- What is IC Markets?

- IC Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

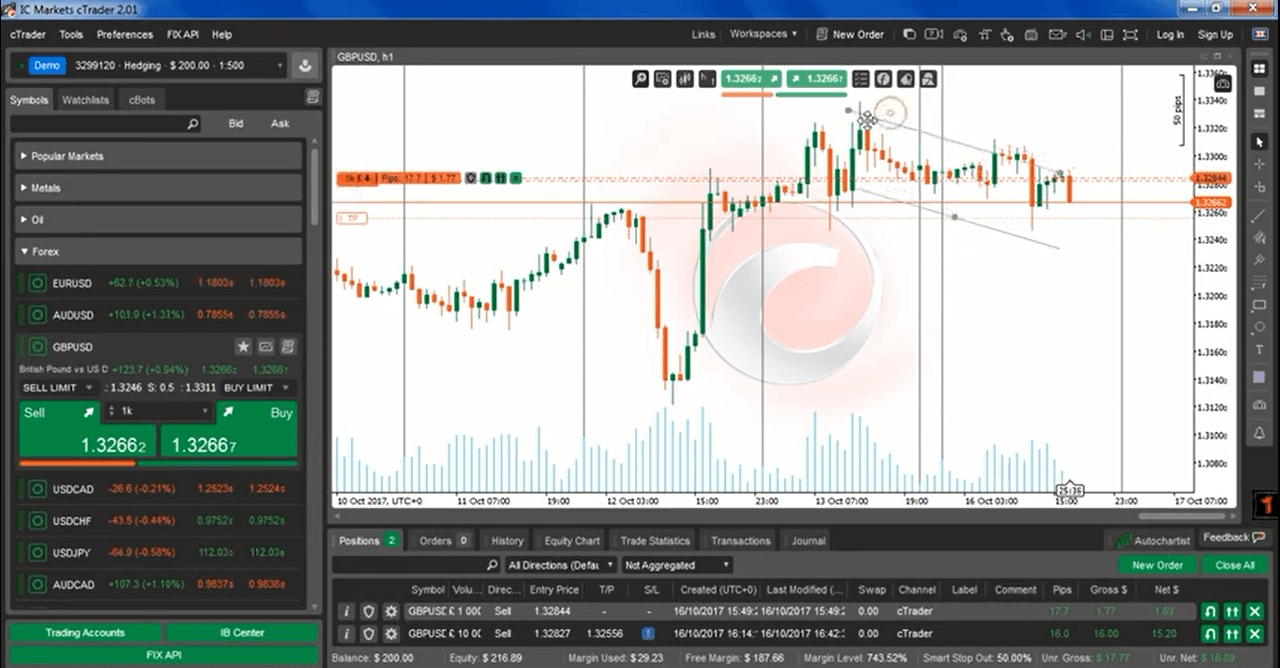

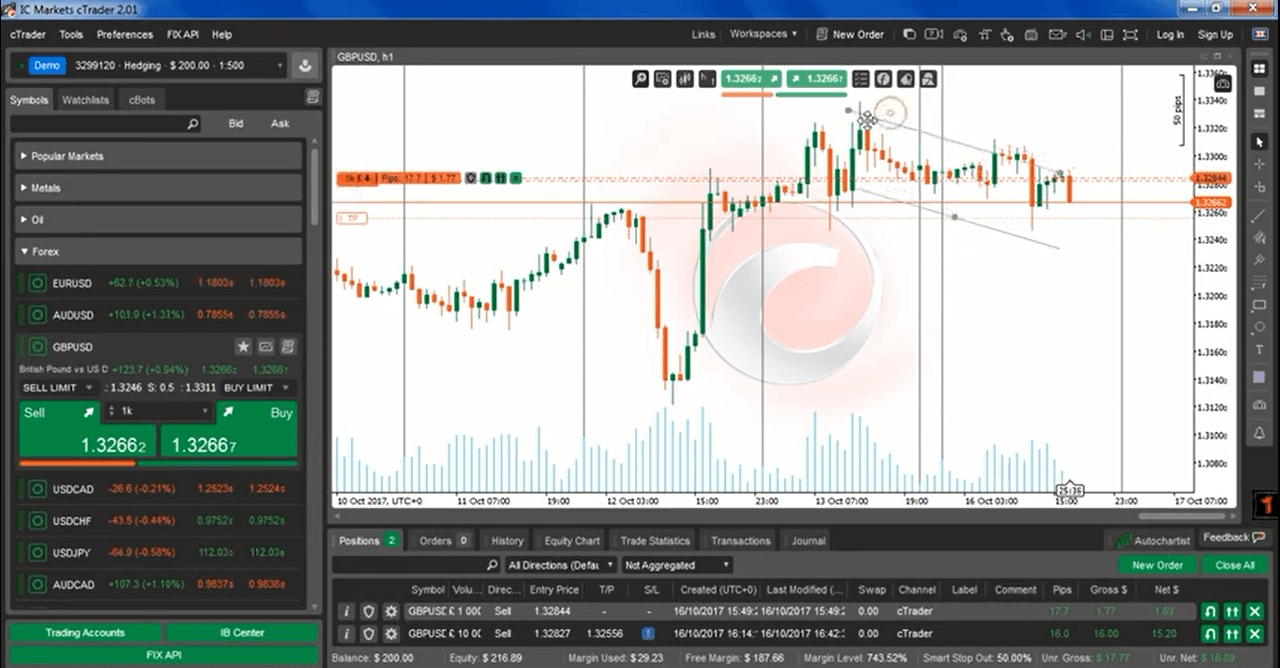

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- IC Markets Compared to Other Brokers

- Full Review of Broker IC Markets

Overall Rating 4.5

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.7 / 5 |

| Research and Education | 4.8 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account Opening | 4.9 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is IC Markets?

IC Markets is a large Forex Trading Company incorporated in Sydney, Australia in 2007 by a team of financial professionals who aimed to bridge the gap between retail and institutional clients offering trading solutions. IC Markets provides an ECN trading environment with spreads from 0.0 pips from the liquidity suppliers from over 50 different banks and dark pool liquidity sources across 61 forex pairs.

Where is IC Markets based?

Recently, as we see with our data and research the broker has grown to one of the leading trading providers in Australia with its headquarter and expanded beyond to serving international and European entities, established a Chinese Support center, and proposes truly competitive trading conditions.

Is IC Markets a CFD broker?

Even though IC Markets is a CFD broker, the execution brings speeds and low latency through fiber optic and connects traders’ orders to the market by servers in the NY4 & LD5 IBX Equinix Data Center New York and London. Yet, instrument and execution might differ based on the instrument you trade.

IC Markets Pros and Cons

IC Markets is a broker with a good reputation, a great selection between platforms including MT4, MT5, and cTrader, and good quality education provided for free and 24/7 customer support. There is a selection between spread basis and raw spread accounts also various instruments are available, which makes it a favorable choice for various traders in our opinion.

On the flip, the proposal varies according to the entity and is larger via offshore entity, also we found some spreads higher than average for other instruments.

| Advantages | Disadvantages |

|---|

| Fully regulated broker

| Trading proposal and conditions vary according to regulation |

| Advanced range of popular trading products, CFD trading | Offshore entity for international clients |

| Raw spread and standard accounts | |

| MT4, MT5 and cTrader platforms | |

| Suitable for beginners and advanced traders | |

| Competitive fees and spreads for Forex | |

| Quality educational materials and research tools | |

| 24/7 Support

| |

IC Markets Features

IC Markets is a well-regulated broker known for its competitive trading environment, good choice in terms of trading platforms and tools, etc. Here are the main features to review while choosing the broker including Trading Instruments, Available Accounts, Trading Platforms, and more.

IC Markets Features in 10 Points

| 🏢 Regulation | ASIC, CySEC, FSA |

| 🗺️ Account Types | cTrader Raw Spread, MetaTrader Raw Spread, Standard, Pro, Islamic Accounts |

| 🖥 Trading Platforms | cTrader, MT4, MT5, TradingView, ZuluTrade |

| 📉 Trading Instruments | CFD on Forex, Commodities, Indices, Futures, Stocks, Bonds, Cryptocurrencies |

| 💳 Minimum Deposit | $200 |

| 💰 Average EUR/USD Spread | 0.82 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, CAD |

| 📚 Trading Education | Webinars, Video Tutorial, Forex and CFD Education, Podcast, Forex Glossary |

| ☎ Customer Support | 24/7 |

Who is IC Markets For?

IC Markets is a reliable broker for various traders, including beginners and professionals. It is also well-suited for International, European, and Australian traders. Based on our findings and financial experts’ opinions, IC Markets is recommended for:

- Beginning traders

- Professional traders

- European traders

- Traders from Australia

- International trading

- Traders who prefer MT4 or MT5 platform or cTrader

- EAs running

- Algorithmic or API traders

- Currency Trading

- Scalping or Hedging strategies

- Social/Copy trading

- Suitable for a variety of trading strategies

IC Markets Summary

In conclusion, IC Markets offers quite an advanced trading offering, as you can choose from a wide range to tailor solutions to almost any trading parameter, which instrument to trade, a platform to use, an account to open, to use auto trading, or social trading, or even become a partner.

Indeed we mark, IC Markets’ technical optimization as among the strongest in terms of execution, platform optimization, the range of tools, and provided support.

55Brokers Professional Insights

IC Markets is widely recognized as a trustworthy and reliable broker with low trading costs and a quality trading environment. In fact, we believe IC Markets is suitable for traders across all skill levels and various trading strategies alike, whether you are a day trader, swing trader, or prefer copy trading, cTrader, or MetaTraders your software to use, also TradingView is Free to use for clients, all will find ICMarkets a fit. Besides, Brokers’ extensive range of trading instruments combined with competitive pricing featuring tight spreads and low commissions, makes it a standout choice in the industry.

In addition, IC Markets is particularly suitable for International, European, and Australian traders due to its adherence to regulatory standards set by reputable authorities. The broker is also known for its array of educational resources, and personalized services. While the only gap or maybe slightly lower points compared to the industry we would mark less additional research available, mainly tools are inbuilt into the platforms, which are in fact very powerful, but if you are among traders who look for extra tools maybe check other Brokers in comparison too.

Consider Trading with IC Markets If:

| IC Markets is an excellent Broker for: | - Need broker with a European, Australian, and International licenses.

- Looking for a broker with low spreads and competitive fees.

- Offering advanced trading platforms.

- Looking for 24/7 customer support.

- Who prefer higher leverage up to 1:500.

- Offering popular trading instruments.

- Need broker with various account types.

- Looking for good educational materials and research tools.

- Providing VPS access.

- Need broker offering Copy Trading/Social Trading.

- Ideal for beginner or professional traders.

- Providing raw spreads and commission based account

- Need broker with average execution speeds of under 40ms.

- Providing a variety of payment methods. |

Avoid Trading with IC Markets If:

| IC Markets might not be the best for: | - Who prefer broker offering proprietary trading platforms.

- Need broker with fixed spreads.

- Require various additional tools

- Traders from certain countries like the USA. |

Regulation and Security Measures

Score – 4.4/5

IC Markets Regulatory Overview

IC Markets holds a Top-Tier license from Australian ASIC and a European license from CySEC in Cyprus making the proposal available for European and Australian clients. The international regulatory FSA in Seychelles also authorizes the broker.

However, it is important to note that international trading is available via the offshore entity. Therefore, we advise checking conditions well and recommend opening an account with the Australian or European branch, as they adhere to strict regulatory standards.

How Safe is Trading with IC Markets?

IC Markets is known as a safe broker, as the licensed and regulated trading companies are constantly overseen and audited by an external reputable authority.

The broker is incorporated in Australia it does its service regarded by the Australian Securities and Investments Commission (ASIC) license. Also, IC Markets runs a regulated entity in Cyprus, therefore officially and legally operating trading services for European clients.

- With a license and regulation from ASIC, which is one of the strictest and most demanding financial regulators, IC Markets traders can feel completely confident. The money protection is provided through multiple regulated ways and includes the client’s money segregation while accounts are accessed by the client only and used to facilitate their trading.

In addition, IC Markets is a member of the Financial Ombudsman Service (FOS), an approved Australian external dispute resolution scheme that fairly and independently resolves disputes between consumers and member financial services providers.

Consistency and Clarity

IC Markets is a regulatory-compliant and trustworthy broker, with a tight regulatory framework that ensures consistent adherence to international standards for transparency, fund protection, and operational integrity. Since IC Markets licenses are top-tier, Broker is among the most trusted brokers worldwide. Also, for the years IC Markets has operated there have been no serious issues or concerns in the history of operation, which is another plus to the Broker’s reliability and constant providing of services.

Traders frequently highlight IC Markets’ reliability, particularly for its fast and efficient trade execution, and competitive spreads. However, some traders have noted occasional delays in withdrawals or minor platform issues, which IC Markets typically resolves efficiently. Overall, the broker’s generally positive client feedback underscores its position as a trusted and consistent broker in the Forex trading industry.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with IC Markets?

IC Markets offers three main account types: cTrader Raw Spread, MetaTrader Raw Spread, and Standard accounts. Additionally, depending on the jurisdiction, there are tailored options, such as Islamic (swap-free) accounts for traders adhering to Sharia principles, available through its international and Australian entities.

European traders may also access Pro accounts for professional clients, offering additional benefits like reduced risk warnings, leverage flexibility, etc. While all accounts share the same features, they are designed to cater to different trading styles and preferences.

The broker also provides a risk-free demo account on MT4, MT5, and cTrader platforms, allowing users to practice strategies in a simulated environment, a good starting point for newcomers. Moreover, accounts can be opened in up to 10 different currencies, ensuring flexibility for international traders.

Standard Account

The account is available on the MetaTrader platforms, and is ideal for traders who prefer commission-free trading, as it charges no additional fees beyond the spread. Spreads start from 0.8 pips, offering competitive pricing for a range of trading strategies, including swing trading and long-term investing.

The minimum deposit required to open a Standard Account is $200. With access to the full suite of MetaTrader tools, including good charting, automated trading capabilities, and a wide selection of technical indicators, this account caters to traders seeking simplicity.

cTrader Raw Spread Account

For international and Australian entities, this account is available on both the cTrader and TradingView platforms, while for European entities, it is exclusively offered on the cTrader platform. The account is tailored for professional and high-frequency traders, such as day traders and scalpers, who require ultra-tight spreads and low-latency execution for optimal trading performance.

The minimum deposit required to open this account is $200, with raw spreads starting from 0.0 pips and a commission fee of $3.0 per side or $6.0 per USD 100k round turn, making it a cost-effective option for active traders who prioritize precision and speed in their trading strategies.

MetaTrader Raw Spread Account

This account is available on the MT4 and MT5 trading platforms, offering users a familiar interface alongside a wide range of technical indicators and good trading tools. The minimum deposit required to open this account is $200, with spreads starting from 0.0 pips. The commission fee is set at $3.5 per side or $7.0 per lot round turn, ensuring competitive trading conditions.

Regions Where IC Markets is Restricted

IC Markets does not provide its services in several countries due to regulatory restrictions and jurisdictional limitations, also those countries operated or not depending on the IC Markets entity due to applicable regulations. The following is a list of regions where the broker’s services are restricted based on our findings:

- USA

- Canada

- Brazil

- Israel

- New Zealand

- Belgium

- United Kingdom

- Iran

- North Korea (Democratic People’s Republic of Korea)

Cost Structure and Fees

Score – 4.5/5

IC Markets Brokerage Fees

IC Markets is known for its competitive and transparent brokerage fees, which vary depending on the account type and trading platform you choose, as well as the applicable spreads and commissions. The broker uses the ECN pricing model, providing access to the real market prices sourced directly from external liquidity providers.

It is important to note that different IC Markets entities, operating under various jurisdictions, may apply distinct trading conditions. Therefore, traders should carefully review the specific terms and conditions of the entity they plan to trade with to ensure they align with their trading needs and expectations.

IC Markets offers competitive floating spreads across its account types, catering to various trading strategies and styles. For the Raw Spread Accounts, spreads start as low as 0.0 pips, making them ideal for scalpers and high-frequency traders. The Standard Account, designed for commission-free trading, features spreads starting from 0.8 pips.

The average spread on major Forex pairs, such as EUR/USD is 0.82 pips, making it among the tightest in the industry. However, spreads may vary depending on market conditions, including volatility and trading hours, as well as the specific IC Markets entity under which you register.

IC Markets operates with competitive commission fees that vary depending on the account type and platform used. For Raw Spread Accounts, the broker charges a commission of $3.5 per side on MetaTrader platforms and $3.0 per side on the cTrader platform. For the Standard Account, IC Markets offers commission-free trading, with spreads starting from 0.8 pips.

- IC Markets Rollover/Swaps

The broker also offers rollover/swap fees for positions held overnight, which are based on the interest rate differentials between the two currencies in a pair. These rates are charged or credited to a trader’s account at the end of each trading day, depending on whether the position is long or short.

How Competitive Are IC Markets Fees?

Overall, IC Markets offers low or average fees in the industry, making it a good choice for traders seeking low-cost trading options. The fee structure is competitive compared to other brokers, particularly for traders who require tight spreads to minimize trading costs, as well as offers flexibility for different levels of traders.

Additionally, the broker’s global entity does not charge any additional fees for deposits or withdrawals so all in all fee structure is both transparent and competitive.

| Asset/ Pair | IC Markets Spread | FXTM Spread | IG Spread |

|---|

| EUR USD Spread | 0.82 pips | 1.5 pips | 1 pip |

| Crude Oil WTI Spread | 0.028 | 6 pips | 2.8 pips |

| Gold Spread | 1 pip | 9 pips | 0.3 |

| BTC USD Spread | 42.036 | 270 | 92 |

IC Markets Additional Fees

Besides regular charges, IC Markets also applies potential extra fees, such as for overnight financing (rollover or swap rates), which depends on your positions and the trading instruments you use. For example, for a long position held for three nights, the charge could be -$18.75, whereas for a short position held for three nights, the swap might be +$7.68.

We recommend always checking the terms specific to your entity or region, as fees can vary depending on the jurisdiction and platform used.

Trading Platforms and Tools

Score – 4.7/5

IC Markets offers popular trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader, all of which provide good charting tools, automated trading features, and robust order execution capabilities. MT4 and MT5 are known for their user-friendly interfaces, extensive technical analysis tools, and EAs allowing automated trading strategies.

cTrader, on the other hand, is praised for its fast order execution and good interface, making it a favorite among traders. Additionally, IC Markets offers access to third-party providers such as TradingView, a powerful charting platform that integrates seamlessly with cTrader under the broker’s international and Australian entities, and ZuluTrade, a social trading platform that allows to choose among thousands of talented traders and follow their trading signals for free, under the Australian entity.

Trading Platform Comparison to Other Brokers:

| Platforms | IC Markets Platforms | FXTM Platforms | IG Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | No |

| cTrader | Yes | No | No |

| Own Platform | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

IC Markets Web Platform

IC Markets offers a web-based trading platform accessible directly from any browser, making it convenient for traders who prefer not to download or install additional software. IC Markets WebTrader supports both MT4 and MT5, providing traders with all the features they would expect from the desktop versions, such as a variety of charting tools, technical indicators, and expert advisors for automated trading.

The web platform allows for easy access to live market data, real-time charting, and trade execution.

IC Markets Desktop MetaTrader 4 Platform

The broker’s desktop MT4 platform is a popular choice for traders due to its reliability, and user-friendly interface. It offers a set of tools for technical analysis, including customizable charts, technical indicators, and a variety of timeframes. MT4 also supports automated trading through Expert Advisors, enabling traders to set up algorithmic strategies for executing trades without manual intervention.

Additionally, the desktop version of MT4 can handle multiple charting windows, real-time data, and a wide range of order types, offering full control over trading decisions.

IC Markets Desktop MetaTrader 5 Platform

The desktop MT5 platform offers traders enhanced features and capabilities over its predecessor, MT4. MT5 supports a greater range of financial instruments making it suitable for traders who wish to diversify their portfolios. It provides advanced charting tools, various timeframes, and technical indicators.

Additionally, MT5 supports multiple order types, improved trade execution, and faster processing speeds, ideal for those who engage in more complex trading strategies. The platform also features a built-in economic calendar, facilitating the monitoring of important market events, and supports automated trading through EAs.

IC Markets Desktop cTrader Platform

The desktop cTrader platform is designed for traders who prioritize speed, precision, and ease of use. The platform stands out for its fast order execution, low latency, and intuitive interface, making it particularly popular among scalpers and high-frequency traders. cTrader supports one-click trading and advanced order types, ensuring traders can act quickly in volatile markets.

Additionally, the platform offers features like automated trading through cAlgo (for creating custom algorithms) and a built-in economic calendar, providing traders with all the tools needed to execute strategies effectively.

IC Markets MobileTrader App

The broker’s mobile app offers traders the flexibility to manage their accounts and execute trades on the go. Available for both iOS and Android devices, the app provides access to key features from the MetaTrader platforms and cTrader, allowing users to trade a wide range of instruments, view real-time quotes, and manage orders with ease.

The MobileTrader app includes advanced charting tools, customizable indicators, and order management features, ensuring that traders can maintain full control over their positions even when away from their desktops.

Main Insights from Testing

Testing IC Markets’ mobile app reveals several key insights that enhance the trading experience. The app offers a user-friendly interface with easy navigation, enabling traders to manage their accounts and execute trades efficiently on both iOS and Android devices. It supports a wide range of trading tools, including real-time charts, multiple timeframes, and technical indicators.

Additionally, the MobileTrader provides real-time push notifications and price alerts, keeping users updated on market movements without the need to monitor the app constantly.

Trading Instruments

Score – 4.5/5

What Can You Trade on IC Markets’s Platform?

IC Markets provides access to a diverse range of trading instruments, catering to traders across various asset classes. With this variety, the broker accommodates diverse trading strategies, enabling both short-term and long-term traders to diversify their portfolios. These instruments are available across MetaTrader platforms, and cTrader, ensuring flexibility and convenience for traders worldwide.

IC Markets provides access to 2250+ tradable instruments, including:

- Over 61 Forex currency pairs, including major, minor, and exotic pairs, with competitive spreads starting from 0.0 pips.

- Access to over 22 CFDs on Commodities including energies and metals.

- 25 Indices to choose from, including the Australian S&P 200 Index, UK FTSE 100 Index, US E-mini S&P 500, and US DJIA Index.

- Over 9 Bonds are available to trade.

- Access to Cryptocurrency pairs like BTCUSD, ETHUSD, LTCUSD, and more.

- More than 2100 Stocks across the Australian and US markets.

- 4 Global Futures are available to trade.

Can I trade Crypto with IC Markets?

Yes, you can trade cryptocurrencies with IC Markets through CFDs. The broker offers a range of popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP), among others. This allows traders to speculate on price movements without owning the underlying digital assets. The leverage is 1:5 on cTrader and TradingView, while on MetaTrader platforms, it is higher, reaching up to 1:200.

Main Insights from Exploring IC Markets’s Tradable Assets

Exploring IC Markets’ tradable assets reveals a diverse and comprehensive range designed to cater to various trading strategies and preferences. This variety makes the broker a suitable choice for traders seeking flexibility and the ability to tap into different markets within one platform, ensuring seamless trading experiences across the board.

Leverage Options at IC Markets

IC Markets offers leverage based on the entity you trade. Initially, the multiplier opens the path to the Forex market for Retail traders with a quite low or small initial deposit to cover margins. The use of leverage can magnify gains but you should always remember that losses can also exceed your initial deposit.

- Maximum of 1:30 available for Australian clients

- 1:30 allowed for European traders

- 1:500 for an international proposal

Leverage is known as a loan given by the broker to the trader to enable trading with a bigger capital and increase potential gains. However, we would recommend that any trader use the tool smartly and read carefully how to set up correct leverage to a particular instrument or trading strategy, as well as leverage defined by the IC Markets entity and particular jurisdiction regulations.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at IC Markets

IC Markets offers a variety of deposit options to traders, ensuring convenience and flexibility. These include traditional payment methods, such as:

- Bank wire transfers

- Credit/debit cards

- e-wallets (e.g., PayPal, Neteller, Skrill)

Deposits are generally processed quickly, with many methods offering instant funding to your trading account. Also, IC Markets supports multiple currencies, helping clients avoid conversion fees. Importantly, no deposit fees are charged by IC Markets, but clients should confirm if their payment provider applies any charges. Always check the deposit options specific to your region and preferred platform, as availability may vary depending on regulatory requirements.

IC Markets Minimum Deposit

IC Markets requires a minimum deposit of $200 to open a live trading account. This applies to all account types, including Standard, Raw Spread for MetaTrader, and Raw Spread for cTrader accounts.

Withdrawal Options at IC Markets

IC Markets withdrawals allow to use of popular Bank transfers, WebMoney, Cards, and e-wallets. The broker does not charge additional fees for withdrawals either. Yet, for International Bank Wire withdrawals, IC Markets passes the transfer fees charged by the company banking institution, which is approximately AUD 20 which is deducted from your withdrawal’s amount.

Customer Support and Responsiveness

Score – 4.7/5

Testing IC Markets’s Customer Support

IC Markets provides 24/7 multilingual customer support, which is available through various channels, including live chat, email, and a dedicated phone line, allowing users to choose the method most convenient for them.

Additionally, IC Markets offers a comprehensive FAQ section on its website to help traders resolve common issues independently. The broker’s commitment to customer satisfaction is reflected in its positive reviews, with many traders praising the support team’s professionalism. However, the quality of support can vary slightly depending on the regulatory entity under which a trader is registered.

Contacts IC Markets

IC Markets Global entity provides dedicated phone numbers for various locations, which can be found on their official website. For general inquiries, you can contact them at +248 467 19 76. They also offer multiple email addresses for specific purposes, such as support@icmarkets.com for customer support.

Research and Education

Score – 4.8/5

Research Tools IC Markets

IC Markets equips traders with a variety of research tools to enhance trading decisions and market analysis. These include access to economic calendars, providing insights into key global events and their potential impact on markets. The platform also features market news updates and technical analysis reports, often shared by industry experts, to help traders stay informed.

Additionally, IC Markets integrates tools like Trading Central, which delivers detailed analytics, trade ideas, and signals for Forex and other assets.

For charting and advanced analysis, platforms like MetaTrader 4/5 and cTrader come with built-in tools, including indicators and algorithmic trading capabilities. The broker also supports TradingView, known for its advanced charting capabilities and technical indicators, and ZuluTrade, a leading social trading platform that allows traders to follow and copy strategies from successful professionals.

Education

IC Markets provides a comprehensive educational suite designed for traders at all levels. The broker offers webinars conducted by industry experts, covering various trading strategies, market analysis, and risk management techniques. Traders can also access a library of video tutorials to learn platform functionalities and advanced trading concepts.

The Forex and CFD education section provides in-depth materials on trading basics, strategies, and market mechanics, making it ideal for beginners and intermediate traders. Additionally, the broker features a podcast series, offering insights into current market trends and trading tips. For quick reference, the Forex Glossary explains essential trading terms, ensuring clarity for newcomers navigating the markets.

Is IC Markets a good broker for beginners?

Yes, IC Markets is a good broker for beginners due to its user-friendly platforms and extensive educational resources. The broker offers access to intuitive trading platforms like MetaTrader platforms and cTrader, which are widely regarded for their ease of use and customization. IC Markets also provides beginner-friendly tools such as video tutorials, webinars, and a comprehensive Forex and CFD education section to help new traders understand market fundamentals and trading strategies.

Additionally, the broker offers a demo account for practice in a risk-free environment, allowing beginners to familiarize themselves with trading without financial pressure.

Portfolio and Investment Opportunities

Score – 3.8/5

Investment Options IC Markets

While IC Markets operates as a Forex trading provider, it also offers investment options like stocks, bonds, and futures. Additionally, the broker supports copy trading through platforms like cTrader, and ZuluTrade, enabling traders to follow and replicate strategies from experienced professionals.

However, the broker does not provide MAM or PAMM accounts, which may limit investment opportunities for those seeking fund management solutions.

Account Opening

Score – 4.9/5

How to Open IC Markets Demo Account?

Opening a demo account with IC Markets allows you to practice trading in a risk-free environment. Follow these steps:

- Go to the official IC Markets website and navigate to the “Demo Account” section.

- Provide your details, including your name, email address, phone number, and country of residence. Choose a username and password for your account.

- Choose the trading platform you prefer. Specify the account type, virtual deposit amount, leverage level, and base currency for your demo account.

- After completing the form, confirm the information and submit your application.

- Once your demo account is created, you will receive login credentials via email. Download and install the selected trading platform and log in using the provided details.

How to Open IC Markets Live account?

Opening a live account with IC Markets involves a simple online process. Here is how to do it:

- Go to the official IC Markets website and click on the “Start Trading” or “Open Live Account” button.

- Fill out your personal information, including full name, email address, phone number, and country of residence. Set a username and password for your account.

- Submit documents for identity verification and proof of address. This step complies with regulatory requirements.

- Choose your trading platform, account type, and base currency. You can also set your preferred leverage during this step.

- Deposit funds into your account using one of the available payment methods, such as bank transfers, credit/debit cards, or e-wallets.

- Once your account is verified and funded, download the chosen trading platform, log in with your credentials, and start trading.

Additional Tools and Features

Score – 4.3/5

In addition to its core trading tools, IC Markets offers a few valuable tools and features, including:

- For traders seeking reliable trade signals, IC Markets provides access to Signal Start, a third-party service, which allows traders to follow signal providers for automated trading strategies.

- The broker also offers TeamViewer for remote access, available on both the Australian and Global entities, enabling efficient troubleshooting and support for traders requiring assistance with platform issues or setup.

- Additionally, IC Markets offers VPS (Virtual Private Server) hosting, ideal for traders who require low latency and uninterrupted connectivity for automated strategies.

IC Markets Compared to Other Brokers

IC Markets offers a competitive trading environment with tight spreads and low costs, especially appealing to professional traders. Compared to competitors, AvaTrade has slightly higher spreads but compensates with a wide range of platforms like AvaOptions and Capitalise.ai, catering to automated and options traders. Exness also provides tight spreads with a competitive commission structure but falls short with its smaller asset range, offering fewer than IC Markets’ 2,250+ instruments.

FP Markets is another competitor with competitive commissions but offers a significantly broader range of assets. However, IC Markets stands out with its diverse platform options, including cTrader, MT4, MT5, and integrations with third-party providers like TradingView and ZuluTrade.

Overall, IC Markets offers better value for traders looking for low spreads, a broad selection of popular instruments, and flexibility in platform choice.

| Parameter |

IC Markets |

AvaTrade |

Exness |

FP Markets |

IC Markets |

Pepperstone |

eToro |

| Spread Based Account |

From 0.8 pips |

Average 0.9 pips |

From 0.2 pips |

From 1 pip |

From 1 pip |

Average 0.7 |

Average 1 pip |

| Commission Based Account |

0.0 pips + $3.5 |

For Professional Account only |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + $3.50 |

0.0 pips + $3.50 |

Available at US eToro Crypto |

| Fees Ranking |

Low/ Average |

Low |

Low |

Low/ Average |

Low/ Average |

Low |

Average |

| Trading Platforms |

cTrader, MT4, MT5, TradingView, ZuluTrade |

MT4, MT5, WebTrader, AvaTrade App, AvaOptions, DupliTrade, ZuluTrade, AvaSocial, Capitalise.ai |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, cTrader |

MT4, MT5, cTrader, TradingView |

Proprietary |

| Asset Variety |

2250+ instruments |

250+ instruments |

200+ instruments |

10,000+ instruments |

1,000+ instruments |

1,200+ instruments |

2,000+ instruments |

| Regulation |

ASIC, CySEC, FSA |

Bank of Ireland, ASIC, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

ASIC, CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FCA, CySEC, ASIC, FSAS, NFA for Crypto Exchange |

| Customer Support |

24/7 |

24/5 support |

24/7 |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

| Educational Resources |

Good |

Excellent |

Fair |

Excellent |

Good |

Excellent |

Good |

| Minimum Deposit |

$200 |

$100 |

$10 |

$100 |

$200 |

$0 |

$200 |

Full Review of Broker IC Markets

IC Markets is a popular broker known for its competitive spreads, low fees, and robust platform offerings, including MT4, MT5, cTrader, and third-party integrations like TradingView and ZuluTrade. With access to over 2,250 instruments, it caters to traders looking for flexibility and variety. Spreads start as low as 0.0 pips on Raw Spread accounts and 0.8 pips on Standard accounts, while the minimum deposit is $200.

Additionally, the broker offers educational resources like webinars, video tutorials, and podcasts, along with a Forex glossary to help beginners get started. While IC Markets operates under an offshore license through its international entity, it maintains strong regulatory oversight from respected authorities such as ASIC and CySEC, making it a solid choice for traders seeking a well-rounded and secure trading experience.

Share this article [addtoany url="https://55brokers.com/ic-markets-review/" title="IC Markets"]

got restricted after moving them to seychelles. they have changed the trading rules and do not allow the money to be withdrawn to a European bank account. They want it to be open for withdrawal outside of European and American directives and rules. I recently found out that since 5 years, an American citizen cannot register in an IcMarkets.

“IC Markets is an online forex and CFD broker based in Sydney, Australia. The company offers traders access to a wide range of financial markets, including foreign exchange (FX), indices, commodities and cryptocurrencies. IC Markets is probably the best Forex broker. TradeEU also refers to a good broker because It allows companies to connect with each other, negotiate prices and arrange international delivery. The platform also provides detailed information about local regulations and taxes for importing and exporting within the EU.

AVOID this Broker

AVOID – Unfortunately I see some false reviews here. From experience if you are succeeding they will definately use some dirty tactics to blow your account. Like the excuse of AML to freeze your withdrawals, prevent deposits even though your bank is OK, excessive spread manipulation, trading against you, not putting your trades through to market and much more. You can also check with the UK FCA they are cancelling being regulated by them. I don’t trust them. Alot of unregulated behaviour. Seychelles Regulator is just a dodgy shopkeeper. Hopefully this review will save your hard earned money.

Yes, I agree 100% with you, they try to appear OK but SCAM client whenever they can.

They give thin excuses or just ignore. No Money back.

This is a good broker house, Please stop spreading rumors that is nit truth at all

They don’t accept traders anymore because they are a total scam! I had to hire a solution professional to get my funds back from them. I’ve gotten so many complaints from victims all over concerning this broker.

you are right. Less than a month ago I started trading and a week ago I am trying to withdraw profits, but unfortunately all my attempts failed and I do not know what to do to withdraw my money

I placed a withdrawal request from Ic market for over two weeks now which they aoproved and deducted from my trading account and up till now they have not accounted for my missing money.The worst of it all is that they no longer respond to my mails.So,becareful with IC market.

Broker declares very attractive spreads, but on a real account there is a huge slippage for all pairs, which can exceed the spread by 3-5 times.

EA sees minimum profit on order, gives command to broker to close order with this profit, and broker executes trade at a loss, in those support they say sorry there was no liquidity to close your order with a profit, that’s where the fraud of this broker lies.

I’m afraid to open an account with ICMarkets after reading a few bad comments here.

I started using IC Markets this year October, so far I haven’t encountered any problems regarding deposits and withdrawals. I made a few losses as a beginner, learned from my mistakes and I now see the light

Ic market i suspect scam broker now..

When i using other broker i keep winning..

When i use ic market all my entry will negative..

Market mover…

All your setup will fail.. trust me..

Just cause you lost money due to your own trading doesnt mean its a scam.

yes they scam me of 400 dollars I started with 50 dollars it got to 400 dollars then as I was watching the pairs from 400 it went to 0 wipes out the whole lot

Hi Everyone,

I am an investment banker for over 24 years UK and internationally and I have also worked for top tier banks within there legal space in regards to regulations.

I have personally traded with IC Markets for over 18 months and have had no such issues as I can categorically tell you that I have withdrawn moneys from my trading account between £1-100k with no hesitation by IC Market AU And IC markets EU / Raw trading. The reason they have only setup a raw trading since Feb 2020 is the fact that IC AU regulation had stated can only be used for AU citizens, hence IC EU / Seychelles were setup to facilitate EU citizens. They are all regulated heavily which means they run secreted account which means client money can never ever be touched the the firm and if they ever folded IC would still have the client money for you to recover. It may not be common sense for most out there and I can see why some are posting negative comments about IC but I can only read through the lines and this people seem to have only posted negative comments due to them losing in the markets. They serve me well and they follow AML regulations diligently as I closed one of my bank accounts down that I had deposited funds to IC markets from and IC requested for me to provide them proof it has closed down ao they would then allow me to withdraw to my new bank account. I did that and they complied and where very swift in doing so. Not sure what people are panicking about they have been around for years and because they setup new entities in other jurisdictions since Feb 2020 makes them not genuine lol. It clearly shows how uneducated people think and struggle in life. Wish you all the best everyone.

ICMarkets often fakes quotes… close your profiles position …

Thanks guys I want to open an account but with all this testimony I can thanks for sharing your own experience the good and the bad if people in the world that is open they would make this place a better place people that were of the scammers and legit One Love

thanks for the reveal, i wanted to open acct with them but no more

i warn everybody to carefully read the account terms of ic markets.if you are not an australian resident,your account will be held with a company called Raw Trading Ltd.this company was only registered february 2020.check it out on the internet and decide for yourself whether you want to join ic markets or not.

And where is the registration in the Seychelles?

GUYS Last advice just stay away from this broker !!!

This company is a scam. They will lock your account and wiped out all the money inside.

regasatarad company

ACD123289109

ABN12123289109

AFSN335692

#USD4567639

Hi, I’m in Mexico and I’d really appreciate if you help me with this questions:

1) It is possible to open an account and trade from here?

2) Do you have a Demo account?

3) In case the first answer was affirmative: What would be the usual protocol and requests on funds withdrawals because the majority of brokers don’t ask you for anything when need you to make a your first deposit for a real account but, when it’s time to withdraw your funds or part of them, the is the moment they ask you for several documents and requests in order to supposedly verify your account and personal info.

Best wishes.

Their server halt made my balance negative

stop-loss in ICMarkets is actually nothing

During the Corona volatility, one Monday morning, on the Asia session, I realized my balanced turned to -600 (was 1,100+) in about 5 minutes.

I was online and my terminal was connected, but there were no movements on the charts (frozen), their servers were not responding to any command and my 1,100+ turned to -600.

When I contacted their customer support they offered me to deposit the same amount of $600 and of course internal transfer is not accepted, in return they promised that they add this amount to my account so it will show balance = 600.

So not only I lose 1000+ I have to deposit 600 more, from my pocket, just to become 0 !!!

Can you please show me proofs because I also have more the n 200k with them

They are a scam house. Close my position when I am winning more than 500k usd and took away all the money in my account.

You can delete my review her but on other websites no h

Don’t create a account with this broker it’s really market maker and stolen only your money because hi trade against you really

They are a scam. They had an IT glitch took all my 12k gpb and refused to reimburse it stating it’s a risk you take in trading. AVOID ICMARKETS AT ALL COSTS!!!!

Be careful with icmarket they not more ECN broker really market maker

They trade against you to pick your money

Do you offer 1:500 leverage on retail accounts? I am experienced investor and a HNWI. I would open the account with €50000 in January rising to €100000 in February. I live in Spain and have professional advisers

Yes, IC Markets offers leverage up to 1:500 for Retail traders, BUT for the EU tarders the max leverage is only up to 1:30. You may check our list of the High Leverage Forex Brokers https://55brokers.com/high-leverage-forex-brokers/ and maybe choose the one who would fit you.

Hi there I would like to open a real account with ic

Markets

They are a scam house. Close my position when I am winning more than 500k usd and took away all the money in my account.

Then you woke up right……..