- What is Qtrade?

- Qtrade Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Qtrade Compared to Other Brokers

- Full Review of Broker Qtrade

Overall Rating 4.4

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Qtrade?

Qtrade is a Canadian online brokerage platform that provides investment services to individual investors. It offers a variety of products, including stocks, bonds, mutual funds, ETFs, options, and more.

The firm is regulated by the Canadian Investment Regulatory Organization (CIRO) and is a member of the Canadian Investor Protection Fund (CIPF). These organizations ensure strict compliance with regulatory standards and help safeguard investors’ assets.

Overall, Qtrade is known for its user-friendly interface, competitive pricing, and comprehensive range of investment products and services.

Is Qtrade Stock Broker?

Yes, Qtrade is a Stock trading broker that offers online brokerage services to investors in Canada. It provides a proprietary platform for clients to buy and sell stocks, along with other investment products such as bonds, mutual funds, ETFs, and more.

Qtrade Pros and Cons

The platform has advantages and disadvantages that are important to consider. On the positive side, its user-friendly online trading platform offers a seamless and intuitive interface, facilitating easy navigation and trade execution. The platform provides access to a diverse array of investment products, enabling investors to build well-rounded Qtrade guided portfolios tailored to their financial goals and risk preferences.

Additionally, Qtrade offers comprehensive research tools and educational resources, empowering investors with valuable insights and knowledge to make informed investment decisions.

For the cons, the broker’s access to international markets may be limited, which could pose challenges for investors seeking exposure to a broader range of global opportunities. Also, it does not offer as many advanced features or tools as some other brokerage platforms, which could be a limitation for more experienced or active traders who rely on sophisticated trading functionalities.

| Advantages | Disadvantages |

|---|

| CIRO and CIPF regulation and oversee | No 24/7 customer support |

| Direct market access | Limited advanced trading features |

| Competitive trading conditions | |

| $0 minimum deposit | |

| Learning materials | |

| Trading products | |

| User-friendly interface | |

| Secure investing environment | |

Qtrade Features

Qtrade is known for its reliable platform, wide range of investment options, and competitive pricing. With intuitive tools and robust research resources, the firm helps investors make informed decisions and build their portfolios with confidence. Below is a comprehensive list of its key features:

Qtrade Features in 10 Points

| 🏢 Regulation | CIRO, CIPF |

| 🗺️ Account Types | Cash, Margin, Tax-Free Savings Accounts (TFSA), Registered Retirement Savings Plans (RRSP) Accounts |

| 🖥 Trading Platforms | Qtrade Proprietary Trading Platform |

| 📉 Trading Instruments | Stocks, Bonds, Mutual Funds, ETFs, Options, GICs, IPOs |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | From $8,75 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, CAD |

| 📚 Trading Education | Articles, Guides, Insights |

| ☎ Customer Support | 24/5 |

Who is Qtrade For?

Qtrade is well-suited for Canadian investors who value a dependable platform with a strong track record of service and support. It appeals to beginners through its user-friendly interface and educational resources, while also meeting the needs of experienced investors with advanced research tools and diverse investment choices. Based on our findings, Qtrade is Good for:

- Canadian traders

- Stocks and Options trading

- Currency trading

- Professional trading

- Advanced traders

- Direct Investing

- User-friendly interface

- Commission-based trading

- Competitive conditions

- Good learning materials

Qtrade Summary

In conclusion, Qtrade is a reliable and comprehensive brokerage platform, offering diverse investment options and tools. Its intuitive interface, coupled with comprehensive research and educational resources, empowers users to make informed investment decisions.

While there may be some limitations, Qtrade’s commitment to client satisfaction and security solidifies its position as a reputable choice for investors seeking a trustworthy partner in their financial journey.

However, we advise conducting your research and evaluating whether the broker’s offerings suit your specific requirements.

55Brokers Professional Insights

Qtrade distinguishes itself as one of Canada’s most trusted online brokerages, consistently earning high marks for its reliability, transparency, and client-focused approach.

What makes Qtrade stand out with our opinion is its balance of accessibility and sophistication: it provides beginner investors with intuitive tools, step-by-step guidance, and educational resources, while also equipping seasoned traders with advanced research, real-time market data, and a wide selection of investment products. So it might be a great choice for a vast of trading styles, levels or account size trades, which makes QTrade very customer friendly broker.

The platform offers access to stocks, ETFs, options, bonds, and mutual funds, giving investors flexibility in building diversified portfolios. The firm’s commitment to customer service, competitive fee structure, and strong security framework further enhance its appeal, making it a standout choice for Canadian investors seeking both confidence and control in their trading experience.

Consider Trading with Qtrade If:

| Qtrade is an excellent Broker for: | - Need a well-regulated broker.

- Canadian investors.

- Suitable for beginners or intermediate traders.

- Long-term investors.

- Secure trading environment.

- Providing diverse account types.

- Professional trading.

- Stock Trading and Investment.

- Competitive trading conditions.

- Looking for broker with a long history of operation and strong establishment.

- Investors who value research tools and learning materials.

- Offering popular financial products. |

Avoid Trading with Qtrade If:

| Qtrade might not be the best for: | - Looking for broker with 24/7 customer support.

- Forex or Futures traders.

- Need a broker with trading services worldwide. |

Regulation and Security Measures

Score – 4.5/5

Qtrade Regulatory Overview

Qtrade is a reliable Stock trading platform that follows the strict rules and guidelines established by Canadian CIRO and CIPF. These regulations safeguard client assets and provide low-risk trading.

How Safe is Trading with Qtrade?

Qtrade is a legitimate and regulated investing platform for traders looking to invest and manage their assets.

The broker aims to prioritize client protection by adhering to industry regulations and implementing security measures to safeguard client assets and sensitive information. Through regulatory oversight and compliance, Qtrade Canada ensures that client accounts are protected against unauthorized access and fraudulent activities.

Additionally, the platform employs encryption technologies and authentication protocols to enhance data security and maintain the confidentiality of client transactions.

Consistency and Clarity

Qtrade has built a strong reputation in Canada as a consistent and reliable broker, supported by years of operation and a solid track record of client satisfaction.

Established in 1999, it has earned high scores in independent reviews for its ease of use, educational resources, and customer support, while also receiving constructive feedback from real traders on areas like platform speed and fee structures.

The broker’s credibility is further reinforced by numerous industry awards recognizing its excellence in online investing services. Beyond trading, Qtrade also maintains an active presence in the community through sponsorships and financial literacy initiatives, which highlight its broader role in promoting responsible investing and strengthening trust with the public.

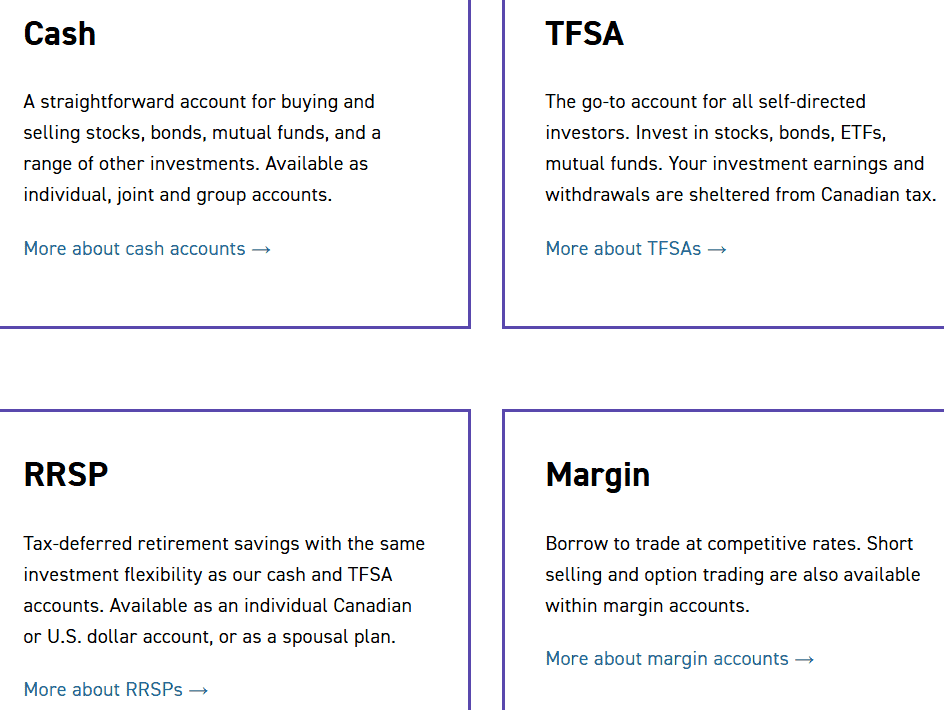

Account Types and Benefits

Score – 4.6/5

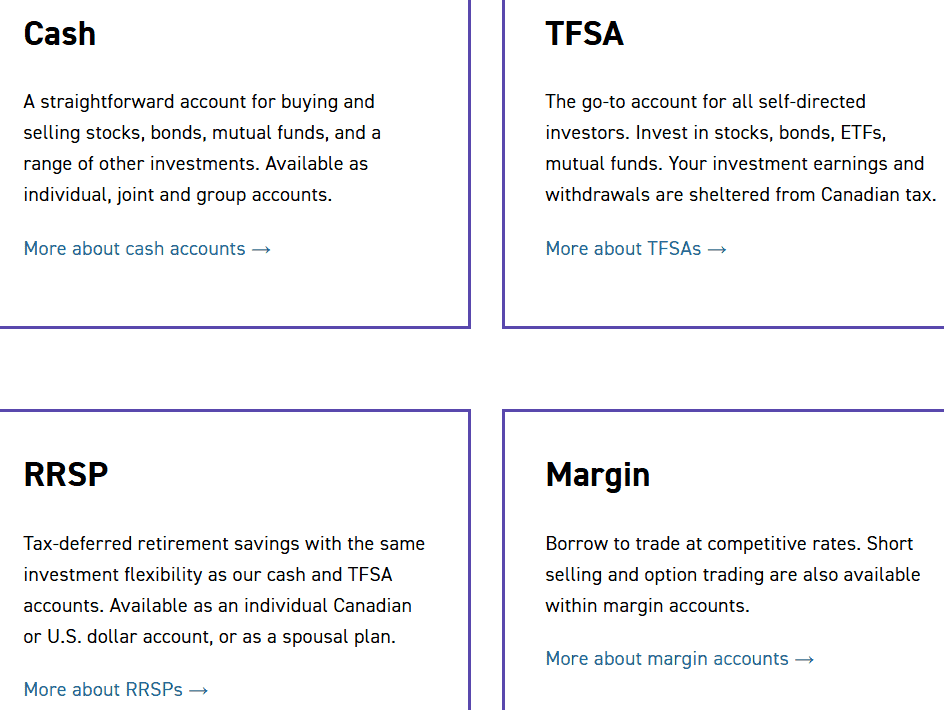

Which Account Types Are Available with Qtrade?

The platform offers various types of accounts tailored to meet the diverse needs of investors. These include Cash and Margin accounts, as well as Tax-Free Savings Accounts (TFSA), and Registered Retirement Savings Plans (RRSP).

Each account type serves different purposes, providing investors with flexibility in tax planning, retirement savings, education funding, and investment management according to their financial goals and circumstances.

The broker also provides a trial account, enabling prospective clients to explore its platforms, practice strategies, and familiarize themselves with the tools before committing real funds.

Cash Account

The Qtrade Cash Account is a non-registered investment account designed for flexible investing without the tax advantages of registered plans.

It allows clients to buy and sell a wide range of assets, including stocks, ETFs, mutual funds, and bonds, suitable for both short-term and long-term strategies. Qtrade does not require a large minimum deposit; investors can typically open a cash account with as little as $1,000 CAD.

Regions Where Qtrade is Restricted

Qtrade is restricted to residents of Canada only and is not available to investors in the United States or other international regions.

Cost Structure and Fees

Score – 4.5/5

Qtrade Brokerage Fees

The broker’s fee structure includes various aspects of trading and account maintenance. While the platform charges commissions on trades, the exact fees can vary depending on the type of investment product and the size of the transaction.

Additionally, there are other charges associated with account management, such as annual fees or inactivity fees. Therefore, investors should carefully review Qtrade’s fee schedule to understand the costs involved and ensure they align with their investment strategy and budget.

The firm’s commission structure typically involves charging a fee for each trade executed on the platform. The commission rates may vary depending on factors such as the type of investment product traded and the size of the transaction.

As fees and commissions can be subject to change, traders should check the broker’s official website or contact customer support for the latest and most accurate information regarding commissions.

Qtrade applies standard regulatory and exchange fees that are common across the Canadian investment industry. These fees are not charged by Qtrade directly but are passed through from regulatory bodies and stock exchanges to cover the costs of maintaining fair, transparent, and well-regulated markets.

Investors may see small charges on certain trades, such as equity or options transactions, which are consistent with industry requirements and help ensure compliance and market integrity.

Qtrade does not operate like a Forex broker, so it does not charge traditional rollover or swap fees on overnight positions. Instead, any interest or carrying costs are tied to margin accounts or specific investment products, such as bonds or money market funds.

In addition to commissions, Qtrade applies additional fees that investors should be aware of, depending on account type and activity.

The broker charges a $25 quarterly Account Administration Fee, which essentially acts as an inactivity fee if certain conditions are not met.

However, this fee is easily waived by meeting specific requirements, such as maintaining a minimum household asset balance of $25,000, completing at least 2 commission-generating equity or options trades in the last quarter, or setting up a recurring electronic funds contribution of $100 or more per month.

How Competitive Are Qtrade Fees?

Qtrade’s fees are considered competitive within the Canadian brokerage environment. While not always the absolute lowest on the market, its pricing structure is transparent and fair, especially when paired with the platform’s strong research tools, educational resources, and customer support.

Active traders can benefit from discounted commission rates, while long-term investors appreciate the cost-effectiveness of Qtrade’s wide range of no-commission ETFs. Overall, the fee structure positions the broker as a solid choice for investors who want both reasonable costs and access to a feature-rich environment.

| Asset/ Pair | Qtrade Commission | Ally Invest Commission | EasyEquities Commission |

|---|

| Stocks Fees | From $8,75 | From $0 | From $10 |

| Fractional Shares | No | No | Yes |

| Options Fees | $8.75 + $0.75 | From $0.50 | - |

| ETFs Fees | From $0 | From $0 | From 0,25% |

| Free Stocks | No | Yes | No |

Trading Platforms and Tools

Score – 4.4/5

Qtrade offers its proprietary platform for direct investing, accessible through desktop and mobile devices. The platform provides a user-friendly interface and a comprehensive suite of tools for trading various investment products.

With the platform, clients can conveniently manage their portfolios, access real-time quotes, conduct research, and execute trades seamlessly, whether they are at home or on the go.

Trading Platform Comparison to Other Brokers:

| Platforms | Qtrade Platforms | Ally Invest Platforms | EasyEquities Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Qtrade Web Platform

The Qtrade Web Platform is the broker’s proprietary online trading system, designed to provide investors with a simple yet powerful way to manage their portfolios.

Accessible directly through a web browser without the need for downloads, it offers a clean and intuitive interface where users can research securities, execute trades, and track performance in real time. The platform integrates robust tools such as advanced charting, customizable watchlists, analyst ratings, and screening filters.

Qtrade Desktop MetaTrader 4 Platform

Qtrade does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support CFD trading, which is typically associated with MT4.

Qtrade Desktop MetaTrader 5 Platform

The broker does not support MetaTrader 5 either. Qtrade does not provide access to advanced platforms like MT5, maintaining its focus on its proprietary platform.

Qtrade MobileTrader App

The Qtrade MobileTrader gives investors the flexibility to manage their portfolios on the go with a user-friendly experience. Available for both iOS and Android, the app allows users to place trades, monitor market movements, access watchlists, and review account balances in real time.

While lighter than the full web platform, it still offers essential tools and research features, ensuring that investors can stay connected to the markets and their investments anytime, anywhere.

Main Insights from Testing

Testing the broker’s Mobile app reveals a well-optimized experience with fast navigation and a responsive design. Users generally find the interface intuitive, making it easy to execute trades, track portfolios, and access key market data.

While some advanced research and charting tools are more limited compared to the web platform, the app performs reliably and provides a practical solution for investors who need to manage their accounts quickly and efficiently while on the move.

AI Trading

Qtrade does not currently offer built-in AI features or automated AI-driven strategies within its platform. Investors looking to leverage AI for trading decisions would need to use external tools or third-party software alongside Qtrade’s platform.

While Qtrade provides robust research, screening tools, and data analytics, any AI-based analysis or algorithmic trading must be implemented externally.

Trading Instruments

Score – 4.5/5

What Can You Trade on Qtrade’s Platform?

The broker provides access to a wide range of products, including Stocks, Bonds, Mutual Funds, Qtrade free ETFs, Options, GICs, and IPOs.

With this comprehensive selection, investors can tailor their investment strategies to capitalize on opportunities in different asset classes while managing risk effectively.

Main Insights from Exploring Qtrade’s Tradable Assets

Exploring Qtrade’s tradable assets reveals a platform that caters to a wide range of investor needs, from conservative portfolios to more active trading strategies.

The selection is diverse, offering flexibility and opportunities for portfolio diversification. Users benefit from access to both domestic and international markets, along with solid research and analytical tools that support informed decision-making.

Margin Trading at Qtrade

Qtrade offers margin trading services, allowing traders to borrow funds against their existing securities to potentially amplify their trading positions.

However, margin trading involves additional risks, as losses can exceed the initial investment. Therefore, investors should thoroughly understand the associated risks and requirements before engaging in margin trading activities on the platform.

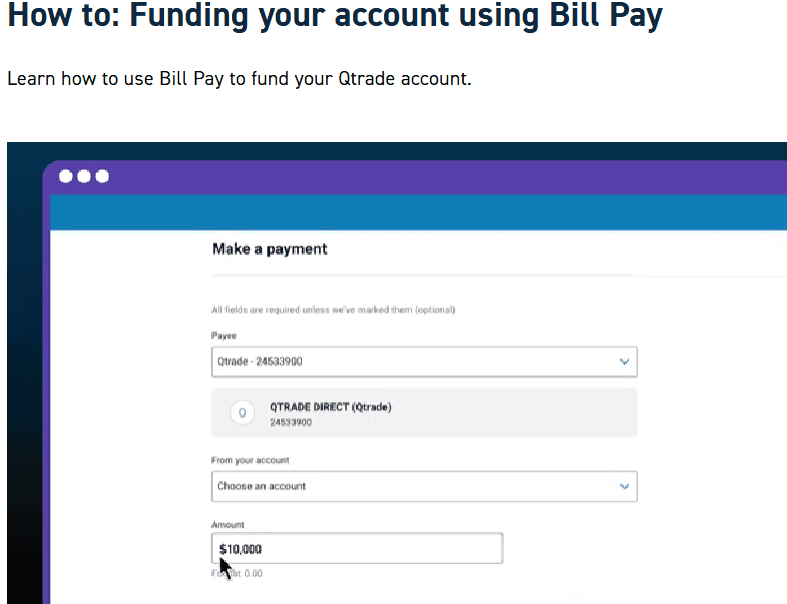

Deposit and Withdrawal Options

Score – 4.4/5

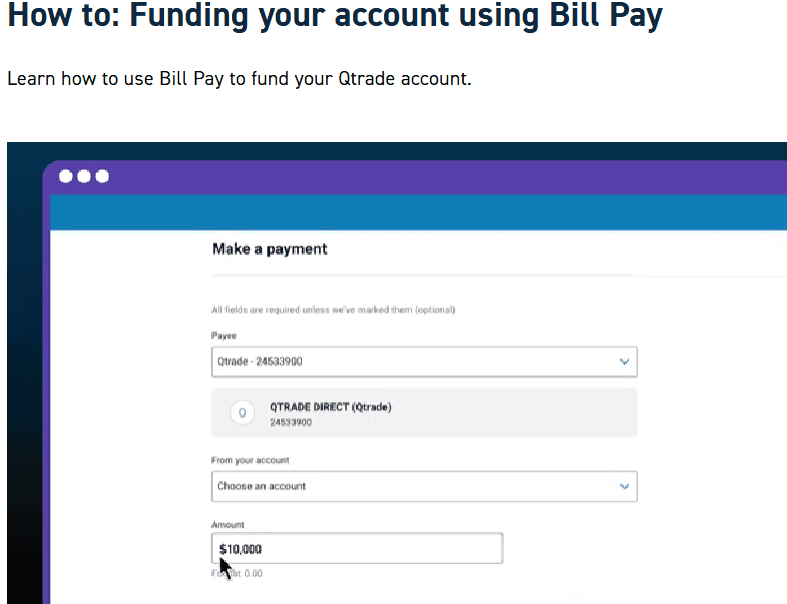

Deposit Options at Qtrade

The broker offers various funding methods to enable clients to deposit funds into their brokerage accounts conveniently. These methods typically include electronic funds transfer (EFT) from a linked bank account, wire transfers, bill payments, and cheque deposits.

Qtrade Minimum Deposit

The platform does not impose a minimum deposit requirement for opening a brokerage account. This flexibility allows investors of varying financial backgrounds to start investing with Qtrade without being constrained by a minimum initial deposit.

Withdrawal Options at Qtrade

The firm provides clients with multiple options for withdrawing funds from their brokerage accounts. These options include EFT to a linked bank account, wire transfers, and cheque requests.

Clients can initiate withdrawal requests through the platform, and processing times for withdrawals may vary depending on the chosen method and any associated verification processes.

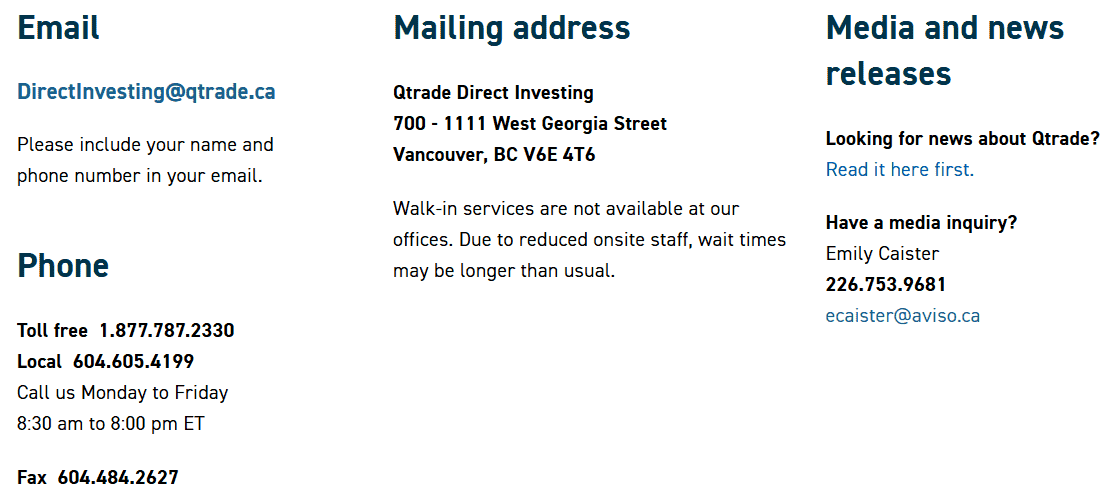

Customer Support and Responsiveness

Score – 4.5/5

Testing Qtrade’s Customer Support

The broker offers 24/5 customer support via email and phone lines. Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

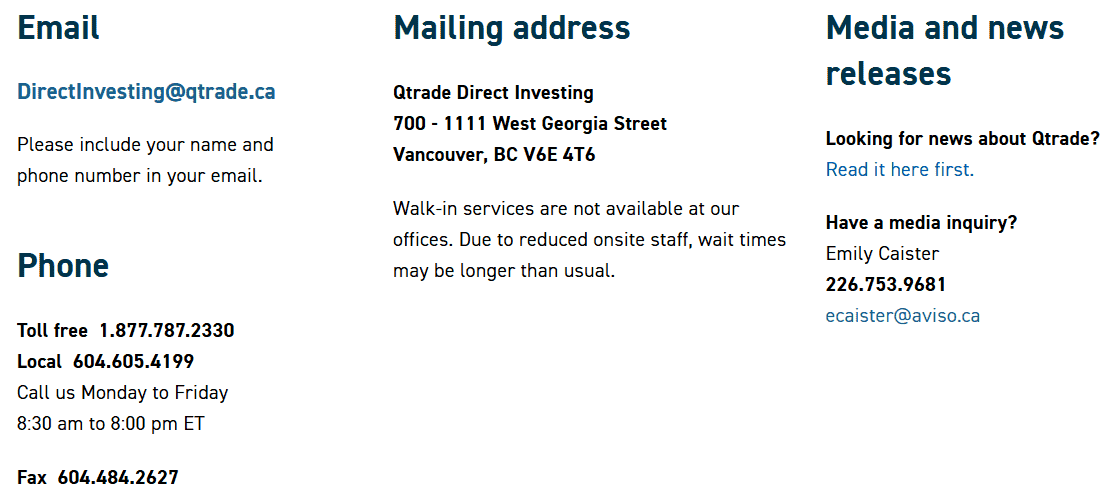

Contacts Qtrade

You can contact Qtrade for support or inquiries via phone at 1.877.787.2330 or by email at DirectInvesting@qtrade.ca. The customer team is available to assist with account questions, technical issues, or general information about the platforms and services.

Research and Education

Score – 4.6/5

Research Tools Qtrade

The platform provides clients with a range of trading tools to enhance their investment experience.

- These tools include real-time market data, charting capabilities, technical analysis tools, and research reports from leading financial institutions.

- Additionally, Qtrade offers features such as portfolio analysis tools and stock screeners to help clients make informed investment decisions.

Education

The broker is committed to empowering Qtrade investors with educational resources to help them navigate the complexities of the financial markets. These resources include articles, tutorials, and workshops covering various topics such as investment strategies, market analysis, risk management, and retirement planning.

Portfolio and Investment Opportunities

Score – 4.5/5

Investment Options Qtrade

Qtrade offers a variety of investment solutions, including stocks, ETFs, mutual funds, bonds, and GICs. These options allow clients to build diversified portfolios, pursue both growth and income strategies, and take advantage of tax-advantaged accounts where applicable.

The platform supports both long-term investing and more active trading approaches, giving investors the flexibility to tailor their investment choices to their individual financial objectives.

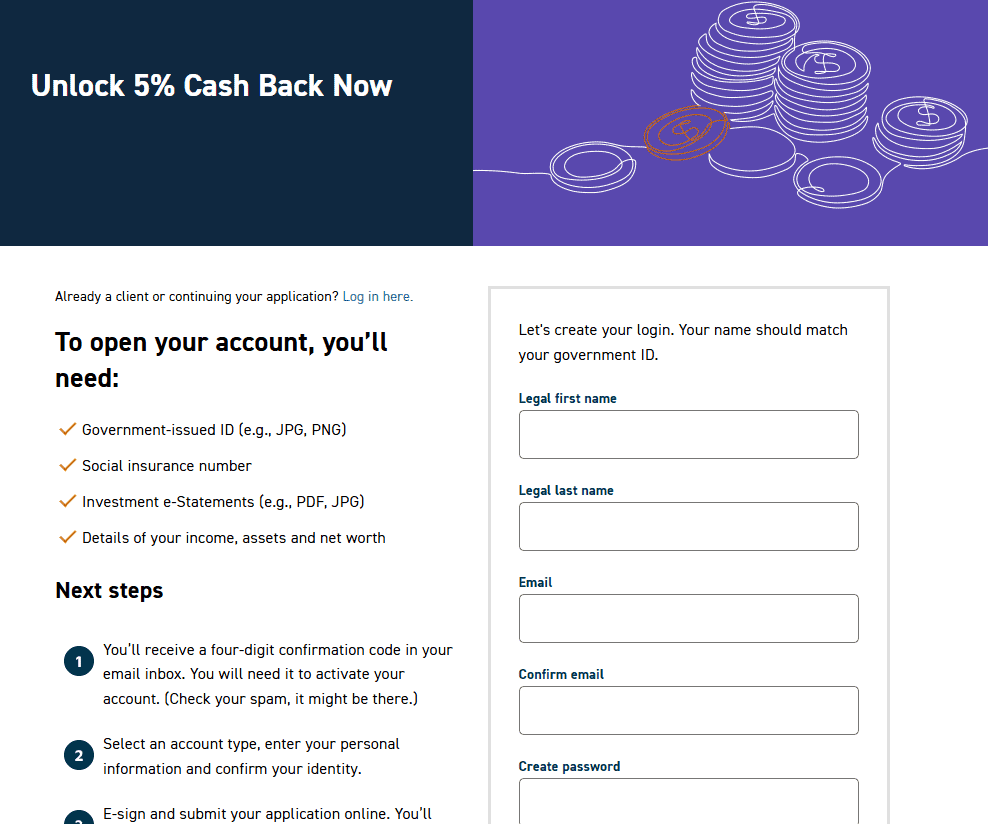

Account Opening

Score – 4.4/5

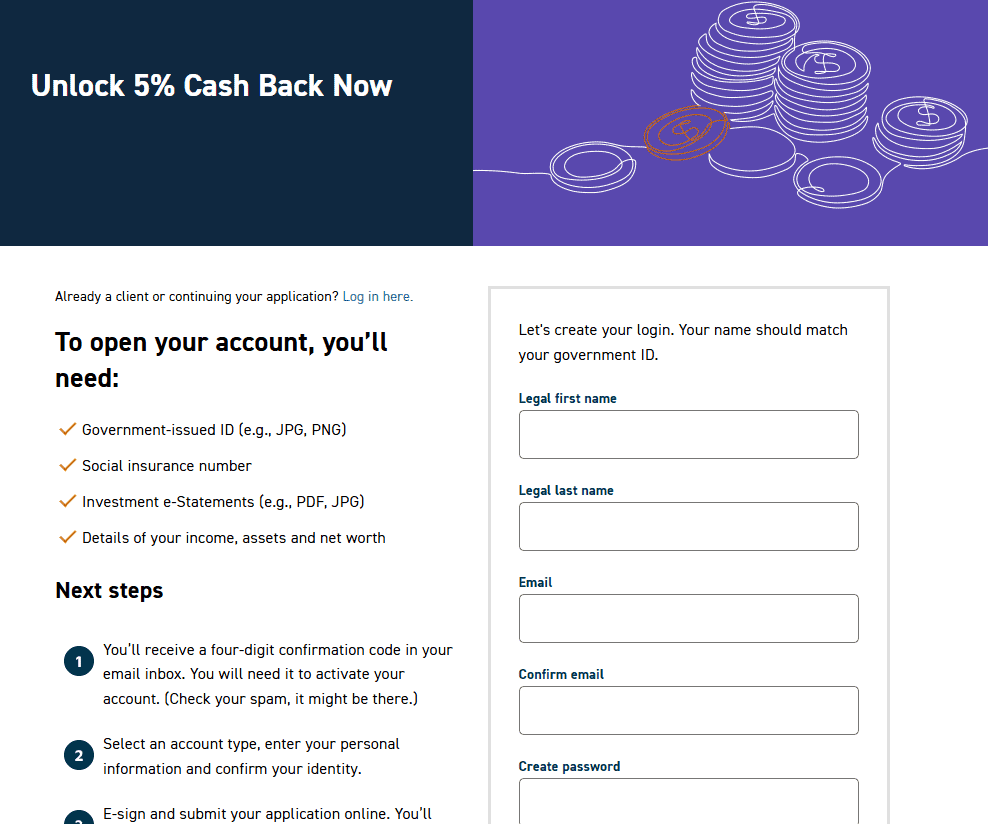

How to Open Qtrade Demo Account?

To open a Qtrade demo account, simply sign up on their website for the 30-day free trial. During registration, you will provide basic personal information and create login credentials, which will give you access to a fully functional simulated trading environment.

The demo account allows you to explore the broker’s platform, execute virtual trades, test strategies, and familiarize yourself with research tools and portfolio management features, all without risking real money.

How to Open Qtrade Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or Qtrade login page and proceed with the guided steps:

- Select and click on the “Open an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to research and trading capabilities, Qtrade offers a few additional tools and features.

- These include customizable watchlists, alerts and notifications, portfolio tracking, and retirement planning calculators. Together, these features help investors monitor their portfolios more effectively, make informed decisions, and develop their investing skills over time.

Qtrade Compared to Other Brokers

Qtrade positions itself as a strong choice among Canadian brokers by offering a balanced combination of features, usability, and investor support. Compared with competitors, it provides a diverse range of tradable assets suitable for both long-term investors and more active traders, though it does not offer futures trading like some platforms.

Its proprietary trading platform is designed for ease of use and reliable performance. Regulation and investor protection are solid, aligning with industry standards, while customer support and educational resources help clients make informed decisions.

Overall, Qtrade stands out for its well-rounded offering, particularly for investors seeking a secure, versatile, and user-friendly brokerage environment, even if some competitors may excel in lower fees or additional trading options.

| Parameter |

Qtrade |

Ally Invest |

AJ Bell |

TD Ameritrade |

Freetrade |

Questrade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from $8,75 |

Futures contracts not available / Stock Commission from $0 |

Futures contracts not available / Stock Commission from £3,50 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$Futures contracts not available / Stock Commission from $0 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Average |

Low/Average |

Low/Average |

Average |

Low |

Low/Average |

Low |

| Trading Platforms |

Qtrade Proprietary Trading Platform |

Ally Invest Proprietary Trading Platform |

AJ Bell Trading Platform |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Questrade Web, QuestMobile, Questrade Edge Mobile, Questrade Edge, Questrade Global |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, Bonds, Mutual Funds, ETFs, Options, GICs, IPOs |

Stocks, ETFs, Options, Bonds, Mutual Funds, Currencies, Securities, Treasuries, CDs |

Stocks, Shares, Funds, ETFs, Bonds, Gilts, Investment Trusts, ETCs, Warrants |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, ETFs, Options, IPOs, CFDs, Mutual Funds, Bonds, GICs, International Equities, FX, Precious Metals |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

CIRO, CIPF |

SEC, FINRA, SIPC |

FCA |

SEC, FINRA, SIPC, MAS |

FCA |

CIRO, CIPF, SEC, FINRA |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/7 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Limited |

Excellent |

Good |

Limited |

Excellent |

Good |

| Minimum Deposit |

$0 |

$0 |

$0 |

$0 |

$0 |

$1,000 |

$0 |

Full Review of Broker Qtrade

Qtrade is a reputable Canadian investment firm offering a comprehensive suite of solutions for a wide range of investors. It provides access to diverse assets, including stocks, ETFs, mutual funds, bonds, and GICs, supported by a reliable proprietary platform and a mobile app for trading on the go.

The broker emphasizes transparency, strong regulatory compliance, and robust customer support, complemented by educational resources and tools to help investors make informed decisions.

With flexible account options, a 30-day free trial, and additional features such as portfolio tracking and alerts, Qtrade delivers a balanced and user-friendly experience.

Share this article [addtoany url="https://55brokers.com/qtrade-review/" title="Qtrade"]