- What is ACY Securities?

- ACY Securities Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

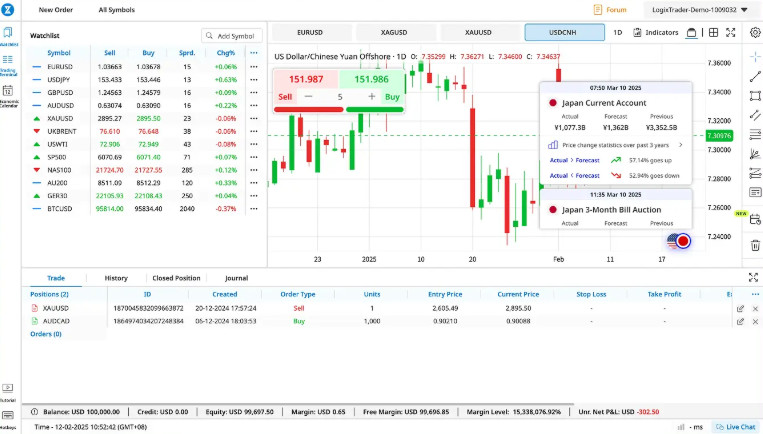

- Trading Platforms and Tools

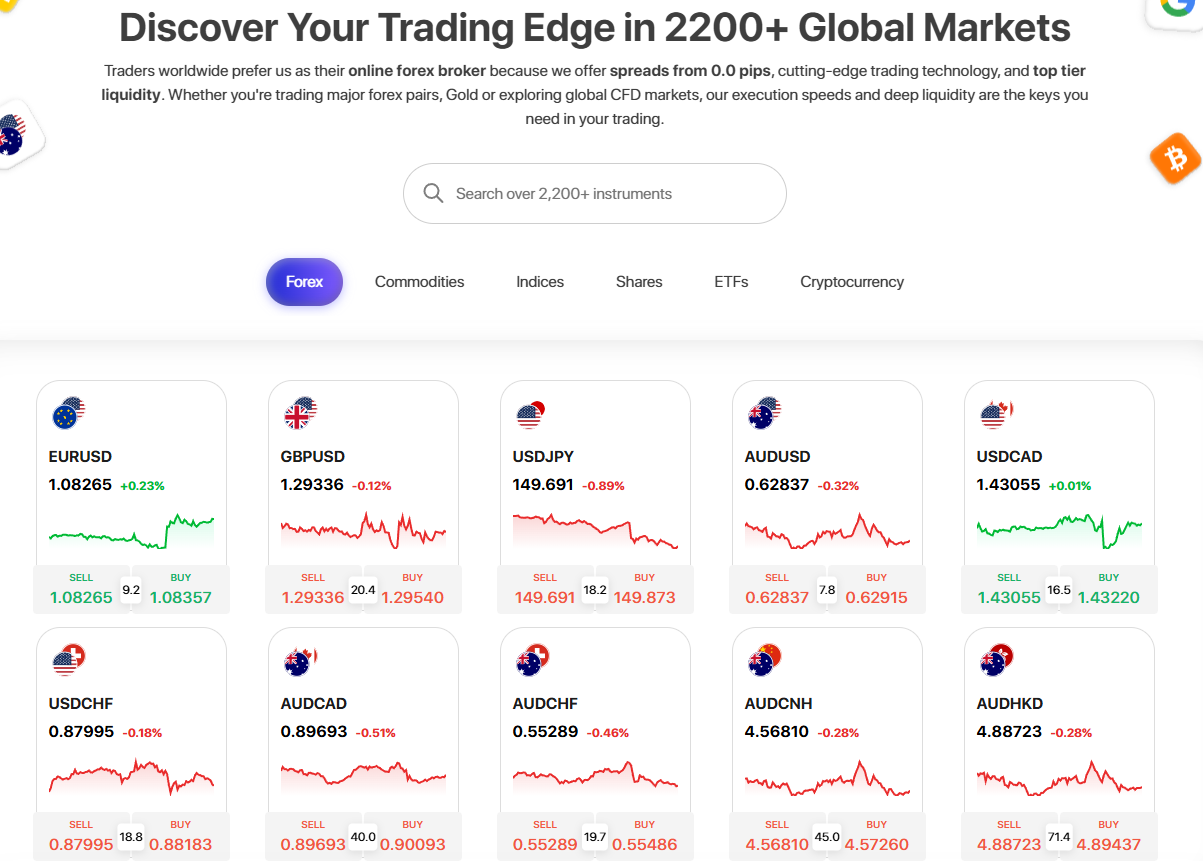

- Trading Instruments

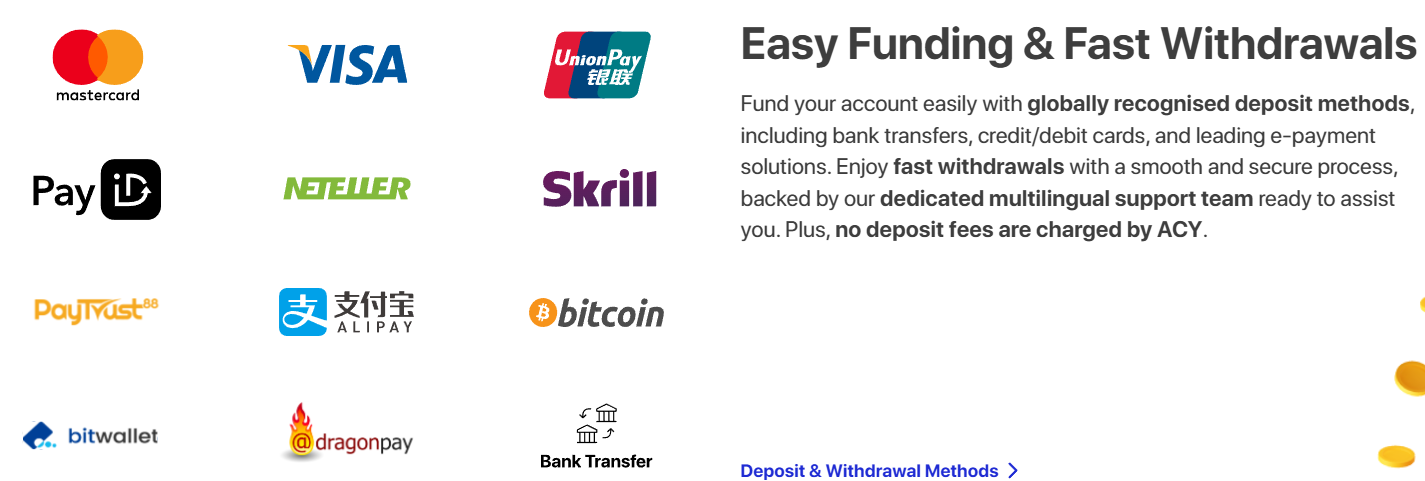

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

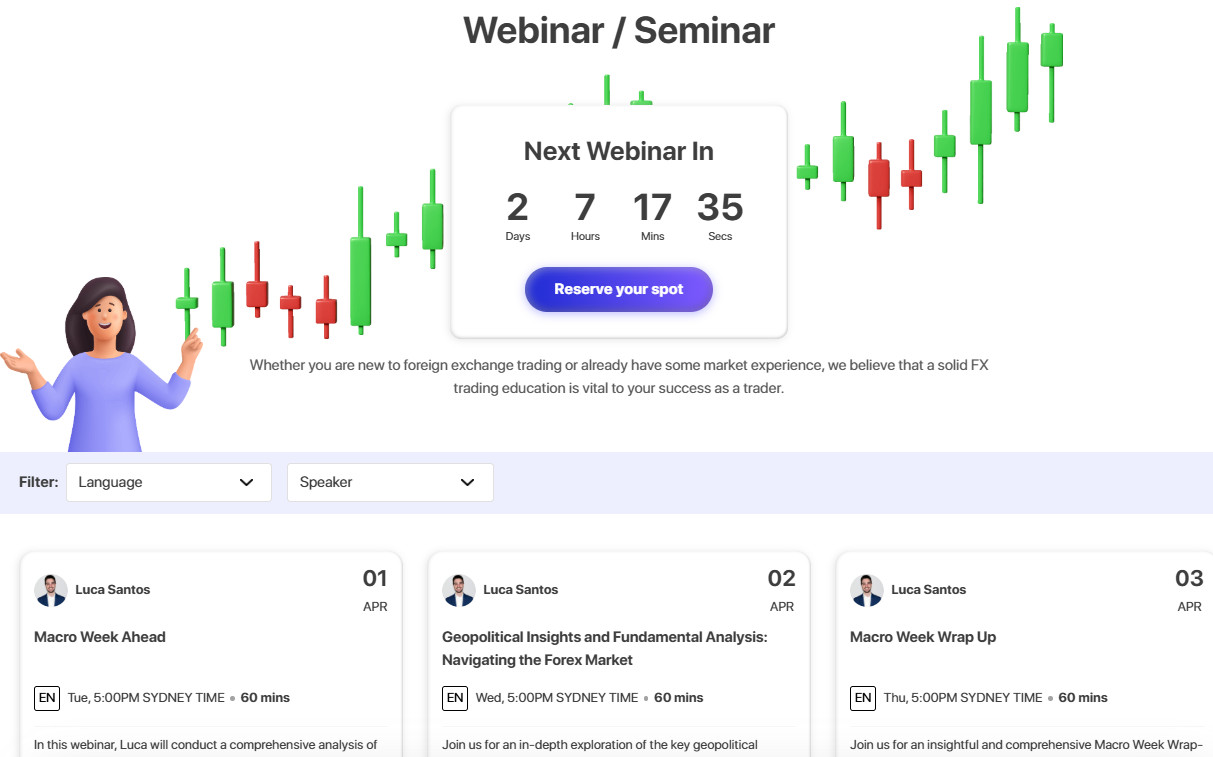

- Research and Education

- Portfolio and Investment Opportunities

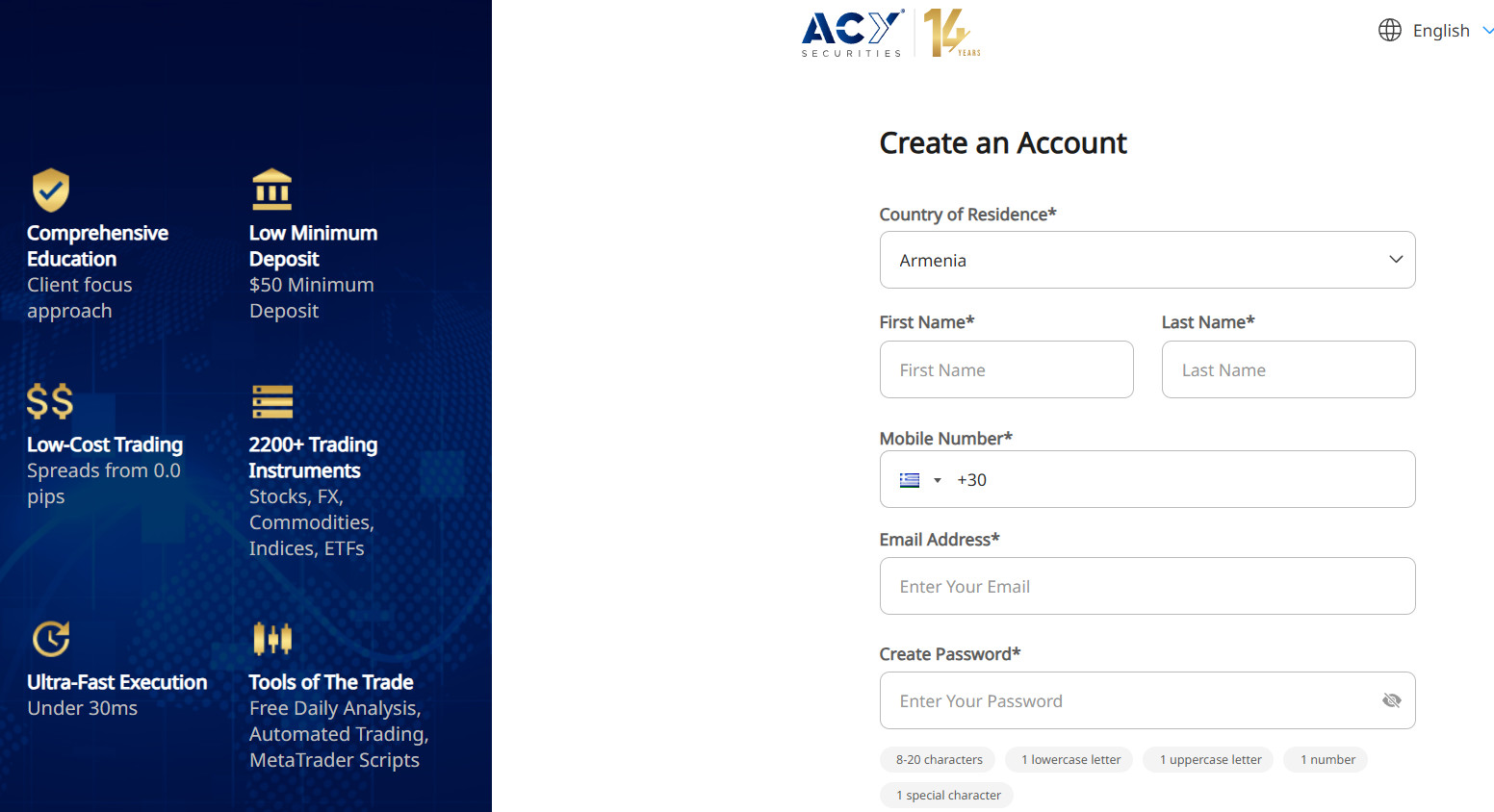

- Account Opening

- Additional Tools And Features

- ACY Securities Compared to Other Brokers

- Full Review of Broker ACY Securities

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is ACY Securities?

ACY Securities is an Australia-based Forex and CFD broker that provides a platform for clients to trade a variety of financial instruments, including Currency, shares, indices, commodities, ETFs, and Precious Metals, suitable for both novice traders and experienced ones, retail or corporate. The company offers services through its online platform, as well as industry-known MT4 and MT5 platforms which are accessible to clients from around the world.

- The specific services offered by ACY Securities may vary according to the jurisdiction it operates, but typically include access to real-time market data, technical analysis tools, and the ability to execute trades directly from the platform.

- ACY serves additional offices in Shanghai and Shenzhen, China, which brings an efficient service to customers even further.

The ACY Securities provides execution through the No Dealing Desk model, performed with no dealer intervention with no requotes through streamed real-time prices presented with tight Forex spreads, high speeds, and low latency.

ACY Securities Pros and Cons

ACY Securities offers a seamless, comprehensive trading experience with competitive spreads and convenient digital account opening. Top-notch educational resources equip traders to excel in the market, while several platforms give them options to customize their approach.

There are a few downsides when it comes to the instrument range, which only offers FX and CFDs. Furthermore, users have access to different offerings depending on their needs, but unfortunately, there is no 24/7 customer support available.

| Advantages | Disadvantages |

|---|

| Reputable broker with a good establishment | Conditions and market offerings vary depending on the entity |

| Global coverage | Market range limited to FX and CFDs |

| Good instrument range | No 24/7 support |

| Low spreads and fees | |

| Good education and research | |

| MetaTrader broker | |

| Negative balance protection and segregated accounts | |

ACY Securities Features

ACY Securities is a globally recognized multi-asset broker offering traders advanced technology, competitive conditions, and a wide range of financial instruments. Below are the key points to consider when choosing ACY as your online trading broker.

ACY Securities Features in 10 Points

| 🏢 Regulation | ASIC, VFSC, SVG FSA |

| 🗺️ Account Types | Standard, ProZero, Bespoke Accounts |

| 🖥 Trading Platforms | MT4, MT5, LogixTrader |

| 📉 Trading Instruments | Forex, CFDs on Shares, Indices, Precious Metals, Commodities, ETFs, Cryptocurrencies, Futures |

| 💳 Minimum Deposit | $50 |

| 💰 Average EUR/USD Spread | 1.1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, AUD |

| 📚 Trading Education | Webinars, Seminars, Courses, eBooks |

| ☎ Customer Support | 24/5 |

Who is ACY Securities For?

ACY Securities is designed for traders of all levels, from beginners looking for educational resources to experienced professionals seeking advanced tools and deep liquidity. Based on our research, ACY is good for:

- Traders of all levels of expertise

- Stock CFDs Trading

- Algorithmic Trading

- Copy Trading

- Hedging and Scalping Trading

- Trading with MetaTrader Suit

- Currency and CFD Trading

- Suitable for Multiple Strategies

- Free VPS

- EAs Trading

ACY Securities Summary

Based on our expert opinion and review, we can conclude that ACY Securities is a good broker and a customer-centric online provider. Since the ACY is an ASIC-regulated broker there are no doubts about its compliance with the laws and reliability.

Also, there is extensive education developed with a good level of expertise. However, the education section needs categorization based on skill levels. STP trading access conducts offerings through the competitive markets and allows using any strategy through a quite low spread.

55Brokers Professional Insights

ACY stands out as a leading multi-asset broker by combining cutting-edge technology, deep liquidity, and a client-focused approach and is quite well-regarded and known among traders, especially active traders. There are low spreads, or commission aligned with industry, fast execution speeds, and access to global markets, overall ACY ensures a seamless experience across Forex, commodities, indices, shares, cryptocurrencies, and more.

The broker is also known for its advanced platforms and trading performance overall, traders having a choice including MT4 and MT5, alongside a proprietary platform and a suite of analytical tools to empower traders with data-driven insights.

With a strong commitment to education, ACY provides an extensive market research making is good choice for beginners too, with webinars, and professional courses, so being an excellent choice for all levels of traders. Additionally, its regulatory compliance, secure environment, and supportive customer service further reinforce its reputation as a trusted broker in the industry.

Consider Trading with ACY Securities If:

| ACY Securities is an excellent Broker for: | - Need a well-regulated broker.

- Looking for broker with low minimum deposit requirement.

- Providing competitive fees and spreads.

- Offering popular instruments.

- Get access to MT4, and MT5 platforms.

- Broker with a variety of strategies.

- Beginners and professional traders.

- Need a broker with good education and research tools.

- Providing Copy Trading.

- Need broker with access to VPS.

- Prefer MAM/PAMM trading.

- Who prefer higher leverage up to 1:500.

- Offering a proprietary platform.

- Australian traders.

|

Avoid Trading with ACY Securities If:

| ACY Securities might not be the best for: | - Looking for broker with 24/7 customer support.

- Who prefer to trade with cTrader.

|

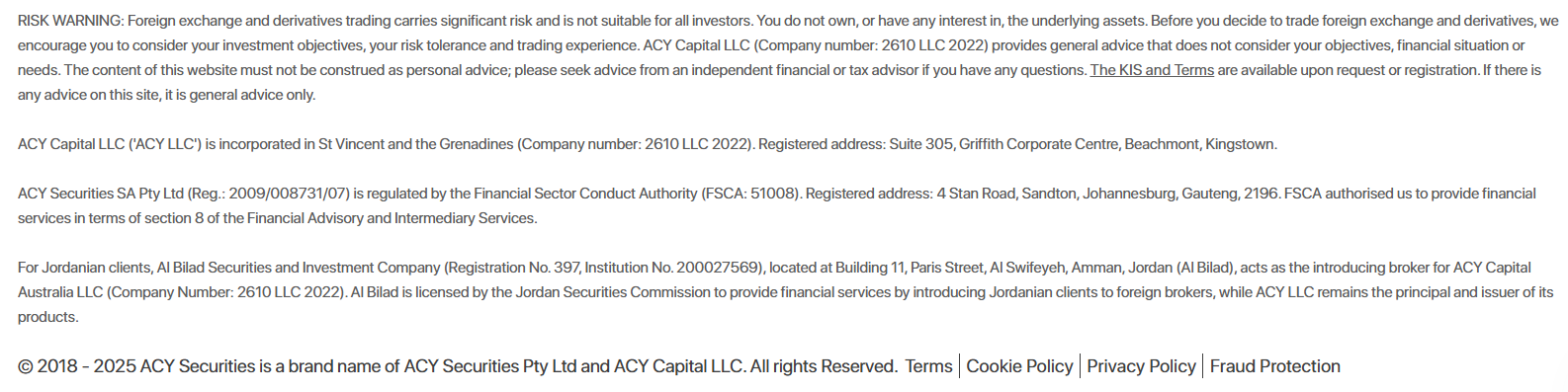

Regulation and Security Measures

Score – 4.5/5

ACY Securities Regulatory Overview

ACY operates under a strong regulatory framework to ensure a secure and transparent environment for its clients. The broker is primarily regulated by the Australian ASIC, a Top-Tier financial authority known for its stringent oversight and investor protection measures.

Additionally, ACY Securities is authorized by the Vanuatu FSC and the FSA of Saint Vincent and the Grenadines, expanding its global reach and providing an offshore trading option with potentially more flexible conditions. While these regulations allow for broader market access and higher leverage, traders should know that offshore entities generally offer fewer investor protections than ASIC-regulated accounts.

How Safe is Trading with ACY Securities?

Trading with ACY is generally considered safe due to its emphasis on transparency, secure transactions, and client fund protection. The broker uses advanced encryption technology to safeguard personal and financial data while maintaining segregated client accounts to ensure funds are kept separate from company operations.

Additionally, ACY Securities provides risk management tools and negative balance protection, helping traders manage their exposure effectively.

Consistency and Clarity

ACY has built a solid reputation in the trading industry, backed by positive reviews, industry recognition, and a strong operational foundation. The broker is well-rated for its competitive conditions, reliable execution, and educational resources, though some traders highlight areas for improvement, such as offshore regulatory oversight.

ACY has received various industry awards, further solidifying its credibility in the market. Additionally, the broker actively engages with the trading community through sponsorships, educational webinars, and social initiatives, reinforcing its presence as a trusted and socially responsible player in the financial sector.

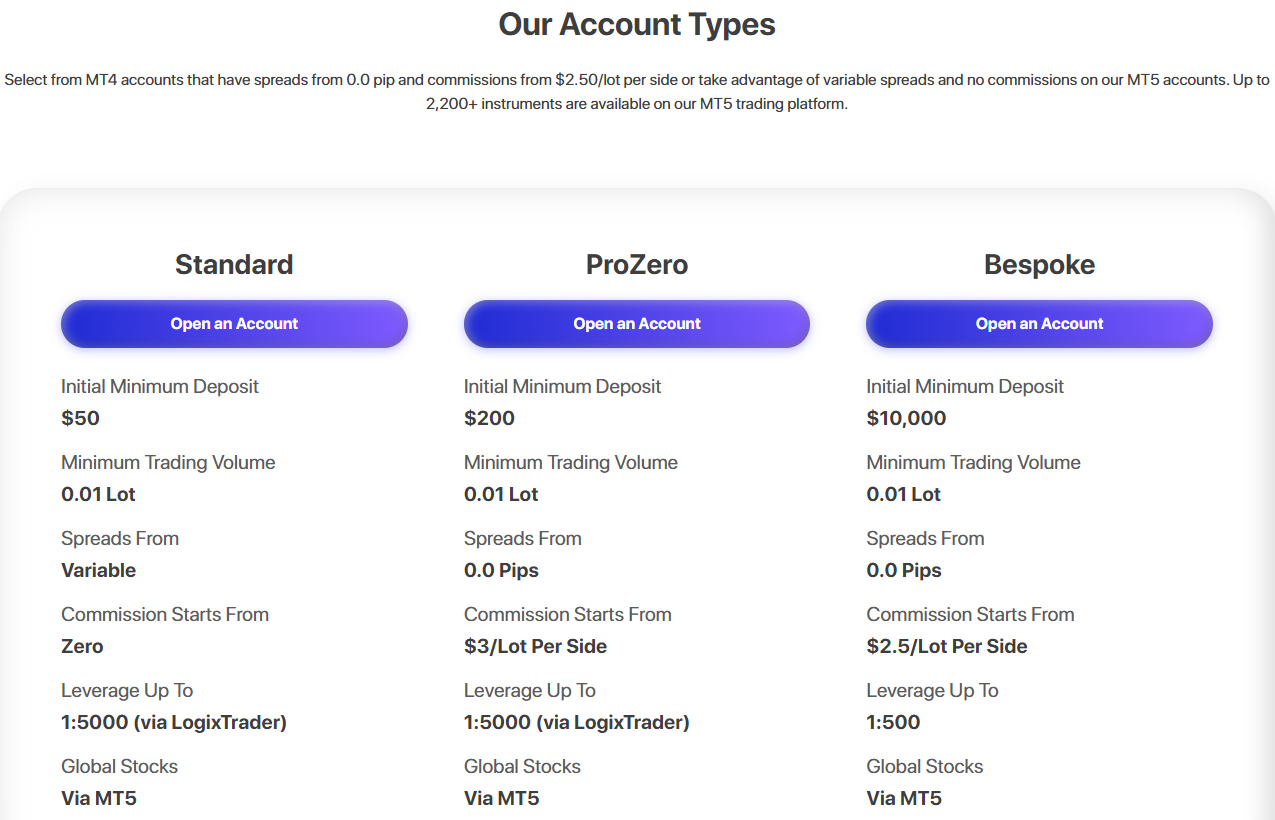

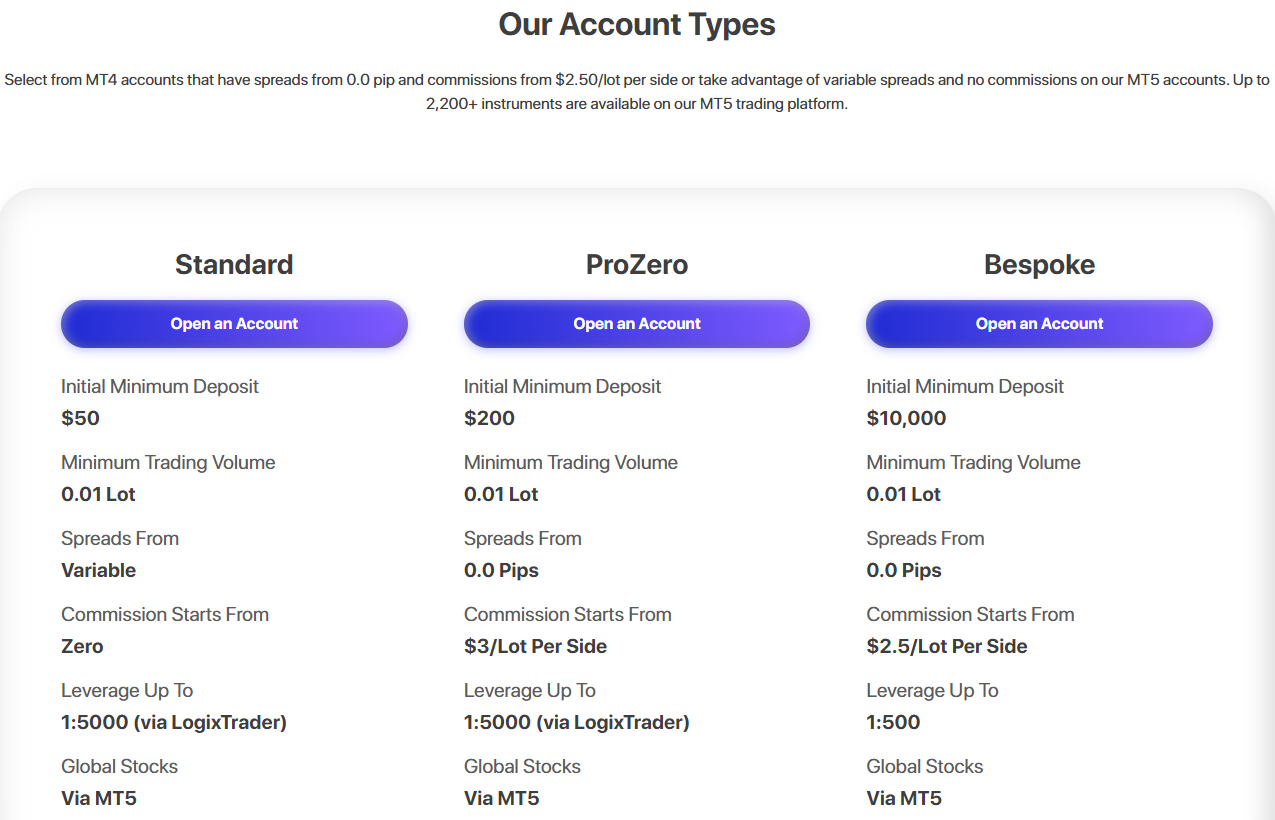

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with ACY Securities?

ACY Securities offers three account types, each designed for different traders’ specific needs with a choice between an account with spreads only basis through Standard account or with a commission by ProZero and Bespoke accounts.

Account types are not only defined by the technology they use and more competitive pricing according to the trading size, but also by deposit and qualification requirements.

The broker also provides swap-free accounts for traders who require Islamic-compliant conditions. Additionally, a demo account is available, allowing users to practice trading with virtual funds before committing to real capital.

Standard Account

The Standard Account is an excellent choice for beginner traders or those looking for a simple and cost-effective way to start trading. With a low initial minimum deposit of just $50, this account provides access to a wide range of markets with a minimum trading volume of 0.01 lots.

Spreads are variable, and there are no commission fees, making it an attractive option for those who prefer a straightforward pricing structure. Additionally, traders can benefit from leverage of up to 1:5000 when using LogixTrader, allowing for greater flexibility in strategies.

ProZero Account

The ProZero Account is designed for more experienced traders who require tighter spreads and lower costs. With an initial minimum deposit of $200, this account offers spreads starting from 0.0 pips, ensuring competitive pricing and precise execution.

A commission of $3 per lot per side applies, making it a cost-effective choice for traders who prioritize low spreads over commission-free trading. Like the Standard Account, traders using LogixTrader can access leverage of up to 1:5000, providing opportunities to optimize their potential.

Bespoke Account

The Bespoke Account is tailored for professional and institutional traders who demand premium conditions. Requiring a minimum deposit of $10,000, this account provides spreads from 0.0 pips and a reduced commission of $2.5 per lot per side, making it the most cost-efficient choice for high-volume traders.

Unlike the other account types, the maximum leverage for the Bespoke Account is 1:500, balancing high trading power with responsible risk management. This account is ideal for serious traders looking for superior execution, deep liquidity, and the most competitive pricing structure available.

Regions Where ACY Securities is Restricted

ACY Securities is a globally accessible broker, but due to regulatory restrictions, it does not offer its services in certain countries, including:

- USA

- Cnada

- Iran

- North Korea, etc.

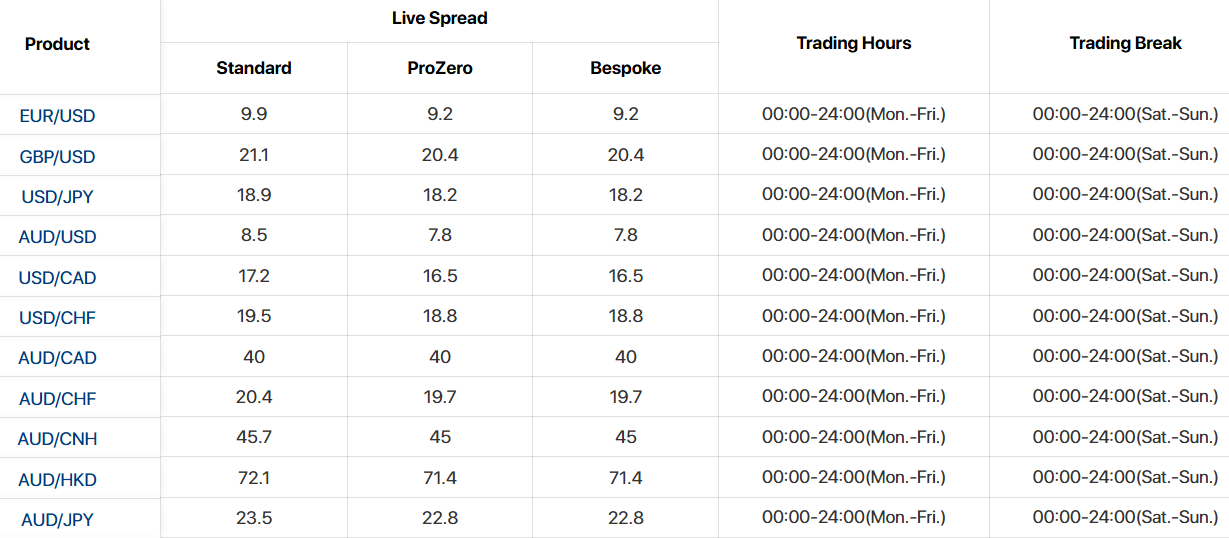

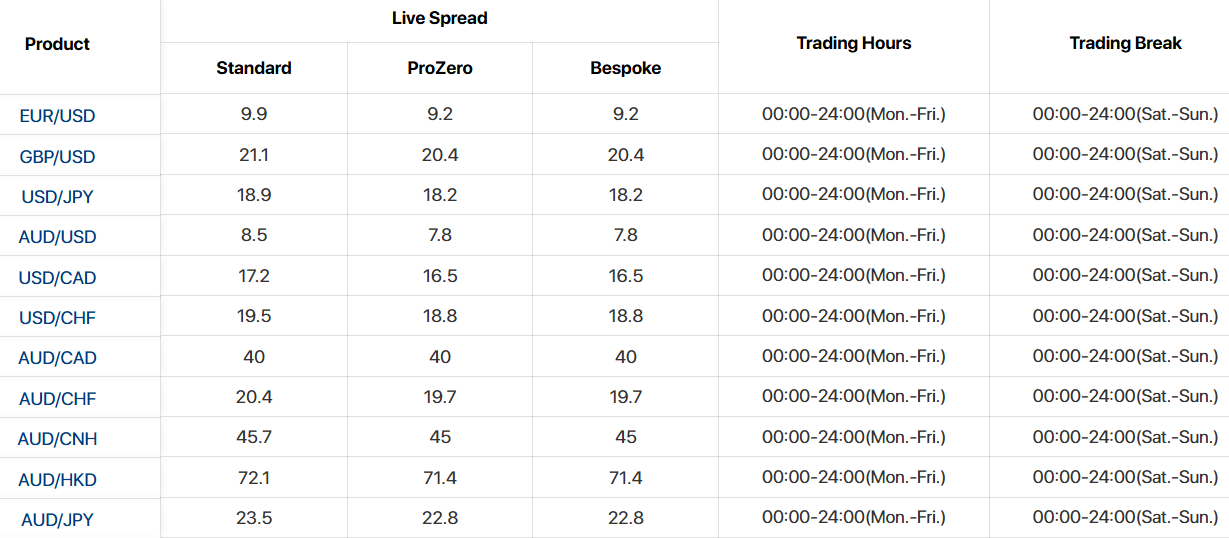

Cost Structure and Fees

Score – 4.5/5

ACY Securities Brokerage Fees

The company charges fees for its services, which can include spreads, commissions, and other charges. ACY Securities fees vary depending on the type of account you have, the instruments you trade, and your trading volume.

Traders should understand all of the fees associated with a broker before opening an account and trading, so we would recommend checking the broker’s website or contacting its support team for more information on its fees. Also, always consider rollover or overnight fee as a cost, which is charged on the positions held longer than a day.

ACY Securities offers competitive spreads across its account types, catering to different styles and preferences. On the Standard Account, the average EUR/USD spread is 1.1 pips.

For those seeking tighter spreads, the ProZero and Bespoke Accounts offer spreads starting from 0.0 pips, with a low commission per lot.

- ACY Securities Commissions

ACY Securities offers a flexible commission structure based on the chosen account type. The ProZero Account applies a $3 per lot per side commission, while the Bespoke Account provides even lower costs with a reduced $2.5 per lot per side commission.

- ACY Securities Rollover / Swaps

ACY Securities applies rollover rates to positions held overnight, reflecting the interest rate differential between the traded currency pairs. These swaps can be either positive or negative, depending on whether the trader is holding a long or short position. The rates are calculated based on interbank interest rates and may vary daily.

Traders should note that swap rates are typically tripled on Wednesdays to account for weekend rollovers when the Forex market is closed.

- ACY Securities Additional Fees

In addition to spreads and commissions, ACY Securities may charge certain additional fees depending on specific conditions. These include fees for fund withdrawals depending on the payment method used, as well as overnight financing costs in the form of rollover or swap rates.

How Competitive Are ACY Securities Fees?

ACY Securities stands out for its competitive fee structure, which is designed to cater to a wide range of trading needs. The broker’s approach focuses on maintaining transparency with no hidden fees and offering flexible conditions to suit both casual traders and more experienced professionals.

This straightforward fee structure allows traders to better manage their costs, contributing to a more efficient and profitable experience.

| Asset/ Pair | ACY Securities Spread | Velocity Trade Spead | Z.com Forex Spread |

|---|

| EUR USD Spread | 1.1 pips | 1 pip | 1 pip |

| Crude Oil WTI Spread | $0.034 | 4 | - |

| Gold Spread | 3 | 40 | - |

| BTC USD Spread | 23.7 | - | - |

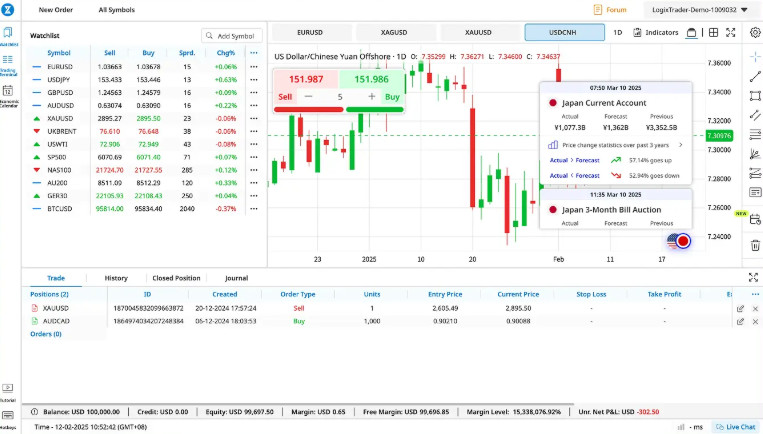

Trading Platforms and Tools

Score – 4.6/5

ACY Securities offers a range of advanced platforms to suit different trader preferences, including MetaTrader 4, MetaTrader 5, and the broker’s proprietary platform LogixTrader.

MT4 and MT5 are widely recognized for their user-friendly interfaces, powerful charting tools, and automated trading capabilities through Expert Advisors. These platforms also provide access to various markets, from Forex to commodities.

For traders seeking enhanced flexibility and advanced features, LogixTrader offers a cutting-edge environment with high-leverage options, customizable layouts, and superior execution speeds. Together, these platforms ensure that traders have the tools traders need to execute strategies effectively and efficiently.

Trading Platform Comparison to Other Brokers:

| Platforms | ACY Securities Platforms | Velocity Trade Platforms | Z.com Forex Platforms |

|---|

| MT4 | Yes | No | No |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

ACY Securities Web Platform

LogixTrader is ACY Securities’ innovative, web-based platform designed to provide a seamless and intuitive trading experience across all devices. Additionally, the execution speed is within 30ms.

The platform offers a range of powerful features, such as a built-in economic calendar, multi-symbol charts, and dynamic margin management. The platform also ensures enhanced risk management with guaranteed stop loss and take profit orders, allowing traders to execute their strategies with confidence.

ACY Securities Desktop MetaTrader 4 Platform

The MT4 platform offered by ACY Securities is equipped with 9 different timeframes that can be accessed with just a click, giving traders the flexibility to analyze the markets from various perspectives.

Additionally, the platform includes 40 technical indicators, allowing for in-depth market analysis and advanced charting capabilities. Whether you are a scalper, swing trader, or long-term investor, MT4 offers the tools needed to execute your strategies with precision, making it a top choice for traders seeking control and versatility in their experience.

ACY Securities Desktop MetaTrader 5 Platform

The Desktop MetaTrader 5 platform offers 21 different timeframes, giving you extensive flexibility to analyze and trade the global markets across a variety of time intervals.

Additionally, it comes with an expanded suite of technical indicators, providing greater depth for market analysis and the development of custom strategies. With its advanced charting tools and improved order execution capabilities, MT5 allows traders to design innovative trading systems and execute strategies with greater precision and efficiency.

Main Insights from Testing

Testing the MT5 platform reveals its powerful and versatile nature, making it ideal for both beginner and professional traders. One of the standout features is its enhanced charting capabilities, offering more timeframes, technical indicators, and graphical tools than its predecessor, MT4.

The platform’s speed and efficiency in executing trades are impressive, ensuring a smooth experience even during high-volatility periods. Additionally, MT5 supports more asset classes, giving traders access to a broader range of markets. Overall, MT5 offers a comprehensive and dynamic environment with advanced tools that cater to diverse needs.

ACY Securities MobileTrader App

The mobile versions of MT4, MT5, and LogixTrader allow traders to stay connected to their trades, manage positions, and execute orders from anywhere. With user-friendly interfaces, these mobile platforms offer a wide range of features, including real-time charting, advanced technical analysis, and customizable settings, all optimized for mobile devices.

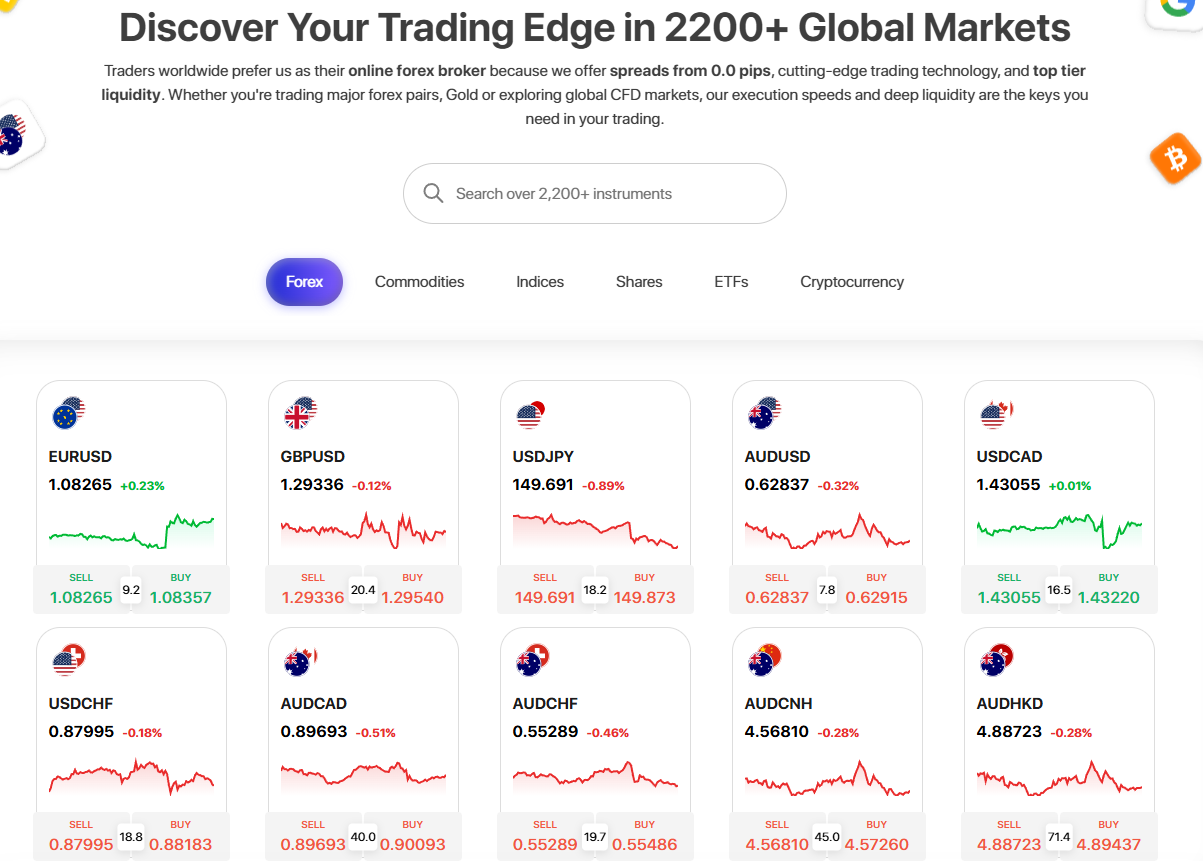

Trading Instruments

Score – 4.5/5

What Can You Trade on ACY Securities’s Platform?

On ACY’s platform, traders have access to over 2,200 instruments, offering a diverse range of options to suit various strategies. This includes popular Currency pairs, enabling currency traders to capitalize on global exchange rate movements.

Additionally, the platform provides CFDs on Shares, Indices, Precious Metals, Commodities, ETFs, Cryptocurrencies, and Futures, ensuring that traders can diversify their portfolios across different asset classes.

Main Insights from Exploring ACY Securities’s Tradable Assets

Exploring ACY Securities’ tradable assets highlights the broker’s commitment to providing a well-rounded experience across multiple markets. With access to a wide variety of asset classes, traders can take advantage of different market conditions and diversify their portfolios.

The broker offers competitive pricing, deep liquidity, and fast execution, ensuring seamless trading across global markets. Whether focusing on short-term opportunities or long-term investment strategies, ACY provides the necessary tools and market access to help traders navigate and capitalize on financial opportunities effectively.

Leverage Options at ACY Securities

Financial leverage refers to the use of borrowed money to increase the potential return on investment. This is accomplished by using funds borrowed from the broker to purchase additional investments or assets that generate income. While trading with ACY, you can operate with the multiplier, which increases your potential gains through its possibility to multiply initial accounts.

ACY Leverage Levels vary based on factors such as the jurisdiction, the type of asset being traded, and the type of account held:

- With ASIC, ACY Securities’ maximum leverage level for clients is 1:30 on Forex instruments.

- While trading with ACY’s international entity, traders are able to use high leverage levels like 1:500 or 1:5000.

Financial leverage can be a powerful tool for increasing returns, but it is also important to be aware of the risks involved and to use it judiciously.

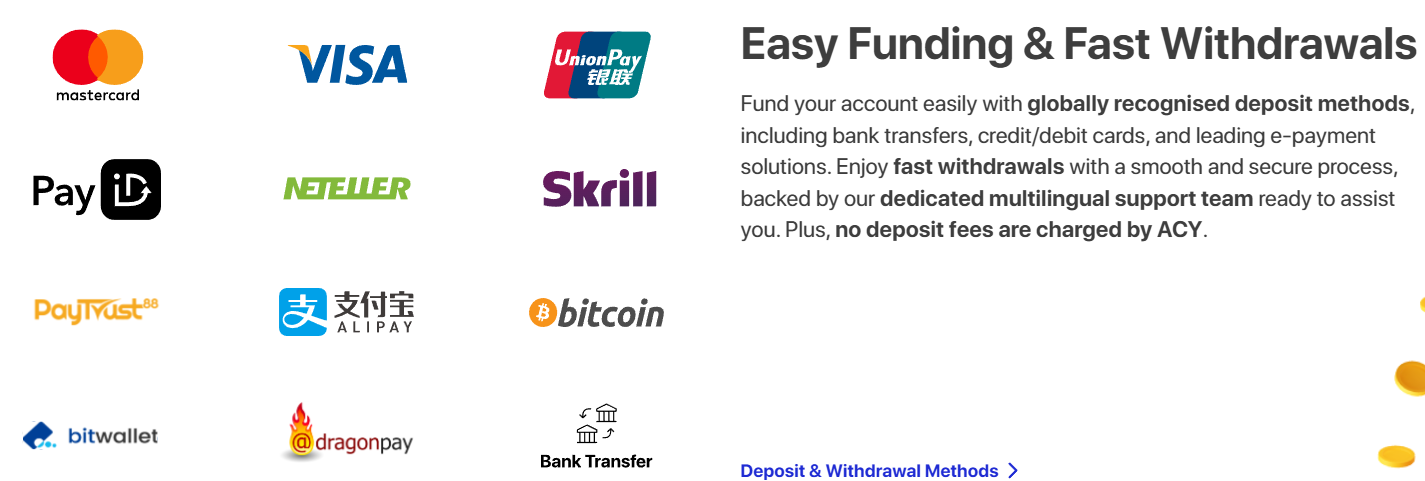

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at ACY Securities

In terms of funding methods, ACY offers a few payment methods, which is a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank wire

- Skrill

- Neteller

- China Union Pay, and more

ACY Securities Minimum Deposit

ACY’s minimum deposit is $50 at the beginning, which also depends on the account type you are planning to trade with.

Withdrawal Options at ACY Securities

Traders can withdraw from ACY by submitting a withdrawal request at any time, while withdrawal options of ACY do not charge for funding accounts by bank transfer. However, for withdrawals, International Transfer (Your receiving bank account is outside of Australia) will incur a $25 service charge per withdrawal, and Skrill – 3% merchant fee per withdrawal, yet free withdrawal is allowed for Australia local bank transfer up to three times per month.

Customer Support and Responsiveness

Score – 4.5/5

Testing ACY Securities’s Customer Support

ACY Securities provides 24/5 customer support to help clients with any questions or issues they may have while using the platform. The specific methods of support offered by ACY Securities can vary, but common methods of support include email, live chat, and phone.

The availability of customer support can also vary depending on the location and time of day.

Contacts ACY Securities

For any inquiries or assistance, ACY offers dedicated customer support to ensure a smooth experience. Traders can reach out to the support team via phone at 1300 729 171 or contact them by email at support@acy.com for prompt assistance with account-related queries, technical issues, or general concerns.

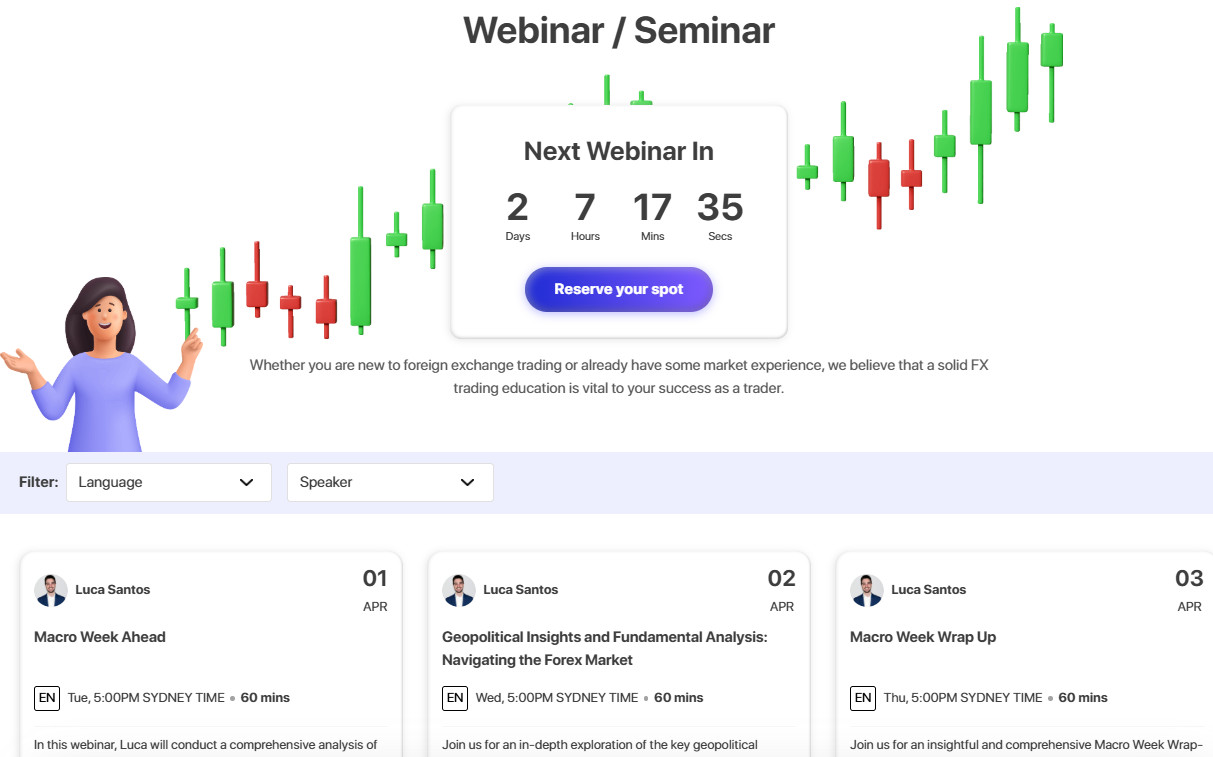

Research and Education

Score – 4.6/5

Research Tools ACY Securities

ACY Securities offers a range of research tools to help traders make well-informed decisions and optimize their strategies.

- On the website, traders can access an economic calendar to track key financial events, as well as a trading widget that provides real-time market data.

- The broker also integrates Capitalise.ai, an AI-powered automation tool that allows traders to create and execute algorithmic strategies without coding.

- Additionally, ACY provides access to MetaTrader Scripts, enabling traders to automate tasks and enhance efficiency, along with Forex VPS hosting for faster trade execution and reduced latency.

- These tools, available across MT4, MT5, and LogixTrader, empower traders with comprehensive market insights, automation capabilities, and technical enhancements for a seamless experience.

Education

ACY provides educational resources to help clients improve their understanding of financial markets and enhance their skills. The specific education resources offered by ACY can vary, but they may include:

- Trading guides and tutorials

- Webinars and online courses

- Market analysis and research reports

- Economic calendar and news updates

However, the broker’s educational section is a bit unorganized. It could be enhanced with the addition of a feature that enables traders to sort and categorize the content based on their skill level.

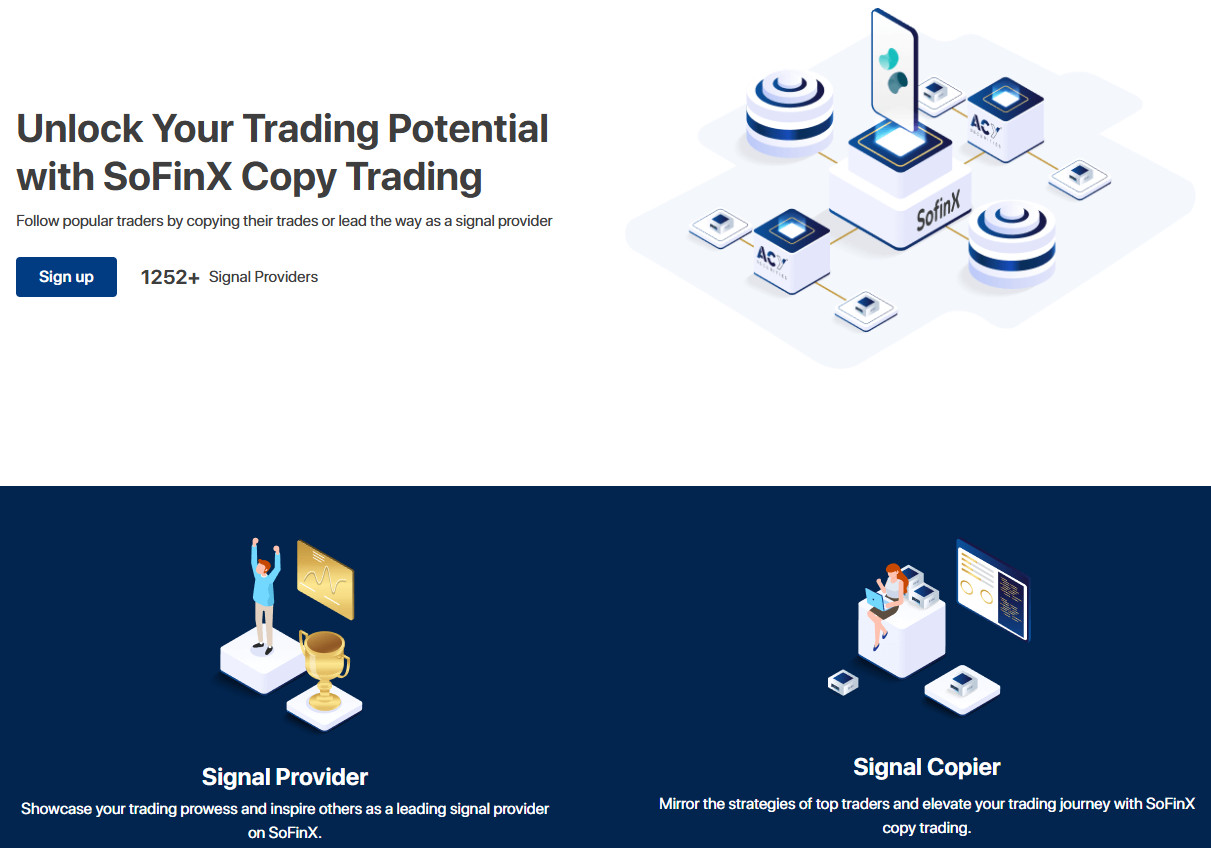

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options ACY Securities

While ACY Securities is primarily a Forex and CFD broker, it also provides investment solutions for traders looking to diversify their strategies. The broker offers MAM and PAMM accounts, allowing experienced traders to manage multiple accounts efficiently while investors can allocate funds to professional traders.

Additionally, the broker supports copy trading, enabling traders to mirror the strategies of successful investors in real time. These investment tools make it easier for traders of all experience levels to participate in the markets, whether they prefer hands-on trading or a more passive investment approach.

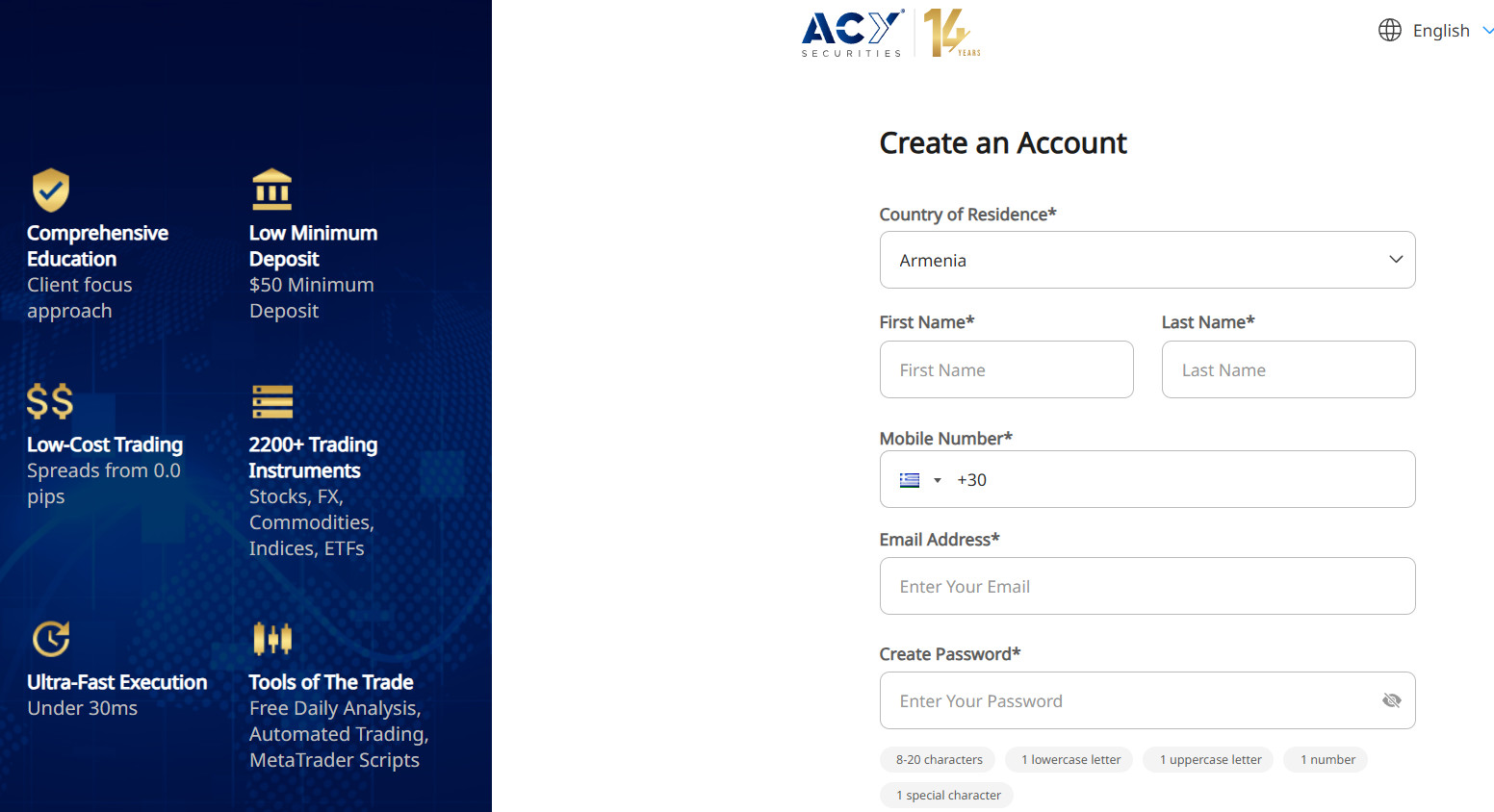

Account Opening

Score – 4.4/5

How to Open ACY Securities Demo Account?

Opening a demo account with ACY is an easy process that allows traders to practice in a risk-free environment before trading with real funds. To get started, visit the ACY website and navigate to the demo account registration page.

Fill out the required details, including your name, email, and contact information, then select your preferred platform. Once your account is created, you will receive login credentials to access the demo environment, where you can trade with virtual funds and explore the platform’s features.

How to Open ACY Securities Live Account?

To open a live trading account with ACY, follow these steps:

-

Visit the broker’s website and click on the “Open an Account” button.

-

Fill out the registration form, providing your details such as name, email, phone number, and country of residence.

-

Choose your account type, selecting from options like Standard, ProZero, or Bespoke, based on your needs.

-

Upload verification documents, including proof of identity (passport or driver’s license) and proof of address (utility bill or bank statement).

-

Select your preferred platform.

-

Fund your account using one of the available deposit methods.

-

Complete the account setup and log in to start trading.

Once your documents are verified and the account is approved, you can begin trading live markets with ACY.

Additional Tools and Features

Score – 4.3/5

In addition to its core trading services, ACY offers several advanced tools and features to enhance the experience.

- One of the standout features is SoFinX Copy Trading, which allows traders to copy the strategies of successful investors in real time, making it an excellent option for beginners or those looking for passive opportunities.

- ACY Securities’ FIX API access enables high-frequency trading with institutional-grade execution speeds. These additional tools empower traders with more flexibility, automation, and efficiency in their trading journey.

ACY Securities Compared to Other Brokers

When comparing ACY to its competitors, it stands out for its wide range of instruments, providing access to over 2,200 assets, which is more extensive than some brokers but not as vast as top-tier multi-asset platforms.

Its fees are competitive, with both spread-based and commission-based pricing models, making it appealing to different types of traders. While some competitors offer lower spreads, ACY compensates with affordable commission structures and high-leverage options.

In terms of platforms, the broker provides access to MT4, MT5, and LogixTrader, whereas competitors may have limited options. Regulatory coverage is solid with ASIC oversight, though some brokers offer more diverse top-tier regulations.

Educational resources and customer support are strong, catering to both beginners and experienced traders. Overall, ACY offers a well-balanced environment, making it a strong contender for traders seeking a blend of competitive pricing, platform variety, and asset selection.

| Parameter |

ACY Securities |

Z.com Forex |

Saxo Bank |

City Index |

Velocity Trade |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1.1 pips |

Average 1 pip |

Average 0.9 pips |

Average 0.8 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

0.0 pips + $3 |

Not Available |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

$3 per side per 100,000 units traded |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, LogixTrader |

Z.com Trader |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

V Trader |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

2,200+ instruments |

50+ currency pairs |

71,000+ instruments |

13,500+ instruments |

250+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

ASIC, VFSC, SVG FSA |

JFSA, SFC |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Excellent |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$50 |

$0 |

$0 |

$0 |

$500 |

$0 |

$0 |

Full Review of Broker ACY Securities

ACY is a globally recognized Forex and CFD broker offering a diverse selection of instruments, including Currency, shares, indices, commodities, ETFs, and cryptocurrencies. The broker provides three main account types tailored to different needs, with competitive spreads and commission-based pricing for professional traders.

Its platforms include MT4, MT5, and LogixTrader, catering to both traditional and modern trading preferences. ACY is regulated by ASIC, ensuring a level of trust and security, though it also operates offshore under VFSC and SVG FSA licenses.

SoFinX Copy Trading, MAM/PAMM accounts, and Forex VPS services make it appealing for passive and algorithmic traders. With strong educational resources and advanced features, ACY is a solid choice for traders seeking a blend of affordability, technology, and market access.

Share this article [addtoany url="https://55brokers.com/acy-securities-review/" title="ACY Securities"]

hello, hope this meets you well. i want to open a real account on mt MT4. i need to know what to do thats why this message is sent.