- Key to Markets Pros and Cons

- Is Key to Markets safe or a scam?

- Leverage

- Fees

- Spread

- Deposits and Withdrawals

- Trading Platform

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading Market check trading offerings including fees, platforms, verified regulations, contacted customer service, and placed trades to see trading conditions and give an expert opinion about Key to Markets

What is Key to Markets?

Key to Markets is a brokerage firm that offers access to online financial trading and markets for Institutional, Corporate and Individual Clients. The broker gives access to the global markets in a secure and regulated environment with competitive spreads with commission-free trading on Forex and CFDs via their MT4 platform; plus fast deposits when opening one of two available live accounts or utilizing the PAMM social feature for unique investment opportunities.

- Established in 2010, the company is headquartered in the UK and registered under the brand name Key to Markets Limited. Also, it holds an international entity in Mauritius.

Among its global coverage, the broker offers a great market range which includes Forex, Shares, Indices, Commodities, and a range of Cryptocurrencies with ECN connection that are available at $8 commissions per round micro-lot and ultra-tight spreads from 0.1 pips.

Pros and Cons

Key to Markets is a reliable broker with top-tier licensed FCA, while the account opening is fully digital and the trading environment is one of the best-reviewed by us UK offering with ECN accounts. There is a powerful research and trading tools available, the range of platforms is great, the spreads offered are ultra-low, and the broker also offers Fix API trading.

For the Cons there are not so many in our opinion, just some minor things like no 24/7 support, also instruments are limited to Forex and CFDs. Besides conditions vary based on the entity and its applicable regulatory standards. Also, the education section is quite empty

| Advantages | Disadvantages |

|---|

| Multiply regulated broker with a strong establishment | Only Forex and CFDs |

| Good Reputation | No 24/7 support |

| Wide range of trading platforms | Conditions vary based on entity |

| Low Spreads | |

| Competitive trading conditions | |

Key to Markets Review Summary in 10 Points

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA, FSC |

| 📉 Instruments | Forex, Shares, Indices, Commodities and range of Cryptocurrencies |

| 🖥 Platforms | MT4 |

| 💰 EUR/USD Spread | 0.4 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | EUR, USD, GBP |

| 💳 Minimum deposit | $100 |

| 📚 Education | Learning materials, research |

| ☎ Customer Support | 24/5 |

Overall Key to Markets Ranking

Based on our Expert finds, and reviews Key to Markets is considered a good broker with reliable service and very favourable trading conditions, that are suitable for beginners or experienced traders. As one of the good advantages, Key to Markets covers almost the globe, so traders from various countries can sign in, also with the lowest spreads.

- Key to Markets’ Overall Ranking is 8.8 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | Key to Markets | XM | AvaTrade |

|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantages | Spreads | Education | Conditions |

Key to Markets Alternative Brokers

However, Key to Markets instrument offering is mainly limited to Forex and CFDs, also international entity provides different trading conditions and range. Even though, spreads, platforms and education are really good at Key to Markets is good to consider other brokers too, see our selection of Alternative Brokers below:

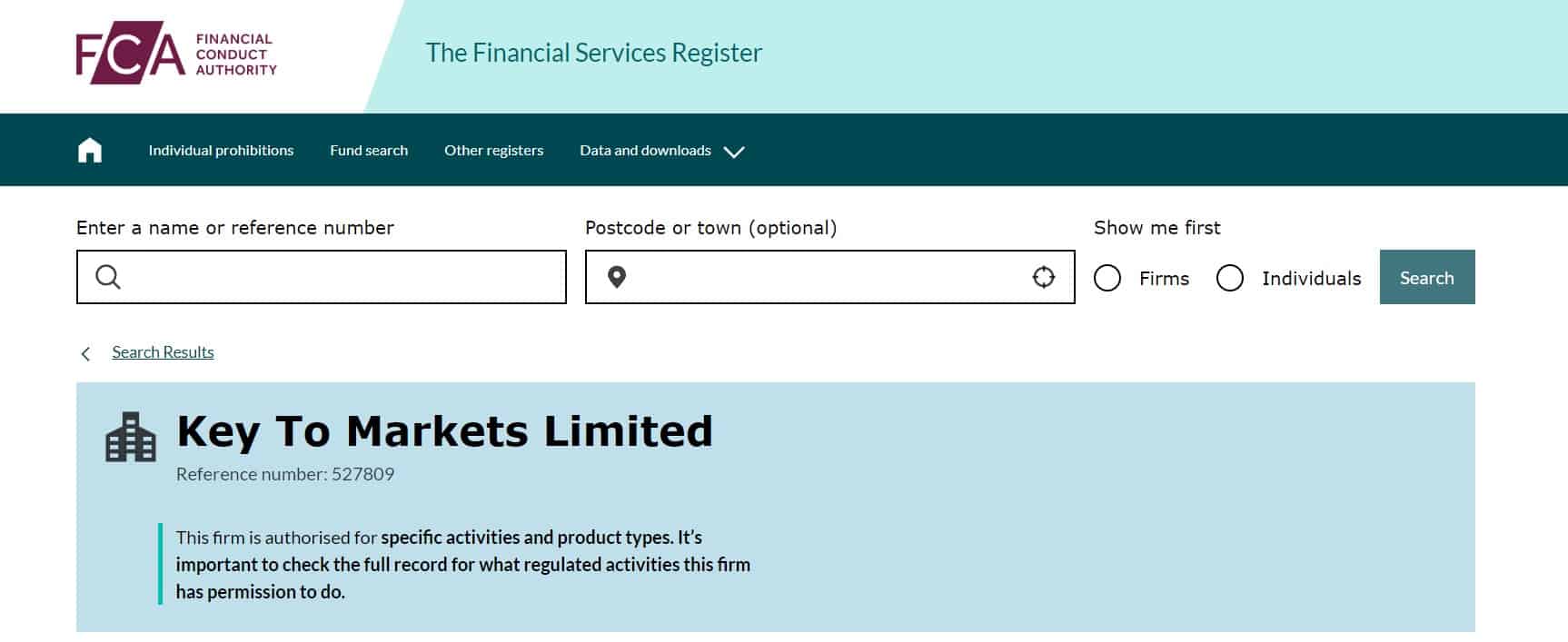

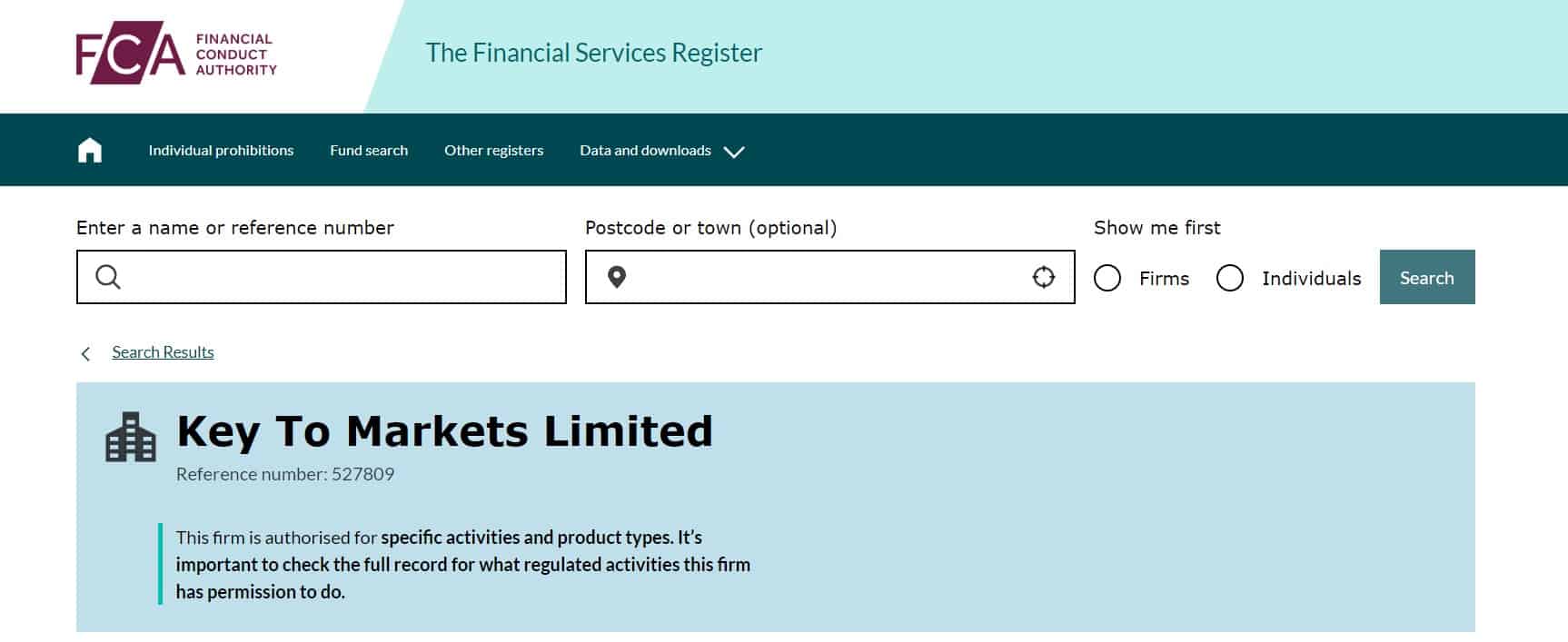

Is Key to Markets safe or scam?

Yes, Key to Markets is a safe broker since is a UK-based company and holds FCA regulations while being authorized to provide financial services that comply with necessary and very strict laws and requirements.

Is Key To Markets a regulated trading broker?

Yes, Key to Markets is fully regulated and authorized by the United Kingdom holding the brand name Key To Markets (UK) Ltd and regulated by the Financial Conduct Authority (FCA), with registration number 527809. The company holds a MiFID passport which allows it to carry out its services in Europe.

Also, Key To Markets International Limited is registered in Port Louis, Mauritius, and is regulated by the Financial Services Commission (FSC), with license number GB19024503.

Our conclusion on Key to Markets Reliability:

- Our ranked Key to Markets Trust Score is 8.4 out of 10 demonstrating good regulation and reputation. The broker holds a highly respected license and is compliant with all regulatory requirements regardless of geographical region. The only point for consideration is the fact that offshore entities are used for international operations; however, we do not advocate such practices due to potential risk factors.

| Key to Markets Strong Points | Key to Markets Strong Points |

|---|

| Broker with good regulation and reputation | Runs Offshore entities |

| FCA-regulated | Trading and protection conditions vary based on the entity |

| Negative Balance Protection | |

| Compensation Scheme | |

| Multiple licenses in various regions | |

| Global expands including Asia, MENA, Africa regions | |

How are you protected?

Due to its regulation, Key to Markets client funds is held in segregated accounts with custodian banks along with the advanced customer protection implemented procedures and operational standards. Which all in all makes it a trustable broker that complies with the best practices.

Key to Markets Leverage

Like the majority of Forex brokers, Key to Markets also offers to use leverage, a powerful tool that increases the potential of gains through its possibility to multiple initial accounts balance. However, leverage should be used smartly as it increases the ratio of losses as well.

Key to Markets Leverage, in particular, depends on the instrument you trade and is defined by the regulatory restrictions together with your personal level of proficiency.

- European retail clients and eligible to use the leverage of 1:30 for major currencies, 1:20 for minor ones, and 1:10 for commodities due to ESMA restrictions.

- Nevertheless, by Trading with the global offshore broker branches traders can get access to higher leverage ratios that go to a maximum of 1:500.

Leverage is a powerful tool, but should be approached with caution. Those considering its use must have an in-depth understanding of potential outcomes and the risks associated – to ensure careless decisions are not made that could lead to devastating consequences.

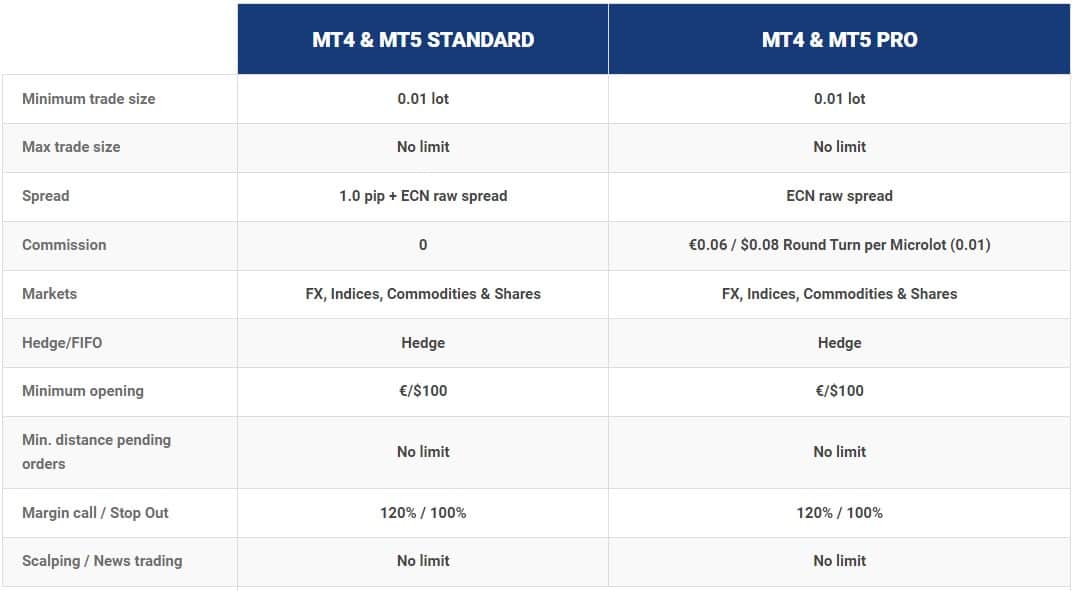

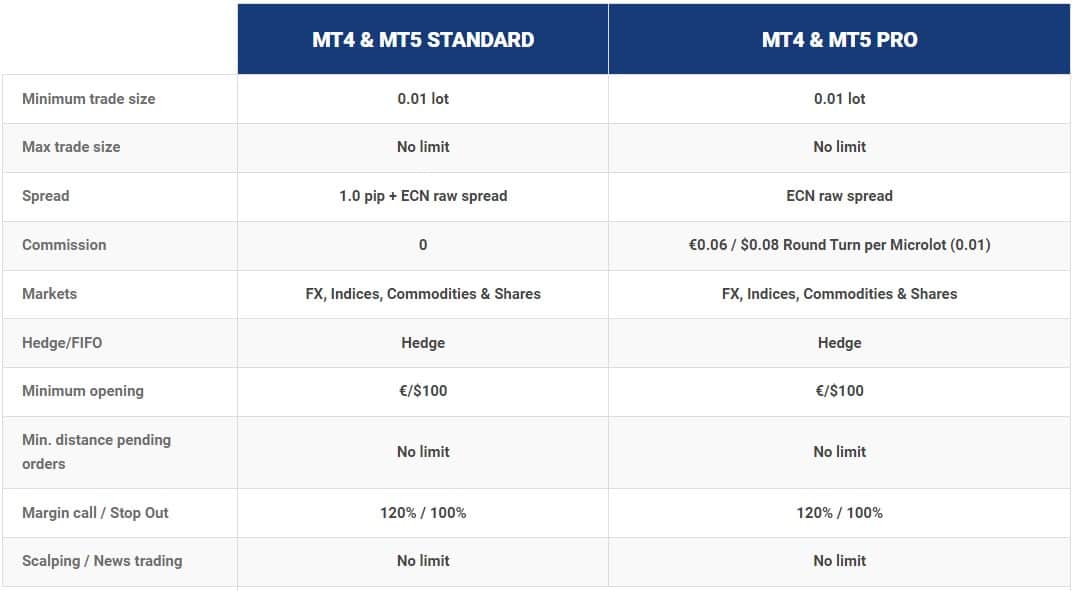

Account types

Key to Markets Account types Standard and Pro Accounts with a true ECN execution through the MT4 or MT5 platform, the only difference between the two accounts is how the commission is charged.

- Standard Account offers no-commission trading, traders only have to pay raw spreads offered by interbank = 1 pip.

- Whereas with a Pro account traders get raw market spreads, however commissions per trade are charged. The commission is €6 or $8 per traded lot round turn.

PAMM accounts also known as a software application that allows traders to pool their funds and invest them under the management of an experienced trader are enabled at the Key to Markets offering too. The PAMM system is located on a web-based platform where the investors or money managers can access the account from any device and have a great investment option.

Is there a demo account available at Key To Markets?

Yes, Key To Markets offers a demo account where you can access real market data with simulated money. We highly recommend signing up for a demo before engaging in any kind of live trading to hone your skills and gain more knowledge on trading.

| Pros | Cons |

|---|

| Fast digital account opening | Conditions vary depending on the account type |

| ECN Execution Type | |

| Demo Account available | |

| Low Spreads and commissions | |

Key to Markets Instruments

Key to Markets Instrument range provides traders with quick, efficient access to a vast selection of FX and CFDs via ECN connection. With 65 forex pairs consisting of 8 major and 11 exotic base currencies; also indices, shares, and commodities.

- Key to Markets Market Range ranked 8.2 out of 10 for its extensive array of Forex and CFD instruments. However, users should be aware that there may be some variation in offers between different entities as well as a slightly restricted range overall offering only CFD-based assets

Fees

Key to Markets fees are either commission-based on spread-based depending on account type. Thus MT4/MT5 Standard account offers a simple feature where all costs are included in the spread from 1 pip + raw market spread without any commissions. This means the company fee above is fixed on the total spread, while the raw spreads are provided by the interbank liquidity pool.

Whereas MT4/MT5 Pro delivers raw market spreads for Forex, Indices, Energy and Metals with a commission of 8$ per round. This account is usually preferred by scalpers and traders who require raw spreads for their strategies at all times, so it remains your choice which account to choose and how to define the costs.

Key to Markets rollover

Also, you should consider Key to Market’s rollover or overnight fee as a cost, charged on the positions held longer than a day and defined by each instrument separately. However, in case you are a trader who follows Muslim belief, Key to Markets specifically designed an Islamic account which features no swaps with no possibility to hold positions overnight.

- Key to Markets Fees are ranked with an overall rating of 8.1 out of 10 based on our testing and compared to over 500 other brokers. Fees and commissions vary based on entity offering, see our findings of fees and pricing in the table below

| Fees | Key to Markets Fees | Alvexo Fee | FXDD Fee |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | High |

Key to Markets Spread

Key to Markets spreads vary depending on the account type and entity you trade with, however, overall the spreads are ultra-low offering USD/EUR spreads starting from as low as 0 pip, which is considered really good offering competitive conditions.

- Key o Markets Spreads are ranked with an overall rating of 8.4 out of 10 based on our testing comparison to other brokers. We found forex spreads much lower than the industry standard which is 1.2 pips. Other spreads are favourable too, see below the table of spreads offered by the broker

| Asset | Key to Markets Spread | Alvexo Spread | FXDD Spread |

|---|

| EUR USD Spread | 0.4 pips | 1.4 pips | 1.9 pips |

| WTI Crude Oil Spread | 3 | 4 | 5 |

| Gold Spread | 28 | 35 | 40 |

Payment Methods

Key to Markets Payment methods are quite diverse offering different payment options including the most used methods Bank Transfers, Credit Cards, Skrill, Neteller and Sticpay, postepay, SEPA, etc.

- Key to Markets Funding Methods we ranked with an overall rating of 8 out of 10. The broker fees are either small or 0 with no deposit/withdrawal fees allowing depositing with different base currencies. And the minimum deposit is among average

Here are some good and negative points for Key to Markets funding methods found:

| Key to Markets Advantages | Key to Markets Disadvantages |

|---|

| Fast digital deposits | Conditions may vary according to trading entity |

| No deposit and withdrawal fees | |

| Multiple Account Base Currencies | |

| Withdrawal requests confirmed within 12-24 hours | |

| $100 minimum deposit | |

Minimum deposit

Key to Markets live trading minimum deposit is 100$ for both the Standard account and the Professional one, which is indeed a fantastic opportunity for all traders or investors.

Key to Markets minimum deposit vs other brokers

|

Key to Markets |

Most Other Brokers |

| Minimum Deposit |

$100 |

$500 |

Key to Markets withdrawal fee

Key to Markets does charge a deposit fee, for all Key to Markets withdrawal methods transaction costs apply 2.5%, except the bank wire transfer which has no fee and 1% for withdrawal that is why to make sure to count on that too.

Trading Platforms

Key to Markets trading platforms are MetaTrader4 and MetaTrader 5 as trading operating system that is available in various versions compatible with all devices, mobiles and tablets. The MT4 platform is well-known for its advanced trading capabilities, powerful level of analytical and technical tools and additional features that enables vast trading possibilities.

- Yet, the MT4 tools enhance trading even further, while MQL Suite improves the skills of discretionary traders with the new generation tools and is available to all clients with a live account with an initial deposit of at least 2,500$. FIX APIs provide the possibility of trading to advanced developers using their proprietary algorithms and black boxes through robust integration and the light protocol.

The easy-to-use dashboard and customisable charts are also newbie-friendly, making this a great platform for beginners and experts alike.

- Key to Markets Platforms are ranked with an overall rating of 8.5 out of 10 compared to over 500 other brokers. The broker has a great offering including leading MetaTrader Suit as well as a sophisticated Myfxbook platform suited for social trading

| Platforms | Keys to Markets | Pepperstone | XM |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| Own Platform | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

Myfxbook

In addition, you may Auto-trade your account powered by Myfxbook which offers to run the Auto system and link it to the MT4 trading account. Experienced traders can create their own portfolios to follow their success, while the novices may copy and learn from the professional for free without paying any performance fees, the cost will be the only small percentage of the successful trade.

Nevertheless, another reward from the company is a free VPS service that enables a constant connection to the servers without interruptions, which allows using EAs without special hardware systems.

Customer service

The broker provides all-around customer service that brings an opportunity to enjoy the trading experience fully. Generally, a transparent and effective approach of the Key to Markets teams makes a broker a reliable partner for any type of investor.

Moreover, Key to Markets is a partner with Forex Nations CIC, which is legally committed to donating at least 65% of its company profit to underserved entrepreneurs around the world through a Microcredit System.

- Customer Support in Ket to Markets is ranked Excellent with an overall rating of 9 out of 10 based on our testing. We got some of the fastest and most knowledgeable responses compared to other brokers, also quite easy to reach during the working days

See our find and Ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quality customer | Support not available 24/7

|

| Fast response | No Live Chat |

| Multichannel and multilingual support | |

| |

Key to Markets Education

Key to Markets Education Section provides good trading tools for your success. In addition to its industry-leading spreads, service, and technology they offer three unique learning environments backed up by articles and webinars. However, the lack of educational research and live chat support is not ideal for beginners.

- Key to Markets Education ranked with an overall rating of 7.7 out of 10 based on our research. Key to Markets provides very good quality Education Materials, however, the range is pretty poor

Key to Markets Conclusion

Based on our research, Key to Markets is a reliable broker with ECN connection with the raw, interbank spreads. The company is fully regulated by reputable world authorities, which means the necessary protection level is provided. The range of account types allows choosing the best option according to the trading style while PAMM, Islamic, and Auto trading accounts are available. In addition, the minimum deposit requirement is relatively low, only 100$, which opens access to all ranges of trading instruments.

Based on Our findings and Financial Expert Opinion Key to Markets is Good for:

- Regular Traders

- Professional Traders

- FIX API Trading

- EAs running

- Copy Trading

- Scalping / Hedging Startegies

- Traders who prefer MT4 or MT5 platform

- Myfxbook trading

- Currency Trading and CFD Trading

- MAM/PAMM Trading

- Suitable for a Variety of Trading Strategies

Share this article [addtoany url="https://55brokers.com/key-to-markets-review/" title="Key to Markets"]

I feel confident when using this broker For now never had problems Really recommended