- What is BrightFunded?

- BrightFunded Pros Cons

- Is BrightFunded Legit?

- BrightFunded Challenge

- Funded Account

- Account Conditions

- Payout

- BrightFunded Alternative

What is BrightFunded Prop Firm?

BrightFunded is a Dutch Proprietary trading firm established in 2023 that allows traders to manage capital up to $400,000 through a structured evaluation process.

Traders begin by paying a one-time fee to enter a two-phase challenge, aiming to meet profit targets of 8% in Phase 1 and 5% in Phase 2, all while adhering to strict risk management rules, including a 5% daily and 10% total drawdown limit. Upon successful completion, traders receive a funded account with profit splits starting at 80%, which can increase to 100% through BrightFunded’s unlimited scaling plan.

The firm supports trading across various asset classes, including Forex, commodities, indices, and cryptocurrencies. BrightFunded’s innovative Trade2Earn loyalty program rewards traders with tokens for their activity, which can be exchanged for benefits such as increased profit splits and reduced evaluation fees.

| BrightFunded Advantages | BrightFunded Disadvantages |

|---|

| Competitive pricing | Not strictly overseen |

| cTrader and MT5 with fast trade execution | No free retakes |

| Multiple asset classes including Crypto pairs | It is hard to become Funded Trader |

| Refundable evaluation fee once you become Funded Trader | |

| Profit Share from Challenge | |

| Low Profit Target | |

| Trade2Earn loyalty program | |

| Fast evaluation payouts | |

Is BrightFunded Legit?

BrightFunded is a Dutch private limited liability company, legally registered in the UAE. While this registration provides a formal legal structure, it does not equate to regulation by a financial authority. As of now, the firm is not regulated by entities or a financial regulatory body.

- Additionally, unlike Forex brokers, prop trading firms like BrightFunded do not operate under a traditional broker license and are therefore not subject to strict financial regulation. As a result, the level of investor protection is lower, and traders should be fully aware of the risks involved when dealing with unregulated entities.

Is BrightFunded Scam?

While BrightFunded is not regulated by financial authorities, it operates as a legitimate prop trading firm with a growing community and a structured approach to trader evaluation and funding. Additionally, the firm has a high Brightfunded Trustpilot score.

- However, we recommend thoroughly understanding prop trading and its risks. You should choose firms with a long-standing reputation and avoid committing significant personal funds, since potential losses are usually lower than trading your capital directly.

BrightFunded Challenge Evaluation Rules

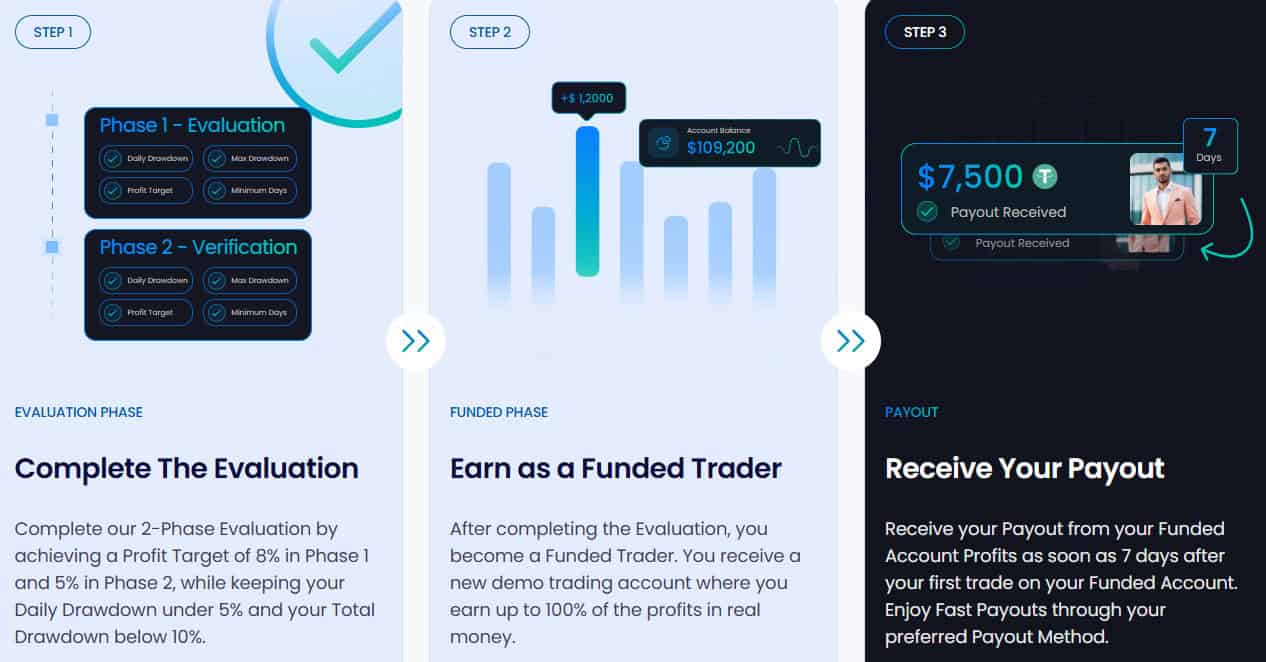

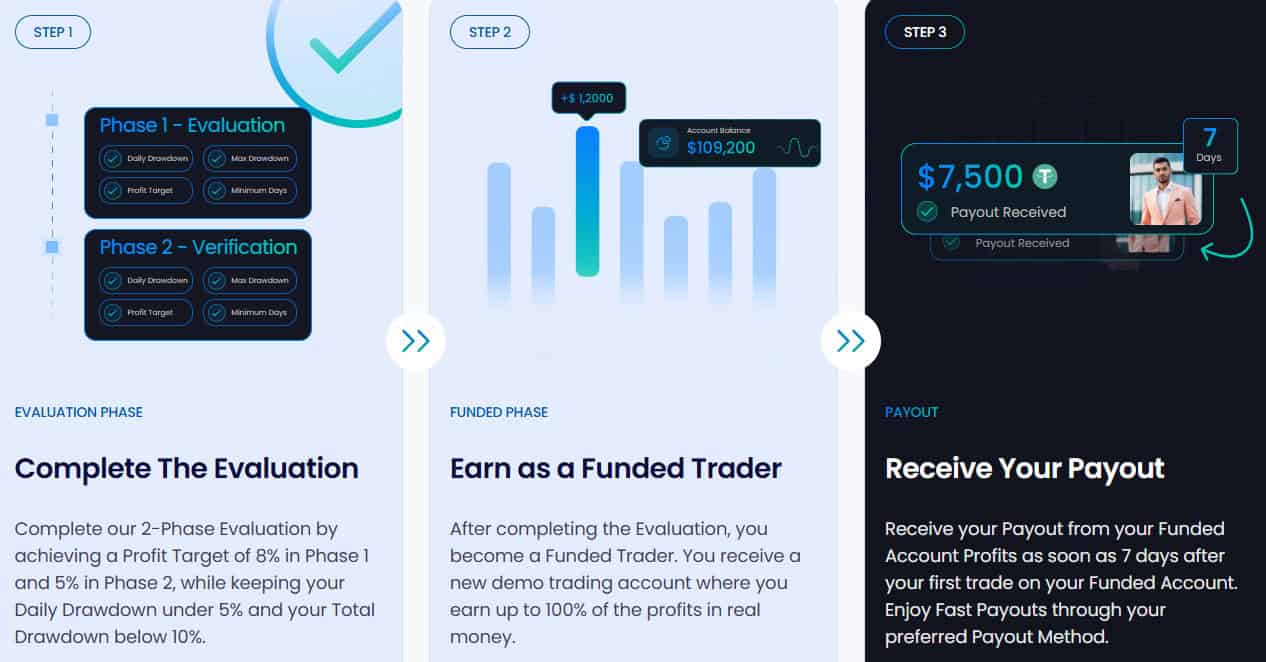

BrightFunded’s Challenge Evaluation is a 2-phase process designed to assess a trader’s ability to manage risk and generate consistent profits.

- In Phase 1, traders are required to achieve an 8% profit target without exceeding a 5% daily drawdown or a 10% overall drawdown. Upon successful completion, Phase 2 requires a 5% profit target under the same risk constraints.

Traders who pass Brightfunded rules receive a funded account with profit splits starting at 80%, which can increase to 100% through performance and participation in the firm’s Trade2Earn loyalty program.

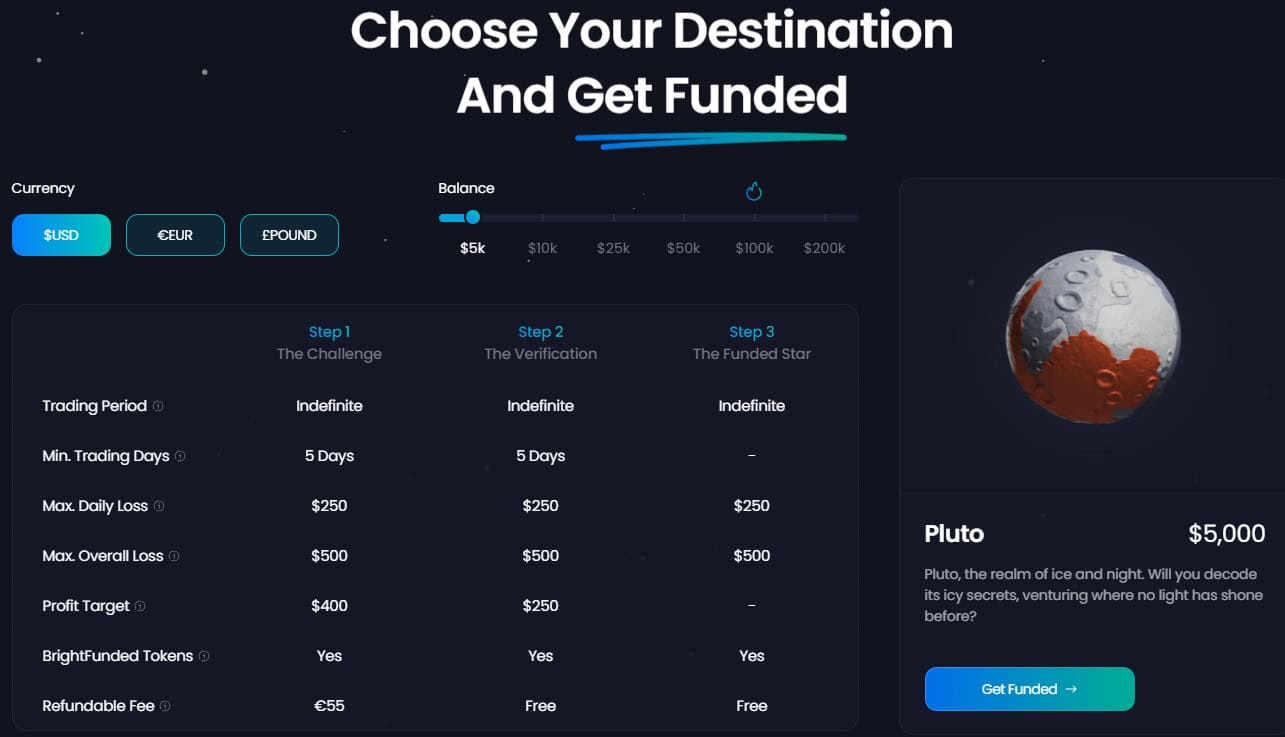

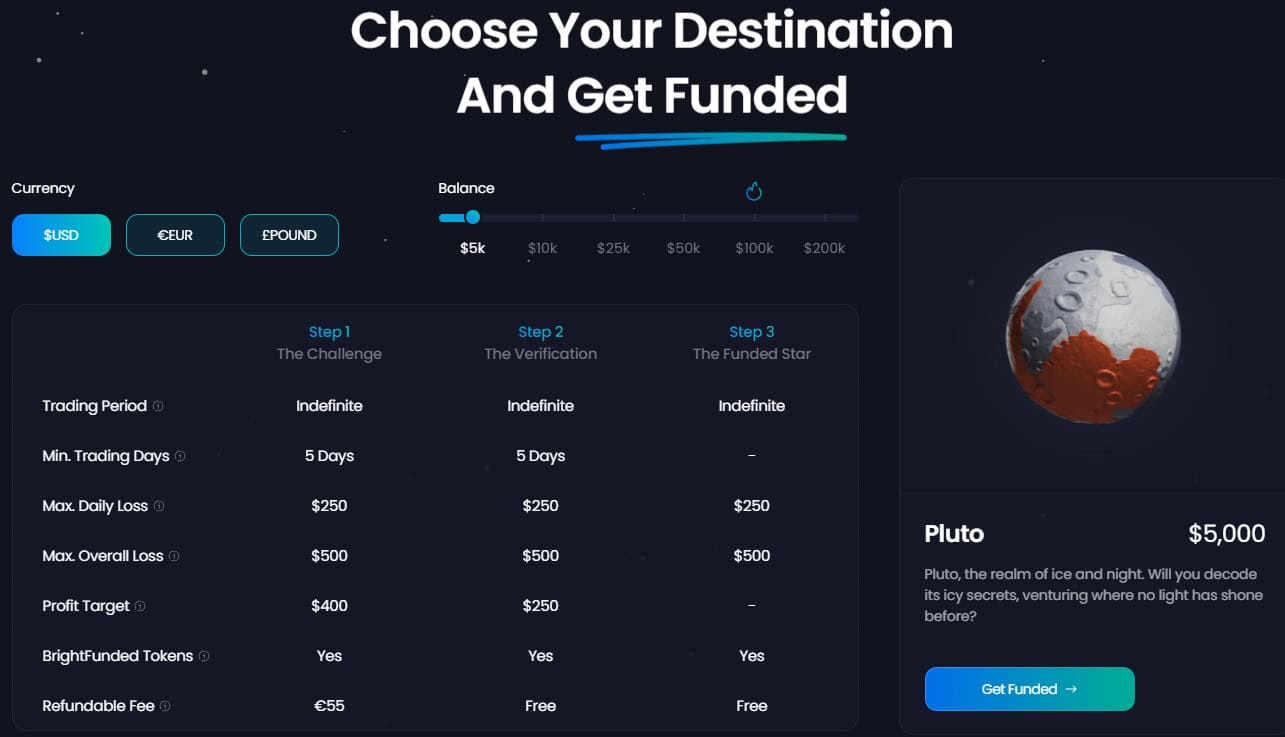

Account Balance and Registration Fee

Before starting the BrightFunded login and evaluation process, traders need to first choose the Evaluation Model and Account Balance they aim to qualify for. BrightFunded operates a 2-Phase Evaluation Model and offers several account sizes to suit different levels of trader experience and capital preference. The conditions of the challenge, such as trading rules, profit targets, and time limits, vary slightly depending on the account size selected.

This choice also affects the registration fee, which must be paid to participate in the challenge. However, BrightFunded offers a refund of this fee once you successfully pass the evaluation and receive your first payout as a funded trader. You can find a detailed breakdown of the registration fees and account sizes in the comparison table below.

The available account options are:

- The Pluto account starts with a balance of $5,000 and a registration fee of €55, making it a good entry point for beginners.

- The Mars account provides $10,000 in virtual capital for a starting fee of €95, offering a step up in exposure.

- For more experienced traders, the Venus account delivers $25,000 starting from €195, while the Neptune option gives access to $50,000 for a fee beginning at €295.

- High-volume traders can consider the Saturn account with $100,000 in funding for €495, or the top-tier Jupiter account, which offers $200,000 of virtual capital for a starting fee of €975.

Traders also have the option to add a Swap-Free feature for an additional 10%, which is ideal for those who wish to avoid overnight fees. The firm’s fees and account options are competitively priced compared to many other prop firms, making it an attractive choice for funded traders.

| Fees | BrightFunded | Liberty Market Investment | FundedNext |

|---|

| Minimum Account Size | $5,000 | $10,000 | $6,000 |

| Fee | €55 | $70 | $59 |

| Maximum Account Size | $200,000 | $150,000 | $200,000 |

| Fee | €975 | $350 | $999 |

| Reset or Test Retake | No | Yes | Yes |

| Is Fee Refundable? | Yes | No | Yes |

Profit Target

BrightFunded sets clear profit targets for its evaluation challenges. In the 2-Phase Evaluation Model, traders need to achieve an 8% profit target in Phase 1 and a 5% profit target in Phase 2, all while staying within the daily and overall drawdown limits.

These targets must be met without breaching any trading rules to progress and ultimately qualify for a funded account.

Maximum Loss

BrightFunded enforces strict maximum loss limits to ensure disciplined trading during its evaluation process. The firm allows a maximum overall drawdown of 10% of the starting account balance. This means that if a trader’s losses exceed 10% at any point during the evaluation, the account is disqualified.

- Additionally, there is a daily drawdown limit of 5%, calculated based on the previous day’s balance. These rules apply throughout both evaluation phases and must be respected to remain eligible for funding.

Minimum Trading Period

BrightFunded allows traders to complete a minimum of 5 non-consecutive trading days during each phase of the evaluation process. This means traders need to place at least one trade on five different calendar days throughout both the Challenge and Verification phases.

These trading days do not need to be consecutive, allowing flexibility in your trading schedule.

See the detailed table with BrightFunded Review Challenge conditions:

Free Trial

As we found, BrightFunded prop trading firm does not offer a free trial for its evaluation challenges. Traders need to pay a one-time registration fee, which varies depending on the chosen account size, to participate in the evaluation process.

- However, the broker provides demo accounts for practice purposes. These demo accounts are used during the evaluation phases and are funded with virtual capital, allowing traders to demonstrate their trading skills without risking real money.

BrightFunded Funded Account

Once a trader successfully passes both phases of BrightFunded’s evaluation, they are granted access to a Funded Star Account, an account with virtual capital that allows traders to operate using the firm’s provided capital.

This account enables traders to start earning real profits while adhering to risk management rules set by BrightFunded. The funded account includes flexible payout options, with the first withdrawal available 30 days after the initial trade and later biweekly payouts.

Profit Split

BrightFunded offers a competitive profit split structure for its funded traders. After completing the evaluation process, traders begin with a default 80/20 split, keeping 80% of the profits while the firm takes 20%.

- Additionally, BrightFunded’s scaling plan allows traders to grow their profit share to 100% over time. By achieving consistent performance milestones, such as a minimum of 10% profit over four months and completing at least two successful payouts, traders can scale their accounts and eventually retain the full 100% of their trading profits.

Payout and Withdrawals

Based on our research, BrightFunded offers a flexible payout structure for its funded traders. After completing the evaluation phases and placing the first trade on a funded account, traders become eligible to request their first payout after 30 days.

- Subsequent payouts are processed on a biweekly basis, providing regular access to trading profits. For those seeking faster access to earnings, the firm offers optional add-ons: a bi-weekly payout cycle for an additional 15% fee and a weekly payout cycle for an additional 25% fee.

Payouts can be received through various methods, including bank transfers and cryptocurrency, allowing traders to choose the most convenient option for their needs.

Withdrawal Method

BrightFunded offers flexible withdrawal methods to accommodate traders’ preferences. Funded traders can receive payouts via bank transfers or USDC ERC20.

Account Conditions

Before starting with the firm, you should review the specific terms related to each account type. Key factors such as available trading instruments, commission structure, maximum leverage, platform choice, and execution conditions can significantly impact your trading experience.

Understanding these elements ensures that the account setup aligns with your trading strategy and risk profile. See the detailed breakdown below:

Trading Instruments

BrightFunded offers over 150 trading instruments, including Forex pairs, commodities, global indices, and over 35 cryptocurrencies. This variety allows traders to diversify their strategies across different markets.

However, it does not offer trading in instruments like options, ETFs, or futures. If you are looking to trade these types of assets, you may need to consider an alternative prop firm that provides a broader range of instruments.

BrightFunded Commission

BrightFunded has a competitive commission structure. The firm charges commissions based on the instrument being traded, such as $3 per lot for Forex pairs, 0.024% for cryptocurrencies, and no commission for indices. Commodities incur a small commission of 0.0010% of the trading volume.

These commissions apply during both the evaluation and funded phases, and there are no additional recurring fees besides the initial evaluation fee, which is refundable once you become a funded trader.

Leverage

BrightFunded offers different leverage levels for various instruments, including up to 1:100 for Forex pairs, 1:40 for commodities, 1:20 for indices, and 1:5 for cryptocurrencies. This leverage allows traders to amplify their positions, but it also comes with increased risk.

BrightFunded Trading Platform

BrightFunded provides traders with access to cTrader, DXtrade, and MT5. cTrader and MT5 are known for their fast order execution, advanced charting tools, and user-friendly interfaces, supporting multiple devices, including iOS, Android, and desktop platforms.

DXtrade offers a customizable trading environment with features tailored to professional traders. All the available platforms are designed to support the firm’s evaluation and funded account processes, ensuring a seamless trading experience. Traders can choose the platform that best suits their trading style and preferences.

Trading Conditions

Based on our findings, BrightFunded offers various account types with flexible trading conditions.

- The firm allows a range of strategies, including scalping, swing trading, EA trading, copy trading, weekend holding, and position trading, providing the flexibility to implement different approaches.

- Traders can use various trading styles, including news trading, within the allowed parameters. While slippage is typically minimal, the firm enforces restrictions around news events, limiting trades 5 minutes before and after major releases to minimize market volatility impacts.

Understanding these conditions is crucial for maximizing success while trading with BrightFunded.

BrightFunded Promotions

BrightFunded, from time to time, offers promotions such as discounts on evaluation fees or bonus opportunities for new traders. These promotions are designed to attract aspiring traders and provide a cost-effective entry into the evaluation process.

However, you should regularly check the firm’s official website or social media channels to stay updated on the latest promotional offers.

BrightFunded Alternative Brokers

Based on our overall findings, BrightFunded is a potentially attractive option for traders seeking a funded account with flexible trading conditions and competitive pricing. The firm offers multiple evaluation models, profit-sharing opportunities, and fee refunds upon becoming a funded trader, features that may appeal to both beginners and experienced traders.

However, while comparing BrightFunded with other prop trading firms in the industry, some competitors might offer a wider selection of trading instruments, more advanced platforms, or a more established track record.

While BrightFunded has its strengths, such as accessible entry costs and trader-friendly strategies, careful consideration of your personal trading needs and preferences is key when choosing the right firm.

See our selection of alternative prop trading firms below, carefully chosen based on overall trader benefits.

- FundedNext – Trading Prop Firm with Lowest Account Balance

- FTMO – Great Swing Trading Prop Firm

- TopTier Trader – Great Prop Trading Firm offering MetaTrader platforms and EA trading

Share this article [addtoany url="https://55brokers.com/brightfunded-review/" title="BrightFunded"]

Hello

Hmmm

Hi how are you. Kya sach mein Ham yahan se paise Kama sakte hain

Ki