- What is LegacyFX?

- LegacyFX Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- LegacyFX Compared to Other Brokers

- Full Review of Broker LegacyFX

Overall Rating 4.3

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.2 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is LegacyFX?

LegacyFX is a multi-asset trading broker operating internationally, providing brokerage services for Forex and CFD trading on gold, oil, cryptocurrencies, indices, and major stocks. Since 2017, it has been serving traders worldwide.

LegacyFX is fully regulated by CySEC and VFSC, with the main objective of enhancing financial transparency and offering greater client protection. Its trading conditions include some of the tightest spreads in the market, starting from just 0.6 pips.

- The broker offers over 250 trading instruments. LegacyFX provides its clients with the MetaTrader 5 platform, granting access to the Forex market 24 hours a day, 5 days a week, and allowing users to trade the most popular major, minor, and exotic currency pairs.

LegacyFX Pros and Cons

Based on our expert opinion, LegacyFX is a reliable broker with good regulation. The broker offers good trading conditions with a range of instruments. The broker provides negative balance protection along with complete segregation of client funds from the company’s assets, ensuring security and transparency. It also offers the widely popular MT5 platform for traders

On the other hand, there is no 24/7 support and conditions may vary according to entity rules and conditions vary according to brokers’ regulations. Also, the market offering is limited to FX and CFDs.

| Advantages | Disadvantages |

|---|

| Broker with good record and establishment under European laws | Conditions may vary according to regulation and entity |

| Negative balance protection | High minimum deposit |

| MT5 trading platform | |

| Popular trading instruments | |

| Suitable for beginners and professionals | |

| Competitive trading conditions | |

| Swap-free accounts | |

LegacyFX Features

LegacyFX offers a range of features designed to enhance the trading experience for traders. With a focus on security, transparency, and advanced technology, the broker provides competitive trading conditions, a good selection of assets, and a user-friendly platform. Below are some of the key features that set LegacyFX apart.

LegacyFX Features in 10 Points

| 🏢 Regulation | CySEC, VFSC |

| 🗺️ Account Types | Standard, Bronze, Silver, Gold, Platinum, Premium, VIP Accounts |

| 🖥 Trading Platforms | MT5 |

| 📉 Trading Instruments | Forex, CFDs on Stocks, Commodities, Indices, Indices, Cryptocurrencies |

| 💳 Minimum Deposit | $500 |

| 💰 Average EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, GBP |

| 📚 Trading Education | Learning Materials, eBooks, Glossary |

| ☎ Customer Support | 24/5 |

Who is LegacyFX For?

LegacyFX is designed for traders of all experience levels looking for a secure and user-friendly platform. The broker caters to individuals and institutions who prioritize transparency, security, and market access. Based on our findings and Financial Expert Opinions LegacyFX is Good for:

- Beginning Traders

- Professional Traders

- EAs running

- Copy Trading

- Scalping / Hedging Strategies

- Traders who prefer the MT5 platform

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

- PAMM Trading

LegacyFX Summary

Overall, our experience with the broker was positive. LegacyFX is a global brokerage company with a well-established, customer-oriented approach that provides a secure and well-regulated trading environment suitable for various trading needs.

One of its key advantages is the low spreads offered on almost all trading instruments, with the tightest spreads for FX pairs starting from just 0.6 pips.

55Brokers Professional Insights

LegacyFX stands out as a well-regulated and transparent broker, suitable for traders looking for trading on MetaTarder5 and focus on popular Forex instruments. One of its key advantages is the competitive trading conditions, including tight spreads mainly within industry averages and good protective tools applied, including negative balance protection.

The execution and trading performance been good at our tests, platform is robust and offers advanced charting tools and automated trading capabilities.

However, while the broker offers a range only of the popular assets, it may not have the same level of market depth or liquidity as some larger competitors, also no platform selection, so if you prefer other software than MT5 some other brokerage firm might be your solution. Additionally, its learning materials are not as comprehensive as those of other brokers, with a noticeable lack of webinars and in-depth video courses.

Consider Trading with LegacyFX If:

| LegacyFX is an excellent Broker for: | - Need a well-regulated broker.

- Providing competitive fees and spreads.

- Offering popular trading instruments.

- Get access to MT5 trading platform.

- Offering MAM/PAMM trading.

- Beginners and professional traders.

- Who prefer higher leverage up to 1:200.

- Broker with a variety of trading strategies.

- Offering a variety of account types.

- Secure trading environment.

- Providing Copy Trading. |

Avoid Trading with LegacyFX If:

| LegacyFX might not be the best for: | - Who prefer 24/7 customer service.

- Looking for MT4 or cTrader platform.

- Need broker with access to VPS Hosting.

- Looking for the lowest minimum deposit amount. |

Regulation and Security Measures

Score – 4.4/5

LegacyFX Regulatory Overview

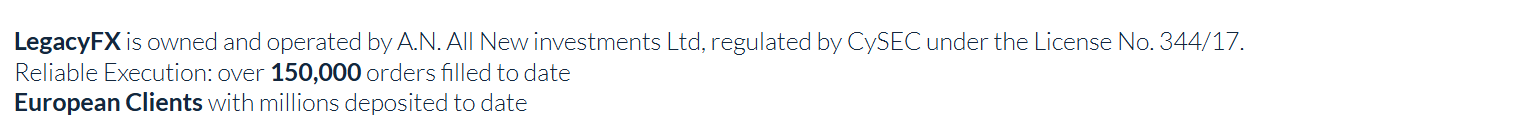

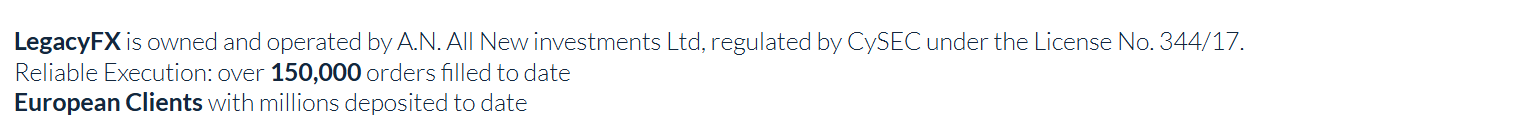

LegacyFX is a brand name of the A.N. Allnew Investments Ltd that is authorized and regulated by the CySEC, a regulatory authority for Investment Services firms in Cyprus, along with cross-border licenses due to its European position, authorizing the company to provide investment services within the EEA zone.

It means that the broker fully establishes its business according to necessary laws and principles of operation, eventually dedicated to protecting clients and enabling market integrity.

However, the broker also operates internationally under an additional license from the Vanuatu VFSC. The trading conditions here are different and applicable to other laws and regulations. It was always quite risky to trade with offshore zones and we should mention that trading with ZYNERIX INNOVATIONS LTD subsidiary is not safe.

How Safe is Trading with LegacyFX?

Since LegacyFX is fully licensed, it adheres to strict regulatory requirements, ensuring that traders’ investments are safe. The broker completely segregates client funds from its operational funds, keeping them in leading, reputable EU banks.

Additionally, CySEC regulatory standards align fully with the European MiFID directive, allowing LegacyFX to offer its services within the EEA zone and beyond. The primary objective of MiFID is to foster a more integrated, deeper, and effective capital market while strengthening investor protection. However, this type of regulation prevents LegacyFX from offering its services in regions where it is not regulated.

Consistency and Clarity

LegacyFX has built a good reputation in the industry, supported by positive reviews from traders highlighting its competitive spreads, reliable platform, and solid customer support. While it benefits from positive ratings for its trading conditions, some traders note the lack of in-depth educational resources and support for MetaTrader 4.

In terms of public presence, LegacyFX has been involved in various sponsorships and partnerships, further establishing its credibility and commitment to engaging with the trading community. Awards and recognition in the industry also reflect the broker’s continuous efforts to deliver quality services. All these factors contribute to LegacyFX’s overall standing in the global financial market, offering a well-rounded picture of the broker’s reputation and influence in the industry.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with LegacyFX?

LegacyFX offers a range of account types to suit different trading needs, including Standard, Bronze, Silver, Gold, Platinum, Premium, and VIP accounts. All account types are swap-free, making them suitable for traders who prefer to avoid interest charges on overnight positions.

While all account types are available under LegacyFX’s international entity, only Silver, Gold, and Platinum accounts are offered through the European entity. Additionally, LegacyFX provides a demo account, allowing traders to practice and refine their strategies in a risk-free environment before transitioning to live trading.

Standard Account

The Standard Account at LegacyFX is designed for beginner traders or those looking to start trading with a moderate initial deposit. With a minimum first deposit of $500, this account offers access to a variety of trading instruments, competitive spreads, and a user-friendly platform.

The spread for the Standard Account starts from 1.2 pips, and there are no commissions charged on trades. The account is swap-free, catering to traders who prefer to avoid overnight interest charges.

Bronze Account

The Bronze Account requires a minimum first deposit of $1,000 and offers slightly better trading conditions compared to the Standard Account. Spreads start from 1.0 pips, making it a cost-effective option for traders seeking to trade with a larger capital base.

This account type offers access to a wider range of instruments and additional features while remaining a good choice for those looking for a balance of affordability and flexibility.

Silver Account

The Silver Account, with a minimum first deposit of $3,000, is designed for more experienced traders who require better trading conditions. This account offers tighter spreads starting from 0.8 pips and improved execution speeds, providing traders with more competitive trading conditions.

The Silver Account benefits from enhanced features, including access to advanced charting tools and larger leverage.

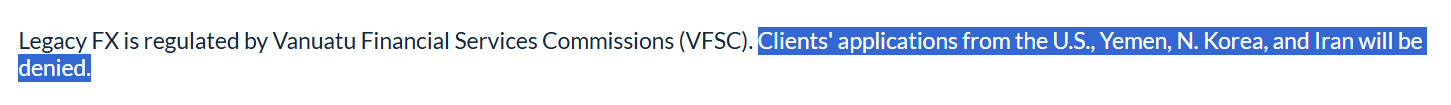

Regions Where LegacyFX is Restricted

LegacyFX is restricted in several regions due to regulatory limitations and compliance with local financial laws. The broker is not available to residents of certain countries, including:

- UK

- Yemen

- North Korea

- Iran, etc.

Cost Structure and Fees

Score – 4.4/5

LegacyFX Brokerage Fees

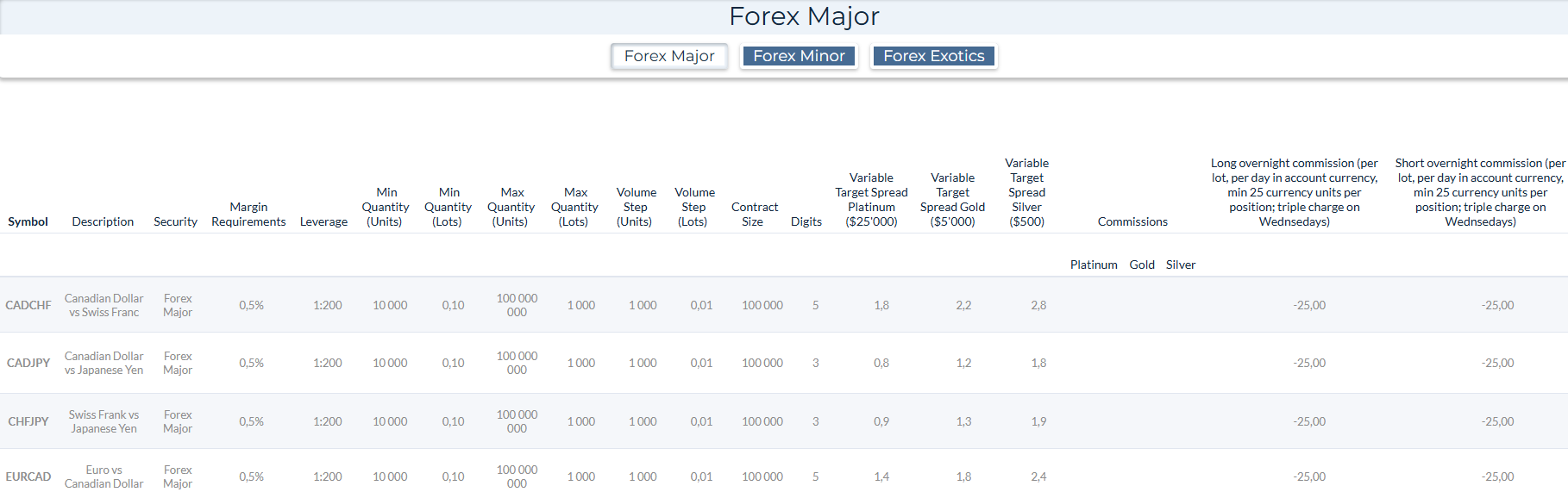

LegacyFX charges brokerage fees that depend on the account type and trading instruments. The broker does not charge a commission on most trades, except for stocks. The fees are based on the spread, which is the difference between the bid and ask price.

For Forex trading, spreads start from as low as 1.2 pips for the Standard Account and can go down to 0.1 pips for VIP accounts, depending on market conditions. Additionally, LegacyFX offers fractional pips, allowing clients to take advantage of smaller price movements with greater precision. There are no hidden fees for deposits or withdrawals, but an inactivity fee is applied to accounts with no trading activity for 90 consecutive days.

LegacyFX offers competitive variable spreads across its trading instruments, with an average EUR/USD spread of 1.2 pips on the Standard Account. The spreads are based on market conditions and account type, with tighter spreads available on higher-tier accounts.

For instance, VIP account holders can benefit from even lower spreads. These tight spreads contribute to the broker’s cost-effectiveness for traders looking to execute efficient trades.

LegacyFX does not charge commissions on most trades, except for stock trading. For stock trades, the broker applies a commission fee of 0.45% on the Silver account. For all other instruments, including Forex, indices, and commodities, LegacyFX earns through the spread rather than a commission.

- LegacyFX Rollover / Swaps

LegacyFX offers swap-free accounts by default, meaning no rollover interest or swap fees are charged on positions held overnight for the first seven days. This applies to all trading instruments, providing an advantage for traders who wish to avoid overnight fees.

After seven days, however, swap rates may apply depending on the specific position and market conditions. The broker’s swap-free structure is particularly appealing for traders who cannot or prefer not to engage in positions that accumulate overnight interest, ensuring a cost-effective trading environment.

How Competitive Are LegacyFX Fees?

LegacyFX offers a competitive fee structure designed to cater to a variety of traders, with no hidden charges or unnecessary fees. The platform provides a flexible and transparent pricing model, ensuring traders are aware of all costs upfront.

Fees are generally based on spreads, which vary depending on the account type and instrument being traded. For traders looking for low-cost access to global markets, LegacyFX stands out for its reasonable fees that help maximize trading profitability, while also offering advanced tools and features to enhance the overall trading experience.

| Asset/ Pair | LegacyFX Spread | X Open Hub Spread | Saxo Bank Spread |

|---|

| EUR USD Spread | 1.2 pips | 0.14 pips | 0.9 pips |

| Crude Oil WTI Spread | 0.13 pips | 0.0214 | 5 |

| Gold Spread | 0.63 pips | 0.0841 | 18 USD Cents |

| BTC USD Spread | 505.03 | 52.3983 | 308 USD |

LegacyFX Additional Fees

LegacyFX applies an inactivity fee for accounts with no trading activity for 90 consecutive days. In such cases, an inactivity fee of $10 (or the equivalent in the account’s base currency) is charged every month.

Additionally, there is a monthly maintenance charge of 100 units per account. These fees are intended to cover the administrative costs associated with maintaining inactive accounts. Traders should ensure their accounts remain active to avoid these additional charges and ensure they get the most out of their trading experience with LegacyFX.

Trading Platforms and Tools

Score – 4.3/5

LegacyFX provides its clients with the industry-leading MetaTrader 5 platform, known for its advanced trading capabilities, intuitive interface, and powerful analytical tools. MT5 offers multiple order types, enhanced charting features, automated trading through Expert Advisors, and access to a wide range of technical indicators.

The platform is available on desktop, web, and mobile devices, allowing traders to manage their positions anytime, anywhere. In addition to MT5, LegacyFX provides various trading tools, including economic calendars, market analysis, and risk management features to enhance the trading experience.

Trading Platform Comparison to Other Brokers:

| Platforms | LegacyFX Platforms | X Open Hub Platforms | Saxo Bank Platforms |

|---|

| MT4 | No | Yes | No |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

LegacyFX Web Platform

LegacyFX offers the MT5 Web Platform, providing traders with a seamless and feature-rich trading experience directly from their browser. The web-based platform includes up to 8 pending order types for precise position management, one-click trading for fast execution, and an optimized strategy tester for enhanced expert advisor performance.

Traders can access 3 chart types and 9 timeframes, real-time quotes in Market Watch, and advanced market depth for better decision-making. Additionally, the platform integrates an economic calendar, offering real-time updates on economic events and indicators.

With cryptocurrency trading features and clear segregation between orders, positions, and transactions, LegacyFX’s MT5 Web Platform ensures flexibility and efficiency for traders of all levels.

Main Insights from Testing

Testing the MT5 Web platform with LegacyFX revealed a smooth and user-friendly experience, making it an excellent choice for traders who prefer flexibility. The platform allows users to trade directly from any web browser without needing additional software or extensions, ensuring seamless access across different devices and operating systems.

It provides a full set of trade orders, including pending and stop orders, enabling traders to execute diverse strategies efficiently. Additionally, the platform maintains high-security standards with reliable data protection, ensuring safe transactions and account integrity.

LegacyFX Desktop MetaTrader 4 Platform

LegacyFX does not offer the MetaTrader 4 platform, as it focuses exclusively on the more advanced MT5. While MT4 remains a popular choice among traders, MT5 provides enhanced features, including additional order types, improved charting tools, and a more sophisticated strategy tester.

LegacyFX Desktop MetaTrader 5 Platform

MetaTrader5 for Desktop is designed to monitor and optimize your entire trading process by offering broad functionality. MetaTrader5 is an institutional multi-asset platform offering outstanding trading possibilities and technical analysis tools.

Traders can enjoy the latest version of the most popular trading platform with plenty of cutting-edge features and benefits brought by LegacyFX.

LegacyFX MobileTrader App

LegacyFX Mobile Platform is available on both Android and IOS and allows traders to place eight types of pending orders to get more precise control over open positions. MetaTrader5 supports the trading of cryptocurrencies with a set of new and unique crypto features.

Mobile MT5 simplifies the process of opening a new position with a single click and includes additional technical tools, which provide options to choose from over 21 timeframes for charting and nine additional techniques for chart structuring.

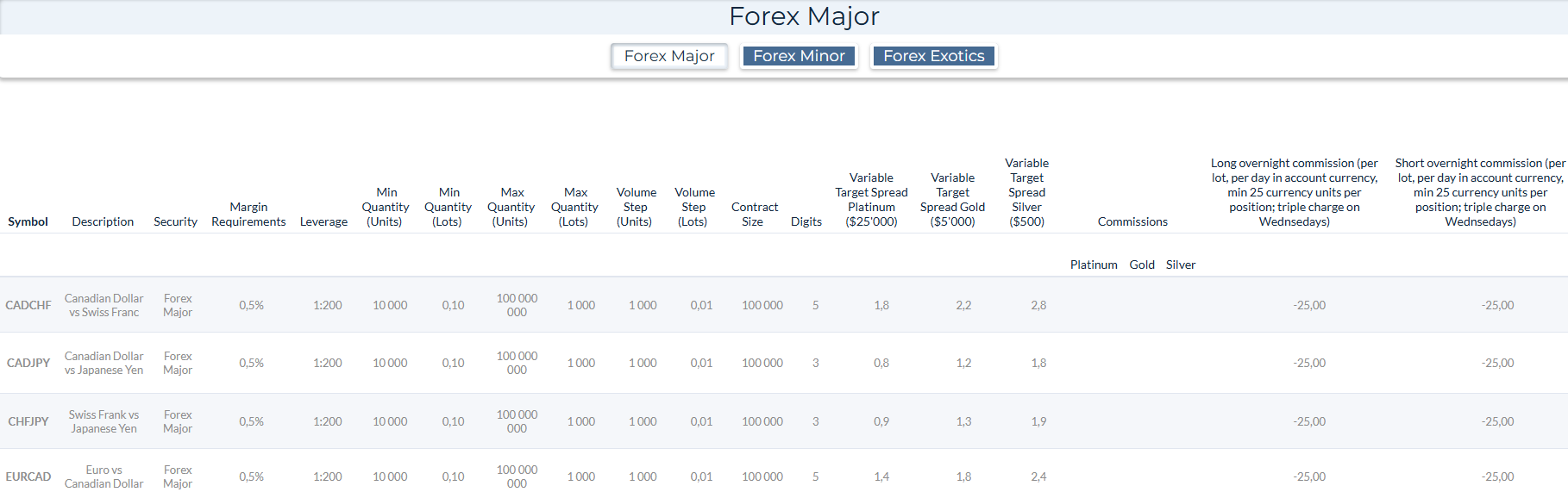

Trading Instruments

Score – 4.2/5

What Can You Trade on LegacyFX’s Platform?

LegacyFX provides access to a diverse range of over 250 trading instruments, catering to traders of all levels. The broker offers Forex trading with major, minor, and exotic currency pairs, as well as CFDs on stocks from global markets, commodities like gold and oil, indices covering major global markets, and cryptocurrencies for those looking to trade digital assets.

This selection allows traders to diversify their portfolios and take advantage of various market opportunities across different asset classes, all within the MetaTrader 5 platform.

Main Insights from Exploring LegacyFX’s Tradable Assets

LegacyFX offers a well-rounded selection of financial instruments, making it a suitable choice for traders looking to diversify their strategies. The broker provides access to multiple asset classes, allowing traders to engage in different market conditions and hedge their positions effectively.

With competitive trading conditions, including tight spreads and zero commission on most assets (except stocks), LegacyFX ensures a cost-efficient trading experience. However, while the range of assets is good, some traders may find the lack of more niche instruments or additional asset classes a limitation compared to other brokers.

Leverage Options at LegacyFX

Leverage, known as a loan given by the broker to the trader enables you to trade through the multiplied volume that may raise your potential gains, yet in reverse increases high risks too. So firstly you should learn how to use tools smartly, also various regulatory standards and restrictions set a particular allowed level of multiplier that is considered to be safe.

- European clients may also use 1:30 leverage on Forex instruments.

- The global LegacyFX traders may be still entitled to a higher range of up to 1:200.

And of course, always learn how to use leverage smartly so as not to fall under inefficient risks.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at LegacyFX

LegacyFX offers a variety of deposit options for its clients, making it easy to fund their accounts and start trading:

LegacyFX Minimum Deposit

As for the minimum deposit amount, the Standard account at LegacyFX requires $500 as a start, while other accounts deploy higher levels of first deposits.

Withdrawal Options at LegacyFX

From the moment you submit and confirm the request to withdraw money from your account the accounting department of LegacyFX typically processes and confirms withdrawal within 3 business days.

As for the transfer fees, make sure to check conditions in detail with the payment provider and broker respectively as various jurisdictions may apply different rules due to international policies. Overall, LegacyFX defines no commission for withdrawals via Bank Cards but charges a $50 fee for Wire Transfer withdrawals.

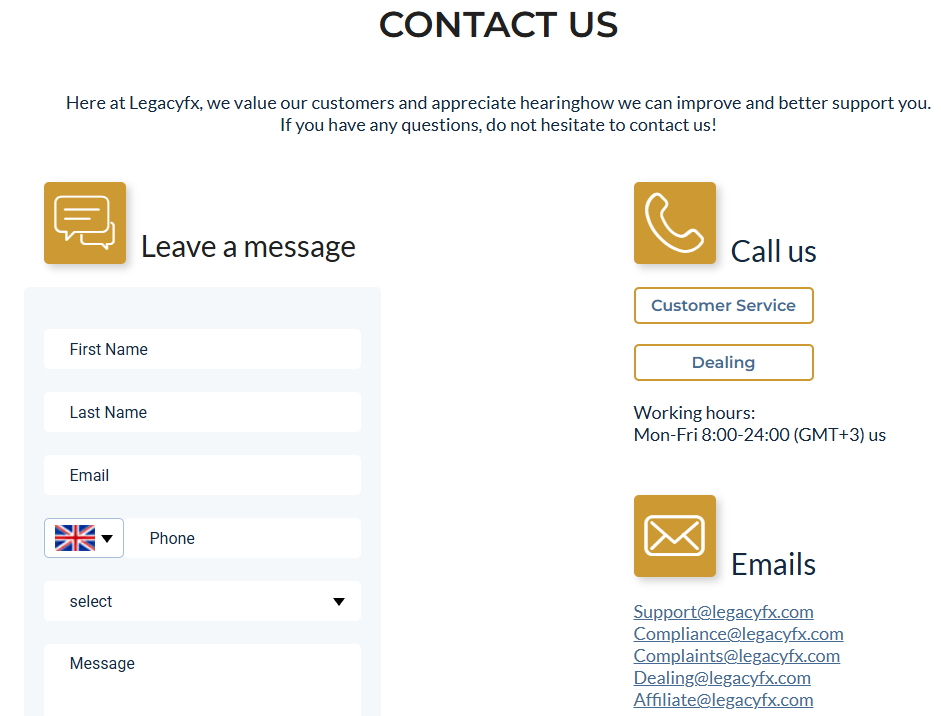

Customer Support and Responsiveness

Score – 4.4/5

Testing LegacyFX’s Customer Support

Support is available 24/5 and clients can either send an email or call support. The support staff is fluent in English, Arabic, and Russian. The broker values customers and is happy to answer all general, technical, and account-related questions that you may have. They also appreciate hearing how they can improve the support available to traders.

Contacts LegacyFX

LegacyFX provides multiple contact options for traders seeking assistance or inquiries. The broker’s international support team can be reached via email at Support@legacyfx.com or by phone at +41 315 087 455. For clients in Cyprus, LegacyFX offers direct contact through +357 2503 0673 and +357 2462 2113, with an additional email contact at info@allnewinvestment.com.

These multiple communication channels ensure traders can easily reach the broker’s support team for any account, trading, or technical-related concerns.

Research and Education

Score – 4.3/5

Research Tools LegacyFX

LegacyFX provides traders with a range of research tools available both on its website and within the MetaTrader 5 platform.

- On the website, traders can access market analysis, and economic calendars to stay informed about market trends and key financial events.

- Additionally, LegacyFX offers market news updates and fundamental insights to help traders make well-informed decisions.

- Within the MT5 platform, traders benefit from advanced charting tools, technical indicators, and an optimized strategy tester for backtesting trading strategies. The platform also features real-time market depth, one-click trading, and integrated news feeds, providing a comprehensive trading experience.

Education

LegacyFX offers a selection of educational resources to help traders build their market knowledge, including learning materials, eBooks, and a trading glossary to explain key terms and concepts. These resources can be useful for beginners looking to understand the basics of trading and market dynamics.

However, the educational offering is not as comprehensive as some other brokers, as LegacyFX currently lacks webinars and video tutorials — tools that many traders find valuable for more interactive and in-depth learning. While the available materials provide a good starting point, traders seeking more immersive educational content may find the resources somewhat limited.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options LegacyFX

LegacyFX primarily operates as a Forex and CFD broker, offering a range of tradable assets. However, in addition to traditional trading, the broker provides investment tools such as MAM and PAMM accounts, allowing experienced traders to manage multiple accounts or investors to allocate funds to professional traders.

Moreover, the broker offers Copy Trading, enabling traders to automatically replicate the strategies of successful traders. These investment options cater to both hands-on traders and those who prefer a more passive approach to the markets.

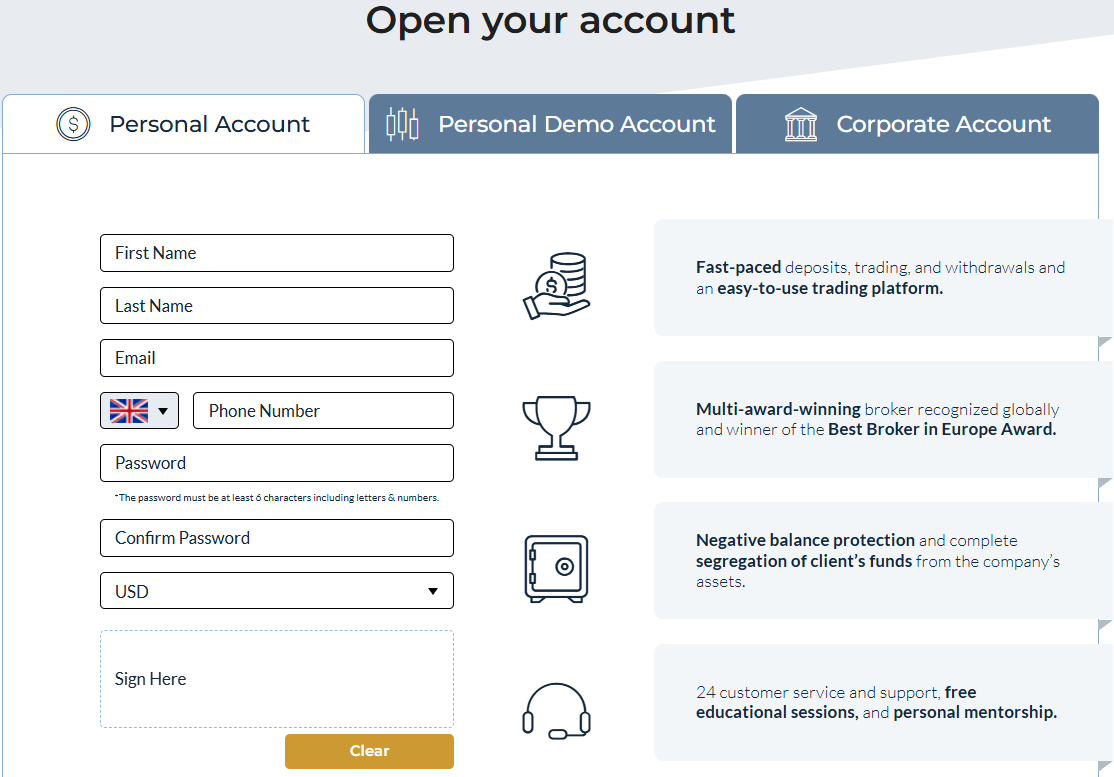

Account Opening

Score – 4.5/5

How to Open LegacyFX Demo Account?

If you want to explore LegacyFX’s trading platform before investing real funds, opening a demo account is a great way to test strategies and experience the platform risk-free with virtual funds.

Here is how to open a LegacyFX demo account:

- Visit the LegacyFX website.

- Navigate to the “Open Demo Account” section.

- Fill out the registration form with your name, email address, and phone number.

- Submit the form and receive your login credentials.

- Access your demo account with virtual funds and start exploring the platform.

- Use the demo account to practice trading and familiarize yourself with LegacyFX’s tools and features.

How to Open LegacyFX Live Account?

To open a LegacyFX Live Account, visit the LegacyFX website and navigate to the “Open Real Account” section. Fill out the registration form with your details, including your name, email, phone number, and country of residence.

Next, submit the required verification documents, such as proof of identity (passport or ID) and proof of residence (utility bill or bank statement). Once your documents are approved, choose your preferred account type and deposit funds using the available payment methods. After funding your account, you can access the trading platform and start trading live with real funds.

Additional Tools and Features

Score – 4.3/5

LegacyFX offers additional tools and features to enhance the trading experience, including Trading Signals and Autochartist.

- Trading Signals provide real-time market insights, helping traders identify potential opportunities based on technical and fundamental analysis.

- Autochartist, a powerful pattern recognition tool, automatically scans the markets for emerging chart patterns, key levels, and trend formations, assisting traders in making informed decisions. These tools add an extra layer of analysis, making it easier for both beginner and experienced traders to navigate the financial markets efficiently.

LegacyFX Compared to Other Brokers

When comparing LegacyFX with other competitive brokers in the market, there are a few key points to consider. LegacyFX stands out with a decent spread offering, providing a competitive average spread on Forex pairs, which is on par with several major players like Spreadex and CMC Markets.

When it comes to asset variety, LegacyFX offers more than 250 instruments, but brokers like Saxo Bank and Spreadex provide access to thousands of instruments, making them more suitable for traders looking for a broader market selection.

LegacyFX operates with a regulatory framework of CySEC and VFSC, offering a secure environment, though brokers such as Saxo Bank and Swissquote are regulated by multiple, highly respected authorities, providing an added layer of credibility.

Overall, LegacyFX presents a balanced option for traders, though it may not be the most competitive in certain areas such as spreads, commission rates, and available educational resources. However, for traders focusing on a reliable platform with a solid regulatory framework and a reasonable asset variety, LegacyFX remains a good choice.

| Parameter |

LegacyFX |

Spreadex |

Saxo Bank |

Dukascopy |

Swissquote |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1.2 pips |

Average 0.6 pips |

Average 0.9 pips |

Average 0.28 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

For Stock CFDs Only (commission fee of 0.45%) |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

For Stock and ETF (commission of $3 per trade) |

$5 per $1 million traded in MT4/MT5 Accounts |

0.0 pips + €2.50 |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT5 |

Spreadex Web Platform, TradingView |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

JForex, MT4, MT5, Binary Trader |

MT4, MT5, Swiss DOTS, TradingView |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

250+ instruments |

10,000+ instruments |

71,000+ instruments |

1200+ instruments |

400+ Forex and CFDs instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

CySEC, VFSC |

FCA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FINMA, FCMC, JFSA |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Good |

Excellent |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

$500 |

$0 |

$0 |

$100 |

$1,000 |

$0 |

$0 |

Full Review of Broker LegacyFX

LegacyFX is a well-established broker that offers a solid trading experience with a wide range of features and services. It provides over 250 trading instruments, including Forex, CFDs on stocks, commodities, indices, and cryptocurrencies, making it a versatile option for traders.

The broker operates with the MT5 platform, which is known for its advanced tools and capabilities, including real-time quotes, economic calendar, and advanced market depth. LegacyFX offers competitive spreads and charges a commission for stock CFDs. It is regulated by CySEC and VFSC, ensuring a reliable and secure trading environment.

Additionally, LegacyFX provides swap-free accounts by default, making it an appealing option for traders who avoid overnight interest charges. The broker also offers several investment options such as MAM/PAMM trading and copy trading, allowing clients to diversify their portfolios.

However, its educational resources are somewhat limited, as there are no video materials or webinars available. Despite these limitations, LegacyFX remains a reliable and secure option for both beginner and experienced traders.

Share this article [addtoany url="https://55brokers.com/legacyfx-review/" title="LegacyFX"]

My recommendation is to avoid LegacyFX – run away from them.

Due to their “fantastic performance” I lost all my savings.

They will call you, sell themselves perfectly, and guide you through their site and reviews.

When you make the first deposit, they will even tell you that the first 5 trades are protected.

Then the problems start. They will recommend you certain trades, apparently with high potential. When those positions go to negative, they will tell you that it is the market volatility. Then it gets worse and worse and you have to hedge.

They will only call you when your account is almost at the stretch limit…

Now you want to get out of it, but you can’t… That is when they call you to deposit more and more money… and of course, will recommend you to open other positions, to recover the losses…

The worse is that they will tell you that it was your decision, and their contact will start to be sporadic, never on time.

If you don’t want to lose your savings, avoid them at all cost

Thanks for all these reviews. I was thinking of opening account with them but now i will not. their reviews at forecpeacyarmy.com is also very bad and mostly people are complaining.

I ended up closing my account from them. Their signal was okay, I made 300% of profit. But when I tried to withdraw my money, it was a hell dealing with their Dealing Desk. They will tell you different reasons not to process your withdrawal. It was a very stressfull for me to make follow-ups regarding the withdrawal status. Stay away from them. If you will earn from their signal, high chance that you will not be able to withdraw your earnings including your capital. Very sad.

They are also pushing me to open an account with them but I am not comfortable to share my CVV code. As you said they are not helpful in withdrawal so did u take your money back or still facing trouble? Is it convenient to go with Pakistani Banks?

I put in with this company 470,000 USD and its the same story, started well, open BIG trades with NO STOP loss and it always goes BAD, so they push u for another injection so save the acc, ended up loosing 470k and only withdraw 50k, this was my nightmare for 18 Months, my acc was HEDGE to the hill and i was Negative 1.4mil in Hedge Trdaes, they never protect u, they say it wikl be fine, your equity is plenty, no stress……. well, it was sleepless nights and the weekends was very nervous cause the markets would open up or down and it was always BAD, stay away…. stay far away. Scammers, and talk allot of CRAP.

Same to me. I Put 1.5mil and eventual loss everything. Avoid. Very acressive and manipulated telephone calls, they always want more money in.

Now I worry, my broker always push me to put much more deposit, i’m the beginner, now i put 2500 usd, but nothing improve from him but he still push me need more deposit. I think is something wrong with this broker. What l know he is senior broker. I really worry right now, what should I do ?

salaam alaikum, don’t trust them big scammer you can’t withdraw your fund, when deposit they happily give wrong signal and make lose your money when you make money they will not let you withdraw be careful!!!

Am pleased I read this. They have been phoning me often. Now they are blocked.

Thanks for the reviews.

Im looking for a way to get my money back , more than $12,000 in deposit that was gone overnight by wrong trade signals from my account manager at legaxy fx, i need my money back. what should i do?

If you’re having any problem with your trade either due to lack of signal accuracy or you’re having any problem with your deposit and withdrawal kingly contact me here on WhatsApp so I can sort out all of that for you.

qual o nome do seu gerente?

Wow..so many problem they make to invester.. so anybody here can help me?.. give me some good sign to trade.

AVOID LIKE THE PLAGUE!

I was doing very nicely trading currency pairs on my own with no help from these scum. My Account Manager started to tell me he could help me perform even better but he helped me trade in what I know know are high risk strategies. 1. No stop losses BIG DANGER! 2. HEDGING, DANGER you can end up with your whole account hedged and you can’t escape your margin gets close to account funds. Then they widen their spreads and you whole account goes down in SECONDS! I went from $1,100,000 to $200.00 after the market closed. I lost my life savings of $260,000.00 STAY AWAY FROM THESE SCUM.

3. I was trading currency pairs and making superb profits, this Martin Baker Got me Trading Gold, Silver & Oil, which I NEVER TRADE. DANGER!

4. I’ve lost everything! $260,000 STAY AWAY DON’T TRUST THEM.

So you traded with legacy FX to get your account up to $1,100,000?

I’ve just registered with them..2weeks back..but don’t how they operate..and I am new in this field..👉

update us on how your journey goes.

Thank your for valuable information. I nearly register with them. But with information I got now. There are

no go area

This guy Carl Miller phoned me to introduce the company and to sell the services. I told him that I am not interested. Since then – I get 2 messages per day “Welcome to this Amazing Journey”. I told them to take me off their list but it won’t stop. I even threatened legal action

It is as if it is a game to annoy me.

If you even enquire to this company, then they will never leave you alone. This is unprofessional. I guess their other services are unprofessional as well. The hard sell is a substitute for a quality product.The only way I can get some revenge is to post my message here.

Carl – If you see this – Take me off your bloody list and stop harassing me.

I bet this doesn’t get published 🙂 I’m gonna make an enquiry on his behalf to every other hard sell merchant I can find and see how he likes it.

I need deposit link

I open account with only 250us – I always answer fast they dont push me – think they are okay

how good are they, please help l wantto start trading with

tem

How is your trading with Legacy FX? Have you made a profit? Did you withdraw your profit?

Very much thanks for your long describsion of this case. You helt me to avoid truble. Best regards, Andrew

Absolutely avoid. Long story short – if the traders at legacy were any good at what they do they wouldn’t be chasing after guys with account less than 10k. They would be on a beach, retired and sipping margaritas. Note that when you lose on a trade, the broker gets the money. Their Spreads wider than the grand canyon (1 lot on WTI will cost 100 GBP. This means the trade must move in your direction, be it buy or sell buy 100 GBP before you make a profit).

They promote unsafe trading practices such as giving incentives to trade based on traded lots. This is specifically against UK FCA guidelines for treating customers fairly. Vanatu is useless at helping you as a retail client.

I got involved with Legacy since I was looking for a ‘safe pair of hands’. I had an account with open trades that were placed by a management company and the trades were in 25% draw down with no hope of things turning around. I got in touch with Legacy to see if they could help. They assigned me to one of their advisors, who was very knowledgeable and even demonstrated some impressive techniques in real-time. This gave me the confidence to trust him. All seemed good so far. He gave me a set of signals (trades to place) on a friday afternoon and by monday morning, my account was in 80% drawdown. By the evening I had lost 7k GBP. Apparently that trader was fined 100k USD however I have no proof.

I wrote in to complain and after threatening legal action, they assigned me to a senior trader, who was head of compliance. As a form of settlement, they gave me 1k GBP and the idea was that the senior trader would help replace lost equity and regain their trust. It worked well for a month – and slowly I began to develop trust with the senior trader.

Slowly, the demands started for me to put the word out and quotas started regarding how many people I could get to sign up with Legacy Fx. This was so that it would be ‘worth their time’, ‘you do something for me, I do something for you ‘ etc. I disagreed with about 50% of the trading suggestions but mostly went along with them. I often risked 50% of the equity as stop loss without realising it. The account grew 300% in 2 months and all was going well. I was truly impressed. Then with 2 trades that went very bad very quickly, all was lost in a day. The account hit margin call before it hit the stop loss, which shows how far the stop loss was.

It’s a big boy game, trading. All I can say is learn to trade yourself, find a regulated broker and never accept signals. Develop your own signals, be consistent and risk max 2% per trade.

Can you say legacyfx is a good broker ? If no which one do you consider a good broker ?

I started trade with $2500 and they took my all money with wrong calculations. they are completely fraud company. i had few balance left but they closed my all trade. please please do not use this broker. they are totally fraud. I had balance $120 balance left and i was doing hedging. as soon market close they have raised all loses and automatically closed all my trades. one of his sales guy was pushing me to use them. don’t trap urself with them

your are 100% right

although i didnt have a big capital to start with, they helped me grow and encouraged me to diversify my portfolio, i just wish they would would give more leverage

Many deposit options. Fast and easy withdrawals. Good variety of spreads and assets. Overall pleased.

Nice broker

No problem with withdrawals

Spreads on Crypto, Indices are high!! please reduce them

LegacyFX’s representatives are driven to get me to invest, yet are not always available to assist me in my trades. Nevertheless, they have given me insight on how to trade better with better assets. Overall, my portfolio has grown, albeit slowly.