- What is Zerodha?

- Zerodha Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Zerodha Compared to Other Brokers

- Full Review of Broker Zerodha

Overall Rating 4.5

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is Zerodha Brokerage?

Zerodha is an Indian Stock broker that enables individuals to engage in the buying and selling of a diverse range of financial products, including stocks, direct mutual funds, commodities, and derivatives, such as futures and options.

The firm adheres to regulatory oversight by the Securities and Exchange Board of India (SEBI), which oversees various aspects of stock trading and brokerage operations to ensure transparency and protect traders’ interests.

Overall, the broker offers a favorable environment and focuses on providing cost-effective and efficient trading solutions for investors.

Is Zerodha Stock Broker?

Yes, Zerodha is a Stock brokerage firm based in India. The company provides a user-friendly platform and enables investors to trade stocks and a diverse range of financial products.

Zerodha Pros and Cons

The firm comes with several advantages and drawbacks that are important for traders to consider. On the positive side, the broker is known for its transparent fee structure, offering low brokerage fees, and providing a user-friendly platform that caters to both novice and experienced traders. The company also emphasizes technological innovations.

For the cons, there is no 24/7 customer support available, and occasional customer service issues are reported by users. Additionally, the firm lacks a top-tier license and operates under a single regulatory body, which could be a concern for traders who prioritize brokers with higher regulatory credentials.

| Advantages | Disadvantages |

|---|

| Competitive trading conditions | No 24/7 customer support |

| $0 minimum deposit | No top-tier license |

| User-friendly interface | |

| Trading products | |

| Transparent fee structure | |

| Technological innovations | |

| Educational resources | |

| Secure investing environment | |

Zerodha Features

Zerodha is known for its user-friendly platform, offering cost-effective brokerage fees and advanced trading solutions. A summary of its main features is as follows:

Zerodha Features in 10 Points

| 🏢 Regulation | SEBI |

| 🗺️ Account Types | Trading & Demat, Commodity Accounts |

| 🖥 Trading Platforms | Kite |

| 📉 Trading Instruments | Stocks, Direct Mutual Funds, Futures, Options, ETFs, IPO (Initial Public Offering), Securities, Bonds, Commodities |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | From ₹20/$0,24 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, GBP, INR |

| 📚 Trading Education | Varsity learning platform, Educational Videos |

| ☎ Customer Support | 24/5 |

Who is Zerodha For?

Zerodha is best suited for traders and investors in India who want low-cost access to the stock markets. It caters to a wide range of clients, from beginners looking to learn through free resources like Varsity, to active traders who need advanced tools for equities, derivatives, commodities, and currencies. Based on our findings and Financial Expert Opinions, Zerodha is Good for:

- Indian traders

- Stocks and Options trading

- Investing

- Professional trading

- Advanced traders

- Commission-based trading

- Direct Market Access

- Competitive investment environment

- Good educational and trading tools

Zerodha Summary

In conclusion, Zerodha is a popular and user-friendly brokerage platform in the Indian market. With its transparent fee structure, advanced tools, and a commitment to investor education, the firm provides a compelling option for traders looking to engage in the financial markets.

While individual experiences may vary, overall, the broker provides a good environment for investment. However, we advise conducting your research and evaluating whether the broker’s offerings suit your specific requirements.

55Brokers Professional Insights

Zerodha stands out as India’s largest retail stockbroker, known for its discount pricing model, transparent practices, and technology-driven platforms.

What makes Zerodha unique is its ability to combine ultra-low costs with a comprehensive financial ecosystem, from the flagship Kite platform offering seamless equity, F&O, commodity, and currency trading, to specialized products like Coin for mutual funds and Console for portfolio analytics.

The firm has also built a strong educational foundation through Varsity, one of the most extensive free learning resources in the country, and TradingQ&A, a vibrant investor community, making the broker good choice for beginners either in trading or investing.

Its partnerships with fintech innovators such as Smallcase, Sensibull, and Streak further enhance opportunities for thematic investing, options trading, and algorithmic strategies. So overall, we mark Zerodha as an attractive choice for Indian market.

Consider Trading with Zerodha If:

| Zerodha is an excellent Broker for: | - Need a well-regulated broker.

- Competitive trading conditions.

- Secure trading environment.

- Stock Trading and Investment.

- Offering popular financial products.

- Professional trading.

- Indian traders.

- Investors who prefer robust educational resources.

- Looking for broker with a long history of operation and strong establishment.

- Futures and options traders.

|

Avoid Trading with Zerodha If:

| Zerodha might not be the best for: | - Need a broker with trading services worldwide.

- Looking for broker with 24/7 customer support.

- High-frequency traders. |

Regulation and Security Measures

Score – 4.4/5

Zerodha Regulatory Overview

Zerodha is a trustworthy Stock broker that follows the rules and guidelines established by SEBI (India). The authority oversees the brokerage operations to ensure transparency and protect traders’ interests.

How Safe is Trading with Zerodha?

Zerodha is a legitimate and reliable company for traders looking to invest and manage their assets. It is regulated by SEBI, which has a good reputation in the financial market.

However, the firm lacks a top-tier or additional license, which could be a drawback for some investors seeking accounts with multiple regulatory authorities.

The firm prioritizes client protection by implementing robust security measures to safeguard users’ accounts and transactions. The platform employs industry-standard encryption protocols to secure sensitive information and offers two-factor authentication for an added layer of account protection.

Additionally, the broker provides educational resources to enhance users’ awareness of potential risks and best practices, further contributing to a secure environment.

Consistency and Clarity

Zerodha has built a good reputation in India since its establishment in 2010, consistently being recognized as the country’s largest retail stockbroker with millions of active clients.

Its credibility stems from transparent pricing, reliable platforms, and regulatory compliance under SEBI, earning it high trust scores and generally positive trader reviews. Many clients praise its low costs, advanced yet user-friendly platforms, and the free educational content, while drawbacks often cited include the lack of international access, limited research support, and occasional tech-related outages during peak trading hours.

Despite these challenges, Zerodha has maintained an image of integrity and innovation, winning multiple awards for fintech excellence and brokerage leadership. Beyond business, the broker is also active in the wider community through social initiatives, sponsorships, and its Rainmatter foundation, which supports startups and sustainability projects.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Zerodha?

Zerodha offers a range of accounts to cover most investment needs. The Trading & Demat account is the core account, allowing clients to buy, sell, and hold equities, ETFs, IPOs, and equity derivatives on Indian exchanges.

For those interested in commodities like gold, silver, crude oil, and natural gas, Zerodha provides a Commodity Trading account, which can be activated separately alongside the main account.

While Zerodha does not provide a fully functional demo account for live market trading, beginners and learners can explore strategies and practice through simulated tools and paper trading features available on partner platforms like Streak, which allow risk-free experimentation before trading with real funds.

Trading & Demat Account

The Trading & Demat account at Zerodha is the primary account type for investors and traders looking to participate in the Indian stock markets. It allows clients to buy, sell, and hold equities, ETFs, IPOs, and derivatives on NSE and BSE.

The Demat component stores shares in electronic form, ensuring safe and convenient ownership. Zerodha requires no minimum deposit amount for opening or activating the account.

Regions Where Zerodha is Restricted

Zerodha primarily caters to resident Indian clients. Currently, non-resident Indians are restricted from opening new accounts, which limits access for international investors looking to trade directly through Zerodha.

Cost Structure and Fees

Score – 4.6/5

Zerodha Brokerage Fees

The firm is known for its transparent and competitive Zerodha charges, making it a popular choice among traders. The brokerage charges a flat fee for equity delivery trades, while intraday and derivative trades incur a nominal fee per executed order.

Zerodha does not impose brokerage fees for direct mutual fund investments, providing users with a cost-efficient option for diversifying their portfolios.

Additionally, the broker provides the Zerodha brokerage calculator, which helps traders estimate the brokerage charges, taxes, and other transaction costs associated with their trades.

The broker charges a flat and competitive commission. The commission structure varies for different segments of trading, such as equity delivery, intraday, and derivatives.

As fees and commissions can be subject to change, traders should check the broker’s official website or contact customer support for the latest and most accurate information regarding commissions.

In addition to brokerage fees, clients are also subject to exchange and regulatory fees, which are standard across all brokers in India. These include Transaction Charges, Securities Transaction Tax, Goods and Services Tax, SEBI turnover fees, and stamp duty, all of which are levied by the exchanges or regulatory authorities.

The exact amount depends on the type of transaction, the segment traded, and the trade value. Zerodha passes these fees directly to the client without any hidden markup, ensuring full transparency, and provides detailed breakdowns in the platform and monthly statements to help investors track all costs.

In Zerodha, rollovers and swaps apply to derivative contracts such as futures and options when positions are carried forward beyond the contract expiry.

For equity and currency derivatives, the broker automatically handles contract rollovers, charging the applicable exchange and regulatory fees. Commodities traded on MCX also follow standard rollover and swap procedures.

In addition to brokerage and exchange fees, Zerodha charges additional fees for certain services or account activities. These include annual maintenance charges for the Demat account, SMS alerts, physical contract notes, or fees for specific third-party integrations like Streak or Smallcase if premium features are used.

Most of these charges are nominal and disclosed upfront, allowing clients to plan costs effectively.

How Competitive Are Zerodha Fees?

Zerodha’s fees are widely regarded as highly competitive within the Indian brokerage industry, particularly for retail traders.

Its flat-rate, discount brokerage model allows investors to execute trades at minimal cost compared to traditional full-service brokers, making it especially attractive for active traders and those with small to medium trade sizes.

| Asset/ Pair | Zerodha Commission | Upstox Commission | Merrill Edge Commission |

|---|

| Stocks Fees | From ₹20 | From ₹20 | From $0 |

| Fractional Shares | No | No | No |

| Options Fees | From ₹20 | From ₹20 | From $0,65 |

| ETFs Fees | From ₹10 | From ₹20 | From $0 |

| Free Stocks | No | No | Yes |

Trading Platforms and Tools

Score – 4.5/5

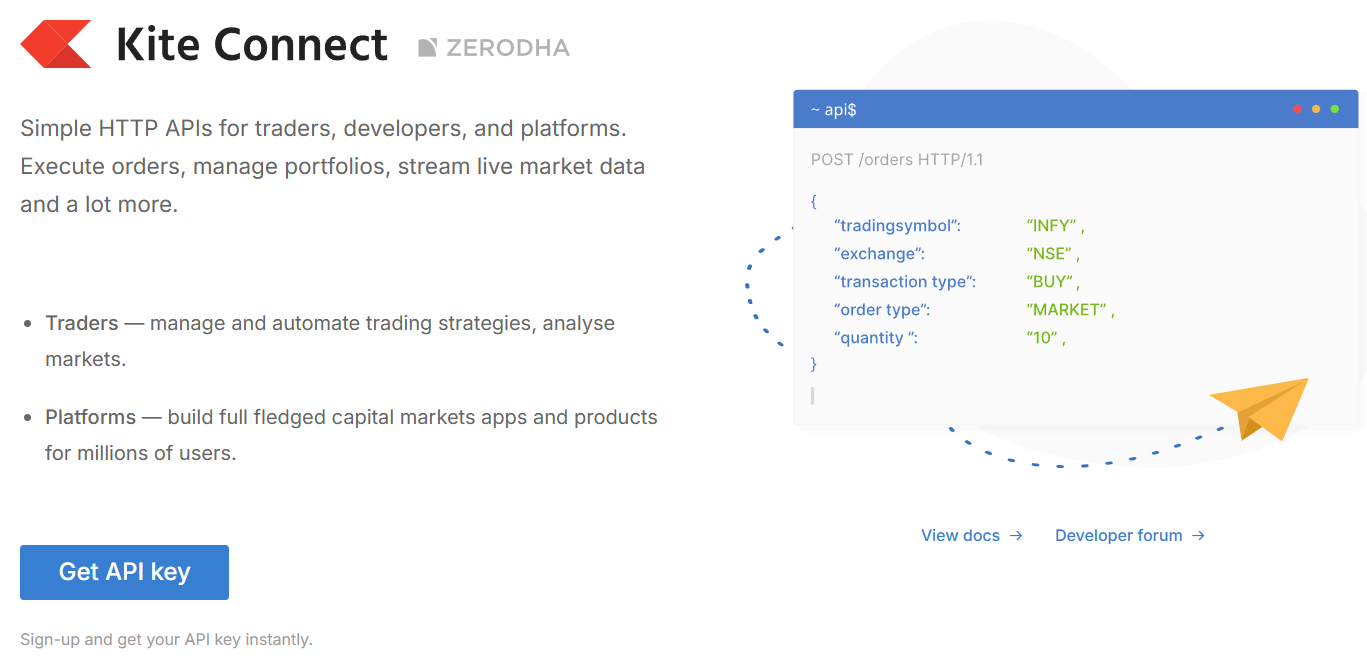

Zerodha offers its web-based platform, Kite, renowned for its intuitive interface and advanced charting tools. Additionally, the broker offers the Zerodha API, as well as mobile apps for both Android and iOS, allowing users to trade conveniently on the go.

The platforms are designed to provide a seamless and efficient experience for traders of all levels, from beginners to seasoned investors.

Trading Platform Comparison to Other Brokers:

| Platforms | Zerodha Platforms | Upstox Platforms | TradeStation Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Zerodha Web Platform

Zerodha’s web platform, Kite, is a powerful and user-friendly interface designed for seamless market access. It offers real-time market data, advanced charting tools, technical indicators, and multi-leg order types such as GTT and basket orders.

With its intuitive layout, fast execution, and customizable dashboards, Kite provides both beginners and experienced traders with a reliable platform for efficient and informed trading.

Zerodha Desktop MetaTrader 4 Platform

Zerodha does not offer the MetaTrader 4 platform for desktop trading, instead relying on its proprietary webtrader and mobile platforms to provide a complete trading experience.

Zerodha Desktop MetaTrader 5 Platform

The broker does not provide the MetaTrader 5 platform either, focusing instead on its proprietary solutions.

Zerodha MobileTrader App

The broker offers a robust mobile app available for both Android and iOS platforms. The app provides a convenient and efficient way for users to trade on the go, offering features such as real-time market data, advanced charting tools, and secure order placement.

With its user-friendly design and comprehensive functionality, the Zerodha app ensures that traders can manage their investments and execute trades seamlessly from their mobile devices.

Main Insights from Testing

Zerodha’s mobile app, Kite, delivers a smooth and intuitive experience, bringing nearly all desktop features to handheld devices. Users benefit from real-time quotes, interactive charts, technical indicators, and seamless order execution

AI Trading

Zerodha offers the Kite Model Context Protocol (MCP), which allows users to securely connect their accounts to AI assistants such as Claude, Cursor, and Windsurf.

This integration enables traders to access real-time portfolio data, market prices, and historical information while receiving personalized insights and analytics through natural language queries. Users can even place, modify, or cancel orders directly via the AI assistant, effectively combining automation and convenience with Zerodha’s existing platforms.

While this is not a fully AI-driven financial system, Kite MCP provides an advanced bridge between traditional trading and intelligent, interactive tools, enhancing the overall user experience for both active traders and long-term investors.

Trading Instruments

Score – 4.6/5

What Can You Trade on Zerodha’s Platform?

The broker offers a diverse range of financial products, including Stocks, Direct Mutual Funds, Futures, Options, ETFs, IPOs, Securities, Bonds, and Commodities.

This diverse selection empowers investors to diversify their portfolios and participate in different segments of the financial markets through a single integrated platform.

Main Insights from Exploring Zerodha’s Tradable Assets

Exploring Zerodha’s tradable instruments shows a diverse and well-structured offering that supports a wide range of strategies.

The platforms provide seamless access to different segments with advanced tools for analysis and execution, allowing traders to efficiently manage positions, hedge risk, and implement both short-term and long-term strategies.

Margin Trading at Zerodha

Zerodha offers margin trading facilities, allowing users to trade beyond their available funds by borrowing from the broker. This feature provides the opportunity to amplify potential returns, but it also comes with increased risk.

The Zerodha margin calculator is a valuable tool that helps traders assess the multiplier and margin requirements for their positions. By using the calculator, investors can make informed decisions, understand the financial implications of their trades, and manage risk effectively in the dynamic stock market environment.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Zerodha

The broker offers multiple funding methods to facilitate seamless transactions for its users. Traders can fund their accounts through online modes such as net banking, Unified Payments Interface (UPI), and various payment gateways.

Additionally, Zerodha allows fund transfers through traditional methods like cheque deposits.

Zerodha Minimum Deposit

The broker does not have a specific minimum deposit requirement for opening an account. Users can start trading with any amount they are comfortable with, making Zerodha accessible to a wide range of investors, including those who prefer to begin with smaller initial investments.

Withdrawal Options at Zerodha

The broker allows users to transfer funds from their accounts to their linked bank accounts. The withdrawal process is user-friendly, providing flexibility for traders to access their funds efficiently whenever needed.

Customer Support and Responsiveness

Score – 4.6/5

Testing Zerodha’s Customer Support

The broker provides 24/5 Zerodha customer care through email and phone support, providing timely assistance to address any issues users may encounter during their trading journey.

Additionally, the support team includes financial specialists who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

Contacts Zerodha

Zerodha offers multiple contact options to assist clients with their queries and support needs. Customers can reach the team by phone at 080 4718 1888 for trading and account-related assistance, or connect via email at press@zerodha.com for media inquiries.

In addition, Zerodha provides an extensive online support portal and ticketing system, making it easy for users to access quick solutions and dedicated customer service when required.

Research and Education

Score – 4.7/5

Research Tools Zerodha

Zerodha offers a comprehensive set of research tools across its website and platforms to support traders and investors.

- Within the Kite platform, users can access advanced charting, technical indicators, and screeners, while the website provides company financials and market data.

- In addition, Zerodha features handy calculators, including brokerage, margin, and P&L calculators, which help users evaluate costs and manage risk effectively. Together, these tools deliver both fundamental and technical insights for more informed decisions.

Education

The broker offers a variety of educational resources, including learning materials, videos, webinars, and tutorials, through its dedicated Varsity learning platform, to help traders, especially beginners, understand the dynamics of the financial markets and enhance their trading knowledge.

Zerodha’s commitment to education enables traders to make well-informed investment decisions and navigate the complexities of the stock market effectively.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options Zerodha

Zerodha provides a wide range of investment solutions for different types of investors. Through its platforms, clients can invest in equities, mutual funds, bonds, government securities, and exchange-traded funds (ETFs).

These options make it possible to build diversified portfolios, balancing long-term wealth creation with short-term market opportunities.

Account Opening

Score – 4.5/5

How to Open Zerodha Demo Account?

While Zerodha does not provide a traditional demo account for live trading, users can still practice in a risk-free environment through partner platforms.

Sensibull offers a virtual feature where traders can simulate options trades and test different strategies without using real money. Similarly, Streak provides backtesting and paper-trading tools that allow users to experiment with strategies and monitor results in real time.

How to Open Zerodha Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or Zerodha login page and proceed with the guided steps:

- Select and click on the “Open a free demat and trading account online” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.4/5

Zerodha also offers a range of additional tools and features beyond research, designed to enhance the trading experience.

- These include Kite Connect API for developers to build custom trading applications, portfolio tracking, and smallcase integration for theme-based investing, Sensibull for options strategies, and tools like Coin for direct mutual fund investments. Such features give traders and investors more flexibility, automation, and diversification opportunities.

Zerodha Compared to Other Brokers

Compared with its competitors, Zerodha stands out as a cost-effective Stock broker focused primarily on the Indian market.

Unlike global brokers such as Interactive Brokers or TD Ameritrade, which provide extensive access to international markets and complex instruments, Zerodha keeps its offering more streamlined around equities, derivatives, mutual funds, and bonds. Its Kite platform is praised for simplicity and efficiency, though it may not offer the same depth of advanced tools that other brokers offer.

Educational resources at Zerodha, through its Varsity program, are among the best in the industry. However, customer support is limited to 24/5, unlike some competitors with 24/7 availability, and global exposure remains a gap compared to brokers serving international traders.

Overall, the broker is best positioned for Indian residents seeking low-cost, transparent, and reliable trading, while traders looking for broader international market access may prefer global competitors.

| Parameter |

Zerodha |

Upstox |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures E-mini contracts not available / Stock Commission from ₹20/$0,24 |

Futures E-mini contracts not available / Stock Commission from ₹20/$0,24 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low/Average |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

Kite |

Upstox Pro Web, Mobile, NEST Desktop, Upstox Developer Trading Platforms, TradingView |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, Direct Mutual Funds, Futures, Options, ETFs, IPO (Initial Public Offering), Securities, Bonds, Commodities |

Stocks, Mutual Funds, Bonds, Commodities, Futures, Options, ETFs, Currencies |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEBI |

SEBI |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Excellent |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

$0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Zerodha

Zerodha is one of India’s leading discount investment firms, known for its low-cost structure, user-friendly platforms, and strong focus on technology.

Through its flagship Kite platform, traders can access equities, derivatives, commodities, mutual funds, and bonds with ease, supported by fast execution and intuitive charting tools.

The broker also provides innovative solutions like Coin for direct mutual fund investments, smallcase for thematic portfolios, and robust API integrations for algorithmic trading.

Beginners benefit from comprehensive educational resources via Varsity, while more advanced traders can explore research tools, margin facilities, and partner platforms for strategy testing. With transparent pricing, Zerodha caters to both novice and experienced investors looking for efficient and accessible solutions.

Share this article [addtoany url="https://55brokers.com/zerodha-review/" title="Zerodha"]