- What is Z.com Forex?

- Z.com Forex Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Z.com Forex Compared to Other Brokers

- Full Review of Broker Z.com Forex

Overall Rating 4.3

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4 / 5 |

| Deposit and Withdrawal Options | 3.9 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 3 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is Z.com Forex?

Z.com Forex is an online Forex trading provider, a subsidiary of GMO Financial Holdings, Inc., allowing Asian traders to diversify their portfolios, with strong regional support from Hong Kong.

The company is one of the leading financial providers in the Asian region. Since 2006, it has been offering financial services, quickly expanding from Japan to global coverage.

Z.com Forex Pros and Cons

Z.com Forex is a low-risk Forex broker due to regulations, there is good software and technology offered. The broker offers well-improved pricing stability for better risk management with fixed and floating spreads and with the Z.com Trader proprietary platform.

For the Cons, there is no 24/7 customer support, and instruments are limited to only Currency trading.

| Advantages | Disadvantages |

|---|

| Regulated broker with a strong establishment | Limited number of trading instruments |

| Competitive trading costs and spreads | No 24/7 customer support |

| Robust trading platform | |

| Suitable for beginners and professionals | |

| Excellent support, learning, and research tools | |

Z.com Forex Features

Z.com Forex offers an efficient experience with low spreads and leverage, and a user-friendly platform. As a subsidiary of GMO Financial Holdings, it provides traders with advanced technology, secure conditions, and strong regulatory oversight. Below are the key points to consider when choosing Z.com Forex as your online broker.

Z.com Forex Features in 10 Points

| 🏢 Regulation | JFSA, SFC |

| 🗺️ Account Types | Standard Account |

| 🖥 Trading Platforms | Z.com Trader |

| 📉 Trading Instruments | Forex |

| 💳 Minimum Deposit | $0 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, HKD, JPY, AUD |

| 📚 Trading Education | Forex Basics, Seminars, Videos, Glossary |

| ☎ Customer Support | 24/5 |

Who is Z.com Forex For?

Z.com Forex is designed for a wide range of traders, from beginners looking for a user-friendly platform to experienced traders seeking competitive spreads and advanced tools. Based on Our findings and Financial Expert Opinions Z.com Forex is Good for:

- Beginners

- Advanced traders

- Professional trading

- Currency trading

- STP/NDD execution

- Traders who prefer a proprietary platform

- Low Spread Trading

- Supportive customer support

- Good research materials and education

Z.com Forex Summary

The final thought upon Z.com Forex review is that the broker is a great offer in technology, reliability, customer service, and pricing. Z.com Forex is part of a well-established financial company that achieved the world’s largest volumes and is also listed in the Tokyo Exchange, bringing a clear state that you will trade with a reliable broker.

The main part of the competitive offer from Z.com Forex is their technology, since the broker uses both NDD and STP practices, which means all trades perform in real-time without any intervention, hence there is no conflict between the trader and the company.

On top of it, the company offers a small amount to start practice and can be considered as having no minimum deposit requirement, which allows new traders to try out trading at Z.com Forex easily.

55Brokers Professional Insights

Z.com Forex stands out as a top-tier Forex broker in Asia, backed by GMO Financial Holdings, a globally recognized financial company, so is greatly suitable for traders from Asia with small or large accounts alike. With low spreads, leverage of up to 1:20, and a commission-free trading model, it provides a cost-effective environment for retail and professional traders.

Its advanced infrastructure provides fast execution speeds, while the user-friendly Z.com Trader platform, available on the web and mobile is good to various style traders. Overal, we find Z.com Forex as transparent broker with good customer satisfaction, offering 24/5 support, good educational resources, and market insights to help traders maximize potential, so is suitable for beginners too.

Consider Trading with Z.com Forex If:

| Z.com Forex is an excellent Broker for: | - Need a well-regulated broker.

- Looking for broker with no minimum deposit requirement.

- Providing competitive fees and spreads.

- Looking for broker suitable for beginners and professional traders.

- Providing good learning materials.

- Leverage up to 1:20.

- Offering proprietary platform. |

Avoid Trading with Z.com Forex If:

| Z.com Forex might not be the best for: | - Providing limited number of instruments.

- Need broker with Copy Trading.

- Who prefer 24/7 customer service.

- Looking for industry known platforms.

|

Regulation and Security Measures

Score – 4.4/5

Z.com Forex Regulatory Overview

Z.com Forex operates under a strong regulatory framework, ensuring a secure and transparent environment for its clients. It is authorized and regulated by the Hong Kong SFC, providing traders with confidence in its compliance with stringent financial standards.

Additionally, as a part of GMO Financial Holdings, Z.com Forex benefits from the oversight of the Japan Financial Services Agency (JFSA), further reinforcing its credibility and commitment to investor protection.

These regulatory approvals highlight the broker’s dedication to maintaining high standards of security, fairness, and operational excellence in the global Currency market.

How Safe is Trading with Z.com Forex?

Trading with Z.com Forex is considered safe due to its strong regulatory oversight and commitment to client protection. The broker employs advanced security measures, such as encrypted transactions and risk management protocols, to safeguard user data and trading activities.

With a transparent environment, reliable execution speeds, and dedicated customer support, Z.com Forex offers a secure and trustworthy platform for traders.

Consistency and Clarity

Z.com Forex has built a solid reputation in the Forex industry, backed by its parent company, GMO Financial Holdings, a well-established financial institution in Japan. With strong regulatory oversight from the Hong Kong SFC and the Japan FSA, the broker is known for its transparency, reliability, and competitive conditions.

Trader reviews highlight its low spreads, fast execution, and user-friendly platforms, though some traders mention limited asset offerings compared to multi-asset brokers. Over the years, Z.com Forex has received industry recognition, earning awards for its technology and customer service. Additionally, the broker actively engages in financial education initiatives, sponsorships, and community-driven events, reinforcing its commitment to traders and the broader financial ecosystem.

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with Z.com Forex?

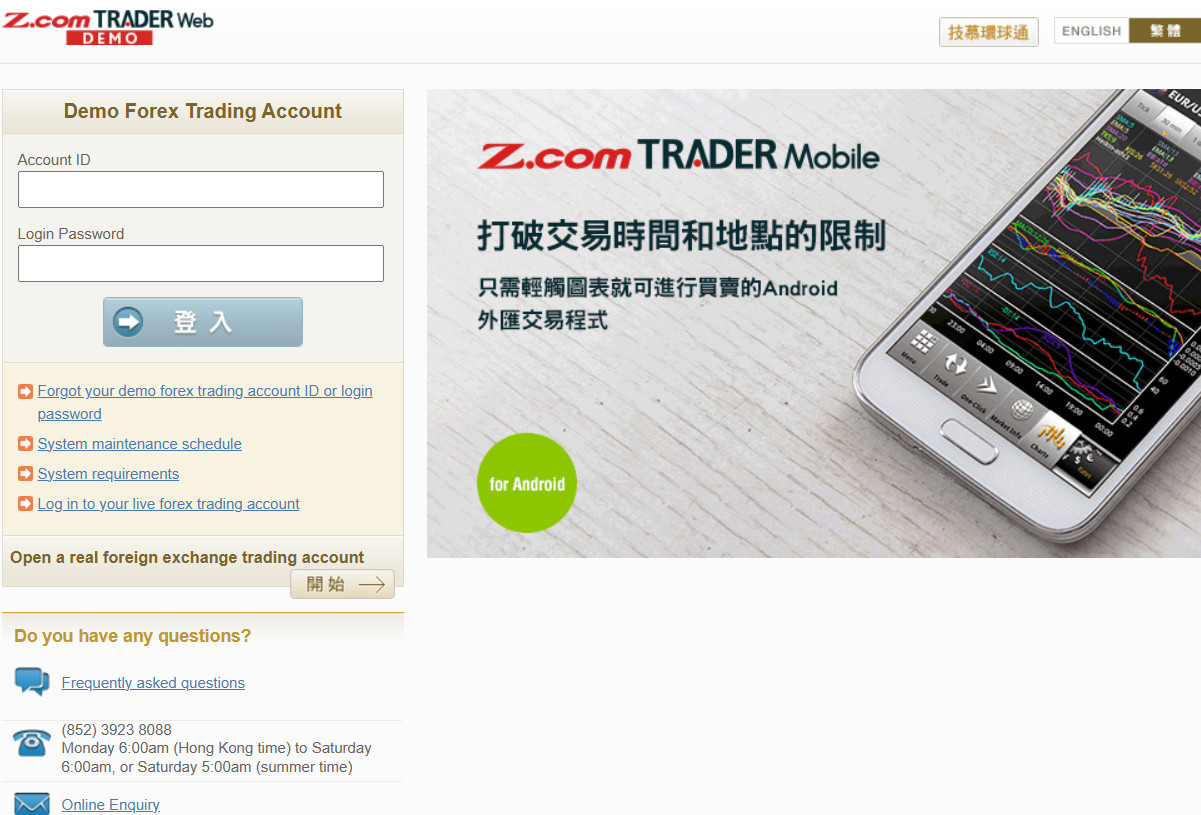

Z.com Forex offers traders a choice between Standard and Demo Accounts, catering to different levels of experience. The Standard Account is designed for real-money trading, featuring competitive spreads, leverage of up to 1:20, and a commission-free structure.

For those looking to practice or test strategies risk-free, Z.com Forex also provides a Demo Account, which replicates real market conditions without requiring any deposit. The demo account is perfect for beginners to gain confidence and for experienced traders to refine their strategies before committing to real funds.

Standard Account

The Standard Account offers traders a seamless and cost-effective experience. This account is accessible through the Z.com Trader platform, available on the web and mobile, ensuring fast execution speeds and a user-friendly interface.

With no minimum deposit requirement, it is ideal for both beginner and experienced traders looking for a secure and efficient Currency trading environment.

Regions Where Z.com Forex is Restricted

Z.com Forex imposes specific eligibility requirements that restrict account openings for certain individuals. The broker does not accept applications from residents or citizens of the following countries:

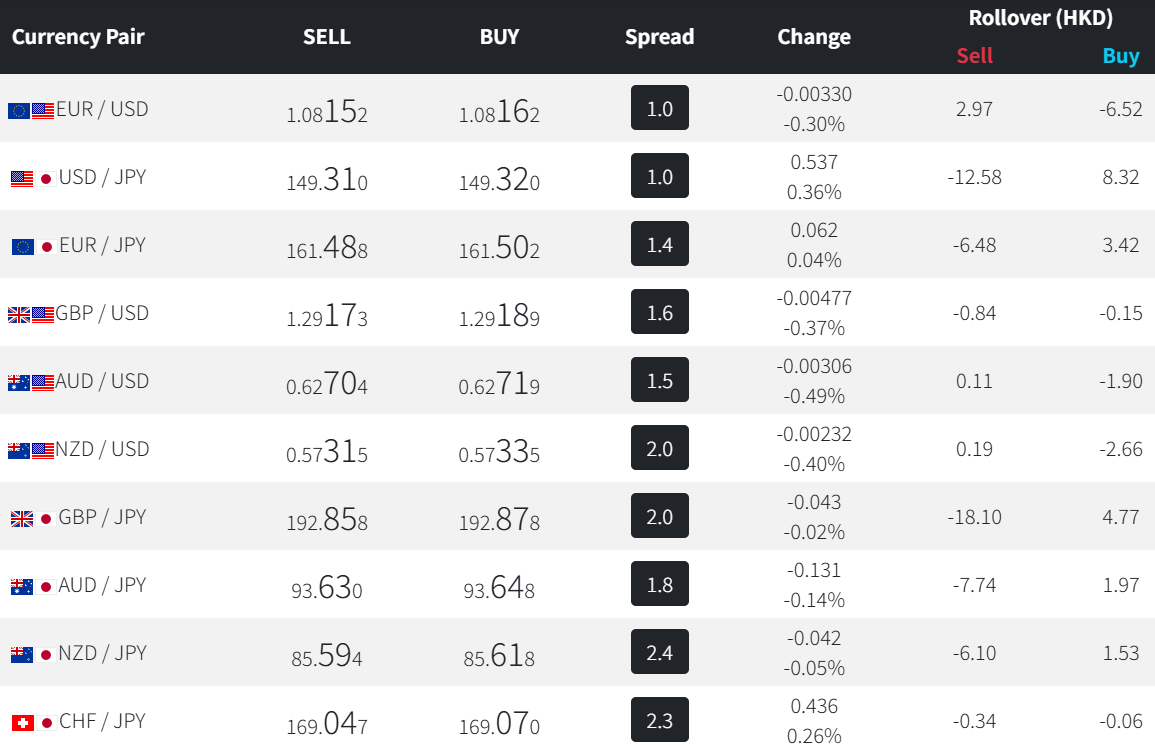

Cost Structure and Fees

Score – 4.5/5

Z.com Forex Brokerage Fees

Z.com Forex costs offer to choose between fixed spread and floating spread. Additionally, there are no deposit or withdrawal fees for most payment methods, though some third-party charges may apply depending on the payment provider.

While the broker does not charge inactivity fees, traders should be aware of potential overnight swap rates for holding positions beyond a trading day.

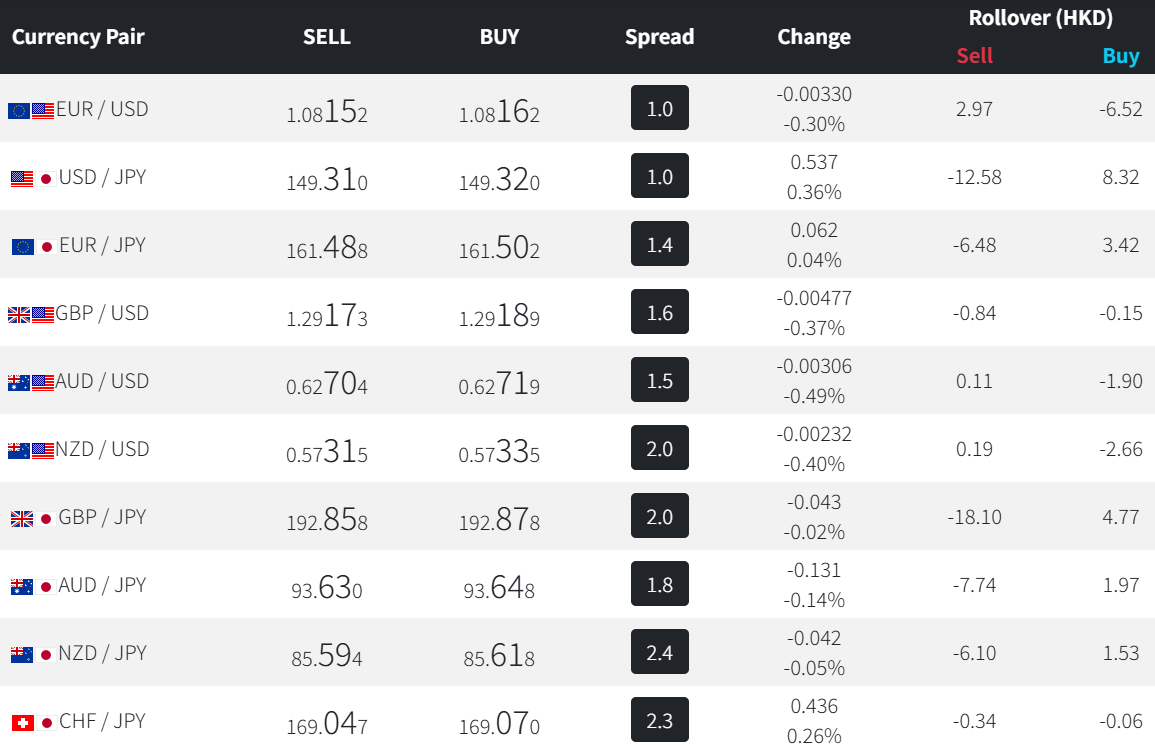

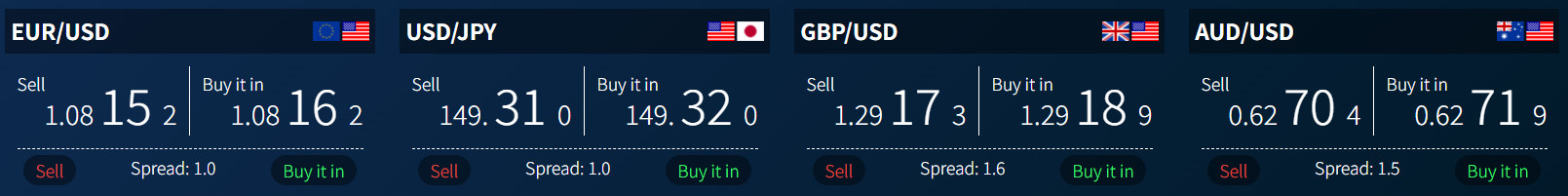

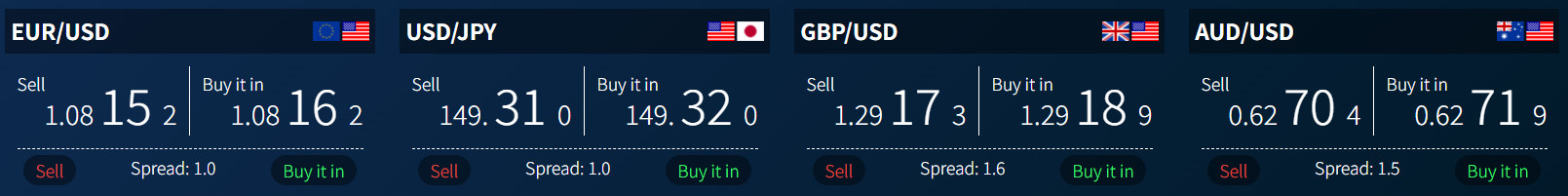

Z.com Forex offers competitive spreads, ensuring cost-effective trading for its clients. The broker provides tight spreads on major currency pairs, with the average EUR/USD spread at just 1 pip. These low spreads help traders minimize costs while benefiting from fast execution speeds.

Z.com Forex operates with a commission-free pricing model, meaning traders only need to account for the spread when calculating their expenses. The broker’s spreads may vary depending on market conditions, such as volatility and liquidity, but remain competitive compared to industry standards.

Z.com Forex operates with a fee structure based on spreads rather than commissions, offering a commission-free environment.

- Z.com Forex Rollover / Swaps

Z.com Forex applies rollover or swap fees for positions held overnight, which are the interest charges or credits added to a trader’s account based on the difference in interest rates between the two currencies in the pair being traded.

These fees can be either positive or negative, depending on the direction of the trade and prevailing market conditions. Z.com Forex calculates swap rates daily, and they can vary based on factors such as market liquidity and central bank interest rates.

- Z.com Forex Additional Fees

Z.com Forex does not impose additional fees for regular trading activities such as deposits, withdrawals, or account maintenance, which helps maintain a cost-effective environment.

However, traders should be mindful of swap/rollover fees for positions held overnight, which are based on the interest rate differentials between the currencies in the trade. Additionally, while there are no fees for standard transactions, some third-party payment providers may charge fees for deposits or withdrawals, depending on the chosen payment method.

How Competitive Are Z.com Forex Fees?

Z.com Forex offers highly competitive fees, relying on tight spreads. With a transparent fee structure and no hidden charges, Z.com Forex stands out by offering competitive pricing compared to other brokers in the industry, allowing traders to focus on their strategies without worrying about excessive fees.

| Asset/ Pair | Z.com Forex Spread | Aetos Spread | LCG Spread |

|---|

| EUR USD Spread | 1 pip | 1.8 pips | 0.8 pips |

Trading Platforms and Tools

Score – 4.3/5

Z.com Forex offers traders access to its proprietary Z.com Trader platform, a user-friendly platform designed to provide a seamless experience. The platform is available on both web and mobile, ensuring that traders can manage their accounts and execute trades from anywhere at any time.

Z.com Trader offers a range of advanced features, including real-time market data, customizable charts, technical analysis tools, and fast order execution. Additionally, the platform is designed for both beginner and experienced traders, with an intuitive interface and a variety of educational resources to help traders improve their skills.

Trading Platform Comparison to Other Brokers:

| Platforms | Z.com Forex Platforms | Aetos Platforms | LCG Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

Z.com Forex Web Platform

The Z.com Trader web platform provides traders with an intuitive experience. It offers a user-friendly interface with real-time market data, advanced charting tools, and customizable layouts to suit individual preferences.

The platform ensures fast order execution and smooth navigation across its features. With a focus on simplicity and efficiency, the platform allows traders to easily manage their accounts, analyze the market, and execute trades with minimal hassle, making it an ideal choice for those looking for a reliable web-based solution.

Main Insights from Testing

Testing of the Z.com Trader platform reveals a highly intuitive and responsive experience. The platform stands out for its user-friendly interface, making it accessible for both beginners and experienced traders.

Additionally, traders appreciate the platform’s stability and smooth navigation, which allow for seamless trading across different devices. Overall, Z.com Trader delivers a reliable and powerful platform for those looking to execute trades quickly and manage their accounts effectively.

Z.com Forex Desktop MetaTrader 4 Platform

Z.com Forex does not offer the MetaTrader 4 platform for its traders. Instead, the broker provides its proprietary Z.com Trader platform, designed for seamless and efficient trading with advanced features and a user-friendly interface.

Z.com Forex Desktop MetaTrader 5 Platform

Similarly, MT5 is also unavailable at Z.com Forex. The broker focuses on its platform, which offers real-time market data, customizable charts, and fast order execution, providing a complete solution for its clients without the need for MT4 or MT5.

Z.com Forex MobileTrader App

Z.com Trader mobile app is available for both Android and iOS devices, providing traders with the flexibility to trade on the go. The app offers a seamless, user-friendly experience, allowing users to access real-time market data, execute trades, and monitor their positions from anywhere at any time.

With its intuitive interface, the Z.com Trader mobile app features advanced charting tools, customizable layouts, and quick order execution, ensuring that traders can manage their accounts and make informed decisions with ease.

Trading Instruments

Score – 4/5

What Can You Trade on Z.com Forex’s Platform?

On Z.com Forex’s platform, traders can access a wide range of Currency pairs, with over 50 currency pairs available for trading. These pairs include major, minor, and exotic currencies, providing traders with ample opportunities to diversify their strategies.

Main Insights from Exploring Z.com Forex’s Tradable Assets

Exploring Z.com Forex’s tradable assets reveals a strong focus on Currency trading, with a range of currency pairs available for traders. While the broker provides competitive pricing and fast execution for Forex markets, a notable drawback is the limited asset selection, as it does not offer commodities, stocks, or indices for trading.

This can be restrictive for traders looking for more diverse investment options. However, for those who specialize in Forex, the platform offers a streamlined and focused environment with the tools necessary for success in the currency markets.

Leverage Options at Z.com Forex

Leverage trading is a unique opportunity to trade bigger than your initial balance. However, you should carefully learn how to use this tool, since the multiplier may work in reverse as well.

Z.com Forex leverage is the following, depending on the regulation:

- The maximum leverage for currency trading is 1:20.

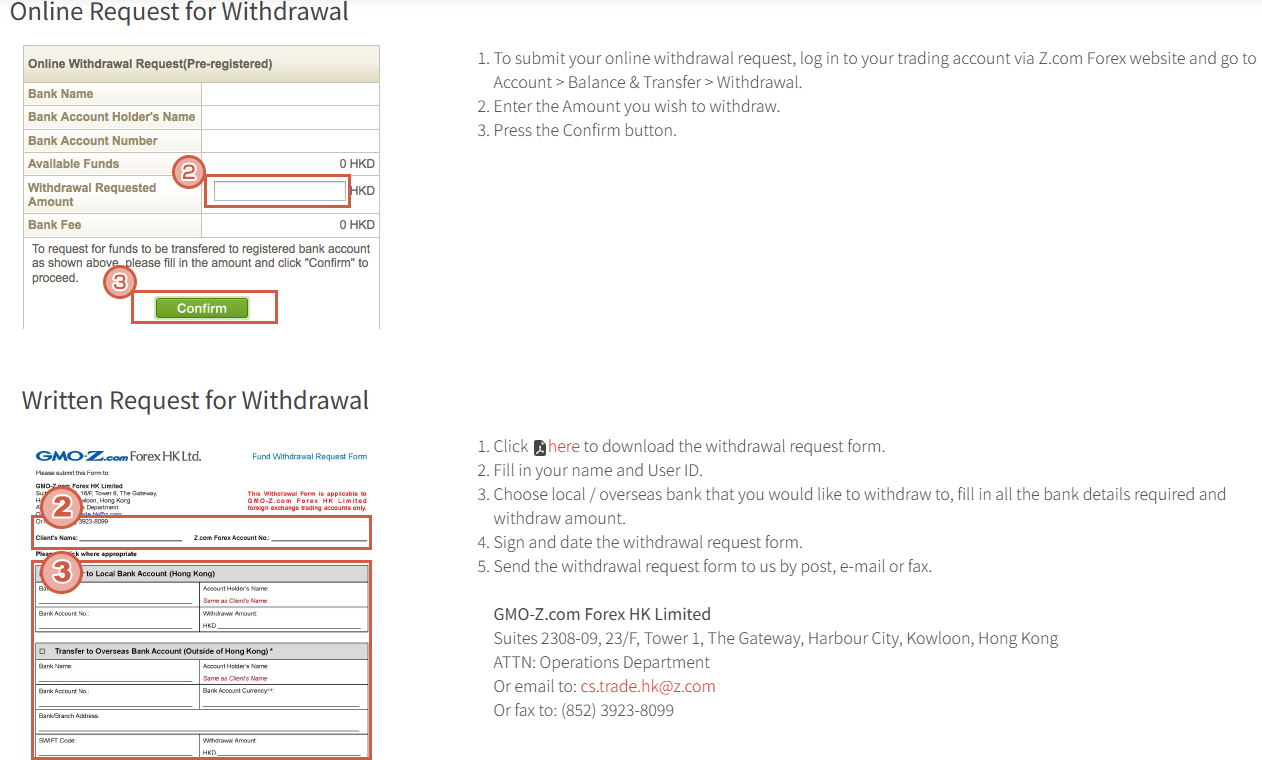

Deposit and Withdrawal Options

Score – 3.9/5

Deposit Options at Z.com Forex

Z.com Forex accepts deposits only from a personal bank account in the client’s name. The broker does not accept cash deposits or third-party transfers, ensuring that all funds come directly from the account holder.

Z.com Forex Minimum Deposit

At Z.com Forex there is no minimum deposit requirement, which means you can open an account with any suitable amount.

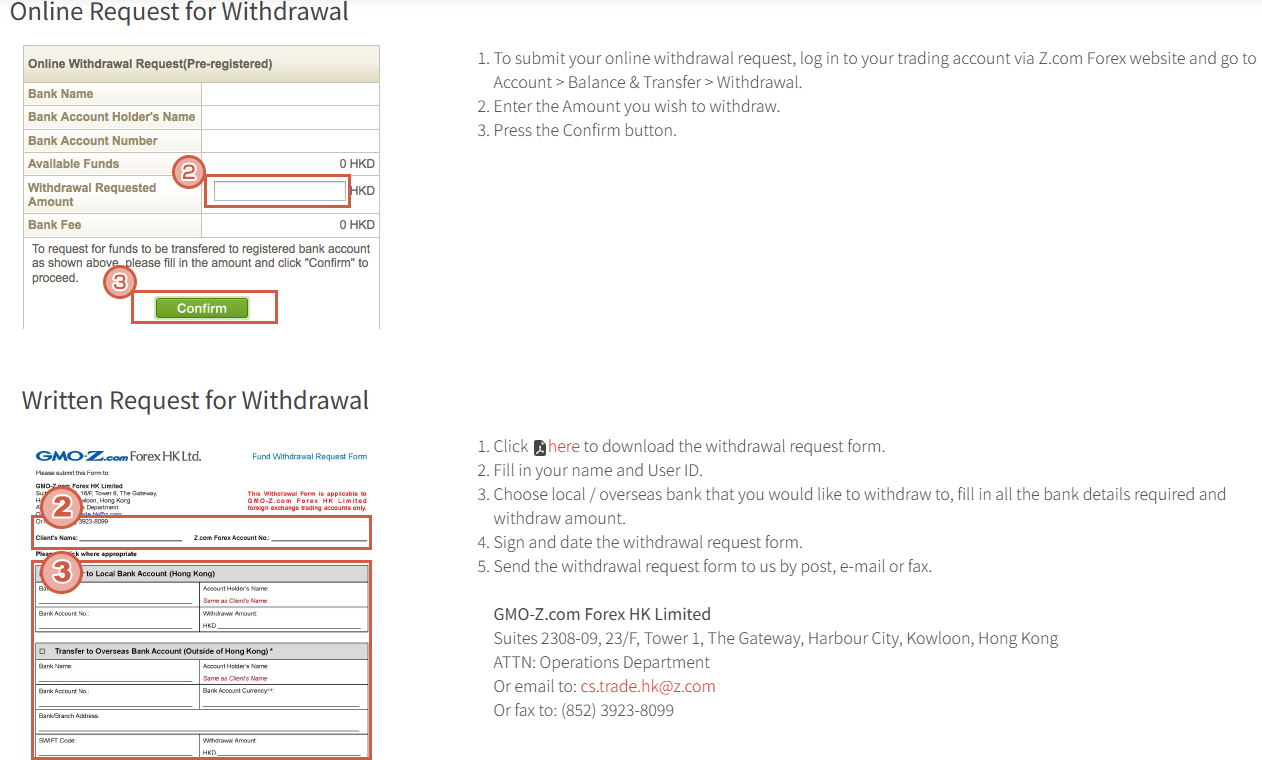

Withdrawal Options at Z.com Forex

Z.com Forex processes withdrawals using the same method as deposits, ensuring that funds are sent back to the client’s personal bank account.

Clients can request withdrawals directly through the platform, and funds will be transferred to their designated bank account. The withdrawal process is secure and follows the same strict policies as deposits to ensure transparency and account security.

Customer Support and Responsiveness

Score – 4.4/5

Testing Z.com Forex’s Customer Support

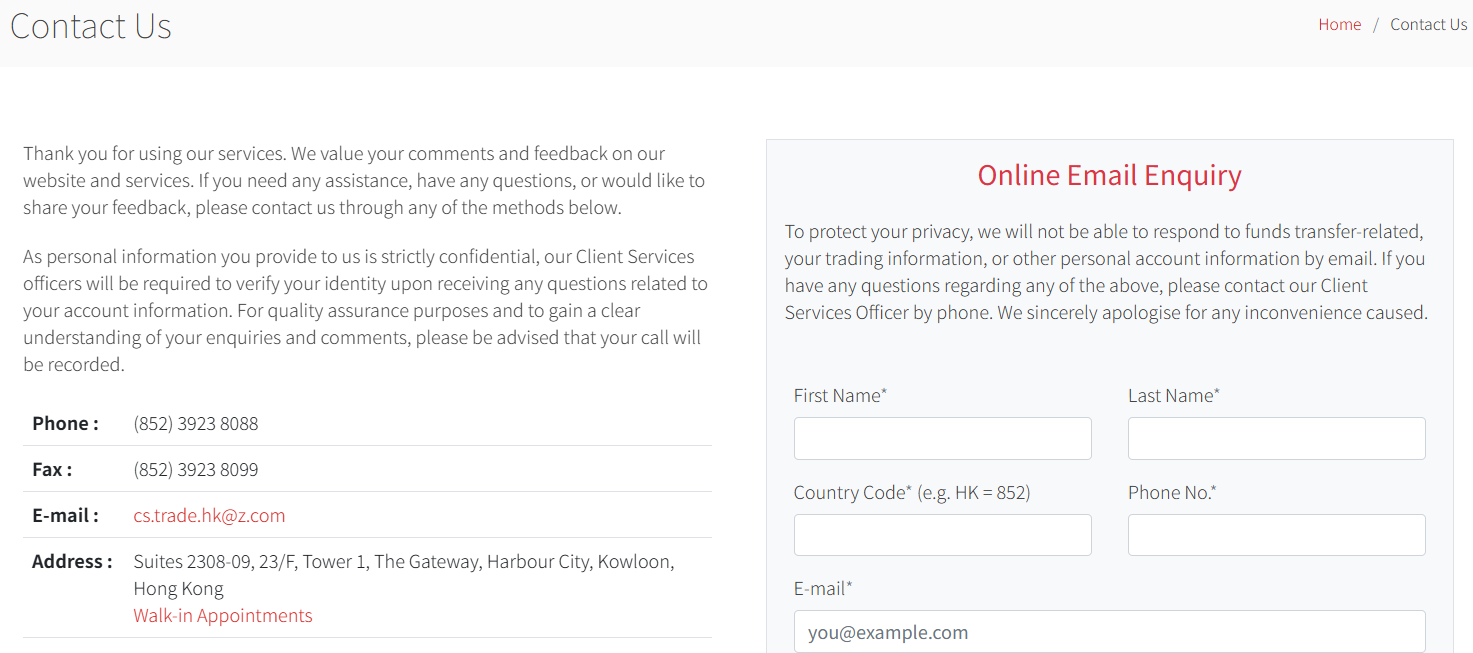

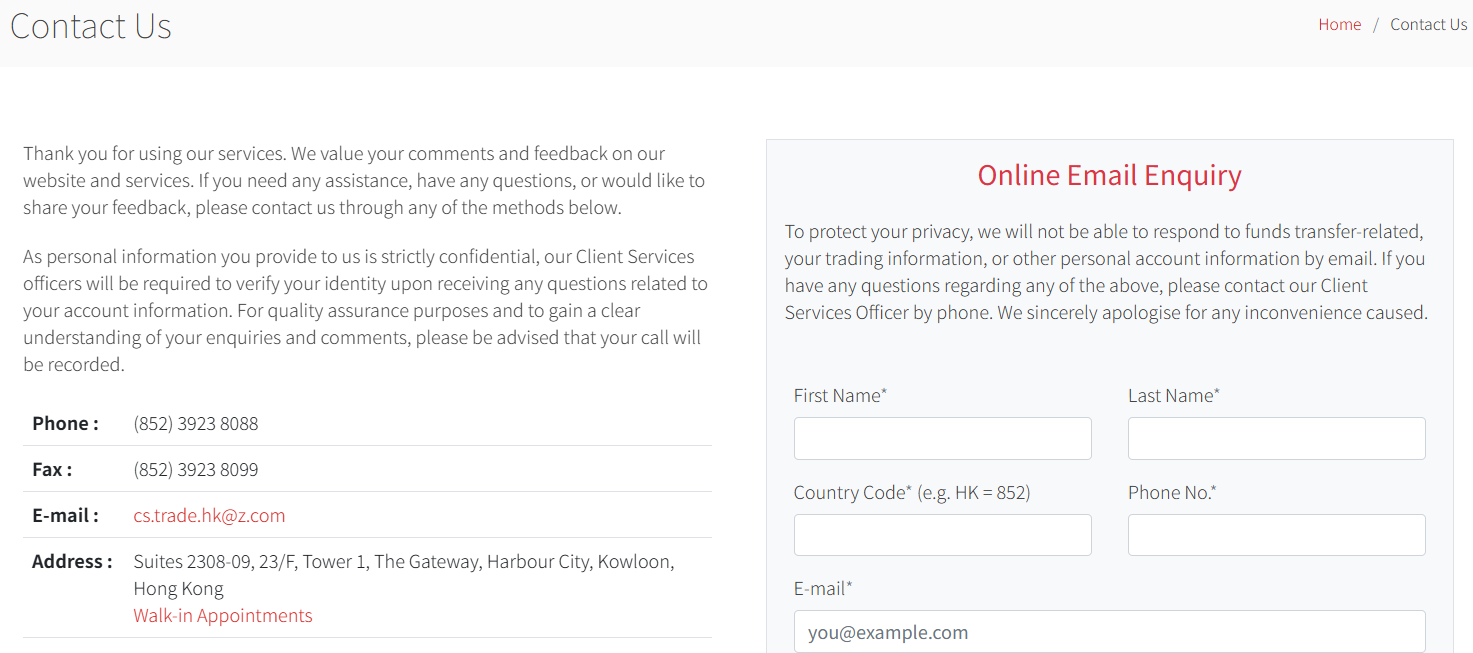

Z.com Forex offers 24/5 customer service at a professional level and supports live chat, phone lines, email, and fax. The broker also provides a detailed FAQ section to assist clients with common inquiries.

Contacts Z.com Forex

To get in touch with Z.com Forex, you can reach their customer support team at (852) 3923 8088 or via email at cs.trade.hk@z.com. The dedicated support team is available to assist you with any queries or concerns you may have regarding your experience.

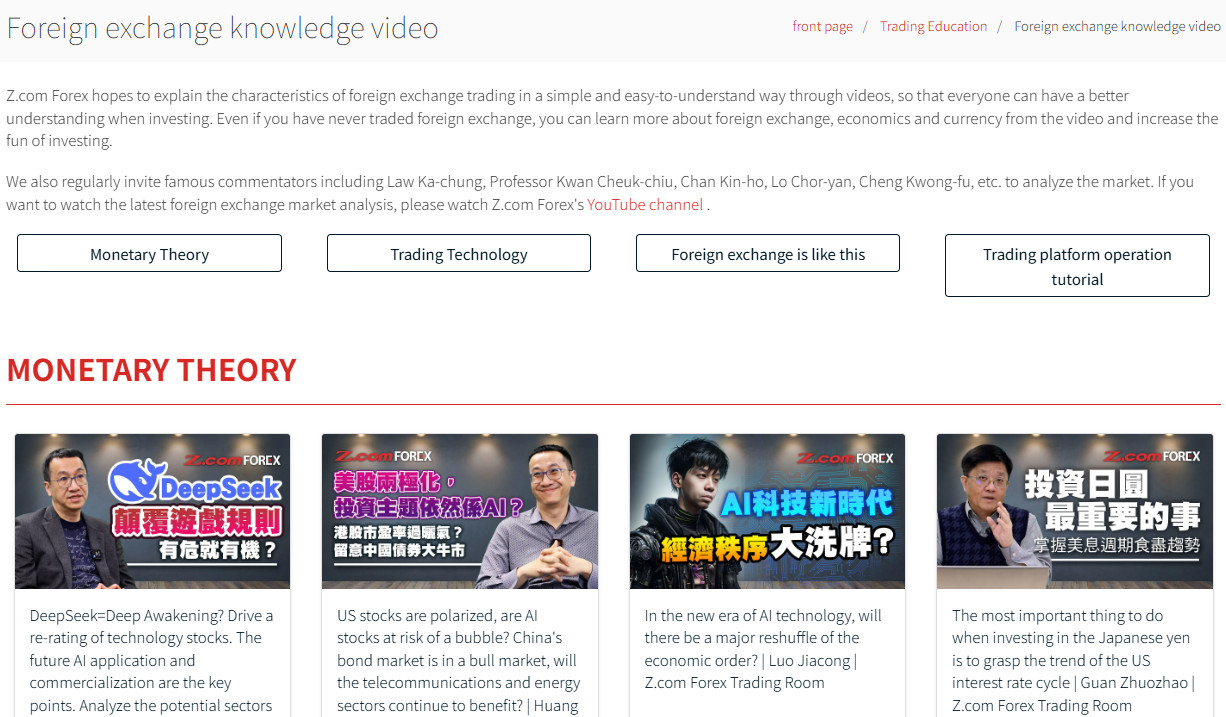

Research and Education

Score – 4.5/5

Research Tools Z.com Forex

Z.com Forex offers a variety of research tools available both on its website and platform to help traders make informed decisions.

- These tools include real-time market data, economic calendars, technical analysis indicators, and customizable charts to help in analyzing market trends and price movements.

- The platform also provides live news feeds and market sentiment analysis to keep traders up to date with the latest market developments. With these comprehensive research tools, the broker ensures that traders have access to the necessary resources to execute well-informed trades and stay ahead in the market.

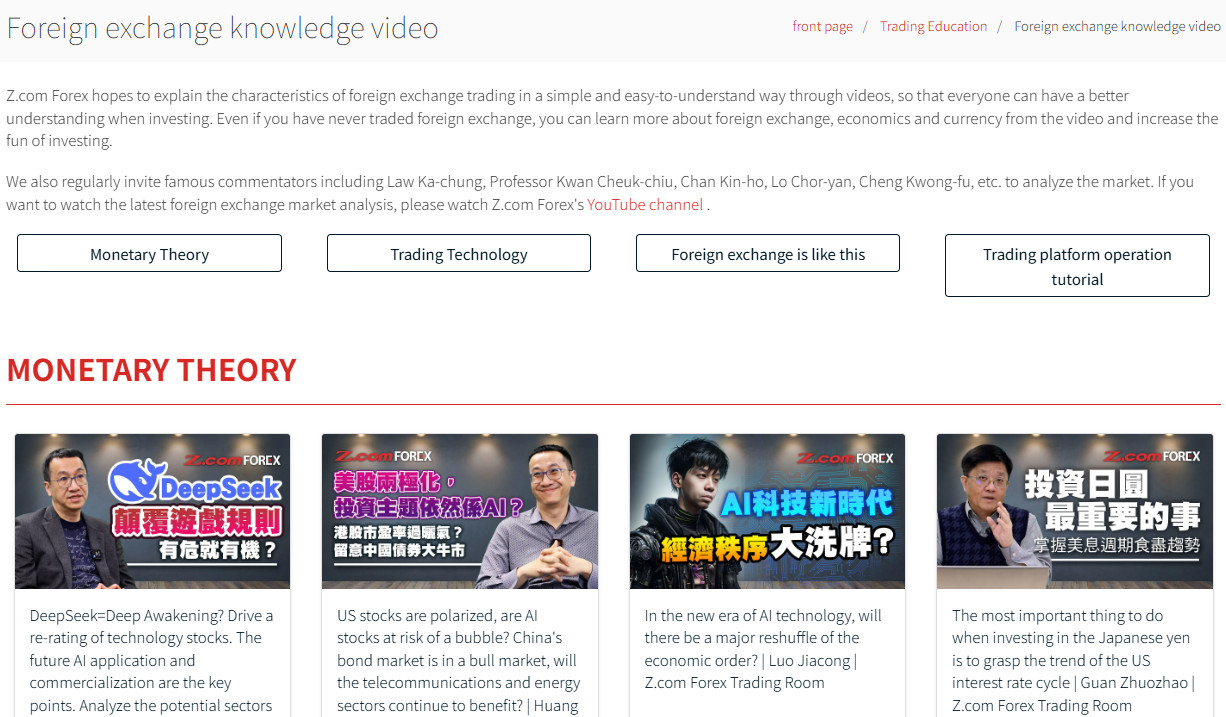

Education

Z.com Forex offers a comprehensive education section designed to help traders at all levels improve their skills and knowledge. The platform provides resources such as Basics for beginners, covering essential concepts like currency pairs, pips, and leverage.

Traders can also access a range of seminars and videos that dive deeper into advanced strategies, market analysis, and techniques. Additionally, Z.com Forex features an extensive glossary, offering clear definitions of key terms to help users navigate the complex world of Forex.

Portfolio and Investment Opportunities

Score – 3/5

Investment Options Z.com Forex

Z.com Forex primarily focuses on Forex and does not function as a traditional investment broker. Unlike brokers offering a range of investment options, Z.com Forex specializes in providing access to a wide variety of currency pairs for active trading.

The platform is designed for traders looking to engage in the Currency market. As such, it is more suited for those interested in speculative trading in the currency market rather than long-term investments in various asset classes.

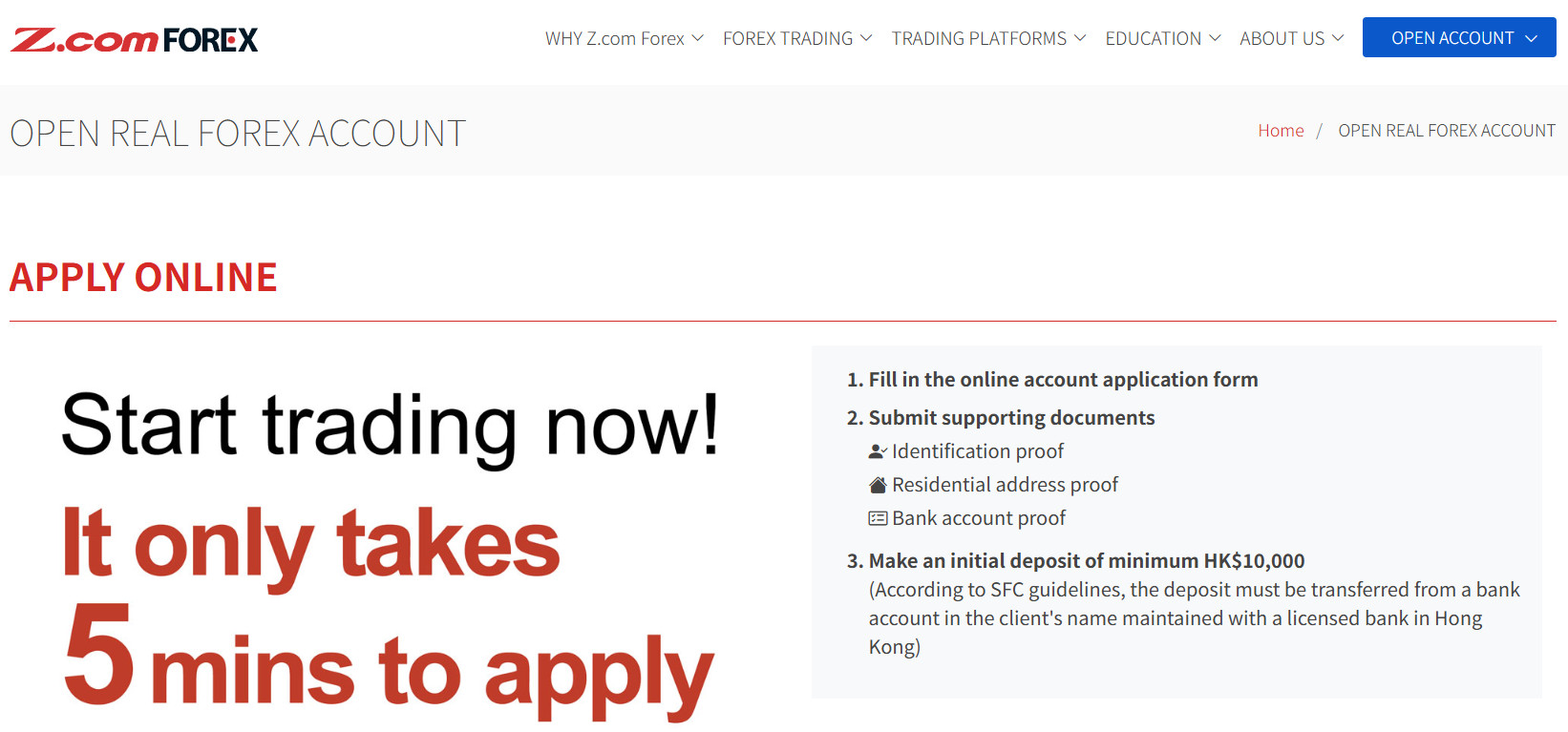

Account Opening

Score – 4.4/5

How to Open Z.com Forex Demo Account?

Opening a Z.com Forex demo account is a simple process that allows traders to practice and familiarize themselves with the platform before committing to real funds. To open a demo account, visit the Z.com Forex website and complete the registration form, providing basic personal details.

Once registered, you will receive login credentials to access the demo account. The demo account offers virtual funds, allowing users to trade in real market conditions without the risk of losing real money.

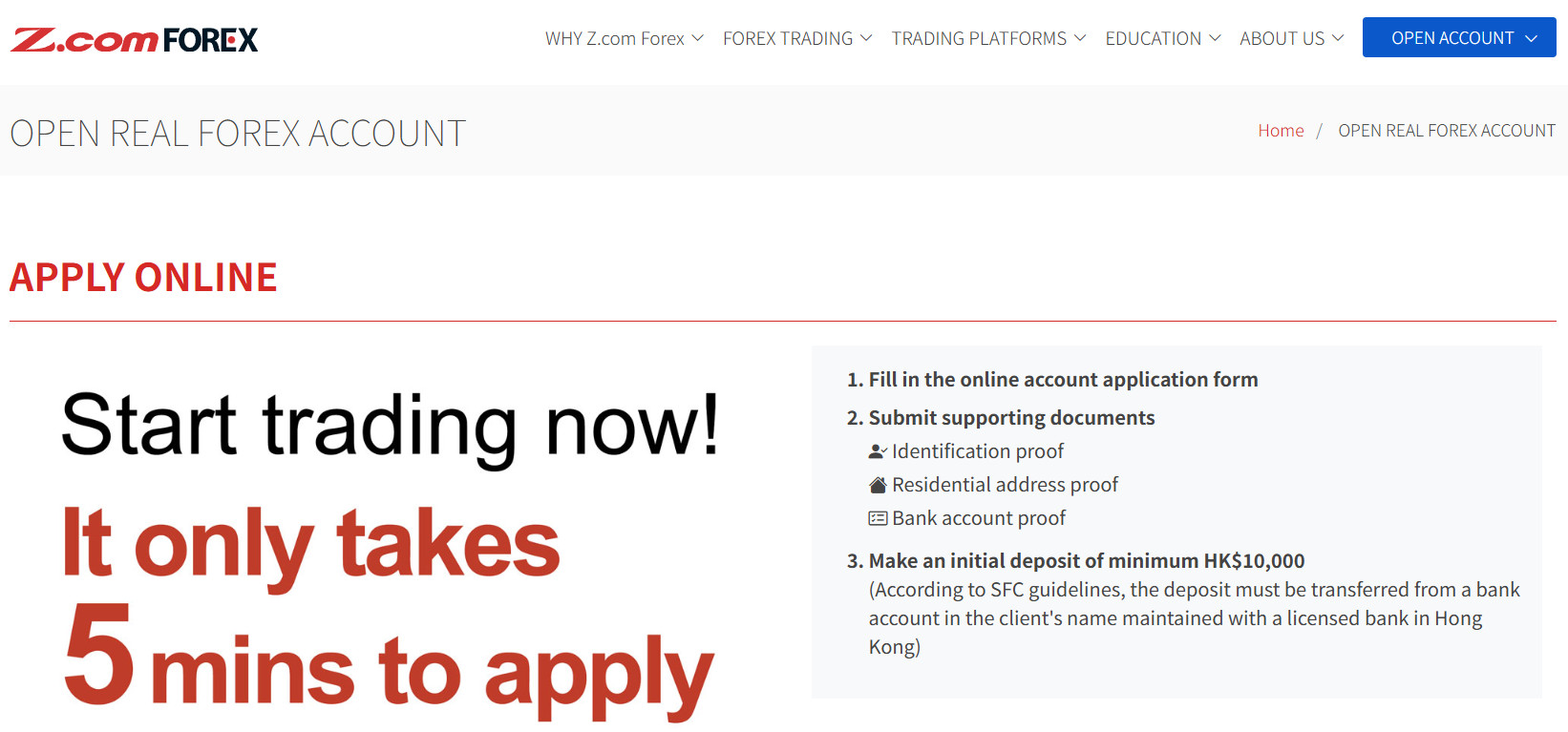

How to Open Z.com Forex Live Account?

Opening an account with Z.com Forex is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Once your account is activated and proven, follow with the money deposit.

- broker provides good quality educational materials, and excellent research also cooperates with market-leading providers of data.

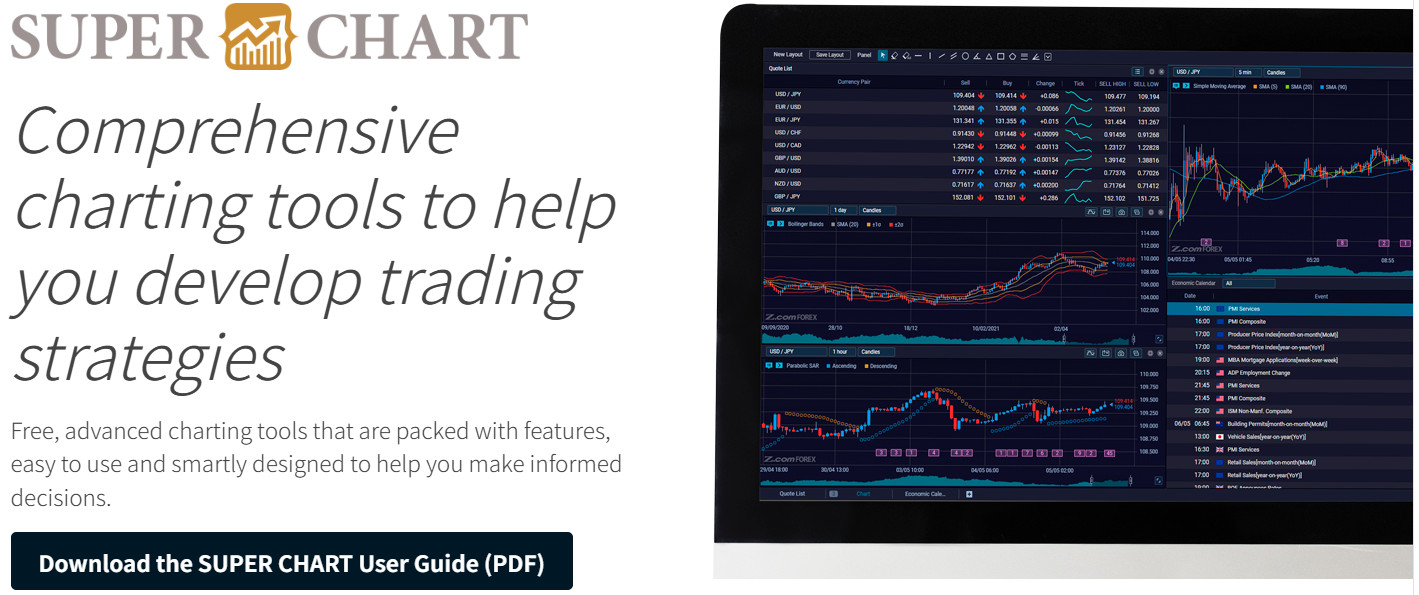

Additional Tools and Features

Score – 4.2/5

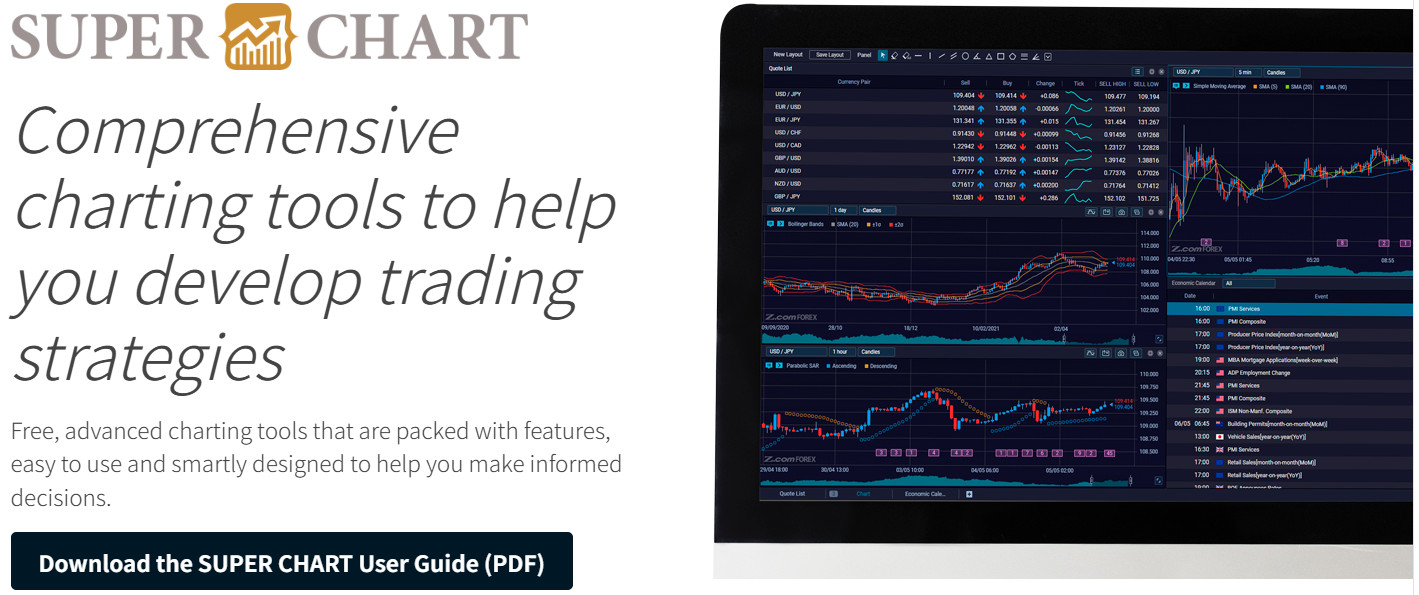

In addition to the research tools available on Z.com Forex, the platform also offers unique features such as the SUPER CHART.

- This advanced charting tool comes with 37 of the most popular technical indicators built in, including Simple Moving Average (SMA), Exponentially Weighted Moving Average (EMA), RSI, MACD, Bollinger Bands, Ichimoku Kinko Hyo, and many more.

- These indicators provide traders with the flexibility to conduct in-depth technical analysis and enhance their strategies.

Z.com Forex Compared to Other Brokers

Compared to its competitors, Z.com Forex stands out with its competitive spreads, keeping costs relatively low. While some brokers offer a broader range of instruments, Z.com Forex specializes in Currency trading, providing access to a solid selection of currency pairs.

Unlike brokers that support MT4 and MT5, Z.com Forex operates on its proprietary Z.com Trader platform, which offers a user-friendly experience with advanced charting tools.

The broker also provides strong educational resources, compared to some competitors that provide limited learning materials. Additionally, Z.com Forex maintains a low entry barrier with no minimum deposit requirement, making it accessible for traders of all levels. However, traders looking for a wider range of assets beyond Forex may find other brokers more suitable for diversification.

| Parameter |

Z.com Forex |

AETOS |

Saxo Bank |

City Index |

Swissquote |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1 pip |

Average 1.8 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

Not Available |

For Australian shares with a 0.07% commission of the contract value, (minimum fee of 7 AUD per trade) |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + €2.50 |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

Z.com Trader |

MT4, MT5 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT4, MT5, Swiss DOTS, TradingView |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

50+ currency pairs |

200+ instruments |

71,000+ instruments |

13,500+ instruments |

400+ Forex and CFDs instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

JFSA, SFC |

ASIC, VFSC, FSC, CIMA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Limited |

Excellent |

Excellent |

Excellent |

Good |

Good |

| Minimum Deposit |

$0 |

$50 |

$0 |

$0 |

$1,000 |

$0 |

$0 |

Full Review of Broker Z.com Forex

Z.com Forex is a regulated broker offering a specialized Currency trading experience with a focus on competitive spreads and a user-friendly Z.com Trader platform. It provides access to robust educational materials and a range of technical analysis tools, including the advanced SUPER CHART with 37 built-in indicators.

The broker ensures transparency in pricing, with fees based on spreads rather than commissions. Traders can choose between Standard and Demo accounts, benefiting from 24/5 customer support via multiple channels. Additionally, Z.com Forex maintains a secure and regulated environment under the JFSA and SFC, making it a reliable choice for traders looking for a streamlined experience.

Share this article [addtoany url="https://55brokers.com/z-com-review/" title="Z.com Forex"]