- What is Darwinex?

- Darwinex Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

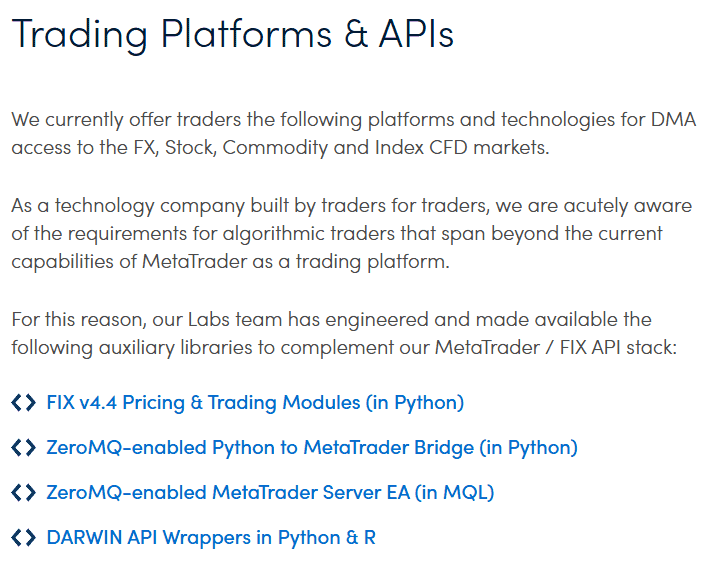

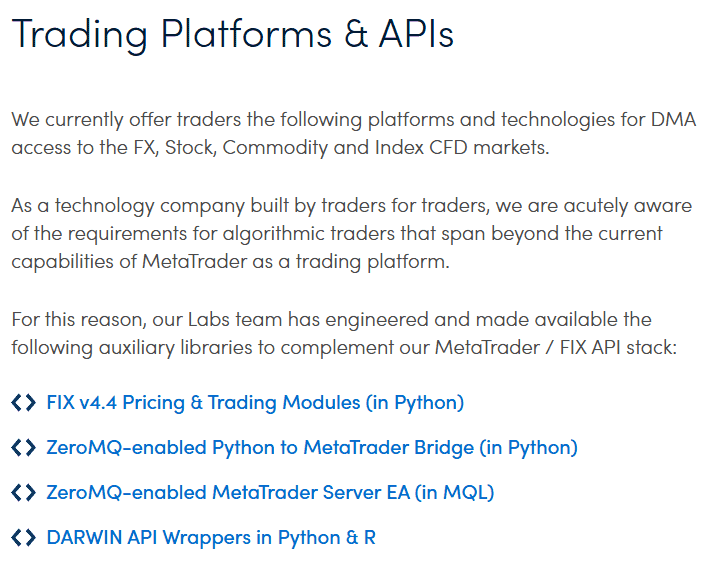

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

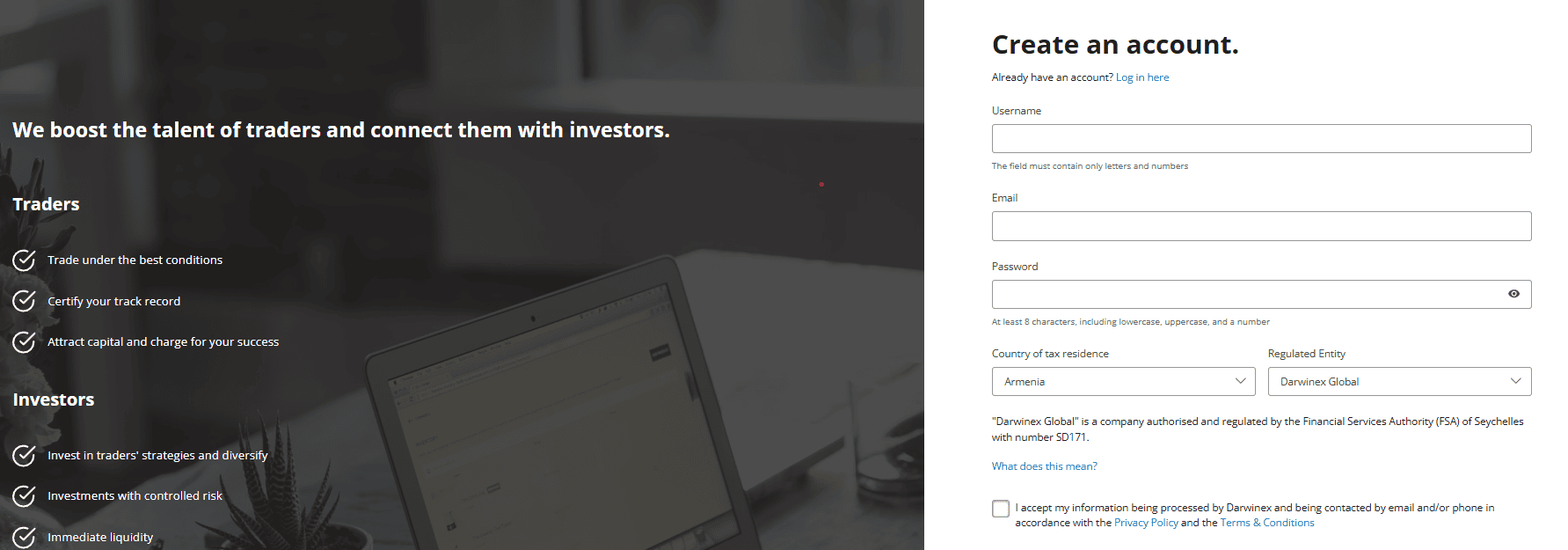

- Account Opening

- Additional Tools And Features

- Darwinex Compared to Other Brokers

- Full Review of Broker Darwinex

Overall Rating 4.5

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4 / 5 |

What is Darwinex?

Founded in 2012 as a technology provider, Tradeslide Trading Tech. two years later started operating as an FCA-regulated broker under the name Darwinex, with headquarters in London and a developed office in Spain. Currently, the company serves traders and investors from more than 100 countries and is a recognized trading provider.

The broker operates as a pooling member of an exchange, facilitating connections between investors and traders. This setup creates opportunities for both parties, ensuring a secure and regulated trading environment. Additionally, the exchange structure includes a transparent 20% success fee, offering a clear and equitable framework for transactions, all under the protection of regulatory oversight.

Darwinex Pros and Cons

Darwinex is a reliable broker with good regulation, a quality trading platform, a good range of trading instruments, fast execution, and technology solutions. It offers unique investment opportunity for traders, and extends trading opportunities and enhances experience.

On the negative side, there is no deep education necessary for beginners, and no 24/7 support. Also, the market range is traded only by Forex and CFDs.

| Advantages | Disadvantages |

|---|

| FCA-regulated | Limited Educational Resources |

| 24/7 support | High First Deposit |

| Wide Range of Instruments | No 27/4 support |

| Low Spreads | |

| Negative Balance Protection | |

| Compensation Scheme | |

Darwinex Features

Darwinex holds a license from the well-regarded FCA, which provides high safety for traders. Over the years of its operation, the broker has constantly enlarged its offerings and global exposure, earning the trust and loyalty of clients. Here we have compiled a short overview of Darwinex’s main aspects for a quick look:

Darwinex Features in 10 Points

| 🗺️ Regulation | FCA, CNMV, FSA |

| 🗺️ Account Types | CFDs Account, Classic Account, Darwin of Stocks, Darwin of Futures |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, Indices, Stock, Commodities, ETFs |

| 💳 Minimum deposit | $500 |

| 💰 Average EUR/USD Spread | 0.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | Several Currencies Available |

| 📚 Trading Education | Available |

| ☎ Customer Support | 24/5 |

Who is Darwinex For?

When researching the broker, we concluded that the broker is especially suitable for certain trading preferences and strategies. Thus, we recommend Darwinex for traders who are:

- Experienced traders

- Run Scalping

- Hedging

- EAs trading

- Copy Trading

- Trading through MT4 or MT5

Darwinex Summary

The Darwinex review revealed a tech-focused broker offering a unique and enhanced trading experience. Darwinex provides a transparent trading experience through the DMA execution model and competitive pricing, with reliable platforms including comprehensive trading tools and solutions for strategy improvements. With access to MT4 and MT5 platforms, spreads on the lower side, and a focus on risk management, Darwinex is especially suitable for experienced traders and investors who prioritize diversification and innovative solutions. However, for beginners, Darwinex’s offerings might be not as appealing, especially since Darwinex does not provide extensive educational resources.

55Brokers Professional Insights

The first positive point about Darwinex is its tight regulation and great reputation for the years Broker operates, standing on a solid background and highest standard UK operations. With our review, Darwinex stands out in the market for its rare approach to the notions of traders and investors, bridging them through its innovative offerings comining classic Forex and availability to sign up for Real Futures Trading or Investments while partnered with another excellent quality Broker IBKR. What we also mark, is unique approach where traders can sell their strategies as DARWINs and attract investor capital, whereas investors get to diversify their portfolios with risk-adjusted strategies.

The broker’s focus on technology and competitive trading conditions with a transparent fee structure makes it a great option for experienced traders and investors. Yet, beginner traders might not share the same enthusiasm about the broker, as it does not provide good educational resources and guidance novice traders usually look for.

Consider Trading with Darwinex If:

| Darwinex is an excellent Broker for: | - Professional Traders

- Traders from UK

- Looking for Broker with good reputation

- Investors

- Clients who prefer trading through the MT4 and MT5 platforms

- Those who look for diversification of their portfolios

- Traders who prefer automated trading |

Avoid Trading with Darwinex If:

| Darwinex is not the best for: | - Beginners

- Traders looking for extensive education

- High leverage enthusiasts

- Traders looking for minimum initial deposit |

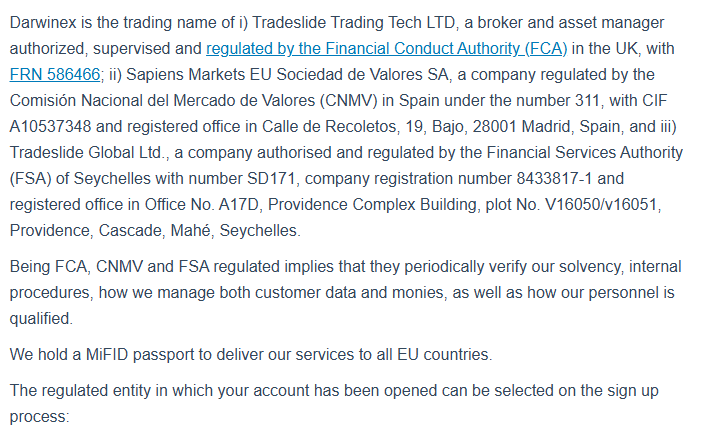

Regulation and Security Measures

Score – 4.6/5

Darwinex Regulatory Overview

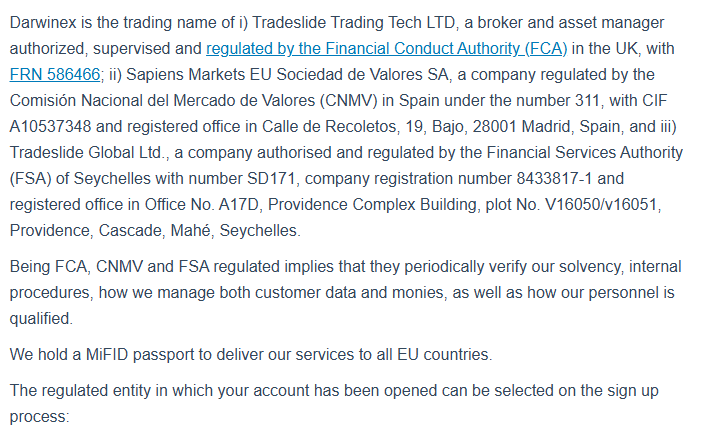

Tradeslide Trading Tech Limited known as Darwinex is authorized and regulated in the UK by the Financial Conduct Authority that protects clients and their investments by every means. As a regulated broker, all client funds are fully segregated and kept in separate bank accounts, ensuring traders’ money is not used for company purposes.

The broker also holds additional licenses from the Comisión Nacional del Mercado de Valores (CNMV) in Spain and the Financial Services Authority (FSA) of Seychelles. Darwinex also holds a MiFID passport to deliver its services to all EU countries.

How Safe is Trading with Darwinex?

Every trader or investor automatically becomes a member of the Financial Services Compensation Scheme (FSCS) which offers protection up to GBP 50,000 per client in case of insolvency. In addition, there is an implemented negative balance protection which secures funds from losses greater than the initial balance.

- As a regulated broker, all client funds are fully segregated at all times and are kept in separate bank accounts ensuring traders’ money is not used for the company purpose.

Consistency and Clarity

Our research of the broker, especially with a focus on the consistency and clarity of the provided services, revealed that Darwinex in its total activity of ten years has proved to provide transparent services with a specific focus on developing its technical side and providing top-notch advanced features.

In this section, we also consider real feedback from traders, as real experience is priceless and gives a lot more insight into the broker’s reliability. As a result, we have discovered a great percentage of positive reviews, accentuating the broker’s advanced and technology-wise services, regulatory compliance, and competitive trading conditions. Among the negative reviews, there were customers pointing out the complexity of the platforms, lack of education, and delays in customer support, which based on our research is not supported. Thus, we recommend traders to consider all of the mentioned, yet do their own research before choosing the broker.

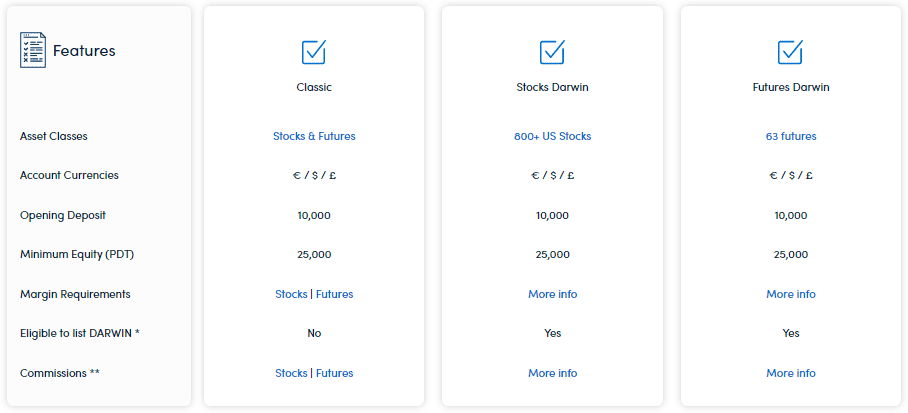

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Darwinex?

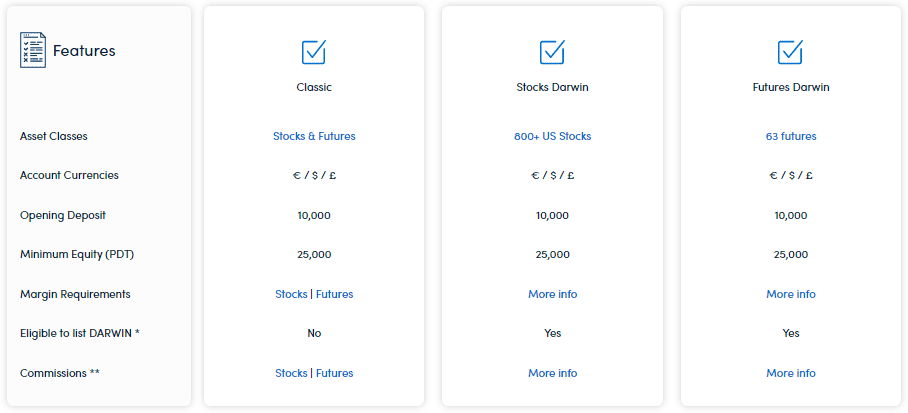

Darwinex offers clients various types of accounts depending on the instruments they want to trade. One account type is intended for trading CFDs and is solely Darwinex proposa, while the other is offered in cooperation trading IBKR stocks and/or futures offering great flexibility for Darwinex clients who prefer to diversify.

CFDs Account

Darwinex offers CFD trading accounts through its MT4 and MT5 platforms, enabling access to a wide range of assets, including Forex, commodities, indices, U.S. stocks, and ETFs. There is a €500 minimum deposit requirement to open the account. The CFDs account comes with special opportunities, as it allows traders to create a DARWIN and attract investors’ capital. Already, Darwinex’s DARWINs have more than $100 million invested.

Interactive Brokers (IBKR) account types

At the moment Darwinex offers 3 types of IBKR accounts:

Classic Account

The Darwinex Classic Account is for traders who prefer trading over investments. It provides easy access to all the products and markets offered by Interactive Brokers. This account does not allow capital-raising opportunities with their DARWINS. While the Classic Account lets traders use a wide array of IBKR, the Darwinex system does not provide performance analysis for this account type. Therefore, it is perfect for independent traders who want full control over their portfolios.

Darwin of Stocks

The Darwin of Stocks account is for traders who want to trade US stocks and ETFs by managing investor capital. Currently, over 800 US stocks and ETFs are already offered in CFD format on MT4 and MT5 platforms, but that number constantly expands. The account type enables the creation of DARWINs, entering into the DarwinIA SILVER challenge, and managing capital for the Darwinex investment community. Stocks and ETFs offer high liquidity, which ensures smoother market execution. The account allows traders to attract investor capital and increase their incomes.

Darwin of Futures

The Darwin of Futures account is aimed at professional futures looking for investor capital. The account grants access to more than 60 of the most liquid, high-volume futures contracts. Traders are also able to build DARWINs and enter the DarwinIA SILVER.

Regions Where Darwinex is Restricted

Being regulated by the FCA and CNMV, Darwinex imposes certain restrictions not accepting residents from a list of countries:

- Russian Federation

- Belarus

- Afghanistan

- Bosnia and Herzagovins

- American Samoa

- Benin

- Iran

- Iraq

- Haiti

- Egypt

Cost Structure and Fees

Score – 4.6/5

Darwinex Brokerage Fees

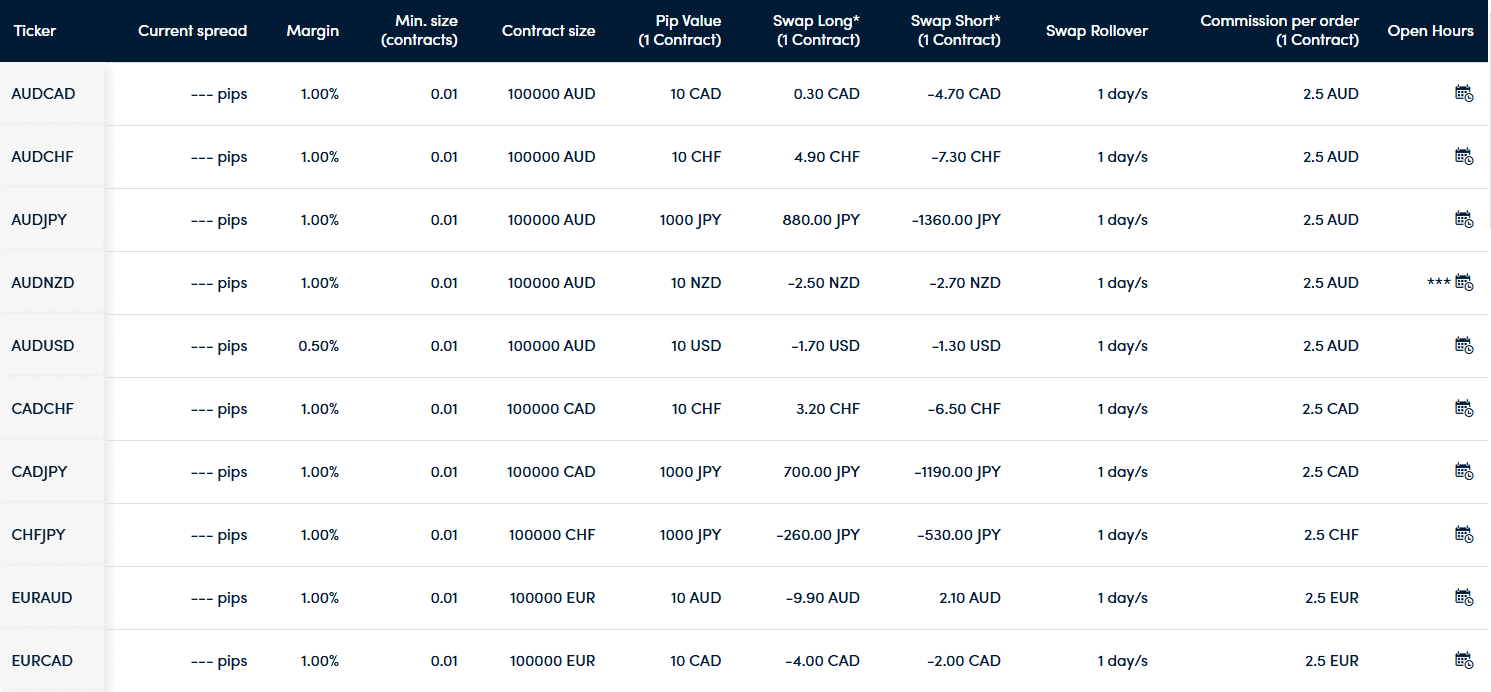

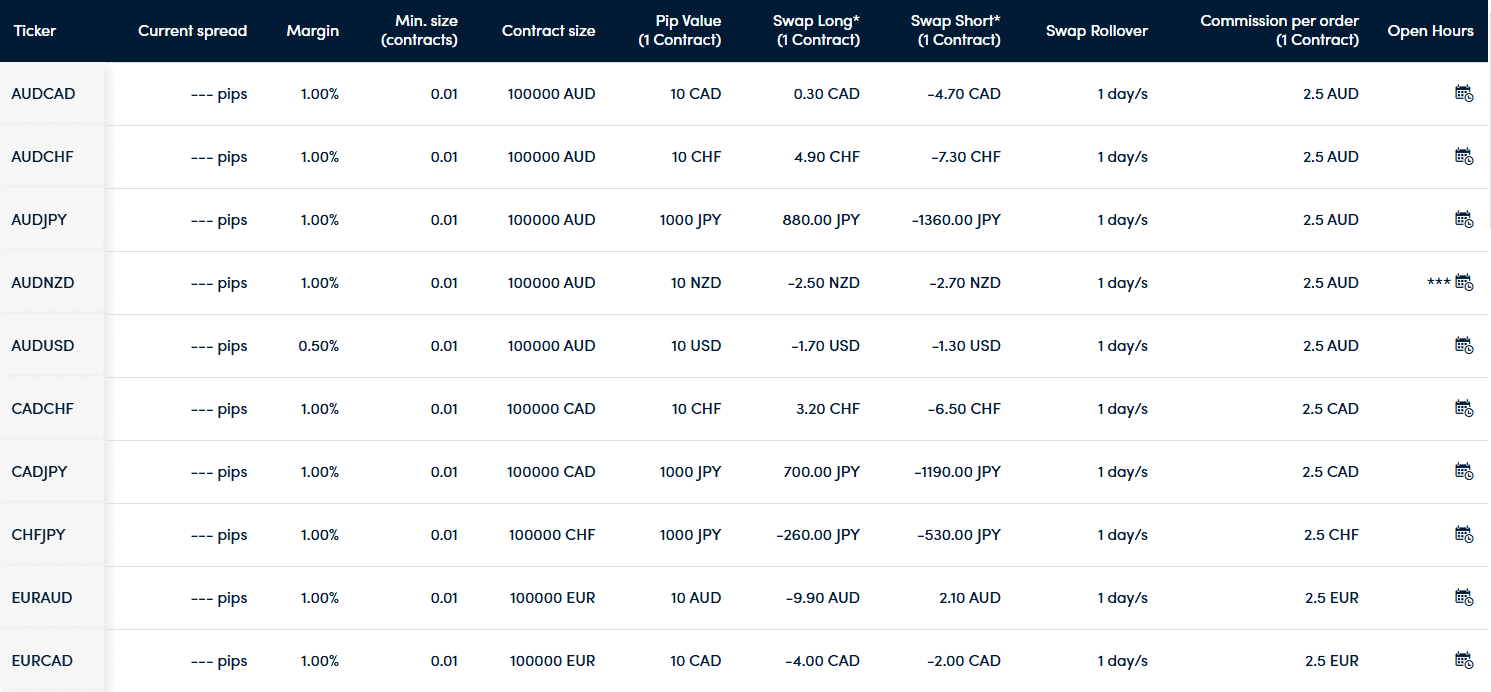

While researching Darwinex fees, we found that all the main costs mainly depend on the instrument traded. For each asset both spreads and commissions are different, thus traders need to check carefully before signing in with the broker.

All in all, Darwinex offers competitive spreads that are mostly in line with the market average, and for some instruments are on the lower side. The average spread for the EUR/USD pair is 0.3 pips, for the XAU/USD the spread is 0.25 points, while for US Crude oil the spread is at 0.02 points.

Darwinex imposes different commissions for trades, based on the instrument. Here is what we found:

For Forex pairs – $2.5 per side per lot

Indices – $2.75

Commodities – 0.0025% order value

Stocks, ETFs – $0.02

- Darwinex Rollover / Swap Fees

Swap fees are applied by Darwinex for holding overnight positions. The long swap charged for the EUR/USD pairs is -7.30 USD, while the short swap for the pair is 2.00 USD. The broker notifies its clients that swap rates are subject to changes and there will not be a prior notice for the changes.

How Competitive Are Darwinex Fees?

Our research of Darwinex fees revealed a competitive fee structure, with costs on the lower side, based mainly on the instruments trade. For each asset type, there is a specified commission. For Forex, the commissions are $2.5 per side per lot ($5 per round turn), while for Indices it is $2.75. For other instruments, the commissions are even lower. As to spreads, Darwinex offers spreads starting from 0.0 pips. Altogether, with the EUR/USD spreads being 0.3 pips, we see that they are on the lower side, with much lower than the spreads offered by most of the brokers.

Besides, we see that Darwinex is transparent about its fees, presenting a detailed chart for the applicable costs for each of the instruments, including spreads, commissions, swaps, etc. Thus, traders who are conscious about charges might find Darwinex a favorable option combined with the clarity of the offering.

| Asset | Darwinex Spread | Capital.com Spread | ThinkMarkets Spread |

|---|

| EUR USD Spread | 0.7 pips | 0.6 pips | 1.1 pips |

| Crude Oil WTI Spread | 0.02 points | 0.4 | 0.03 |

| Gold Spread | 0.25 points | 0.03 | 19 cents |

Darwinex Additional Fees

We have also managed to detect a few additional fees that would be beneficial for clients to be aware of. As we found, Darwinex charges a 20% performance fee on any 3rd party profit in DARWINs from which 15% is for the clients and 5% for Darwinex. Besides, although Darwinex does not charge fees for deposits and withdrawals, there might still be fees charged by third-party payment providers.

Score – 4.5/5

Darwinex allows traders to conduct trades on the two most popular trading platforms – MT4 and MT5. The trades are possible to conduct through webtrader, desktop, and mobile, adding versatility and flexibility to the offering.

| Platforms | Darwinex Platform | XM Platform | Pepperstone PLatform |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| Own Platform | No | Yes | Yes |

| Mobile App | No | Yes | Yes |

Darwinex Web Platform

Web-based trading at Darwinex through the MetaTrader Web Terminal allows traders to work with their accounts straight from any browser with no need for downloads and installations. From any operating system, be it Windows, Mac, or Linux, the web browser enables traders to explore the market and trading opportunities. About 30 technical indicators, graphical objects, and multiple timeframes for displaying prices are used for market analysis, providing insights to the market.

Darwinex Desktop MetaTrader 4 Platform

The Darwinex MT4 platform supports a wide range of asset classes: Forex, indices, commodities, and shares. Besides, the platform provides advanced features such as account analysis, account linking capabilities, and tracking of trading performance. Also, clients can backtest strategies, create DARWINs to attract investor capital or take part in the DarwinIA challenge. All in all, the MT4 platform equips traders with a good assortment of enhanced tools to execute and refine their strategies.

Darwinex Desktop MetaTrader 5 Platform

The Darwinex MT5 offers a good set of advanced features that come in handy for those traders who look for intense analysis and flexibility in trade execution. It contains 21 timeframes, including 11-minute charts, 7 hourly charts, and daily, weekly, and yearly views. The hedging is supported and traders can hold both long and short positions on the same instrument. Besides, MT5 is equipped with advanced means such as built-in indicators, graphical objects, and support for algorithmic trading using the MQL5 programming language.

Main Insights from Testing

The testing of the

MT4 and MT5 platforms revealed two platforms equipped with advanced features, enabling traders to explore new tools and strategies. The MT5 platform is the more advanced version of the MT5 platform, providing a better range of analytical tools, built-in

indicators, and fast execution.

Darwinex MobileTrader App

The Darwinex offers its clients an Investor App, a unique opportunity for investors to try a variety of trading strategies The app allows investors to explore and choose among different DARWINs. The application also provides key analytics and real-time updates to aid investors in monitoring their funds, assessing risk, and optimizing returns. Add to all these features the flexibility of trading from anywhere, and the Darwinex mobile app becomes a great choice for conducting trades on the go.

Trading Instruments

Score – 4.6/5

What Can You Trade on the Darwinex Platform?

We have found that Darwinex offers over 1500 CFD-based instruments across Currencies, Indices, Commodities, ETFs, and Stocks. Traders have access to the major, minor, and exotic Forex pairs, Indices from the Global markets, commodities such as Gold and Silver, and Exchange-Traded Funds from the U.S. market.

Besides, Broker enables investors to diversify their portfolios by selecting multiple DARWINs, which are tradable assets created by traders on the platform.

Main Insights from Exploring Darwinex Tradable Assets

While exploring Darwinex’s offering of tradable assets, we were pleased to find +1500 instruments available. This is quite a good range that will enable traders to diversify their trading and investigate the market further, at the same time expanding their portfolios.

The great thing about Darwinex is the unique investment opportunity – an offer that is one of a kind in the market: clients can invest in DARWINS – innovative financial assets offered by the broker that represent the strategies of traders, and allow investors to backtest, assess, and invest in the mentioned strategies in an environment that is risk-controlled.

Leverage Options at Darwinex

Since Darwinex is a UK-based brokerage firm that delivers its service through FCA strict regulations, there are applicable requirements towards every offering Darwinex complies with. Therefore, Darwinex offers marginal trading allowing you to trade larger positions through leverage.

- The maximum allowed leverage levels are set to 1:30 for major currency pairs,

- 1:20 for minor ones

- 1:10 for commodities.

However, since leverage gives a great advantage and may increase your potential gains, you should learn how to use it smartly and obtain good knowledge about it.

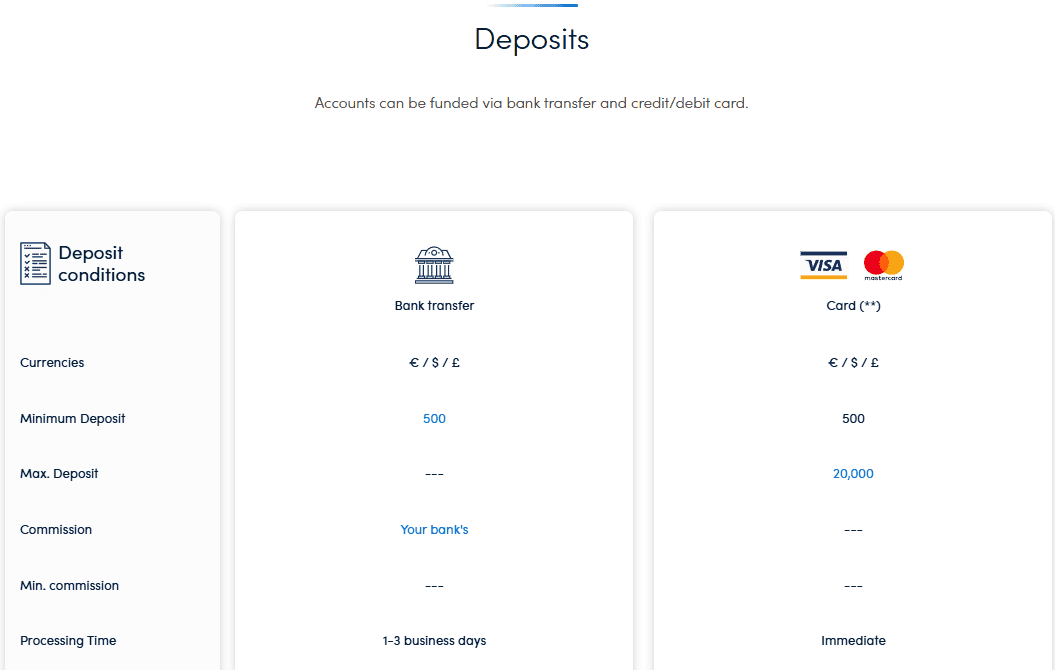

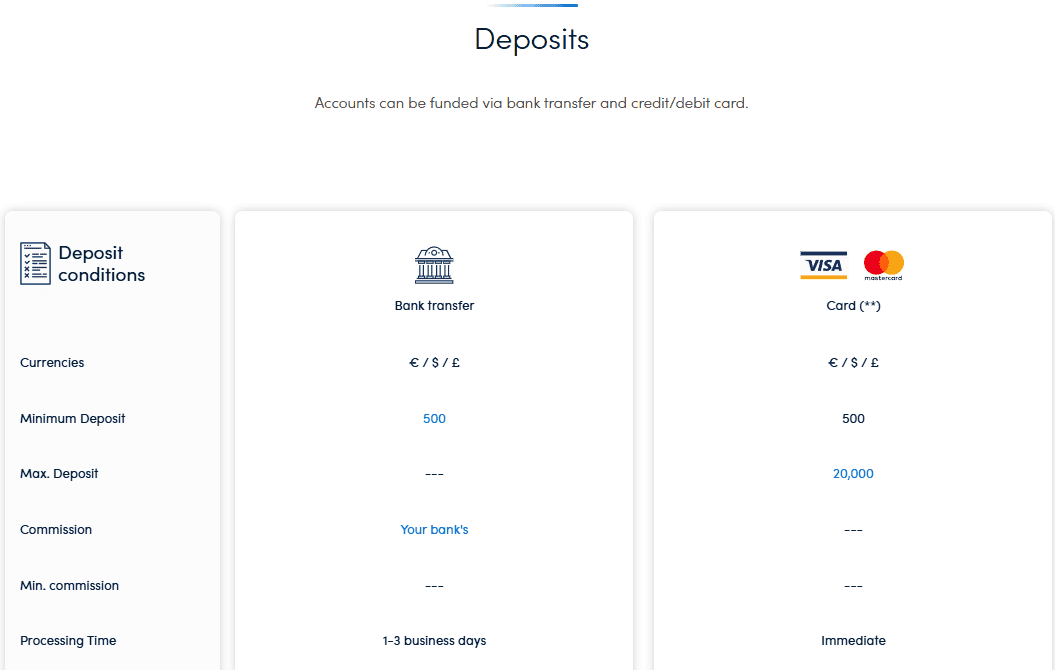

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Darwinex

Darwinex allows deposits through Bank wires and credit/debit cards. The broker allows only Mastercard, VISA, and VISA Electron. The deposits through bank wires are processed in 1-3 days while funding through cards is processed immediately.

Minimum Deposit

The minimum deposit allowed by Darwinex is $500, while the maximum funding is $20.000. To deposit more than the mentioned maximum amount, traders should get in touch with the broker support team.

Withdrawal Options at Darwinex

Withdrawals are also allowed through bank wire and credit/debit cards. Traders should use the same methods for withdrawals, as were used for deposits. The maximum allowed amount for withdrawal is $20.000 through cards.

- The processing time is usually estimated at 1-3 days.

- A $5 commission is applied to deposits by bank transfer below $500. Additional charges by our bank may apply in case of USD deposits by bank wire below $2,000.

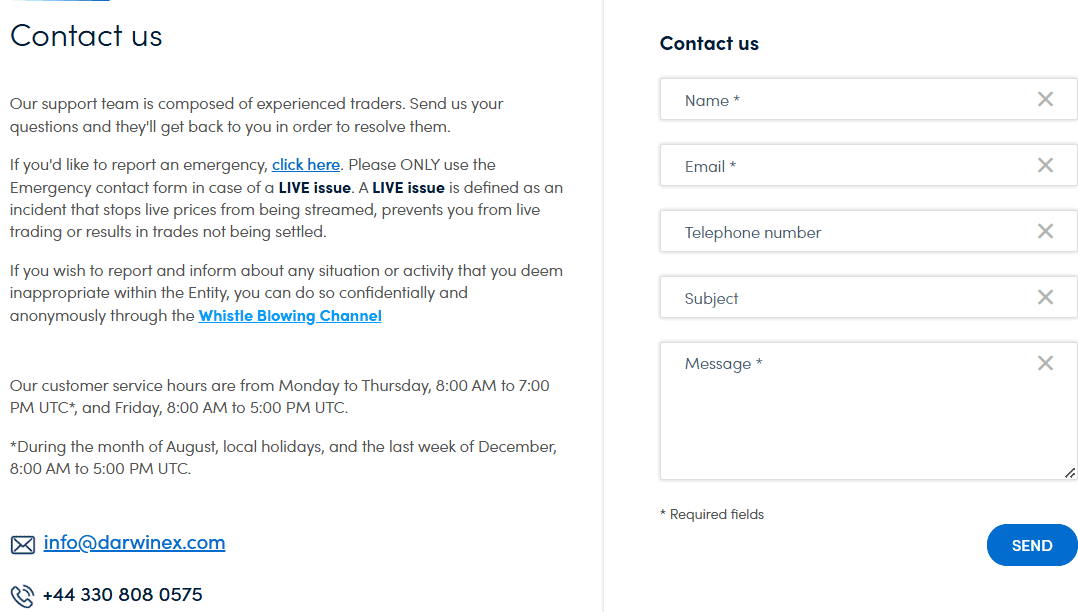

Customer Support and Responsiveness

Score – 4.6/5

Testing Darwinex Customer Support

Based on the research on Darwinex customer support, we concluded that the broker provides dedicated service with prompt and quick answers and assistance. Darwinex offers support through a quick requirement form right from the website, live chat, which we found provided instant and accurate answers, and by email and phone line. Besides, Darwinex is pretty social, constantly updating its FB, IG, Linkedin and YouTube pages.

Contacts Darwinex

The broker’s customer service hours are Monday to Thursday, 8:00 AM to 7:00 PM UTC, and Friday, 8:00 AM to 5:00 PM UTC.

- Traders can direct their questions to the info@darwinex.com email address

- For urgent live matters and issues, traders can report an emergency from the broker’s website ‘Contacts’ section.

- At last, those who prefer to address their questions through a phone call can use the following number: +44 330 808 0575.

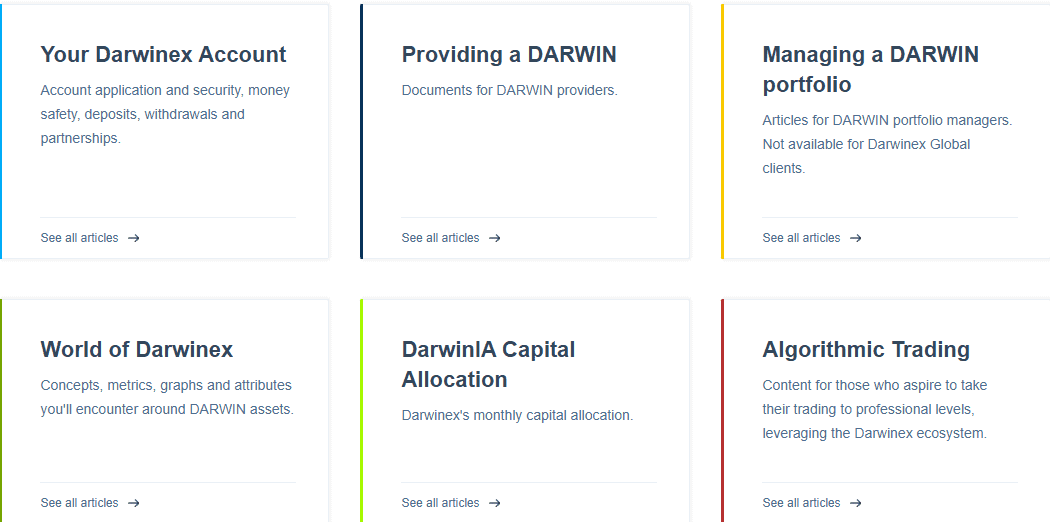

Research and Education

Score – 4 /5

Research Tools Darwinex

As we found, Darwinex does not concentrate on intensive research and educational materials. However, the broker still has certain offerings we would like to list here. Darwinex offers the following research tools:

- The Core Diagnostic Toolkit is included in MetaTrader platforms and helps analyze trading performance and identify aspects that need enhancement.

- Performance Metrics consist of metrics and graphs regularly updated to help traders estimate the performance of the employed strategy.

Education

Darwinex offers a few educational resources to help traders and investors enhance their skills and knowledge. Here is what traders can find with Darwinex:

- Blog Articles and insights on different trading strategies, analysis of the market, and recent updates about the broker in terms of its offerings and services.

- Help Center includes guides and FAQs to assist in different aspects of trading with Darwinex, such as how to use the Darwinex platform and understand its features and offerings.

- The broker also regularly organizes Webinars on a range of trading topics, such as how to use different strategies and or how to implement various platform features in the trading process.

- YouTube video tutorials can be useful for users who need guidance in navigating the market.

Is Darwinex a Good Broker for Beginners?

Based on our research, Darwinex is surely better suited for professional and experienced traders. With its minimum deposit of $500, which is on the higher side, advanced, and maybe a little complicated system of trading offered, Darwinex might put beginner traders at discomfort. For those beginner traders who want to explore the market at their own pace and get good guidance and assistance, Darwinex might not be a good fit.

Portfolio and Investment Opportunities

Score – 4.5 /5

Investment Options Darwinex

Darwinex allows traders to invest in real stocks through the Stocks DARWIN Account. This account allows investment in actual shares rather than CFDs. Trading real stocks is facilitated through Interactive Brokers, with access to a wide range of global markets.

- In addition, clients have the unique option of investing in DARWINs—trader-developed strategies listed on the Darwin Exchange. Each DARWIN represents a tradable asset for investment, much like stocks or ETFs. This will allow traders to diversify their portfolios and explore different strategies.

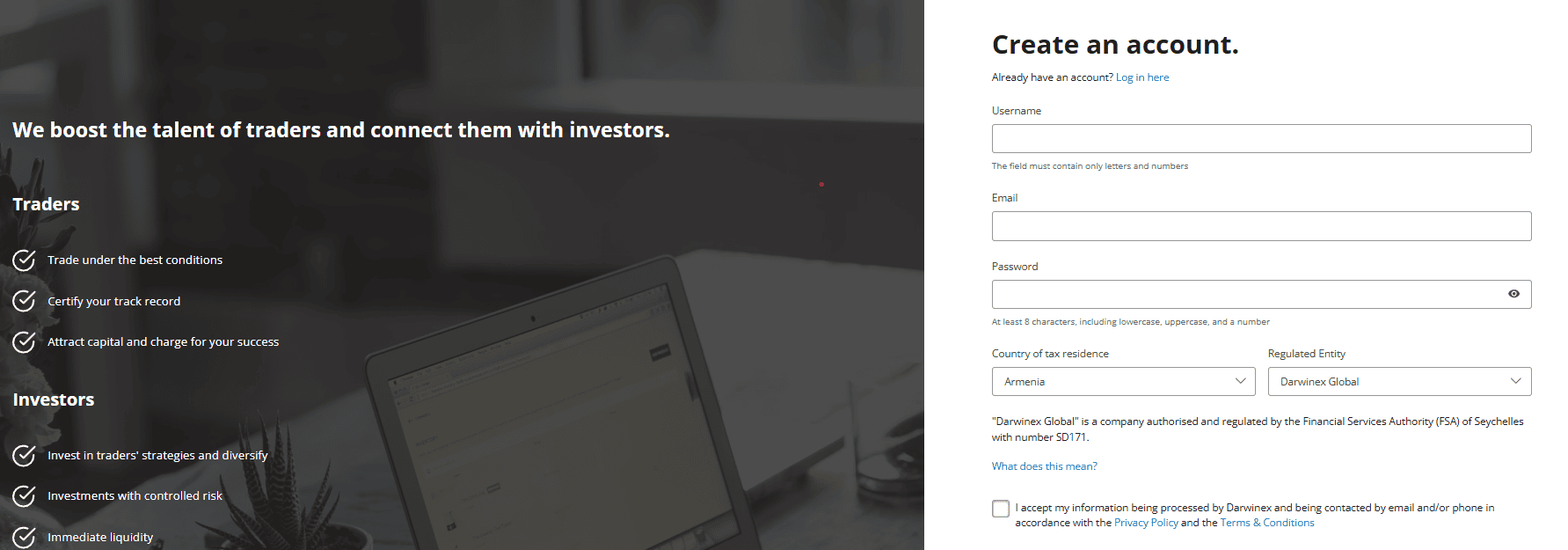

Account Opening

Score – 4.6/5

How to Open a Demo Account?

Darwinex offers a demo trading account to its clients to practice trading before entering the real market with real funds. Follow the listed steps to open a demo account:

- Log in to the Darwinex Platform (if you don’t have an account, sign up first)

- Go to the “Trading” tab on the platform

- Select ‘Open an Account’ and choose ‘Open a Demo’ account option

- Choose between MT4 or MT5 platforms

- Provide the necessary information, such as your preferred account type, leverage, initial balance, etc.

- Submit the form

- Download the MetaTrader platform (MT4 or MT5) to your device

- Use the credentials provided by Darwinex to log in to your new demo account

How to Open a Darwinex Live Account?

Opening a live trading account with Darwinex is similar to the opening of a demo account, with the difference of more information, documents, and verifications to be provided. Here are the steps to open a live account with the broker:

- Sign up for an account on the Darwinex website

- Fill out the necessary details in the application form, providing personal information and financial details

- Upload the required documents and verify your identity (a valid ID and proof of address)

- Once you’ve submitted your application and documents, wait for Darwinex to review and approve your account, which might take up to several business days

- After approval, deposit funds into your account via the deposit method available and suitable for you

- As soon as your account is funded, you can start trading on either MT4 or MT5 platforms

Score – 4/5

Darwinex also offers a few additional features and tools, that will help traders enhance their trading experience even further:

- DARWIN API enables access to Darwinex data automatically, allowing the creation of custom tools and applications.

- Customizable Alerts allow traders to set alerts for specific market conditions or trading activities. This way, they will be informed about the market changes and movements.

- D-Leverage is a unique tool that measures the risk of trading decisions, helping traders manage their risk effectively. D-Leverage, enables the risk comparison of all the open positions regardless of the assets, the type of strategy, etc.

Darwinex Compared to Other Brokers

We also compared Darwinex to several other well-regarded brokers in the market to estimate where Darwinex stands in comparison. Regarding regulation, Darwinex is regulated by the FCA and the CNMV in Spain, ensuring compliance with stringent European standards. However, Admiral Markets operates under the FCA, CySEC, and ASIC, ensuring better regulatory coverage.

Looking into Darwinex fees we find them competitive, particularly for its innovative DARWINs, with spreads from 0.0 pips and transparent and low commission. Compared to Pepperstone fees, we see that here the offering is also favorable with low spreads and lower commissions, especially on its Razor account. In terms of platform, Darwinex’s offering is good with access to popular MT4/MT5, although many brokers such as Exness come with the same offering.

However, in terms of education, the resources provided are not as extensive as those provided by FxPro and CMTrading. Yet, there are still webinars, video guides, and blog articles available with Darwinex. At last, the broker is suitable for those who are looking for real investments, as many brokers like TopFX allow only CFDs-based trading, which considerably restricts investors.

| Parameter |

Darwinex |

Admiral Markets |

Exness |

CMTrading |

FxPro |

Pepperstone |

eToro |

| Spread Based Account |

Average 0.3 pips |

From 0.6 pips |

From 0.2 pips |

Average 3 pips |

Average 1.4 pips |

Average 0.7 |

Average 1 pip |

| Commission Based Account |

Forex pairs – $2.5 |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $3.5 |

No commissions |

0.0 pips + $3.5 |

0.0 pips + $3.50 |

Available at US eToro Crypto |

| Fees Ranking |

Low |

Low/ Average |

Low |

Average/High |

Average |

Low |

Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, Admiral Markets app |

MT4, MT5 |

MT4, CMTrading Webtrader |

MT4, MT5, cTrader |

MT4, MT5, cTrader, TradingView |

Proprietary |

| Asset Variety |

1500+ instruments |

8000+ instruments |

200+ instruments |

Less than 200 instruments |

2,100+ instruments |

1,200+ instruments |

2,000+ instruments |

| Regulation |

FCA, CNMV, FSA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

FSCA, FSA |

FCA, CySEC, FSCA, SCB, FSA |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FCA, CySEC, ASIC, FSAS, NFA for Crypto Exchange |

| Customer Support |

24/5 |

24/7 |

24/7 |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

| Educational Resources |

Basic |

Excellent |

Fair |

Excellent |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$500 |

$1 |

$10 |

$299 |

$100 |

$0 |

$200 |

Full Review of Broker Darwinex

Darwinex is a technology-driven broker that offers a new approach to connecting traders and investors. The broker offers a unique solution by allowing traders access to DARWINs. The broker is FCA-regulated, ensuring strict adherence to rules and providing security for clients. It also has MT4 and MT5 platforms equipped with professional-level conditions offering ultra-low spreads and advanced tools. Darwinex particularly suits the needs of experienced traders engaged in scalping, hedging, and algorithmic trading.

However, Darwinex is not exactly a good fit for beginners because of the limited educational resources, the lack of 24/7 support, and the high minimum deposit requirement. Despite these limitations, Darwinex offers transparency, risk management tools, and advanced tools beneficial for active traders and investors.

Share this article [addtoany url="https://55brokers.com/darwinex-review/" title="Darwinex"]