- What is Fondex?

- Awards

- Is Fondex safe or a scam?

- Leverage

- Accounts

- Fees

- Market Instruments

- Deposits and Withdrawals

- Trading Platform

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check trading offerings, fees, platforms, verified regulations, contacted customer service, and placed trades to see trading conditions and give an expert opinion on Fondex

What is Fondex?

Fondex, previously known as Kawase Exchange, is a European online trading broker based in Cyprus which operates inspired by Japanese concepts such as trust, power, determination, flexibility, and simplicity. While Fondex uses years of expertise and regulated license to provide high-performance trading experience combined with the latest technologies.

Fondex operated as an international brokerage firm specializing in liquidity provision and regulated institutional brokerage services that began its operation in 2010 and operated several brands including Fondex, for now Fondex is not avialbale any longer and the offering is available on TopFX – Check our TopFX broker review. The retail operation started only 5 years later, while Kawase and than Fondex launched trading in key Asian markets.

Fondex Pros and Cons

Based on our expert findings, Fondex has a good reputation and reviews from traders and is a European broker with Japanese technology. There are Powerful cTrader platform capabilities, Great copy trading options suitable for beginners, Low commission trading fees, and a Single account with transparent conditions.

On the negative side, there is no comprehensive education, no MT4 offered as alternative and Conditions vary according to regulations.

| Advantages | Disadvantages |

|---|

| Good reputation and reviews from traders | No comprehensive education |

| European broker with Japanese technology | No MT4 offered as alternative |

| Powerful cTrader platform capabilities | Conditions vary according to regulations |

| Great copy trading options suitable for beginners | |

| Low commission trading fees | |

| Single account and transparent conditions

| |

Fondex Review Summary in 10 Points

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation | CySEC, FSA |

| 📉 Instruments | Fondex FX, Shares, iShares, Powershares ETFs, Indices, Metals and Commodities |

| 🖥 Platforms | cTrader |

| 💳 Minimum deposit | No deposit requirement |

| 💰 Base currencies | Several Currencies offered |

| 🎮 Demo Account | Available |

| 💰 EUR/USD Spread | 0.28 pips |

| 📚 Education | No comprehensive education |

| ☎ Customer Support | 24/5 |

Overall Fondex Ranking

Based on our Expert finds, Fondex is considered a good broker with reliable service and very favorable trading conditions, that are suitable for beginners or experienced traders. The broker is good for technical trading through the cTrader platform with low fees and the lowest spreads. The broker offers an extensive instrument range offering the best conditions for FX and CFD trading.

- Fondex Overall Ranking is 8.1 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | Fondex | FP Markets | XM |

|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantage | Technical Analysis | MT4 | Education |

Fondex Alternative Brokers

However, the broker also has its disadvantages. What we found really upsetting is that the broker doesn’t offer popular MetaTrader platforms and educational resources are rather poor. Also, the broker’s instruments range is limited to FX and CFDs and there’s no 24/7 support. So it is good to check other options as well:

Awards

Its successful model of operation and delivery of trading environment has been recognized by numerous rewards and Awards from popular exhibitors or publishers. Also, what we also wanted to highlight is that Fondex clients have voted the company as number one in customer service, value for money, and overall client satisfaction proving Fonex’s good position within the proposals. Here are some of the most remarkable awards Fondex has gained:

Is Fondex safe or scam?

No, Fondex is not scam, it is considered a low-risk Forex trading broker since being headquartered in Cyprus. So traders can be assured that their funds will be safe since due to the regulation the broker has several safety programs.

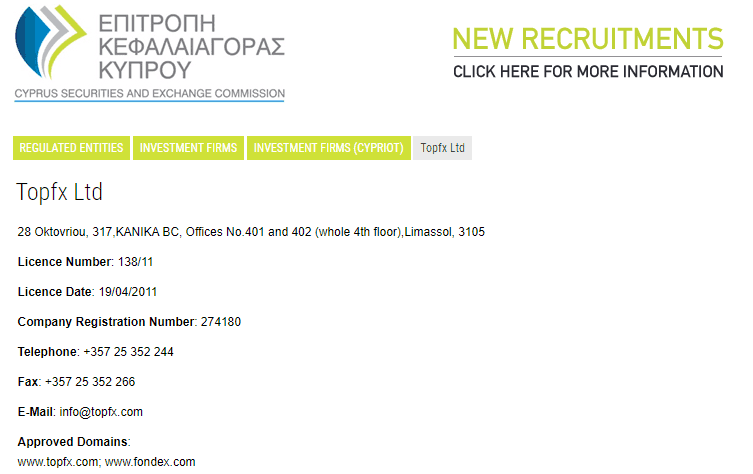

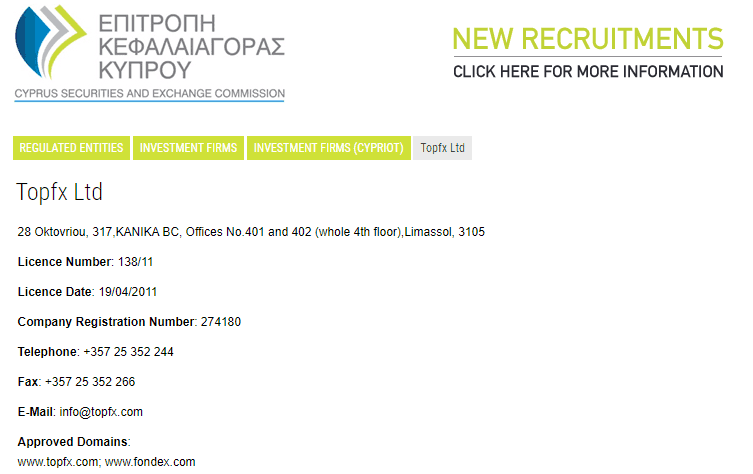

Is Fondex regulated?

The company is registered under the name TopFX LTD and respectively conducts its business with imposed regulation by CySEC. Previously TopFX used the trading name Kawase and recently was rebranded to Fondex, while still remaining the regulated company also cross-border registered with 25 EU regulators to serve clients within the EEA zone.

Even though the additional entity is located in the offshore zone, recent offshores also created more strict licensing rules, while in addition to ESMA regulations Fondex is considered a safe broker to invest and trade with.

See our conclusion on Fondex Reliability:

- Our Ranked Fondex Trust Score is 8 out 0f 10 for good reputation and service over the years, the broker is highly regulated by reliable regulator ensuring fund safety. The only point is that it holds an offshore entity as well.

| Fondex Strong Points | Fondex Weak Points |

|---|

| Regulated by Cyprus CySEC and authorized for EEA crossborder proposals | International trading performed via Seychelles entity |

| Mainstay on transparent conditions | |

| International proposal available | |

| Negative balance protection

| |

Is Fondex Available In The US?

No, Fondex is not available for US clients. To operate in the US, the broker must be registered and compliant with the local financial regulator of securities (See best US Brokers), since the regulator restricts non-US brokers from trading in the UD.

How are you protected?

The CySEC has multiple requirements, that have also complied with the MiFID directive including capital adequacy, financial reporting to the regulators, and undertaking of a detailed audit, making control over Fondex activity constant and unparalleled.

- Money Protection and client safety are provided in multiple ways also, the traders’ funds are kept in world-leading banks and fully segregated, meaning are separated from the company’s activities along protected by negative balance protection.

In addition, Fondex is also a member of the ICF (Investor Compensation Fund) resolves issues in unlikely events, and compensates investors. Read more about CySEC by the link.

Leverage

Leverage is the mechanism by which you may trade a large amount of money, due to leverage capability to magnify your initial trading size. For example, if your trading account has a 1:30 leverage, assume that you have $1000 in your account, meaning 1:30 leverage allows you to trade a $30,000 position.

Fondex Leverage may magnify your trading exposure, yet the probability of profits or losses increases simultaneously, which makes it essential to learn how to use leverage smartly.

- Retail trader leverage goes to 1:30 for major currencies, 1:20 for minor ones, and 1:10 for commodities.

- Fondex enables you to trade with leverage up to 1:500 for Professional clients

- International traders entitle for 1:500 for major currency pairs

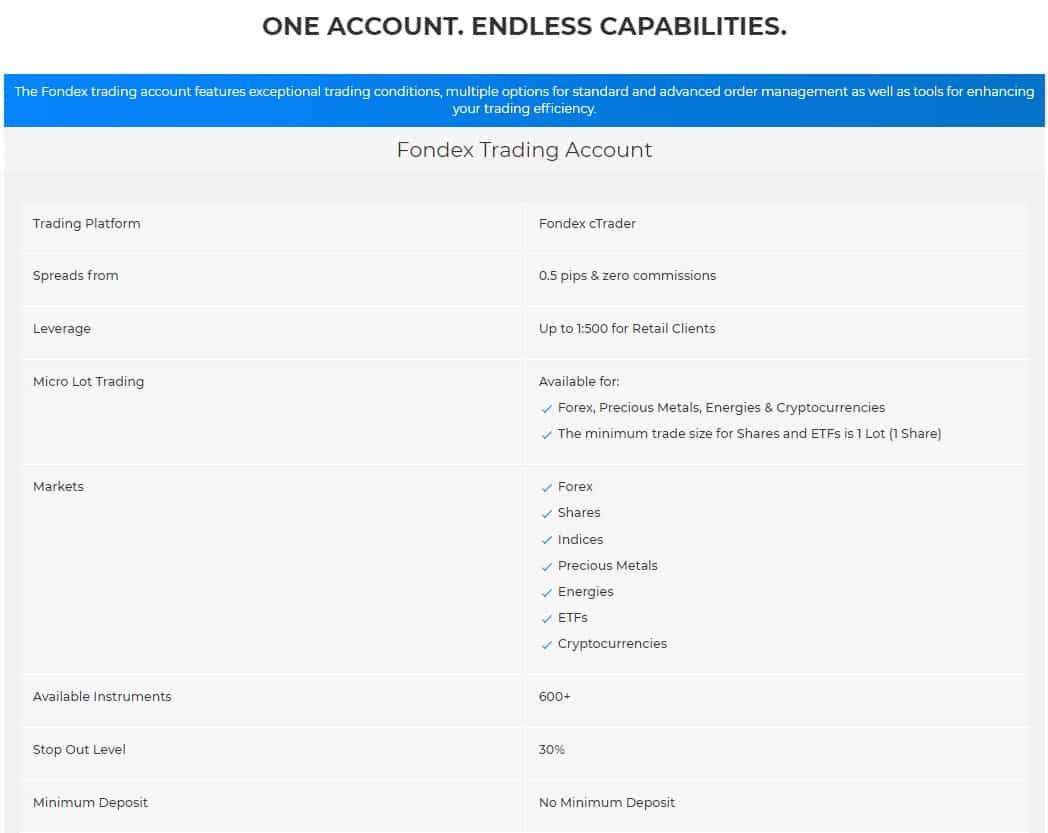

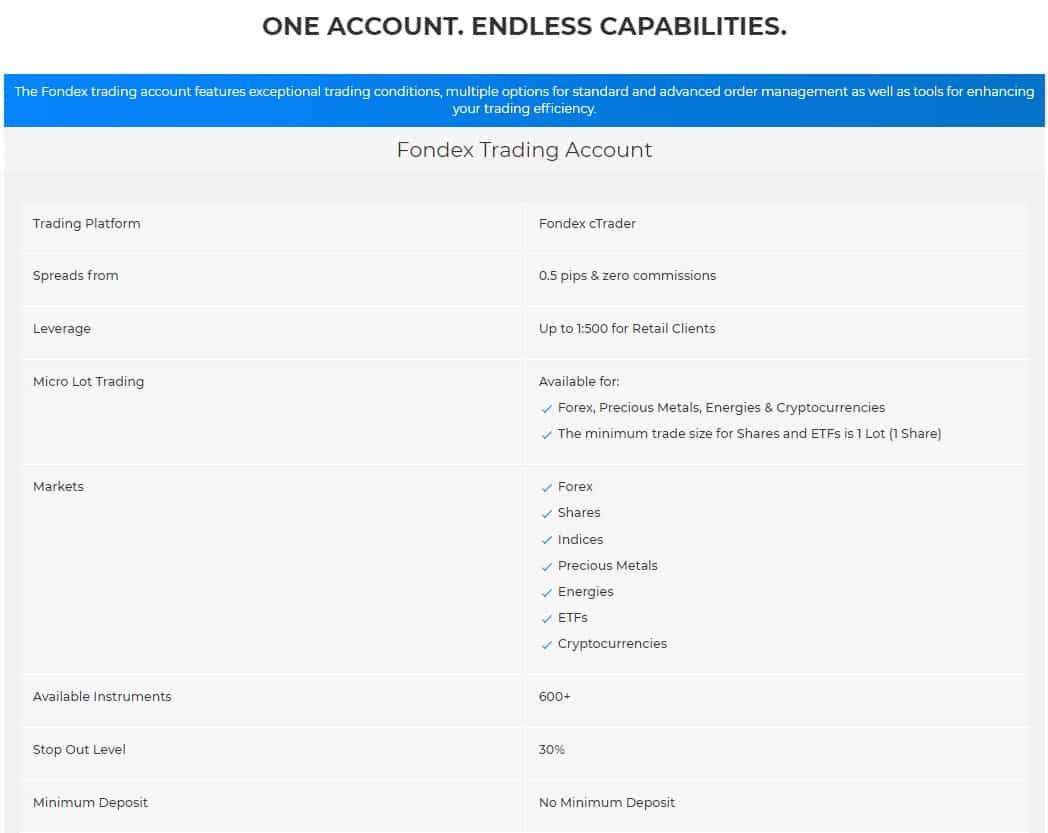

Account types

Fondex does not offer different account types and built its proposal into a Fondex single account to suit different trading styles or volumes with spreads from 0 pips. Also for Muslim traders, there is an option to trade via a Swap-free account.

| Pros | Cons |

|---|

| Fast Account Opening, fully Digital | None |

| Single Account feature | |

| No Minimum deposit | |

| Free deposits | |

| Swap-free available | |

| Active Trader account bonuses | |

Fondex Instruments

Based on our findings, Fondex delivers more than 1000 Markets to trade, so international traders gain access to the world’s premier liquidity providers and global exchanges through sources of proprietary aggregator engines with the best possible pricing from tier-1 grade banks. The range of trading markets includes most traded instruments making Fondex FX, Shares, iShares, Powershares ETFs, Indices, Metals, and Commodity Broker.

- Fondex Markets Range Score is 8.3 out 0f 10 for wide trading instrument selection, yet the only gap the broker offers mainly CFDs and Forex Instruments, and availability of assets as well as conditions vary based on entity

Fees

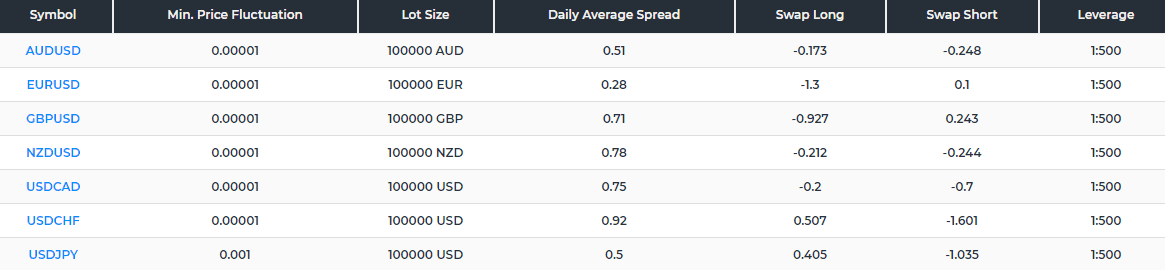

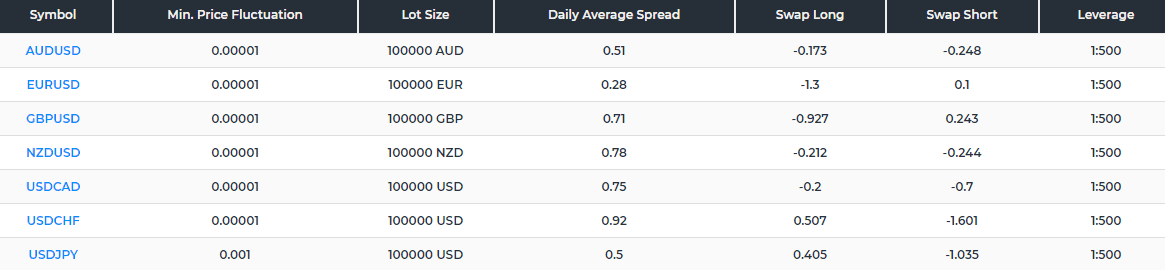

Fondex fees use proprietary price aggregation with the unique identification of the price on interval of more than 50 times per second to identify the lowest available quote for an instrument, thus Fondex spreads are raw with trading charges entirely commission-based. Overall, the broker doesn’t charge deposit-withdrawal fees and has low non-trading fees.

- Fondex Fees are ranked low with an overall rating of 8.4 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity offering, see our findings of fees and pricing in the table below

| Fees | Fondex Fees | City Credit Capital Fees | Equiti Fees |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | Average |

Fondex Spreads

Fondex spreads as mentioned are raw spreads with an additional commission charge of 2.5$ per side and 100k$ traded, which makes it a pretty good choice for active traders and beginners as well. For 100 Shares and ETFs, there is a commission of 1$ per side, which is also very low compared to similar brokers and market proposals.

- Fondex Spreads are ranked low with an overall rating of 8.9 out of 10 based on our testing comparison to other brokers. We found Fondex offering raw spreads for forex majors which is a great plus, especially for beginners and spreads for other instruments are very attractive too. See our table of spreads below in comparison with other brokers in the industry

| Asset | Fondex Spread | City Credit Capital Spread | Equiti Spread |

|---|

| EUR USD Spread | 0.28 pips | 1.2 pips | 1.4 pips |

| Crude Oil WTI Spread | 3 | 3 | 3 |

| Gold Spread | 30 | 35 | 20 cents |

Fondex rollover

Also, always consider Fondex rollover or overnight fee as a cost, charged on the positions held longer than a day and determined by the direction you trade and is differential between bids. Holding costs are based on many factors and most often positive swaps are paid on buy positions.

The Fondex Swap-free account also offers access to traders of Islamic belief to enter the trading process with no swap charges or spread widening. In order to apply for this account, you should proceed with a form that requires proof of faith to complete the process.

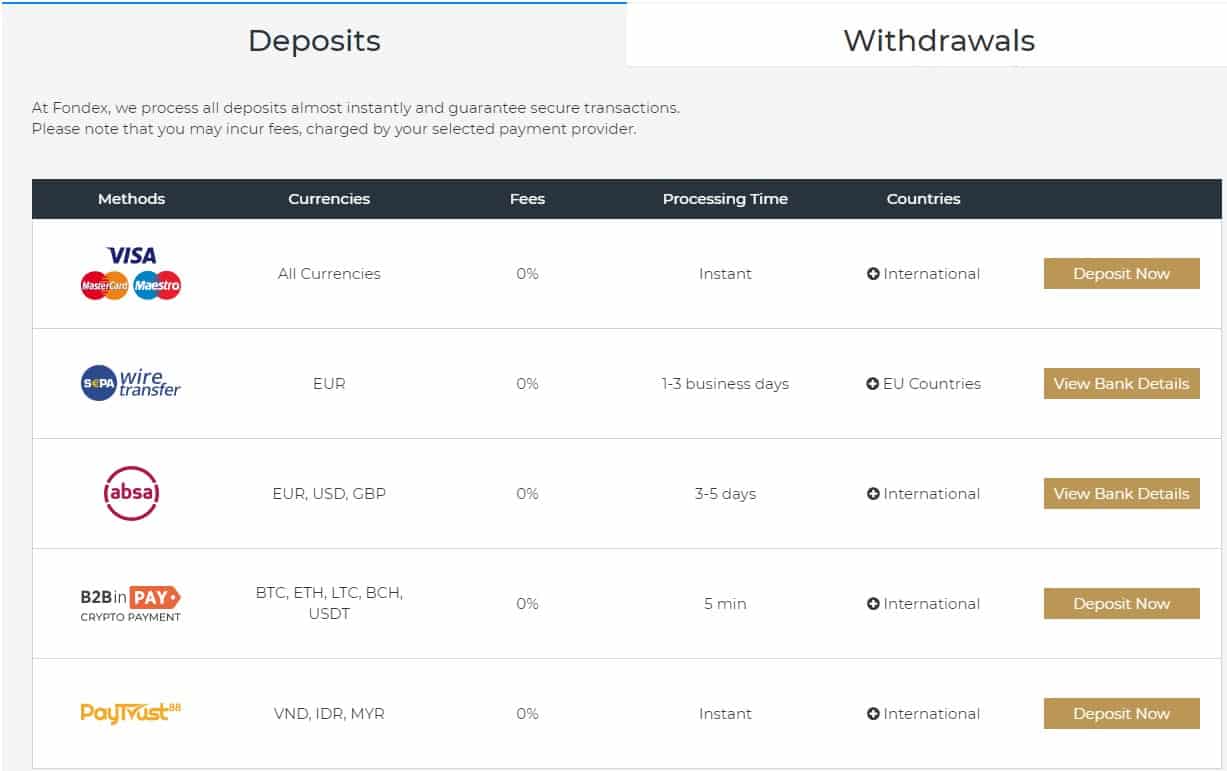

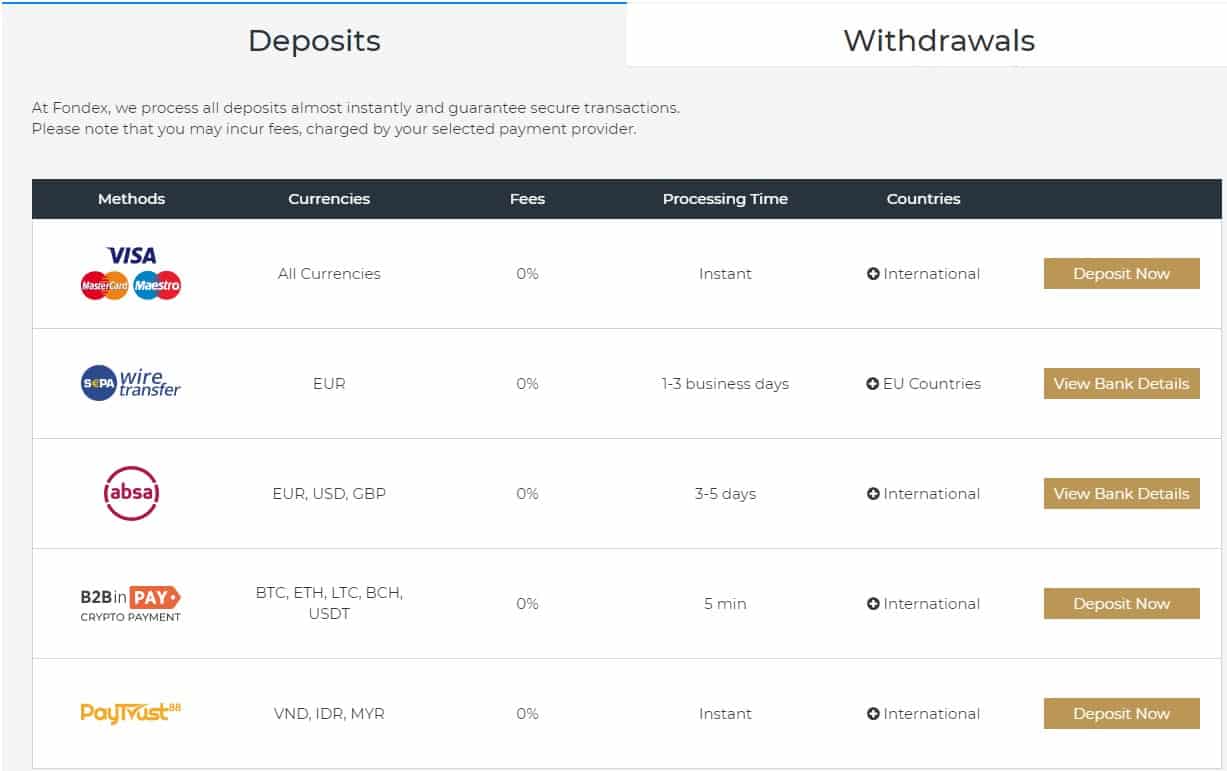

Deposit and Withdrawal Methods

Deposit or withdrawal of funds is directly available from Fondex cTrader which bypasses the client area making it a convenient process, while the transactions will be performed by the desired method.

- Fondex Funding Methods we ranked Excellent with an overall rating of 8.3 out of 10. The broker doesn’t have a minimum deposit requirement, yet Fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity

Here are some good and negative points for Fondex funding methods found:

| Fondex Advantages | Fondex Disadvantages |

|---|

| Good selection of deposit methods | Conditions vary according to regulations |

| WebMoney and Credit Cards supported | Withdrawals will add on fee |

| No minimum deposit requirement | |

| Withdrawals will take 1-2 days

| |

Deposit methods

The available methods including

- Card Payments,

- Bank Transfers,

- UnionPay,

- Qiwi,

- WebMoney,

- Skrill,

- Neteller,

- Yandex money.

However, some payment methods are available only in specific countries and will only appear if the deposit window is launched from a specific region.

Is there a Minimum Deposit to start trading with Fondex?

Fondex minimum deposit is 0$, however, the recommended amount that allows you to engage in live trading at the beginning is set to 200 units of your chosen currency USD200, GBP200, etc. Which is a reasonable amount for any size of trader, along with Fondex one account offering with no differences on the account you trade.

Fondex minimum deposit vs other brokers

|

Fondex |

Most Other Brokers |

| Minimum Deposit |

$0 |

$500 |

Withdrawals

Fondex does not charge deposit fees, yet check carefully with your payment provider in case any fees will be waived from their side. However, the withdrawals will incur an additional processing fee that is divided by the payment method, Fondex withdrawal options Cards and Online Transfers will add on a 3% fee, and Bank Wire Transfer costs 0.9% for transfers in Euro.

Trading Platforms

We found that Fondex offers its proprietary trading platform offering truly bank-grade trading conditions along with fast execution through a depth of market and direct connection to banks with its NDD model.

The proprietary platform is actually one of the greatest advantages of Fondex, its previously known Kawase cTrader Broker and now Fondex cTrader was built as a DMA platform with execution always defined by speed and high characteristics directly connected to the market with no bridge technology. Thus you are gaining access to trade on the same level as the institutional clients do, which is of course a fantastic opportunity.

- Fondex Platforms are ranked with an overall rating of 7 out of 10 compared to over 500 other brokers. The broker offers a great proprietary platform with add-ons and sophisticated features as well as offers a cTrader platform for professional technical traders. However, the lack of MetaTrader platforms which are the most popular ones is a major drawback

Trading Platform Comparison to Other Brokers:

| Platforms | Fondex Platforms | Pepperstone Platforms | Activtraders Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | No |

| cTrader | Yes | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Web Platform

The platform delivers extremely unparalleled transparency with a detailed order, deal, and position timeline, live order book values, and 50 fields of position details.

Desktop platform

Fondex cTrader scales to various devices through Desktop, Web, and Mobile versions making the performance accessible to almost everything with Live market sentiment Charting tools, trading history and session info, and on-server trailing stops.

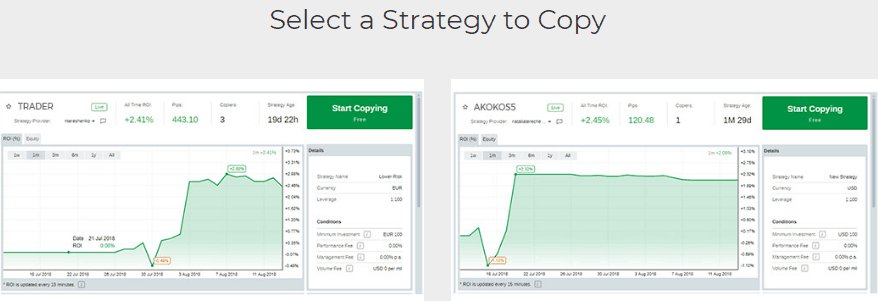

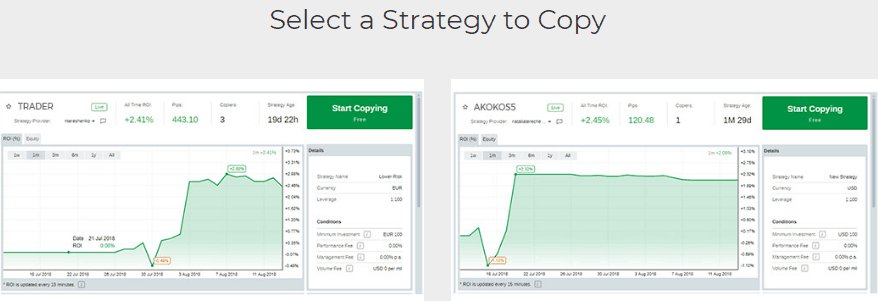

Mirror trading

Furthermore, the cTrader enhances the offering with mirror trading and algorithmic trading through cMirror and cAlgo. Alongside the cMirror was developed to allow mirroring of 1000+ strategies from top traders that increases significantly the possibilities to trade with ease and convenience.

Therefore, you may become either a signal provider and earn a commission or automate your trading positions through a follow of a strategy and all that is available through one account feature.

Can I copy trade with Fondex?

Yes, Fondex allows traders to copy trades through cTrader platform. The platform gives access to hundreds of strategies for more than 600 instruments across 7 asset classes.

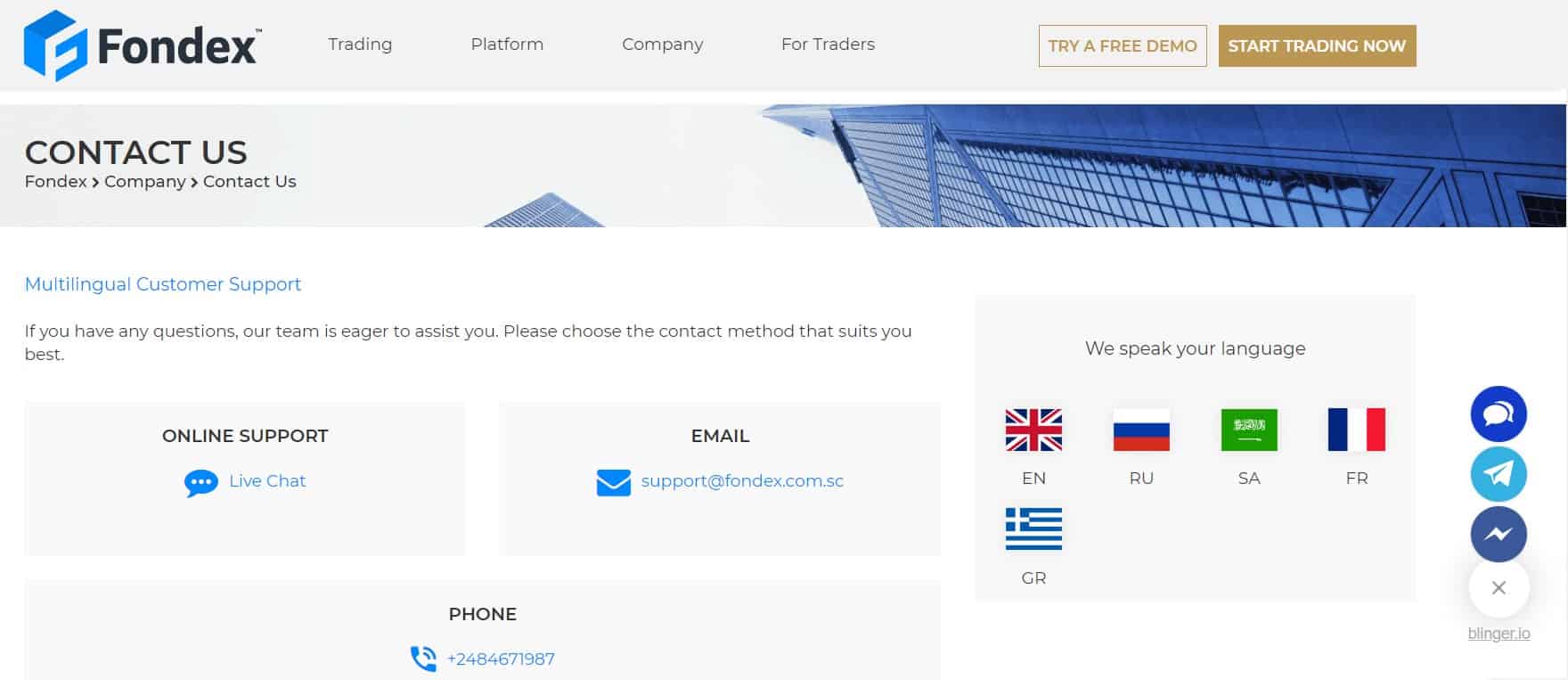

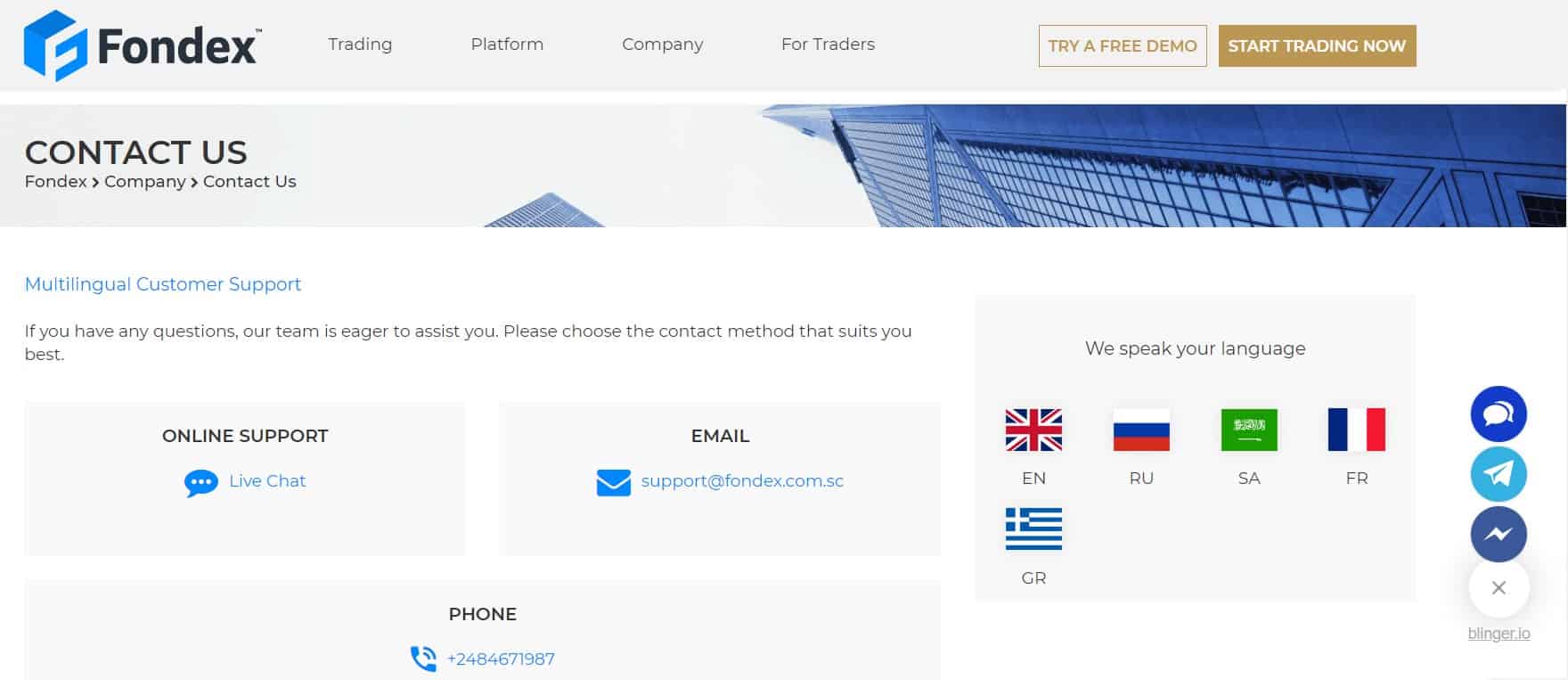

Customer Support

What is more, Fondex customer support service proved its proficiency and is among the leading positions, providing multilingual support and fast response with a Live chat option Along with its competitive trading conditions Fondex support team can guide you through the account opening, trading process, and at any stage.

There is an international phone line and email support, so overall Fondex traders are covered with professional service any trader may need, which is definitely a big plus.

- Customer Support in Fondex is ranked Excellent with an overall rating of 9.8 out of 10 based on our testing. We got some of the fastest and most knowledgeable responses compared to other brokers, the main point is that it isn’t 24/7

See our find and Ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Customer oriented policy | No 24/7 support |

| Worldwide coverage | |

| Live Chat and phone lines | |

| Support of international languages

| |

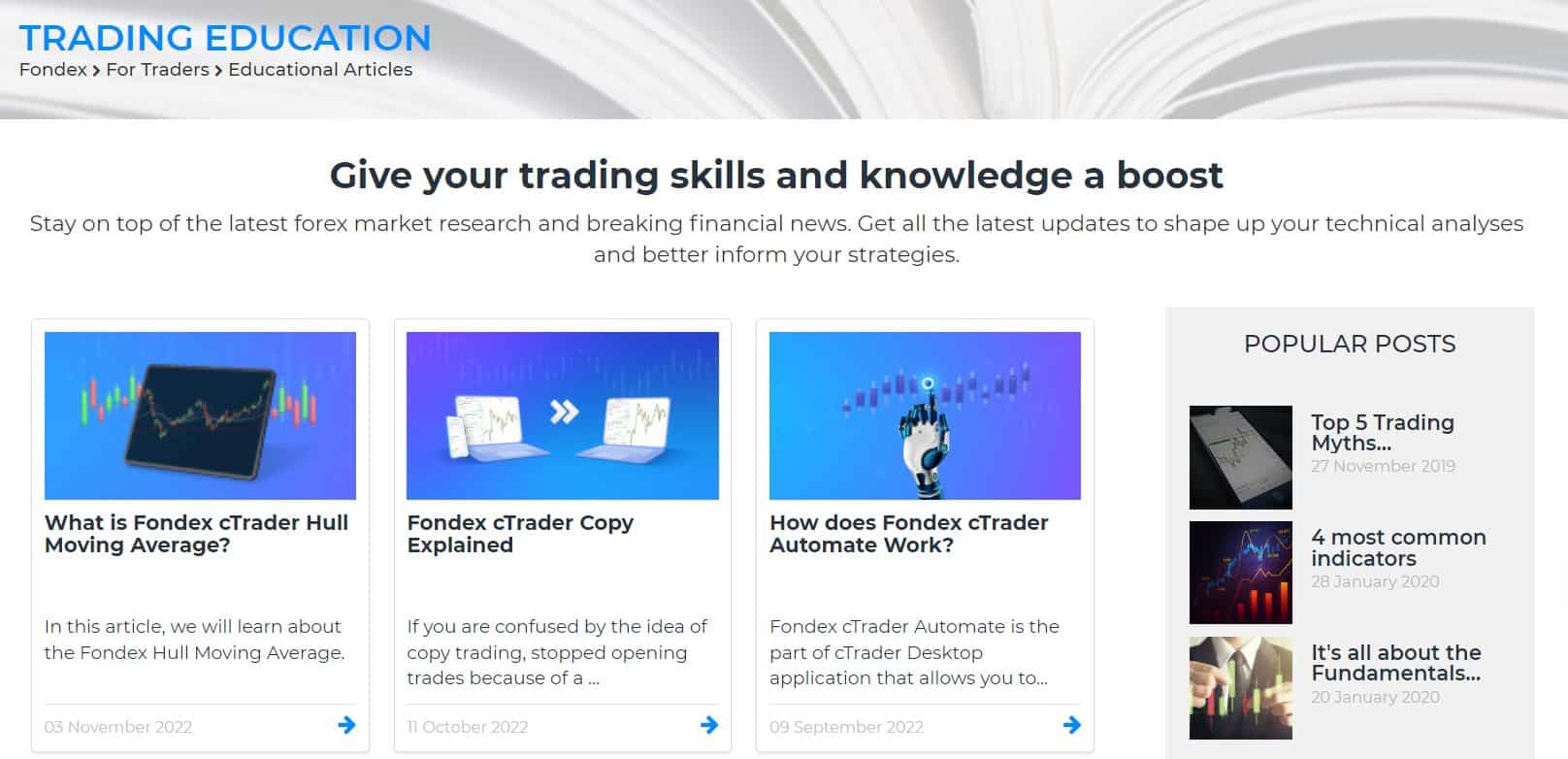

Education

So the last point in our Fondex Review is education materials, and here we saw that broker provides education articles for numerous topics along with Forex News and recent market updates. However, that is all that education is limited for, so if you are a very beginner you better sign in for a good educational course with webinars and seminars through a third-party provider if you still wish to trade with Fondex.

Research tools, yet, are very advanced and at the professional level since Fondex cTrader supports various tools and enlarging capabilities with good analysis features.

- Fondex Education ranked with an overall rating of 8 out of 10 based on our research. The broker provides good educational articles but the resources overall are limited. Yet, it offers highly sophisticated research tools via cTrader platform

Fondex Review Conclusion

The Fondex review presents a company brokerage, previously known as Kawase Exchange which relied on its liquidity provision and institution brokerage expertise to deliver a competitive offering to retail clients. The direct access to the market based on exceptional technology solutions while the proprietary platform connected directly to the Banks generates consistency for active traders with various benefits upon the trading size reach and comprehensive trading tools.

Based on Our findings and Financial Expert Opinion Fondex is Good for:

- Beginning Traders

- Professional Traders

- Technical Trading

- EAs running

- Copy Trading

- Scalping / Hedging Startegies

- For cTrader Platform

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

- CFD Share Trading

Fondex Update

Our research revealed that Fondex is now operating under another brand, TopFX, after ceasing operations under its Fondex trading name. The company operated as a group running several brands, therefore since Fondex is no longer available we would advise redirecting to TopFX trading offering.

Share this article [addtoany url="https://55brokers.com/kawase-exchange-review/" title="Kawase Exchange | Fondex"]

It seems like a mistake to provide only one trading platform for a broker like Fondex. But It’s up until the point you start trading with cTrader.

In reality this platform is very cool and there is nothing that you can’t do with it. All the trading styles and strategies are welcomed.

It’s the best broker for those relishing cTrader software. It’s highly optimized here and possesses many valuable functions and instruments! 😎

I want to write my opinion about this company and ask something.

I have been trading on this platform for a few months now.

And I noticed that the trading platform has many advantages.

I want to list those that seemed to me the most effective:

– A large number of indicators.

– Possibility to use custom indicators.

– Big set of tools for technical analysis.

– High level of platform reliability.

In addition to this set of tools and services, the platform can use an additional service Autochartist. Can someone tell me more about it and share your opinion?

I agree with your thoughts on the platform. The variety of indicators available and the ability to use custom ones for advanced technical analysis are impressive.

Regarding Autochartist, it’s a valuable additional service provided by Fondex. It offers in-depth market analysis, identifies trading opportunities, and helps enhance trading decisions. I highly recommend exploring Autochartist as it can significantly contribute to your trading strategies.

Reliable broker with tight spreads, flexible leverage, copy trading, and more.

I respect that they have a long history, many awards and recognitions, but they are from like a few years ago.

Even though I see that they are trying to be innovative and offer advanced technologies, new features, they need to slightly get better at it, because their reputation and overall recognition in the industry amongst retail traders can go down if they don’t work on it more intensively.

What catch my attention with this broker is the awards it has won. It just seems like a lowkey app but I didn’t guessed it was well known in the expert circles. I also like the cTrader. It is really incredible trading platform and its very capable of handling all your needs. Trading needs📊.

Trustworthy broker with tight spreads and a valuable youtube channel.

They have win many trading award before.the broker is a popular forex and CFD broker that provides traders with reliable trading platform. They offer the great cTrader platform which is powerful and user-friendly. The platform offers advanced charting tools, technical analysis indicators, and customizable trading strategies.

At first I fear that I will be confuse using the platform because I hear of the cTrader before and sound complex. I maybe was in good mood when I try the broker and it is good.

Is it a nice place to began trading?

I feel that this broker is perfect to start trading. See for yourself, it has all the necessary conditions.

The trading conditions are fairly attractive – you can trade with 1:500 with good spreads and no fees. The cTrader platform seems promising, although you may not like it if you are an MT fan.

Back wen we used to trade years aago, you kind of had to wait munites for your trades to be executed. Now I get shocked everyday by how fast everything happens on this platform for exmple. It’s great!

Rather satisfied with the company’s services than dissatisfied.

Fondex has a preferable trading conditions, one of the best on the forex market. Plus its copy trading feature with cTrader makes me think about it seriously. as I have a profitable strategy and I need some scaling.

Does anybody know if I can become a strategy provider for copy trading here, or it’s a one way street?

Sure, as far as I concerned ther is such possibility. Check their official website, I think there should be info about how to do it.

This broker is all about simplicity. I mean simple trading process and simple perception of company’s services. It doesn’t want to stand out of the crowd by adding certain features and proclaim them to be “genuine and exclusive”. Everything here is similar to something that other brokerage companies offer.

Nevertheless, after I tried trading here I realized that it so satisfying for me to trade on the platform! You are granted an opportunity to copy trade, the platform itself is quick.

All contemporary tools are available and what the hell you need more? Me needs nothing, I am in paradise.

I found Fondex not so long time ago, but it has already proved its reliability. I like spread sizes, account conditions, comfortable trading platform and helpful customer service. Just what I was looking for.

recently I found this broker and it gives me a good feeling to trade here. Everything looks nice. And does anybody knows if I can trade via mobile here?

The simple answer is yes. The fondex ctrader app is available for mobile too.

It was a big surprise to me that this broker has so many awards and yet I had never heard about this company before. I guess I need to visit forums more often to get the latest information about brokers with a good reputation.

I recently signed up with this broker. It attracted me with good trading conditions for currency pairs. I liked that it offers the same leverage for majors and minors. I also appreciate the trading process here.

I have one question. I’m also interested in trading ETFs. I wanna know what leverage size you provide for ETFs?

Fondex ETFs go with the same level of leverage across all of them – 1:10. It may seem rather low, but ETFs are assets like shares, meaning that they are usually used for investing; or in our case long-term trading. It is for one simple reason, ETFs have low volatility rate, so it’s a comfortable instrument to hold.

My point is investing assets imply low leverage to reduce the risk pressure from your deposit.

Fondex ETFs leverage is low for complete noobs of the industry. Anyone who has some experience in trading knows that stock as well as ETFs always go with this, or close to this leverage ratio. Because these assets are used for different purposes rather than mindless speculation.

Try to utilize them in the long-term deals and you will see the value of such leverage.

Plus the variety of instruments provided, allows traders choose the one that has the appropriate leverage.

Not a bad choice if you are a up-and-coming new trader, in pursuit of a broker that does no discrimination to newbies. You can put in some small amount of money and get to trading right away at Fondex. Don’t let the fact that copy trading is incentivized get you any lazy though. You still should generate your own trade ideas and follow your own plan to make money.

interesting conditions. actually, spreads here from 0.5 pips and it’s enough for me to start trusting this broker. I always pay attention only on spreads and how do they dilate during the times of high volatility.

btw, guys, how do the spreads important for you? do you pay attention to them when you are about to choose a particular broker?

For me, spreads don’t matter because I trade on H4, D, and W. The higher your timeframes, the less stressful your trading is.

Discovered new direction in trading

It’s copy trading

I connected my account to this service and copy proven strategies of experienced traders

My trades are opene and close automatically 😮

If I don’t like something I can close it manually

I like this kind of trading! It’s easy and I don’t bother at all 😎

Fondex is the broker that has been on my radar for some time. The only thing that scared me was a cTrader platform that I wasn’t familiar with. It turned out cTrader is easy to use and has cool features. As for broker, I’ve been trading for two months, so far so good.

I enjoy using fondex cTrader trading platform. It is different from what I used before. Featuring risk management, fast execution and market analysis tools, it is the optimal platform for both beginners and professional traders.

By this moment I have a question concerned to automatization. Is there any roboservices here?

I do enjoy ctrader trading platform also. Sure, there is roboservices. Advanced technical features is what you need. Check automate section for optimisation of automative processes. There are four types of cbots availabe for your goal.

What do you mean? Fondex cTrader specializes in algo trading.

1. There is a huge database of cBots, free or paid.

2. Code your own cBot with the inbuilt code. Test it, apply it.

3. There is a forum for algo trading enthusiasts. Exchange your opinions of different auto trading strategies, bots, etc.

The company has clear and open regulation and licensing. it is full of modern technical tools for advanced traders. you can trade here on the ctrader platform.

Copy-trading and algorithmic trading functionality can be useful for novice and experienced traders. I use cbots to automate trades fully or you can build your robot using the broker’s inbuilt code editor.

I chose this broker to trade news. When deciding on the broker I was mostly motivated by their trading platform, namely cTrader. It comes with a well-thought news section. It’s positioned to the right of the chart window. Nothing overlaps with each other. I see previews of news and can even refrain from views whole texts of news cuz I already see decisive numbers in previews and instantly decide on a trade.

I occasionally discovered this broker. Should confess that the thing that attracted me was cTrader. Earlier I had an opportunity to work on this platform, so I’m aware of its advantages. Then, what I also briefly noticed is that they offer 1:500 leverage. That’s an optimal leverage size for me. I don’t need higher or smaller leverage. I want to ask one question before I open a real account. Can I trade without commission here?

suree!! i know here is an opportunity to trade without commissions, as I know it works for all assets

Trading is not only my new profession but it’s also a new hobby that gives me a thrill. My number one interest in trading is to discern market makers’ cunning traps long before I got into them. Yeah, I’m learning to dodge this stuff and get rewarded each time I’m right.

I became the client of this brokerage because I’m very interested in DoM feature available on cTrader + the broker offers affordable traing fees.

I won’t lie to you… this is not my first broker.

I am a big fan of the Forex market and I like to trade currency pairs, but I am constantly looking for better conditions.

For example, low spreads and strong trading software features. … as well as scalping.

This is exactly what I found in the Fondex broker.

I don’t think this is news to all of you.

Just thought I’d write my own review.

I came into trading couple of days ago and of course, as professional traders told me on various forums, I started to search for a broker which would offer me all the basic things in trading. I chose this one and actually I liked here everything. Mobile application is a cool solution for those ones who sometimes can be far away from their homes…

By the way, as I am new here, maybe someone tells me, does negative balance protection work under any circumstances?

Yes, broker has protection against negative balance.

Fondex knows very well how to ensure deposit safety and carries out two actions.

1. If margin is not enough to maintain an open position, position is closed only partially, exactly as much as necessary to regain required margin.

2. As soon as funds in account fall below 50% of required margin, Fondex will notify trader with margin call that not enough funds are available to keep position open. At this point, trader can turn situation around by depositing additional funds or closing some of his positions.

So I feel confident that my balance is protected against unnecessary risks!

Fondex is a pretty unusual broker. I mean that there are not so many brokers nowadays which specialize solely on ctrader. However, I find such a uniqueness to be a pro rather than a con.

The most important requirements for a broker to meet are credibility, reliable service and low charges. Surely we can witness many brokers which work with c trader and they can meet the first two demands, but they can hardly offer low trading charges. There are no commissions and the spreads are pretty tight and start from 0.5 pips.

The only disadvantage of the broker, from my perspective, is that it limits the number of traders by working with one signle trading platform.

Although I trade manually, I know from my friends’ reviews that Fondex has a great opportunity to take advantage of copy trading…

Algorithmic trading is also available here. Sometimes, looking at the rating of experienced traders, it seems to me that I’m the only one who trades manually, while all the less successful traders use robots…

I feel my time has come to master algorithmic trading…

There is a quite fascinating feature, which is proposed by this broker. It concerns algo trading, you can either use cBot (buy it) or you can create your own bot, using built-in code editor. C# skills are required.

I was also definitely attracted to Fondex by the small spreads – it somehow stands out from the other offers you can find on the internet these days.

On the other hand, I still have questions that I would like to clarify, such as how quickly can I top up my account with a Bitcoin Wallet with them? Any experience.

Zero commission on indices and cryptocurrencies were something that I missed a lot, since I left my previous broker… I had to seek for a new one for a very long time and I was really delighted when I finally met this one. It seemed to me that this broker is pretty reliable and it turned out to be the real truth. No doubts, that one can state that there is something that he/she don’t like, but for me, everything turned out to be suitable.

Of course, some people might not like it…

These are all just opinions.

As for me… the situation is the same. I like everything)

I am sure that every trader would like to receive only the best trading conditions and this includes the trading platform and technical analysis capabilities.

As we know, a lot of things depend on technical analysis, and therefore I want to ask how you assess the capabilities of the tools of the Fondex broker’s trading platform.

Don’t you agree cTrader looks very impressive in this regard?

If I had to choose my top three favorite brokers, one of the brokers would be Fondex broker.

Here the most modern cTrader trading platform is available for trading, very low spreads and no commissions for trading currency pairs and many other assets.

At least I can say that for EUR/USD the average spread is about 0.4 pips. For metals, the spreads are also very low.

CTrader is an awesome product, much better than MTs. I joined the broker exactly because of cTrader. As for EUR/USD I hate it. It’s very cunning. I have recently shifted to cross pairs and that’s a completely different experience – far more pleasant.

I joined this broker following the recommendation of my friend. Moreover, he stressed that the broker recently canceled its trading conditions that made trading with it even more attractive. However, it took some time to get used to their trading platform, cTrader because earlier I worked on Metraders. Over time once I started working on cTrader I saw that it’s much better than MTs.

I have never imagined that I once I would join the community of a broker on a cTrader platform. Nevertheless it has hapenned and now I’m here. It’s pretty difficult to answer what exactly keep me with this broker, but I can allege that the abundance of technical indicators is the main feature for me. I’m fond of technical analysis, so that’s why I remain here. Moreover, zero commissions on depositing/withdrawals help me a lot. However, my question is there negative balance protection?

This broker offers negative balance protection, so you shouldn’t bother about it.

I like brokers that provide algorithmic trading. Almost any trading strategy you can imagine can be transferred to automatic mode, it allows you to make fewer mistakes and not to use emotions. Also, by creating algorithms, you can find out the most profitable strategies in the shortest time and improve them. Fondex broker was perfect for this requirement. It has a ctrader platform which executes orders without delays. There is also the possibility of algorithmic trading.

So if I have to say a few words about this broker, I can probably say that this is one of my three favorite brokers.

I decided to start working with this broker because Fondex is a broker with good trading conditions.

I should confess that I thought that the cTrader trading platform was very difficult and I could not cope with it.

Nothing is impossible!

Fortunately, I was able to use a demo account for a long time, which I need to study trading instruments and create my own trading strategy.

I am sure that the trade will be successful!

It is good to hear that. I mean that it is never too late to acquire new skills and habits and the very fact of coming to fondex because of good trading conditions speaks volumes. Anyway, good luck with mastering ctrader and conquering the market 😎

Actually, I have tried so many brokers in my life and this one is the last, mainly because it suited my trading needs. There are pretty low spreads and that was the main thing which gained my attention once. Nevertheless, I have some questions. Is it worth exp[loring the copy trading platform further, what’s your experience with it?

It seems to me that using a copy of the trading platform should be an additional tool.

The trader must learn to trade, forecast and open orders by himself. But, this is just my opinion.

How nice that the Fondex cTrader Copy service is now available from a mobile phone. This feature is currently only available to owners of Android phones. I used to copy trade on the desktop version, now I will be able to choose and follow my favorite copy strategies from my mobile phone. They have made a very user-friendly interface where the Blotter dashboard contains all user information such as position protection, opening orders, closing orders, cTrader Copy alerts. The only point is, the site could be made more informative.

It wasn’t hard to start trading. This is probably due to the fact that I trade on a demo account. Of course, while I am not yet worried about my money and I am sure that this awaits me, so I am getting ready.

The good news is that Fondex offers a minimum deposit of $ 100. This is a little money and I think I’ll start with that.

I’m looking forward to trading with you because I find your trading conditions very attractive. I have recently found out that you abolished fees on all assets. I welcome this decision of yours. I have nearly decided to open a real account with your company. I intend to trade very actively throughout the day and I want to make one thing clear. What assets do you recommend me to trade to quickly increase my depo?

Of course, there is no ideal asset for quickly increasing your deposit. Among traders the most profitable are usually the most volatile currency pairs, pairs that are considered to be majors.

This can be a dangerous misconception, because trading on these currency pairs allows you not only to quickly increase your deposit, but also quickly lose it.

More experienced traders are inclined to believe that trading in stocks is ideal for increasing the deposit. Perhaps, the increase in the deposit will not be as fast as it is possible on the major currency pairs. But I increased my Fondex deposit by closely following the news of major companies and trading stocks.

I read different Forex brokers for several days, looked for a broker and decided to try trading here. I liked Fondex with its low spreads and a small deposit to start trading. But of course I will start trading with a demo account. Everybody does it. It is necessary to study and there is such an opportunity, but something worries me. I know that there is a special trading platform cTrader that a small number of brokers have. I don’t worry much. Is this software not complicated? Is it ok to trade here ??

I want to convince you that cTrader will not be more difficult than the rest of the trading software.

Besides, cTrader has more options for quality analysis. This is very important for profit.

I recently tested this broker. I allocated about two hundred bucks for the test. I always test brokers on real accounts because I don’t take demo accounts seriously. Only a real account can tell the whole truth about the broker.

I heard various things about the broker. Many folks praised its spreads and its cutting-edge platform. So, I came there to see with my own eyes what was good and what not.

Well, I can say that their floating spreads are really good. I also like that they charge no commission, but the problem is that I need fixed spreads too. I don’t need fixed spreads all the time but I got used to using them in some situations such as news trading or trading at night. I know many brokers who offer both fixed and floating spreads and I value this a lot.

Secondly, I dislike that I can’t open more than one account here. I prefer to trade on several accounts. For example, one of them with fixed spreads could be used for night trading, while an ECN one would suffice for other scenarios, while one more account could be used for anything else.

I also lack Metatrader here. I often use custom indicators specially created for this platform and I respectively can’t use them on cTrader. So, I expect from this broker at least one more account with fixed spreads and Metatrader in addition to its cTrader.

Fondex is the trading company that gave a boost to my trading thanks to the copy trading service it provides.

I could not decide on my trading strategy before, but then I chose a successful trader for copy trading and everything immediately fell into place. Also there is a possibility of algorithmic trading, I am thinking to buy a good robot or over time to learn programming and convert my trading strategy into an algorithm.

First of all, I would like to mention the excellent affiliate program offered by the broker. There are partnership offers for both traders and brokers. You can also become a regional broker’s representative and get your commission from it.

For those who want to learn how to trade, the broker’s website has an excellent educational section with very interesting articles on technical and fundamental analysis, as well as a large number of analytical tools.

I am trading and testing strategies for a very long time, about 10 years. I traded on my own and helped many newbies in trading with many brokers to customize programs. I can confidently say that Fondex is a broker that you can work very productively with via cTrader terminals.

My personal summary: this broker is pretty good, I have never had difficulties with withdrawal of funds, the withdrawal is very fast, I would recommend to develop and test trading strategies for automatic trading on servers of this broker and I do it myself.

There are lots of reasons why I chose this broker. For example, I liked floating spread, starting from 0 pips, or quite medium leverage 1:500 which allows traders not to forget about risk management practices and make deals wisely. Moreover, I would note the presence of both manual and automatic trading here. As for automatic, then you can choose either between a provided trading bot or you can write the code for your own in a special platform. By the way, anyone knows something about deposits and withdrawing conditions?

The only thing that you should keep in mind regarding deposits and withdrawals is that you should use the same payment methods for both types of operations. The rest is completely free as Fondex does not charge any commissions for deposits and withdrawals, while processing takes very short time. So once you make good profits and request a withdrawal, don;t be surprised to see your funds in your account in a blink of an eye 😉

I have noticed a few advantages which Fondex has, but I liked negative balance protection function very much. I have never been a fan of using leverage in my trading because I had lots of fears associated with going into red. However, this function made me change my opinion as the risks were reduced, so now I can trade with leverage and improve my trading results.

I recently started looking for a new broker. I wanted to change something. I read some good Fondex reviews on one of the forums. That is why I decided to open an account here. At first, I opened a demo account, because the cTrader trading platform is new to me and I thought it would be difficult for me. It actually looks a bit like MT5. Therefore, it was not difficult for me to start trading here.

Otherwise, I really like everything. There are no commissions on some assets, very low spreads, trading assets are all popular. I will continue to study the Fondex broker, it seems to me that there are still many pleasant surprises.

I trade indices here. By the way, it’s possible to trade these popular assets without commission with this broker. I don’t trade any other assets. Earlier I traded on Metatraders. Here I use cTRader. Any other platforms are unavailable but this one is no inferior to MTs. It supports so-called cBots. I’m going to test them soon.

I always tried to find the most suitable for my needs broker in order to be delighted with trading activity and decrease the amount of some sad situations and negative emotions. I believe that brokers always have to strive for the best mainly because they need to make theirs traders happy. I liked this broker mainly because it offers some interesting tools like copy trading platform and low spreads on particular currency pairs and other instruments.

That is a good broker for those who are fond of ctrader platform. The trading conditions are among the best for this platform on the market as the spreads are really tight as they start from 0 pips and there are no commissions which is really awesome. However, despite the fact that the broker claims that it has some educational center, there is no so much information for newbies, so they’d better find some other source for their education.

I am working with Fondex recently. I can’t specifically say anything good or bad about this broker. It seems to be an ordinary forex broker, with its pros and cons. I have not noticed anything super, and I have no problems either. I like the customer service, the support team is very responsive, they work well, they help if necessary, and they do not annoy me unnecessarily. I have already withdrawn money a couple of times, so this point has already been checked. The broker offers more than 1000 assets for trading, among them are more than 900 stocks such as Apple, Amazon, BMW; 15 indices such as NASDAQ, DAX, FTSE; precious metals. There is a free demo version and protection against negative balance, copy trading – copying proven strategies of other traders is allowed. Automated trading is allowed. I am 100% happy with my broker at the moment. Over time, I will see how things go, and if anything changes, I will write a second review. The cTrader trading platform is suitable for professionals and novice traders.

Is it advantageous to trade cryptos here?

Yes, you can save money on each trading position because the broker doesn’t charge fees on cryptos.

I trade indices and metals with this broker. The broker charges commission on these assets but it’s OK for me because I trade intensively throughout the day and I manage to compensate that commission at the cost of my gains. What’s more, the broker demonstrates reliability and I mean both the quality of the trading process and withdrawals. I’m satisfied with all of this.

I have been trading with Fondex broker for more than 2 years, I am sure the broker was, is and will be a stable and reliable partner. Any questions regarding misunderstandings can be resolved with a simple trivial consultation. The broker offers a large number of affiliate programs, starting from affiliate program for brokers who provide their clients, referral program for traders. It’s also possible to get rewards if you share your trading strategies.

What is the commission for trading cryptocurrency with Fondex?

Broker Fondex tries to offer the best trading conditions and therefore there are 0 commissions for cryptocurrency trading.

I decided to open a trading account here because this broker offers very good trading conditions for digital coins – my favorite financial instruments. The company gives an excellent opportunity to trade cryptos without commission.

I have been trading forex for about 8 years now. During this time I have worked with different brokers. Frankly speaking, I have never heard anything about Fondex 2.5 months ago. I got to know it purely by chance and opened a demo account. I will tell you right away that there is no difference between demo and real account. I am very glad to advise that there is no spread, no limits on pipsing and hedging. I was surprised by the great access to the trading tools.

For those who are new to currency trading, the company’s analytics and tutorials section will be of great help. It is possible to receive information directly in the browser of the trading platform, without applications and any routine.

The broker also offers advanced fundamental analysis with FXStreet. As a user of the cTrader trading platform, you will be able to generate a detailed report on your trading activity.

Anyone who knows how to make money will do so at any broker, but if you want more quality, then try working with these guys.

A decent broker, without the hype of scandals. I am always pleased with the accurate execution.

I have only used the Metatrader4 platform before, but I have no experience with cTrader. Can you advise how easy it will be for me to learn this new program?

I also recently started using the cTrader trading platform and I want to say that this software is much easier than Metatrader 4.

I like to use this.

I can characterize this brokerage company as quite universal. It’s quite suitable to trade literally anything – from currency pairs and metals to stocks and cryptos. By the way, it feels like indices and cryptos have privileges here because it’s possible to trade them without commission. I certainly take advantage of it but I also trade assets with commission, mostly metals and several major currency pairs.

It seems to me that this company employs real professionals and very polite people. I sometimes use the support service because I am a beginner trader. If I have any questions, the answer comes quickly and clearly!

Also, Fondex broker has many trading assets that can be used for profitable trading.

I have been trading with a broker for the third month. So far, it goes so-so, with a variable success. Someone can tell you which indicators bring you the most profit when trading with Fondex?

I often use MACD and RSI. When these two indicators work together, they almost always give the correct signal to trade.

Overall, I find it hard to say that Fondex is a company that can surprise you with anything. It is really similar to many other offers.

But the commissions here are really adequate and not artificially inflated, so for me that’s a plus, which I personally appreciated.

I like to trade here. I think that it’s a crypto-oriented broker because it ensures the best trading conditions exactly to trade these assets. Commission-free crypto trading is a very good thing because it allows to trade very intensively throughout the day while saving on each trade.

In general, I like everything about Fondex, I started trading because of the entry threshold available to me and because of the positive articles and reviews about it, but as I trade I saw their other advantages, appreciated the work with their terminal, high-quality analytics from the broker. Spreads can widen, but this is generally a common situation in the market, and such moments should still be taken into account by a normal trader in his trading strategy. Essentially, everything is in order, they are working according to the regulations.

I am doing well with this broker. There were no problems with opening a personal account. I trade little by little, earn and withdraw funds. There are already quite good successes, although I am a beginner.

I trade here most likely due to small spreads. Despite the floating spread, slippages are minimal and they are not critical, stops do not fly off, the terminal works perfectly. There are small delays with the withdrawal, but they pay regularly.

I can point out that the broker has a large arsenal for withdrawing funds, among which there are such as withdrawals to a card, web money, PayTrust, EPS, B2B in Pay (cryptocurrency).

So far, everything is fine.

The Fondex brokerage offers many choices when it comes to trading styles. For instance, the ctrader platform is well-adapted software for manual trading, while the automation section is easy to understand how to code strategies even for beginners. The Copy-trade platform is a great option for diversification as following a successful trader automatically in a proportional way creates flexibility.

This is a good company and I am very glad that I was able to get here. There is the possibility of copy trading here. It is very convenient for me because sometimes it is difficult for me to make a correct prediction. I also think that this is also a good chance for beginners to start making money in Forex. Also broker Fondex has a revolutionary trading platform cTrader. There are more than 70 analysis indicators and you can see the depth of the market. This all increases your chances to trade profitably!

I have recently registered a trading account here. I was mainly attracted by the possibility to trade cryptos without commission. So, crypto trading met my expectation. I still believe in cryptos no matter what China tells. Cryptos have survived many threats.

But I also want to try trading other assets. When it comes to trading some exotic assets such as USD/ZAR, it’s crucial to know spreads. It’s especially true for night trading. How can I learn spreads?

It is with Fondex that I have found the commissions to be very favourable – especially on cryptocurrencies – it really allows you to work with different volumes without significant restrictions, and still get new opportunities every day – I personally really like it.

To trade successfully, I often need to go back and look at the history of transactions. I want to know if there is access to the user’s complete history of transactions?

Access to the complete history of your trades can be viewed in the History tab.

After years of trading on the MT4 platform, I was wondering why some brokers try to stand out of the proven software solution for online trading. Fondex caught my attention as the broker offers the only choice of trading terminals – cTrader. Although the regulation is rather light here (CySEC is present), the advantages of comparatively high leverages cover that issue. The number of assets is impressive, spreads and commissions are more than competitive (it’s possible to check them out online). But the key strengths of the Fondex brokerage are as follows:

Automation of the trading process. cTrader has a section for developing own algorithms that is very simple even for beginners.

Manual trading functions include trading from charts and managing positions in one click. The number of postponed orders adds flexibility, while smart trailing stop and advanced protection mitigate risks.

Copy-trade option allows following profitable traders automatically. In-depth analysis of their performance and diversification are helpful.

Reliable and fast execution facilitates scalping and other high-frequent methods. Hedging is allowed.

This company has already gained popularity .. I mean that Fondex can have competitors .. but not now. Because now they have a unique offer. The trading platform of the Fondex broker has a very fast order execution. This is very important for trading. You don’t want to have slippage, right ?? There is also a unique offer for 0 spreads and commissions.

I also think Fondex has unique conditions, and they provide excellent services. That’s why they have gained popularity among traders all over the world.

The broker is reliable, predictable and stable.

I have been trading with a fondex broker for four years now due to the presence of a strader trading platform. The broker is reliable, predictable and stable. I trade on long-term trends, when trading I use locks from pending orders, I don’t use stop losses in principle. I carefully choose the time to enter the market, but sometimes unforeseen situations happen and my pending order is triggered. In this case, I leave the castle by doubling the position.

Fondex offers a wide range of financial instruments to trade in the modern cTrader platform. I like its functionality and visual perception of all blocks. Trading from charts is convenient and fast, additional types of postponed orders give more flexibility.

I would like to tell you about my experience of trading with a Fondex broker. Two years ago I was a complete loser, using scalping and losing deposit after deposit. After realizing that scalping is not for my nervous system, I switched to long-term trading with an Islamic account from fondex.

Long-term traders usually trade on daily (or even weekly or monthly) time frames. Transactions can be held from several weeks to several years. It’s not a joke.

For example, one of the richest people on the planet, W. Buffett, reported that he was holding transactions for an average of 5 years. Of course, I’m not Buffett, but I either don’t have much to complain about 🙂 good trading to everyone …

I thought it would be difficult to trade. In fact, if you study and practice a lot, you will succeed. I recently decided to change my broker. The thing is that I didn’t really like MetaTrader 4. I wanted something new and easier. I learned about the cTrader trading platform. I watched a lot of videos about it and realized that this is what I need. Really very nice interface and convenient functionality. I was told that Fondex broker has this trading platform. Plus, it has good trading conditions. I am wondering what are the spreads for currency pairs at Fondex?

I wanted to use the cTrader trading platform because I watched a lot of videos about it and I really liked it)) BUT at first I did not understand which broker I needed. On the forums, all traders told me that I need to register an account with Fondex if I want to trade on such a trading platform.

I’ve been trading here for the second month now, and I really like it. Convenient platform, good trading tools!

This broker was recommended as reliable and having good trading conditions as well as protection against negative balance. I am confused by the absence of such familiar trading platforms as MT4 and MT5.

I would like to hear feedback from those who used the trading platform cTrader.

Indeed, it is difficult to move on to something new than you’re used to. I would like to hear about the advantages and disadvantages of this trading platform, whether its functionality is similar to MT4 and MT5.

In general, is the broker planning to add new trading platforms?

I have no idea whether the broker intends to add new platforms or not. As for me, I’m quite satisfied with cTrader. Its layout is completely different from Metatraders. It’s more user-friendly. So, I think that you’ll easily get used to it.

It’s more convenient to view news on this platform. Besides this, it’s much easier to access assets here – they are all in the list to the left.

I came to this broker as a crypto trader.I should note that I have been trading Bitcoin since 2014. Since 2019, I’m also interested in altcoins. The latter is getting more interesting as they become more independent from Bitcoin. For example, you see that Etherem is getting more attractive against the backdrop of struggling Bitcoin.

This broker offer very good conditions to trade cryptos. The company doesn’t charge commission for crypto trading and spreads on these assets are attractive too.

This is quite a strange brokerage service. It offers a universal trading account instead of the possibility to choose from several trading accounts. I’m used to opening several accounts with brokers. Here I had to put up with the only one. Although it’s compensated by good trading conditions and a high general reliability of the broker. The latter finally convinced me to sign up with the broker.

The company works well on its reputation. No complains, really. I guess the big part of such success is the trading platform that is used here. It’s cTrader. The broker definitely has got the best trading conditions for cTraders community.

There are traders like me who are happy to trade with cTrader, and we just don’t need MT5, but I know a lot of MT-only traders, so the company is losing a significant part of the market.

But ok, if they decided to concentrate on cTrader service and make it their unique feature, then they have succeeded. Or at least the success is near. I have tried different cTrader brokers, but I haven’t found any brokerage to offer such tight spreads.

I am a trader and I am glad that I made such a choice. Nowadays, it is important to have a high income and at the same time be able to stay at home. I learned how to trade and chose a broker that has almost no commission and has low spreads. I decided to trade indices and gold. I understand how to work with these assets. My broker is Fondex and I think you understand why?) When I trade my favorite assets, I have no commission and have low spreads. This helps to make more profit than if I was trading with another broker. It’s true. Besides, you can scalp here. This is also a good advantage. And now I have a question for experienced traders, how many indicators does the Fondex trading platform have and which indicators are best used in intraday trading? Thank you)

How can I customize my leverage?

Setting up leverage with Fondex broker is when you open your trading account. But if you change your mind and understand that you need a higher or lower leverage, you can change it in the Fondex trading account settings!

Fondex provides good trading conditions and leverage up to 1: 500. You can change the settings in your account. I don’t know any other way. You can also contact the Fondex support service and they will help you.

I chose Fondex for indices and cryptocurrency trading. I should say that it’s not the only brokerage service with which I trade digital coins, but this brokerage service provides very favorable trading conditions to trade these popular and promising financial instruments.

I have a mixed attitude to cryptocurrency. First, my interest to these assets arose in 2015, but I wasn’t very enthusiastic about them once I first learned about cryptos. However, I had to change my mind once Bitcoin demonstrated its first mind-blowing ascend in 2017. After that I began trading cryptos. However, I barely lost my belief in a strong potential of cryptos because cryptos were stagnating for most of 2020. Nevertheless, they revived by the end of that year and I realized that I needed to get back to crypto trading once again.

What I like in cryptos is that one shouldn’t crack one’s hand on their market moves. I know that they will keep going up and my only concern here is not to be hurt by their corrections.

Fondex doesn’t charge commission for trading cryptos that is very good active day trading. It took some time to get used to their cTrader because previously I traded on Metatraders only.

This company has all the necessary conditions for professional trading. I mean professional trading, not just a push-button one. Let the beginners do that. And I’m more interested in something more advanced and profitable.

I joined this company solely to trade digital coins. I should confess that when cryptos kept diving for most of the last year I was very sceptical about these assets. But when they started to get back to life, I barely caught the suitable moment to trade this stuff.

This broker offers very good trading conditions to trade cryptos. It allows to trade these assets with no commission and also with decent spreads.

Recently I started to study trading and all its subtleties. I like watching the news on economic topics and watching Forex. It fascinates me.

I have been at Fondex for over a month. It seems to me that this is a good enough broker with acceptable trading conditions. During the month of my activity, I have never been delayed in payment or frozen my account, as other unfair brokers do!

I like the platform of this broker. cTrader is practical and convenient for both beginners and pro traders. The broker clearly worked through the instructions and training on the platform, where he gave answers to all the necessary questions. However, I still want to clarify from those who know. How to choose the right master trader? Thanks in advance!

I think you need to look at the popularity of a trader and his strategy. And you also need to pay attention to what percentage of the profit to the deposit this strategy brings. You can easily see this on the Fondex website. There is also a rating of master traders.

I want to say that the services of this broker are impressive.

Recently working with a brokerage company Fondex, I like the trading conditions. Also, my friend and I checked the broker for honesty and tried to withdraw funds. Like my friend, I waited 1-2 hours for my conclusions. Transactions were not frozen or served. The broker seems to be honest and reliable.

By the way, the cTrader platform is very user-friendly with many functions! I think it is ideal for beginners, as the developers have made an easy tutorial with all the necessary information. Trade smart!

I wouldn’t say I’m very impressed with the broker. It provides the service in a sketchy way. I think there are a good platform and the right trading conditions. But for beginner traders, there are no educational products. This is kind of weird.

If I briefly describe my experience with Fondex, it is positive. I get more profits due to savings on spreads and commissions. And also due to the large selection of assets.

Can I trade microlots on any asset supported by Fondex?

Yes, you can trade mini and micro-lots in Forex, energy, metals and indices. For Stocks and ETFs, the minimum trade size is 1 lot.

I’m pleased with spreads and commissions at Fondex. Usually brokers give either account without commissions or without spreads. In both first and in the second case, the costs are quite substantial. If you miscalculate the volume of the trade, you can get a significant loss. And to cover it, you will need a large profit.

Fondex has a different model, which I like the most on the market so far. So, at Fondex, the spread is 0.2-0.5 pips on EUR/USD, and the commission is only 5 dollars per lot. These are minimum values.

But I got so caught up in my story that I completely forgot to ask: did anyone use the Autochartist in cTrader from Fondex? let me know how do you do that?

I will tell you more about using Autochartist in Fondex.

So, Autochartist contains a window of signals for each asset. The signals are in a time sequence. The most recent ones are always on the top.

So you open the Autochartist window in the Fondex platform. Then you look at the pattern, how long it lasted (how many candles), and the signal’s Significance. The last parameter is represented as a scale. This is the value I usually use. If the Significance is high, then I open a trade in the direction shown. If it is small, then I skip it and wait for the next signal.

What if I burn my depo completely on my live account. Will it be closed by the broker?

No, your account will not be closed by the broker. It only remains to deposit money and you can get back to trading.

In my opinion, the broker does not particularly stand out among the other companies. And the fact that it offers low spreads and commissions is temporary. As soon as the company gains enough clients, spreads, and commissions will increase.

I’ve been trading at Fondex not so long. I came here on the recommendation of my friend. He discovered this broker less than a year ago. At that time, not much was known about this company yet. But my friend managed to discern the company’s potential and says that he has never regretted his choice.

I’m also pleased with the trading conditions at Fondex. I trade in the comfortable cTrader platform with the possibility of copying trades.

But I have one question. I recently opened a Bitcoin chart and wanted to open a trade. But I was confused by the very tight spread. It was several times smaller than in other companies. Is this really so? Or do I have to pay some extra costs besides a small spread and commission?

No, the company really doesn’t have any hidden fees. Everything rather transparent and clear with Fondex. Spreads and commissions are lower than the average on the market. And you’re right. It’s especially noticeable on the Bitcoin chart.

I recently decided to change my broker. So, I chose this company because of the tight spreads and low commissions. I was tired of paying a lot before it. And now I’m satisfied with the trading conditions.

Are there many assets here? Which are the most diverse?

There are a lot of assets, primarily Forex currency pairs and stocks. I can’t say anything about other assets, because I simply don’t trade them. All in all, if you are not looking for something very specific, I don’t think you will have any issues and you would diversify your portfolio.

What’s your trading commission?

About $2.50 on currency pairs, and $1 on stocks.

I want to praise the company for a simple and straightforward website. I want to note the quality of the terminal, fast execution of orders. I would also like to mention very competitive spreads and commissions. The broker really provides some of the most favorable trading conditions. The company is very convenient both for those who trade independently and those who use robots. And even those who are used to copying trades will find a suitable solution in the company. And it is even better to use all approaches to diversify your investments as much as possible.

I was looking for cTrader brokerage and Fondex was one of the most obvious choices, so I just chose it to trade with. I was choosing brokers only by the spread size, nice that on Fondex you can check them on the website even without signing up, so that’s as fast as possible. Spreads for major Forex pairs are even lower than 1 pips, that’s the most tasty offering among cTrader brokers. I’m trading a year already, everything is nice, I have nothing to complain about. But I can’t find info about scalping there, is it allowed? I’ve seen info that there’s 60 seconds time requirement, is that true?

Of course, you can scalp with this broker. As for the 60-second time limit, I guess that you are confusing Fondex with another broker. They don’t have any restrictions regarding the time that a trade must last. So it suits perfectly for scalping. I know that from my own experience.

Oh, and I liked cTrader, it turned out that here you can quickly set up Fibo and other level indicators, and this is what I need. There are also more than a dozen timeframes, and I like the fact that I can analyze the market in short periods of time quite accurately.

I’m using Fondex as a second brokerage for copy-trading purpose only and in this regard brokerage is a great choice. I don’t like there’s cTrader only, so I’m not using this brokerage like my primarly brokerage, MT5 is much more convenient as for me, but MT5 has no copy-trading, so I need to combine two brokers.

Can I withdraw money from my account using PayTrust?

I was looking for a broker with a cTrader platform and the right conditions for the number of assets. On the forum, I came across a description of this company. I’ve visited the site, read the conditions, and looked at the spread table. All these ones have satisfied me, so I registered.

I trade indices most of the time, so no commissions for indices was a lucky deal. Very cost-effective trading!

So I stay with this company because of the platform and trading fees.

I occasionally stumbled on this broker online and now I’m happy to trade with it. In addition to its advanced trading platform cTrader with up to 26 timeframes and the depth of the market feature, Fondex also offers decent trading conditions. The spreads are variable and are kept tight even under volatile market conditions.

So, I tried this broker and like it, but I have a question. I’m interested in copying trades. How can I do this with this broker?

Just normal brokerage, I’ve chose it only because of my friend (he is also trading with Fondex), I can’t say this brokerage offers sth unique, rather its just stable brokerage, without any new featuires.

What are trading conditions for Cryptocurrencies in Fondex?

Trading conditions in this company are quite specific. First, one should say that it’s a cTrader-oriented broker. So, you will not find any other trading platforms, including classical and widespread ones, such as Metatraders. Here you are expected to use only cTrader. However, it can be a problem only for true fans of Metatraders. Many people, especially freshers like cTrader for its catchy and intuitive design and decent functionality.

Another thing that may surprise you is that Fondex offers only one account, but it’s pretty universal and boasts a slew of attractive features. For example, you can enjoy very low spreads (from o pips). It’s possible to trade digital coins as well as indices without commission. As for other assets, get ready to pay $1 per side for 100 shares and ETFs and also $2.5 per side per $100k traded volume for energies, precious metals, and currency pairs.

There’s no minimum deposit here. The maximum leverage is 1:500.

There are no commissions on crypto currencies.

But there is a variable spread – about 10 dollars.

There is not only the usual bitcoin, but also other crypto currency options.

Money for bitcoin wallets are withdrawn without commission.

The brokerage actually has quite favorable trading conditions for the cTrader trading platform. I really like to trade with cryptocurrencies with a broker, as it has very favorable trading conditions for it. Spreads are truly excellent, especially for crypto and liquid pairs. With other broker I had a bitcoin spread of $20-50, and it wasn’t that profitable to trade it. Here the spred is 10 bucks for BTCUSD.

I’ve been trading with Fondex for 5 months. On the whole, I am satisfied, especially with the size of spreads. 0.5 for majors is fantastic, the tighest spreads I have ever seen. Now I want to try automated trading, is Fondex offering such a thing? Considering that there is a cTrader platform, it should be, but I’m not sure…

Narrow spreads and light commissions – I don’t even know if there is anything else you need for a real trader who is used to working with high dynamics and tends to some unexpected experiments. Everything else depends on the chosen strategies, but the conditions are quite clear.

What kind of platform is cTrader? I’ve never heard of it before, and I think it’s weird. But I’d be happy to be informed a bit about it, thank you in advance 😉

Just an MT4/MT5 analogue. I think the platform to trade with depends only on your mindset, so I can’t suggest nothing in this regard. By the way, there is one strong advantage that allows cTrader to overcome MT4/MT5. You can use C## to create scripts (cBots) for further trading. So creating code is easier for cTrader, compared to Metatrader and its MQL

I never thought such a young broker can be so great. But it is. There are really the lowest commissions and the tightest spreads here. 2.5$ commission against 10$ in some other companies. It`s strange but true. I like also a wide choice of assets here.

I have already tried to use automated trading strategies here. Everything works fine.

There is a question about trading signals. Are those posted every day?

Yes, signals are usually provided within a day. And as I have noticed, usually the least signals are provided on Monday – well, this is understandable, because on this day the market only “recovers” after the weekend. On the other weekdays, however, there are a lot of them.

Brokerage offers interesting trading conditions, especially cTrader platform. It was interesting experience and I can say it’s even better than MT4, so I recommend it, just need to get used to it a little.

I started trading with Fondex because of its quite favorable trading conditions. But of course, while working with a brokerage, I found both its disadvantages and advantages. Its advantages are that it has reeeelly profitable trading conditions. A lot of assets for trading, commission-free entry/exit of money, fast orders execution – that’s not even all that Fondex can show off with. But of course there are also disadvantages – for me personally, the big disadvantage is the lack of training at the broker. Because I understand that trading is not just a business, it is also a constant training, growth over myself. And I would like very much that the brokerage understood it and gave me additional possibilities for it. To tell the truth I doubt now that I want to keep trading myself. The only chance that I leave my depo here is if I can find a decent trading system to automatically follow. Do you have any in mind?

If I have any problems, can someone help me here? Support service?

I’d suggest using a live chat. I’m not a big fan of phone conversations, moreover that you’ll need to spend time on identification before they can help you anyhow with your account by phone. So the live chat is the fastest and the most convenient method. To tell the truth I’ve never used mail with them apart for sending the docs, but I guess that can work fine either. At least the verification process was very fast in my case too (by e-mail)

My 4 reasons to trade with this brokerage:

1. CySEC regulated, I checked it out and there’s info on CySEC website

2. Tight spreads, for major currency pairs lower than 1 pips

3. Copy-trading available

4. Scalping allowed

How effective is Fondex automated trading?

It’s quite effective, with typical limitations of automated trading system. It is more effective than manual trading of a non-professional trader, but certainly not more effective than trading of a professional trader. I see automated trading as a way to diversify risks. I invest part of my money in manual trading, part of my money in automated trading.

A place to try different approaches.