- What is Charles Schwab?

- Charles Schwab Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Charles Schwab Compared to Other Brokers

- Full Review of Broker Charles Schwab

Overall Rating 4.7

| Regulation and Security | 4.8 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6/5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.8 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is Charles Schwab?

Charles Schwab is a Real Stock trading and Investing company that provides a wide range of services to individual investors and institutions. The firm offers online brokerage services, allowing investors to buy and sell a variety of financial assets, including stocks, bonds, mutual funds, ETFs, options, and more.

Based on our research, the broker has an international presence, mainly catering to U.S. expatriates and international investors. In various locations such as the UK, Hong Kong, Singapore, and more, Charles Schwab has established entities that adhere to local rules and regulations and offer assistance to investors.

Broker was founded by Charles R. Schwab in 1971 and has grown to become one of the largest and most well-known brokerage firms in the USA. In addition, Charles Schwab offers a wide range of investment products, managed portfolios, Charles Schwab retirement accounts (IRAs), education savings accounts (529 plans), and annuities.

Overall, the firm is well-known for its commitment to prioritizing the best interests of traders and investors, emphasizing low fees and commissions and a long-term investment approach.

Is Charles Schwab Stock Broker?

Yes, Charles Schwab is a Stock trading and financial services company that provides brokerage services to investors and institutions. The firm allows clients to buy and sell various financial assets, including stocks, bonds, mutual funds, ETFs, options, and other investment products.

Additionally, it offers a range of financial services, including banking, retirement accounts, and investment advisory services.

Charles Schwab Pros and Cons

The broker is well-regarded for its user-friendly online trading platforms, extensive research and educational resources, and competitive fee structure, often offering commission-free trades for Stocks and ETFs. It also provides access to a wide range of investment products, making Broker a great choice for investments, and has a good customer service reputation with both online and physical branch support.

For the cons, the availability of specific features and services may vary for international clients outside the US, so traders should verify conditions applicable to them, as not all are available based on your residency. Additionally, some investors might find their fee structure for certain services, such as managed portfolios, to be relatively higher.

| Advantages | Disadvantages |

|---|

| Strict regulation by SEC, SIPC, and FCA | Conditions and offering vary depending on the entity and regulations |

| Trading products | No 24/7 customer support |

| $0 minimum deposit | |

| Stocks and Options trading, investing | |

| Low trading fees and commissions | |

| Good education and research | |

| Competitive trading conditions | |

| Advanced trading platforms | |

| US and International traders | |

Charles Schwab Features

Charles Schwab is known for its good reputation, extensive range of services, and commitment to low-cost investing. Below is a comprehensive list of its key features:

Charles Schwab Features in 10 Points

| 🏢 Regulation | SEC, SIPC, FCA, SFC, MAS |

| 🗺️ Account Types | Brokerage, Retirement, Custodial Accounts, etc. |

| 🖥 Trading Platforms | Schwab.com, Schwab Mobile app, thinkorswim |

| 📉 Trading Instruments | Stocks, Mutual Funds, ETFs, Index Funds, Options, Bonds, CDs & Fixed Income, Cryptos, Futures, etc. |

| 💳 Minimum Deposit | $0 |

| 💰 E-mini and Standard Contract | $2.25 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, HKD |

| 📚 Trading Education | Live Webcasts, Virtual Workshops, Podcasts, Coaching, etc. |

| ☎ Customer Support | 24/5 |

Who is Charles Schwab For?

Charles Schwab is well-suited for individuals who value a balance of professional-grade tools and user-friendly platforms. From casual investors building portfolios over time to those planning for retirement or exploring ETF and mutual fund strategies, the firm caters to a broad range of personal finance needs. Based on our findings, Charles Schwab is Good for:

- Real Stock Trading

- Investing

- Traders from the USA, UK, Hong Kong, Singapore, etc.

- Fractional Shares

- Real Futures trading

- Currency trading

- Advanced traders

- Professional trading

- Commission-based trading

- Good education and trading tools

- Supportive customer service

Charles Schwab Summary

In summary, Charles Schwab is a well-established Stock Trading and Investing company known for its comprehensive range of investment products, competitive fee structures, robust trading platforms, and a strong commitment to investor education and support.

The firm is heavily regulated and authorized by various Top-Tier financial authorities around the world. With a blend of traditional brokerage services and robo-advisory solutions, it appeals to a wide range of investors and professionals.

Overall, Schwab provides a good trading environment for investment; however, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

Charles Schwab stands out as one of leading Stock Trading brokerage and is highly regarded and recommended by us too dut to its powerful combination of low-cost investing, robust trading platforms, and trusted service. It offers commission-free trading on stocks, ETFs, and options, which is great for cost effective investing and long holding investors. There is access to an extensive range of investment products, including mutual funds, fixed income, and managed portfolios, so you may fix portfolio with great diversification all at one place.

Schwab’s platforms provide professional-grade tools like customizable charts, technical indicators, and backtesting features suitable for active and experienced traders, we enjoyed navigating platform ass its easy to catch-up and navigate too.

Additionally, the broker’s commitment to education through webinars, podcasts, articles, and tutorials empowers investors at every level. very beginner new to stock trading, will find it very appropriate. Latly, there is supportive customer service, a wide network of physical branches, and a strong track record of financial stability providng good status at the place. Overall, Charles Schwab remains a top choice for those looking for a comprehensive and reliable investment experience and is definitely one of the Brokers to consider.

Consider Trading with Charles Schwab If:

| Charles Schwab is an excellent Broker for: | - Looking for Reputable Firm.

- Suitable for professional traders and investors.

- Looking for broker with a long history of operation and strong establishment.

- Competitive fees and commissions.

- Need a well-regulated broker.

- Stock Trading and Investment.

- Access to robust proprietary trading platforms.

- Excellent trading tools and trading technology.

- Offering popular financial products.

- US and UK investors.

- Looking for broker with Top-Tier licenses.

- Secure trading environment.

- Excellent educational materials, and customer support.

|

Avoid Trading with Charles Schwab If:

| Charles Schwab might not be the best for: | - Beginners who prefer simpler trading approach.

- Looking for broker with 24/7 customer support.

- Need a broker with trading services worldwide. |

Regulation and Security Measures

Score – 4.8/5

Charles Schwab Regulatory Overview

Charles Schwab is a reliable Stock trading broker that follows the strict rules and guidelines established by the SEC, SIPC, and FCA, along with international licenses the broker operates. These Top-Tier regulations safeguard client assets and provide low-risk Stocks and Options trading.

How Safe is Trading with Charles Schwab?

Charles Schwab is a legitimate and reputable company for traders looking to invest and manage their assets. It is regulated by financial authorities in the countries where it operates and has a good reputation and integrity in the financial industry.

The firm prioritizes the security and protection of its clients‘ investments by adhering to regulatory standards and industry best practices. This commitment includes implementing measures to prevent fraud, unauthorized account access, and robust online transaction coding, along with stringent identity verification processes.

Moreover, as a member of the Securities Investor Protection Corporation (SIPC), Charles Schwab offers insurance coverage for client assets held at the firm in the event of brokerage failure, providing an additional layer of security. However, traders should remain cautious, regularly monitor their investments, and practice safe online habits to enhance their trading protection further.

Consistency and Clarity

Charles Schwab has built a long-standing reputation for consistency and transparency, earning the trust of investors across the US and beyond. With over five decades in the industry and managing more than $10 trillion in client assets, the broker is often praised for its stability and well-regulated operations.

Trader reviews highlight strengths such as low fees, responsive support, and strong educational resources, though some have raised concerns over technical issues following the TD Ameritrade platform merger.

The firm maintains its industry leadership, further demonstrated by numerous awards and its active role in financial literacy programs, charitable initiatives, and sponsorships.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Charles Schwab?

The firm offers a variety of cash and margin accounts to cater to the diverse needs of investors. These include individual brokerage accounts, which are suitable for trading stocks, bonds, and other securities. The broker also provides retirement account options such as Traditional and Roth IRAs, as well as education savings accounts like 529 plans.

Additionally, Charles Schwab offers custodial accounts for minors, trusts for estate planning, and various types of managed portfolios and advisory services for those seeking professional guidance. This wide array of account options allows clients to tailor their investments to their specific financial goals and preferences.

Traders can access the paperMoney paper trading feature through thinkorswim, which allows users to practice strategies in a risk-free, real-time simulated environment.

Individual Brokerage Accounts

Charles Schwab’s Brokerage Account is a flexible, beginner-friendly option that requires no minimum deposit to open or maintain. Investors can start trading stocks, ETFs, mutual funds, and more with no account fees and $0 commissions on online equity trades.

For those interested in margin trading, a $2,000 minimum balance is required. The account also provides access to Schwab’s powerful trading platforms, which feature a paper trading environment for practicing strategies risk-free.

Regions Where Charles Schwab is Restricted

Charles Schwab operates globally; however, its services are restricted in certain regions and countries due to regulatory limitations, local laws, or political factors:

- Philippines

- South Africa

- UAE

- New Zealand

- South Korea

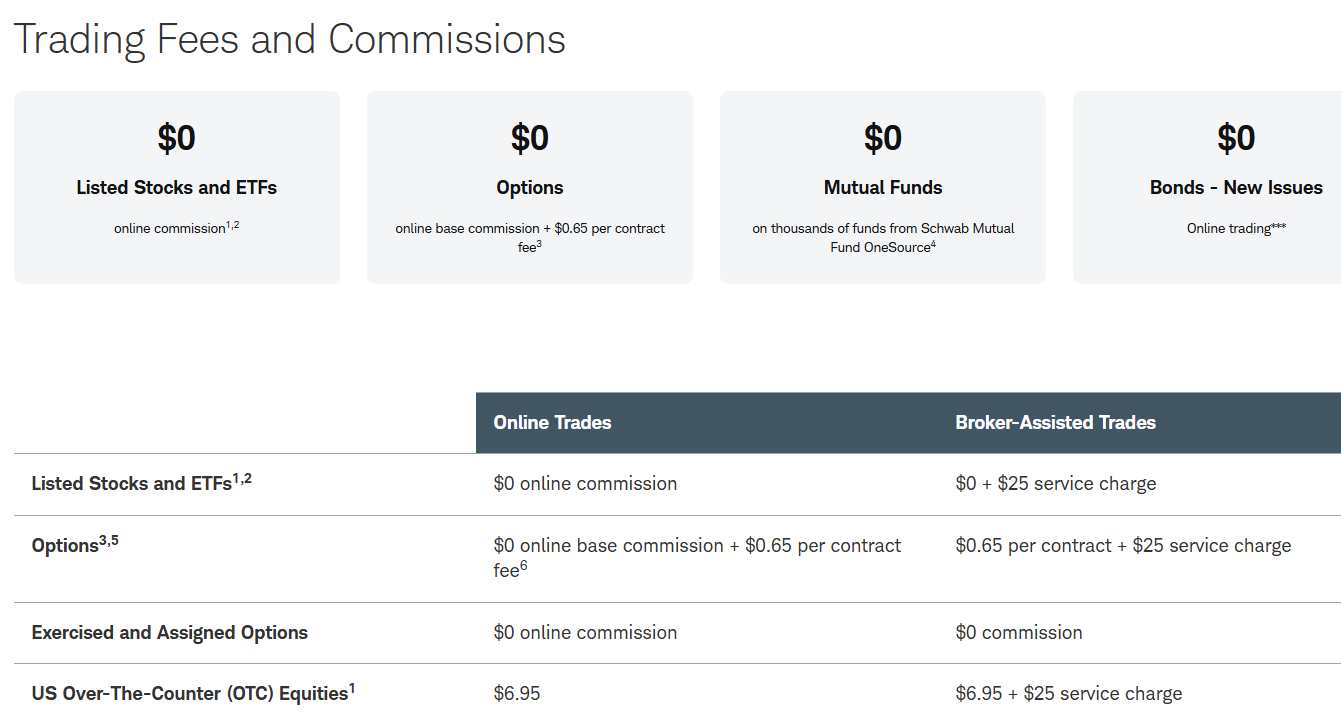

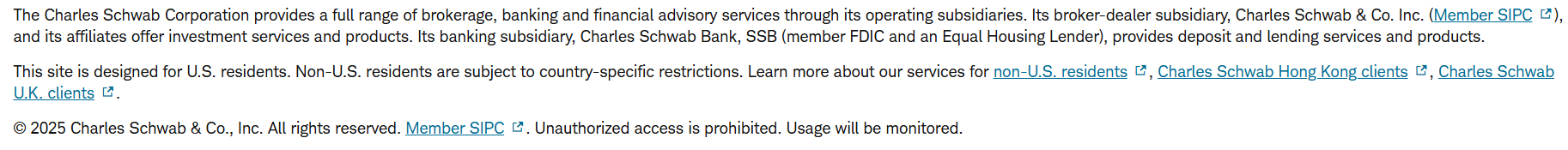

Cost Structure and Fees

Score – 4.6/5

Charles Schwab Brokerage Fees

In terms of fees, the broker offers a competitive fee structure and Schwab stock price with a focus on reducing costs for investors. However, specific fees can vary depending on the type of account, the investment products used, and other factors.

For instance, there might be fees associated with certain mutual funds, options contracts, or advisory services. Additionally, while trading fees are often low or nonexistent, other charges like margin interest and wire transfer fees might apply. Therefore, investors should review Charles Schwab’s current fee schedule and terms, as they can change over time.

- Charles Schwab Broker Fee

Charles Schwab offers competitive futures trading fees through its thinkorswim platform. For standard futures contracts, including E-mini contracts, Schwab charges a $2.25 fee per contract, per side.

For Micro E-mini contracts, the fee is lower at $0.50 per contract, per side, plus any applicable exchange and regulatory fees. These flat-rate commissions provide cost-effective access to futures markets while supporting advanced trading tools and real-time data.

- Charles Schwab Exchange Fee

Charles Schwab’s exchange fees for futures trading are passed through directly to the trader and vary depending on the product and the exchange. These fees are set by the exchanges themselves, such as CME, CBOT, NYMEX, or COMEX, and are charged in addition to Schwab’s standard per-contract commission.

For example, trading E-mini or Micro E-mini contracts, traders are subject to individual exchange, clearing, and regulatory fees, all detailed on their trade confirmations.

- Charles Schwab Rollover / Swaps

Charles Schwab does not charge traditional rollover or swap fees for holding positions overnight on standard brokerage accounts, as it does not offer leveraged Forex trading like specialized Forex brokers.

However, for futures contracts, any rollover involves manually closing the expiring contract and opening a new one, potentially incurring commission and exchange fees. Additionally, in margin accounts, interest charges may apply for borrowed funds if positions are held overnight.

How Competitive Are Charles Schwab Fees?

Charles Schwab’s fees are highly competitive, especially for self-directed investors and active traders. It offers $0 commission on online stock and ETF trades, along with low-cost options trading at $0.65 per contract.

The broker’s transparent pricing, no account maintenance fees, and wide access to no-transaction-fee mutual funds make it a cost-effective choice for investors.

| Fees | Charles Schwab Fees | MEXEM Fees | Webull Fees |

|---|

| Broker Fee - E-mini and Standard Contract | $2.25 | $0.85 | $0.70 |

| Exchange Fee | Defined by Exchange | Defined by Exchange | Defined by Exchange |

| Trading Platform Fee | No | No | No |

| Data Fee | Yes | No | No |

| Fee ranking | Low/Average | Low/Average | Low |

Charles Schwab Additional Fees

Charles Schwab keeps its pricing transparent; however, there are some additional fees to consider. These include $25 for broker-assisted trades, $50 for full account transfers, and $25 for outgoing wire transfers.

Some mutual funds outside the OneSource network may carry a transaction fee up to $74.95. While most standard services are free or low-cost, occasional administrative or service-related charges may apply depending on how the account is used.

Trading Platforms and Tools

Score – 4.7/5

Charles Schwab offers a robust range of trading platforms and tools designed to meet the needs of investors at every level. The main platform, Schwab.com, provides a clean and intuitive interface for managing accounts, placing trades, and accessing research and educational resources.

For on-the-go investing, the Schwab Mobile app offers full trading functionality, real-time quotes, and account management features. Active traders benefit from the powerful thinkorswim platform, available on desktop, web, and mobile, featuring advanced charting tools, technical indicators, customizable layouts, and paper trading through the paperMoney simulator.

Trading Platform Comparison to Other Brokers:

| Platforms | Charles Schwab Platforms | MEXEM Platforms | TradeZero Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Charles Schwab Web Platform

Charles Schwab’s web-based platforms offer a wide range of trading styles, from long-term investing to more sophisticated trading strategies. Schwab.com serves as the primary portal, providing clients with essential tools for placing trades, researching investments, and managing accounts. It features screeners, watchlists, portfolio performance tracking, and access to in-depth research.

For more active traders, the thinkorswim web platform delivers enhanced functionality with real-time data, advanced charting, technical analysis tools, and strategy testing, all accessible without a software download.

Charles Schwab Desktop MetaTrader 4 Platform

Schwab does not offer MetaTrader 4, the popular third-party trading platform widely used in Forex and CFD markets. Investors looking for MT4 functionality need to consider specialized brokers instead.

Charles Schwab Desktop MetaTrader 5 Platform

The broker does not support MetaTrader 5 either. Charles Schwab does not provide access to advanced trading platforms like MT5, maintaining its focus on its proprietary trading platform.

Charles Schwab MobileTrader App

The broker’s MobileTrader offers a seamless and powerful trading experience right from your smartphone or tablet. The app provides real-time market data, customizable watchlists, and easy order placement for stocks, ETFs, options, and mutual funds.

It includes intuitive navigation, secure account access with biometric login, and integration with Schwab’s broader research and educational resources. For advanced users, the app supports features like options chains and alerts, making it a convenient tool for managing investments on the go.

Main Insights from Testing

Testing Charles Schwab Mobile App reveals a well-designed platform that balances functionality with ease of use. The app performs smoothly with fast loading times and reliable order execution, providing a responsive experience even during volatile market conditions.

Navigation is straightforward, allowing users to quickly access account details, trade history, and market news. While it offers many advanced features, the app maintains simplicity for beginners by presenting information clearly and minimizing unnecessary complexity.

AI Trading

The broker offers Charles Schwab’s robo-advisor service known as Schwab Intelligent Portfolios. This service combines automated investing with professional portfolio management to provide clients with a diversified and personalized investment portfolio.

Schwab Intelligent Portfolios uses algorithms to create and manage portfolios based on the client’s risk tolerance, financial goals, and investment timeline. It automatically rebalances the portfolio to maintain the desired asset allocation.

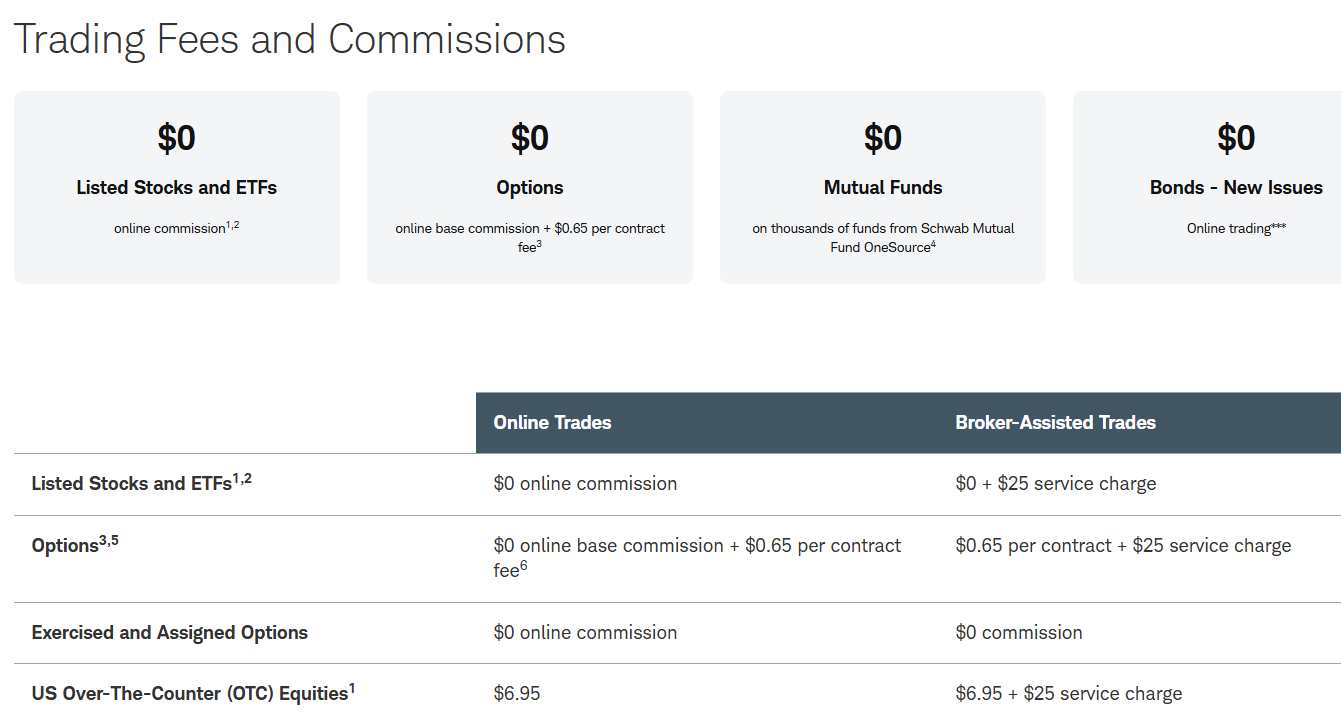

Trading Instruments

Score – 4.8/5

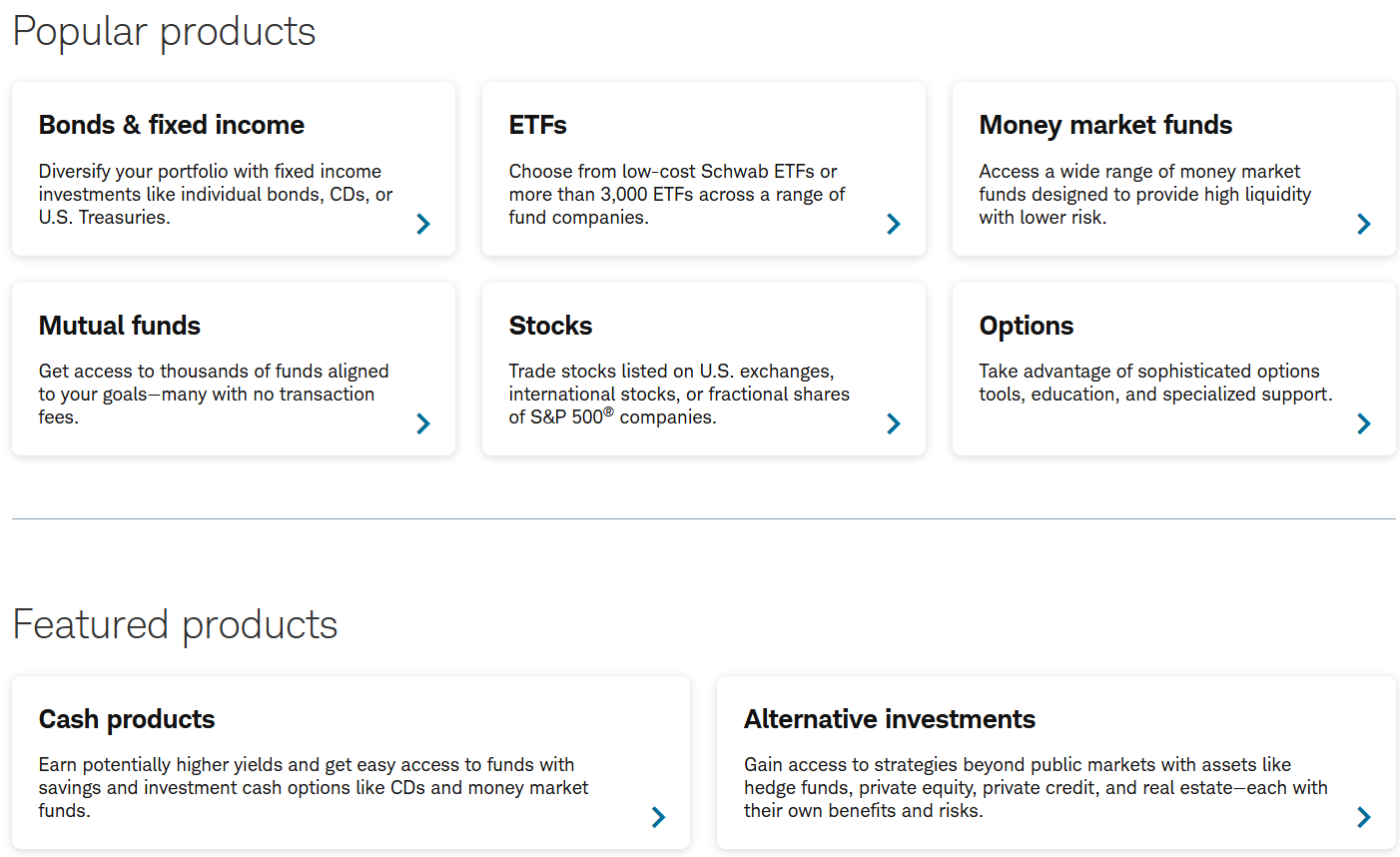

What Can You Trade on Charles Schwab’s Platform?

Charles Schwab provides access to a comprehensive range of trading products for investors, which includes stocks, bonds, options, Charles Schwab ETFs, mutual funds, Forex, index funds, CDs & fixed income, cryptos, futures, and more.

However, the availability of specific trading instruments may vary depending on the entity, so we advise conducting good research to determine the range of options available, and if conditions vary based on your residence.

Main Insights from Exploring Charles Schwab’s Tradable Assets

Exploring Charles Schwab’s tradable assets reveals a broad investment range that supports diverse strategies, from conservative wealth building to active trading, providing access to both traditional and innovative investment opportunities.

The broker’s extensive offerings are complemented by powerful research tools and market data, empowering clients to make informed decisions. Overall, the variety and depth of tradable assets make Schwab a flexible choice for investors with different goals and trading experience levels.

Margin Trading at Charles Schwab

Charles Schwab offers margin trading to qualified clients, requiring a minimum account balance of $2,000 to borrow against securities. Margin interest rates vary based on the amount borrowed, and interest is calculated daily.

While a multiplier can increase buying power and potential returns, it also amplifies risk, so maintaining required equity levels is essential to avoid margin calls. The broker supports margin traders with tools and resources to manage their accounts effectively.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Charles Schwab

The broker offers multiple funding methods to deposit money into your brokerage account, including:

Additionally, Charles Schwab provides a mobile app and online portal for convenient account management and funding. However, specific funding options and associated fees may vary, so you should consult the broker’s official website or contact their customer service for the most up-to-date information on funding methods.

Charles Schwab Minimum Deposit

The broker offers great options with no minimum deposit requirement for opening an account.

Withdrawal Options at Charles Schwab

The broker provides multiple options for withdrawing funds from your brokerage account, including electronic EFTs to your linked bank account, wire transfers, check requests, etc.

Clients can initiate withdrawals through the online platform or by contacting customer support, and the processing time and potential fees may vary depending on the chosen withdrawal method.

Charles Schwab Bank

The firm also operates as a bank in addition to its brokerage services. Charles Schwab Bank is a federal savings bank that offers a range of banking services to its clients. This includes checking and Charles Schwab savings accounts, certificates of deposit (CDs), mortgage and home equity loan services, as well as personal and business lending products.

Clients can access their Charles Schwab Bank accounts online or through mobile banking, and the bank also provides ATM fee rebates worldwide, making it convenient for clients to access cash.

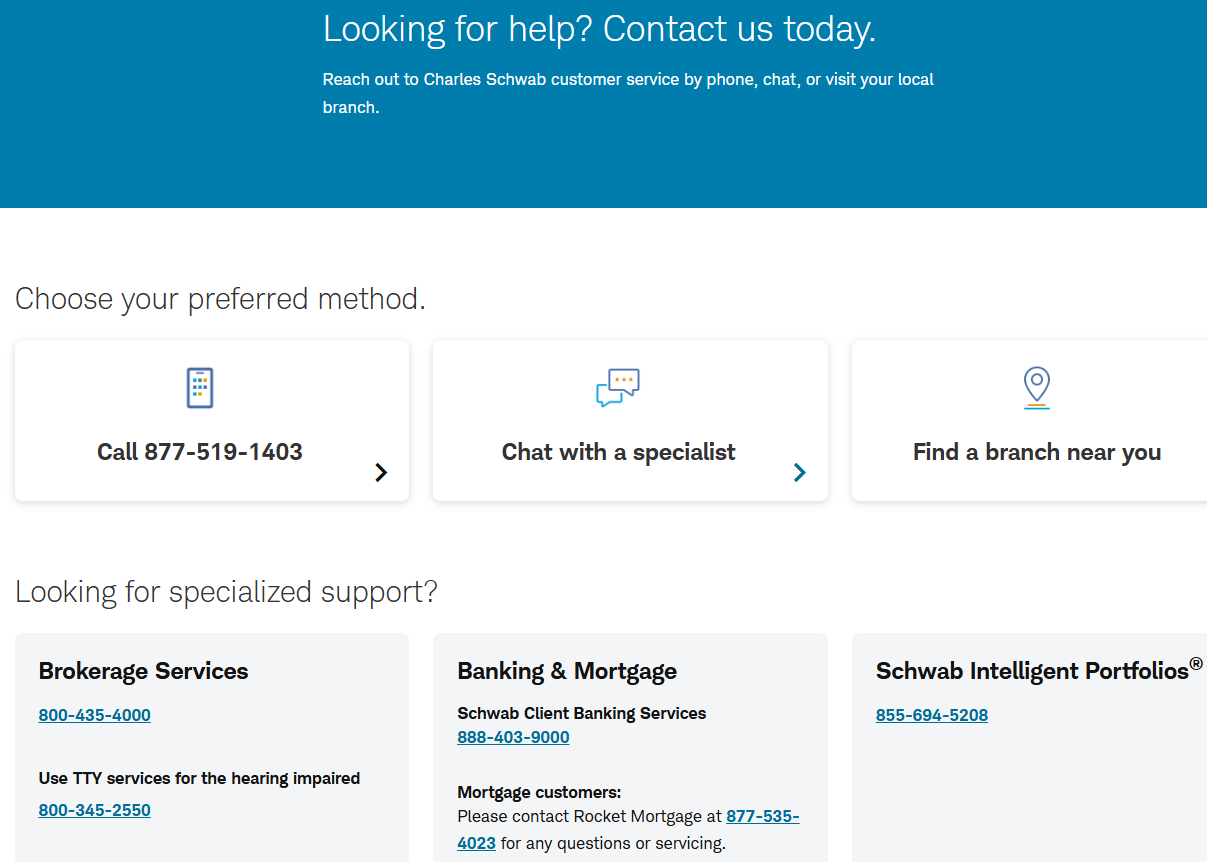

Customer Support and Responsiveness

Score – 4.6/5

Testing Charles Schwab’s Customer Support

The broker provides a high level of 24/5 customer service and support through phone, email, live chat, and social media channels, making it easy for clients to get in touch with their representatives.

In addition to digital support, the broker has physical branch locations across the United States, where clients can receive in-person assistance and guidance.

Contacts Charles Schwab

You can contact Charles Schwab by phone at 1-877-519-1403 for general US support or +1-415-667-7870 for international assistance. Brokerage services are available at 800-435-4000, and Schwab Intelligent Portfolios support can be reached at 855-694-5208.

While there is no direct customer service email, you can submit inquiries securely through their online contact form. For accessibility help, email AccessibilityHelp@Schwab.com.

Research and Education

Score – 4.7/5

Research Tools Charles Schwab

Charles Schwab provides robust research tools across its platforms and the website.

- On the website, clients can access stock, ETF, mutual fund, and fixed income screeners; third-party research from Morningstar, CFRA, and Credit Suisse; earnings calendars; portfolio performance tools; market news; and Schwab’s proprietary insights and commentary.

- The Schwab Mobile app offers a streamlined version of these tools, including market news, watchlists, and portfolio tracking.

- For more advanced features, the thinkorswim platform includes interactive charts with technical indicators, real-time data, in-depth fundamental analysis, heat maps, economic calendars, risk analysis tools, and screeners for various asset classes.

Education

Charles Schwab offers a comprehensive range of educational resources to support investors at all levels. Clients can access live webcasts, virtual workshops, and an extensive library of on-demand videos, articles, and podcasts covering various financial topics.

Additionally, Schwab provides personalized coaching and interactive courses to help users build their investing knowledge and confidence. These resources are available through the website and the mobile app, making learning accessible anytime and anywhere.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options Charles Schwab

Charles Schwab provides a wide range of investment solutions for different financial goals and risk profiles. Clients can choose from professionally managed portfolios, including Schwab Intelligent Portfolios and Schwab Managed Portfolios, or work with a dedicated financial consultant for customized advice.

The broker also offers access to thematic investing, retirement planning solutions, and wealth management services, giving investors flexible options to build and grow their portfolios.

Account Opening

Score – 4.5/5

How to Open Charles Schwab Demo Account?

If you want to test trading strategies without risking real money, Charles Schwab offers a paper trading account through its thinkorswim platform. Here is how to get started:

- Log in to the thinkorswim platform and select paperMoney mode; no extra registration needed.

- Sign up for a 30-day Guest Pass on Schwab’s website to access thinkorswim with $100,000 in virtual funds.

- Choose paperMoney and select a virtual margin or IRA account.

- Trade stocks, options, futures, and Forex in real-time with full platform tools.

How to Open Charles Schwab Live Account?

Opening a live account with Charles Schwab is fully online. To begin, visit the official Schwab website and choose the type of account you want to open, such as an individual brokerage, retirement, or custodial account.

You will need to provide personal information, including your Social Security number, employment details, and financial background. Once submitted, your application typically gets processed within a few business days.

After approval, you can fund your account via bank transfer or other supported methods and start trading through Schwab’s platforms like Schwab.com, Schwab Mobile, or thinkorswim.

Additional Tools and Features

Score – 4.4/5

In addition to its main trading tools, Charles Schwab provides a variety of additional tools and features to enhance the investing experience.

- These include portfolio rebalancing tools, tax-loss harvesting, real-time news feeds from top providers like Reuters and Morningstar, and customizable alerts for market events or price changes.

- The broker also offers retirement planning calculators, goal tracking, and automated dividend reinvestment.

Many of these features integrate across Schwab.com, thinkorswim, and the mobile app to provide investors with a comprehensive and flexible toolkit.

Charles Schwab Compared to Other Brokers

Charles Schwab stands out among its competitors by offering a well-rounded brokerage experience with a strong emphasis on diverse asset variety.

Its trading platforms, including the advanced thinkorswim, cater to both casual investors and active traders, providing comprehensive tools and features. While its trading fees are competitive, some brokers may offer slightly lower commissions, particularly for high-frequency traders.

The broker’s robust regulatory oversight and reputable customer support enhance its reliability. Compared to other brokers, Schwab excels in educational resources and a seamless user experience, though some competitors may have advantages in 24/7 support.

Overall, Schwab offers a balanced package appealing to a broad range of investors who need both versatility and quality service.

| Parameter |

Charles Schwab |

MEXEM |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

$2.25 |

$0.85 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low/Average |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

Schwab.com, Schwab Mobile app, thinkorswim |

Client Portal, Desktop TWS, Mobile TWS, MEXEM Lite |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, Mutual Funds, ETFs, Index Funds, Options, Bonds, CDs & Fixed Income, Cryptos, Futures |

Stocks, Bonds, ETFs, Options, Futures, Warrants, Mutual Funds, Forex, Metals |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEC, SIPC, FCA, SFC, MAS |

CySEC, FCA, AFM, FSMA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Good |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

€0.1 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Charles Schwab

Charles Schwab is a well-known Stock Trading firm known for its comprehensive range of investment products, including stocks, ETFs, options, futures, and managed portfolios.

Additionally, the broker offers commission-free trading on stocks and ETFs, alongside competitive fees for futures and options trading. The platform suite, including the powerful thinkorswim platform, provides extensive research tools, real-time data, and customizable charting.

Schwab’s strong regulatory standing, reliable customer service, and extensive educational resources make it a trusted choice for investors seeking innovation, flexibility, and support.

Share this article [addtoany url="https://55brokers.com/charles-schwab-review/" title="Charles Schwab"]