- What is Fxview?

- Fxview Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

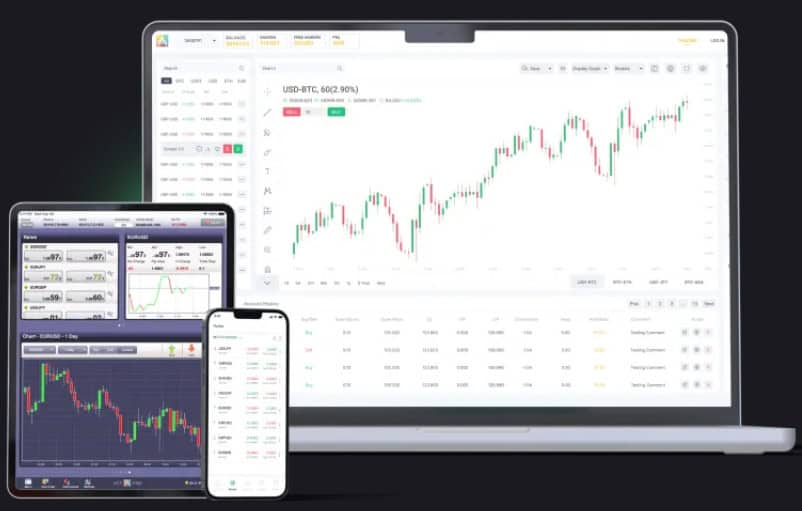

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Fxview Compared to Other Brokers

- Full Review of Broker Fxview

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is Fxview?

Fxview is a Forex trading brokerage firm that offers traders access to a variety of trading instruments, including Forex, CFDs, Commodities, Indices, Stocks, and Cryptocurrencies.

Based on our research, the firm is headquartered in Cyprus and is regulated by the reputable European regulatory body CySEC. Additionally, the broker possesses a license from the reputable South African FSCA. It also has a presence in Mauritius and India, being authorized by FSC and SEBI, respectively.

Overall, Fxview offers competitive trading conditions and efficient trade execution through advanced trading platforms, including the advanced MT5, ActTrader, and Zulu Trade.

Fxview Pros and Cons

Per our findings, the broker has advantages and disadvantages that are important for clients to consider. For the pros, Fxview offers competitive trading conditions, a low minimum deposit requirement, and access to the well-known MetaTrader 5 trading platform, ActTrader, and Zulu Trade. The firm also provides comprehensive educational materials, enabling clients to make informed trading decisions.

For the cons, there is no 24/7 customer support available. Additionally, the brokerage lacks a top-tier license, which could be a concern for traders who prioritize brokers with higher regulatory credentials. However, trading under CySEC and FSCA is considered safe enough.

| Advantages | Disadvantages |

|---|

| European license and oversight | No 24/7 customer support |

| Advanced trading platforms | No top-tier license |

| Good trading conditions | |

| Low fees | |

| Professional trading | |

| Competitive pricing | |

| Education | |

| Funding methods | |

| NDD/ECN execution | |

Fxview Features

According to our analysis, Fxview provides a reliable environment with favorable features, making it an attractive option for traders of various experience levels. The broker offers access to advanced platforms that allow users to trade diverse instruments. Below is a short visual for all the aspects of trading with Fxview:

Fxview Features in 10 Points

| 🗺️ Regulation | CySEC, FSCA, FSC, SEBI |

| 🗺️ Account Types | Raw ECN, Premium ECN, Islamic accounts |

| 🖥 Trading Platforms | MT4, MT5, ActTrader, ZuluTrade |

| 📉 Trading Instruments | Forex, CFDs, Commodities, Indices, Stocks, Cryptocurrencies |

| 💳 Minimum deposit | $50 |

| 💰 Average EUR/USD Spread | 0.2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is Fxview For?

We have carefully considered the broker’s proposal to see what it offers. Fxview’s services can be most beneficial for the following:

- European traders

- Clients from South Africa and the African Region

- Those who prefer the MT5 platform

- Zulu Trade enthusiasts

- International traders

- Forex Traders from India

- Currency trading

- Professional trading

- Beginners

- Advanced traders

- Competitive spreads and fees

- NDD/ECN execution

- Good education and trading tools

- EA/Auto trading

Fxview Summary

In summary, Fxview is a trustworthy Forex trading broker that offers competitive trading solutions, advanced trading platforms, and low fees and spreads. Another advantage is the low minimum deposit requirement and the availability of different payment methods. Additionally, traders have access to a wide range of educational materials that support them in expanding their knowledge and staying informed about the market.

Overall, we found that the firm provides a good trading environment; however, we advise conducting your research and evaluating whether the company’s offerings suit your specific trading requirements.

55Brokers Professional Insights

Considering overall Fxview’s proposal to determine how it meets the needs of clients, we conclude Fxview as a well-established broker, allowing traders from various regions to engage, including European, India and Africa markets. The conditions offered are favorable; there are distinct account types for its clients to choose the most suitable option based on your trading preference, while Trading platforms are advanced and equipped with some good and innovative features. Clients can choose from the MT5 platform, ActTrader, or ZuluTrade, each offering its own benefits and unique features.

The fee structure offers transparency and clarity, with spreads starting from 0.2 pips which are considered competitive. The instrument choice is wide, allowing diversity and market exposure. Additionally, the broker offers various promotional programs, free VPS, MAM, and PAMM account features, so is an option for account managers or those who prefer to follow a master account to engage.

As we found, the educational and research resources are also comprehensive, with webinars, a glossary, blog articles, and more. Customer support is available 24/5 through multiple channels.

Consider Trading with Fxview If:

| Fxview is an excellent Broker for: | - European traders

- Traders from India

- The MT5 platform enthusiasts

- Zulu Trade platform users

- Clients who prioritize free VPS

- Traders looking for a wide range of instruments

- Beginner and professional clients

- Novice traders looking for good education

- Islamic traders

- Cost-conscious traders

- Traders from South Africa and the African Region

|

Avoid Trading with Fxview If:

| Avoid Trading with Fxview If: | - Traders preferring the MT4 platform

- Traditional investors

- Clients from certain regions, such as the US |

Regulation and Security Measures

Score – 4.5/5

Fxview Regulatory Overview

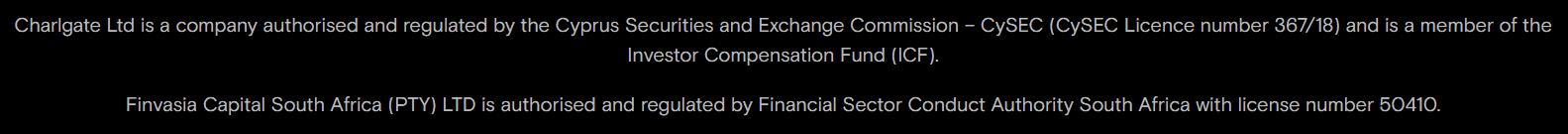

Fxview is a trustworthy broker, ensuring a low-risk Forex trading environment. It is authorized and regulated by the well-regarded Cyprus Securities and Exchange Commission (CySEC) and the FSCA in South Africa.

What we found is that Fxview is a legitimate brokerage firm for those looking to invest and manage their assets. The broker’s compliance with industry standards is assured by its regulation under reputable authorities.

- The broker also holds a license from the SEBI, providing reliable services in India.

- However, the broker also holds an offshore license. Therefore, before engaging in trading activities, traders should carefully consider and understand the differences while trading in different jurisdictions.

How Safe is Trading with Fxview?

According to our findings, Fxview adheres to industry standards and compliance requirements, which include client fund protection and segregation from company funds. Moreover, the firm offers additional protections, such as negative balance protection, which ensures that traders do not incur losses exceeding their account balance.

However, it is essential to conduct thorough research and carefully examine the broker’s documentation, legal agreements, and policies. It will provide a comprehensive understanding of the specific trading protections offered by the platform, as trading conditions can vary across jurisdictions.

Consistency and Clarity

Since its establishment, Fxview has offered consistent and constantly developing services to please its clients worldwide. The broker has acquired top-tier licenses and established its services in various regions to be available for traders globally.

Per our findings, Fxview has been recognized and awarded over time. It has earned multiple awards for its dedicated and quality services. The feedback from clients is also positive, with praises about fast execution, dedicated customer support, and very low raw spreads.

Overall, the broker has a favorable record and appealing offerings, attracting both beginners and professionals. From our side, we recommend checking the differences in conditions between the entities.

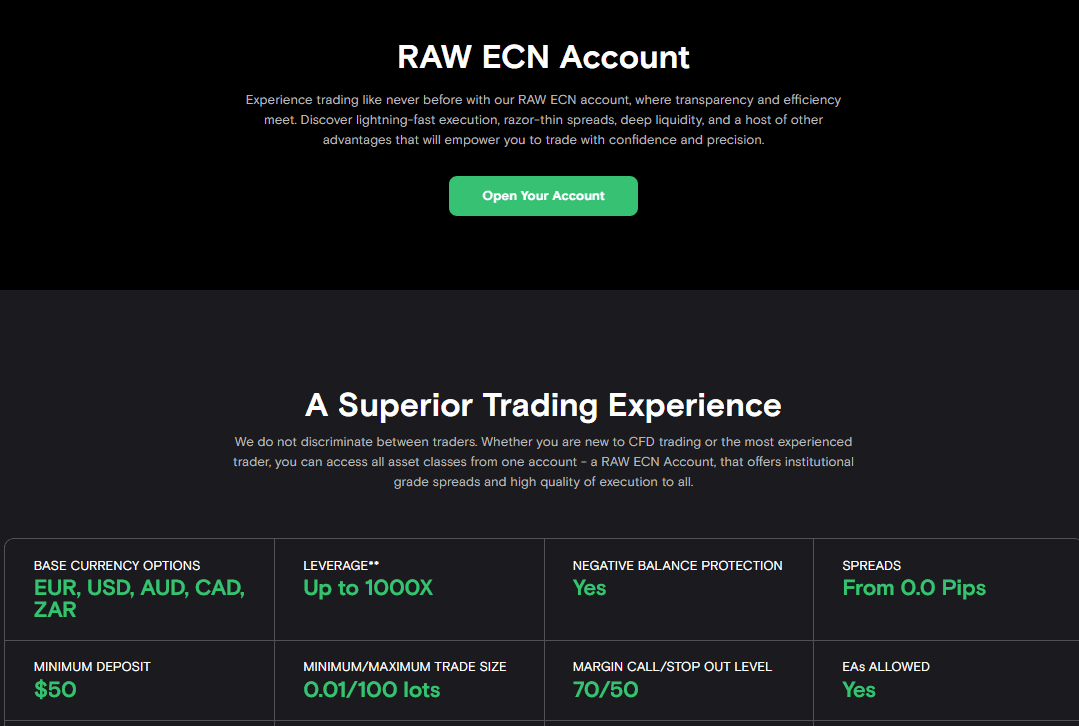

Account Types and Benefits

Score – 4.5/5

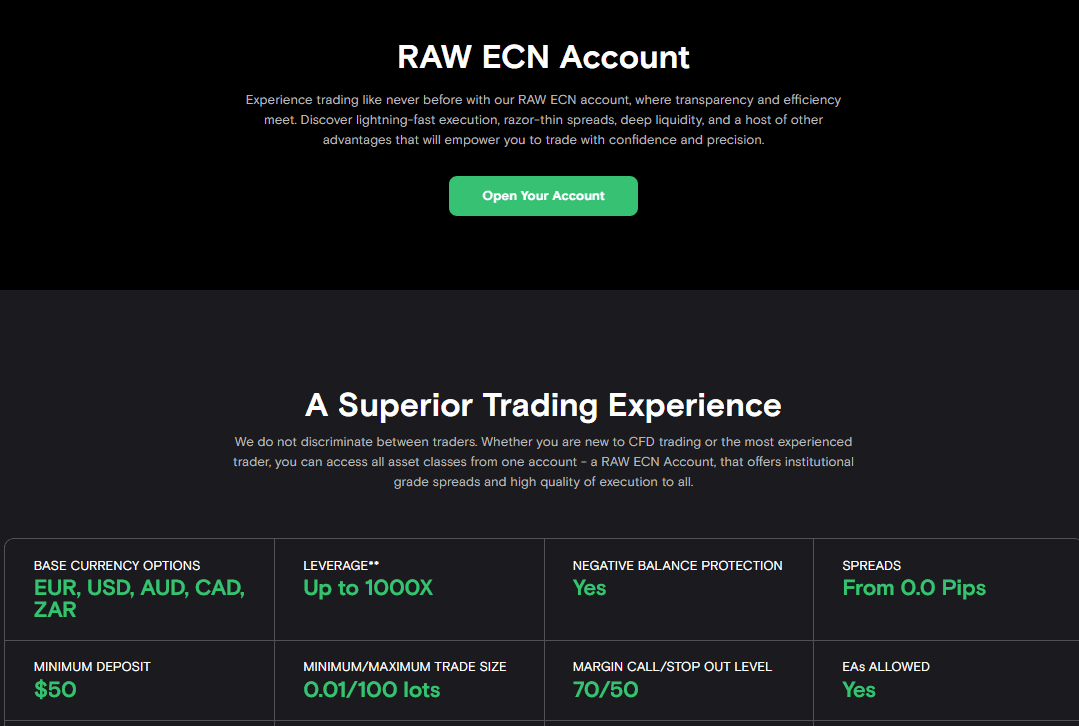

Per our research, the broker offers RAW ECN and Premium ECN accounts that might suit the needs of different traders. Additionally, Fxview provides Islamic Accounts for religious purposes.

The conditions for each account are distinct, allowing clients access to different fee structures and overall trading features.

- The Raw ECN account is a spread-based account with very low spreads, depending on the instrument traded. The account offers various base currencies, high leverage of up to 1:1000, multiple trading strategies, and a low minimum deposit requirement of $50. All these features make the account a favorable option for beginner to intermediate traders.

- The Premium ECN account will be a good match for more professional and experienced clients. With its commission-based fee structure, the Premium ECN account offers spreads at 0.0 pips, combined with low commissions of $1 per side per lot. This reasonable fee structure, appealing conditions, and high leverage make the account suitable for clients who prioritize razor-sharp spreads, fast execution, and diverse opportunities. The minimum deposit requirement for this account type is $5000.

- The Islamic account is a good opportunity for Islamic traders. The account provides Negative balance protection for safety measures. The account base currency is USD. Trades are conducted through the popular MT5 platform. Spreads for this account type start from 0.6 pips.

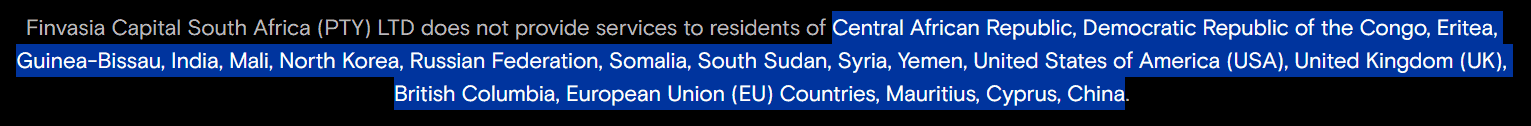

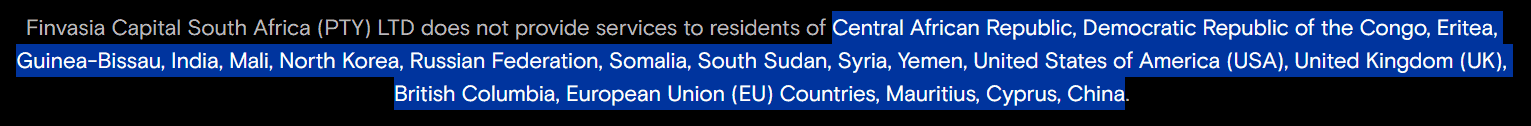

Regions Where Fxview is Restricted

Due to its multiple regulations in the European region, South African region, India, and globally, Fxview offers its services to a large list of countries. Yet, due to regulatory restrictions, the services are not reachable for residents of the countries listed below:

- Central African Republic

- Democratic Republic of the Congo

- Eritea

- Guinea-Bissau

- Mali

- North Korea

- Russian Federation

- Somalia

- South Sudan,

- Syria

- Yemen

- United States of America

- United Kingdom

- British Columbia

- Mauritius

- China

Cost Structure and Fees

Score – 4.4/5

Fxview Brokerage Fees

After examining the broker’s fee offering, we found that Fxview offers competitive pricing for most trading services. The firm does not impose deposit and withdrawal fees; however, additional charges may be applicable during trading activities as well.

Therefore, carefully review the broker’s fee structure and terms and conditions to understand the associated fees and their potential impact on trading operations.

Based on our test trade, the platform provides competitive spreads with an average spread of 0.2 pips for the EUR/USD currency pair in the Forex market. However, spreads can vary based on market conditions, volatility, and liquidity, so consult the broker’s website or contact customer support for detailed information on the spreads they offer for specific instruments and account types.

Besides, each account type offers different fee structures; thus, for the Raw ECN account, all the charges are included in spreads, whereas the Premium ECN account offers spreads from 0.0 pips, combined with commissions. On the other hand, for the Islamic account, the average spread is 0.6 pips.

As we found, Fxview offers one commission-based account, the Premium ECN account. The account is suitable for professional clients who prioritize very low spreads and fixed transaction fees. The applied commission of $1 per lot is one of the lowest offerings in the market.

How Competitive Are Fxview Fees?

From our test trades, it becomes evident that Fxview offers competitive fees for all of its account types. Generally, prices depend on several factors, including the chosen account type, the instrument, and the entity.

Fxview offers both spread and commission-based accounts, meeting various trading expectations. The average spreads start at 0.2 pips for the EUR/USD pair. The applied commissions are some of the smallest in the market, at $1 per side per lot.

All in all, the broker has a transparent fee structure with no hidden charges. Traders should also check charges for each entity, as the costs may vary depending on the jurisdiction.

| Asset/ Pair | Fxview Spread | Capital.com Spread | TD Markets Spreads |

|---|

| EUR USD Spread | 0.2 pips | 0.6 pips | 1.8 pips |

| Crude Oil WTI Spread | 0.02 | 0.4 | 2 |

| Gold Spread | 0.16 | 0.03 | 8 |

Fxview Additional Fees

The first thing we noticed while considering the broker’s fees is that there are no deposit or withdrawal fees applied.

- As we found, Fxview applies an inactivity fee of $10 per month for accounts that have been dormant for over 12 months.

Score – 4.5/5

Fxview provides a diverse range of trading platforms to cater to the varied needs of its users. Traders can choose from popular and versatile options such as MT5, known for its advanced charting tools and automated trading capabilities.

Additionally, the broker offers ActTrader, with a user-friendly interface and robust features. For those interested in social trading, the platform integrates with ZuluTrade, enabling users to follow and replicate the strategies of experienced traders.

| Platforms | Fxview Platforms | Capital.com Platforms | TD Markets Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Fxview Web Platform

Fxview supports web trading through its MT5 and ActTrader platforms, ensuring a seamless and user-friendly experience. With its advanced technologies, intuitive design, and real-time data, both platforms allow trading from the browser without installation or downloads. The platforms include all the features of the desktop platforms, assisting with quick decision-making.

Fxview Desktop MetaTrader 4 Platform

During our research, we noticed that Fxview used to offer the popular and easy-to-use MT4 platform. However, the broker has updated its proposal, and as a result, the MT4 platform is no longer available. Novice traders will find this change a drawback.

Fxview Desktop MetaTrader 5 Platform

We found that the broker offers a robust set of trading tools designed to enhance the trading experience for its users. The broker’s MT5 platform comes equipped with a variety of technical analysis tools and indicators.

Traders can use 36 technical indicators, 44 analytical objects, 21 timeframes, and numerous charts. The MT5 platform also allows traders to design their own EAs or test ready-to-use automated trading systems. At last, clients can benefit from the platform’s built-in economic calendar and news streaming capabilities.

These comprehensive trading tools cater to the diverse needs and preferences of traders, empowering them with the resources necessary for effective decision-making in the financial markets.

Fxview ActTrader

The broker’s ActTrader enhances the trading experience with its intuitive interface and a range of analytical tools. Traders can adjust the interface by combining charts and adding or removing windows.

ActTrader users can also create automated strategies with the visual strategy editor. The platform also supports autotrading. Besides, clients can create robots directly from charts.

Fxview MobileTrader App

Clients can easily download the mobile versions of the MT5 or ActTrader platforms. The app versions of the platforms are advanced and innovative, maintaining all the essential features and variety. Both Android and iOS versions are available, ensuring easy access for everyone. The apps allow clients good functionality, flexibility, and an efficient trading experience on the go.

Main Insights from Testing

Fxview allows good versatility of platforms, including the popular MT5 and ActTrader, both of which stand out for their great capabilities. Traders can enter their accounts through web, desktop, and mobile apps, supporting convenience and functionality. All the platforms are easily downloadable and have all the essential tools and features for an efficient trading experience.

In addition, access to Zulu Trade enables clients to interact with seasoned traders and copy their trades directly into their platform. It is not only an excellent chance for alternative investments, but also a perfect opportunity to learn from the pros.

AI Trading

Based on our research, Fxview offers AI-assisted tools for the automation of trades. It also provides a free API, an attractive chance for trade automation. However, the broker does not include fully AI-powered tools.

Trading Instruments

Score – 4.4/5

What Can You Trade on the Fxview Platform?

Fxview provides access to popular trading instruments, such as Forex, CFDs, Commodities, Indices, Stocks, and Cryptocurrencies. The broker enables traders to diversify their portfolios and participate in various markets according to their individual preferences and trading strategies.

- Fxview supports over 70 Forex pairs and makes it a perfect choice for currency traders.

- The broker is also a favorable option for CFD traders, as all the available products are based on CFDs, allowing clients to profit from small price fluctuations. On the other hand, it means traditional traders cannot make investments or own assets.

Main Insights from Exploring Fxview Tradable Assets

We have researched the broker’s instrument proposal to see how it supports traders in expanding their portfolios. The overall number of instruments is 500 with 70 currency pairs, four cryptocurrencies, eight commodities, over eleven global indices, and 400 stocks on CFDs.

This is not an extensive offering, but it allows measured diversity. Conditions and trading charges for each instrument are favorable and in line with or lower than the market average.

- Note that the availability of instruments may also depend on the jurisdiction.

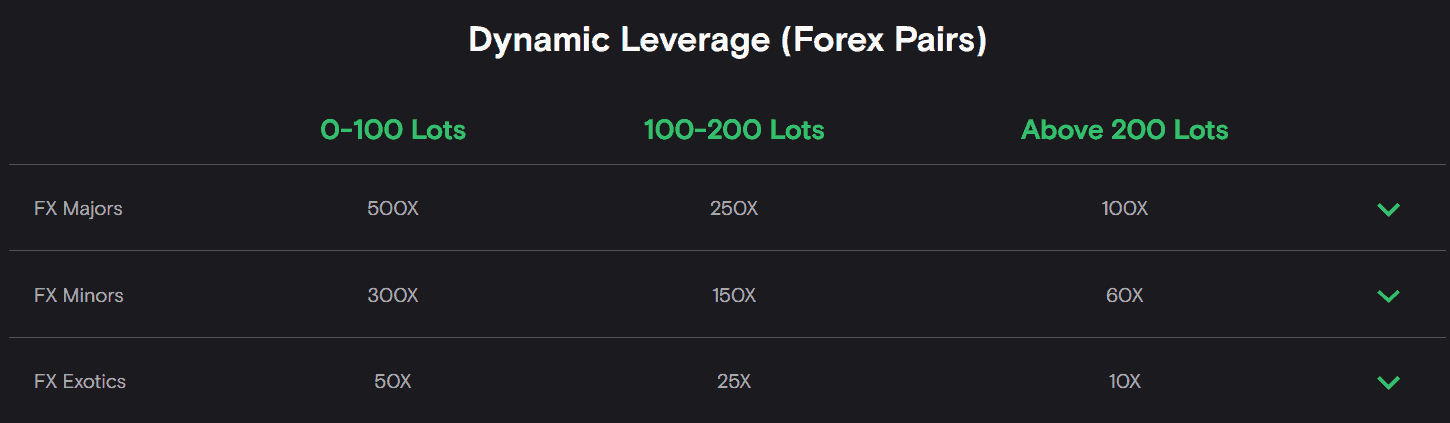

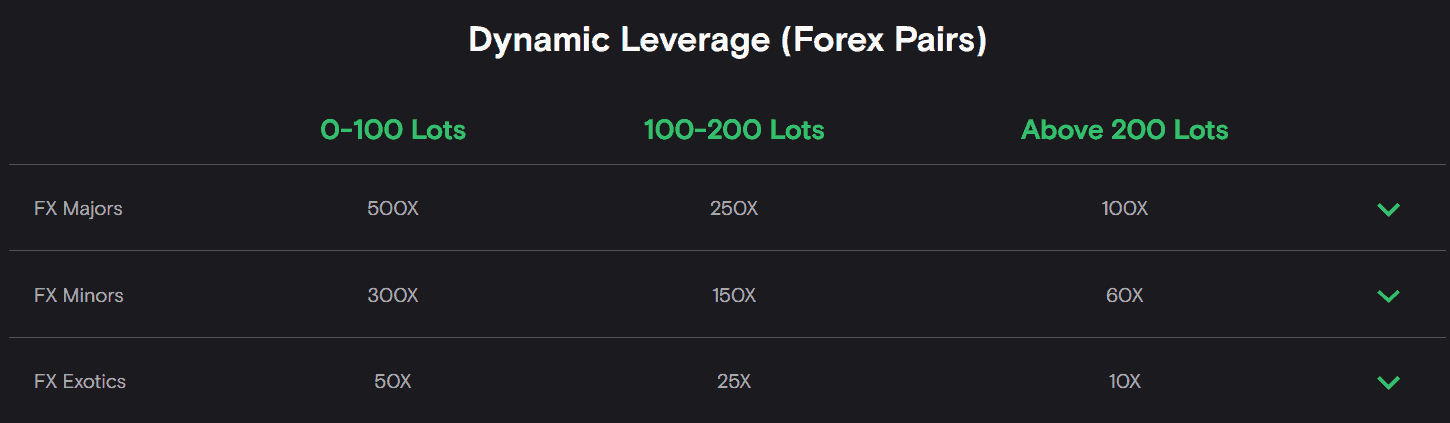

Leverage Options at Fxview

Leverage is a valuable tool that allows traders to enter the market with limited capital. However, traders understand that it can result in substantial gains or losses. Therefore, they must have a comprehensive understanding of how leverage operates and its potential consequences before engaging in any trading activities involving leverage.

Fxview offers leverage according to CySEC, FSCA, FSC, and SEBI regulations:

- European and South African traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- Indian traders may use a maximum of up to 1:50 for major currency pairs.

- International traders may use higher leverage up to 1:1000, so understanding the implications and risks associated with leverage is important before making decisions about its use in trading.

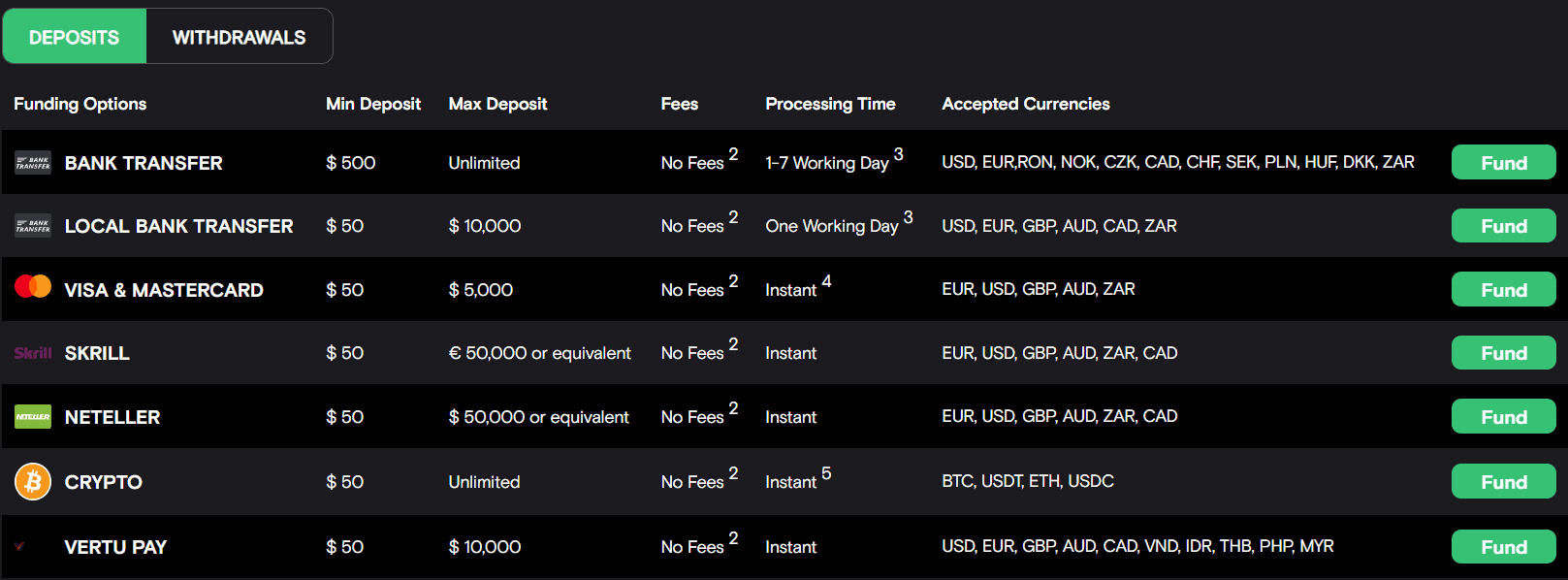

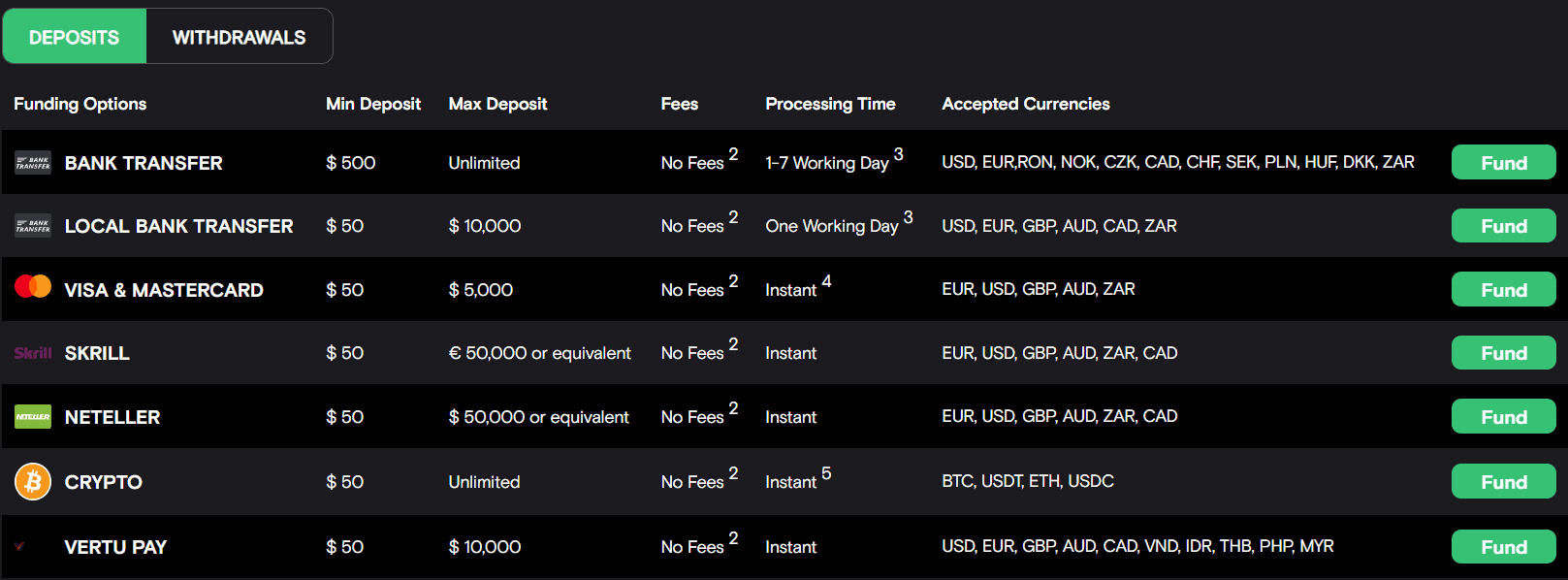

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Fxview

The broker offers a variety of funding methods for traders to deposit funds into trading accounts, including Bank Wire Transfers, Credit/Debit cards, and E-wallets. However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved.

- As we found, Fxview does not apply transaction charges for deposits and withdrawals.

Minimum Deposit

Based on our analysis, the withdrawal process is both convenient and swift. The broker typically processes withdrawal requests within one day. To open a Premium ECN account, clients are required to make an initial deposit of $5,000.

Withdrawal Options at Fxview

We have found that Fxview does not apply any withdrawal fees; however, the payment provider may do so, so clients should be careful.

There are limits on the withdrawal amount based on the funding method. The minimum withdrawal is $50. Skrill and Neteller allow one-time withdrawals of $50.000. Other methods usually limit withdrawals to $50.

- Additionally, at the time we reviewed Fxview, withdrawals via Mastercard are temporarily unavailable. Thus, we recommend checking thoroughly.

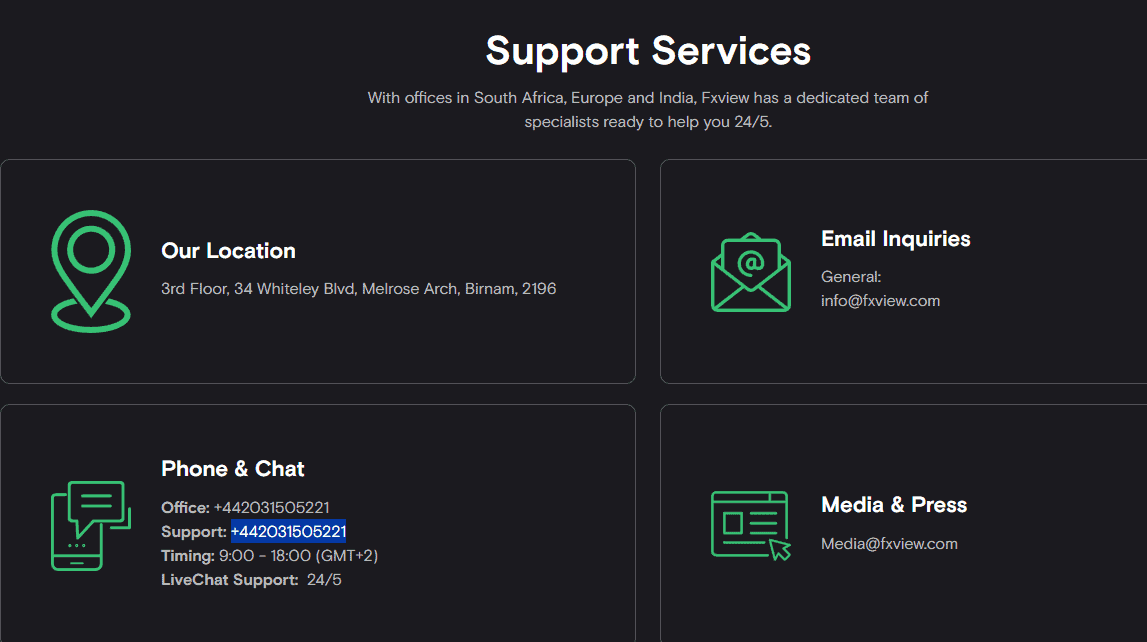

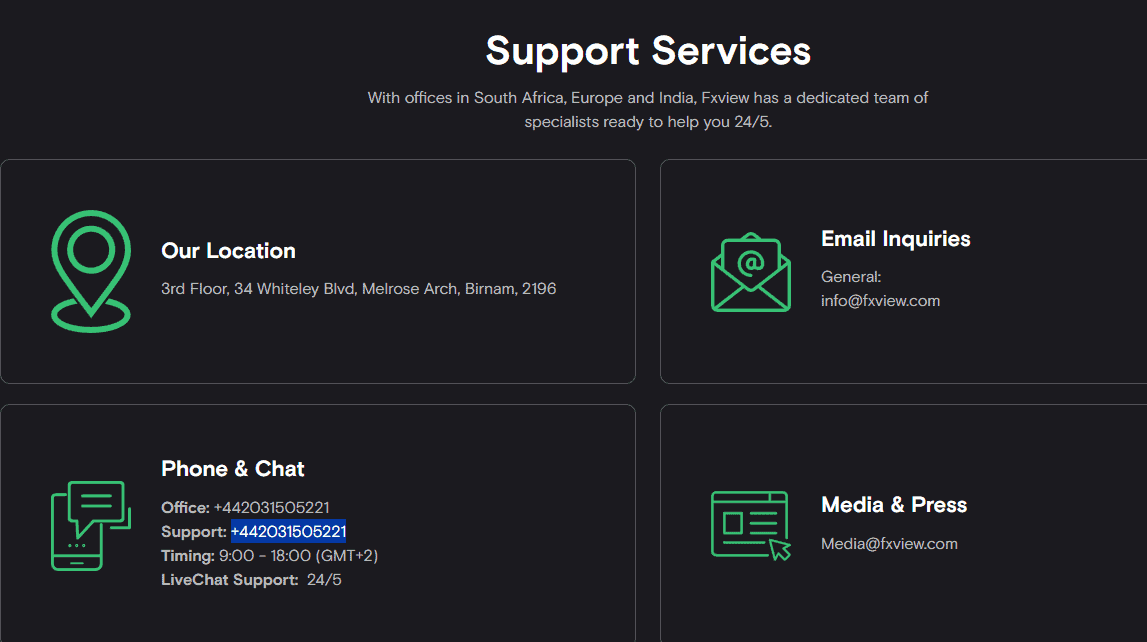

Customer Support and Responsiveness

Score – 4.6/5

Testing Fxview Customer Support

The broker provides 24/5 customer support via live chat, email, and phone lines. Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

- The broker also has an informative FAQ section with answers to the most essential trading-related questions, offering detailed information on account types, trading platforms, bonus offers, trading tools, affiliates, and more.

Contacts Fxview

Fxview stands out for its dedicated support through multiple options.

- The live chat is a quick way to receive prompt solutions and answers.

- Clients can direct requests and questions by using the available email address: info@fxview.com.

- Also, clients can use the available phone numbers: +442031505221.

- Another way to contact the support team is to fill out the contact form on the broker’s website.

- At last, Fxview is active on social media, including IG, Facebook, LinkedIn, YouTube, X, and Reddit.

Research and Education

Score – 4.5/5

Research Tools Fxview

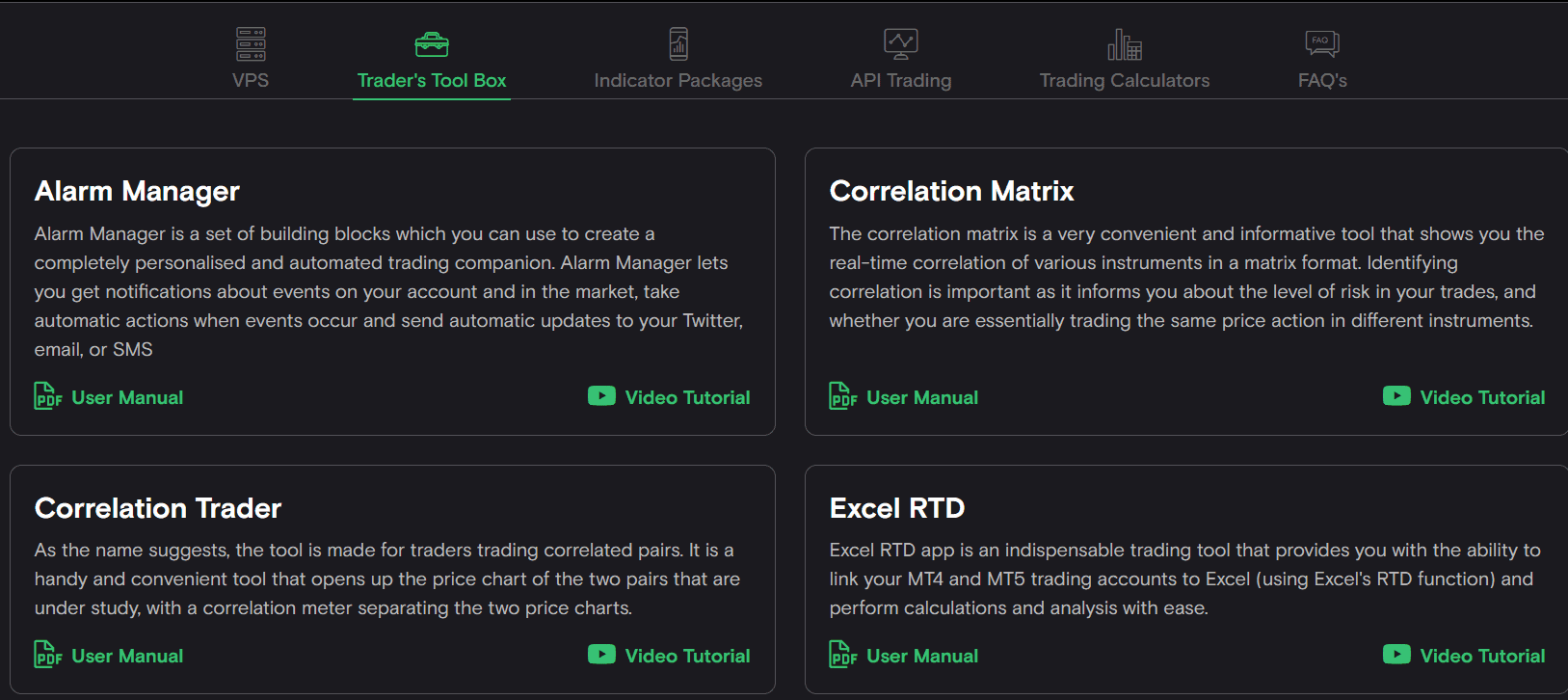

Fxview offers great research tools both through its advanced platforms and the features available independently on its website. Traders can benefit from the following tools to enhance their trading experience and make informed decisions:

- Thanks to the free VPS, the broker’s clients can enjoy fast trade execution and ultra-competitive spreads. The VPS is provided when clients deposit $5000 or more.

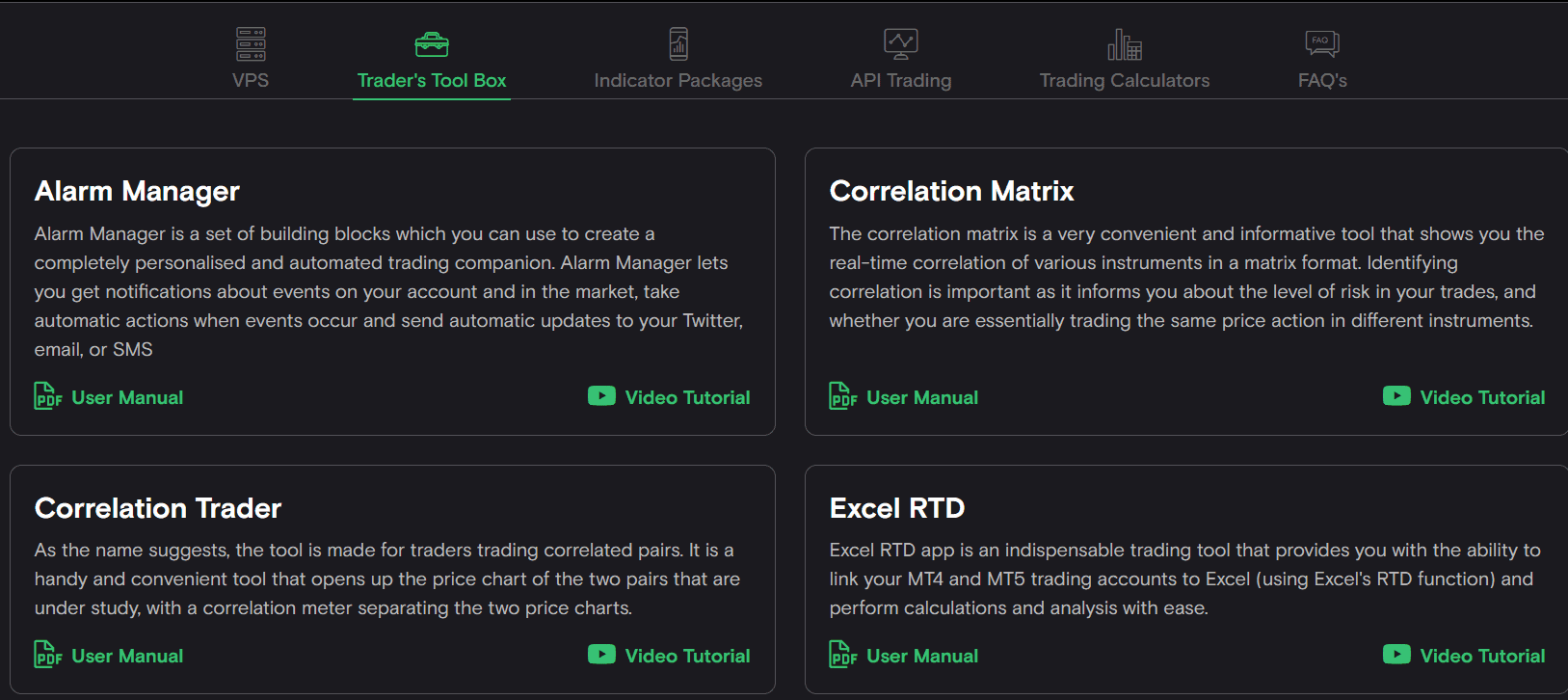

- The Trader’s Toolbox includes essential tools that can radically enhance trading outcomes. It offers an Alarm Manager, Correlation trader, Market manager, Sentiment trader, Stealth orders, Trade Terminal, Correlation matrix, Excel RTD app, Mini Terminal, Session map, and Tick Chart Trader.

- Fxview also offers an innovative Indicator Package that includes a Mini chart indicator, Pivot point, Magnifier, Bar Changer, Keltner Channel, and more useful tools and features.

- API Trading is another tool to enhance the agility and precision that traders seek. The Rest API is provided free, while to access the FIX API, traders need to maintain a $10,000 monthly balance.

Education

The education section of Fxview is also rather impressive. The broker offers a variety of learning materials, including video tutorials, webinars, glossaries, market insights, an economic calendar, and more. These resources are all designed to enhance the knowledge and skills of traders.

- The availability of a Forex Glossary helps beginner traders to comprehend complicated market expressions and terms.

- The availability of webinars is an advantage for all traders. Each trader can find a topic that will enhance their knowledge and skills.

Is Fxview a Good Broker for Beginners?

Fxview is a great broker for beginner traders. It includes a range of instruments, advanced platforms, and account types tailored for different needs and expectations. The minimum deposit requirement is $50, an attractive proposal for cost-conscious traders.

- Besides, the availability of a demo account is another advantage, allowing clients to practice in a risk-free environment.

- Fxview offers comprehensive educational materials tailored for beginners and professionals. The availability of educational resources builds a perfect knowledge base for traders. To build a successful trading journey.

Portfolio and Investment Opportunities

Score – 4.4 /5

Investment Options Fxview

Fxview allows clients to diversify their portfolios and get exposure to the market. The broker offers over 500 instruments. It is especially favorable for currency trading as it offers more than 70 currency pairs with favorable prices and conditions.

The broker does not, however, support long-term and traditional investments.

- Fxview also supports alternative investment options, such as Copy trading, MAM, and PAMM account features.

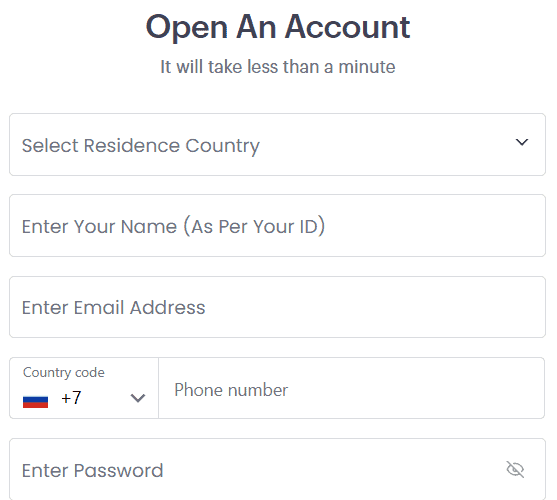

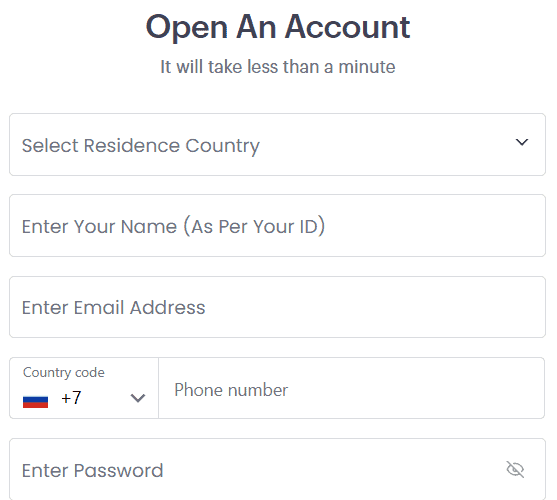

Account Opening

Score – 4.5/5

How to Open a Fxview Demo Account?

We found that Fxview also offers a demo account, an easy way to practice without financial risk. The demo account is active if used for 30 consecutive days. However, after the expiration, clients can ask for an extension. Through the Fxview demo account, clients can trade with $10,000 virtual balance.

Here is a step-by-step guide on how to open a demo account with Fxview.

- Visit the broker’s website and choose the demo option.

- Fill out the registration form with the requested information (name, email, phone number, etc.)

- Verify your email via a confirmation link.

- Choose the trading platform and other account specifications.

- Get the virtual funds and start trading.

How to Open a Fxview Live Account?

Opening an account with the broker is an easy process, as you can log in and register with Fxview within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Get Started” page.

- Enter the required personal data (name, email, phone number, etc.)

- Verify your data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Score – 4.2/5

The broker includes useful tools in its proposal, enabling traders to access innovative and advanced features for profitable trading. In its research and education section, the broker offers multiple features, such as an economic calendar, trading calculators, VPS, FIX API, and other innovative and helpful tools to elevate the trading experience.

- Besides, Fxview stands out for its promotions and bonuses, enabling traders to benefit from features like Refer a friend, 100% Deposit bonus, a Fxview Loyalty Program, and more.

- The broker also supports White labels solutions and the IB Program.

Fxview Compared to Other Brokers

We have also compared Fxview to other brokers, to see where it stands in the market and what it stands out for.

With regulations from CySEC, FSCA, FSC, and SEBI, Fxview ensures safety, reliability, and adherence to strict rules. Other brokers we reviewed have similar or even more stringent oversight, such as XM with licenses from ASIC, CySEC, FSC, and DFSA.

The trading costs applied by Fxview are lower than the market average, with spreads of 0.2 pips and commissions of $1, which is lower than most brokers offer, including FXPrimus (1.5 pips) and FXTM (1.5 pips).

Fxview offers an average range of instruments (over 500 products). Compared to FXPro Markets with its 160 instruments, Fxview surely allows more diversity. However, clients have access to 1000+ products with XM, IC Markets, and FXTM. The platform offering of Fxview is also impressive, with advanced platforms like MT5, ActTrader, and Zulu Trade. On the other hand, traders have access to only WebTrader with XPro Markets.

Ultimately, the education section offered by Fxview is comprehensive, featuring engaging learning materials and extensive research tools. However, XM stands out in the market for one of the most comprehensive educational sections.

| Parameter |

Fxview |

XPro Markets |

XM |

HFM |

FXPrimus |

IC Markets |

FXTM |

| Spread-Based Account |

Average 0.2 pips |

Average 2.5 pips |

1.6 pips |

Average 1 pip |

From 1.5 pip |

From 1 pip |

Average 1.5 pips |

| Commission-Based Account |

0.0 pips + $1 |

No commissions |

Only on Shares Account |

0.0 pips + $3 |

0.0 pips + $2.5 |

0.0 pips + $3.50 |

0.0 pips + $3.5 |

| Fees Ranking |

Low/ Average |

Average |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

| Trading Platforms |

MT5, ActTrader, Zulu Trade |

WebTrader |

MT4, MT5, XM WebTrader |

MT4, MT5, HFM App |

MT4, MT5, WebTrader |

MT4, MT5, cTrader |

MT4, MT5 |

| Asset Variety |

500+ instruments |

160+ instruments |

1,000+ Instruments |

500+ instruments |

200+ instruments |

1,000+ instruments |

1,000+ instruments |

| Regulation |

CySEC, FSCA, FSC, SEBI |

FSCA |

ASIC, CySEC, FSC, DFSA |

FCA, DFSA, FSCA, FSA, CMA, FSC |

CySEC, VFSC |

ASIC, CySEC |

FCA, FSC, CMA |

| Customer Support |

24/5 |

24/7 |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

| Educational Resources |

Excellent |

Good |

Excellent |

Good |

Basic |

Good |

Good |

| Minimum Deposit |

$50 |

$250 |

$5 |

$0 |

$15 |

$200 |

$200 |

Full Review of Broker Fxview

Based on our research, we can conclude that Fxview is a trustworthy broker with an extensive offering and good standing in the market. Due to its multiple regulations, the broker is present in over 180 countries, delivering high-quality and diverse services to both beginner and professional-level clients.

Fxview is regulated by respected authorities, including CySEC, FSCA, FSC, and SEBI, ensuring adherence to stringent rules and various safety measures in place. The broker is a favorable choice for many, including various account types tailored for small-scale clients, experienced traders, and Islamic clients. All the accounts offer very low spreads, with an average of 0.2 pips, and a fixed commission of $1 per side per lot (for the commission-based account), which is again lower than the market average.

Another advantage we found is the broker’s advanced platforms, packed with innovative tools and features. The MT5 platform, ActTrader, and Zulu Trade are all advanced and sought-after platforms that can elevate the trading experience. The availability of Copy trading, MAM, and PAMM features makes the offering even more attractive for traders looking for alternative ways for investments.

The comprehensive education and research tools will let traders enrich their market knowledge and make informed decisions. Traders can benefit from an excellent assortment of research features, as well as webinars, a trading glossary, and more. The Fxview clients can also receive various promotions and bonuses.

Share this article [addtoany url="https://55brokers.com/fxview-review/" title="Fxview"]

Those looking for all in one kind of a broker, don’t need to go anywhere else. Fxview has competitive conditions like $0 commission, faster execution, user-friendly platforms, helpful customer support and educational resources. Top Notch broker.

I’ve been using the premium ecn account. I’m impressed with its fast execution and spreads from 0.0 pips. Highly recommend it!