- What is Plus500?

- Plus500 Pros and Cons

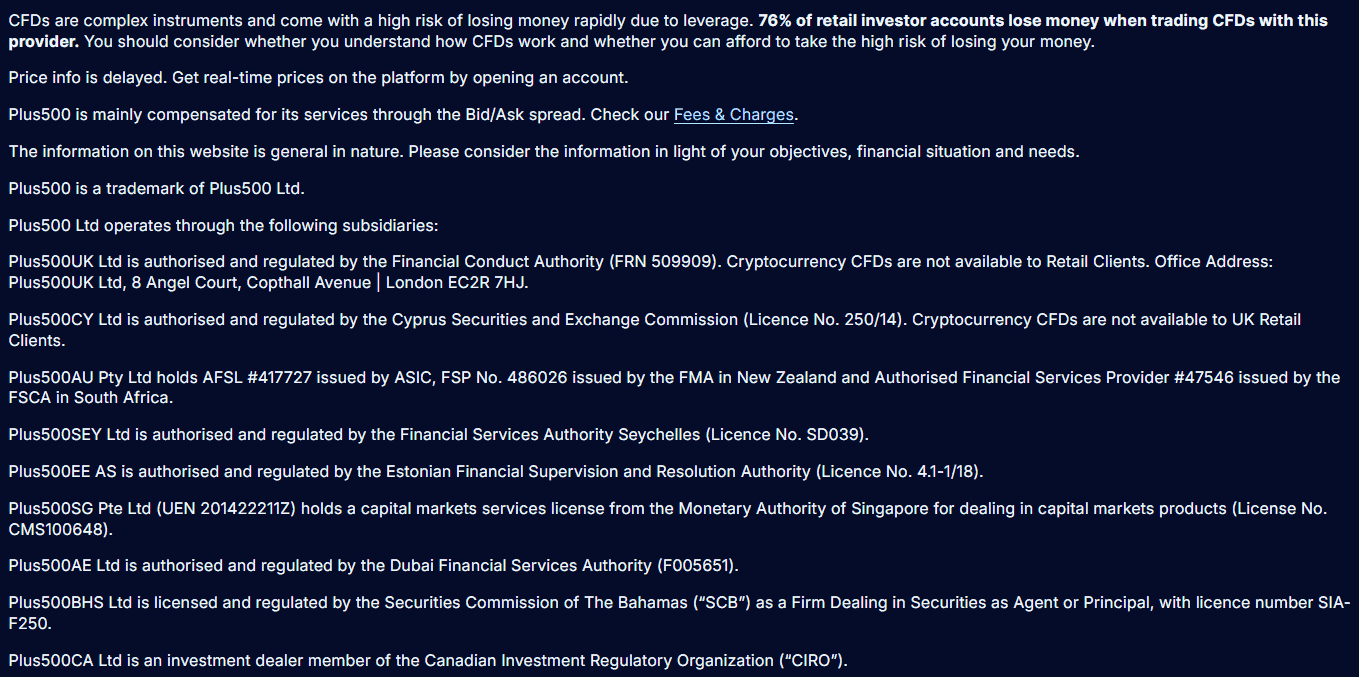

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

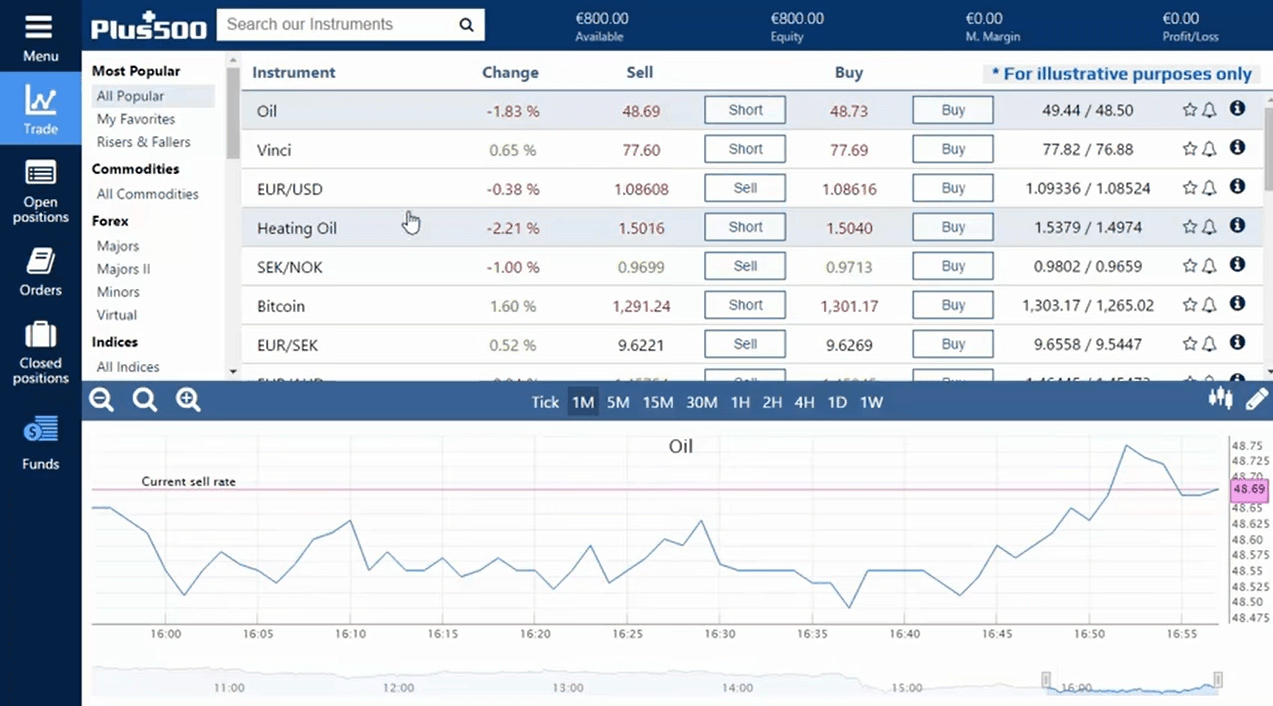

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

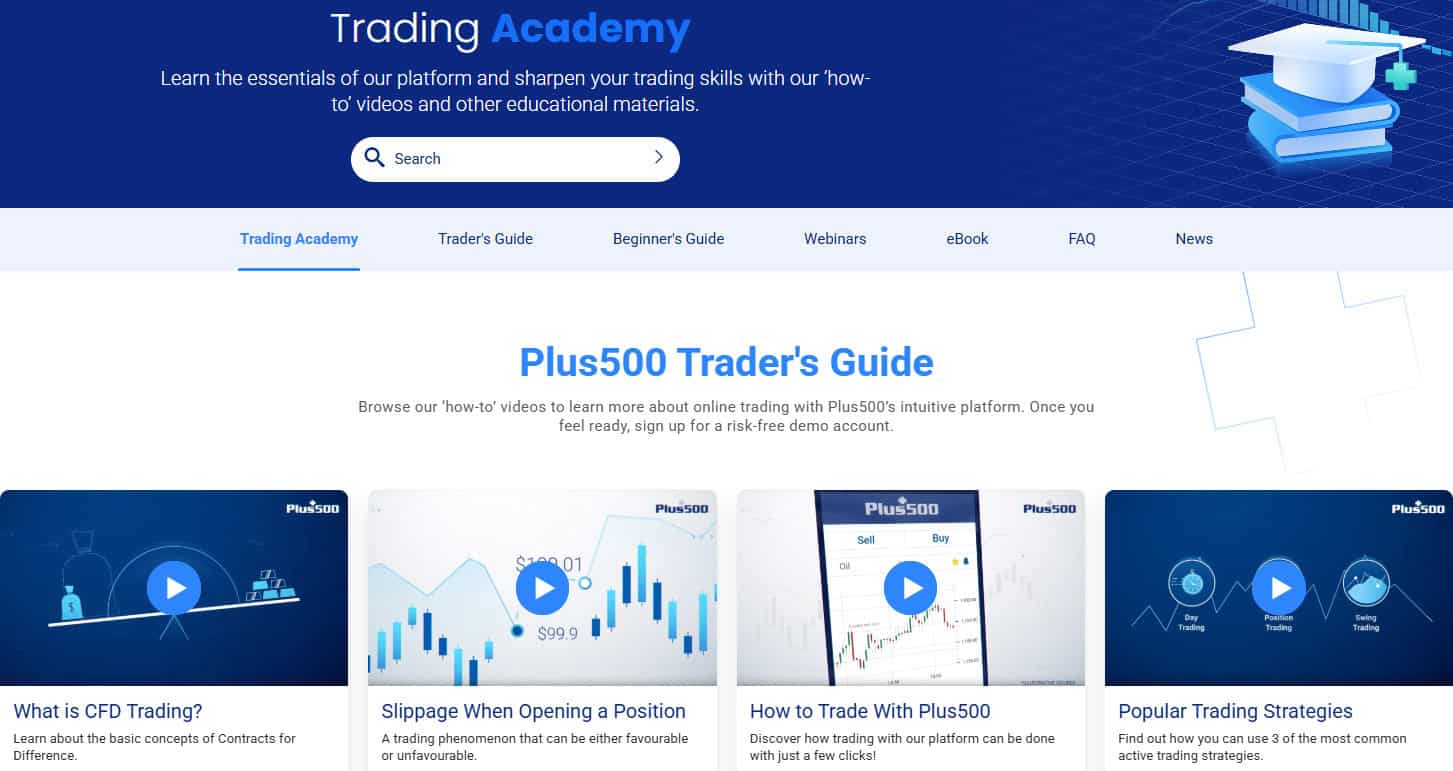

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Plus500 Compared to Other Brokers

- Full Review of Broker Plus500

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

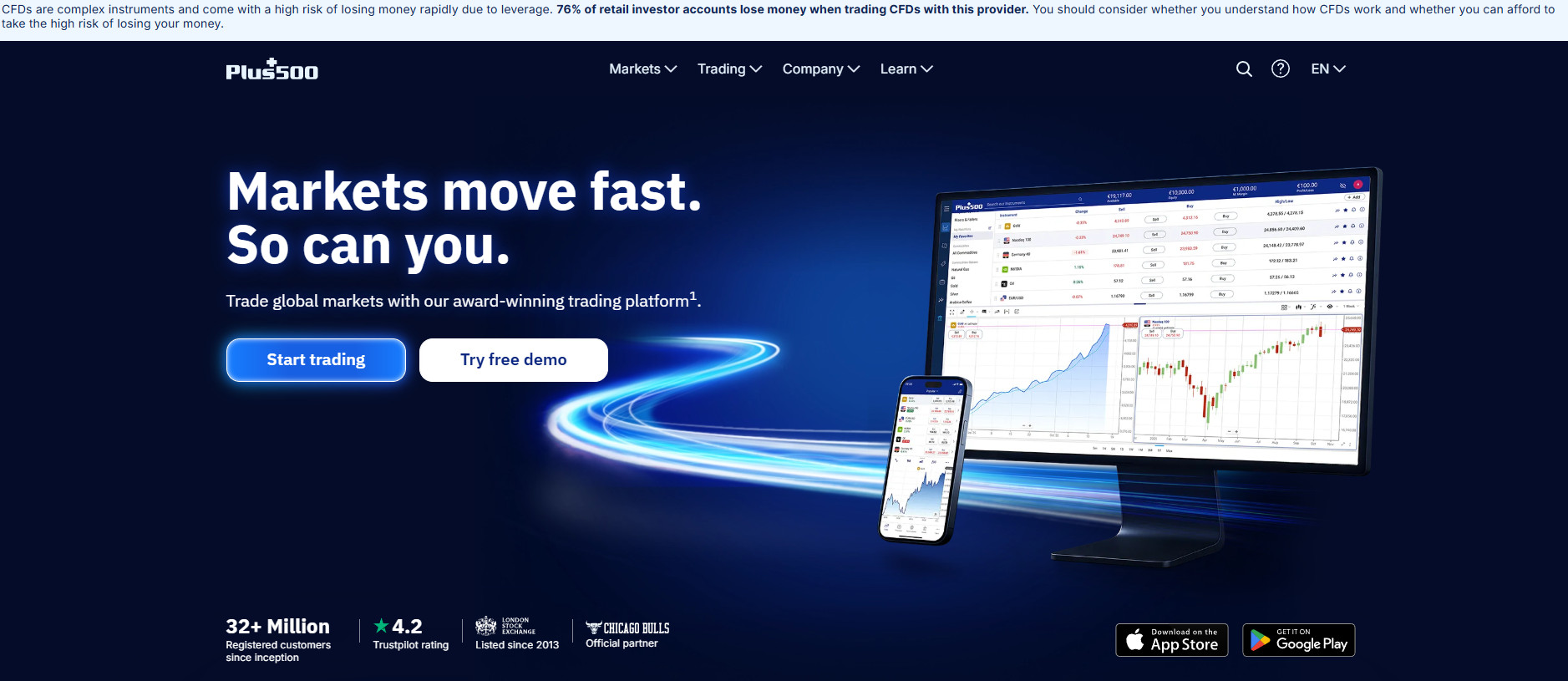

What is Plus500?

Plus500 is a leading CFD provider that truly established a strong foundation for its professional trading environments and further growth. Plus500 was founded in 2008 in Israel and now operates numerous entities worldwide through the UK, Cyprus, Australia, Singapore, and more.

The broker is also a listed regulated financial CFD provider, and the real size of the company is visible by the official number, serving over 32 million registered clients.

What Type of Broker is Plus500?

Plus500 is a top-tier regulated global CFD and Forex broker offering over 2,800 instruments to over a million clients. The broker has a premium listing on the Main Market of the London Stock Exchange.

Plus500 Pros and Cons

Plus500 is a reputable brokerage company with numerous traders worldwide, carrying top-tier licenses from the FCA and ASIC. The broker is also listed on the Stock Exchange for extra transparency. Plus500 is one of the best brokers for CFD trading with easy to use platform and mobile app.

For the Cons, there are no proper research tools, and the product offering is based solely on CFDs. Also, there is a limited selection of platforms when trading with Plus500.

| Advantages | Disadvantages |

|---|

| Heavily regulated broker with a strong establishment | Only CFDs products |

| Listed in London Stock Exchange | Limited research tools |

| Global expansion in over 50 countries | No MT4/MT5 trading platforms |

| One of the best CFDs proposals including CFDs on Indices, Forex, Commodities, and more | |

| Great technical solutions and tools | |

| Competitive trading conditions

| |

| 24/7 customer support | |

Plus500 Features

Plus500 offers a range of instruments, good conditions, and low spreads and fees. Here are the main features that the broker offers:

Plus500 Features in 10 Points

| 🏢 Regulation | FCA, CySEC, MAS, ASIC, FMA, FSCA, ISA, FSA, EFSA, DFSA |

| 🗺️ Account Types | Retail, Demo Accounts |

| 🖥 Trading Platforms | Plus500 Platform |

| 📉 Trading Instruments | Forex, CFDs on Indices, Commodities, Options, Shares, ETFs, Cryptocurrencies |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, CHF, AUD |

| 📚 Trading Education | Trading Academy, Webinars, Beginner's Guide, Glossary, Insights, Economic Calendar |

| ☎ Customer Support | 24/7 |

Who is Plus500 For?

Plus500 enables retail and professional accounts to trade CFDs on a range of assets, offering more than 50 countries with advanced support in 16 languages, 24/7, and truly global coverage of the enabled operation. Based on our findings and Financial Expert Opinions, Plus500 is Good for:

- CFD Trading

- UK clients

- International trading

- Professional traders

- Variety of strategies

- Competitive conditions

- Great technical solutions and tools

- Algorithmic or API traders

- Competitive spreads

- Supportive customer support

Plus500 Summary

Concluding the Plus500 review, we admit a trusted broker with an extensive variety of instruments, provided by OTC operation.

For the quality of service, we witness the good ability to cover various trading demands, easy to use a simple environment, good apps with great spread offering, and a balance between conditions. Overall, Plus500 is among the largest Brokers worldwide and is one of the best for CFD Trading overall.

55Brokers Professional Insights

Plus500 is a globally recognized online broker known for its strong regulatory standing, user-friendly technology, and transparent pricing model.

Founded in 2008 and publicly listed on the London Stock Exchange, the company stands out for its financial transparency and long-term stability in the CFD trading industry. It is regulated by multiple top-tier authorities, including the FCA, ASIC, and CySEC, which enhances client trust through strict compliance standards and fund protection measures.

One of Plus500’s key strengths is its proprietary platform, designed to be intuitive and accessible across desktop and mobile devices, making it especially appealing to beginner and intermediate traders. The broker operates on a commission-free model, with costs primarily built into competitive spreads, ensuring simplicity and cost clarity.

Additionally, Plus500 offers a wide range of instruments, including Forex, stocks, indices, commodities, ETFs, and cryptocurrencies, allowing users to diversify their portfolios within a single platform. With features such as a free demo account, risk management tools, multilingual customer support, and relatively low entry requirements, Plus500 distinguishes itself as a reliable and convenient choice for clients seeking a secure, streamlined, and professionally managed environment.

Consider Trading with Plus500 If:

| Plus500 is an excellent Broker for: | - Need broker with great reputation and Top-Tier licenses.

- Selecting broker with popular instruments.

- Competitive conditions.

- Low fees and spreads.

- Providing services worldwide.

- Beginners and professionals.

- Supports a variety of strategies.

- Need broker with fast execution.

- Secure environment.

- International trading.

- Who prefer higher leverage up to 1:300․

- Looking for 24/7 customer support.

|

Avoid Trading with Plus500 If:

| Plus500 might not be the best for: | - Who prefer industry-known platforms.

- PAMM and MAM accounts are absent.

- Looking for broker with access to VPS Hosting.

- Need broker offering copy trading features. |

Regulation and Security Measures

Score – 4.7/5

Plus500 Regulatory Overview

Plus500 is a safe broker to trade with. It is regulated and licensed by several top-tier financial authorities, including the FCA and ASIC. The broker has an eligible status to offer CFD trading and various underlying products through the application of the strictest guidelines.

How Safe is Trading with Plus500?

Plus500 is fully legit and set according to safety rules applied by world-known and respected regulatory bodies.

- Registration within the world’s respected jurisdiction provides you with a state company that is constantly overseen and established under high standards, thereby guaranteeing its sustainability.

- In addition, Plus500 Ltd is listed on the Main Market of the London Stock Exchange with a solid financial background, bringing an additional level of trust toward them.

In accordance with the FCA, ASIC, CySEC, and other respected regulators, the CFD provider strongly complies with numerous client protective tools.

Regulators are obliged to afford maximum protection of funds under various rules, as well as to apply safety measures under any or various circumstances to guarantee day traders’ safety.

The clients’ funds are always paid into a segregated trust account, so the provider uses its own funds for hedging or any other business purposes.

In addition, all clients’ accounts are protected with Negative balance protection, which means customers cannot lose more than the funds they have in their accounts. For more details, you may verify through the regulators’ official website.

Consistency and Clarity

Plus500 has built a solid reputation in the online trading industry through its long-standing operation, public listing on the London Stock Exchange, and regulation by multiple top-tier authorities.

It consistently receives strong scores from professional review platforms and generally positive feedback from users, who highlight its easy-to-use platform, transparent pricing, and reliable execution. At the same time, some users point out drawbacks such as limited advanced tools, occasional support delays, and spreads that may be higher than those of certain competitors.

Beyond trading services, Plus500 maintains strong brand visibility through major sports sponsorships and global marketing partnerships, reinforcing its presence in the public eye. Overall, its combination of regulatory credibility, stable performance, mixed but largely favorable user reviews, and active corporate profile reflects a broker that delivers consistent service while remaining open to improvement.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Plus500?

Plus500 offers Retail and Demo accounts to all clients. You may simply proceed with account activation along with a minimum deposit to convert your Demo account to a live one.

In addition, you can choose a free unlimited Demo account, which is easily opened and can be converted to real trading.

Retail Account

Plus500 Retail Account offers a straightforward entry point into live CFD trading with a relatively low minimum deposit requirement of $100 to open a live account, depending on your region and payment method.

This account gives users access to a wide range of instruments on Plus500’s proprietary platform with no commission on trades and negative balance protection. There is also a free, unlimited demo account available to practice before funding a live account, and typical conditions include variable spreads and overnight funding fees.

Regions Where Plus500 is Restricted

Plus500 operates globally, but due to regulatory restrictions and compliance requirements, its services are not available in certain regions and countries:

- USA

- Belgium

- Japan

- North Korea

- Iran

- Syria

- Sudan

- Cuba

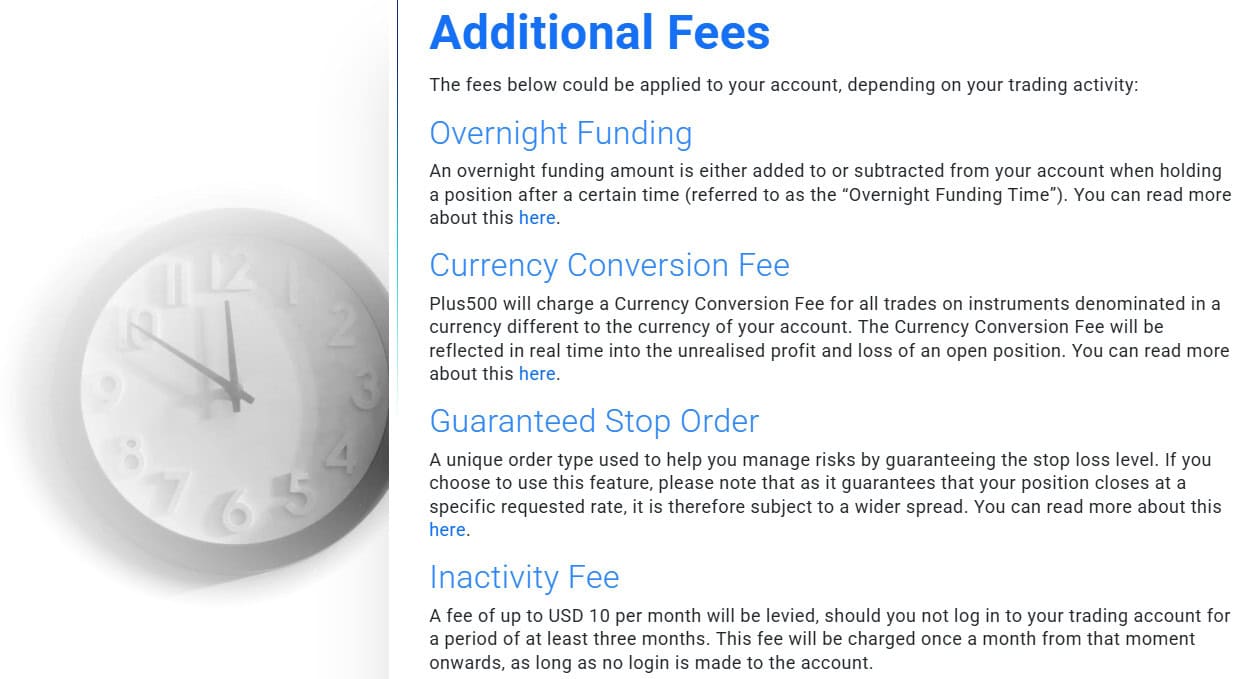

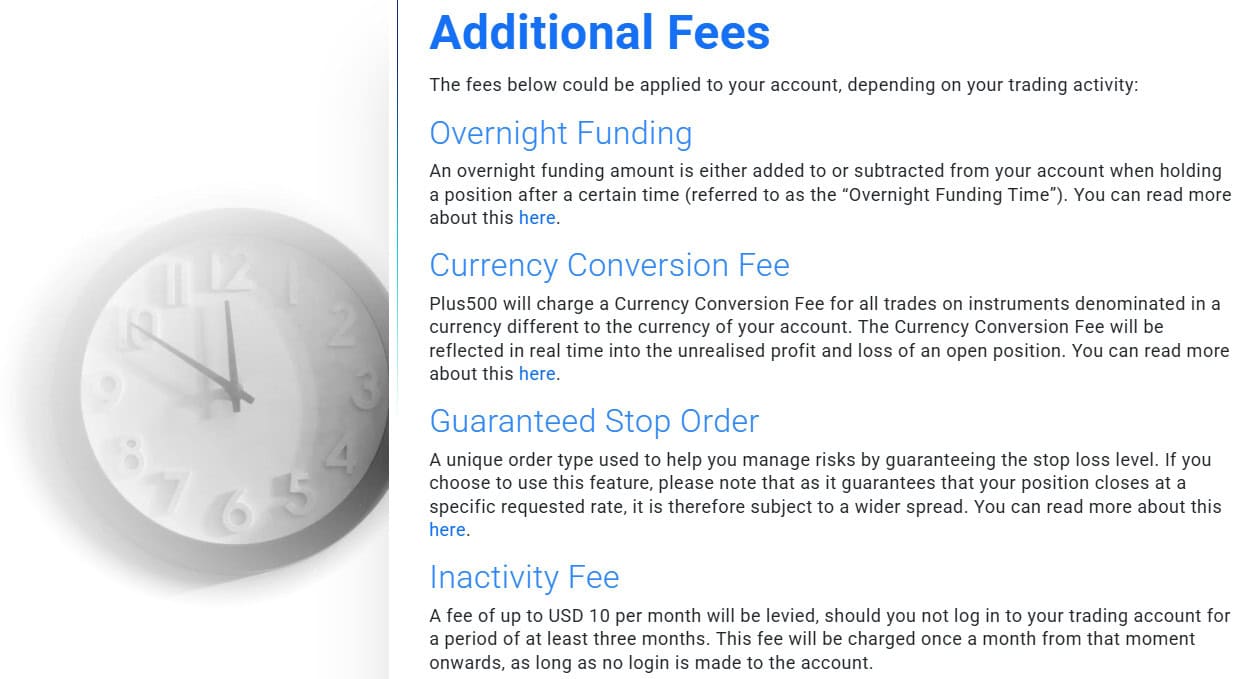

Cost Structure and Fees

Score – 4.6/5

Plus500 Brokerage Fees

Plus500 applies a transparent fee structure with no surprises; all costs are essentially built into the competitive spread. The broker charges no withdrawal or deposit fees. However, some additional fees, like a $10 inactivity fee, are charged in case your account remains inactive with no trades for a period of three months.

Always note that fees are always changing as Plus500 offers fixed and dynamic spreads. They are constantly adjusted to the market conditions; therefore, here we provide spreads and rates for reference only, that was actually at the time of writing.

Plus500’s charges are primarily built into its spreads, which also include most of the CFD fees offered by the broker. The broker provides competitive pricing, with spreads considered among the tighter ones in the market, and an average EUR/USD spread of 1 pip.

Plus500 generally does not charge commissions on standard CFD trades across its range of markets, including Forex, stocks, indices, commodities, and cryptocurrencies.

The broker may apply additional fees in specific cases, such as for overnight positions or certain corporate actions, but there are no direct per-trade commission charges on regular CFD transactions.

Plus500 applies rollover charges on positions that are held open overnight, which reflect the cost of financing the leveraged portion of the trade.

These fees vary depending on the instrument, the direction of your position, and market interest rates, and are automatically calculated and applied each day the position is kept open past the trading session cutoff. Rollover charges are shown clearly in the platform before you open a trade, helping you understand the potential cost of holding positions over multiple days.

Besides costs like spreads and rollover charges, Plus500 applies a few additional account fees. The most notable is a $10 monthly inactivity fee, charged if an account remains unused for a certain period, typically three months.

Other potential charges include currency conversion fees if your account currency differs from the instrument traded and bank or withdrawal fees, depending on the payment method. All such fees are clearly disclosed in the broker’s schedule and visible in the platform.

How Competitive Are Plus500 Fees?

Plus500’s overall fee structure is competitive within the online brokerage space, especially for users who prefer a simple, commission‑free pricing model.

As costs are primarily incorporated into spreads rather than separate charges, many clients find it easier to understand and compare trading expenses. While spreads can widen during volatile market conditions, Plus500 generally offers spreads that are in line with or tighter than those of many similar CFD brokers, making it an attractive choice for cost‑conscious retail traders.

Additionally, its transparent fee disclosures and lack of hidden charges contribute to a clearer picture of costs compared with some other providers.

| Asset/ Pair | Plus500 Spread | eToro Spread | Purple Trading Spread |

|---|

| EUR USD Spread | 1 pip | 1 pip | 1.3 pips |

| Crude Oil WTI Spread | 0.04 | 5 pips | 0.03 |

| Gold Spread | 2.64 | 45 | 0.09 |

| BTC USD Spread | 133.75 | 1% | - |

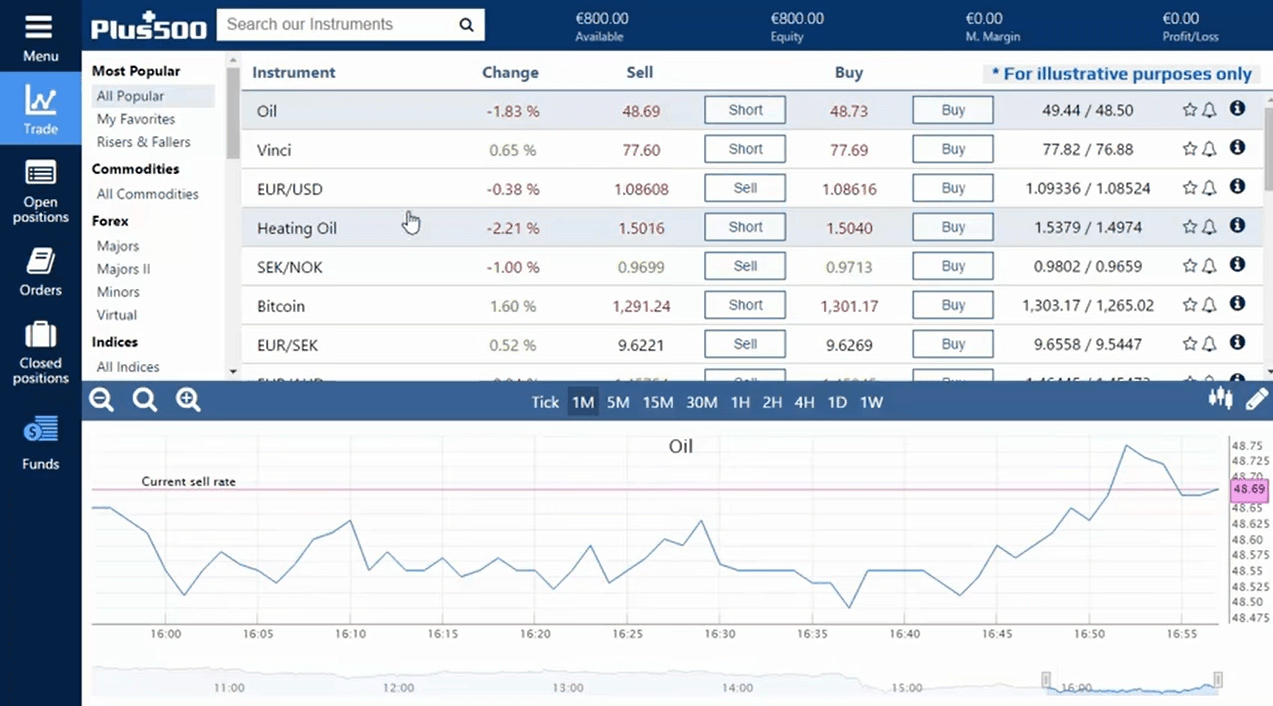

Trading Platforms and Tools

Score – 4.4/5

Plus500 has a simple, intuitive, and easy-to-use platform interface for CFDs that is a Plus500 proprietary platform. The platform is solely based online.

Trading Platform Comparison to Other Brokers:

| Platforms | Plus500 Platforms | eToro Platforms | Purple Trading Platforms |

|---|

| MT4 | No | No | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | Yes |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Plus500 Web Platform

The trading software is simple to use and understand, while everything happens right through the website. Once you log in, you will see a clean and understandable interface with a watchlist and full control over your account, with search, portfolio settings, and fee reports, along with statistics.

Plus500 web platform is easy to navigate and use, with a nice and clean design and great charts, as well as well-defined product search functions.

Main Insights from Testing

Plus500’s web platform is intuitive, fast, and easy to navigate, making it suitable for both beginners and experienced users. Charting tools are clear and include essential indicators, while order entry is straightforward with quick access to market data.

The platform is fully browser‑based, so it requires no downloads, and updates and executions happen in real time. Although advanced traders may find some tools limited compared with specialized platforms like MetaTrader, the overall usability, clean interface, and integrated risk management features make the Plus500 web platform a reliable and accessible option for CFD trading.

Plus500 Desktop MetaTrader 4 Platform

Plus500 does not offer the MetaTrader 4 platform. Instead, the broker provides its own proprietary platform, which includes built-in charting, risk management tools, and access to a wide range of CFDs.

Plus500 Desktop MetaTrader 5 Platform

Plus500 does not support the MT5 platform either. Traders using Plus500 rely on the broker’s proprietary platform for all CFD trading, rather than MT5, which means features and tools are specific to Plus500’s system rather than the MetaTrader environment.

Plus500 MobileTrader App

Along with WebTrader, you may use great mobile trading, especially well designed, suitable for Android, iPhone, or iPad. Actually, it gained one of the highest ratings as the best mobile platform as a CFD trading mobile app on Apple’s App Store and Google Play.

Plus500 mobile platform is also packed with the necessary tools and full control over your account or positions, which brings you great accessibility on the go.

AI Trading

Plus500 does not currently offer dedicated AI‑driven tools such as automated algorithmic advisors or predictive AI signals built into its platform.

The broker focuses on providing a clean and intuitive proprietary interface with standard charting and analysis tools, but does not market features like AI‑based trade recommendations or algorithmic strategy automation.

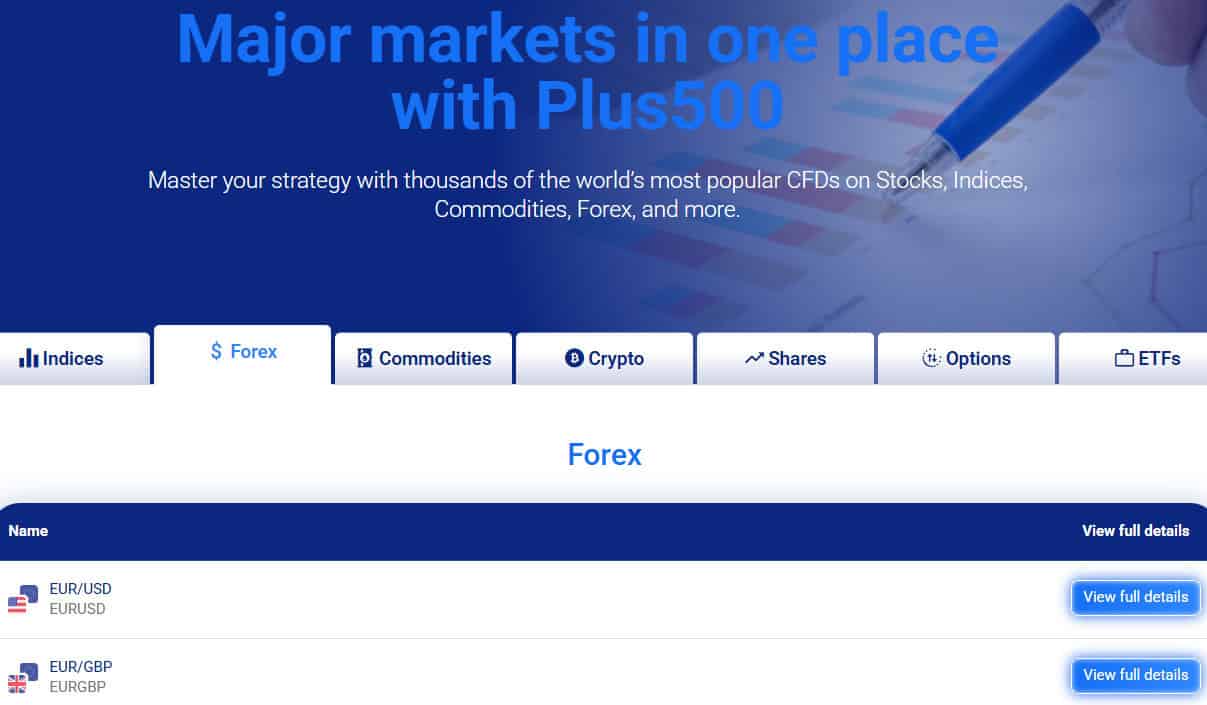

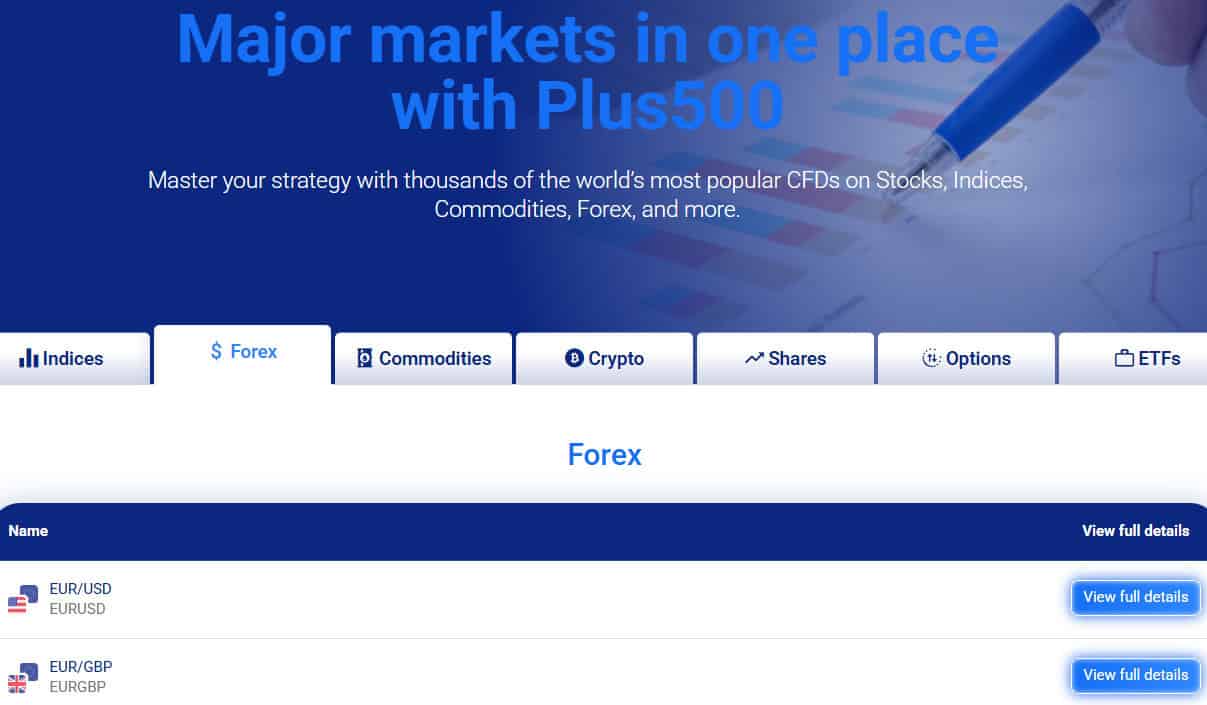

Trading Instruments

Score – 4.6/5

What Can You Trade on Plus500’s Platform?

Plus500 offers a truly great portfolio with over 2,800 instruments, so you surely will find the right portfolio to trade. The provider enables you to trade and speculate on movements in the price alongside innovative technology.

The proposal itself offers indices, shares, commodities, currency pairs, ETFs, and options on CFD instruments on a basis. In addition, Plus500 also offers quite an advanced capability of crypto trading while adding more and more instruments to its list.

CFDs and Forex via CFDs trading offer a great advantage to you as a trader, as it means you are not buying or selling the underlying instrument but speculating on its movement. Also, CFDs are traded as leveraged products with the possibility to access higher options if you are a professional trader, which magnifies your possibilities as well as your losses when using leverage. Therefore, you need to use them smartly.

Main Insights from Exploring Plus500’s Tradable Assets

The broker offers a well-balanced and diversified selection of instruments that allows users to access multiple global markets from a single platform. During testing, asset information was clearly presented, with transparent margin requirements and contract details, making it easier for users to understand conditions before opening positions.

Leverage Options at Plus500

The residents of various countries fall under particular jurisdiction rules. So before you get started, you should verify and clear what level you are entitled to use, as users will face some differences between the multiplier levels offered due to regulations. Also, according to your level of experience, as professionals, you may access high-leverage ones once the status is proven.

- European CySEC, ASIC, and FCA-regulated traders will enjoy maximum leverage of 1:30.

- MAS traders are allowed to get a multiplication of Plus500 leverage up to 1:50.

- South African traders will be offered to use 1:20 for Shares, 1:300 for Forex and Indices, and 1:30 for Crypto assets.

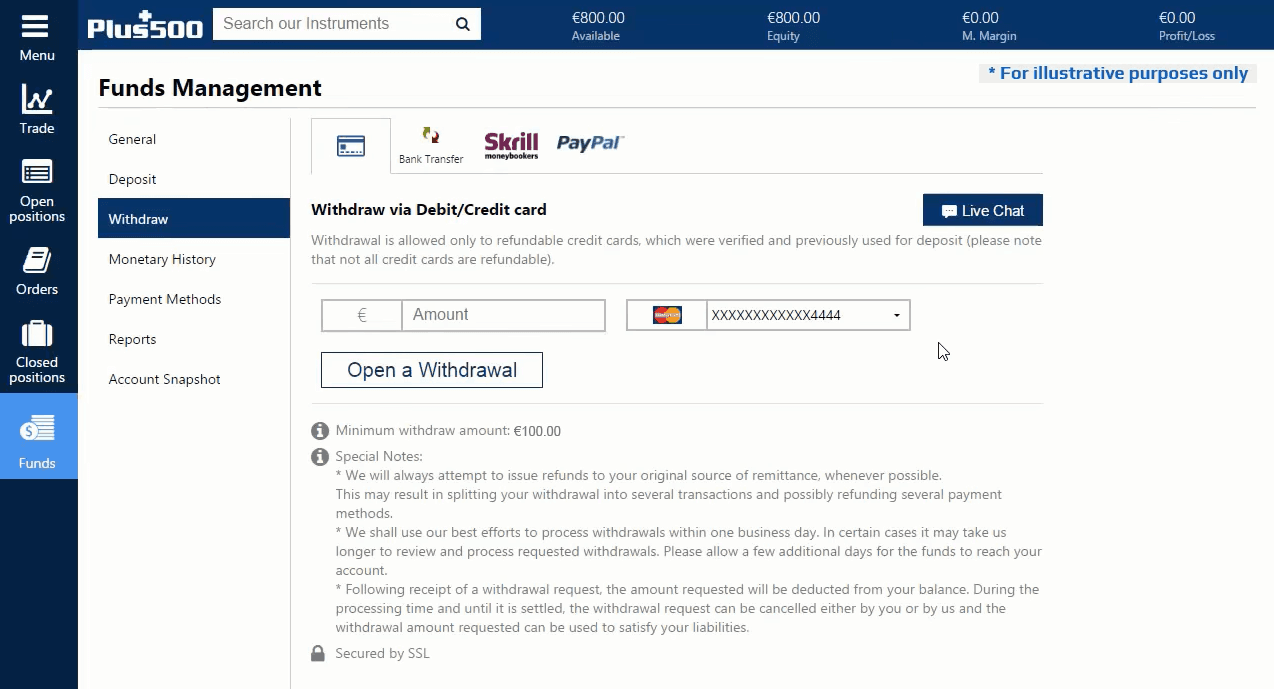

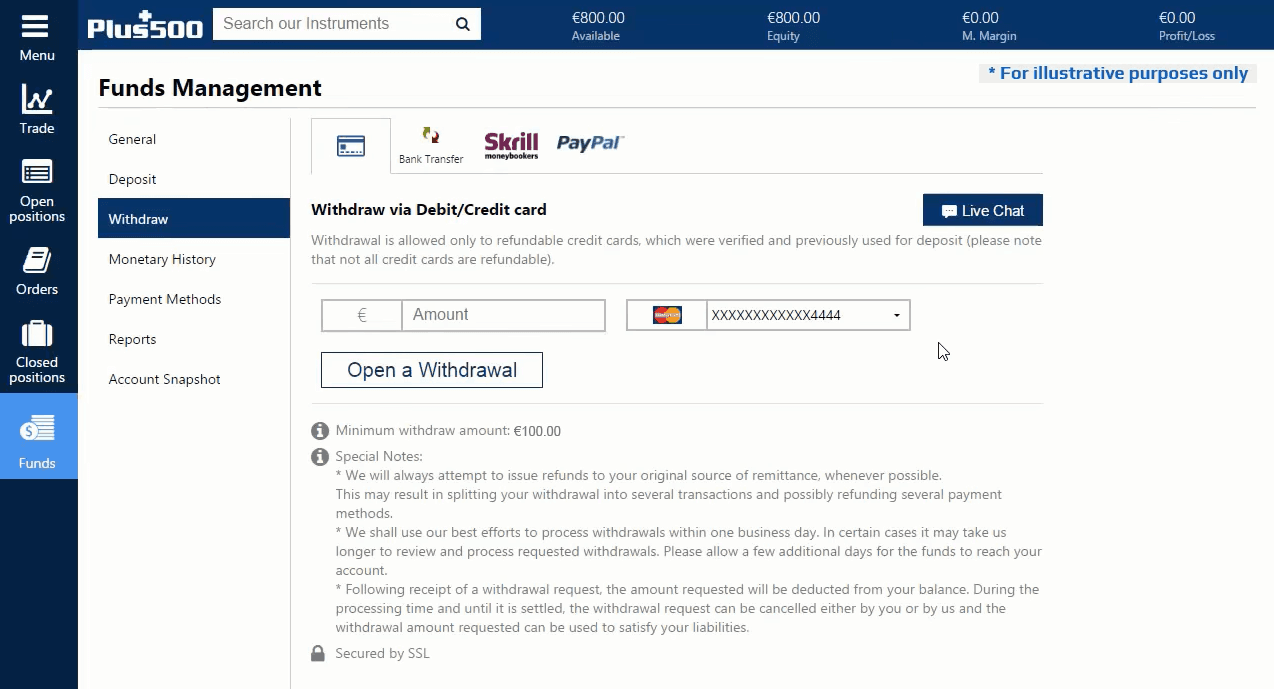

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Plus500

In terms of funding methods, Plus500 offers numerous payment methods, which is a very good plus, yet check according to its regulations whether the method is available or not.

- Credit/Debit cards

- Bank Wire

- PayPal

- Skrill, etc.

Plus500 Minimum Deposit

Plus500’s minimum deposit is $100, but varies according to the jurisdiction under which the trading account is opened. It is important to note that each method has its own minimum deposit requirement, too.

Withdrawal Options at Plus500

Plus500 does not charge any fees or commissions on deposits/withdrawals; however, you may be subject to fees from banks involved in the case of bank transfers. The broker typically processes withdrawal requests within 1-3 business days.

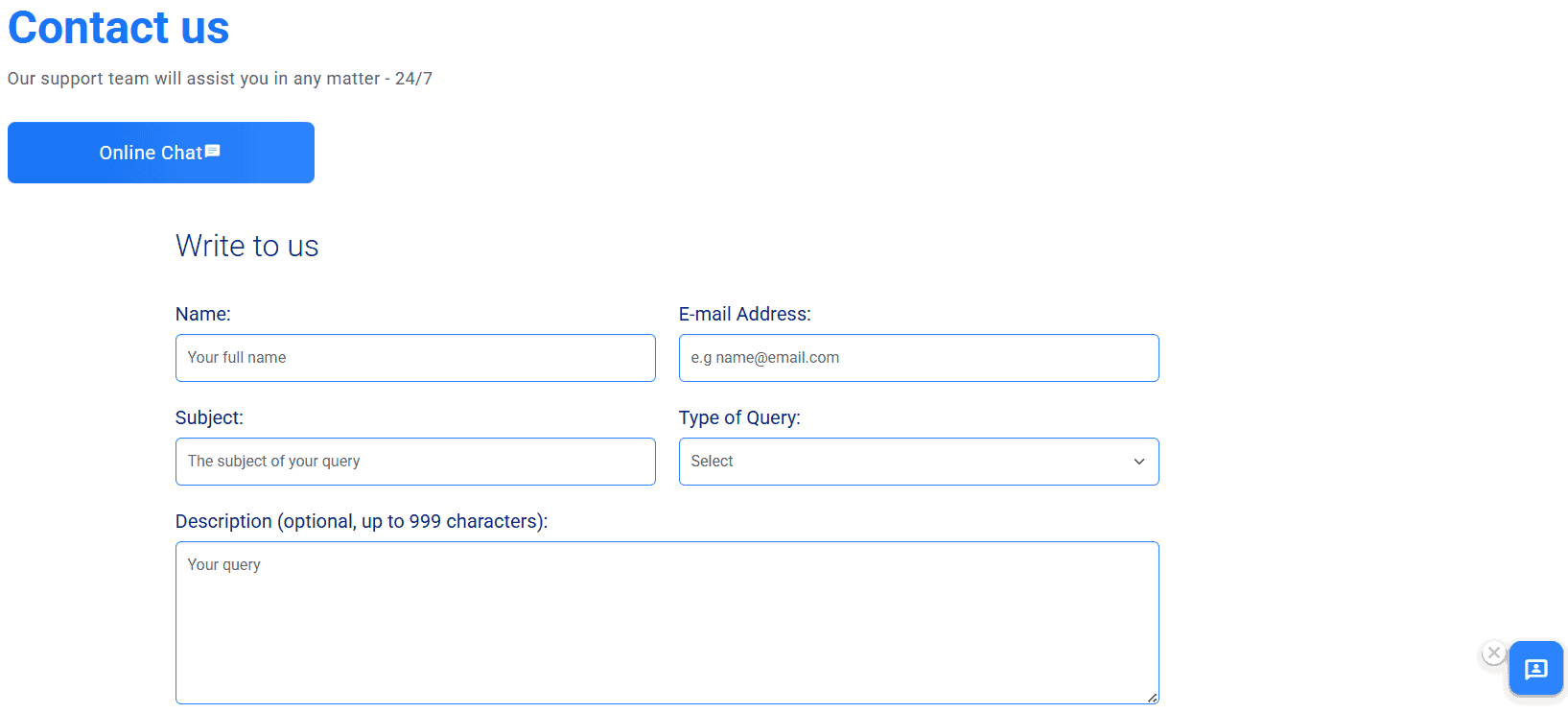

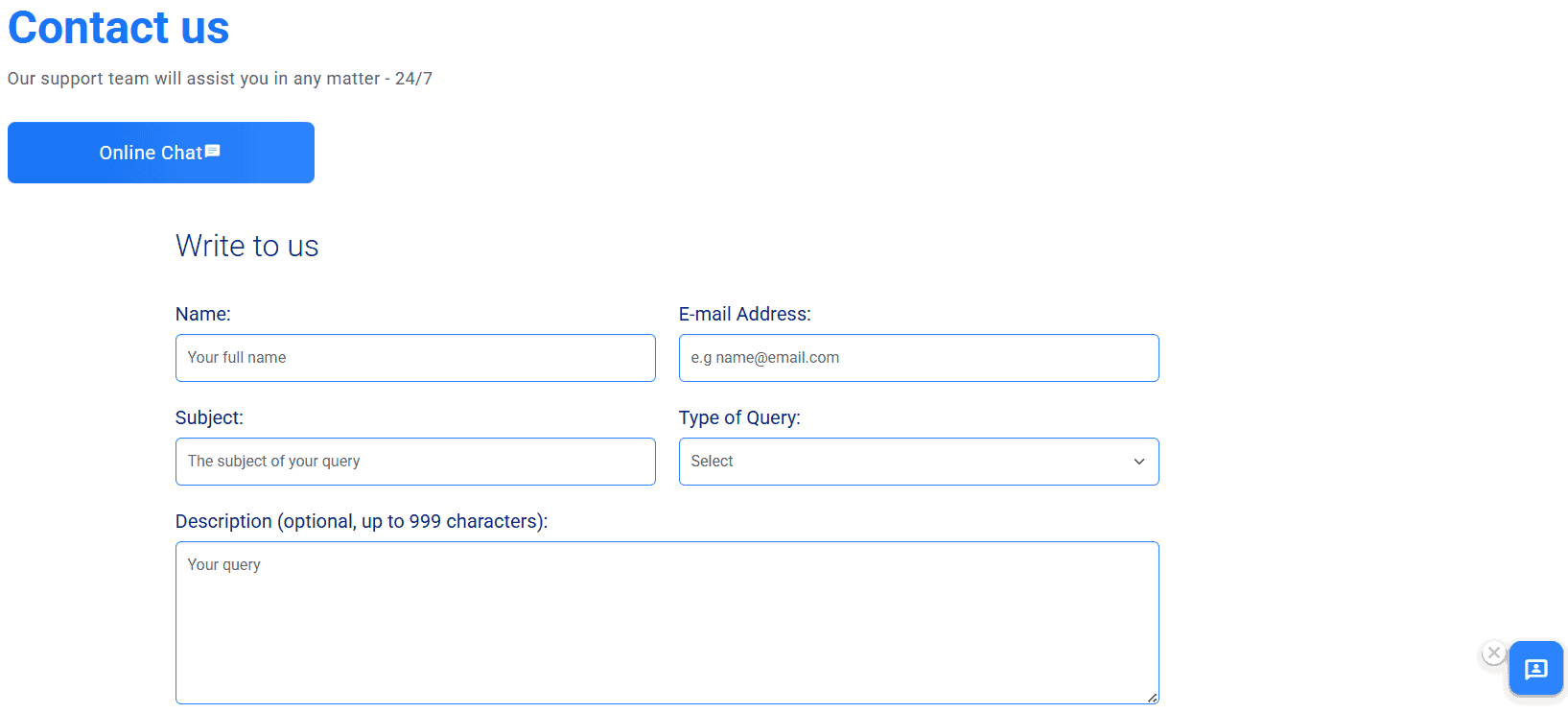

Customer Support and Responsiveness

Score – 4.6/5

Testing Plus500’s Customer Support

Another great strength of Plus500 is its customer support service, which is available 24/7 and offers assistance through live chat and email. This means that whenever you have a question or inquiry, you can easily contact the support team and expect professional and reliable help.

Plus500 supports users in various ways by providing relevant answers and quick, clear guidance when needed. This high level of responsiveness is especially valuable for clients. In addition, the wide range of supported languages and round-the-clock availability through live chat further enhance the broker’s reputation, as this level of customer support is relatively rare among many other brokers.

Contacts Plus500

If you need to get in touch with Plus500’s customer support, you can contact them by email at compliance@plus500.co.uk. For telephone support, you may call +44 203 876 1640 for general inquiries and assistance.

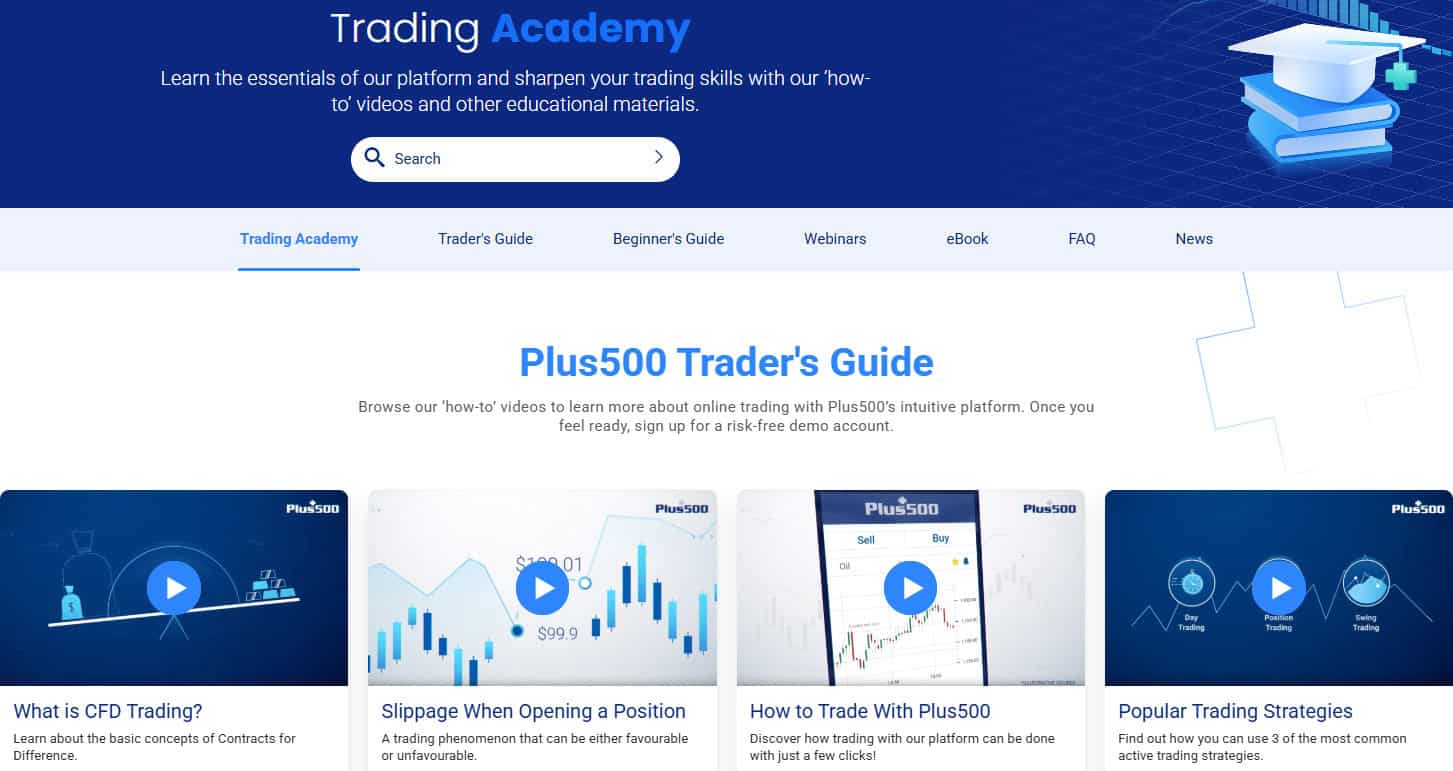

Research and Education

Score – 4.5/5

Research Tools Plus500

Plus500 provides a useful suite of research and analysis tools accessible both through its website and directly on the platform.

- On the website, users can find market news updates, the economic calendar, and instrument specifications that help with understanding conditions and market events.

- Within the platforms, built-in tools include real-time price quotes, customizable charts with technical indicators, and risk management overlays that support informed decision-making.

While not as advanced as specialized third-party analysis software, these integrated research tools offer users essential market insights and analytical capabilities within a single, streamlined environment.

Education

Plus500 offers a range of educational resources to help users of all levels improve their skills and understanding of the markets. These include a Trading Academy with structured lessons, Webinars on relevant topics, a Beginner’s Guide for new users, and a glossary of key financial terms.

The platform also features market insights and an economic calendar to keep traders informed about important events that may impact markets. Together, these tools create a solid foundation for learning and staying up to date with market developments.

Portfolio and Investment Opportunities

Score – 4/5

Plus500 is primarily focused on Forex and CFD trading, offering access to a wide range of markets including currency pairs, indices, commodities, stocks, ETFs, and cryptocurrencies through leveraged contracts for difference.

While its core offering centers on speculative trading rather than traditional investing, Plus500 also offers an Invest account in select regions that allows direct ownership of real shares. However, the platform does not offer broader investment solutions such as managed portfolios, robo-advisors, or long-term wealth-management products.

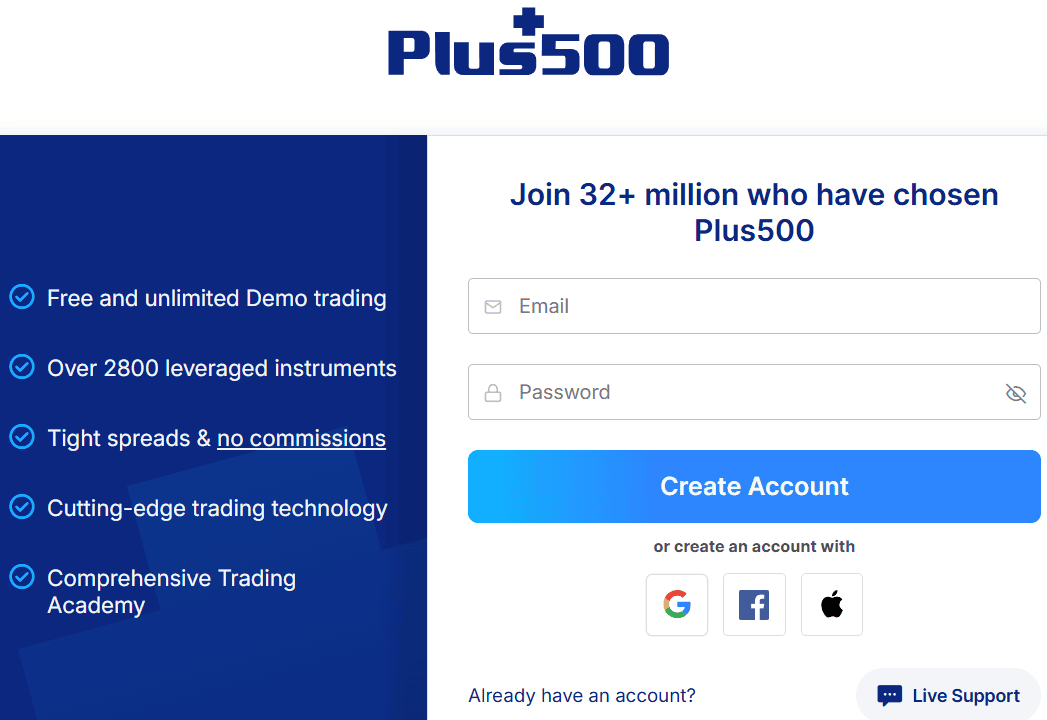

Account Opening

Score – 4.5/5

How to Open Plus500 Demo Account?

Opening a Plus500 demo account is a simple and quick process that allows users to practice without risking real money. You can start by visiting the Plus500 website or downloading the app, then selecting the option to open a demo account.

Registration usually requires only basic information, such as an email address and password, and no initial deposit is needed. Once registered, you gain instant access to a virtual balance and the full platform, enabling you to explore features, test strategies, and become familiar with market conditions before moving to a live account.

How to Open Plus500 Live Account?

Opening an account with Plus500 is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Follow the Plus500 Sign-In or create an account link.

- Enter your personal data (Name, email, phone number, etc.).

- Verify your account and identity by uploading confirmation documents (residential proof like a utility bill, a copy of your ID, a bank statement, etc.).

- Complete the online quiz form to confirm your trading experience.

- Once an account is activated and proven, which may take up to 2 business days, follow with the money deposit and enjoy trading.

Additional Tools and Features

Score – 4.4/5

Beyond standard research and educational resources, Plus500 offers several additional tools and features to enhance the experience.

- These include price alerts to notify you of key market movements, trailing stops, and advanced risk-management orders to help protect positions, customizable watchlists to monitor favorite instruments, and account performance reports that help track your trading history.

These built-in features support more effective trade planning and risk control, making the platform more versatile for both new and experienced users.

Plus500 Compared to Other Brokers

Plus500 stands out as a broker with a simple and accessible offering, particularly appealing to retail traders due to its low minimum deposit and straightforward proprietary platform.

Compared to competitors, it maintains competitive spreads and transparent pricing, making it suitable for users who value clarity and low entry costs. While some competitor brokers provide access to multiple platforms like MT4/MT5 or advanced charting tools, Plus500 focuses on its own intuitive platform, which prioritizes ease of use over advanced customization.

In terms of assets, Plus500 offers a broad range of instruments, though some competitors may offer larger or more specialized selections. The broker is heavily regulated across multiple jurisdictions, ensuring strong oversight and client protection, and it offers 24/7 customer support, which exceeds the availability provided by many peers.

Overall, Plus500 positions itself as a reliable, beginner‑friendly broker with solid regulation, transparent fees, and a user-focused environment, while some competitors may appeal more to advanced traders seeking sophisticated platforms or extremely wide asset choices.

| Parameter |

Plus500 |

GBE Brokers |

Ultima Markets |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1 pip |

Average 0.8 pips |

Average 1 pip |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

Not available for standard CFD trades. For Futures Contracts only ($0.49 per side for Micro futures contracts and $0.89 per side for Standard or E‑Mini futures contracts)

|

0.0 pips + $3.5 per side |

0.0 pips + $2.5 per side |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

Plus500 Platform |

MT4, MT5, TradingView |

MT4, MT5, MT4 WebTrader, Mobile App |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

2,800+ instruments |

1000+ instruments |

250+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FCA, CySEC, MAS, ASIC, FMA, FSCA, ISA, FSA, EFSA, DFSA |

CySEC, BaFin, FSA |

FCA, CySEC, FSC |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/7 |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Excellent |

Good |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

$100 |

$1,000 |

$50 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker Plus500

Plus500 is a well-established Forex broker, publicly listed and regulated by multiple top-tier authorities, offering a reliable and transparent environment.

It specializes in CFDs across a wide range of markets, including Forex, indices, commodities, stocks, ETFs, and cryptocurrencies, with costs embedded in competitive spreads and no commissions on standard CFD trades.

The broker provides a user-friendly proprietary platform accessible via web and mobile, featuring real-time charts, risk management tools, price alerts, and an economic calendar to support informed decisions. Additional resources include educational materials, a demo account for practice, and 24/7 multilingual customer support.

With a low minimum deposit, strong regulatory oversight, and a focus on simplicity and accessibility, Plus500 is well-suited for retail traders seeking a secure and straightforward trading experience.

Share this article [addtoany url="https://55brokers.com/plus500-review/" title="Plus500 – CFD Service"]

Do you also have an acc manager and a trade on us initial trade upon trading?

Comment Sorry to compare you, but is there a risk free zone to trade like some other brokers? If there is, pls enlighten me. The risk is too much

Comment I am interested in opening PAMM accounts and what are the conditions?Area