- What is Hantec Markets?

- Hantec Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

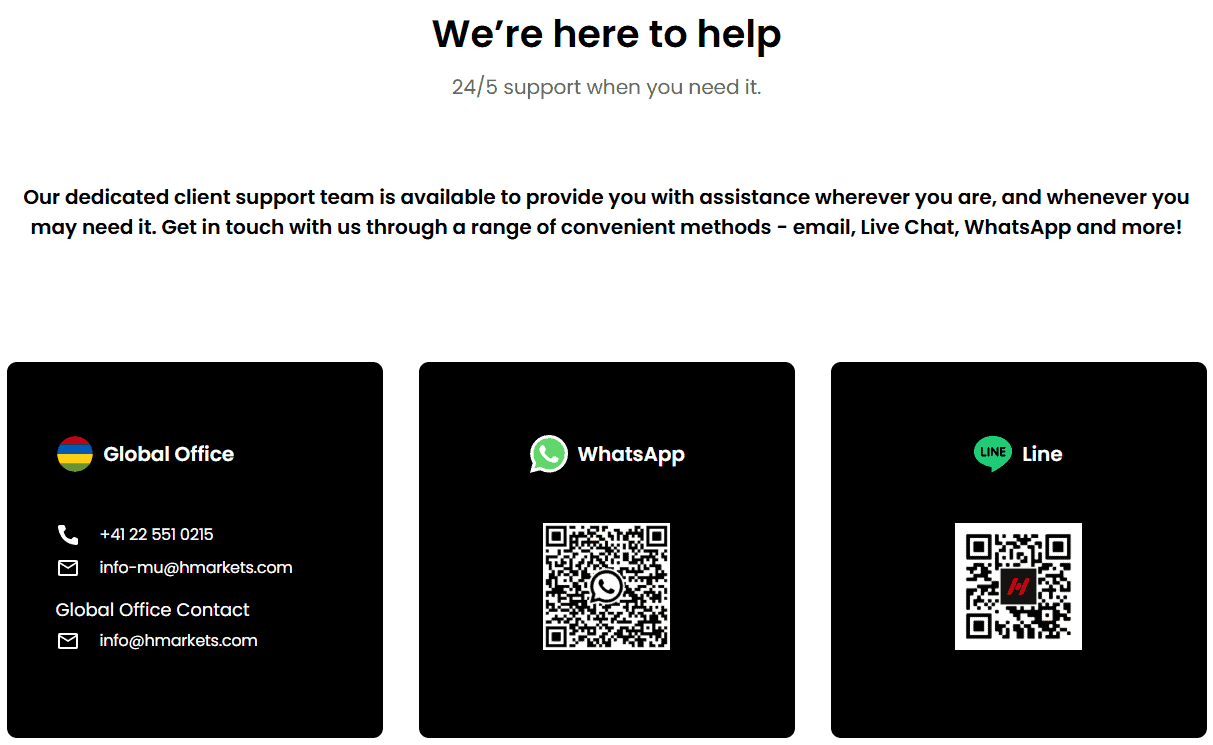

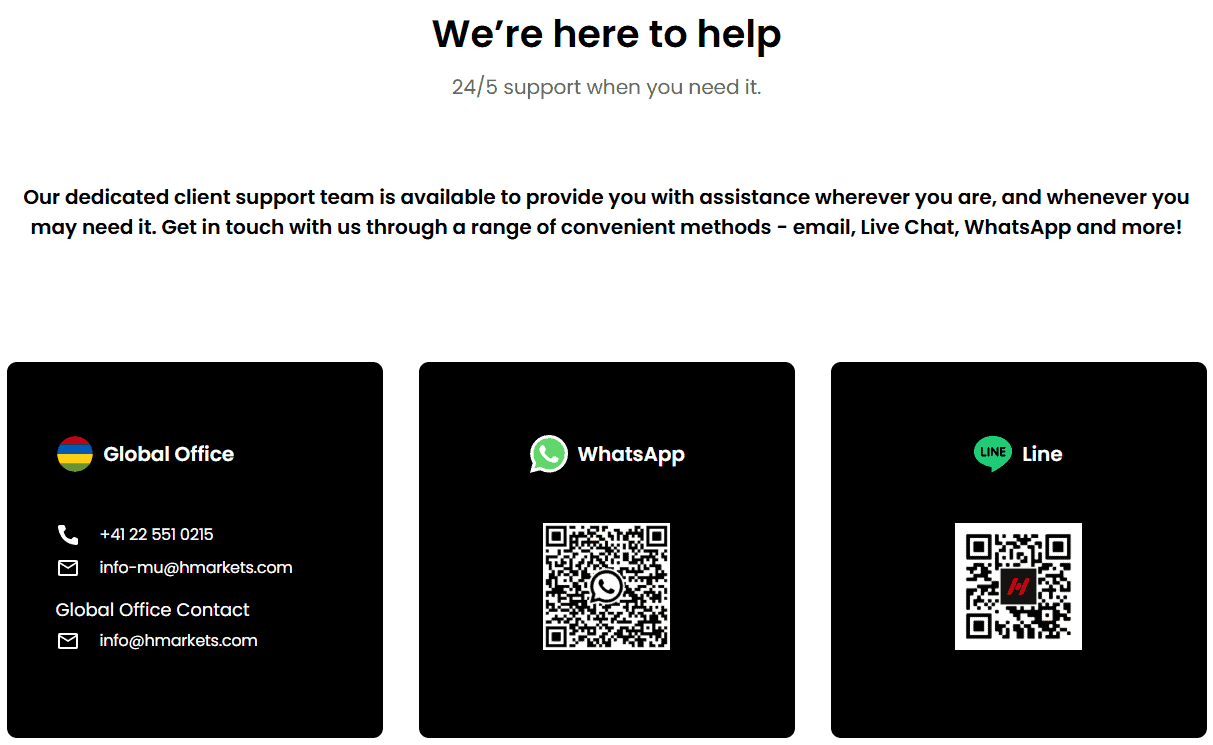

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Hantec Markets Compared to Other Brokers

- Full Review of Broker Hantec Markets

Overall Rating 4.3

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4 / 5 |

| Customer Support and Responsiveness | 4.2 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Hantec Markets?

Hantec Group is a global Broker and provider of specialized financial services that operates through the Hantec Markets brand name. It has established enterprises and subsidiaries in China, Japan, Australia, and New Zealand, and it has been headquartered in Hong Kong and the UK since 1990.

Furthermore, through the company’s years of growth and expansion, the broker received licenses from the local regulatory authorities and enhanced their online trading offerings to optimize business performance. Currently, operations are mainly held via the UK entity and specialized according to its regulations, while international offering is established through Mauritius, Vanuatu, and Seychelles licenses and the Broker runs several offices worldwide including Chile, Nigeria, and Thailand trading.

Therefore, due to Hantec’s global presence and differences between the jurisdictions and regulations they comply with there are some variations on specific conditions between proposals to the traders of a particular residence. Hantec’s proposal is quite large, while Broker specializes in Retail Trading, Institutional Trading, also launched Hantec Markets Prop Trading via Hantec Trader. Thus we advise carefully checking under which regulation you will fall and which conditions you can count on with Hantec.

Is Hantec Markets an ECN broker?

No, Hantec Market is a market maker broker meaning that it uses a dealing desk and its liquidity to fill clients’ orders.

Hantec Markets Pros and Cons

Hantec Markets is a recognized and regarded broker worldwide with a long history of operation and is heavily regulated in various jurisdictions including the UK FCA, Australian ASIC, and Hong Kong. It offers trading for numerous instruments with tailored proposals suitable for either beginners or professionals with quite Powerful trading software, accompanied by learning materials and research. We found costs very attractive too while overall Hantec Markets Portal proposal is very well balanced and might be suitable for a wide range of trading styles.

For Cons, there is No 24/7 customer service and conditions vary according to the entity. Also, we admit the market range is rather narrow and limited to CFDs and FX.

| Advantages | Disadvantages |

|---|

| Recognized and regarded broker worldwide | No 24/7 customer service |

| Long history of operation | Conditions vary according to the entity |

| Regulated by Top-Tier licenses | Limited market range |

| Good selection of instruments | Run offshore entities |

| Tailored proposal for beginners and professionals | |

| Industry-known trading platforms | |

| Good research tools | |

Hantec Markets Features

Hantec Markets is a global Forex and CFD trading provider offering features tailored to traders of all experience levels. Below are the main features of Hantec Markets to consider when choosing a broker:

Hantec Markets Features in 10 Points

| 🏢 Regulation | FCA, ASIC, CGSE, JFSA, FSC, VFSC, FSA, SVG FSA, JSC |

| 🗺️ Account Types | Standard, Hantec Global, Pro, Cent, Corporate Accounts |

| 🖥 Trading Platforms | MT4, MT5, Hantec Social |

| 📉 Trading Instruments | Forex, CFDs on Index, Stock, Cryptocurrency, Metal, Commodity, ETF, Pairs, Bullion and Spread Betting (available for UK) |

| 💳 Minimum Deposit | $10 |

| 💰 Average EUR/USD Spread | 1.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, AUD, JPY |

| 📚 Trading Education | Learning Hub, Glossary, Blogs |

| ☎ Customer Support | 24/5 |

Who is Hantec Markets For?

Hantec Markets is a highly reliable broker known for its strong compliance with regulatory jurisdictions and global availability, making it a trusted choice for international trading. Based on Financial Expert Opinions Hantec is Good for:

- Traders from the UK

- Australian traders

- International Traders

- Prop Trading

- Beginning Traders

- Professional Traders

- Traders from Hong Kong and Mainland China

- Algorithmic or API Traders

- EAs running

- Copy Trading

- Scalping/ Hedging Strategies

- Traders who prefer MT4, MT5

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

Hantec Markets Summary

Overall, the review of Hantec Markets highlights its long-standing history, numerous offices in major financial hubs, adherence to necessary regulations, and transparent trading conditions. The broker is recognized for offering competitive pricing models, STP execution, robust trading platforms, good trading technologies, comprehensive support, and a full range of tools.

However, some confusion may arise regarding the offerings, as different jurisdictions follow separate trading conditions, costs, and capabilities. Therefore, when opening an account with Hantec Markets, you should verify the specific brand under which your account will operate to ensure alignment with your trading needs.

55Brokers Professional Insights

Hantec Markets stands out as one of pioneer Brokers in the industry, operating for many years, has solid background and high capitalization, marking it as one of trusted Brokers. The proposal itself is competitive too that combines a robust trading infrastructure with global regulatory compliance and accessibility to traders from almost any corner including China Traders.

While the pricing is on industry-average, which we think is fair for the quality provided, as there are advanced technology including a 2-millisecond trade execution time, make it a preferred choice for traders seeking speed and precision like scalpers or long-term investors too. Overall, hantec might suit various style or size traders, also good fit for traders operating larger volumes and with big capital, since performance is very smooth.

However, Broker services vary across jurisdictions, potentially confusing trading conditions and costs. Additionally, the range of available instruments is somewhat limited, and the absence of certain advanced educational and research tools may not meet the needs of all traders.

Despite these limitations, Hantec Markets remains a reliable choice in the industry, delivering transparency and a comprehensive suite of tools to traders worldwide.

Consider Trading with Hantec Markets If:

| Hantec Markets is an excellent Broker for: | - Need broker holding reputable licenses.

- Looking for broker with worldwide presence.

- Need broker offering MT4 and MT5 trading platforms.

- Who prefer higher leverage up to 1:500.

- Need broker with various account types.

- Offering both spread-based and commission-based accounts.

- Providing VPS hosting.

- Need broker with copy trading features.

- Offering PAMM or MAM accounts.

- Ideal for beginner or professional traders.

- Who prefer Prop Trading.

- Broker with a variety of trading strategies.

- Offering popular trading instruments.

- Looking for institutional trading.

|

Avoid Trading with Hantec Markets If:

| Hantec Markets might not be the best for: | - Who prefer 24/7 customer support.

- Looking for extensive asset coverage.

- Need broker with fixed spreads.

- Looking for European license.

- Who prefer cTrader trading platform. |

Regulation and Security Measures

Score – 4.7/5

Hantec Markets Regulatory Overview

Hantec Markets operates under a robust regulatory framework, adhering to standards set by multiple international authorities.It is authorized by Top-Tier FCA in the UK, ensuring stringent oversight and client protection. In Australia, it is regulated by the reputable ASIC, known for its rigorous financial standards. The company also holds a license from the Japan Financial Services Agency (JFSA), highlighting its compliance with Japanese financial laws. Additionally, the company is a member of the Chinese Gold and Silver Exchange, specializing in precious metals trading.

However, international trading is regulated in offshore jurisdictions, such as the FSC in Mauritius, the Vanuatu Financial Services Commission (VFSC), the FSA in Seychelles, and the FSA in St Vincent & the Grenadines. Moreover, it is licensed by the Jordan Securities Commission, reflecting its presence in the Middle Eastern market.

How Safe is Trading with Hantec Markets?

Trading with Hantec Markets is considered safe due to its strong regulatory compliance and measures to protect client funds. The broker is licensed by reputable financial authorities, ensuring adherence to stringent financial standards. Additionally, Hantec Markets segregates client funds from its operational funds, enhancing fund security.

The broker employs advanced encryption technology to safeguard personal and financial information, and it offers negative balance protection to shield traders from incurring debts beyond their deposits. However, for accounts registered under offshore jurisdictions, regulatory protections may be less robust compared to tier-tier regulators. Therefore, traders should verify the specific entity and regulatory framework governing their accounts to ensure alignment with their safety and compliance expectations.

Consistency and Clarity

Hantec Markets is widely recognized and got high score rankings for its consistency and reliability, supported by its multi-decade presence in the trading industry and strong adherence to global regulatory standards. Its robust trading infrastructure, featuring fast trade execution and dependable platforms, further reinforces its reputation.

Traders often highlight the broker’s competitive pricing, efficient customer service, and user-friendly trading environment as key strengths. However, some feedback highlights the variability in trading conditions and account features depending on the regulatory jurisdiction, along with certain drawbacks, such as a limited range of trading instruments. Overall, Hantec Markets maintains a positive reputation among traders, reflecting its commitment to providing a secure and stable trading experience.

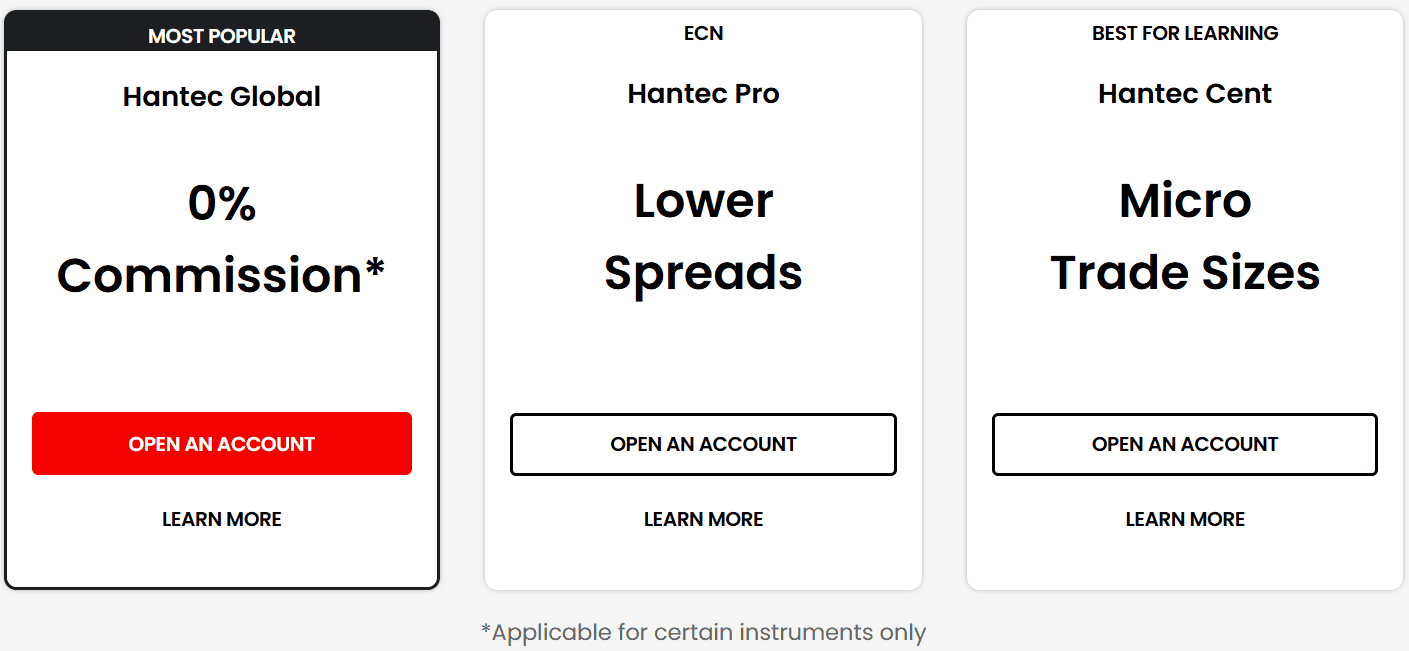

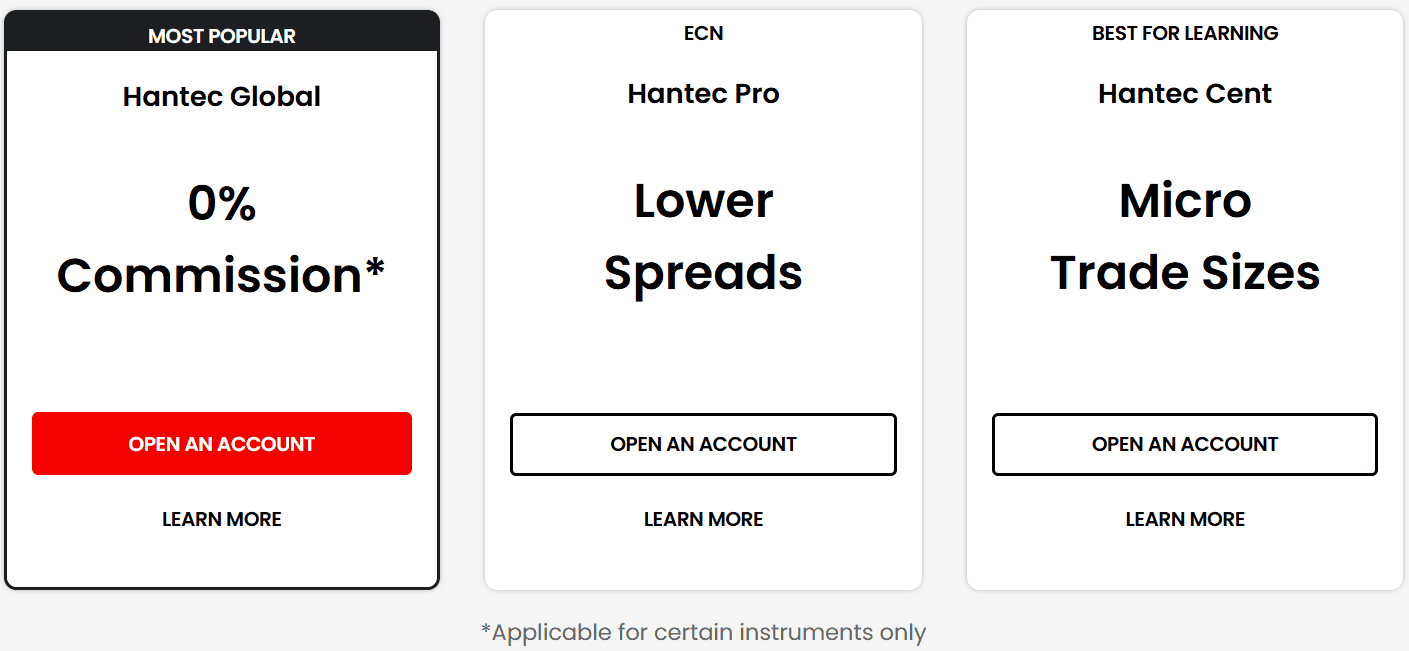

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with Hantec Markets?

Hantec Markets offers a variety of account types tailored to different trader needs. These include the Standard Account, suitable for new and intermediate traders, and available across multiple jurisdictions, including under the international Vanuatu license.

Other account options include the Hantec Global Account for broader international trading, The Pro Account, which offers lower spreads and professional-grade features for experienced traders, and the Cent Account designed for micro-lot trading with smaller capital requirements, and the Corporate Account for institutional-level clients. The broker also provides Swap-Free Accounts tailored to Islamic traders, ensuring compliance with Sharia law.

Additionally, traders can also explore the risk-free environment of Demo Accounts, which allows users to practice strategies and familiarize themselves with the platforms.

While the range of account types provides flexibility, certain features and conditions may vary depending on the regulatory jurisdiction, which can lead to inconsistencies in trader experience.

Standard Account

The Standard Account offered by Hantec Markets is designed for beginner and intermediate traders. With a minimum deposit requirement of $100, it is one of the most accessible account types for those new to Forex and CFD trading. The spreads for this account type start at 0.1 pips, making it a spread-only account. This account provides a straightforward trading environment without complex fee structures.

Hantec Global Account

The Hantec Global Account provides a more flexible solution for international traders, offering access to both MT4 and MT5 platforms. The account is suitable for those looking for broader global trading opportunities, with spreads starting from 1.0 pips. The minimum deposit is set at $10, and commissions may apply depending on the jurisdiction and specific trading instrument.

This account is offered under multiple regulatory entities, which allows traders to access the account in different regions, subject to their local laws and requirements.

Hantec Pro Account

The Hantec Pro Account is tailored for experienced traders who prioritize low spreads and advanced trading conditions. With a minimum deposit requirement of $10, this account type is designed for those who require professional-grade trading experience.

The spreads for this account start as low as 0.2 pips, and commissions are typically between $3 and $6 per round turn per lot.

Hantec Cent Account

The Hantec Cent Account is an excellent choice for new traders who want to test their strategies with smaller amounts of capital. With a minimum deposit as low as $10, it allows traders to engage in micro-lot trading without significant financial risk. The account is available through MT4, providing a simple platform for beginners.

The spreads for this account start from 1.5 pips, allowing users to practice and refine their trading strategies before committing larger funds.

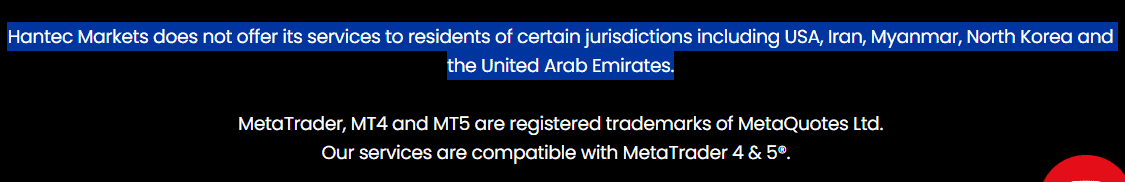

Regions Where Hantec Markets is Restricted

Hantec Markets is a global trading platform that has certain restrictions regarding the regions it serves. As of the latest information, it is not available in all countries due to regulatory and legal constraints. Specifically, the broker is restricted in countries such as:

- USA

- Canada

- Iran

- North Korea

- Macau

- Myanmar

- the United Arab Emirates

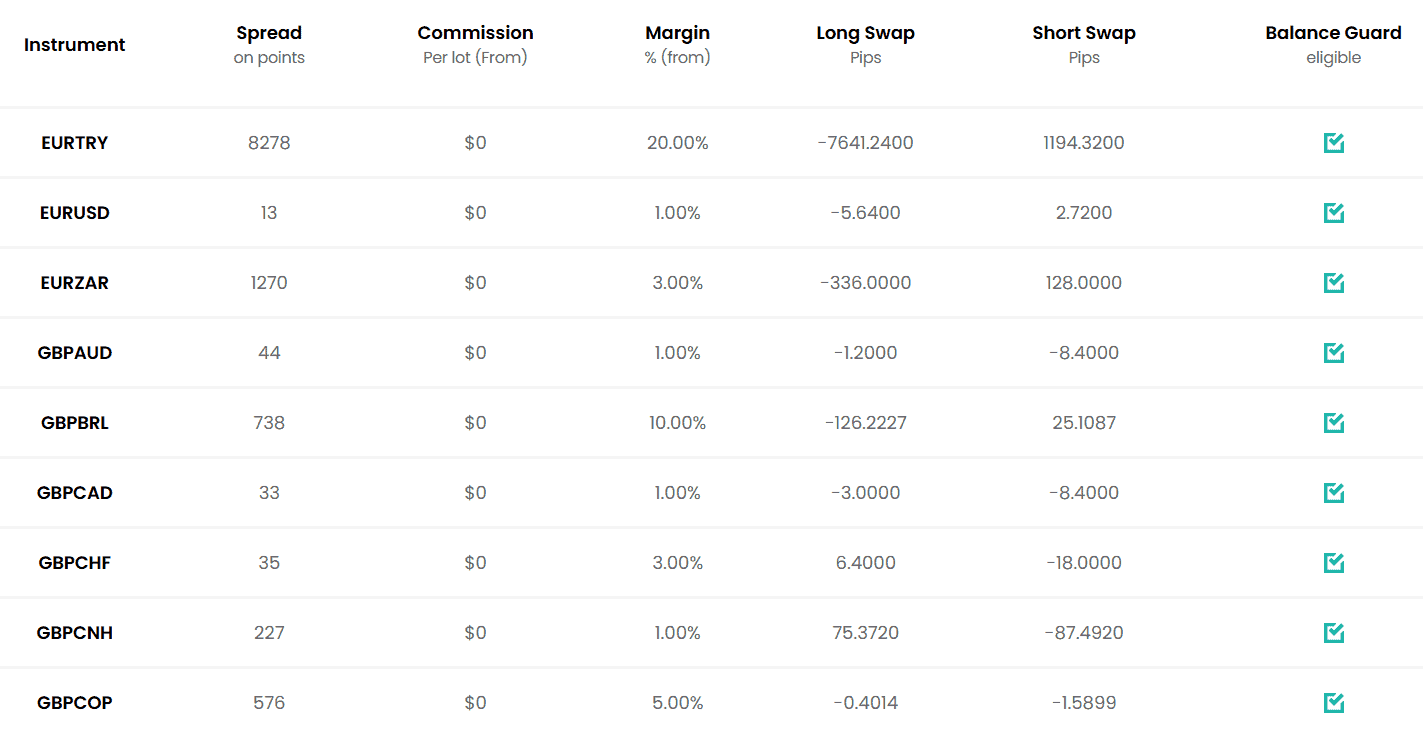

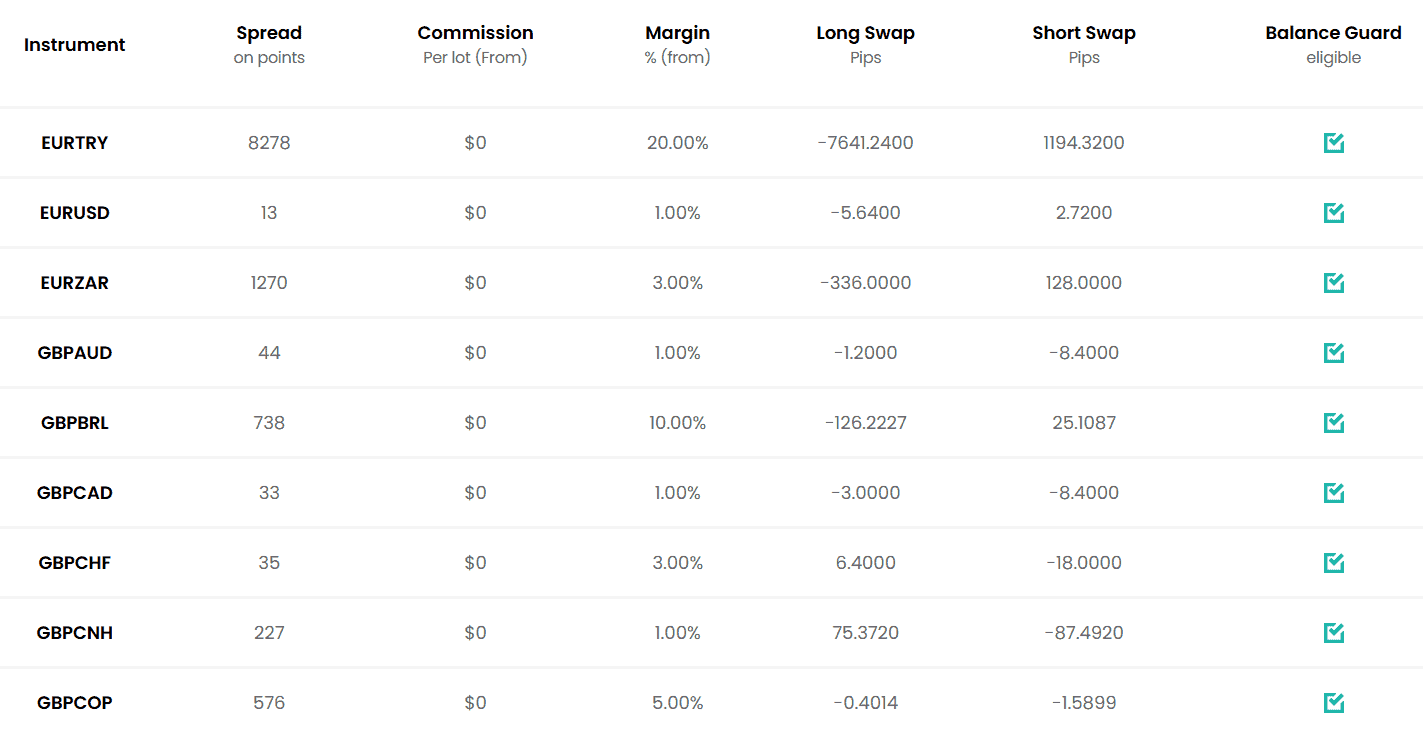

Cost Structure and Fees

Score – 4.4/5

Hantec Markets Brokerage Fees

Hantec Markets has a transparent fee structure that consists of spreads, commissions, and additional costs such as swap rates. The average spread for the Forex EUR/USD pair is 1.3 pips, and traders can expect commission-based charges on specific CFDs. For currency conversion, there is a 0.6% fee applied. Furthermore, traders holding positions overnight may incur swap fees, depending on the asset and position type.

As for the minimum deposit, the broker generally requires a minimum deposit of $10 for most account types, making it accessible to a wide range of traders. This amount may vary depending on the account type and the specific regulatory jurisdiction under which the account is opened.

Hantec Markets offers competitive spreads, starting as low as 0.1 pips for certain account types, with the average spread for the Forex EUR/USD pair being 1.3 pips. The spreads are variable and depend on factors such as market conditions, the specific asset being traded, and the account type selected.

Spreads for most currency pairs and CFD instruments can fluctuate, particularly during periods of high volatility. Traders can choose between a spread-only pricing structure or a spread-plus-commission model, depending on their account type

- Hantec Markets Commissions

Hantec Markets applies commission fees primarily on CFD instruments and certain account types, depending on the trader’s choice of pricing structure. For accounts with spread-plus-commission models, the commissions are clearly outlined and vary based on the asset being traded.

For example, the commission on shares and stock CFDs may differ from that of commodities or indices. However, the broker offers a competitive commission structure, with rates typically starting at $3 per side for the Pro Account.

- Hantec Markets Rollover / Swaps

The broker applies swap fees to positions that are held overnight. These fees are determined by the difference in interest rates between the two currencies involved in a forex pair, or the cost of holding a CFD position overnight.

The swap rate can be either positive or negative, depending on the position type (long or short) and the direction of interest rate differentials. Additionally, Hantec Markets provides a swap-free account option for traders who are unable to participate in swaps for religious reasons. Swap rates are subject to change based on market conditions, and traders should check the current rates regularly to manage their positions effectively.

How Competitive Are Hantec Markets Fees?

Hantec Markets offers competitive fees for a wide range of traders, with pricing structures that include spread-only and spread-plus-commission models. The broker’s fee transparency is a notable benefit, as traders can easily understand the costs associated with their trades before entering the market.

However, the competitiveness of the fees can vary depending on the account type and the instruments being traded. While the spreads are generally reasonable, some traders may find the commissions on certain assets to be slightly higher. Additionally, overnight swap rates may add to the overall cost of holding positions, which could be a consideration for longer-term traders.

Overall, Hantec Markets offers a well-rounded fee structure that balances competitive pricing with flexibility, but traders need to review their specific needs and account conditions before making a decision

| Asset/ Pair | Hantec Markets Spread | FXCM Spread | Axi Spread |

|---|

| EUR USD Spread | 1.3 pips | 1.3 pips | 1.2 pips |

| Crude Oil WTI Spread | 0.6 pips | 0.04 | 0.03 |

| Gold Spread | 3.7 pips | 0.35 | 0.16 |

| BTC USD Spread | 0.50% | 3.73% | 18 |

Hantec Markets Additional Fees

Hantec Markets applies additional fees under certain circumstances, such as a $5 monthly inactivity fee for accounts that remain dormant for six months or more. Additionally, traders may incur a currency conversion fee of 0.6% when transferring funds between different currencies.

If positions are held overnight, swap or rollover fees may also apply, varying based on the instrument, position type, and market conditions. While these fees are clearly outlined, traders should ensure they are aware of all potential charges that may apply to their account, particularly when it comes to account inactivity and currency conversions.

Trading Platforms and Tools

Score – 4.5/5

Hantec Markets offers a range of reliable trading platforms to meet the needs of various traders along with fast execution from 2 milliseconds. The popular MetaTrader 4 and MetaTrader 5 platforms are available, providing traders with diverse charting tools, a wide range of indicators, automated trading capabilities, and customizable layouts. MT5 extends these features with additional timeframes and more advanced order types, making it suitable for more experienced traders.

In addition to these platforms, Hantec Markets offers the Hantec Social Copy Trading App, which allows traders to copy the strategies of experienced traders and potentially benefit from their expertise. This tool is ideal for those new to trading or who prefer a more hands-off approach.

Trading Platform Comparison to Other Brokers:

| Platforms | Hantec Markets Platforms | FXCM Platforms | Axi Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Hantec Markets Web Platform

The web platform is built on the MetaTrader platforms, offering a robust and user-friendly interface directly accessible through a web browser. This platform allows traders to enjoy the same advanced features and tools on the desktop versions, including real-time market analysis, multiple charting options, and custom indicators.

It provides a convenient solution for traders who prefer to access their accounts and execute trades without downloading software. Hantec Markets web platform is fully compatible with the features of MT4 and MT5, ensuring that users can manage their accounts and trades seamlessly across all devices

Hantec Markets Desktop MetaTrader 4 Platform

The MT4 is an industry-standard trading platform that provides a comprehensive set of tools for Forex and CFD traders. The platform is known for its ease of use, stability, and a wide range of features, including advanced charting capabilities, automated trading via Expert Advisors, and access to a broad selection of technical indicators.

The desktop version offers a seamless and customizable trading experience, allowing traders to create multiple chart setups, use one-click trading, and take advantage of in-depth market analysis tools. Additionally, MT4 is compatible with custom indicators and scripts, giving experienced traders the ability to personalize their trading strategies.

Hantec Markets Desktop MetaTrader 5 Platform

The Hantec Markets Desktop MT5 platform is a feature-rich trading platform that builds upon the foundation of MetaTrader 4 with enhanced functionalities, including additional timeframes, more advanced order types, and an integrated economic calendar. MT5 also offers a greater selection of charting tools, technical indicators, and a wider range of asset classes, such as stocks and commodities.

The platform supports EAs and provides a multi-currency strategy tester for those looking to develop or refine their trading strategies. Its seamless integration with Hantec Markets’ liquidity pool ensures reliable and fast trade execution.

Hantec Markets MobileTrader App

Broker offers three mobile trading apps, the Hantec Mobile Trading App, the MetaTrader Mobile, and the Hantec Social Copy Trading App, Hantec Social. Both Hantec Mobile App and MetaTrader Mobile allow traders to access their accounts, place trades, and manage positions from anywhere, with various charting tools, technical analysis, and fast execution.

Hantec Social, on the other hand, provides a unique feature that enables traders to follow and copy the trades of experienced and successful traders. This app is ideal for beginners or those looking for a more passive approach to trading, as it allows them to replicate the strategies of professionals and potentially benefit from their expertise.

Main Insights from Testing

Testing the Hantec Social Trading App reveals several key insights. The app offers a user-friendly interface that allows traders to easily browse and follow top traders. One notable feature is the transparency of trader performance data, which helps users make informed decisions when choosing who to follow. Additionally, the app allows for customizable risk settings, ensuring that traders can adjust their exposure based on their risk tolerance.

However, some users have noted that the performance of copied trades can sometimes differ slightly due to delays in execution or differing market conditions. While the app is intuitive, the dependency on other traders’ strategies means that it may not suit those who prefer a more hands-on approach to their trading. Overall, the app provides a practical solution for those interested in social trading, offering convenience and access to experienced traders’ strategies, though traders should remain mindful of the risks involved with copying trades.

Trading Instruments

Score – 4.4/5

What Can You Trade on Hantec Markets’s Platform?

Hantec Markets provides access to instant execution through the STP model, offering quotes sourced from 16 of the world’s largest banks. The broker supports Forex and CFDs trading, including over 2,650 assets such as Forex pairs, indices, stocks, cryptocurrencies, metals, commodities, ETFs, and bullion. Additionally, spread betting is available exclusively for UK residents.

Main Insights from Exploring Hantec Markets’s Tradable Assets

Exploring Hantec Markets’ tradable assets reveals a robust selection of trading instruments, including cryptocurrency CFDs on popular options like Bitcoin, Ethereum, and Ripple. The broker offers access to over 2,650 assets, providing a diverse portfolio for traders. However, the range of available instruments varies by jurisdiction, and the market proposal primarily focuses on Forex and CFDs. This focus may not meet the needs of traders seeking direct access to real futures or physical stock trading, who might need to explore alternative brokers.

Overall, Hantec Markets’ portfolio is well-suited for CFD and Forex traders, but it has limitations for those looking for broader market access, particularly outside the scope of derivatives trading.

Leverage Options at Hantec Markets

Hantec Markets leverage offers an attractive path to maximize the offering and potential of trading performance through leverage. Yet the multiplier can also increase the potential for significant losses, especially in highly volatile markets. Therefore, traders should carefully consider their risk tolerance and trading strategy before using high leverage.

Hantec Markets leverage ratios vary according to the trader’s residence, as well as under which jurisdiction the account is open:

- UK clients may use restricted leverage with a maximum of 1:30 for major currency pairs.

- Australian entity traders can use a maximum leverage of 1:30 as well.

- The international entities of Hantec Markets offer ratios up to 1:500 for retail traders.

Deposit and Withdrawal Options

Score – 4/5

Deposit Options at Hantec Markets

The deposits and withdrawals at Hantec Markets are simple with secure transactions and 100% automatic. Traders can fund their accounts using popular methods such as bank wire transfers, credit/debit cards, and online payment systems like Perfect Money and WebPayment.

However, the availability of deposit methods may vary depending on the trader’s region and the Hantec entity they are registered with.

- Credit/Debit cards

- Bank Wire

- e-Wallets

- BPay for Australia, and more

Hantec Markets Minimum Deposit

Hantec Markets’ minimum deposit is $10 for most account types offered through its international branches, catering to traders who wish to access the full suite of Hantec’s features.

However, the required minimum deposit may vary based on the specific account type and the regulatory entity under which you register.

Withdrawal Options at Hantec Markets

Hantec Markets does not charge any commission for withdrawing funds. However, transaction fees may be applied by payment providers or banks, which should be clarified with the support center of your specific Hantec entity.

Withdrawal methods are similar to deposit options and can be conveniently requested through the online account portal, where you can also track the status of your transactions. Processing times are generally fast but may vary depending on the payment method and regional laws.

Customer Support and Responsiveness

Score – 4.2/5

Testing Hantec Markets’s Customer Support

Hantec Markets offers dedicated 24/5 customer support through multiple channels, including email, phone, and live chat, ensuring prompt and efficient responses to inquiries. Additionally, the broker provides multilingual support with international phone lines available in the UK, China, Thailand, Nigeria, Pakistan, and Jordan, enhancing its accessibility for clients from diverse regions.

While customer reviews generally highlight the responsiveness and professionalism of the support team, the availability of service hours may vary depending on the region.

Contacts Hantec Markets

There are several ways for Hantec Markets’s clients to get in touch, offering direct communication via email, phone, and live chat. The company’s UK office can be reached at +44 (0) 207 036 0850 for inquiries.

For clients in Australia, Hantec Markets offers support at +61 2 8017 8099, and there are also region-specific contact options available in Thailand, China, and other locations. Additionally, emails can be sent to the general support address at info@hmarkets.com.

Research and Education

Score – 4.3/5

Research Tools Hantec Markets

Hantec Markets offers a diverse range of research tools tailored to enhance trading efficiency, though their availability varies depending on the regulatory entity. On the MetaTrader platforms, traders can leverage charting tools, automated trading capabilities, and technical analysis indicators.

- A key feature is the integration of Trading Central, which provides professional trading signals, market analysis, and actionable insights directly within the platform.

On the broker’s website, the Client Portal serves as a hub for real-time market updates, an economic calendar, and analytical tools to track global financial events. However, the specific features and services offered may depend on the Hantec entity with which you are registered, so you should verify availability with your chosen branch.

Education

Hantec Markets offers a variety of educational resources aimed at helping traders enhance their skills and knowledge. The Learning Hub serves as a central platform offering tutorials, webinars, and educational articles covering trading strategies, market analysis, and platform navigation, while the Glossary simplifies trading terminology for beginners.

Additionally, the Blogs feature insights into financial markets and trading strategies. However, the educational offerings are not highly comprehensive and may not fully meet the needs of advanced traders seeking in-depth analysis or advanced strategies.

Also, the availability of these resources can vary depending on the regulatory entity and the trader’s region. Therefore, users should explore the specific educational tools offered by their local Hantec Markets branch.

Is Hantec Markets a good broker for beginners?

Yes, Hantec Markets is a good broker for beginners due to its user-friendly trading platforms, which are widely recognized for their intuitive interfaces. The broker also offers educational resources, blogs, and a glossary, designed to help new traders understand the basics of trading.

Additionally, its low minimum deposit for certain accounts makes it accessible for those starting with limited capital.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options Hantec Markets

Hantec Markets focuses primarily on Forex and CFD trading and does not directly provide access to real stocks or futures.

- However, it compensates for this limitation by a few investment opportunities. These include PAMM and MAM accounts, which enable professional traders to efficiently manage multiple accounts, appealing to both account managers and their investors.

- In addition, the broker provides a social trading platform through its Hantec Social app. This tool allows users to copy the strategies of experienced traders, making it easier for beginners and less experienced traders to participate in the markets. However, the availability of these features may vary depending on the jurisdiction and regulatory entity.

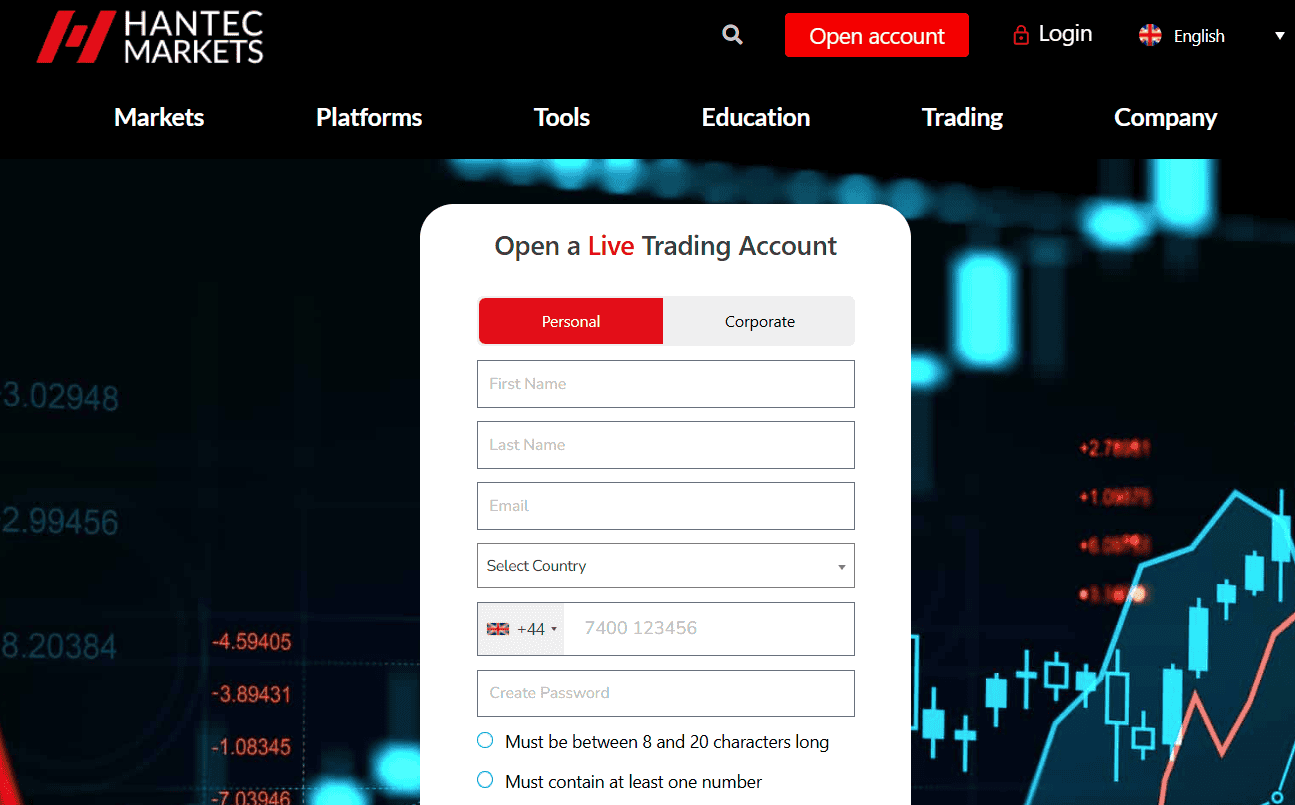

Account Opening

Score – 4.5/5

How to Open Hantec Markets Demo Account?

Opening a demo account with Hantec Markets is a simple process designed to help traders explore the platform and practice trading without financial risk. Follow these steps:

- Navigate to the Hantec Markets website and locate the “Demo Account” option, typically found under the “Accounts” or “Trading” section.

- Complete the online form with your details, such as name, email address, phone number, and preferred platform (MetaTrader 4 or 5).

- Choose your account type, base currency, and the virtual funds amount you would like to trade with. Some jurisdictions might offer additional customization options.

- Once registered, you will receive an email with login details for the demo account, including the server information.

- Download and install the chosen trading platform or use the web version if available.

- Log in using the credentials provided and begin exploring the platform with virtual funds to practice trading strategies and familiarize yourself with the tools and features.

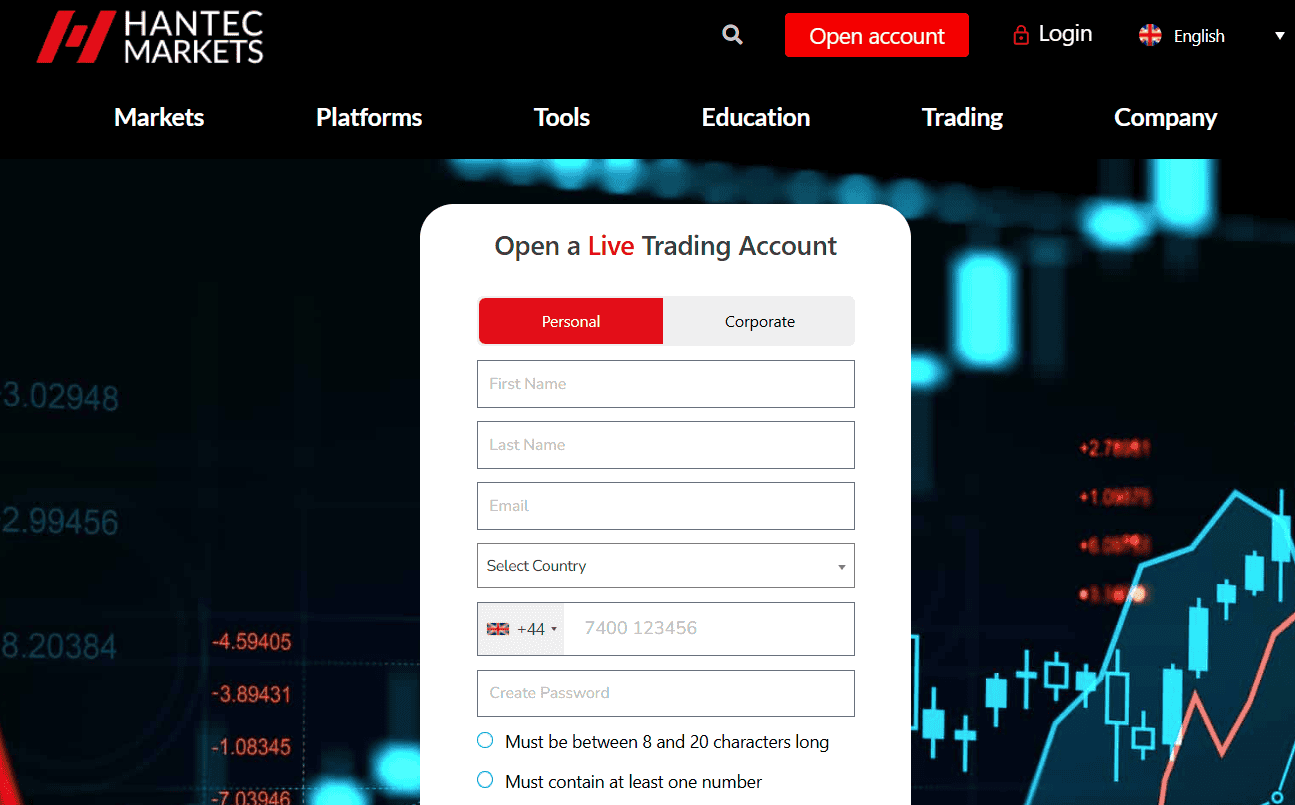

How to Open Hantec Markets Live account?

To open a live account with Hantec Markets, you need to visit the broker’s official website and complete the online application process. This involves filling out a form with your personal information, including your name, email, phone number, and country of residence.

Next, you will select your desired account type, base currency, and trading platform (MT4 or MT5). As part of the process, you will need to provide identification documents, such as a valid passport or ID and proof of address, to comply with regulatory requirements.

Once your documents are verified and your account is approved, you can fund it using one of the available deposit methods and start trading. Note that the specifics of account features and requirements may vary depending on your region and the Hantec Markets entity under which your account is registered.

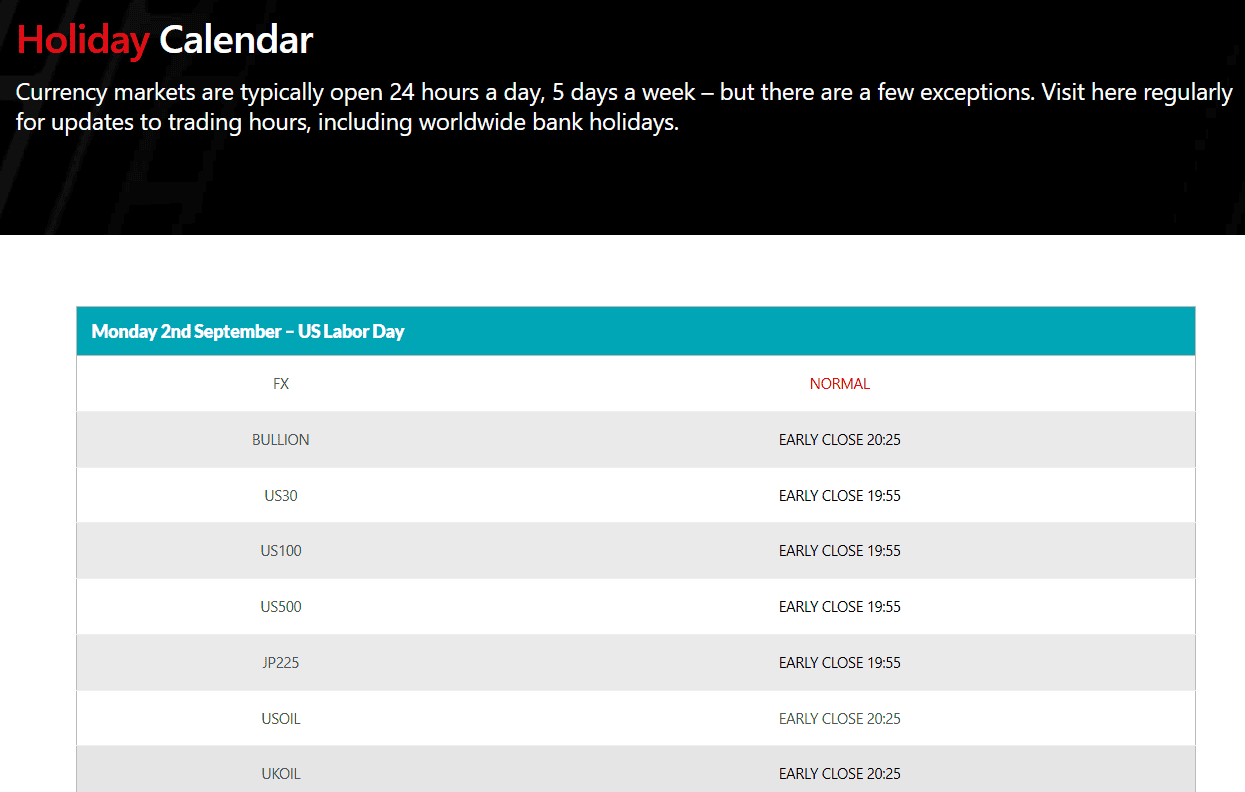

Additional Tools and Features

Score – 4.3/5

In addition to the standard features and tools, Hantec Markets provides several additional features to enhance the trading experience.

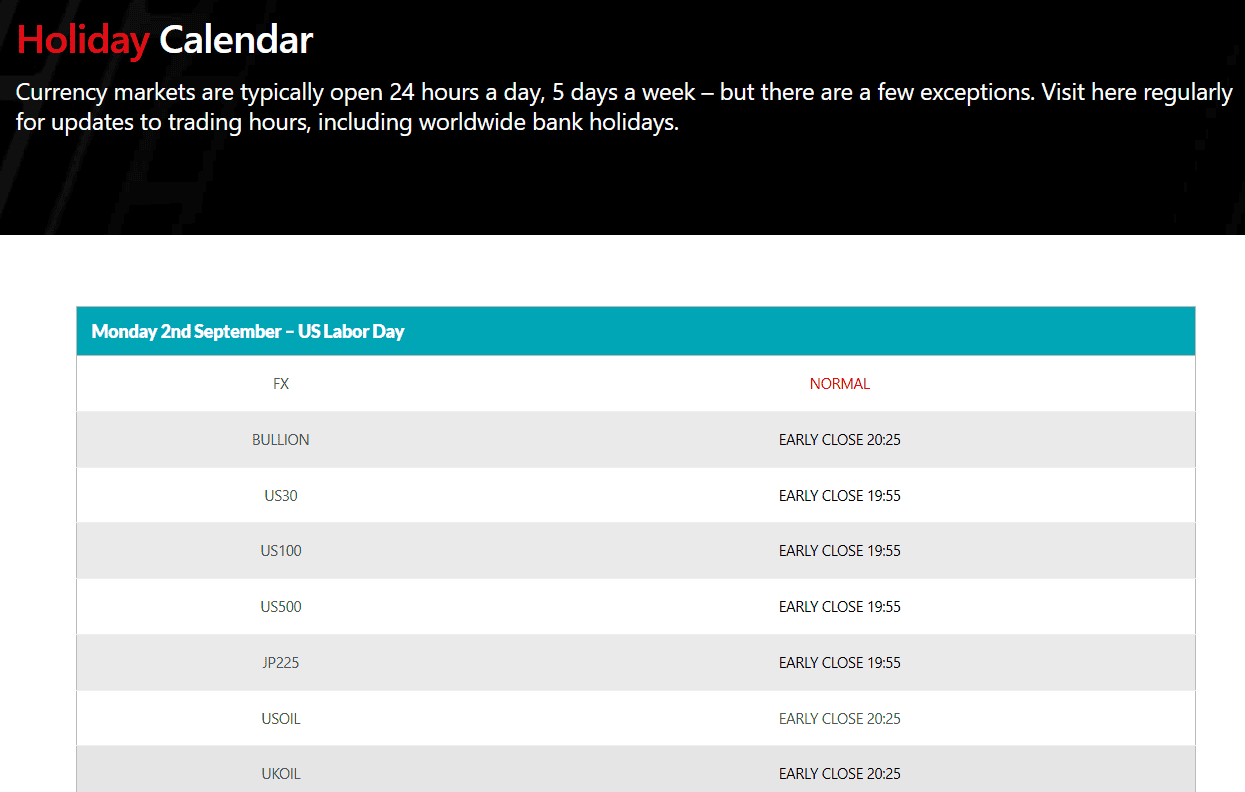

- The Economic Calendar is a valuable resource, offering traders insights into upcoming economic events, which can impact the forex and CFD markets. This calendar helps traders stay informed about key releases such as interest rate decisions, GDP reports, and other major events that could lead to market volatility.

- Hantec Markets also offers a Markets Holiday Calendar, which is important for keeping track of global market holidays that may affect trading hours and liquidity. Understanding market closures can help traders plan their strategies around these events.

- The broker provides a VPS service, which allows traders to run their MetaTrader platforms on a remote server. This ensures fast, stable, and uninterrupted execution of trades, which is especially beneficial for those using automated trading strategies, Expert Advisors, or trading in volatile market conditions.

- Additionally, the broker provides Trading Signals with tools such as the RSI (Relative Strength Index), which helps traders identify potential buy or sell signals based on overbought or oversold conditions.

Hantec Markets Compared to Other Brokers

Hantec Markets stands out with its low minimum deposit requirement, offering access to a popular range of trading instruments. This is quite competitive when compared to brokers like FXTM and Axi, where the asset variety is somewhat limited. While Hantec Markets does not offer the most extensive range of assets like Forex.com or FP Markets, which boast thousands of instruments, it provides a solid choice for Forex and CFD traders.

The regulatory coverage of Hantec Markets is also noteworthy, as it is regulated by multiple authorities, ensuring a relatively broad trust foundation.

In terms of fees, the broker provides competitive spreads and commission structures, particularly for those using its commission-based accounts. However, brokers like Pepperstone and XTB offer lower spreads, which may appeal to those seeking tighter pricing.

Additionally, Hantec Markets offers a good educational package, including resources like a Learning Hub and trading guides. While not as comprehensive as some competitors, such as Forex.com, which offers a broader range of educational materials, it still provides valuable content for traders.

Overall, Hantec Markets is an attractive choice for those focused on a reliable trading environment, competitive pricing, industry-known trading platforms, and good customer support. However, it might not be the best choice for traders looking for the widest range of instruments or the most extensive educational resources.

| Parameter |

Hantec Markets |

FXTM |

Forex.com |

FP Markets |

Axi |

Pepperstone |

XTB |

| Spread Based Account |

1.3 pips |

Average 1.5 pips |

Average 1.3 pips |

From 1 pip |

Average 1.2 pips |

Average 0.7 |

Average 1 pip |

| Commission Based Account |

0.2 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $5 |

0.0 pips + $3 |

0.0 pips + $7 |

0.0 pips + $3.50 |

0.0 pips + 0.2% (for real stocks and ETF above €100,000 monthly turnover) |

| Fees Ranking |

Average |

Average |

Average |

Low/ Average |

Average |

Low |

Low/ Average |

| Trading Platforms |

MT4, MT5, Hantec Social |

MT4, MT5 |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, Axi Trading App, Axi Copy Trading App |

MT4, MT5, cTrader, TradingView |

xStation 5, MT4 |

| Asset Variety |

2,650+ instruments |

1000+ instruments |

6000+ instruments |

10,000+ instruments |

220+ instruments |

1,200+ instruments |

6100+ instruments |

| Regulation |

FCA, ASIC, CGSE, JFSA, FSC, VFSC, FSA, SVG FSA, JSC |

FCA, FSC, CMA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, DFSA, FSA |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FCA, CySEC, KNF, FSC, CNMV, DIFC |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/7 support |

24/5 |

24/7 support |

24/5 support |

| Educational Resources |

Good |

Good |

Excellent |

Excellent |

Good |

Excellent |

Good |

| Minimum Deposit |

$10 |

$200 |

$100 |

$100 |

$0 |

$0 |

$0 |

Full Review of Broker Hantec Markets

Hantec Markets is a solid choice for Forex and CFD trading, offering competitive solutions with a diverse range of trading instruments and a low minimum deposit requirement. Regulated by several authoritative bodies, it provides a reliable foundation for traders. The broker supports popular platforms like MT4, MT5, and its own Hantec Social app for copy trading.

The asset selection is strong for Forex and CFDs, and it offers resources like Trading Central, a client portal, trading signals, and various market research tools. While the availability of these resources can vary depending on the jurisdiction.

Overall, Hantec Markets is an excellent option for traders seeking a well-regulated, user-friendly platform with competitive fees. However, those looking for a wider variety of assets or more extensive educational resources might want to consider other brokers.

Share this article [addtoany url="https://55brokers.com/hantec-markets-review/" title="Hantec Markets"]

Two months ago, I deposited 10k funds into a hantec account with my dollar debit card because I was promised low spread on the currency pair I wanted to trade (GBPJPY). *But going forward I noticed they kept increasing the spread on the pair gradually until it was so high as opposed to their initial promise. *So I decided to withdraw my money but it was cancelled over and over again, and they never sent me any withdrawal email. *I contacted the account manager and she stated that I can’t get my money back via the debit card method I had used before. After asking me to verify my bank account and to send my bank statement, *I was told I’ll be charged $230 for inactivity fee despite having traded for close to two weeks. *She said to avoid the inactivity fee I needed to trade a 30 standard lot size, but I refused and applied for another withdrawal letting them take the $230 inactivity fee. *They kept cancelling my withdrawal but were quick to take the $230 first. *After a week+ of placing the withdrawal request for my capital over again, regular calls, emails and messages, they finally sent the remaining funds but took an additional $40 making it a total of $270 they took from me for deciding to use their brokerage.

I have told my friends who I had recommended to Hantec to forgive me and withdraw their money from that scam brokerage.

I would advise anyone thinking about funding their account with Hantecmarket to contact me for proof and screenshot to verify my claim that Hantecmarket is a fraudulent brokerage.

The error occurred during registration, I want it corrected so I can fund my real account. Thank you.

My account was just verified. Though am trying to go into real trading for the first time. But I have wrongly entered four zero in the provision for zip code. Can this error be kindly corrected so I can find my account?

I have been trading with Hantec for more than 10 years. Recently, I have had serious technical issues with them. One time, I was not able to trade for more than 3-4 hours, and I told them that I needed to buy dow jones. I wasnt able to execute on that day and dow went up 1000 points. Then this time, they reset my account without telling me, and obviously the account was reseted erroneously. Somehow my leverage was completely adjusted down. So I was not able to execute my desired size at my desired entry levels. So I asked them to execute my trades instead of waiting till their technical issues is resolved, and of course they dont help me and this time US100 is up 60 points. So due to their technical errors, i missed my trades, despite me telling them BEFORE the market rally to execute the orders at what price and what stops.

This case has now been resolved, and my account has been properly adjusted.

can a beginner start with as low as 50 dollars to trade?

So for those starting with 5000$,are you saying there is a system.that trades for them.automatically? I didn’t really get the VIP part clearly?

Her name is Mrs Sheyi

Please i deposited 20k in hantec Zenith account but my account officer told me that the company will refund my money because they don’t accept ATM transferis it true? I made the transfer yesterday but up till now i haven’t received any payment.please i need your assistance.

What if my area falls under the regulation from Mauritius?

Spread very high

Respected,

I am from Pakistan & looking to switch my existing broker.

Please contact at your earliest.

Regards,

Asif

+92321-4871723

uniqueideas247@gmail.com

Any relation between Hajtec Markets and

the company below?

Hantec Global is the trading name of Hantec Global Ltd, it is regulated and authorized by 3 international regulations; Financial Conduct Authority (FCA) in Uk. Financial Service Commission (FSC) in the Republic of Mauritius, and. Australian Securities and Investment Commission (ASIC) in Australia