ATC Brokers 2025 Review

-

Written by:

George Rossi -

Updated:

Leverage: 1:30 | 1:200

Regulation: FCA, CIMA

Min. Deposit: $2,000

HQ: UK

Platforms: MT4, MT Pro

Found in: 2005

Advertising Disclosure

Written by:

George Rossi

Updated:

Leverage: 1:30 | 1:200

Regulation: FCA, CIMA

Min. Deposit: $2,000

HQ: UK

Platforms: MT4, MT Pro

Found in: 2005

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

ATC Brokers is an ECN brokerage firm offering access to trade Forex, CFDs, Metals, Cryptos, Indices, and Commodities trading products.

The company does not act as a counterparty to any of its clients and operates in an agency model with ECN aggregation and competitive pricing through top-tier banks.

In addition, ATC Brokers develops a range of solutions for various purposes, including liquidity provision and institutional trading, as well as vast opportunities for professional traders. Also, the broker offers tools to manage multiple accounts through MAM and PAMM accounts that bring custom software solutions.

ATC Brokers is a reliable broker with a good ECN environment, low tight spreads, a great proposal for active traders, and wide funding methods.

For the Cons, the company lacks educational materials, as well as offers a quite high deposit to start the trade, hence the broker may not be the best option for beginner traders, but a very considerable option for professional traders. Also, there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|---|

| FCA license and overseeing | No 24/7 customer support |

| Regulated broker with a strong establishment | High initial deposit amount |

| Competitive trading costs and spreads | Limited educational materials |

| ECN trading environment | |

| Professional trading | |

| International trading | |

| Client protection | |

| Access to NDD operation |

ATC Brokers offers reliable conditions, including competitive spreads, fast execution, and transparent pricing. The broker supports professional platforms such as MetaTrader 4 and provides access to a wide range of markets. Here are the main features that the broker offers:

| 🏢 Regulation | FCA, CIMA |

| 🗺️ Account Types | Individual, Joint, Corporate accounts |

| 🖥 Trading Platforms | MT4, MT Pro |

| 📉 Trading Instruments | Forex, CFDs, Metals, Indices, Commodities, Cryptocurrencies |

| 💳 Minimum Deposit | $2,000 |

| 💰 Average EUR/USD Spread | 0.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP |

| 📚 Trading Education | Basics of Trading Fundamentals, Market Insight, Market News |

| ☎ Customer Support | 24/5 |

ATC Brokers is designed for traders who value reliability, transparency, and consistent execution quality. It is well-suited for experienced retail traders, active market participants, and professionals who require stable conditions and access to advanced platforms. Based on our findings and financial expert opinions, ATC Brokers is good for:

Overall, ATC Brokers is considered a reliable and safe broker with quite competitive pricing in the industry. The firm provides customers with a neutral environment and an NDD approach, which is very preferable among active traders.

ATC Brokers also provides custom solutions to money managers offering PAMM and PAMM Plus accounts. The broker also offers Introducing Broker partnership programs, making it a suitable choice for traders, asset managers, and partners seeking flexible and scalable trading arrangements.

ATC Brokers stands out for its commitment to transparency, strong regulation, and high-quality trade execution. The broker operates a neutral, NDD environment with ECN-based pricing, supporting fair market access and competitive conditions.

Beyond its execution model, ATC Brokers offers reliable infrastructure, professional-grade platforms, and stable connectivity designed to support active trading strategies.

The broker also provides tailored solutions for money managers through PAMM structures, alongside Introducing Broker partnership programs that allow for scalable business growth. Combined with a client-focused approach and institutional-style standards, these features position ATC Brokers as a solid choice for professionals seeking long-term stability, flexibility, and operational reliability.

| ATC Brokers is an excellent Broker for: | - Need a well-regulated broker․ - Offering a range of popular instruments. - Secure environment. - Providing competitive trading conditions. - Who prefer higher leverage up to 1:200․ - Currency trading. - Get access to MT4 platform. - Various strategies allowed. - International trading. - Need broker with fast execution. - Looking for broker with access to VPS solution. - Offering a variety of account types. - UK traders. - Prefer MAM/PAMM trading. - Need a broker with a Top-Tier license. |

| ATC Brokers might not be the best for: | - Who prefer 24/7 customer service. - Need MT5 or cTrader platforms. - Looking for Copy trading features. |

Score – 4.5/5

ATC Brokers is a company established in the UK and authorized by the world-respected Financial Conduct Authority (FCA). This regulation requires the broker to follow strict rules on operations, education, and trade execution, ensuring a high level of client protection and the safety of clients’ funds.

The broker also holds international registration with the Cayman Islands Monetary Authority (CIMA), which provides recognized but less stringent oversight compared to the FCA.

The most important note is funds protection delivered by accounts’ segregation, while the trader’s money is kept separate from the company’s accounts.

Additionally, all customers of financial service firms operated under the FSCS (Financial Services Compensation Scheme) are compensated and protected up to 50,000 GBP per person per firm in case of insolvency.

ATC Brokers has built a solid reputation through its established market presence, transparent operations, and feedback from traders. Independent ratings and user reviews commonly highlight advantages such as strong regulation, reliable execution, and professional conditions, while also reflecting certain drawbacks, including platform limitations or pricing considerations for specific trading styles.

Alongside its operational track record, the broker’s industry recognition, awards, and involvement in sponsorships and community initiatives contribute to a well-rounded public profile.

Score – 4.4/5

ATC Brokers offers traders three ECN or STP account types: Individual, Joint, or Corporate accounts. Also, new users or those who want to see the broker’s performance with no risks can benefit from the trial trades through Demo-Account.

Individual Account

The Individual Account at ATC Brokers is for solo traders seeking direct access to professional conditions. This account type requires a minimum deposit of $2,000 and provides access to the broker’s core platforms, competitive pricing, and a regulated environment, making it suitable for both active and experienced individual traders.

ATC Brokers does not accept clients from jurisdictions where its services would be contrary to local laws or regulations. In particular, clients from the USA are subject to restrictions and must qualify as Eligible Contract Participants under the Commodity Exchange Act for their applications to be considered.

Score – 4.5/5

ATC brokers’ fees are mainly built into a spread model, while a diversity of CFDs and other products brings an opportunity to speculate on the price differences with good conditions. For mini contracts, the commission is set to $0.60, and $6.00 for a standard contract.

Also, consider inactivity fees and swap or rollover rates as well, which are charged in case the position is open longer than a day.

As ATC Brokers provides an ECN pricing model, the spreads are variable and not fixed. The average spread for EUR/USD is 0.3 pips.

ATC Brokers applies a transparent commission structure, charging $0.60 per mini contract and $6.00 per standard contract, in line with its ECN-based pricing model.

The broker applies rollover, or swap fees, to positions held overnight, reflecting the interest rate differential between the two currencies in a trading pair.

These swap rates may be positive or negative depending on market conditions and the direction of the trade, and are calculated transparently according to standard market practices.

In addition to costs, the broker charges an inactivity fee of $50 per month for accounts that remain dormant. Other non-trading fees may apply depending on specific account services or administrative actions.

ATC Brokers offers a competitive fee structure, designed to provide cost-efficient trading while maintaining transparency. This makes it appealing for users looking for professional conditions and fair access to the markets.

| Asset/ Pair | ATC Brokers Spread | Purple Trading Spread | Ultima Markets Spread |

|---|---|---|---|

| EUR USD Spread | 0.3 pips | 1.3 pips | 1 pip |

| Crude Oil WTI Spread | 3 | 0.03 | 1 |

| Gold Spread | 7 | 0.09 | 0.3 |

| BTC USD Spread | 0.01 | - | 11 |

Score – 4.6/5

ATC Brokers offers its own MT Pro software for the popular MetaTrader 4, providing a variety of new features to improve the MT4 experience and allow users to customize it for their trading needs.

MT Pro for MetaTrader offers a friendly and powerful interface and a powerful ECN execution model for beginners and professional traders. The platform indeed suits any trading style and can be accessed on all devices, including desktop, mobile, and tablet.

A complete charting package built-in with indicator libraries can be fully customized. In addition, to automate the trading experience, the software provides the ability to import EA signals for order execution.

| Platforms | ATC Brokers Platforms | Purple Trading Platforms | Ultima Markets Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platforms | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

ATC Brokers offers a proprietary desktop platform built for stability, performance, and professional trading needs. The platform includes advanced charting tools, real-time market data, and efficient order execution, providing a comprehensive desktop experience.

ATC Brokers supports the desktop MetaTrader 4 platform, offering clients a reliable and widely used environment. MT4 provides advanced charting tools, technical indicators, automated trading capabilities, and efficient order execution, making it suitable for both manual and strategy-based trading.

Testing the MT4 platform with ATC Brokers shows a stable and responsive environment with smooth navigation and reliable performance during normal market conditions.

Order placement and management function efficiently, while the overall platform experience supports disciplined trading and effective strategy execution.

ATC Brokers does not offer the MetaTrader 5 platform, as its services are focused on alternative desktop solutions. Users seeking MT5 functionality may need to consider other platforms or brokers that support this software.

ATC Brokers offers a MobileTrader app that allows clients to monitor markets and manage trades on the go. The app provides essential functions, real-time pricing, and account management features, giving users flexibility and control when away from their desktop platform.

ATC Brokers does not currently offer dedicated AI-driven solutions as part of its platform suite. Users interested in AI-assisted or algorithmic trading can still implement their own strategies through supported platforms and tools, but there are no proprietary AI features provided by the broker at this time.

Score – 4.5/5

ATC Brokers offers its clients over 100 instruments across various asset classes, including Forex, CFDs, Metals, Indices, Commodities, and Crypto trading opportunities from one account.

The broker provides competitive pricing, as well as access to a non-dealing desk operation and ECN pricing model for Forex traders.

Exploring ATC Brokers’ tradable assets reveals a well-structured offering aimed at supporting diversified strategies and active market participation.

The available instruments provide sufficient depth and flexibility for users to manage risk, respond to changing market conditions, and operate across different market environments, while maintaining a focus on liquidity and execution quality.

Leverage is a well-known instrument that increases the initial capital you trade with and can be a very useful tool if you use it smartly. However, always note that high leverage can work in reverse, too.

Score – 4.4/5

In terms of funding methods, ATC Brokers offers the following payment methods:

The minimum required deposit for ATC Brokers is $2,000 or the equivalent amount in GBP or EUR. Indeed, the amount is quite high; it might be a good option for active and experienced traders.

Withdrawal options are good, including Bank transfers, Cards, and E-wallets. However, ATC Brokers adds a charge of 2.9% for Cards and E-wallet deposits, and the withdrawal fee for USD currency will be $40.

Score – 4.5/5

ATC Brokers provides 24/5 expert customer support through Live Chat, Email, and Phone Lines. The support team assists clients with account-related inquiries, technical issues, and general trading questions

Clients can reach ATC Brokers by phone at +44 20 3318 1399 or by email at support@atcbrokers.com for general inquiries and customer support. Additional contact options include info@atcbrokers.com for official correspondence and compliance@atcbrokers.com.

Score – 4.4/5

ATC Brokers provides a variety of research tools both on its website and through its platforms to support informed decision‑making.

ATC Brokers provides the basics of trading fundamentals, market insight, market news, etc. However, the broker does not provide comprehensive educational materials, seminars, webinars, research, and analysis, which are crucial for beginner traders.

Score – 4.3/5

ATC Brokers primarily operates as a CFD broker, focusing on trading rather than traditional investment services. However, the broker offers MAM and PAMM account solutions, which allow investors to allocate funds to professional traders’ strategies, providing a form of managed trading that resembles an investment opportunity.

Score – 4.4/5

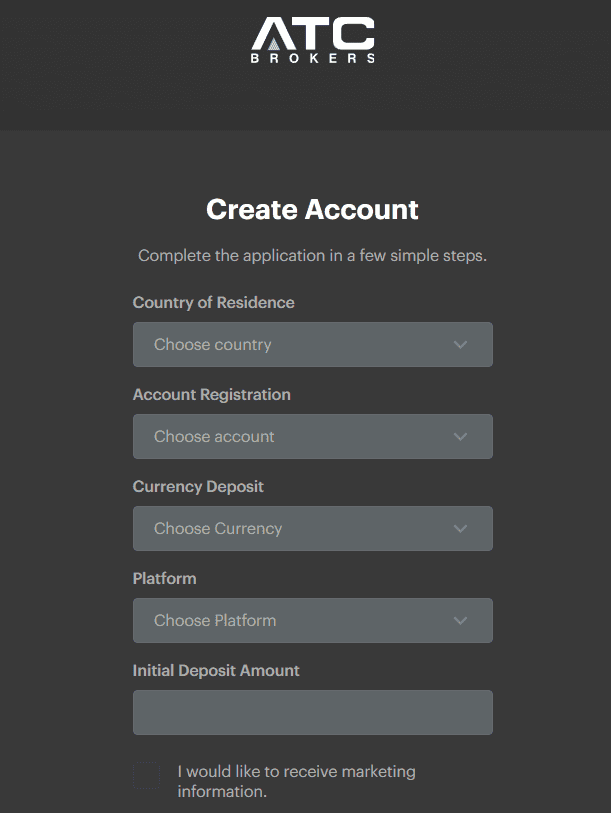

To open an ATC Brokers demo account, users can visit the broker’s official website and complete the demo registration form by providing basic personal details.

Once registered, login credentials are issued, allowing traders to access the demo platform and practice trading in a simulated market environment without risking real funds.

Opening an account with ATC Brokers is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

Score – 4.3/5

ATC Brokers offers additional tools and features designed to enhance the experience, including risk management tools and VPS hosting for automated trading.

These tools help users monitor performance, optimize strategies, and maintain control over their trading activities beyond the standard research and charting resources.

When compared with competitor brokers, ATC Brokers positions itself as a professional-focused provider offering balanced costs, solid regulatory coverage, and a streamlined platform selection.

While some competitors provide a broader range of instruments, lower entry requirements, or more extensive educational resources, ATC Brokers emphasizes stable conditions, reputable regulation, and tools suited to experienced and active traders.

Overall, it competes effectively in terms of execution quality and platform reliability, though it may be less appealing to beginners seeking low deposits, wide asset diversity, or advanced learning materials.

| Parameter | ATC Brokers | GBE Brokers | Ultima Markets | Colmex Pro | Taurex | CMC Markets | ActivTrades |

| Spread Based Account | Average 0.3 pips | Average 0.8 pips | Average 1 pip | Average 4 pips | Average 1.7 pips | Average 0.5 pips | Average 0.5 pips |

| Commission Based Account | 0.03 pips + $3 per side | 0.0 pips + $3.5 per side | 0.0 pips + $2.5 per side | For stock CFDs, $0.01 per share + a minimum of $1.5 per side | 0.0 pips + $2 per side | 0.0 pips + $2.50 | For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking | Average | Average | Low/ Average | Average | Low/ Average | Low/ Average | Low/ Average |

| Trading Platforms | MT4, MT Pro | MT4, MT5, TradingView | MT4, MT5, MT4 WebTrader, Mobile App | Colmex Pro 2.0, MT4 | MT4, MT5, Taurex Trading App | CMC Markets Next Generation Web Platform, MT4 | ActivTrader, MT4, MT5, TradingView |

| Asset Variety | 100+ instruments | 1000+ instruments | 250+ instruments | 28,000+ instruments | 1,500+ instruments | 12,000+ instruments | 1,000+ instruments |

| Regulation | FCA, CIMA | CySEC, BaFin, FSA | FCA, CySEC, FSC | CySEC, FSCA | FCA, FSA, SCA | FCA, ASIC, BaFin, IIROC, FMA, MAS | FCA, CMVM, FSC, SCB |

| Customer Support | 24/5 | 24/5 | 24/7 | 24/5 | 24/5 | 24/5 | 24/5 |

| Educational Resources | Limited | Excellent | Good | Limited | Excellent | Good | Good |

| Minimum Deposit | $2,000 | $1,000 | $50 | $500 | $10 | $0 | $0 |

ATC Brokers is a UK-established broker, offering a range of account types, reliable platforms, and a transparent fee structure tailored to active traders.

The broker provides access to a solid selection of tradable assets and supports both individual and managed account solutions, while customer support and additional tools aim to assist clients across their trading journey.

With a focus on professional execution and operational integrity, ATC Brokers presents a credible choice for users seeking a regulated and structured trading environment.

No review found...

No news available.

Moi je ne sais pas trader, mais je souhaiterais confier mes fonds à ATC BROKERS comme un fonds d’investissement pour une période de 6 mois, que dois-je faire?

Quel type de contrat de performance pourrais-je avoir ?

A you serve south african trade