OvalX 2025 Review

-

Updated:

Leverage: 30:1

Regulation: FCA

Min. Deposit: 100 GBP

HQ: UK

Platforms: TraderPro, MT4

Found in: 1965

OvalX Licenses

- Monecor (London) Ltd - authorized by FCA (UK) registration no. 124721 - not active

Advertising Disclosure

Updated:

Leverage: 30:1

Regulation: FCA

Min. Deposit: 100 GBP

HQ: UK

Platforms: TraderPro, MT4

Found in: 1965

OvalX Licenses

OvalX, previously known as ETX Capital, is quite an old company with a history dating back to 1965, that nowadays acts as a global provider of online FX and CFD trading innovative technology and gives an opportunity to access up to 6000 markets, supported by the strong customer service team and enhanced opportunities through FCA regulated guidelines.

It is true that OvalX’s primary business is heading more toward institutional clients, yet as retail trading becomes more and more popular on a daily basis, OvalX expanded its offering to global traders as well. Even though online trading offering is active for the last 15 years, it now became one of the competitive trading solutions, and what is more important a reliable solution.

Based on our expert findings, OvalX is a highly reliable broker with top-tier regulation that ensures traders a safe trading environment providing client protection and compensation. The broker has a good selection of FX and CFD instruments with low trading fees and spreads through the industry-standard MT4 platform. Moreover, Spread Betting is available for UK traders. The broker is also famous for providing institutional financial features to retail brokers.

On the negative side, there’s not enough information on conditions provided by the broker as well as a narrow market range including only FX and CFD instruments and it doesn’t provide trading of cryptocurrencies. Also, the broker’s customer support can be reached only during business days.

| Advantages | Disadvantages |

|---|---|

| FCA regulated Broker | Only FX and CFD trading |

| Good reputation and long years of operation | No 24/7 support |

| Negative Balance protection | Trading conditions are not clear |

| Compensation Scheme | |

| Provides institutional financial services | |

| Low spreads and Fees | |

| Global expansion across the globe |

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA |

| 📉 Instruments | 50+ Forex pairs, commodities, CFD products or spread betting |

| 🖥 Platforms | TraderPro, MT4 |

| 💰 EUR/USD Spread | 0.6 pips |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | $100 |

| 💰 Base currencies | GBP, USD, EUR |

| 📚 Education | Trading education on a very high level |

| ☎ Customer Support | 24/5 |

Overall, our impression of the broker was positive, it is a reliable broker with good service and long years of operation. The broker is suitable for clients from different countries, the fees offered are among the lowest as well as the spreads for FX pairs.

| Ranking | OvalX | XM | BlackBull Markets |

|---|---|---|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantage | Low Spread | Education | Leverage |

However, we found the broker has not a very wide range of markets offering only FX and CFD trading instruments and doesn’t have a cryptocurrency option. It also doesn’t provide a high leverage trading which is a regulatory case, so here we gather some alternative Brokers for your consideration:

Overall, for its strives and achievements, OvalX has gained various awards and gained international recognition, which ensures the quality of OvalX trading services, not only from reputable issuers but from the traders’ community as well.

Also, the educational section eas poor so beginners might look for other options. Here we suggest you to look through some alternative brokers and their offerings:

No, OvalX is not a scam. It is a reliable broker with top-tier regulation and a secure trading environment offering traders safe and transparent conditions with protection and compensation programs.

OvalX is an online trading name of Monecor (London) Limited, the firm headquartered in London and authorized by the Financial Conduct Authority, as well as an active member of the London Stock Exchange.

These set of authorized controls include the most important thing to keep customer money secure that including but not limited to daily security checks for sufficient regulatory capital, separation of the client’s funds which are also kept in investment-grade rated UK banks, participation in schemes that covers traders in case of insolvency and many more.

See our conclusion on OvalX Reliability:

| OvalX Strong Points | OvalX Weak Points |

|---|---|

| FCA regulated | None |

| Global Expansion | |

| Negative balance protection | |

| Compensation Scheme | |

| Good Reputation and long years of operation |

Leverage is an opportunity for traders to borrow funds from other brokers with the aim to amplify their returns from an investment. Always note that the leverage bears risks and can potentially lead to the loss of all your funds, so be cautious and calculate your chances beforehand.

OvalX Leverage offer a potentially appropriate opportunity to their traders since increased leverage may also increase trading risk, however leverage always is a regulated offeringn:

To simplify the account opening process, OvalX provides its clients with one standard trading account, while the only choice goes to the platform that offers three different elaborated platforms, allowing them to select the one that suits the best. The broker also offers to open a demo account upon proceeding to real trading to improve your trading skills.

| Pros | Cons |

|---|---|

| Fast digital account opening | Only one account type |

| Low minimum deposit | |

| Demo Account |

Based on our findings, OvalX offers its clients access to 60+ forex pairs, worldwide indices, over 1000 US and European shares, and commodities all through CFD; the broker’s offerings also include spread betting for UK residents.

As a former institutional financial service provider, OvalX started providing its retail clients with numerous powerful features that were previously available for institutional clients only.

The OvalX follows the strategy of tight spreads since tighter the spread smaller the distance that the market in question has to move in, so you can benefit and enjoy truly competitive pricing.

OvalX trading fees are built into the OvalX spread and are considered to be on a very competitive level among the market offering. It offers commission-free stock CFD trading while non-trading fees are low. As for forex fees, they are average.

| Fees | OvalX Fee | ICM Capital Fee | ActivTrades Fee |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | Low |

OvalX’s spreads tariffs are provided via access to the institutional greed of pricing, the OvalX trading fees are built into the spread.

As you can see below, the OvalX spread is a very competitive offering among the market, as Forex spreads start at 0.7 pips for EUR/USD, Equities – 0.08 indicative spreads for some stocks, Commodities– minimum spreads starting from 3 pips, Indices– minimum spreads starting from 1 pip for certain major indices.

“Typical” spreads for noted pairs represent the median and are tracked during a specified time frame, however, spreads may vary based on market conditions, including volatility, available liquidity, and other factors.

| Asset | OvalX Spread | ICM Capital Spread | ActivTrades Spread |

|---|---|---|---|

| EUR USD Spread | 0.6 pip | 1.3 pip | 0.63 pips |

| Crude Oil WTI Spread | 0.03 | 4 | 3 |

| Gold Spread | 0.4 | 35 | 35.75 |

From what we found, OvalX offers a range of popular ways to deposit money into the trading account that allows you to choose among major Credit and Debit Cards except for AMEX, Wire Transfers, Online Bank Transfers, as well several forms of e-payment UnionPay, Skrill, Sofort, giropay and Neteller.

Here are some good and negative points for OvalX funding methods found:

| OvalX Advantages | OvalX Disadvantages |

|---|---|

| 100 GBP minimum deposit | None |

| Fast digital deposits via Credit/Debit, Bank Transfers, and multiple e-payments | |

| Free Deposit and Withdrawal processes |

OvalX minimum deposit amount is £100 or the currency equivalent.

OvalX minimum deposit vs other brokers

| OvalX | Most Other Brokers | |

| Minimum Deposit | $250 | $500 |

OvalX also applied a competitive proposal for a withdrawal option, as supplies each trading account with five withdrawals over USD 100 within each month without a processing fee or withdrawal fee. Further on, in case you wish to withdraw more funds then it will incur a charge of 25$ per transaction.

OvalX Platform offering a choice between proprietary platform and industry-leading MetaTrader4. While Broker brings trading opportunities with access to 5,000 markets and spread betting round-the-clock with a variety of tailored price alerts through email or texts, customized charts and indicators, limits, drag and drop stops, as well as educational and analysis support.

Trading Platform Comparison to Other Brokers:

| Platforms | OvalX Platforms | Pepperston Platforms | AvaTrade Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Platform | Yes | Yes | Yes |

Likewise, you still have a choice to use an industry-leading MetaTrader4 that is famous for its charting package, selection of automating capabilities or ability to bring your own EAs to automate orders. MT4 is a global platform with around worlds presence, the highest implemented security and execution offers, that gained the highest rankings and it is smart enough from OvalX to propose both platforms to your convenience.

Moreover, OvalX offers all of its platforms in mobile format, meaning that you can access your TraderPro platform on your Apple or Android phone or tablet. Nowadays, most traders execute positions wherever they are, that’s why OvalX trading allows you to move around freely while you trade.

The tools are available on both platforms that OvalX stays on and includes proprietary OvalX previously known as ETX TraderPro, a truly powerful, fully customizable software, yet with intuitive design and advanced charting. OvalX features flexible graph options and is a platform with the highest-grade professional tools, bringing highly interactive trading with a chance to embrace significant risk in the ambition of significant returns.

Another advantage we found with OvalX is their proactive and knowledgeable customer support committed to providing client satisfaction 24/7. The support is omnichannel offering Live chat, email, and international phone calls.

See our find and Ranking on Customer Service Quality:

| Pros | Cons |

|---|---|

| Quick response | No 24/7 Support |

| Relevant answers | Live Chat available only in English |

| Availability of Live Chat |

In addition, the broker undertakes to ensure that new traders are properly educated and ready to start trading. For that reason, Demo account is available for opening at any time, as well as the detailed and various levels of trading education that are considered to be on a very high level compared to its peers.

In conclusion, our experience with OvalX was positive. OvalX has everything to prove its reliability and excellent reputation. Years of experience and the long operation history of the OvalX parent company still keep a broker at a strong position among institutional providers as well as maintain competitive offerings to the traders.

Nevertheless, the broker work with vast institutional clients and the retail traders will find OvalX expanded approaches too. Among the OvalX benefits, we have to admit their platform solutions, as well as a comprehensive and well-built educational system with a range of free materials available to traders of different experiences.

Based on Our findings and Financial Expert Opinion OvalX is Good for:

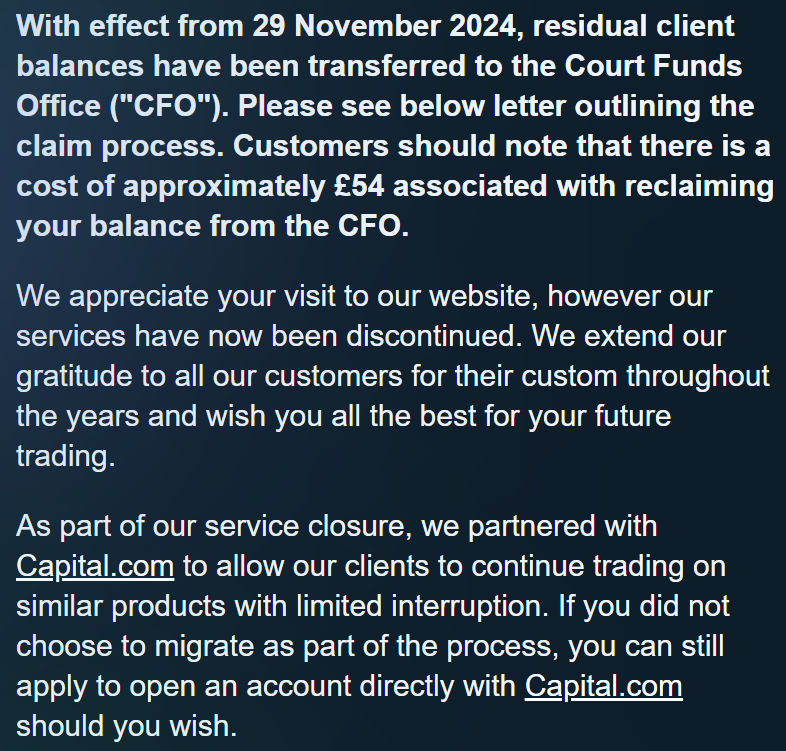

Based on our research we found that as of 6 September 2023, Monecor (London) Limited, trading under the business name OvalX, entered into Member’s Voluntary Liquidation. The company’s regulated financial services activities have thus come to an end. Clients were provided with the option to transfer their accounts to Capital.com to allow them to continue trading with a reputable broker without disturbing their trades.

No review found...

No news available.

Hi,I from Malaysia,I want to ask some questions.In Malaysia have any branch or IB(persons) for support? Then can transfer deposit/withdraw to local bank Malaysia?