputation, is a Globally recognized and awarded broker, and provides Platforms MT4 and proprietary Rakuten FX with Excellent support, learning and research tools Suitable for beginners and professionals.

For Cons, Conditions and trading offering itself may vary according to regulation and entity. Also, the range of instruments is limited to FX and CFDs.

| Advantages | Disadvantages |

|---|

| Long years of operation and excellent reputation | Conditions and trading offering itself may vary according to regulation and entity |

| Globally recognized and awarded broker | |

| Platforms MT4 and proprietary Rakuten FX | |

| Excellent support, learning and research tools | |

| Suitable for beginners and professionals | |

Rakuten Review Summary in 10 Points

| 🏢 Headquarters | Tokyo |

| 🗺️ Regulation | ASIC |

| 📉 Instruments | Equities, commodities, bonds, investment trusts, ETFs and FX, CFDs |

| 🖥 Platforms | MT4, Rakuten FX, ZuluTrade |

| 💰 EUR/USD Spread | 0.5 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | EUR, GBP, AUD, USD |

| 💳 Minimum deposit | 50$ |

| 📚 Education | Equities, commodities, bonds, investment trusts, ETFs and FX, CFDs |

| ☎ Customer Support | 24/5 |

Overall Rakuten Ranking

Based on our research, Rakuten offers great trading conditions suitable for both beginners and advanced traders with a good reputation and a decade of proper operation. The broker offers a variety of trading platforms with low trading costs available on an international scale.

The broker supports multiple trading styles backed up with high leverage making it the best choice for traders of any type. Also, traders of any expertise level are welcomed since the broker provides an excellent range of educational resources and research tools.

- Rakuten Overall Ranking is 8.4 out of 10 based on our testing and compared to 500 other brokers. See Our Ranking below compared to other popular and industry Leading Brokers.

| Ranking | Rakuten | FXTM | AvaTrade |

|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantage | Spreads | Real Stocks | Trading Conditions |

Rakuten Alternative Brokers

However, Rakutwn instrument offering mainly limited to Forex and CFDs, also international entity provides different trading conditions and range. Even though, spreads, platforms and education are really good at Rakuten is good to consider other brokers too, see our selection of Alternative Brokers below:

Is Rakuten safe or scam?

Yes, Rakuten is safe and is heavily regulated by ASIC. It is low-risk trading Forex and CFDs with Rakuten due to its regulations.

Is Rakuten legit?

Yes, Rakuten is fully legit, regulated and authorized for all the businesses it does and offers around the world.

The head office of the Rakuten Securities responsible for trading activity and proposal is located in Japan while authorized by the local Financial Services Agency (FSA Japan) while also is a member of the Financial Futures Association and the Commodity Futures Association.

Hong Kong branch RSHK is authorized and regulated by SFC, while the Australian entity RSA, is regulated by the respected ASIC. In addition, the Malaysian branch is restricted by the Securities Commission Malaysia and holds Capital Markets Services License (CMSL).

See our conclusion on Rakuten Reliability:

- Our Ranked Rakuten Trust Score is 8.2 out 0f 10 for good reputation and service over the years. The broker is licensed by a top-tier regulator and ensures trader safety.

| Rakuten Strong Points | Rakuten Strong Points |

|---|

| Regulated broker with good record and history of operation

| None |

| Global coverage and regulated by ASIC | |

| Negative balance protection | |

| Global expands including Asia, MENA, Africa regions | |

How are you protected?

The above-mentioned range of regulations and authorizations ensures Broker’s reliability and that the operations are handled according to the set regulatory requirements. This ensures the trusted investment solution, while clients are protected in multiple ways with money segregation rules and other control that are audited by the authorities so you’re getting transparent conditions.

Rakuten Leverage

Being an international broker that serves various entities and is respectively regulated by local authorities, various branches of Rakuten Leverage may offer different levels, see some of our finds below:

- While Japanese and Australian entities of Rakuten before offer quite high leverage levels, for now only 1:30 is Available due to regulations

- The other international branches may maximum allow 1:100 on Forex major pairs.

Of course, leverage offers a great benefit opportunity, yet, make sure to learn deeply about leverage and how to use it smartly, as a leveraged or increased trading size may play a significant role in your either potential income or losses as well.

Account types

Rakuten account types are divided into two including a Standard Account and High Leverage Account. The conditions are similar while the difference is about the maximum allowed leverage, spread and maximum allowed lots.

So to avoid confusing account types possibilities, check over the applicable entity the account type you can handle, since the conditions and offers may vary from one regulation to another.

| Pros | Cons |

|---|

| Fast account opening

Suitable for new and experienced traders | Account conditions vary according to regulation |

| Standard and High leverage accounts | |

| Easy switch between Demo and Live Accounts | |

| Various Account base currencies | |

Rakuten Instruments

Rakuten Instrument range based on our research includes equities, commodities, bonds, investment trusts, ETFs and FX, CFDs. Even though at some point trading instruments may seem limited if compare with other brokers, there are still enough popular trading instruments to diversify your portfolio especially considering the good cost-wide

- Rakuten Markets Range Score is 7.8 out 0f 10 for a good selection of instruments with great conditions and low costs. However, the broker’s disadvantage is that market is solely limited to FX and CFD trading and the range might vary according to jurisdiction

Fees

Rakuten uses pricing technology directly from the platform, since this option allows it to leverage the larger orders and present better prices to the global markets, offering a spread basis fee. Rakuten Securities has low forex and CFD trading fees.

Non-trading fees are average, as there is no inactivity fee, but a withdrawal fee is charged on international bank transfers and electronic wallets.

- Rakuten Fees are ranked low with an overall rating of 8.8 out of 10 based on our testing and compared to over 500 other brokers. The broker charges little to no fees, however, conditions for fees will vary according to jurisdiction

| Fees | Rakuten Fees | CMC Markets Fees | XM Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | High |

Spreads

Rakuten does not charge any commission on the spreads, while the spread in 95% is fixed during regular working hours and the rest 5% may vary due to the low liquidity reason.

Also, as we saw via the Australian proposal there are two accounts with Standard EUR USD 0.5 pipsand High leverage conditions EUR USD 0.8 pips, where the last one will offer a slightly higher spread, yet remain competitive as we compare to other market proposals.

- Rakuten Spreads are ranked low with overall rating 9 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower than the industry average of 1.2 pips for EURUSD, and spreads for other instruments are very attractive too

| Asset/ Pair | Rakuten Spread | CMC Markets Spread | XM Spread |

|---|

| EUR USD Spread | 0.5 pips | 0.7 pips | 1.6 pips |

| Gold Spread | 1.5 | 3 | 35 |

Rakuten Payment Methods

As a Rakuten client, you can choose and fund a trading account with different currencies, typically AUD, USD, EUR and GBP, while you still can select which base currency to utilize and even have multiple accounts.

- Rakuten Funding Methods we ranked Excellent with an overall rating of 8 out of 10. The minimum deposit required from the broker is among the average in the industry, and fees are little to no, the minimum deposit requirement, however, may vary according to jurisdiction

Here are some good and negative points for Rakuten funding methods found:

| Rakuten Advantages | Rakuten Disadvantages |

|---|

| Fast digital deposits, including Credit Card, Debit Card and Wire transfer | Some methods may add on commission and are different in each region |

| Various account base currencies | |

| Low minimum deposit requirement 50$ | |

| Free Withdrawals for some methods | |

Deposit Options

There widely supported methods and payment options that may be different due to regions as well, yet typically include

- domestic and international bank wire transfers,

- e-wallets option Neteller, Skrill, ChinaUnion Pay,

- Credit or Debit cards, Amex,

- along with Bitcoin via the e-wallets.

What is the minimum deposit for Rakuten?

The minimum deposits at Rakuten is 50$, thus the trader of any size may involve into trading with Rakuten at ease. Nevertheless, consult with the broker in order to cover all necessary margins according to the trading instrument you working with.

There are no fees for deposits made by domestic transfers, however, banks may charge international transaction fees for other payment options.

Rakuten minimum deposit vs other brokers

|

Rakuten |

Most Other Brokers |

| Minimum Deposit |

$50 |

$500 |

Withdrawals

Rakuten withdrawal options are processed through the same methods as deposits, including popular bank Wire and Cards, while the withdrawal fee will vary from one method to another, e.g. Neteller and Skrill will add on a 2% fee. Nevertheless, check funding methods with your Rakuten entity, as various regions may apply slightly different conditions on payments.

Trading Platforms

The branched nature of Rakuten delivers various platforms to their clients that may incur some differences between the entities as well. Main Rakuten Platforms are MT4 and Rakuten FX.

- Rakuten Platforms are ranked Excellent with an overall rating of 9 out of 10 compared to over 500 other brokers. We mark it as excellent being one of the best proposals we saw in the industry, and a great range including MT4. Also, all are provided with good research and excellent tools

| Platforms | Rakuten | Pepperstone | XM |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| Own Platform | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

Desktop Platform

Australia Rakuten offers as a trading platform the industry-known MetaTrader4 Platform that besides its powerful performance allows analyzing the price with a slew of charts, technical tools and a highly customizable interface and modular approach.

Another platform solution is the Rakuten FX trading platform that delivers offering to Hong Kong entities is an easy-to-use software with robust functionality, while its AS Streaming trading function performs speedy order execution with lower trading costs through the tight fixed spread and no extra cost.

Web Trading

The investment and Rakuten trading available at pre-set preferred trading lot size, auto copy notification, real-time account reports also available via desktop, web and mobile platforms so supporting all devices.

The Malaysian offering includes also access to the market platform via iSPEED.my app or web-based trading screen that provides with a more efficient way to manage trading activities from the online account.

Mobile Platform

Mobile platform features Support for Android, Support for iOS, Full Set of Trading Orders, Analysis and Technical Indicators.

Customer Support

Customer support is available around the clock also supporting live chat, and phone lines and is reachable through various sources including WhatsApp making communication easily accessible. Besides, Rakuten gained a good ranking among other brokers for its quality customer service, which is another plus to its proposal.

- Customer Support in Rakuten is ranked Excellent with an overall rating of 8.9 out of 10 based on our testing. We got quick and relevant responses compared too other brokers. The only negative point is that it’s not available on weekends

See our find and Ranking on Customer Service Quality:

| Pros | Cons |

|---|

| 24/7 support

| None |

| Quick response and Relevant answers | |

| Live Chat, International Phone Lines and email | |

| Professional and regarded customer service | |

Rakuten Education

The beginning traders or even seasoned ones are also supported with the educational resources and materials, including powerful technical analysis support coverage of important topics via the Education courses, regularly held Webinars and videos also done in various languages making learning better.

For practice trading in risk free Demo Account you can sign up for free at any time and test strategy or Rakuten conditions.

- Rakuten Education ranked with an overall rating of 9 out of 10 based on our research. Rakuten provides very good quality Education Materials, and excellent research, also provides Excellent Trading videos and Analysis

Rakuten Review Conclusion

Our final thought on Rakuten Review are good, the broker provides professional services, while constantly improving their offering. The overall proposal to the investors and traders indeed very comprehensive by the number of account types, fixed or floating spreads, trading platforms and availability of progressive tools. While all in all concludes Rakuten as a reliable and very attractive broker to trade with. The only thing you should be attentive with is to check the relevant information due to his own country of residence and under which branch the client will be trading, as the conditions may be slightly different.

Based on Our findings and Financial Expert Opinion Rakuten is Good for:

- Professional Traders

- Advanced traders

- Investment

- Traders who prefer MT4 platform

- Currency Trading and CFD Trading

- Running various Strategies

- EAs trading

- PAMM Trading

- Excellent Research

- Hedging/Scalping traders

- Copy trading

Share this article [addtoany url="https://55brokers.com/rakuten-securities-review/" title="Rakuten Securities"]

From: Aftab Ahmed. London. UK

06 February 2021

Dear sir, I would be grateful if you could reply the following questions asap.

1. For UK residents the regulations of Japan or UK will apply ?

2. Do you tax any profits at source.

3. What Leverage for trading Indices: WS30, Nasdaq, Germany 30; 1 contract BUY/SEL USD.

Many thanks. aftab ahmed

Hi,

Some Hongkong traders are offering 100:400 ratio for 10 days programme in India.

Is trading official in India?

Please advice.

Kind regards,

Minesh Shah,Mumbai