- What is Webull?

- Webull Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

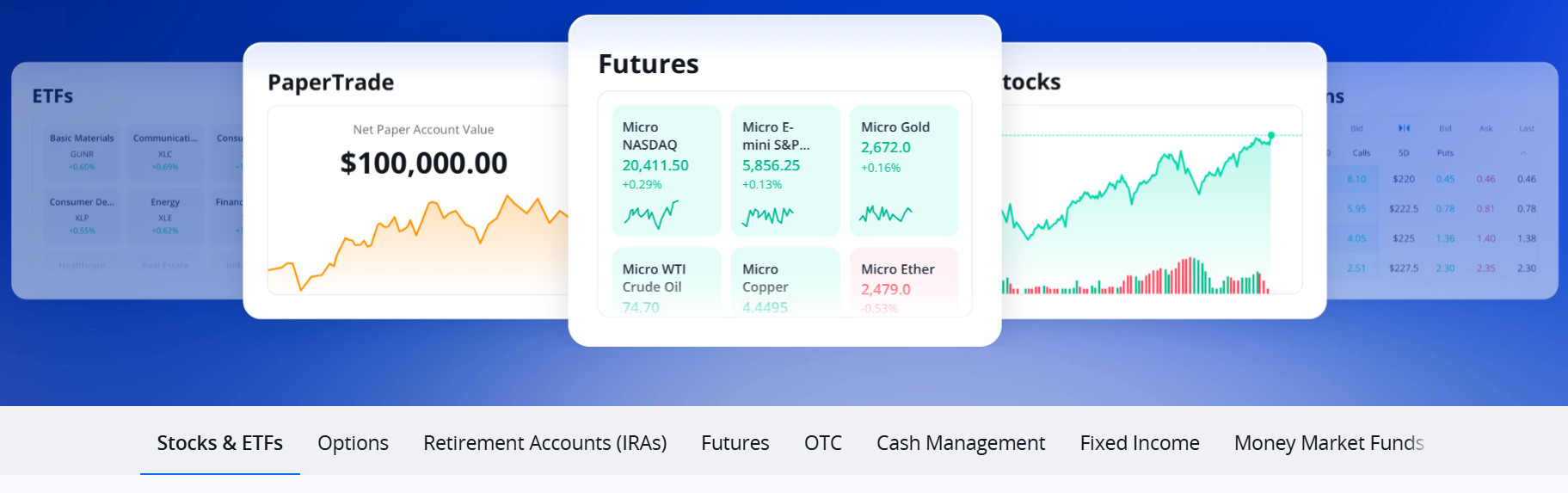

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Webull Compared to Other Brokers

- Full Review of Broker Webull

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.7 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.6 / 5 |

What is Webull?

Webull is a financial technology company and a Stock Trading platform that provides commission-free trading services for stocks, ETFs, options, futures, OTC, ADRs, shares, and cryptocurrencies.

The company was founded in 2016 and is based in the United States. Per our research, Webull maintains compliance with the regulations set by the U.S. Securities and Exchange Commission (SEC), the CFTC, and is a member of the Financial Industry Regulatory Authority (FINRA) and NFA.

Additionally, the broker has expanded its operations and established subsidiaries in different countries, and also operates under the oversight of ASIC in Australia, SFC in Hong Kong, and MAS in Singapore. Being fully regulated in top-tier financial destinations, it operates.

Is Webull Stock Broker?

Yes, Webull is a Stock Trading Broker that provides quite good options for Real Stock trading and Investment, with other options including ETFs, Shares, etc. The firm provides a suite of advanced trading tools, including real-time market data, technical indicators, and customizable screeners, along with quite powerful trading conditions and offerings overall, making them quite a popular and used choice among US Traders and worldwide investors too.

Webull Pros and Cons

With analysis, we have identified some benefits and drawbacks to consider when selecting Webull as your investment platform. For the pros, the broker stands on quite a sustainable background, being a reliable Broker to trade and invest with. It offers a good choice of trading software, including a mobile app, desktop, and a web-based platform, allowing trade various financial instruments with access to advanced trading tools.

Additionally, the commission-free structure is great for Investment and investing in Shares or Stocks, also Options Trading with access to a variety of trading products without incurring trading fees, potentially saving costs over time.

For the cons, the product offerings may be more limited compared to some established brokerages. It may not provide access to certain niche markets or investment options. Though customer support is 24/7, some users have reported issues with Webull’s customer support, including delays in response and difficulty resolving account-related problems.

While Webull offers educational resources, they may not be as extensive or comprehensive as compared of some other brokerages with Live Trading Rooms or other sources.

| Advantages | Disadvantages |

|---|

| Strict regulation by US SEC and CFTC | Limited trading products |

| Comprehensive Trading Offering, Real Stock Trading and Investment | Conditions and offering vary depending on the entity and regulations |

| Multi-regulated broker with Funds protection up to $500,000 | No comprehensive learning materials |

| Good for US Traders and Professionals | |

| 0 commission | |

| No minimum deposit | |

| Paper trading | |

| 24/7 customer support | |

Webull Features

Webull is a competitive stock trading brokerage platform, offering commission-free trading, advanced tools, and extended hours trading, also suitable for Advanced Traders, US Trading, and real access to Stocks and ETFs. Below is a comprehensive list of its main features:

Webull Features in 10 Points

| 🏢 Regulation | SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| 🗺️ Account Types | Individual, IRA, Futures, Advisor, Entity, Joint, Event |

| 🖥 Trading Platforms | Webull Trading Platform, TradingView |

| 📉 Trading Instruments | Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| 💳 Minimum Deposit | $0 |

| 💰 E-mini and Standard Contract | $0.70 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | Webull Learn, Video Tutorials, Webinars |

| ☎ Customer Support | 24/7 |

Who is Webull For?

Webull is designed for active traders and investors who want a commission-free trading experience with advanced tools. Ideal for those who are comfortable managing their investments, Webull offers a smooth platform with real-time data, customizable charts, and extended-hours trading. Based on our findings, Webull is Good for:

- Real Stock Trading

- Investing

- Fractional Stocks Trading

- Free Stocks

- Traders from the USA

- Singapore Trading

- Traders from Hong Kong

- Australian traders

- Advanced traders

- Professional trading

- Access to Options and ETF trading

- Good trading tools

Webull Summary

In summary, Webull is a reputable Stock brokerage that offers a range of features and services for traders, suitable for various traders, including beginners and advanced traders.

The broker is heavily regulated and authorized by various Top-tier financial authorities, standing on a strong establishment and background, adding an element of trust and security for traders, including US Traders. It provides a user-friendly trading platform with advanced charting capabilities, real-time market data, and customizable layouts.

The firm offers advantages such as good Investment Opportunities and an easy process to buy Stocks or Shares, commission-free trades for some instruments based on commission as a main trading fee, extended hours trading, and 24/7 customer support.

Yet, there are some limitations too, like limited trading products, potential issues with customer support, and a relatively low range of educational resources.

55Brokers Professional Insights

Webull stands out as a modern, tech-focused brokerage that primarily appeals to active traders and experienced investors looking for robust tools without high costs. One of its biggest strengths is the commission-free trading it offers across a range of asset classes, including stocks, ETFs, and options, so is highly recommended by us for cost-effective and tech packed invest options.

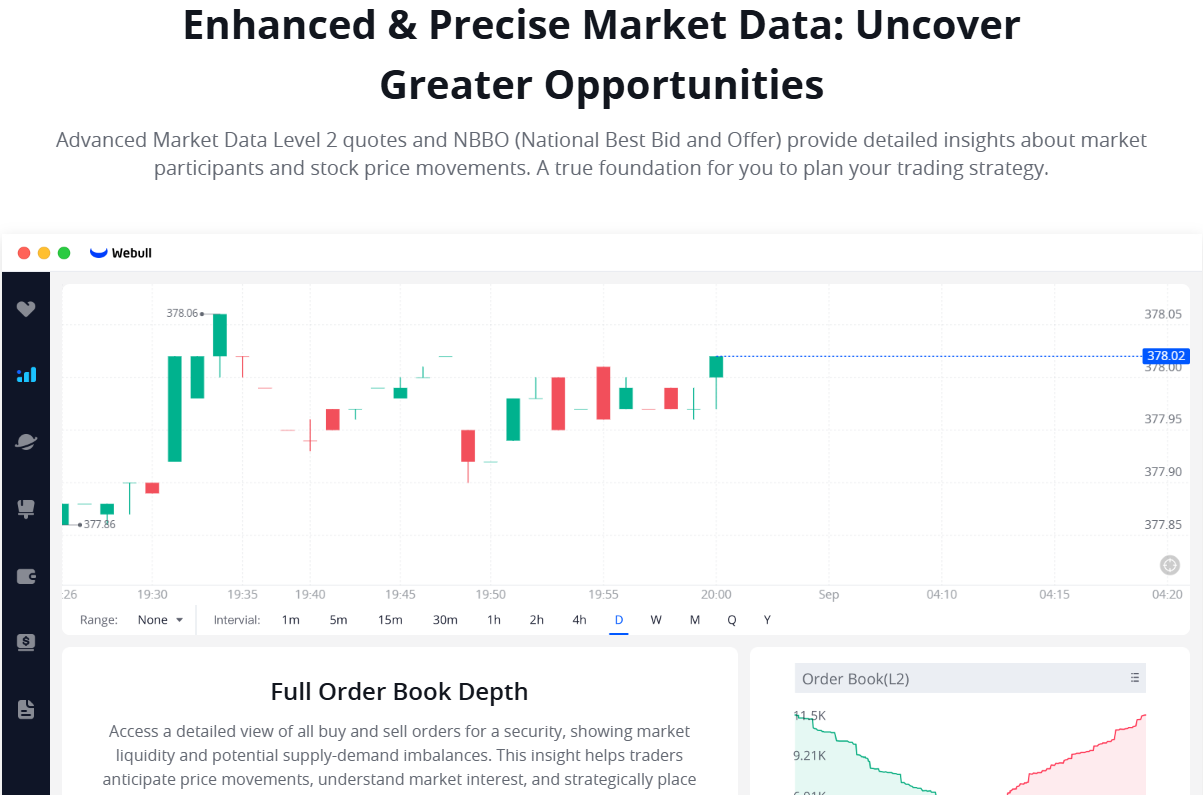

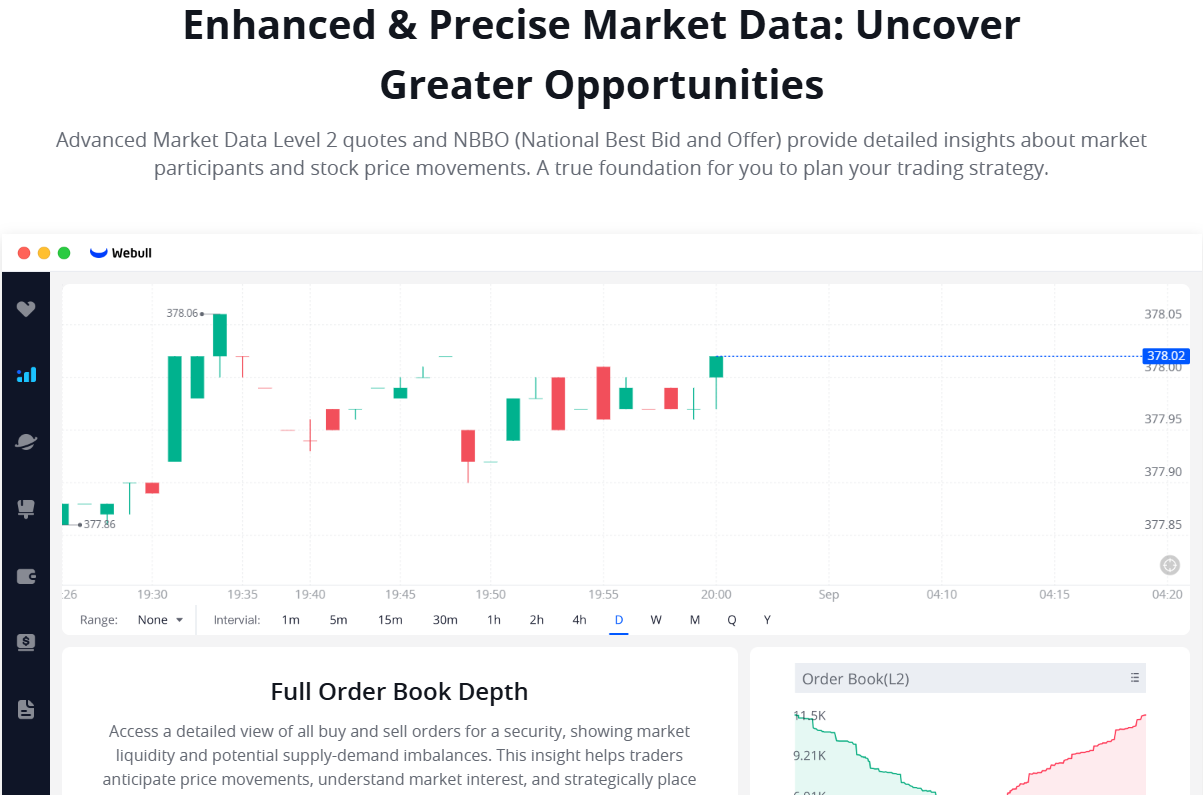

What makes the broker especially attractive and regarded by us too is its intuitive and powerful trading platform, available across various devices and provides advanced charting with a range of technical indicators, drawing tools, and customizable layouts, that are very well organized, powerful, yet intuitive to use. Trades also benefit efficiency from real-time quotes, extended-hours trading, and access to Nasdaq Level 2 market data for deeper market insight.

Additionally, Webull offers features such as paper trading for strategy testing, smart order routing, and comprehensive performance analytics. This combination of low-cost trading, advanced research capabilities, and a user-friendly interface makes Webull a standout choice for tech-savvy investors from various regions and globally alike, combining a very balanced proposal suitable for various invest needs.

Consider Trading with Webull If:

| Webull is an excellent Broker for: | - Looking for Reputable Firm.

- Suitable for professional traders and investors.

- Low fees and commissions.

- Need a well-regulated broker.

- Looking for broker with a long history of operation and strong establishment.

- Access to robust proprietary trading platform.

- Excellent trading tools and trading technology.

- Offering popular financial products.

- Stock Trading and Investment.

- Trading of Real Futures.

- US investors.

- Long-term investing.

- Secure trading environment.

- Looking for broker with Top-Tier licenses.

|

Avoid Trading with Webull If:

| Webull might not be the best for: | - Novice traders who prefer simpler trading approach.

- Who prefer to trade with popular trading platforms.

- Need diverse investment products.

|

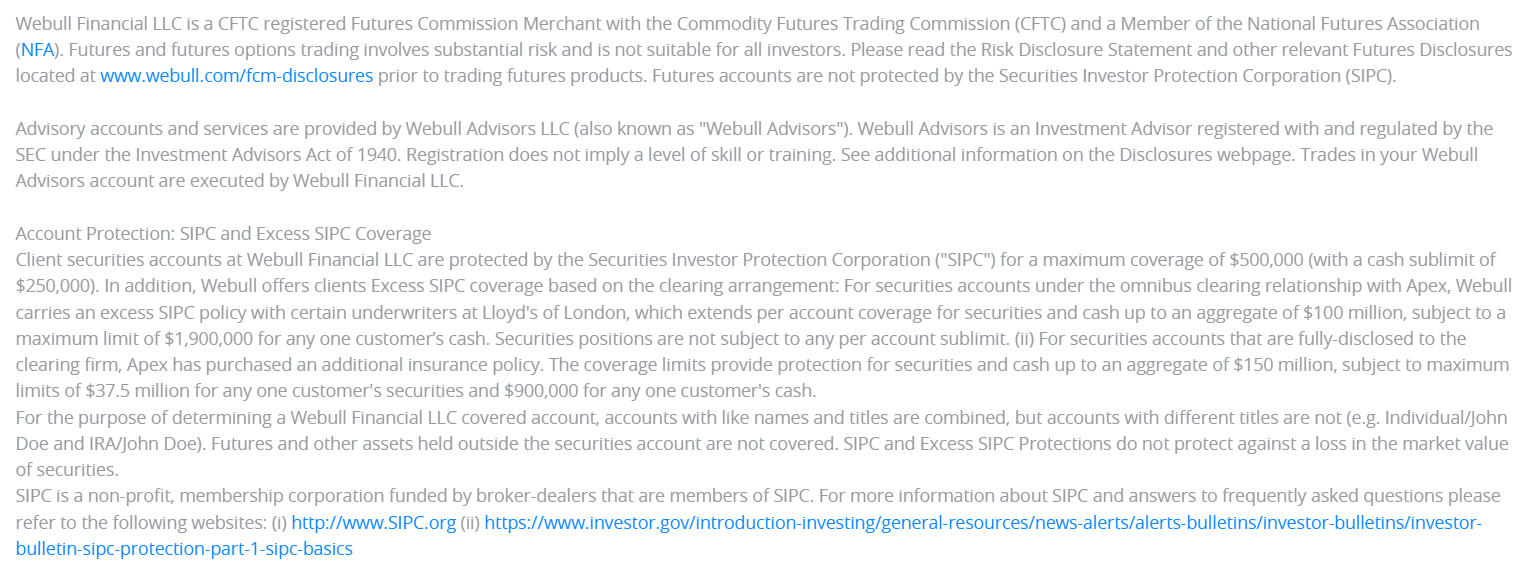

Regulation and Security Measures

Score – 4.7/5

Webull Regulatory Overview

Webull is a legit and regulated broker, making it a good Broker to invest with. The broker focuses on following rules and regulations set by Top-Tier authorities, including the US SEC and CFTC, as well as the Australian AISC, which ensures that Webull operates within established financial guidelines and provides a secure trading environment for its clients.

Additionally, an advantage of the company’s legitimacy is that it does not offer services in offshore zones, emphasizing its commitment to operating within regulated jurisdictions and providing transparency to traders.

How Safe is Trading with Webull?

Webull is a reliable and secure Stock Trading Broker that follows the strict rules and guidelines established by the Top-Tier US regulations, along with other licenses the broker operates through, including the MAS Singapore and SFC Licenses.

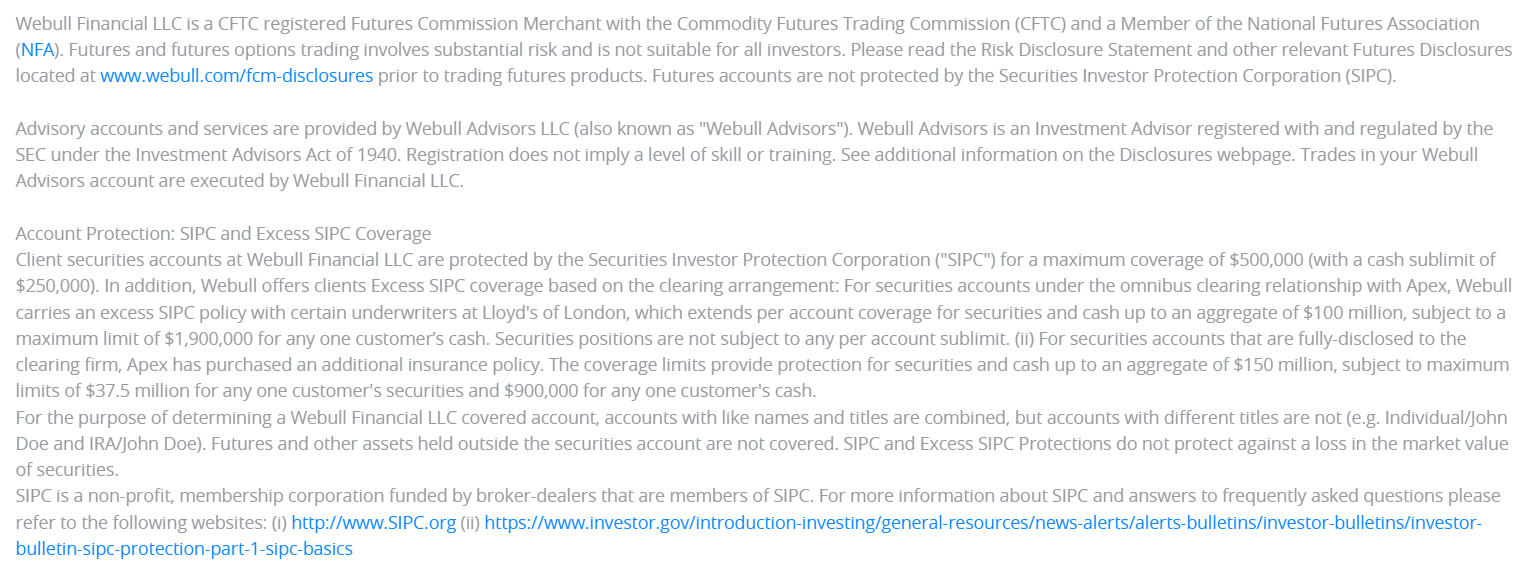

The broker is a member of the SIPC in the US, which provides limited protection for clients in the event of a brokerage failure. SIPC coverage includes up to $500,000, including a $250,000 limit for cash.

Webull also employs various security measures to protect user accounts and personal information, which is a strong advantage. Overall, US Brokers maintain quite a solid customer protection level, which makes Broker a safe choice.

Various measures include two-factor authentication for enhanced login security, data encryption, and secure socket layer (SSL) technology to encrypt data transmission, as well as the ability to complain or submit a report to the regulatory body in the US, Singapore, or Hong Kong in case fraudulent activity is detected.

Consistency and Clarity

Webull has built a solid reputation in the financial trading community for its consistent performance, transparency, and user-focused innovation. With millions of users globally and high ratings across platforms, the broker is frequently praised for its advanced interface, zero-commission structure, and access to diverse trading tools.

Trader reviews often highlight the platform’s reliability and responsiveness, though some note drawbacks such as limited access to mutual funds and a lack of personalized customer support. Webull also maintains an active presence through community support and sponsorships, helping position the brand as a trustworthy player in the fintech and trading environment.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Webull?

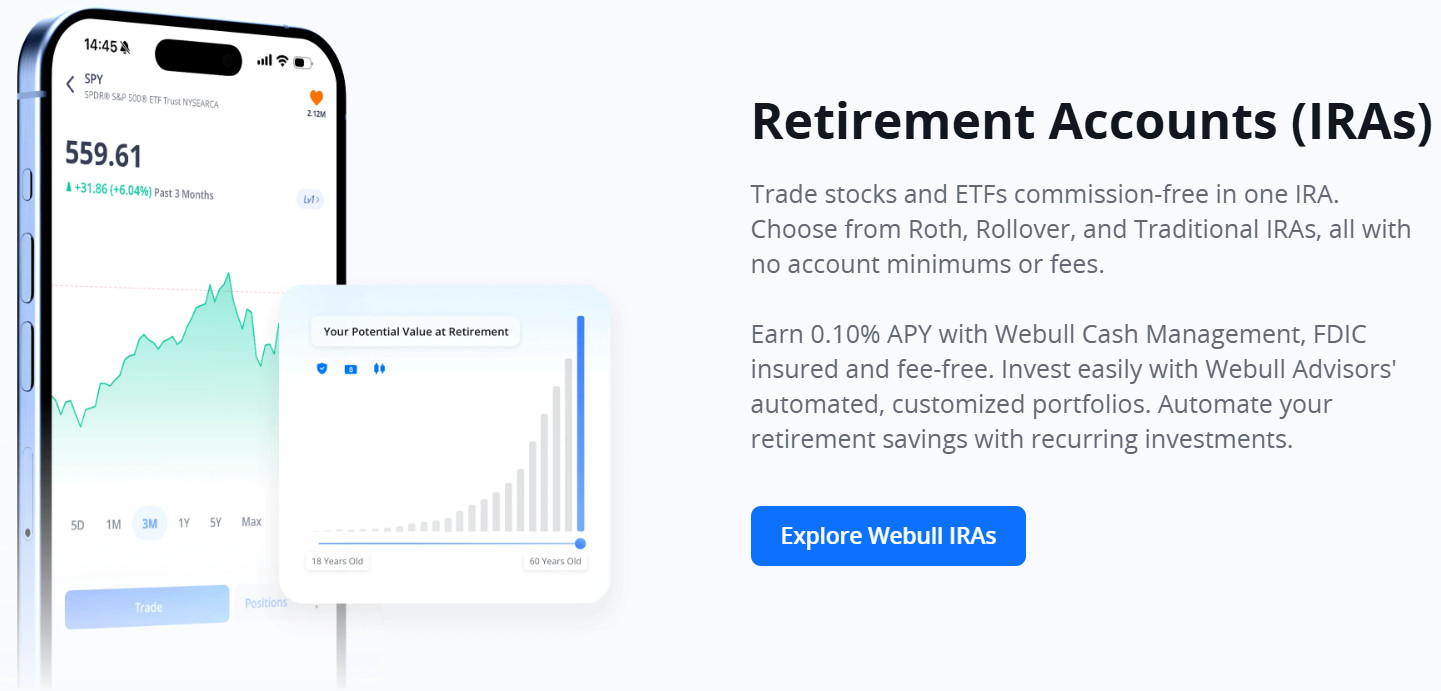

Webull offers a diverse range of account types to suit various trading and investment needs. These include Individual brokerage accounts for everyday trading, IRAs (Traditional, Roth, Rollover) for retirement savings, and Futures accounts for active traders looking to access futures markets.

For those who need professional guidance, Webull provides an Advisor account. Businesses can open Entity accounts, while Joint accounts allow shared ownership between two individuals. Additionally, Webull provides Event accounts for special promotions and trading competitions.

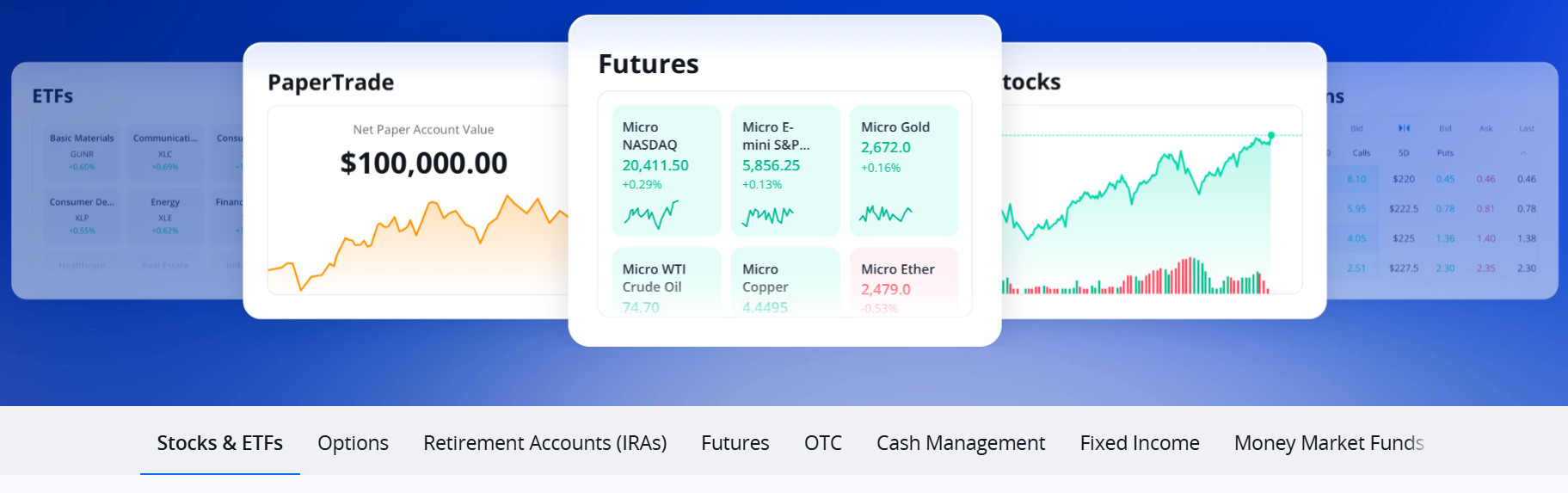

The company also provides a feature called Paper Trading, which is an advantage for U.S. traders. Traders can test their strategies in a virtual environment that replicates real market conditions without risking actual funds on the stock exchange.

Individual Accounts

The Individual Account is the most common and flexible account type, designed for self-directed investors and traders. It comes in two forms: Cash and Margin Account.

A Cash Account allows users to trade using only settled funds with no minimum deposit requirement, ideal for those who want to avoid leverage. In contrast, the Margin Account requires a minimum deposit of $2,000 and provides access to leveraged trading, short selling, and full options strategies.

With margin, clients can borrow funds to increase their buying power and take advantage of more advanced trading strategies. Both account types offer commission-free trading on stocks, ETFs, and options, along with access to real-time data, extended-hours trading, and Webull’s full suite of advanced trading tools.

Regions Where Webull is Restricted

Webull maintains strict regional compliance based on international regulations and internal risk policies. As a result, the broker restricts account openings from various countries and jurisdictions, including:

- Cuba

- Iran

- Myanmar

- North Korea

- Russia, etc.

Cost Structure and Fees

Score – 4.5/5

Webull Brokerage Fees

In terms of fees, the broker offers commission-free trading for stocks, ETFs, and options, which is quite a competitive offering overall. This means that there are no trading fees or commissions charged by Webull for executing trades in these financial instruments.

However, there may be certain fees and charges associated with specific activities or services on the platform. These can include fees for certain account actions, such as wire transfers, account transfers, or paper statement requests. Margin trading may also involve interest charges on borrowed funds.

Webull offers competitive futures trading fees with a commission of $0.70 per contract per side for E-Mini or Standard contracts, such as the popular E-Mini S&P 500.

For smaller-scale traders, Micro contracts carry a lower fee of $0.25 per contract per side. These low-cost rates make Webull an attractive choice for both active and casual futures traders.

Webull charges additional exchange and regulatory fees. These fees include charges imposed by market exchanges like the CME Group, which cover transaction processing and clearing services.

Regulatory fees, such as those from the NFA, FINRA, or other governing bodies, are also charged to traders.

Webull charges rollover fees on certain leveraged positions, such as margin stock trades and futures contracts, when held overnight. These fees represent the interest cost for borrowing funds to maintain the position and vary based on the asset type, market rates, and position size.

In addition to commissions, exchange, and regulatory fees, Webull charges several other fees depending on the services. These include wire transfer fees for certain types of deposits or withdrawals, paper statement fees if you request physical copies of account documents, and margin interest charges for borrowed funds in margin accounts.

While Webull keeps costs low with no account minimums or inactivity fees, users need to review the full fee schedule to understand any potential additional charges that might apply to their specific trading activities or account services.

How Competitive Are Webull Fees?

Webull is known for offering some of the most competitive fees in the financial market. Its commission-free trading on stocks, ETFs, and options makes it easier for users to start trading without extra costs, while its transparent pricing ensures there are no hidden charges.

For more specialized trading, such as futures and cryptocurrencies, Webull maintains low fees compared to many competitors. This balance of affordability and comprehensive features helps Webull stand out as a cost-effective broker for many investors.

| Fees | Webull Fees | AMP Fees | AvaFutures Fees |

|---|

| Broker Fee - E-mini and Standard Contract | $0.70 | $1.25 | $0.49 |

| Exchange Fee | Defined by Exchange | Defined by Exchange | Defined by Exchange |

| Trading Platform Fee | No | No | No |

| Data Fee | No | Yes | No |

| Fee ranking | Low | Low | Low |

Trading Platforms and Tools

Score – 4.6/5

Analysing WeBull Trading Software broker provides a comprehensive trading platform for its users. The primary trading platform offered by Webull is a desktop platform also available on the web. Additionally, it offers a mobile trading app that is available for both iOS and Android devices.

Webull’s trading platform is known for its user-friendly interface, advanced charting capabilities, and real-time market data, especially suitable for easy Investment and Stock Trading, with good monitoring and portfolio management.

Additionally, the broker integrates with TradingView charts, allowing users to access sophisticated technical analysis tools and a vast library of indicators.

Trading Platform Comparison to Other Brokers:

| Platforms | Webull Platforms | TradeZero Platforms | Freetrade Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Webull Desktop Platform

Webull desktop platform offers traders numerous advantages, including advanced charting capabilities with a wide range of technical indicators and customization options, real-time market data for timely decision-making, customizable layout for personalized trading setups, fast and stable performance for quick order execution suitable for various strategies, yet important to note some limitations in place too, alike hedging not available in the US.

These features combine to provide traders with a user-friendly desktop trading experience, empowering them to analyze markets, make informed decisions, and execute trades efficiently.

Main Insights from Testing

Testing the Webull desktop platform reveals a smooth, fast, and highly customizable interface that caters well to active traders. Features like integrated news, technical indicators, and instant order execution make it efficient for both day trading and long-term investing.

Overall, the desktop platform provides a professional-grade experience without the complexity, a strong choice for users who value both performance and usability.

Webull Desktop MetaTrader 4 Platform

Webull does not offer MetaTrader 4, the popular third-party trading platform widely used in Forex and CFD markets. Investors looking for MT4 functionality need to consider specialized brokers instead.

Webull Desktop MetaTrader 5 Platform

Similarly, the broker does not support MT5. Webull focuses on its trading platform, instead of offering third-party platforms.

Webull MobileTrader App

Webull Mobile App offers an intuitive trading experience right from your smartphone. Designed for traders on the go, the app features real-time quotes, advanced charting tools, customizable watchlists, and seamless order execution.

Traders can also access news, earnings reports, and key market data all in one place.

AI Trading

Webull integrates AI technology to enhance the trading experience by offering smarter tools and automation. The platform includes features like AI-powered voice commands for hands-free trading, intelligent market scanning that highlights trends and opportunities, and support for automated trading strategies through integrated bots.

These AI-driven tools help users make more informed decisions, react faster to market movements, and reduce the influence of emotions in trading.

Trading Instruments

Score – 4.5/5

What Can You Trade on Webull’s Platform?

Webull provides clients the opportunity to trade and invest in U.S.-listed stocks, ETFs, Over-the-counter (OTC) securities, Option Trading, Index Options, Futures, ETFs, Cryptocurrencies, and more. However, the availability of specific trading instruments may vary depending on the entity, so we advise conducting good research to determine the range of options available, and also if conditions vary based on your residence.

Main Insights from Exploring Webull’s Tradable Assets

Webull offers various cryptocurrency trading available on Webull Pay, the range includes Bitcoin Cash (BCHUSD), Bitcoin (BTCUSD), Dogecoin (DOGEUSD), Ethereum Classic (ETCUSD), Ethereum (ETHUSD), Litecoin (LTCUSD), Shiba Inu (SHIBUSD), USD coin (USDCUSD) through Apex Crypto.

However, US residents may trade a specific range, so traders should check availability based on their residence.

Margin Trading at Webull

Webull offers Margin Trading to traders on Margin accounts. The specific leverage amount provided by Webull can vary depending on factors such as the trader’s account equity and the individual stock being traded.

Per our research, if a margin account has a minimum of $2,000 in margin equity at the end of the previous business day, Webull provides up to four times the buying power for day trading and two times the buying power for holding positions overnight on the following business day. However, if a margin account has less than $2,000 in margin equity, no leverage is available.

- To find out the WeBull leverage options available for specific stocks on Webull, traders can navigate to the stock’s quotes page. On that page, they should look for a dollar icon, which can be either blue or yellow, positioned at the top right corner. This icon indicates margin details specific to that stock, allowing users to determine available options.

- Offered multiplier levels depend on the entity you trade too, varying from 1:50 for US Traders, 1:30 in Hong Kong, 1:20 in Singapore, and 1:30 in Australia.

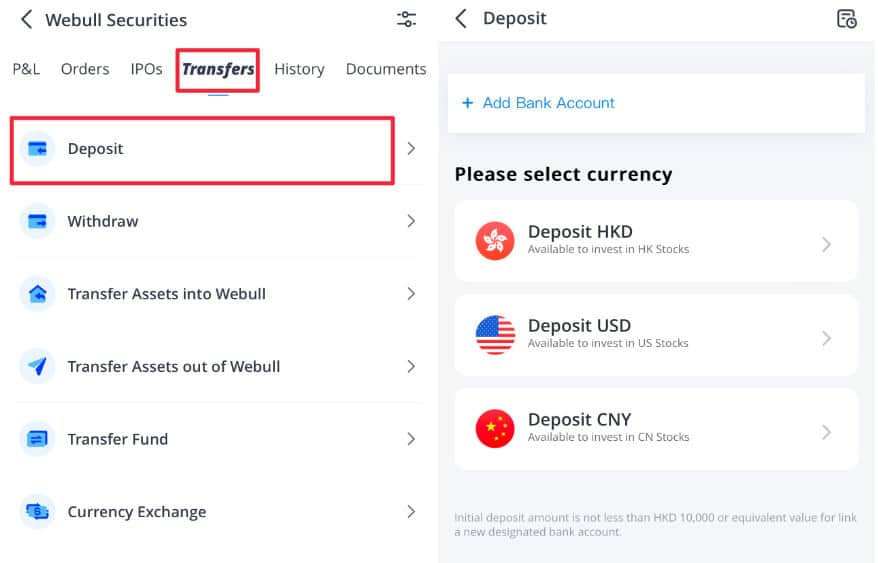

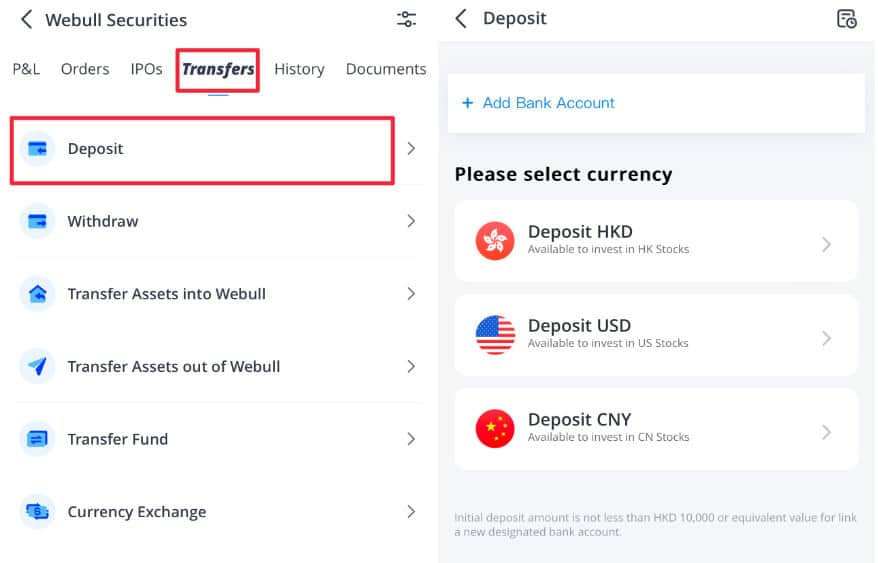

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Webull

The broker offers several funding methods to deposit funds into your trading account. The specific funding methods may vary based on your location and the regulations in your country. Some common options provided by Webull include:

Also, US Traders will mainly be able to use Bank Transfers only, so good to check these conditions too.

Webull Minimum Deposit

The broker offers great options with no minimum deposit requirement for opening an individual cash account. This means that you can start trading on Webull with any amount of funds you choose.

Withdrawal Options at Webull

As we found, there may be certain restrictions on withdrawals, fees, or processing times associated with withdrawals. For example, depending on your location and the specific financial institution involved, withdrawal processing times can vary, ranging from a few business days to longer periods.

Even though it is not a drawback from the Broker but rather follows of regulation, traders should verify withdrawal conditions carefully too.

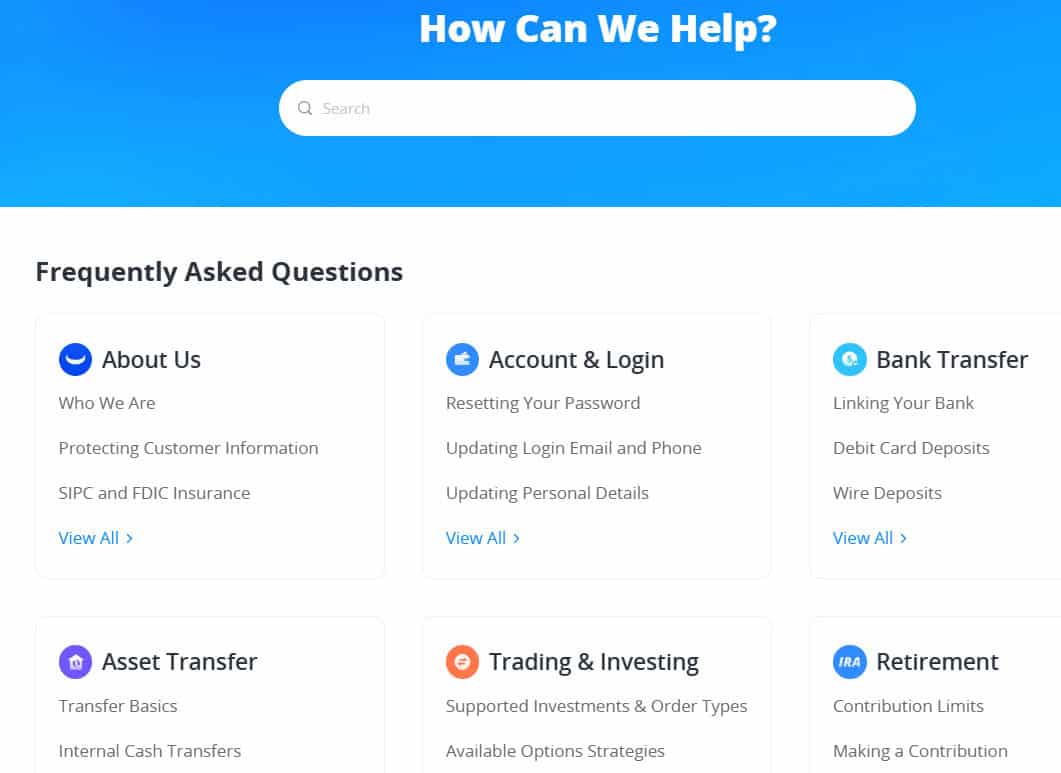

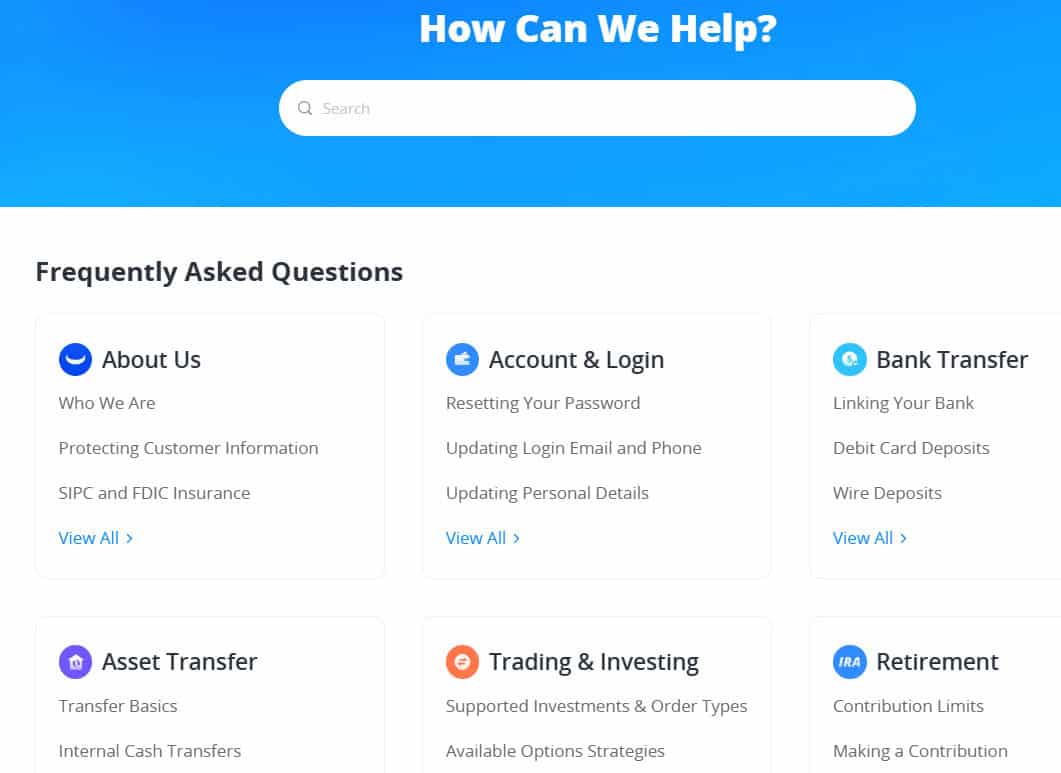

Customer Support and Responsiveness

Score – 4.5/5

Testing Webull’s Customer Support

The broker’s customer support is available 24/7, allowing users to reach out for help at any time. It provides support via email, live chat, phone, and help center, offering multiple options to suit different preferences and urgency levels.

While some traders have reported positive experiences with their customer support, others have expressed dissatisfaction with response times and problem resolution.

Contacts Webull

Webull offers multiple contact options for customer support. For U.S.-based clients, support is available by phone at 1‑888‑828‑0618 or by email at support@webull.com.

International users can reach out to regional branches at +65 6013 3322 or clientservices@webull.com.sg for Singapore. Webull’s support team helps with account issues, technical questions, and general inquiries.

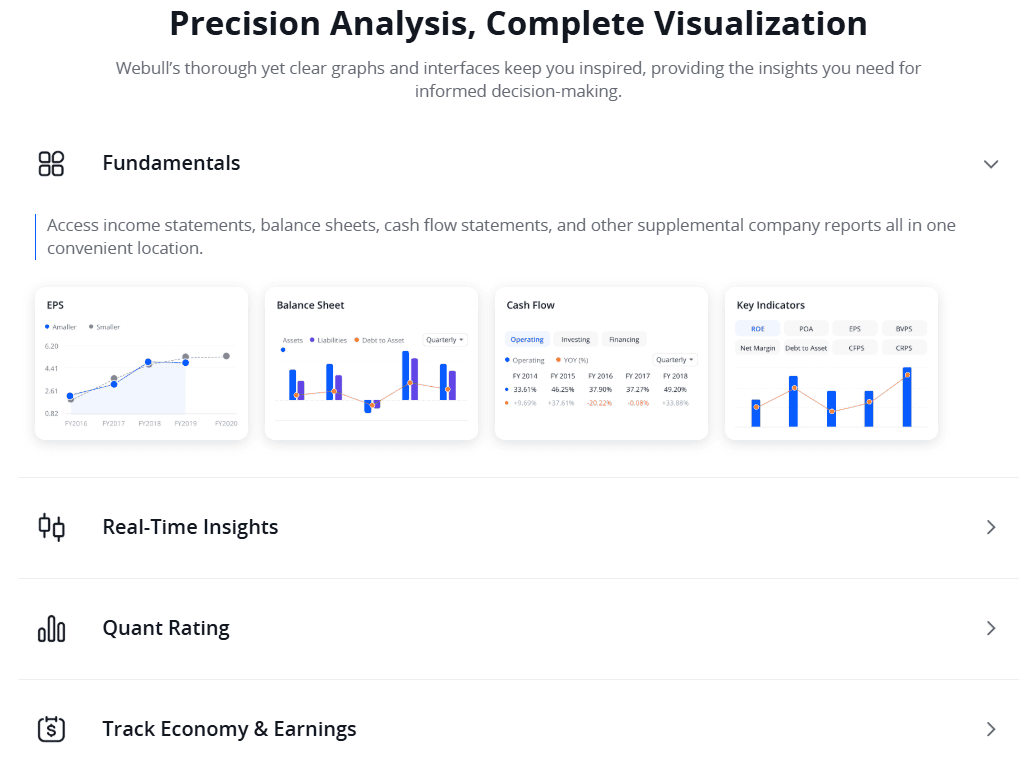

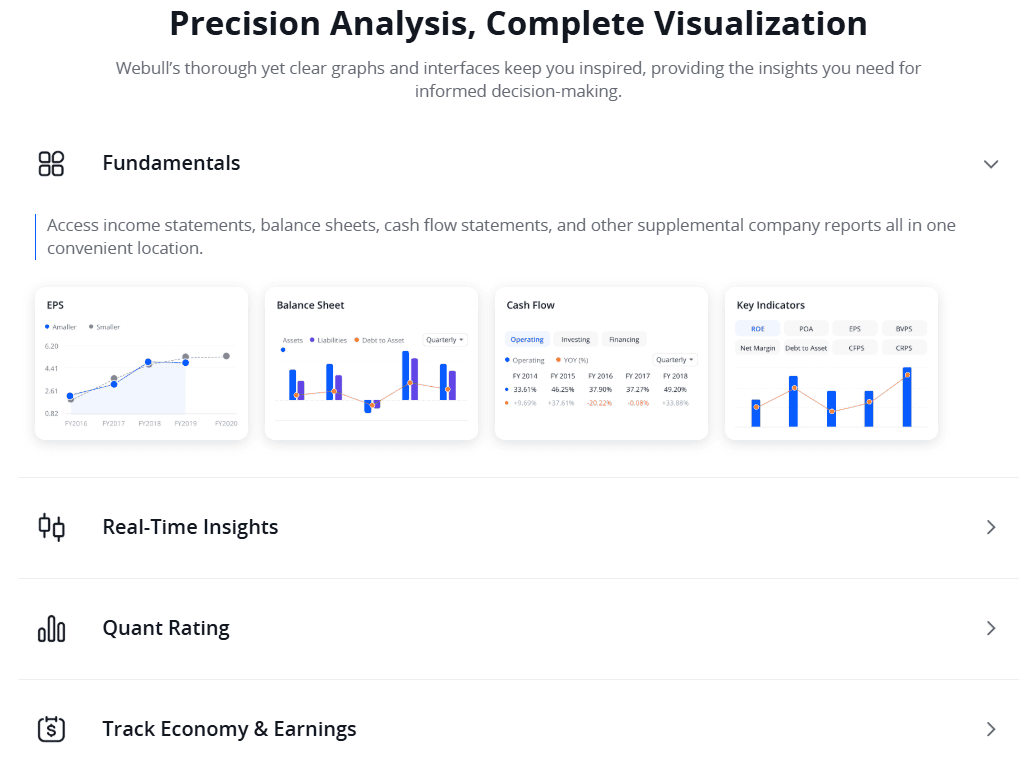

Research and Education

Score – 4.6/5

Research Tools Webull

Webull’s research tools are comprehensive and accessible across all platforms, including desktop, mobile, and web.

- They include advanced charting with real-time streaming data, over 60 technical indicators, customizable drawing tools, dual-chart layouts, and even TradingView integration for enhanced analysis.

- The platform also offers live quotes and Level 2 market depth, customizable screeners for stocks, ETFs, and options, as well as quantitative ratings that distill financials and price action into easy-to-read metrics.

- Traders can backtest strategies via paper trading, access financial statements, news feeds, and institutional portfolio data, all designed to support informed decision-making.

Education

The broker offers a range of educational resources, including articles, video tutorials, and webinars covering various trading topics such as market analysis, technical indicators, trading strategies, an overview of Investment Programs and Plans, and more.

While the learning materials provided by Webull are beneficial for traders seeking financial knowledge and insights, some users have expressed that the educational materials may not be as comprehensive as those offered by specialized educational platforms or other brokers. Therefore, traders who require more extensive resources may consider additional materials from alternative sources.

However, since the Broker focuses mainly on advanced and Professional traders, the company would provide good research and tools, but education is ultimately basic since the Broker offers more advanced trading instruments.

Portfolio and Investment Opportunities

Score – 4.7/5

Investment Options Webull

Webull offers a wide range of investment options for both active traders and long-term investors. Users can invest in U.S. and international stocks, over 3,000 ETFs, and fractional shares with as little as $1.

The platform also supports commission-free options trading, allowing for multi-leg strategies without contract fees. Additional investment solutions include IPO participation, OTC stocks, and ADRs for global market exposure.

The broker also supports retirement planning through Traditional, Roth, and Rollover IRAs, along with recurring investments for those using dollar-cost averaging strategies.

Account Opening

Score – 4.5/5

How to Open Webull Demo Account?

Opening a demo account on Webull is simple through its paper trading feature, which allows users to practice trading without risking real money.

To get started, you just need to create a free Webull account via the mobile app, desktop platform, or web interface. Once logged in, navigate to the “Paper Trading” section, where you will receive virtual funds to simulate live market trades.

The platform mirrors real-time data and provides access to all standard tools, including charts, technical indicators, and order types.

How to Open Webull Live Account?

Opening an account is quite a seamless task. To log in to Webull, you can open an account within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Sign Up” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Additional Tools and Features

Score – 4.6/5

In addition to its main trading tools, Webull offers a variety of extra features that enhance the overall trading experience.

- These include price alerts, watchlists, and customizable widgets to monitor markets in real time.

- The platform also provides calendar tools for tracking earnings, dividends, IPOs, and economic events, as well as fundamental data like analyst ratings, insider transactions, and institutional holdings.

- Webull users can also access social sentiment analysis and voice-command functionality for easier navigation and trade execution.

Webull Compared to Other Brokers

Compared to its competitors, Webull stands out as a modern, low-cost Stock Trading Brokerage that offers a strong combination of advanced trading tools, a good range of investment options, and user-friendly platforms.

Webull’s platform is intuitive and integrates with TradingView, offering a professional-grade experience across desktop, mobile, and web. Unlike some brokers that require a minimum deposit, the broker allows users to start with zero, making it accessible to beginner investors as well.

Webull is also well-regulated across multiple jurisdictions and provides 24/7 customer support. Overall, the firm competes strongly in affordability, innovation, and usability, especially for traders who prioritize tech-driven platforms and commission-free access to financial markets.

| Parameter |

Webull |

AvaFutures |

Interactive Brokers |

TD Ameritrade |

Fidelity |

AMP |

E-Trade |

| Broker Fee – Futures E-mini and Standard Contract |

$0.70 |

$0.49 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.25 |

$1.50 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Low |

Low |

Average |

Low |

Low |

Average |

| Trading Platforms |

Webull Trading Platform, TradingView |

MT5 |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Active Trader Pro, Fidelity Go, Fidelity.com Web |

MT5, TradingView, CQG, Rithmic, TT, and more |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

| Asset Variety |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

Futures |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, Mutual Funds, ETFs, Options, Bonds, CDs, Precious Metals, Crypto |

Futures Contracts, Commodities, Options on Futures |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds, and CDs |

| Regulation |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

ASIC, MiFID, Bank of Ireland, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

SEC, FINRA, IIROC |

NFA, CFTC |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

| Customer Support |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Good |

Excellent |

Excellent |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

$0 |

$100 |

$100 |

$0 |

$0 |

$100 |

$0 |

Full Review of Broker Webull

Webull is a US-based, well-regulated Stock trading platform offering investment solutions to active traders and self-directed investors. It offers access to a range of assets, including stocks, ETFs, options, futures, and cryptocurrencies, all within a streamlined and user-friendly interface.

The platform provides powerful trading tools such as advanced charting, paper trading, smart alerts, and AI-enhanced features to analyze markets and execute trades efficiently.

With zero account minimums, strong regulatory backing, and full platform availability across desktop, mobile, and web, Webull delivers a flexible and cost-effective trading experience backed by innovative technology.

Share this article [addtoany url="https://55brokers.com/webull-review/" title="Webull"]