- What is FBK Markets?

- FBK Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- FBK Markets Compared to Other Brokers

- Full Review of Broker FBK Markets

Overall Rating 4

| Regulation and Security | 4.2 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.1 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4 / 5 |

| Portfolio and Investment Opportunities | 3 / 5 |

| Account opening | 4.3 / 5 |

| Additional Tools and Features | 3.5 / 5 |

What is FBK Markets?

Established in 2020, FBK Markets is a Forex trading company based in South Africa that provides access to a diverse range of trading products, including Forex, Commodities, Bonds, and Indices.

Based on our research, the firm is an appointed juristic representative of RocketX (Pty), a company duly incorporated under the laws of South Africa. FBK Markets provides its services to clients across Africa and global markets.

Overall, the broker is recognized for its reliability, offering competitive trading conditions and a variety of popular trading instruments through the advanced MetaTrader trading platform.

FBK Markets Pros and Cons

Per our findings, the broker presents both pros and cons that are important to consider. On the positive side, FBK Markets provides competitive trading solutions, a low minimum deposit requirement, and access to the widely recognized MT4 trading platform. Being a South African broker, it is particularly appealing to traders in the African region. Moreover, FBK Markets provides 24/7 live chat support.

For the cons, the broker lacks a top-tier license and operates under a single regulatory body, which could be a drawback for some traders seeking accounts with multiple regulatory authorities. Yet, trading under a South African entity is considered safe enough. Additionally, the broker has a limited range of trading instruments and markets available for traders.

| Advantages | Disadvantages |

|---|

| FSCA regulation | No additional and top-tier license |

| Low minimum deposit | Limited trading products |

| MT4 trading platform | No demo account |

| Good trading conditions | |

| 24/7 live chat support | |

FBK Markets Features

According to our analysis, FBK Markets provides a reliable trading environment with competitive fees, making it an attractive option for traders of all levels. The firm offers access to an advanced MT4 trading platform, which enables users to trade well-known financial instruments. Below is a quick assessment of all the aspects of FBK Markets’ proposal:

FBK Markets Features in 10 Points

| 🗺️ Regulation | FSCA |

| 🗺️ Account Types | Standard, Zero Spread, Bonus 100, ECN, Micro |

| 🖥 Trading Platforms | MT4, Mobile Apps |

| 📉 Trading Instruments | Forex, Commodities, Bonds, and Indices |

| 💳 Minimum deposit | R20≈ $1,06 |

| 💰 Average EUR/USD Spread | 0.5 pips |

| 🎮 Demo Account | No |

| 💰 Account Base currencies | ZAR, USD, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/7 |

Who is FBK Markets For?

FBK Markets delivers regulated services overseen by the respected authority of the South African Financial Sector Conduct Authority (FSCA). Although the broker can be a favorable choice for many, its services are well-suited for the following traders or trading purposes:

- Traders from the African continent

- Traders who prefer the MT4 trading platform

- Currency trading

- Beginners

- Advanced traders

- International traders

- STP execution

- Competitive pricing

- 24/7 customer support

- EA/Auto trading

- Good trading tools

FBK Markets Summary

FBK Markets is a trustworthy Forex trading broker that stands out with competitive pricing, efficient fund withdrawal processes, and accessibility through the popular MT4 platform. However, potential drawbacks include a limited variety of trading instruments, a sole regulatory authority, and a less extensive educational offering.

Overall, we found that the firm provides a reliable trading environment; however, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

FBK Markets’ offering is quite good for traders of various trading styles, those that look for cost effective and competitive fees and commissions, run EAs, prefer MT4 platform and need a Broker who accept clients internationally. As we have found, the range of available instruments is limited, offering tradable products across main paits of Forex, indices, commodities, and bonds. So, those who are looking for more diversity and exposure to the market will feel restricted. The broker’s proposal will also not suit long-term investors interested in stock trading.

The minimum deposit requirement for the Micro account is very low, so almost any individual may start, yet we would advise to check margins well so to cover costs effectively and trade instruments you wish to trade. Trades are conducted on the popular MT4 platform, providing all the advanced tools which is a plus, yet, traders who prefer more advanced or modern platforms, such as MT5 or cTrader, will not be satisfied with the offering so good to check competitors.

All in all, FBK Markets can become a favorable choice for many, especially for traders from the African region, since it holds a license from the well-respected South African authority, FSCA.

Consider Trading with FBK Markets If:

| FBK Markets is an excellent Broker for: | - Traders from the African region

- Beginner traders

- Professional clients

- MT4 platform enthusiasts

- Currency traders

- CFD traders

- Cost-conscious clients

- Traders looking for 24/7 customer support

- Client favoring the FSCA regulation

- Auto traders |

Avoid Trading with FBK Markets If:

| FBK Markets is not the best for: | - Long-term investments

- Clients favoring platforms other that MT4

- Traders looking for diversity

- Clients prioritizing top-tier licenses

- Beginner traders looking for extensive educational resources |

Regulation and Security Measures

Score – 4.2/5

FBK Markets Regulatory Overview

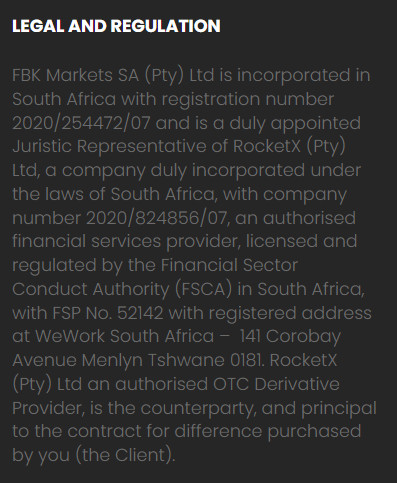

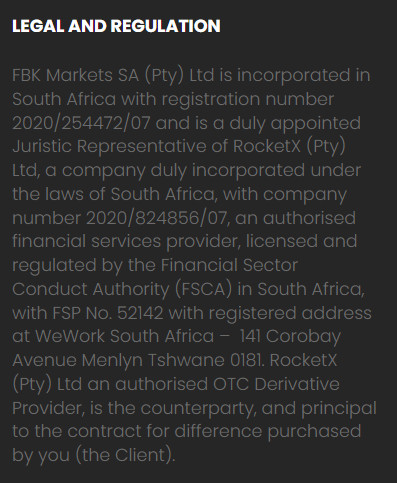

FBK Markets is a regulated broker with fair practices and compliance with stringent rules. Being a duly appointed juristic representative for RocketX (Pty) Ltd. and holding authorization from the FSCA in South Africa implies a notable level of credibility and a commitment to industry standards.

Although FBK Markets is not regulated by a top-tier financial authority, it is a legitimate and regulated broker that complies with the regulatory rules set by the FSCA. The broker’s adherence to rules enhances the safety and confidence of traders who choose to trade with the broker.

How Safe is Trading with FBK Markets?

Based on our analysis, FSCA plays an essential role in enforcing regulatory compliance within the financial services industry, especially for Africa Trading. It ensures the security of clients’ funds by requiring the segregation of funds from company accounts. This prevents the use of client funds for operational purposes, adding an extra layer of protection for clients.

- However, we suggest conducting thorough research, including reading user reviews and considering other factors, to assess the broker’s reputation and legitimacy.

Consistency and Clarity

FBK Markets has been operating since 2020, and from then on, the broker has earned over 200K clients. The broker is a well-respected company in the African region, offering satisfying financial services to a large community of traders. From our research, it is evident that FBK Markets is consistent in its practices and provides good transparency and clarity of conditions.

We have reviewed feedback from the broker’s clients to see what they share. The feedback is mixed, with positive reviews mentioning the broker’s advanced platform and trading tools, dedicated customer support, and low minimum deposit requirement. However, we found negative feedback, too; although small in number, it is still important to pay attention to the concerns customers share.

All in all, FBK Markets is a trustworthy broker that, in the last five years of its operation, has shown its consistency and reliability.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with FBK Markets?

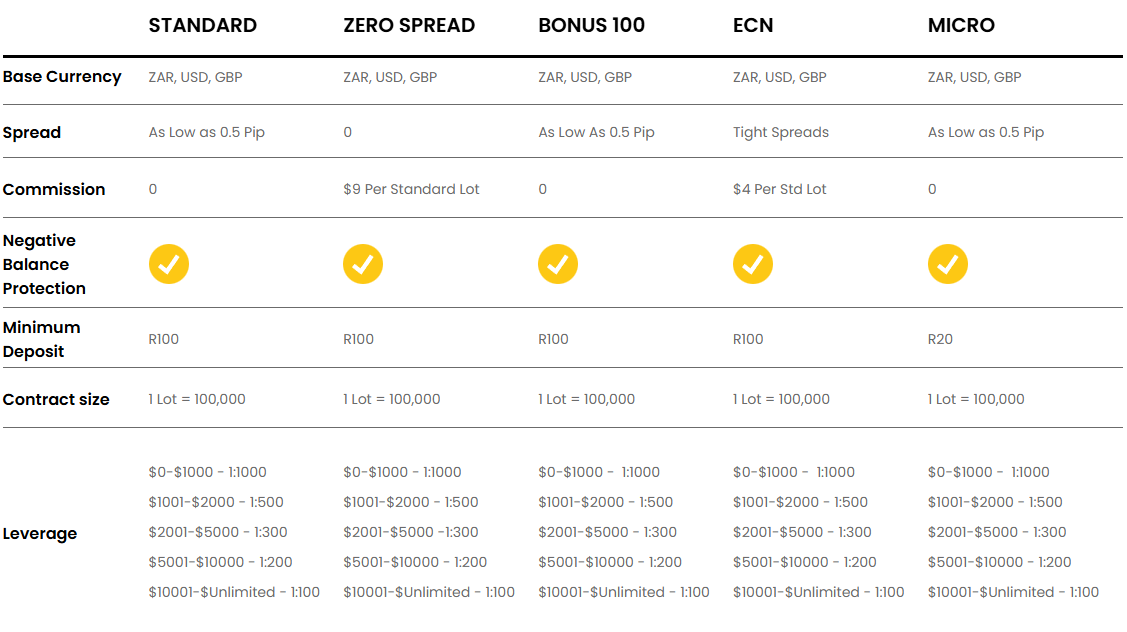

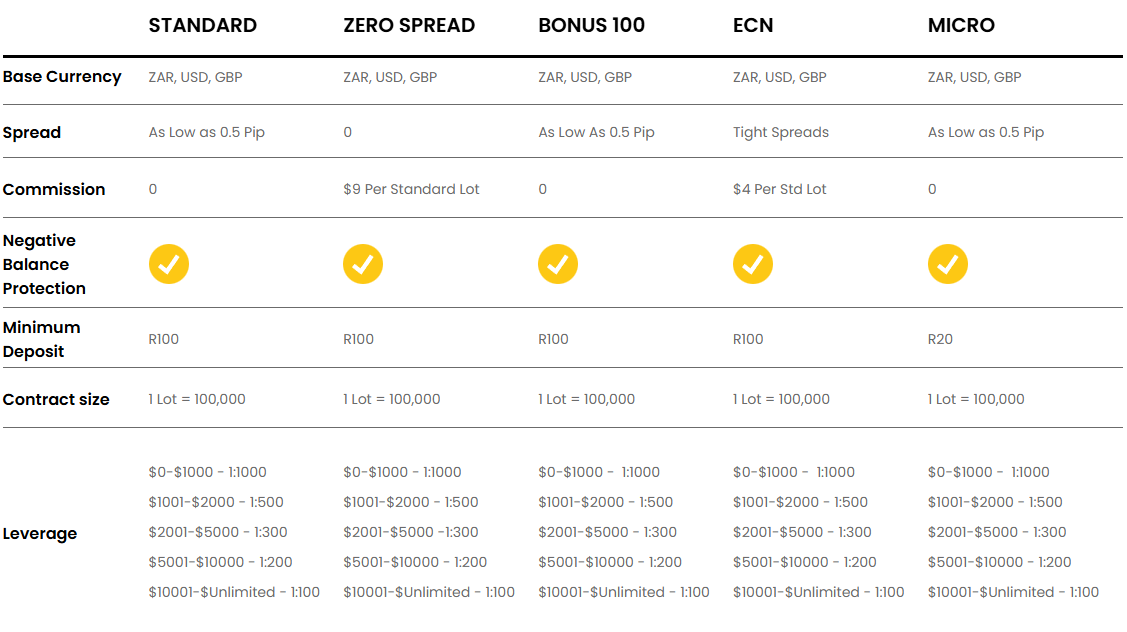

Per our findings, the broker offers Standard, Zero Spread, Bonus 100, ECN, and Micro Account types that might suit the needs of different traders. The initial deposit required for a Micro account is R20, which equals $1,06. For other account types, the minimum deposit amount is R100 ($5.55). All the account types enable up to 1:1000 leverage, based on the trading volume.

The broker’s account types are either spread-based or commission-based, meeting the needs of different clients with different structure preferences.

- Standard, Bonus 100, and Micro accounts are spread-based, including all the trading costs in spreads. The average spread for the spread-based accounts is 0.5 pips. The Micro account is a good choice for those who want to start small and with minimal risk.

- The commission-based accounts are Zero Spread and ECN accounts. The ECN account suggests lower fixed commissions of $2, while commissions for the Zero Spread account are higher.

Regions Where FBK Markets is Restricted

As FBK Markets is regulated by the South African FSCA, it complies with the rules imposed by the authority. This also applies to certain restrictions regarding some regions.

Here is the list of countries where the broker does not offer its services due to regulatory restrictions:

- The USA

- North Kores

- Belarus

- Malawi

- Cuba

- Syria

- Iran

- Angola

Cost Structure and Fees

Score – 4.3/5

FBK Markets Brokerage Fees

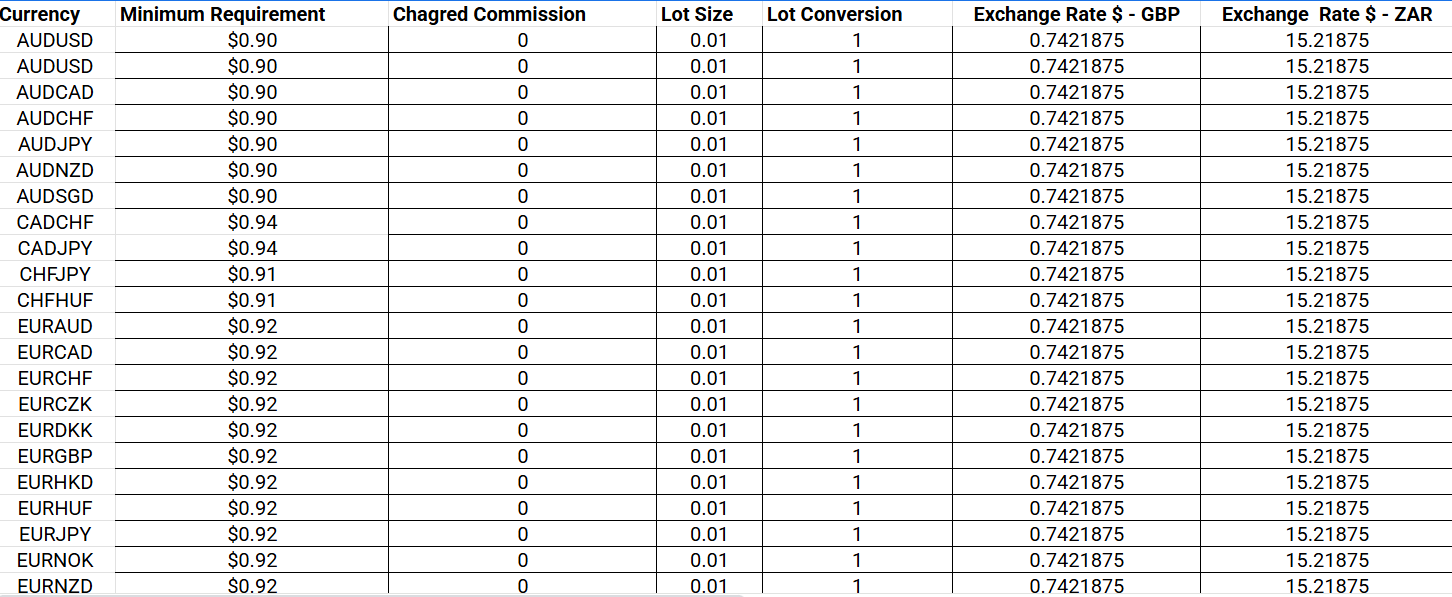

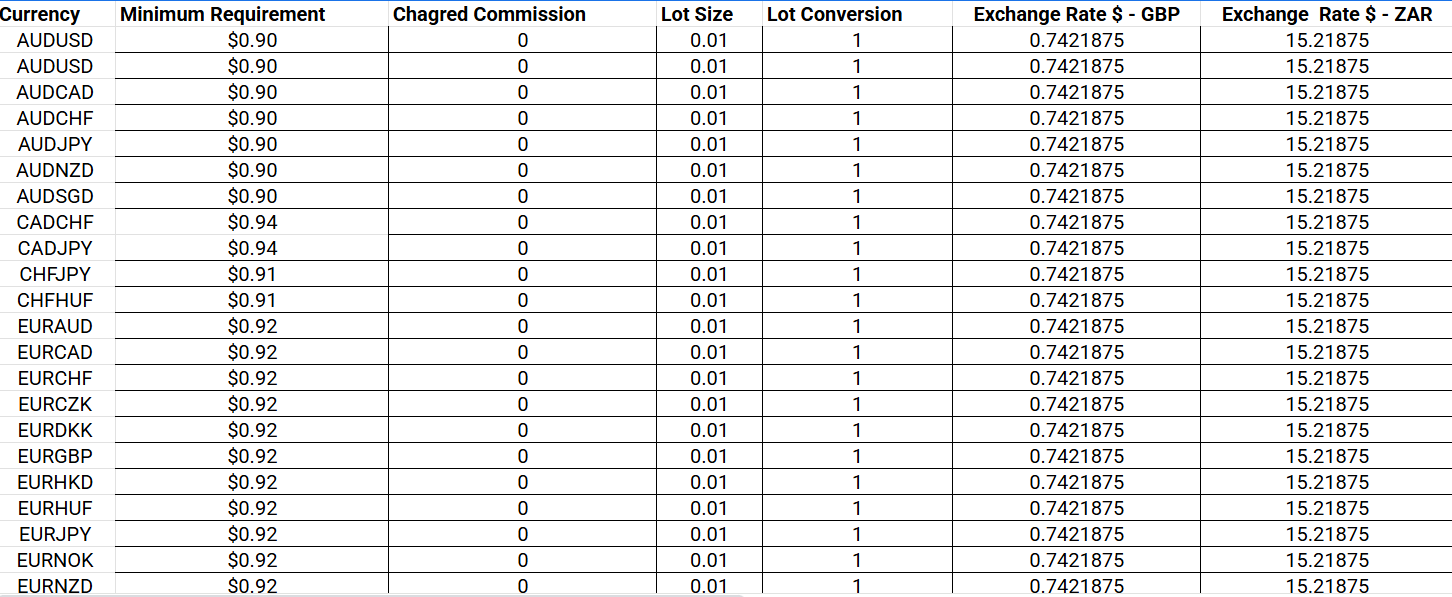

After examining the broker’s fee offering, we found that FBK Markets offers competitive pricing for most of its trading services. We found that the broker imposes a minimum deposit requirement of R100 for its funding methods, and additional fees may be applicable during trading activities as well.

The trading fees of the broker are applied either via spreads or commissions based on the account type chosen. Generally, the fees applied are average or lower than the market standard.

Based on our test trade, the broker provides competitive spreads, with an average spread of 0.5 pips for the EUR/USD currency pair in the Forex market. However, spreads can vary based on market conditions, volatility, and liquidity, so consult the broker’s website or contact their customer support for detailed information on the spreads they offer for specific instruments and account types.

The broker applies commissions for two of its account types, Zero Spread and ECN. For the Zero Spread account, the broker applies commissions of $9 per lot, combined with zero spreads. For the ECN account, there is a fixed transaction fee of $4 with very tight spreads.

How Competitive Are FBK Markets’ Fees?

FBK Markets offers competitive fees based on the account types. Each account has a different fee solution, enabling clients to choose the most suitable option for their trading aspirations. The broker’s spread-based accounts offer an average spread of 0.5 pips, with no commissions, as all the fees are included in spreads. This makes the broker’s fees lower than the market average, offering traders a cost-efficient trading opportunity. The commission-based options are also beneficial for clients looking for fixed transaction fees for each trade. While spreads are based on the instrument traded, commissions are fixed and applied to each trade.

All in all, FBK Markets’ trading charges are transparent and competitive, providing traders with clarity and availability. However, before engaging with the broker, we recommend checking all the applicable costs and non-trading fees.

| Asset/ Pair | FBK Markets Spread | RCG Markets Spread | ThinkMarkets Spread |

|---|

| EUR USD Spread | 0.5 pips | 1 pips | 1.1 pips |

| Crude Oil WTI Spread | 3 | 3 | 0.03 |

| Gold Spread | 1 | 1 | 19 cents |

FBK Markets Additional Fees

Based on our findings, the broker does not apply deposit or withdrawal fees. In regard to the inactivity fee, the broker only mentions that all the accounts that have been inactive for 90 days will be archived. If there is a remaining balance on the account, the broker will reserve the right to deduct the money.

Score – 4.1/5

Traders have the advantage of accessing the well-known MetaTrader 4 while trading at FBK Markets. This platform is highly acclaimed in the industry for its robust features, user-friendly interfaces, advanced charting tools, and extensive trading capabilities.

Additionally, the broker provides mobile trading platforms compatible with both IOS and Android devices.

| Platforms | FBK Markets Platforms | RCG Markets Platforms | WelTrade Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | No | No | No |

| Mobile Apps | Yes | Yes | Yes |

FBK Markets Web Platform

FBK Markets’ web platform enables easy access to the broker’s MT4 web platform without the need for installation and downloads. The platform includes all the essential tools for efficient trading, with advanced charting capabilities and in-depth research. All in all, the platform offers good functionality, access to order types, various timeframes, and more. However, there is no EA support, and some features of the desktop platform might be unavailable.

FBK Markets Desktop MetaTrader 4 Platform

We found that the FBK Markets platform provides a variety of charting tools, various timeframes, trading signals, technical indicators, and additional features. Additionally, MT4 includes automated trading functionality, allowing traders to detect market movements and refine their strategies for market entry and stop-loss. The platform’s interface is simple and easy to use, allowing traders of every level to benefit from simple yet efficient trading.

FBK Markets Desktop MetaTrader 5 Platform

FBK Markets does not allow trading through the advanced MT5 platform. Although the broker’s MT4 platform includes great tools and trading capabilities, traders looking for more innovative solutions, faster executions, and a more professional approach may find the MT4 platform slightly outdated.

FBK Markets MobileTrader App

FBK Markets understands the importance for traders of easy access to their accounts. The broker’s mobile app is a perfect solution for traders on the go who want to stay informed about trading and capitalize on market changes. The mobile app offers a range of great features and tools, enabling its users to conduct in-depth research, access charts and graphs, view multiple timeframes, utilize risk management tools, and more.

Main Insights from Testing

After careful consideration, we can say that the broker’s MT4 platform is a favorable choice for almost any trader, regardless of their experience. The platform is available via web, desktop, and mobile, ensuring easy access to the accounts. However, those traders who prefer a better variety of platforms and access to more innovative and diverse tools will likely look for a broker with a better platform selection.

Trading Instruments

Score – 4.4/5

What Can You Trade on the FBK Markets Platform?

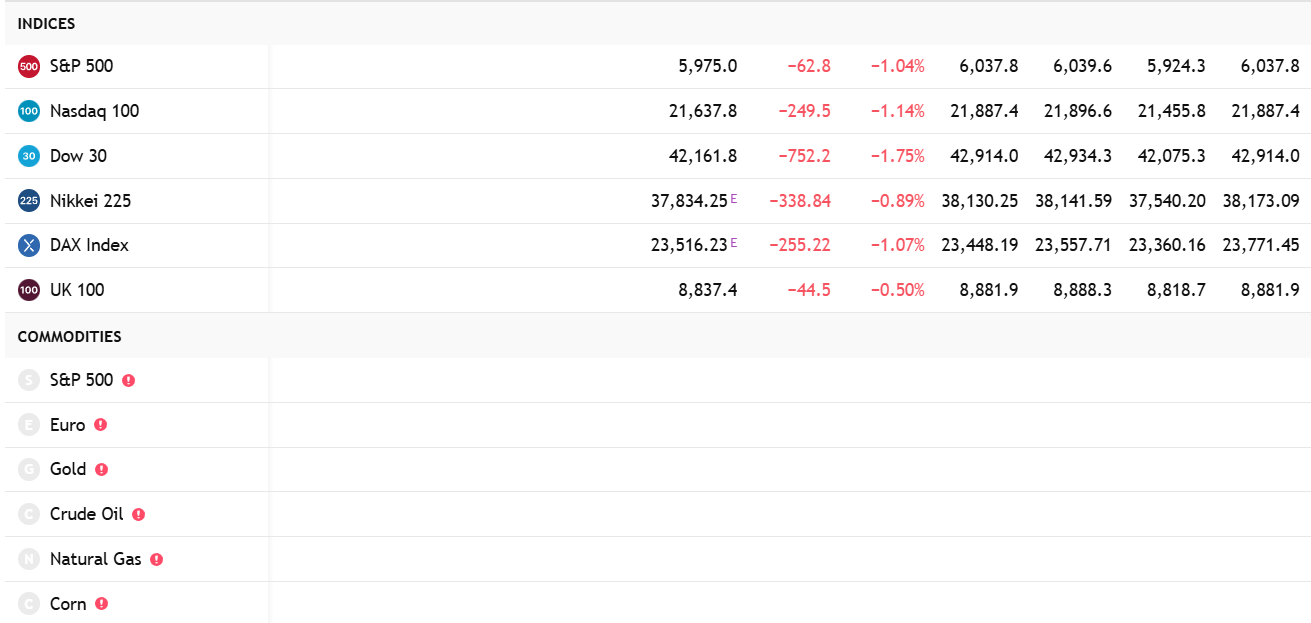

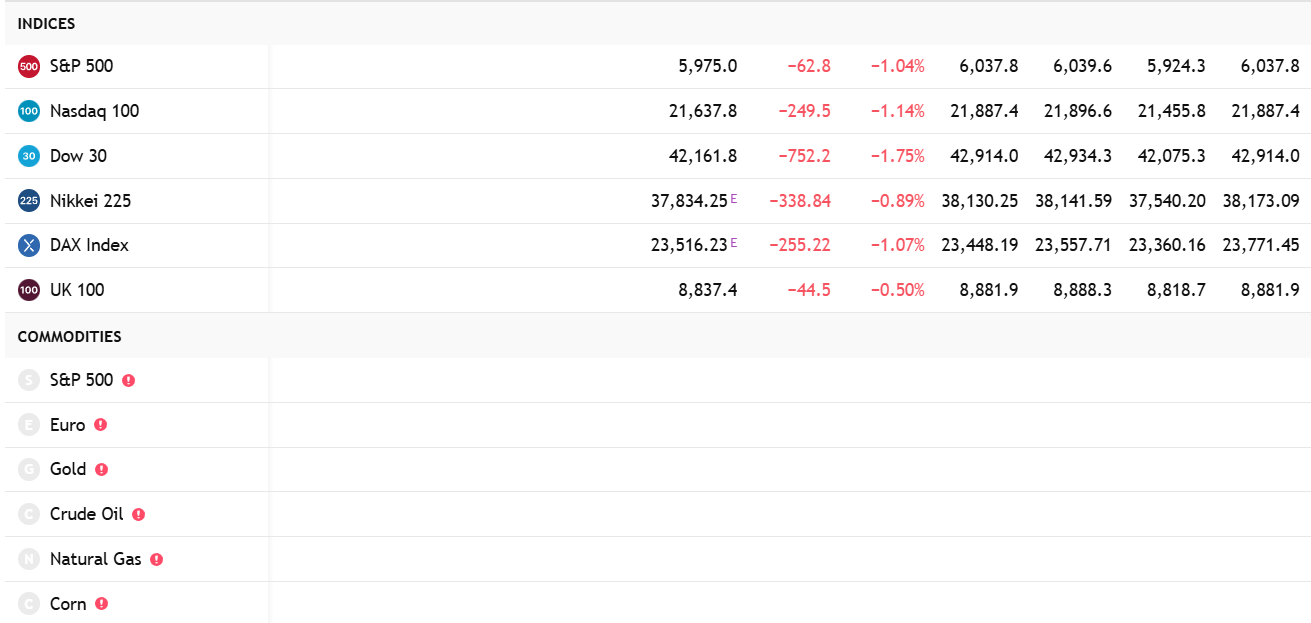

FBK Markets provides access to popular trading instruments, such as Forex, Commodities, Bonds, Indices, and more. We found that the firm enables traders to diversify their portfolios and participate in various markets according to their individual needs and trading strategies.

However, the broker does not offer opportunities for traditional investments, limiting the chances for traders interested in long-term trading or the ownership of real stocks.

Main Insights from Exploring FBK Markets Tradable Assets

Based on our research, FBK Markets offers all the popular instruments for traders who want to engage in the trading of the most demanded tradable products. However, the overall number of the broker’s available instruments is limited, only 22 in total.

FBK Markets offers only the 6 most popular currency pairs (EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, and USD/CAD). Traders also have access to popular indices, such as the Nasdaq 100, Dow 30, S&P 500, UK 100, and more. With the broker, clients can trade commodities like gold, crude oil, natural gas, and corn. At last, traders have access to a few popular bonds, including T-bonds, ultra T-bonds, Euro Bunds, etc.

Although FBK Markets does not provide a good diversity of instruments and is not the best choice to expand portfolios, it still offers the most popular financial products with competitive trading conditions and cost-effective solutions.

Leverage Options at FBK Markets

Using leverage in trading can be beneficial as it allows traders to access the market with a smaller capital investment. However, it can also work in another way and cause not only gains but also losses. Therefore, it is important to have a thorough understanding of how leverage works and the potential consequences it can cause.

FBK Markets’ leverage is offered according to the FSCA regulation:

- Trades from South Africa are eligible to use low leverage up to 1:30 for major currency pairs.

- However, the website states the potential for higher leverage of up to 1:1000, so understanding the implications and risks associated with leverage is crucial before making decisions about its use in trading.

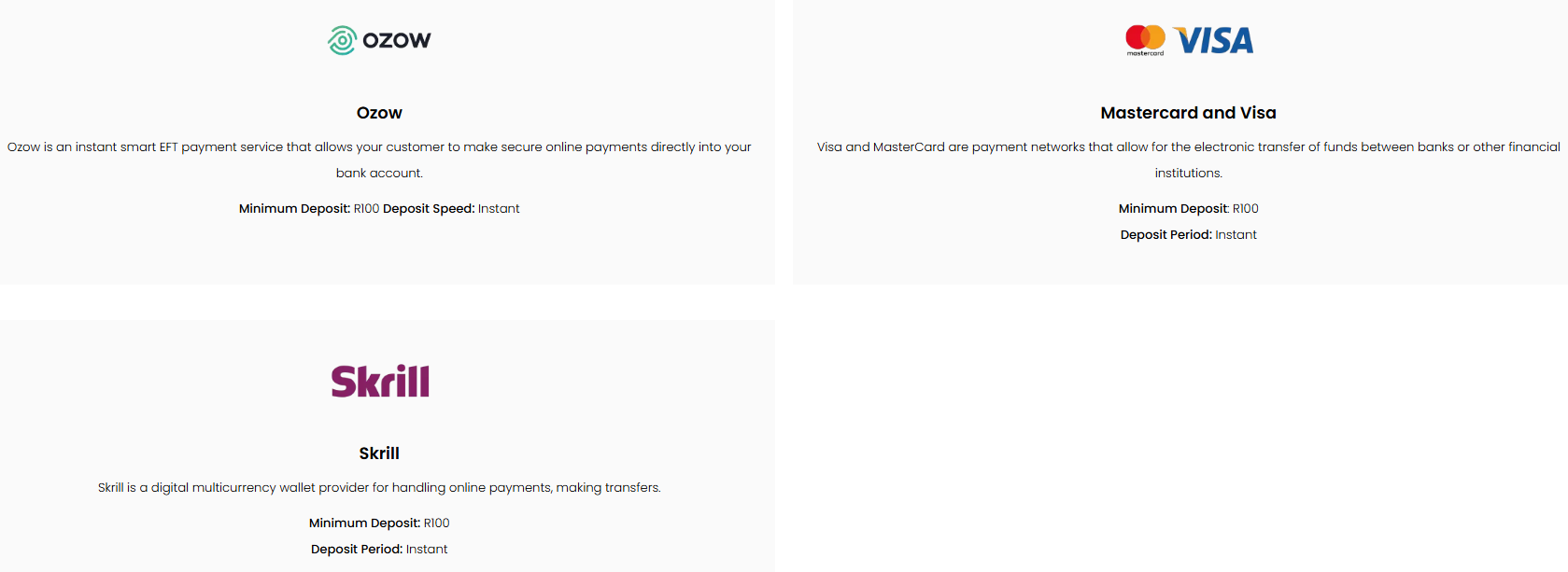

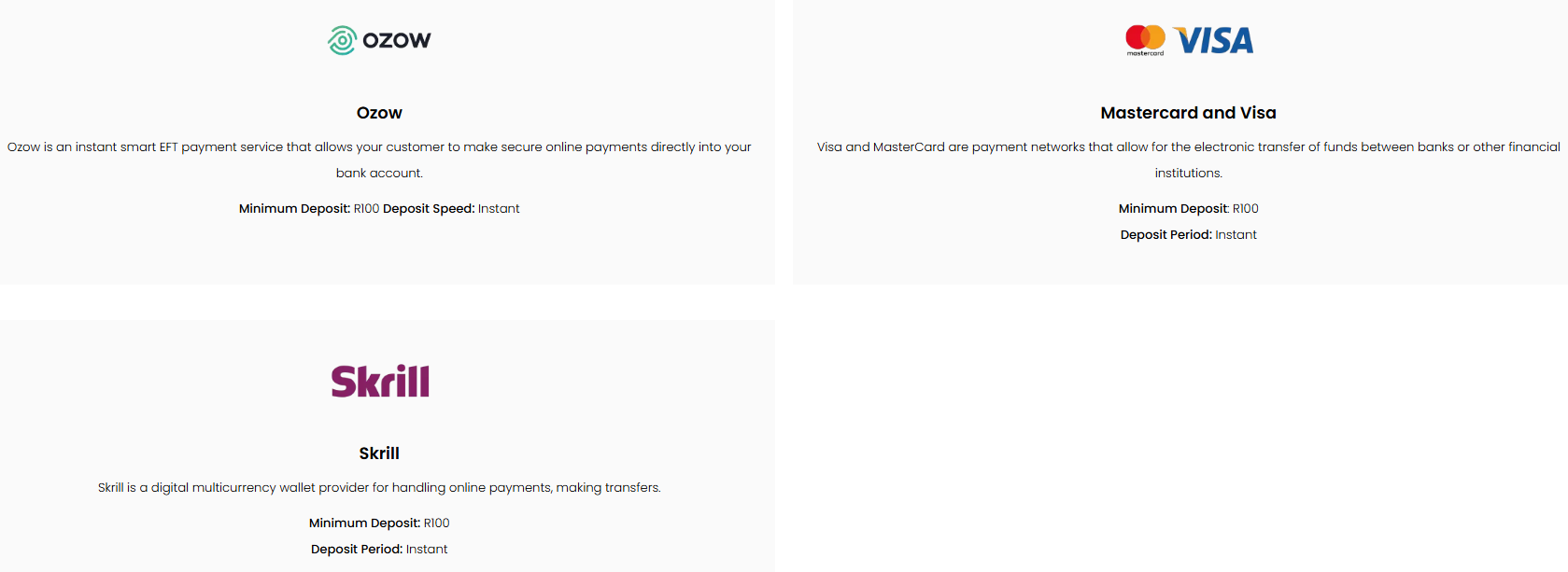

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at FBK Markets

FBK Markets offers a few options for traders to instantly deposit funds into their trading accounts, including Visa and MasterCard, Skrill, Virtual Pay, and Ozow. However, certain funding methods may have specific requirements based on the client’s bank or other financial institutions involved.

Minimum Deposit

To open a live trading account with the broker, clients need to deposit $1.06 as an initial deposit amount for Micro accounts, while for other account types, the minimum deposit is $5.55, which is considered a good offering.

Withdrawal Options at FBK Markets

We found that the process of withdrawing funds from your account is simple and swift, taking up to 48 working hours for processing. The minimum withdrawal requirement is R100, which equals $5.55. On the other hand, there is no maximum withdrawal amount; however, the broker reserves the right to impose withdrawal limits or withdrawal fees at its discretion. Traders can process only one withdrawal at a time.

Customer Support and Responsiveness

Score – 4.5/5

Testing FBK Markets Customer Support

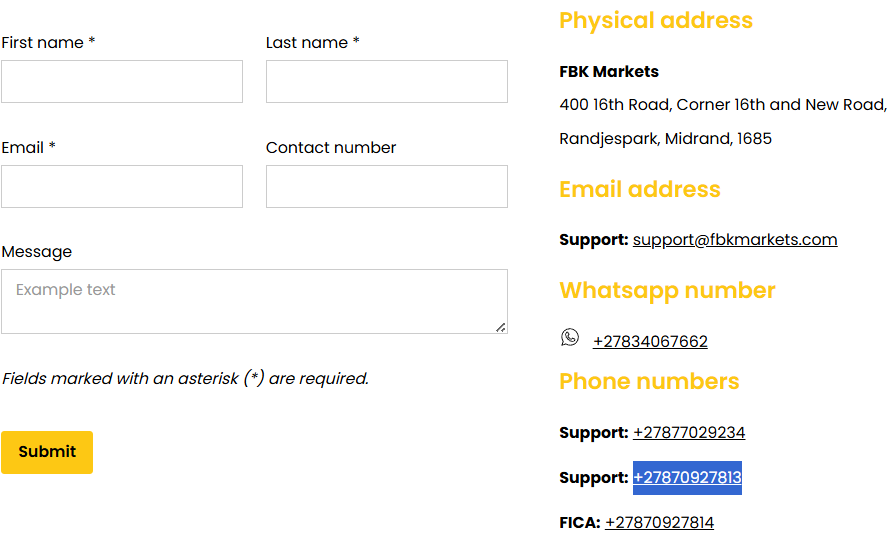

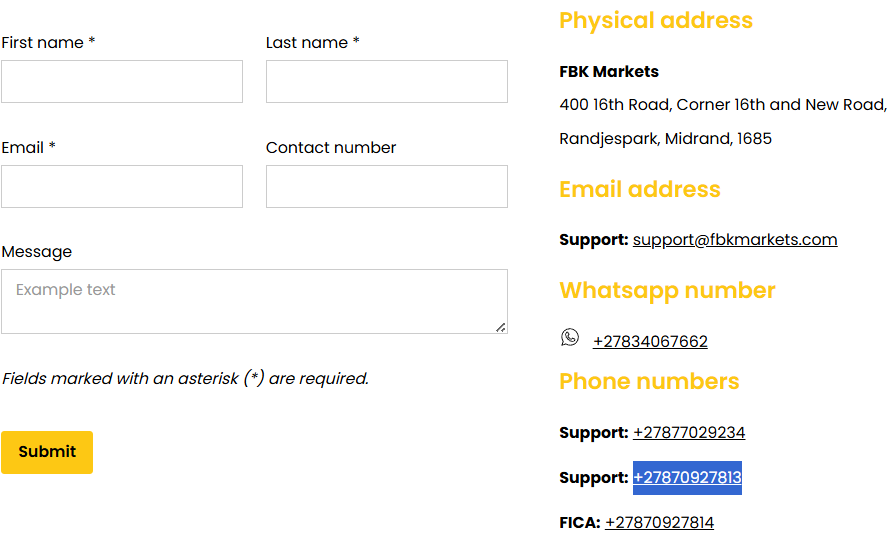

The broker offers 24/7 customer support via live chat, email, phone, WhatsApp, and social media channels. Additionally, it has a physical address staffed by trading experts who are available to assist with technical support, analysis recommendations, general inquiries, and operational issues.

- The broker also includes an FAQ section, which offers answers and solutions to the most common and frequently asked questions and issues.

Contacts FBK Markets

The fact that FBK Markets provides 24/7 customer support makes the broker a favorable choice, especially for beginner traders who need support and guidance. The broker offers the following support options:

- FBK Markets Live chat is the quickest and most efficient way to find answers and solutions to trading-related problems.

- The broker offers an Inquiry form, and traders can fill out the form right from the website and send their concerns, questions, or suggestions to the broker’s support team.

- An email is another option to communicate with the broker’s support team. Clients can use the following email addresses: support@fbkmarkets.com.

- Traders can also contact the support team via WhatsApp by using the provided number: +27834067662.

- Those who prefer direct contact via phone line are free to use one of the provided numbers: +27877029234 or +27870927813.

- Besides, FBK Markets is active on social media, providing updated news and market information via X or Instagram.

Research and Education

Score – 4/5

Research Tools FBK Markets

FBK Markets’ research tools are available on its MT4 platform, providing clients with helpful and efficient analysis and charting capabilities to conduct in-depth market research and make informed decisions. However, there are a few additional research tools outside of the broker’s platform, which might limit traders’ research opportunities.

- The broker provides a Margin Calculator and a Micro Account Margin Calculator that can be used to calculate margins for specific instruments, different trade sizes, and leverage ratios.

Education

FBK Markets offers Video courses right from its platform. While the broker provides learning materials through Videos, it lacks in offering seminars and webinars. For traders seeking more comprehensive educational resources, we suggest exploring other brokers that provide a broader range of learning opportunities.

- However, we learned that the broker has a separate FBK Online Services page, where traders can access eBooks, free mentorship, trading sessions, one-minute trading strategies, etc.

Is FBK Markets a Good Broker for Beginners?

FBK Markets offers financial services suitable for different traders, from beginners to professionals. Due to the broker’s good selection of account types, traders can choose the most favorable option for their trading expectations. Moreover, the broker’s MT4 platform offers an easy-to-use interface, good tools and features, and flawless navigation. Although the broker does not offer a demo account, its Micro account enables novice traders to trade cost-efficiently with a minimum deposit of about $1.06. Besides, the deposit requirement for all other account types is also very low, only $5.55. At last, traders have access to video courses, eBooks, and free mentorship through the broker’s educational program.

Portfolio and Investment Opportunities

Score – 3 /5

Investment Options FBK Markets

As our research revealed, FBK Markets offers a small number of trading instruments (22 in total), and all the tradable products are based on CFDs. This means that traders cannot own the asset and can only profit from speculating on price movements. Thus, traditional investments are not possible with the broker.

- We have also found that currently, the broker does not offer any alternative investment options, such as copy trading or PAMM and MAM features.

Account Opening

Score – 4.3/5

How to Open an FBK Markets Demo Account?

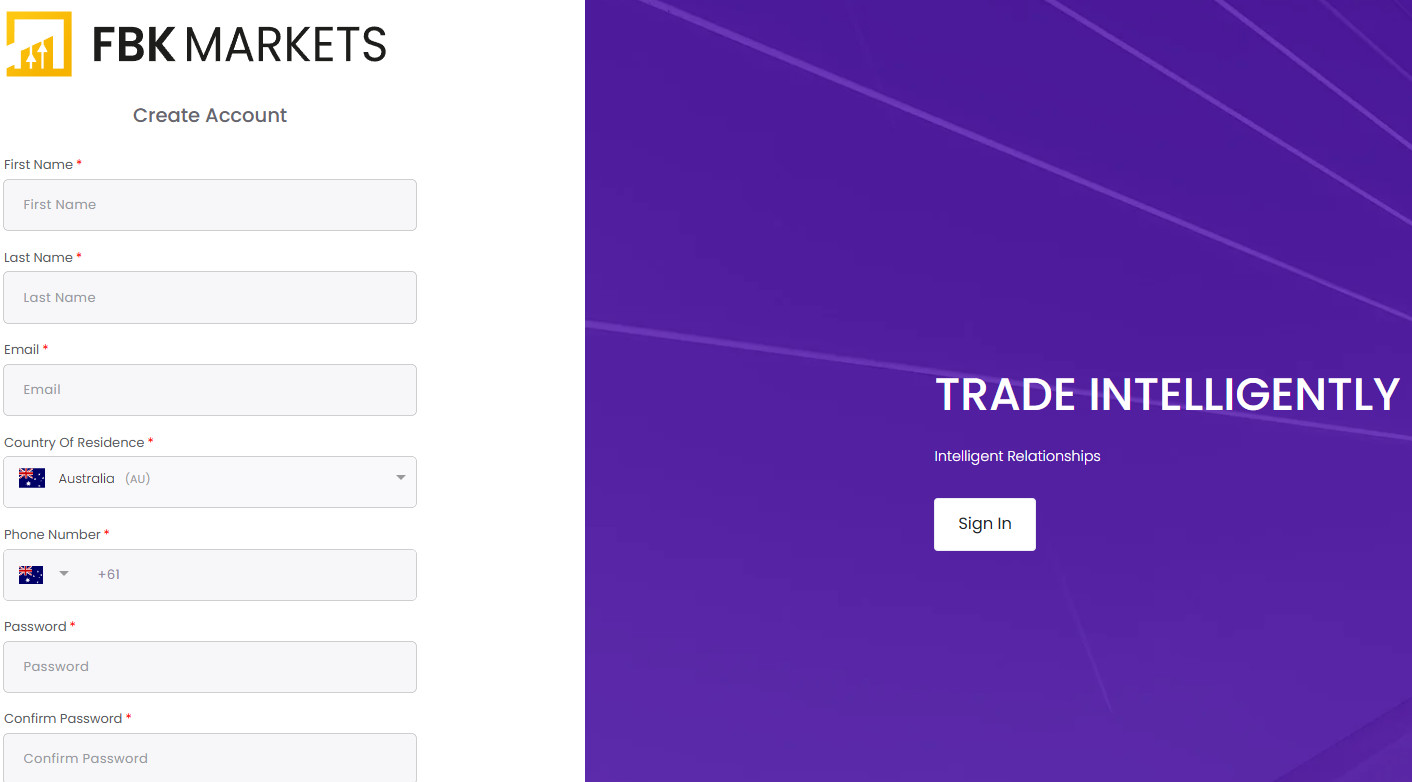

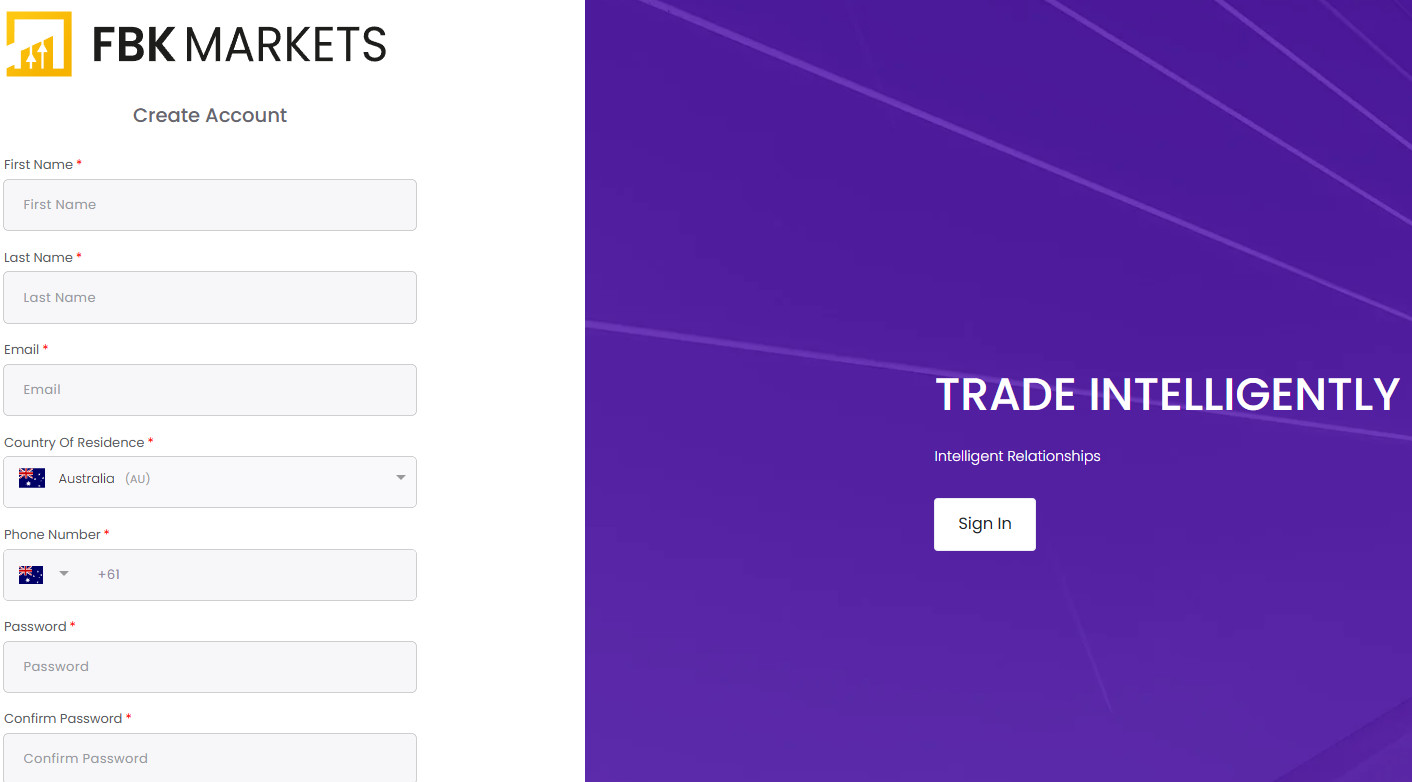

Based on our findings, FBK Markets does not offer a demo account. Instead, it offers a micro account with a very low deposit requirement and favorable conditions for novice traders to trade with minimum risk. However, the absence of a demo account is still a disadvantage for many traders who prefer to practice and test new strategies before switching to live trading.

How to Open an FBK Markets Live Account?

Opening an account with the broker is easy and quick, as the registration process can be completed within minutes. Traders need to access the account opening page and proceed with the guided steps:

- Select and click on the “Start Trading” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Score – 3.5/5

Based on our research, FBK Markets’ trading features and conditions are available on the broker’s platform, ensuring trading through advanced features and analysis capabilities. As to additional opportunities, the broker offers a 100% deposit bonus.

- Upon the first deposit, clients get a 100% deposit bonus. Traders cannot use the deposit bonus without a positive balance on their accounts. Besides, the bonus cannot be transferred to another account or be withdrawn. Clients are eligible to withdraw only the profits from using the bonus.

FBK Markets Compared to Other Brokers

At last, we have compared FBK Markets to other respected firms offering similar services. As we found, FBK Markets is regulated by the FSCA, providing regulated and reliable services to its clients. Admirals are also regulated by FSCA; however, it holds top-tier licenses from ASIC and FCA, offering better safety measures. The broker’s fees are competitive, mostly low or average. With its average spread of 0.5 pips, it is lower than FP Markets’ and HFM’s average of 1 pip.

Regarding the broker’s available platforms, FBK Markets offers the popular MT4 platform via web, desktop, and mobile apps. Although the MT4 platform is a favorable trading solution, Pepperstone and FP Markets provide different platforms to choose from. Besides, FBK Markets offers a small number of trading instruments (only 22), whereas CapTrader, in comparison, offers a striking number of 12 million tradable products, which is not even comparable.

One of the advantages of FBK Markets is its 24/7 customer support, which even well-respected brokers, such as HFM or CapTrader, do not provide. However, the education section of the broker is less extensive when compared to Pepperstone or Admirals. Also, the broker does not provide a demo account, something all the other brokers we compared to FBK Markets do. Yet, FBK Markets offers a Micro account with a very low initial deposit of $1.06, which is much lower than CapTrader’s $2,000.

| Parameter |

FBK Markets |

Pepperstone |

Admirals |

Exness |

FP Markets |

HFM |

CapTrader |

| Spread-Based Account |

From 0.5 pips |

From 1 pip |

From 0.6 pips (0.02 commissions for Share and ETF CFDs) |

From 0.2 pips |

From 1 pip |

Average 1 pip |

Average 0.1 pip |

| Commission-Based Account |

0.0 pips + from $2 to $4.5 based on the account type |

0.0 pips + $3.5 |

0.0 pips + from $0.02 to $3.0 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + $3 |

0.1 pips + from $1 to $8 based on the instrument |

| Fees Ranking |

Low/Average |

Low/Average |

Low/Average |

Low |

Low/ Average |

Low/ Average |

Low/Average |

| Trading Platforms |

MT4, Mobile App |

MT4, MT5, cTrader, TradingView |

MT4, MT5, Admiral Markets app |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, HFM App |

Trader Workstation TWS, TradingView, AgenaTrader, Mobile App |

| Asset Variety |

22 instruments |

Over 1,200 instruments |

8000+ instruments |

200+ instruments |

10,000+ instruments |

500+ instruments |

12 million instruments |

| Regulation |

FSCA |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

BaFin |

| Customer Support |

24/7 support |

24/7 |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Good |

Excellent education and research |

Excellent |

Fair |

Excellent |

Good |

Excellent |

| Minimum Deposit |

$1,06 |

$0 |

$1 |

$10 |

$100 |

$0 |

$2000 |

Full Review of Broker FBK Markets

We have researched all the aspects of trading with FBK Markets and concluded that the broker offers regulated and reliable services, adhering to the South African FSCA laws and guidelines. The broker is a favorable choice not only for clients from the African region but also for traders from all over the world.

FBK Markets offers competitive trading conditions, with low spreads from 0.5 pips and reasonable commissions that vary based on the account type. The broker offers various account types, meeting the needs of different traders, from beginners to professionals. However, the broker’s instrument selection is limited, disabling clients from diversifying their portfolios and exploring the market further. The broker offers the market-popular MT4 platform via web, desktop, or mobile app.

However, FBK Markets does not provide long-term investment opportunities, as all the products are on CFDs. Besides, there are no alternative investment options, such as Copy trading, or access to PAMM or MAM accounts.

The minimum deposit requirement is very low for the Micro account, only $1.06, and for all the other accounts, $5.55, which is considered a very low and favorable proposal. Also, FBK Markets does not have a demo account, which can be a disadvantage for many.

Share this article [addtoany url="https://55brokers.com/fbk-markets-review/" title="FBK Markets"]