- What is Nadex?

- Nadex Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Nadex Compared to Other Brokers

- Full Review of Broker Nadex

Overall Rating 4.4

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 3.5 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 3 / 5 |

What is Nadex?

North American Derivatives Exchange, better known as Nadex, is the first and actually largest US exchange that offers legal and fully regulated opportunities to trade Binary options, Knock-outs, and Call Spreads.

There is a dramatic difference between a broker and an exchange. Since Nadex matches buyers and sellers, it does not take positions in any of the markets. Thus, Nadex is a fully legit US Broker with access to a Regulated Binary Options Exchange.

- This is indeed an absolutely progressive trading opportunity, as previously, the majority of US residents could only trade through offshore entities, which we never recommend due to lack of reliability and regulation.

Nadex Pros and Cons

Based on our findings, Nadex is an established, and reliable exchange regulated in the US. The exchange has an excellent reputation since it provides competitive trading proposals, and is the only Regulated exchange to trade binary options. Nadex offers great trading tools and technology with low fees.

For the Cons, binary options are a risky trading instrument, and also there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Strong establishment and US regulation | No 24/7 support |

| Good reputation | Binary Option is risky trading instrument |

| The Only Binary Options Regulated Broker | |

| Competitive trading proposal, legal way to trade binary options | |

| Great trading tools and trading technology | |

| Proprietary awarded software | |

| Low fees and commissions | |

Nadex Features

Nadex is an exchange with regulation in the US, offering innovative solutions and access to innovative products like binary options, knock-outs, and call spreads. With favorable conditions, a transparent fee structure, and regulated status, Nadex will satisfy clients looking for advanced trading opportunities. For more insight into the company’s proposals, we have researched and compiled its main aspects in one place:

Nadex Features in 10 Points

| 🗺️ Regulation | CFTC |

| 🗺️ Account Types | Individual account, Demo account |

| 🖥 Trading Platforms | Nadex Platfrom, NadexGO |

| 📉 Instruments | Binary options and spreads trading on stock indices, Forex and commodities |

| 💳 Minimum deposit | No minimum deposit |

| 💰 Average EUR/USD Spread | 0.25 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD |

| 📚 Trading Education | Learning center with comprehensive materials |

| ☎ Customer Support | 23/5 |

Who is Nadex For?

Based on Our findings and Financial Expert Opinions Nadex is Good for different traders and market needs. Here are the main spheres where Nadex excels and is good for:

- Professional traders

- US Traders

- Binary options and spreads trading

- Variety of trading strategies

- Good customer support

- Excellent educational materials

- Low fees and competitive spreads

Nadex Summary

To summarize the company’s offerings, Nadex is very promising and competitive. Traders have the pure opportunity to trade Binary Options and Call Spreads with a fully regulated company in the US, which is the only one offering this in the market compared with unreliable offshore brokers.

In addition, traders will benefit from a low-cost strategy, with a commission of $1 per contract, good educational materials, great company support, and low deposits.

55Brokers Professional Insights

Nadex is remarkable for its regulated and innovative exchange for retail traders in the US with availability to legally trade Binary Options. It offers a unique range of products like binary options, knockouts, and call spreads that are typically offered only by offshore brokers and are not very safe. These financial instruments allow traders to take advantage of short-term market opportunities with defined risks and rewards, which is great to have under the regulated by the US entity, which is the only Broker we mark as good to trade Options.

As we found, Nadex’s services are easily accessible and quite simple, with no minimum deposit requirement, fees that are mostly transparent, and an intuitive trading interface that stands out for its flexibility and simplicity. The platform is suitable for the needs of both beginners and professional traders. Another advantage is the availability of a free demo account that enables clients to test strategies on the platform and gain skills before switching to real trading. Nadex also provides learning materials that broach various trading subjects guiding traders to navigate the market with success. However, its target products are binary options and short-term contracts, mostly unsuitable for long-term investors and clients who favor traditional financial instruments. Nevertheless, we see that Nadex clearly stands out as an innovative, flexible, and well-regulated opportunity.

Consider Trading with Nadex If:

| Nadex is an excellent Broker for: | - Beginner traders

- Short-term investors

- US Traders

- Those who favor Binary options

- Clients looking for lower fees and competitive costs

- Those looking for innovative ways of investment

- Professional traders

- Various trading strategies |

Avoid Trading with Nadex If:

| Nadex is not the best for: | - Those who prefer traditional investment options

- Long-time investors

- Clients outside the US |

Regulation and Security Measures

Score – 4.4/5

Nadex Regulatory Overview

Nadex is a US-based company located in Chicago and is regulated by the CFTC as a financial exchange. Due to the rigorous regulation, Nadex adheres to strict guidelines, ensuring transparency, security, and clarity in the company’s services. Based on our findings, Nadex is indeed a pioneer company that offers a fully legal way to trade binary options and Call Spreads. We also found that Nadex is part of the Crypto.com global brand.

How Safe is Trading with Nadex?

We learned that Nadex operations are strictly overseen and comply with international safety measures while the client is protected by numerous obligations.

Nadex also defines its function as an exchange service company that ensures all trades are executed fairly and in accordance with US laws. The environment is fully collateralized without leveraged risk, with no margin calls or debt risk. In particular, Nadex complies with solid risk control trading systems and strongly protects client money. All funds are kept in segregated accounts in US banks.

Consistency and Clarity

As we found Nadex has been operating since 2009. However, our research revealed that the company was founded back in 2004 and functioning under another brand name – HedgeStreet. Through the years, Nadex has approved its offerings, concentrating mainly on innovative, short-term financial instruments like binary options, knock-outs, and call spreads. The offering is completely safe, as Nadex is strictly regulated by the Commodity Futures Trading Commission (CFTC).

As a global reputable exchange company, Nadex has over 10,000 hourly, daily, and weekly contracts traded five days a week on desktop and mobile platforms. It is a highly regarded company, which has gained great reviews from global traders for its transparency and good quality services. Many traders share their positive experiences with the company, pointing out Nadex’s intuitive platform and mobile app, security Nadex ensures, and good educational resources. Among concerns are technical issues some traders report, and lacking experience with the customer support team. However, despite negative experiences, which is also a normal occurrence in the market, as the experience and expectations are purely individual, we still find Nadex a well-established exchange company, enabling traders to explore unique opportunities.

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with Nadex?

Nadex offers accounts with innovative features, an advanced platform, and access to the products and markets that it offers.

Individual Account

For its retail traders, Nadex offers an Individual Account, which provides full access to Nadex’s innovative products, including binary options, knock-outs, and call spreads. There is no minimum deposit requirement and the fees offered are transparent and clear, with a $1 per contract fee. With the Nadex Individual account, traders gain access to a wide range of global markets, including forex, commodities, and stock indices. receiving real-time pricing and essential market data. The account gives access to the market 23/5.

Demo account

Nadex’s Demo account is a great option for traders who first want to get acquainted with the peculiarities of trading with Nadex, before opening a live account. The Demo Account offers virtual funds of $10,000, allowing users to explore the market risk-free. The demo account offers the same features as the live account, providing access to the same instruments and markets, the platform, and the same tools. The opening process is quick, with only essential personal information required.

Regions Where Nadex is Restricted

Nadex accepts clients from a good range of countries, enabling residents from different parts of the world to join the market. Below are listed the available countries:

- Austria

- Belgium

- British Virgin Islands

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Guernsey

- Hungary

- India

- Ireland

- Isle of Man

- Israel

- Italy

- Japan

- Jersey

- Liechtenstein

- Lithuania

- Luxembourg

- Malaysia

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Slovakia

- Slovenia

- South Korea

- Spain

- Sweden

- Switzerland

- United Kingdom

- United States

Cost Structure and Fees

Score – 4.3/5

Nadex Fees

Trading fees on Nadex depend on the product type: binary options, call spreads, and Knock-Out contracts. Nadex does offer spreads, but they are a little different from traditional forex brokers. Instead of variable bid-ask spreads, the spreads at Nadex are determined by market supply and demand on the exchange. As an exchange, Nadex allows traders to place limit orders directly without broker intervention, eliminating expensive commissions. Instead, Nadex charges a fixed $1 per side, per contract, for direct members.

The average spread for EUR/USD depends on prevailing market conditions, volatility, and the type of contract, whether binary options, call spreads, or Knock-Out contracts.

- If you hold a position until expiration and it settles in the money, then you will be charged a settlement fee of $1 per contract.

- If you hold the position to expiration and it expires out of the money with a value of zero, there is no settlement fee charged.

For more detailed information, traders can go to the Contract Specification section on the broker’s website.

How Competitive Are Nadex Fees?

We found Nadex fees transparent and competitive, particularly because it states clearly exactly how much it costs to enter and exit a trade. While traditional brokers charge variable spreads and commissions, Nadex charges $1 per contract on each side, with reduced pricing as low as $0.35 per side for high-volume traders. For some traders, this per-contract pricing might not be appealing, especially for those who prefer commission-based structures. However, Nadex with its fee structure can be suitable for short-term trading.

| Asset/ Pair | Nadex Spread | Pepperstone Spread | IG Spread |

|---|

| EUR USD Spread | 0.25 pips | 1 pips | 1 pip |

| Crude Oil WTI Spread | 0.25 pips | 2.4 pips | 2.8 pips |

| Gold Spread | 0.25 | 0.15 pips | 0.3 |

| BTC USD Spread | $1.00 | 20.22 | 92 |

Nadex Additional Fees

Also, we found that Nadex has a non-trading fee to consider. If the account is inactive for 12 months, the account might be archived and the Nadex membership canceled. However, for accounts that hold funds, there would be a monthly inactivity fee of $10.00. Otherwise, Nadex is transparent in its pricing and does not have any hidden fees that might catch clients by surprise.

Score – 4.4/5

Based on our Expert research, we found that Nadex offers its proprietary Nadex web and desktop trading platforms and NadexGO mobile app.

| Platforms | Nadex Platforms | Pepperstone Platforms | XM Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Nadex Web Platform

Nadex offers online and mobile platforms that allow clients to take short-term positions and speculate on the minimum price movements for an offered wide range of markets. Nadex platforms connect users directly to the Nadex exchange, so the pricing is built accurately and orders are placed quickly.

Nadex Desktop Platform

We learned that the Nadex desktop platform is equipped with powerful characteristics, that allow clients to track, manage, and analyze markets in the best manner with its full-featured charts, technical indicators, drawing tools, and signals. Besides, clients have free access to market data with unique ladder charts, making trading from charts easy and possible by selecting markets and orders to be placed, which is a good offering overall.

Nadex MobileTrader App

NadexGO is another addition to the seamless trading as a mobile version, which is synchronized with the desktop version but allows clients to stay up-to-date on the go from almost any point so long as they have an internet connection. It provides complete access to the trading products of Nadex, real-time market data, and order management tools for comfortable and efficient trading. The intuitive interface and responsive design of NadexGO enable traders to easily make and monitor trades from any location.

Main Insights from Testing

Testing of Nadex platforms reveals that the company offers a user-friendly platform, featuring real-time market data, advanced charting, and seamless synchronization between desktop and mobile (NadexGO). We found that Nadex has its own platforms and does not offer the market-popular MT4 or MT5 platforms.

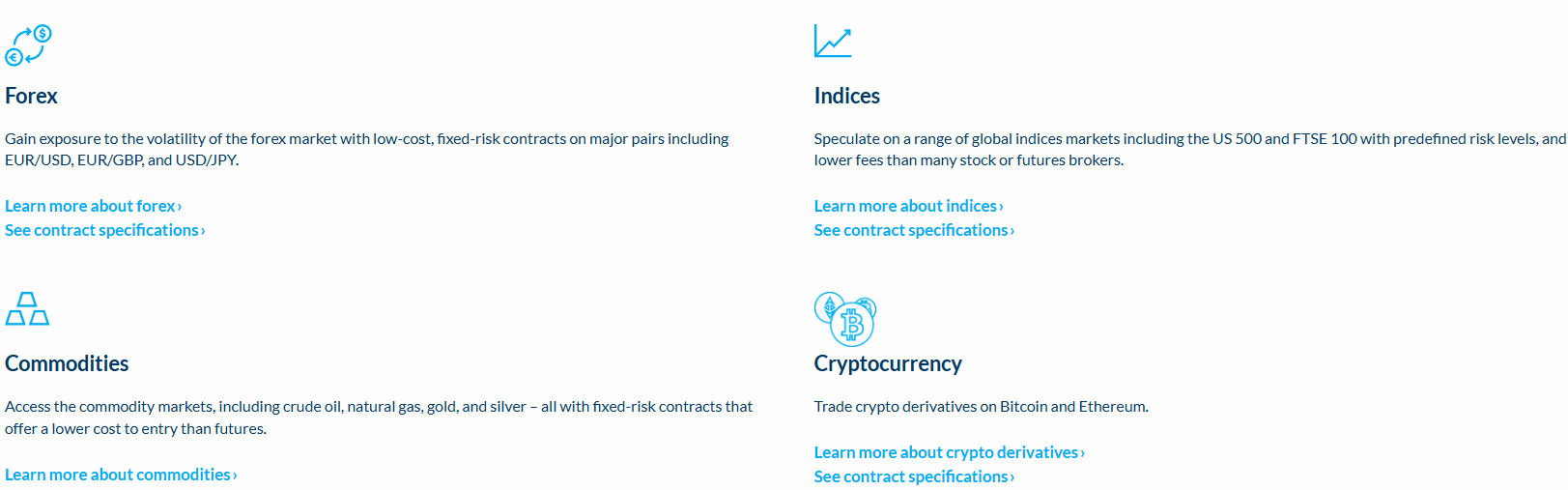

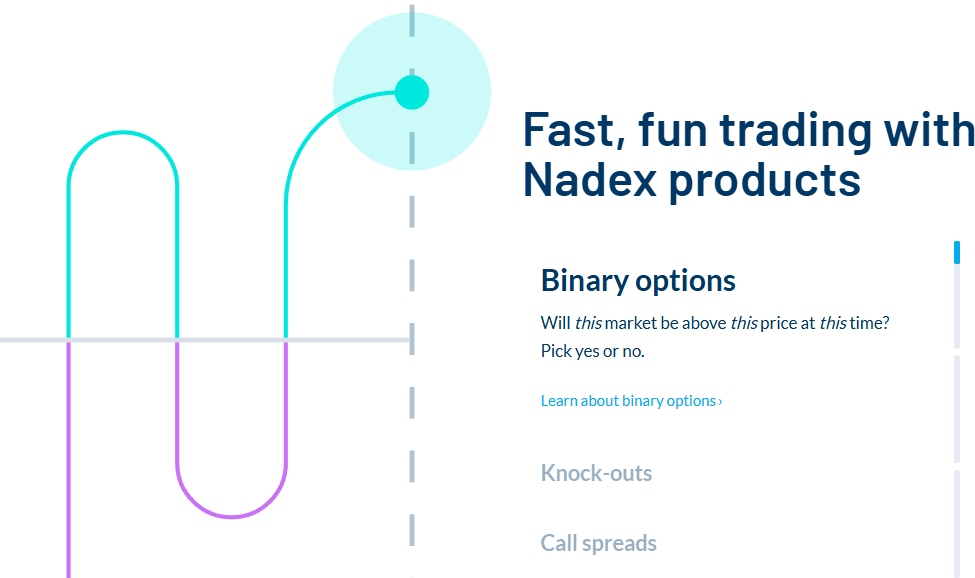

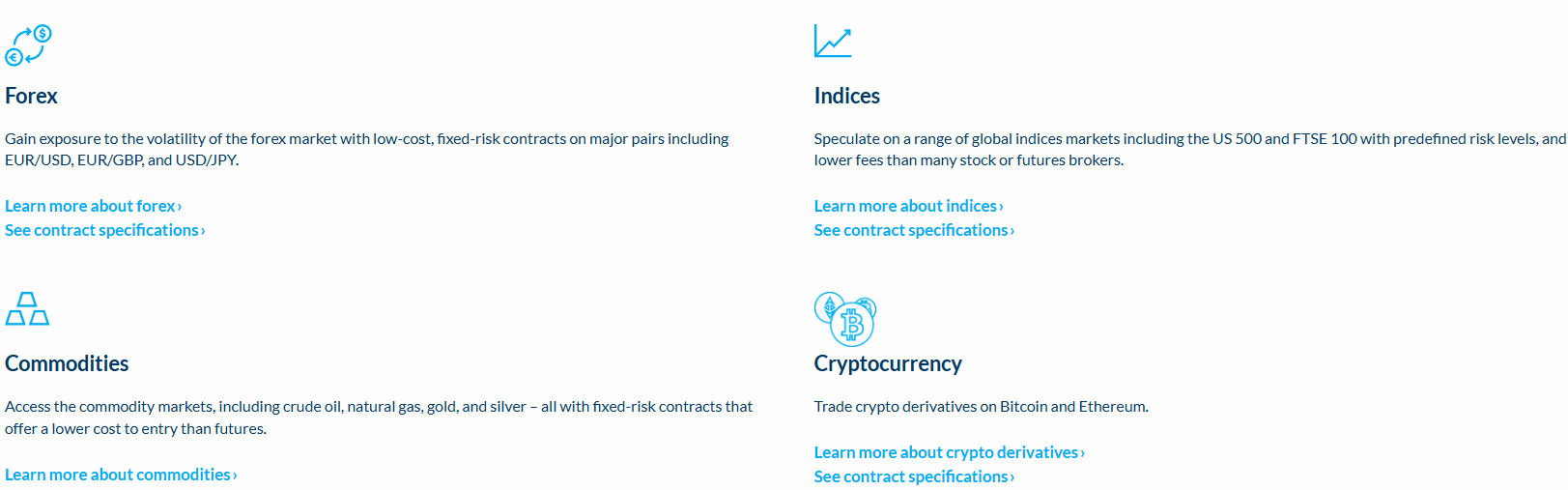

Trading Instruments

Score – 4.4/5

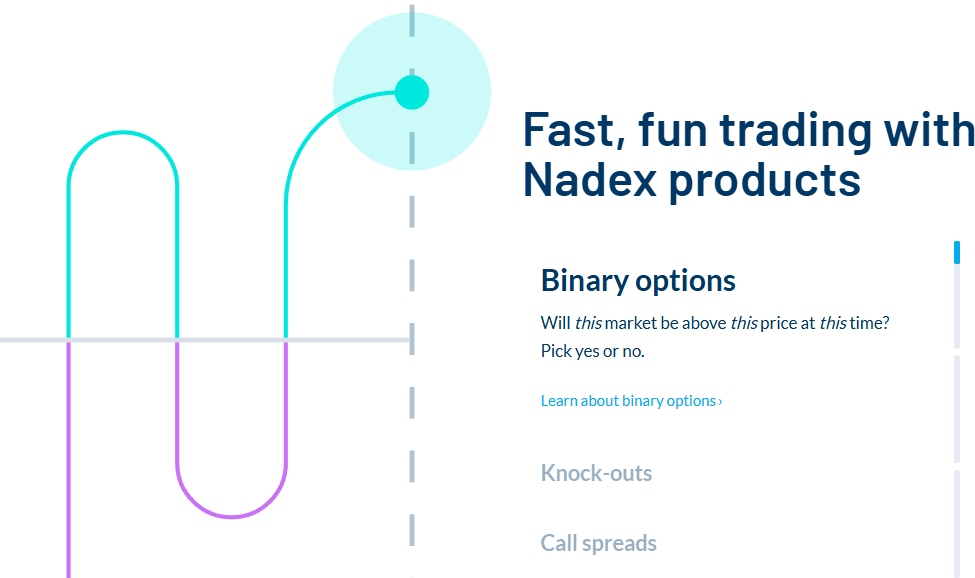

What Can You Trade on the Nadex Platform?

Nadex offers its clients access to a variety of short-term products, such as binary options, call spreads, and knock-out contracts. These products are available in various asset classes:

- 11 forex-pairs

- Commodities (gold, crude oil, and natural gas)

- Stock indices including the S&P 500, Nasdaq 100, Dow Jones

- Cryptocurrency (Bitcoin, Ethereum)

Main Insights from Exploring Nadex Tradable Assets

All in all, our research revealed that Nadex offers unique trading products, making the Nadex offering different in its kind. Each product comes with clear risk parameters, defining clearly the maximum loss and gain beforehand, which helps clients estimate the trading outcome in advance.

Nadex offers Binary options as its main offering. Generally, binary options are considered risky, however, Nadex’s regulated nature gives more insurance to traders. These products allow clients to speculate on the price movement of the underlying market. Knock-out contracts, another unique product of Nadex, enable users to speculate on the markets and earn a profit if the market moves in the predicted direction. At last, a call spread is a trading strategy in which the trader buys and sells call options simultaneously. Thus, Nadex’s offering of tradable products can be appealing to traders who are ready to explore novel and innovative solutions.

Leverage Options at Nadex

Leverage, which is defined as a loan given by the broker to the trader, enables vast trading opportunities because a multiplied size of the initial capital allows traders to operate at a much bigger size in exchange for increasing potential to make higher gains. However, the leverage significantly increases risk levels too.

However, Nadex does not offer leverage in its traditional sense. The closest to leveraged trading in Nadex are Knock-out contracts, since traders can get full market exposure with a smaller capital requirement, while the risk is drawn to a minimum.

- Although Nadex’s structure is different from traditional brokers, US firms generally are obliged to use and offer a maximum of 1:40 multiplier.

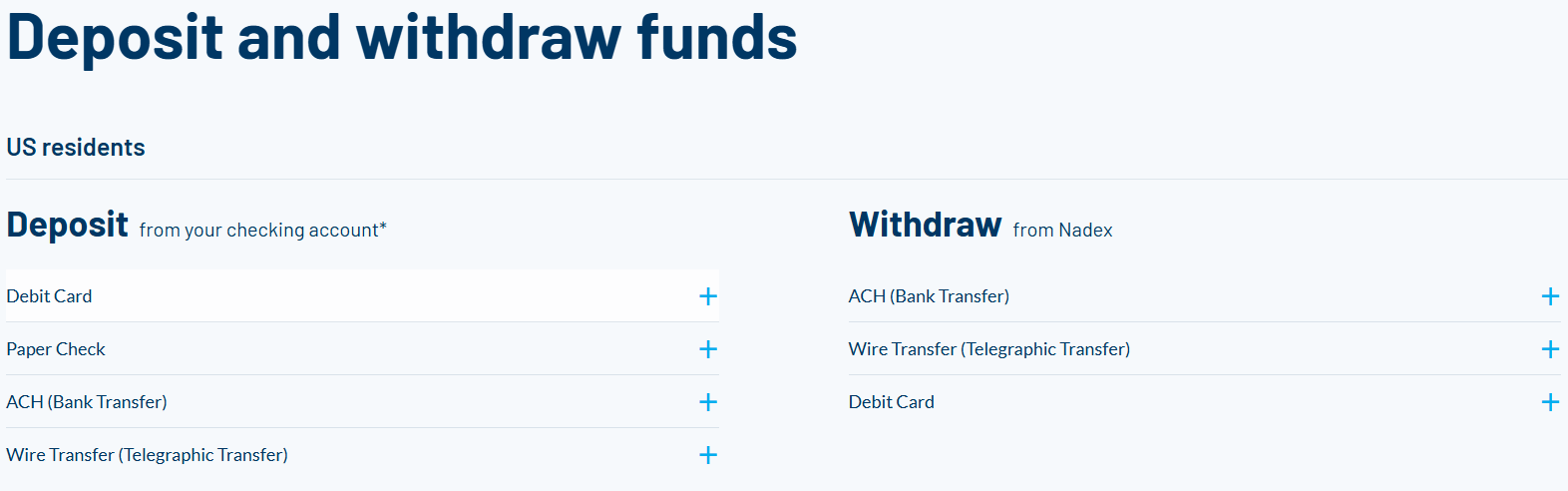

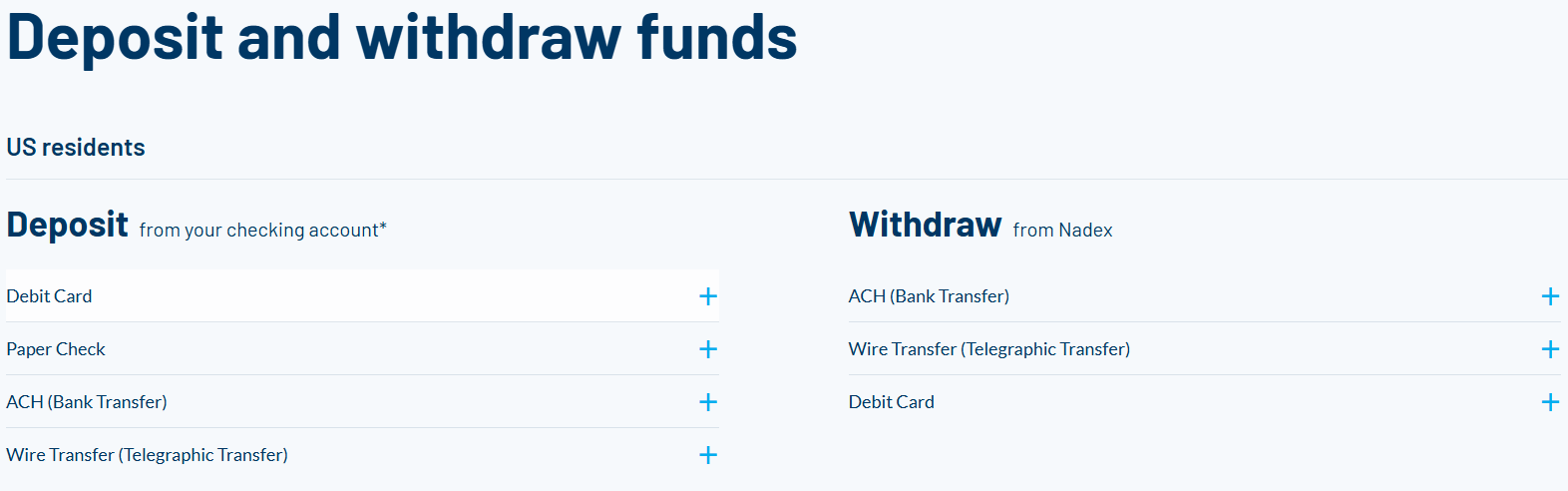

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Nadex

We found that after you open your free account with Nadex and deposit funds, you can begin trading almost instantly. There might be slight differences for the US or international clients, due to regulatory restrictions, so make sure to check conditions with Nadex Customer Support.

Generally, there are several deposit options available, including:

- Bank Wire Transfers

- Cards

- ACH Transfers

- Paper checks for US clients

Minimum Deposit

There is no minimum deposit with Nadex. However, the cost to start a trade is equal to the maximum risk, and any applied trade fees. This amount should be in the account when the order is placed.

Withdrawal Options at Nadex

For withdrawal of Nadex funds, you may choose either bank wire transfer or ACH withdrawal, which are available for both US and international traders. Nadex does not charge any fees for an ACH withdrawal, however, a bank wire withdrawal will cost $25 for processing fees.

- It will take 3-5 business days on average for the funds to reach the bank account. To process withdrawals, Nadex at its own discretion can require additional documentation for proof of identity and account ownership.

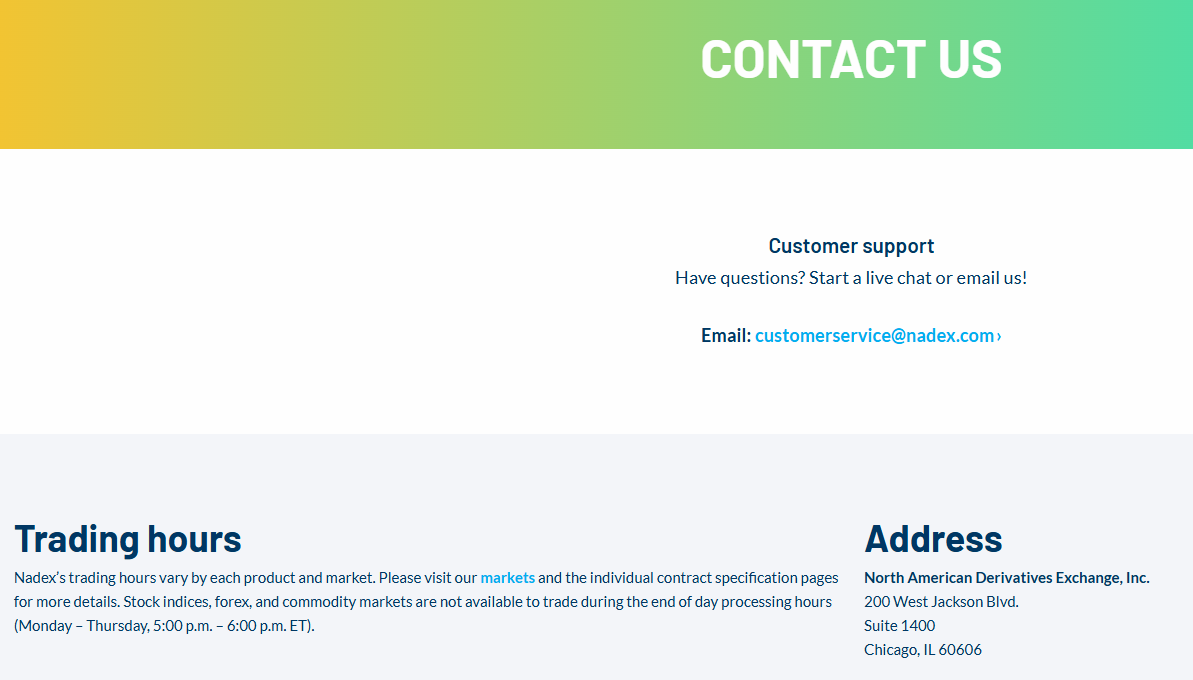

Customer Support and Responsiveness

Score – 4.6/5

Testing Nadex Customer Support

Nadex also provides reliable, and high-level support to their traders and clients. The customer service team is available via phone and Live Chat. Besides, Nadex also provides answers to the most common and trading-relevant questions and explains in detail all its unique products, and overall services.

- It should be noted that Nadex trading hours vary based on the product and market traded.

Contacts Nadex

We found Nadex’s customer support team very helpful, with multiple options for assistance. The live chat, our research showed, provides quick answers and solutions.

- Clients who prefer to direct their questions via email can use the following email address: customerservice@nadex.com

- Nadex is also social, offering recent updates on the market and company information through its social media pages: Linkedin, FB, IG, and YouTube. On the YouTube page clients can find helpful videos and courses that contain a lot of useful information and provide good guidance.

Research and Education

Score – 4.5/5

Research Tools Nadex

All the research tools and features Nadex offers are already included in the platforms, thus, as we see, Nadex does not offer many additional research tools for better assistance.

- On the company’s website, we only found Market Data available. The provided data is updated daily, listing every contract offered, with volume, high and low trades, expiration value, and payout.

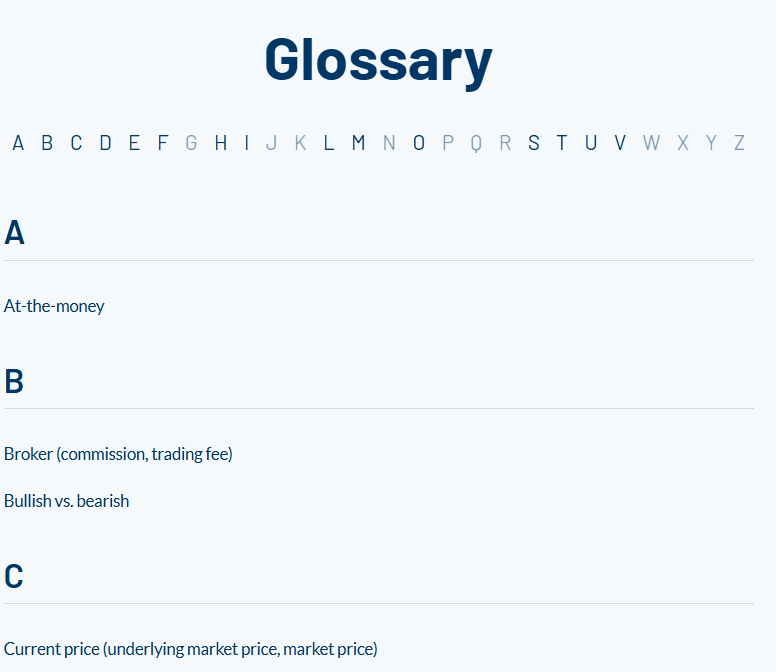

Education

We found that Nadex also has an established Learning Center, for clients to deepen their knowledge and potentially become better traders. Clients have access to comprehensive learning materials and webinars held on a regular basis by Nadex specialists.

- The learning section provides detailed answers to the essential questions on the account opening, products provided by Nadex, how to fund the account, etc.

- Webinars provided by Nadex are essential for clients to gain more insight into the market, and enhance trading skills. Traders can find the list of the available webinars on the official website.

- A glossary is also helpful for clients, especially for those who get confused by new terms they come across. Having access to the glossary of the main concepts and terms will make the trading process easier.

- Access to the blog articles is another advantage, as Nadex provides detailed, and informative articles on very different topics on the financial market. This is not only a great way to gain knowledge, but also stay informed on the recent updates of the market.

Is Nadex a Good Broker for Beginners?

Overall, we find Nadex’s offerings unique and innovative, and suitable for traders of different levels. However, it is essential for both beginner and even professional traders to take time to understand Nadex’s offerings and unique products, as trading with Nadex is different from trading with traditional brokers. It might take some time for beginners to fully comprehend the nuances of trading with Nadex, but the good news is that it provides a great educational section, a useful demo platform, and no minimum deposit requirement, which altogether makes Nadex a good choice for novice traders.

Portfolio and Investment Opportunities

Score – 3.8 /5

Investment Options Nadex

We found that Nadex is not the best choice for those clients who prefer traditional investments and want to diversify their portfolios. This is because Nadex does not provide stocks, ETFs, or long-term investment opportunities, specializing rather in short-term trades, enabling traders to speculate on price movements across different asset classes.

- Nadex also doesn’t allow any other alternative options of investment, such as social/copy trading. Since Nadex is a regulated exchange, all trades are self-directed, and traders place and manage their orders independently.

- Consequently, PAMM accounts are not available either, as Nadex does not provide managed accounts or allow traders to allocate funds to professional money managers.

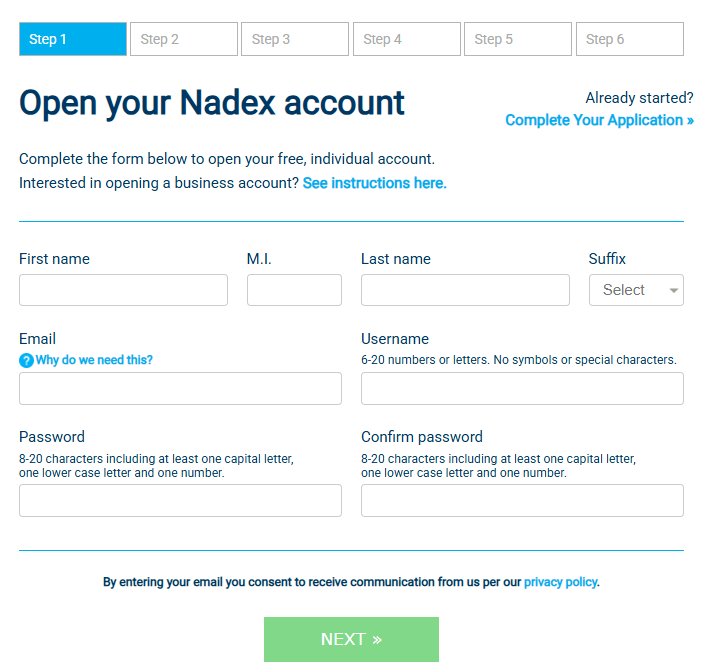

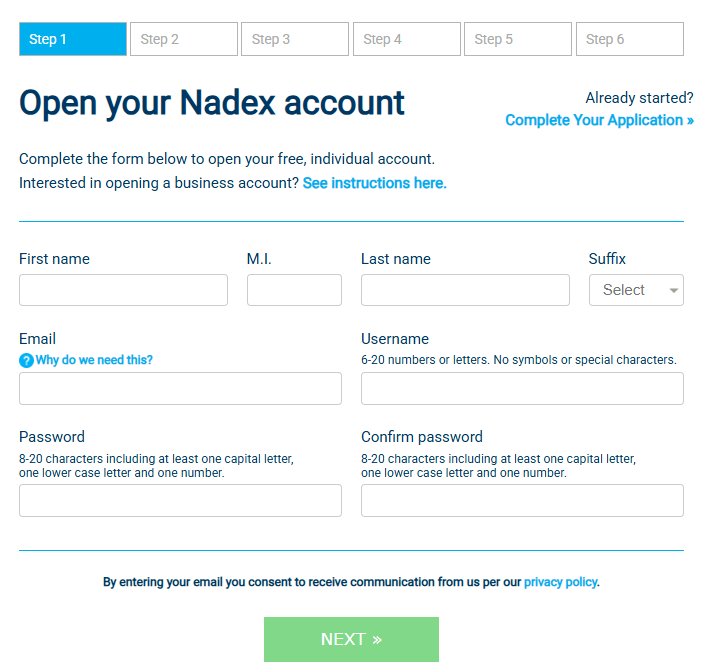

Account Opening

Score – 4.6/5

How to Open a Nadex Demo Account?

Nadex offers a simplified demo account opening process, making it even more accessible, and available for quick access. Here are a few simple steps to follow:

- Go to Nadex’s website and click on the ‘Create free demo account’

- Fill out the registration form, by supplying your name, email, username, password, and phone number

- Receive the account credentials via email

- Use them to log in

- Start exploring the platform

How to Open a Nadex Live Account?

To open a live account with Nadex will take a little longer than in the case of the demo account, however, the process is straightforward and will require just several minutes.

- Visit the official website and on the top right corner click on “Open Account”

- Select Account Type

- Provide Personal Information (name, email, phone number, country, username, password)

- Verify Identity by providing ID and proof of residence

- Deposit funds using one of the available funding methods

- Once the account is approved, log in to the Nadex platform by using the account credentials received through email

Score – 3/5

We found that all the features and tools are already included in the Nadex platforms. However, there is still a feature that will assist traders in enhancing their trading experience.

- Nadex API allows traders to build and execute automated trading strategies. This is ideal for advanced traders, and algorithmic traders who want to enhance their trading experience.

Nadex Compared to Other Brokers

We compared Nadex to other companies who also offer similar services, as Nadex is unique in its proposals and not all brokerages can be compared to it in terms of offerings and available services.

We compared Nadex and IG to find that both are regulated, however, Nadex holds a license from CFTC (US), while IG is a multi-regulated brokerage also holding a license from the reputable FCA and offers services globally. Whereas Nadex primarily offers binary options, call spreads, and Knock-Out contracts, IG’s products include more, including forex, stocks, indices, commodities, and CFDs. Besides, Nadex is more suitable for short-term trades, while IG supports both short- and long-term investments.

We also compared Nadex to Deriv, which also supports similar services and products. We compared the two companies in terms of education resources to find that Nadex’s educational resources are mainly directed at understanding its binary options, call spreads, and Knock-Out contracts via webinars, video tutorials, and blog articles. On the other hand, Deriv provides a wider range of educational materials. Deriv also offers multiple platforms, including DTrader, DMT5, and Deriv X, to Nadex’s own platform and NadexGO app.

| Parameter |

Nadex |

Deriv |

AvaTrade |

HFM |

IG |

IC Markets |

Pepperstone |

| Spread Based Account |

0.25 pips |

Average 0.5 pips |

Average 0.9 pips |

Average 1 pip |

Average 1 pip |

From 1 pip |

Average 0.7 |

| Commission Based Account |

$1 per contract side |

Zero Spread Account |

For Professional Accounts only |

0.0 pips + $3 |

0.0 pips + £3 |

0.0 pips + $3.50 |

0.0 pips + $3.50 |

| Fees Ranking |

Average |

Low/ Average |

Low |

Low/ Average |

Average |

Low/ Average |

Low |

| Trading Platforms |

Nadex Platform, NadexGO |

Deriv MT5, Deriv cTrader, Deriv X, Deriv Trader, Deriv Bot, Deriv GO, SmartTrader |

MT4, MT5, WebTrader, AvaTrade App, AvaOptions, DupliTrade, ZuluTrade, AvaSocial, Capitalise.ai |

MT4, MT5, HFM App |

IG Web Platform, MT4, TradingView, ProRealTime, L2 Dealer |

MT4, MT5, cTrader |

MT4, MT5, cTrader, TradingView |

| Asset Variety |

Limited |

200+ instruments |

250+ instruments |

500+ instruments |

17,000+ instruments |

1,000+ instruments |

1,200+ instruments |

| Regulation |

CFTC |

MFSA, Labuan FSA, BVI FSC, VFSC |

Bank of Ireland, ASIC, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

FCA, ASIC, BaFin, FINMA, MAS, DFSA, FSCA, JFSA, FMA, NFA, BMA |

ASIC, CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

| Customer Support |

23/5 |

24/7 |

24/5 support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

| Educational Resources |

Good |

Good |

Excellent |

Good |

Excellent |

Good |

Excellent |

| Minimum Deposit |

$0 |

$5 |

$100 |

$0 |

$0 |

$200 |

$0 |

Full Review of Nadex

Nadex is a regulated exchange in the US, offering a transparent fee structure, with no hidden fees. Nadex charges a fixed fee of $1 per contract per side, with discounts for high-volume traders. This simple, straightforward pricing model eliminates risks, allows for more accurately calculated costs, and effective means of managing risks.

As to the available instruments with Nadex, we found that it really offers unique trading products like binary options, call spreads, and Knock-Out contracts. As to the available platforms, the Nadex platform has an intuitive interface equipped with great tools and features. Additionally, Nadex has extensive learning resources that guide clients and help to understand Nadex’s offerings.

However, the company concentrates mainly on short-term contracts, which might not be attractive for long-term investors or those looking for more traditional financial instruments. To sum up, the regulated status, transparent fees, and innovative platforms make Nadex a good choice for those who are ready to explore trading in a new light.

Share this article [addtoany url="https://55brokers.com/nadex-review/" title="Nadex"]

$100 mysteriously disappeared from my account. Will be filing complain with federal regulators if not resolved.