- What is City Index?

- City Index Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

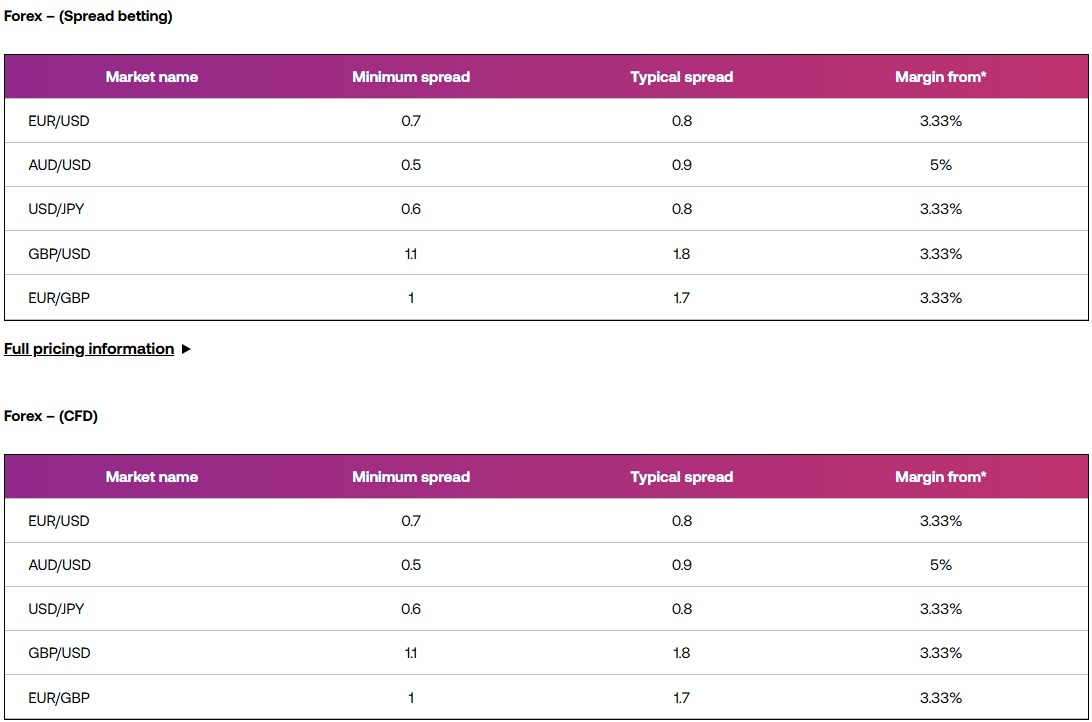

- Cost Structure and Fees

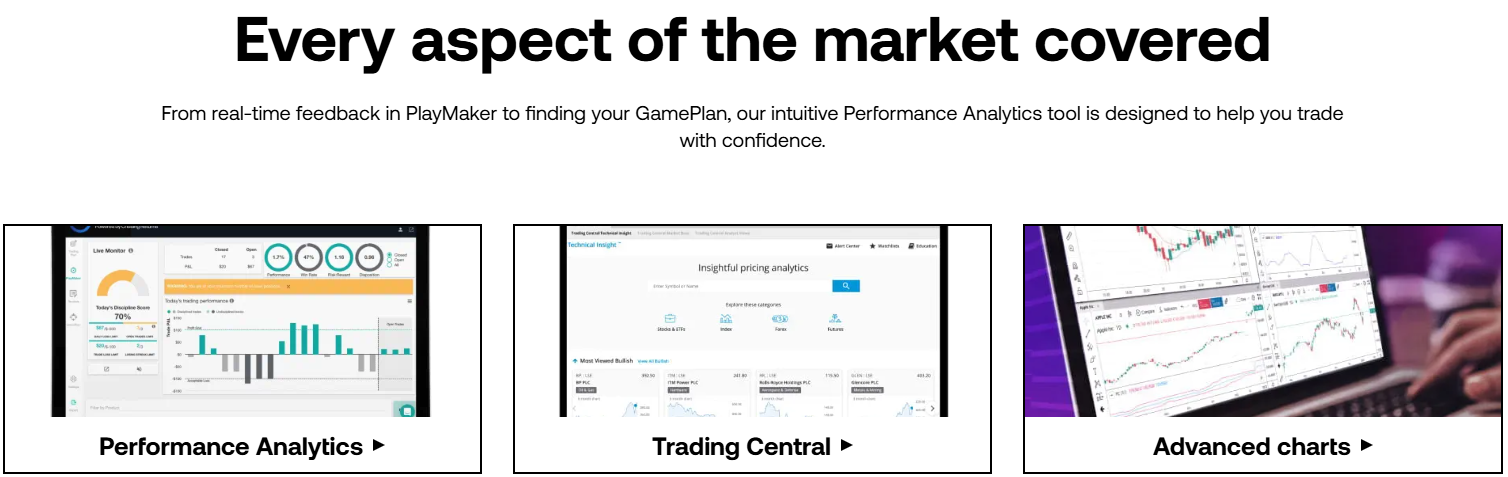

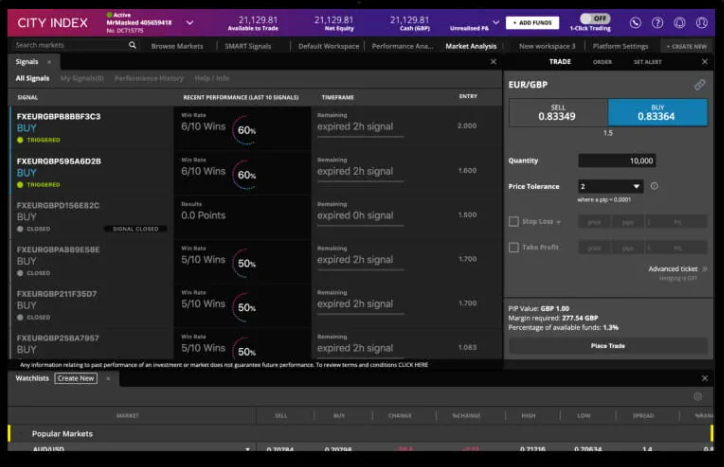

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- City Index Compared to Other Brokers

- Full Review of Broker City Index

Overall Rating 4.7

| Regulation and Security | 4.8 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.8 / 5 |

| Deposit and Withdrawal Options | 4.8 / 5 |

| Customer Support and Responsiveness | 4.8 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.6 / 5 |

What is City Index?

City Index is a trusted muti-asset Trading Provider with over 40 years of experience. The broker was established in 1983 in London, UK, and is one of the world’s leading spread betting, Currency, and CFDs trading in Forex, indices, shares, commodities, bonds, interest rates, and cryptocurrencies.

As part of the NASDAQ-listed StoneX group, over 1 million traders can trade confidently, relying on City Index’s proven record of financial strength and security. The broker is also a partner of the Saracens, one of Europe’s most successful rugby clubs.

Is City Index a Good Broker?

The broker’s quality execution, competitive pricing, low margins, tight spreads from 0.7 points of FX, and truly supportive relationship management make the broker an excellent choice suitable for both beginner and advanced traders. Our research showed that the broker’s client base comes to over 150,000 traders worldwide, and this is not a surprising fact.

Is City Index a Market Maker?

Yes, since its inception, City Index has been primarily operating as a market maker just like many other CFD brokers.

City Index Pros and Cons

Based on our research, City Index is a respected and reliable broker and is a part of the large strong established group listed in stock. The broker is considered one of the Best UK brokers with a large instrument range, low spreads, and a professional education section.

On the negative side, their customer support is not available 24/7 also there are no multi-currency accounts, so conversion fees for funding might be applicable. Also, we noticed that the broker lacks social trading which is one of the most popular sophisticated strategies that benefits traders.

| Advantages | Disadvantages |

|---|

| Good reputation with over 40 years of experience | No multi-currency accounts |

| Sharp adherence to regulation and good standing | No Social trading |

| Listed on the NASDAQ | No 24/7 support |

| Professional trading environment | |

| Great range of market instruments | |

| Proposal suitable for beginners and professionals | |

| Based on MetaTrader and proprietary technology | |

| Good education support | |

City Index Features

City Index offers a variety of features that cater to both financial trading and spread betting clients. Below is a comprehensive list of its key features:

City Index Features in 10 Points

| 🏢 Regulation | FCA, ASIC, MAS |

| 🗺️ Account Types | Standard, MT4, Corporate Accounts |

| 🖥 Trading Platforms | City Index Web Trader, MT4, TradingView |

| 📉 Trading Instruments | Forex, CFDs on Indices, Shares, Metals, Commodities, Cryptocurrencies, Bonds, Options, ETFs, Futures |

| 💳 Minimum Deposit | $0 |

| 💰 Average EUR/USD Spread | 0.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | GBP, USD, EUR, PLN, CHF |

| 📚 Trading Education | Learning Academy, Webinars, Courses, Glossary |

| ☎ Customer Support | 24/5 |

Who is City Index For?

City Index is a versatile platform designed to cater to a diverse range of traders, offering financial trading and spread betting with competitive spreads, tax advantages, and ease of use. Based on our findings, City Index is well-suited for:

- Beginning traders

- Professional traders

- Traders who prefer the MT4 platform

- Traders from UK

- Currency and CFD trading

- Suitable for a variety of strategies

- Spread Betting

- Cryptocurrency trading

- Good learning materials

City Index Summary

Based on our expert findings, City Index is highly regulated and offers great conditions in the Forex and CFDs market. The broker is well-known for providing a wide range of instruments globally for international trading. Additionally, for UK residents, it offers competitive conditions for spread betting.

Additionally, City Index provides a wide range of technical optimization tools, along with a highly developed selection of platforms and various instruments for analysis, strategy improvement, and advanced functionalities. This combination makes it an excellent choice for traders of all skill levels, solidifying its reputation as one of the best brokers in the UK.

55Brokers Professional Insights

City Index distinguishes itself in the industry through its robust regulatory framework, a diverse range of platforms, and commitment to client education. As part of the NASDAQ-listed StoneX Group Inc., City Index operates under the oversight of top-tier financial authorities, including the UK FCA, Australian ASIC, and the Monetary Authority of Singapore (MAS) it is recognized as one of the most trusted and sustainable firms, with great reputation and oversight. For this reason and great performance provided overall we rank City Index at highest mark and rank them as suitbale for most traders, especially large trading size, high frequency and investors.

The broker offers robust platforms to cater to different trader preferences, such as the proprietary Web Trader platform, the globally recognized MT4, and integration with TradingView for advanced charting and social trading features.

Additionally, City Index provides comprehensive educational resources, including webinars, tutorials, and market analysis, empowering traders to make informed decisions. This combination of strict regulation, versatile platform options, and a strong educational focus positions City Index as a standout choice for traders seeking a reliable and enriching experience.

Consider Trading with City Index If:

| City Index is an excellent Broker for: | - Need a well-regulated broker.

- UK and Australian traders.

- Spread betting trading.

- Looking for broker with no minimum deposit requirement.

- Offering low leverage up to 1:30.

- Providing competitive fees and spreads.

- Quality educational materials.

- Secure environment.

- Offering popular instruments.

- Broker with a variety of strategies.

- Access to MT4 VPS Hosting.

- Institutional clients and professional traders.

- Access to robust platforms.

- Offering services worldwide. |

Avoid Trading with City Index If:

| City Index might not be the best for: | - Who prefer 24/7 customer service.

- Providing Copy Trading.

- Looking for MAM/PAMM trading. |

Regulation and Security Measures

Score – 4.8/5

City Index Regulatory Overview

City Index operates under a strong regulatory framework, ensuring a secure and transparent environment for its clients. It is authorized and regulated by several top-tier financial authorities, including the FCA in the UK, the ASIC in Australia, and the MAS in Singapore.

These regulatory bodies enforce strict compliance standards, safeguarding client funds and ensuring fair practices. As part of the NASDAQ-listed StoneX Group, City Index benefits from additional financial stability and oversight, making it a trusted choice for traders worldwide.

How Safe is Trading with City Index?

Trading with City Index is considered highly safe due to its strong regulatory oversight and financial backing.

As a retail client money is fully segregated from the broker funds and is kept separately and safely with world-leading banks. Along with the rest, necessary protection procedures that are carefully followed by the company the accounts, and overall management of the traders from A to Z adhere to provide you with a clear state of mind.

In addition, the broker applied for negative balance protection, and in case of insolvency, FSCS controlled clients’ compensation to recover accounts up to £85,000.

Consistency and Clarity

City Index has established a strong reputation in the trading community, reflected in its high trust ratings and numerous industry awards. User reviews highlight the platform’s reliability and customer-oriented services, with clients praising its versatile platform and professional support.

However, some traders have noted areas for improvement, such as the absence of MT5 and higher spreads on certain instruments. Beyond its trading services, City Index actively engages in social initiatives, including sponsorships of prominent sports teams, further enhancing its presence and reputation in the broader community.

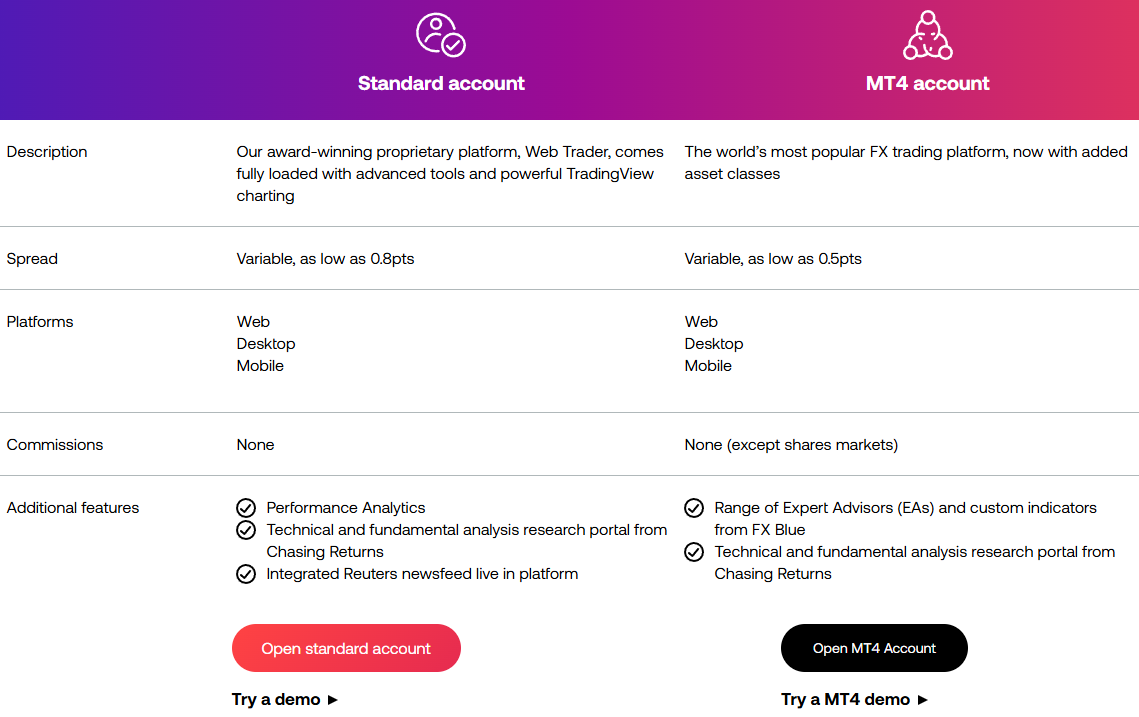

Account Types and Benefits

Score – 4.5/5

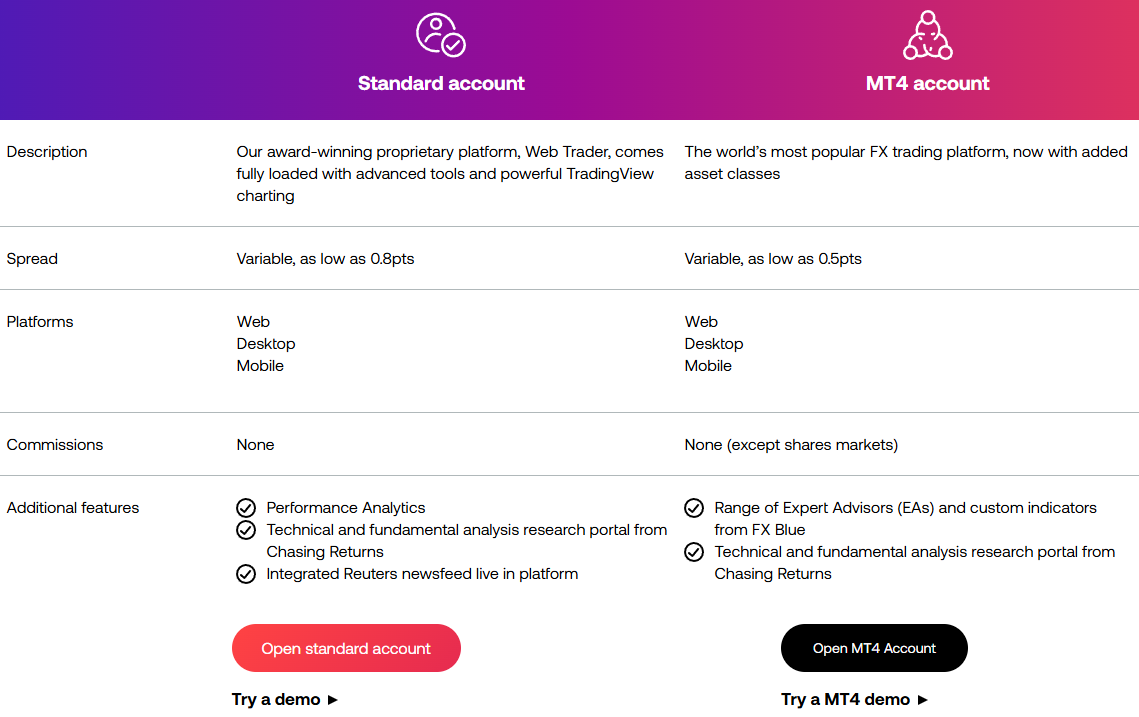

Which Account Types Are Available with City Index?

City Index offers a few account types for both individual and corporate traders. The Standard Account is the primary option, providing access to a wide range of markets with competitive spreads and leverage.

For traders who prefer the MetaTrader 4 platform, the MT4 Account offers seamless integration with automated capabilities and advanced charting tools. Corporate Accounts are available for businesses and institutional clients, allowing for customized solutions and dedicated account management.

Additionally, City Index provides a Demo Account, which enables traders to practice risk-free with virtual funds, helping both beginners and experienced traders test strategies before committing real capital.

Standard Account

The Standard Account is designed for traders seeking a comprehensive experience. With spreads as low as 0.8 pips, this account offers competitive pricing across a wide range of markets.

It is accessible via Web Trader, a platform equipped with advanced tools and TradingView charting, allowing traders to perform in-depth technical analysis and execute trades efficiently. Additionally, the account includes Performance Analytics, which helps traders track their trading habits and improve decision-making.

For those who rely on market insights, the Standard Account integrates a technical and fundamental analysis research portal from Chasing Returns and a live Reuters newsfeed, ensuring traders stay informed with real-time financial news and data directly within the platform.

MT4 Account

The MT4 Account for traders who prefer the MetaTrader 4 platform. With spreads as low as 0.5 pips, the account offers cost-effective conditions for Currency traders.

One of its standout features is access to a range of Expert Advisors and custom indicators from FX Blue, enabling traders to automate strategies and enhance their market analysis.

Similar to the Standard Account, the MT4 Account also includes a technical and fundamental analysis research portal from Chasing Returns, providing traders with valuable insights to optimize their performance. This account is an excellent choice for those who rely on algorithmic trading, custom indicators, and deep analytical tools to refine their strategies.

Regions Where City Index is Restricted

Due to regulatory constraints, City Index does not offer its services in certain countries, including:

- USA

- Canada

- Belgium

- North Korea, etc.

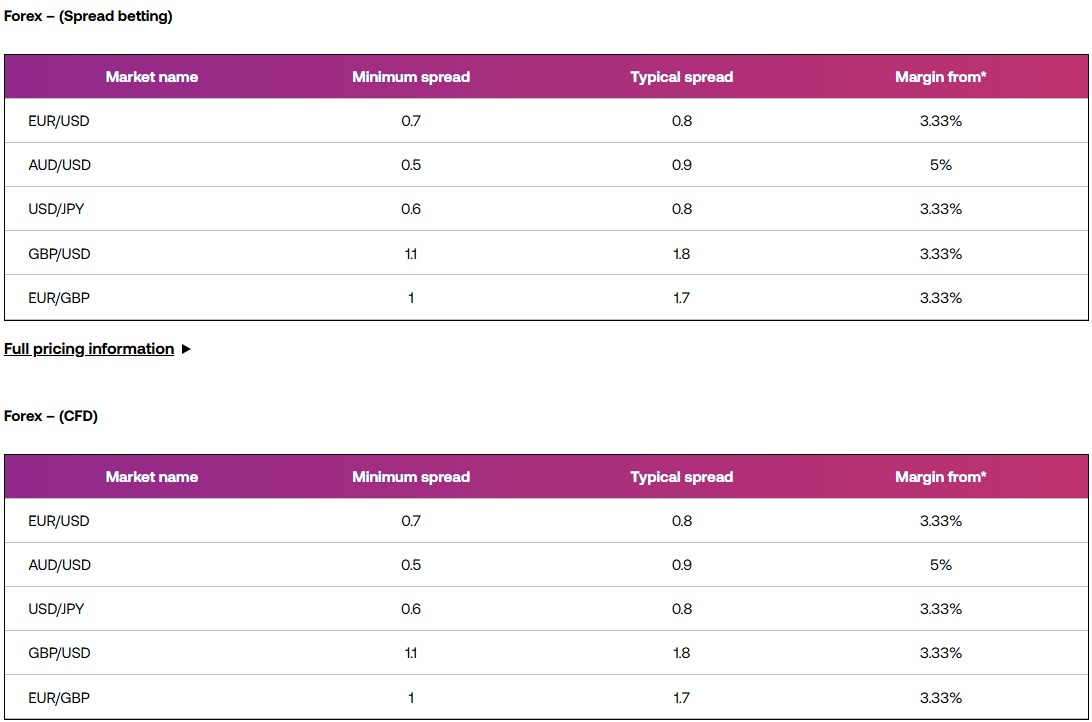

Cost Structure and Fees

Score – 4.6/5

City Index Brokerage Fees

City Index offers a transparent and competitive pricing model, ensuring traders benefit from fair and cost-effective conditions. The broker provides a mix of fixed and variable spreads, with spreads starting from 0.5 pips for Currency pairs and from 0.4 points for Indices, making it an attractive choice for traders looking to minimize costs.

Additionally, margins start from 3.33%, allowing for flexible leverage options. City Index does not charge commissions on most trades, as costs are built into the spread, though overnight financing fees and inactivity fees may apply. Overall, the brokerage fee structure is designed to provide affordability while maintaining high-quality conditions.

City Index spread depends on the market you wish to trade, as well as giving you the option to choose between the fixed or variable spreads according to the strategy you prefer to use.

The broker provides an average spread of 0.8 pips for EUR/USD, making it attractive for currency traders. The broker’s transparent pricing model ensures traders can access tight spreads without hidden fees, making it a preferred choice for both retail and professional traders seeking efficient market execution.

City Index operates primarily on a spread-based pricing model, meaning most trades are commission-free. However, commissions apply when trading Shares on CFD accounts or when Spread Betting.

For example, UK Shares incur a CFD commission of 0.08% per trade, with a minimum charge of £10. This structure ensures traders benefit from competitive costs while accessing a wide range of markets.

- City Index Rollover / Swaps

City Index applies rollover or swap fees on positions that are held overnight. These fees are based on the difference in interest rates between the two currencies in a Forex pair or the cost of holding other assets overnight.

The rollover rates can be either positive or negative, depending on the direction of the trade and the interest rate differential. These fees are typically calculated at the end of each trading day and may vary depending on market conditions and the asset being traded.

- City Index Additional Fees

In addition to spreads and commissions, City Index may charge additional fees depending on the activity. These include overnight financing fees for positions held overnight, which are based on the interest rate differential of the currencies or instruments traded.

Additionally, an inactivity fee of £12 per month will be charged if there has been no trading activity for 12 months. This fee will continue until there is trading activity in the account or the account balance reaches zero.

Additionally, withdrawal fees may apply depending on the method used to transfer funds.

How Competitive Are City Index Fees?

City Index offers competitive fees across its range of services, making it an appealing choice for traders. With tight spreads starting from as low as 0.5 pips, the broker ensures low-cost conditions.

Most trades do not carry additional commissions, as fees are incorporated into the spreads. While there are commissions for specific services, such as CFD trading on shares and spread betting, the overall fee structure remains highly competitive, particularly for traders who prioritize cost-effective market access.

Overall, City Index’s fee transparency ensures that traders can easily understand the costs involved before making any decisions.

| Asset/ Pair | City Index Spread | LegacyFX Spread | X Open Hub Spread |

|---|

| EUR USD Spread | 0.8 pips | 1.2 pips | 0.14 pips |

| Crude Oil WTI Spread | 0.4 | 0.13 pips | 0.0214 |

| Gold Spread | 0.3 | 0.63 pips | 0.0841 |

| BTC USD Spread | 35 | 505.03 | 52.3983 |

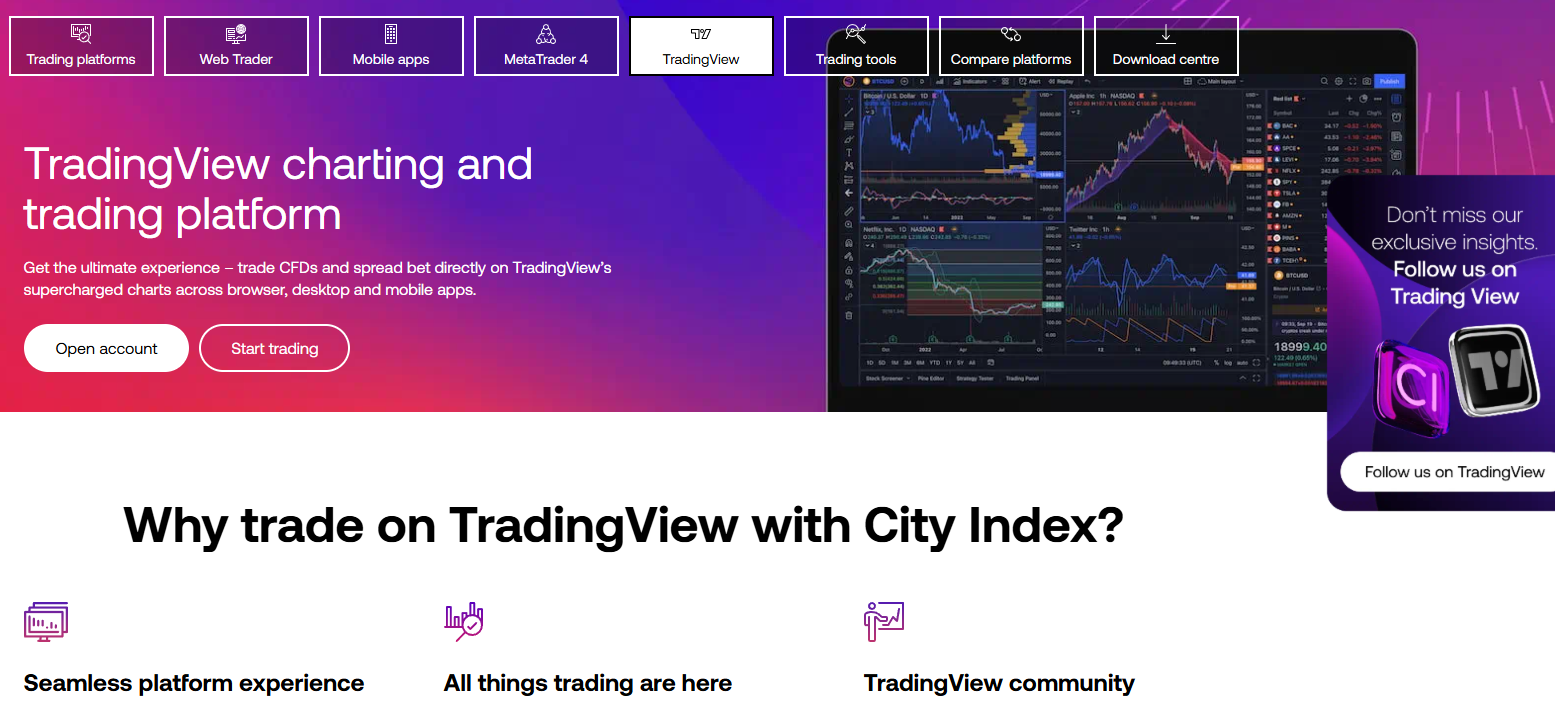

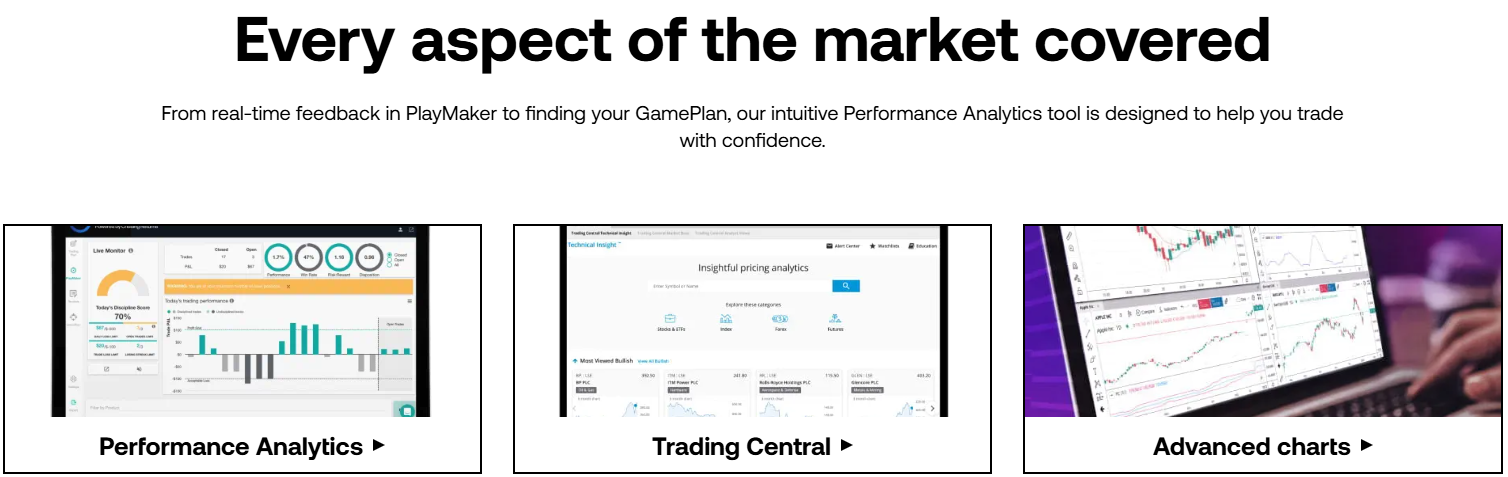

Trading Platforms and Tools

Score – 4.5/5

City Index offers platforms and tools designed to suit different trading styles and preferences. The City Index Web Trader is a versatile, user-friendly platform that provides seamless access to a wide range of markets.

It comes equipped with advanced charting tools, including integration with TradingView, allowing traders to perform in-depth technical analysis and customize their experience. Additionally, the average trade will execute in just 0.05 seconds, ensuring fast and efficient trade execution.

For those who prefer a more established platform, MT4 is also available, offering robust capabilities, automated trading via EAs, and advanced charting features.

Trading Platform Comparison to Other Brokers:

| Platforms | City Index Platforms | LegacyFX Platforms | X Open Hub Platforms |

|---|

| MT4 | Yes | No | Yes |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

City Index Web Platform

The City Index Web Trader is a highly customizable web platform designed to meet the needs of traders at all experience levels. This platform allows users to trade directly from any browser, eliminating the need for installations, and making it an ideal choice for those who prioritize easy access and efficiency.

It offers 16 types of customizable charts, 80 indicators, and actionable trade ideas sourced from the integrated research portal, providing traders with robust tools for both technical and fundamental analysis. Known for its high performance, the City Index Web Trader has earned several awards for excellence and has become a popular choice among traders due to its outstanding capabilities, enabling them to make informed and strategic decisions with ease.

Main Insights from Testing

Testing the City Index Web Trader reveals a highly responsive and intuitive platform with a smooth user experience. Traders can easily navigate through various tools and charts, benefiting from quick order execution and seamless access to real-time market data.

The platform’s customizability stands out, allowing users to tailor the interface to their preferences, improving trading efficiency. Additionally, its integration with advanced analysis tools and research features ensures that traders have the necessary resources to make informed decisions. Overall, the platform offers solid performance, making it an excellent choice for both beginners and experienced traders.

City Index Desktop MetaTrader 4 Platform

The desktop MT4 platform is a widely popular solution, known for its user-friendly interface, and access to a wide range of technical analysis tools, including customizable charts, indicators, and automated trading through Expert Advisors.

The platform’s powerful functionality allows traders to execute trades efficiently, track market trends in real time, and implement complex strategies with ease.

City Index Desktop MetaTrader 5 Platform

City Index does not offer the MetaTrader 5 platform. Instead, the broker provides access to the widely used MetaTrader 4 platform, which is known for its advanced features and robust performance.

While MT5 offers additional functionalities like more timeframes and more advanced order types, City Index has chosen to focus on the popular MT4 platform to meet the needs of its traders.

City Index MobileTrader App

The City Index MobileTrader App provides traders with the flexibility to trade on the go, offering access to the same powerful tools and features available on the desktop platform. The app integrates seamlessly with the MT4 mobile app, allowing traders to access their MetaTrader 4 account directly from their mobile device, enabling quick order execution, charting, and analysis while on the move.

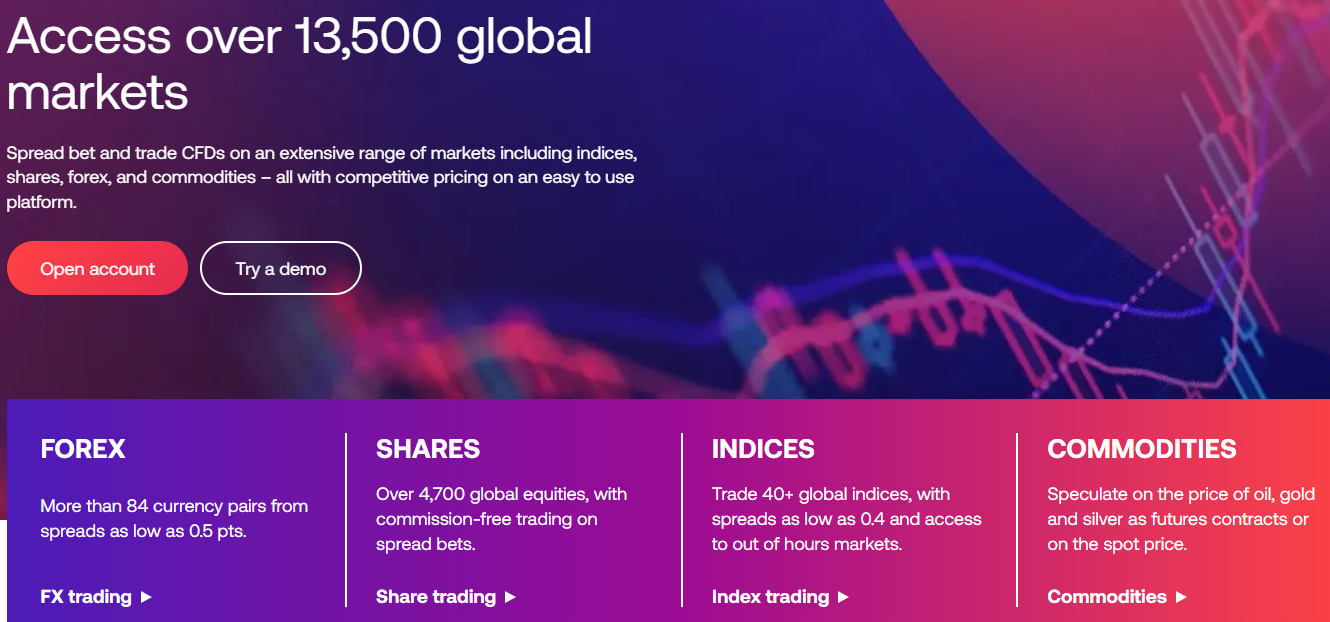

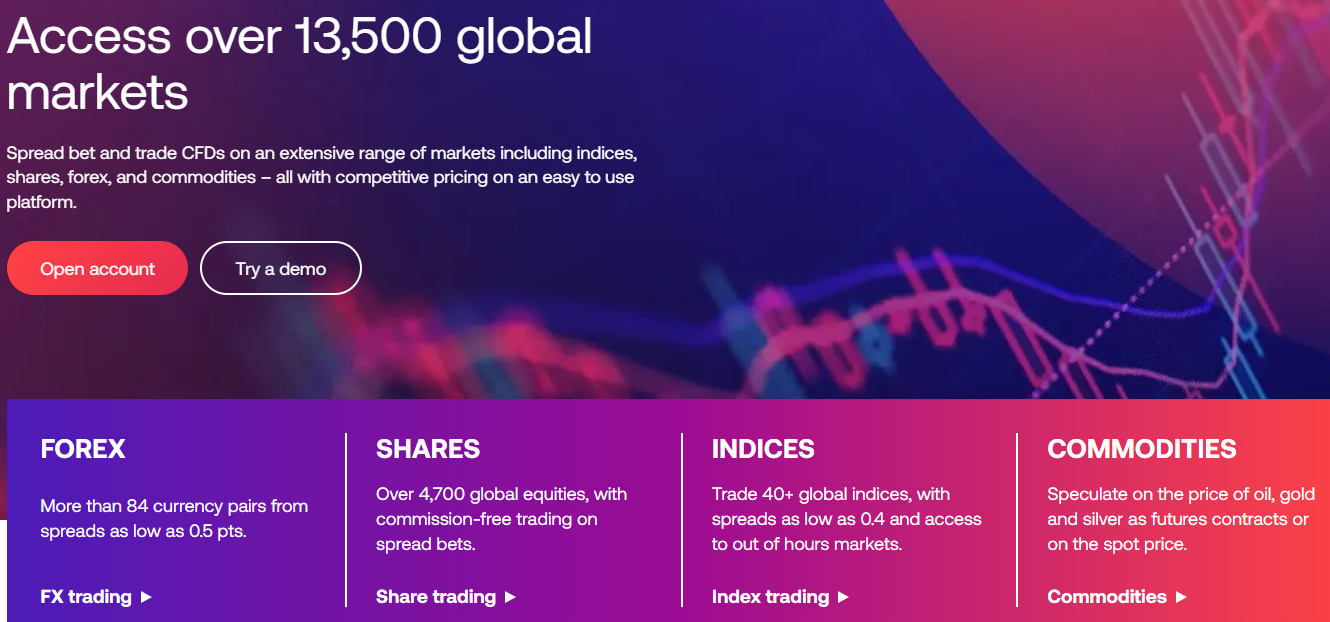

Trading Instruments

Score – 4.8/5

What Can You Trade on City Index’s Platform?

City Index enables trading on over 13,500 global markets consisting of Spread Betting, CFD, and Currency Trading for 40+ global Indices, 4,700+ Shares, 84 FX pairs, Crypto, and 25+ Commodities. The Crypto market at City Index is also widely presented and includes Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Ripple, with an opportunity to adjust strategy and start to trade as a spread bet from 10p a point or as CFD Minis.

Beyond Indices, FX, Shares, and Commodities City Index offers an additional choice of markets to trade, including Metals, Bonds, Interest Rates, ETFs, and Futures.

However, crypto trading is banned in the UK, so UK residents might prefer trading under a different jurisdiction.

Main Insights from Exploring City Index’s Tradable Assets

Exploring City Index’s tradable assets reveals a diverse and expansive selection that caters to various strategies and preferences. The platform offers a wide range of Currency pairs, CFDs, indices, and commodities, providing traders with ample opportunities across different markets.

With access to both major and exotic currency pairs, as well as global stock indices and popular commodities, City Index allows for a well-rounded experience.

Leverage Options at City Index

Leverage known as a loan given by the broker to the trader that allows you to trade larger capital than the initial capital is a very useful tool, yet you should use it carefully. City Index multiplier based on entity conditions and instrument you trade:

- Traders from the UK are eligible to use a maximum of up to 1:30 for major currency pairs.

- The Australian branch is entitled to 1:30 too.

Deposit and Withdrawal Options

Score – 4.8/5

Deposit Options at City Index

In terms of funding methods, City Index offers a few payment methods which are a very good plus, yet check according to its regulations whether the method is available or not.

City Index Minimum Deposit

There is no minimum deposit requirement for account opening, even so, we advise you to deposit £100 to cover margins.

Withdrawal Options at City Index

Transactions involving card deposits and transfers, for both deposits and withdrawals, do not incur any charges from the company. Traders can choose from a variety of methods, including convenient options like bank transfers and e-wallets. However, if you wish to receive same-day payment via a CHAPS bank transfer, a £25 charge will apply.

Customer Support and Responsiveness

Score – 4.8/5

Testing City Index’s Customer Support

Testing City Index’s customer support reveals a responsive and efficient service, available 24/5 through multiple channels including email, phone support, and leaving a message.

The support team is highly knowledgeable, offering timely assistance with both account-related queries and technical issues. During testing, the response time was quick, with representatives providing clear and helpful answers to inquiries.

Additionally, City Index offers a comprehensive FAQ section for traders, making it easy to find answers to common questions and enhance the experience. Overall, City Index’s customer support ensures that traders have reliable assistance when needed, contributing to a positive user experience.

Contacts City Index

To get in touch with City Index, you can reach their customer support team through multiple contact methods. For direct assistance, you can call their phone number at 0203 194 1801 or use the freephone number 0800 060 8609.

Alternatively, you can email the team at support.uk@cityindex.com for any inquiries or support-related requests.

Research and Education

Score – 4.7/5

Research Tools City Index

City Index provides a comprehensive suite of research tools across both its website and platforms, helping traders analyze markets and refine their strategies.

- On the website, traders can access Trading Central, real-time market news, an economic calendar, and sentiment analysis tools to track key financial events and market positioning.

- Web Trader and MT4 offer a range of technical indicators, interactive charts, and moving averages for in-depth analysis.

- MT4 users can also benefit from VPS hosting for automated trading. Whether on the website or platforms, City Index ensures traders have access to great tools to support their decisions.

Education

City Index offers a well-structured Education Center designed to support traders at all experience levels. The platform’s Academy provides comprehensive courses tailored to different skill levels, covering trading concepts, technical and fundamental analysis, and strategies.

Additionally, traders can benefit from regular webinars, where experts discuss market trends and strategies in real-time. The broker also provides a glossary, helping traders understand key financial terms.

Along with ongoing trading news and research materials, City Index ensures that traders can access valuable educational content to enhance their knowledge and skills.

Portfolio and Investment Opportunities

Score – 3.8/5

Investment Options City Index

City Index primarily operates as a Forex and CFD broker, offering a wide range of tradable assets across global markets. Additionally, the broker provides options trading, allowing clients to trade options on various asset classes.

However, the broker does not offer traditional investment products such as mutual funds or direct stock ownership, instead, it focuses on leveraged instruments suitable for active traders.

Account Opening

Score – 4.5/5

How to Open City Index Demo Account?

Opening a City Index Demo Account is a simple process designed to help traders practice in a risk-free environment. To get started, visit the City Index website and select the option to open a demo account. You will need to provide basic details such as your name, email, and phone number before gaining instant access to a virtual environment.

The demo account allows you to explore City Index’s platforms, including Web Trader and MT4, with real-time market data and a virtual balance. This is an excellent way to test trading strategies, platform features, and market conditions before transitioning to a live account.

How to Open City Index Live Account?

Opening a City Index Live Account allows traders to access a wide range of financial markets. Follow these steps to get started:

- Go to the official City Index website and click on the “Open Account” button.

- Provide your details, including your name, email, phone number, and country of residence.

- Upload the required documents, such as a passport, national ID, or utility bill.

- Select from Standard, MT4, or Corporate Accounts, depending on your trading needs.

- Deposit funds using bank transfers, or credit/debit cards.

- Once your account is verified and funded, you can access City Index’s platforms and begin trading.

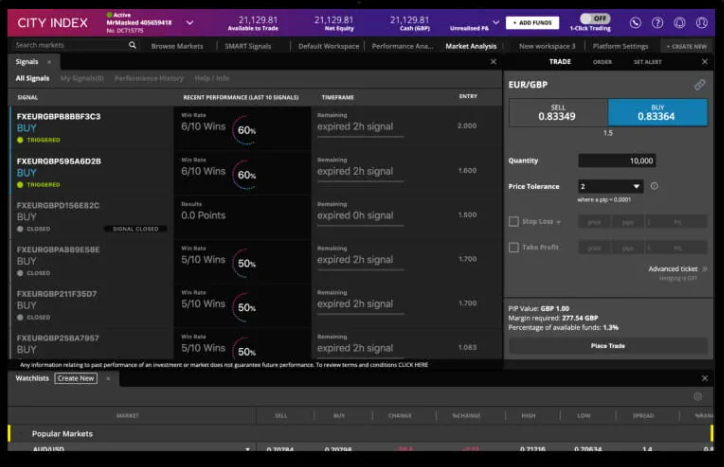

Additional Tools and Features

Score – 4.6/5

City Index offers a range of additional tools and features designed to enhance the experience.

- Beyond its core research tools, traders can benefit from Trading Signals, providing actionable trade ideas based on technical analysis.

- Additionally, the integration with TradingView allows users to access advanced charting tools and a social trading community for deeper market insights.

- The Performance Analytics tool helps traders review their strategies and optimize their decisions.

- Moreover, the broker offers customizable alerts and risk management tools, ensuring traders stay informed about market movements and can manage their positions efficiently.

City Index Compared to Other Brokers

City Index stands out in the market with its combination of competitive spreads, strong regulatory oversight, and a variety of platforms.

While brokers like Spreadex and CMC Markets offer slightly lower spreads, City Index provides a well-rounded experience with platforms like Web Trader, MT4, and TradingView integration, appealing to traders who value flexibility and ease of use. Saxo Bank, with a broader range of instruments, is more attractive for those looking for a massive selection of assets, however, City Index provides a balanced variety without overwhelming traders with complexity.

In comparison, brokers like CMC Markets and X Open Hub are also highly regulated but may not provide the same level of educational resources and customer support that City Index offers. Overall, City Index provides a solid blend of competitive fees, robust educational support, and diverse platform choices, making it a strong contender among its competitors.

| Parameter |

City Index |

Spreadex |

Saxo Bank |

LegacyFX |

Swissquote |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 0.8 pips |

Average 0.6 pips |

Average 0.9 pips |

Average 1.2 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

For Stock and ETF (commission of $3 per trade) |

For Stock CFDs Only (commission fee of 0.45%) |

0.0 pips + €2.50 |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

City Index Web Trader, MT4, TradingView |

Spreadex Web Platform, TradingView |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

MT5 |

MT4, MT5, Swiss DOTS, TradingView |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

13,500+

instruments |

10,000+ instruments |

71,000+ instruments |

250+ instruments |

400+ Forex and CFDs instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

FCA, ASIC, MAS |

FCA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

CySEC, VFSC |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Good |

Excellent |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

$0 |

$0 |

$0 |

$500 |

$1,000 |

$0 |

$0 |

Full Review of Broker City Index

City Index is a well-established broker offering a wide range of options, including Forex, CFDs, and spread betting. It is highly regulated by top authorities such as the FCA, ASIC, and MAS, ensuring a secure environment for its users.

City Index provides traders with access to competitive spreads, with various platform options like the Web Trader, MT4, and integration with TradingView, allowing for flexibility in strategies. The broker also offers a robust selection of educational resources, including courses, webinars, and a comprehensive learning academy to cater to both beginners and experienced traders.

With a user-friendly interface and advanced tools for analysis, City Index is suitable for traders looking for reliable execution speeds, a solid range of assets, and a supportive customer service team available 24/5.

Share this article [addtoany url="https://55brokers.com/city-index-review/" title="City Index"]

Can usa citizens use your trading services

Hello, can Iranians register?

Hi, I from Malaysia, I want to ask some questions. In Malaysia have any branch or IB(persons) for support and it can withdraw/deposit transfer to local bank Malaysia(any charges)? Thanks