- What is Markets.com?

- Markets.com Pros and Cons

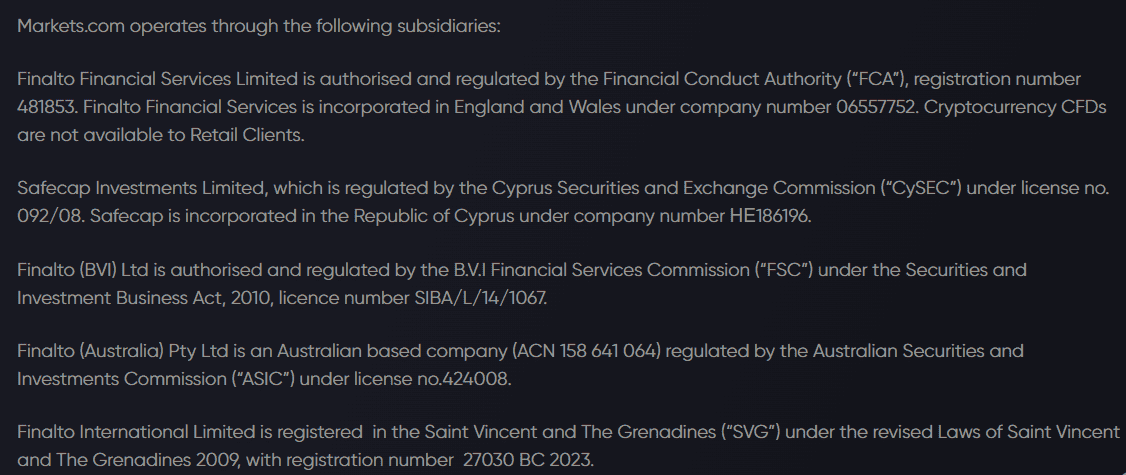

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

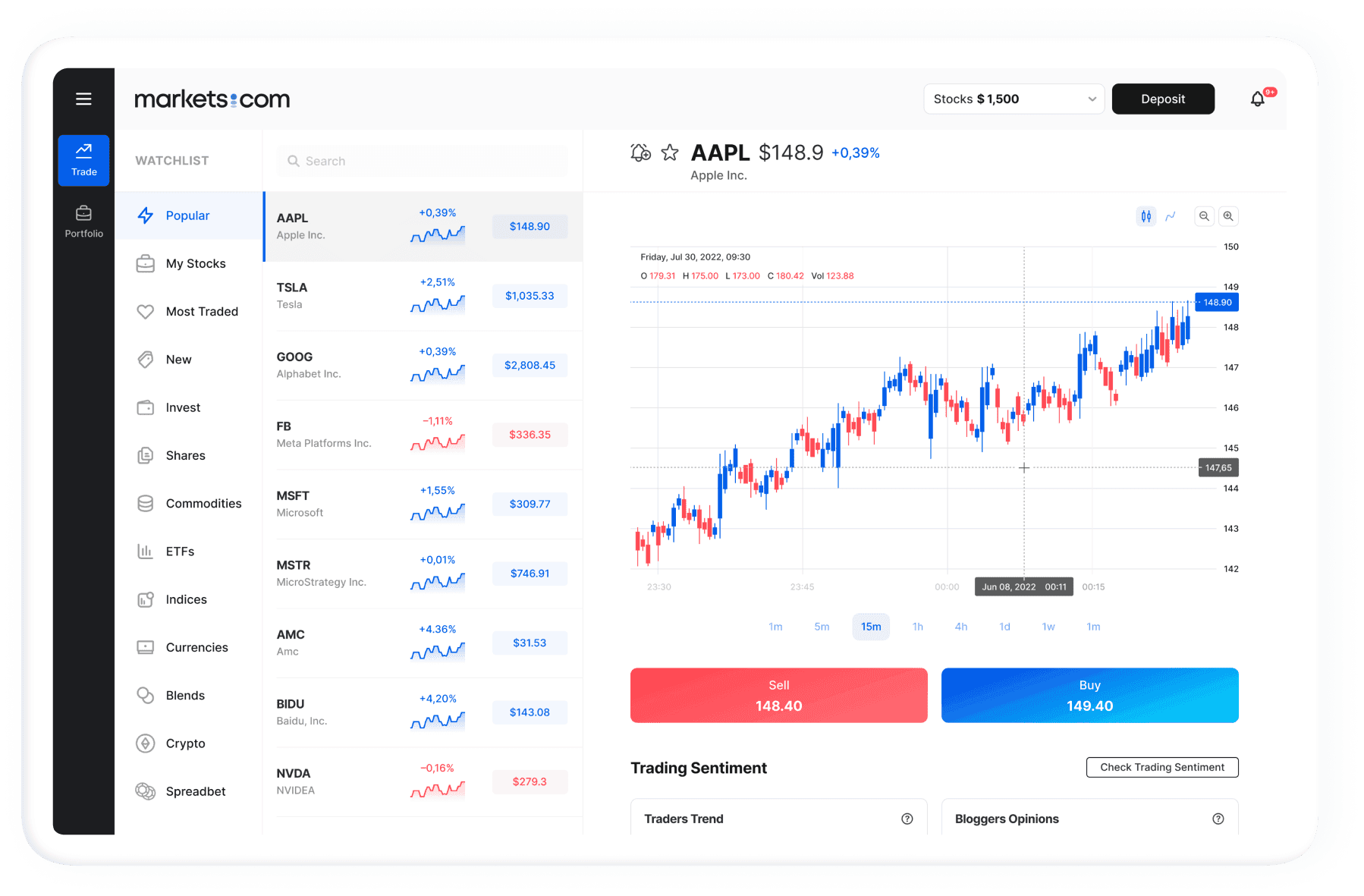

- Trading Platforms and Tools

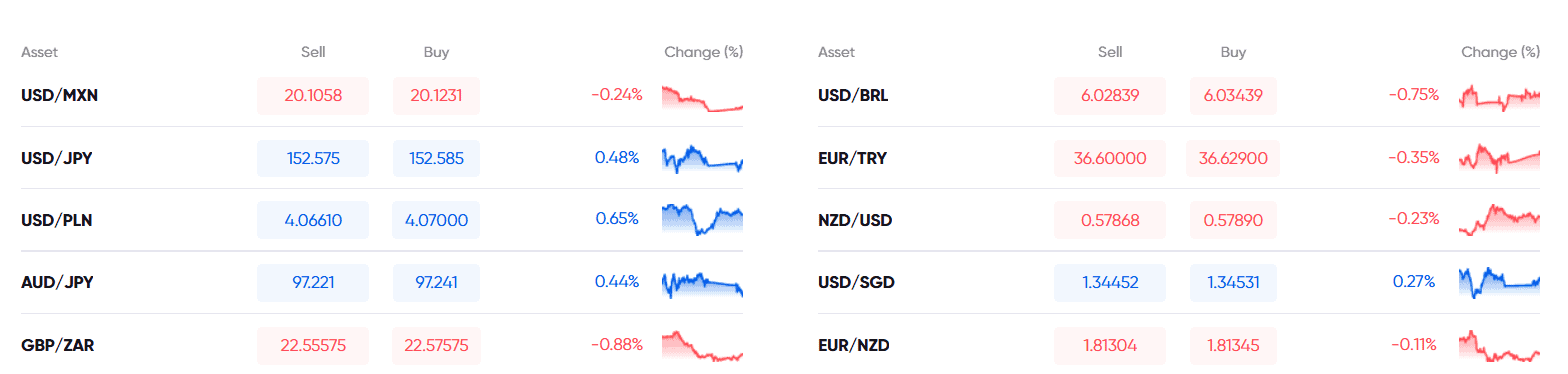

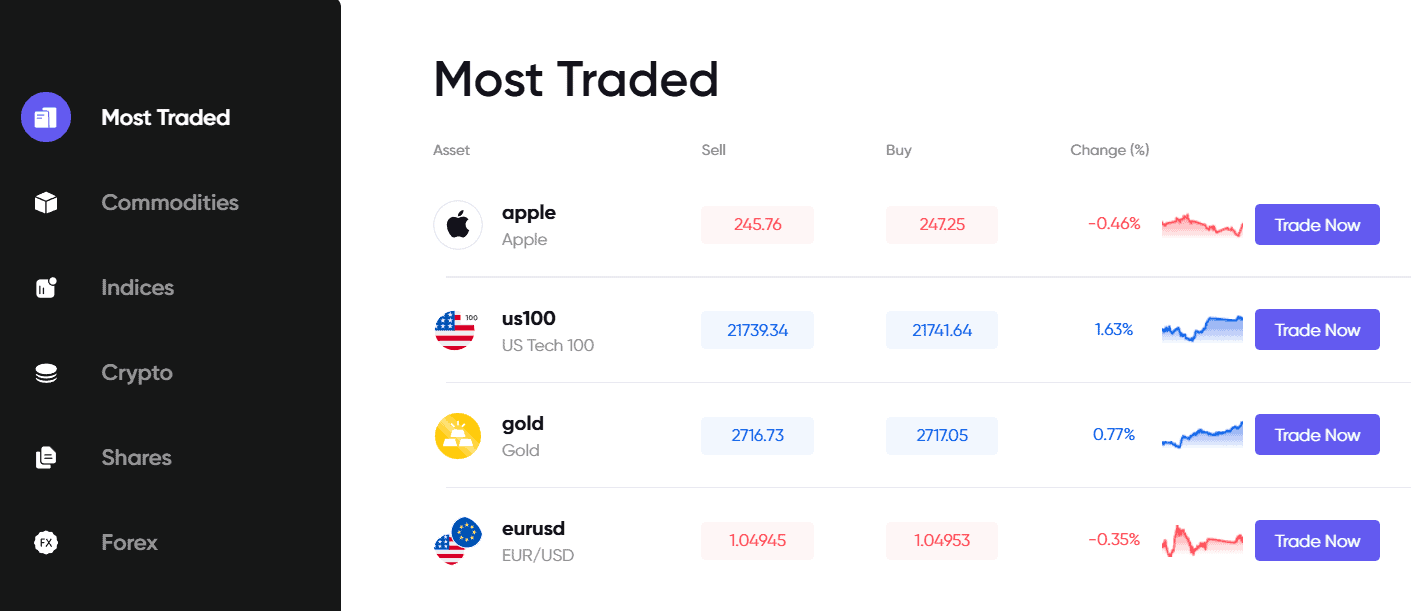

- Trading Instruments

- Deposit and Withdrawal Options

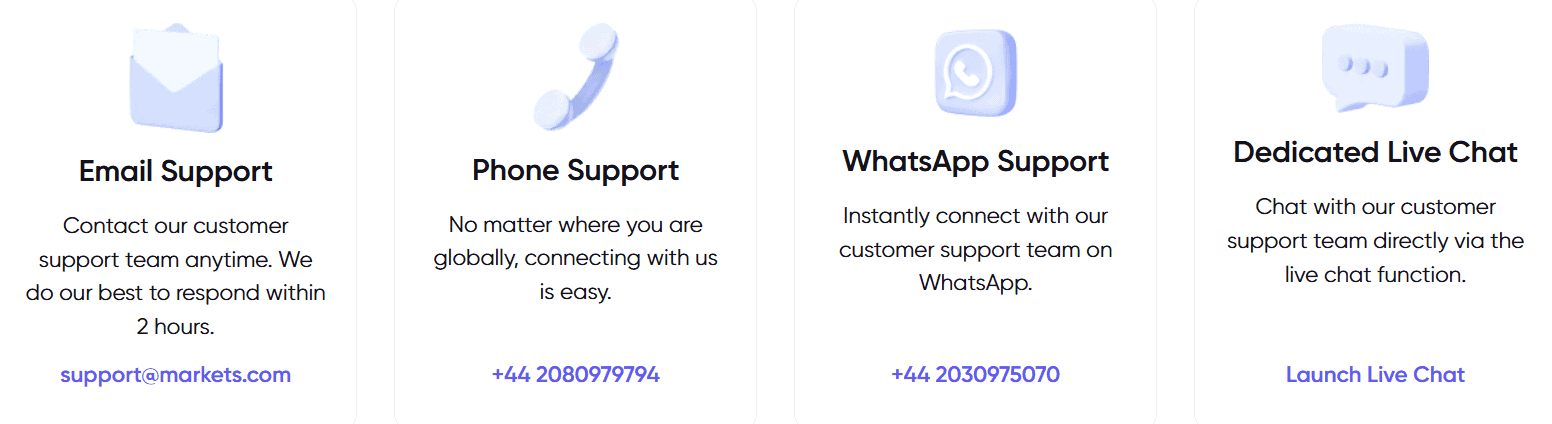

- Customer Support and Responsiveness

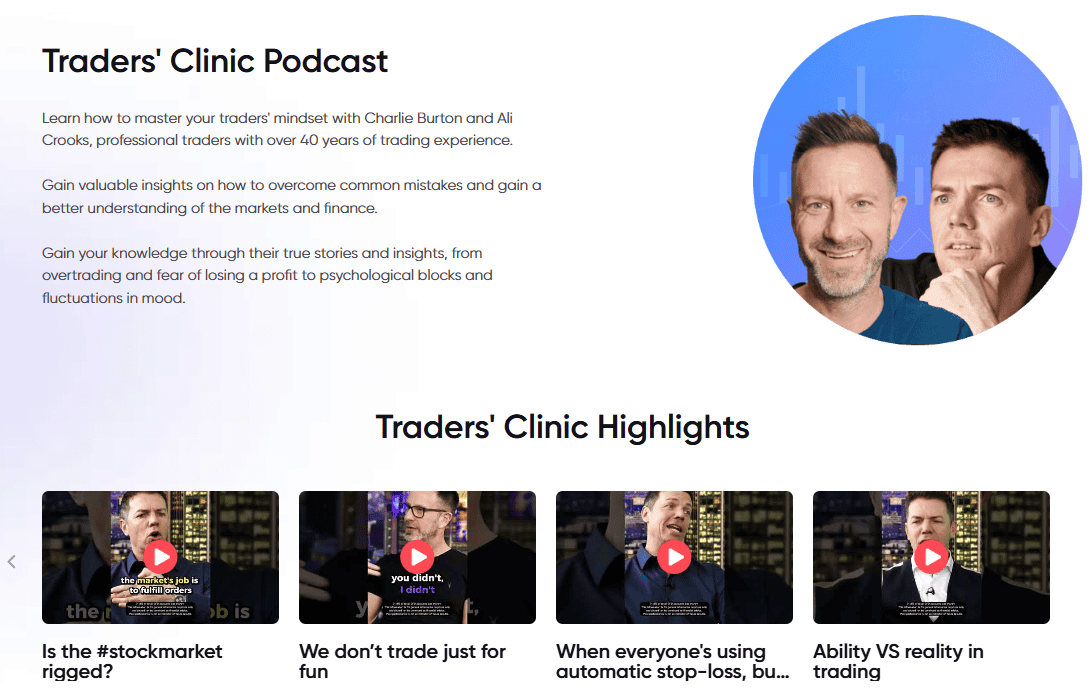

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Markets.com Compared to Other Brokers

- Full Review of Broker Markets.com

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 3.7 / 5 |

| Account Opening | 4.3 / 5 |

| Additional Tools and Features | 4.5 / 5 |

What is Markets.com?

Markets.com is a global brokerage firm with clients worldwide. It is one of the largest Forex and CFD providers, offering more than 2,200 trading assets.

We found that the firm is regulated by some of the most stringent financial authorities, including the FCA of the UK and ASIC of Australia. Markets.com also offers excellent customer service by providing support in various languages.

What Type of Broker is Markets.com?

Markets.com is a Currency and CFD broker providing access to the most popular markets including CFD on Stocks, ETFs, Forex, Crypto, and more. The broker offers its clients access to top-tier liquidity and advanced trade execution.

Markets.com Pros and Cons

Markets.com is a heavily regulated Broker with an excellent reputation. With easy account opening, user-friendly platforms, and numerous tools and instruments, Markets.com is one of the most reputable and large brokers. By providing educational tools and expert financial analysis, the broker’s offering is suitable for clients with different levels of experience.

For the Cons, the fees for Stock CFDs are higher, and there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Recognized and regarded broker worldwide | No 24/7 customer service |

| Wide range of trading platforms and competitive trading conditions | Conditions vary based on the entity |

| Great technical solutions and tools | |

| Regulated by Top-Tier authorities | |

| Suitable for beginners and professionals | |

| Good quality learning materials and research | |

| Quality customer support with live chat and fast response | |

Markets.com Features

Markets.com is a well-known online broker that offers a comprehensive suite of features designed to provide traders with a dynamic, user-friendly, and efficient experience across global financial markets. Here are the key features offered by Markets.com to consider when choosing a broker:

Markets.com Features in 10 Points

| 🏢 Regulation | CySEC, FCA, ASIC, FSCA, FSC, FSA |

| 🗺️ Account Types | Classic, Pro Accounts |

| 🖥 Trading Platforms | Markets.com Web, MT4, MT5, TradingView, Markets.com Social Trade App |

| 📉 Trading Instruments | Forex, CFDs, Commodities, Cryptocurrencies, Bonds, Shares, Indices, ETFs |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, ZAR, GBP, EUR |

| 📚 Trading Education | Professional knowledge center and research materials including live news, analysis, webinars, etc. |

| ☎ Customer Support | 24/5 |

Who is Markets.com For?

Markets.com is designed for traders of all levels who seek a user-friendly platform, powerful tools, and a diverse range of instruments. Based on our findings and expert financial opinions, Markets.com is ideal for:

- Beginners

- Advanced traders

- Traders who prefer MT4/MT5 platforms

- Currency and CFD trading

- EAs running

- Variety of strategies

- Competitive spreads

- Algorithmic or API traders

- Learning about Currency trading

- Supportive customer support

Markets.com Summary

Concluding the Markets.com review, we admit a safe broker to trade with reliable solutions. Markets.com provides expanded strategies and a certain way of dealing with markets and traders. The broker has gained a reliable and respected reputation operating for many years and is ranked as one of the leading Forex brokers.

We mark Markets.com’s flexibility in terms of platforms, currency pairs, and several provided solutions as another key advantage to its positive side. The broker offers competitive costs and good education materials suitable for traders of different levels.

55Brokers Professional Insights

Markets.com is one of the strong reliable brokers, that has operated for many years has a great reputation, and is well known in the trading community. The broker provides a range of services suitable for most trading demands with competitive initial deposit requirements, platform offering, quality execution, and good costs, marking it as a reliable partner. A strong selection of platforms, and robust tools, which are equipped with advanced charting features, sentiment indicators, and integrated market analysis tools are other points of interest.

Markets.com also supports traders with quality educational resources, including webinars, tutorials, and insightful market analyses, making it a great choice for traders at any experience level, especially beginners. The only point to markup we would mention absence of account of fees based on commission, so if traders prefer this type of Broker fee may be better to opt for another proposal, also some exotic instruments and thousands of products might be larger at other portfolios along with MAM account unavailability.

Consider Trading with Markets.com If:

| Markets.com is an excellent Broker for: | - Need broker holding multiple licenses.

- Offering popular instruments.

- Regulated by reputable authorities.

- Offering high leverage up to 1:500.

- Looking for broker providing MT4/MT5 platforms.

- Need broker with good tools and research.

- Offering competitive fees and spreads.

- Looking for excellent Social Trading features.

- Integration with TradingView.

- Offering promotions and bonuses.

- Looking for broker suitable for beginners and professional traders.

|

Avoid Trading with Markets.com If:

| Markets.com might not be the best for: | - Who prefer 24/7 customer service.

- Need broker with fixed spreads.

- Looking for cTrader platform.

- Traders who prefer no minimum deposit requirements.

- MAM or PAMM Accounts for Account Managers. |

Regulation and Security Measures

Score – 4.7/5

Markets.com Regulatory Overview

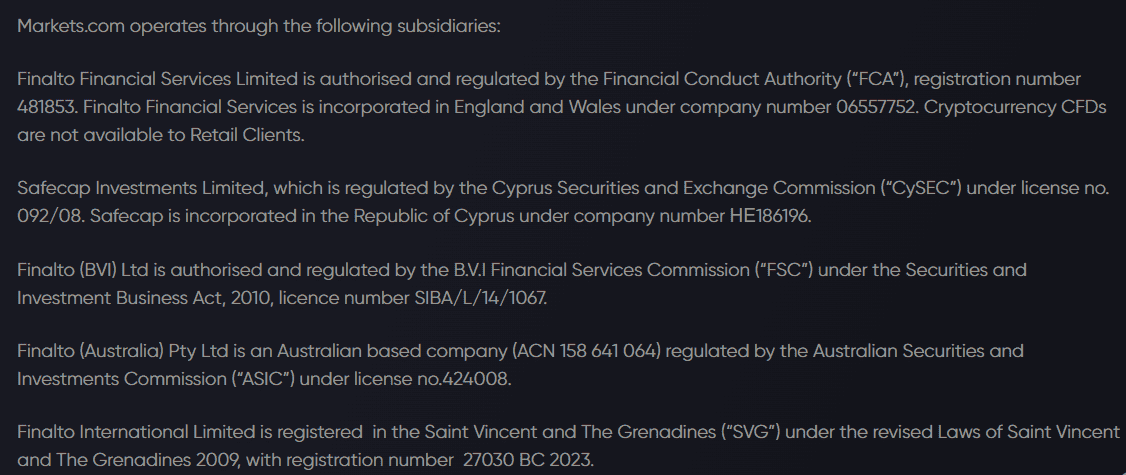

Markets.com is a well-regulated broker that ensures high safety and transparency for its clients. The broker is licensed and regulated by multiple top-tier financial authorities, including the FCA in the UK, the Australian ASIC, the CySEC in Cyprus, and the FSCA in South Africa. These regulatory bodies enforce stringent standards for financial security, client fund protection, and operational integrity.

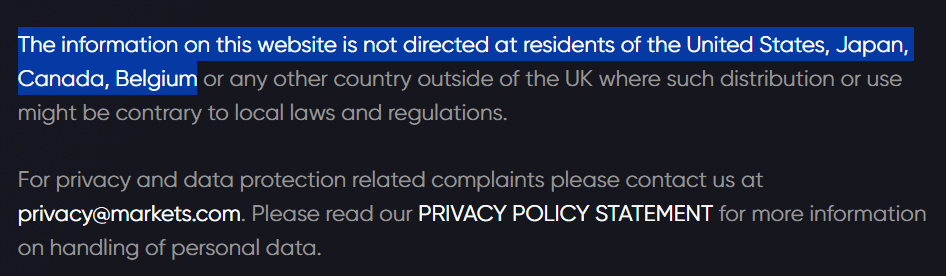

However, international trading is regulated under offshore licenses issued by the FSC in the British Virgin Islands and the FSA in Saint Vincent and the Grenadines, providing access to global markets while maintaining essential compliance standards. While these licenses ensure a certain degree of oversight and legitimacy, they may not offer the same level of protection as those from more stringent regulators, such as the FCA or ASIC.

Traders should consider the regulatory environment carefully and ensure it aligns with their specific needs and expectations.

How Safe is Trading with Markets.com?

Trading with Markets.com is considered safe due to its strong regulatory framework and commitment to client security. The broker is licensed by several reputable authorities that enforce strict standards for financial practices, and operational transparency.

Additionally, the broker provides negative balance protection, ensuring clients cannot lose more than their account balance. In particular, the broker keeps its clients’ funds in segregated bank accounts at regulated banks, validates capital ratio along with reporting, and provides web security protection. worldwide.

Consistency and Clarity

Markets.com has established itself as a reliable broker with over a decade of operational experience in the industry. Its long-standing presence demonstrates stability and trustworthiness. Overall, Markets.com’s proposal and offerings are very clear and consistent due to its long history of operation marking it as a broker suitable for long-term investment purposes. One of its notable advantages is that the broker holds licenses from reputable regulators and offers global accessibility, allowing traders from various countries to register and benefit from its services.

Traders often praise the platform’s intuitive design, competitive spreads, and popular tradable instruments, as well as its learning materials and responsive customer support. However, some users mention that the educational resources, while helpful, may not be as comprehensive or in-depth as those offered by specialized brokers. Additionally, while some reviews point out areas for improvement, such as concerns about offshore licensing, the overall sentiment reflects satisfaction with the broker’s reliability and transparent operations.

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with Markets.com?

Markets.com offers a few account types to cater to different needs, including Classic and Pro Accounts, as well as Demo and Swap-Free Accounts.

The Classic Account is designed for beginner and retail traders, offering competitive spreads and access to a wide range of instruments with lower deposit requirements. The Pro Account, on the other hand, is geared towards more experienced traders, providing tighter spreads and higher leverage, but with a larger initial deposit requirement.

For those who wish to practice without risk, Markets.com offers a Demo Account that replicates real market conditions, allowing users to test their strategies and become familiar with the platform. Additionally, Swap-Free Accounts are available for traders who cannot engage in swap-based transactions due to religious beliefs.

Classic/Standard Account

The Classic Account at Markets.com provides competitive conditions, starting with low spreads from 0.8 pips on major currency pairs like EUR/USD. While there are no commissions on Currency trades, a small commission may apply to stock CFDs.

To open a Classic Account, the minimum deposit required is $100 USD. However, the conditions, including spreads and commission structures, may vary depending on your region and the specific entity through which you are trading.

Pro Account

The Pro Account is designed for more experienced traders who require advanced features and better conditions. It offers tighter spreads, starting from 0.1 pips for major currency pairs like EUR/USD, making it ideal for high-frequency traders.

The minimum deposit requirement for a Pro Account is typically higher than that of the Classic Account, often starting around $1,000. This account is available on the MT4 and MT5, and the Markets.com proprietary platform. However, account conditions and availability may vary depending on your region and the specific entity through which you trade

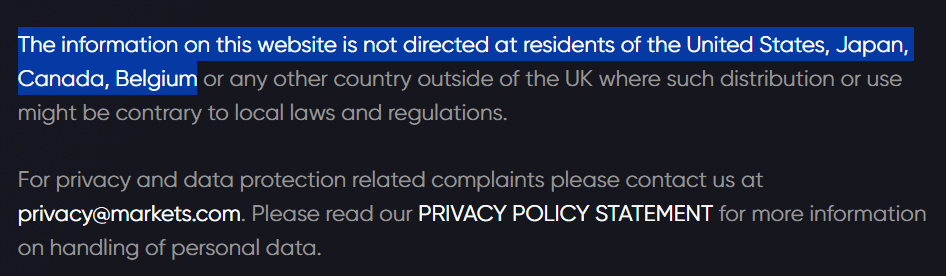

Regions Where Markets.com is Restricted

Markets.com is not available in several regions due to local regulations and licensing restrictions. Some of the countries where Markets.com is not available include:

Cost Structure and Fees

Score – 4.6/5

Markets.com Brokerage Fees

Markets.com offers a fee structure tailored to accommodate various trading styles, focusing primarily on a spread-only model for most trades.

Additionally, there are no deposit or withdrawal fees for verified accounts, though third-party providers may impose currency conversion charges when applicable. However, Markets.com applies an inactivity fee after a period of account dormancy and charges overnight financing fees (swap fees) for positions held beyond market hours. While this balanced fee structure provides cost-efficiency for traders and supports a seamless experience, traders should note that fees may vary depending on the entity offering the services and regional regulations.

Markets.com offers competitive variable spreads across its various account types and instruments. For major currency pairs like EUR/USD spreads start at 0.8 pips on the Classic Account, making it accessible to traders seeking cost-effective trading. The Pro Account provides even tighter spreads, starting from 0.1 pips, catering to more advanced traders and high-frequency strategies.

Spreads for other assets, such as commodities, indices, and stocks, vary depending on market conditions and liquidity but remain competitive within the industry.

Markets.com primarily operates on a spread-only fee model, however, for stock CFDs, the platform typically charges a commission starting at around 0.1% of the trade value. For instance, a $1,000 trade would incur a commission of approximately $1.

This fee structure is transparently disclosed on the platform, ensuring traders are fully aware of the costs involved. However, traders should review specific terms, as commissions and other fees may vary depending on the entity regulating the account and the trader’s region.

- Markets.com Rollover / Swaps

Markets.com charges an overnight fee, also known as a rollover or swap, for positions held beyond a single trading day. This fee is an additional cost that traders should factor into their strategies when holding positions overnight.

For example, the overnight fee for the EUR/USD pair is -2.05 for short positions and -0.54 for long positions. These fees may vary depending on the currency pair, position type, and market conditions, and are displayed on the platform. Traders should be aware of these costs, especially if they plan to hold positions for extended periods, as they can impact the overall profitability of their trades.

- Markets.com Additional Fees

In addition to spreads and commissions, Markets.com charges a few other fees that traders should be aware of. An inactivity fee of $10 will be charged monthly if a live account has been inactive for more than three months (90 days). This fee is designed to encourage account engagement.

There are also swap fees for positions held beyond market hours, which can vary based on the instrument and position type. While there are no deposit or withdrawal fees for verified accounts, traders should note that third-party providers may impose currency conversion charges.

Additionally, fees and conditions may differ depending on the regulatory entity overseeing the account and the trader’s region, so reviewing the specific fee schedule is recommended.

How Competitive Are Markets.com Fees?

Markets.com offers a generally competitive fee structure that is appealing to many traders. The broker primarily offers a simple and transparent spread-only model with tight spreads available on major currency pairs. Spreads are overall competitive, with the average for Currency pairs like EUR/USD being around 1 pip, making it an attractive option for active traders.

There are no fees for deposits or withdrawals for verified accounts, making it a cost-effective option for frequent traders. However, there are some additional fees to consider, such as inactivity fees for accounts that remain dormant for extended periods, and swap fees for positions held overnight, which may vary depending on the instrument.

While these fees are relatively standard across the industry, traders should be mindful of them, particularly if they plan to hold positions long-term or do not trade frequently. Overall, Markets.com’s fees are competitive but can add up depending on trading behavior and account activity.

| Asset/ Pair | Markets.com Spread | Hantec Markets Spread | FXCM Spread |

|---|

| EUR USD Spread | 0.8 pip | 1.3 pips | 1.3 pips |

| Crude Oil WTI Spread | 0.09 | 0.6 pips | 0.04 |

| Gold Spread | 0.3 | 3.7 pips | 0.35 |

| BTC USD Spread | 104.94 | 0.50% | 3.73% |

Trading Platforms and Tools

Score – 4.7/5

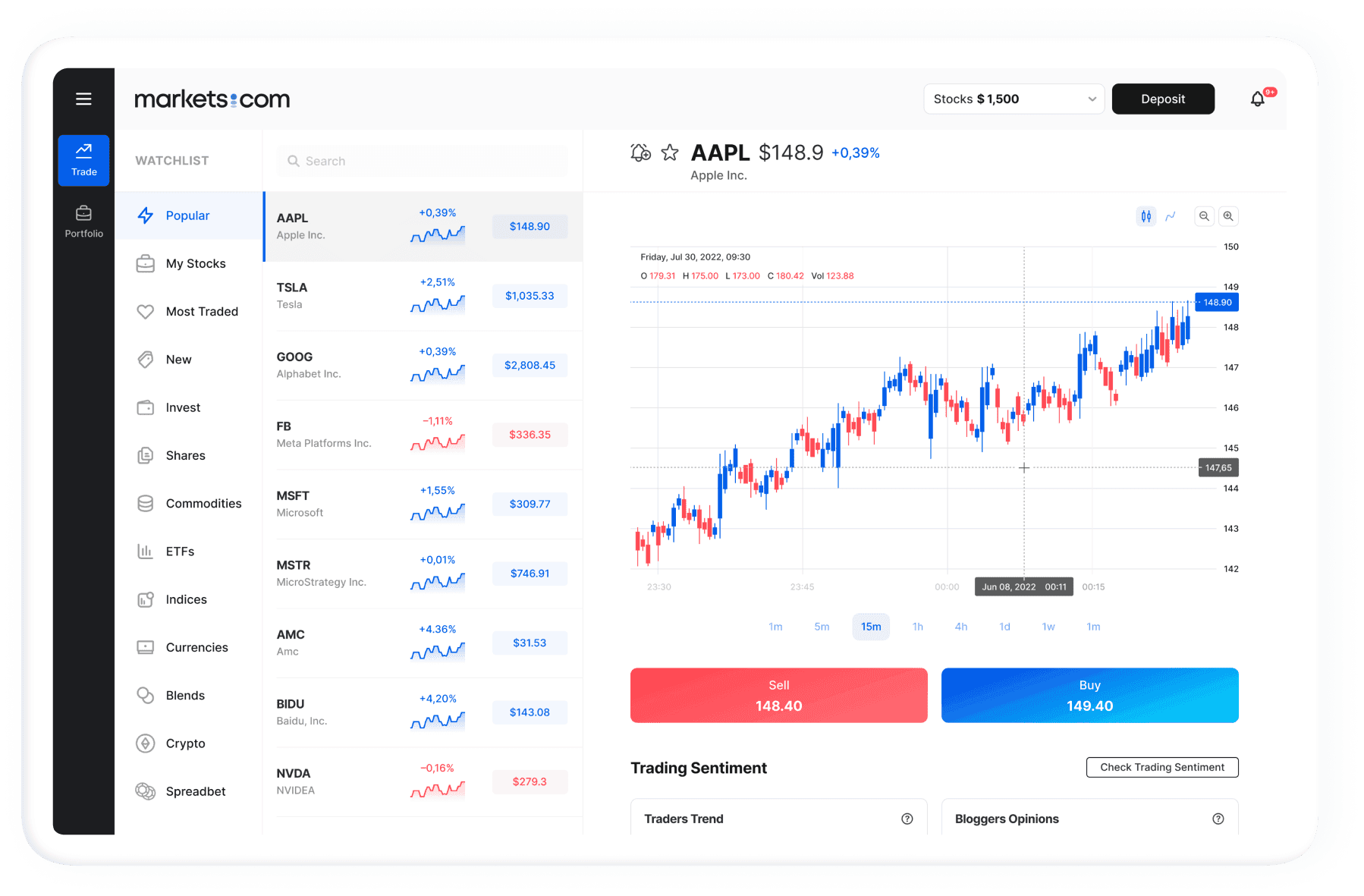

Markets.com offers a variety of platforms suitable for different preferences and needs. The Markets.com Web platform provides a user-friendly interface with a wide range of fundamental, technical, and sentiment-based tools as well as expert analysis. For traders who prefer more robust and widely recognized platforms, Markets.com also supports MT4 and MT5, both of which are known for their extensive range of technical analysis tools, automated capabilities, and user customization options.

Additionally, the broker integrates TradingView, a popular charting platform that offers advanced technical analysis and social trading features. For those interested in social trading, the Markets.com Social Trade App enables traders to follow, copy, and interact with other successful traders, fostering a collaborative experience. This diverse range of platforms ensures that traders have the tools they need.

The broker is known for its advanced infrastructure, boasting an average execution speed of 0.082 seconds, ensuring efficient and timely order processing for its clients. Markets.com is also renowned for its fast execution speed, with orders processed as quickly as 0.35 milliseconds, ensuring a smooth and efficient experience. However, the availability of these platforms may vary depending on the regulatory entity overseeing the trader’s account.

Trading Platform Comparison to Other Brokers:

| Platforms | Markets.com Platforms | Hantec Markets Platforms | FXCM Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | No |

| cTrader | No | No | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Markets.com Web Platform

The Markets.com Web platform features market-leading analysis tools, including Analyst Recommendations and Insiders, offering valuable insights to help traders make informed decisions. Traders can also benefit from expert tips and guidance through XRay, with several live shows each day providing market analysis and strategies.

The platform keeps traders up-to-date with real-time news and market-moving updates through a live stream, ensuring they stay ahead of market trends. Additionally, the platform integrates pro-level charting tools powered by TradingView, providing advanced technical analysis and a customizable interface for traders at all experience levels. This combination of features makes the Markets.com Web platform a powerful choice for those seeking an all-in-one trading solution.

Main Insights from Testing

Testing Markets.com’s proprietary Web platform reveals a robust and intuitive experience, with an emphasis on user-friendly navigation and powerful analytical tools. The platform’s integration of market-leading features such as Analyst Recommendations, live market news, and expert-driven content like XRay ensures traders have access to valuable insights.

The advanced charting tools from TradingView provide technical analysis capabilities, while the live stream of market-moving updates keeps traders informed in real-time. Overall, the platform offers a seamless and efficient environment suitable for traders of all levels.

Markets.com Desktop MetaTrader 4 Platform

The desktop MT4 platform is a popular choice for traders seeking a customizable environment. Known for its user-friendly interface and extensive range of features, MT4 allows traders to execute trades with precision and speed.

The platform offers a range of intuitive charts, technical indicators, and automated trading capabilities through Expert Advisors, allowing users to set up and run custom trading strategies. With a wide array of order types, real-time price updates, and a rich selection of analytical tools, the platform is designed to meet the needs of traders.

Markets.com Desktop MetaTrader 5 Platform

The desktop MetaTrader 5 offers enhanced trade management and a broader selection of assets, making it an ideal choice for traders who want advanced features and flexibility. In addition to the capabilities of MT4, MT5 introduces more timeframes, order types, and an integrated economic calendar, offering traders improved tools for strategic planning and execution.

The platform’s advanced charting, technical analysis tools, and additional indicators help users make more informed decisions. Traders can access a wider range of markets, providing opportunities for diversified strategies. MT5’s efficient trade management, faster execution speed, and improved user interface make it a comprehensive platform for traders of all levels.

Markets.com MobileTrader App

Markets.com provides traders with access to the mobile version of its proprietary platform, ensuring seamless trading on the go. With the app, users can execute trades, access diverse charting tools, and monitor their portfolios from anywhere.

Additionally, the Markets.com Social Trade App offers a unique feature for social trading, allowing users to follow top traders’ strategies and gain insights into their decisions. This app provides instant signals, enabling traders to follow the moves of successful traders and automate their strategies to match their objectives. Traders can explore a variety of approaches, enhancing their market analysis and decision-making, and access diverse opportunities across CFDs on Forex, Shares, Crypto, and more.

Trading Instruments

Score – 4.5/5

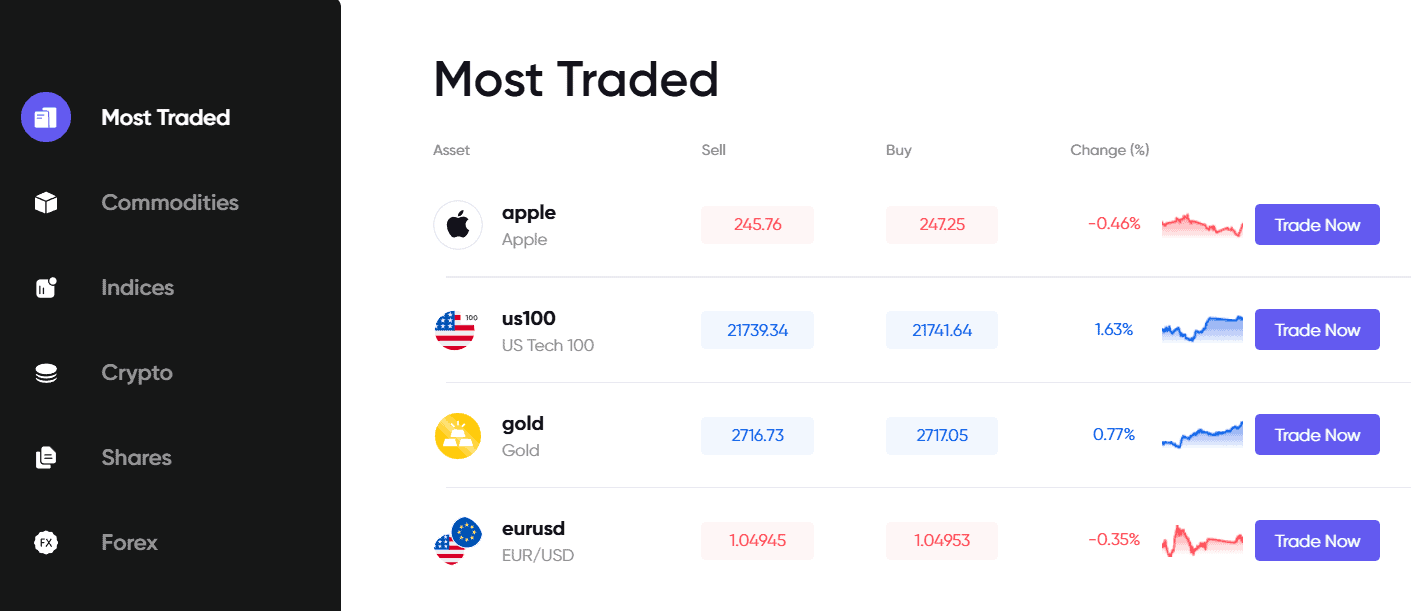

What Can You Trade on Markets.com’s Platform?

Markets.com offers access to over 2,200 assets, including Currency, CFDs, Commodities, Cryptocurrencies, Bonds, Shares, Indices, and ETFs, with leverage ratios of up to 1:500.

The instruments include both common offerings among brokers and unique ones. There are several advantages to trading Shares through Markets.com, including access to over 12 major markets with zero commission.

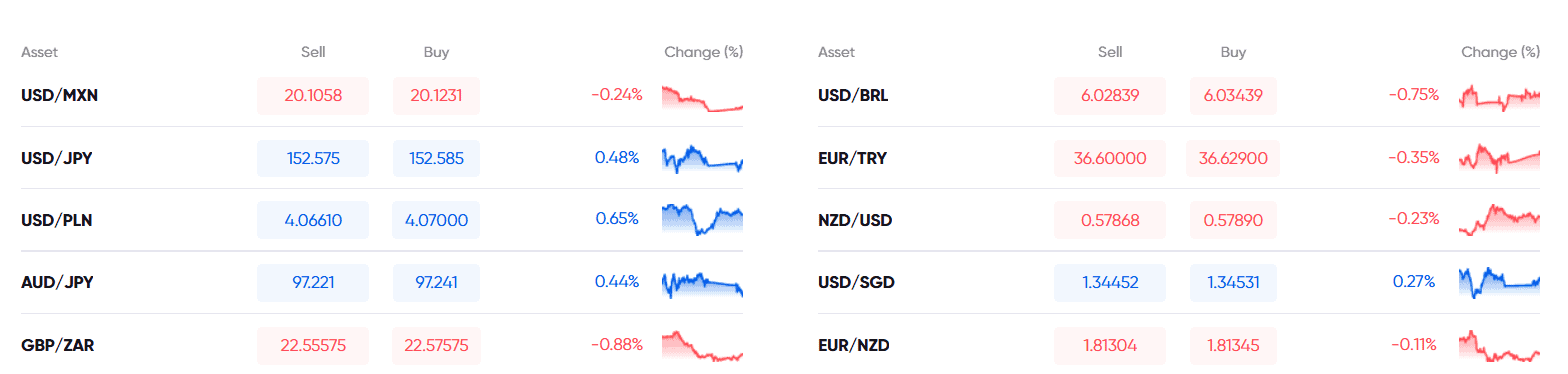

Forex trading includes major, minor, and exotic currency pairs, with more than 60 pairs available, all with spreads only.

Additionally, the specific selection of assets can vary depending on the regulatory entity under which the account is registered, which may impact the overall diversity available to traders.

Main Insights from Exploring Markets.com’s Tradable Assets

Markets.com offers a popular selection of tradable assets, including cryptocurrencies like Bitcoin, Ethereum, and Ripple. Its range is good overall, yet may not be as extensive as some competitors that offer thousands of different products. The broker does not provide instruments like options or real futures, which may limit traders seeking more specialized or advanced financial products.

Additionally, the specific selection of assets can vary depending on the regulatory entity under which the account is registered, potentially affecting the overall diversity of available instruments. While the platform’s offerings are well-suited for most retail traders, those looking for a more niche or expansive range of instruments may find Markets.com’s asset selection somewhat limited.

Leverage Options at Markets.com

Markets.com offers marginal trading, meaning that you can trade through a multiplied amount of your initial deposit and operate larger positions. This tool gives a great advantage as it increases your potential gains, however, traders should understand the multiplier and be aware of the risks when using it.

We found that Markets.com Leverage offers the following conditions:

- European and UK resident traders can use a maximum leverage of 1:30.

- Australian clients can use a maximum leverage of 1:30 too.

- The international entities offer a high leverage of 1:500.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Markets.com

Markets.com offers a variety of payment options to accommodate traders worldwide. Deposits are typically processed quickly, while withdrawal times can vary depending on the chosen payment method.

However, the availability of payment methods may differ based on the trader’s location and the regulatory entity governing the account.

- Credit/Debit Cards

- Bank Wire

- PayPal

- Skrill

- Neteller, and more

Markets.com Minimum Deposit

The minimum deposit for Markets.com is $100, which allows beginners or traders of any size to open an account easily. Yet, check the specific requirements based on your residence and the applicable account type.

Withdrawal Options at Markets.com

For withdrawals, transactions are generally processed quickly and without charge, however, some banks may impose a transaction fee. The minimum withdrawal amounts and timeframes may vary depending on the payment method. Withdrawal processing times differ based on the chosen method, with e-wallets typically being the fastest, often completed within 24 hours. Bank transfers may take longer, usually 3-5 business days.

Customer Support and Responsiveness

Score – 4.5/5

Testing Markets.com’s Customer Support

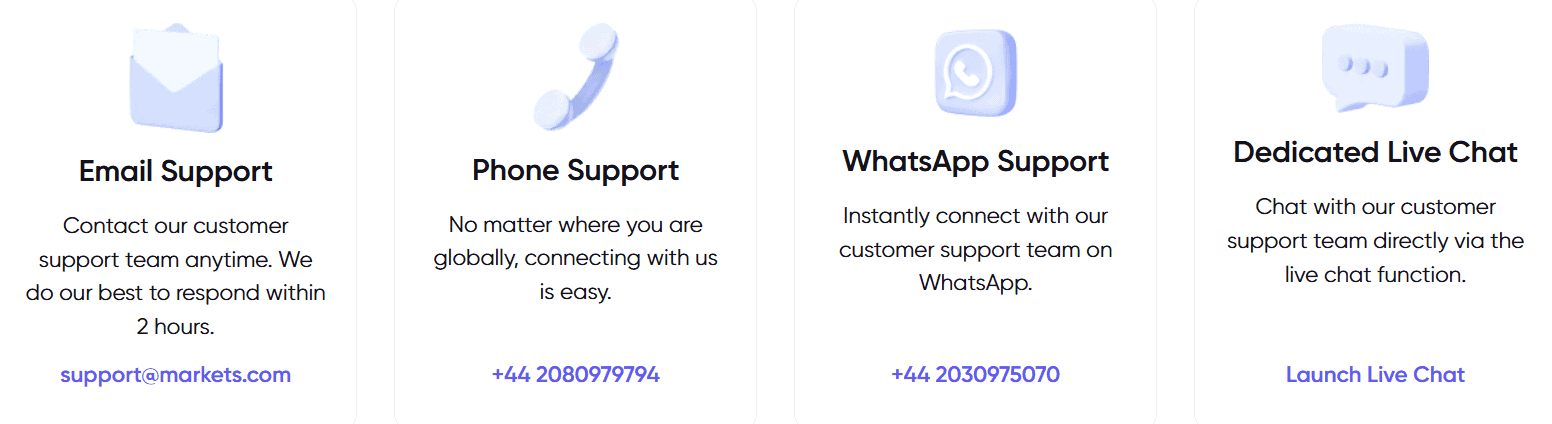

Markets.com offers reliable 24/5 customer support, available through various channels including live chat, email, and phone. The support team is responsive and knowledgeable, ready to assist with inquiries related to account management, technical issues, and trading.

Additionally, the support service is available in multiple languages, including English, Thai, Vietnamese, Spanish, Arabic, Italian, and Greek, ensuring that traders from different regions can easily access help. Also, Markets.com provides a Help Centre, and FAQ section, allowing users to resolve common issues on their own. While the quality of support is generally praised, response times may vary based on the volume of inquiries, with live chat often being the quickest option for immediate assistance.

Contacts Markets.com

Markets.com offers various methods for traders to get in touch with customer support. Traders in the UK can reach phone support at +44 208 097 9794, and international support at +27 104 470 539. For WhatsApp support, the numbers are +44 203 097 5070, and +971 4 542 9158.

Additionally, traders can contact customer support via email at support@markets.com for assistance. These contact options ensure that traders can easily get help, according to their preferences.

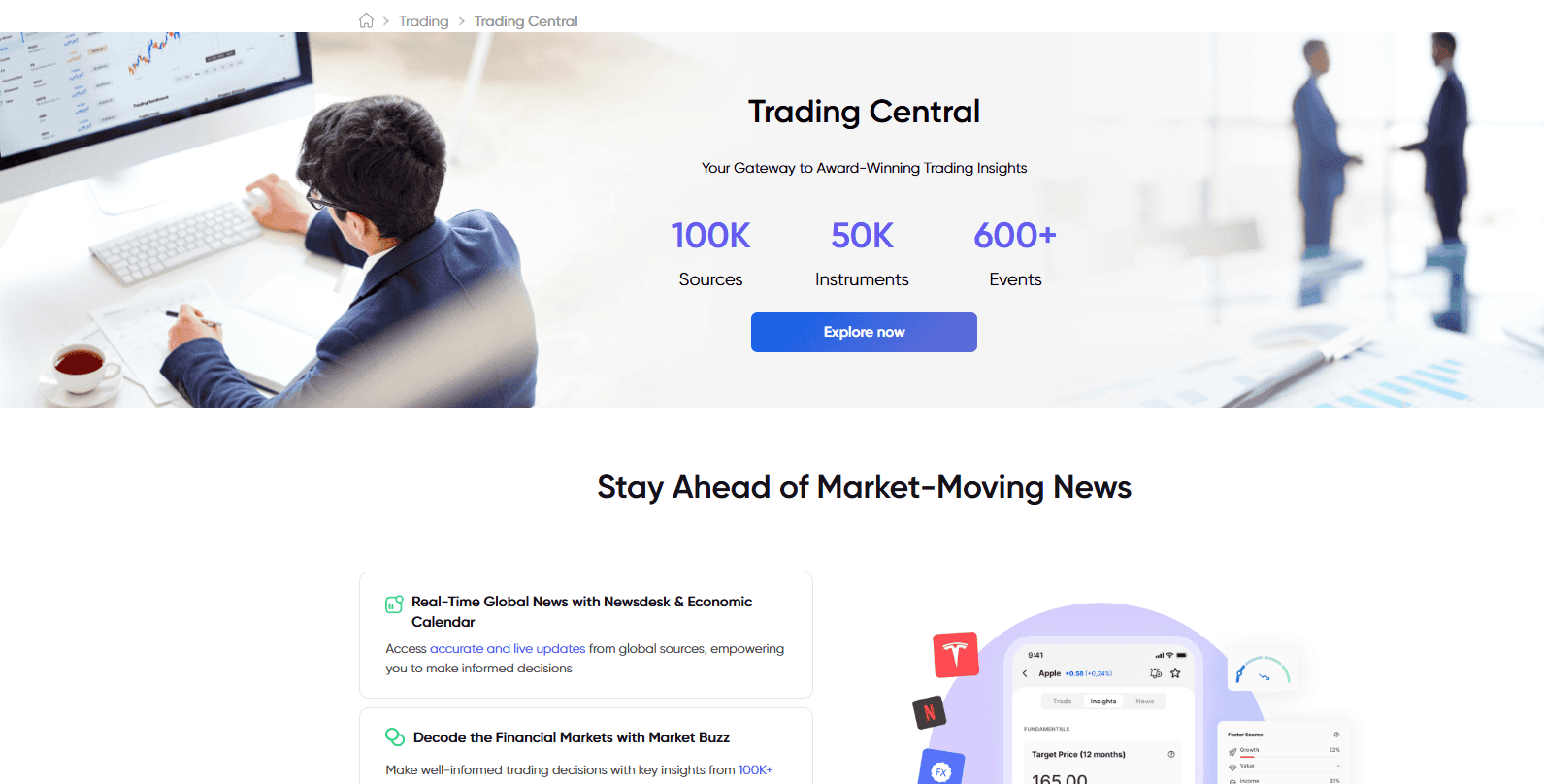

Research and Education

Score – 4.4/5

Research Tools Markets.com

Markets.com offers a variety of research tools to empower traders with valuable market insights.

- On the website, traders can access real-time news updates, ensuring they stay informed about market-moving developments and economic events. The Traders’ Clinic, also available on the website, provides personalized advice and strategy reviews from expert analysts.

- Additionally, the Academy serves as an educational hub, featuring an Economic Calendar for tracking impactful events, strategy guides, and detailed market analysis.

- On the platforms, Markets.com offers advanced charting tools and integrated news features, allowing traders to perform in-depth market analysis directly from the platform for a seamless experience.

Education

Markets.com offers a comprehensive learning suite designed to empower traders with professional knowledge and market insights. The platform features a Professional Knowledge Center, which includes an array of research materials, live news, and detailed market analysis to support informed decision-making.

Additionally, traders can benefit from interactive webinars conducted by market experts, covering a wide range of topics and strategies. These resources cater to traders of all experience levels, offering practical insights and the latest market developments to enhance their trading expertise and confidence.

Is Markets.com a good broker for beginners?

Markets.com is a solid choice for beginners due to its user-friendly interface, low minimum deposit requirement, comprehensive learning resources, and market analysis. The availability of demo accounts allows new traders to practice without financial risk, while features like fast execution and a variety of tools make the learning process smoother.

However, beginners should be mindful of the platform’s fee structure and take the time to understand risks before diving in.

Portfolio and Investment Opportunities

Score – 3.7/5

Investment Options Markets.com

Markets.com is primarily known as a Forex broker, offering a range of robust tools and features tailored for individual traders. While it does not support MAM or PAMM accounts, which may limit options for account managers handling multiple portfolios, the platform makes up for this limitation with its Social Trading features. These features enable users to follow and replicate the strategies of experienced traders, providing a collaborative and guided approach to trading.

As a result, Markets.com caters to both active traders and those who prefer a more strategy-driven investment approach.

Account Opening

Score – 4.3/5

How to Open Markets.com Demo Account?

Opening a demo account with Markets.com is a straightforward process designed to help traders practice and familiarize themselves with the platform. To get started, visit the Markets.com website and select the option to open a demo account.

You will be asked to provide some basic information, such as your name, email address, and preferred password. Once submitted, you can choose the amount of virtual funds to simulate real-market conditions. After completing the registration, you will gain instant access to the demo account and can begin trading with virtual money, allowing you to test different strategies and explore the features of the platform without any financial risk.

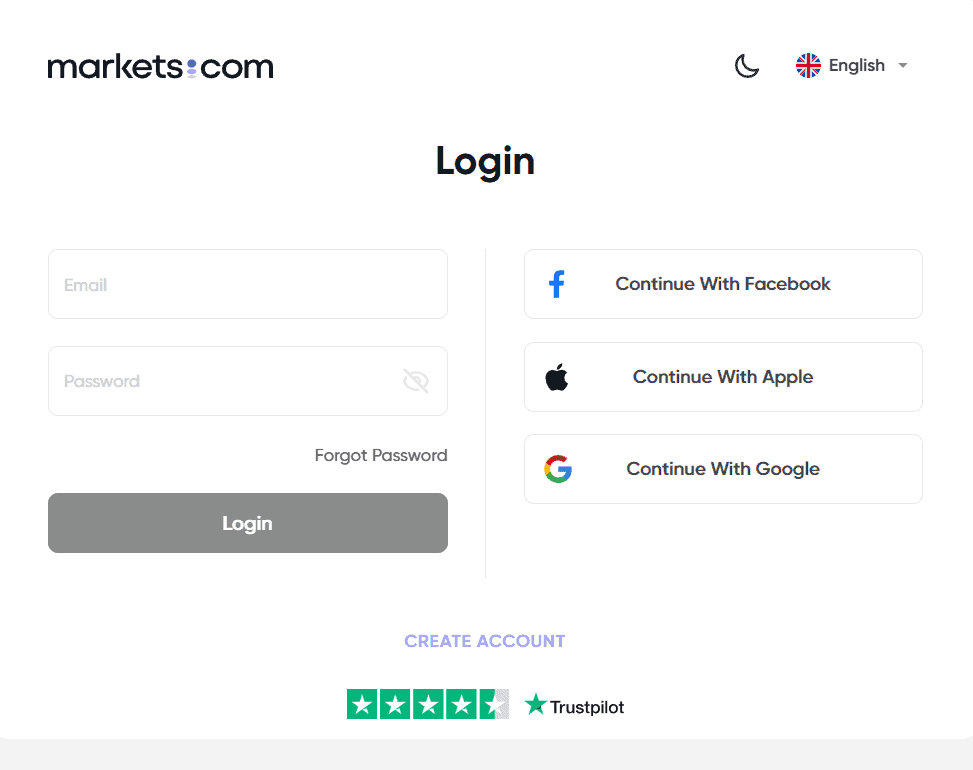

How to Open Markets.com Live Account?

Opening an account with Markets.com is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Click on the “Sign Up” icon on the Markets.com homepage.

- Provide your personal information, such as your full name, email address, phone number, and country of residence.

- Choose your preferred account type.

- Set your preferences, including the base currency of your account and leverage.

- Upload the necessary identification documents for verification (e.g., passport or ID card, utility bill for address proof).

- Complete the risk disclosure and agree to the terms and conditions.

- Make an initial deposit to fund your live account. The minimum deposit may vary based on your region and account type.

- Once your account is verified and funded, you can start trading with real money on the Markets.com platform.

Additional Tools and Features

Score – 4.5/5

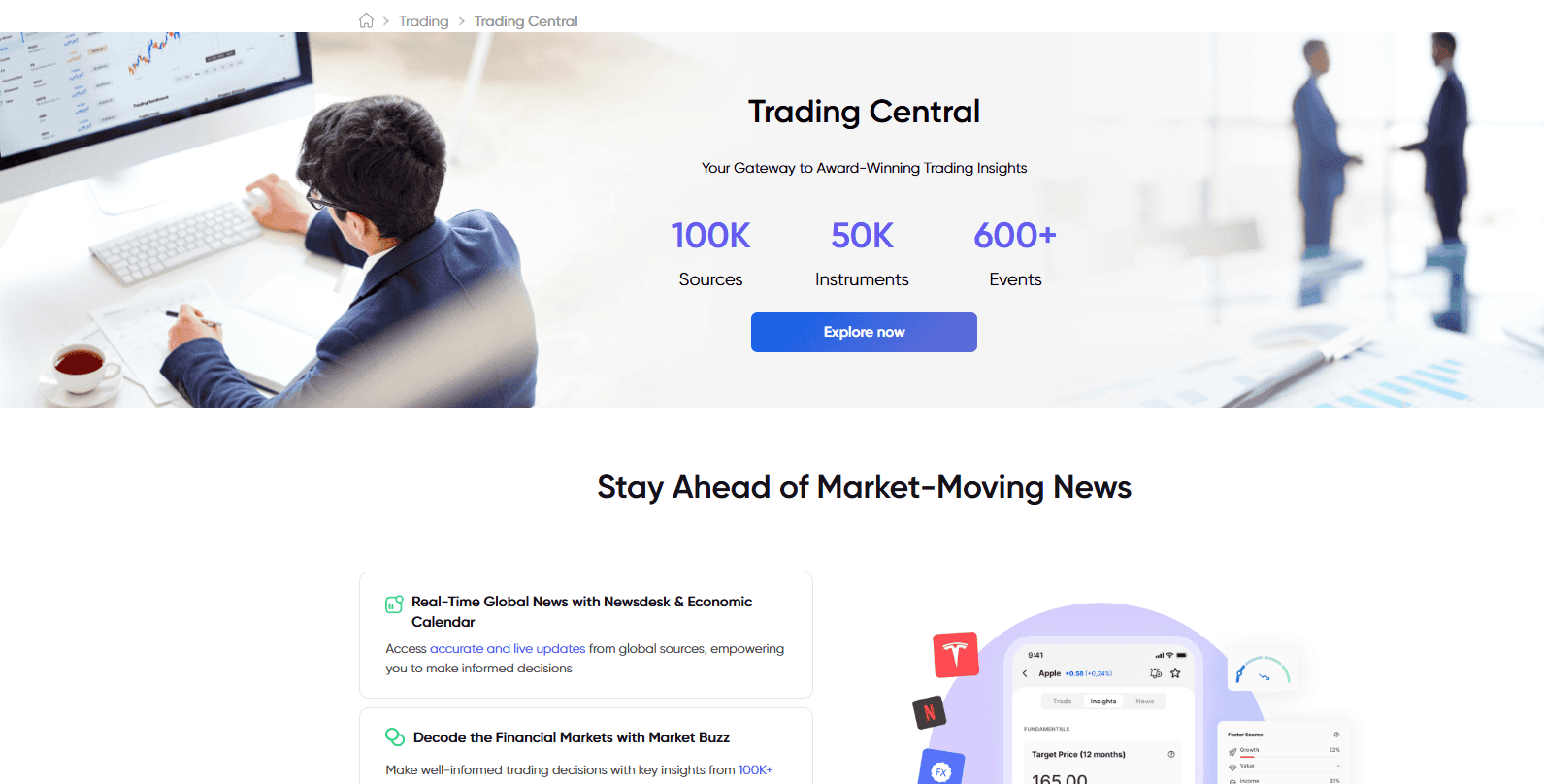

Markets.com offers a range of additional tools and features to enhance the trading experience.

- The integration with TradingView allows traders to access advanced charting and analysis tools directly within the platform, making it easier to analyze market trends.

- Trading Central provides in-depth research, market analysis, and signals for international entities, helping traders make informed decisions.

- The broker also offers several calculators, such as the CFD calculator, Forex margin calculator, commodities profit calculator, and Forex profit calculator, which assist traders in managing risk, calculating potential profits, and understanding margin requirements. These tools provide a comprehensive set of resources for traders to enhance their strategies and optimize their trading performance.

Markets.com Compared to Other Brokers

Markets.com stands out as a strong option for many traders, offering a robust set of features for retail traders. It stands out for its user-friendly platforms, including its proprietary web platform and integration with TradingView, offering good charting tools and social trading options.

In terms of fees, its spreads are competitive, however, some competitors might offer slightly lower spreads, also there is no commission-based account for trades looking for this fee structure Brokers like FP Markets or FXTM might be more fit. While Markets.com offers access to over 2,200 instruments, some competitor brokers like FP Markets or Forex.com, provide a wider variety of assets, including a more extensive range of instruments, such as options and real futures.

Markets.com also offers educational resources and customer support in multiple languages, but competitors like FXCM and FP Markets provide more extensive educational tools and 24/7 customer service. Lastly, while the broker’s minimum deposit is relatively accessible for beginners, it is slightly higher than some competitors that have a minimum deposit requirement of $0 or $50, such as Axi and FXCM.

Overall, Markets.com offers a well-rounded platform for most retail traders but may not be ideal for those seeking the most diverse assets or lowest costs.

| Parameter |

Markets.com |

FXTM |

Forex.com |

FP Markets |

Axi |

FXCM |

XTB |

| Spread Based Account |

Average 1 pip |

Average 1.5 pips |

Average 1.3 pips |

From 1 pip |

Average 1.2 pips |

Average 1.3 pips |

Average 1 pip |

| Commission Based Account |

For Stocks Only ($1 per $1,000 trade) |

0.0 pips + $3.5 |

0.0 pips + $5 |

0.0 pips + $3 |

0.0 pips + $7 |

0.2 pips + $0.05 per 1K lot |

0.0 pips + 0.2% (for real stocks and ETF above €100,000 monthly turnover) |

| Fees Ranking |

Average |

Average |

Average |

Low/ Average |

Average |

Average |

Low/ Average |

| Trading Platforms |

Markets.com Web, MT4, MT5, TradingView, Markets.com Social Trade App |

MT4, MT5 |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, Axi Trading App, Axi Copy Trading App |

MT4, Trading Station, ZuluTrade, TradingView Pro, NinjaTrader, Capitalise AI |

xStation 5, MT4 |

| Asset Variety |

2,200+ instruments |

1000+ instruments |

6000+ instruments |

10,000+ instruments |

220+ instruments |

200+ instruments |

6100+ instruments |

| Regulation |

CySEC, FCA, ASIC, FSCA, FSC, FSA |

FCA, FSC, CMA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, DFSA, FSA |

FCA, ASIC, CySEC, FSCA, FSA, ISA |

FCA, CySEC, KNF, FSC, CNMV, DIFC |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/7 support |

24/5 |

24/5 |

24/5 support |

| Educational Resources |

Good |

Good |

Excellent |

Excellent |

Good |

Excellent |

Good |

| Minimum Deposit |

$100 |

$200 |

$100 |

$100 |

$0 |

$50 |

$0 |

Full Review of Broker Markets.com

Markets.com is a well-established broker offering a comprehensive suite of platforms that provide traders with a variety of tools, such as robust charting features, social trading capabilities, and seamless integration with third-party platforms like TradingView.

The broker offers over 2,200 tradable assets, making it a versatile choice for retail traders. However, it does not offer more complex products like options or real futures.

In terms of regulation, Markets.com is authorized by several respected financial authorities, including the FCA, ASIC, CySEC, and others, providing a secure and reliable environment. Its fee structure includes competitive spreads, starting at around 1 pip. While the broker offers a strong range of features and learning resources, it may fall short for those seeking the lowest fees or a broader selection of instruments. Overall, Markets.com is a reliable choice for traders seeking solid trading experience with a strong regulatory background and user-friendly platforms.

Share this article [addtoany url="https://55brokers.com/markets-com-review/" title="Markets.com"]

Help my funds have been locked..

Please who can assistance me out with their support

Hello please i really need help

they ripped me, but i got it back with the help of the mail on my headline…

Can I somebody assist me with this cos it’s been G too long now without my profit under Mrs Nkutu melese

I have traded in your company under a Mrs Nkutu melese of which now takes time to respond with me can someone tell me what to do I have spent more than 15000 thill now now one is willing to help me can you please tell me what is going on here please

I deposited 100USD but the money wasn’t credited into my trading account and I also went to my bank to confirm the transaction and the funds was deducted from my bank account that people stole my money and now they are not answering my questions even live chat they keep me holding without any answer

I think that it’s always necessary to check everything out when it comes to trading. I investigated everything about investmarkets before making the first deposit. It works. But I don’t like that they don’t provide services in Canada. Because of my relatives I gotta travel a lot to Canada, and it’s not comfortable.

hi there

thanks for the review

i tried investmarkets and it got nice actually

i love this platform to trade on

my anticipated income has been achieved so fast

can i trade 400:1 in germany and do you have an demoaccount?