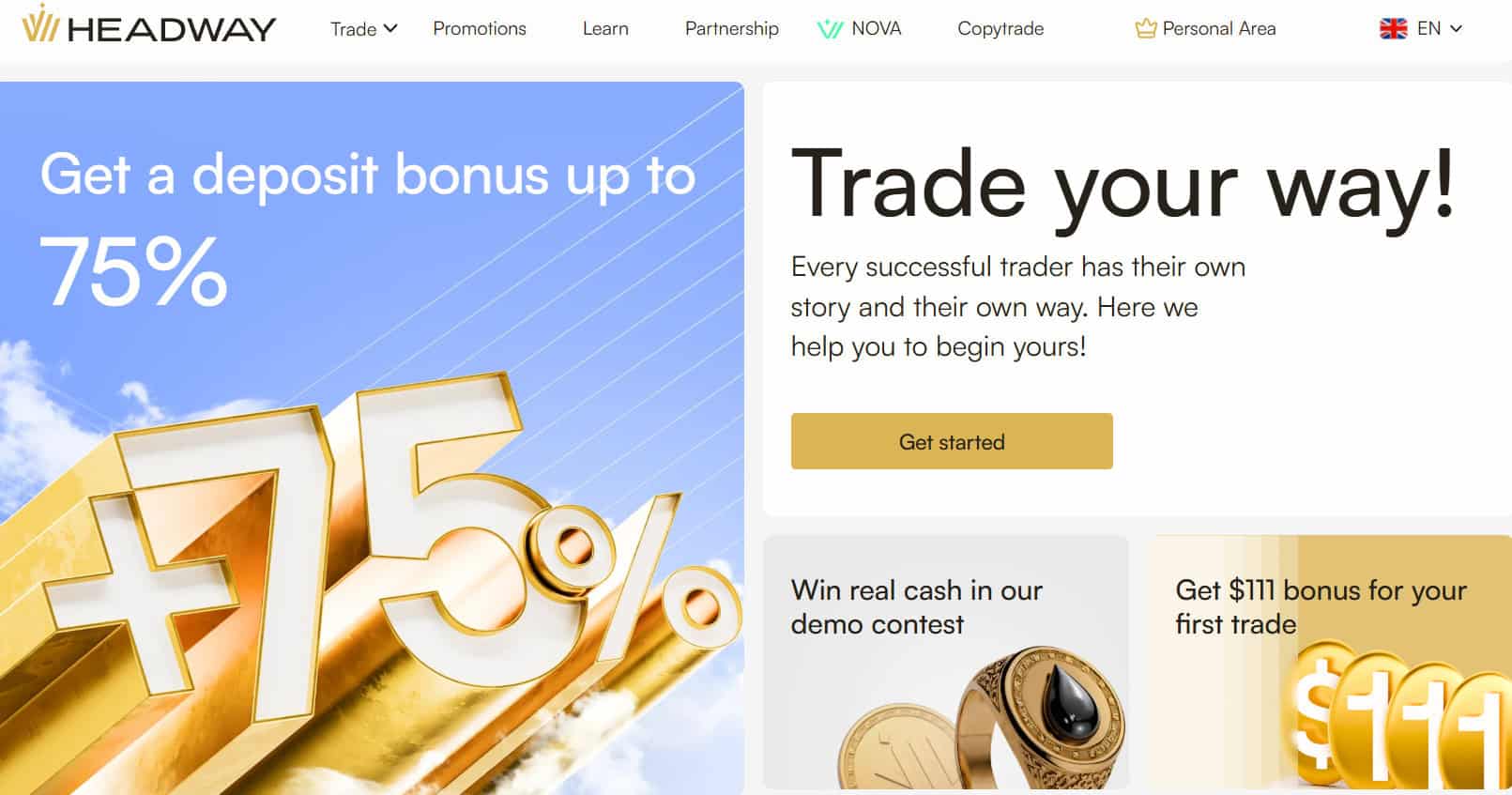

- What is Headway?

- Headway Pros and Cons

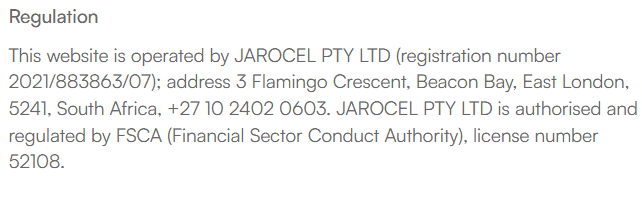

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

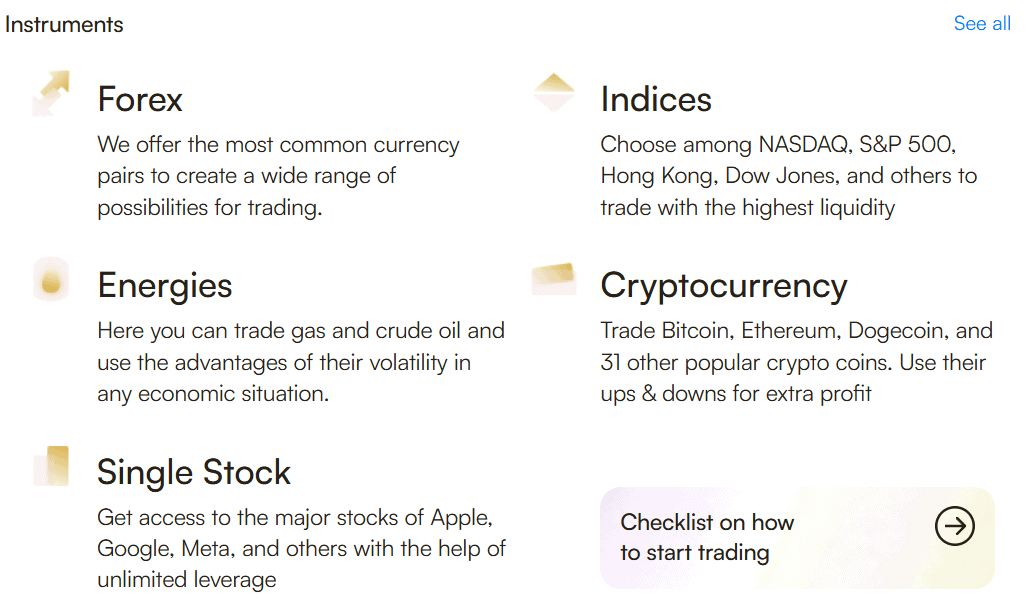

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Headway Compared to Other Brokers

- Full Review of Broker Headway

Overall Rating 4.2

| Regulation and Security | 4.2 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.6 / 5 |

| Additional Tools and Features | 4.1 / 5 |

What is Headway?

Headway is a Forex trading company that offers traders access to a variety of trading instruments, including Forex, Metals, Cryptocurrencies, Energies, Synthetics, Stocks, and Indices.

Based on our research, the broker is headquartered in South Africa and holds a license from the reputable FSCA authority. As a South African broker, the firm provides its services to clients across the African region.

In general, the firm offers competitive trading conditions and efficient trade execution through the advanced MetaTrader trading platforms.

Headway Pros and Cons

We found that the broker presents advantages and disadvantages that are important for traders to consider. On the positive side, Headway Broker offers competitive trading conditions, low minimum deposit requirements, and access to the well-known MT4 and MT5 trading platforms.

For the cons, the firm lacks a top-tier license operating under a single regulatory body, which could be a drawback for some traders seeking accounts with multiple regulatory authorities. However, trading under the South African entity is considered safe enough.

| Advantages | Disadvantages |

|---|

| FSCA regulation and oversight | No additional and top-tier license |

| MT4 and MT5 trading platforms | |

| Low minimum deposits | |

| Professional trading | |

| 24/7 customer support | |

| NDD execution | |

| NOVA investment service | |

| Competitive fees | |

| Learning materials | |

| Good trading conditions | |

Headway Features

Headway is a reliable broker with a presence in the South African region. The broker offers competitive costs, advanced platforms, and well-tailored account types. Below is a list of the main aspects of trading with Headway.

Headway Features in 10 Points

| 🗺️ Regulation | FSCA |

| 🗺️ Account Types | Cent, Standard, Pro |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, Metals, Cryptocurrencies, Energies, Synthetics, Stocks, Indices |

| 💳 Minimum deposit | $1 |

| 💰 Average EUR/USD Spread | 0.7 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, IDR, JPY, THB, NGN, ZAR, BRL, MYR |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/7 |

Who is Headway For?

Headway stands out for its favorable conditions and reliability. It is an attractive trading option for clients with no prior trading knowledge and for more professional clients. Here is what Headway is especially good for:

- Traders from South Africa and the African Region

- Traders who prefer the MT4 and MT5 trading platforms

- Currency trading

- Beginning Traders

- Advanced traders

- NDD execution

- Proprietary investment service

- Competitive fees

- 24/7 customer support

- Good trading tools

- EA/Auto trading

Headway Summary

Headway is a reliable Forex trading company that offers competitive trading solutions, efficient execution, and access to the popular MT4 and MT5 trading platforms. The firm’s competitive and diverse features make it an attractive option for both beginners and advanced traders.

Overall, we found that the firm provides a good trading environment; however, we advise traders to conduct thorough research and evaluate whether the broker’s offerings suit their specific trading requirements.

55Brokers Professional Insights

With our pro thought, Headwat is great for trading from Africa region, those who wish to start with small amount, beginners and traders who prefer low cost trading conditions, with small fee built into the commission or spread. As the broker provides trustworthy trading conditions and competitive fees, making it an attractive option for traders of all levels, it offers balanced conditions with MT4 and MT5 trading platforms, enabling users to trade popular financial instruments, over 350 instruments in total. Yet, the proposal iis rather basic not so comprehensive like other brokers may have, which is logic as costs are quite low at Headway, so quality trading execution is its main part.

We also found that Headway offers attractive educational materials and a few research tools, not so advanced but the main once are included, if you require more sophistication either seek other Broker or subscribe to 3d party tools like on TradingView or so. Beginners can also trade in a demo mode to enhance their trading experience.

Consider Trading with Headway If:

| Headway is an excellent Broker for: | - The South African clients

- Beginner and cost-conscious traders

- Professionals

- MT4 and MT5 platform enthusiast

- Copy traders

- Traders looking for different account options

- Mobile traders

- CFD and Forex traders |

Avoid Trading with Headway If:

| Headway is not the best for: | - For clients looking for top-tier licenses

- Long-term investors

- Clients looking for MAM and PAMM account features

- Beginner traders looking for extensive educational materials |

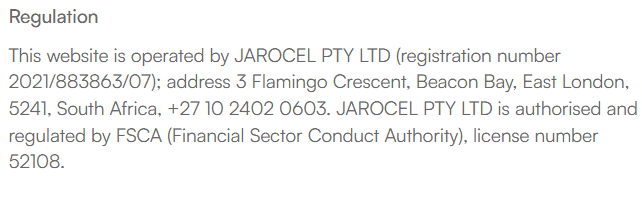

Regulation and Security Measures

Score – 4.2/5

Headway Regulatory Overview

Headway is a regulated Forex trading broker authorized by the FSCA in South Africa, which suggests a level of credibility and adherence to industry standards. Compliance with the regulatory rules set by the South African FSCA enhances the safety and confidence of traders who choose to trade with the broker.

- However, we recommended conducting your research, reviewing customer feedback, and considering personal factors before deciding to engage with the broker.

How Safe is Trading with Headway?

According to our findings, FSCA enforces regulatory compliance within the financial services industry. The regulatory body ensures the security of traders’ funds by requiring the segregation of funds from company accounts. This practice prevents the use of client funds for operational purposes, adding an extra layer of protection for clients.

However, we suggest conducting thorough research, including reading user reviews and considering other factors, to assess the broker’s reputation and legitimacy.

Consistency and Clarity

We have also considered the broker from the perspective of its consistency and transparency. The company has been in the market since 2022, registering impressive growth and development in its operations. It holds a license from the well-regarded FSCA, providing secure services in the South African region. The trading conditions have enhanced since its establishment, providing clients with more opportunities from year to year.

The customer feedback is mostly optimistic, indicating security of practices, advanced trading tools and features, and responsive customer support. There are also a few negative reviews that point out areas for improvement, including aspects such as deposits and withdrawals, as well as issues during periods of volatility.

However, the overall portrait of trading with Headway is positive, with an emphasis on the broker’s consistency and reliability.

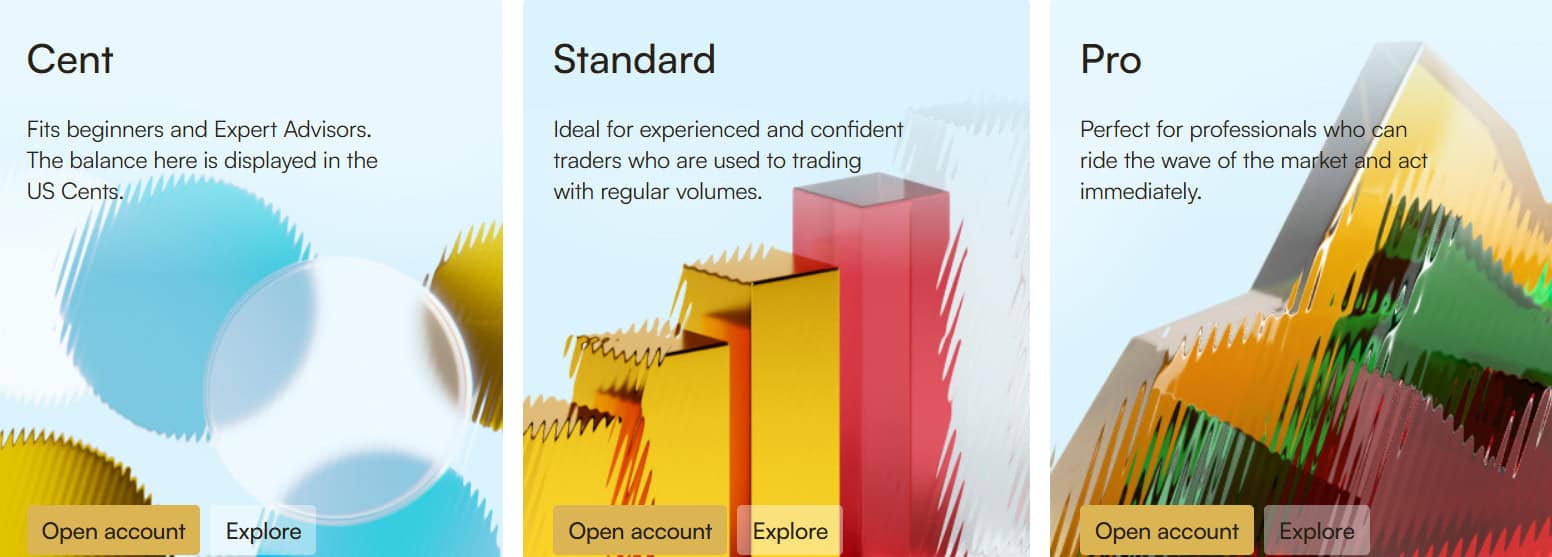

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Headway?

Our research revealed that the broker offers Cent, Standard, and Pro accounts that suit the needs of different traders. Additionally, the broker provides swap-free trading options for religious purposes.

There are common features among the account types; all accounts offer floating spreads, starting from an average of 0.3 pips. Trades are conducted through the MetaTrader platforms, ensuring access to over 300 instruments. The leverage is unlimited after traders complete a few basic requirements.

- The Cent account allows clients to begin with a small initial deposit of $1. The account’s base currency is USD. The Cent account is a suitable choice for beginner traders who want to start small, with minimal risks.

- The Standard account is another great opportunity to start small, with $10 initial deposit. The base currencies for this account type are USD, EUR, IDR, JPY, THB, NGN, ZAR, BRL, and MYR. This account type is also a beneficial choice for more experienced clients, as it suits all trading styles and strategies.

- The Pro account is the only commission-based account combined with floating spreads from 0.0 pips. It offers access to more instruments than the other two account types do (over 350) across Forex, cryptocurrencies, metals, energies, stocks, indices, and FX indices. The initial deposit starts from $100, which is in line with the market standards. The Pro account offers advanced features and faster execution, making it a suitable choice for high-volume traders.

Regions Where Headway is Restricted

Headway’s services are predominantly directed at the residents of the South African regions. Due to regulatory restrictions, the broker does not provide its services to the countries blacklisted by the FATF.

Cost Structure and Fees

Score – 4.5/5

Headway Brokerage Fees

After examining the broker’s fee offering, we found that Headway provides competitive fees for its trading services. The broker does not impose deposit and withdrawal fees; however, additional charges may be applicable during trading activities as well.

So, carefully review the broker’s fee structure and terms and conditions to gain a comprehensive understanding of the associated fees and their potential impact on trading operations.

Based on our test trade, the broker provides competitive spreads, with an average spread of 0.7 pips for the EUR/USD currency pair in the Forex market.

The broker offers floating spreads for all of its account types. For the Cent and Standard accounts, spreads start at 0.3 pips. The Pro account applies lower spreads from 0.0 pips, combined with reasonable conditions.

However, spreads can vary based on market conditions, volatility, and liquidity, so consult the broker’s website or contact customer support for detailed information on the spreads they offer for specific instruments and account types.

Headway offers a single commission-based account, the Pro account. The account is tailored for more professional trading, allowing clients to access spreads from 0 pips, combined with fixed transaction fees of $1.5 per side per lot for each trade.

How Competitive Are Headway Fees?

We have noticed that Headway offers low pricing for all of its account types. The spreads are floating and start from 0.3 pips for the Standard account. The Pro account allows even lower spreads. Spread for the popular EUR/USD pair is 0.7 pips. As we found, commissions are also reasonable, with $1.5 per side per lot, which is lower than the market average commissions.

All in all, Headway provides transparency and clarity of fees, as it discloses them on its website for each instrument. All the essential instruments offer low or average pricing with strong safety measures in place. The broker’s customer support provides details on each instrument traded, thus clients can contact the team for more specifics.

| Asset/ Pair | Headway Spread | Traders Trust Spread | WH SelfInvest Spread |

|---|

| EUR USD Spread | 0.7 pips | 1.5 pips | 1 pip |

| Crude Oil WTI Spread | 10 pips | 0.05 | 2.5 |

| Gold Spread | 0.3 pips | 1.4 | 1 |

Headway Additional Fees

Headway applies a few additional fees, which are calculated into the total trading charges.

- The broker applies swap fees for the positions held overnight. The long swaps for the EUR/USD pair are -6.34, and the short one is 1.47.

- We checked if Headway charges inactivity fees for dormant accounts and found that it does not charge fees for inactive accounts.

- There are also no deposit or withdrawal fees. However, payment providers may incur fees on their side.

Score – 4.4/5

Traders have access to the popular MT4 and MT5 platforms, renowned for their advanced features and user-friendly interfaces. The platforms offer a wide range of features, including technical indicators, user-friendly interfaces, and advanced charting tools.

| Platforms | Headway Platforms | Traders Trust Platforms | WH SelfInvest Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

Headway Web Platform

Headway clients can access their accounts through the MT4 and MT5 web platforms. Clients can trade with ease and flexibility right from the web browser. The web options provide all the essential features for efficient trading. Web trading stands out for many advantages, from user-friendliness and easy accessibility to in-depth charting capabilities, real-time market data, and more. The Headway web platforms allow users to trade without the need for installation and downloads.

Headway Desktop MetaTrader 4 Platform

The Headway MT4 platform ensures a reliable and quality trading experience by providing access to over 102 instruments across multiple markets. The MT4 trading platform offers users one-click trading, advanced charting, technical analysis, trading signals, market alerts, hedging, and Buy Stop Limit/Sell Stop Limit pending orders.

The platform can easily be downloaded for Windows, macOS, iOS, Android, and Google Play.

Headway Desktop MetaTrader 5 Platform

Headway MT5 platform offers traders an advanced and exceptional trading experience through its innovative features and great capabilities. Through the MT5 platform, Headway clients can access over 330 trading instruments. The platform offers unique instruments, such as technical analysis-based scanners, visualization with 3D graphics, market watch, one-click trading, autotrading, and more advanced features.

The platform is available through web, desktop, and mobile versions, ensuring easy accessibility and flexibility.

Headway Nova Investment Platform

Additionally, clients have access to the NOVA investment service, a proprietary platform developed by Headway. This innovative service provides traders with comprehensive tools and resources to enhance their investment strategies and optimize their trading experience. The platform allows its users to invest in tokenized property from world-class markets.

Main Insights from Testing

Our testing of Headway’s platforms revealed robust and flexible tools, facilitating various users to benefit from strong analytical features and capabilities. The MT4 and MT5 platforms are available in web, desktop, and mobile versions, ensuring flexibility and functionality. Even though Headway does not provide additional platforms, like cTrader and other alternatives, its platforms have all the necessary features to explore the market, access powerful analytical tools, and a range of financial products.

Headway MobileTrader App

We found that the broker offers a convenient mobile solution for traders with its dedicated app available on both Android and iOS platforms. This user-friendly app allows traders to stay connected to the markets, manage their accounts, execute trades, and access essential market data and analysis on the go. Traders can also access the MT4 and MT5 platforms’ mobile apps, gaining additional flexibility.

AI Trading

As we noticed, the broker currently does not offer dedicated AI-powered features. However, it still allows automation of trades. However, its MT4 and MT5 platforms allow automation of trades through EAs. Those who prefer full automation will need to look for alternative brokers with full AI functionality.

Trading Instruments

Score – 4.3/5

What Can You Trade on the Headway Platform?

Headway products proposal provides access to popular trading instruments, including Forex, Metals, Cryptocurrencies, Energies, Stocks, and Indices. The broker enables traders to diversify their portfolios and participate in various markets according to their individual preferences and trading strategies.

Besides, clients can invest through the broker’s Nova proprietary platform by investing in tokenized property from world-class markets. Traders get to diversify their portfolios with tokens of various properties.

Main Insights from Exploring Headway Tradable Assets

Headway offers over 350 instruments across multiple financial assets. As we found, instrument availability depends on the account type and the platform. The MT5 platform supports only 102 tradable products, while the MT5 platform ensures access to the full range of instruments. Besides, through the Cent and Standard accounts, clients can access 300 instruments. The Pro account allows the full range of instruments.

All in all, Headway is a favorable broker for CFD and Forex trading. It offers about 70 Forex pairs for its Pro account. For the other accounts, traders can access over 40 currency pairs. It also offers a good range of global Indices and stocks. Clients can also trade the essential commodities and cryptocurrencies.

Leverage Options at Headway

Leverage is a useful tool popular among Forex Brokers as it enables traders to enter the market with limited capital. However, leverage can be a risky tool. Therefore, traders should have a good understanding of how it works and its possible consequences before engaging in any trading activities that involve leverage.

The offering of Headway leverage is in accordance with the FSCA regulation:

- Trades from South Africa are eligible to use low leverage up to 1:30 for major currency pairs.

- However, the website states the potential for unlimited leverage, so understanding the risks associated with leverage is essential before making decisions about its use in trading.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Headway

The firm offers a variety of funding methods for traders to deposit funds into trading accounts, including Wire Transfers, Credit/Debit cards, E-wallets, and Crypto. However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved.

- We found that Headway does not charge transaction fees for deposits.

Minimum Deposit

Clients are required to deposit $1 to open a Cent account, $10 for a Standard account, and $100 for a Pro account when initiating a live trading account with the broker.

Withdrawal Options at Headway

Based on our analysis, the withdrawal process is both efficient and prompt. Typically, the broker handles withdrawal requests within a day. There are no withdrawal fees; however, some cryptocurrency withdrawals may be subject to a commission based on the payment system policies.

Customer Support and Responsiveness

Score – 4.5/5

Testing Headway’s Customer Support

The broker offers 24/7 customer support via live chat, email, and phone lines. Additionally, the support team comprises trading experts who can provide technical support, analysis recommendations, address general inquiries, and resolve operational issues.

- The broker also offers a help center with the most common and essential answers to guide new clients through their trading journey.

Contacts Headway

Headway provides its clients with dedicated customer support through various channels.

- Traders can communicate with the support team through WhatsApp.

- The live chat is the most favored option of communication, ensuring quick and detailed answers.

- Through email, clients will get detailed and informative answers to any query or issue they have.

- Another operative method to contact the support team is the Line, which allows you to make phone calls and send emails to the assistants.

- Also, traders can follow the broker’s social media pages, including Facebook, Twitter, Instagram, TikTok, X, Telegram, and LinkedIn.

Research and Education

Score – 4/5

Research Tools Headway

Headway includes excellent research tools in its advanced platforms, allowing in-depth research and detailed analysis.

- The broker also offers an Economic Calendar, which ensures that clients are updated and informed about the latest market developments.

Education

Educational materials are essential for beginner traders to gain knowledge about the market and trade with confidence. Headway includes a few resources to enhance traders’ skills and support them during their trading journey.

- The article section includes numerous articles covering various trading-related topics.

- The glossary is another useful resource providing traders with explanations of complex market terms.

- The Forex News section offers market-related updates and keeps clients in the know.

Is Headway a Good Broker for Beginners?

Based on the research of Headway’s different aspects, we have concluded that the broker can become a favorable choice for novice traders looking for cost-friendly options. The available account types offer very low initial deposit opportunities, allowing clients to start small with minimal risk.

The availability of the MT4 and MT5 platforms is an excellent option for clients looking for ease of use, combined with advanced capabilities. Besides, both spreads and the applied commissions are lower than the market average, with a few additional fees included.

The education section provides basic resources, combined with the availability of a demo account, another beneficial feature to consider.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options Headway

The availability of the broker’s instruments depends on the account type and the platform. Clients will have access to the largest number of products through the MT5 platform (over 350).

As we found, most products are based on CFDs, allowing clients to speculate on the price movements rather than own real assets.

- Headway clients can also invest in tokenized property for the world-class markets, a unique way to invest and gain profits.

- At last, Headway offers Copy trading. Clients can engage in alternative investments by copying trades of professional clients and earning profits.

Account Opening

Score – 4.6/5

How to Open a Headway Demo Account?

Trading through the demo account will help beginner traders practice and gain skills in a risk-free environment, gaining confidence and essential knowledge.

Here are the steps to follow to set up a demo account:

- Click the Log in button on the broker’s website.

- Follow the instructions to set up an account and fill out the registration form.

- Select account specifications.

- After entering the requested information, select Create an account.

- The account credentials will be sent to the provided email address.

- Access the demo account by using the account details provided by the broker.

How to Open a Headway Live Account?

Opening a live account with the broker is easy, as traders can follow the Headway instructions and register within minutes.

- Select and click on the “Open Account” page.

- Enter the required personal data (name, email, phone number, etc.)

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Score – 4.1/5

The broker offers all the innovative features and tools on its platforms. As it is, there are no additional features available. The broker also offers an Economic Calendar, a News section, and a Forex glossary, which we have already discussed in the research and education sections.

- Traders can also get a bonus when starting their trading journey with Headway. The broker provides a $111 starting bonus. After opening the bonus account, it will be credited with $111. No verification or deposit is needed to get the bonus.

Headway Compared to Other Brokers

To see how Headway complies with market standards, we have compared it with its competitive brokers.

We found that Headway offers a favorable trading experience, with its focus on low costs and attractive conditions. Unlike XTrade (2 pips) or FxPro (1.4 pips), Headway offers floating spreads, starting from 0.7 pips. The commissions are also lower than the market average offering ($1.5 per side per lot).

Headway’s asset variety is somewhat limited compared to FXTM or Forex.com, which offer thousands of instruments across multiple asset classes. Headway, on the other hand, offers up to 350 instruments, depending on the account type and platform.

In terms of regulation, Headway is regulated by the South African FSCA, offering reliable services in the South African region. This contrasts with brokers like FXCM or Forex.com, which offer top-tier licenses, such as the FCA and ASIC.

As to education, Headway offers basic educational resources, while FxPro, FXCM, and Forex.com stand out for their extensive education and research tools.

Overall, Headway is a favorable broker for cost-conscious traders who prioritize advanced platforms and access to popular instruments.

| Parameter |

Headway |

FXTM |

Forex.com |

Xtrade |

Axi |

FXCM |

FxPro |

| Spread-Based Account |

Average 0.7 pips |

Average 1.5 pips |

Average 1.3 pips |

From 2 pips |

Average 1.2 pips |

Average 1.3 pips |

Average 1.4 pips |

| Commission-Based Account |

0.0 pips + $1.5 |

0.0 pips + $3.5 |

0.0 pips + $5 |

No commissions, based on fixed spreads |

0.0 pips + $7 |

0.2 pips + $0.05 per 1K lot |

0.0 pips + $3.5 |

| Fees Ranking |

Low/ Average |

Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5, Nova app |

MT4, MT5 |

MT4, MT5, Forex.com Web Trader, TradingView |

Xtrade WebTrader |

MT4, Axi Trading App, Axi Copy Trading App |

MT4, Trading Station, ZuluTrade, TradingView Pro, NinjaTrader, Capitalise AI |

MT4, MT5, cTrader, FxPro WebTrader |

| Asset Variety |

350+ instruments |

1000+ instruments |

6000+ instruments |

1,000+ instruments |

220+ instruments |

200+ instruments |

2,100+ instruments |

| Regulation |

FSCA |

FCA, FSC, CMA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

FSC, FSCA |

ASIC, FCA, CySEC, DFSA, FSA |

FCA, ASIC, CySEC, FSCA, FSA, ISA |

FCA, CySEC, FSCA, SCB, FSA |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Basic |

Good |

Excellent |

Good |

Good |

Excellent |

Excellent |

| Minimum Deposit |

$1 |

$200 |

$100 |

$250 |

$0 |

$50 |

$100 |

Full Review of Broker Headway

We have carefully reviewed the broker’s different sections and aspects, revealing both its positive aspects and the areas where the broker needs improvement.

Headway provides a reliable and regulated service, overseen by the South African FSCA authority.

The broker offers several account types, allowing favorable conditions to start with ease and no risk. The platforms available are the market-popular MT4 and MT5, offering appealing features for efficient trading and effective outcomes. The copy trading feature is another opportunity that expands clients’ investment abilities.

The instrument range depends on the platform and account type. Through the MT4 platform, clients can access 102 instruments, while the MT5 platform allows the most extensive range, over 350 instruments.

Furthermore, Headway clients can access a few educational resources, including articles, a news section, and a Forex glossary. The broker’s support is available through multiple channels, including live chat, email, phone line, WhatsApp, and Line.

Share this article [addtoany url="https://55brokers.com/headway-review/" title="Headway"]

Good 😊 and the boys and I have

The customer service is excellent and you get a daily update of your account. I executed a withdrawal and it was processed promptly without issue. This will be my trading home for a long time. I will recommend express profitx for everyone.

Meta Trader 4 and 5 , i see the experience you do have in field gives me to trust your company. But appreciate the tools mostly you developed in the field of trading.

I have not checked in here for a while because I thought it was getting boring, but the last several posts are good quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂