- What is Upstox?

- Upstox Pros and Cons

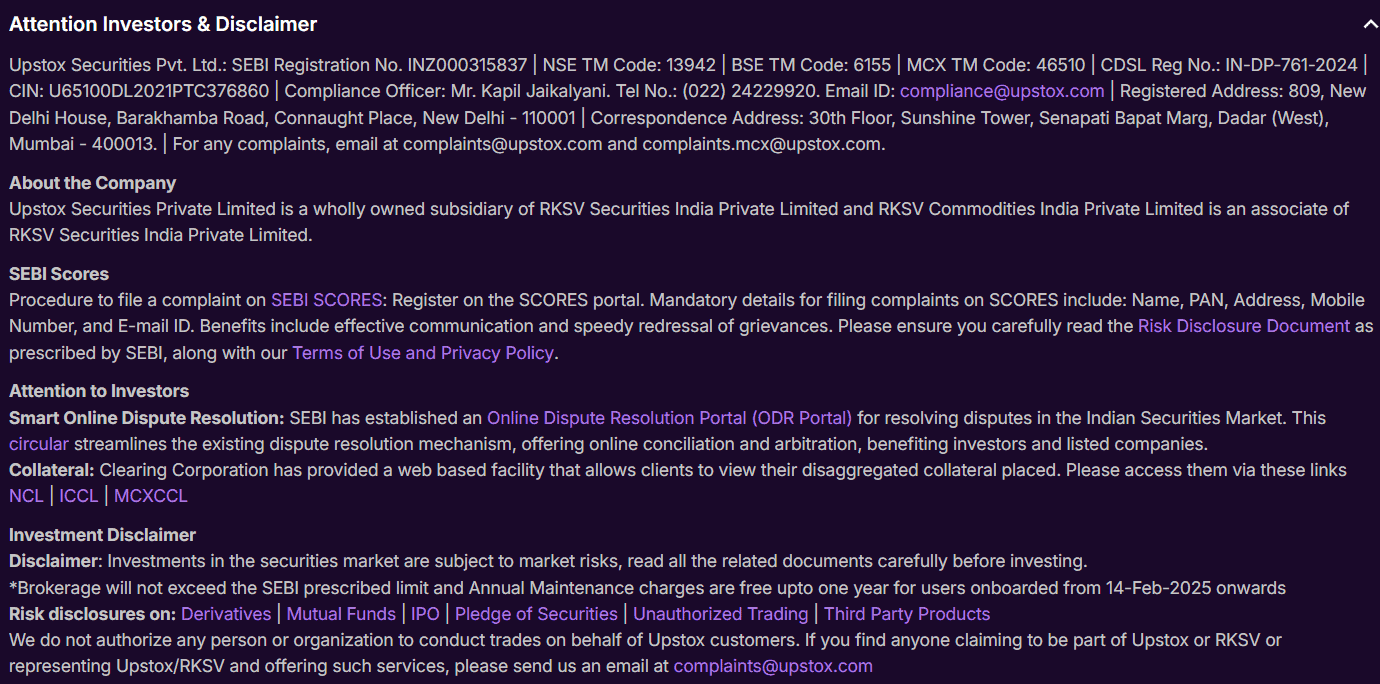

- Regulation and Security Measures

- Account Types and Benefits

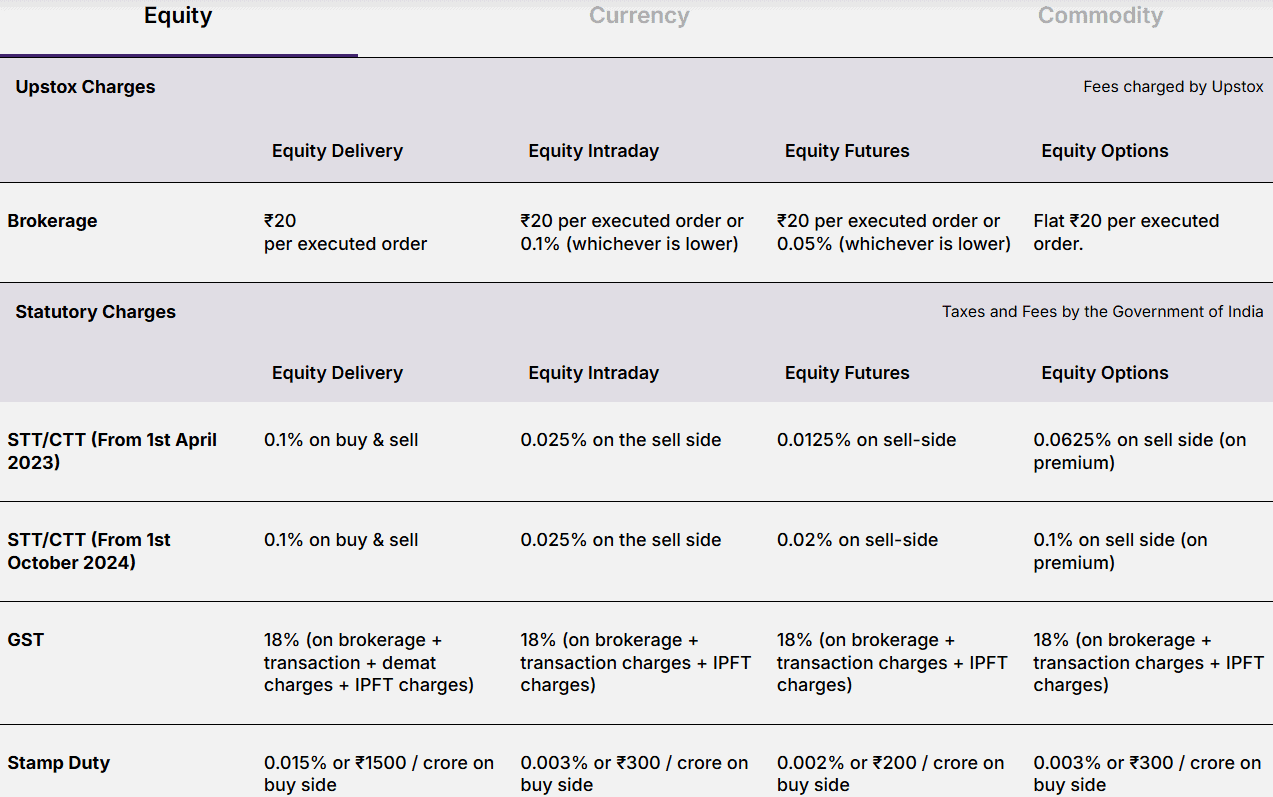

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Upstox Compared to Other Brokers

- Full Review of Broker Upstox

Overall Rating 4.5

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.6 / 5 |

What is Upstox?

Upstox is an Indian-based Stock trading firm that allows users to trade in stocks, futures, options, mutual funds, and more through its online platforms.

The broker is regulated by the Securities and Exchange Board of India (SEBI), which oversees various aspects of stock trading and brokerage operations to ensure transparency and protect investors’ interests.

Overall, the firm aims to make trading accessible and convenient for investors by offering a user-friendly interface and various tools for analysis.

Is Upstox Stock Broker?

Yes, Upstox is a Stock brokerage firm. It provides a platform for individuals to buy and sell various financial instruments, including stocks, mutual funds, commodities, futures, options, and currencies. Users can trade online through Upstox’s platforms, and the company facilitates these transactions as a broker, connecting investors with the stock market.

Upstox Pros and Cons

The broker comes with its set of pros and cons. On the positive side, it offers a user-friendly interface, making it accessible for both beginners and experienced traders. The platform provides advanced charting tools and analytical features for in-depth market analysis. Moreover, Upstox is known for its competitive brokerage rates, which can be appealing to cost-conscious investors.

For the cons, some users have reported occasional technical and server issues, which could be a drawback for those who require seamless and uninterrupted trading experiences. Additionally, the broker lacks a top-tier license, which could be a concern for traders who prioritize brokers with higher regulatory credentials.

| Advantages | Disadvantages |

|---|

| $0 minimum deposit | No top-tier license |

| Trading Platforms | Some reported technical and server issues |

| Popular Trading Products | |

| Direct Market Access | |

| Competitive trading conditions | |

| Charting tools and analytical features | |

| Learning materials | |

| User-friendly interface | |

| Secure investing environment | |

Upstox Features

Upstox has gained popularity in the Indian stock brokerage industry, providing a user-friendly platform, competitive brokerage rates, and a comprehensive range of financial instruments. A summary of its key features is as follows:

Upstox Features in 10 Points

| 🏢 Regulation | SEBI |

| 🗺️ Account Types | Securities, Commodities, Demat Accounts |

| 🖥 Trading Platforms | Upstox Pro Web, Mobile, NEST Desktop, Upstox Developer Trading Platforms, TradingView |

| 📉 Trading Instruments | Stocks, Mutual Funds, Bonds, Commodities, Futures, Options, ETFs, Currencies |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | From ₹20/$0,24 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, GBP, INR |

| 📚 Trading Education | Courses, Webinars, Trading Glossary |

| ☎ Customer Support | 24/5 |

Who is Upstox For?

Upstox is designed for a wide range of investors looking for a fast and low-cost trading experience. With its intuitive mobile and web platforms, flat brokerage fees, and access to equities, derivatives, commodities, and mutual funds, it appeals to cost-conscious users who want a simple yet powerful way to trade. Based on our findings and Financial Expert Opinions, Upstox is Good for:

- Indian traders

- Investing

- Stocks and Options trading

- Advanced traders

- Professional trading

- Commission-based trading

- Direct market access

- Competitive trading environment

- Good educational materials and research

Upstox Summary

In conclusion, Upstox stands out as a comprehensive online brokerage platform in the Indian market, offering a user-friendly experience, diverse products, and cost-effective solutions. The broker is known for its accessibility and robust features, as well as offering a range of educational resources and research.

Overall, we found that Upstox provides a competitive environment for investment. However, we advise conducting your research and evaluating whether the firm’s offerings suit your specific trading requirements.

55Brokers Professional Insights

Upstox stands out by combining technology-driven platforms with competitive pricing, making it one of the most attractive choices for traders from India and the region. The firm has built a strong reputation for reliability and innovation with its flat-fee brokerage model, charging as little as ₹20 per order, which provides significant savings for high-volume traders, while beginners benefit from zero commission on equity delivery trades.

Upstox Pro technology is quite good too, it offers advanced charting tools, real-time market data, and seamless order execution, enabling both technical and fundamental analysis on the go, suitable for various trading styles. Additionally, the broker supports trading across multiple segments within a single integrated account, so no confusion on the choices of conditions either.

Overall, with a focus on user experience, low-cost trading, and comprehensive market access, Upstox has positioned itself as a top choice for retail investors and active traders seeking efficiency and value in the Indian markets.

Consider Trading with Upstox If:

| Upstox is an excellent Broker for: | - Need a well-regulated broker.

- Competitive fees.

- Secure trading environment.

- Offering popular financial products.

- Stock Trading and Investment.

- Professional trading.

- Indian traders.

- Diversified investors.

- Investors who prefer robust educational resources. |

Avoid Trading with Upstox If:

| Upstox might not be the best for: | - Need a broker with trading services worldwide.

- High-frequency traders.

- Looking for broker with 24/7 customer support. |

Regulation and Security Measures

Score – 4.4/5

Upstox Regulatory Overview

Upstox is a legitimate and regulated investing firm. It is regulated and authorized by SEBI (India), which has a good reputation in the financial market.

However, the broker lacks a top-tier license and operates under a single regulatory body, which could be a drawback for some traders seeking accounts with multiple regulatory authorities.

How Safe is Trading with Upstox?

Upstox is a reliable Stock broker that follows the rules and guidelines established by the Securities and Exchange Board of India. This authority oversees the brokerage operations to ensure transparency and protect investors’ interests.

However, traders should also be proactive in implementing security features such as two-factor authentication and staying informed about best practices to further enhance their trading protection.

Consistency and Clarity

Upstox has grown into a leading Indian broker by combining low-cost trading, advanced technology, and strategic partnerships.

The platform has earned awards like the Golden A’ Design Award for its user-friendly interface and sponsors major events like the ICC and IPL, boosting its visibility and financial literacy efforts.

Trader reviews are mixed; many praise the low fees and innovative tools, while some note customer support issues and occasional platform downtime. Overall, Upstox maintains a strong reputation for efficiency and innovation; however, it may not suit users needing extensive advisory services.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Upstox?

Upstox offers a range of accounts to cater to different types of investors and traders. The Securities Account combines a Trading and Demat account, enabling users to trade equities, derivatives, currencies, and mutual funds seamlessly.

For those interested in commodities, Upstox provides a dedicated Commodities Account for trading futures and options on MCX. Investors also need a Demat Account to hold shares and securities in electronic form, with options available for NRIs, including repatriable and non-repatriable accounts.

Additionally, Upstox offers a demo account through its Pro Web and Pro Mobile platforms, allowing users to practice trading with virtual funds, explore order types, and familiarize themselves with the platform without risking real money.

Securities Account

Upstox’s Securities Account is a combined Trading and Demat account designed for investing in equities, derivatives, currencies, and mutual funds.

It allows users to buy and sell stocks seamlessly on NSE and BSE while holding them in electronic form. The account comes with no minimum deposit requirement, making it accessible for beginners as well as active traders.

With this account, investors benefit from competitive brokerage rates, advanced charting tools, and real-time market data. It also supports margin trading, enabling users to leverage funds for intraday and F&O trades, all within a single integrated account.

Regions Where Upstox is Restricted

Upstox is primarily available for resident Indians, while non-resident Indians are currently restricted from opening new accounts, and direct trading in foreign securities is not offered.

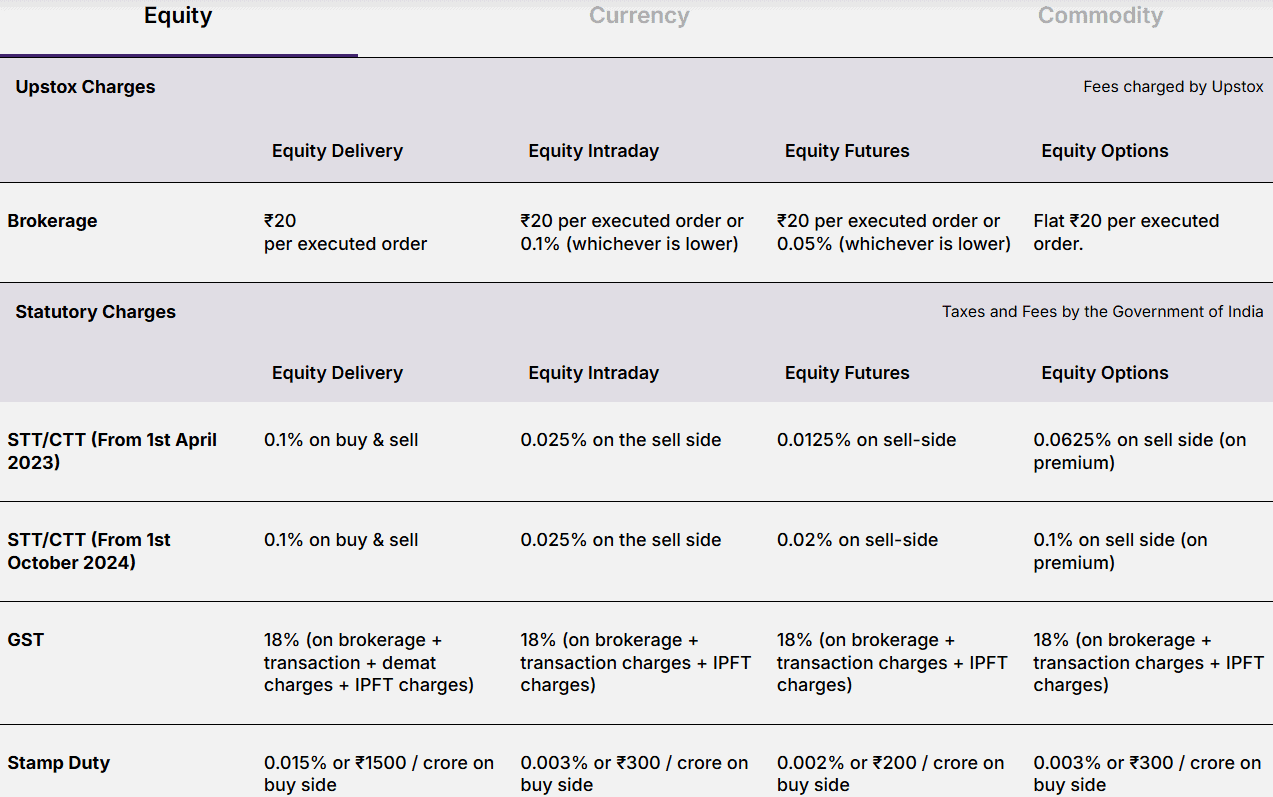

Cost Structure and Fees

Score – 4.6/5

Upstox Brokerage Fees

The firm is known for its competitive fee structure, offering cost-effective solutions for online trading. The broker has different fee structures for equity, commodity, and currency trading, including brokerage fees, Upstox share price, and other charges.

Upstox commission is typically applied per transaction and can vary based on the type of asset being traded, such as equities, commodities, or currencies.

As fees and commissions can be subject to change, users should check the broker’s official website or contact customer support for the latest and most accurate information regarding commissions.

When trading through Upstox, investors are required to pay certain exchange and regulatory fees in addition to brokerage charges. These fees are charged by the stock exchanges and regulatory authorities to facilitate transactions and maintain market infrastructure.

For equities and derivatives traded on NSE and BSE, Upstox passes on the applicable Securities Transaction Tax, stamp duty, GST, SEBI turnover fees, and transaction charges set by the exchanges.

Similarly, for commodities trading on MCX, applicable exchange, clearing, and regulatory fees are added per trade. These charges are generally small compared to brokerage but are mandatory and vary based on the type of security, segment, and trade value, ensuring compliance with India’s market regulations.

In derivatives trading on Upstox, rollover or swap charges apply when positions in futures or options contracts are carried forward beyond the contract’s expiry date.

These charges cover the cost of extending the contract to the next expiry and are determined by the exchange rules for each segment.

The fees are automatically calculated and debited from the trader’s account, allowing positions to remain open without manual intervention, while helping maintain compliance with trading and settlement regulations.

How Competitive Are Upstox Fees?

Upstox is widely recognized for its low-cost and transparent fee structure, making it one of the most competitive brokers in India. The platform offers flat brokerage of ₹20 per order for intraday and F&O trades, while equity delivery trades are completely free, appealing to both beginners and active traders.

| Asset/ Pair | Upstox Commission | Merrill Edge Commission | Trade Republic Commission |

|---|

| Stocks Fees | From ₹20 | From $0 | From €1 |

| Fractional Shares | No | No | Yes |

| Options Fees | From ₹20 | From $0,65 | - |

| ETFs Fees | From ₹20 | From $0 | €1 |

| Free Stocks | No | Yes | Yes |

Upstox Additional Fees

Beyond standard brokerage and exchange charges, Upstox applies additional fees for certain services or account activities. These include Demat account annual maintenance charges, margin funding or leverage interest, and fees for physical delivery requests if investors choose to convert electronic holdings into paper certificates.

Other optional services, such as SMS alerts, premium research tools, or API access for algorithmic trading, may also carry separate charges.

Trading Platforms and Tools

Score – 4.5/5

Upstox offers proprietary platforms to cater to different preferences and needs. Upstox Pro Web provides a user-friendly web-based platform for seamless online trading. The Upstox Pro Mobile app allows users to trade on the go, providing a convenient and intuitive mobile experience.

For those preferring a desktop solution, the broker integrates with NEST Desktop, a comprehensive trading platform. Additionally, Upstox Developer Trading Platforms cater to users who want to customize and build their trading solutions.

Moreover, Upstox has collaborated with TradingView, a popular charting and analysis platform, enhancing traders’ technical analysis capabilities.

Trading Platform Comparison to Other Brokers:

| Platforms | Upstox Platforms | TradeStation Platforms | Merrill Edge Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Upstox Web Platform

Upstox Pro is a robust, web-based platform tailored for both beginners and experienced traders. It offers advanced charting tools with multiple indicators, drawing tools, and technical analysis features to help users make informed decisions.

The platform provides real-time market data, live price feeds, and watchlists for equities, derivatives, currencies, and commodities. Its customizable interface allows traders to arrange windows, charts, and order panels according to their preferences, enabling faster and more efficient trade execution.

Additionally, Upstox Pro supports multi-segment trading within a single account, making it convenient for users to monitor and trade across different markets seamlessly. The platform also emphasizes security and reliability, ensuring trades are executed smoothly even during high-volume market periods.

Main Insights from Testing

Testing the Upstox Pro web platform highlights its speed, stability, and intuitive navigation. Users find it easy to place orders quickly and track positions across multiple segments, with minimal lag even during peak trading hours.

The platform’s alert and notification system helps traders stay updated on market movements, while integration with research tools and news feeds enhances decision-making.

Upstox Desktop MetaTrader 4 Platform

Upstox does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support CFD trading, typically associated with MT4.

Upstox Desktop MetaTrader 5 Platform

Upstox does not support MetaTrader 5 either. The firm does not provide access to advanced platforms like MT5, maintaining its focus on its platforms.

Upstox MobileTrader App

The Upstox Mobile App is an easy-to-use mobile trading platform made for traders on the go. It provides real-time market data, customizable watchlists, and advanced charting tools, allowing users to analyze and execute trades directly from their smartphones.

The app supports features like order alerts, quick order placement, and portfolio tracking. Its intuitive interface and responsive design make it convenient for all levels of investors to manage their investments anytime, anywhere.

AI Trading

Upstox offers algorithmic trading solutions through its API platform, enabling users to automate their strategies. While the platform provides tools for backtesting and executing trades based on predefined criteria, it does not explicitly advertise the use of artificial intelligence in its trading algorithms.

However, Upstox has integrated AI into other aspects of its services, such as customer support, where it utilizes an AI-powered Trading Copilot to provide real-time, context-aware assistance to its users.

Additionally, the firm offers educational resources, including webinars, to help users understand and implement algorithmic strategies using its API.

Trading Instruments

Score – 4.6/5

What Can You Trade on Upstox’s Platform?

The broker offers a diverse range of financial products, including Stocks, Upstox Mutual Funds, Bonds, Commodities, Futures, Options, ETFs, and Currencies.

This diverse selection enables investors to diversify their portfolios and engage in various trading strategies based on their financial goals and risk preferences.

Main Insights from Exploring Upstox’s Tradable Assets

Exploring Upstox’s tradable assets reveals a platform designed for flexibility and accessibility, allowing traders to diversify their strategies within a single account.

The platform provides real-time data, seamless order execution, and efficient portfolio management, making it easier to monitor performance and react quickly to market movements.

Margin Trading at Upstox

Upstox offers margin trading facilities, allowing users to trade with borrowed funds and amplify their market positions.

The margin calculator provided by the broker helps investors determine the multiplier requirements for their trades by considering factors such as stock volatility and market conditions.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Upstox

The broker provides various funding methods to facilitate deposits into users’ accounts. These methods typically include:

- Online bank transfers

- Net banking

- Google Pay

- Cheque

- Unified Payments Interface (UPI)

Additionally, users can use the National Electronic Funds Transfer (NEFT), Real-Time Gross Settlement (RTGS), or Immediate Payment Service (IMPS) to fund their Upstox accounts.

Upstox Minimum Deposit

The broker does not have a mandatory minimum deposit requirement. Users can open an account and start trading with the amount they find suitable.

Withdrawal Options at Upstox

The broker allows traders to withdraw funds from their accounts through a straightforward process. Users can initiate withdrawals through the platform, and the funds are typically transferred to the registered bank account.

Customer Support and Responsiveness

Score – 4.6/5

Testing Upstox’s Customer Support

The broker provides 24/5 customer support through email, Upstox customer care number, or the live chat feature available on their website.

Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

Contacts Upstox

You can reach Upstox customer support via email at support@upstox.com for general inquiries or assistance. For phone support, the company provides multiple lines: 022-41792999, 022-69042299, and 022-71309999, ensuring users can get timely help for account, trading, or technical issues.

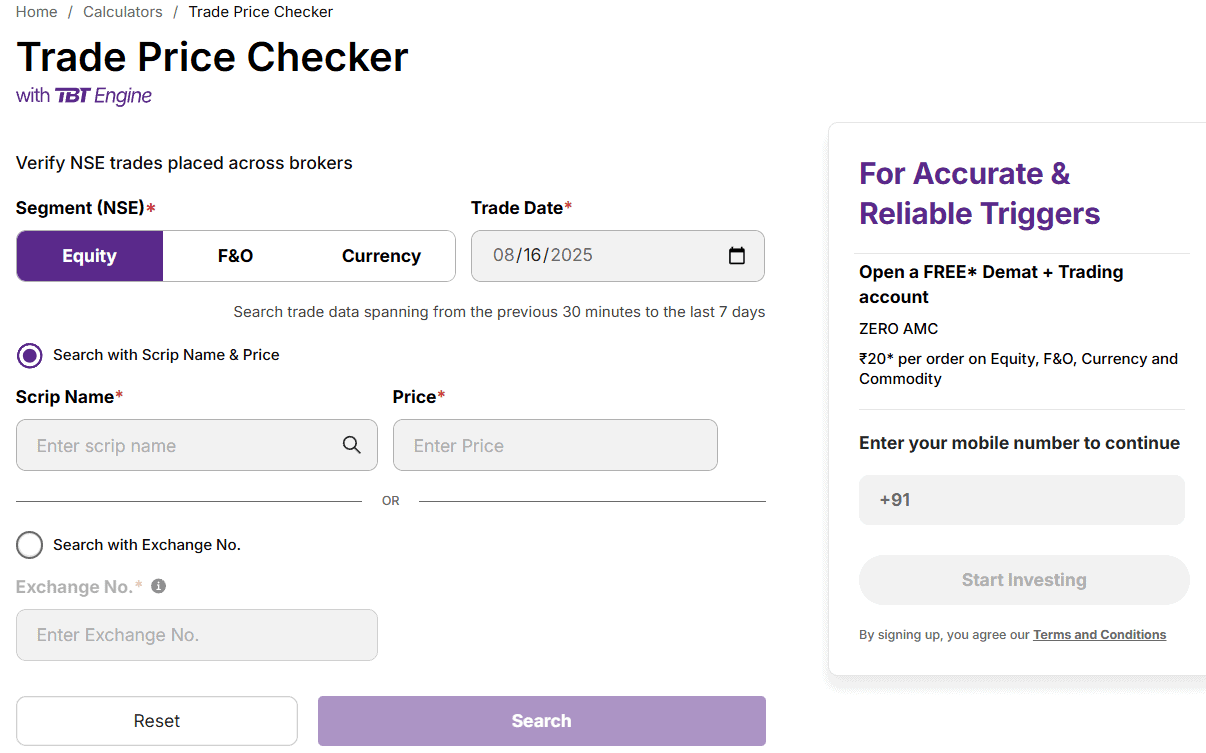

Research and Education

Score – 4.7/5

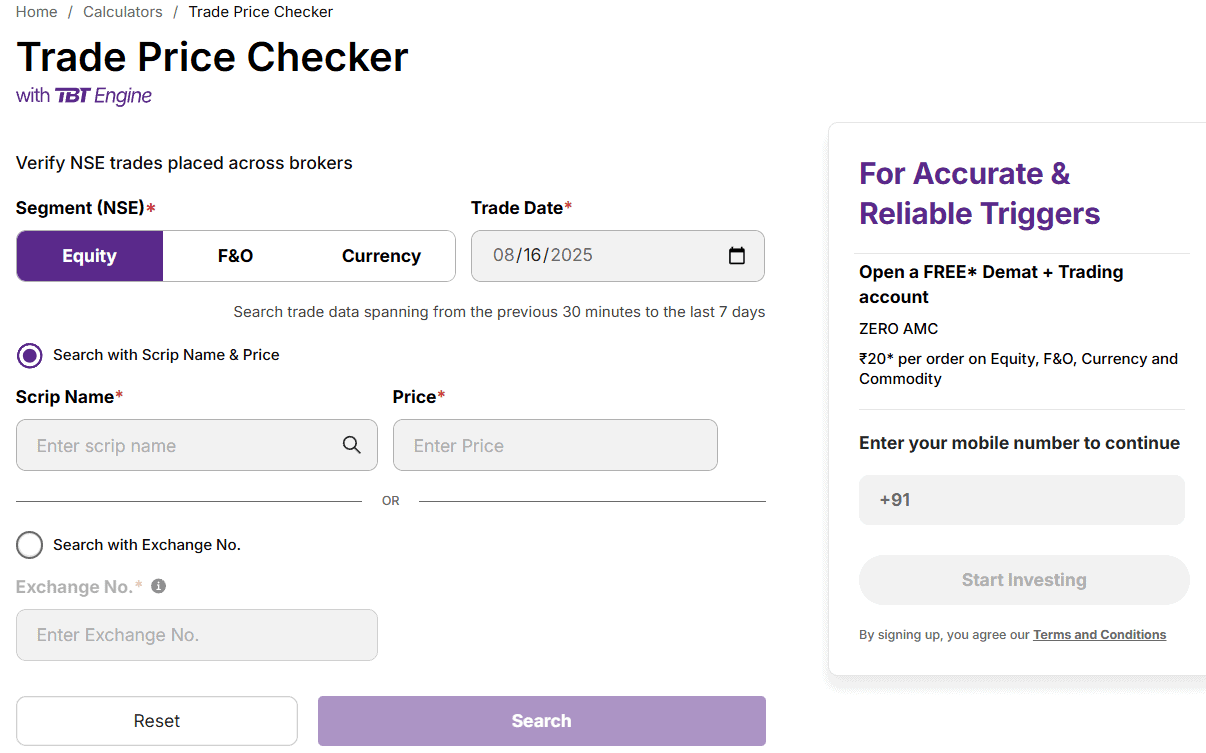

Research Tools Upstox

Upstox provides a range of research and analysis tools to help traders make informed decisions.

- On both the website and platforms, users can access real-time market data, advanced charts, technical indicators, and customizable watchlists.

- The platforms also feature news feeds, market insights, and fundamental data for stocks and other securities.

- Additionally, Upstox provides a variety of calculators, including brokerage, span, NPV, Lumpsum, NPS, and more, enabling traders to plan their strategies and make informed decisions with precision.

- Also, the firm offers a Trade Price Checker tool, which allows traders to monitor executed trade prices and ensure accuracy, helping them make informed and precise trading decisions.

Education

Upstox provides a range of educational resources, including informative articles, tutorials, and webinars, to help users understand various aspects of trading, market analysis, and risk management.

Additionally, the platform offers educational events and initiatives to further support users in their financial journey.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options Upstox

Upstox provides a range of investment solutions to cater to different investor needs. Users can invest in equities, derivatives, mutual funds, and ETFs, all within a single integrated account.

These options allow traders and investors to diversify their portfolios, access multiple markets, and tailor their investment strategies according to their risk preferences and financial goals.

Account Opening

Score – 4.5/5

How to Open Upstox Demo Account?

Opening a demo account with Upstox is a simple process designed for beginners and those who want to practice trading without risking real money.

To start, visit the Upstox website or download the Upstox Pro mobile app and sign up for a free account. Once registered, users can request demo access through the platform, which provides virtual funds to practice trading across equities, derivatives, commodities, and currencies.

The demo account allows users to explore order types, charting tools, watchlists, and market analysis features, giving them a realistic trading experience in a risk-free environment before transitioning to a live account.

How to Open Upstox Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or Upstox login page and proceed with the guided steps:

- Select and click on the “Open a Demat Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.6/5

Upstox offers several additional tools and features to enhance the trading experience beyond its core research and analysis capabilities.

- The platform integrates with TradingView, providing advanced charting, technical analysis, and custom scripts for more sophisticated market insights.

- For tech-savvy traders, Upstox provides API access, enabling algorithmic and automated strategies. Other features include smart order types, advanced alerts, and portfolio tracking tools, all designed to give users greater control, flexibility, and efficiency in managing their trades and investments.

Upstox Compared to Other Brokers

Upstox positions itself as a cost-effective Stock trading broker catering to both beginner and active traders. Compared to competitors, it stands out with low fees, a user-friendly web and mobile platform, and access to multiple asset classes.

While brokers like Interactive Brokers and TD Ameritrade offer extensive global market access and advanced professional tools, Upstox focuses on simplicity, intuitive interfaces, and integration with tools like TradingView, making it ideal for Indian retail investors.

In terms of regulation and security, Upstox is fully compliant with Indian authorities, providing a reliable trading environment. Educational resources and customer support are robust enough for most retail users, though global brokers may offer wider coverage or more specialized research.

Overall, Upstox balances affordability, technology, and multi-asset access, making it a strong choice for traders in India.

| Parameter |

Upstox |

Trade Republic |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures E-mini contracts not available / Stock Commission from ₹20/$0,24 |

Futures contracts not available / Stock Commission from €1 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

Upstox Pro Web, Mobile, NEST Desktop, Upstox Developer Trading Platforms, TradingView |

Trade Republic Mobile App |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, Mutual Funds, Bonds, Commodities, Futures, Options, ETFs, Currencies |

Stocks, Shares, ETFs, Bonds, Derivatives, Crypto |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEBI |

BaFin, Bundesbank |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Limited |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

€0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Upstox

Upstox is a technology-focused investment firm in India that offers a comprehensive suite of investment solutions. The broker provides access to equities, derivatives, mutual funds, ETFs, and more through an integrated platform, supporting both web and mobile trading.

Its user-friendly interface, advanced charting tools, and additional features like API access and TradingView integration cater to both beginners and active traders.

Upstox stands out for its low-cost fee structure, transparency in charges, and seamless account management, including Demat services. While occasional customer support concerns have been reported, the platform’s reliability, speed, and market accessibility make it a popular choice for retail investors and traders looking for an efficient, cost-effective trading experience in India.

Share this article [addtoany url="https://55brokers.com/upstox-review/" title="Upstox"]