- What is SiegPath?

- SiegPath Pros Cons

- Is SiegPath Legit?

- SiegPath Challenge

- Funded Account

- Account Conditions

- Payout

- SiegPath Alternative

What is SiegPath Prop Firm?

SiegPath is a Hong Kong-based proprietary trading firm that funds skilled traders, enabling them to access significant trading capital without risking their own money.

Established in 2016 as SiegFund and rebranded to SiegPath in 2025, the firm has expanded its mission to empower traders through advanced technology, professional training, and career development opportunities.

Its flagship evaluation programs, such as the 1 Step Express, 2 Step Standard, and the fast-track 10K Flash Challenge, are designed to test trading skill, discipline, and risk management before granting access to funded accounts. Depending on performance, traders can scale their accounts to as much as $1 million under the SiegCertified program.

SiegPath supports its own proprietary Sieg Terminal, with access to popular trading instruments including Forex pairs, indices, commodities, metals, stocks, and cryptocurrencies. With transparent rules, tiered account sizes, and competitive leverage options, the Prop firm aims to bridge the gap between skilled retail traders and professional-level trading resources.

| SiegPath Advantages | SiegPath Disadvantages |

|---|

| Good pricing | Not strictly overseen |

| Multiple evaluation programs | No free challenges |

| Advanced technology and AI tools | Strict evaluation rules |

| High capital scaling potential | |

| Multiple asset classes including Crypto pairs | |

| Educational resources | |

| Low profit target | |

| Profit share from challenge | |

Is SiegPath Legit?

SiegPath is a prop trading firm registered in Hong Kong that operates with a strong emphasis on regulatory compliance through strategic partnerships with licensed private equity funds in the Cayman Islands and DMA brokers.

- While prop firms like SiegPath are not always directly overseen by traditional financial regulators in the same way as retail brokers, SiegPath’s collaborations help ensure a more secure and transparent trading environment.

Is SiegPath Scam?

While SiegPath is not regulated by traditional financial authorities, it operates as a legitimate proprietary trading firm with a clear evaluation process and a growing global community of traders.

- The firm maintains partnerships with licensed private equity funds and brokers, providing a structured and transparent approach to trader funding.

However, traders should fully understand how prop trading works and the associated risks. Always research thoroughly and avoid risking large personal funds, as prop trading typically involves lower financial exposure compared to trading your capital directly.

SiegPath Challenge Evaluation Rules

SiegPath’s Challenge Evaluation is a structured process to assess a trader’s skill, risk management, and consistency. The evaluation includes 3 programs where traders must meet specific profit targets while adhering to strict risk limits.

- Traders might need to achieve an 8% profit target in Phase 1 without exceeding a 5% daily drawdown or a 10% overall drawdown. Upon passing Phase 1, Phase 2 usually requires a 5% profit target under the same risk constraints.

Successful traders are then granted funded accounts with profit splits starting around 80%, which can increase up to 90% or more as they scale their accounts and demonstrate consistent performance.

SiegPath also offers programs and incentives to reward loyal and high-performing traders, helping them progress toward professional fund manager status.

Account Balance and Registration Fee

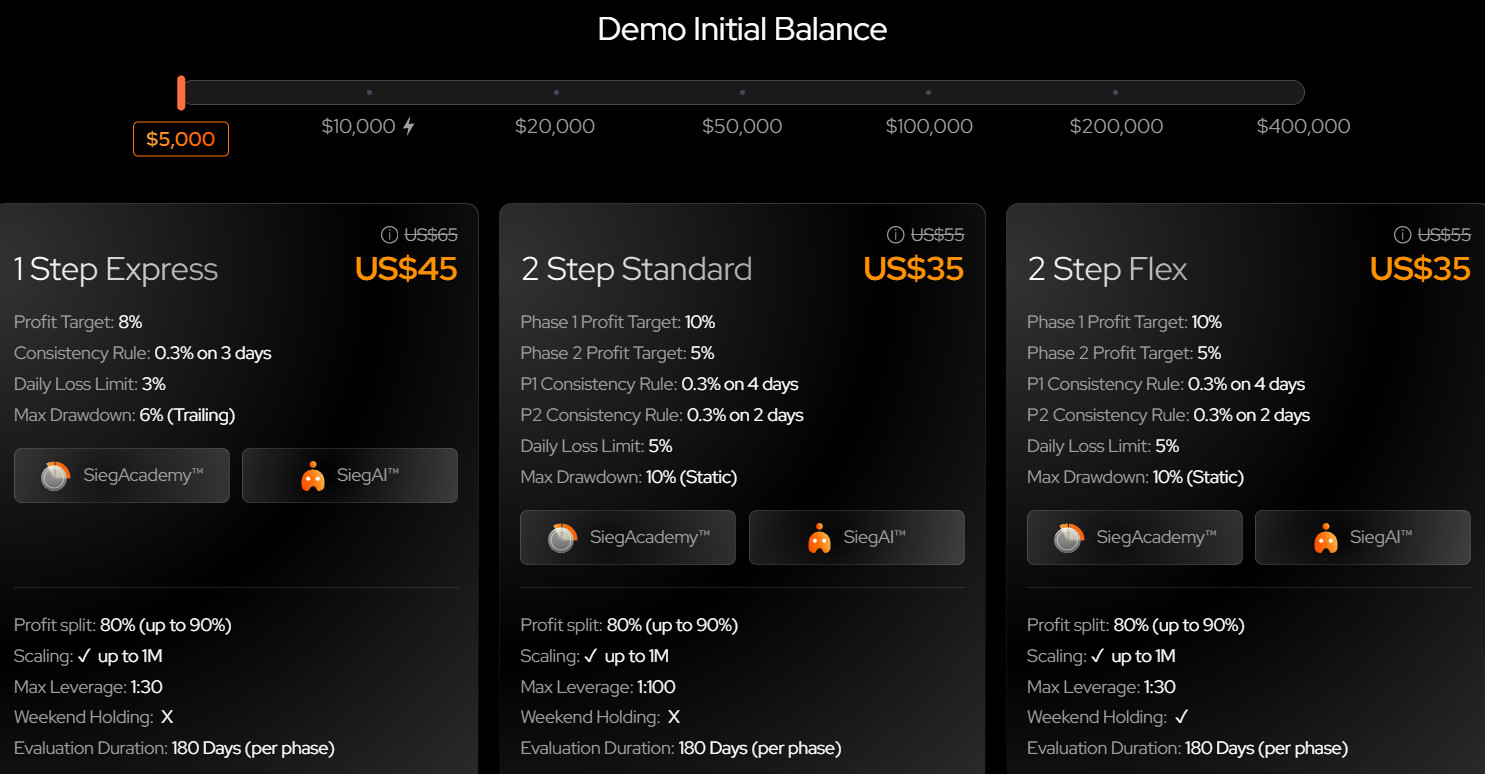

Before beginning the SiegPath login and evaluation process, traders must select the Evaluation Program and Account Balance they wish to qualify for. SiegPath offers multiple evaluation paths, including the 1 Step Express, 2 Step Standard, and the fast-track 10K Flash Challenge, with various account sizes tailored to different trading experience levels and capital preferences.

The challenge conditions, such as profit targets, trading rules, and time limits, vary depending on the chosen account size and program.

This selection also determines the registration fee required to participate in the challenge. Unlike some other firms, SiegPath’s fees are non-refundable, so traders should choose carefully. Below is an overview of common account sizes and their starting fees:

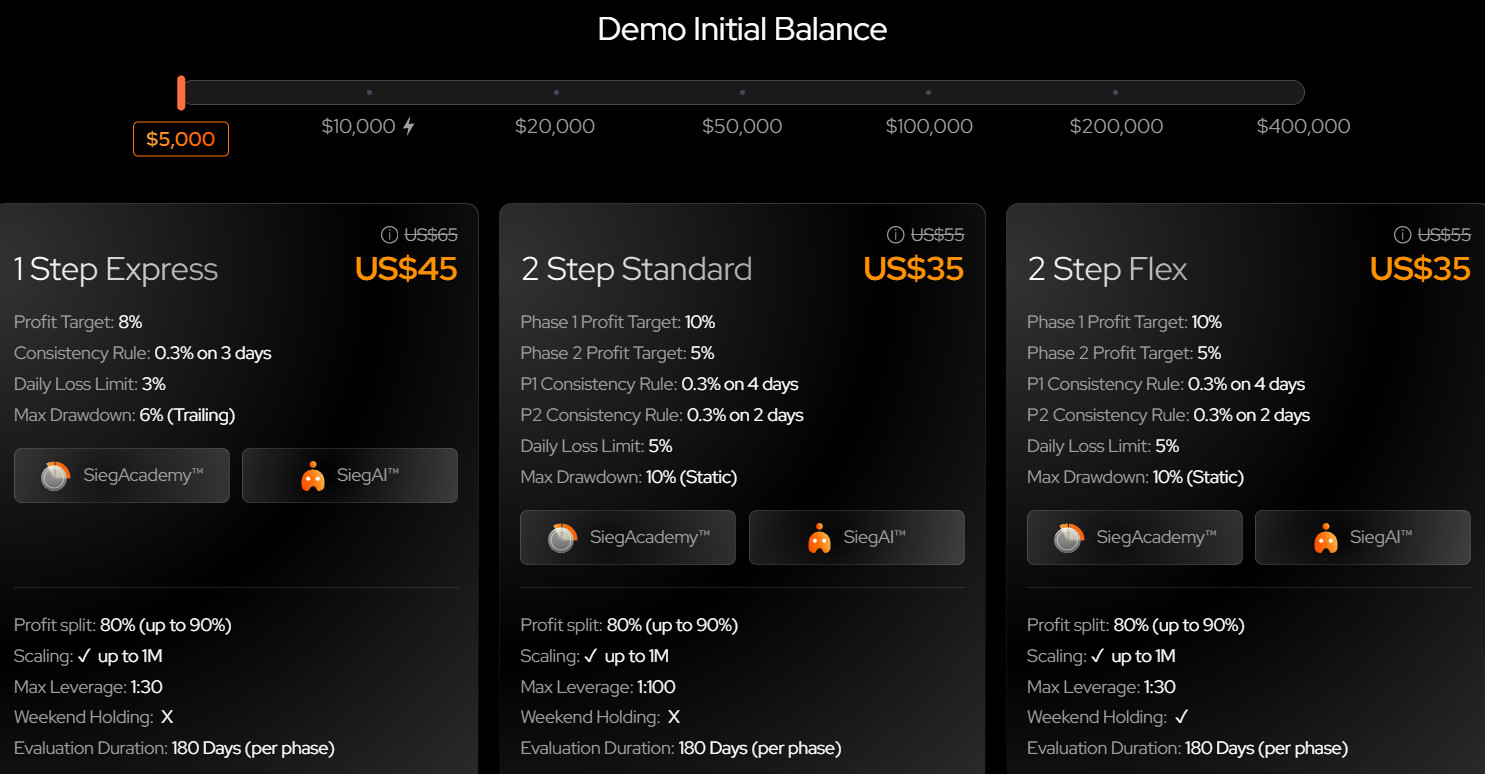

- $5,000 Account is an entry-level funding option with a registration fee of $45 via the 1 Step Express plan, and $35 for 2 Step Standard and 2 Step Flex plans.

- $10,000 Account offers increased exposure for a fee of $60.

- $20,000 Account is suitable for more experienced traders, with fees of $190.

- $50,000 Account provides significant capital for scaling, costing $290.

- $100,000 Account is for high-volume traders, starting at $570.

- $200,000 and above are top-tier options with fees ranging from $1,080 and up.

Overall, the firm’s pricing is competitive within the prop trading industry and offers flexible options for traders at various stages of their journey toward professional funding.

| Fees | SiegPath | BrightFunded | Liberty Market Investment |

|---|

| Minimum Account Size | $5,000 | $5,000 | $10,000 |

| Fee | $35 | €55 | $70 |

| Maximum Account Size | $400,000 | $200,000 | $150,000 |

| Fee | $2160 | €975 | $350 |

| Reset or Test Retake | No | No | Yes |

| Is Fee Refundable? | No | Yes | No |

Profit Target

SiegPath’s evaluation programs set clear profit targets that traders must achieve within specified timeframes to qualify for funded accounts.

For example, in the 1 Step Express challenge, traders typically need to reach an 8% profit target while adhering to strict risk management rules like daily and overall drawdown limits.

Other programs may have slightly different targets or phases, but all are designed to test a trader’s ability to generate consistent profits under real-market conditions.

Maximum Loss

SiegPath enforces strict maximum loss limits during its evaluation challenges to ensure disciplined risk management. Traders must stay within defined daily drawdown limits, 5%, as well as an overall maximum loss limit, set at 10% of the account balance.

Exceeding these thresholds results in immediate disqualification from the challenge. These rules are designed to promote responsible trading and protect both the trader and the firm’s capital throughout the evaluation process.

Minimum Trading Period

SiegPath’s evaluation programs require a minimum of 3 trading days to complete a challenge evaluation. This minimum trading period ensures that traders demonstrate consistent performance and disciplined risk management over several sessions, rather than relying on short-term gains.

The requirement encourages a steady approach to trading, helping to prepare traders for managing funded accounts responsibly.

See the detailed table with SiegPath Review Challenge conditions:

Free Trial

SiegPath offers a Free Trial for traders to practice and familiarize themselves with their trading platform before committing to an evaluation challenge.

This trial allows you to test strategies and explore the platform’s features without any financial commitment. It is useful for beginners to gain confidence and experience. You can retake the Free Trial as needed to refine your skills.

SiegPath Funded Account

SiegPath’s funded account is granted to traders who complete the firm’s evaluation challenges, providing them with real capital to trade without risking their own money.

These accounts come with clear trading rules, risk limits, and profit targets designed to encourage disciplined and consistent trading. Funded traders benefit from competitive profit-sharing arrangements, often starting around 80%, and have opportunities to scale their accounts up to $1 million through the SiegCertified program.

Profit Split

SiegPath offers competitive profit splits to traders who pass their evaluation challenges and receive funded accounts.

- Typically, traders start with an 80% profit share, allowing them to keep the majority of their trading profits. As traders demonstrate consistent performance and scale their accounts through the SiegCertified program, their profit split can increase up to 90% or more.

Payout and Withdrawals

SiegPath provides efficient payout and withdrawal processes for its funded traders, ensuring timely access to earned profits. Once traders qualify for payouts, profits are typically processed within a few hours, with withdrawal requests allowed every 14 days.

- The firm supports various payout methods to offer flexibility and convenience to its traders. Common payout options include direct bank transfers, e-wallet payments, and other widely used electronic payment systems.

Withdrawal Method

SiegPath offers several convenient withdrawal methods to cater to traders from various regions. These typically include bank wire transfers, popular e-wallets, and other secure online payment options. The firm aims to provide flexible and reliable withdrawal channels, ensuring traders can access their profits smoothly and securely.

Account Conditions

Before joining the firm, carefully review the specific terms associated with each account type. Essential aspects like the range of trading instruments, commission fees, maximum leverage, available trading platforms, and execution policies can greatly influence your overall trading experience.

Having a clear understanding of these factors helps ensure that your chosen account matches your trading style and risk tolerance. Below is a detailed overview:

Trading Instruments

SiegPath offers a diverse range of trading instruments to cater to different trader preferences and strategies. These include major and minor Forex currency pairs, global indices, commodities such as metals and energies, individual stocks, and popular cryptocurrencies.

This selection allows traders to diversify their portfolios and take advantage of opportunities across various markets using the firm’s supported trading platforms.

SiegPath Commission

SiegPath does not charge any commission fees for placing orders, allowing traders to keep their trading costs lower compared to many competitors.

Leverage

SiegPath offers competitive leverage options that vary depending on the evaluation program and trading instrument. Leverage for Forex trading can range from 1:30 in programs like the 1 Step Express to as high as 1:100 in the 2 Step Standard plan.

Other instruments, such as cryptocurrencies, typically have lower leverage limits to help manage risk. These leverage settings allow traders to maximize their potential returns while staying within the firm’s strict risk management guidelines.

SiegPath Trading Platform

SiegPath provides traders with access to its proprietary platform, the Sieg Terminal, which offers advanced features, fast execution, and seamless integration with tools like TradingView for enhanced charting and analysis.

The platform is designed to deliver a smooth, reliable trading experience across both desktop and mobile devices, catering to traders of all levels with an intuitive interface and powerful functionality.

Trading Conditions

Based on our findings, SiegPath offers advanced trading conditions supported by a suite of powerful AI-driven tools designed to enhance trading strategies and risk management.

- Its SiegAI platform includes an AI-Advisor that creates personalized investment strategies based on individual goals, and an AI-Trader system that provides real-time risk control, predictive analytics, and automated alerts like stop-loss and margin calls to help optimize performance.

- Additionally, AI-Support delivers intelligent customer service with instant query resolution and fraud detection, while AI-Research assists institutional clients with in-depth, compliance-focused market analysis.

- The AI-Community fosters a regulated social network to promote engagement and reliable information sharing.

SiegPath Promotions

SiegPath regularly offers promotions to support and reward traders at various stages of their journey. These include special challenges like the fast-track 10K Flash Challenge, loyalty programs that boost profit splits, and occasional fee discounts or seasonal offers.

By combining innovative tools with attractive rewards, the firm aims to motivate traders to perform at their best while providing opportunities for accelerated growth and increased earnings.

SiegPath Alternative Brokers

According to our overall findings, SiegPath presents itself as a compelling choice for traders interested in funded accounts, offering advanced technology, unique evaluation challenges, and attractive leverage options.

Its proprietary Sieg Terminal, AI-driven trading solutions, and varied account models cater to both beginners and experienced traders seeking a professional trading environment without putting their capital at risk.

However, in comparison with other prop trading firms, certain competitors may offer a larger selection of platforms, a longer industry track record, or alternative funding structures that align better with specific trading approaches.

SiegPath’s strengths lie in its advanced tools, flexible evaluation pathways, and competitive pricing, but traders should weigh these benefits against their objectives, preferred markets, and risk profile before making a final decision.

See our selection of alternative prop trading firms below, carefully chosen based on overall trader benefits.

- BrightFunded – Prop Firm with Fast Payouts and Transparent Trading Rules

- FundedNext – Trading Prop Firm with Lowest Account Balance

- FTMO – Great Swing Trading Prop Firm

Share this article [addtoany url="https://55brokers.com/siegpath-review/" title="SiegPath"]