- What is Rakuten Securities?

- Rakuten Securities Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Rakuten Securities Compared to Other Brokers

- Full Review of Broker Rakuten Securities

Overall Rating 4.3

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.2 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 3.9 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is Rakuten?

Rakuten Securities is an online broker that provides financial derivatives such as margin Forex and CFD. It is headquartered in Japan with subsidiaries in HK, and Malaysia.

- Rakuten is one of the leading internet services companies with businesses in e-commerce, travel, banking, securities, e-money, marketing, and more.

- Rakuten Group is expanding globally and currently performs operations throughout Asia, Europe, the Americas, and Oceania.

The company headquarters is located in Tokyo, Japan while branching out into Hong Kong, and Malaysia. While the financial services Rakuten Securities launched in 1999 since then it has grown into a large brokerage firm with a comprehensive range of financial opportunities and available assets.

Is Rakuten a Good Broker?

Ever since until now, Rakuten has been one of the major online brokers in Japan and across Asia servicing over 2.6 million clients. Also, the company continuously enhances its structure and includes even more possibilities to offer and greater options for investors, which is always a benefit.

Rakuten Pros and Cons

Rakuten has a long years of operation and an excellent reputation. It is a globally recognized and awarded broker and provides proprietary Rakuten FX Webr, MARKETSPEED FX, and iSPEED FX platforms with excellent support, learning, and research tools suitable for beginners and professionals.

For Cons, conditions, and trading offering itself may vary according to regulation and entity. Also, the range of instruments is limited to FX and CFDs.

| Advantages | Disadvantages |

|---|

| Long years of operation and excellent reputation | Conditions may vary according to regulation and entity |

| Globally recognized and awarded broker | No 24/7 support |

| Proprietary trading platforms | Limited trading instruments |

| Excellent support and research tools | No Top-Tier license |

| Good learning materials | |

| Suitable for beginners and professionals | |

Rakuten Features

Rakuten Securities is a leading online brokerage offering a range of services with a strong presence in Asia. The key features are summarized in 10 points, covering aspects like Account Types, Instruments, available Platforms, and more.

Rakuten Securities Features in 10 Points

| 🏢 Regulation | SFC, SCM |

| 🗺️ Account Types | Individual Forex, Corporate Accounts |

| 🖥 Trading Platforms | Rakuten FX Webr, MARKETSPEED FX, iSPEED FX |

| 📉 Trading Instruments | Forex, Equities, Derivatives, Commodities, Bonds, ETF, CFDs, Investment Trusts |

| 💳 Minimum Deposit | HK$0 |

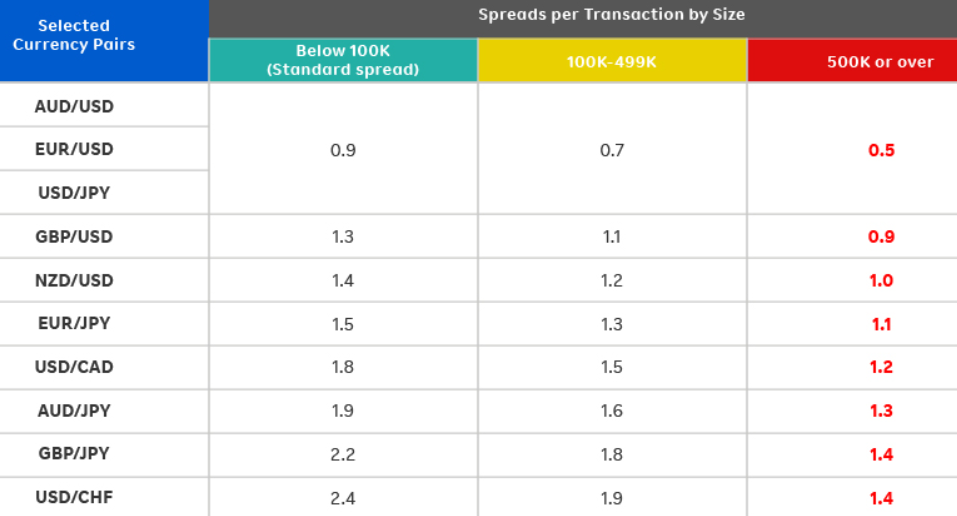

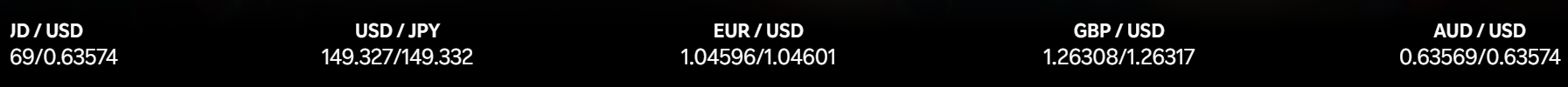

| 💰 Average EUR/USD Spread | 0.5 pips |

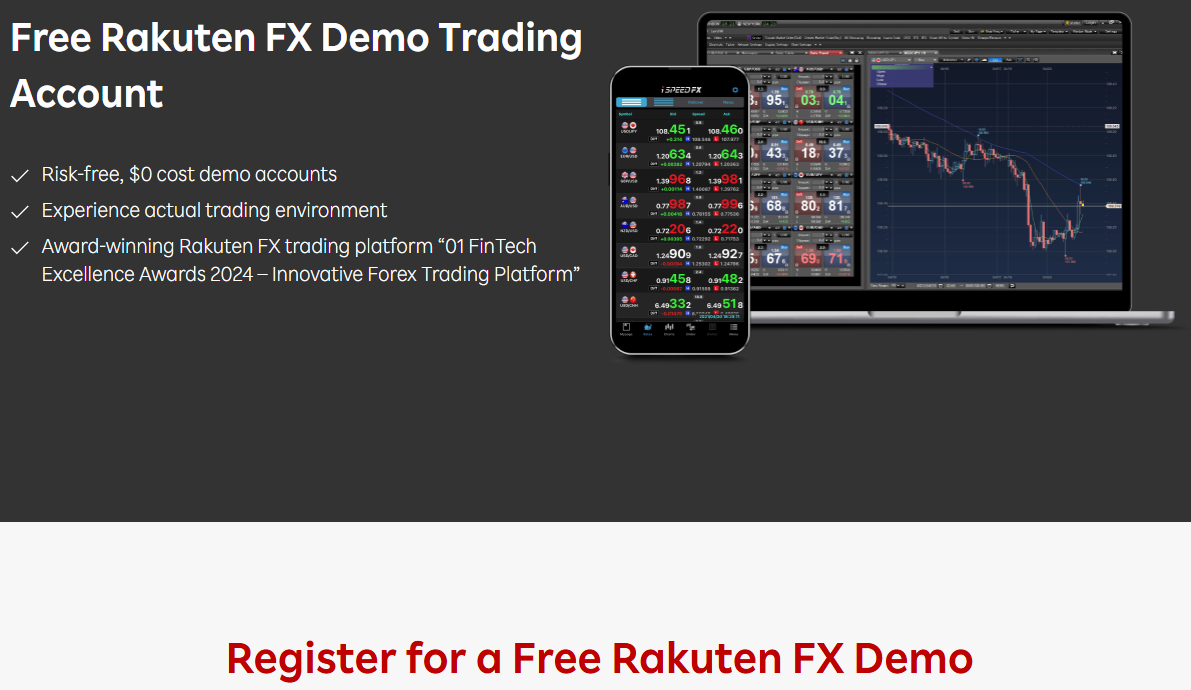

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, HKD |

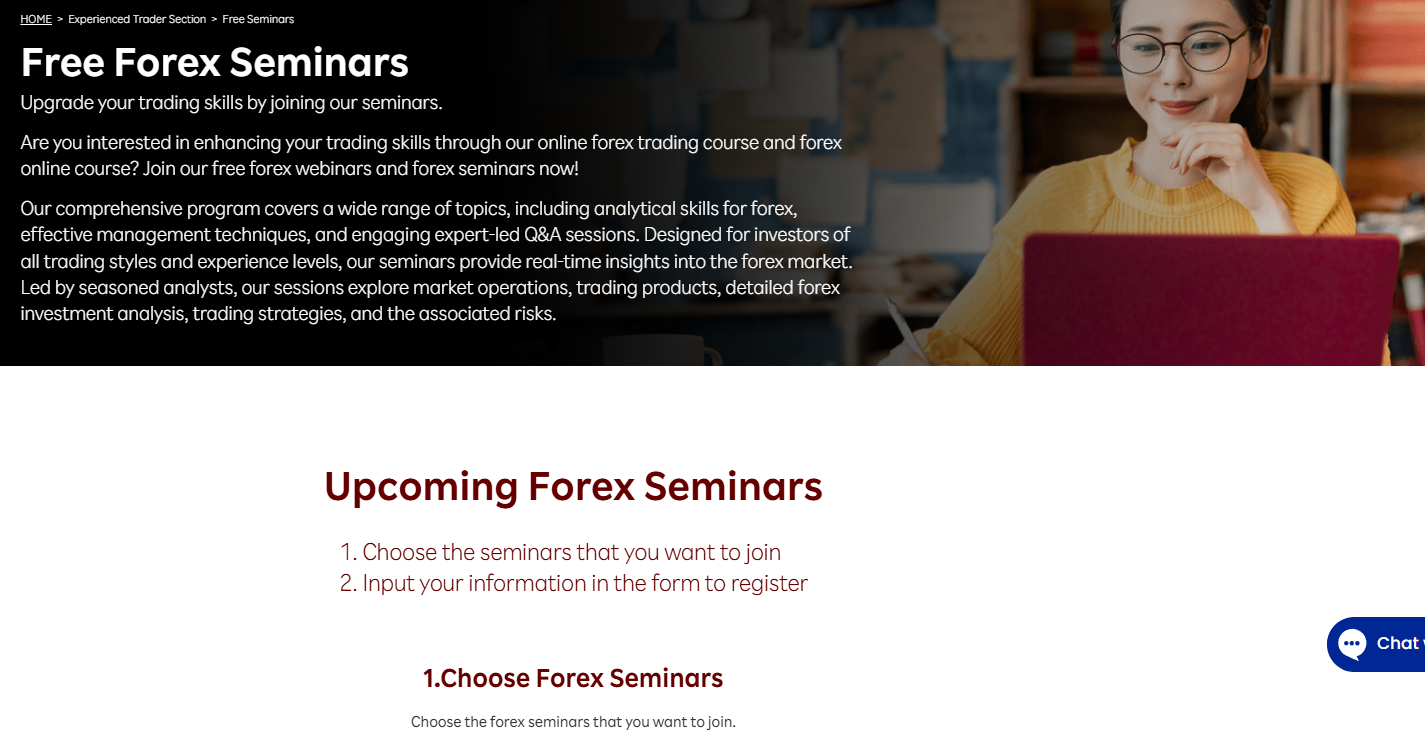

| 📚 Trading Education | FX Academy, Free Seminars, Market Insight |

| ☎ Customer Support | 24/5 |

Who is Rakuten For?

Rakuten Securities is suited for traders of all experience levels, from beginners to seasoned professionals. Its user-friendly platforms and competitive pricing make it an excellent choice for those looking to trade Forex and bullion. With a focus on simplicity, security, and customer support, the broker caters to individuals who want a seamless and reliable experience, whether they are just starting or have a more advanced strategy.

- Professional Traders

- Advanced traders

- Beginners

- Investment

- Traders who prefer proprietary platforms

- Currency and CFD Trading

- Running various Strategies

- Excellent Research and Education

- Copy Trading

- Quality customer support

Rakuten Summary

Our final thoughts on Rakuten Review are good, the broker provides professional services, while constantly improving its offering. The overall proposal to the investors and traders is indeed very comprehensive by the fixed or floating spreads, platforms, and availability of progressive tools.

All in all, Rakuten is a reliable and very attractive broker to trade with. The only thing you should be attentive to is checking the relevant information based on the client’s country of residence and the branch under which they will be trading, as the conditions may vary slightly.

55Brokers Professional Insights

Rakuten Securities is a well-established online broker offering competitive conditions and is a good choice for Pro traders and Trent Traders, especially from Asia region including Malaysia Trading. One of the standout features is its user-friendly Rakuten FX web platform, providing tight spreads and advanced tools great for any startegy. Additionally, it offers access to mobile trading through the iSPEED FX app, and MARKETSPEED FX desktop platform, enhancing flexibility.

However, a significant downside is that Rakuten Securities is no longer authorized by the Australian ASIC, limiting its availability for Australian clients. While the broker provides a reliable and secure environment, potential clients should carefully review the specific conditions based on their region, as these can differ depending on the branch they trade with.

Consider Trading with Rakuten If:

| Rakuten Securities is an excellent Broker for: | - Providing competitive fees and spreads.

- Beginners and professional traders.

- Need a broker with good education and research tools.

- Providing both fixed and floating spreads.

- Traders from Asia.

- Access to VPS hosting.

- Providing Copy Trading.

- Offering popular instruments.

- Need a broker with a long history.

- Offering low leverage up to 1:20. |

Avoid Trading with Rakuten If:

| Rakuten Securities might not be the best for: | - Looking for broker with 24/7 customer support.

- Who prefer to trade with industry-popular platforms.

- Who look for MAM/PAMM trading.

- Need a broker authorized by Top-Tier authorities.

|

Regulation and Security Measures

Score – 4.3/5

Rakuten Regulatory Overview

Rakuten Securities operates under the regulatory oversight of the Securities and Futures Commission (SFC) in Hong Kong. As a licensed entity, it adheres to the strict regulatory standards set by the SFC to ensure transparency, integrity, and the protection of client interests in the financial markets.

Additionally, Rakuten is governed by the Securities Commission Malaysia for its operations in Malaysia. Rakuten Trade Sdn. Bhd., a joint venture in Malaysia, holds a restricted Capital Markets Services License from the SC, allowing it to deal in listed securities and provide investment advice.

How Safe is Trading with Rakuten?

Trading with Rakuten Securities is generally considered safe due to its strong regulatory oversight and commitment to maintaining high standards of security. As a licensed entity under the SFC in Hong Kong and the Securities Commission Malaysia, Rakuten adheres to strict regulatory requirements designed to protect client funds and ensure fair trading practices.

The broker also employs advanced security measures, such as encryption and two-factor authentication, to safeguard personal and financial information. However, as with any investment, traders should understand the risks involved and practice proper risk management strategies when trading.

Consistency and Clarity

The broker has built a solid reputation over the years, receiving recognition for its competitive pricing, secure environment, and robust customer support. While many traders praise Rakuten for its user-friendly platforms and regulatory adherence, some have pointed out that the lack of MetaTrader 4 and limited leverage options could be drawbacks for certain strategies.

The broker has also gained industry awards for its commitment to innovation and client satisfaction, participating in various sponsorships and financial events. These activities reflect Rakuten’s active role in the market, positioning itself as a reliable company in the financial industry.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Rakuten?

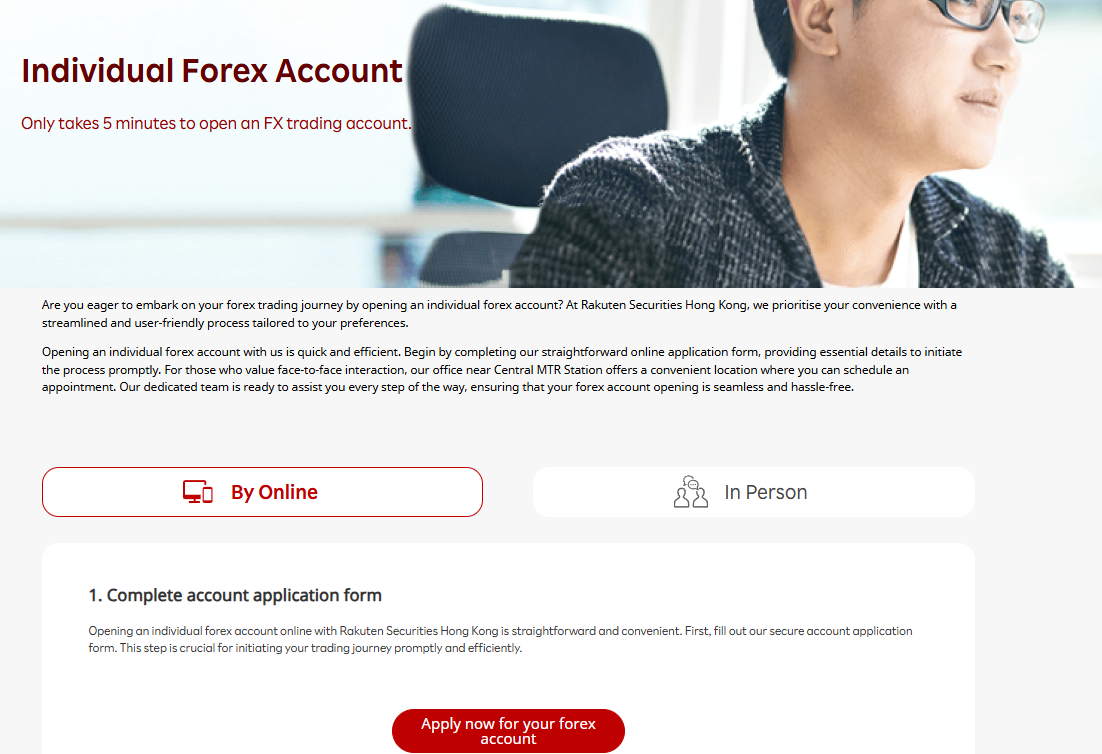

Rakuten Securities offers different account types to cater to both individual and corporate clients. The most common account type is the Individual Forex Account, which is designed for retail traders looking to trade currency and bullion with competitive spreads and fees.

Corporate Accounts are available for businesses and institutions looking to engage in trading on behalf of clients or for corporate investment purposes. Additionally, Rakuten provides a Demo Account option, allowing potential traders to practice their strategies and familiarize themselves with the platform without risking real funds.

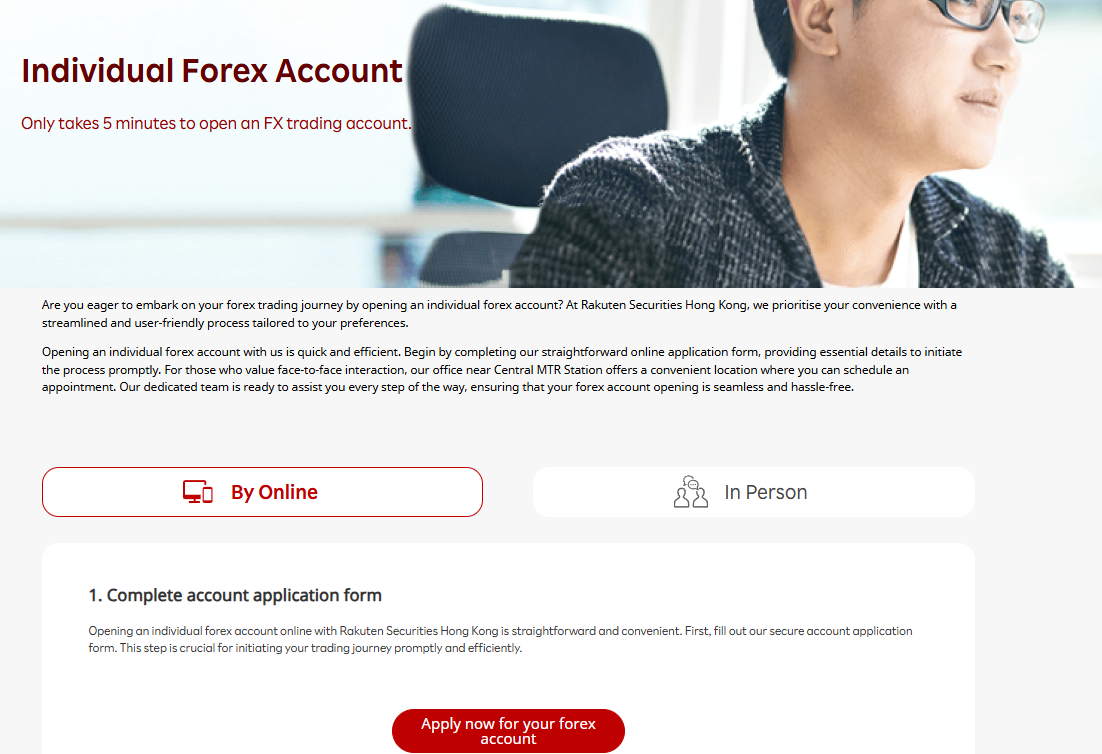

Individual Forex Account

Rakuten Securities offers an Individual Forex Account designed for retail traders. For clients opening this account online, the minimum deposit is no less than HK$10,000, making it accessible for those who wish to start trading with a reasonable capital.

However, for clients who choose to open an account in person at Rakuten’s office, there is no minimum deposit requirement, providing more flexibility for those who prefer to meet the broker in person. This account provides access to Rakuten’s competitive spreads, advanced tools, and its proprietary platform, Rakuten FX, ensuring a user-friendly experience.

Corporate Account

Rakuten Securities also offers Corporate Accounts, tailored for businesses, institutions, and organizations looking to trade on behalf of clients or for corporate investment purposes. This account type allows corporations to access the same competitive conditions as individual traders, with additional features suited to institutional trading needs.

Corporate clients can benefit from Rakuten’s advanced tools, a secure environment, and dedicated support for corporate traders. The account setup process for corporate clients may involve additional documentation and verification to meet regulatory requirements, ensuring that the trading activities are compliant with the relevant financial regulations.

Regions Where Rakuten is Restricted

Rakuten Securities operates globally but has certain restrictions on clients from specific countries due to regulatory and compliance considerations. The broker does not accept clients from the countries, including:

- USA

- Canada

- Belgium

- Iran

- Israel, etc.

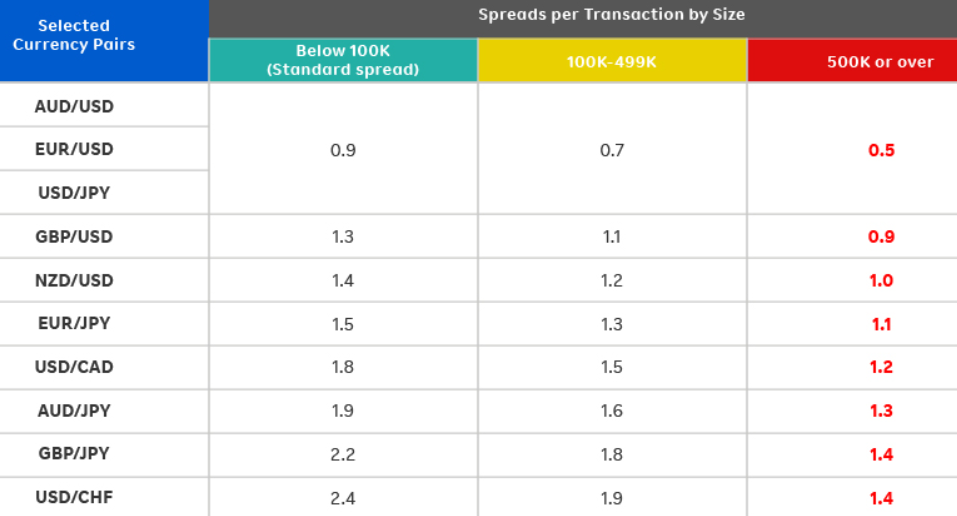

Cost Structure and Fees

Score – 4.5/5

Rakuten Brokerage Fees

Rakuten uses pricing technology directly from the platform since this option allows it to leverage the larger orders and present better prices to the global markets, offering a spread basis fee. Rakuten Securities has low currency and CFD fees.

Non-trading fees are average. Rakuten imposes an annual administrative fee of HKD 200 (USD 25) on dormant accounts after 12 consecutive months of inactivity. If the account balance is less than the fee amount, the entire balance will be deducted.

Additionally, a withdrawal fee is charged for international bank transfers and electronic wallets.

Rakuten’s fees are primarily based on spreads, with 95% of the spreads being fixed during regular working hours. The remaining 5% may vary due to low liquidity. The average EUR/USD spread is 0.5 pips.

Rakuten primarily offers commission-free trading for its Forex and bullion instruments. However, for other instruments, such as stocks, indices, and commodities, Rakuten may charge commissions or fees.

For example, in Malaysia, brokerage fees for stock trades range from RM1 to a maximum of RM100, depending on the transaction amount. These fees vary based on the type of instrument, so traders should check the specific commission structure for the assets they wish to trade.

Rakuten charges rollover or swap fees for positions held overnight. These fees are typically applied to currency trades and reflect the difference in interest rates between the two currencies involved in the trade.

The swap rates can either be positive or negative, depending on the direction of the trade and the interest rate differential.

How Competitive Are Rakuten Fees?

Rakuten Securities offers competitive fees, with a pricing model primarily based on spreads. This spread-based approach helps keep costs low for most currency and CFD instruments, making it an appealing option for traders in these markets.

While the broker does not charge commissions for most trades, there are some additional costs to consider, such as withdrawal fees for international bank transfers and electronic wallets. These non-trading fees are relatively standard compared to other brokers but may vary depending on the method of withdrawal.

Traders should evaluate their specific preferences, asset types, and withdrawal methods to get a full understanding of the total cost of trading with Rakuten.

| Asset/ Pair | Rakuten Spread | City Index Spread | LegacyFX Spread |

|---|

| EUR USD Spread | 0.5 pips | 0.8 pips | 1.2 pips |

| Crude Oil WTI Spread | 6.10 | 0.4 | 0.13 pips |

| Gold Spread | 1.5 | 0.3 | 0.63 pips |

| BTC USD Spread | - | 35 | 505.03 |

Rakuten Additional Fees

In addition to its fees, Rakuten Securities applies certain non-trading fees. The broker does charge an annual administrative fee of $25 on dormant accounts that have been inactive for 12 consecutive months.

Withdrawal fees also apply when transferring funds via international bank transfers or electronic wallets, which can vary depending on the method used. Therefore, traders should consider these additional costs when managing their accounts, especially if they plan to withdraw funds frequently or have accounts with long periods of inactivity.

Trading Platforms and Tools

Score – 4.3/5

Rakuten offers a variety of platforms to cater to different trader preferences, including the Rakuten FX Web, MARKETSPEED FX desktop, and iSPEED FX mobile platforms.

The Rakuten FX Web platform provides an easy-to-use web-based interface, suitable for traders who prefer a straightforward, browser-based experience without needing installations. MARKETSPEED FX, available for desktop users, offers advanced charting tools, real-time market data, and order execution features for more experienced traders.

For those on the go, the iSPEED FX mobile platform allows traders to access their accounts and trade from anywhere. It has a user-friendly design and essential features for managing trades on mobile devices.

Trading Platform Comparison to Other Brokers:

| Platforms | Rakuten Platforms | City Index Platforms | LegacyFX Platforms |

|---|

| MT4 | No | Yes | No |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Rakuten Web Platform

Rakuten FX Web is a versatile, web-based platform designed for traders who prefer a seamless, no-download experience. It is fully compatible with both Windows and Mac OS and can be accessed directly through popular browsers such as Google Chrome, Safari, Microsoft Edge, and Firefox, with desktop use being recommended for optimal performance.

The platform features an intuitive interface and powerful analytical tools, including 9 unique chart types and over 30 basic and advanced indicators, allowing traders to conduct in-depth technical analysis. With its user-friendly design and comprehensive features, Rakuten FX Web offers a convenient and efficient experience without the need for software installation.

Rakuten Desktop MetaTrader 4 Platform

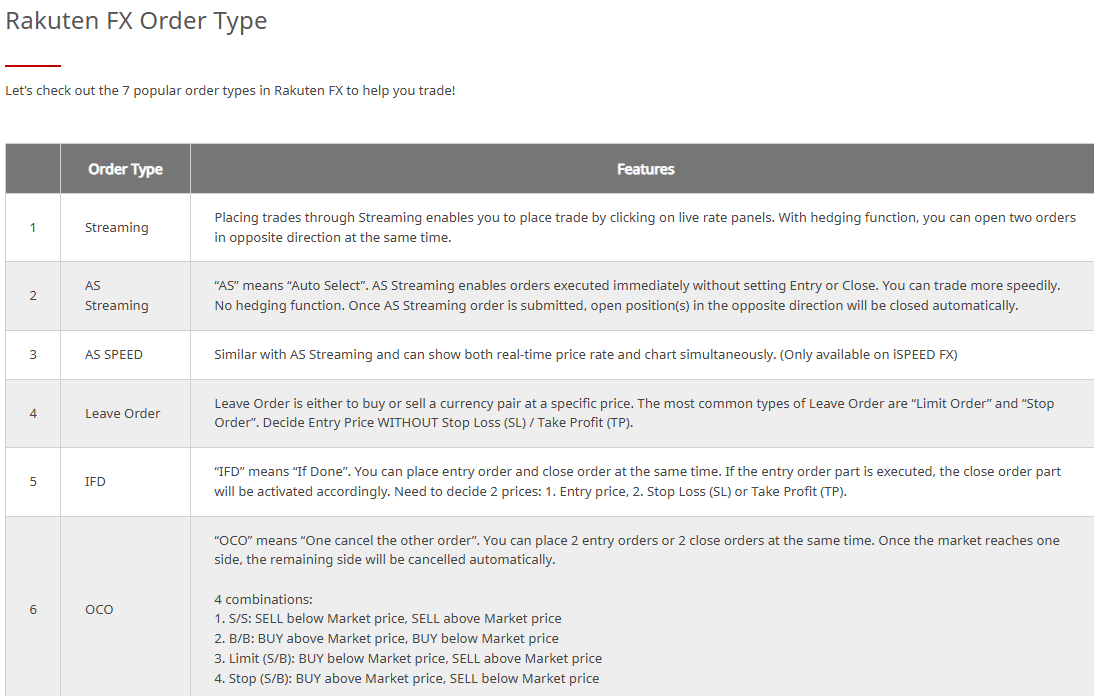

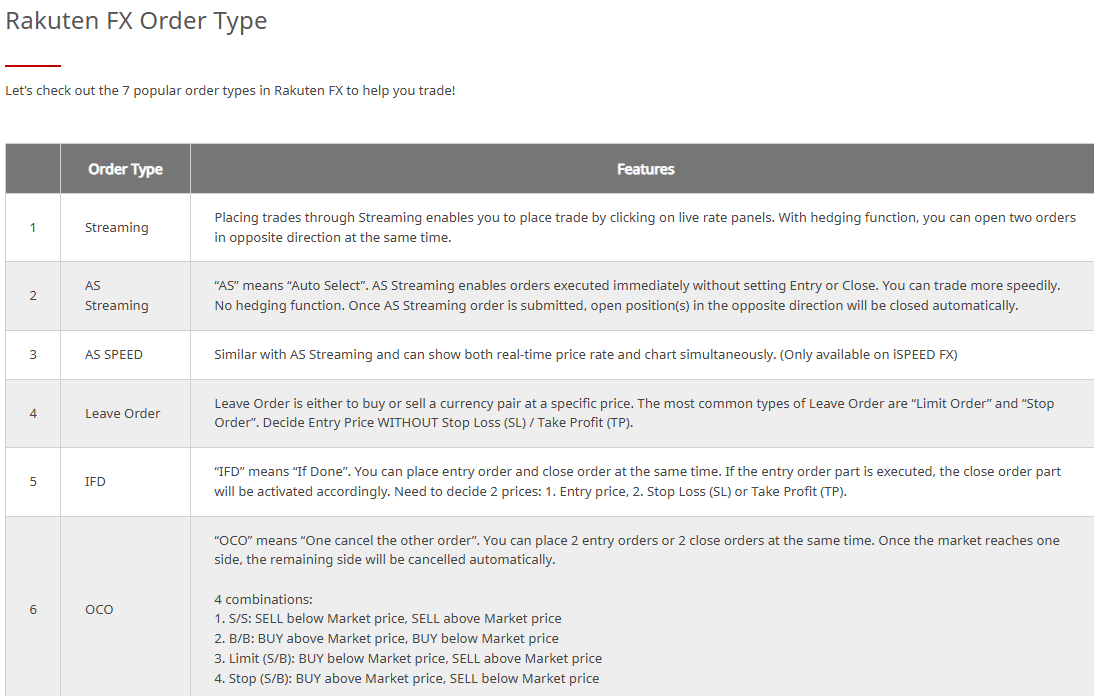

Rakuten does not offer the MetaTrader 4 platform. However, traders can access the MARKETSPEED FX desktop platform, which provides a robust and feature-rich environment. The platform includes 7 superior order types, including One-Click order execution, allowing traders to execute trades swiftly.

The platform also supports 9 unique chart types and 44 basic and advanced indicators for in-depth market analysis. Traders can manage orders directly on the chart, customize the interface to fit their preferences, and access various news feeds for real-time market updates. Additionally, real-time account reports ensure transparency and efficient trade monitoring, making MARKETSPEED FX a comprehensive alternative for desktop trading.

Rakuten Desktop MetaTrader 5 Platform

Rakuten does not offer the MT5 platform. Instead, the broker provides its proprietary MARKETSPEED FX desktop platform, which is designed to meet the needs of both beginner and experienced traders.

Rakuten MobileTrader App

Rakuten offers the iSPEED FX mobile platform, which features fast One-Click order execution directly from the chart, ensuring swift trade placements. With rich chart functions comparable to the desktop platform, traders can conduct in-depth technical analysis while accessing up to 4 charts simultaneously for a comprehensive market view.

The “My Page” feature allows users to organize charts, monitor rates, stay updated with news, and access the trading screen efficiently. Additionally, the platform offers customizable alert pop-up messages, enabling traders to stay informed about market movements and key opportunities in real-time.

Main Insights from Testing

The testing of Rakuten’s mobile app revealed a user-friendly and responsive interface, making it suitable for all traders. The app delivers a smooth trading experience with stable performance, quick execution speeds, and intuitive navigation.

While it provides essential tools for market analysis and trade management, some traders may find the customization options limited compared to desktop platforms. Overall, the app ensures accessibility and efficiency for mobile trading, allowing users to stay connected to the markets anytime, anywhere.

Trading Instruments

Score – 4.4/5

What Can You Trade on Rakuten’s Platform?

Rakuten Securities provides over 1,000 instruments, including over 40 currency pairs, Equities, Derivatives, Commodities, Bonds, ETFs, CFDs, and Investment Trusts. Traders can access a variety of global markets, with a strong focus on Forex trading.

The broker offers a selection of major, minor, and exotic currency pairs, along with other asset classes tailored to different strategies. However, cryptocurrency trading is not available.

Main Insights from Exploring Rakuten’s Tradable Assets

Exploring Rakuten’s tradable assets reveals a well-rounded selection that caters to a variety of trading styles. The platform offers a solid range of Forex, equities, and derivatives, providing traders with diverse opportunities in these markets.

However, a notable drawback is that crypto trading is not available, which limits the options for traders interested in digital assets. Additionally, while the platform offers a diverse selection of instruments, its range is not as comprehensive as some other brokers, which may be a limitation for those looking for more varied opportunities across different asset classes.

Leverage Options at Rakuten

Rakuten’s leverage depends on the regulation and jurisdiction governing the account. Each jurisdiction operates under specific rules and laws, meaning that the multiplier levels and conditions vary based on the trader’s country of residence.

- Traders from Hong Kong are eligible to use a maximum of up to 1:20 for major currency pairs.

Of course, multiplier offers a great benefit opportunity, yet, make sure to learn deeply about leverage and how to use it smartly, as a leveraged or increased trading size may play a significant role in your potential income or losses as well.

Deposit and Withdrawal Options

Score – 4.2/5

Deposit Options at Rakuten

Rakuten offers only one method for deposit, as Rakuten Securities Bullion does not accept deposits via credit card cash advances or funds transferred from Stored Value Facilities (SVF). Additionally, third-party payments are not allowed.

Rakuten Minimum Deposit

The minimum deposit requirement at Rakuten varies depending on the type of account and the deposit method. For online deposits, the minimum deposit amount is HK$10,000. However, if the deposit is made in person, there is no minimum deposit requirement.

Withdrawal Options at Rakuten

Rakuten withdrawal options are processed through the same method as deposits, via bank transfers. However, international bank transfer withdrawals may incur fees. Clients should ensure that the withdrawal is made to the same bank account used for the deposit, as third-party withdrawals are not allowed. The processing time for withdrawals may vary depending on the chosen method and the client’s region.

Customer Support and Responsiveness

Score – 4.4/5

Testing Rakuten’s Customer Support

Customer support is available 24/5 supporting live chat, email, and phone lines, and is reachable through various sources including WhatsApp making communication easily accessible. Besides, Rakuten gained a good ranking among other brokers for its quality customer service, which is another plus to its proposal.

Contacts Rakuten

For any inquiries or assistance, you can contact Rakuten through its customer service. Reach them via email at info@sec.rakuten.com.hk, or call their support lines at (852) 2119-0116 or (852) 2119-0117. Their team is available to assist with any account-related or general queries, providing professional support to help with your needs.

Research and Education

Score – 4.6/5

Research Tools Rakuten

Rakuten Securities offers a variety of research tools both on its website and platforms.

- On the website, clients can access market news, economic calendars, and a range of analysis reports to stay updated on market trends.

- Additionally, the platforms, such as Rakuten FX Web, MARKETSPEED FX desktop, and iSPEED FX mobile, provide advanced charting tools with over 30 basic and advanced indicators, 9 unique chart types, and customizable chart options for a more personalized experience. These platforms also offer news feeds, and the ability to manage trades directly on the charts, helping traders execute their strategies effectively.

Education

The beginning traders or even seasoned ones are also supported with educational resources and materials, including powerful technical analysis support coverage of important topics via the Education courses, regularly held Webinars, and videos also done in various languages making learning better.

Portfolio and Investment Opportunities

Score – 3.9/5

Investment Options Rakuten

Rakuten mainly focuses on currency and CFD trading, offering a range of instruments across various asset classes. While its core offering is in currency pairs, the broker also provides Copy Trading as an investment tool. This feature allows traders to replicate the strategies of more experienced traders, making it an attractive option for those looking to invest without actively managing trades themselves.

Account Opening

Score – 4.4/5

How to Open Rakuten Demo Account?

Opening a demo account with Rakuten allows traders to practice and refine their strategies in a risk-free environment using virtual funds. This provides an excellent opportunity to familiarize yourself with the platform’s features, tools, and conditions before committing to real capital. The process is simple and can be completed in just a few steps.

- Visit the Rakuten Securities website.

- Select the “Open Demo Account” option.

- Fill in the required personal information (name, email, phone number, etc.).

- Choose the demo account type (Forex, CFD, etc.).

- Select the desired account currency and leverage options.

- Complete the verification process, if prompted.

- Once registered, you will receive access to the demo account credentials via email.

- Download the platform or access the web-based platform.

- Log in with the provided demo account credentials to start practicing trading with virtual funds.

How to Open Rakuten Live Account?

To open a live account with Rakuten, you will need to visit the broker’s official website and complete the online registration process. First, select the “Open Live Account” option and fill in the required personal details such as your name, contact information, and residential address.

You will also need to choose the type of account you would like to open, such as an individual or corporate account. After submitting your information, you will be asked to provide proof of identity and residence for verification purposes. Once your documents are approved, you will be able to fund your account and start trading live. Depending on your location and the type of account, you may also need to agree to specific terms and conditions.

Additional Tools and Features

Score – 4.2/5

In addition to the research tools offered by Rakuten, the platform provides several other useful features to enhance the experience.

- One of these is VPS integration with third parties, which allows traders to run automated trading systems without interruptions, ensuring seamless execution of trades even when their computer is off.

- Rakuten also offers multiple order types, including advanced options for more precise execution strategies.

- The broker also provides real-time account reports to help traders keep track of their performance and make informed decisions.

Rakuten Compared to Other Brokers

When comparing Rakuten with its competitors, several factors stand out. Rakuten offers a competitive spread-based account with relatively low fees, similar to some of its competitors like CMC Markets and Spreadex.

The broker’s range of tradable instruments, while robust, does not match the vast variety available with some competitors, such as Saxo Bank and Spreadex, which provide access to tens of thousands of assets.

In terms of platforms, Rakuten provides its proprietary platforms, such as Rakuten FX Webr and MARKETSPEED FX, offering customizable features, but lacks the well-known MetaTrader 4/5, which some brokers like Swissquote and City Index offer.

Overall, Rakuten offers competitive features and favorable fees, but the wider asset variety and more advanced platforms from competitors may be more appealing to advanced traders.

| Parameter |

Rakuten Securities |

Spreadex |

Saxo Bank |

City Index |

Swissquote |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 0.5 pips |

Average 0.6 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

For Stock CFDs (Commission of RM1 to a maximum of RM100 in Malaysia) |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + €2.50 |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

Rakuten FX Webr, MARKETSPEED FX, iSPEED FX |

Spreadex Web Platform, TradingView |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT4, MT5, Swiss DOTS, TradingView |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

1000+

instruments |

10,000+ instruments |

71,000+ instruments |

13,500+ instruments |

400+ Forex and CFDs instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

SFC, SCM |

FCA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Good |

Excellent |

Excellent |

Excellent |

Good |

Good |

| Minimum Deposit |

$0 |

$0 |

$0 |

$0 |

$1,000 |

$0 |

$0 |

Full Review of Broker Rakuten

Rakuten is a reliable broker offering a solid range of services, especially for traders looking for low-fee currency and CFD trading. It stands out with its proprietary platforms, which provide good customization and charting tools.

The broker is regulated by reputable authorities, ensuring a secure environment. While Rakuten offers competitive spreads and a commission-free model for many instruments, it does not provide the highly popular MetaTrader platforms, which could be a limitation for some traders.

Additionally, its asset selection is not as extensive as some larger brokers, focusing more on Forex, CFDs, and a limited selection of other instruments. Overall, Rakuten is a solid choice for traders looking for a user-friendly experience and low fees, though those seeking a wider range of assets or advanced platform features might look elsewhere.

Share this article [addtoany url="https://55brokers.com/rakuten-securities-review/" title="Rakuten Securities"]

From: Aftab Ahmed. London. UK

06 February 2021

Dear sir, I would be grateful if you could reply the following questions asap.

1. For UK residents the regulations of Japan or UK will apply ?

2. Do you tax any profits at source.

3. What Leverage for trading Indices: WS30, Nasdaq, Germany 30; 1 contract BUY/SEL USD.

Many thanks. aftab ahmed

Hi,

Some Hongkong traders are offering 100:400 ratio for 10 days programme in India.

Is trading official in India?

Please advice.

Kind regards,

Minesh Shah,Mumbai