- What is Key to Markets?

- Key to Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

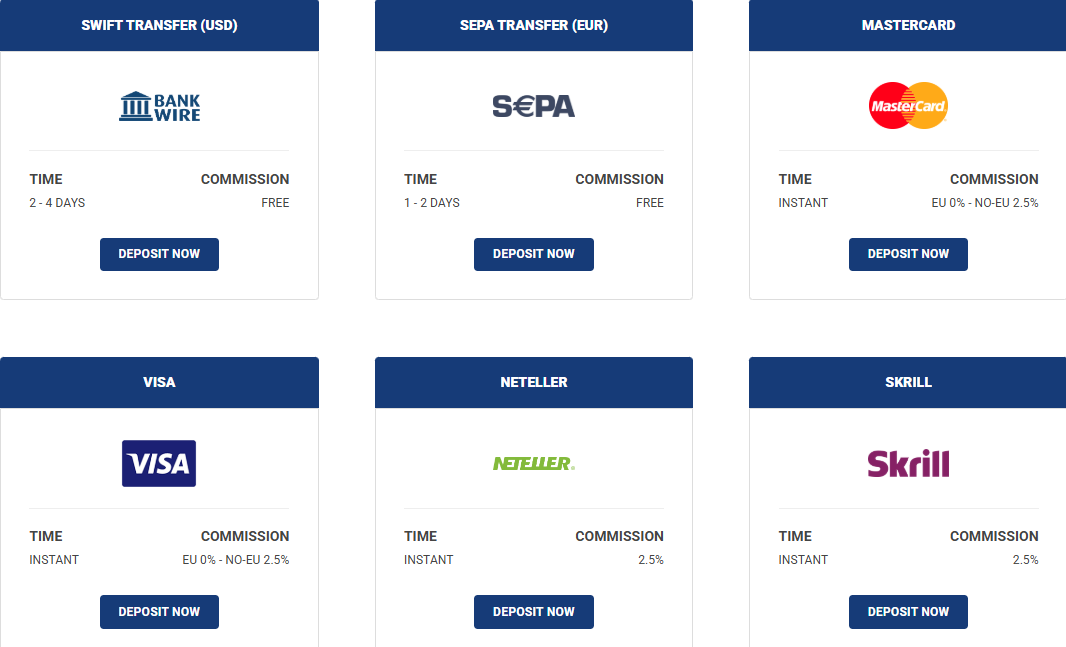

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

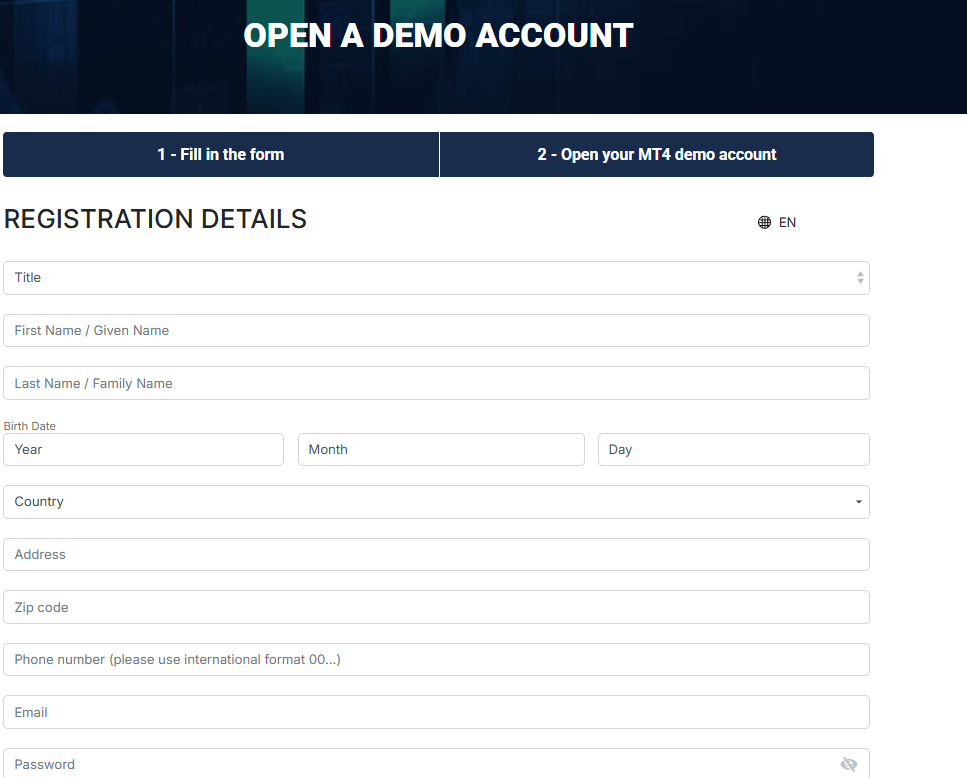

- Account Opening

- Additional Tools And Features

- Key to Markets Compared to Other Brokers

- Full Review of Broker Key to Markets

Overall Rating 4.2

| Regulation and Security | 4.1 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.1 / 5 |

| Research and Education | 4.1 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Key to Markets?

Key to Markets is a brokerage firm that offers access to online financial trading and markets for Institutional, Corporate, and Individual Clients. The broker gives access to the global markets in a secure and regulated environment with competitive spreads, commission-free trading on Forex and CFDs via their MT4 and MT5 platforms, plus fast deposits when opening one of two available live accounts or utilizing the PAMM social feature for unique investment opportunities.

- Established in 2010, the company Kleis EU Ltd is registered in Cyprus. Also, the broker holds an international entity in Mauritius.

In addition to its global coverage, the broker offers a great market range, which includes Forex, Shares, Indices, and Commodities, with ECN connections and competitive fees.

Key to Markets Pros and Cons

Key to Markets is a trustworthy broker registered in Cyprus, with a reliable trading environment overseen by CySEC. The broker enables powerful research and trading tools, the range of platforms is great, and the spreads offered are low. Key to Markets also offers PAMM solutions for investors to benefit from profitable strategies. Its ECN technology ensures fast executions, transparent pricing, and tight spreads.

For the cons, there is no 24/7 support; also, instruments are limited to Forex and CFDs. Besides, conditions vary based on the entity and its applicable regulatory standards. Also, the education section is quite empty.

| Advantages | Disadvantages |

|---|

| Regulated broker with a strong establishment | Only Forex and CFDs |

| Good Reputation | No 24/7 support |

| Wide range of trading platforms | Conditions vary based on the entity |

| Low Spreads | |

| Competitive trading conditions | |

Key to Markets Features

Key to Markets gives access to ECN trading with direct market access through its MT4 and MT5 platforms. It features raw spread accounts, fast execution, and PAMM account compatibility for money managers. Key to Markets is focused on transparency and is suitable for traders interested in low-latency trading environments. We have compiled the main aspects of trading with Key to Markets for a quick look:

Key to Markets Features in 10 Points

| 🗺️ Regulation | CySEC, FSC |

| 🗺️ Account Types | MT4/MT5 Standard, MT4/MT5 PRO |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, Shares, Indices, and Commodities |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base Currencies | EUR, USD, GBP |

| 📚 Trading Education | Learning materials, research, webinars |

| ☎ Customer Support | 24/5 |

Who is Key to Markets For?

Based on Our findings and Financial Expert Opinions Key to Markets offers great trading conditions and is especially suitable for the following:

- Regular Traders

- Professional Traders

- EAs running

- Copy Trading

- Scalping/Hedging Strategies

- Traders who prefer the MT4 or MT5 platform

- Free VPS

- Currency Trading and CFD Trading

- MAM/PAMM Trading

- Suitable for a Variety of Trading Strategies

Key to Markets Summary

Based on our research, Key to Markets is a reliable broker with an ECN connection with the raw, interbank spreads. The company is registered in Cyprus, with the necessary protection level provided. The range of account types allows choosing the best option according to the trading style while PAMM, Islamic, and auto trading accounts are available. In addition, the minimum deposit requirement is relatively low, only $100, which opens access to all ranges of trading instruments.

55Brokers Professional Insights

Key to Markets is one of the brokers with a good professional ranking for trading performance overall. Being a well-regulated company the traders’ money is secured, and the platforms and trading conditions are mainly on the lower competitive side. Also, as one of the advantages, Key to Markets is available all over the globe, so traders from various countries can sign in. Key to Markets offers competitive fees, a good range of instruments but with most traded assets in place, quite a low minimum deposit requirements, and diversity in account types.

We found that previously Key to Markets Limited was authorized and regulated by the UK’s Financial Conduct Authority (FCA), providing the utmost safety and security. However, at present, the FCA license is not active any longer. Instead, at the moment, Key to Markets is registered in Cyprus and operates under its rules, being available for all EU traders. Also, international traders are welcomed via an offshore entity under the FSC in Mauritius. This means the broker does not offer the same rigorous oversight as before, yet is still registered in Cyprus and follows stringent rules and guidelines. Also, if you look for thousands of instruments check other Brokers since Key to Markets is good for popular assets only.

Consider Trading with Key to Markets If:

| Key to Markets is an excellent Broker for: | - All types of traders

- Automated traders

- FIX API Trading

- Copy traders

- PAMM trading

- Traders who prefer MT4 or MT5 platform

- Forex and CFD traders |

Avoid Trading with Key to Markets If:

| Key to Markets is not the best for: | - Those who look for extensive education

- Clients who look for very tight regulatory oversight

- Limited investment opportunities |

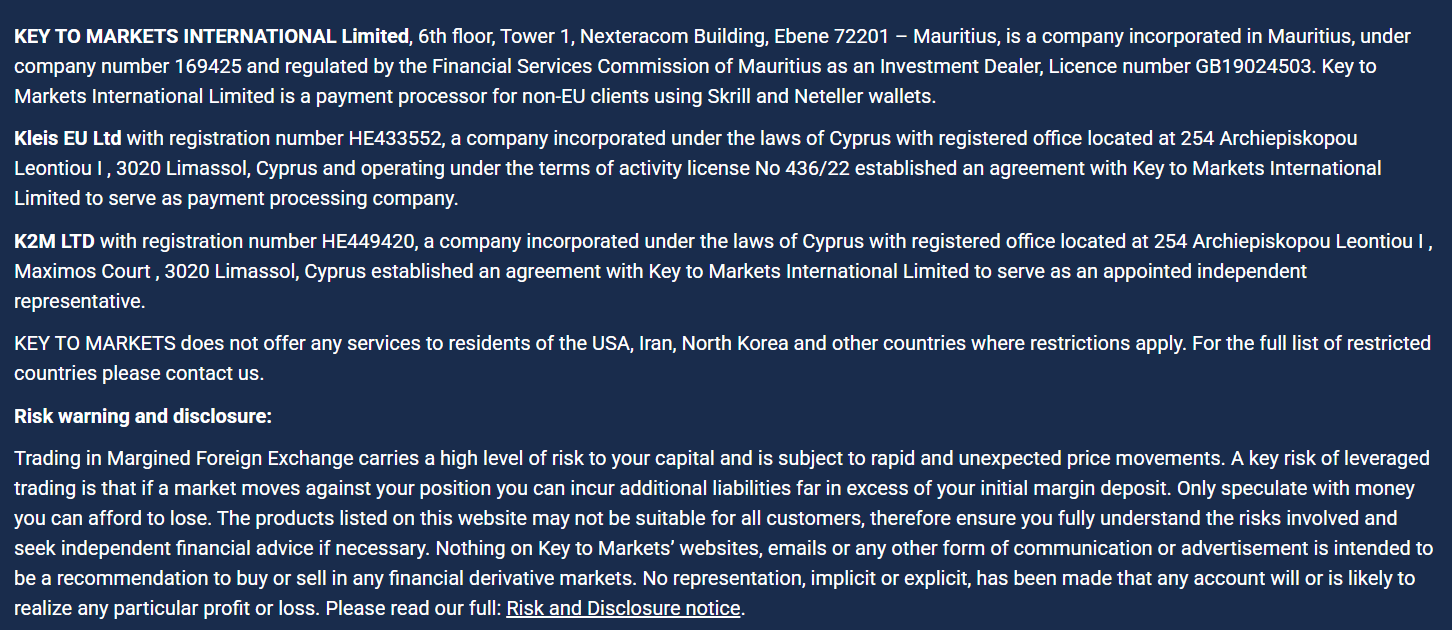

Regulation and Security Measures

Score – 4.1/5

Key to Markets Regulatory Overview

K2M LTD is registered in Cyprus, and it acts as an appointed independent representative of Key to Markets International Limited, operating under the 436/23 license number. The registered website under the CySEC entity is www.keytotrading.com.

- We found that up until lately, Key to Markets was based in the UK and held a license from FCA, being authorized to provide financial services that comply with necessary and very strict laws and requirements. However, the license is not active anymore, and Key to Markets does not lie under FCA’s rigorous oversight, which is, of course, a downside, as the authority is considered one of the most respected and serious regulatory bodies in the financial market. Yet, the fact that it now holds a license from CySEC, another respected authority, proves that the broker’s services are still safe and under control.

- Also, Key To Markets International Limited is registered in Mauritius and is regulated by the Financial Services Commission (FSC), with license number GB19024503.

How Safe is Trading with Key to Markets?

Due to its Cyprus registration, Key to Markets follows rules and guidelines imposed by the local regulatory body, so clients can enjoy a safe trading environment.

Consistency and Clarity

Key to Markets is a good broker with favorable offerings and great market conditions. It has evidently expanded its scope of services over the years and has proven consistent in its growth.

However, while previously the broker provided a very high level of protection to its clients by being licensed by the FCA, right now the license from the authority has expired and Key to Markets operates only under its offshore entity. Also, the company is Cyprus-based and complies with its rules. Yet, the fact of revoking its FCA license is a serious thing to consider, especially for those clients who prioritize high regulatory practices.

Another important aspect to mention is the feedback from clients, which, as we have found, is mostly positive. Although there are some mentions of withdrawal issues and regulatory issues, most traders are satisfied with the broker’s services and the overall trading environment.

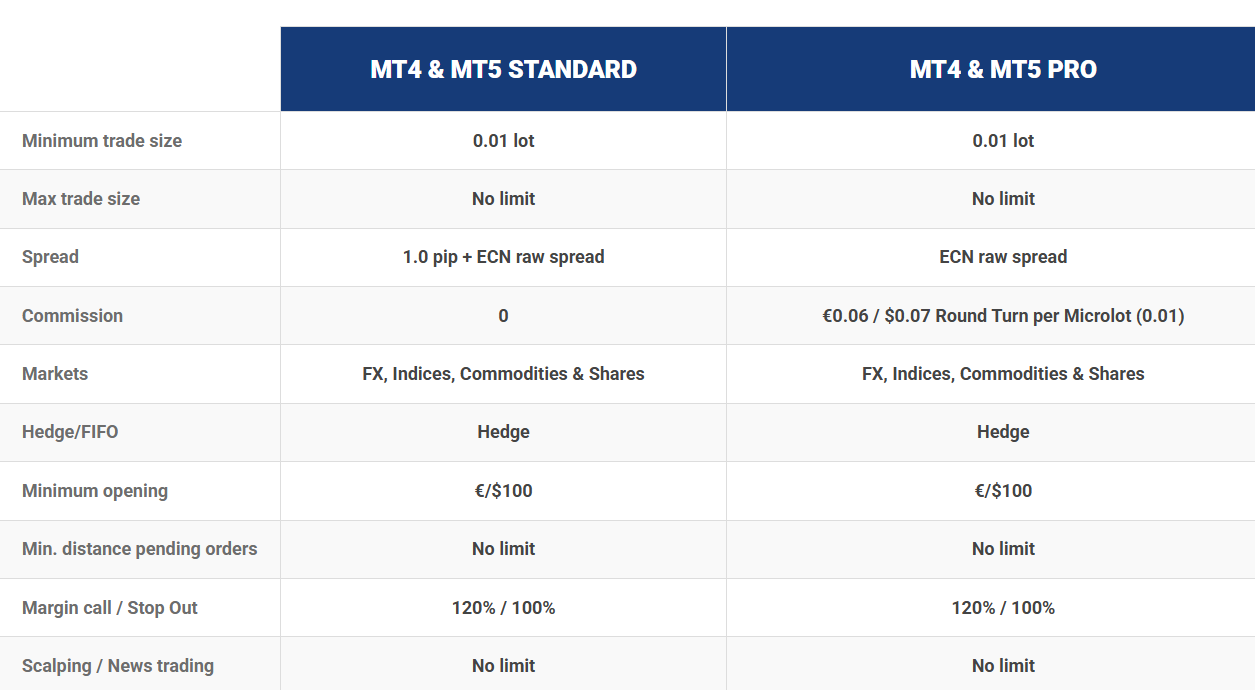

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with Key to Markets?

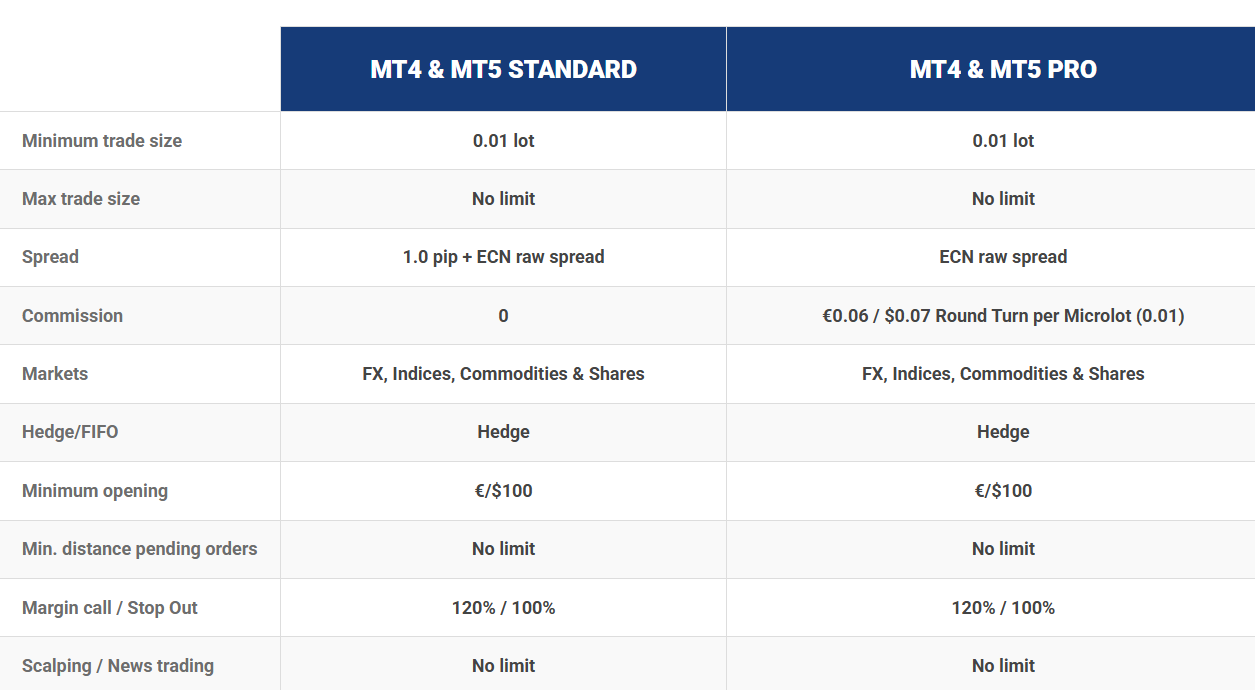

Key to Markets offers two main account types – Standard and Pro Accounts with a true ECN execution through the MT4 or MT5 platform. The available leverage is up to 1:500. The main difference between the two accounts is how the commission is charged.

- Standard Account offers no-commission trading; traders only have to pay raw spreads offered by interbank = 1 pip.

- Whereas with a Pro account, traders get raw market spreads, with additional commissions per trade charged. The commission is €6 or $7 per traded lot round turn. The Pro account is usually favored by scalpers and traders who prioritize tight raw spreads.

- PAMM accounts, also known as a software application that allows traders to pool their funds and invest them under the management of an experienced trader, are included in the Key to Markets offering too. The PAMM system is located on a web-based platform where the investors or money managers can access the account from any device and have a great investment option.

Regions Where Key to Markets is Restricted

We found that Key to Markets has a wide global exposure, offering its services to the residents of many countries worldwide. However, see below the list of the restricted countries that Key to Markets limits due to regulatory issues.

Cost Structure and Fees

Score – 4.3/5

Key to Markets Brokerage Fees

All in all, we find Key to Markets fees quite competitive and transparent with two distinct fee structures – either commission-based or spread-based depending on account type. Thus, the MT4/MT5 Standard account offers a simple feature where all costs are included in the spread from 1 pip + raw market spread with no commissions. This means all the costs are integrated into spreads, while the interbank liquidity pool provides the raw spreads. Whereas, the MT4/MT5 Pro account delivers raw market spreads for Forex, Indices, Energy, and Metals with a fixed commission.

Key to Markets offers the ECN interbank market raw spreads. Spreads mainly depend on the account types. For the Standard account, all the costs are integrated into spreads; for the EUR/USD pair, the spreads are calculated at the raw market spread + 1 pip. For the Pro account, the spreads are very tight, accompanied by commissions per trade.

- Key to Markets Commissions

The broker’s Pro account is based on commissions, with very low spreads. We found that Key to Markets offers commissions of €6 or $7 per traded lot round turn (€3/$3.50 per turn), which are proportional to the trade volume.

- Key to Markets Rollover / Swap Fees

Also, you should consider Key to Market’s rollover or overnight fee as a cost, charged on the positions held longer than a day and defined by each instrument separately. However, in case you are a trader who follows Muslim beliefs, Key to Markets has a specifically designed Islamic account. The broker updates swap values daily, so traders should check them beforehand.

How Competitive Are Key to Markets Fees?

When exploring the Key to Markets costs, we found that the broker offers competitive fees, which are provided clearly and transparently. With its two types of fee structure, clients can choose either a spread or commission-based structure based on their trading expectations.

As we have found, there are no hidden fees, and the spreads and commissions offered are mostly on the lower side. The Pro account with its commission-based structure is especially favorable for scalpers or high-frequency traders. Also, while the broker charges swap fees for positions held overnight, the applicable fees are in line with the market average. At last, we recommend traders be careful when it comes to fees applicable for trading, as based on the different entities the broker operates, these fees may be very different.

| Asset | Key to Markets Spread | Fortrade Spread | Trade245 Spread |

|---|

| EUR USD Spread | 1 pips | 2 pips | 1 pip |

| WTI Crude Oil Spread | 50 | 0.04$ | 3 |

| Gold Spread | 18 | 0.45$ | 1 |

Key to Markets Additional Fees

As to additional fees, we found that for some funding methods, there are additional transaction fees of about 2.5%. We also found that Key to Markets does not charge Inactivity fees for accounts that have been dormant for a while. The broker allows clients to keep their accounts open without additional charges applied.

Score – 4.4/5

Key to Markets trading platforms are MetaTrader4 and MetaTrader 5 which are available in various versions compatible with different devices, mobiles, and tablets. Both platforms provide access to advanced tools and favorable conditions, offering a secure and diversified trading environment.

| Platforms | Keys to Markets | Pepperstone | XM |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| Own Platform | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

Key to Markets Web Platform

The broker offers flexibility of trades, enabling its clients access to the market through the MetaTrader Web Trader. The Web platform does not require downloads or installations, and grants quick access to the accounts, at the same time providing the most essential tools and features that are crucial for positive outcomes of trades. The platform includes pending orders, comprehensive analysis with advanced graphical objects, technical indicators, also, good data protection.

Key to Markets Desktop MetaTrader 4 Platform

The MT4 platform is well-known for its advanced trading capabilities, with a powerful level of analytical and trading tools and additional features that enable vast trading possibilities. The platform offers a user-friendly interface and simplicity, combined with professional charting tools, a good range of technical analysis and graphs, custom indicator programming capabilities through MQL language, and different advanced strategies. The easy-to-use dashboard and customizable charts are also beginner-friendly, making this a great platform for novice traders and experts alike.

Key to Markets Desktop MetaTrader 5 Platform

The MT5 is an enhanced platform that provides innovative functions to conduct trades with more ease and profitability. The platform also allows its users to automate their trading by using robots and trading signals, which means less effort and time spent on trades and better outcomes. Key to Markets MT5 platform ensures flexibility and accessibility by giving access to the platform through multiple devices and operating systems like Windows, MacOS, or Linux.

Main Insights from Testing

Our testing reveals powerful MetaTrader platforms that support traders in trading, enabling them to use innovative features, automate trades, create custom indicators, and access a good range of analytical tools. Although the MT5 platform is the more innovative and latest version of the MT4, both platforms support traders, creating a favorable environment and providing the best conditions.

Key to Markets MobileTrader App

Clients can easily download the free MT5 application on their iPhone, iPad, or Android devices and gain access to a wide range of markets, including Forex, stocks, and futures. The flexibility the mobile apps offer makes trading more accessible, supporting advanced features and conditions for mobile apps that are as efficient as those available through the desktop platform.

Trading Instruments

Score – 4.3/5

What Can You Trade on the Key to Markets Platform?

Key to Markets Instruments

Key to Markets provides traders with quick, efficient access to a vast selection of FX and CFDs via ECN connection, with 65 forex pairs consisting of 8 major and 11 exotic base currencies, also, indices, shares, and commodities. The broker also offers over 12 CFDs on commodities including precious metals, energy, and soft commodities. Traders also have access to the major Indices of the global market based on CFDs and over 60 shares from the most important stock exchanges.

Main Insights from Exploring Key to Markets Tradable Assets

All in all, while exploring Key to Market’s tradable instruments, we discovered over 180 instruments available through the broker’s platforms across different asset classes. This offering by any means is not extensive, as many brokers offer 10.000+ tradable products which will surely provide intense diversification of trades. However, Key to Markets offers the main range of instruments clients are usually looking for.

Another drawback that will limit the chances of trade diversification is the fact that most instruments are based on CFDs, which restricts the chances of long-term investments. However, combined with transparency, advanced platforms, and competitive fee structure Key to Markets’ offering is still considered good. Yet, once again we want to remind our readers that it is important to verify what instruments are available under the entity you register.

Leverage Options at Key to Markets

Like the majority of Forex brokers, Key to Markets also offers leverage, a powerful tool that increases the potential of gains by multiplying the initial accounts balance. However, leverage should be used smartly as it increases the ratio of losses as well. Key to Markets Leverage, in particular, depends on the instrument you trade, and the entity.

- Under its CySEC regulation traders have access to up to a 1:30 leverage ratio, based on the instrument.

- The fact that it is regulated by an offshore authority enables access to higher leverage ratios that can be as high as 1:500.

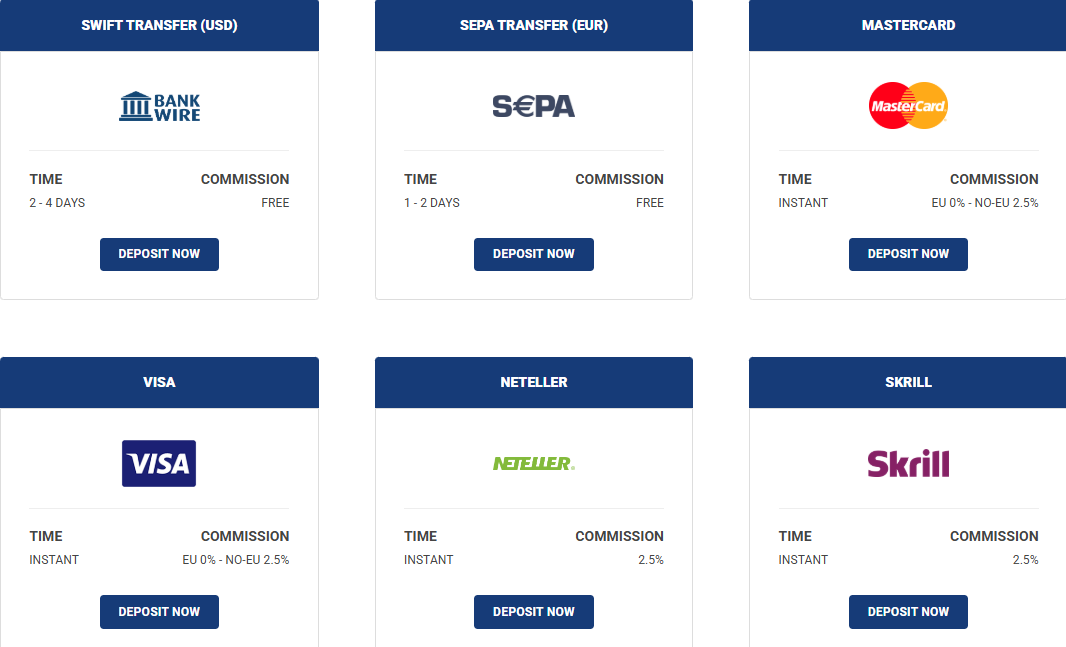

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Key to Markets

Key to Markets Payment methods are quite diverse offering different payment options including the most used methods such as Bank Transfers, Credit Cards, Skrill, Neteller and Sticpay, SEPA, etc. Note that Key to Markets charges a deposit fee of 2.5% for all Key to Markets deposit methods.

Minimum Deposit

The minimum deposit for Key to Markets live trading is $100 for both the Standard account and the Professional one, which is in line with the market average deposit requirement and a good opportunity for all traders or investors.

Withdrawal Options at Key to Markets

Withdrawals are processed to the same trading methods the deposits were made from. Key to Markets does not allow third-party payments.

- Key to Markets charges a 1% withdrawal fee for Skrill, Neteller, and Sticpay. For Bank Wire withdrawals there are no transaction fees.

- The withdrawal through all the methods takes 1 business day on average.

Customer Support and Responsiveness

Score – 4.1/5

Testing Key to Markets Customer Support

We have also researched the Key to Markets customer support section to find that the broker offers decent assistance through multiple channels: email, phone line, and a messaging opportunity right from the broker’s Contacts section. One of the negative points about the broker’s customer support is that it does not provide a Live chat, which is an excellent option for quick answers and solutions.

Contacts Key to Markets

There are several options for directing trading-related questions to the broker’s team for professional support:

- By directing your question or issue to the broker via email (info@keytomarkets.com) clients get detailed and helpful answers operatively.

- Many traders prefer to discuss their issues directly with the support team through a phone, which is another operative way to find answers. Clients can use the provided +230 215 8020 phone number from 9 a.m. to 6 p.m. GMT on business days.

- At last, there is a quick way to send a message right from the broker’s Contacts page by filling in the required information and the main question.

Research and Education

Score – 4.1/5

Research Tools Key to Markets

We have gone through all the available research tools Key to Markets offers outside its trading platforms to see if there are additional tools and features to enhance the trading experience. As a result, we discovered the following features, which are not quite varied but still provide a certain amount of diversity and insight into the market:

- Weekly Market Updates provide deep analysis of the market during the week, giving insights and predictions on how the market will move further. This helps traders to make better decisions.

- The Market Analysis section provides daily and midweekly analysis of the market, concentrating on the major events that happen globally and their impact on the overall financial market.

- At last, the Thoughts and Insights section again concentrates on global events in the market and gives insight and thoughts on each event and its possible impact.

Education

When we reviewed the Key to Markets education section it became evident that it does not provide comprehensive materials and resources that would completely support both beginner and experienced traders. However, the broker has 3 distinct sections concentrating on how to trade with Key to Market and use its tools to their maximum capacity.

- Learn to Trade Forex, Learn to Trade CFDs, and Learn to Trade Shares sections concentrate on how to trade with Key to Markets and use its tools and features, also they give overall knowledge and insights of the market. These sections guide on how to navigate the broker’s platforms, automate trades, use the MyFXbook feature provided by the broker, and other aspects of trading that are essential to success.

- Besides, Key to Markets organizes webinars on different trading topics, however, at the moment we did not find any recordings of the previous webinars or a schedule for the upcoming ones.

Is Key to Markets a Good Broker for Beginners?

In general, Key to Markets offers favorable conditions that will suit traders of different levels of experience. The fee structure is competitive, the available trading platforms are simple to navigate yet equipped with advanced features and tools. Also, the initial deposit is not very high. However, the broker does not provide extensive research and education materials, which is a drawback for those who rely on the broker to gain skills and knowledge on the market. Besides, traders should carefully consider the broker’s offerings and regulatory status before opening a trading account.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options Key to Markets

When it comes to the investment opportunities and expanding of the portfolio with Key to Markets, it does not provide great diversification. This is based on the fact that traders gain access to only 180 tradable products that are mainly based on CFDs, leaving no space for traditional investments and ownership of real shares.

- However, the good news is that clients have full access to PAMM accounts, which gives alternative options for investments, with quick setups and favorable opportunities.

- Traders also have access to Copy trading, enabling traders to copy trades of well-performing professionals. The Copy trading features are free of charge, with no additional or unexpected costs. Copy trading gives traders full control of their accounts. Only they decide when to open or close trades or when to deposit or withdraw funds.

- Social trading is another option to evaluate the trades of other experienced traders and invest in their strategies.

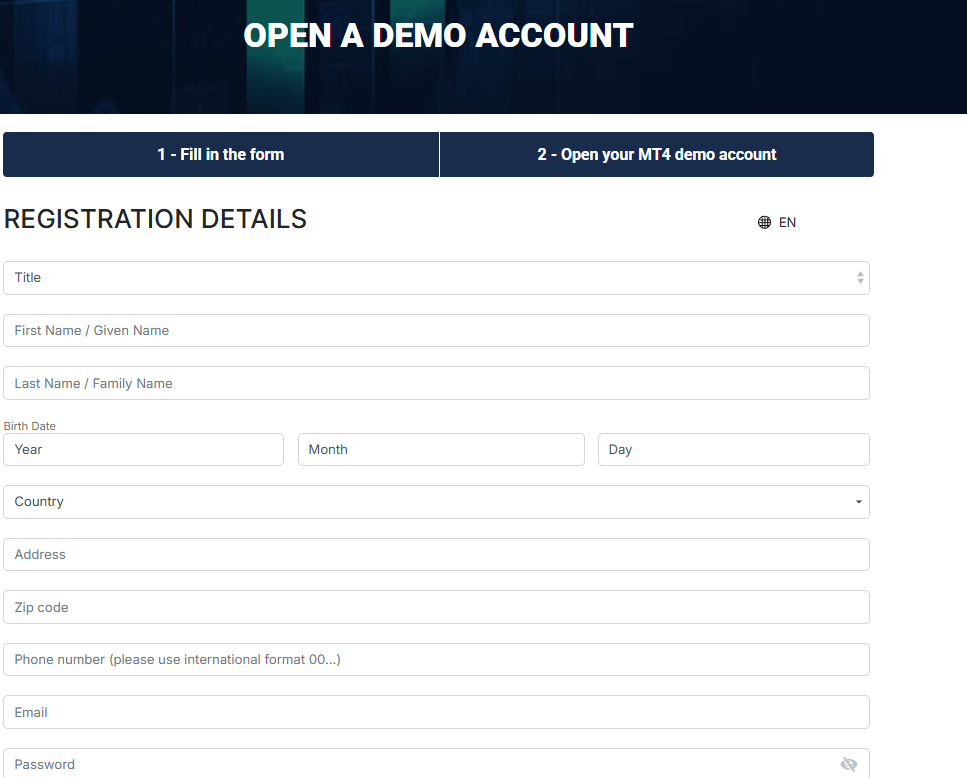

Account Opening

Score – 4.5/5

How to Open a Key to Markets Demo Account?

Opening a demo account with Key to Markets will enable traders to practice trading on the broker’s platforms and gain skill and market knowledge before going live and trading with real money. This is a great way to practice without risking funds, by trading with virtual $50.000 money.

Here are the quick steps on how to open a Demo account with Key to Markets:

- At the top of the broker’s website select the ‘Open a Demo Account option’

- Fill out personal information (name, address, email, country of residence, phone number, etc.) and create a password

- Key to Markets will send an email with a link to verify your email address

- Afterward, open the Demo account using your account credentials, and on the Dashboard select the Demo account option

- Then select the preferred trading conditions, by choosing leverage, currency, etc.

- Download and install the MT4 platform and log in with your account information

- The account is open and you can start exploring

How to Open a Key to Markets Live Account?

Opening a Live account with Key to Markets requires similar steps to complete as for the opening of a demo account, only for the live account opening traders need to provide documentation for the proof of identity:

- Go to the broker’s website and at the top of the homepage choose the ‘Open a Live Account’ option

- Fill out the registration form by providing personal information, country of residence, email address and phone number, etc

- Afterward, you will need to verify your identity by providing a valid passport or ID, and proof of address, such as a utility bill or bank statement

- When your identity is verified, choose trading parameters, including platform, leverage, account type, currency, etc.

- The next step is funding the account by using one of the available deposit methods

- Start trading

Score – 4.3/5

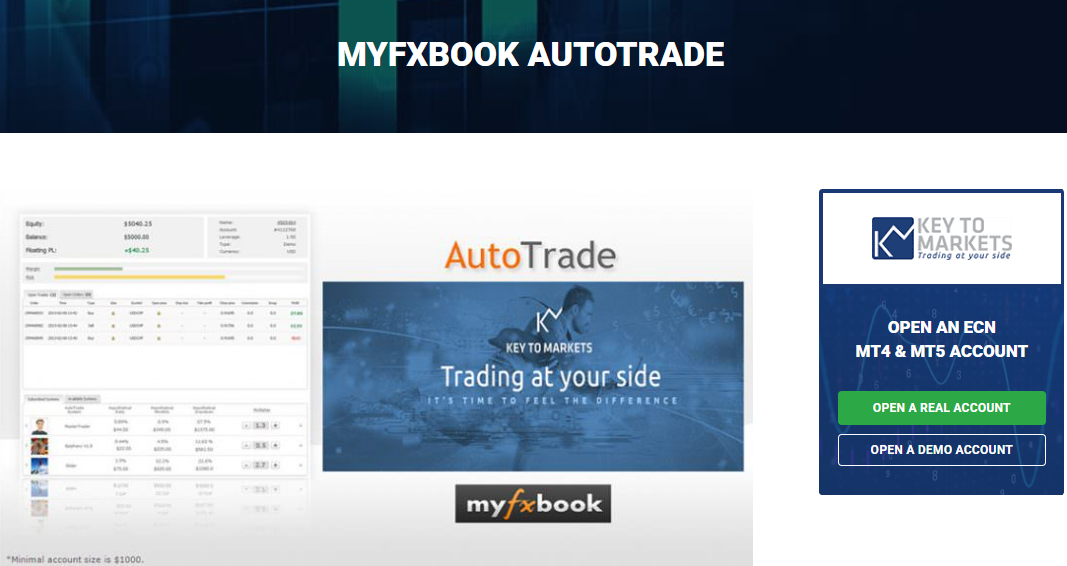

We have found additional features and opportunities clients can benefit from when trading with Key to Markets. Here are the main tools and features that will enhance your trading experience and give you more chances for success:

- Myfxbook offers to run the auto system and link it to the MT4 trading account. No additional installations are required for Myfxbook. Experienced traders can create their own portfolios, while novice traders may copy and learn from the professionals for free without paying any performance fees. To activate Myfxbook, clients need to open a live account with the broker and select the “Myfxbook AutoTrade” account type.

- Another great feature Key to Markets allows free VPS service that enables a constant connection to the servers without interruptions, which enables using EAs without special hardware systems.

Key to Markets Compared to Other Brokers

We also compared Key to Markets to other brokers in the market, which, in our opinion, offer competitive trading conditions and provide safety of trades. The first thing we compared was Key to Markets’ regulation to other well-standing brokers, such as Fortrade and TMGM. In terms of regulation, Key to Markets does not provide as much security in this respect as Fortrade with its ASIC, FCA, and IIROC, and TMGM with its ASIC and FMA licenses.

As to the fee structure and applicable costs, Key to Markets offers average fees with spreads from 1 pip and commissions from $3.5. This offering is similar to Pepperstone’s and TMGM’s fees. As to the available platforms, Key to Markets offers the MT4 and MT5 platforms, which are considered regular offerings, and they are still brokers that offer more diversity, such as FP Markets and Pepperstone.

As to the broker’s education and favorability for beginner traders, we have found brokers with better educational resources that enable beginner traders to gain skills and knowledge on the market. Admiral Markets and Pepperstone offer extensive educational materials and research tools to enhance trading skills and get more insights into the market.

| Parameter |

Key to Markets |

Pepperstone |

TMGM |

TriumphFX |

FP Markets |

Admiral Markets |

Fortrade |

| Spread Based Account |

Average 1 pips |

From 1 pip |

Average 1 pip |

Average 0.6 pip |

From 1 pip |

From 0.6 pips |

Average 2 pip |

| Commission Based Account |

0.0 pips + $3.5 |

0.0 pips + $3.5 |

0.0 pips + $3.5 |

Not available |

0.0 pips + $3 |

0.0 pips + from $1.8 to $3.0 |

No commission |

| Fees Ranking |

Average |

Low/Average |

Average |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, cTrader, TradingView |

MT4,MT5, TGM app |

MT4 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, Admiral Markets app |

Fortrader Platform, MT4 |

| Asset Variety |

180+ instruments |

Over 1,200 instruments instruments |

12,000+ instruments |

64+ instruments |

10,000+ instruments |

8000+ instruments |

300+ instruments |

| Regulation |

CySEC, FSC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

ASIC, FMA, VFSC, FSC |

CySEC, FSC, FSA |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

| Customer Support |

24/5 support |

24/7 |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Basic |

Excellent education and research |

Good |

Good |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$100 |

$0 |

$100 |

$100 |

$100 |

$1 |

$100 |

Full Review of Broker Key to Markets

In conclusion, we have found that Key to Markets offers ECN trading with raw interbank spreads and is especially popular with professional traders, scalpers, and automated trading enthusiasts. Traders can conduct their trades through the MetaTrader 4 and MetaTrader 5 platforms and have access to copy/social trading, PAMM accounts, and the broker’s unique offering Myfxbook. With a rather good variety of instruments, Key to Markets provides competitive trading conditions for both retail and institutional traders.

While Key to Markets previously had an FCA license in the UK, it is no longer under the regulation of the FCA. Instead, it is now registered in Cyprus and holds an offshore license from FSC in Mauritius. Although FSC regulation is not as tight, the broker still offers services in line with industry standards. This means that although Key to Markets is still a good broker with good products, traders should remember that it does not provide the same level of protection as it did previously. Overall, based on our research, Key to Markets continues to provide a reliable trading environment, so it is still a decent choice for traders requiring ECN execution and diversified trading options.

Share this article [addtoany url="https://55brokers.com/key-to-markets-review/" title="Key to Markets"]

I feel confident when using this broker For now never had problems Really recommended