- What is EasyEquities?

- EasyEquities Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- EasyEquities Compared to Other Brokers

- Full Review of Broker EasyEquities

Overall Rating 4.4

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

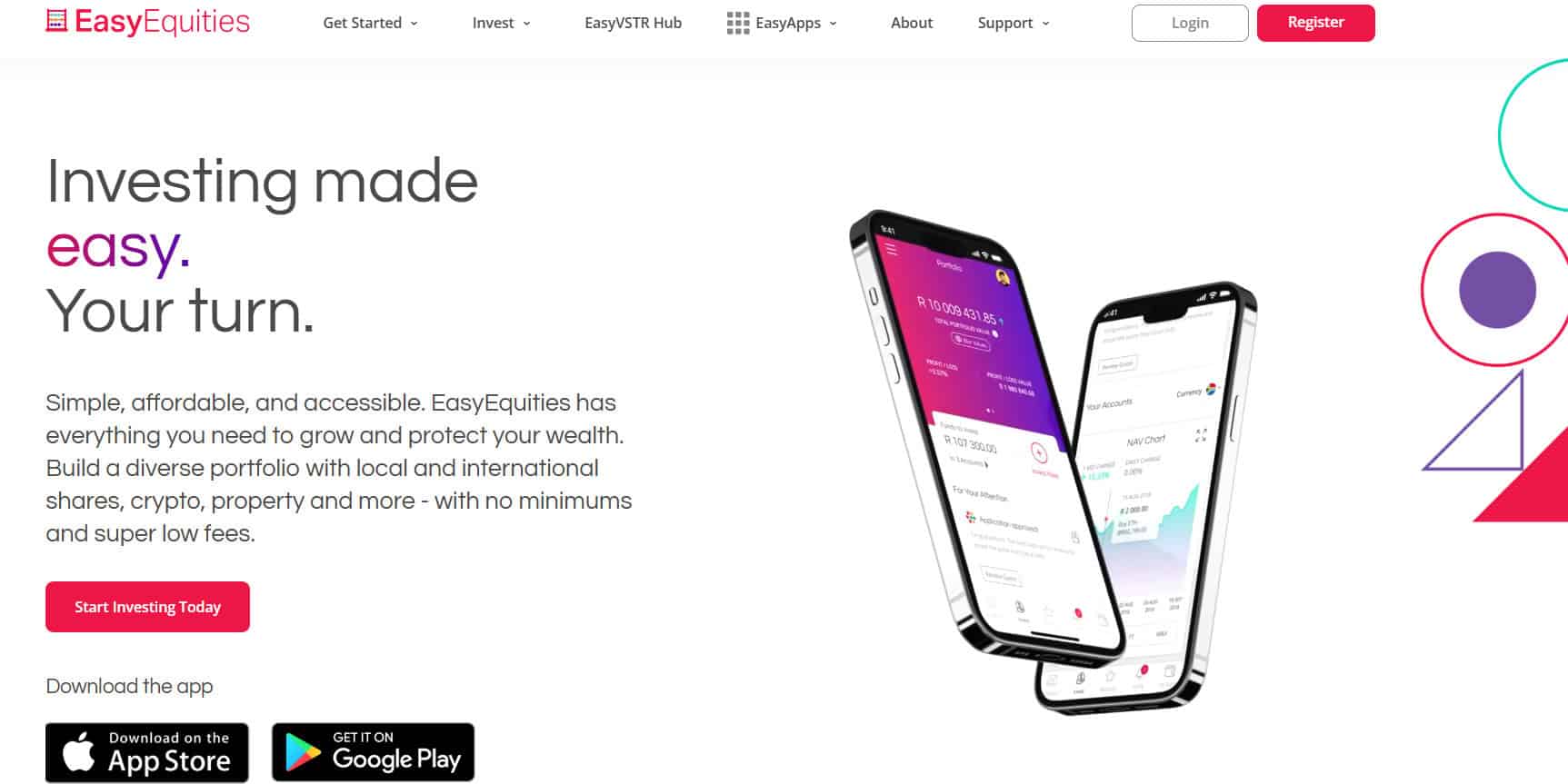

What is EasyEquities?

EasyEquities is an online Stock trading and investment platform that provides individuals with the ability to invest in Stocks, ETFs, Crypto, and Property.

The company is headquartered in South Africa and operates under the regulatory supervision of the reputable FSCA authority. Additionally, it has a presence in Australia and is registered with the top-tier ASIC, enabling Australian investors to access stock markets in Australia, the U.S., the UK, and Europe through the platform.

Overall, the platform is known for its user-friendly interface and aims to make investing accessible to a broad range of audiences.

Is EasyEquities Stock Broker?

Yes, EasyEquities operates as a stockbroker and an online investment platform. It facilitates the buying and selling of Stocks and other financial instruments and allows individuals to manage their investment portfolios.

EasyEquities Pros and Cons

The broker comes with its set of advantages and disadvantages. On the positive side, it offers a user-friendly online platform, making it accessible to investors of all levels. Another advantage is the availability of fractional investing, enabling individuals to invest in portions of high-value stocks. The firm also offers extensive educational resources to empower investors in making informed decisions.

For the cons, there is no 24/7 customer support available, which might be a drawback for those who prefer round-the-clock assistance. Additionally, the range of available markets is not as extensive as some other stock trading platforms, which could limit investment options for certain individuals.

| Advantages | Disadvantages |

|---|

| Good trading conditions | No 24/7 customer support |

| $0 minimum deposit | Limited trading products |

| User-friendly interface | |

| Cost-effective | |

| Learning materials | |

| Secure investing environment | |

| Fractional Shares | |

| Self-directed investing | |

EasyEquities Features

EasyEquities is known for its competitive investment solutions, user-friendly trading platform, and commitment to low-cost investing. A summary of its key features is as follows:

EasyEquities Features in 10 Points

| 🏢 Regulation | FSCA, ASIC |

| 🗺️ Account Types | South African Rand (ZAR), Tax Free Savings (TFSA), Australian Dollar (AUD), US Dollar (USD), British Pound (GBP), Euro (EUR) Accounts |

| 🖥 Trading Platforms | EasyEquities Proprietary Trading Platform, Mobile Apps |

| 📉 Trading Instruments | Stocks, ETFs, Crypto, Property |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | From $10 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, ZAR, AUD, GBP, EUR |

| 📚 Trading Education | EasyEquities Academy, Webinars, Videos, Blog |

| ☎ Customer Support | 24/5 |

Who is EasyEquities For?

EasyEquities is designed for investors of all levels who want a simple, low-cost way to access global and local stock markets. Whether you are just starting or looking to diversify your portfolio, the platform allows you to buy fractional shares, ETFs, and even property shares with minimal fees. Based on our findings, EasyEquities is Good for:

- Traders from the African continent

- Australian traders

- Investing

- Stock trading

- Advanced traders

- Professional trading

- Self-Directed Investing

- Low fees

- Commission-based trading

- Competitive investment conditions

- Good learning materials

EasyEquities Summary

In conclusion, EasyEquities stands out as a comprehensive Stock trading firm, offering a range of features tailored to both novice and experienced investors. With a commitment to low-cost trading, transparency, and a suite of educational resources, the platform aligns with various investment preferences.

While the broker may lack certain advanced features, it provides competitive solutions for those seeking straightforward investment tools.

Overall, the firm provides a reliable environment for investment. However, we advise conducting your research and evaluating whether the platform’s offerings suit your specific trading requirements.

55Brokers Professional Insights

EasyEquities stands out by combining affordability, accessibility, and innovation, suitable for traders looking to trade both local and international stocks, ETFs, and fractional shares with minimal fees, making it highly attractive for beginners and cost-conscious traders or larger size.

One of its key strengths is the ability to invest with very low minimums, enabling users to start small while gradually building a diversified portfolio, so is a big plus for trades from different levels or regions alike. Additionally, EasyEquities supports fractional investing, which gives exposure to high-value stocks without requiring large capital outlay. Its user-friendly interface is combined with educational resources and transparent pricing visible right on every transaction; we mark its smooth layout and friendly management too. All together software and portfolio provided empower investors to make informed decisions and is easy to navigate.

Also, we mark several extra services like bridging local and global markets by offering innovative tools like EasyTrader and EasyProperties. All in all, EasyEquities delivers a platform that balances professional-grade features with simplicity, making it a compelling choice for both novice and experienced investors alike.

Consider Trading with EasyEquities If:

| EasyEquities is an excellent Broker for: | - Need a well-regulated broker.

- Suitable for professional traders and investors.

- Low fees and commissions.

- Stock Trading and Investment.

- Secure trading environment.

- African and Australian investors.

- Investors who prefer robust learning resources.

- Professional trading.

- Providing diverse account types.

- Looking for broker with a long history of operation and strong establishment.

- Advanced trading technology.

- Competitive trading conditions.

- Long-term investing. |

Avoid Trading with EasyEquities If:

| EasyEquities might not be the best for: | - Need a broker with trading services worldwide.

- Real Futures traders.

- Looking for broker with 24/7 customer support. |

Regulation and Security Measures

Score – 4.6/5

EasyEquities Regulatory Overview

EasyEquities is a reliable Stock trading broker that follows the rules and guidelines established by the South African FSCA and Top-Tier Australian ASIC. These regulations safeguard client assets and provide low-risk trading.

How Safe is Trading with EasyEquities?

EasyEquities is a legitimate and reputable firm for traders looking to invest and manage their assets.

The firm implements a variety of security measures to protect client trading. This includes encryption protocols for secure data transmission, two-factor authentication for account access, negative balance protection, and adherence to regulatory guidelines to ensure a safe environment.

However, conduct thorough research and carefully examine the firm’s documentation, legal agreements, and policies. This will provide a comprehensive understanding of the specific trading protections offered by the platform.

Consistency and Clarity

Established in 2014, EasyEquities has built a solid reputation as a low-cost, accessible broker for both local and international investors. Regulated by South Africa’s FSCA and Australia’s ASIC, and backed by its publicly listed parent company Purple Group Limited, the platform offers transparency and accountability.

Users praise its affordability, fractional investing, and user-friendly interface, though some note occasional customer support delays and platform glitches during high market activity.

EasyEquities has received industry recognition, including the 2025 Best Online Share Trading Platform award and accolades at the Anthem Awards, reflecting both innovation and social responsibility.

Account Types and Benefits

Score – 4.5/5

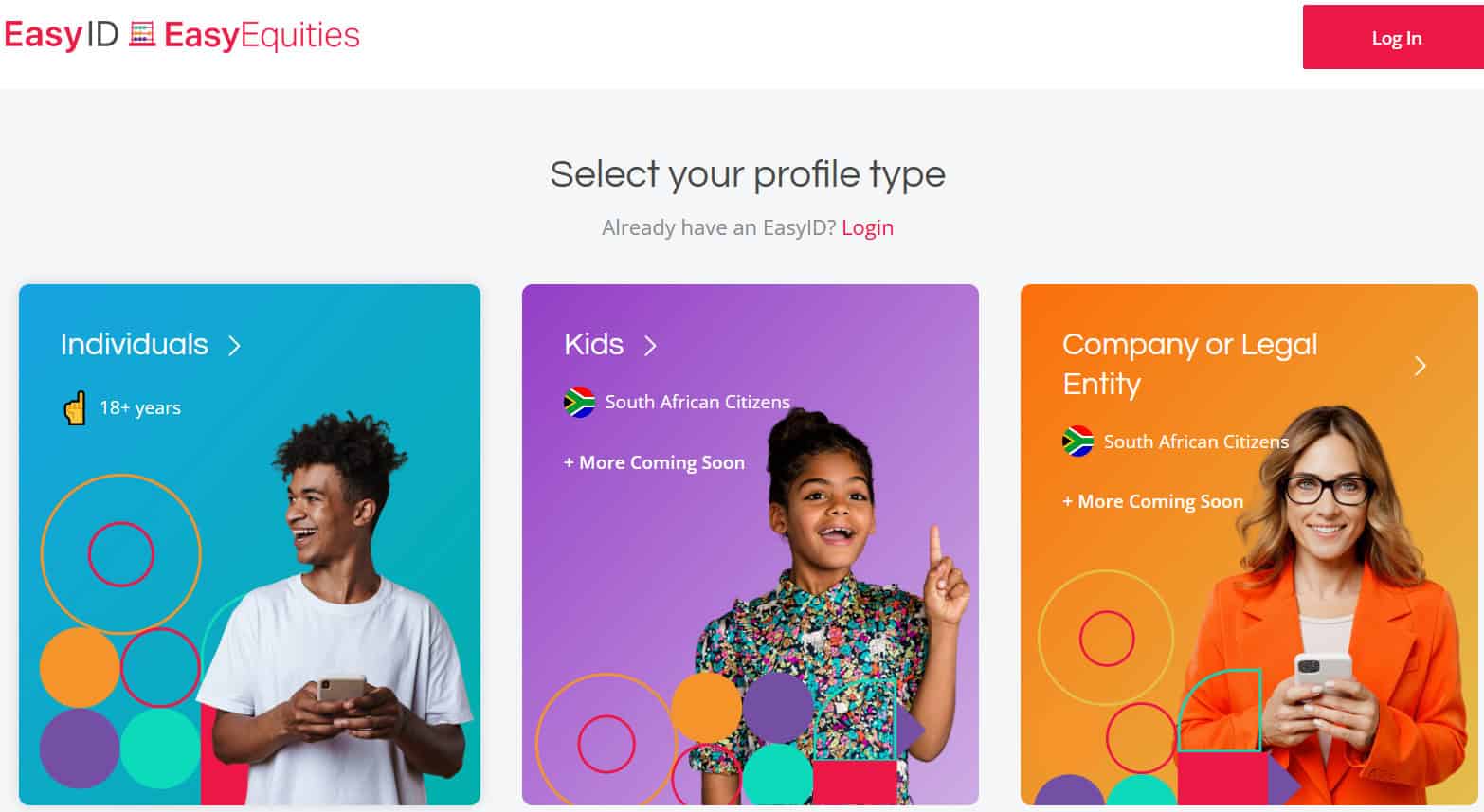

Which Account Types Are Available with EasyEquities?

The firm offers various account types expressed in different currencies, including South African Rand (ZAR), Australian Dollar (AUD), US Dollar (USD), British Pound (GBP), and Euro (EUR). These currency-specific accounts cater to users in different regions, providing flexibility for investors to operate in their preferred currency.

EasyEquities also provides a demo account, enabling beginners to explore its platforms, practice strategies, and familiarize themselves with the tools before committing real funds.

South African Rand Account

The South African Rand (ZAR) Account at EasyEquities allows investors to trade JSE-listed shares, ETFs, and other local products with no set minimum deposit, meaning you can start investing with any amount.

Despite this flexibility, trades remain cost-effective with low fees of 0.25% per transaction. The account also supports fractional shares, enabling portfolio diversification even with limited capital.

Fully regulated by South Africa’s FSCA, it ensures transparency and security. Additionally, tax-efficient options like the Tax-Free Savings Account (TFSA) are available, making the ZAR account a flexible, affordable, and secure gateway to the local stock market.

Regions Where EasyEquities is Restricted

EasyEquities is a widely accessible broker, but due to regulatory and compliance reasons, access is restricted in certain regions. While most of its services are available internationally, some account types, especially South African Rand (ZAR) accounts, are limited to specific countries.

Countries where EasyEquities is restricted:

- Countries outside South Africa and the Common Monetary Area (CMA)

- Namibia

- Lesotho

- Eswatini

Cost Structure and Fees

Score – 4.6/5

EasyEquities Brokerage Fees

The firm typically charges EasyEquities costs associated with various aspects of trading and account management. These fees include brokerage commissions, which are costs incurred when buying or selling stocks or ETFs. Additionally, users should be aware of any currency conversion fees if they are trading in different currencies.

While EasyEquities aims to keep its fees competitive, traders should review the detailed fee structure on the platform’s official website or contact customer support to ensure a clear understanding of the costs associated with their specific transactions and account activities.

EasyEquities charges commissions on transactions made through its platform. The specific commission structure may vary based on factors such as the size of the trade, the type of financial instrument, and the currency involved.

However, commissions and fees can change over time and may vary based on the specific investments and market conditions. Therefore, investors should review the platform’s fee details for a comprehensive understanding of the costs associated with their investments.

- EasyEquities Exchange Fee

When trading on EasyEquities, investors may incur exchange and regulatory fees in addition to the standard commission. These fees are charged by the stock exchanges and financial authorities to cover transaction processing, market regulation, and statutory requirements.

Although these fees are typically small, they are applied per trade and are separate from EasyEquities’ own commission, ensuring compliance with local market regulations.

- EasyEquities Rollover / Swaps

EasyEquities does not offer leveraged products or CFDs, so there are no rollover or swap fees charged on positions. Investors buying and holding regular shares or ETFs do not incur these types of fees, making it straightforward for long-term, non-leveraged investing.

- EasyEquities Additional Fees

Beyond standard commissions, EasyEquities charges small additional fees for certain services, such as currency conversion for international trades, account inactivity, or electronic fund transfers. These fees are clearly disclosed and are typically minor, ensuring transparency while covering operational and regulatory costs.

How Competitive Are EasyEquities Fees?

EasyEquities is widely recognized for its low-cost structure, making it highly competitive compared to traditional brokers. Its transparent fee model allows investors to keep costs predictable, while the platform’s focus on accessibility ensures even small investors can participate in the markets without being burdened by high charges.

The combination of affordability, fractional investing, and access to both local and international markets positions EasyEquities as a cost-effective choice for long-term portfolio building and diversified investing.

| Asset/ Pair | EasyEquities Commission | Firstrade Commission | M1 Finance Commission |

|---|

| Stocks Fees | From $10 | From $0 | From $0 |

| Fractional Shares | Yes | Yes | Yes |

| Options Fees | - | From $0 | - |

| ETFs Fees | From 0,25% | From $0 | From $0 |

| Free Stocks | No | Yes | Yes |

Trading Platforms and Tools

Score – 4.4/5

EasyEquities offers access to a proprietary platform designed by the company. This platform provides a user-friendly interface for executing trades and managing investments.

Additionally, the broker provides mobile applications, allowing users to trade and monitor their portfolios on the go through smartphones or tablets.

Trading Platform Comparison to Other Brokers:

| Platforms | EasyEquities Platforms | Firstrade Platforms | M1 Finance Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

EasyEquities Web Platform

EasyEquities offers a proprietary web-based platform designed to make investing simple and accessible. The platform allows users to trade local and international shares, ETFs, and fractional investments directly from their browser without any downloads.

Its interface is user-friendly and intuitive, providing real-time pricing, portfolio tracking, and investment research tools. Fully responsive, it works seamlessly on both desktop and mobile browsers, ensuring investors can manage their portfolios anytime, anywhere.

EasyEquities Desktop MetaTrader 4 Platform

The broker does not offer the MT4 platform. Traders looking to use MT4’s interface or automated features should consider alternative brokers that support it.

EasyEquities Desktop MetaTrader 5 Platform

EasyEquities does not offer access to the MetaTrader 5 platform. Traders looking for MT5 functionality will need to consider other brokers.

EasyEquities MobileTrader App

The platform provides a mobile app that allows users to conveniently trade and manage their investment portfolios from their smartphones or tablets. The app typically offers a user-friendly interface, enabling users to monitor market activities, execute trades, and access account information on the go.

Investors can stay connected to the financial markets and make informed decisions with the EasyEquities mobile app, providing flexibility and accessibility to their investment activities. Users can download the app from the respective app stores based on their device’s operating system.

Main Insights from Testing

The EasyEquities mobile app offers a smooth and intuitive experience for trading on the go. Users can access local and international shares, ETFs, and fractional investments, monitor their portfolio in real time, and execute trades quickly.

The app is stable, responsive, and user-friendly, with clear navigation and integrated educational resources.

AI Trading

EasyEquities does not currently offer built-in AI trading features or algorithmic tools on its platform. Investors can execute trades manually through the web or mobile app, but any automated or AI-driven strategies would need to be implemented externally using third-party software.

The platform focuses on low-cost, accessible investing rather than advanced AI or algorithmic trading solutions.

Trading Instruments

Score – 4.5/5

What Can You Trade on EasyEquities’s Platform?

The broker provides a range of products, including Stocks, ETFs, Crypto, and Property. Users can invest in individual stocks, gain ownership in specific companies, and diversify their portfolios by trading ETFs that represent a collection of assets.

The platform’s emphasis on fractional investing allows traders to buy and sell fractional shares, making it more accessible for investors with smaller amounts of capital.

Main Insights from Exploring EasyEquities’s Tradable Assets

EasyEquities offers a diverse and accessible range of investment opportunities, allowing users to build balanced portfolios with ease. The platform’s user-friendly interface and transparent pricing make exploring and investing straightforward, empowering investors to make informed decisions and diversify their holdings effectively.

Margin Trading at EasyEquities

EasyEquities does not offer a margin trading feature. Margin trading involves borrowing funds to leverage investment positions, and not all trading platforms provide this feature.

However, for the most accurate and current information about the firm’s offerings, including multiplier or margin trading, we recommend checking the official website or contacting its customer support directly.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at EasyEquities

Investors can fund their accounts with bank transfers, allowing users to transfer funds from their linked bank accounts and credit and debit cards, which are often accepted for quick and convenient transactions.

EasyEquities Minimum Deposit

The platform does not impose a strict minimum deposit requirement, making it accessible to investors with varying capital amounts.

Withdrawal Options at EasyEquities

The firm allows users to initiate withdrawals from their accounts, providing a straightforward process for accessing funds. Traders can check the platform’s official documentation or contact customer support for specific details on withdrawal methods, processing times, and any associated fees.

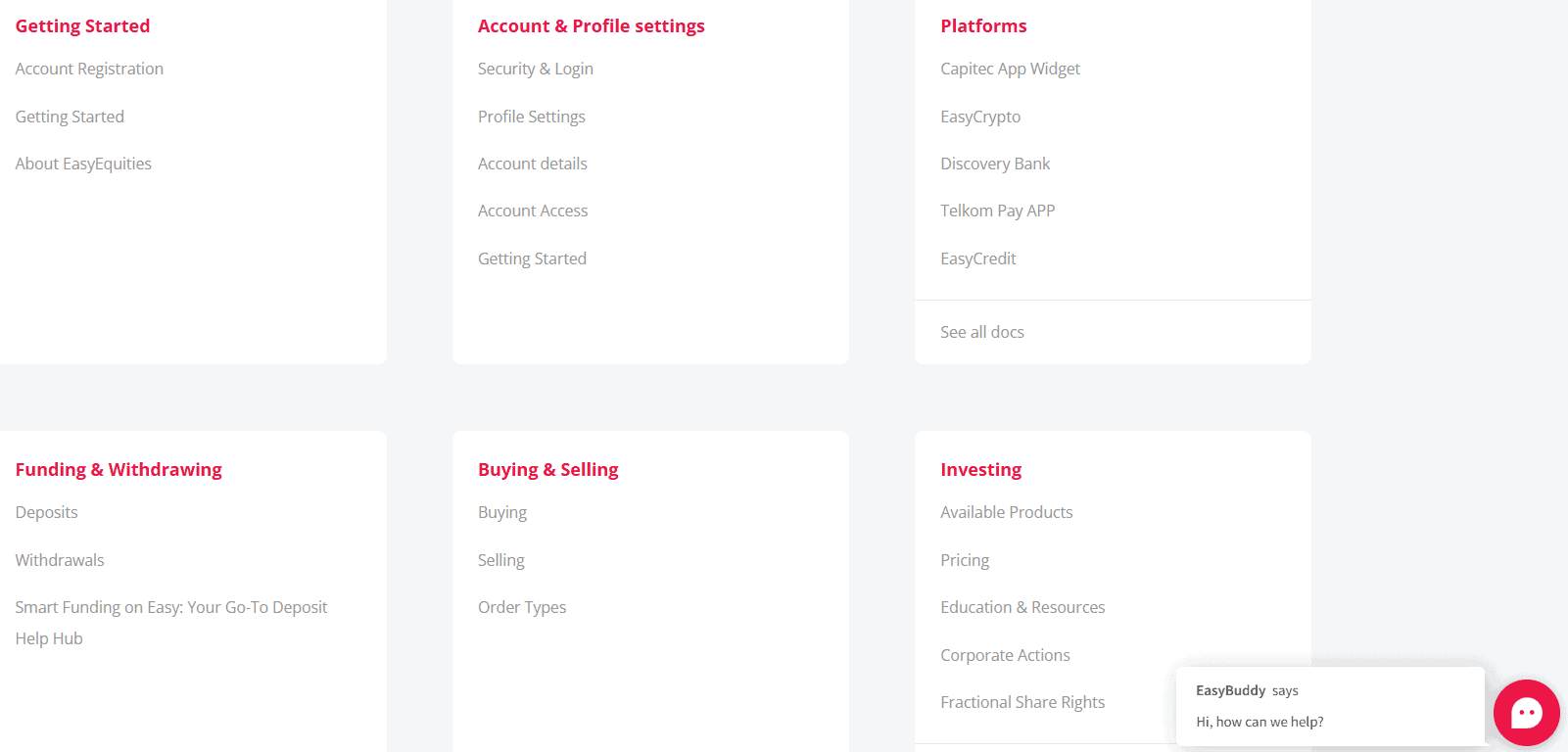

Customer Support and Responsiveness

Score – 4.5/5

Testing EasyEquities’s Customer Support

The broker offers 24/5 customer support through email, live chat, EasyEquities contact number, and the help center. The platform aims to offer responsive assistance to EasyEquities problems and address user concerns, ensuring a positive and supportive experience for its investors.

Contacts EasyEquities

You can reach the EasyEquities Trading Desk for assistance by calling 010 141 2202. Additionally, you can send an email to tradingdesk@purplegroup.co.za for support with trades or account-related inquiries.

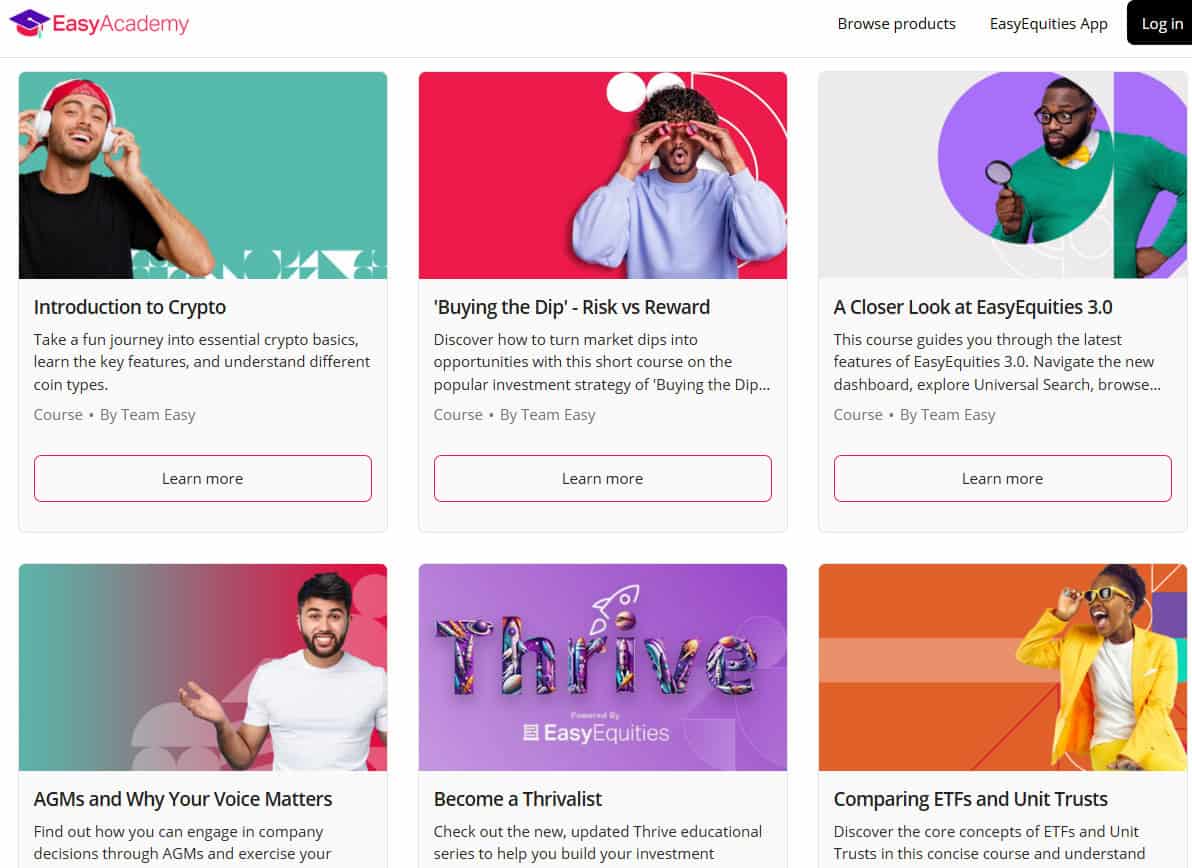

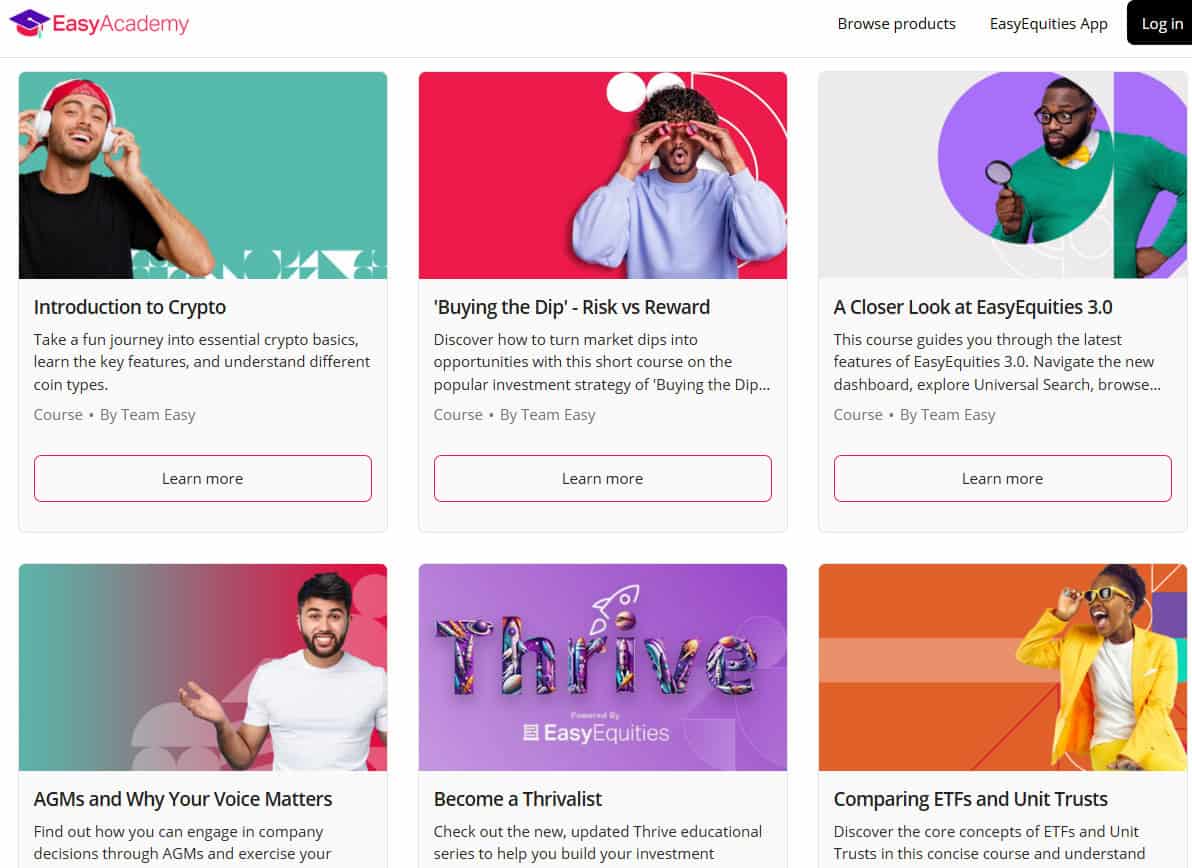

Research and Education

Score – 4.6/5

Research Tools EasyEquities

EasyEquities provides a range of research and analytical tools to help investors make informed decisions.

- On both its web platform and mobile app, users can access real-time pricing, historical charts, and market data.

- The platform also offers company profiles, financial statements, and key performance metrics, allowing investors to evaluate stocks and ETFs effectively.

- Additionally, EasyEquities includes market news and portfolio tracking features, giving users the insights needed to plan and manage their investments confidently.

Education

The broker offers a learning academy to empower investors and enhance their understanding of financial markets. The other resources include articles, tutorials, webinars, and guides covering various aspects of investing, from basic concepts to more advanced strategies.

Portfolio and Investment Opportunities

Score – 4.5/5

Investment Options EasyEquities

EasyEquities offers a variety of investment solutions to suit different investor needs. Users can invest in local and international shares, ETFs, fractional shares, and property investments.

These options allow investors to diversify their portfolios, access multiple markets, and tailor their investment strategy according to their financial goals.

Account Opening

Score – 4.4/5

How to Open EasyEquities Demo Account?

Opening a demo account on EasyEquities is quick and straightforward. First, visit the official EasyEquities website and select the “Demo Account” option. Provide basic information such as your name, email address, and create a password.

Once registered, you can log in to the demo platform via web or mobile app and start practicing trades using virtual funds. This allows beginners to explore the platform, familiarize themselves with its tools, and test trading strategies without risking real money.

How to Open EasyEquities Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or EasyEquities login page and proceed with the guided steps:

- Select and click on the “Register” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.3/5

Beyond its research tools, EasyEquities provides several additional features to enhance the investing experience.

- These include fractional investing, which allows users to buy portions of high-value stocks, and EasyProperties, which enables investors to gain exposure to property investments.

- The platform also provides automatic dividend reinvestment, watchlists, price alerts, and customizable notifications to help investors stay informed and manage their portfolios efficiently. Together, these features make it easier for investors to diversify, monitor, and optimize their investment strategies.

EasyEquities Compared to Other Brokers

EasyEquities stands out among its competitors for offering a low-cost, accessible trading environment, particularly for investors looking to enter local and international markets without high barriers to entry.

Its proprietary web and mobile platforms provide a user-friendly interface, while competitors may offer more advanced or specialized platforms with additional tools.

In terms of asset variety, EasyEquities offers a solid range suitable for most retail investors, though some competitors provide broader options such as options, futures, or international instruments. Regulation is strong, with EasyEquities being fully compliant under key authorities, similar to most established brokers, ensuring a safe trading environment.

While customer support and educational resources are reliable, some brokers may offer extended hours or more comprehensive learning materials. Overall, EasyEquities emphasizes simplicity, affordability, and accessibility, making it particularly attractive for beginners or those seeking straightforward investing solutions.

| Parameter |

EasyEquities |

Firstrade |

AJ Bell |

TD Ameritrade |

Freetrade |

Questrade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from $10 |

Futures contracts not available / Stock Commission from $0 |

Futures contracts not available / Stock Commission from £3,50 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$Futures contracts not available / Stock Commission from $0 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low/Average |

Low/Average |

Average |

Low |

Low/Average |

Low |

| Trading Platforms |

EasyEquities Proprietary Trading Platform, Mobile Apps |

Firstrade Proprietary Trading Platform, Options Wizard, Mobile Apps |

AJ Bell Trading Platform |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Questrade Web, QuestMobile, Questrade Edge Mobile, Questrade Edge, Questrade Global |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, ETFs, Crypto, Property |

Stocks, ETFs, Options, Mutual Funds, Fixed Income, Bonds |

Stocks, Shares, Funds, ETFs, Bonds, Gilts, Investment Trusts, ETCs, Warrants |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, ETFs, Options, IPOs, CFDs, Mutual Funds, Bonds, GICs, International Equities, FX, Precious Metals |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

FSCA, ASIC |

SEC, FINRA, SIPC |

FCA |

SEC, FINRA, SIPC, MAS |

FCA |

CIRO, CIPF, SEC, FINRA |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/7 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Excellent |

Excellent |

Good |

Limited |

Excellent |

Good |

| Minimum Deposit |

$0 |

$0 |

$0 |

$0 |

$0 |

$1,000 |

$0 |

Full Review of Broker EasyEquities

EasyEquities is a low-cost South African Stock brokerage designed to make investing accessible to a wide range of investors. It offers a proprietary web and mobile platform that allows seamless trading, portfolio tracking, and access to a variety of investment options.

The firm is fully regulated, ensuring security and compliance, and provides educational resources to help investors make informed decisions.

With no minimum deposit required and transparent fees, EasyEquities is particularly appealing for beginners and long-term investors seeking straightforward, cost-effective ways to build and manage a diversified portfolio. Its commitment to accessibility, fractional investing, and community engagement reinforces its reputation as a trusted platform for retail investors.

Share this article [addtoany url="https://55brokers.com/easyequities-review/" title="EasyEquities"]