- What is Varianse?

- Varianse Pros and Cons

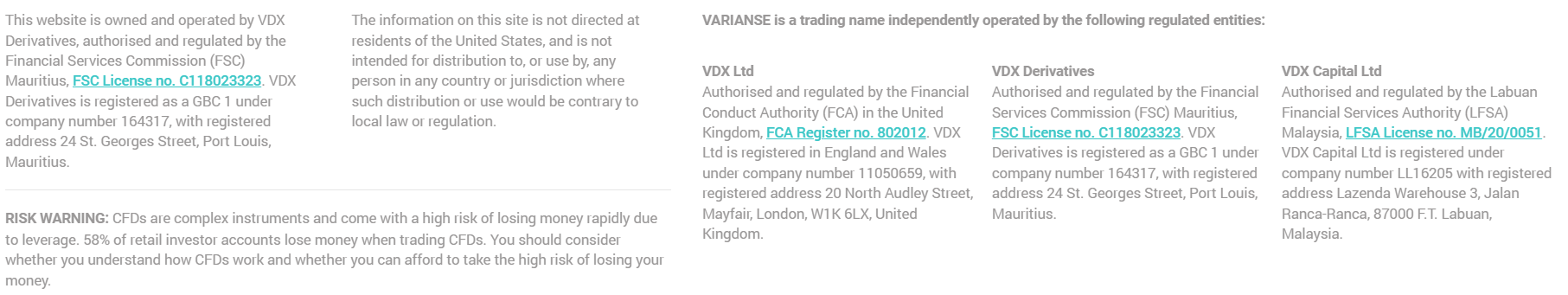

- Regulation and Security Measures

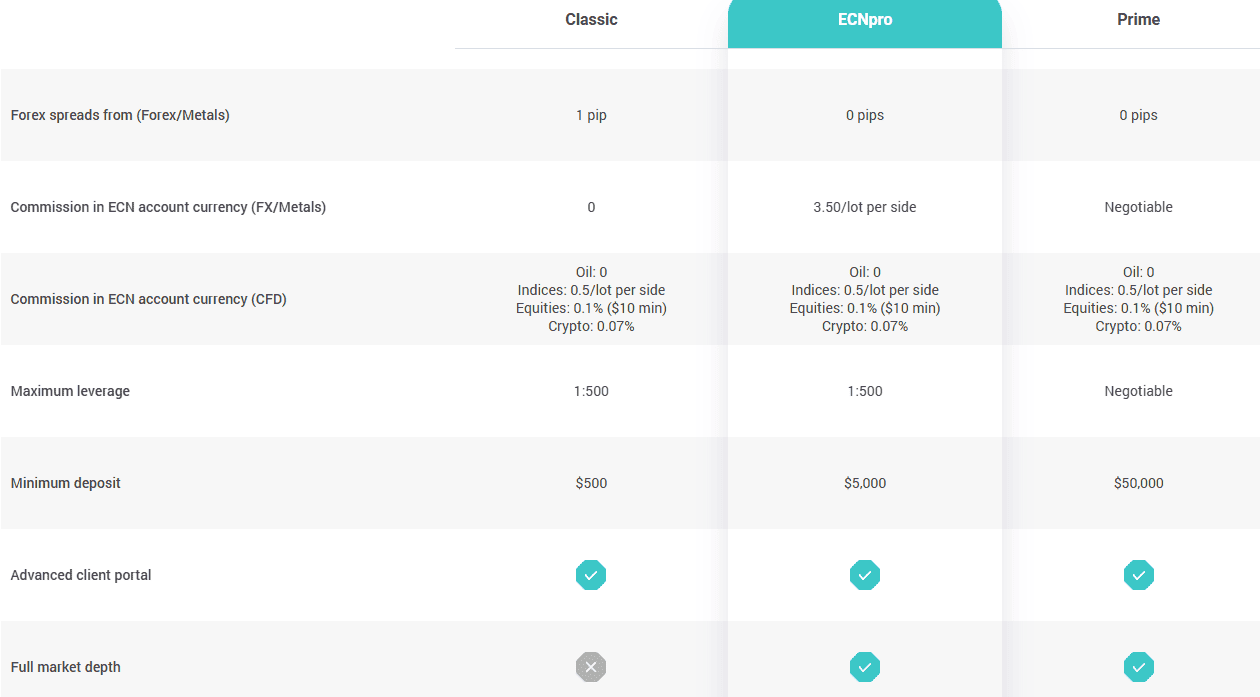

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

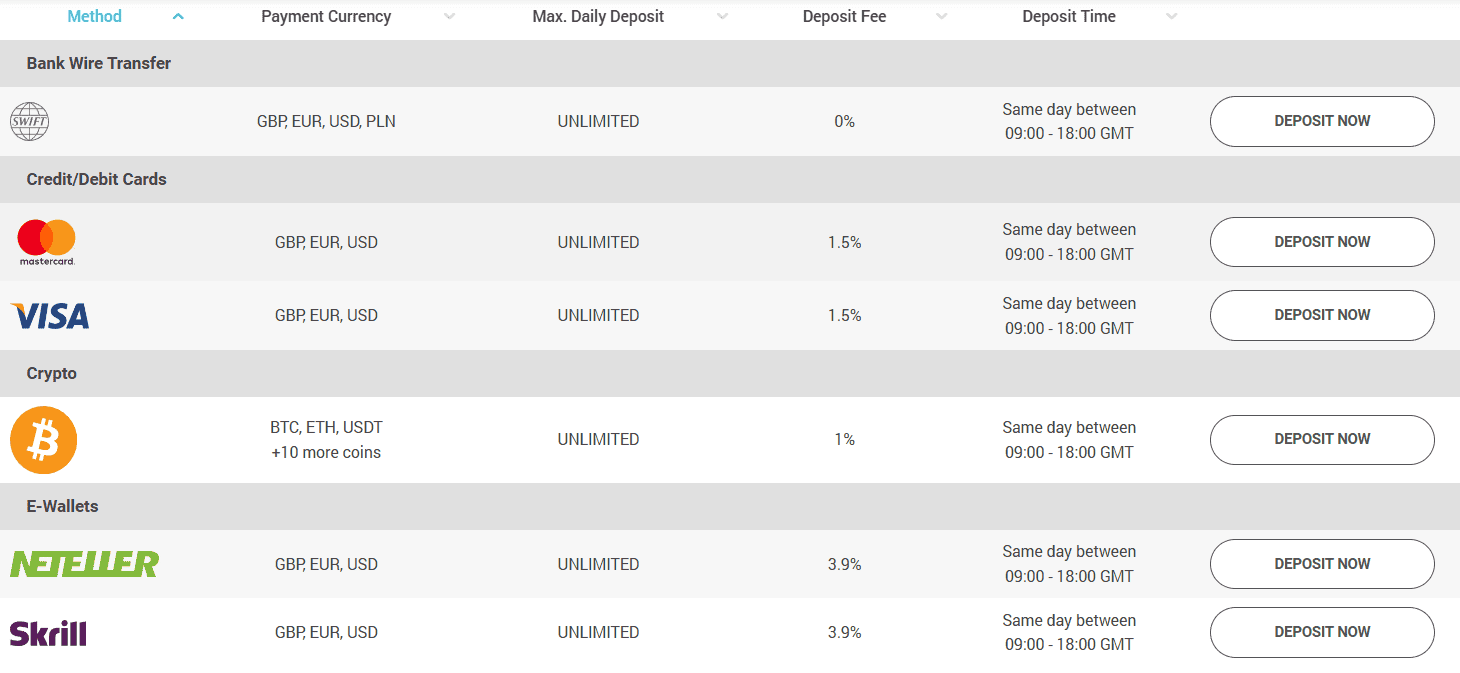

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Varianse Compared to Other Brokers

- Full Review of Broker Varianse

Overall Rating 4.4

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.7 / 5 |

| Additional Tools and Features | 4.1 / 5 |

What is Varianse?

Varianse is a UK-based Forex trading company that enables clients to trade with a wealth of experience in institutional and retail environments with a pure STP model to access a deep pool of liquidity. The broker is authorized and regulated by the UK top-tier FCA. Additionally, it possesses licenses from the FSA in Mauritius and the LFSA in Malaysia.

Along with the range of financial markets, including CFDs on FX, crypto, metals, indices, and equities, Varianse developed technology powered by Equinix, a data center in London, which provides real-time market news and analytics. In addition, Equinix provides the information you may need in an organized and intuitive way, along with the empowering tools typically used by professionals globally in Tier 1 banks, hedge funds, and brokerage houses.

Overall, per our research, traders can enjoy advanced trading with up-to-date information and necessary tools, which are all available and at clients’ disposal at Varianse.

Varianse Pros and Cons

According to our findings, the broker offers robust trading technology and seamless, transparent execution through advanced trading platforms like cTrader and MT4. Moreover, the company provides a wide range of trading instruments, including spread betting, at competitive rates based on either commission or spread.

For the cons, Varianse is more suitable for traders with more experience or bigger-size traders. Additionally, its website lacks comprehensive educational resources, and customer support is not available 24/7.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversight | No 24/7 customer support |

| cTrader and MetaTrader trading platforms | Limited educational materials |

| Funds protection | |

| Low spreads | |

| Available for UK and international traders | |

| Institutional trading | |

| FIX API availability | |

Varianse Features

Varianse is a reliable broker with a top-tier license from the FCA. It offers multiple asset classes, transparent fees, and advanced platforms with fast execution and in-depth analysis. To be able to estimate the broker and different aspects of trading with it, we have compiled all its most essential features in a list:

Varianse Features in 10 Points

| 🗺️ Regulation and License | FCA, FSC, LFSA |

| 🗺️ Account Types | Classic, ECNpro, Prime |

| 🖥 Trading Platforms | MT4, cTrader, FIX API |

| 📉 Trading Instruments | CFDs on Crypto, Forex, Metals, Energy, Indices, Equities |

| 💳 Minimum deposit | $500 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | EUR, USD, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is Varianse For?

Varianse is a good-standing broker with diverse opportunities, enabling traders to explore the market with favorable and versatile features and get the best out of trading. Here is what Varianse is good for:

- Traders from the UK

- Forex Trading in Malaysia

- International trading

- CFD and currency trading

- Traders who prefer the MT4 and cTrader platforms

- Advanced traders

- Institutional trading

- STP/NDD execution

- Copy Trading

- Competitive spreads

- EA/Auto trading

- Good trading tools

Varianse Summary

Varianse offers powerful trading technology, competitive pricing, and a wide range of trading instruments. The availability of popular trading platforms MT4 and cTrader enhances the trading experience by offering advanced features and real-time charting.

Also, the company is sharply regulated and overseen by the industry leader, FCA. Additionally, the pure STP model delivers vast investment opportunities, while many traders of different expertise and trading styles can engage in trading with Varianse. However, the lack of comprehensive educational materials on the website and the absence of 24/7 customer support are notable drawbacks.

55Brokers Professional Insights

Varianse is with quite good reputation and good standing among the trading community for its secure trading platforms, competitive spreads and quality trading services. The broker is available in over 100 countries, which is a plus for global reach, with its servers located in the low-latency suite of London’s Equinix LD4 and LD5 data centers providing seamless execution on trading.

With Varianse more than 200 tradable products across 5 asset classes, and popular MT4 platform or cTrader, various traders may join in despite trading software preference, allowing to experience advanced solutions and explore the trading potential of both. Varianse also enables copy trading, automated trading, with FIX API availability so mostly all startegy traders will find it comfortable at Varianse.

However, traders should be aware that the broker operates under several entities, and the trading conditions can be different based on the jurisdiction.

Consider Trading with Varianse If:

| Varianse is an excellent Broker for: | - UK clients

- Traders from Malaysia

- Algorithmic and API traders

- CFD traders

- cTrader enthusiasts

- Traders who prefer VPS

- International traders

- Advanced clients |

Avoid Trading with Varianse If:

| Varianse is not the best for: | - Beginner traders

- Wide diversity of instruments

- Clients who look for diverse trading platforms

- Customers who look for 24/7 support

- Long-term investors |

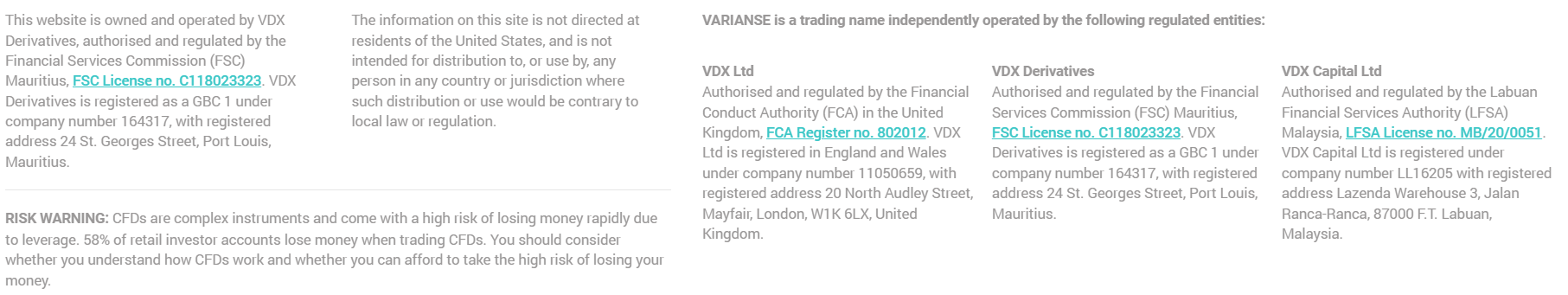

Regulation and Security Measures

Score – 4.6/5

Varianse Regulatory Overview

Varianse is regulated by the top-tier authority FCA and delivers strictly legal financial services. Compliance with the regulatory requirements set by the FCA enhances the safety and confidence of traders who choose to trade with Varianse.

- Also, Varianse has additional entities for international trading and Asia Trading via its entity in Malaysia, which is fully regulated by the Labuan Financial Services Authority (LFSA), making the broker a good choice for Malaysian traders.

- Besides, Varianse runs an offshore entity authorized and regulated by the Financial Services Commission (FSC), Mauritius. Although, in other circumstances, the offshore regulation would raise doubts, the broker’s FCA license makes the broker a reliable choice.

How Safe is Trading with Varianse?

In accordance with the strictest FCA rules, the company performs operations with the required level of security and client treatment standards. Client money management must meet the necessary conditions, and all client funds are held in segregated accounts with reputable banks like Barclays Bank in London.

- Furthermore, Varianse is required to submit financial reports to regulators and to participate in the compensation scheme FSCS that will cover clients’ funds in case of the company’s insolvency.

Consistency and Clarity

Varianse has been operating since 2015. During its years of operation, the broker has not only shown consistency in its services but also shown consistent development, growth, and expansion of offerings. The broker has expanded its services to over 100 countries globally, making it accessible worldwide. Besides, Varianse has received recognition for its reliable trading services in the financial sector as the best broker for professionals, the best forex broker for online trading, and many others.

We found that most customer feedback about the broker is positive, indicating the broker’s reliability, responsive customer support, and the platform’s friendly interface combined with strong analytical features. However, there are some negative comments about high fees and slippage issues. We have also noticed that Varianse does not have many reviews from clients, despite the fact that it has been in the market for about 10 years already.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Varianse?

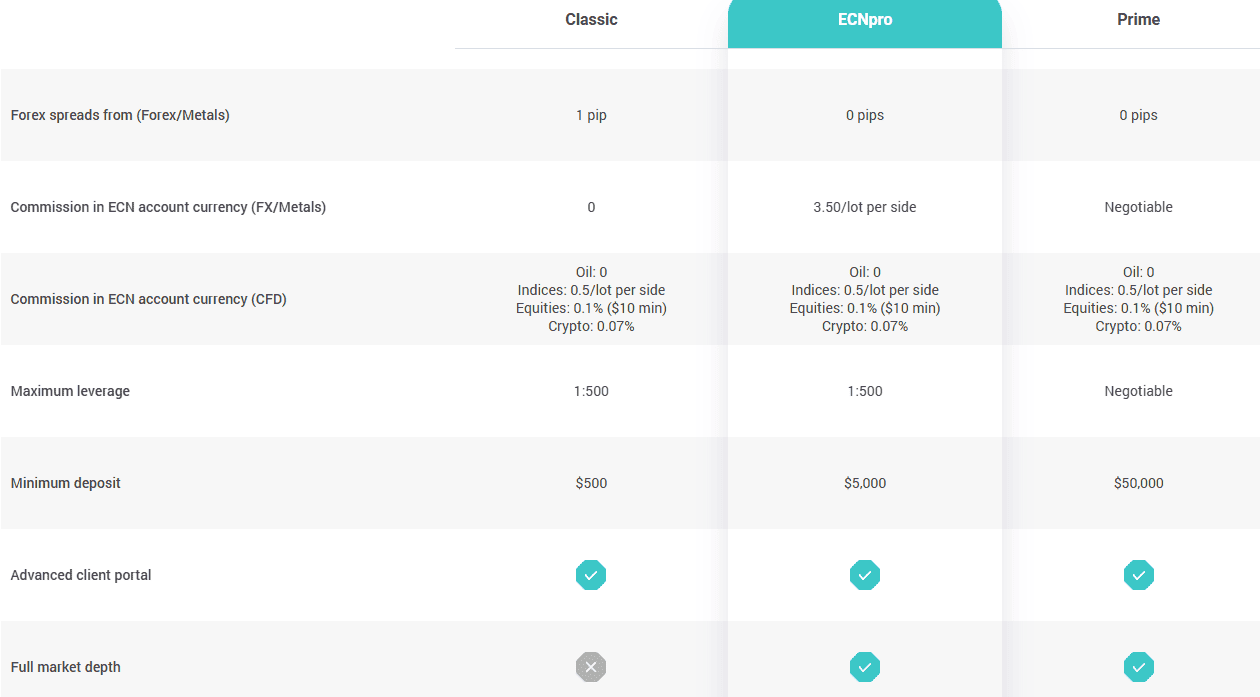

The account types available at Varianse cover various trading needs, with multiple base currency accounts, including USD, EUR, GBP, PLN, AUD, and JPY. Of course, all accounts receive personal trading support, dedicated account management, and a Free demo account to practice on MT4. Overall, there are three main account types: Classic, ECNpro, and Prime. The accounts have differences in trading conditions and offer various fee structures.

Classic Account

The Classic account is spread-based, including all the trading costs into spreads. Spreads for the EUR/USD pair is 1 pip, with no transaction charges for FX and metals. However, for the ECN account, there are certain commission fees, including indices at 0.5% per side, 0.1% for equities, and 0.07% for cryptos. The account type gives traders access to an advanced client portal. As we have found, the minimum deposit requirement is $500, which is a little higher when compared to other brokers. The leverage available is up to 1:500.

ECNpro Account

ECNpro is a commission-based account with spreads starting from 0 pips. The commission for FX and metals is $3.5 per side per lot. For oil, indices, equities, and crypto, there are specified transaction fees, the same as mentioned for the classic account. This account type is suitable for intermediate and more experienced traders, with a minimum deposit of $5,000. It enables an advanced client portal, market depth, and FIX API.

Prime Account

The Prime account is for professional and high-frequency traders who are looking for specifically tailored services and conditions. The account is commission-based, with spreads from 0 pips and negotiable commissions for FX and metals. For CFD oil, indices, equities, and cryptos, the commissions are fixed for all three account types. The available leverage is also negotiable and can be higher than 1:500. The minimum initial deposit requirement is very high, starting from $50,000. The account enables tailored liquidity and execution optimization, VPS and FIX API availability, and provides full market depth.

Regions Where Varianse is Restricted

We have also considered which regions are restricted with Varianse. Due to regulatory reasons, there are certain countries the broker cannot accept clients from. However, the list of restricted countries is small and is as follows:

Cost Structure and Fees

Score – 4.5/5

Varianse Brokerage Fees

Based on our research, Varianse offers a floating tight spread or a commission charge. The broker offers complete price transparency since it uses direct ECN connectivity. However, clients should consider an overnight policy that applies in case the trading order is held for longer than a day. The fees depend on the account types that have spread-based or commission-based structures.

Based on our test trade, Varianse spreads depend on the account type, with an average spread of 1 pip for the widely traded EUR/USD currency pair in the Forex market for the Classic account.

Further, ECNpro and Prime accounts start from a 0 pip spread, with additional commission per lot applied. However, the trading conditions can differ depending on the entity, so do your research to understand the specific spread conditions.

Varianse offers two commission-based accounts that come with different conditions. There are also certain commissions for the spread-based account, depending on the instrument traded. As we have found, for all three account types, the broker charges transaction fees for indices at 0.5% per side, 0.1% for equities, and 0.07% for cryptos. For the Classic account, there is no commission for FX and metal trading. For the ECNpro account, there is a fixed $3.5 transaction fee for Forex and metals, and the already mentioned transaction fees for indices, equities, and cryptos. This is also true for the Prime account, whereas, for FX and metal trading, the commissions are negotiable based on the trader’s professional level, trading size, expectations, and other conditions.

How Competitive Are Varianse Fees?

Based on our research, Varianse is a fairly transparent broker with low or average spreads and clear commissions. The broker is especially a good choice for professional or high-frequency traders. The broker offers average spreads from 1 pip for the EUR/USD pair. As we have found, the gold spread is 0.22 pips, and the crude oil spread is 0.05 pips. For the commission-based accounts, spreads start from 0 pips. The commissions are $3.5 for the Classic account for the FX pairs and metals, while there are specified commissions for indices, equities, and cryptos. All in all, the broker mentions all spreads and commissions for each instrument, which makes the offering transparent and clear.

As far as we have found, there are no hidden fees; thus, traders will not be obliged to pay unexpected charges. However, there are swap fees, and there might also be deposit and withdrawal fees.

| Asset/ Pair | Varianse Spread | SquaredFinancial Spread | Advanced Markets Spread |

|---|

| EUR/USD Spread | 1 pips | 1.2 pips | 1.2 pips |

| Crude Oil WTI Spread | 0.05 | 0.03 USD | 3 |

| Gold Spread | 0.22 | 0.10 USD | 1 |

Varianse Additional Fees

We have found that the broker does not charge an inactivity fee, and traders can trade without any restrictions. However, there is a 1.5% charge for certain deposit methods, including Mastercard and Visa cards, and a 3.9% charge for e-wallets.

Score – 4.4/5

The broker’s proposal covers a choice among three platforms: the popular MetaTrader 4, cTrader, and FIX API, accessible through various devices such as desktop, web, and mobile, allowing traders to stay connected to the markets and execute trades at their convenience, regardless of their location.

These platforms provide comprehensive charting tools, real-time market data, and a wide range of technical indicators to assist traders in making informed trading decisions.

| Platforms | Varianse Platforms | Fortrade Platforms | Advanced Markets Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | No | Yes |

| cTrader | Yes | No | No |

| Own Platform | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Varianse Web Platform

Varianse does not have a proprietary web platform; however, traders can still trade through the web via the popular MT4 and cTrader. The platforms are easily accessible through any browser, requiring no downloads or installations. Both MT4 and cTrader web platforms provide one-click trading, 30+ technical indicators, real-time charts, and quick execution of trades. The web platform enables flexibility without restricting clients from using the capabilities peculiar to the desktop platform.

Varianse Desktop MetaTrader 4 Platform

According to our findings, traders using MT4 can access a wide selection of technical indicators, customizable charting options, and automated capabilities through Expert Advisors (EAs). These tools enable traders to analyze market trends, identify trading opportunities, and execute trades efficiently. Clients are also able to create custom indicators and more than 50 built-in indicators.

Varianse cTrader

The Varianse cTrader platform has many advanced features, including market depth, advanced order types, and built-in algorithmic trading tools. cTrader also offers advanced charting tools, real-time market data, price alerts, and comprehensive trade history. Clients also have access to trade management tools and customizable features to tailor trades according to their preferences. The platform provides ultra-low-latency STP execution and access to 200+ instruments, including forex, indices, metals, commodities, and US equities. Besides, traders can access cTrader via desktop platform, web, and mobile app, which makes it more accessible.

Varianse MobileTrader App

Although Varianse does not offer its proprietary app, it provides traders with access to the cTrader and MT4 mobile apps. The apps retain a lot of the most advanced tools and features of the desktop platform, making trading from the palm of the hand a profitable experience. There are innovative charts, trade history, real-time market data, various order types, trade management tools, and a user-friendly interface. Varianse makes trading from anywhere an easy task, enabling traders to monitor their trades with flexibility and freedom.

Trading Instruments

Score – 4.6/5

What Can You Trade on the Varianse Platform?

According to our research, the broker provides over 200 CFDs across 6 asset classes, including crypto, forex, metals, energy, indices, and equities, as well as spread betting for UK clients. The availability of trading instruments might vary depending on the entity, so it is recommended to carefully research the available options.

- Based on what we have found, Varianse offers 44 major, minor, and exotic Forex pairs; 2 metals, including gold and silver; 2 energies (UK and US oil); 10 global indices; 23 cryptos such as Bitcoin, Ethereum, Ripple, Tether, and others; and 121 equities.

Main Insights from Exploring Varianse Tradable Assets

Based on our research and testing, we have found that Varianse offers over 200 tradable products across a wide range of financial assets. The instruments are CFD-based, enabling traders to benefit from price movements of the underlying asset rather than owning the instruments. For many traders, this is a perfect opportunity to explore that market and expand their portfolios. However, this offering limits long-term trading opportunities and the chance for traditional investments.

Despite this, Varianse is a favorable choice for traders looking for a good number of instruments, tight spreads, fair commissions, and an overall transparent trading experience.

Leverage Options at Varianse

Leverage is a valuable tool that allows traders to enter the market with limited capital. However, traders should understand that it can result in substantial gains or losses. Therefore, having a comprehensive understanding of how leverage operates and its potential consequences before engaging in any trading activities involving leverage is essential.

Varianse leverage is offered according to FCA, FSC, and LFSA regulations:

- UK traders are eligible to use leverage of up to 1:30 for major currency pairs and 1:10 for commodities.

- International entity clients can use leverage of up to 1:500 for professional trading.

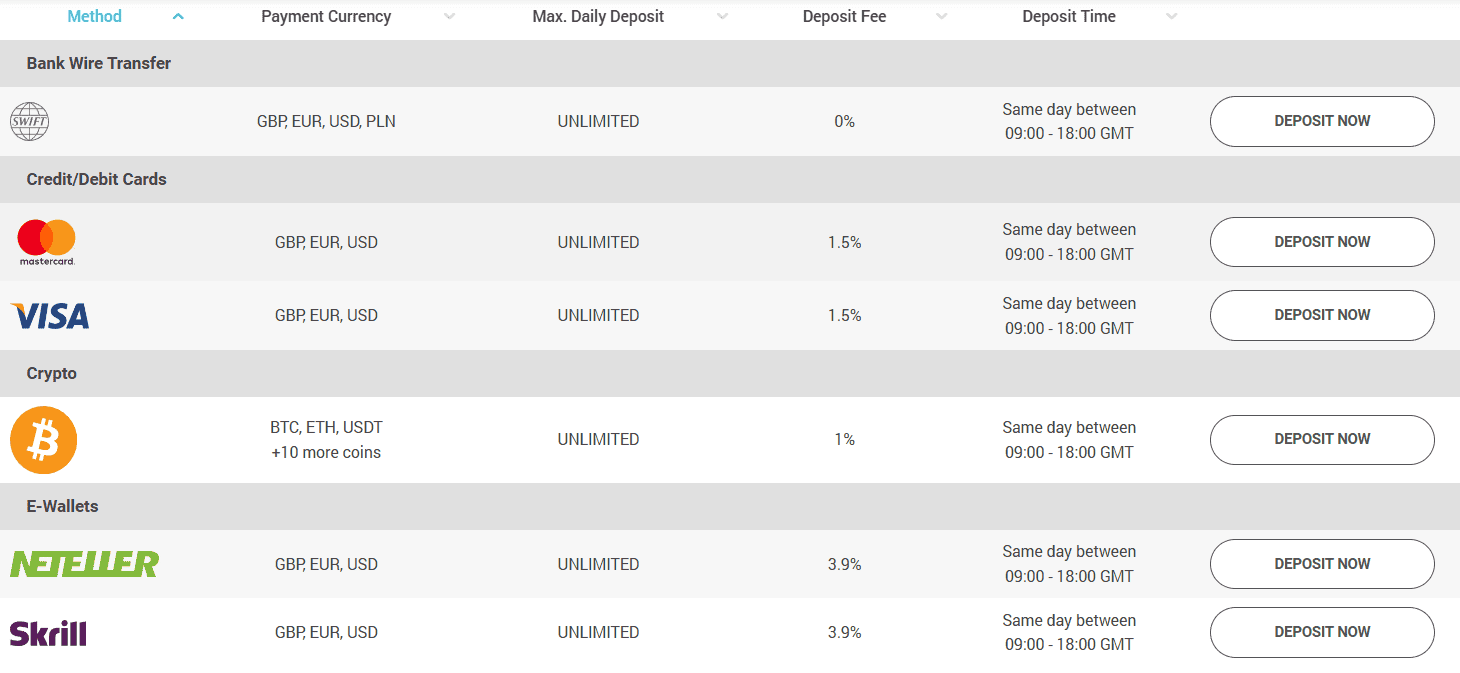

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Varianse

To fund a Live account, clients can choose from the available deposit and withdrawal methods. These include bank wire transfers, credit/debit cards, crypto payments, and e-wallets like Neteller and Skrill. For some deposit methods, such as Mastercard and Visa, there is a 1.5% charge, 1% for cryptos, and for e-wallets, such as Skrill and Neteller, the deposit fee is 3.9%.

Minimum Deposit

A Classic Varianse account requires $500 as a first deposit. Usually, minimum deposits are defined by the account type chosen. A higher-grade account demands more funds since it brings a professional environment and tailored solution to trading.

Withdrawal Options at Varianse

The withdrawals are usually processed via bank wire transfer, and some through credit cards and e-wallets. The withdrawals are processed on the same day, but it usually takes 1-3 days for the funds to reach the account.

Customer Support and Responsiveness

Score – 4.6/5

Testing Varianse Customer Support

The broker’s customer support is available 24/5 through live chat, email, and phone. We found that Varianse has a team of experienced trading experts who are available to help clients with various issues. These include technical problems, market analysis, general inquiries, and operational concerns.

- The FAQ section is very helpful, providing detailed answers and guides for informed trading and answers to the most common questions.

Contacts Varianse

Based on our testing, Varianse provides quick and dedicated assistance through its multiple support methods. We have tested its live chat to find quick and detailed answers within minutes. As to the email and phone assistance, based on the entity, the numbers and email addresses are different, so clients should be attentive to find the right contacts:

- For the UK entity, clients can contact the support team through the following phone number: +44 (0) 203 475 2285.

- The email address to contact the team for the UK entity is as follows: support@varianse.co.uk.

- The live chat provides quick and on-point answers, and is the fastest way to find answers to your questions and issues. It is available 24/5.

Research and Education

Score – 4.2/5

Research Tools Varianse

Varianse provides great tools and features that can enhance the analysis capabilities. Even though the MT4 and cTrader platforms are already heavily equipped with research tools, there are also additional opportunities for clients that are as follows:

- The broker has a separate section where clients can find forex fundamental and technical analysis.

- Through the account analysis section, traders gain access to a complete dashboard where they can dive deeper into their trading performance with advanced analytics provided for the cTrader account.

- The Client Back Office provides clients with easy-to-use account management tools through round-the-clock access to their accounts.

- On the Varianse MT4 platform, traders now have access to the advanced Fintwit Twitter feed, providing world-famous Fintwit tweets to the watchlist instruments and hundreds of relevant subjects.

Education

We noticed that the broker lacks comprehensive learning materials, seminars, and webinars on its website. This absence can be considered a drawback since educational resources play a crucial role in the development and improvement of traders’ skills. Varianse only provides Forex trading news and articles, which may not be sufficient for those seeking comprehensive educational support.

Is Varianse a Good Broker for Beginners?

We reviewed different aspects of trading with Varianse to see if it is a suitable broker for beginner traders. All in all, Varianse comes with favorable trading conditions, good analysis tools, advanced platforms, a range of account types tailored for different trading needs, and both spread- and commission-based fee structures. However, the main features that are essential for beginner traders and are important to make a good choice for them are mostly missing: the broker does not include extensive educational materials, and the minimum deposit requirement for its Classic account is $500, which is higher than average. Those novice traders who prioritize educational materials and guidance and are cost-conscious, looking for smaller options for initial investments, might look for more suitable brokers or, at least, look for additional sources of forex knowledge.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options Varianse

Varianse offers more than 200 instruments across various asset types, enabling traders to explore the market and expand their portfolios. The instrument range, however, is average, and traders have access to mainly the most popular tradable products. In addition, all the available products are based on CFDs. Besides, the broker does not offer stock, shares, or ETF trading. This means that with Varianse, traders can engage in short-term trading, while long-term trades and traditional investments are out of the question.

However, clients can still diversify their trading via alternative options:

- Copy trading is available through the broker’s cTrader platform. Traders can copy more experienced traders without commitment and get profits from successful trades. It is possible to start or quit trades at any moment. Clients can experience full transparency, with access to trade history and open positions.

Account Opening

Score – 4.7/5

How to Open a Varianse Demo Account?

The availability of a demo account is an advantage, as it enables beginner traders to practice and gain skills and knowledge before diving into live trading. The demo account opening is an easy and straightforward process that requires the following steps:

- Go to the official website and choose the demo account option.

- Fill out personal details, including name, phone number, and email address.

- Check your email for a confirmation email.

- Click on the Client Portal link in the email to be transferred to the activation page.

- On the activated page, choose the “Try Demo” option.

- Complete the application by selecting an account type, leverage, and deposit amount.

- You will then receive another email with your account login details.

How to Open a Varianse Live Account?

Opening an account with the broker is quite easy. With Varianse, you can open an account within minutes. Follow the opening account or sign-in page and proceed with the guided steps.

- Go to the account registration page.

- Enter the required personal data (name, email, phone number, etc.) and submit the information.

- You will receive an email with a link. Click on the client portal link to be redirected to the activation web page.

- Provide the required documentation (residential proof, ID, etc.) to complete the account registration process.

- You will get another confirmation email with your login details.

- You can enter your live account and start trading.

Score – 4.1/5

Varianse includes a few essential tools and features that can drastically boost the trading experience and generate better outcomes. In general, the availability of different tools is an advantage that not many brokers offer. Below, you can see what more you can get by trading with Varianse:

- Varianse offers a virtual private server (VPS), an exclusive server hosted in a high-specification data center. The VPS enhances the trading experience and is especially useful for high-frequency traders. VPS adds more reliability to the trading process and increases the execution speed.

- The broker’s FIX API is a connectivity solution that enables traders high-speed access to their trades. FIX API provides a direct connection to the broker’s liquidity providers and enables complex order types that are not available on common retail platforms.

Varianse Compared to Other Brokers

As a final step, we have compared Varianse to other brokers that offer similar services and trading conditions. Varianse, as we have found based on our research, is a trustworthy broker with an FCA license and additional offshore licenses that ensure the broker’s global exposure. From the brokers we have compared Varianse to, only Admiral Markets and Fortrade hold an FCA license. The brokers also have other licenses from respected authorities, such as ASIC, CySEC, and IIROC, providing an extra layer of security.

As to the trading fees, Varianse offers average spreads from 1 pip, which, as we have found, is the same for TMGM, FP Markets, and other brokers. Fortrade’s spreads are higher, with an average of 2 pips. On the other hand, Admiral Markets’ spreads start from 0.6 pips, which is a better option for cost-conscious traders. As to the trading platforms, Varianse offers the largely popular MT4 platform that most brokers include in their offerings, such as TMGM, TriumphFX, FP Markets, and Admiral Markets. Yet, Varianse also offers a more advanced cTrader, suitable for advanced and high-frequency traders.

When we compared the broker’s initial deposit to others, it had a higher requirement of $500. On the other hand, most brokers, including TMGM, Fortrade, and FP Markets, require $100 initial funding, while in the case of Admiral Markets, it is only $1. And at last, we reviewed the available educational resources, to find that Varianse offers limited materials, making it an unfavorable option for beginners looking for comprehensive assistance. Out of the brokers we researched, FP Markets and Admiral Markets stand out for their exceptional educational and research resources.

| Parameter |

Varianse |

TMGM |

RoboForex |

TriumphFX |

FP Markets |

Admiral Markets |

Fortrade |

| Spread Based Account |

Average 1 pips |

Average 1 pip |

Average 1.3 pip |

Average 0.6 pip |

From 1 pip |

From 0.6 pips |

Average 2 pip |

| Commission Based Account |

0.0 pips + $3.5 for FX and Metals |

0.0 pips + $3.5 |

0.0 pips + $4 |

Not available |

0.0 pips + $3 |

0.0 pips + from $1.8 to $3.0 |

No commission |

| Fees Ranking |

Average |

Average |

Average |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

MT4, cTrader |

MT4,MT5, TGM app |

MT4, MT5, R StocksTrader |

MT4 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, Admiral Markets app |

Fortrader Platform, MT4 |

| Asset Variety |

200+ instruments |

12.000+ instruments |

12,000+ instruments |

64+ instruments |

10,000+ instruments |

8000+ instruments |

300+ instruments |

| Regulation |

FCA, FSC, LFSA |

ASIC, FMA, VFSC, FSC |

FSC |

CySEC, FSC, FSA |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

| Customer Support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Limited |

Good |

Good |

Good |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$500 |

$100 |

$10 |

$100 |

$100 |

$1 |

$100 |

Full Review of Broker Varianse

In conclusion, we can state that Varianse is a reliable broker with advanced and reliable offerings, innovative technologies, and reasonable pricing. Variance is regulated by one of the most respected authorities in the financial world, the FCA. The broker also holds additional offshore licenses that make it possible for the broker to accept clients globally. The broker also offers an optimal fee structure, both spread-based and commission-based, enabling clients with different preferences to choose the best option. The spreads are 1 pip on average, while commissions for Forex pairs and metals are $3.5 per side per lot. However, for all the other assets, the commissions are based on the particular instrument traded.

We have also found that the broker offers advanced trading platforms that combine flexibility, innovative solutions, and simplicity in one place. The MT4 and cTrader platforms enable beginner and high-frequency traders to conduct efficient and profitable trades. Clients can also access their accounts through the web platform or mobile app.

Among other advantages is the devoted and responsive customer support, available 24/5. However, there are also certain disadvantages that can limit novice traders: the broker does not include extensive educational resources. In addition, the minimum deposit is rather high, starting at $500, which can be a negative point for cost-conscious traders who want to start small.

Share this article [addtoany url="https://55brokers.com/varianse-review/" title="VARIANSE"]

Overall Good broker. I have used Varianse for a couple months alongside my other broker account with icmarkets, VARIANSE has fast order execution, good customer service and good spreads on their ECN accounts.