- What is XGLOBAL?

- XGLOBAL Pros and Cons

- Regulation and Security Measures

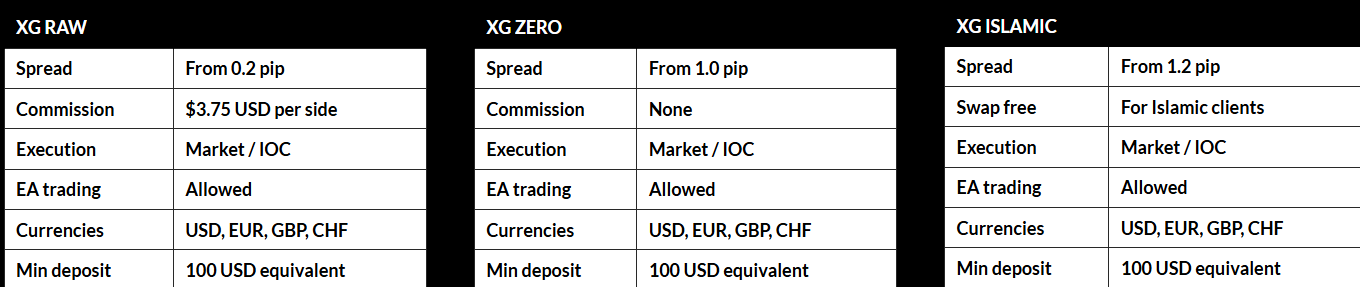

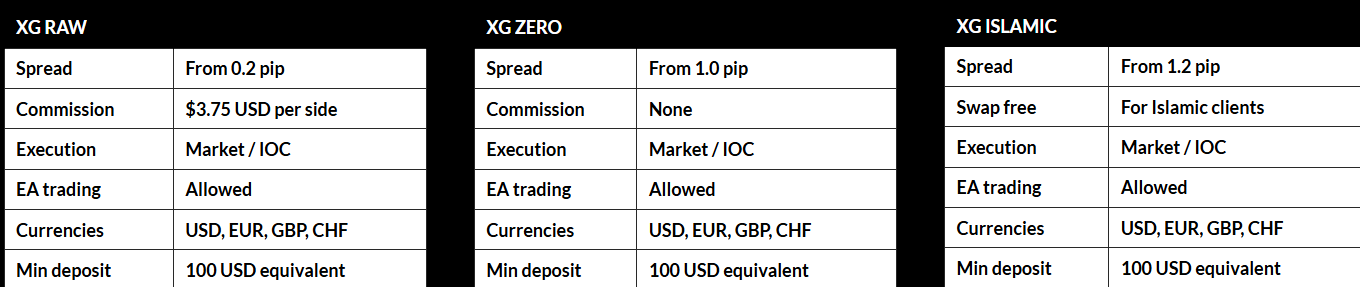

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

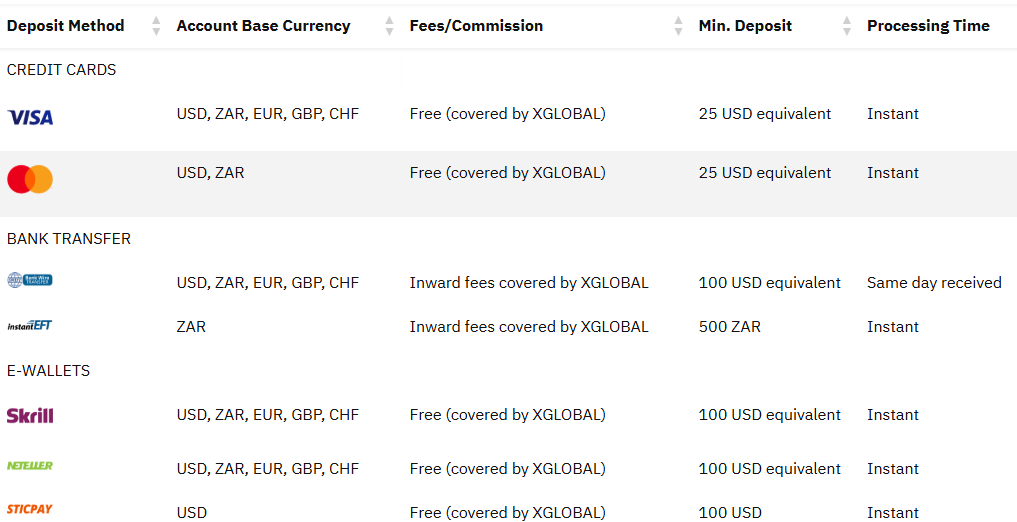

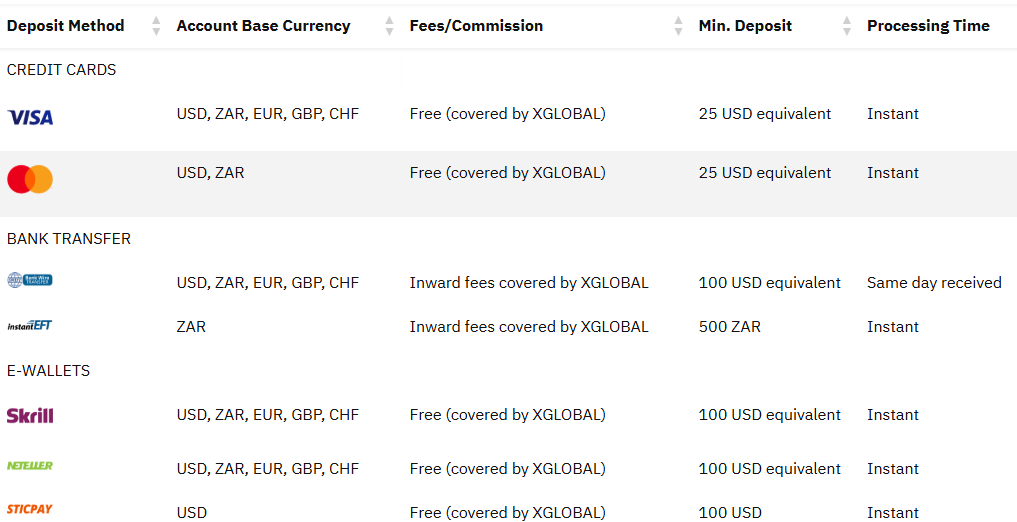

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- XGLOBAL Compared to Other Brokers

- Full Review of Broker XGLOBAL

Overall Rating 4.2

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4.1 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4 / 5 |

What is XGLOBAL Markets?

XGLOBAL Markets is a European Forex and CFD trading broker offering a wide range of FX, precious metals, equity indices, energies, commodities, and shares. In addition, the firm provides OTC derivatives for self-directed traders, as well as a portfolio management service.

Based in Limassol, Cyprus, the broker is fully licensed by the European Cyprus Securities and Exchange Commission (CySEC) and, in accordance with Law 144(1)/2007, is a member of the Investor Compensation Fund (ICF). In addition, XGLOBAL Markets is regulated by the Financial Sector Conduct Authority (FSCA)—a respected regulatory body in South Africa. The company also carries an international Vanuatu Financial Services Commission (VFSC) license as a Dealer in Securities, so it is available for clients almost everywhere.

XGLOBAL Markets Pros and Cons

The broker provides secure and reliable trading services through the industry’s popular MT5 platform. It offers a good variety of market instruments with tight spreads and no commission fees. Additionally, the broker offers a wide choice of account types for beginners, professionals, and corporate clients, as well as Islamic accounts for Muslim traders.

For the cons, the trading conditions and regulations may vary depending on the entity; also, international regulation is lax, with no strict guidelines and rules in place. The broker also does not offer 24/7 customer support.

| Advantages | Disadvantages |

|---|

| CySEC-regulated broker with competitive trading conditions | Conditions might vary based on the entity |

| Available for European and international traders | No 24/7 customer support |

| MT5 trading platform | |

| Commission-free trading with competitive and tight spreads | |

| Range of trading instruments | |

| Member of Investor Compensation Fund | |

| Wide choice of account types | |

XGLOBAL Markets Features

XGLOBAL Markets is a regulated broker with attractive trading conditions suitable for different trading needs and expectations. Below, we have compiled the main aspects of trading with the broker for a quick assessment:

XGLOBAL Markets Features in 10 Points

| 🗺️ Regulation | CySEC, FSCA, VFSC |

| 🗺️ Account Types | XG RAW, XG ZERO, XG ISLAMIC |

| 🖥 Trading Platforms | MT5 |

| 📉 Trading Instruments | Forex, CFDs, Precious Metals, Equity Indices, Commodities, Shares, Cryptocurrency CFDs |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP, CHF |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is XGLOBAL Markets For?

We have researched the broker and its offering to see who it can be most attractive to. Based on our financial expert’s opinion, XGLOBAL Markets can be good for the following:

- Traders from Europe

- International traders

- Those who prefer the MT5 trading platform

- CFD and currency trading

- Beginners

- Advanced traders

- Professionals

- Islamic clients

- Scalping/Hedging strategies

- STP/NDD execution

- Competitive spreads and prices

- EA/Auto trading

- Good trading tools

XGLOBAL Markets Summary

XGLOBAL Markets offers quite competitive trading conditions, with access to a range of instruments across various markets. With the use of the MT5 trading platform, there are many trading tools and features available to enhance the trading experience. The broker also provides various account types suitable for different trading styles, including a free demo account for new traders to practice and improve their skills.

Additionally, clients can enjoy commission-free trading and a variety of funding options for easy and fast deposits and withdrawals. While we note the broker does not offer comprehensive educational resources, its customer support team provides 24/5 assistance to traders with their inquiries and issues.

55Brokers Professional Insights

XGLOBAL Markets is a marked as reliable and cost-effective option for traders, and due to muultiiple licenses available in various jurisdictions covering global demand and available for international traders.

The good thing at the proposal is flexibility of accounts, either spread-based or commission-based, with variable low spreads and average commissions so either you’re more looking into investment trading with longer holding or day trading, the suitable options are available. Also, there is a good range of trading instruments across various Forex and CFDs. For the platform, the Trades are conducted through the popular MT5 platform so all the benefits or numerous extensions and free analysis is available, yet if you prefer other software, opt to other brokers then.

Overall trading conditions can depend on the entity, but are quite balanced overall. So we recommend traders carefully review the broker’s proposal before choosing XGLOBAL Markets as a trading broker to ensure that it meets your expectations, based on the entity you will be trading through.

Consider Trading with XGlobal Markets If:

| XGLOBAL Markets is an excellent Broker for: | - European clients

- Clients from the African region

- Beginner and intermediate traders

- Professional and corporate clients

- Traders who prefer the MT5 trading platform

- CFD and currency trading

- Muslim traders

- Those looking for competitive trading costs

- Clients who prefer variable spreads

- EA/Auto traders |

Avoid Trading with XGLOBAL Markets If:

| XGLOBAL Markets is not the best for: | - Clients looking for platforms other than MT5

- Traders looking for more rigorous regulatory oversight

- Traders looking for extensive trading tools

- Beginner traders in need for a comprehensive educational resources

- Traders looking of 24/7 customer support |

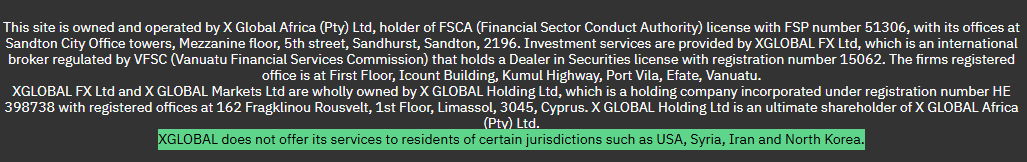

Regulation and Security Measures

Score – 4.3/5

XGLOBAL Markets Regulatory Overview

XGLOBAL Markets is a trustworthy company that adheres to strict rules and guidelines set by CySEC (Cyprus), a European regulatory body that oversees the broker’s operations. The broker is also regulated by one of the best-regarded agencies in South Africa—the Financial Sector Conduct Authority—adding a layer of security to the broker and making it available for traders from the African region.

- In addition, XGLOBAL Markets holds a license from the Vanuatu Financial Services Commission, which enables the broker to accept clients globally.

How Safe is Trading with XGLOBAL Markets?

As a regulated broker, the company is committed to safeguarding its clients’ funds by separating them from the firm’s accounts and not utilizing them for operational purposes. We also discovered that XGLOBAL Markets offers several protective measures, such as negative balance protection during times of market volatility or unforeseen events, investor compensation fund protection, and access to the financial ombudsman, which further enhances the safety of traders’ accounts.

Consistency and Clarity

Based on our research, XGLOBAL Markets has been in the market for over a decade, operating with consistency and clarity. The broker has over 5000+ registered clients, and the client base grows continuously. To expand its services globally, XGLOBAL Markets has recently obtained the Financial Sector Conduct Authority license, offering its services to the residents of the African region.

We have also considered customers’ feedback to see what clients share about their real experiences. Based on the research, the positive reviews prevail over the negative ones, pointing out an advanced and easy-to-use platform, low costs, and fast execution. The negative reviews mostly point out withdrawal issues, platform instability, and other aspects of trading. However, there are indications that some of the positive reviews might be fabricated to put the broker in a positive light.

This said, as far as our findings have revealed, XGLOBAL Markets offers transparent services, showing consistency in the growth and development in its offerings.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with XGLOBAL Markets?

Based on our analysis, traders can choose from three different account types when selecting XGLOBAL Markets as their trading broker: XG RAW, XG ZERO, and XG ISLAMIC, each offering unique trading options. In addition, professional and corporate clients can access specialized accounts; thus, the broker’s proposal might suit different trading needs. Besides, new traders can use a demo account, allowing them to practice trading and make trial trades.

- The XG RAW account is a commission-based account that offers very low spreads from 0.2 pips, with a fixed $3.75 per side commission.

- The XG ZERO account is a completely spread-based account with an average spread of 1.0 pips. There are no additional transaction fees for this account type.

- The XG ISLAMIC account also follows a spread-based structure, with spreads starting from 1.2 pips.

All in all, the account types have many common features and conditions. The minimum deposit requirement for all account types is $100. The account base currencies are USD, EUR, GBP, and CHF. Traders can access a range of instruments through the popular MT5 platform. Besides, all the account types enable clients to engage in hedging, swing trading, and copy trading. However, the broker does not support high-frequency trading. All this said, traders should remember that the account types differ from entity to entity.

Regions Where XGLOBAL Markets is Restricted

XGLOBAL Markets is an international broker, available to residents of numerous countries. However, based on regulatory restrictions, it does accept residents of certain jurisdictions:

- The USA

- Syria

- Iran

- North Korea

Cost Structure and Fees

Score – 4.4/5

XGLOBAL Markets Brokerage Fees

XGLOBAL Markets offers its clients different fee structures, enabling them to choose the best and most cost-efficient option that meets their expectations. The trading fees mostly depend on the account type, the instrument traded, and, of course, the entity. The broker also includes a few non-trading fees added to the general charges. All in all, XGLOBAL Markets stands out for its transparent pricing and fair practices.

As per our research, traders can choose tight and floating spreads for their XGLOBAL Markets trading accounts. The average spread for the XG ZERO account is 1.0 pips. For the XG Islamic account, the spreads start from 1.2 pips, while for the commission-based XG RAW account, spreads are floating from 0.2 pips, combined with fixed commissions.

- XGLOBAL Markets Commissions

XGLOBAL Markets offers a single commission-based account. The commission-based structure can be a suitable choice for professional traders looking for very low spreads and steady commissions. With spreads from 0.2 pips, the broker offers $3.75 per side.

How Competitive Are XGLOBAL Markets’ Fees?

We have reviewed XGLOBAL Markets’ trading costs to see how they align with the market average. Besides, we have studied the charges from the viewpoint of transparency and clarity. Our research revealed mostly low or average fees for all the available trading instruments, clearly mentioning the applied fees for each instrument. \The different fee structures enable traders to choose the most efficient option.

Beginner or cost-conscious traders are more likely to choose spread-based accounts, while more experienced clients will benefit from the commission-based offering, with access to low spreads and fixed transaction fees. Different factors determine the broker’s overall trading costs, and the most essential of them are the account type, instrument chosen, and the entity under which the account is opened.

| Asset/ Pair | XGLOBAL Markets Spread | Deriv Spread | ATFX Spread |

|---|

| EUR USD Spread | 1 pips | 0.5 pips | 1.8 pips |

| Crude Oil WTI Spread | 0.035 | 3.6 pips | 3 pips |

| Gold Spread | 0.20 | 0.015 | 3.8 pips |

XGLOBAL Markets Additional Fees

Almost all brokers apply additional fees for different services, including account funding, administration support of dormant accounts, etc. Based on our findings, XGLOBAL Markets does not charge any fees for deposits or withdrawals, providing traders with a cost-effective solution. However, we discovered that the broker does apply an inactivity fee for accounts that remain inactive for more than 12 months.

Score – 4.2/5

XGLOBAL Markets offers the MetaTrader 5 trading platform to its clients, which is a popular and widely used platform in the financial markets. MT5 is known for its advanced charting capabilities, technical analysis tools, and customizable interface, making it an ideal platform for both novice and experienced traders.

Our research also revealed that the platform is available for download on various devices, including desktop, web, macOS, Android, and iOS, ensuring traders can access their trading accounts from anywhere and at any time.

| Platforms | XGLOBAL Markets Platforms | Deriv Platfroms | ATFX Platforms |

|---|

| MT4 | No | No | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

XGLOBAL Markets Web Platform

XGLOBAL Markets provides browser-based access, a quick and flexible way to enter your accounts and monitor trades without downloads or installations. The web platform is available via any device connected to the internet, enabling accessibility. The XGLOBAL Markets web platform has the most essential capabilities the desktop platform provides, including in-depth charting tools, real-time data, one-click trading, various order types, and other features to enhance the trading experience. The platform also ensures security and quick execution of trades.

XGLOBAL Markets Desktop MetaTrader 4 Platform

XGLOBAL Markets does not offer the popular MT4 platform. For many traders, this can be a negative point, especially for beginner traders who are looking for a simple and easy-to-use interface. However, the broker offers the advanced version of the platform, the MT5, which is a great platform opportunity and will enable traders to access more innovative features and explore the market in a more advanced setting.

XGLOBAL Markets Desktop MetaTrader 5 Platform

XGlobal Markets introduces its clients to the innovative MetaTrader 5 platform to conduct profitable trades and explore the market efficiently. Traders can access advanced charting capabilities, with multiple chart types, timeframes, and technical indicators to assist with market analysis. The platform also provides a built-in economic calendar, which shows scheduled events and news releases that could affect the markets, allowing traders to plan their trades accordingly. Traders can also copy trades from other traders or create and share their own trading signals with the community.

Additionally, the MT5 platform allows for automated trading with the use of Expert Advisors and algorithmic trading, making it an excellent option for traders who prefer a more advanced approach to trading.

XGlobal Markets MobileTrader App

XGlobal Markets offers the MT5 mobile app to help its clients trade on the go and access the market whenever they choose. The mobile app offers an easy-to-use interface while including excellent trading tools and functionalities. Traders can access over 30 indicators, charting tools, trading history, all types of orders, and customize the screen according to their preferences. The mobile app gives traders the freedom and flexibility to trade from any device by downloading the app on their phones.

Main Insights from Testing

Our testing of the XGlobal Markets trading platforms has left us with a positive impression. Although the broker offers only the MT5 platform through desktop, web, and mobile apps, it includes all the necessary tools and features to meet both beginners’ and professionals’ expectations. The platforms are easy to install or download and simple to navigate. Although the MT5 platform is a great choice for different levels of traders, it can be limiting that the broker does not include other options, such as MT4, cTrader, TradingView, etc.

Trading Instruments

Score – 4.3/5

What Can You Trade on the XGLOBAL Markets Platform?

Based on our research, XGLOBAL Markets offers a diverse range of trading instruments, including Forex, CFDs, precious metals, equity indices, commodities, shares, and cryptocurrency CFDs. The broker enables traders to access a good range of tradable products with competitive trading costs and conditions. We encourage traders to check the instrument availability for each entity, as the proposal may vary. Traders can access all the instruments via the MT5 platform and trade in a reliable and safe environment.

Main Insights from Exploring XGLOBAL Markets Tradable Assets

Our testing of the instrument section has revealed a basic range of trading instruments, enabling clients to access the major and most popular products. Traders can access 44 major, minor, and exotic currency pairs, precious metals, including gold and silver, and commodities such as Spot Crude Oil, Spot Brent Oil, and Spot Natural Gas.

The broker also offers 13 industry-popular indices, including the Dow Jones Index, S&P 500 Index, Nasdaq-100 Index, FTSE 100 Index, and Nikkei 225 Index. As we have found, traders can also access a good range of cryptocurrency CFDs, such as the popular Bitcoin, Ethereum, Litecoin, Ripple, and others.

We strongly recommend that clients check the instrument availability based on the entity under which they are opening the account, as the range of products may differ from entity to entity.

Leverage Options at XGLOBAL Markets

Leverage is a useful tool that allows traders to access the market with less capital, but it can also result in significant profits or losses depending on its usage. Therefore, it is essential to have a thorough understanding of how leverage operates and its potential consequences before engaging in trading activities that involve leverage.

XGLOBAL Markets leverage is offered according to CySEC, VFSC, and FSCA regulations:

- European traders can use a maximum of up to 1:30 for major currency pairs.

- International entity clients can use leverage up to 1:200 for professional trading.

- Traders from the South African region can access up to 1:500 leverage, based on the instrument traded.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at XGLOBAL Markets

XGLOBAL Markets offers numerous deposit and withdrawal options, including bank transfers, credit/debit cards, e-wallets, and internal transfers for money transfers to or from their trading accounts. However, it is essential to remember that each funding method might have specific requirements and limitations depending on the involved financial institutions and the entity of XGlobal Markets.

XGLOBAL Markets offers the following payment methods:

- Bank Wire,

- Credit/Debit cards,

- Skrill,

- Neteller, etc.

- Sticpay

Minimum Deposit

To open a live trading account with the broker, traders are required to deposit $100 as an initial amount, which is considered a very good offering.

Withdrawal Options at XGLOBAL Markets

Withdrawals are generally processed quickly and without additional fees. For most of the methods, there is no limitation on the withdrawal amount. Only wire transfers require at least $100 to process the withdrawal.

- The withdrawal processing time depends on the chosen method. The withdrawals through Visa, Mastercard, and wire transfers usually take up to 5 working days. eWallets such as Skrill and Neteller process the withdrawals instantly.

Customer Support and Responsiveness

Score – 4.5/5

Testing XGLOBAL Markets Customer Support

At XGLOBAL Markets, traders have access to 24/5 customer support through the phone line, live chat, and email. Also, the support team is comprised of trading experts who can provide assistance with technical issues, analysis recommendations, and general inquiries.

- The broker also offers an FAQ section where clients can find all the answers to the most common questions.

XGLOBAL Markets Contacts

XGLOBAL Markets offers its clients dedicated and responsive customer support through multiple methods.

- Traders who prefer immediate communication with the support team can use the provided phone number: +357 25 262002.

- The live chat is another option to contact the broker. The answers are quick and detailed, making the live chat the most suitable method for urgent issues.

- To send an email to the broker, traders can use the info@xglobalmarkets.com email address. Through email, clients will get detailed and informative answers to any question or inquiry.

- Also, traders can send a question or inquiry right from the broker’s contact us section, via the inquiry form.

- At last, traders can stay updated by following the broker’s social media pages, including Facebook, Twitter, and LinkedIn.

Research and Education

Score – 4.2/5

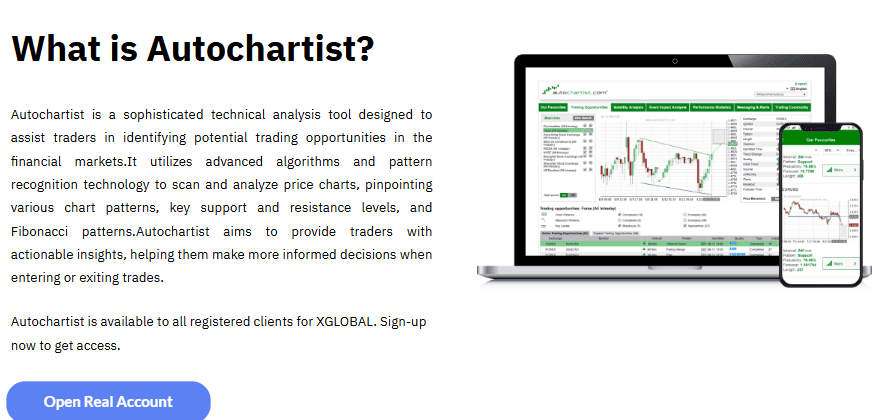

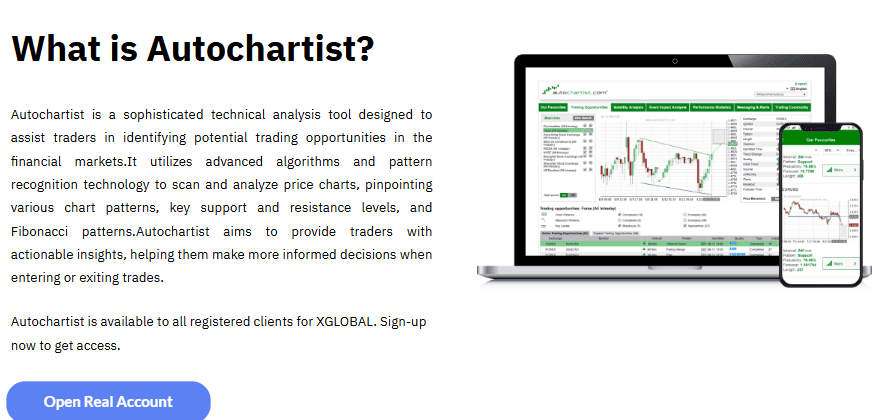

Research Tools XGLOBAL Markets

XGLOBAL Markets mostly relies on the MT5 platform and its analytical tools for market research. However, we reviewed the broker’s different entities to see what other research tools traders benefit from.

- Through the broker’s FSCA and VFSC entities, traders can access Autochartist, an innovative analytical tool to support traders and inform them about the market changes and opportunities. Using Autochartist, traders will get market analysis, trading signals sent through a Telegram channel, and emails with analysis for the active clients.

- Besides, traders can access the economic calendar to stay informed about the coming changes in the market. Being informed at all times helps clients make the right decisions and avoid poor trading choices.

Education

Based on our research, education is available only through the FSCA entity. The resources offered are not extensive, but still enable traders access to essential materials, such as blog articles, trading courses, and a video center. Although the broker does not include webinars, seminars, a forex glossary, and other essential educational tools, the offering is still not bad.

- The learning center includes beginner courses, articles on different trading-related topics, and money management techniques.

- The video center includes guides on how to trade and navigate the broker’s platform, how to manage accounts, etc.

- The blog includes many detailed articles that help traders dive deeper into forex trading and enhance their knowledge of the market.

Is XGLOBAL Markets a Good Broker for Beginners?

XGLOBAL Markets offers favorable trading conditions and essential safety measures that enable any trader to benefit from the broker’s proposal. The advanced platform, availability of trading accounts, competitive spreads, and educational materials make XGLOBAL Markets a good choice for beginners. The initial deposit is not high, starting from $100, which makes the broker suitable even for cost-conscious traders. Besides, beginners can open a demo account and enhance their trading skills in a safe and risk-free setting before switching to a live account.

Portfolio and Investment Opportunities

Score – 4.1 /5

Investment Options XGLOBAL Markets

XGLOBAL Markets provides all the most demanded tradable products across a good range of financial assets. Clients can access more than 44 forex pairs, major indices, precious metals, and an attractive selection of cryptocurrencies. However, the broker’s offerings are based on CFDs, which means limitations in investment opportunities, excluding traditional and long-term investments.

Yet, the broker includes copy trading and MAM accounts in its proposal, which gives traders an alternative to invest.

- The broker’s copy trading enables traders to copy the successful trades of experienced traders, expanding their portfolios and increasing the opportunities to profit.

- MAM account availability is another advantage for traders. Account managers manage the MAM accounts, and both traders and managers benefit from profitable trades.

Account Opening

Score – 4.5/5

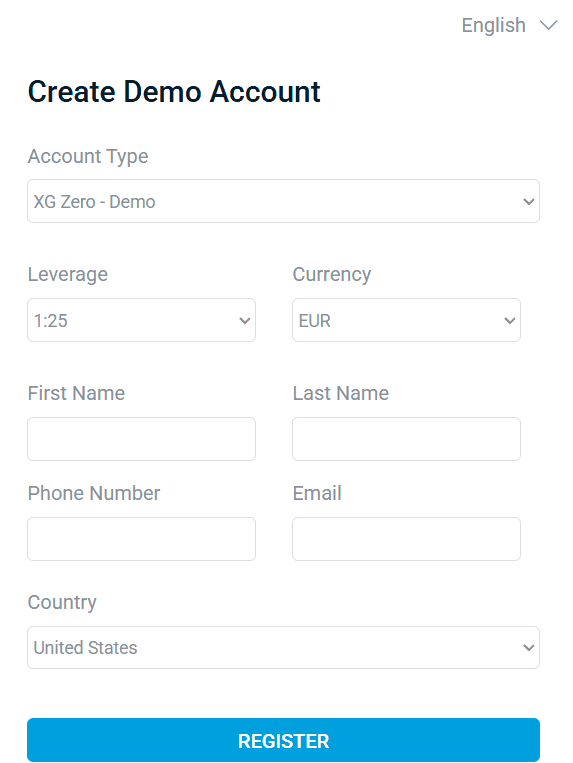

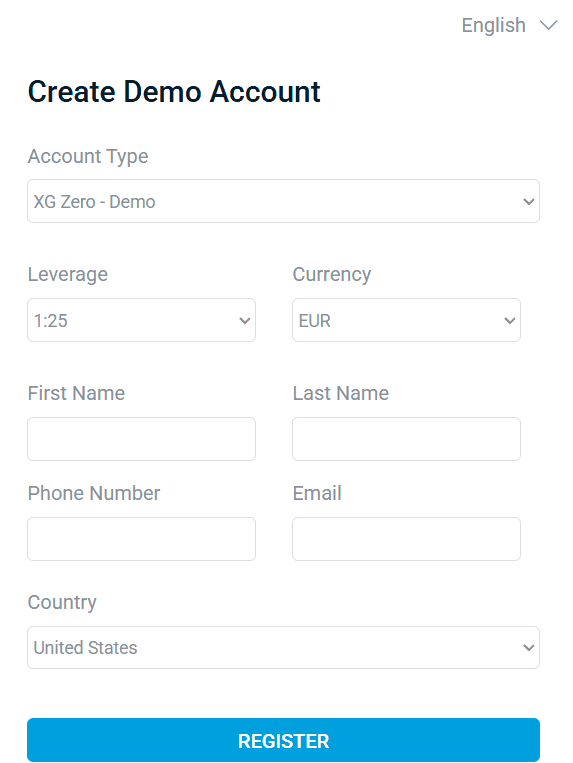

How to Open an XGLOBAL Markets Demo Account?

The availability of a demo account is a big advantage, enabling traders to practice their skills before engaging in live trading. To open a demo account with XGLOBAL Markets, traders need to follow a few consecutive simple steps and set up their demo accounts in a matter of minutes:

- Visit the broker’s official website and choose the ‘Open Demo Account’ button.

- Provide basic information, like name, phone number, email, and country.

- Also, choose the account type, account base currency, and leverage.

- Get the login credentials to the email address you provided.

- Download the MT5 platform to your device.

- When the platform is downloaded, use the account credentials and enter your demo account.

How to Open an XGLOBAL Markets Live Account?

Opening an account with a broker is quite easy. You should follow the opening account or sign-in page and proceed with the following easy steps:

- Select and click on the “Open Real Account” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz to confirm your trading experience.

- Once the account is activated and proven, follow up with the money deposit.

Score – 4/5

XGLOBAL Markets offers an innovative platform with advanced tools and features that can take trading to another level. The broker also offers an economic calendar and Autochartist, additional tools for assessing the market and predicting upcoming events and changes.

The availability of MAM accounts and copy trading adds additional trading opportunities. Based on our research, these are the main tools the broker offers through its different entities.

XGLOBAL Markets Compared to Other Brokers

We have compared XGLOBAL Markets to other brokers for a final evaluation. XGLOBAL Markets holds licenses from CySEC, FSCA, and VFSC. Although the broker holds serious licenses, we found that FP Markets and AvaTrade have tighter regulation and follow stricter guidelines and laws, as they hold licenses from authorities like the FCA, ASIC, and more.

When we compared the broker’s trading fees, it was evident that XGLOBAL Markets has average costs with spreads from 1 pip and a fixed commission of $3.75 per side. On the other hand, Deriv offers tighter spreads from 0.5 pips and low commissions. The availability of trading platforms is also diverse for other brokers. Whereas XGLOBAL Markets offers only the MT5 platform, Deriv and AvaTrade stand out for a good selection of platforms, including their proprietary platforms.

The initial deposit fee is low for XGLOBAL Markets, starting from $100, which is a common offering among forex brokers. However, there are brokers with lower requirements, such as HFM, which has a $0 initial deposit.

At last, the broker’s education availability depends on the entity. Traders who open accounts under the FSCA can access educational materials, such as blog articles and video tutorials.

| Parameter |

XGLOBAL Markets |

AvaTrade |

HFM |

FP Markets |

IC Markets |

Pepperstone |

Deriv |

| Spread-Based Account |

Average 1 pip |

Average 0.9 pips |

Average 1 pip |

From 1 pip |

From 1 pip |

Average 0.7 |

Average 0.5 pips |

| Commission-Based Account |

0.2 pips + $3.75 |

For Professional Account only |

0.0 pips + $3 |

0.0 pips + $3 |

0.0 pips + $3.50 |

0.0 pips + $3.50 |

0.0 pips + $0.05 |

| Fees Ranking |

Average |

Low |

Low/ Average |

Low/ Average |

Low/ Average |

Low |

Low |

| Trading Platforms |

MT5 |

MT4, MT5, WebTrader, AvaTrade App, AvaOptions, DupliTrade, ZuluTrade, AvaSocial, Capitalise.ai |

MT4, MT5, HFM App |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, cTrader |

MT4, MT5, cTrader, TradingView |

Deriv MT5, Deriv cTrader, Deriv X, Deriv Trader, Deriv Bot, Deriv GO, SmartTrader |

| Asset Variety |

300+ instruments |

250+ instruments |

500+ instruments |

10,000+ instruments |

1,000+ instruments |

1,200+ instruments |

200+ instruments |

| Regulation |

CySEC, FSCA, VFSC |

Bank of Ireland, ASIC, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

ASIC, CySEC, FSCA, CMA |

ASIC, CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

MFSA, Labuan FSA, BVI FSC, VFSC |

| Customer Support |

24/5 support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

| Educational Resources |

Good |

Excellent |

Good |

Excellent |

Good |

Excellent |

Good |

| Minimum Deposit |

$100 |

$100 |

$0 |

$100 |

$200 |

$0 |

$5 |

Full Review of Broker XGLOBAL Markets

To sum up, based on our research on each aspect of trading with XGLOBAL Markets, we found the broker a favorable option for engaging in trading. The broker’s attractive proposal may appeal to traders of different levels.

With XGLOBAL Markets, trades are conducted through the advanced and intuitive MT5 platform. Users can access the market through web and desktop platforms and the mobile app. All the platforms enable access to popular instruments across Forex, Precious Metals, Equity Indices, Commodities, Shares, and Cryptocurrency CFDs. The spreads start from 1 pip for the spread-based account with no commissions. The commission-based account offers spreads from 0.2 pips, combined with fixed commissions of $3.75 per side.

Traders can also access a good range of trading tools and features through the MT5 platform. Besides, the broker offers Autochartist, copy trading, and MAM accounts that diversify the broker’s offering and enable clients to explore the market with more tools and opportunities.

The education section is available only for traders opening accounts under the FSCA entity. The section is not extensive, but it still includes materials to assist beginner traders.

As we have found, trading conditions, such as account types, trading costs, and other aspects, may vary from entity to entity. Our recommendation to traders is to be careful and conduct research to see how the broker meets their trading expectations and needs.

Share this article [addtoany url="https://55brokers.com/xglobalmarkets-review/" title="XGLOBAL Markets"]