- What is Libertex?

- Libertex Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

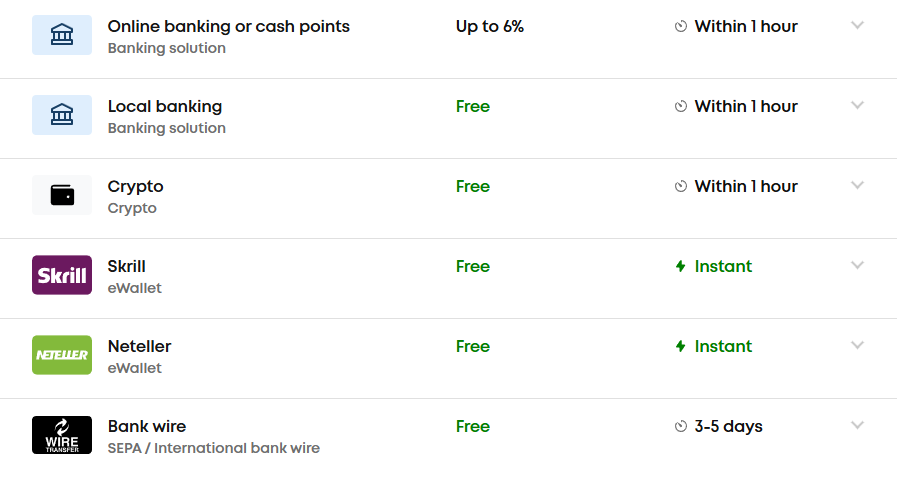

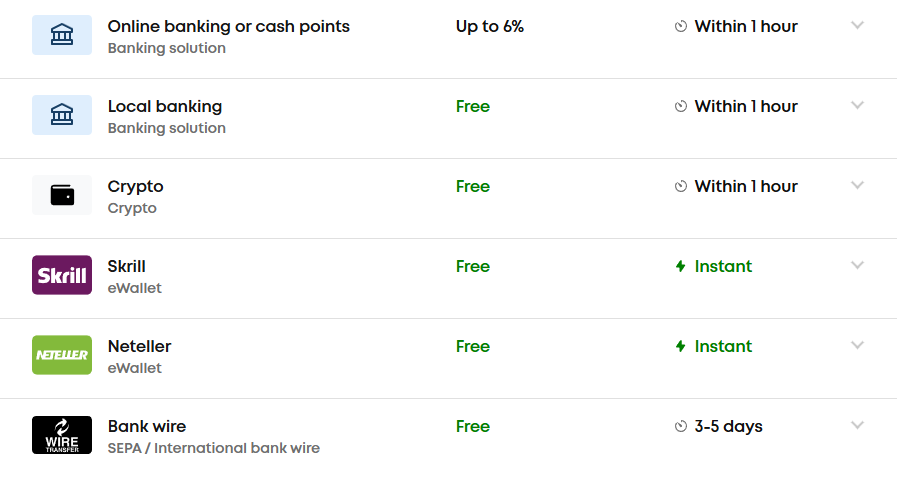

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Libertex Compared to Other Brokers

- Full Review of Broker Libertex

Overall Rating 4.3

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.1 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4 / 5 |

What is Libertex?

Libertex is an international brokerage company with its base in Cyprus offering professional experience with the main focus on Forex and CFD trading to customers from all over the world since 1997. The broker offers 170 tradable assets available on a reliable, award-winning platform performed by high-speed execution of orders, processed through market execution.

Based on our research, Libertex stands out by its cutting-edge user-friendly technology backed up with high-quality technical equipment offering traders an exceptional trading environment that caters to their trading needs. Libertex strives to provide its clients with the best conditions for trading with good technology and offerings making itself a good choice for traders.

Libertex Pros and Cons

Our experts find Libertex a broker with flexible trading conditions offering a decent variety of platforms, and pricing built into a commission charge. One of the main advantages is that the broker doesn’t have spreads for trades on its proprietary platform, and charges small commissions on trades calculated in accordance with market conditions and percentage of trades.

On the negative side, education is insufficient hence the broker may be suitable for professional traders only. Also, the market range is limited to CFDs and FX, and support is not available on weekends. On top of that, the broker doesn’t provide Islamic accounts so it is not suitable for those who want to trade in accordance with Sharia Laws.

| Libertex Strong Points | Libertex Weak Points |

|---|

| Regulated by CySEC | No Islamic Account |

| Negative Balance protection | No 24/7 customer support |

| Compensation Scheme | Few account types |

| Good reputation and long years of activity | |

| Low Minimum Deposit | |

| Global Coverage including Asia, the MENA, and Africa | |

| Demo Account available | |

Libertex Features

Libertex is a global forex broker licensed by CySEC, ensuring a safe trading environment and protection of funds. The broker offers competitive conditions and can be a favorable choice for many traders. We have compiled the essential points on trading with Libertex for more insight into its offerings:

Libertex Features in 10 Points

| 🗺️ Regulation | CySEC, SVG |

| 🗺️ Account Types | A single account type |

| 🖥 Trading Platforms | Libertex WebTrader, MT4, MT5 |

| 📉 Trading Instruments | Forex currency pairs, stocks, metals, indices, commodities and Cryptocurrencies |

| 💳 Minimum deposit | $10 |

| 💰 Average EUR/USD Spread | from 0.00003 |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | GBP, USD, EUR |

| 📚 Trading Education | Basic learning materials |

| ☎ Customer Support | 24/5 |

Who is Libertex For?

Based on Our findings and Financial Expert Opinion Libertex is a good choice, especially for those who prioritize secure trading with favorable conditions for enhanced experience. By offering a competitive fee structure, low minimum deposit, and a good selection of trading instruments, Libertex is a good choice for the following:

- Professional Traders

- Commission Based Trading

- Copy Trading

- Scalping / Hedging Strategies

- Traders who prefer the MT4/MT5 platforms

- Cryptocurrency CFD Trading

- Currency Trading and CFD Trading

- Stock CFD Trading

- Suitable for a Variety of Trading Strategies

Libertex Summary

We find Libertex a trustable company with more than 25 years of operations, with advanced offerings through a variety of trading instruments and a proprietary platform developed for trading convenience. The trading costs are calculated smartly based not on the spreads but according to the market condition and the particular trade as a percentage, so clients do not pay extra spreads or additional charges that are hard to calculate.

55Brokers Professional Insights

Overall, our impression of Libertex was mostly positive, as we found that Libertex is a broker with a secure environment for investments and favorable trading conditions, mainly suitable for trader who prefer commission based trading. Libertex has a reliable with good reputation offering excellent experience, and is mostly suitable for professionals, since the biggest advantage is that Libertex doesn’t have spreads and has few commissions on trades which are on the lower side.

On the other hand, Libertex does not offer a very wide range of instruments, which can be limiting for those traders who want to expand their portfolios and experience new opportunities. Also it lacks educational materials making it unsuitable for beginner traders.

Besides its CySEC-regulated entity, Libertex also operates under the St. Vincent and the Grenadines license, an offshore entity. Although the range of services is wider when trading under an offshore entity, the safety measures are more lax and inconsistent, thus we recommend the security of the top-tier regulation, to keep the investments with Libertex in safety.

Consider Trading with Libertex If:

| Libertex is an excellent Broker for: | - Professional traders

- Cost conscious traders who prefer spread and commission free trading

- Traders who prefer MT4 and MT5 platforms

- Traders who look for high leverage opportunities

- A Variety of Trading Strategies |

Avoid Trading with Libertex If:

| Libertex is not the best for: | - Spread-Based Trading

- US Traders

- Beginner traders

- Those traders who rely on educational and research resources

- For those who are looking for extensive instrument availability

- Traders who prefer 24/7 customer support |

Regulation and Security Measures

Score – 4.3/5

Libertex Regulatory Overview

Libertex is a brand name that is used by Indication Investment Ltd, a Cyprus established Investment Firm, which is regulated and supervised by the Cyprus Securities and Exchange Commission (CySEC) and is considered a low-risk forex broker.

- The regulatory status is indeed the most important thing to check while choosing a broker, as a serious authority requirement establishes a set of rules that are governed by the MiFID in the case of Libertex. This means that the EU authority supervises the financial markets and investment services firms, their compliance and reliability within the zone, and enables them to provide services to all EEA (European Economic Area).

- The broker has also an established offshore entity regulated by St. Vincent and the Grenadines (registration No. 1277 LLC 2021). However, we strongly recommend trading through the CySEC entity, as the latter provides robust regulations.

How Safe is Trading with Libertex?

Libertex takes important measures to keep its clients’ investments protected. It acts in accordance with the CySEC and MiFID laws by providing segregated client funds, negative balance protection, and participation in the Investor Compensation Fund (ICF), ensuring a secure and transparent trading environment.

Consistency and Clarity

When it comes to Libertex’s consistency in operations and reliability, the broker is considered a stable choice, due to its tight regulations and adherence to strict rules. Besides, the broker has been in the market for over two decades, which already speaks about its credibility, and ability to adapt to changing market conditions while maintaining a secure trading environment for its clients.

Another proof of the credibility of the broker is the 30+ international awards that Libertex has received at different times during the years. Its over 2 million client base also indicates that traders trust the platform for its safe environment, competitive conditions, and long-lasting presence. However, we also found some negative reviews from clients, mostly complaining about difficulties in the withdrawal process. Overall we find that Libertex has mostly positive feedback and is known as a good-standing broker that provides high-quality trading opportunities.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Libertex?

Libertex offers one account type to retail traders with a simple opening process. The account is named Libertex, which allows clients to trade with the broker’s proprietary platform.

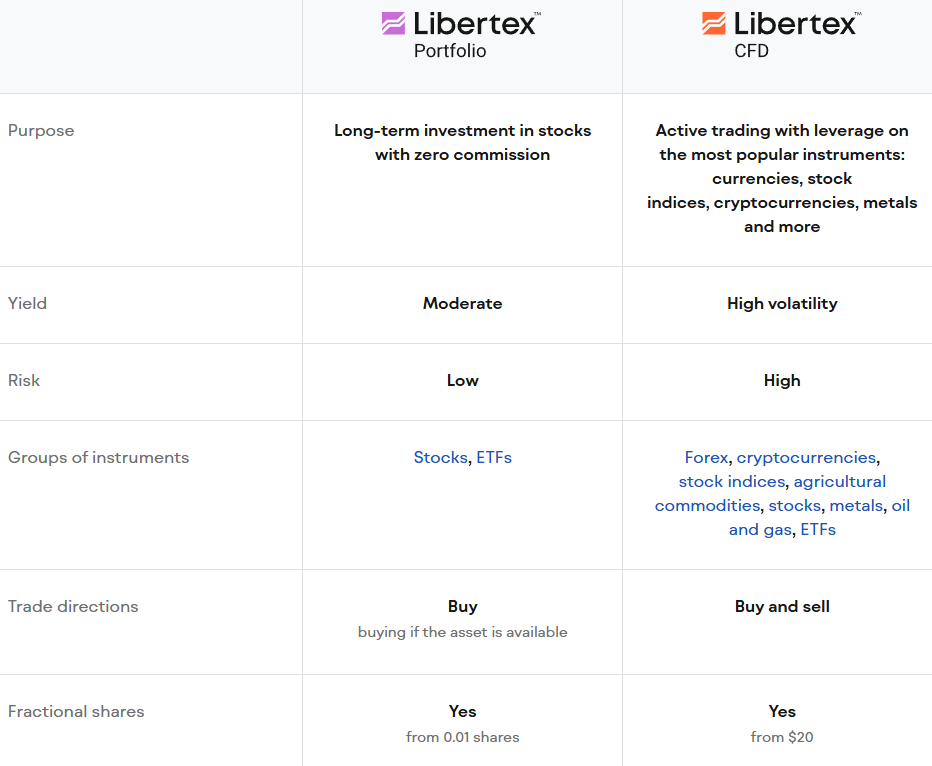

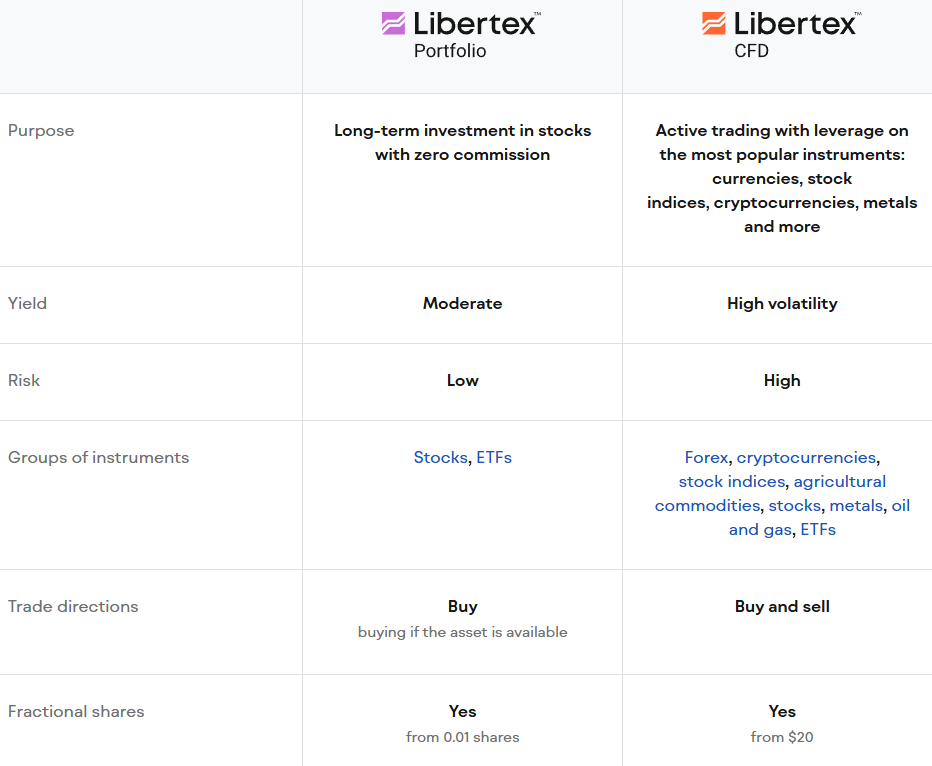

However, based on the entity, the account type offering differs. Through its offshore entity, traders gain access to 2 main account types – Libertex Portfolio and Libertex CFD.

- Libertex Portfolio is a unique account type that allows traders to invest in stocks with zero swaps or commissions. This account type is suitable for traders who want to engage in long-term investment, mainly giving access to stocks and ETFs.

- On the other hand, Libertex CFD enables access to cryptocurrencies, currency pairs, gold, oil, and stock indices. The account enables a multiplier of up to 1:999 to increase potential profit.

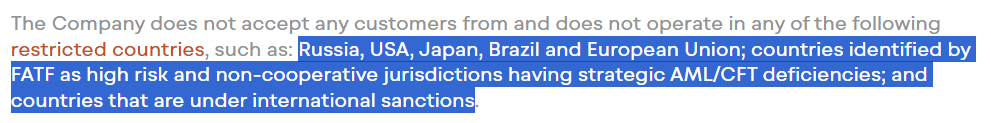

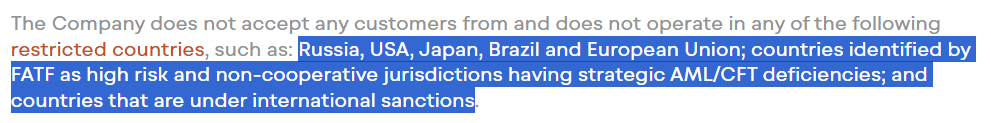

Regions Where Libertex is Restricted

According to the information on Libertex’s website, the broker does not accept clients from countries identified by FATF as high-risk and countries that are under international sanctions:

- Russia

- USA

- Japan

- Brazil

- Iran

Cost Structure and Fees

Score – 4.4/5

Libertex Brokerage Fees

Libertex offers a different cost structure, with the service cost calculated as a trading commission through a specified percentage according to the opened position. The spreads and commissions applied depend on the platform traded and the entity, thus clients should be very careful while signing with the broker under a certain entity, and while choosing a platform to conduct trades.

While trading through the Libertex proprietary platform, spreads start from 0.00003 pips, and commissions from $0, based on the trade size.

If traders choose the MT4 platform, then the applicable spreads start from 0.0 pips, with fees from $0.04 for each trade, depending on the instrument.

As for the MT5 platform, there are two options traders can choose from – for the MT5 Market option spreads start from 0.0 pips, combined with commissions, while for the MT5 instant option spreads start from 0.6 pips.

However, traders should remember, that under the CySEC entity, traders can only trade through the Libertex platform. The MT4 and MT5 platforms with their spread and commission offerings are available through the offshore entity.

Libertex’s platform is on a commission-only basis without spreads for any product or asset class. The commissions vary by product and asset class. For example, forex commission ranges between 0.005% to 0.1% per transaction, and commodities like gold and oil have about 0.1% to 0.3% commissions.

How Competitive Are Libertex Fees?

In general, Libertex fees are favorable, with the combination of zero spreads for its Libertex proprietary platform and small commissions for each trade. This is an advantageous offering, especially among high-frequency traders. Even with MT4/MT5 platforms, the tight spreads and small commissions put Libertex on the competitive ground among investors. Thus, the fee structure of Libertex is transparent and clear, although traders should be careful, as the conditions differ from entity to entity, together with safety measures.

| Fees | Libertex Fees | City Index Fees | Dukascopy Fees |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Commission based fee | Yes | Yes | Yes |

| Fee ranking | Average | Low | Low |

Libertex Additional Fees

While looking for the broker’s overall fees, we also viewed the non-trading fees and hiding fees, to see if there are any additional costs traders should be aware of. Mostly, we found that there are no deposit costs incurred by the broker. However, for online banking or cash points, there is a 6% deposit fee. For withdrawals, too there is a $2 fee for credit and debit card withdrawals, 2.5% plus $5 for local banking, and $29 for bank wire.

- The Company charges a commission for servicing inactive Trading Accounts if the account has not been active for 90 days. The monthly Inactivity fee is $10.

Trading Platforms and Tools

Score – 4.3/5

Libertex offers access to the market through industry-standard MT4 and MT5 platforms, as well as a Libertex proprietary platform. The platforms are simple to use with user-friendly interfaces and deep market analysis features that help users to make better decisions.

| Platforms | Libertex Platforms | Pepperstone Platforms | AvaTrade Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Libertex Web Platform

Access to the web platform is possible with the broker’s MT4 and MT5 platforms with no installation and download requirements. Traders gain access to charting tools, deep market analysis, and extensive tools and conditions. The good thing about the web platform is that most of the features of the desktop platforms are maintained, enabling traders to explore the market with ease and great flexibility.

Libertex Desktop MetaTrader 4 Platform

The broker’s MT4 platform gives access to a wide range of strategies, that have been backtested for years. The platform provides a good range of analytical tools with plugins, trailing stop orders, built-in trading signals, and robots. Also, clients can engage in copy trading, mirroring the trades of successful professionals. Besides, the economic newsfeed available on the platform, keeps traders in the know all the time, enhancing their trading decisions. The platform is available through Windows, mobile and tablets, and web versions.

Libertex Desktop MetaTrader 5 Platform

MetaTrader 5 is the latest version of the popular MT4 platform. In addition to Forex currency pairs, MT5 supports trading stocks, indices, oil and gas, agriculture, cryptocurrencies, ETFs, metals, and more with enhanced features that make the MT5 platform innovative and more productive. 12 new timeframes have been included to support scalpers and high-frequency traders. MT5 has 38 built-in technical indicators as opposed to only 30 in MT4. Besides, traders gain access to an unlimited number of charts and drawing tools.

Libertex Platform

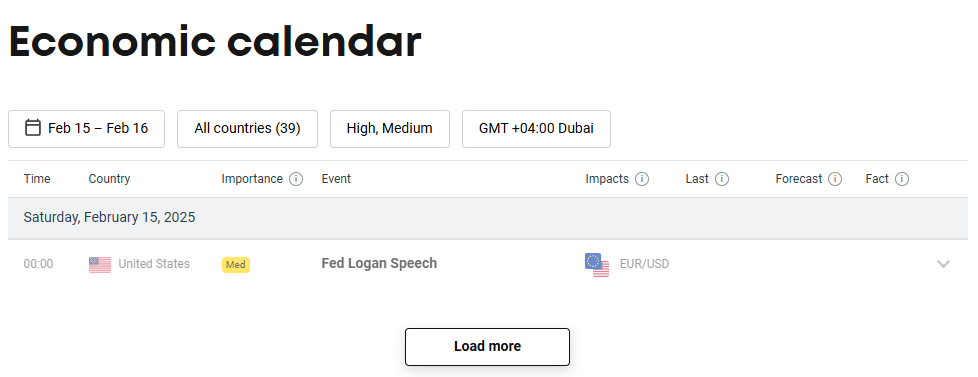

The Libertex platform is equipped with unique tools and features that stand out from other platforms. It enables clients to fully automate their trading, and gain access to ChatGPT-based products, available only through the Libertex platform. Besides, the platform enables reach to the Nobel Investment Portfolio, built on the principles invented by Harry Markowitz, a Nobel laureate in economics. In addition, the platform provides trading ideas from market professionals, a list of assets with the largest price fluctuations in the past few hours, an economic calendar, and a newsfeed.

Main Insights from Testing

The Libertex platform has been available to traders since 1997 and has proved its efficiency and flexibility. With deep market analysis, great charting tools, innovative solutions, and unique features, the Libertex platform enables traders to gain access to the market with very low fees, no spreads, and very low commissions per trade.

Libertex MobileTrader App

Libertex has also designed a mobile trading platform that is one of the best software for effective trading with different financial assets directly from the phone through comprehensive charts and numerous trading tools. Also, in case traders prefer to use the popular MT4 and MT5 platforms, they also have this option with Libertex. The apps are available both through iOS and Android gadgets. All in all, mobile apps give access to the market, at the same time providing the same functionality and versatility of tools as the desktop platforms. Thus, clients get full flexibility and the ability to trade from anywhere, enjoying advanced conditions.

Trading Instruments

Score – 4.5/5

What Can You Trade on the Libertex Platform?

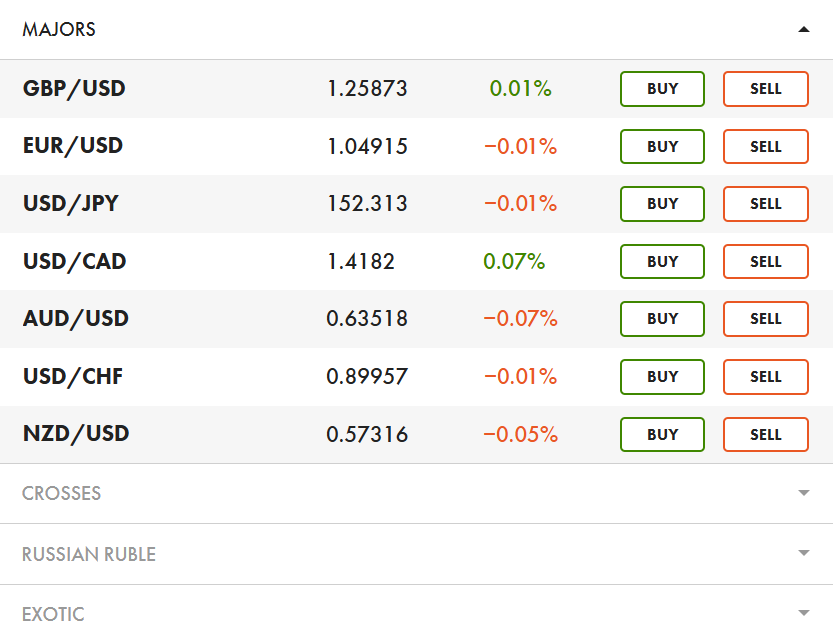

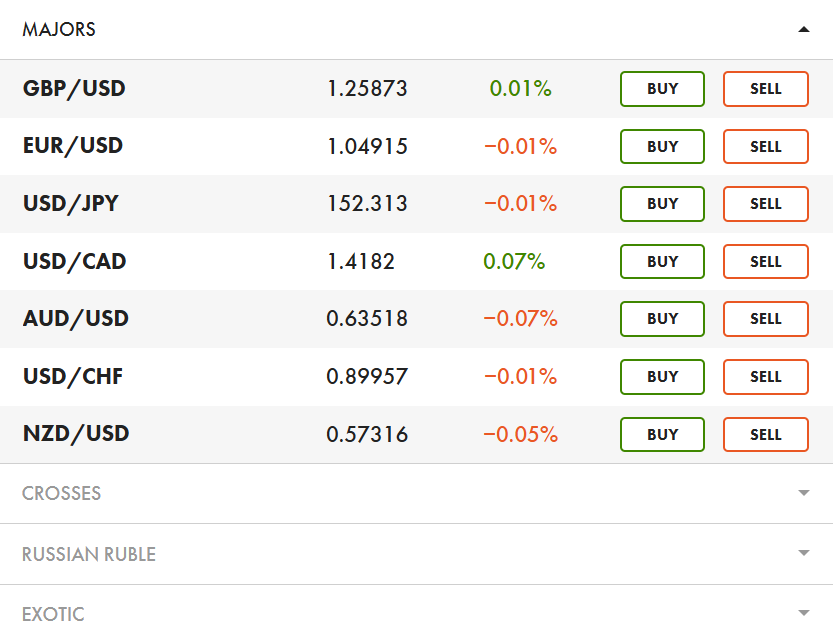

According to our investigation, the Libertex trading instrument range includes Forex currency pairs, stocks, metals, indices, and commodities. Moreover, Libertex enables clients to trade Cryptocurrencies that are widely presented to their benefit through the range of popular or even less common pairs like Bitcoin, Ethereum, Ripple, Monero, Dash, Stellar, Zcash, EOS, NEO, and many more.

Actually, during its years of operations, Libertex has won around 30 international awards from various reputable organizations and institutions for its quality services and specifically for Cryptocurrency trading solutions.

Main Insights from Exploring Libertex’s Tradable Assets

Libertex provides traders with a broad selection of tradable instruments. Forex is available with major, minor, and exotic currency pairs, while stock CFDs comprise well-known global companies like Apple, Tesla, and JPMorgan. Traders also have the option to trade popular indices such as the S&P 500, DAX, and Nikkei 225. It is also possible to trade commodities in metals such as gold and silver, energy commodities such as Brent and WTI crude oil, and agriculture commodities such as wheat and coffee. Cryptocurrency trading is also available using top coins such as Bitcoin and Ethereum. This good coverage of assets allows customers to diversify their portfolios and access different opportunities in the market. However, the instrument availability is different from entity to entity and from platform to platform, thus our advice is to check properly before opening an account with the broker.

Leverage Options at Libertex

Leverage is a financial technique allowing traders to borrow a larger amount of money from the broker with the aim of magnifying their initial balance. Leverage is indeed a great option, yet the probability of profits or losses increases in parallel, which makes it essential to learn how to use leverage smartly.

Libertex leverage levels as usual are determined by the regulatory restrictions, as set by the European MiFID, therefore is limited:

- The maximum leverage level is set to 1:30 for major currencies, 1:20 for minor currencies, and 1:5 for Cryptocurrencies.

- International Traders can access high leverage ratios, gaining access to multipliers as high as 1:1000

The misuse of leverage can lead to serious consequences, so it is of utmost importance to be careful and never use it with a hands-off approach.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Libertex

Libertex funding methods offer a selection of the preferred payment options that are available through the client’s menu within the Trading Platform. Currently, there are numerous possibilities to use:

- Bank Transfer

- Cards

- e-wallets like Skrill, Sofort, Ideal, Trusty, P24, and Neteller

However, it is important to note that you should check with customer service about your applicable option, as some jurisdictions may be entitled to some particular payment method.

Libertex Minimum Deposit

Libertex’s minimum deposit is $10 as a start to open a real trading account. As mentioned Libertex offers only one account type for retail traders and professionals may submit accounts only by confirming their status and thus will access tailored trading conditions.

Withdrawal Options at Libertex

Libertex does not charge any commissions for deposits from their side, yet make sure with the payment provider in case any other internal fees are applied. Also, Libertex may add on a withdrawal fee, which varies by the payment method, while Skrill is Free of Charge, 1% is added for Neteller transfers or 0.5% for International bank transfers.

- For e-wallets, the withdrawals are processed within 24 hours. Through local banking, it might take up to 3 business days for the withdrawal to be processed. Bank wires take longer – from 3 to 5 business days.

Customer Support and Responsiveness

Score – 4.5/5

Testing Libertex’s Customer Support

What we would like to highlight as well is the Libertex customer support available 24/5 in different languages and providing multichannel support through email and international calls.

The Libertex customer service team, which counts over 700 employees is able to provide high-quality support which explains its efficiency for the last 25 years to their millions of clients from numerous countries.

Contacts Libertex

As we found, Libertex offers different options for clients to communicate with the support team.

- The Live chat, based on our experience, is good, with prompt and detailed answers.

- Clients can also send their inquiries through email by using the following address: info@libertex.com

- The broker also provides a phone number for those who would like to communicate and direct their questions through a phone call: +357 22 025 100. There are other phone numbers provided, for different regions, so clients should check the information on the broker’s website, in the Contacts section.

- Also, Libertex is active on social platforms, providing updates on its operations and market news through IG, FB, YouTube, TikTok, and X.

Research and Education

Score – 4.1/5

Research Tools Libertex

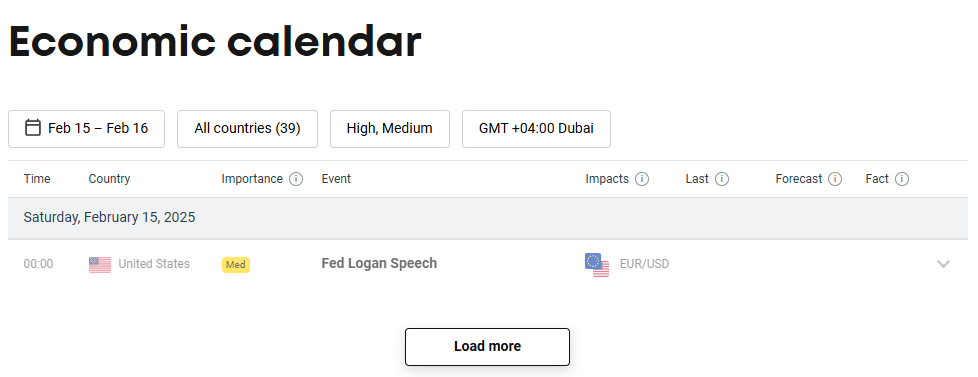

We also considered the research section for additional tools and features that will enhance the overall trading experience. However, based on our findings, there are no extensive tools and features, besides the ones that are already included in the broker’s platforms. Here is what we found:

- Economic Calendar keeps clients aware of the coming major events in the market, helping them to consider the changes and make informed decisions.

Education

Beginners can find some educational materials in the form of articles, however, overall the education section is poor and covers only basic trading information, with no access to courses, webinars, or glossary. We highly recommend traders use third-party education providers to enhance their trading skills.

- Also, in the Support section, traders can find articles and guides on how to trade with the broker and use the features and tools it provides correctly.

Is Libertex a Good Broker for Beginners?

Libertex is a good broker with competitive conditions and good and innovative platforms with enhanced features, yet a simple interface. It’s a suitable broker for cost-conscious traders, who want to start small, with minimum investments. However, for those beginner traders who are looking for extensive educational materials, this might be an unfavorable choice, as the education is only limited to articles. Still, to enhance their trading skills, users can access the Demo account with virtual money of $50.000.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options Libertex

As we have found, Libertex offers its tradable products mostly based on CFDs, which limits investment opportunities. However, we also found that through its offshore entity, traders can buy real stocks, ETFs, and fractional shares by signing in with the Portfolio account.

- Also, by conducting trades through the Mt4 platform, clients can use the Copy Trading opportunity, copying trades from experienced traders, and gaining profits without putting much effort and time.

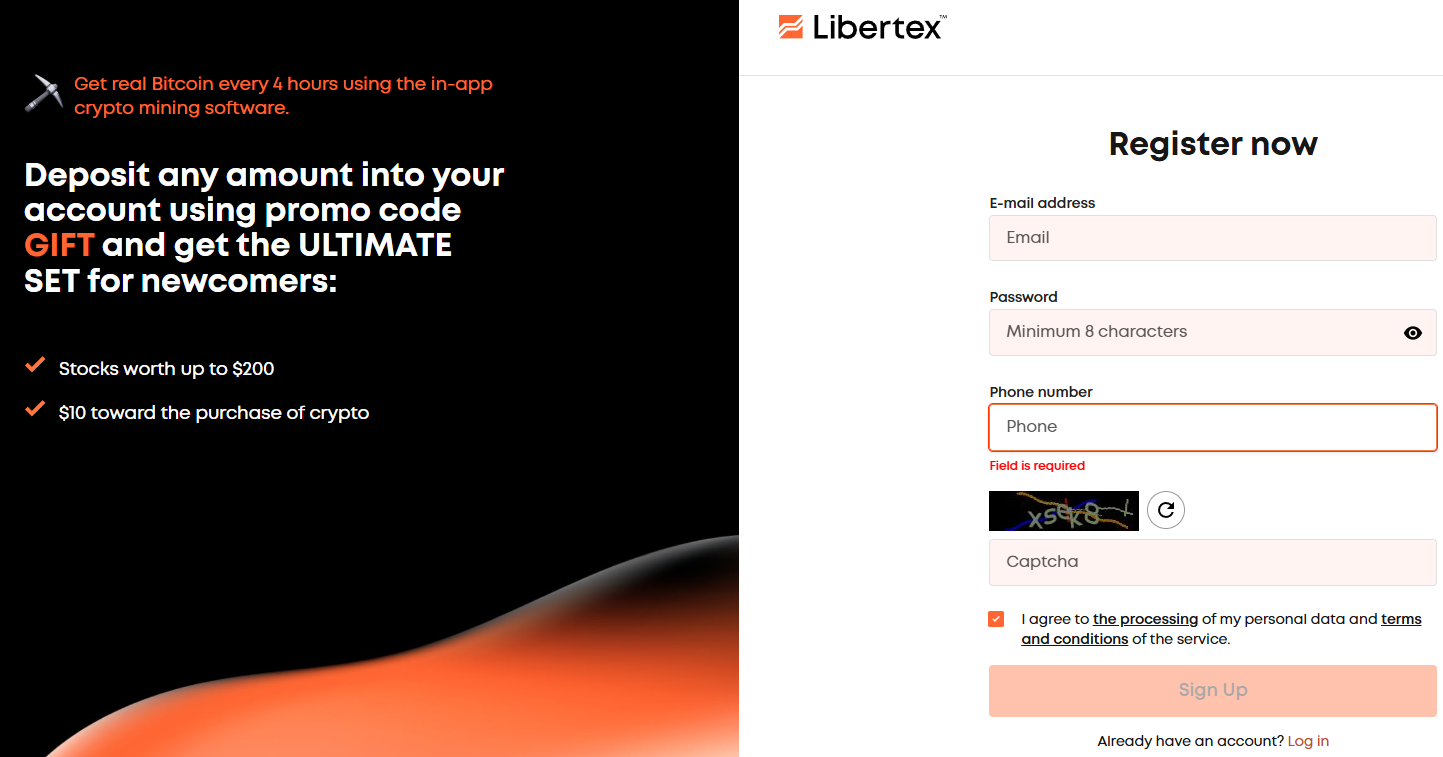

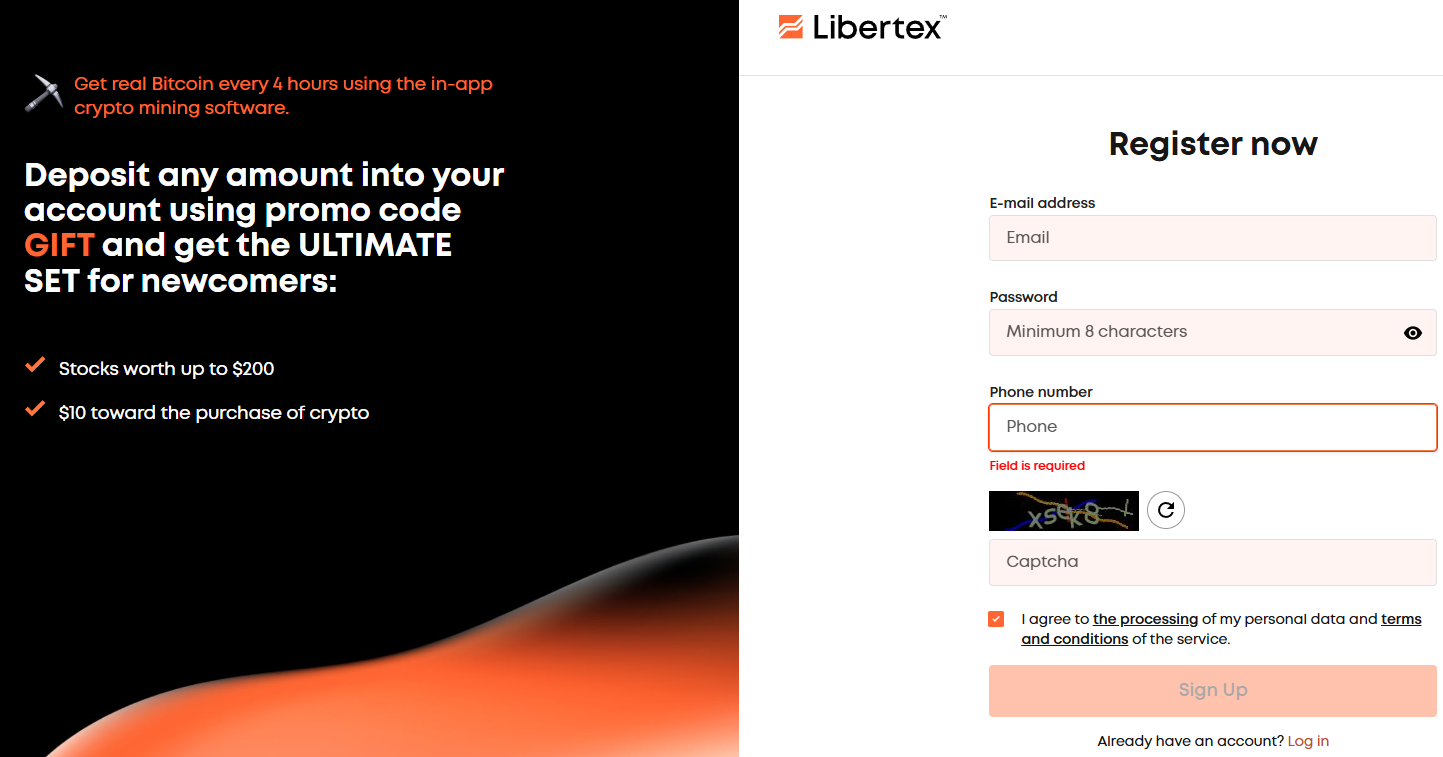

Account opening

Score – 4.5/5

How to open a Libertex Demo Account?

Libertex offers a straightforward account opening experience both for its Demo and Live accounts. Here we describe the simple steps for opening a Demo account with the broker:

- Go to the Libertex website, and choose a Demo account option

- Provide your email address, and phone number, create a password, and click on the Open an account button

- Receive the account credentials through the email

- Trades through the Demo account are conducted via the Web trader

How to open a Libertex Live account?

The opening of a Live account is also an easy process that will probably take only minutes if all the required information is submitted correctly. Follow the following steps to open a Live account without difficulty:

- Go to the broker’s website and click on the Sign-up button

- On the registration page provide all the required information, including your email address, phone number, and password

- Get acquainted with the terms and conditions and confirm

- A verification email will be sent to the provided email address

- When your account is verified by clicking on the provided verification link, return to the website and log in by using the registered email address and password

- Verify the phone number by receiving a code and confirming it

- When all the mentioned steps are completed you can start trading

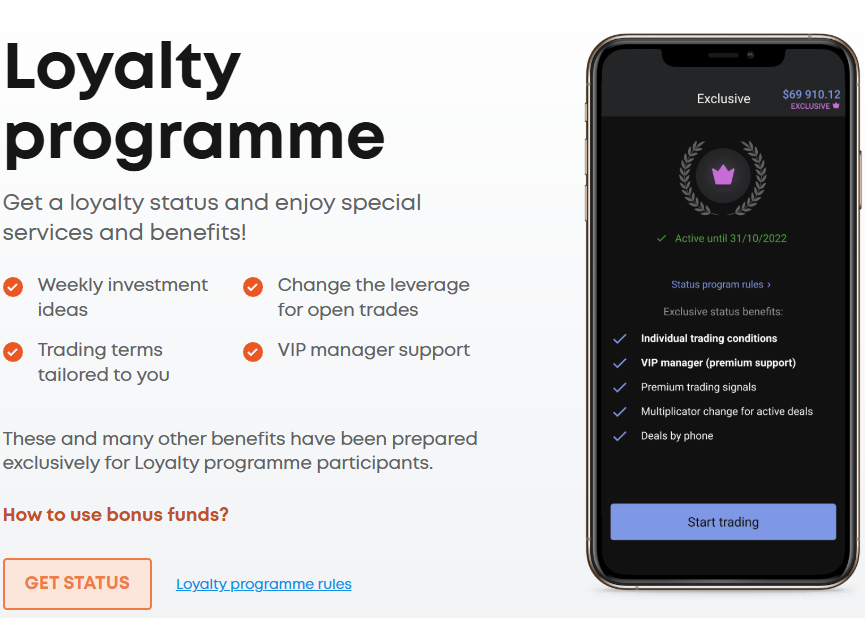

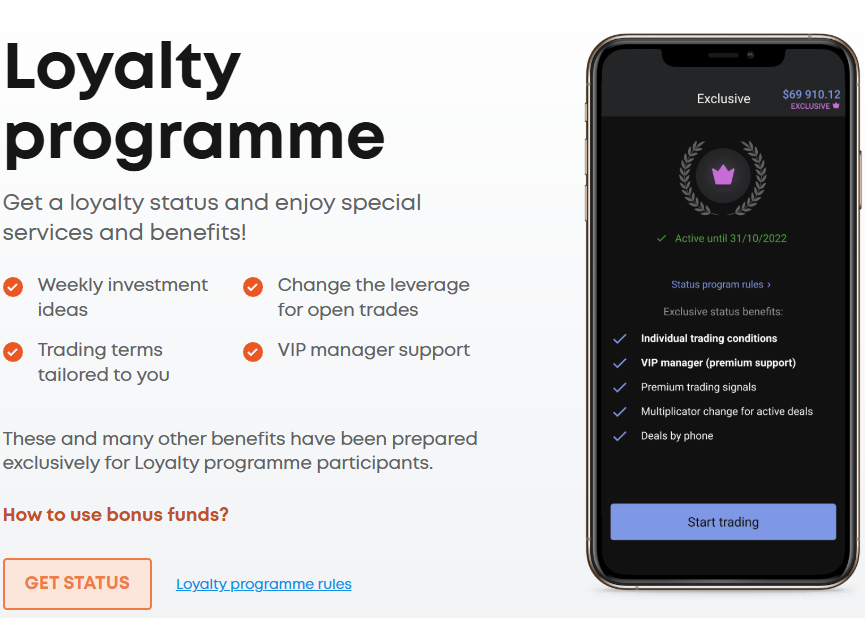

Additional Tools and Features

Score – 4/5

Libertex does not stand out for its numerous additional features, however, it still has a few advantageous offerings traders can benefit from.

- The welcome bonus is received by traders upon opening an account. The bonus is available in case of $10 to $10.000 initial deposits. When clients start to trade, the bonus converts into real money and can be withdrawn at any moment.

- The Loyalty Programme is another opportunity that gives traders special services and opportunities. After gaining the status, traders gain access to weekly investment ideas, VIP manager support, specifically tailored trading conditions, and the option of changing leverage for open trades.

Libertex Compared to Other Brokers

After reviewing all the aspects of trading with Libertex, we compared the broker’s offerings with other good-standing brokers in the market, to see how competitive it is.

First of all, we compared Libertex’s regulatory status with brokers like Fortrade and Eightcap. Our comparison revealed that although Libertex is regulated by well-respected CySEC, Fortade, and Eightcap have better regulatory oversight from top-tier ASIC, FCA, and other serious regulatory bodies.

As to Libertex’s fees, the broker offers low and competitive fees, although the fee structure is different than it is for brokers like FIBO Group and Admiral Markets. For accounts, the broker does not have spread basis accounts, it only applies very low commissions. In contrast, FIBO Group and Admiral Markets have low spreads from 0.6 pips and fixed commissions.

As to the education section, in this respect, Libertex lacks considerably, as there is no comprehensive offering, while Fortrade and Admiral Markets allow their clients access to extensive courses, detailed articles, webinars, and other useful materials. Then we compared Libertex’s platform offering to OANDA and Eightcap, to find that much like OANDA, Libertex also offers its proprietary platform, together with the popular MT4 and MT5 platforms, while Eightcap allows access to MT4/MT5 and TradingView platforms.

All in all, we found that Libertex is a broker with favorable conditions and strict safety measures, and while it might lack in certain aspects, it excels in others.

| Parameter |

Libertex |

Fortrade |

OANDA |

FIBO Group |

FP Markets |

Admiral Markets |

Eightcap |

| Spread Based Account |

N/A |

Average 2 pips |

From 0.8 Pips |

From 0.6 pips |

From 1 pip |

From 0.6 pips |

Average 1 pip |

| Commission Based Account |

0 pips+ 0.005% |

Not Available |

0.1 pips + $4 |

0 pips+ 0.003% |

0.0 pips + $3 |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $3.5 |

| Fees Ranking |

Low/Average |

Average |

Low |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

Libertex Platform, MT4, MT5, |

Fortrader Platform, MT4 |

MT4, MT5, OandaTrade |

MT4, MT5, cTrader |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, Admiral Markets app |

MT4, MT5, TradingView |

| Asset Variety |

170+ instruments |

300+ instruments |

500+ instruments |

200+ instruments |

10,000+ instruments |

8000+ instruments |

800+ instruments |

| Regulation |

CySEC, SVG |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

FCA, CFTC, NFA, MAS, ASIC, IIROC, FFAJ |

FSC BVI, CySEC |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

ASIC, SCB, CySEC, FCA |

| Customer Support |

24/5 support |

24/5 |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Basic |

Excellent |

Good |

Good |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$10 |

$100 |

$0 |

$0 |

$100 |

$1 |

$100 |

Full Review of Broker Libertex

In summary, we found that Libertex is a well-regarded broker that has been operating for more than two decades, excelling its offering through the years. The broker’s CySEC regulation ensures the safety of investments and combined with years-long reputation, recognition in the market, and client loyalty, the broker ensures credibility in the trading process. Its competitive fee structure, proprietary platform, and the availability of MT4 and MT5 platforms allow access to varied trading instruments like forex, and stock CFDs, enabling multiple trading opportunities.

However, there are still certain limitations while trading with the broker, such as the lack of high-quality educational materials, which makes the broker less suitable for beginners. Besides, the instrument range might not be as diverse as for some of its competitors. Additionally, while Libertex’s offshore entity registered under the St. Vincent and the Grenadines offers more diverse trading conditions, it comes with fewer regulatory protections and precautions. Some clients have also raised concerns about withdrawal problems, which should be taken into account. However, our final opinion of the broker is that Libertex remains a good choice for experienced traders who are looking for low fees and a professional trading platform, but for novice traders, there might be better broker choices with extensive education and guidance.

Share this article [addtoany url="https://55brokers.com/libertex-review/" title="Libertex"]

Scam they are dont trust.

¿Alguna razón para considerarlos estafa?

In demo account leverage is much higher than 1:30