- What is Advanced Markets?

- Advanced Markets Pros and Cons

- Regulation and Security Measures

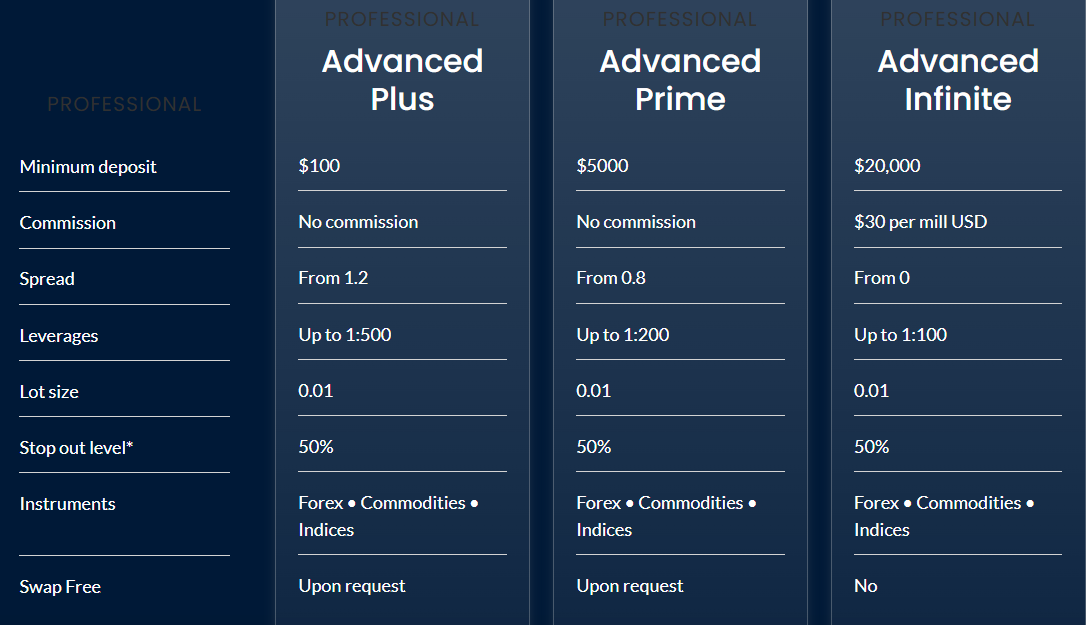

- Account Types and Benefits

- Cost Structure and Fees

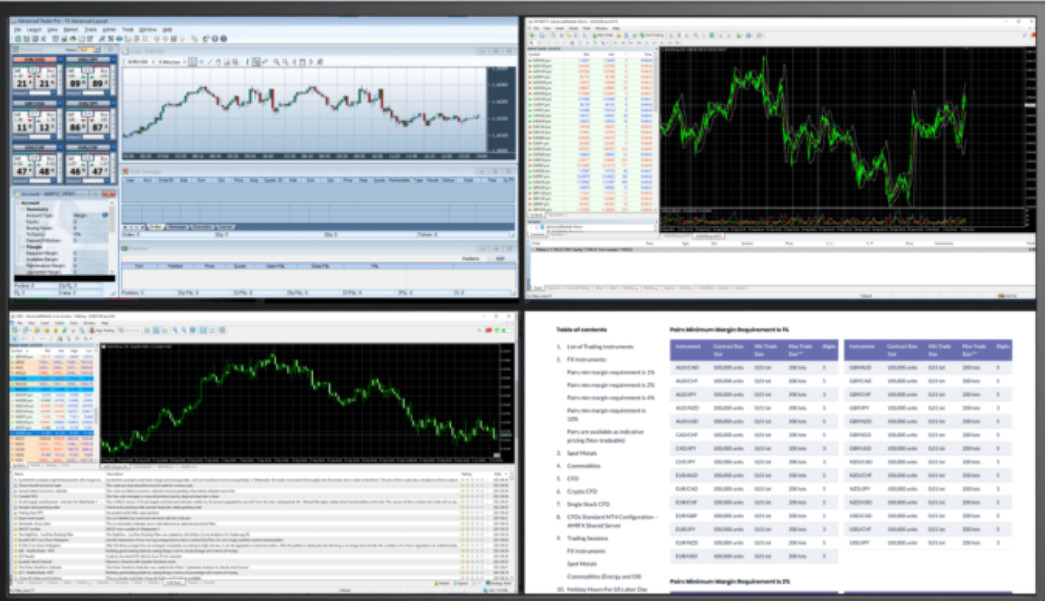

- Trading Platforms and Tools

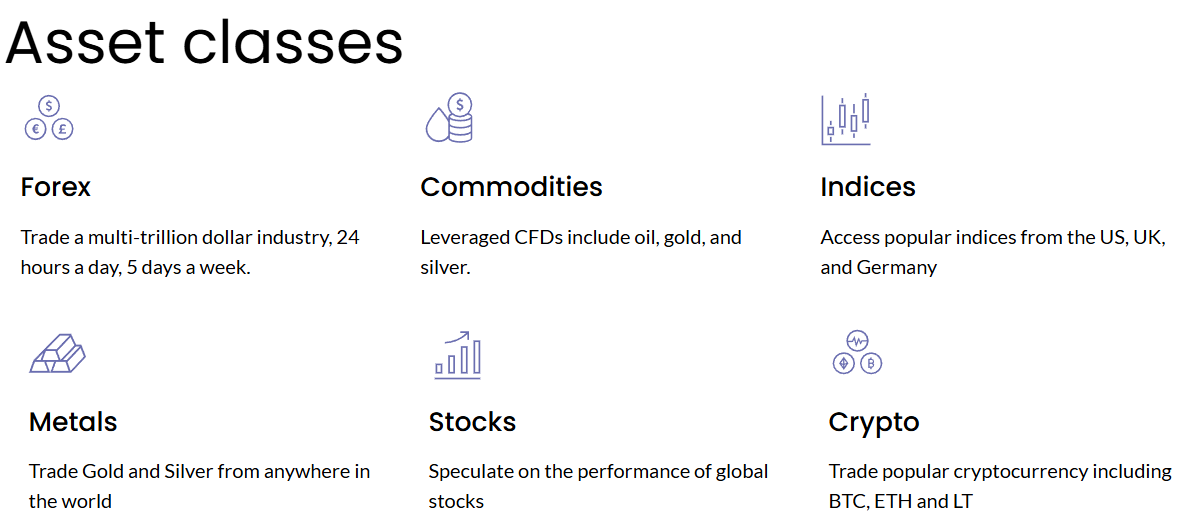

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

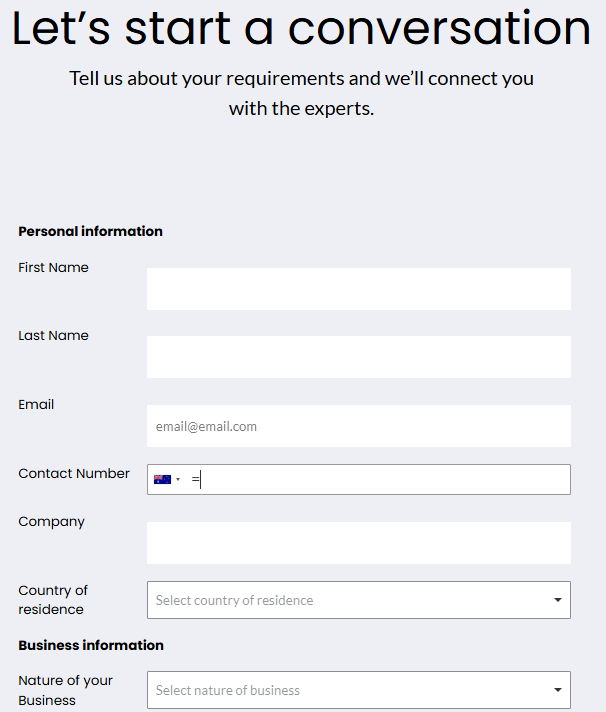

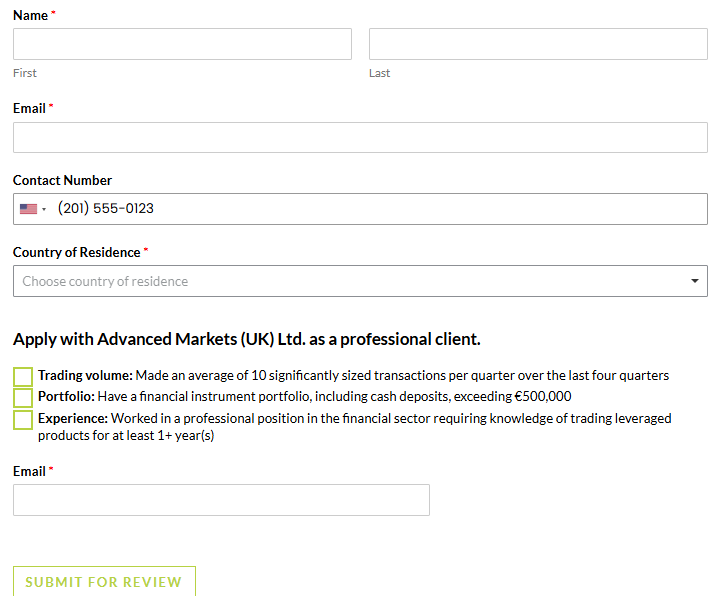

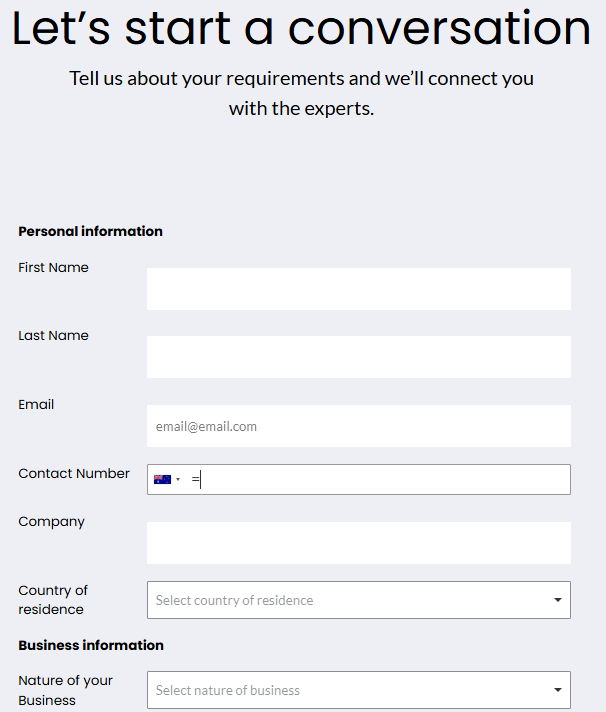

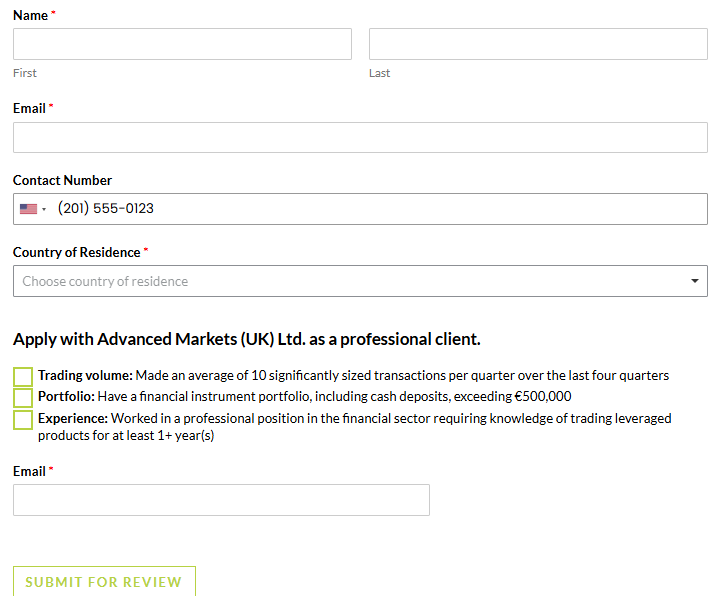

- Account Opening

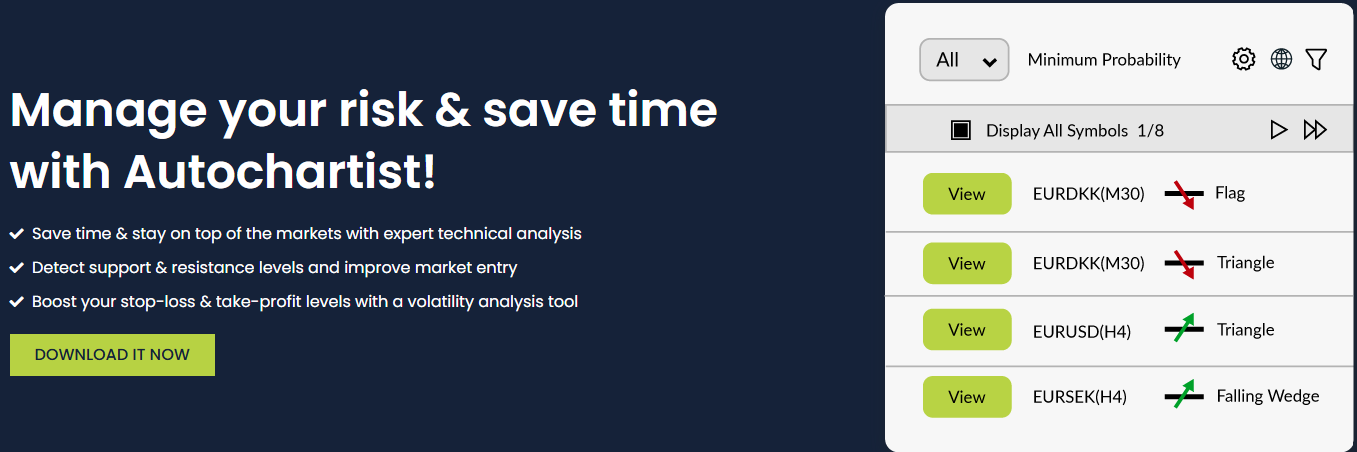

- Additional Tools And Features

- Advanced Markets Compared to Other Brokers

- Full Review of Broker Advanced Markets

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4 / 5 |

What is Advanced Markets?

Advanced Markets provides a transparent and secure trading environment, Direct Market Access (DMA) liquidity, and technology solutions to Forex, energy, precious metals, and CFD markets. The broker was launched in 2006 and since then has offered wholesale services to institutional clients worldwide, including trade execution and prime brokerage solutions to banks, hedge funds, commodity trading advisors, corporations, and other institutional market participants.

The company has secured FCA regulation and provides tightly overseen services to 40,000 institutional and individual clients in more than 30 countries globally. The headquarters is in Charlotte, North Carolina, and it also maintains offices in London and the Cayman Islands to support its international clients.

Advanced Markets Pros and Cons

Based on our research, the broker offers competitive trading solutions to corporate clients as well as acts as a technology liquidity provider. Being a retail trader, you may benefit from full direct access to bank, non-bank, and ECN multi-asset class liquidity on tight, competitive spreads. Advanced Market delivers a guarantee on all client positions that are instantly passed straight through the liquidity providers while the broker does not take any Market risk.

For the cons, the proposal might be more suitable for advanced and professional traders, and there is no 24/7 customer support or proper educational materials.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversight | No 24/7 customer support |

| Direct Market Access | Limited educational materials |

| Powerful technology and platforms | |

| Available for UK traders | |

| Account segregation | |

| Suitable for institutional trading | |

| Low spreads | |

Advanced Markets Features

Advanced Markets is a tightly regulated company with tailored services directed at institutional clients. With DMA access, advanced trading platforms, low spreads, and the availability of multiple markets, the firm can be a favorable choice for professional clients looking for transparent and reliable solutions. Below we have compiled the main features of Advanced Markets:

Advanced Markets Features in 10 Points

| 🗺️ Regulation | FCA, ASIC, Bermuda |

| 🗺️ Account Types | Advanced Plus, Advanced Prime, Advanced Infinite |

| 🖥 Trading Platforms | MT4, MT5, Fortex 5 |

| 📉 Trading Instruments | Forex, Commodities, Indices, Metals, Stocks, Crypto |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | EUR, USD, GBP, AUD |

| 📚 Trading Education | Research tools |

| ☎ Customer Support | 24/5 |

Who is Advanced Markets For?

Based on our research and expert opinion, Advanced Markets offers favorable trading conditions, a reliable environment, and top-notch technical solutions to ensure a profitable and successful experience. Here is what Advanced Markets is especially beneficial for:

- Traders from the UK

- International traders

- CFD and currency trading

- Traders who prefer the MT4 and MT5 platforms

- Professional traders

- Institutional trading

- Hedge funds

- STP execution

- Direct market access

- Competitive spreads and fees

- EA/Auto trading

- Good trading tools

Advanced Markets Summary

Overall, Advanced Markets is a model of a broker with competitive, multi-bank elements combined with low latency, transparency, and anonymity of ECNs servicing for traders seeking consistent and interbank liquidity. Together with its advanced options for traders or institutions, a choice of cutting-edge platforms makes the firm a good choice for traders looking for a reliable broker. Clients can access multiple assets through their chosen platform, with low spreads and overall favorable market conditions.

Yet, we have also found that the broker lacks educational and research materials. We recommend conducting thorough research before choosing Advanced Markets as your broker to ensure that it suits your trading requirements.

55Brokers Professional Insights

Advanced Markets besides being regulated by leading financial authorities, therefore highly secure. it also has been in the market for a little less than two decades and has always stood out for the transparency of its practices, clarity in trading costs and overall fee structure, and great customer assistance. We rank the broker with high mark for its secure trading platform, smooth trading execution and trading process overall, with competitive spreads and fees for its trading services.

With Advanced Markets, traders gain access to Forex pairs, commodities, indices, metals, stocks, and cryptos with overall good diversification over markets, making them suitable for day tarders, scalpers or long-holding alike. Traders have a good choice in trading platforms, including the popular MT4 and MT5 platforms and the advanced Fortex 5, which is suitable for professional trading. What is most great it that Advanced Markets gives its clients access to DMA solutions, with great transparency of execution and eliminating conflicts of interest by routing all trades directly to liquidity providers, which is also essential for fast orders like scalping, algo trading or high-frequency trading.

Consider Trading with Advanced Markets If:

| Advanced Markets is an excellent Broker for: | - Professional traders

- UK traders

- Currency traders

- High volume or algorithmic traders

- Retail brokers needing prime liquidity

- MT4/MT5 platforms enthusiasts

- Institutional trading

-Clients looking for competitive and transparent fees

- Traders looking for a direct market access |

Avoid Trading with Advanced Markets If:

| Advanced Markets is not the best for: | - Beginner and retail traders

- Long-term investors

- Traders looking for 24/7 support

- Clients favoring extensive educational resources

- Traders looking for a wide range of trading products |

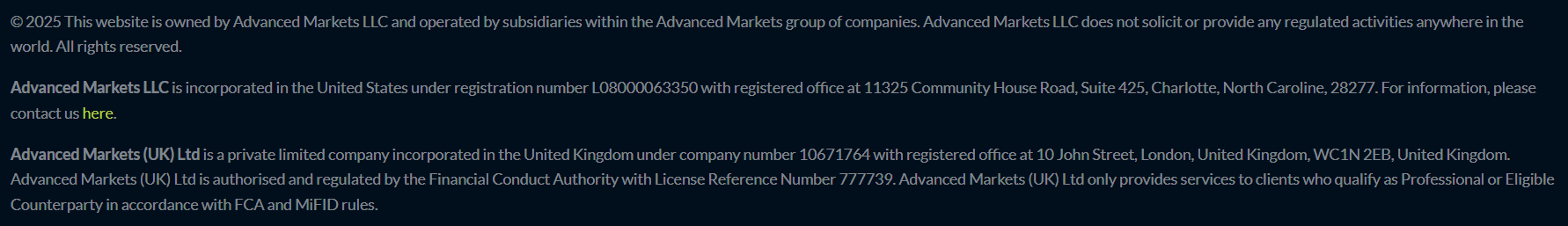

Regulation and Security Measures

Score – 4.7/5

Advanced Markets Regulatory Overview

Advanced Markets has made sure to comply with regulatory standards established by the leading authorities in the world, complying with stringent rules and ensuring a favorable and reliable trading environment.

- Advanced Markets LLC is based in the United States, North Carolina, under registration number L08000063350.

- Regulated by the respected FCA, Advanced Markets UK provides services to professional clients only, following the rules imposed by FCA and MiFID.

- We have also found that Advanced Markets (Bermuda) Ltd. is an incorporated company in Bermuda with registration number 56562.

- The company has also formed Advanced Markets LTD (“AMLTD”) as a corporation in the Cayman Islands. Despite operating in an offshore zone, the broker’s registration is secured through an Australian financial services license (AFSL) No. 444649, and it is a registered foreign entity under the Australian Securities & Investments Commission (ASIC). Although ASIC is a reliable regulatory body, its oversight of Advanced Markets is limited to its financial services activities in Australia.

How Safe is Trading with Advanced Markets?

As a regulated company, the license ensures financial markets are complying with their legal responsibilities to operate fair and transparent markets. And surely, client funds are held by the requirements in segregated client trust accounts separate from the firm’s capital. All clients and firm funds are kept at internationally rated banks, including Bank of America, Citi, Macquarie Bank, and Deutsche Bank.

- Besides, Advanced Markets’ yearly financial reports are audited by one of the world’s leading accountancy firms. This ensures transparency and integrity, ensuring clients of fair practices from the side of the company.

Consistency and Clarity

Advanced Markets has been present in the market since 2006, and since then, the broker has constantly expanded its global exposure and services. At present, the broker has a client base of 40,000 institutional and individual clients and is licensed in multiple jurisdictions, providing safe and trustworthy services to professionals, hedge funds, family offices, and brokers.

We found that Advanced Markets has received recognition for its reliable trading services and innovative financial technology, holding awards as the best ECN/execution venue, best B2B liquidity provider, most transparent broker, and other substantial awards confirming the company’s reliability and good standing in the market. To see what real clients think about the broker and share their experience, we reviewed customer feedback. Many clients praise the company’s services, highlighting its fast execution and tight spreads, the DMA model, etc. However, some traders indicate certain areas for improvement, such as customer support, withdrawal processing, and others.

To sum up, Advanced Markets has been consistent in its development, acquisition of new licenses, and offering of innovative and advanced services, features that are essential for a long-term establishment.

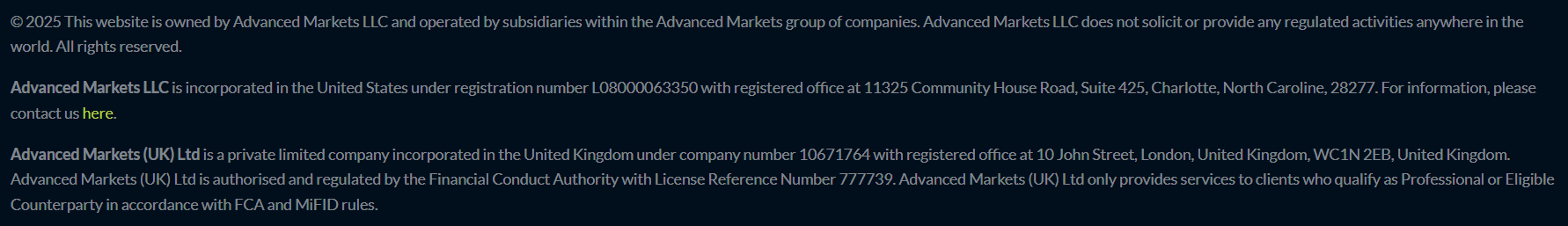

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Advanced Markets?

Account type availability depends on the entity clients are registered. For the FCA entity, only professional clients and eligible counterparties are allowed to trade. The account types for this entity are not classified publicly and are tailored exclusively based on the client’s needs. Here we will discuss the account types available under the Bermuda entity with different trading conditions to meet different expectations and needs.

Advanced Plus

The Advanced Plus account offers more accessible trading conditions, with a $100 minimum deposit requirement. This is a spread-based account with no commissions applied. The average spread for this account is 1.2 pips. Traders can use a high leverage of up to 1:500. Under the Bermuda entity, traders have access to limited financial assets, with access to Forex, commodities, and indices. This is true for all the other account types as well.

Advanced Prime

The Advanced Prime account requirements are above average, with a minimum deposit of $5000. The account allows up to 1:200 leverage. This account type is also spread-based, with all the fees integrated into spreads that start from 0.8 pips.

Advanced Infinite

The Advanced Infinite account requires at least $20,000, with a 1:100 leverage availability. The account type has a commission-based fee structure, with spreads starting from 0 pips, combined with fixed commissions of $30 per mill USD.

Regions Where Advanced Markets is Restricted

Advanced Markets operates under several entities, thus, its availability in certain regions depends on the entity. However, based on certain regulatory rules and restrictions, the company does not accept clients from the following regions:

- Afghanistan

- Albania

- Burundi

- Central African Rep

- Dem. Rep. of Congo

- Gaza Strip

- Haiti

- Iran

- Iraq

- Lebanon

- Libya

- Mali

- Myanmar

- Mozambique

- Nigeria

- N. Korea

- Panama

- Philippines

- Palestine (West Bank)

- Russian Federation

- Somalia

- S. Sudan

- Syria

- Tanzania

- Turkey

- Venezuela

- Western Sahara

- Yemen

Cost Structure and Fees

Score – 4.5/5

Advanced Markets Brokerage Fees

Advanced Markets fees depend on different factors, including the account type, the entity under which the account is opened, and others. For UK and Australian registered clients, the services are only for professionals and institutional clients; the trading costs and other trading conditions are tailored individually for each customer. We have reviewed the applicable costs of Advanced Markets under the Bermunda registration, which offers 3 account types tailored for clients of different experience levels and trading expectations.

Based on our test trade, Advanced Markets’ spreads depend on the account type. The broker offers 2 spread-based account types that involve all trading costs in fixed spreads. For the Advanced Plus account, the average spread is 1.2 pips. The Advanced Prime offers lower spreads, starting from 0.8 pips.

- Advanced Markets Commissions

Advanced Markets offers only one commission-based account intended for more advanced traders, with higher deposit requirements and better opportunities. The trading costs for the Advanced Infinite account include spreads from 0 pips and fixed commissions of $30 per million USD, which is equal to $3 per lot.

How Competitive Are Advanced Markets Fees?

Based on our research, Advanced Markets offers competitive trading costs that are in line with the market average. The broker gives a clear picture of the applicable charges, defining its spreads and commissions based on the account type. Advanced Markets is more suitable for advanced and high-frequency traders looking for customized liquidity and clear and transparent charges. Spreads are average at 1.2 for its Advanced Plus account. Commissions are $3 per lot, enabling professional clients to have fixed and transparent charges for each trade. There are no account management fees or hidden costs; thus, clients can consider only the publicly mentioned charges that are common in the market.

| Asset/ Pair | Advanced Markets | SquaredFinancial Spread | Eightcap Spread |

|---|

| EUR USD Spread | 1.2 pips | 1.2 pips | 1pips |

| Crude Oil WTI Spread | 3 | 0.03 USD | 3 pips |

| Gold Spread | 1 | 0.10 USD | 1.2 pips |

Advanced Markets Additional Fees

Per our findings, Advanced Markets does not impose any deposit or withdrawal fees. However, we advise clients to consider third-party provider costs. Advanced Markets does not disclose inactivity fees; it only mentions that after three months of inactivity, the account will be dissolved.

Score – 4.5/5

The broker offers the most popular and widely used trading platforms, MetaTrader 4 and MetaTrader 5. Also, the platform offerings and the underlying supporting technology have been developed to facilitate Direct Market Access (DMA) via Bridge technology and FIX API. Clients also have access to Advanced Markets’ Fortex 5, developed for professional trading.

| Platforms | Advanced Markets | Scandinavian Capital Markets Spread | JP Markets |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | No | No | No |

| Mobile Apps | Yes | Yes | Yes |

Advanced Markets Web Platform

Based on our findings, Advanced Markets ensures connectivity through web-based platforms straight from the web browser with no need for downloads or installation. Via the web browser, clients gain access to Advanced Markets’ MT4, MT5, and Fortex 5. All the platforms retain their main features and capabilities, providing a favorable trading experience with more flexibility and ease of access.

Advanced Markets Desktop MetaTrader 4 Platform

MT4 is known as one of the most popular retail platforms, with multiple advanced features and tools, ensuring a positive experience. The platform allows algorithmic trading, expert advisors, trading robots, and copy trading. Also, it supports scalping and hedging. Users also gain access to a wide range of built-in technical indicators, 9 timeframes, and 3 chart types. The platform is available through different devices and operating systems, including Windows and macOS.

Advanced Markets Desktop MetaTrader 5 Platform

The MT5 platform stands out for its superior tools and features, ensuring advanced trading functionality. The platform offers a wide range of instruments across different assets. With the MT5 platform, clients gain access to exclusive market depth, various order types, advanced charting tools, an impressive range of technical indicators, and access to the MQL5 programming language. Also, traders always stay informed of the coming market events and changes through the integrated Economic Calendar.

Advanced Markets Fortex 5

The Fortex 5 platform is a great fit for professional clients looking for portfolio management, real-time market depth, and enhanced charting tools and capabilities. The platform is favorable for high-frequency trading with extra-fast execution. Fortex 5 is also easily customized with a user-friendly interface, real-time monitoring, and configurable layouts. The platform includes risk-management tools, set limits, and alerts. Also, Fortex 5 ensures seamless integration with FIX API.

Main Insights from Testing

Our research and testing of Advanced Markets’ platforms have revealed advanced trading solutions with innovative tools and great trading opportunities. The popular MT4 and MT5 platforms include all the essential features to provide a seamless trading experience to traders of any level of experience. On the other hand, the Fortex 5 platform is tailored for professional clients, ensuring fast execution, FIX API connection, low latency, and direct market access.

Advanced Markets MobileTrader App

Although the broker does not offer a proprietary mobile app, it ensures access through the mobile applications of MT4, MT5, and Fortex 5. The platforms are easily available through iOS and Android devices, enabling access to the market from the palm of the hand. The mobile platforms have great tools and features, enabling trading history, push notifications, and other enhanced capabilities. The mobile app is a great way to monitor accounts from anywhere, allowing flexibility and independence.

Trading Instruments

Score – 4.4/5

What Can You Trade on the Advanced Markets Platform?

Advanced Markets provides its clients with access to financial instruments, such as Forex, CFDs, Commodities, Indices, Metals, Stocks, and Crypto, that can be tailored to meet the specific needs and requirements of clients. The company offers Forex pairs—major, minor, and exotic. Clients can also trade the world’s popular indices on CFDs and global commodities, including energies, agricultural products, and metals. All the tradable products are available through transparent fees and advanced trading platforms. Clients can also access cryptos, such as Bitcoin and Ethereum, for eligible jurisdictions.

Main Insights from Exploring Advanced Markets Tradable Assets

Consider the differences between the entities; as with Advanced Markets, every entity has its own conditions and tailored services. For instance, the UK and Australian entities offer their services to professionals and institutional clients, including hedge funds, brokers, family offices, and introducing brokers. On the other hand, the Bermuda entity offers its services to traders of different experience levels. Based on this, the instrument availability is also different, combined with completely different fee structures, instrument availability, platforms, and other differences.

All in all, with direct market access, fast execution, tight spreads, and tailored solutions, Advanced Markets is a great broker with access to the most essential tradable products across multiple financial assets.

Leverage Options at Advanced Markets

Leverage is mostly beneficial for traders as it permits them to access the market with less capital. However, it also has the potential to result in significant gains or losses, depending on how it is used. Therefore, it is crucial to have a clear understanding of how leverage works and its associated risks before engaging in leveraged trading activities.

Advanced Markets leverage depends on the FCA, ASIC, and Bermuda regulations:

- UK traders can use low leverage up to 1:30 for major currency pairs and 1:10 for Commodities.

- International entity clients can use leverage up to 1:100 for professional trading.

- Bermuda clients have access to higher leverage based on the account types. The highest available leverage for the Advanced Plus account is 1:500.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Advanced Markets

There are multiple methods to fund the accounts with Advanced Markets. Clients can choose from options, including debit/credit card, cryptocurrency transfers, Perfect Money, and bank wire transfers. All the available methods ensure complete transparency and the safety of money transfers. Besides, the company does not incur any deposit or withdrawal transaction fees. Just the opposite, the broker covers all the transaction fees for credit/debit cards and international bank wire transfers that are higher than $200.

Minimum Deposit

The minimum deposit required for Advanced Markets’ account opening is $100. This depends on the account type, as the Advanced Infinite requires $20,000. The minimum deposit requirement also depends on the entity. Under the FCA and ASIC-regulated entities, the account opening standards and conditions are very different, as the registration is available only for professional clients with tailored trading conditions and special offerings.

Withdrawal Options at Advanced Markets

With Advanced Markets, there is no minimum withdrawal amount specified. Withdrawals usually take about 24 hours to process if the requests are backed by all the necessary documentation.

- Bank wires and transfers via credit cards might take longer, up to 3-5 working days.

- On the contrary, clients can receive their funds instantly through Perfect Money.

Customer Support and Responsiveness

Score – 4.6/5

Testing Advanced Markets Customer Support

Traders can access 24/5 customer support through live chat, email, and phone lines at Advanced Markets. We found that the broker’s support team consists of trading professionals who can offer help for technical difficulties, general questions, and operational concerns. The support team provides fast and knowledgeable responses and is easy to reach during working days.

- The available FAQ section is also helpful, including detailed answers to the most common trading-related questions.

- The company is also social, with active pages on platforms such as IG, FB, YouTube, and LinkedIn.

Contacts Advanced Markets

Advanced Markets has a supportive customer team that assists clients through multiple methods.

- Clients can send their inquiries straight from the broker’s contact section, indicating the issue and also providing personal details and an email address to receive the answer.

- The broker offers a very responsive live chat with quick and detailed answers.

- Clients can also contact the customer team through WhatsApp: +971 58 551 3935.

- Another option to contact Advanced Markets is their Telegram: @Advanced_Markets_bot.

Research and Education

Score – 4/5

Research Tools Advanced Markets

We have reviewed the Advanced Market research tools to see what the company offers its clients for in-depth research. The main tools are integrated into its advanced platforms—MT4, MT5, and Fortex 5. Through its platforms, the broker provides detailed financial news and a built-in comprehensive economic calendar. However, there are no additional research tools that will help clients experience more enhanced research opportunities.

Education

We have also reviewed the broker’s educational resources to see if clients can find useful materials to guide them in the market and help them gain more knowledge and skills. Advanced Markets provides a demo account for clients who want to practice trading without risking real money, making it an excellent educational tool for novice traders. Also, it provides market insights, industry updates, newsfeeds, and guides to help clients trade with ease and make the most of the broker’s products and services.

- However, we found that Advanced Markets does not have seminars, webinars, or other essential materials, such as eBooks or a Forex Glossary. One of the reasons for a limited educational section is that its services are predominantly directed to professional clients who already possess substantial knowledge of the market and trading nuances.

Is Advanced Markets a Good Broker for Beginners?

Advanced Markets primarily has an institutional focus tailored for professional and institutional clients, hedge funds, family offices, brokers, etc. Hence, the company’s services meet the needs of advanced and high-frequency traders. The initial deposit for the accounts registered under the FCA and ASIC entities is well above the cost-conscious level. Besides, there are no educational resources, which makes the company non-friendly for beginners. However, under the Bermuda entity, clients are provided with different account choices that can meet various trading needs and expectations. Despite this, Advanced Markets is initially focused on professional trading, with more complex solutions, platforms, and trading strategies.

Portfolio and Investment Opportunities

Score – 3.8 /5

Investment Options Advanced Markets

Advanced Markets offers short-term trading solutions with access to multiple financial assets, including forex, commodities, global indices, metals, cryptos, and stocks. However, all the available products (60+) are CFD-based. This means that Advanced Markets is not a favorable choice for traders who favor long-term trading and traditional investments.

However, there are still alternative investment opportunities with the broker to diversify trading and expand clients’ portfolios.

- Through its MT5 platform, Advanced Markets gives access to copy trading, enabling less experienced clients to copy professionals and gain profits without much effort and dedication.

Account Opening

Score – 4.6/5

How to Open an Advanced Markets Demo Account?

Demo accounts are for training purposes, helping clients practice their skills and gain essential knowledge on trading. Advanced Markets’ demo accounts are available only for 180 days. However, clients can open as many demo accounts as they need. Here is a step-by-step guide on how to open a demo account:

- Go to the broker’s website and choose a demo account option.

- Fill out the registration form by providing the full name, email address, phone number, etc.

- Set up your account by choosing the trading platform, currency, account type, etc.

- Receive your account credentials at the provided email address.

- Verify your account and download the trading platform.

- Receive the virtual funds and start trading.

How to Open an Advanced Markets Live Account?

Opening an account with a broker is easy; the account can be opened within minutes. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open Account” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

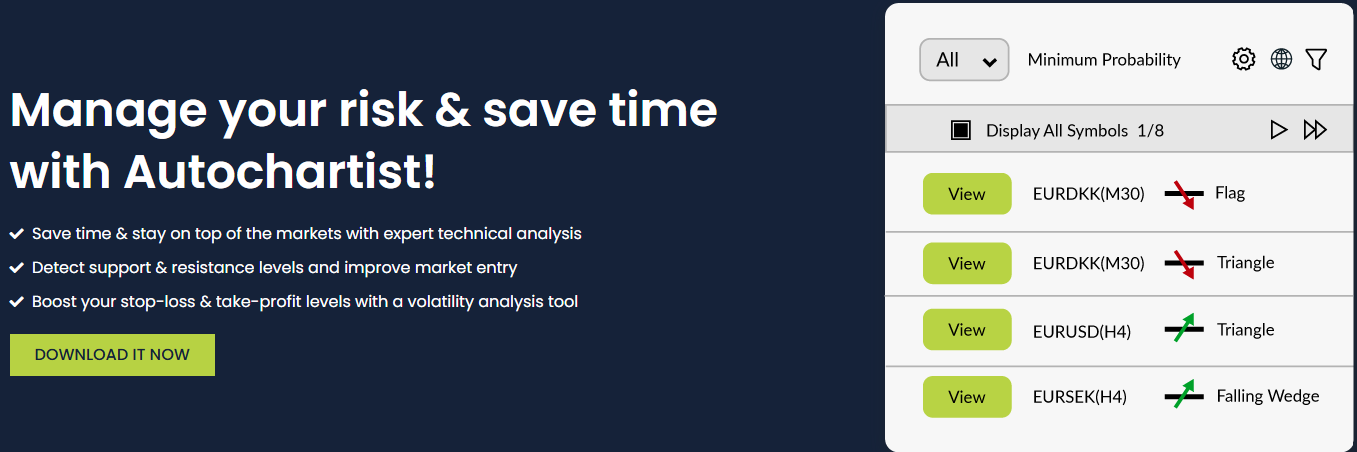

Score – 4/5

All the essential tools and features are already included in the broker’s advanced trading platforms. In particular, the Fortex 5 includes innovative and in-depth analytical capabilities tailored specifically for professionals. However, there are still a few additional tools that play an essential role in the successful trading outcome, and as we found, one of them is Advanced Markets’ Autochartist:

- Autochartist ensures expert technical analysis and improves market entry by detecting the resistance and support levels. Autochartist also provides volatility analysis, performance statistics, and up-to-date market news.

Advanced Markets Compared to Other Brokers

After reviewing all aspects of trading with Advanced Markets, we have compared the company to other brokers in the market. Advanced Markets holds top-tier licenses, including FCA, ASIC, and an additional license from Bermuda. As we compared the broker with other good-standing competitors, we noticed that brokers such as Forex.com and Axi also hold top-tier licenses. We specifically compared the fee structure under the Bermuda offering to find that spreads at 1.2 pips are in line with the market average, with Forex.com offering 1.3 pips and Axi 1.2 pips. Tradeview spreads are much lower in comparison, starting at 0.3 pips.

As to the trading platforms, Advanced Markets offers MT4/MT5 and the Fortex 5 platform, designed for professionals. Tradeview has similar offerings with MT4/MT5 platforms and cTrader. Markets.com, on the other hand, has a wider selection of platforms, including Markets.com Web, MT4, MT5, TradingView, and Markets.com Social Trade App.

The minimum deposit is also on the lower side at $100 for the Advanced Plus account. Most brokers, like Markets.com and Forex.com, have similar requirements. As we have found, Axi has a $0 deposit requirement. However, as Advanced Markets is more suitable for professional clients, it does not offer extensive educational resources for beginners. Forex.com, on the contrary, has an excellent educational section with great materials, articles, courses, and many other resources.

All in all, Advanced Markets has its own place in the market, with its unique offerings and services tailored for professionals.

| Parameter |

Advanced Markets |

Markets.com |

Forex.com |

Tradeview |

Axi |

Xtrade |

GMI |

| Spread Based Account |

Average 1.2 pips |

Average 1 pip |

Average 1.3 pips |

Average 0.3 pips |

Average 1.2 pips |

Average 2 pips |

Average 1 pip |

| Commission Based Account |

0.0 pips + $3 |

For Stocks Only ($1 per $1,000 trade) |

0.0 pips + $5 |

0.1 pips +$2.5 |

0.0 pips + $7 |

No commissions based on fixed spreads |

0.0 pips +$4 |

| Fees Ranking |

Average |

Average |

Average |

Low/ Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5, Fortex 5 |

Markets.com Web, MT4, MT5, TradingView, Markets.com Social Trade App |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5, cTrader |

MT4, Axi Trading App, Axi Copy Trading App |

Xtrade WebTrader |

MT4, MT5, GMI Edge |

| Asset Variety |

60+ instruments |

2,200+ instruments |

6000+ instruments |

200+ instruments |

220+ instruments |

1,000+ instruments |

70+ instruments |

| Regulation |

FCA, AFSL, Bermuda |

CySEC, FCA, ASIC, FSCA, FSC, FSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

MFSA, CIMA, FSC, FSA |

ASIC, FCA, CySEC, DFSA, FSA |

FSC, FSCA |

FCA, FSC |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Good |

Excellent |

Good |

Good |

Good |

Good |

| Minimum Deposit |

$100 |

$100 |

$100 |

$1000 |

$0 |

$250 |

$25 |

Full Review of Broker Advanced Markets

After considering all aspects of trading with Advanced Markets, we can sum up the broker and its offerings. Advanced Markets is a tightly regulated broker with licenses from the FCA, ASIC, and Bermuda. Under every entity, Advanced Markets offers different trading conditions and services. For its FCA-regulated entity, Advanced Markets determines its services for only professional trading, including institutional clients, hedge funds, brokers, and family offices. However, the Bermuda website makes trading with Advanced Markets more accessible, with 3 account types meeting various trading needs.

The broker allows trading through the MT4, MT5, and Fortex 5 platforms. The platforms are equipped with advanced tools and features to support professional expectations. The Fortex 5 platform is specifically tailored for professional clients and provides in-depth analysis tools, built-in technical indicators, and other innovative features.

Advanced Markets allows access to multiple financial assets, including forex, commodities, cryptos, metals, indices, and stocks. However, the number of tradable products is limited to about 60, which is a very modest offering when compared to other brokers. Another point for improvement is the Advanced Markets educational section, which lacks proper resources.

All in all, our review of the broker has revealed a favorable offering designed to meet special trading needs.

Share this article [addtoany url="https://55brokers.com/advanced-markets-review/" title="Advanced Markets"]

Its like their method of deposit looks weird if they don’t receive via skrill and their likes.

What’s weird about wire transfer? It’s the best method anyway.