- What is CPT Markets UK?

- CPT Markets UK Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- CPT Markets UK Compared to Other Brokers

- Full Review of Broker CPT Markets UK

Overall Rating 4.4

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.3 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is CPT Markets UK?

CPT Markets UK is a UK-based Forex and CFD trading firm that offers a range of financial derivatives including Equities, Futures, Options, Forex, and CFDs to both individual and institutional traders.

Based on our research, the company is authorized and regulated by the Financial Conduct Authority (FCA) in the UK and also carries additional license from the Financial Sector Conduct Authority (FSCA) in South Africa.

As we found, with 17 years of experience in the industry, CPT Markets UK provides customized solutions for retail traders as well as specialized conditions for institutional traders, focusing on reliability and delivering high-performance services.

CPT Markets UK Pros and Cons

After conducting an analysis, we have identified both pros and cons to consider when selecting CPT Markets UK as your broker. On the positive side, the broker offers Straight Through Processing (STP) execution and a fee structure based on spreads, which can be beneficial for traders. It also provides a range of trading instruments and popular MT4 and MT5 trading platforms.

For the cons, the trading conditions may vary depending on the specific entity you are dealing with, which could potentially affect your trading experience. Additionally, customer support is not available 24/7, which may be inconvenient for some traders. Moreover, the availability of educational materials may be limited depending on the entity you and the country you are registered in.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversee | No 24/7 customer support |

| Competitive spreads | Limited educational materials |

| MetaTrader trading platforms | Trading conditions might vary based on the entity |

| Available for UK, South African, and international traders | |

| Institutional trading | |

| STP execution | |

CPT Markets UK Features

CPT Markets UK offers multi-asset trading services since 2008. With a focus on transparency and security, the firm provides access to global markets, including Forex, CFDs, equities, and commodities. Traders benefit from the popular MetaTrader platforms, competitive spreads, and robust risk management tools, making it a reliable choice for both novice and experienced investors.

CPT Markets UK Features in 10 Points

| 🏢 Regulation | FCA, FSCA |

| 🗺️ Account Types | Classic, Prime, ECN |

| 🖥 Trading Platforms | MT4, MT5, cTrader |

| 📉 Trading Instruments | Forex, CFDs, Futures, Options, Equities, Commodities, Indices, Stocks, Crypto CFDs |

| 💳 Minimum Deposit | $0 |

| 💰 Average EUR/USD Spread | 1.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, GBP, USD |

| 📚 Trading Education | CPT Markets Academy |

| ☎ Customer Support | 24/5 |

Who is CPT Markets UK For?

CPT Markets UK is designed to accommodate a diverse range of traders. The broker’s commitment to transparency and security makes it a reliable choice for those seeking a trustworthy trading environment. Based on our findings, CPT Markets UK is Good for:

- Traders from the UK

- Traders from South Africa

- International trading

- CFD and currency trading

- Traders who prefer the MT4 and MT5 platforms

- Beginners

- Advanced traders

- Institutional trading

- Derivatives trading

- STP/NDD execution

- Copy Trading

- Competitive spreads

- EA/Auto trading

- Good trading tools

CPT Markets UK Summary

In conclusion, CPT Markets UK is a well-regarded Forex trading broker that caters to the needs of both retail and institutional traders. The presence of widely used trading platforms like MT4 and MT5 guarantees a trading experience that is both comprehensive and packed with advanced features. Moreover, the reputable FCA regulates the broker, providing traders with a sense of security and trust.

The STP execution model offered by CPT Markets allows for diverse investment opportunities, accommodating traders of varying expertise and trading styles. However, the broker’s website lacks comprehensive educational materials, which may be a disadvantage for those seeking educational resources. Additionally, the absence of 24/7 customer support is a limitation that traders should consider.

While the broker offers secure and competitive trading conditions, it is recommended to conduct thorough research to ensure it aligns with your specific trading needs. You should evaluate the broker’s regulations, fees, spreads, and customer reviews before making a decision.

55Brokers Professional Insights

CPT Markets UK stands out through good regulatory foundation and client-centric approach, with good level of transparency, fund protection, and operational integrity, which makes them suitbale for long term trading and investment, also for clients with Large accounts or trading size.

What truly sets CPT Markets UK apart is its blend of institutional-grade trading conditions and accessibility for retail clients. Traders benefit from competitive spreads, very good and quality execution, also access to an excellent range of asset classes, including Forex, indices, commodities, and CFDs, providing both diversification and quality of trading.

The firm’s commitment to professional excellence is further reflected in its dedicated client support, tailored educational resources, and robust risk management tools, making it a standout choice for those seeking a secure and sophisticated trading experience.

Consider Trading with CPT Markets UK If:

| CPT Markets UK is an excellent Broker for: | - Need a well-regulated broker.

- UK and international traders.

- Looking for broker with no minimum deposit requirement.

- Providing competitive fees and spreads.

- Offering popular trading instruments.

- Secure trading environment.

- Beginners and professional traders.

- Get access to well-known trading platform.

- Providing Copy Trading.

- Who prefer higher leverage up to 1:1000.

- Access to MAM solutions. |

Avoid Trading with CPT Markets UK If:

| CPT Markets UK might not be the best for: | - Who prefer 24/7 customer service.

- Prefer PAMM trading. |

Regulation and Security Measures

Score – 4.5/5

CPT Markets UK Regulatory Overview

CPT Markets UK Limited is a well-regulated brokerage firm with an international presence, operating under multiple financial authorities to ensure client protection and operational transparency.

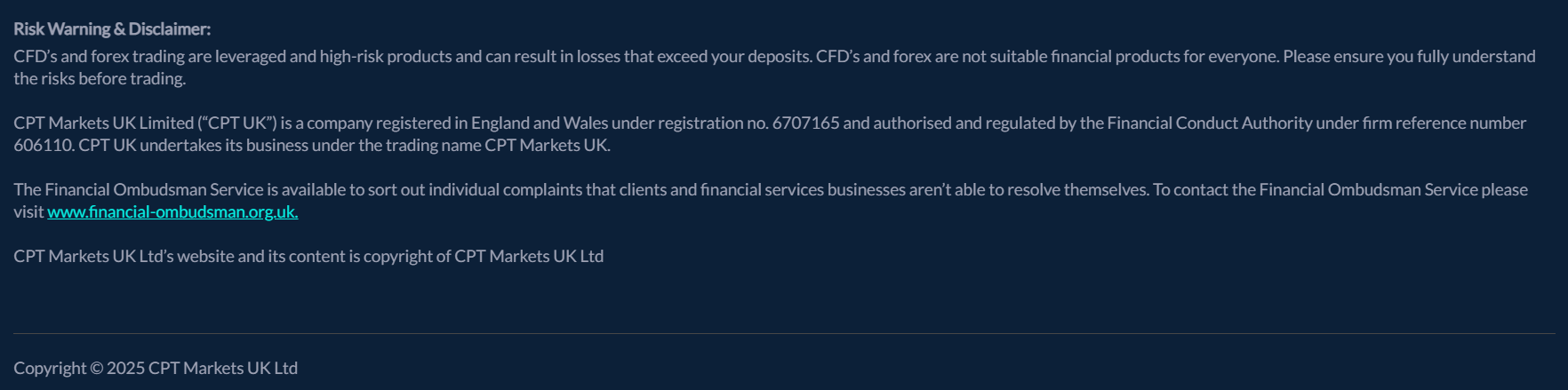

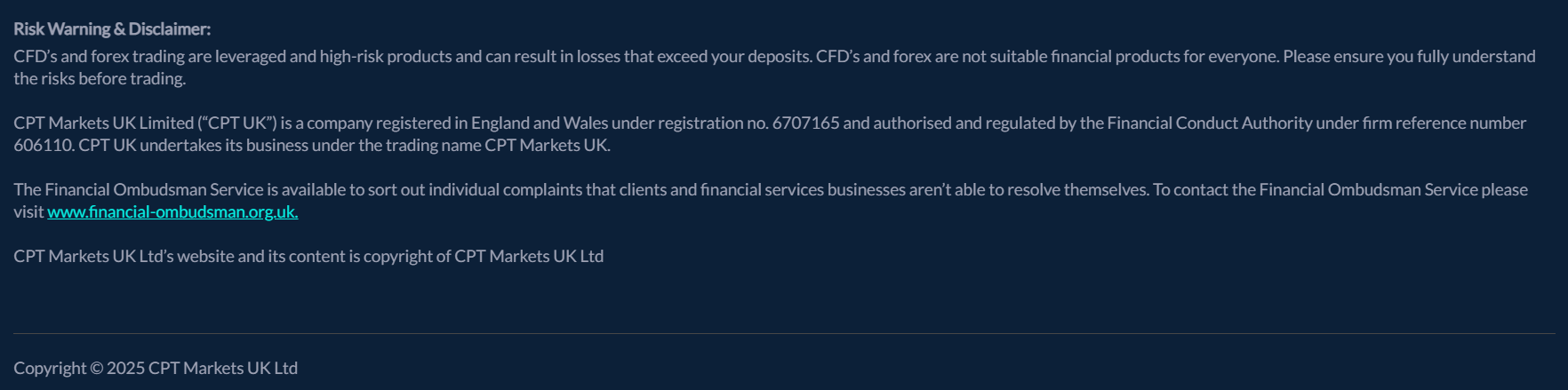

In the UK, the company is authorized and regulated by the FCA under firm reference number 606110. The FCA’s supervision requires adherence to stringent financial regulations and operational standards, including capital adequacy, client fund segregation, and transparent business practices.

Additionally, CPT Markets extends its regulatory compliance to South Africa, where its subsidiary, CPT Markets PTY LTD, is authorized by the FSCA under license number 45954. The FSCA regulation ensures adherence to South African financial laws, focusing on fair treatment of clients and market integrity.

How Safe is Trading with CPT Markets UK?

Trading with CPT Markets UK is considered safe due to its strong regulatory oversight and robust client protection measures. The FCA regulation ensures that the broker adheres to stringent financial standards, including the segregation of client funds from company assets, providing an additional layer of security for traders.

Additionally, clients are protected under the UK’s Financial Services Compensation Scheme (FSCS), which offers compensation up to £85,000 in the event of the firm’s insolvency. These measures collectively contribute to a secure trading environment for clients of CPT Markets UK.

Consistency and Clarity

CPT Markets UK has a solid reputation in the trading community, backed by years of operation since its establishment and strong regulatory credentials under the FCA. The broker generally receives favorable ratings across industry review platforms, with many traders praising its fast execution, transparent trading conditions, and responsive customer service.

However, some users have noted areas for improvement, such as platform variety and withdrawal processing times. CPT Markets also maintains an active presence within the industry and society, participating in global expos and engaging in sponsorships.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with CPT Markets UK?

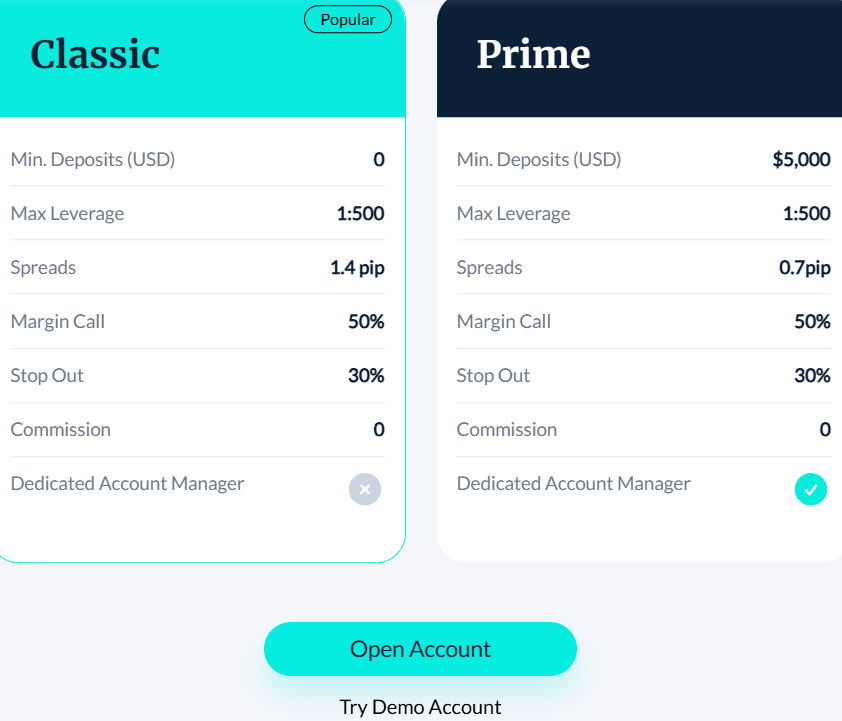

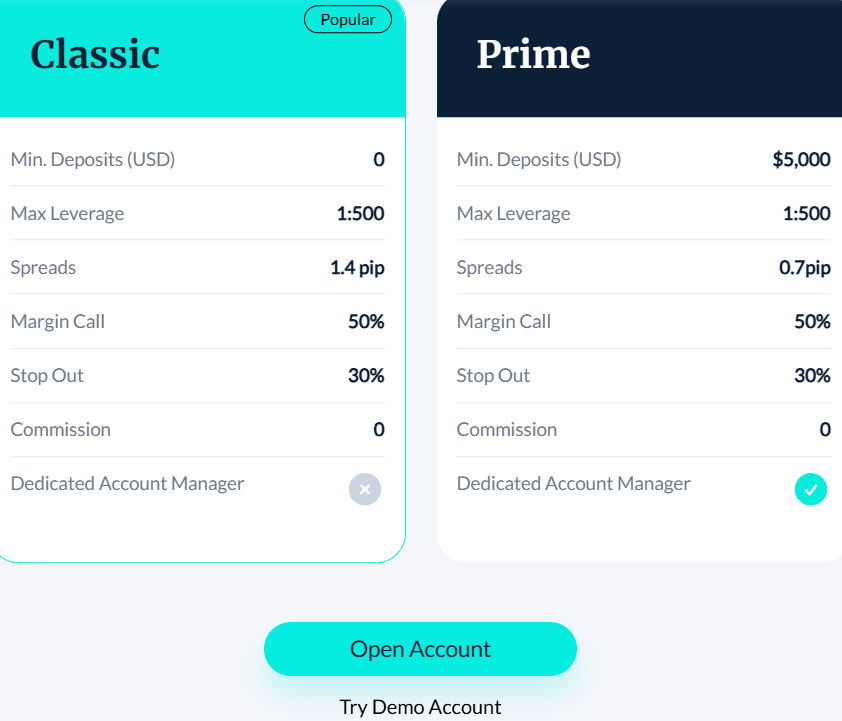

CPT Markets UK offers a range of account types tailored to meet the diverse needs of traders, including Classic and Prime accounts. Under its FSCA-regulated entity, the broker also offers ECN accounts.

Additionally, CPT Markets UK provides a Demo Account, allowing traders to practice and familiarize themselves with the trading platforms and market conditions without risking real capital. For clients seeking interest-free trading, a Swap-Free Account is available, enabling trading without overnight fees for up to seven consecutive days, after which standard swap charges apply.

Classic Account

The Classic Account is an ideal starting point for beginner traders or those who prefer flexibility with minimal financial commitment. With a $0 minimum deposit requirement, this account type offers accessible entry into the financial markets.

The account typically comes with variable spreads and no commissions, making it well-suited for low-frequency traders. However, the account conditions, such as spreads, leverage, and available instruments, may vary depending on which CPT Markets entity you register under.

Prime Account

The Prime Account is tailored for more experienced or professional traders seeking tighter spreads and enhanced trading conditions. With a minimum deposit of $5,000, this account type provides access to institutional-level pricing, often featuring lower spreads starting from 0.7 pips and potentially faster execution speeds.

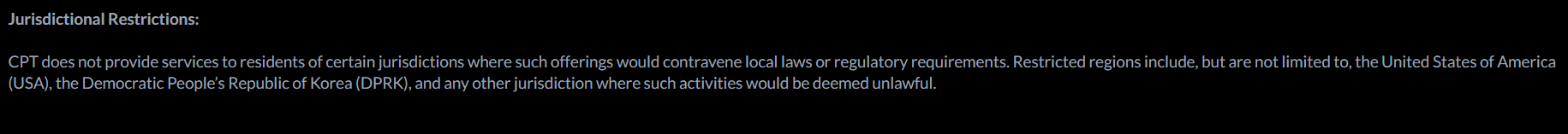

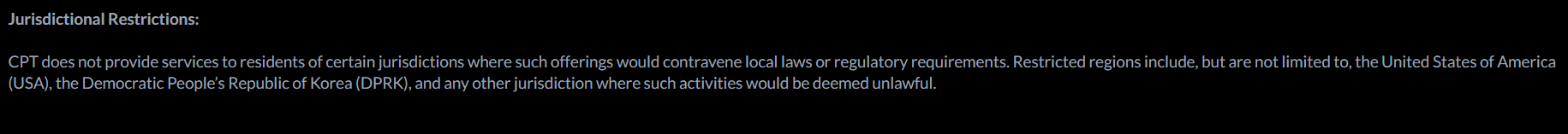

Regions Where CPT Markets UK is Restricted

CPT Markets UK complies with strict regulatory requirements, including restrictions on offering services in jurisdictions where doing so would breach local laws. As a result, the broker does not accept clients from several regions, including:

Cost Structure and Fees

Score – 4.4/5

CPT Markets UK Brokerage Fees

The fees and pricing of the broker are mainly built into a spread. There is no imposition of any hidden fees, no charges for opening, closing, or inactivity of accounts, as well as deposit and withdrawal fees.

However, you should consider an overnight policy that applies in case the trading order is held for longer than a day. In this case, a rollover fee, swap, or overnight fee will apply to the position.

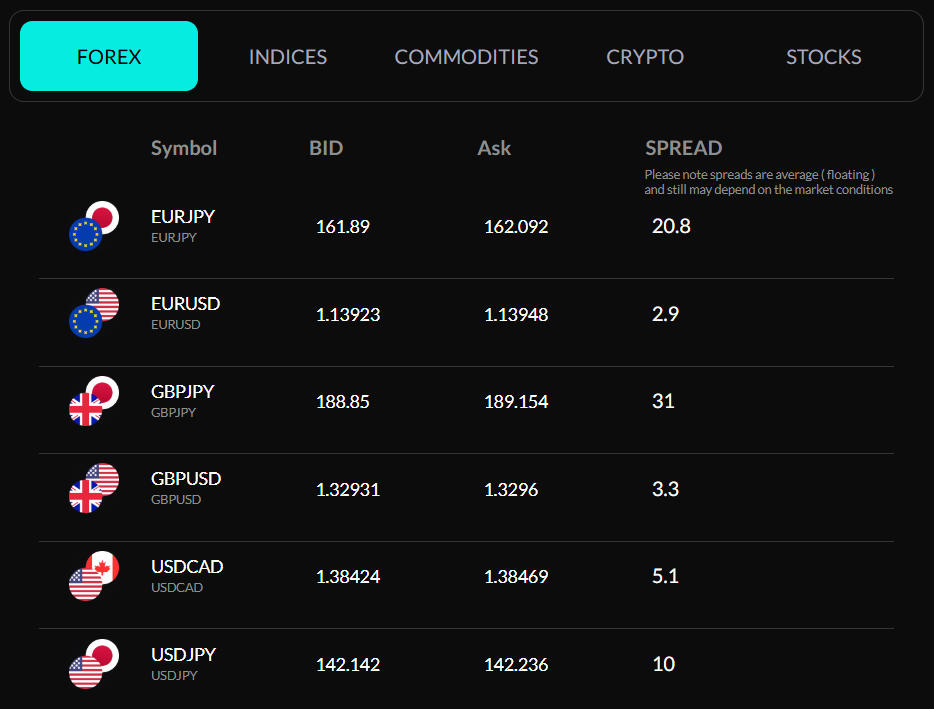

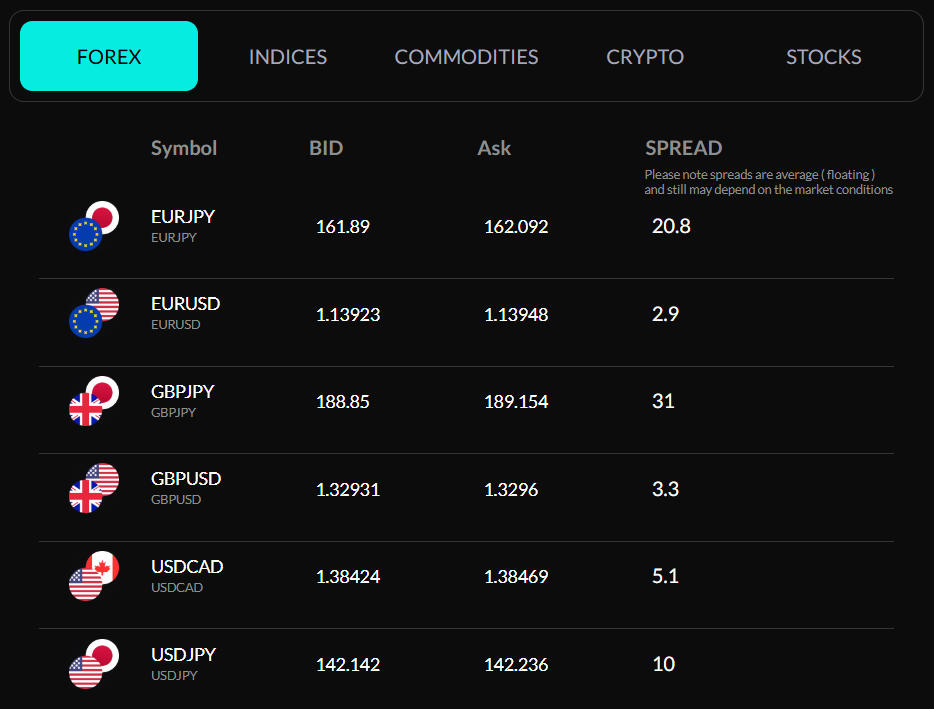

Based on our test trade, the broker provides competitive floating spreads with an average spread of 1.8 pips for the widely-traded EUR/USD currency pair in the Forex market. Additionally, the broker provides competitive spreads for all major currency pairs and other popular trading instruments too.

However, the trading conditions might differ depending on the entity, so do your research to understand the specific spread conditions that are in place.

- CPT Markets UK Commissions

CPT Markets UK offers commission-free trading across its Classic and Prime account types, with trading costs included in the variable spreads. However, under the FSCA-regulated entity, the broker provides an ECN account that involves trading commissions.

This account is subject to a commission fee, typically around $5 per round turn lot.

- CPT Markets UK Rollover / Swaps

CPT Markets UK applies rollover fees, commonly known as swap charges, for positions held open overnight. These fees are either credited or debited based on the interest rate differential between the two currencies involved in the trade and the direction of the position. Typically, a triple swap is applied on Wednesdays to account for weekend holding costs.

How Competitive Are CPT Markets UK Fees?

CPT Markets UK offers a fee structure that is generally competitive within the retail trading industry. With commission-free trading on most account types and spreads that align with market averages, the broker provides cost-effective options for both beginner and intermediate traders.

The broker focuses on transparent pricing, allowing traders to manage their costs without hidden fees. Overall, its fee model is suitable for a wide range of trading styles, particularly for those who prefer simplicity and ease of cost calculation.

| Asset/ Pair | CPT Markets UK Spread | ALB Spread | ADS Securities Spread |

|---|

| EUR USD Spread | 1.8 pips | 1.5 pips | 0.7 pips |

| Crude Oil WTI Spread | 7.8 | 3 | 6 pips |

| Gold Spread | 2.8 | 1.4 pips | 5 pips |

| BTC USD Spread | 6 | 14 pips | $120 |

CPT Markets UK Additional Fees

CPT Markets UK maintains a transparent fee structure with minimal additional charges. The broker does not impose fees for deposits or withdrawals, as it covers third-party transaction costs on behalf of its clients.

While the broker does not explicitly mention inactivity fees, traders should consult the broker’s terms and conditions or contact customer support to confirm any potential charges related to inactive accounts. Overall, CPT Markets UK’s approach to additional fees is designed to provide a cost-effective trading environment for its clients.

Trading Platforms and Tools

Score – 4.6/5

CPT Markets UK provides traders with access to the widely recognized MT4 platform, known for its user-friendly interface, advanced charting tools, and robust trading capabilities. This platform is available to clients under both the UK FCA and the South African FSCA-regulated entities.

For traders registered under the FSCA-regulated entity, the broker expands its platform offerings to include MT5 and cTrader. MT5 provides enhanced features such as additional technical indicators, improved order management, and access to a broader range of financial instruments.

cTrader is tailored for traders seeking a more advanced trading environment, offering faster order execution and algorithmic trading capabilities.

Trading Platform Comparison to Other Brokers:

| Platforms | CPT Markets UK Platforms | ALB Platforms | FinecoBank Platforms |

|---|

| MT4 | Yes | No | No |

| MT5 | Yes | Yes | No |

| cTrader | Yes | No | No |

| Own Platforms | No | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

CPT Markets UK Desktop cTrader Platform

The cTrader desktop platform offered by CPT Markets under its FSCA-regulated entity features high-speed order execution, detailed technical analysis tools, and a wide range of trading indicators.

Traders can benefit from features like multiple take-profit orders, optimized Expert Advisor processing, and advanced platform customization. The platform also includes extensive educational videos to support both beginners and experienced users, all within a user-friendly interface that enhances the overall trading experience.

CPT Markets UK Desktop MetaTrader 4 Platform

The MT4 desktop platform comes with 57 preinstalled technical indicators, 24 analytical charting tools, and supports 3 chart types and 9 timeframes for in-depth market analysis.

MT4 enables 1-click trading, trading directly from charts, and features such as Trailing Stop for effective trade management. Users can customize charts, add custom indicators and EAs, and stay informed with an integrated news feed and broker mailbox. The platform’s easy-to-use interface is available for both Windows and Mac, offering flexibility and performance.

Main Insights from Testing

Testing the MT4 platform highlighted its reliability and efficiency in trade execution, as well as its stability during high-volatility periods. The platform performed smoothly, with minimal latency, and provided quick order placement and modification.

We found the integration with CPT Markets’ pricing and order systems is seamless, offering a consistent trading experience. Custom indicator installation and EA testing also ran without issues, making MT4 a solid and trusted choice for traders who value performance and familiarity.

CPT Markets UK Desktop MetaTrader 5 Platform

The MT5 desktop platform, available under the FSCA-regulated entity, offers a modern and intuitive interface paired with advanced analytics and fully customizable features to suit a wide range of trading strategies.

MT5 supports a broader selection of instruments, giving traders access to more assets and opportunities. It provides robust support for Expert Advisors, ensuring efficient automated trading. The platform is secure, stable, and flexible while remaining user-friendly. It is available for both Windows and Mac, making it a powerful solution for active and professional traders.

CPT Markets UK MobileTrader App

The broker ensures traders can stay connected to the markets on the go by offering mobile versions of all its supported platforms, including MetaTrader 4, MetaTrader 5, and cTrader.

The mobile apps provide access to real-time quotes, interactive charts, trade execution, and account management features, all from the convenience of a smartphone or tablet. With a user-friendly interface and essential tools at your fingertips, these apps make it easy to monitor and manage trades anytime, anywhere.

Trading Instruments

Score – 4.5/5

What Can You Trade on CPT Markets UK’s Platform?

The broker offers a diverse selection of financial products, with over 2,200 instruments available, including 100 Forex pairs, CFDs, Futures, Equities, Commodities, Indices, Stocks, Crypto CFDs, and Options.

However, the availability of trading instruments might vary depending on the entity, so it is recommended to thoroughly research the range of available options.

Main Insights from Exploring CPT Markets UK’s Tradable Assets

Exploring CPT Markets UK’s tradable assets reveals a well-rounded selection designed to cater to a variety of trading styles and strategies. The broker provides access to a broad range of financial instruments, including major and minor Forex pairs, commodities, indices, and stocks.

This variety allows traders to diversify their portfolios and capitalize on global market movements.

Leverage Options at CPT Markets UK

Leverage is a valuable tool that allows traders to enter the market with limited capital. However, you should understand that it can result in substantial gains or losses. Therefore, have a comprehensive understanding of how it operates and its potential consequences before engaging in any trading activities that involve a multiplier.

CPT Markets leverage is offered according to FCA and FSCA regulations:

- UK traders are eligible to use low leverage up to 1:30 for major currency pairs and 1:10 for Commodities.

- International entity clients can use leverage up to 1:1000 for professional trading.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at CPT Markets UK

In terms of funding methods, CPT Markets UK offers numerous payment methods, which is a very good plus, yet check according to its regulations whether the method is available or not.

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller, and more

CPT Markets UK Minimum Deposit

The Classic Account at CPT Markets UK comes with a $0 minimum deposit requirement, making it easily accessible for all types of traders.

Withdrawal Options at CPT Markets UK

For both deposits and withdrawals, no fees are charged by the broker, however, you should always check with your payment provider in case any fees are applied on their end.

Customer Support and Responsiveness

Score – 4.3/5

Testing CPT Markets UK’s Customer Support

Broker’s customer support is available 24/5 through Email and Phone under the UK entity. We found that CPT Markets has a team of experienced trading specialists who are available to help clients with various issues. These include technical problems, market analysis advice, general inquiries, and operational concerns.

Contacts CPT Markets UK

CPT Markets UK provides customer support via phone and email. You can reach their team by calling +44 (0) 203 988 2277 during business hours or by emailing info@cptmarkets.co.uk.

Research and Education

Score – 4.4/5

Research Tools CPT Markets UK

CPT Markets UK equips traders with a suite of research tools available both on its website and integrated within its trading platforms.

- On the international website, traders can access the Economic Calendar, which provides insights into upcoming economic events. Additionally, live market updates are available to keep traders informed about market trends.

- Within the trading platforms, such as MT4, traders benefit from a range of analytical tools, including preinstalled technical indicators, analytical charting tools, and the ability to add custom indicators and Expert Advisors. These tools facilitate in-depth market analysis and support various trading strategies.

- The platforms also feature real-time news feeds and customizable charts, enhancing the overall trading experience.

Education

CPT Markets, under its FSCA-regulated entity, provides educational resources through the CPT Markets Academy. This resource is designed to support traders at all levels, providing a variety of learning materials, including video tutorials and in-depth articles.

The Academy covers essential trading topics, from fundamental and technical analysis to platform navigation and risk management strategies. By leveraging these educational tools, traders can enhance their market understanding and develop more effective trading strategies.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options CPT Markets UK

While CPT Markets UK is primarily a Forex and CFD broker, it also offers investment-oriented tools designed to cater to both individual and institutional clients. Notably, the broker provides Copy Trading services, allowing clients to follow and replicate the strategies of experienced traders. This feature enables investors to benefit from the expertise of seasoned professionals without actively managing trades themselves.

Additionally, CPT Markets offers MAM accounts, which are ideal for fund managers and professional traders. These investment tools enhance the broker’s offerings, providing clients with options that go beyond traditional trading and catering to those interested in more passive investment strategies or professional fund management.

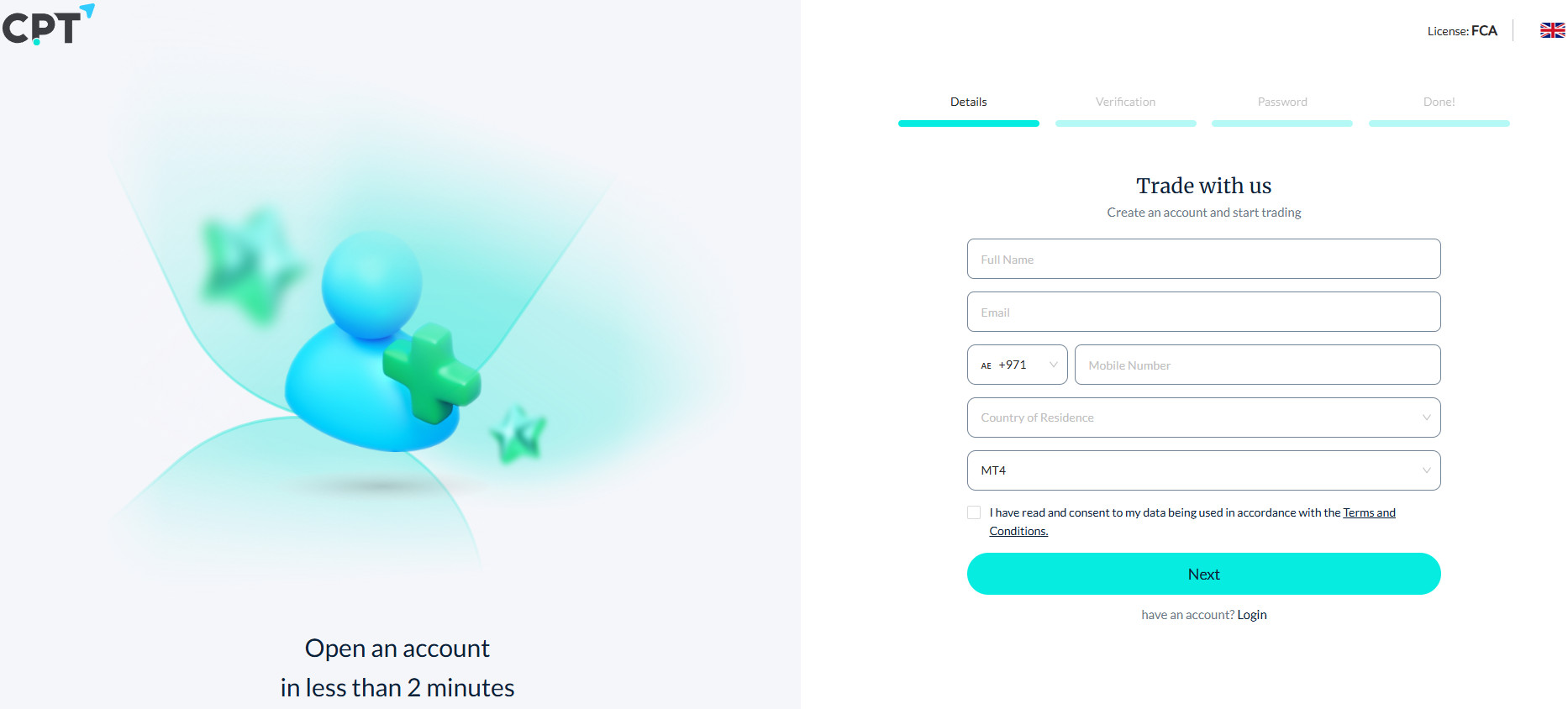

Account Opening

Score – 4.5/5

How to Open CPT Markets UK Demo Account?

Opening a demo account with CPT Markets UK is a straightforward process designed to help traders familiarize themselves with the trading environment without risking real capital.

To get started, visit the CPT Markets UK website and click on the “Demo Account” button. You will be prompted to complete a simple registration form, providing details such as your name, email address, and phone number.

Once registered, you will receive login credentials via email, granting you access to the trading platform. The demo account comes preloaded with $50,000 in virtual funds and is valid for 30 days, allowing you to practice trading strategies and explore the platform’s features in a risk-free environment.

How to Open CPT Markets UK Live Account?

Opening an account with a broker is quite easy. You can open an account within minutes. Follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to its core research tools, CPT Markets offers a few additional features aimed at enhancing the trading experience.

- The broker integrates market sentiment indicators, which help traders gauge market trends and make informed decisions.

- Moreover, multilingual customer support, secure client portal access, and regular market insights contribute to a user-friendly and supportive trading environment.

CPT Markets UK Compared to Other Brokers

CPT Markets UK positions itself competitively among a range of well-established brokers, offering a blend of services that cater to different trader needs.

The broker supports popular options like MetaTrader 4 and MetaTrader 5, along with cTrader, providing flexibility for traders across different strategies, though competitors may offer additional platform variety or proprietary options.

In terms of regulation, CPT Markets UK is overseen by reputable authorities like the FCA and FSCA, ensuring a strong level of security and reliability, which is on par with other leading brokers in the market.

While educational resources are somewhat limited, the broker stands strong in its customer support. However, its asset variety, though extensive, does not reach the scale of some brokers offering thousands of instruments, but it remains competitive for traders looking for Forex and CFD options.

Overall, CPT Markets UK offers a balanced package with competitive pricing, reliable platforms, and solid regulatory oversight, making it a strong competitor in the online trading space.

| Parameter |

CPT Markets UK |

ADS Securities |

Saxo Bank |

City Index |

Velocity Trade |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1.8 pips |

Average 0.7 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

$2.5 per side |

0.0 pips + $3 |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

$3 per side per 100,000 units traded |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, cTrader |

ADSS Platform, MT4 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

V Trader |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

2,200+ instruments |

1,000+ instruments |

71,000+ instruments |

13,500+ instruments |

250+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

FCA, FSCA |

SCA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

$100 |

$0 |

$0 |

$500 |

$0 |

$0 |

Full Review of Broker CPT Markets UK

CPT Markets UK is a well-regulated broker offering a comprehensive trading experience through its FCA and FSCA-regulated entities. Traders can access a wide range of over 2,200 financial instruments, including Forex, indices, commodities, and shares.

The broker provides multiple account types such as Classic, Prime, ECN, and swap-free options, accommodating various trading styles and levels. It also supports industry-leading platforms, with both desktop and mobile access.

CPT Markets UK features a diverse range of research tools, including market sentiment indicators, market analysis, trading insights, and more. Educational resources are available under the FSCA entity through the CPT Markets Academy.

With its strong regulatory framework, solid platform offering, and diverse trading conditions, the broker presents itself as a reliable choice for retail and professional traders alike.

Share this article [addtoany url="https://55brokers.com/cpt-markets-uk-review/" title="CPT Markets UK"]