- What is WH SelfInvest?

- WH SelfInvest Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- WH SelfInvest Compared to Other Brokers

- Full Review of Broker WH SelfInvest

Overall Rating 4.5

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4.7 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4 / 5 |

What is WH SelfInvest?

WH SelfInvest is a European online broker that allows Forex and CFD trading and investment services. It offers a range of trading instruments, including Forex, CFDs, stocks, options, and futures.

Based on our research, the broker is headquartered in Luxembourg and is regulated and authorized by the Commission de Surveillance du Secteur Financier (CSSF). Additionally, the company has branches in France and Germany, under the French Prudential Supervision and Resolution Authority (ACPR) and the Federal Financial Supervisory Authority (BaFin).

All in all, the broker allows a comprehensive range of financial solutions through advanced trading platforms.

WH SelfInvest Pros and Cons

Per our findings, the broker has both advantages and disadvantages that are important for traders to consider. On the positive side, WH SelfInvest offers a variety of financial instruments, allowing traders to diversify their investment portfolios. Additionally, the firm provides advanced trading platforms, including the widely used MT4 and NanoTrader, offering flexibility and choice. Moreover, the broker holds regulatory licenses from reputable European financial authorities, ensuring compliance with high standards and enhanced client protection.

For the cons, the minimum deposit requirement is higher compared to other brokers. Additionally, the fee structure, including trading commissions and other costs, might be complex for some traders; therefore, users should thoroughly understand the fee details to avoid any surprises.

| Advantages | Disadvantages |

|---|

| European licenses and oversight | No 24/7 customer support |

| Good trading conditions | High minimum deposit |

| Good trading platforms | |

| A variety of trading instruments | |

| Professional trading | |

| Education and research | |

| Competitive spreads | |

| STP/ECN execution | |

WH SelfInvest Features

According to our analysis, WH SelfInvest provides favorable trading conditions, including competitive spreads and fees for its financial activities. To understand the broker’s proposal better, we have compiled the main aspects of trading.

WH SelfInvest Features in 10 Points

| 🗺️ Regulation | CSSF, ACPR, BaFin |

| 🗺️ Account Types | Forex and CFD account, Futures account, Investment account |

| 🖥 Trading Platforms | MT4, NanoTrader, NinjaTrader, TradingView |

| 📉 Trading Instruments | Forex, CFDs, Stocks, Options, Futures |

| 💳 Minimum deposit | €500 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | EUR, USD, GBP, CHF |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is WH SelfInvest For?

Our findings and Financial Expert Opinions revealed that WH SelfInvest is a tightly regulated broker that assures a secure environment and profitable trading conditions. The broker can better serve the following traders or trading expectations:

- European traders

- Currency trading

- Professional trading

- Investing

- Beginners

- Advanced traders

- Competitive spreads

- Good education and research

- EA/Auto trading

- Good trading tools

WH SelfInvest Summary

WH SelfInvest stands as a reputable brokerage with a strong commitment to regulatory standards, offering a diverse range of trading instruments and user-friendly platforms, including NanoTrader and MT4. The broker’s regulatory framework ensures compliance with stringent requirements, providing traders with a level of transparency and security.

Overall, we found that the broker provides a solid foundation for traders seeking a reliable and versatile trading experience within the European regulatory framework. However, we advise researching and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

According to our analysis, WH SelfInvest offers reliable trading conditions with efficient trade execution, making it an attractive option for traders at all levels. Additionally, the broker provides access to advanced trading platforms that allow users to trade well-known trading products. Clients can access the market through one of the available account types – CFD and Forex accounts, Futures, or Investment. Each account type offers varying conditions and different opportunities for specific trading needs.

As we found, trades are conducted through the MT4, NanoTrader, and NinjaTrader platforms, allowing great trading features and diversity. The broker also offers a competitive fee structure, ensuring clear and transparent fees with no hidden charges.

In addition to the favorable trading opportunities, the broker ensures a safe and tightly regulated environment, where clients are protected by the stringent European rules and guidelines.

With WH SelfInvest, traders can also find educational materials and practice through the deno account, enhancing their skills and knowledge.

Consider Trading with WH SelfInvest If:

| WH SelfInvest is an excellent Broker for: | - Forex and CFD traders

- Futures trading

- European traders

- Beginners and professionals

- Clients looking for competitive traders

- Novice traders looking for webinars

- Those who appreciate dedicated customer support

- For longer-term Investments |

Avoid Trading with WH SelfInvest If:

| Avoid Trading with WH SelfInvest If: | - Traders looking for very low minimum deposit requirement

- Clients looking for fixed spreads

- Crypto traders

- The MT5 platform enthusiasts |

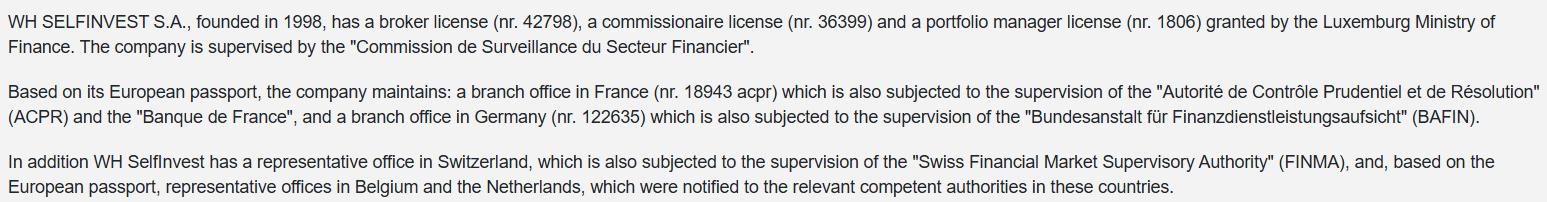

Regulation and Security Measures

Score – 4.6/5

WH SelfInvest Regulatory Overview

The broker is trustworthy, ensuring a low-risk trading environment. It is regulated by Top-Tier European authorities and follows the strict rules and guidelines established by them.

WH SelfInvest holds three types of licenses – a broker license, commissionaire license, and a portfolio management license, all issued by the Commission de Surveillance du Secteur Financier (Luxembourg).

Through its EU passport, the broker has been constantly expanding its reach in Europe and has multiple branches, each with supervision from the local authorities. Thus, WH SelfInvest holds additional licenses from BaFin (Germany), FINMA (Switzerland), ACPR (France), and AFM (the Netherlands).

How Safe is Trading with WH SelfInvest?

According to our findings, WH SelfInvest places a strong emphasis on client trading protection by adhering to regulatory standards and implementing measures to ensure a secure trading environment. As a broker holding European regulatory licenses, the company is committed to safeguarding client funds and maintaining transparent and fair practices.

The use of encryption technologies, secure payment methods, and stringent compliance with data protection regulations contribute to creating a robust framework that prioritizes the security and protection of client trading activities.

Consistency and Clarity

WH SelfInvest has been in the market for many years, and during its years of operation, the broker has constantly enhanced both its regulatory status and different trading aspects. We also found that WH SelfInvest has garnered recognition and accolades over the years, which further confirms the broker’s secure and favorable service.

As a result of our research, we also noticed that the broker’s clients leave positive feedback on different platforms, praising various aspects of WH SelfInvest. Both traders and investors recommend WH SelfInvest to others, pointing out various opportunities, capabilities, and advanced platforms the broker provides.

We can conclude that WH SelfInvest is a well-respected firm with many years of experience and stringent regulatory oversight, making it a perfect choice for European traders.

Account Types and Benefits

Score – 4.5/5

Per our research, the broker provides a range of specialized account types to accommodate diverse trading preferences. Traders can opt for a Forex and CFD account, facilitating the trading of currency pairs and contracts for difference.

Additionally, the broker offers a Futures account for those interested in trading futures contracts. For investors focused on stocks, WH SelfInvest provides an Investment account, allowing users to engage in stock trading.

- Each account has different conditions and deposit requirements. The minimum deposit for the CFD-Forex account is €500. For other account types, the minimum funding is much higher.

Regions Where WH SelfInvest is Restricted

Due to its multiple regulations in the European region, WH SelfInvest offers its services to a large list of countries. Yet, due to regulatory restrictions, the services are not reachable for residents of the countries listed below:

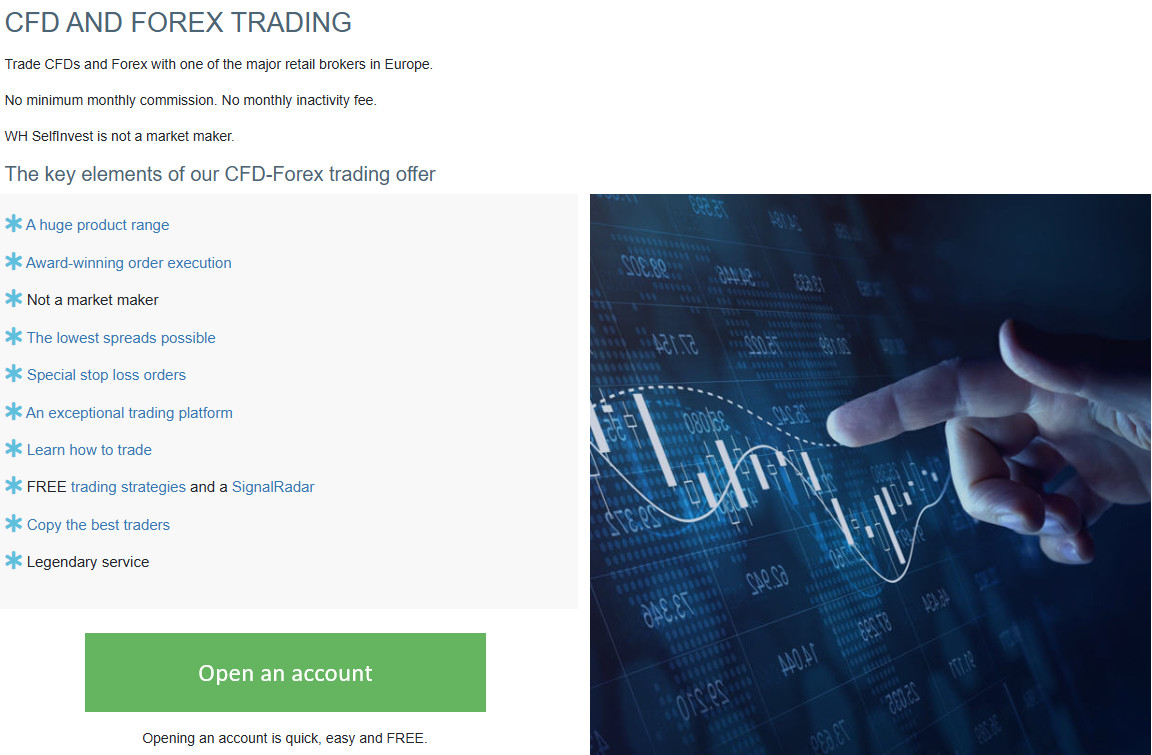

Cost Structure and Fees

Score – 4.4/5

WH SelfInvest Brokerage Fees

After examining the broker’s fee offering, we found that WH SelfInvest’s fee structure includes various aspects of trading. The broker charges trading commissions, especially in the case of certain instruments like Forex and CFDs. Additionally, traders should be mindful of bid-ask spreads, which can impact overall trading costs, particularly in dynamic markets.

While the broker has competitive fee structures, individuals should be aware of other potential costs, such as account-related fees or charges associated with specific trading platforms.

Based on our test trade, the broker provides competitive fixed and variable spreads with an average spread of 1 pip for the EUR/USD currency pair in the Forex market.

However, spreads can vary based on market conditions, volatility, and liquidity, so consult the broker’s website or contact customer support for detailed information on the spreads they offer for specific instruments and account types.

- WH SelfInvest Commissions

We found that the broker applies commissions, combined with low spreads. Commissions depend on the trading asset. For the Forex and CFD products, the average commissions are 0.1%. On the other hand, for Futures and options, the fixed commissions are €2.20 per lot per side

How Competitive Are WH SelfInvest Fees?

Based on our research and testing, WH SelfInvest’s fees depend on the account type and the products traded. The broker offers several account types, each dedicated to the trading of specific financial assets. The broker offers both fixed and floating spreads and low commissions. The commissions are not the same for all the products; thus, it is essential to carefully review the proposal and applicable fees.

All in all, the trading costs are average compared to market standards, offering traders an affordable and efficient trading experience in a tightly regulated trading environment.

| Asset/ Pair | WH SelfInvest Spread | Fxview Spread | Trive Spread |

|---|

| EUR USD Spread | 1 pip | 0.2 pips | 1.2 pips |

| Crude Oil WTI Spread | 2.5 | 0.02 | 0.4 pips |

| Gold Spread | 1 | 0.16 | 1.7 pips |

WH SelfInvest Additional Fees

As we have found, WH SelfInvest applies a few additional fees to consider. There might be an account holding fee of €39 on average. The broker also charges an inactivity fee of €10 per month for the dormant accounts.

- As to withdrawals, there is a one-time free withdrawal per month. For the consecutive withdrawals, the broker charges €8.

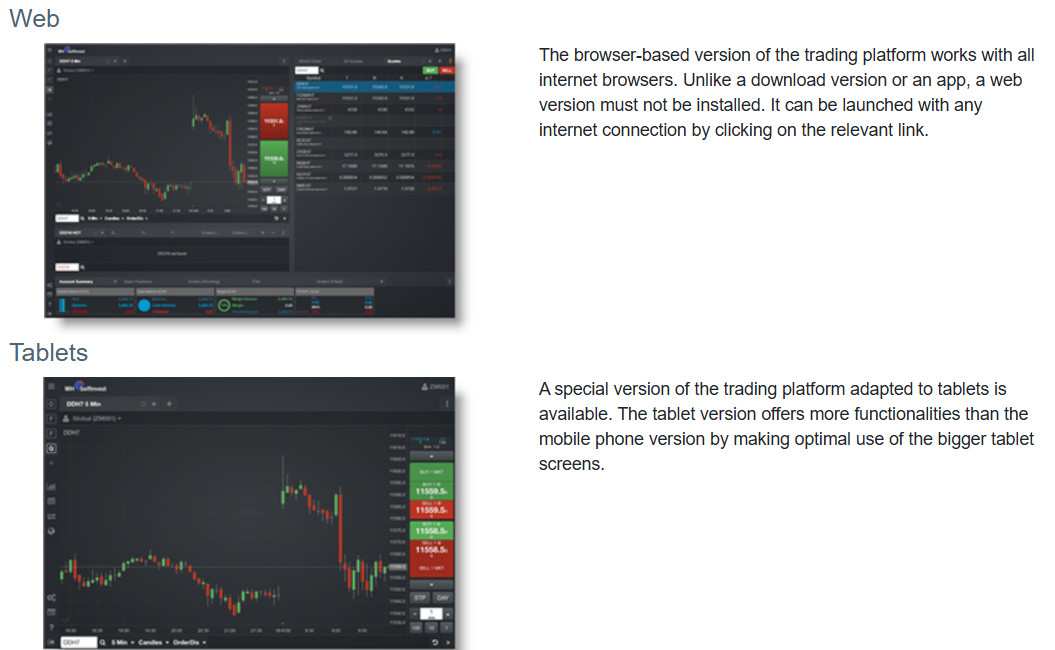

Score – 4.5/5

WH SelfInvest offers a diverse selection of trading platforms to cater to the preferences of different traders. The widely used MT4 is available, offering advanced charting and analysis tools, along with algorithmic trading capabilities.

Additionally, the proprietary NanoTrader platform is an advanced and innovative solution, allowing traders to conduct deep market analysis, automate various strategies, and trade with precision. Clients can also access the popular and demanded TradingView.

| Platforms | WH SelfInvest Platforms | Fxview Platforms | Trive Invest Platforms |

|---|

| MT4 | Yes | No | No |

| MT5 | No | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

WH SelfInvest Web Platform

WH SelfInvest offers its clients web trading with easy access to the available platforms. The web versions are compatible with all browsers. The web platforms do not require installations or downloads, and are flexible and functional. They also include all the essential tools and features, and allow in-depth analysis.

WH SelfInvest Desktop MetaTrader 4 Platform

The broker’s MT4 platform is dedicated to Forex and CFD trading only. It supports both manual and automated trading. The platform is a favorable choice for day traders and supports various strategies and opportunities. Traders can simultaneously hold multiple accounts and manage all of them with precision.

The platform allows backtesting and includes numerous advanced tools and features, enabling clients to analyse using various bars, candles, Heikin Ashi, different drawing tools, and more.

WH SelfInvest Desktop MetaTrader 5 Platform

During our research, we noticed that WH SelfInvest does not include the popular and advanced MT5 platform in its proposal. Although many traders might find the lack of an MT5 platform a drawback, the broker still offers very impressive and innovative platforms, including NanoTrader, Ninja Trader, and TradingView.

WH SelfInvest NanoTrader

We found that NanoTrader is a proprietary trading platform offered by WH SelfInvest. Known for its user-friendly interface and comprehensive features, the platform caters to both novice and experienced traders. It provides advanced charting tools, technical analysis capabilities, and automated trading functionalities.

With a focus on simplicity and efficiency, NanoTrader aims to offer a seamless trading experience, making it a preferred choice for those looking for a versatile and intuitive platform for trading all the financial instruments the broker offers. The broker offers the free version of NanoTrader and the full version, which includes more capabilities and opportunities.

WH SelfInvest TradingView

The TradingView platform is another advanced solution to access all the available financial products and trade with favorable conditions. The platform includes innovative features and tools, automation of trades, stop/loss orders, an Economic Calendar, built-in trading signals and strategies, backtesting and optimization features, and many more. The platform is available in multiple languages, including English, Dutch, French, Italian, German, and more.

WH SelfInvest MobileTrader App

All WHS platforms are available for mobile trading for free. The mobile platforms deliver real-time market data, advanced charting, and high-speed order execution. The ability to trade on the go is one of the greatest advantages for many traders. The functionality and versatility of the mobile platforms are what many clients are looking for. It enables access to their open positions from anywhere and allows them to never miss profitable trading opportunities.

Main Insights from Testing

We were impressed by the broker’s advanced platforms and professional-level opportunities. Clients can access advanced tools and features through the broker’s NanoTrader, TradingView, and MT4 platforms. The MT4 platform is for Forex and CFD trading, while the other two platforms allow access to all the available financial markets, with excellent conditions. Mobile and web traders can also access their accounts with ease, benefiting from the attractive offering and great functionality.

AI Trading

Although WH SelfInvest does not offer fully AI-powered services, it still enables automation of trades. The NanoTrader platform allows its clients to create numerous automated strategies or use already existing ones.

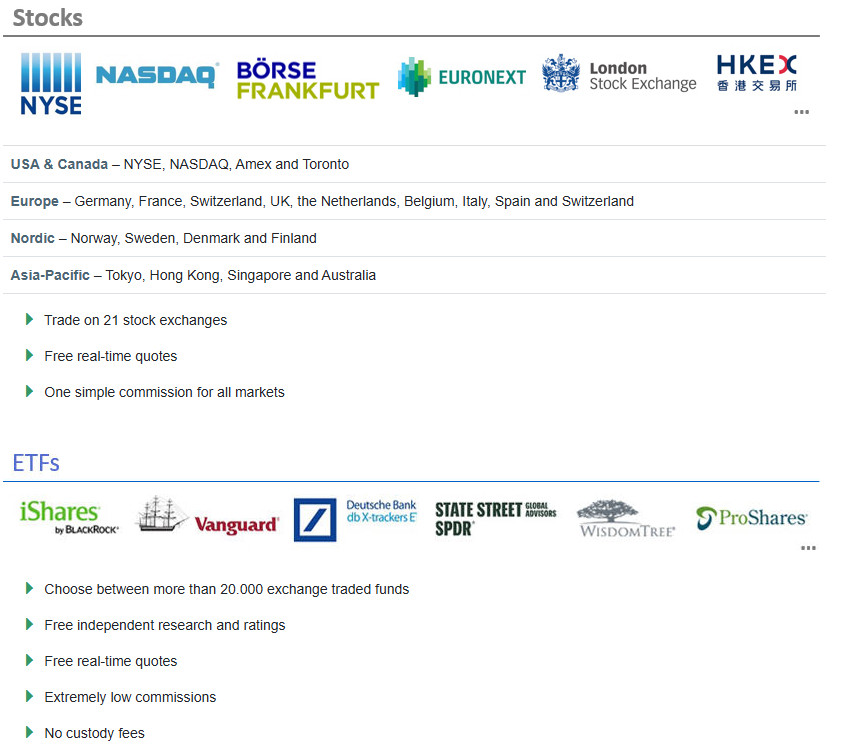

Trading Instruments

Score – 4.7/5

What Can You Trade on the WH SelfInvest Platform?

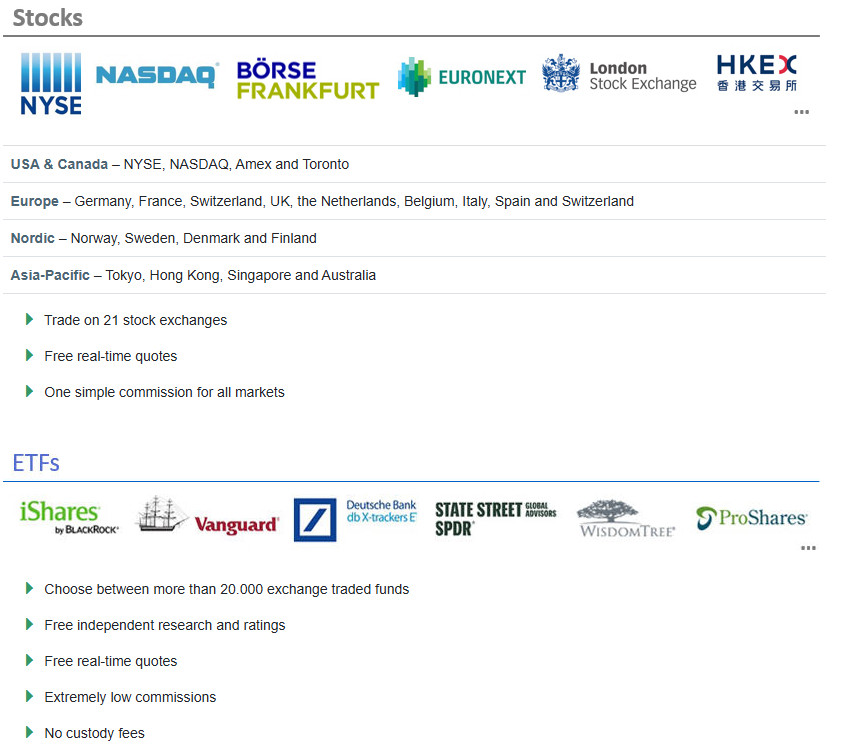

WH SelfInvest provides access to popular trading instruments, including Forex, CFDs, Stocks, Options, and Futures. The broker enables traders to diversify their portfolios and participate in various markets according to their individual preferences and trading strategies.

WH SelfInvest offers separate account types, based on the instrument traded. We have also found that to access all the markets, traders should access the market through NanoTrader or TradingView. The popular MT4 platform allows trading only CFDs and Forex.

Main Insights from Exploring WH SelfInvest Tradable Assets

Based on our research, WH SelfInvest has one of the most impressive instrument offerings. Access to different instruments is determined by the chosen account type. Clients can choose the CFD and Forex account and access a good range of products for the mentioned assets, or choose the Futures account with access to over 2000 products.

With the WH SelfInvest’s Multi-Asset Account, powered by Interactive Brokers, clients can access over 150 exchanges, with an availability of over 1.200.000 instruments.

All in all, WH SelfInvest stands out for its attractive instrument offering, combined with competitive charges and overall conditions.

Leverage Options at WH SelfInvest

Using leverage in trading can be beneficial as it allows traders to access the market with a smaller capital investment. However, it carries the potential for significant gains and losses as well. Therefore, have a thorough understanding of how leverage operates and the potential consequences it can bring before engaging in leveraged trading.

WH SelfInvest leverage is offered according to CSSF, ACPR, and BaFin regulations:

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

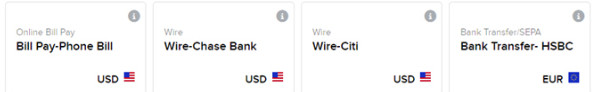

Deposit and Withdrawal Options

Score – 4.5/5

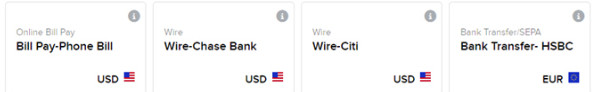

Deposit Options at WH SelfInvest

Our research shows that the broker offers multiple funding methods to facilitate deposits and withdrawals for its traders. The funding options include bank transfers, credit/debit card transactions, and electronic payment methods. Traders can choose the method that suits their preferences and supports efficient and secure transactions.

As we found, there are no deposit fees applied by the broker.

Minimum Deposit

The broker has a minimum deposit requirement of €500. While some brokers may offer lower minimum deposits, especially in highly competitive markets, WH SelfInvest provides traders with a relatively accessible entry point to start their investment journey with the broker.

Withdrawal Options at WH SelfInvest

Based on our analysis, the broker provides a straightforward process for withdrawals, allowing traders to access their funds efficiently. The firm supports various withdrawal methods, such as bank transfers and electronic payments, with details available on their official website or through customer support.

- The first withdrawal each month is free. For every other withdrawal during the month, there is a €8 commission fee.

Customer Support and Responsiveness

Score – 4.6/5

Testing WH SelfInvest Customer Support

The platform provides 24/5 customer support via live chat, email, and a phone line. Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

Contacts WH SelfInvest

WH SelfInvest provides a dedicated customer support through the following channels:

- Live chat is a quick and efficient way to find answers to the most urgent trading-related questions. Generally, this is the most used method to contact the support team.

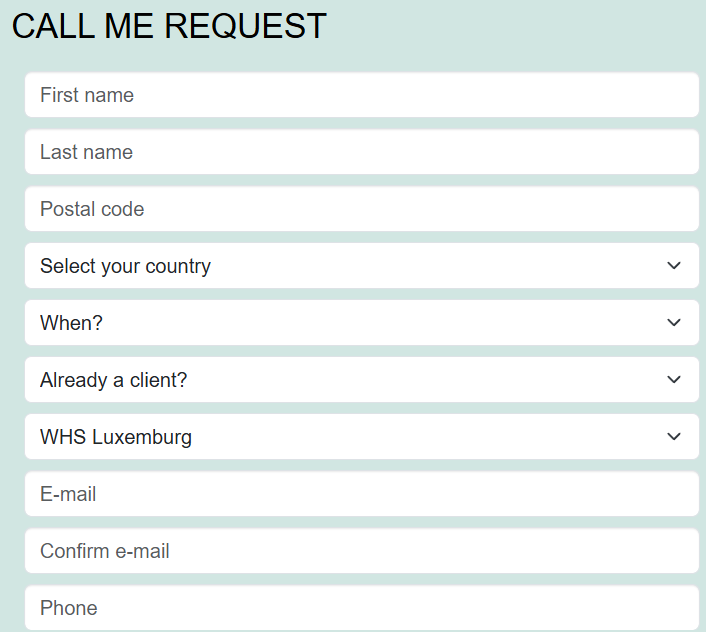

- WH SelfInvest also offers a callback service. Clients can fill out the request form and wait for the customer representative to contact them through a phone call.

- The broker also offers separate phone numbers and email addresses for the Netherlands, Luxembourg, France, Belgium, and Switzerland. Clients can find the phone numbers and email addresses on the ‘Contact us’ section of the broker’s website.

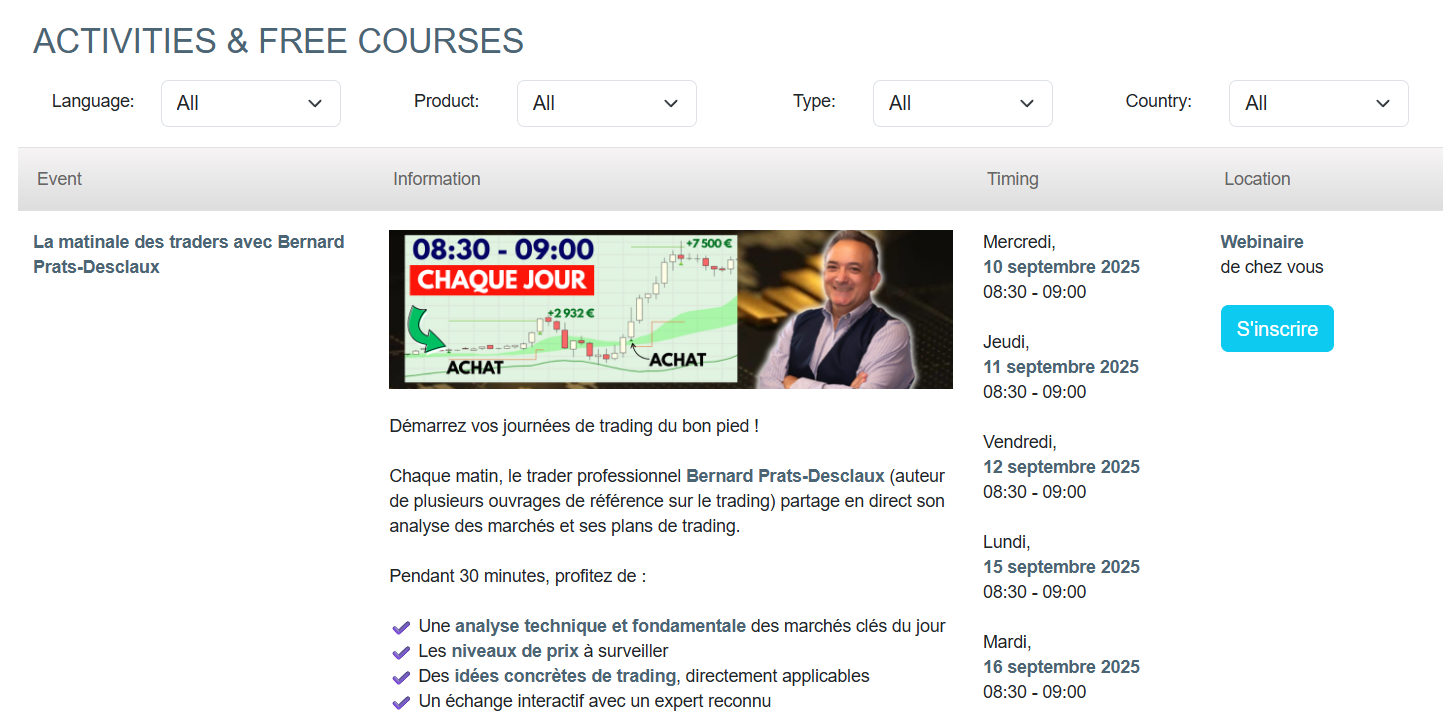

Research and Education

Score – 4.3/5

Research Tools WH SelfInvest

WH SelfInvest stands out for its advanced platforms. Traders can benefit from market analyses and insights provided by the platforms, enhancing their understanding of market dynamics and potential trading opportunities. Clients can access the economic calendar, market quotes, and other innovative features to elevate their trading experience. It also includes NinjaTrader in its offering, with a professional-grade charting package, multiple drawing tools, over 100 indicators, and more.

Education

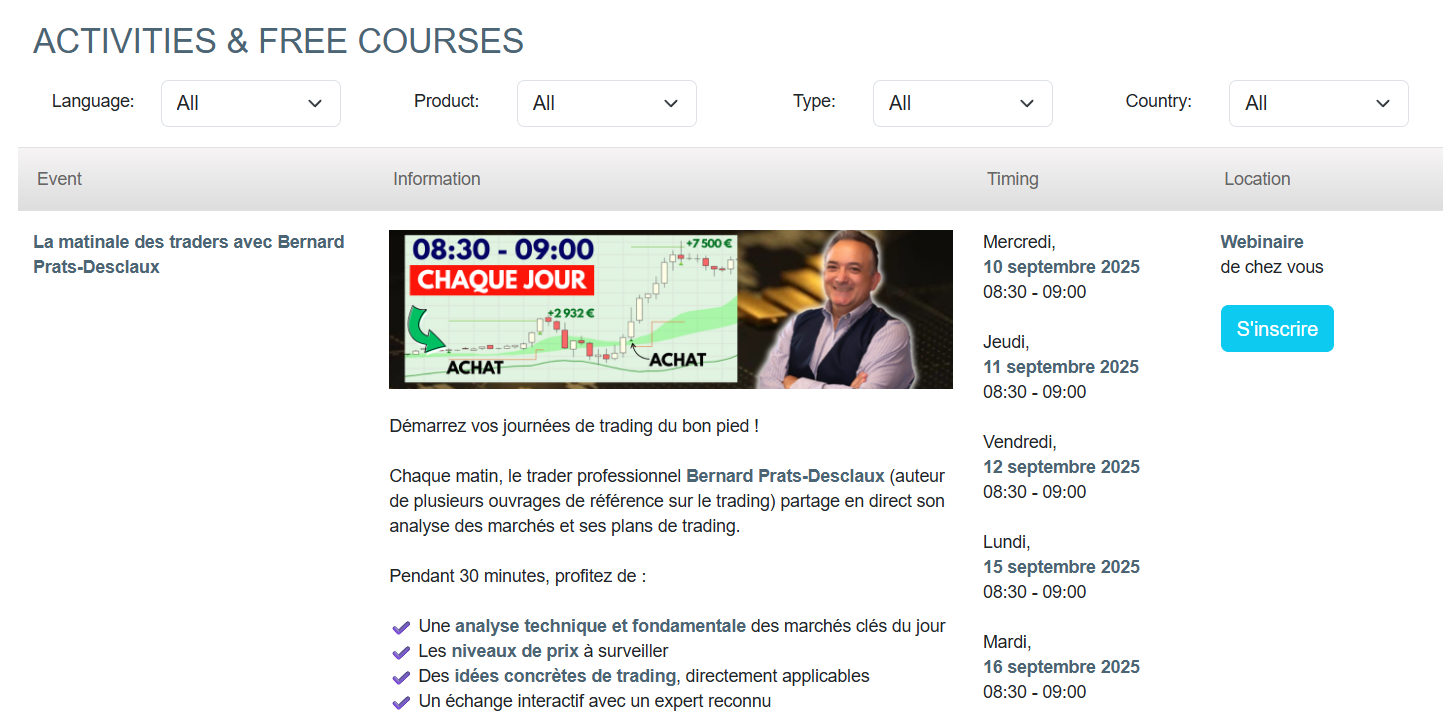

WH SelfInvest includes various educational resources to support traders in their financial journey. These include webinars, seminars, and articles covering a range of topics, from basic trading concepts to advanced strategies.

- The webinars and trading courses are helpful for traders, providing clients with knowledge and insights into the market. The webinars take place daily, allowing clients to practice and enhance their knowledge continuously.

Is WH Selfinvest a Good Broker for Beginners?

WH SelfInvest offers a wide range of services and opportunities to meet the needs of its traders. Along with its advanced platforms, the broker also offers the popular MT4 platform, mostly favored by beginner traders. Clients can access CFD-based products and Forex with favorable conditions.

Besides, the broker has a demo account option, allowing clients to practice and gain the essential knowledge and skills for live trading. The webinars and courses available on the broker’s website are another way to assist and encourage traders. The only point is the broker’s initial deposit requirement of $500, which is higher than the market average.

Portfolio and Investment Opportunities

Score – 4.7 /5

Investment Options WH SelfInvest

In fact, WH SelfInvest has one of the most extensive offerings of real stocks and ETFs. It covers financial markets of over 33 countries, with access to more than 150 exchanges. In total, the broker offers about 1.2 million instruments.

Thus, with WH SelfInvest, traders can engage in both CFD and Forex trading, as well as traditional investments, with ownership of real assets.

- Additionally, through its NanoTrader platform, the broker offers a group trading feature, allowing clients to trade in virtual groups.

Account Opening

Score – 4.5/5

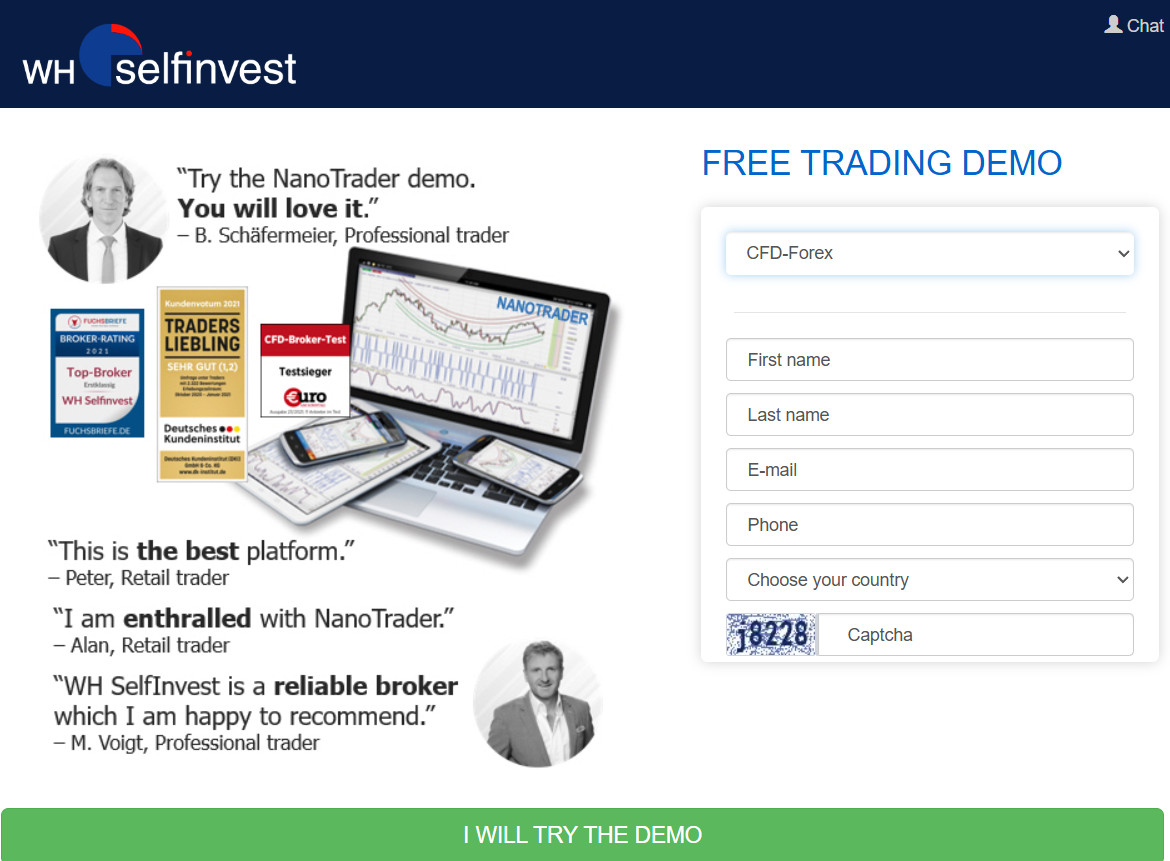

How to Open a WH SelfInvest Demo Account?

The availability of a demo account is a good opportunity for traders to practice in a safe environment, with no real investments.

Here are the consecutive steps for a quick demo account opening:

- Go to the broker’s website and choose the “Demo account” option.

- Fill out the registration form by choosing the products to trade and providing personal information (name, phone number, country of residence, etc.).

- Submit the form and get the account credentials through the provided email address.

- Download or install the platform of your choice.

- Access the demo account with the provided credentials and start practicing.

How to Open a WH SelfInvest Live Account?

Opening a live account with WH SelfInvest is an easy process, as you can log in and register with the broker within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open an Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Score – 4/5

Our research revealed that all the main tools and features offered by WH SelfInvest are integrated into the broker’s advanced platforms. All platforms provide innovative features and tools, including approximately 100 indicators, advanced charting and drawing tools, and automated trading capabilities. Users also have access to the Economic Calendar and real quotes.

- Clients can also follow the News and novelties section, where the broker informs about new services and opportunities.

WH SelfInvest Compared to Other Brokers

We have reviewed WH SelfInvest and then compared its offerings to other well-regarded brokers in the market to estimate its status in the market.

WH SelfInvest is a unique European broker with multiple licenses from respected European authorities, including CSSF, ACPR, and BaFin.

All the other brokers we reviewed, such as 26 Degrees and One Royal, are also tightly regulated by ASIC, CySEC, and other well-regarded regulators. Only Xtrade lacks regulation, as it holds licenses from FSC and FSCA, with no top-tier oversight.

The instrument availability of WH SelfInvest is one of the most attractive in the market (about 1.2 million). Another broker with an extensive offering is 26 Degrees (over 26,000).

The trading platforms of WH SelfInvest stand out for their advanced features and tools. Clients can choose from NanoTrader, NinjaTrader, TradingView, and MT4. The other competitors we reviewed mostly offer the MT4 or MT5 platforms. 26 Degrees provides more advanced platforms, including Iress Trader, Iress ViewPoint, Iress Pro, and Bloomberg.

The trading fees WH SelfInvest applies are mostly average and in line with market standards. WH SelfInvest also includes webinars, seminars, and courses, unlike 26 Degrees and SX.

| Parameter |

WH SlefInvest |

26 Degrees |

Forex.com |

XS |

OneRoyal |

Xtrade |

Trive |

| Spread-Based Account |

Average 1 pip |

From 0.2 pips |

Average 1.3 pips |

Average 1.1 pips |

Average 1 pip |

Average 2 pips |

Average 1.2 pips |

| Commission-Based Account |

0.0 pips + $5 |

No specified commissions |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $3.50 |

No commissions, based on fixed spreads |

0.0 pips + $5 |

| Fees Ranking |

Low/Average |

Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, NanoTrader, TradingView, Ninja Trader |

Iress Trader, Iress ViewPoint, Iress Pro, and Bloomberg |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, MT5 |

Xtrade WebTrader |

MT4, MT5 |

| Asset Variety |

1.2 million instruments |

26,000+ instruments |

6000+ instruments |

1000+ instruments |

2,000+ instruments |

1,000+ instruments |

300+ instruments |

| Regulation |

CSSF, ACPR, BaFin |

ASIC |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FSC, FSCA |

BAPPEBTI, FCA, ASIC, MFSA, FSCA, FSC |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Unavailable |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$500 |

$5,000 |

$100 |

$0 |

$50 |

$250 |

$50 |

Full Review of Broker WH SelfInvest

We have carefully reviewed WH SelfInvest’s proposal to see how the broker stands out in the market. WH SelfInvest is a tightly regulated and reputable European broker that has been in the market for many years. It holds licenses from CSSF, ACPR, and BaFin.

It offers services for various traders, including beginners, professionals, and real investors. The account types are tailored to meet specific expectations of clients.

The trading platforms stand out for their advanced and innovative features. Beginners can enjoy the MT4 platform and access CFDs and Forex. On the other hand, professional clients will benefit from the more advanced NanoTrader, TradingView, or NinjaTrader, enjoying an extensive range of instruments and competitive conditions.

The broker also provides webinars, seminars, and various courses to boost its clients’ knowledge and skills. The customer support is available 24/5 through multiple channels. The phone numbers and email addresses are provided based on the country.

Share this article [addtoany url="https://55brokers.com/wh-selfinvest-review/" title="WH SelfInvest"]