- What is FXORO?

- FXORO Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

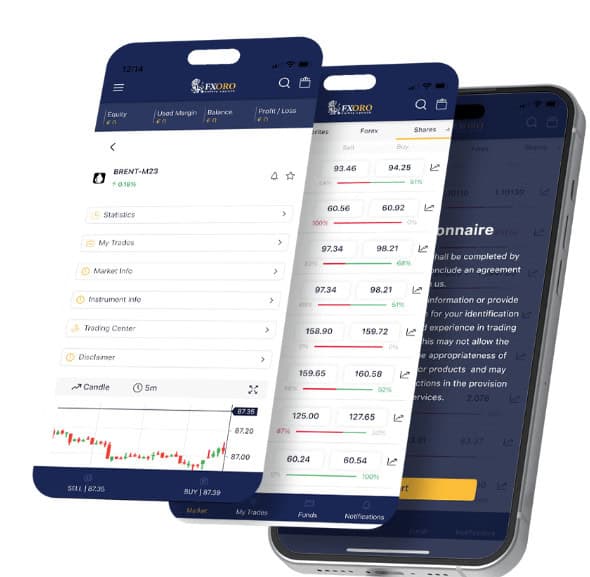

- Trading Platforms and Tools

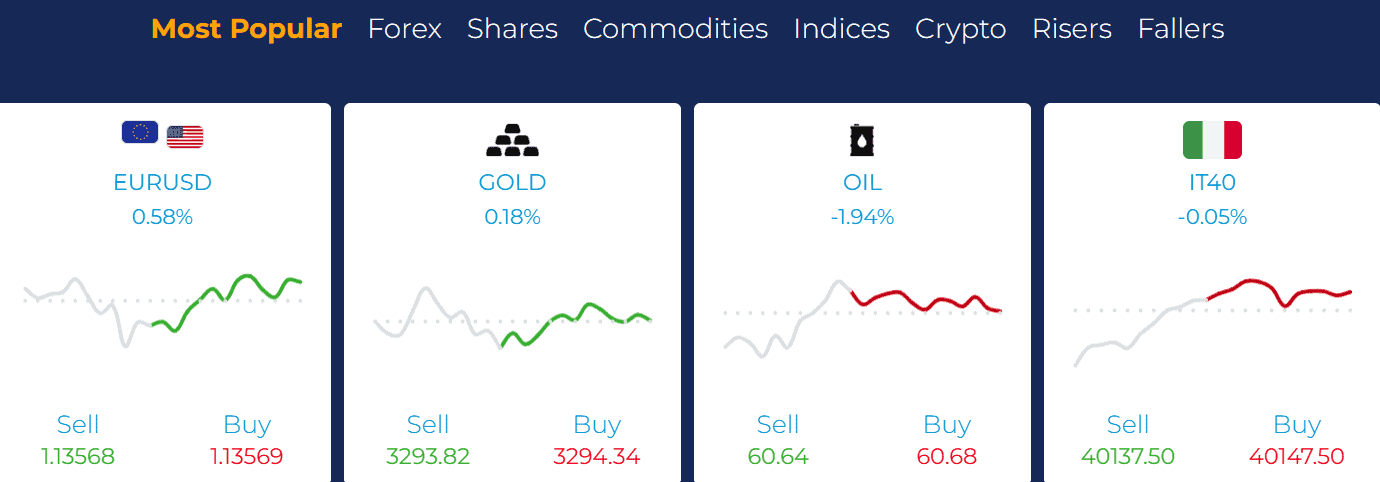

- Trading Instruments

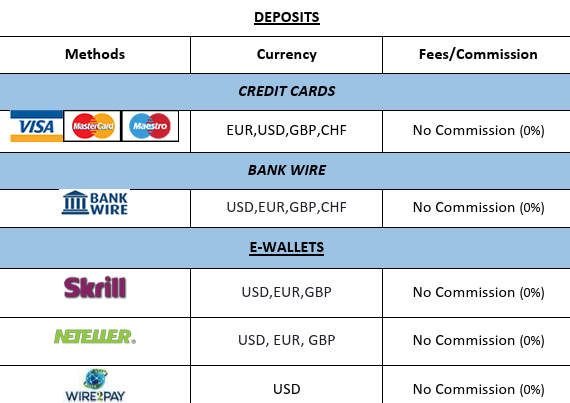

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- FXORO Compared to Other Brokers

- Full Review of Broker FXORO

Overall Rating 4.3

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is FXORO?

FXORO is a Forex and CFD trading brokerage firm that offers a variety of trading instruments in different asset classes, including Forex, CFDs, Shares, Commodities, Stocks, Indices, Cryptos, and ETFs.

Based on our research, the firm is headquartered in Cyprus and is regulated and authorized by a reputable European regulatory body, CySEC. Additionally, the broker has a presence in Seychelles and is authorized by the Financial Services Authority (FSA).

Overall, the broker provides competitive trading conditions and a diverse range of trading products through the advanced MetaTrader trading platform.

FXORO Pros and Cons

Per our findings, the firm has both advantages and disadvantages that are important for traders to consider. For the pros, the broker offers a competitive trading environment, low pricing, as well as access to a range of trading instruments, and the industry-known MT4 trading platform. The firm also provides comprehensive educational materials, resources, and Trading Central.

For the cons, there is no 24/7 customer support available. Additionally, the broker lacks a top-tier license, which could be a concern for traders who prioritize brokers with higher regulatory credentials. However, trading under CySEC is considered safe enough.

| Advantages | Disadvantages |

|---|

| European license and oversight | No 24/7 customer support |

| Good trading conditions | No top-tier license |

| Trading instruments | |

| MT4 trading platform | |

| Professional trading | |

| Competitive pricing | |

| Learning materials | |

FXORO Features

According to our analysis, FXORO provides reliable trading solutions with competitive fees, which is an advantage for all levels of traders. Moreover, the broker’s good selection of trading instruments with competitive trading spreads presents an appealing proposition to traders. Here are the main aspects listed below for a quick assessment:

FXORO Features in 10 Points

| 🗺️ Regulation | CySEC, FSA |

| 🗺️ Account Types | Fix, Floating accounts |

| 🖥 Trading Platforms | MT4, Mobile App |

| 📉 Trading Instruments | Forex, CFDs, Shares, Commodities, Stocks, Indices, Cryptos, ETFs |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is FXORO For?

We have carefully reviewed FXORO’s proposal and found that it is a good broker for different levels of clients and various trading needs. FXORO is especially favorable for the following:

- European traders

- Traders who prefer the MT4 trading platform

- International traders

- Currency trading

- Investing

- Beginners

- Advanced traders

- NDD execution

- Competitive spreads and fees

- EA/Auto trading

- Good trading tools

FXORO Markets Summary

In conclusion, FxOro is a comprehensive and reliable brokerage firm that provides access to a diverse range of trading instruments across multiple markets. With its competitive conditions, diverse account options, collaboration with Trading Central for market insights, and educational resources, the broker aims to provide a well-rounded trading experience.

Additionally, the availability of the advanced MT4 trading platform caters to various trading strategies, appealing to all levels of traders.

However, there are drawbacks as well, such as trading within an offshore zone and the absence of 24/7 customer support. Therefore, we advise traders to carefully evaluate whether the broker’s offerings suit their specific trading requirements.

55Brokers Professional Insights

FXORO might be a solid choice for traders from EU, due to its base in Cyprus. The conditions and trading performance we find overall good, based on quality trading execution with good sstability, which makes them match for day traders, scalpers and high frequaency trading alike.

With FXORO, clients can choose between the 2 spread-based trading accounts—Fix and Floating. Each account type stands out for its unique conditions and features, so good to check those for most suitbale for you. There is a range of trading instruments across Forex, CFDs, shares, commodities, stocks, indices, cryptos, and ETFs, provided all at MT4 platform, coming along with advanced tools which is a plus. Yet, if you look for other platforms and find MT4 outdated, check other brokers then by the categories.

Besides, clients have access to good banch of tool Trading Central, the Economic Calendar, and market news, along an extensive education section with basic and advanced courses, a Forex glossary, webinars, eBooks, etc. So the proposal is suitable for beginners and traders willing to improve trading too.

Consider Trading with FXORO If:

| FXORO is an excellent Broker for: | - Intermediate and advanced traders

- CFD traders

- MT4 platform enthusiasts

- Traders looking for competitive fees

- Traders looking for a diversity in tradable products

- Clients looking for dedicated multilingual support

- Those who prioritize a good selection of educational materials |

Avoid Trading with FXORO If:

| Avoid Trading with FXORO If: | - Long-term investors

- Copy traders

- Traders relying on PAMM and MAM accounts

- Clients who prefer fixed commissions

- Those looking for 24/7 customer assistance |

Regulation and Security Measures

Score – 4.3/5

FXORO Regulatory Overview

FXORO is authorized by the well-regarded Cyprus Securities and Exchange Commission (CySEC). This regulatory authority imposes strict rules and regulations to ensure high standards in the financial industry. The broker follows the necessary regulations for offering Forex trading services. The broker’s commitment to compliance with industry standards is evident through its regulation under a respected European authority.

- However, the broker also holds an offshore license. Therefore, before engaging in trading activities, traders should carefully consider and understand the differences when trading under different jurisdictions.

How Safe is Trading with FXORO?

According to our findings, FXORO implements various measures to protect its trading accounts. These typically include regulatory oversight and ensuring compliance with applicable rules and regulations. The firm also maintains fund protection mechanisms to keep client funds separate from the broker’s operational funds.

- However, we urge clients to conduct thorough research and carefully examine the broker’s documentation, legal agreements, and policies. This will provide a comprehensive understanding of the specific trading protections offered by the broker, as trading conditions can vary across jurisdictions.

Consistency and Clarity

Founded in 2010, FXORO offers a favorable trading opportunity for different clients worldwide. The broker is consistent in its services, providing transparency and a reliable setting. Following tight regulations, FXORO is a great choice for those who prioritize security.

Based on our research, FXORO is committed to enhancing its services and efficiently expanding its global client base. However, real feedback from clients is mostly mixed, with some concerning revelations to consider. The positive aspects highlight efficient withdrawals, a user-friendly trading platform, a diverse range of tradable products, and a regulated nature. However, the negative reviews raise concerns that shouldn’t be neglected. Many clients claim that their profits have been frozen, and they are unable to make withdrawals. Among other cons are wide spreads, high inactivity fees, and insufficient customer support.

Another essential point is the difference in conditions based on the entity. Even though the broker’s offerings are attractive, we urge clients to consider all the mentioned points and concerns before opening an account with FXORO.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with FXORO?

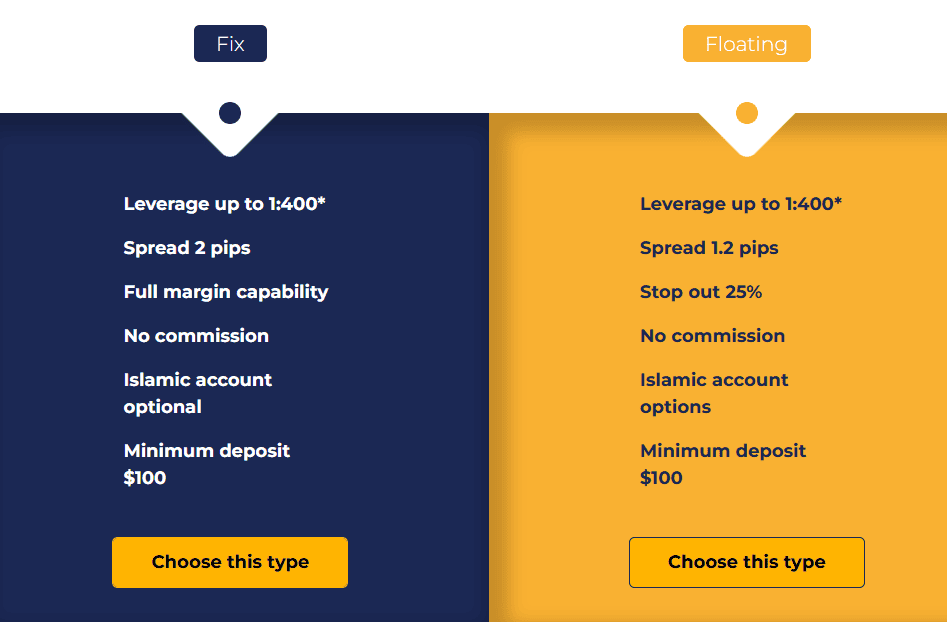

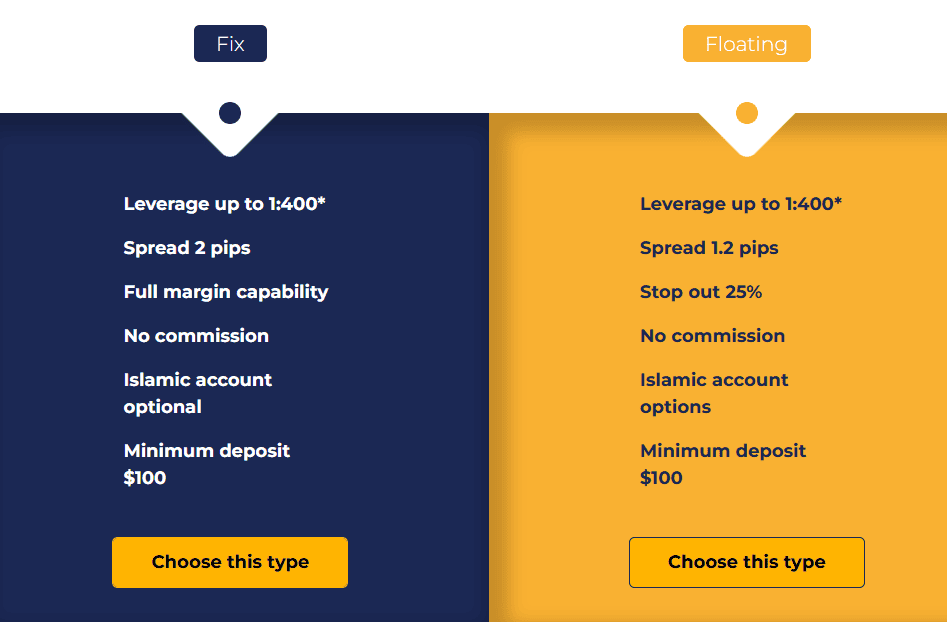

Per our research, the broker offers Fixed and Floating accounts that suit the needs of different traders. Additionally, FXORO offers Islamic accounts tailored for Muslim traders.

The account types have a few common features, including the minimum deposit requirement of $100. The leverage is up to 1:400 for both accounts, depending on the instrument and jurisdiction.

- The Fixed Account is a fixed-spread-based account with an average of 2 pips for the EUR/USD pair. The fixed spread structure enables traders to rely on unchanging costs regardless of market changes. There are no commissions, with all the trading costs included in spreads. There is also an optional Islamic account for this account type.

- The Floating spread account is a better match for high-frequency traders who benefit from daily trades. The spreads applied are floating and can be impacted by market volatility and liquidity. The average spread is 1.2 pips for the EUR/USD pair.

- The Islamic option is available for Fixed and Floating account types. After opening an account with the broker, traders can request an Islamic account. The account is for USD-based currency only. There are no swap fees for overnight positions and no widening of spreads. However, for the Islamic account, there are fixed admin charges for the overnight positions.

Regions Where FXORO is Restricted

Based on our research, FXORO offers its services to European clients due to its CySEC regulation and to global clients due to its FSA license. However, because of regulatory restrictions, there are a few countries where the broker’s services are unavailable:

Cost Structure and Fees

Score – 4.4/5

FXORO Markets Brokerage Fees

After examining the broker’s fee offering, we found that FxOro typically charges fees in the form of spreads and overnight/swap costs. Also, additional fees may be incurred during trading activities. Therefore, carefully review the broker’s fee structure and terms and conditions to gain a comprehensive understanding of the associated charges and their potential impact on trading operations.

Based on our test trade, the broker provides competitive spreads, with an average spread of 1.2 pips for the EUR/USD currency pair in the Forex market for floating spread accounts. For the fixed-spread account, the average spread is 2 pips. The fixed spread does not undergo changes based on market conditions, introducing traders to predictable charges. On the other hand, spreads for the Floating account can vary based on market conditions, volatility, and liquidity, so consult the broker’s website or contact customer support for detailed information on the spreads they offer for specific instruments and account types.

As we further revealed, the fixed spreads for gold are 50 pips and 5 pips for Brent oil.

FXORO does not charge commissions for its Fixed and Floating accounts. Both are spread-based, offering different conditions and spread opportunities. However, the absence of commissions might be a negative factor for advanced traders who prefer fixed transaction fees, combined with very low spreads for each trade.

Swap fees are applied for overnight positions. Swaps can change depending on market conditions, so clients should check them before placing a trade. As we have found, the broker publicly discloses the swap fees on the broker’s website, in the ‘trading conditions’ section. Swaps can be long and short. The long swap for the EUR/USD pair is -0.0103%, and the short swap is -0.0017%.

How Competitive Are FXORO’s Fees?

Our research has revealed transparent and competitive costs. FXORO discloses all the applicable spreads and swap fees, based on the account type and the instrument. This makes the trading charges predictable, enabling them to calculate all the trading-related costs beforehand.

However, traders should remember that the floating spreads and swap fees depend on the market conditions and can change based on market volatility and liquidity. On the other hand, fixed spreads remain the same under any market condition, ensuring the predictability of costs. Floating spreads will be more attractive for high-frequency and advanced traders, who place new trades every day.

At last, our impression of the broker’s fee structure and overall costs is positive. Another important reminder to traders is to check trading conditions based on the entity.

| Asset/ Pair | FXORO Spread | XPro Markets Spread | StarTrader Spread |

|---|

| EUR USD Spread | 2 pips | 2.5 pips | 1.3 pips |

| Crude Oil WTI Spread | 5 | 2.8 pips | 1 |

| Gold Spread | 50 | 2.8 pips | 1 |

FXORO Additional Fees

In addition to common trading costs, such as spreads and swap fees, FXORO also charges a few non-trading fees that traders should consider.

- The inactivity fee is charged after the account is dormant for three consecutive months. The monthly charge is $25 and is deducted from the client’s account.

- FXORO incurs a one-time account maintenance fee of $25.

- The broker also charges withdrawal fees. The fees depend on the funding method used.

Score – 4.2/5

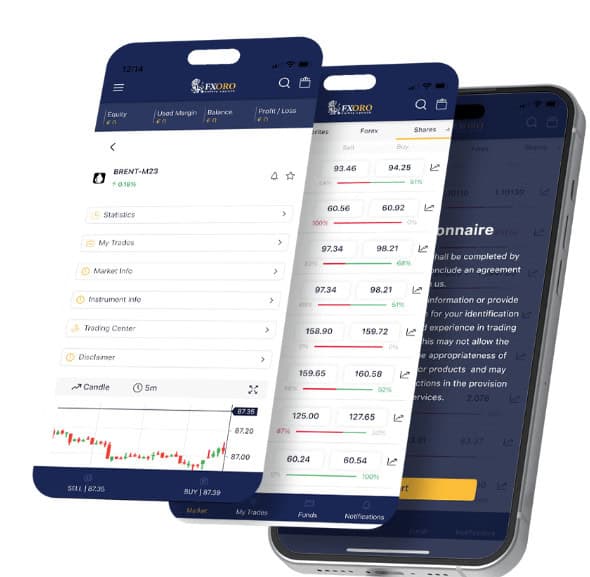

FxOro provides traders with the widely used MT4 platform for desktop and mobile apps, known for its user-friendly interfaces and comprehensive trading tools. The platform facilitates the execution of trades, chart analysis, and the implementation of various trading strategies.

Additionally, traders may have access to the broker’s proprietary trading app designed for mobile devices. These apps enable users to trade on the go, manage their accounts, and stay updated on market movements.

| Platforms | FXORO Platforms | XPro Markets Platforms | StarTrader Platforms |

|---|

| MT4 | Yes | No | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

FXORO Web Platform

The FXORO web platform is an ideal opportunity for traders to access their accounts and place trades right from the browser without the hassle of downloads and installations. The platform offers all the essential capabilities of the MT4 desktop platform.

Through the web platform, traders have more flexibility and liberty in trading from any device, just with access to the internet. The FXORO web platform includes charting and analytical opportunities, enabling traders insights into the market and the ability for informed decisions.

FXORO Desktop MetaTrader 4 Platform

The FXORO MT4 platform is an excellent chance to enter the market equipped with advanced and innovative trading tools and features. The platform is available for Windows, iOS, and Android devices. Among the benefits of the desktop platform are a simple and easy-to-use interface, flexibility, security, and fast execution.

Traders can also access advanced charting tools and trading indicators, gaining insight into the market. Besides, clients can make use of EAs, fully automating their trading. The MT4 platform is accessible via desktop and web platforms and the mobile app.

FXORO Desktop MetaTrader 5 Platform

As the research showed, FXORO does not offer the market-popular MT5 platform. This is the more innovative successor of the MT4 platform, offering more extensive and innovative opportunities. Traders who prefer trading through the MT5 platform might find the MT4 platform a little limiting.

FXORO MobileTrader App

FXORO offers its proprietary mobile platform. It also enables traders to access the MT4 app version. Mobile trading allows clients flexibility in trades and the liberty to trade from anywhere they want. The mobile app works for iOS and Android devices, ensuring wider accessibility.

Traders can access advanced tools and a wide range of instruments and get the latest market updates. All in all, a user-friendly interface, real-time quotes, one-click trading, and secure account management will allow mobile traders an efficient trading experience right from their phones.

Main Insights from Testing

Our experience with FXORO is mostly positive. The broker’s MT$ platform provides all the essential conditions for a profitable trading experience. Besides, the availability of the web and mobile versions is another advantage, making trading more flexible and accessible.

However, the availability of only the MT4 platform limits traders who are looking for diverse opportunities and platforms with super-innovative features. Platforms like MT5, cTrader, and TradinView are not available with FXORO.

Trading Instruments

Score – 4.4/5

What Can You Trade on the FXORO Markets Platform?

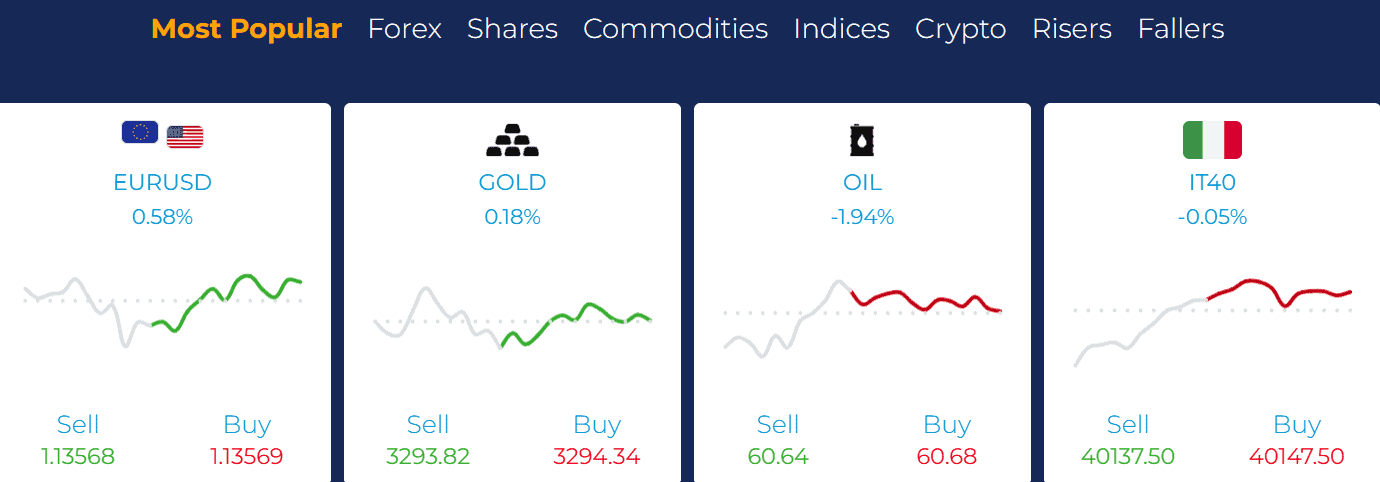

FXORO provides access to popular trading instruments, such as Forex, CFDs, Shares, Commodities, Stocks, Indices, Cryptos, and ETFs.

The broker also offers real stocks, enabling traders to invest in long-term investments and traditional trading, owning shares of some of the most popular companies, including Amazon, Google, Facebook, Apple, etc.

Main Insights from Exploring FXORO Tradable Assets

FXORO offers tradable products across a good range of financial assets, enabling traders to explore the market further. The broker offers 60 major, minor, and exotic currency pairs and the most popular commodities, such as gold, silver, oil, agricultural products, etc. The broker also enables access to the most popular indices, ETFs, and shares on CFDs. Besides, FXORO offers cryptocurrency trading with access to Bitcoin, Litecoin, Ethereum, Dash, Dogecoin, and Ripple.

- With FXORO, traders can diversify their portfolios by investing in real stocks. Traders can buy physical shares of well-known US companies and engage in traditional investments. To start investing in stocks, clients just need to open an account with the broker and access the market through the broker’s platform. Traders can engage in both stock trading and CFD trading at the same time.

Leverage Options at FXORO

Leverage allows traders to enter the market with limited capital. Yet, it is essential to have a comprehensive understanding of how leverage operates and its potential consequences before engaging in trading using leverage.

FXORO leverage is offered according to CySEC and FSA regulations:

- European traders are eligible to use a maximum of 1:30 for currency pairs.

- International traders may use higher leverage up to 1:400, so understanding the implications and risks associated with leverage is crucial before making decisions about its use in trading.

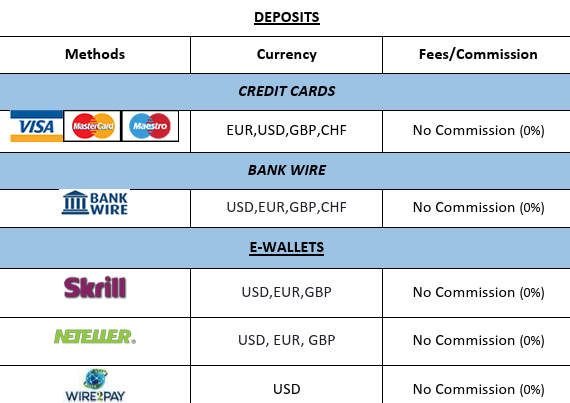

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at FXORO

Our research showed that the broker provides multiple funding methods to accommodate diverse preferences, including bank transfers, credit/debit card transactions, and electronic payment systems. However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved. The overall fees are low, and traders can benefit from various account-based currencies.

Minimum Deposit

To open a live trading account with the broker, clients need to deposit $100 as an initial deposit amount for all trading accounts.

Withdrawal Options at FXORO

Based on our analysis, the withdrawal request is processed by the broker’s back office within 48 hours. You will receive your money via bank wire or credit/debit card between 3 to 10 business days.

There are withdrawal fees, depending on the funding method. For credit cards, the withdrawal fee is $5. For Neteller, the transaction fees are higher, at $15.

Customer Support and Responsiveness

Score – 4.6/5

Testing FXORO Customer Support

The broker offers 24/5 customer support via live chat, email, phone lines, and social media channels. Additionally, the support team comprises trading experts who can provide technical support, offer analysis recommendations, address general inquiries, and resolve operational issues.

- FXORO also includes an FAQ section, providing traders with the most common answers users are looking for while trading.

Contacts FXORO

FXORO offers dedicated customer assistance to its clients worldwide. Traders can choose the most comfortable means of communication to solve their issues and find answers to their trading-related questions:

- The broker provides email addresses for different kinds of requests, questions, and complaints. For general information, clients can use info@global.fxoro.com. Complaints should be sent to complaints@global.fxoro.com, and for partnerships, the following address: partnership@global.fxoro.com.

- Traders can also use the provided phone numbers for direct communication with the support team: +442031290670 / +2482548988.

- At last, the broker is very active on social platforms, providing market updates and various company news. The broker can be found on the following platforms: Facebook, Instagram, YouTube, LinkedIn, X, and TikTok.

Research and Education

Score – 4.3/5

Research Tools FXORO

FXORO provides analytical and research tools not only through its advanced platform but also through its official website.

- The Economic Calendar is essential in providing market updates and upcoming changes to inform clients about upcoming events. This way, traders can make informed decisions based on professional insights.

- Traders can also find the latest market news and stay informed about changes and movements in the market.

- FXORO clients can also access trading signals right from the broker’s website. However, it is important to remember that the signals are provided by a third party and should not be taken directly as investment advice.

Education

FXORO offers a variety of educational materials, including tutorials, webinars, and interactive courses, aimed at both novice and experienced traders. These resources cover topics like market analysis, trading strategies, risk management, and more.

- We found that the broker collaborates with Trading Central, providing valuable insights, market analysis, and tools to assist traders in informed decisions. Through this partnership, traders on the FXORO platform can benefit from the expertise and resources provided by Trading Central, potentially enhancing their ability to navigate the financial markets effectively.

- FXORO offers beginner and advanced courses for traders of different levels. The courses help novice traders find their footing in trading and enable advanced traders to polish their knowledge further.

- Webinars are another way to enhance trading skills and knowledge, and discover new opportunities and possibilities in trading.

- FXORO offers an eBook that introduces traders to the business of online trading. Clients can find essential insights and knowledge that would guide and assist them throughout their trading journey.

- At last, the Forex glossary simplifies the intricate and complicated terms, making the trading language more understandable.

Is FXORO a Good Broker for Beginners?

Based on our research of the broker, we can assume that it is a favorable option for beginner traders. FXORO offers two account types with fixed and floating spreads, an advanced trading platform that is available through the web, desktop, and mobile versions, and great trading tools and features. Traders also have access to Trading Central, with access to various analytical tools and market insights. The education section overall is dedicated to providing novice traders with essential trading and market knowledge. At last, the availability of a demo account and a low minimum deposit requirement make the broker ideal for inexperienced traders who want to start small.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options FXORO

FXORO offers a range of tradable products across Forex, precious metals, commodities, global indices, and ETFs. This ensures a good opportunity for diversification, enabling traders to expand their portfolios.

- The best way for diversification with FXORO is to engage in traditional investments. The broker offers real stock trading, allowing its clients to access stocks of famous companies and own them. By ownership of shares, traders will receive dividends.

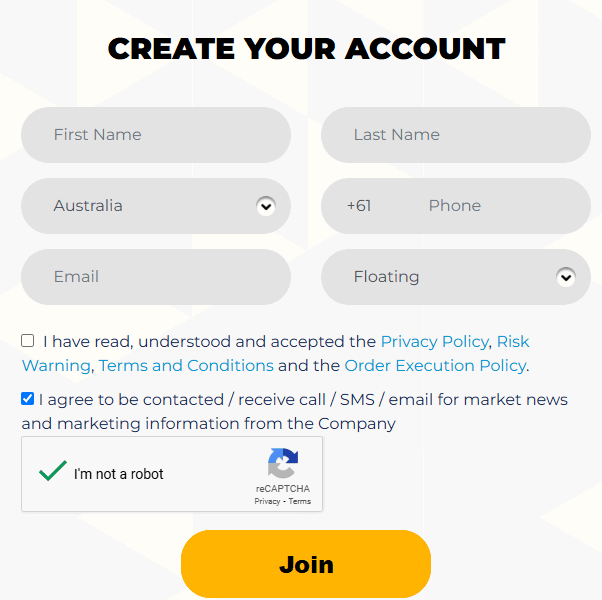

Account Opening

Score – 4.6/5

How to Open an FXORO Demo Account?

The availability of a demo account enables traders to gain trading skills and knowledge before engaging in live trading. However, unlike many other brokers, the demo account setup is possible after opening a live account.

- Traders who are trading through the mobile app can change the account mode to demo right from the app.

- Clients who are trading through the web or desktop platforms should contact a customer support agent and request the demo account credentials.

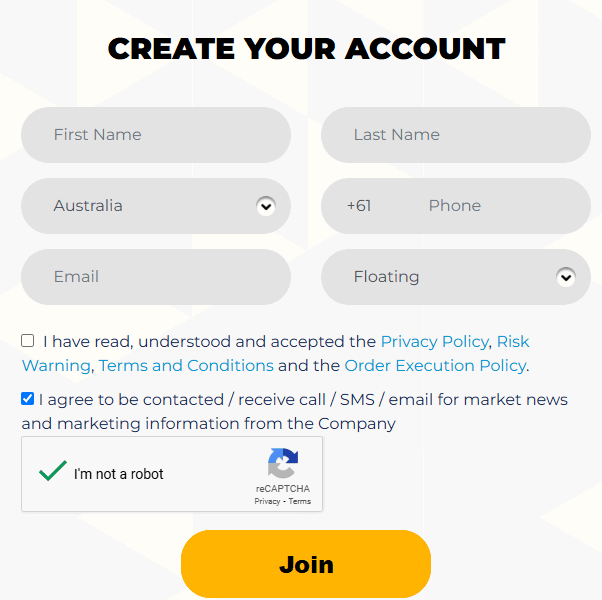

How to Open an FXORO Live Account?

Opening a live account with FXORO is an easy process that will take only minutes. Traders just need to follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Register” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once the account is activated and proven, follow with the money deposit.

Score – 4.2/5

FXORO also offers a few additional features and tools, enabling traders to get the most out of trading.

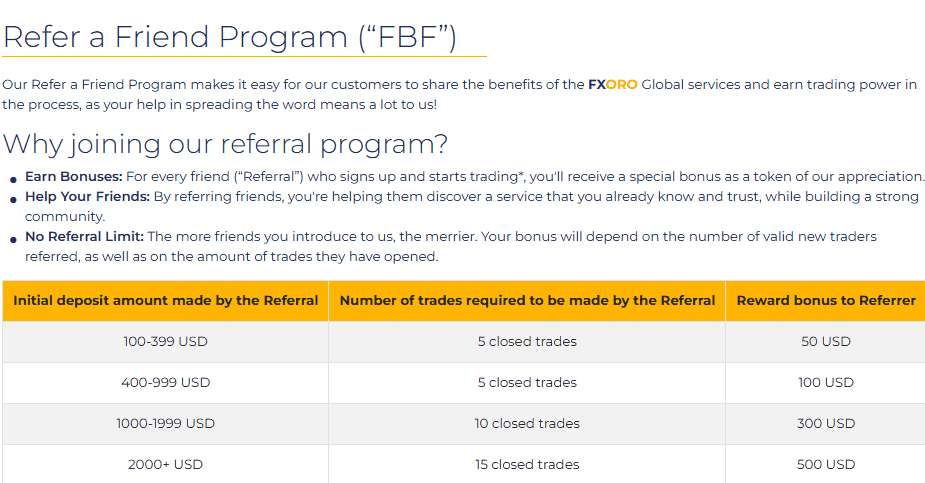

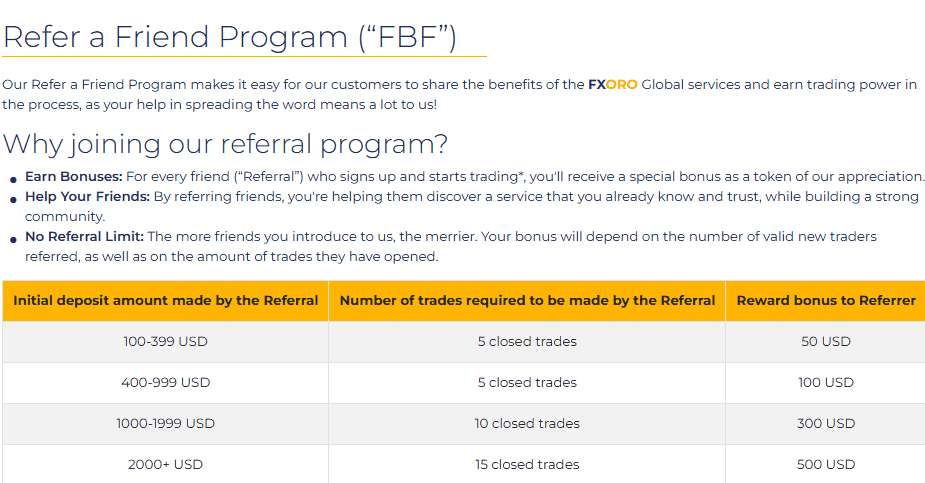

- The Refer a Friend program enables traders to gain trading power by referring the broker to other traders. For each referral, clients get bonuses, and for each of the five closed trades from the referred friend, clients gain $50, depending on the trading volume.

- When traders open an account with FXORO, they are entitled to get a $50 welcome bonus. However, the bonuses cannot be withdrawn or transferred to other accounts.

FXORO Compared to Other Brokers

As a final step, we have compared FXORO to other brokers in the market with similar offerings. In terms of regulation, the broker holds CySEC and FSA licenses. Due to the CySEC regulation, FXORO ensures the credibility and reliability of trades, while the FSA license ensures that the broker has a global reach. On the other hand, in addition to Think Markets’ CySEC license, the broker holds licenses from FCA, ASIC, FSCA, FSA, JFSA, CIMA, FSC, DFSA, and FMA, ensuring a higher level of protection.

When it comes to the platform availability, FXORO offers the MT4 platform via web, desktop, and mobile app. It also includes its proprietary mobile app. All the brokers we have compared to FXORO also offer the popular MT4 platform. However, we noticed that most of them include the more advanced MT5 platform, too. The instrument offering of FXORO is satisfactory, yet when compared to RoboForex’s 12,000 available products or ThinkMarkets’ 4,000+ instruments, FXORO, with its approximately 130 products, is far behind them.

At last, the broker offers proper research and education sections, enabling beginner traders access to a wide selection of educational materials. XM, ThinkMarkets, and Blueberry Markets also stand out for their excellent educational resources.

| Parameter |

FXORO |

Blueberry Markets |

RoboForex |

Exness |

XM |

HFM |

ThinkMarkets |

| Spread-Based Account |

From 2 pips |

Average 1 pip |

Average 1.3 pip |

From 0.2 pips |

Average 1.6 pips |

Average 1 pip |

From 0.4 pips |

| Commission-Based Account |

No commissions |

0.0 pips + $3.5 |

0.0 pips + $4 |

0.0 pips + $3.5 |

Only on the Shares Account |

0.0 pips + $3 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Average |

Average |

Low |

Average |

Low/ Average |

Average |

| Trading Platforms |

MT4, Mobile app |

MT4, MT5, Web Trader |

MT4, MT5, R StocksTrader |

MT4, MT5 |

MT4, MT5, XM WebTrader |

MT4, MT5, HFM App |

MT4, MT5, ThinkTrader , TradingView |

| Asset Variety |

130+ instruments |

300+ instruments |

12,000+ instruments |

200+ instruments |

1,000+ Instruments |

500+ instruments |

4000+ instruments |

| Regulation |

CySEC, FSA |

ASIC, VFSC |

FSC |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

CySEC, FSC, DFSA, FSCA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

FCA, ASIC, FSCA, FSA, CySEC, JFSA, CIMA, FSC, DFSA, FMA |

| Customer Support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Excellent |

Good |

Fair |

Excellent |

Good |

Excellent |

| Minimum Deposit |

$100 |

$100 |

$10 |

$10 |

$5 |

$0 |

$50 |

Full Review of Broker FXORO

Based on our research of FXORO, the broker is a reliable and trustworthy option to engage in Forex trading. Due to its CySEC license, the broker follows strict rules and is an efficient and safe broker for European clients. Its FSA regulation ensures the global reach of FXORO.

The broker offers both fixed and floating spreads, with no commissions. The spread type depends on the account chosen. Altogether, FXORO offers average trading fees that mostly align with the market standards. Trades can be conducted on the web, desktop, or app versions of the popular MT4 platform and the broker’s proprietary app. With advanced tools and features, the broker enables a positive experience. FXORO offers an economic calendar, signals, and market news, ensuring informed decisions.

The overall number of available trading instruments is 130, with access to Forex, CFDs, shares, commodities, stocks, indices, cryptos, and ETFs. Although the number of products is modest, the broker also ensures access to real stocks, allowing its clients to engage in real stock trading right from the platform. The good thing about the broker is its extensive educational resources, Trading Central availability, webinars, eBooks, Forex glossary, and courses for beginner and advanced traders.

All in all, FXORO provides services that are suitable for all levels of trading. However, be aware that it runs two entities, and the trading conditions can vary.

Share this article [addtoany url="https://55brokers.com/fxoro-review/" title="FXORO"]

This is completely false information , FXOro is out to cheat people and conduct international fraud. This is bee reported to India cyber crime cell. Please update your findings