- What is Capital Markets Elite Group?

- Capital Markets Elite Group Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

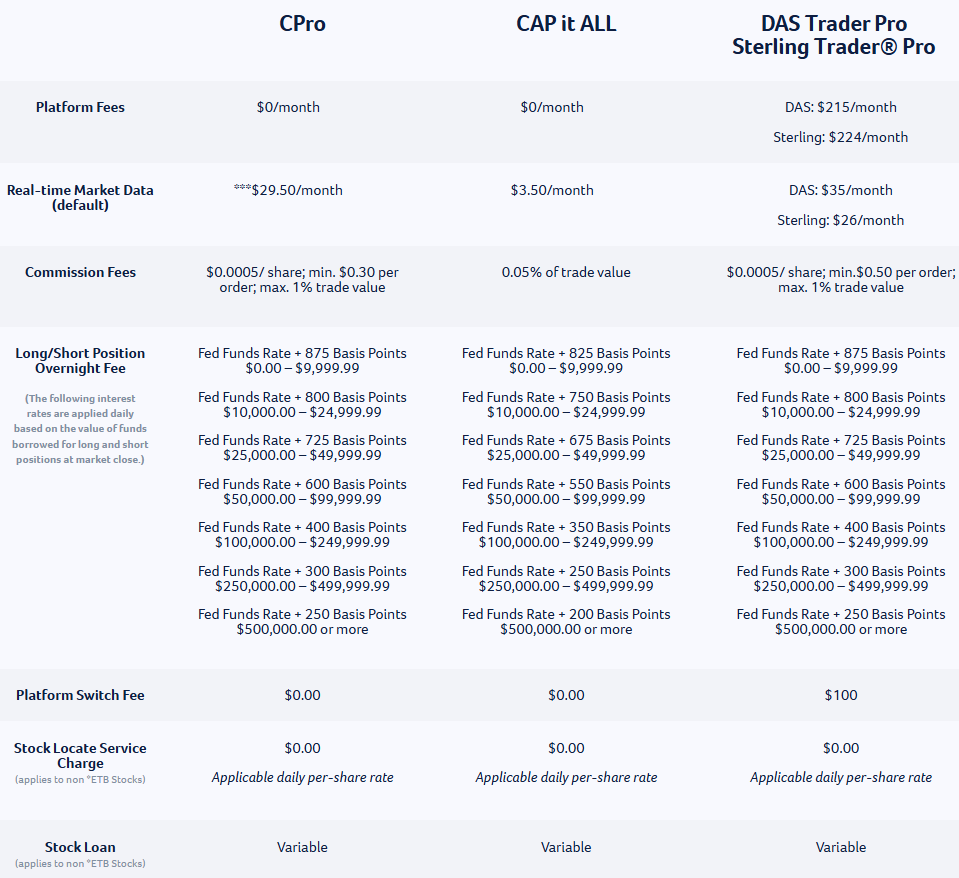

- Cost Structure and Fees

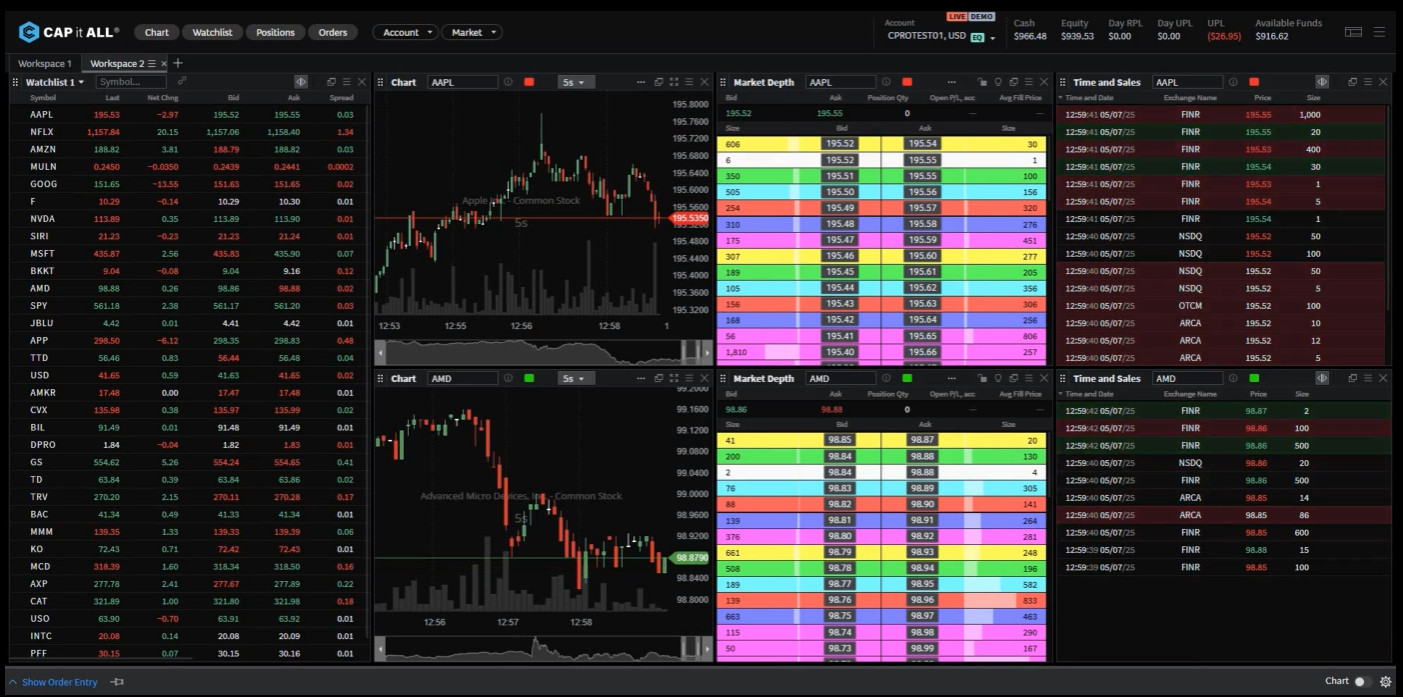

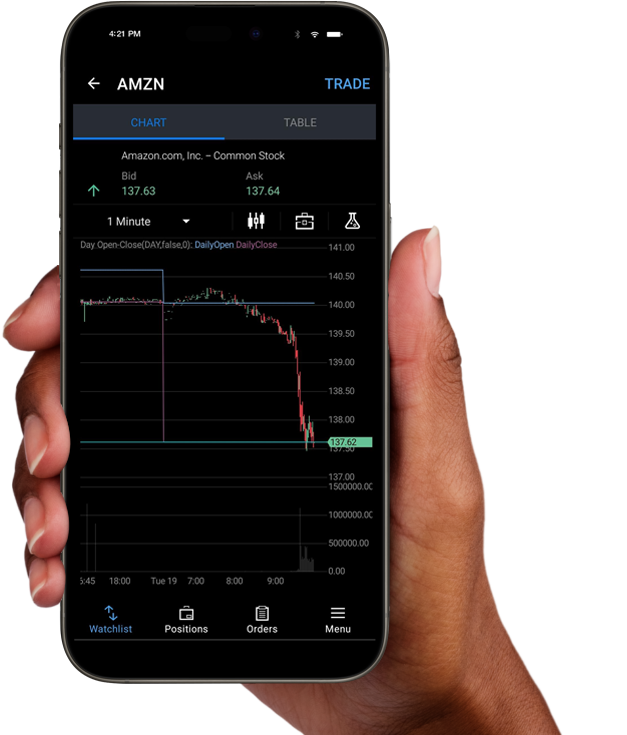

- Trading Platforms and Tools

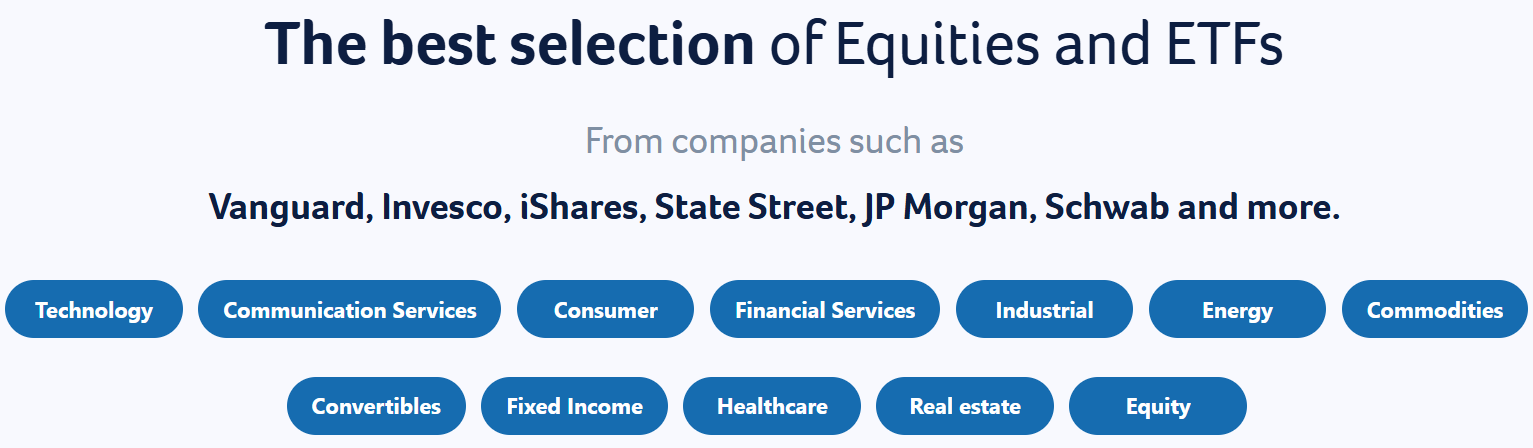

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Capital Markets Elite Group Compared to Other Brokers

- Full Review of Broker Capital Markets Elite Group

Overall Rating 4.4

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.3 / 5 |

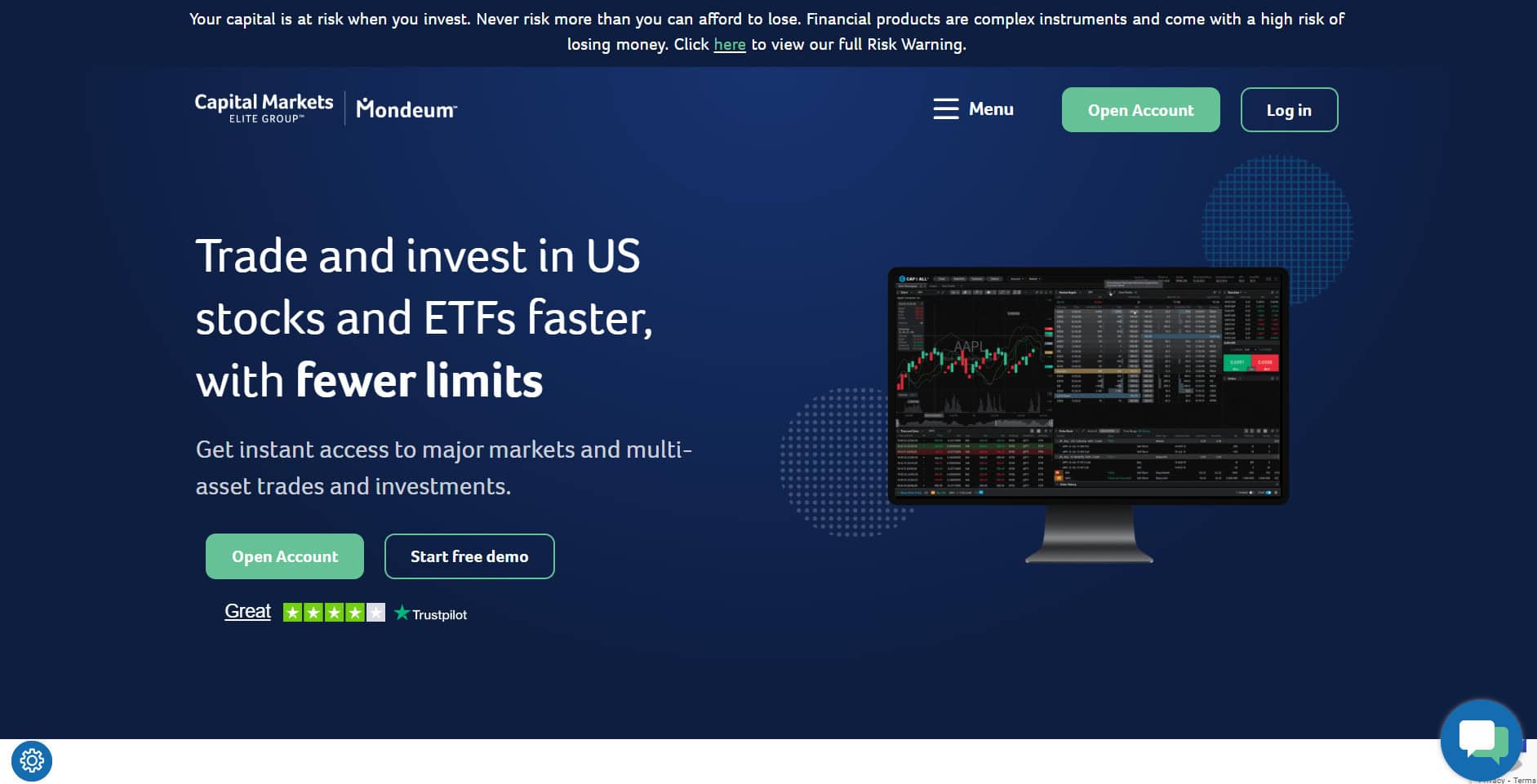

What is Capital Markets Elite Group?

Capital Markets Elite Group is a multi-asset investment firm that provides access to global financial markets, including equities, ETFs, and limited Forex and CFD trading.

Founded in 2013 and operating through entities in the UK, Trinidad and Tobago, and the Cayman Islands, the broker primarily caters to active traders and professional clients.

CMEG offers advanced platforms, including DAS Trader Pro and Sterling Trader Pro, which support direct market access for U.S. equities and other instruments.

Is Capital Markets Elite Group Stock Broker?

Yes, Capital Markets Elite Group is primarily a Stock broker that provides access to U.S. equities and ETFs listed on major exchanges such as the NYSE and NASDAQ.

The firm caters mainly to active and professional traders who seek advanced tools, margin trading, and direct market access. While CMEG operates as a stock brokerage, it also offers limited CFDs under different entities.

Capital Markets Elite Group Pros and Cons

Capital Markets Elite Group offers several advantages, making it appealing to active and professional traders. The broker provides access to U.S. stocks and ETFs with direct market access through advanced platforms like DAS Trader Pro and Sterling Trader Pro.

Users benefit from flexible margin trading, competitive buying power, and the ability to trade actively without the U.S. pattern day trader restrictions. Additionally, users have reported high platform fees, slow withdrawals, and limited transparency on conditions.

Therefore, while CMEG can be attractive for experienced day traders seeking high leverage and professional tools, it may not be ideal for beginners or those prioritizing strong regulatory protection and low-cost trading.

For the Cons, its regulation is less robust compared to top-tier brokers, with entities registered in offshore jurisdictions such as Trinidad and Tobago and the Cayman Islands. Additionally, users have reported high platform fees, slow withdrawals, and limited transparency on trading conditions.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversee | Conditions and offering might vary depending on the entity and regulations |

| Providing competitive trading conditions. | Limited educational materials |

| Stock trading and investing | No 24/7 customer support |

| Advanced trading platforms | |

| UK and international clients | |

| Global market access | |

| Professional trading | |

| Competitive fees and commissions | |

Capital Markets Elite Group Features

The firm offers a range of features to support users seeking direct access to global markets. The broker offers real-time market data, smart order routing, and customizable tools, catering to traders who value control and performance. Here is a detailed overview of its key features:

Capital Markets Elite Group Features in 10 Points

| 🏢 Regulation | FCA, CIMA, TTSEC |

| 🗺️ Account Types | Active, Standard Accounts |

| 🖥 Trading Platforms | CPro, CAP it ALL, DAS Trader Pro, Sterling Trader Pro |

| 📉 Trading Instruments | Equities, ETFs, Currencies, CFDs |

| 💳 Minimum Deposit | $500 |

| 💰 Average Stock Commission | From $0.0005 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP |

| 📚 Trading Education | Trends and Insights, Knowledge Hub |

| ☎ Customer Support | 24/5 |

Who is Capital Markets Elite Group For?

Capital Markets Elite Group is best suited for users who require advanced tools and direct market access to U.S. stocks and ETFs. The broker caters to individuals seeking to bypass the U.S. Pattern Day Trader rule, offering an opportunity for frequent trading with smaller account balances. In our opinion, CMEG is Good for:

- Investing

- UK traders

- Direct Market Access

- Real Stock Trading

- Portfolio management

- International clients

- Competitive conditions

- Advanced traders

- Active investors

- Professional trading

- Short-term and long-term investment strategies

Capital Markets Elite Group Summary

Overall, Capital Markets Elite Group is a brokerage firm focused on providing comprehensive access to global financial markets, particularly U.S. equities and ETFs.

The firm offers professional-grade platforms, real-time market data, and direct market access, enabling efficient execution and portfolio monitoring. CMEG supports a variety of investment strategies, including leveraged positions and long-term holdings, while catering to international clients and corporate entities.

Its infrastructure emphasizes flexibility, advanced tools, and multi-jurisdictional services, making it suitable for sophisticated market operations and strategic investment activities.

55Brokers Professional Insights

Capital Markets Elite Group stands out by combining access to U.S. stocks and ETFs with advanced market infrastructure. The broker offers direct market access and professional platforms such as DAS Trader Pro and Sterling Trader Pro, which provide real-time market data, smart order routing, customizable interfaces, and advanced charting for efficient and precise execution.

CMEG supports diverse investment strategies, including leveraged trades, short-term positions, and long-term holdings, while offering multi-account management, international market access, and flexible margin structures.

The firm also provides robust customer support and tools for portfolio analysis and risk management. Its operations across multiple jurisdictions allow global clients to access U.S. markets efficiently.

Consider Trading with Capital Markets Elite Group If:

| Capital Markets Elite Group is an excellent Broker for: | - Competitive conditions.

- For UK users.

- Suitable for investors and active traders.

- International trading.

- Looking for broker with a Top-Tier license.

- Stock Trading and Investment.

- Advanced technology.

- Various strategies allowed.

- Good trading tools.

- Offering MAM and PAMM Trading.

- Access to robust platforms.

- Long-term investors.

- Low fees and commissions.

- Offering popular financial products.

|

Avoid Trading with Capital Markets Elite Group If:

| Capital Markets Elite Group might not be the best for: | - Who need advanced educational materials.

- Looking for broker with 24/7 customer support.

- Real future traders. |

Regulation and Security Measures

Score – 4.5/5

Capital Markets Elite Group Regulatory Overview

Capital Markets Elite Group maintains a multi-jurisdictional regulatory framework to ensure transparency and adherence to international financial standards.

The firm’s UK entity, Capital Markets Elite Group (UK) Limited, is authorized and regulated by the Financial Conduct Authority, ensuring compliance with strict UK financial regulations.

Additionally, its offshore operations are regulated by the Cayman Islands Monetary Authority, which supervises its financial conduct and investment services. The firm’s regional branch, Capital Markets Elite Group (Trinidad and Tobago) Limited, is licensed and monitored by the Trinidad and Tobago Securities and Exchange Commission.

How Safe is Trading with Capital Markets Elite Group?

Trading with CMEG is generally considered secure due to its regulatory framework and commitment to client protection. Client funds are held in segregated accounts, separate from the company’s operational funds, which adds an extra layer of security.

However, offshore entities operate under different regulatory standards, which may offer less investor protection than Top-Tier jurisdictions like the FCA.

Consistency and Clarity

Capital Markets Elite Group maintains a solid reputation in the trading community, recognized for its professional-grade platforms, direct market access, and transparent environment.

Since its establishment, the broker has built credibility among active traders through competitive execution speeds, responsive customer support, and reliable market connectivity.

Reviews from users often highlight CMEG’s advanced tools and access to U.S. markets as major advantages, while some note that its offshore registration and higher minimum deposit requirements can be drawbacks for casual traders. Over the years, the firm has expanded its global presence and demonstrated industry engagement through market events and sponsorships.

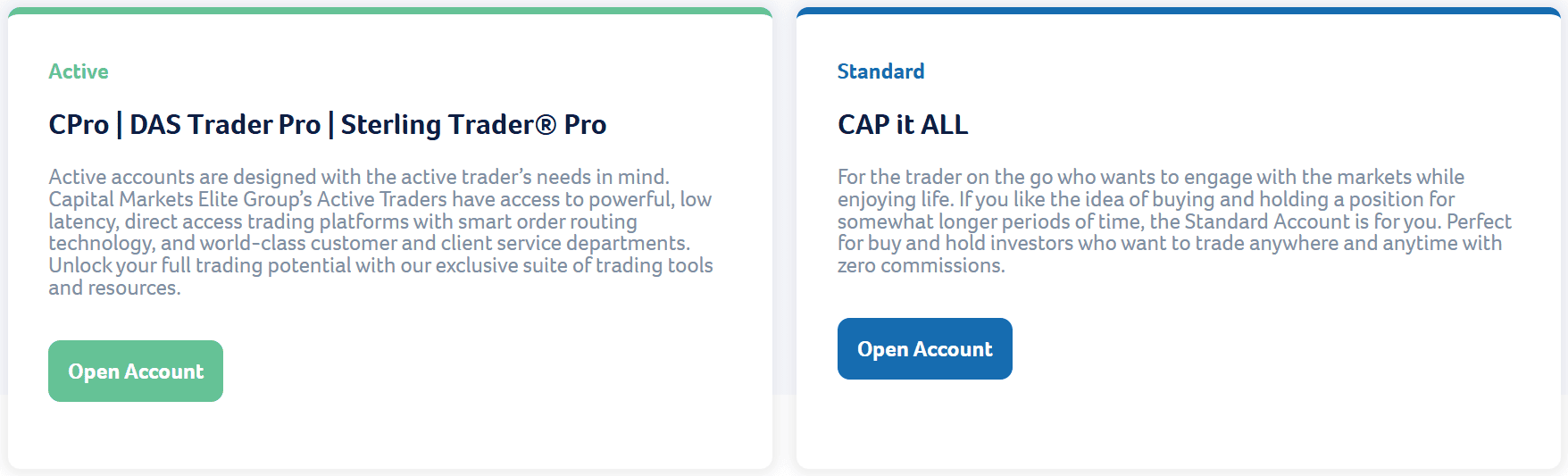

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Capital Markets Elite Group?

Capital Markets Elite Group offers the Active Trader Account and the Standard Account. The Active Trader Account is tailored for high-volume or professional traders seeking direct market access, advanced execution speed, and lower commission rates.

Meanwhile, the Standard Account is better suited for individual or moderate traders who prefer a more straightforward trading setup with competitive pricing and essential tools.

In addition, CMEG provides access to a demo account, allowing users to practice strategies and familiarize themselves with the broker’s platforms before committing real funds.

Active Account

The Active Account is for professional and high-frequency traders who require advanced market access and optimal execution conditions. This account type provides direct market access, allowing clients to trade U.S. equities and ETFs with precision and real-time order routing.

The minimum deposit for an Active Account is typically $500, giving traders access to lower commission rates, faster execution speeds, and advanced platforms such as DAS Trader Pro and Sterling Trader Pro.

Regions Where Capital Markets Elite Group is Restricted

Capital Markets Elite Group imposes certain geographical restrictions on its services due to regulatory and compliance considerations.

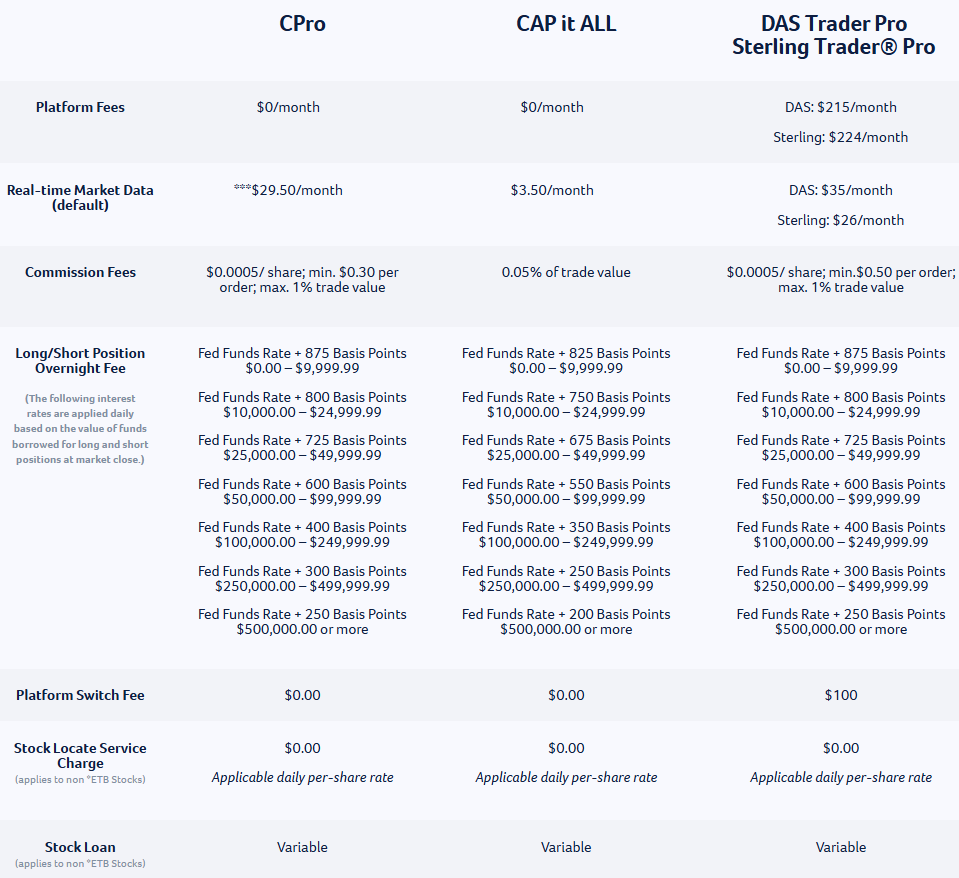

Cost Structure and Fees

Score – 4.5/5

Capital Markets Elite Group Brokerage Fees

The broker operates with a tiered commission and fee structure that varies by account type and platform. Also, platform access and real-time market data incur additional monthly fees.

There are also charges for wire withdrawals and locate/borrow fees for short-selling. While the fee levels are competitive for advanced traders, they can be relatively high for casual or long-term investors.

- Capital Markets Elite Group Commissions

Capital Markets Elite Group uses a competitive, volume-based commission structure to suit active and professional traders. The broker’s average stock commission rate starts at $0.0005 per share, making it appealing for high-frequency traders who execute large volumes.

A minimum commission per order applies, depending on account type and platform used, ensuring transparency in pricing. This per-share model allows users to benefit from lower overall costs on high-volume trades compared to flat-fee brokers.

- Capital Markets Elite Group Exchange Fee

CMEG applies exchange and regulatory fees to client transactions, along with an administrative fee. These costs are separate from standard commissions and represent expenses related to market access, data, and compliance with exchange requirements.

Users should review the broker’s detailed fee schedule, as the exact rates may differ depending on the platform used, trading route, and account type.

- Capital Markets Elite Group Rollover / Swaps

The broker charges overnight financing fees on leveraged positions held beyond the trading day. These fees, calculated daily as a percentage of the borrowed amount.

While not labeled as traditional Forex “swap fees,” they serve a similar purpose by reflecting the cost of maintaining open leveraged positions overnight.

How Competitive Are Capital Markets Elite Group Fees?

Capital Markets Elite Group offers a competitive fee structure, particularly for professional clients. Its pricing model supports high-volume trading and direct market access, making it attractive for sophisticated investors seeking cost-efficient execution.

While casual traders may face higher relative costs due to platform and data service requirements, CMEG’s overall structure aligns well with the needs of serious market participants who prioritize speed, transparency, and advanced capabilities.

| Asset/ Pair | Capital Markets Elite Group Commission | KGI Securities Commission | Cobra Trading Commission |

|---|

| Stocks Fees | From $0.0005 | NT$20 | From $0.0015 |

| Fractional Shares | - | Yes | - |

| Options Fees | $0.0005 | From $20 | $0.30 |

| ETFs Fees | $0.0005 | From $25 | From $0.0015 |

| Free Stocks | No | No | No |

Capital Markets Elite Group Additional Fees

The firm charges several additional fees beyond standard commissions to cover platform access, market data, and specialized services.

These include monthly platform and data fees, charges for short-selling, inactivity fees for dormant accounts, and margin-related fees when borrowing funds for leveraged positions.

While these fees support the broker’s professional infrastructure and services, clients need to review the detailed fee schedule to understand how they may apply based on account type, trading activity, and chosen platforms.

Trading Platforms and Tools

Score – 4.6/5

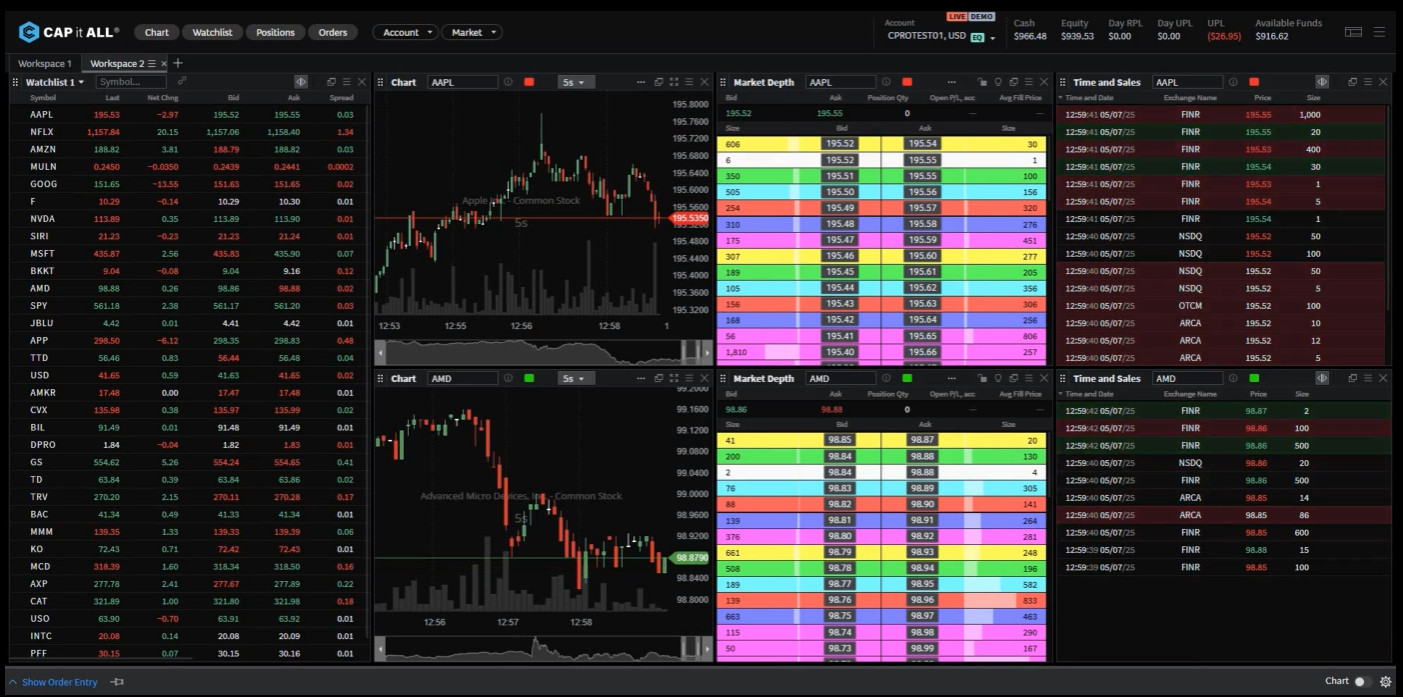

Capital Markets Elite Group offers a range of platforms to suit different trader needs. CPro provides professional-grade tools and real-time data for sophisticated analysis, while CAP it ALL offers a simple, customizable interface for web, desktop, and mobile use.

For active traders, DAS Trader Pro delivers fast execution and advanced charting, and Sterling Trader Pro supports highly customizable workflows with robust reporting and order management. Together, these platforms give users flexibility and access to professional tools.

Trading Platform Comparison to Other Brokers:

| Platforms | Capital Markets Elite Group Platforms | KGI Securities Platforms | Cobra Trading Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Capital Markets Elite Group Web Platform

The broker offers CAP it ALL, a proprietary web-based platform for both novice and active traders. Accessible via desktop, mobile, and browser, the platform provides a minimalist and customizable interface, real-time Level 1 market data, and efficient trade execution for U.S. stocks and ETFs.

The platform emphasizes ease of use and flexibility, making it suitable for traders who prefer a web-based solution without sacrificing essential tools and functionality.

Main Insights from Testing

Testing CAP it ALL reveals a platform that is fast, intuitive, and responsive, with smooth navigation between watchlists, charts, and order entry screens.

Its customizable layout and drag-and-drop modules allow traders to tailor the interface to their workflow, while real-time market updates and alerts support timely decision-making.

Capital Markets Elite Group Desktop MetaTrader 4 Platform

The broker does not offer MetaTrader 4 as part of its platforms. Users looking for MT4 compatibility will need to consider alternative brokers, as CMEG focuses on proprietary and professional third-party platforms.

Capital Markets Elite Group Desktop MetaTrader 5 Platform

Similarly, CMEG does not provide MT5. The broker emphasizes platforms like CPro, CAP it ALL, DAS Trader Pro, and Sterling Trader Pro for professional trading instead of MT5.

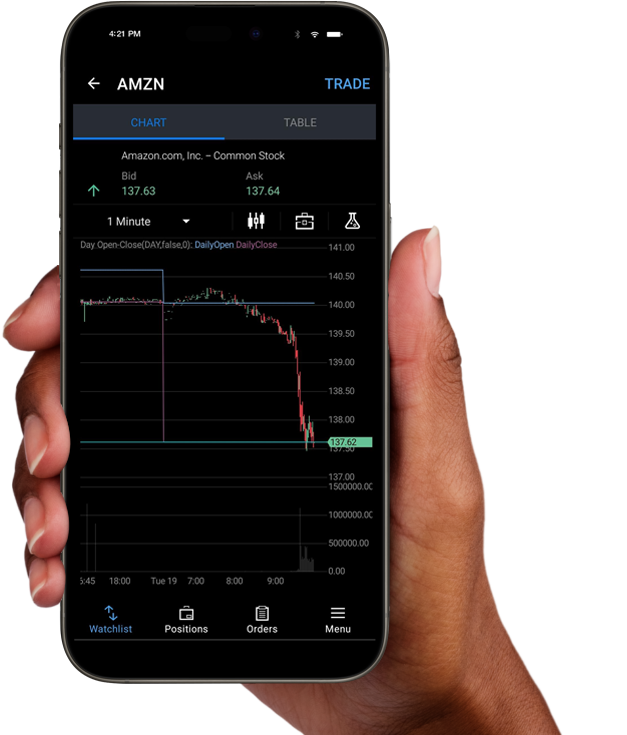

Capital Markets Elite Group MobileTrader App

The broker offers mobile trading capabilities through its proprietary CAP it ALL platform. This mobile app is for traders who prefer to manage their portfolios and execute trades on-the-go.

It provides access to U.S. stocks and ETFs, featuring Level 1 market data and a customizable interface. The app is available for download on both Android and iOS devices, allowing traders to monitor their investments and place trades conveniently from their smartphones.

AI Trading

The broker does not currently offer proprietary AI solutions. While it focuses on professional-grade platforms and tools for equities and ETFs, it does not provide built-in AI features for automated trading or predictive analytics.

Users looking to use AI-based strategies would need to implement them externally, as CMEG’s platforms are primarily designed for manual and high-performance trading rather than algorithmic AI trading.

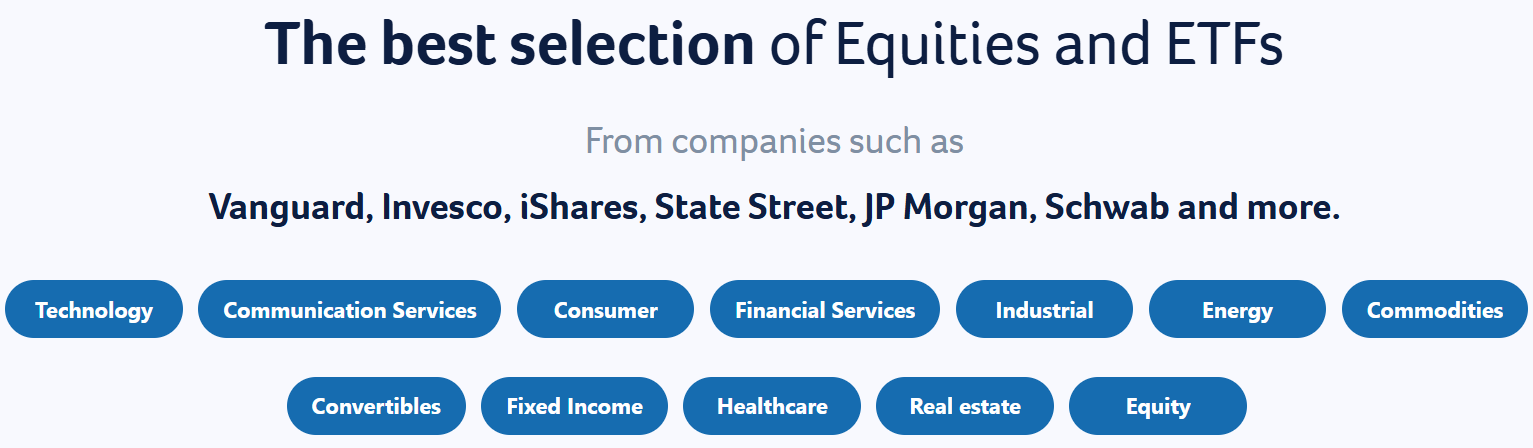

Trading Instruments

Score – 4.5/5

What Can You Trade on Capital Markets Elite Group’s Platform?

Capital Markets Elite Group offers trading in U.S. equities and exchange-traded funds (ETFs), providing access to a broad range of stocks and ETFs listed on major exchanges like NASDAQ and the New York Stock Exchange.

This selection includes prominent companies such as Apple, Amazon, and Tesla, catering to both short-term traders and long-term investors seeking to diversify their portfolios.

Main Insights from Exploring Capital Markets Elite Group’s Tradable Assets

Margin Trading at Capital Markets Elite Group

CMEG offers margin trading with varying leverage based on account type and balance. Standard accounts with a minimum deposit of $100 can access up to 4:1 leverage during regular market hours, while Active accounts require a minimum deposit of $500 and provide up to 6:1 leverage.

Enhanced accounts, with a minimum deposit of $2,500, may offer up to 10:1 leverage. Additionally, CMEG does not offer margin trading on short positions for stocks priced below $5.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Capital Markets Elite Group

Capital Markets Elite Group accepts funding via international wire transfers in major currencies such as USD, EUR, and GBP.

Capital Markets Elite Group Minimum Deposit

The minimum deposit varies by account type. For standard access on platforms like CAP it ALL and CPro, the minimum deposit is $100, while more advanced platforms such as DAS Trader Pro and Sterling Trader Pro require a minimum of $500.

Higher-tier or professional accounts may have larger deposit requirements depending on the services and leverage offered.

Withdrawal Options at Capital Markets Elite Group

Withdrawals are processed via international bank wire transfers only. Funds can be withdrawn in USD, EUR, or GBP, and should be sent to an account under the same name as the account.

While CMEG does not charge withdrawal fees, intermediary or receiving banks may apply additional charges, and processing typically takes 3-5 business days.

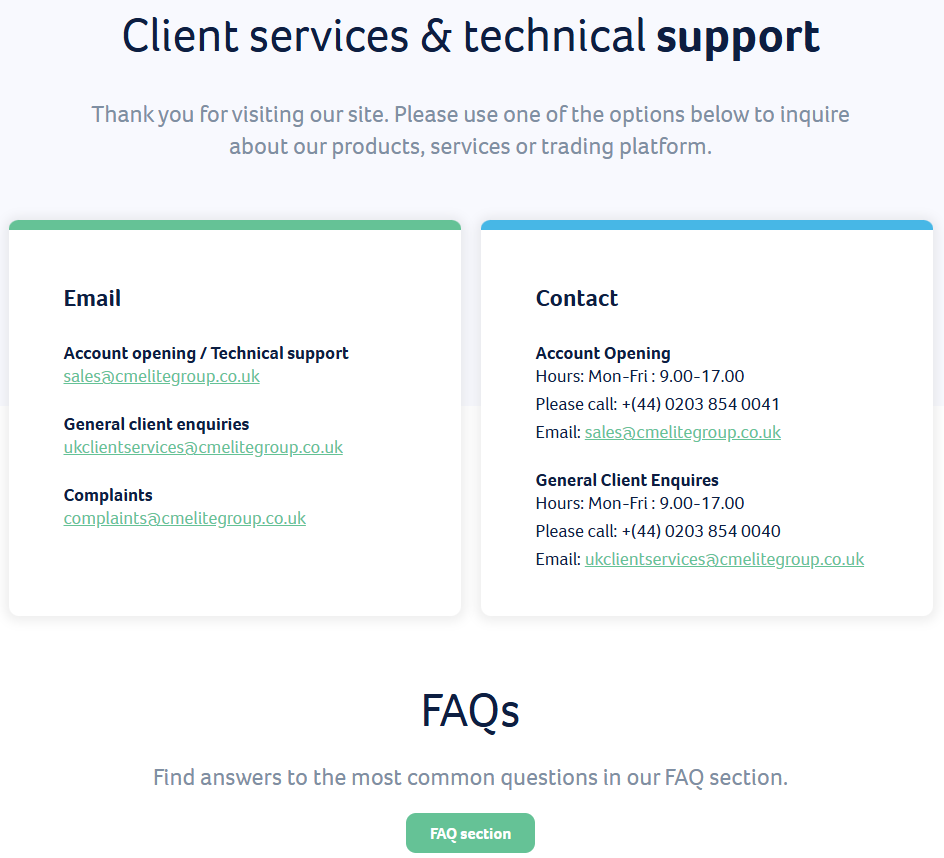

Customer Support and Responsiveness

Score – 4.5/5

Testing Capital Markets Elite Group’s Customer Support

The broker provides 24/5 customer support via phone lines, live chat, and email, allowing users to choose the most convenient method.

Clients can reach the support team for assistance with account setup, platform navigation, funding, or technical issues. In addition, the broker provides a FAQ section for self-help.

Contacts Capital Markets Elite Group

Users can reach the broker through several communication channels. For direct assistance, the UK support team can be contacted via email at ukclientservices@cmelitegroup.co.uk or by phone at +(44) 0203 854 0040.

These contact options ensure traders receive prompt help with account-related inquiries, platform support, and general service questions.

Research and Education

Score – 4.6/5

Research Tools Capital Markets Elite Group

CMEG offers a range of research and analytical tools to enhance market insight and trading precision.

- Through its platforms, including CAP it ALL, DAS Trader Pro, Sterling Trader Pro, and CPro, traders gain access to real-time market data, customizable alerts, advanced charting with technical indicators, and live market scanners.

- The broker’s website also provides market updates and analytical resources, helping users stay informed and make data-driven trading decisions.

Education

The broker provides an educational foundation through its Knowledge Hub and Trends and Insights sections. These resources offer traders information on market trends, strategies, risk management, and platform usage.

The educational materials support both new and experienced traders in building their understanding of global markets and developing effective approaches. By combining practical insights with regularly updated content, CMEG helps clients enhance their skills and stay informed about evolving market conditions.

Portfolio and Investment Opportunities

Score – 4.4/5

Investment Options Capital Markets Elite Group

Capital Markets Elite Group offers a variety of investment solutions, including access to U.S. equities, ETFs, and leveraged trading options for active and long-term investors.

The broker also provides multi-account management and direct market access, allowing clients to execute trades efficiently and manage diverse portfolios. These options cater to both individual investors and institutional clients seeking flexible and professional-grade investment opportunities.

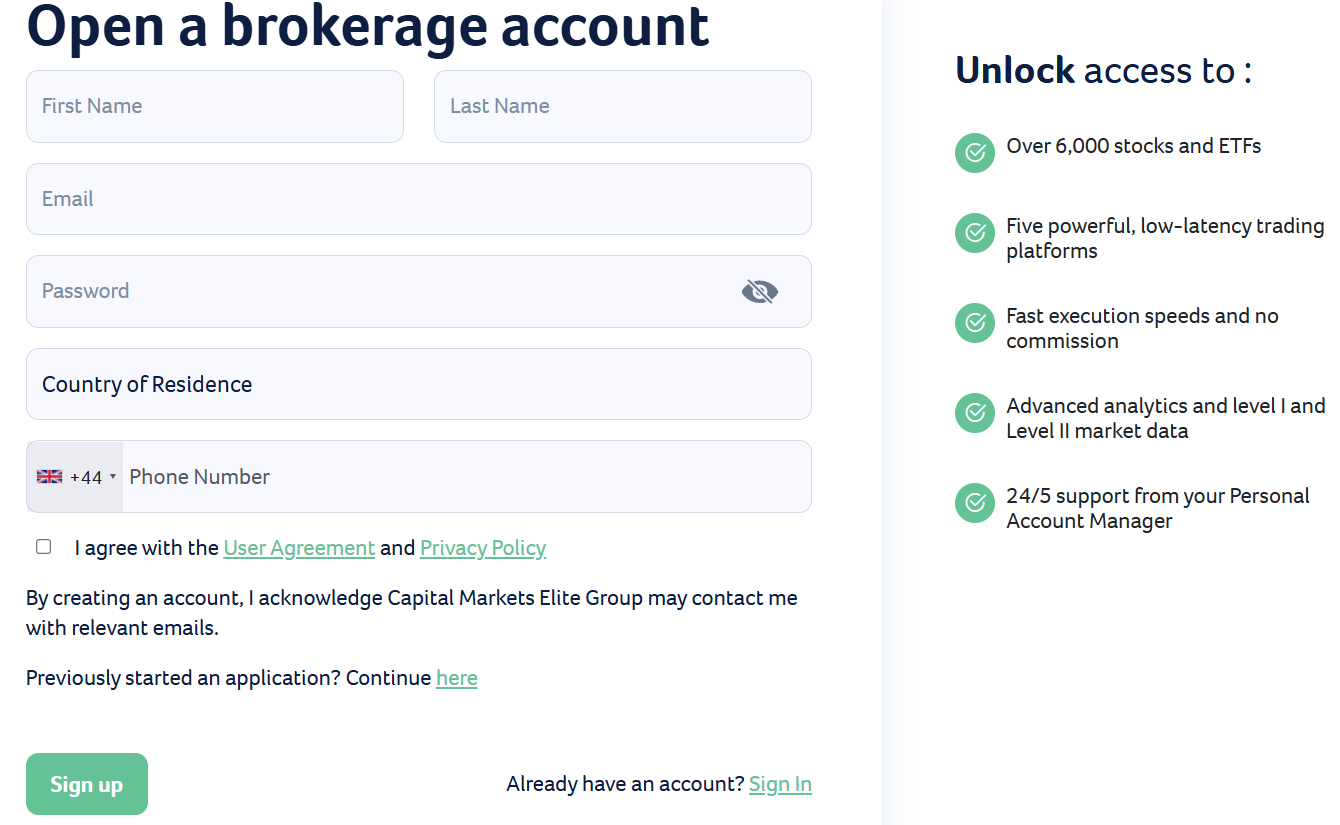

Account Opening

Score – 4.5/5

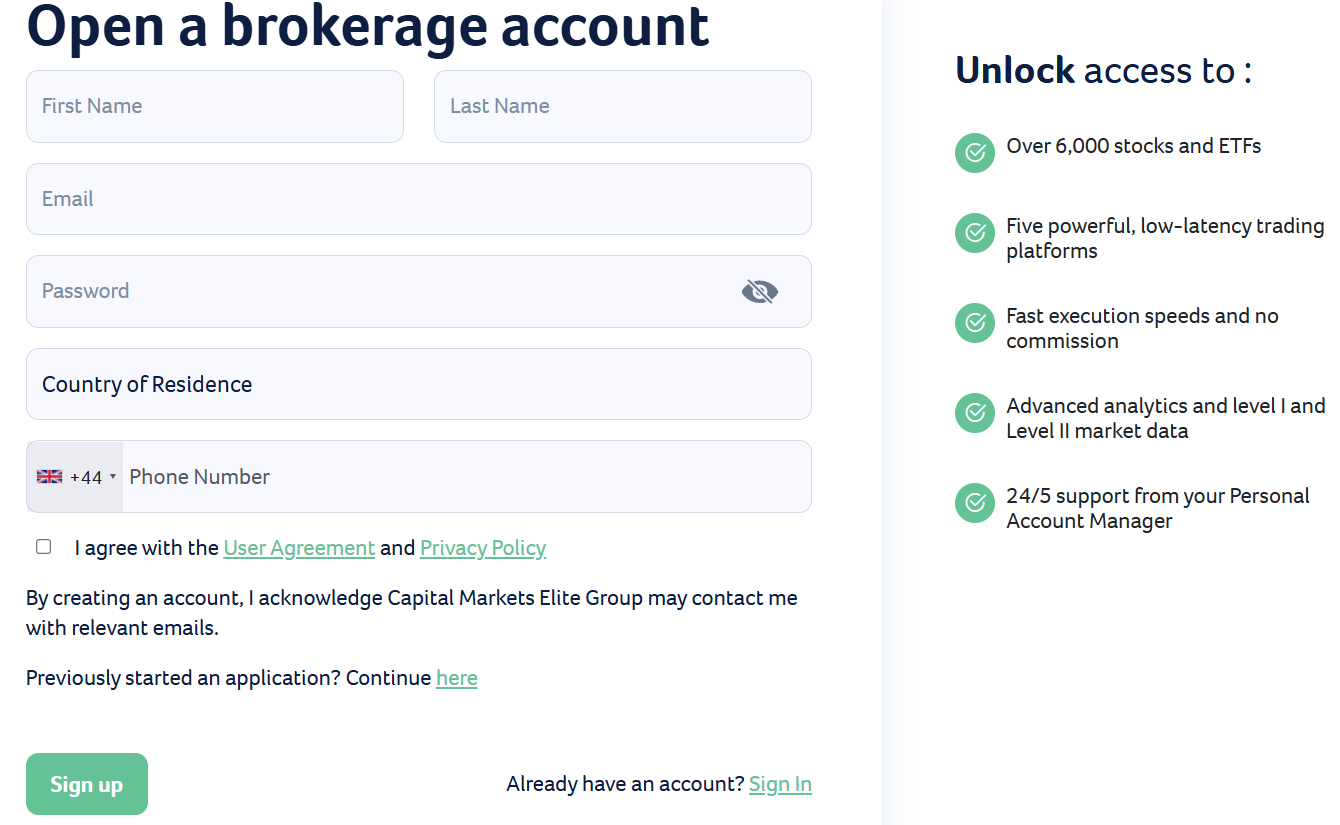

How to Open Capital Markets Elite Group Demo Account?

Opening a demo account with Capital Markets Elite Group is a simple process designed for users who want to explore the platform before committing real funds.

Interested clients can visit the broker’s official website and select their preferred platform, such as CAP it ALL or CPro, to request a demo account setup.

After completing a short registration form, users receive login details to access a simulated environment with real-time market data, allowing them to practice strategies and familiarize themselves with platform features risk-free.

How to Open Capital Markets Elite Group Live Account?

Opening a live account with Capital Markets Elite Group allows traders to access real markets, execute trades, and take full advantage of the broker’s professional tools and platforms. The process is simple and structured to ensure compliance and account security:

- Choose your account type based on trading needs and deposit requirements.

- Complete the registration form by providing personal information, contact details, and identification documents for verification.

- Make a deposit using accepted methods like international wire transfer in USD, EUR, or GBP.

- Choose your preferred platform, such as CAP it ALL, CPro, DAS Trader Pro, or Sterling Trader Pro.

- Once the account is verified and funded, you can access the markets and begin trading.

Additional Tools and Features

Score – 4.3/5

Beyond research and analysis, the broker offers a range of supplementary tools to enhance trading efficiency.

- These include multi-account management, advanced order types, and risk management tools.

- The broker also provides portfolio tracking, performance reporting, and customizable dashboards across its platforms, helping users monitor positions, optimize strategies, and manage multiple accounts effectively.

Capital Markets Elite Group Compared to Other Brokers

Capital Markets Elite Group positions itself as a specialized broker focusing on U.S. equities and ETFs, with a range of professional-grade platforms tailored for active and institutional traders.

Compared to competitors, the broker emphasizes direct market access, multi-account management, and high-performance execution, whereas some other brokers offer a broader range of instruments, including bonds, futures, and more.

While educational resources at CMEG are more limited than some larger global brokers, its platforms provide good trading tools and customizable interfaces that appeal to professional users. In terms of regulation and market reputation, the broker maintains strong oversight through the FCA entity, providing a secure environment, though other brokers may offer more extensive global coverage or additional support for retail investors.

Overall, Capital Markets Elite Group is more focused on efficiency, platform sophistication, and equity and ETF trading, making it competitive for experienced traders and institutions, while others cater to broader retail needs and diverse investment products.

| Parameter |

Capital Markets Elite Group |

KGI Securities |

Interactive Brokers |

Cobra Trading |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Stock Commission from $0.0005 |

Stock Commission NT$20 |

$0.85 |

Stock Commission from $0.0015 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Average |

Average |

Low |

Average |

Low |

Low/Average |

Low |

| Trading Platforms |

CPro, CAP it ALL, DAS Trader Pro, Sterling Trader Pro

|

KGI e-World Trading website, KGI e-Strategy App, KGI e-Agent App, MT5 |

TWS, IBKR WebTrader, Mobile |

DAS Trader Pro, Sterling Trader Pro, TradingView |

Freetrade Platform |

Power E*TRADE Pro, Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Equities, ETFs, Currencies, CFDs |

Stocks, ETFs, Options, Futures, Mutual Funds, Warrants, Bonds |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds, CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

FCA, CIMA, TTSEC |

FSC, MAS, SFO |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Limited |

Limited |

Excellent |

Limited |

Limited |

Excellent |

Good |

| Minimum Deposit |

$500 |

$10,000 |

$100 |

$30,000 |

$0 |

$0 |

$0 |

Full Review of Broker Capital Markets Elite Group

Capital Markets Elite Group is an investment provider specializing in over 6,000 stocks and ETFs. It offers direct market access through advanced platforms like CPro, CAP it ALL, DAS Trader Pro, and Sterling Trader Pro, catering to both active and institutional traders.

The broker provides margin trading, multi-account management, and real-time market tools, ensuring efficient and precise execution. While educational resources are limited, CMEG supports clients with market insights, research tools, and responsive customer support via live chat, email, and phone.

With regulation under multiple authorities, a focus on platform reliability, and a clear fee structure, the broker delivers a professional-grade environment suited for sophisticated investors and strategic portfolio management.

Share this article [addtoany url="https://55brokers.com/capital-markets-elite-group-review/" title="Capital Markets Elite Group"]

At this time it appears like Drupal is the best blogging platform available right now. (from what I’ve read) Is that what you’re using on your blog?