- What is Trive?

- Trive Pros and Cons

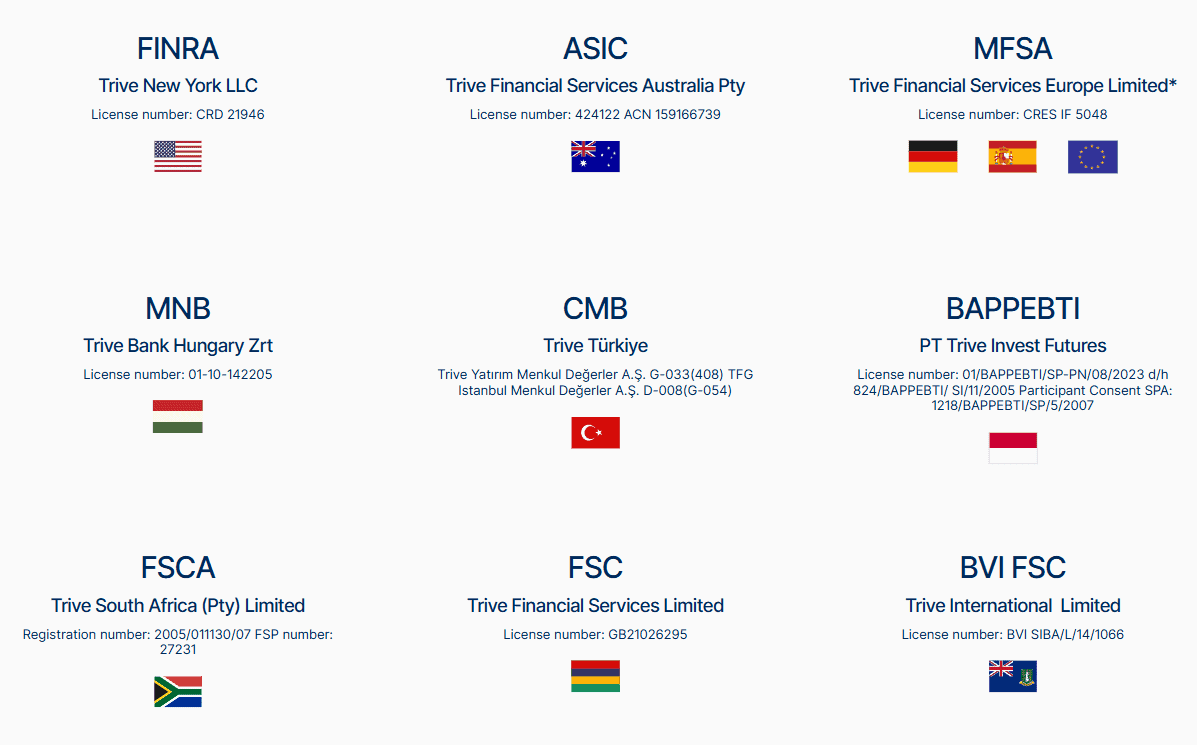

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

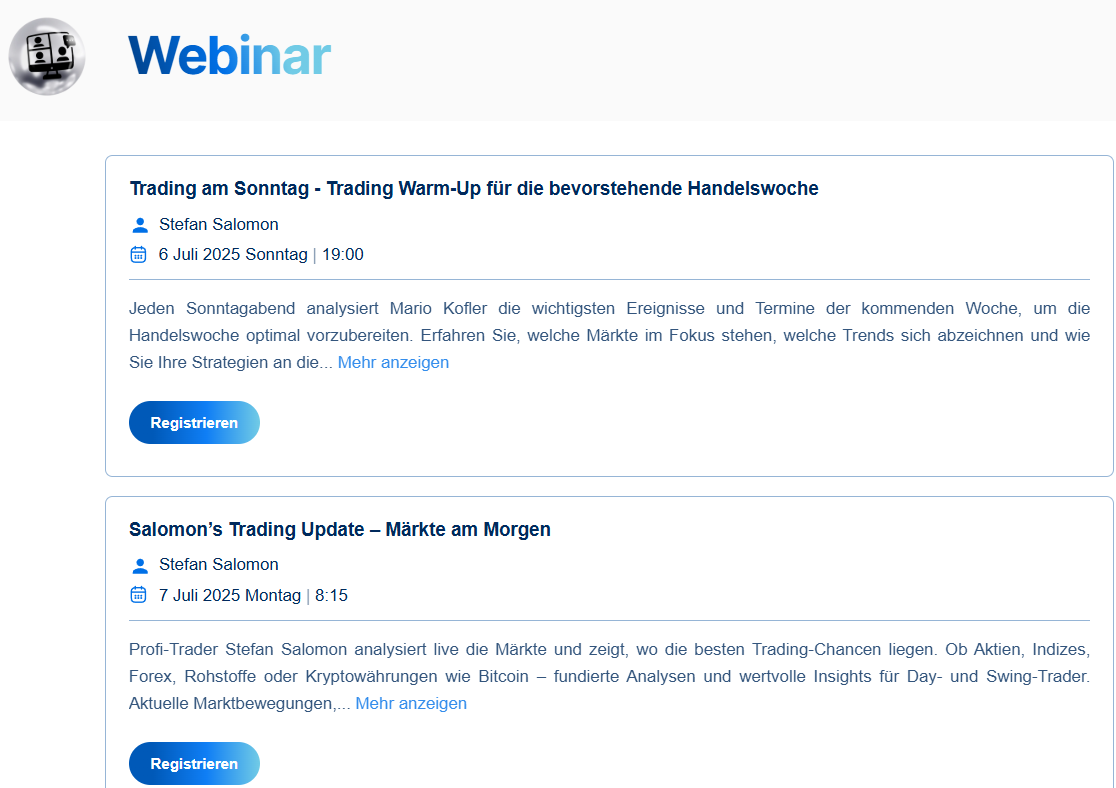

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Trive Compared to Other Brokers

- Full Review of Broker Trive

Overall Rating 4.5

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Trive?

Trive, previously known as GKInvest, operates as a Forex trading company based in Indonesia. It provides a range of trading instruments across various asset classes, including Forex, CFDs, Commodities, Indices, Precious Metals, and Stocks.

Based on our research, the broker is under the supervision and authorization of the Indonesian Commodity Futures Trading Supervisory Agency (BAPPEBTI). The firm has expanded its reach globally, holding licenses from top-tier regulatory bodies such as the FCA in the UK, ASIC in Australia, the European MFSA in Malta, and the reputable FSCA in South Africa. Additionally, it is licensed by the Financial Services Commission in Mauritius.

In general, the company offers competitive trading conditions and efficient trade execution through the advanced MetaTrader trading platforms.

Trive Pros and Cons

Per our findings, the broker presents both pros and cons that are important to consider. On the positive side, Trive offers competitive trading conditions, a low minimum deposit requirement, and access to the well-known MT4 and MT5 trading platforms.

For the cons, the primary entity of Trive Invest lacks a top-tier license, which might be a concern for traders who prioritize brokers with more robust regulatory oversight. Additionally, the brokerage provides a limited range of financial instruments compared to other Forex trading platforms. Also, the availability of educational resources is limited, so novice traders might consider more suitable offerings.

| Advantages | Disadvantages |

|---|

| Good trading conditions | No 24/7 customer support |

| Low minimum deposit | Limited trading products |

| Global coverage | Conditions vary based on entity |

| Professional trading | Limited learning materials |

| Competitive pricing | |

| Advanced trading platform | |

| Competitive spreads | |

Trive Features

According to our analysis, the broker provides favorable trading conditions, including competitive spreads and fees for its financial activities. For more insight into the broker’s proposal, we have compiled the main aspects of trading with Trive.

Trive Features in 10 Points

| 🗺️ Regulation | BAPPEBTI, FCA, ASIC, MFSA, FSCA, FSC |

| 🗺️ Account Types | Standard, VIP, ECN Zero, ProLeverage |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, CFDs, Commodity, Index, Precious Metals, Stocks |

| 💳 Minimum deposit | $50 |

| 💰 Average EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP, AUD |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is Trive For?

Our findings and Financial Expert Opinions revealed that Trive is a tightly regulated broker that ensures a safe environment and favorable trading conditions for an efficient and profitable trading experience. The broker can better fit the following traders or trading expectations:

- Traders from Indonesia

- European traders

- UK traders

- Traders who prefer the MT4/MT5 trading platforms

- Global traders

- Currency trading

- Beginners

- Advanced traders

- Swap-free trading

- International trading

- Competitive spreads and fees

- EA/Auto traders

- Social traders

Trive Summary

Trive, formerly GKInvest, is a reliable Forex trading broker that offers competitive trading solutions, efficient execution, and access to the popular MT4 and MT5 trading platforms. The broker ensures the safety of clients’ funds and provides various payment methods. The firm’s competitive trading conditions make it an attractive option for both beginners and advanced traders.

Overall, we found that the firm provides a good trading environment; however, we advise traders to conduct research and evaluate whether the broker’s offerings suit their specific trading requirements.

55Brokers Professional Insights

One of the strongest points we noticed about Trive is its tight oversight and regulation in over 15 regions, including licenses from well-respected ASIC, FCA, Bappebti, FINRA, FSCA, and more. However, under each entity, the services and conditions may differ. Also, clients from Indonesia can register only under the entity overseen by Bappebti, under Trive Invest.

The account types the broker offers also differ from entity to entity. Under the global entity, traders have access to five account types, with different fee structures and opportunities. The Standard account does not require a minimum deposit to start trading.

In addition, the platform’s availability also depends on the jurisdiction. The global traders can access both MT4 and MT5 platforms. However, some entities, such as Trive Invest, include only the MT5 platform. Moving forward, the instruments offered are also dependent on the entity. On average, traders have access to 300 trading instruments across Forex, CFDs, commodities, indices, precious metals, and stocks. This variety of tradable products can ensure a certain diversity to expand portfolios and explore the market.

As we have found from our testing, the broker’s trading costs are average, with spreads and commissions that depend on the account type. The average spread for the EUR/USD pair is 1.2 pips.

Lastly, although Trive is favorable for both beginner and professional clients, the broker does not provide a comprehensive educational section. Many beginner traders might see this as a disadvantage, as the availability of diverse learning materials is essential for novice traders.

Consider Trading with Trive If:

| Trive is an excellent Broker for: | - Beginner and Intermediate traders

- Global clients

- Traders from Indonesia

- MT4 and MT5 platform enthusiasts

- Auto traders

- Currency traders

- Clients from UK

- Those prioritizing tight relations |

Avoid Trading with Trive If:

| Trive is not the best for: | - Long-term investors

- Beginner traders looking for comprehensive education

- Traders looking for platforms other than MT4/MT5

- Traders looking for 24/7 customer support |

Regulation and Security Measures

Score – 4.7/5

Trive Regulatory Overview

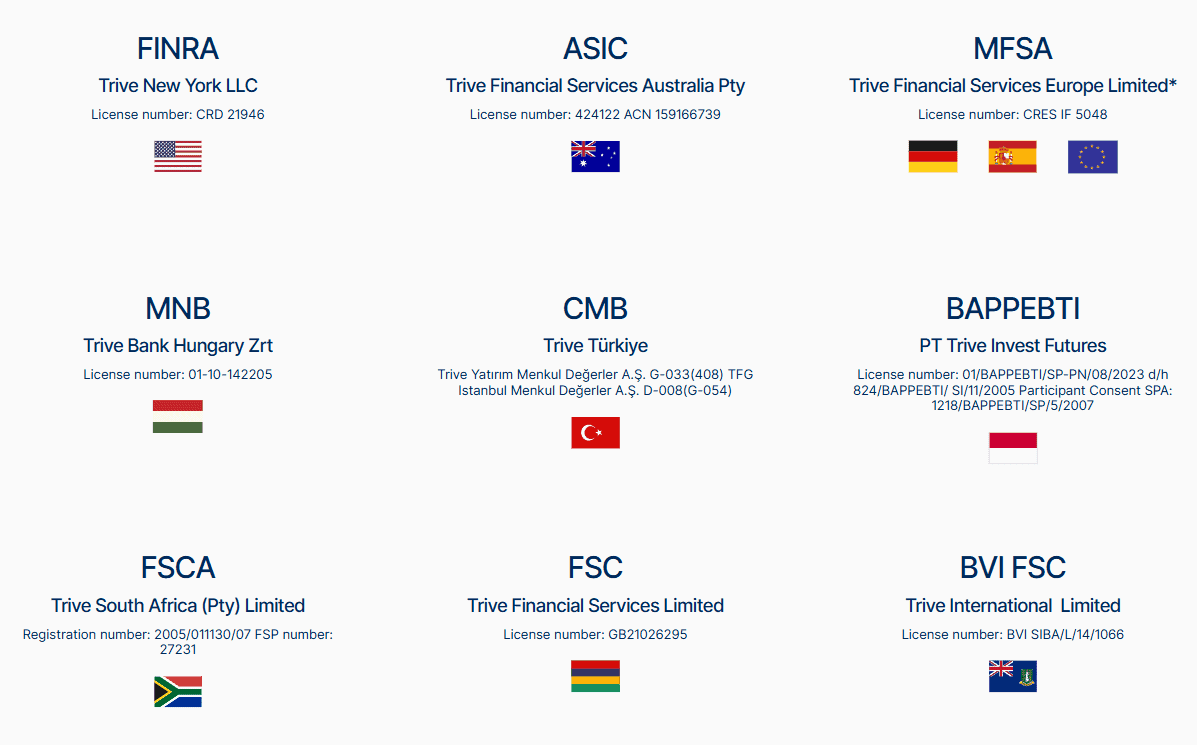

Trive is a global brand regulated in more than 15 regions and holding licenses from some of the most renowned authorities. The broker is regulated by the FCA in the UK, the ASIC in Australia, the FSCA in South Africa, and BAPPEBTI in Indonesia. While BAPPEBTI is not classified as top-tier, it is regarded as a secure regulatory body, ensuring compliance with regulatory requirements.

Thus, Trive is a legitimate and regulated broker that holds the necessary licenses and follows regulations for offering Forex trading services.

- The broker also holds licenses from the FSC (Mauritius), ensuring its global availability. Despite operating in an offshore zone, the broker holds top-tier licenses, which confirm the broker’s credibility and reliability.

- However, we recommend traders conduct their research, review customer feedback, and consider personal factors before deciding to engage with Trive, as the conditions under each entity are different and require careful examination.

How Safe is Trading with Trive?

Based on our research, the broker demonstrates adherence to industry standards and compliance requirements. These include measures to protect client funds, such as segregation from company funds to keep client funds separate from the broker’s operational funds. It also provides additional safeguards, like negative balance protection, to prevent clients from incurring losses exceeding their account balance.

However, thoroughly review the broker’s documentation, legal agreements, and policies to gain a comprehensive understanding of the specific trading protections they offer. This will help you make an informed decision before engaging in any trading activities.

Consistency and Clarity

We have reviewed the broker to see its consistency and development over the years. During our research, we found that the component parts of Trive Group were established before the official formation of the Trive Group. For instance, Trive Invest in Indonesia and Trive South Africa were founded back in 2005, while the broker obtained other licenses later on.

The fact that Trive is regulated in more than 15 regions speaks to the broker’s inclination to thrive and expand. Trive has been awarded multiple times and recognized as the most trusted, most reliable, transparent, and best broker for beginners.

Trive’s customer feedback is also positive, with traders sharing their satisfying experience with the broker, mentioning its competitive costs, advanced platforms, and dedicated support. However, we also found concerning reviews about the insufficient withdrawal process and hidden fees. Although the negative reviews are not that many, traders still need to consider them and carefully weigh the benefits and drawbacks of trading with the broker.

Overall, we can conclude that Trive offers favorable conditions, with mostly transparent and clear practices.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Trive?

We found that Trive’s account types depend on the entity. Each jurisdiction offers different account types with different trading conditions, including costs and fees, initial deposit requirements, and even platform availability. Thus, before opening an account under any jurisdiction, traders should check the specific conditions.

Here we have reviewed Trive’s available account types under the global entity. The account types are the following: Standard, VIP, ECN Zero, and ProLeverage.

- The Standard and VIP accounts have a spread-based structure with no additional commissions. The average spread for the Standard account is 1.2 pips. As we have found, there is no minimum deposit requirement for this account type. On the contrary, the VIP account has a high deposit requirement of $2,000. The average spread for the VIP account is 0.6 pips. The available leverage is 1:500.

- The ECNZero and ProLeverage accounts have a commission-based structure accompanied by low or average spreads. The ECNZero account enables 1:500 leverage, whereas the ProLeverage account provides higher leverage up to 1:1000. There is no deposit limit for the ECNZero and ProLeverage accounts.

Regions Where Trive is Restricted

The regional restrictions depend on the entity under which traders open an account. Overall, Trive is available worldwide as it is licensed in 15 regions and provides regulated services internationally. However, below you can see the list of restricted countries where the broker’s services cannot be reached:

Cost Structure and Fees

Score – 4.5/5

Trive Brokerage Fees

After examining the firm’s fee offering, we found that Trive Invest offers competitive pricing for most trading services. The broker’s fees depend on the entity, the account type, and the instrument traded. However, Trive offers both spread and commission-based structures, enabling its clients to choose the most favorable option for them

Based on our test trade, the broker offers competitive both fixed and variable spreads, with an average spread of 1.2 pips for the EUR/USD currency pair in the Forex market. However, spreads can vary based on the entity, account type, and instrument traded. Besides market conditions, volatility, and liquidity also affect spreads; thus, it is advisable to consult the broker’s website or contact their customer support for detailed information on the spreads they offer for specific instruments and account types.

Under its international entity, Trive offers two commission-based account types, ECNZero and ProLeverage. The ECNZero account offers very low spreads from 0 pips, combined with $10 per lot. The ProLeverage account also offers a $10 transaction fee per lot; however, the commission fees are added to spreads of an average of 1.2 pips.

How Competitive Are Trive’s Fees?

Based on our research and testing, Trive’s trading conditions, including fees, depend on the entity under which traders open an account. Also, the fees depend on the account type and the tradable products. The broker offers different account types with two distinctive fee structures to meet every trading experience. More professional clients will be interested in the commission-based accounts, while novice or cost-conscious traders will favor the spread-based account options.

All in all, the trading costs are average compared to market standards, offering traders an affordable and efficient trading experience in a tightly regulated trading environment.

| Asset/ Pair | Trive Spread | Aurum Markets Spread | EC Markets Spread |

|---|

| EUR USD Spread | 1.2 pips | 1.8 pips | 1.1 pips |

| Crude Oil WTI Spread | 0.4 pips | 1 | 0.45 |

| Gold Spread | 1.7 pips | 1 | 2.8 |

Trive Additional Fees

While trading with Trive, traders will face a few additional fees, which are a common occurrence in the market.

- Trive applies swap fees for the positions held overnight. For each instrument, swaps can be long and short. Long swaps for the EUR/USD pair are -7.9, while short swaps for the pair are 1.9.

- As to the deposit and withdrawal fees, the broker does not charge fees for bank transfers; however, additional fees may be incurred during trading activities. Therefore, we traders thoroughly review the broker’s fee structure and terms and conditions to gain a complete understanding of the applicable charges and their potential impact on trading activities.

Score – 4.3/5

The broker provides access to the widely used MT4 and MT5 trading platforms, available across desktop, web, and mobile devices. These versatile platforms offer a user-friendly interface and advanced features, allowing traders to execute trades, analyze market trends, and manage their portfolios seamlessly. However, traders should be careful, as the platform’s availability depends on the entity.

| Platforms | Trive Platforms | Aurum Markets Platforms | EC Markets Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | No | No | No |

| Mobile Apps | Yes | Yes | Yes |

Trive Web Platform

Traders looking for fast and easy access to their trading accounts will favor the web versions of the MT4 or MT5 platforms. The web-based version does not require downloads or installations. The advantage of the platform is that it still includes all the essential tools and features of the desktop platform. The web versions offer great charting and analysis tools, multiple timeframes, real-time pricing, and trading indicators. They are ideal both for beginners and advanced traders, combining flexibility and professional tools in one place.

Trive Desktop MetaTrader 4 Platform

The broker’s MT4 platform offers a robust set of trading tools, including advanced charting tools with multiple timeframes and over 30 pre-installed technical indicators. Traders can utilize automated trading strategies with built-in Expert Advisors, conduct in-depth market analysis, and manage risks with features like stop-loss and take-profit orders.

The platform is stable and safe, ensuring reliability even in volatile market conditions. Traders can also access Trading Central and enjoy professional market analysis.

The MT4 platform is easy to access through the web, desktop, and mobile platforms.

Trive Desktop MetaTrader 5 Platform

The MT5 platform of Trive offers even more advanced tools and features compared to the older MT4 version. It offers over 38 pre-installed technical indicators, 44 graphical objects, various order types, more than 22 timeframes, and many other innovative features. The platform also includes the MQL5 programming language to create powerful functions.

Additionally, MT5 provides economic calendars and real-time news feeds to help traders stay informed about market events that may impact their decisions. Traders can also access Trading Central for more market insights and in-depth analysis.

Trive MobileTrader App

The availability of mobile trading is one of the greatest advantages for many traders. Many clients prioritize the functionality and versatility of the mobile platform. It enables access to their open positions on the go, to never miss trading opportunities. For this, Trive can attract traders with its MT4 and MT5 mobile versions, providing essential tools and favorable features of the desktop platform, and ensuring the efficiency of trades.

Main Insights from Testing

Our conclusion about the broker’s trading platforms is positive. Trive offers the most popular MT4 and MT5 platforms, although the availability depends on the jurisdiction. For instance, the broker under the Indonesian entity offers only the MT5 platform.

The platforms are available through the web, desktop, and mobile versions and can be easily installed or downloaded. Traders can access the most essential tools, charts, graphs, and indicators to enjoy profitable trading. However, those traders who prefer more advanced or professional platform solutions can look for alternative broker options.

AI Trading

Traders can find a few AI-driven tools on Trive, such as Trading Central. However, the broker does not offer a fully powered AI engine that will completely automate trading.

Trading Instruments

Score – 4.3/5

What Can You Trade on the Trive Platform?

The firm provides access to popular trading instruments, including Forex, CFDs, commodities, indices, precious metals, and shares. The broker enables traders to diversify their portfolios and participate in various markets according to their individual preferences and trading strategies.

Trive offers a good variety of major, minor, and exotic Forex pairs. Clients also have access to the most popular commodities, precious metals, including gold and silver, with competitive fees and conditions. The broker also offers a good range of global indices and shares on CFDs.

Main Insights from Exploring Trive Tradable Assets

Based on our findings, Trive offers a good range of trading instruments across a range of financial assets. Global traders can access over 300 tradable products and expand their portfolios.

However, the availability of instruments depends on the entity. The total range of the products across various jurisdictions of the broker varies from 80 to 300.

We have found that under the European entity, clients can also open investment accounts and engage in real asset ownership. This is an ideal opportunity for long-term traders.

Leverage Options at Trive

Leverage is a useful tool that enables traders to enter the market with limited capital. However, its use can lead not only to substantial profits, but losses. As such, traders should have a comprehensive understanding of how leverage works and its possible consequences before engaging in any trading activities that involve leverage.

Trive Invest leverage is offered according to the BAPPEBTI, FCA, ASIC, MFSA, FSCA, and FSC regulations:

- The traders that hold ASIC-regulated accounts are entitled to up to 1:30.

- European, South African, and UK traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- Traders from Indonesia may use higher leverage up to 1:400.

- Global traders can access up to 1:500 leverage, while professional traders who open a ProLeverage account can even use leverage up to 1:2000.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Trive

Per our research, the broker provides multiple funding methods to accommodate diverse preferences, including bank transfers, credit/debit card transactions, and electronic payment systems. However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved. Besides, the availability of certain funding methods depends on the jurisdiction. Below are the main methods traders can use for deposits:

- Credit/Debit cards

- Bank transfers

- VirtualPay

- my Fatoorah

- Neteller

- Skrill

- Orbital

- ozow

Minimum Deposit

Trive’s minimum deposit requirement varies from one entity to the other. It also depends on the account type. For the Global Standard account, there is no minimum deposit requirement. Under other entities, the initial deposit for the Standard account might be $50. For more professional accounts, the minimum deposit is higher. To open a VIP account, traders need $2,000 to start.

Withdrawal Options at Trive

Based on our analysis, the withdrawal process is both convenient and swift. The broker typically processes withdrawal requests within one day. For Credit card withdrawals, clients can withdraw only the same amount of money they deposited.

Customer Support and Responsiveness

Score – 4.5/5

Testing Trive’s Customer Support

The broker offers 24/5 customer support via live chat, phone line, email, and WhatsApp. Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues. We found that the support team is responsive during working days, ensuring efficient assistance.

- Trive is also social and actively provides updated information on the market via its social media pages: Facebook, X, YouTube, Instagram, LinkedIn, and X.

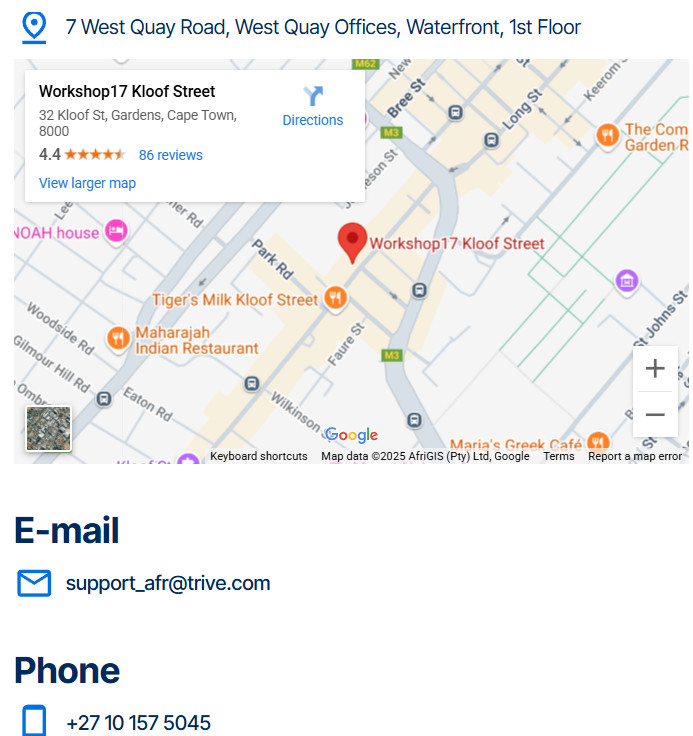

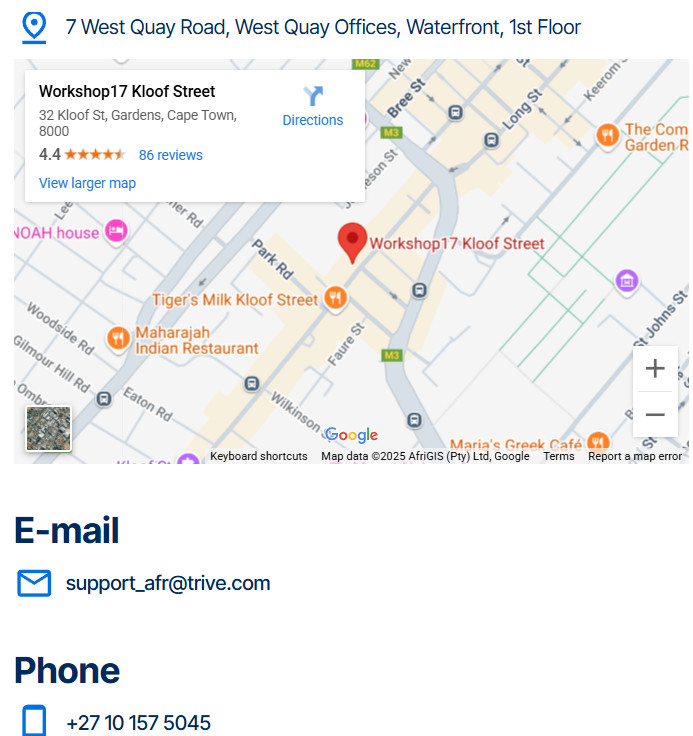

Contact Trive

We have tested the broker’s customer support to see how the broker assists its clients and solves ongoing issues and questions. Based on our experience, the broker supports its clients through the following channels:

- Live chat is the most efficient way to find quick solutions to unexpected issues or get answers to essential questions.

- Those who prefer to contact the broker via email and send their questions, suggestions, or complaints can use the following address: support_afr@trive.com.

- Many clients prefer to talk to the customer team directly and address their questions on the spot. They can use the available phone number: +27 10 157 5045.

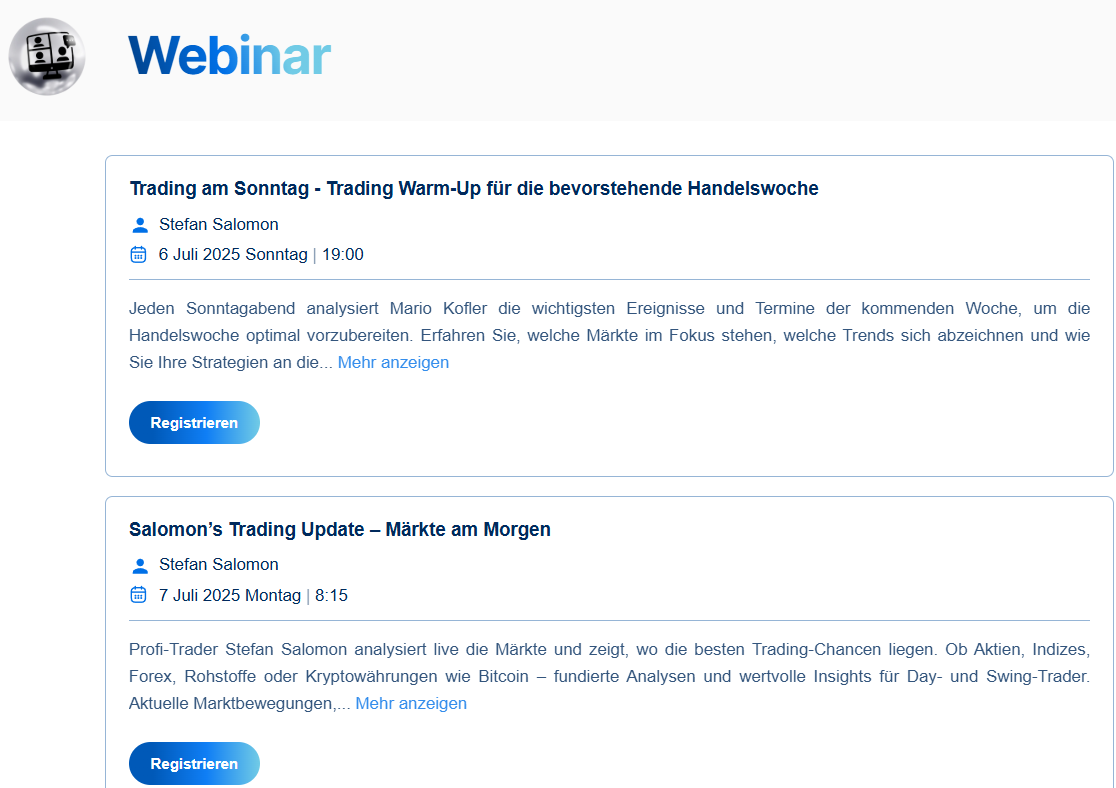

Research and Education

Score – 4.2/5

Research Tools Trive

Based on our findings, Trive offers traders a comprehensive arsenal of research tools and features for the market’s in-depth analysis. The broker’s MT4 and MT5 platforms include essential tools, enabling traders to conduct professional research.

Besides, there are additional research tools on the broker’s website. However, under each entity, the availability of the tools and features can vary.

- Traders have access to daily market analysis, technical analysis, and market insights.

- Trive offers an Economic Calendar, ensuring that its clients are informed about upcoming economic events powerful enough to impact the market and the trading outcome.

Education

Trive’s education materials also depend on the entity under which traders open an account. Generally, the broker’s Trading Hub includes educational articles, guides, and the Trive blog.

- We found that under its European entity, the broker offers webinars covering different trading topics that can boost traders’ knowledge and skills.

Is Trive a Good Broker for Beginners?

We have reviewed all the aspects of trading with Trive and found that the broker offers competitive trading conditions, suitable for various traders. The broker offers a good range of account types, enabling traders a wide choice to meet their trading expectations. With Trive, both beginners and professionals can find what they are looking for in trading. The broker offers a low minimum deposit or no deposit requirement, based on the entity. It also includes a demo account that is ideal for practicing and gaining knowledge, and skills.

Although the education section offers limited materials, it can still help novice traders gain essential knowledge of the market.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options Trive

We have found that Trive can be an attractive broker for expanding portfolios and exploring new trading opportunities. Although the broker offers about 300 tradable products, it can be a favorable choice for currency traders, as the range of major, minor, and exotic pairs is quite satisfying.

Also, as the broker has many entities and offers different conditions accordingly, depending on the jurisdiction, traders can also engage in long-term investments. For instance, the European entity offers a separate investment account, enabling traders to invest and own real assets.

- The alternative investment opportunities with Trive are also numerous. Clients can engage in social trading or open MAM and PAMM accounts. The MAM and PAMM accounts bring together professional managers and clients to cooperate and gain profits.

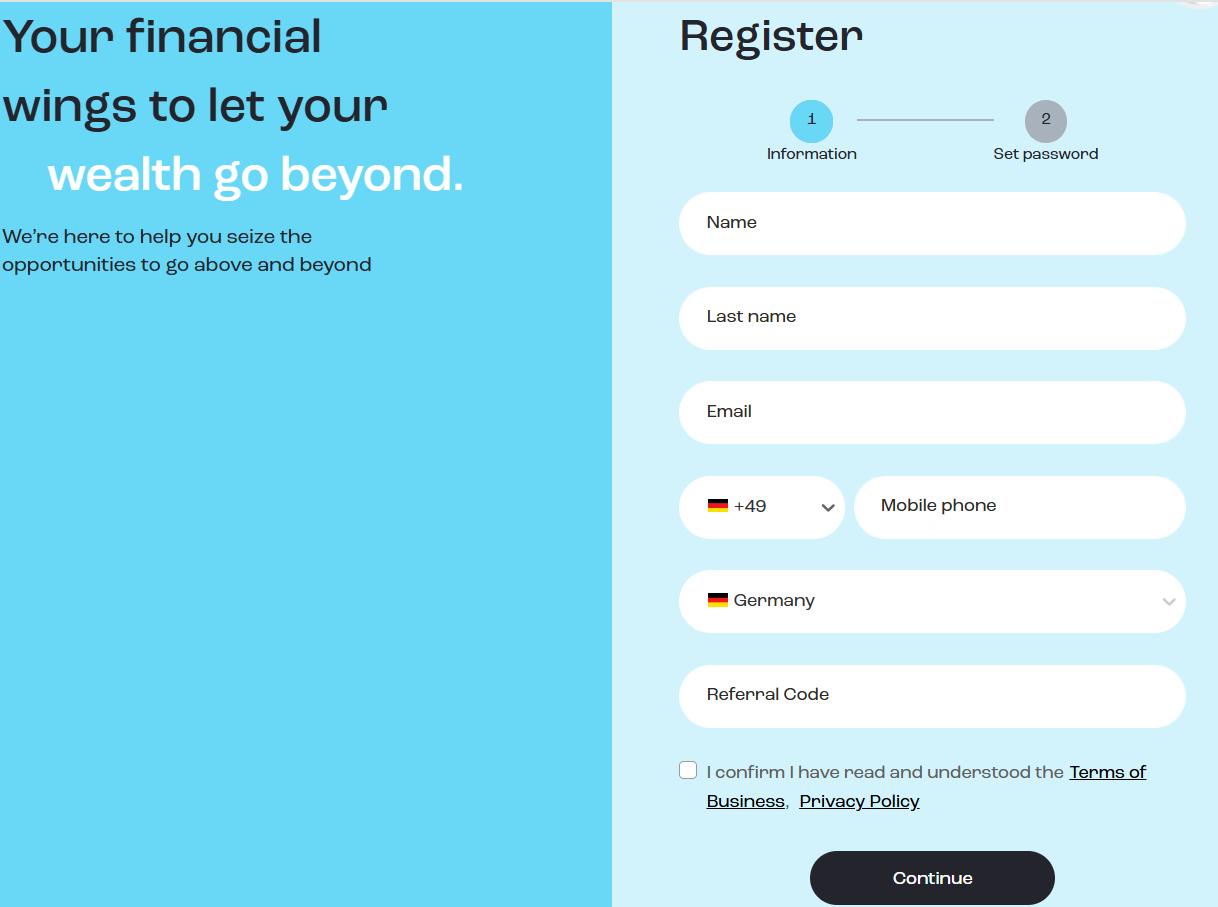

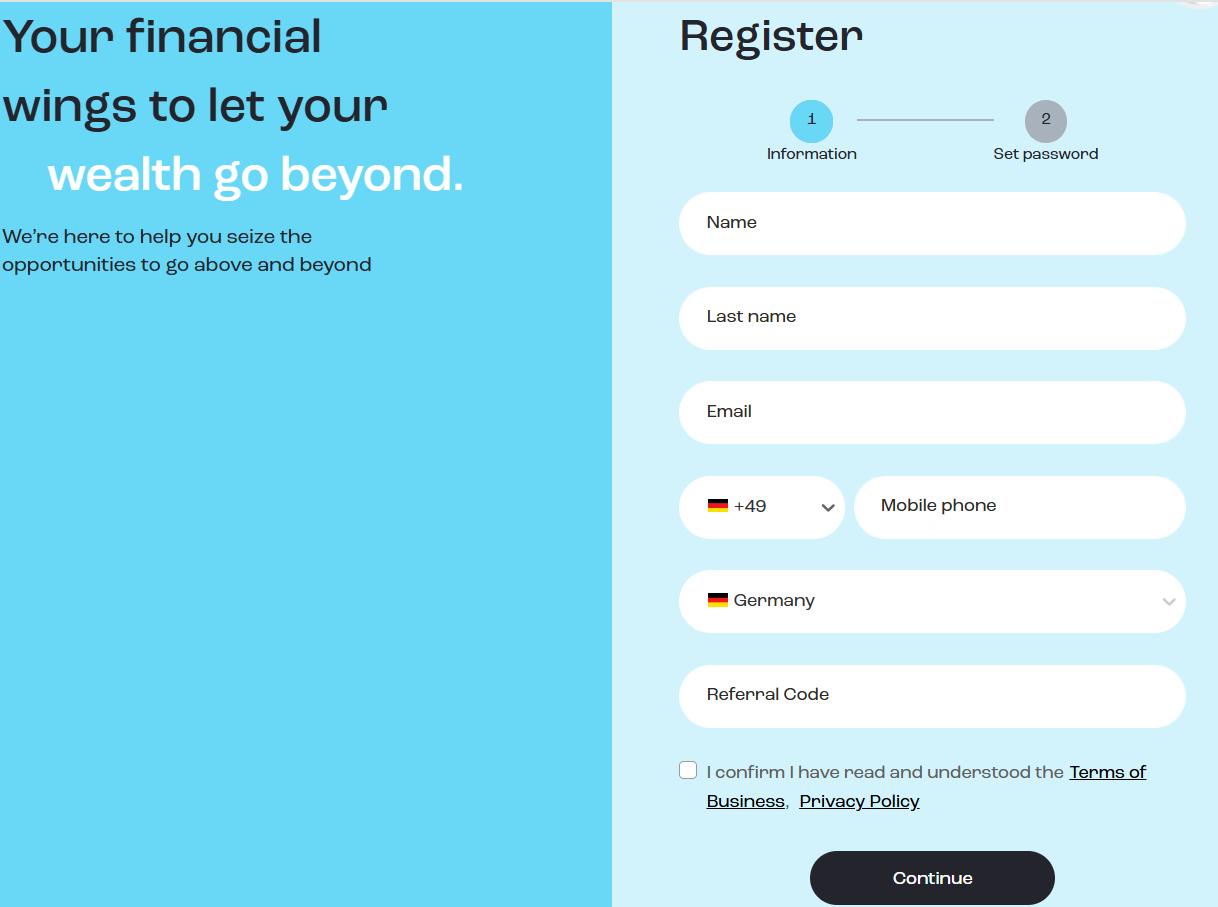

Account Opening

Score – 4.5/5

How to Open a Trive Demo Account?

Opening a demo account and practicing is a wise decision, especially for beginner traders or those who want to try new strategies. With Trive, opening a demo account is a simple and quick process.

- Go to the broker’s website and click on ‘Register’.

- Fill out the registration form with personal information.

- You will receive an email or an SMS for verification.

- Afterwards, choose the Demo account option.

- Choose the platform and download.

- Use the credentials sent via email and access your demo account.

- Start practicing.

How to Open a Trive Live Account?

Opening an account with Trive is a quick and straightforward process. The overall process takes several minutes. Traders simply need to go to the official website and follow the steps below:

- Select and click on the “Register” button.

- Enter the required personal data (name, email, phone number, etc.)

- Upload documentation for verification (residential proof, ID, etc.)

- Download the platform of choice.

- Complete the electronic quiz to confirm the trading experience.

- Once the account is activated and proven, traders need to follow up with the money deposit.

Score – 4.3/5

Trive offers its clients great opportunities and trading possibilities due to the features and tools it includes in its proposal. In addition to the already mentioned features we discussed in the research section, the broker offers a few bonuses and promotions that grant traders better chances for a profitable trading outcome:

- The 20% bonus is for all Trive’s clients, both new and existing. It is applied to every deposit, maximizing the trading potential of the clients. The bonus is available for the Standard, VIP, and ECN accounts.

- The broker also offers a 100% welcome bonus available for everyone. It also has a 50% redeposit bonus for the second deposit. This way, traders are encouraged to place more trades and start strong.

Trive Compared to Other Brokers

We have also compared Trive and different aspects of trading with the broker with other similar brokers in the market. This way it is easier to see how the broker stands out with its proposal and what it is better suited for.

One of the strongest points of the broker is its strict regulation and licenses from some of the best-regarded authorities, including ASIC, FCA, FSCA, and BAPPEBTI. Forex.com has similar regulatory oversight that ensures safety and transparency.

The broker’s trading costs are mostly average, with spreads of 1.2 pips. As we found, Tradeview has a lower offering of 0.3 pips; however, most brokers we reviewed here offer spreads of 1 to 1.3 pips. As to the trading platforms, trades with Trive are conducted on MT4 and MT5. XS, OneRoyal, and Tradeview also support the MT4 and MT5 platforms, while Xtrade has its proprietary platform. The overall number of tradable products is 300, which is considered a modest number, especially compared to 26 Degrees’ 26,000+ instruments or Forex.com‘s 6,000+ available products.

At last, Trive offers a few educational materials, which can be helpful for beginners. On the contrary, XS’s educational resources are limited, which is a drawback for novice traders who prioritize comprehensive education.

| Parameter |

Trive |

26 Degrees |

Forex.com |

XS |

OneRoyal |

Xtrade |

Tradeview |

| Spread-Based Account |

Average 1.2 pip |

From 0.2 pips |

Average 1.3 pips |

Average 1.1 pips |

Average 1 pip |

Average 2 pips |

Average 0.3 pips |

| Commission-Based Account |

0.0 pips + $5 |

No specified commissions |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $3.50 |

No commissions, based on fixed spreads |

0.0 pips + $2.5 |

| Fees Ranking |

Average |

Average |

Average |

Average |

Average |

Average |

Low/ Average |

| Trading Platforms |

MT4, MT5 |

Iress Trader, Iress ViewPoint, Iress Pro, and Bloomberg |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, MT5 |

Xtrade WebTrader |

MT4, MT5, cTrader |

| Asset Variety |

300+ instruments |

26,000+ instruments |

6000+ instruments |

1000+ instruments |

2,000+ instruments |

1,000+ instruments |

200+ instruments |

| Regulation |

BAPPEBTI, FCA, ASIC, MFSA, FSCA, FSC |

ASIC |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FSC, FSCA |

MFSA, CIMA, FSC, FS |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Unavailable |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$50 |

$5,000 |

$100 |

$0 |

$50 |

$250 |

$1000 |

Full Review of Broker Trive

Our review of Trive allows us to conclude that it is a reliable, transparent, and trustworthy broker regulated in over 15 regions worldwide. The broker holds licenses from the best-regarded authorities in the financial market, including BAPPEBTI, FCA, ASIC, MFSA, FSCA, and FSC. This strict oversight ensures the security of trades. However, the operation under different entities also means differences in trading conditions, including variations in account types, trading platforms, trading costs, educational resources, funding methods, and other essential aspects of trading.

Trive offers competitive fees based on the spreads or commissions. The average spread is 1.2 pips, which aligns with the market standard. However, the commission of $5 per side per lot is considered a little higher compared to other brokers.

Traders can access over 300 tradable products through the MT4 or MT5 platforms, using advanced tools and features for in-depth analysis and research purposes. Traders can also access social trading, MAM, and PAMM accounts, expanding their trading opportunities. However, the availability of instruments and the trading platform also depend on the jurisdiction.

Trive also offers dedicated customer support, adequate research and education sections, and promotional bonuses to its traders. All in all, based on real customer feedback, many clients appreciate the broker’s services and share their positive experiences.

Share this article [addtoany url="https://55brokers.com/trive-invest-review/" title="Trive | GKInvest"]

Trive Invest is best broker in Indonesia. You dont need anything else. no swap, $1 komisi.