- What is TradeZero?

- TradeZero Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

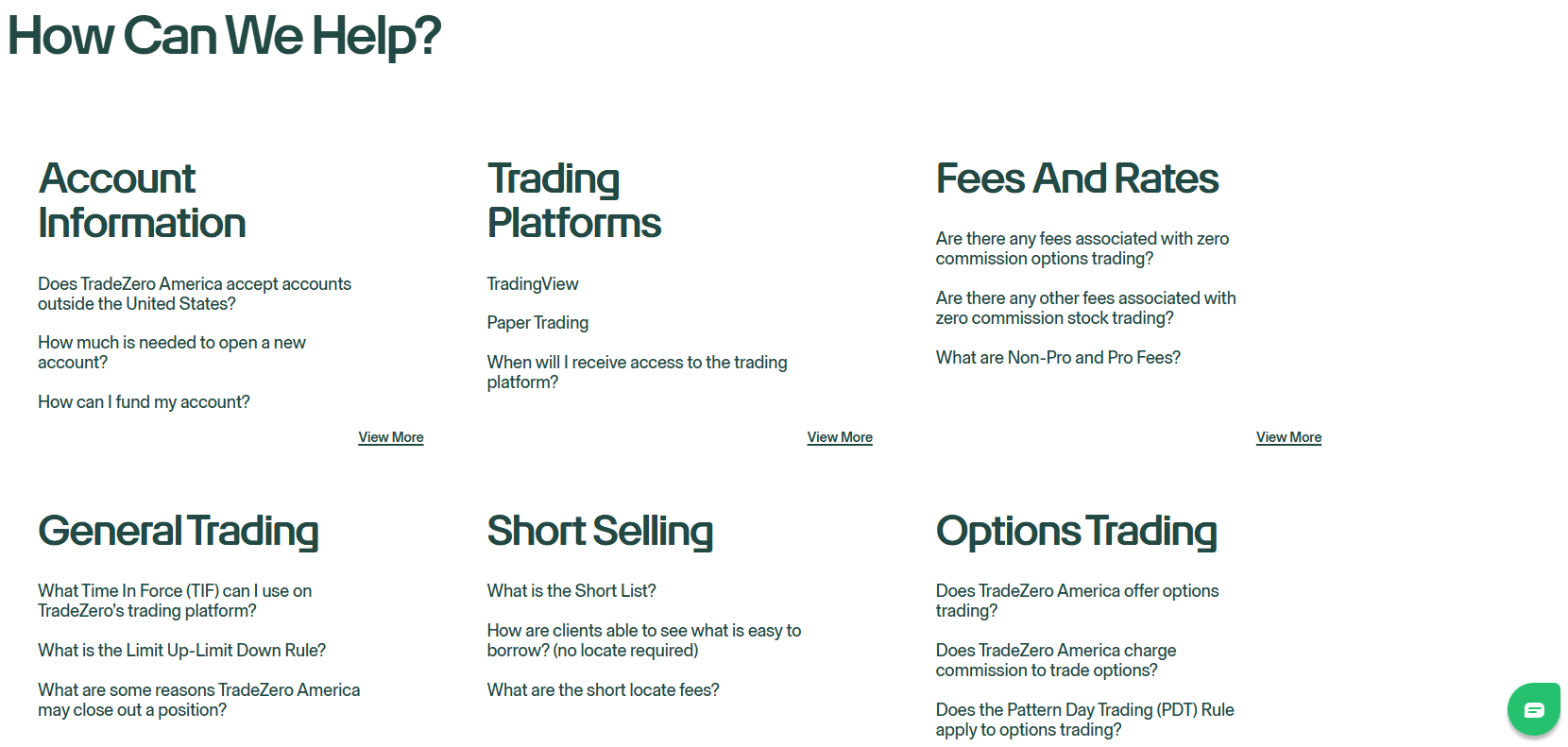

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- TradeZero Compared to Other Brokers

- Full Review of Broker TradeZero

Overall Rating 4.5

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is TradeZero?

TradeZero is a Stock Trading firm based in the USA, offering traders access to stocks, options, and ETFs. Established in 2015, the brokerage is regulated by the US Financial Industry Regulatory Authority, ensuring compliance with industry standards and investor protection.

In addition to its US operations, TradeZero also has offices in Canada and maintains an international presence through its office in the Bahamas, catering to traders from around the world.

Is TradeZero Stock Broker?

Yes, TradeZero is a Stock Trading Broker. TradeZero America Inc. is a US-based broker headquartered in New York and is a member of FINRA and SIPC, providing access to trading US equities, options, and ETFs.

The broker adheres to strict compliance and investor‑protection standards, offering a secure and legitimate trading environment for all types of investors.

TradeZero Pros and Cons

TradeZero is a solid choice for investors, offering a range of advantages. The platform provides commission-free trading on US stocks and ETFs with qualifying limit orders, as well as on options. It provides advanced, customizable trading platforms and extended trading hours. Additionally, the broker offers 24/7 phone support for international clients.

For the Cons, TradeZero offers limited access to asset classes beyond stocks, ETFs, and options. Moreover, while its US entity is regulated by FINRA, its international operations are conducted through an offshore entity, which may raise concerns for some users. Overall, TradeZero is best suited for experienced, high-volume traders who need robust tools and competitive pricing.

| Advantages | Disadvantages |

|---|

| FINRA regulated broker | Conditions and offering vary depending on the entity and regulations |

| Stock Trading and Investment | Limited investment products offered |

| Competitive fees and commissions | No popular trading platform available |

| Suitable for active traders and professionals | |

| Advanced proprietary trading platforms | |

| Good research tools and educational resources | |

| 24/7 phone support | |

TradeZero Features

TradeZero offers a range of powerful features that meet the needs of investors. From commission-free trading to advanced trading platforms with real-time data, the broker provides a competitive trading environment with professional-grade tools. Below is a comprehensive list of its main features:

TradeZero Features in 10 Points

| 🏢 Regulation | FINRA, SIPC, CIRO, SCB |

| 🗺️ Account Types | Individual, Joint, Corporate Accounts |

| 🖥 Trading Platforms | ZeroPro, ZeroWeb, ZeroFree, ZeroMobile, TradingView |

| 📉 Trading Instruments | Stocks, Options, ETFs |

| 💳 Minimum Deposit | $500 |

| 💰 Average Stock Commission | From $0 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | DailyEdge, Live Sessions, Blog |

| ☎ Customer Support | 24/7 |

Who is TradeZero For?

TradeZero is ideal for active traders who require direct market access, advanced charting tools, and short-selling opportunities. It is also a great choice for day traders and professionals who need fast execution and customizable trading platforms. Based on our findings, TradeZero is Good for:

- Investing

- USA Traders

- International trading

- Beginners and professionals

- Direct market access

- Real Stock Trading

- Traders from Canada

- Commission-free trading

- Quality educational materials

- Great customer service

- Competitive trading fees

- Short-term investors

TradeZero Summary

Overall, TradeZero caters primarily to active and professional traders, offering commission-free trading on US stocks, ETFs, and options under specific conditions.

Established in 2015, it operates under FINRA regulation in the US, with international services provided through its Bahamas-based entity. The platform stands out for its powerful trading tools, extended market hours, and short-selling capabilities.

While it offers responsive customer support and good educational materials, its asset selection is limited, and international investors may face regulatory and trading conditions differences. Overall, TradeZero is a competitive choice for experienced traders seeking low-cost, good trading solutions.

55Brokers Professional Insights

TradeZero is a great Broker for traders that are into stock trading, investing and ETFs trading, with lare number of instruments available, also in combination of margin trading, we mark it as one of the good competitors in its nieche. Additionally, the broker offers up to 1:6 intraday leverage on margin accounts and extended trading hours, giving traders more opportunities to capitalize on market movements.

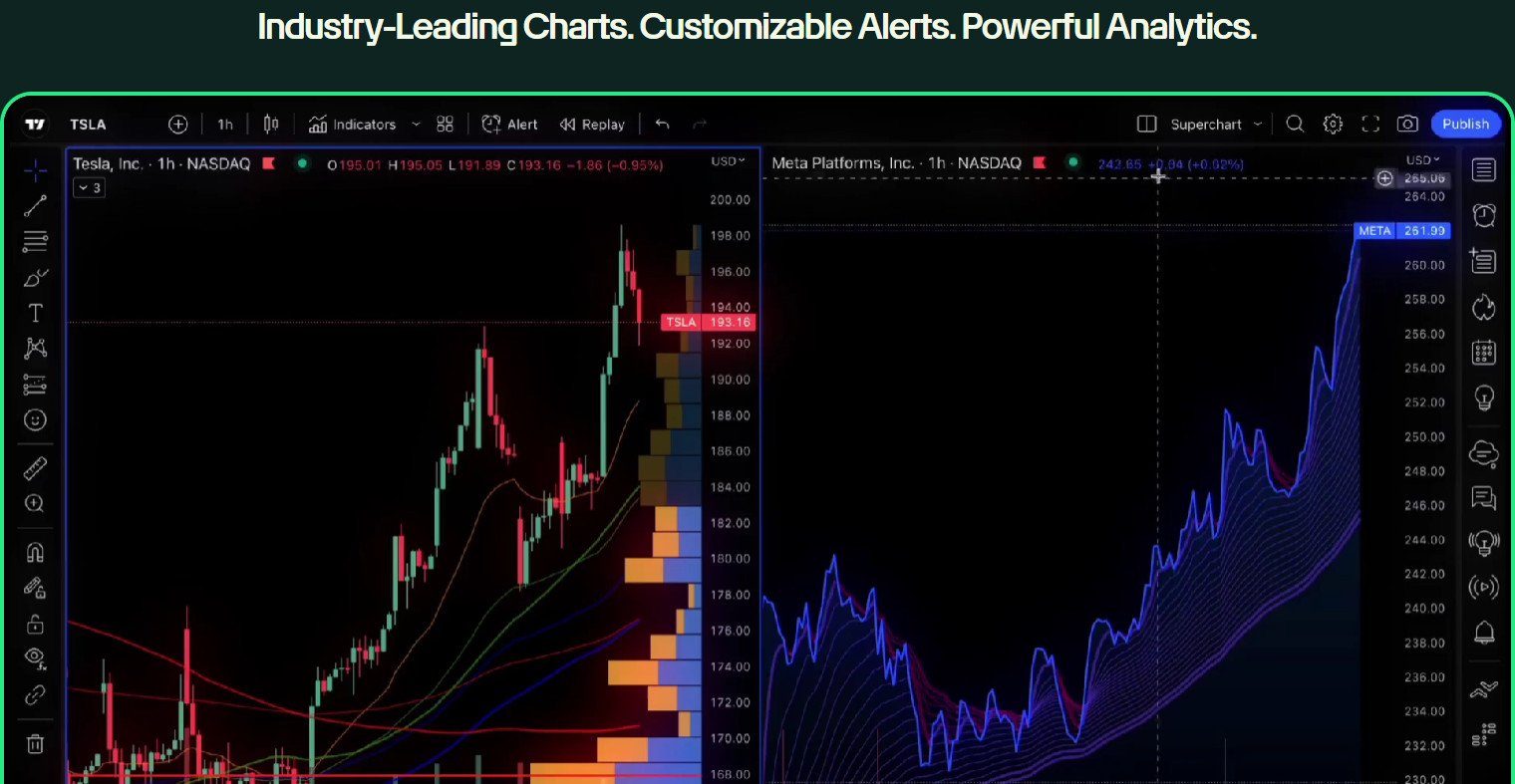

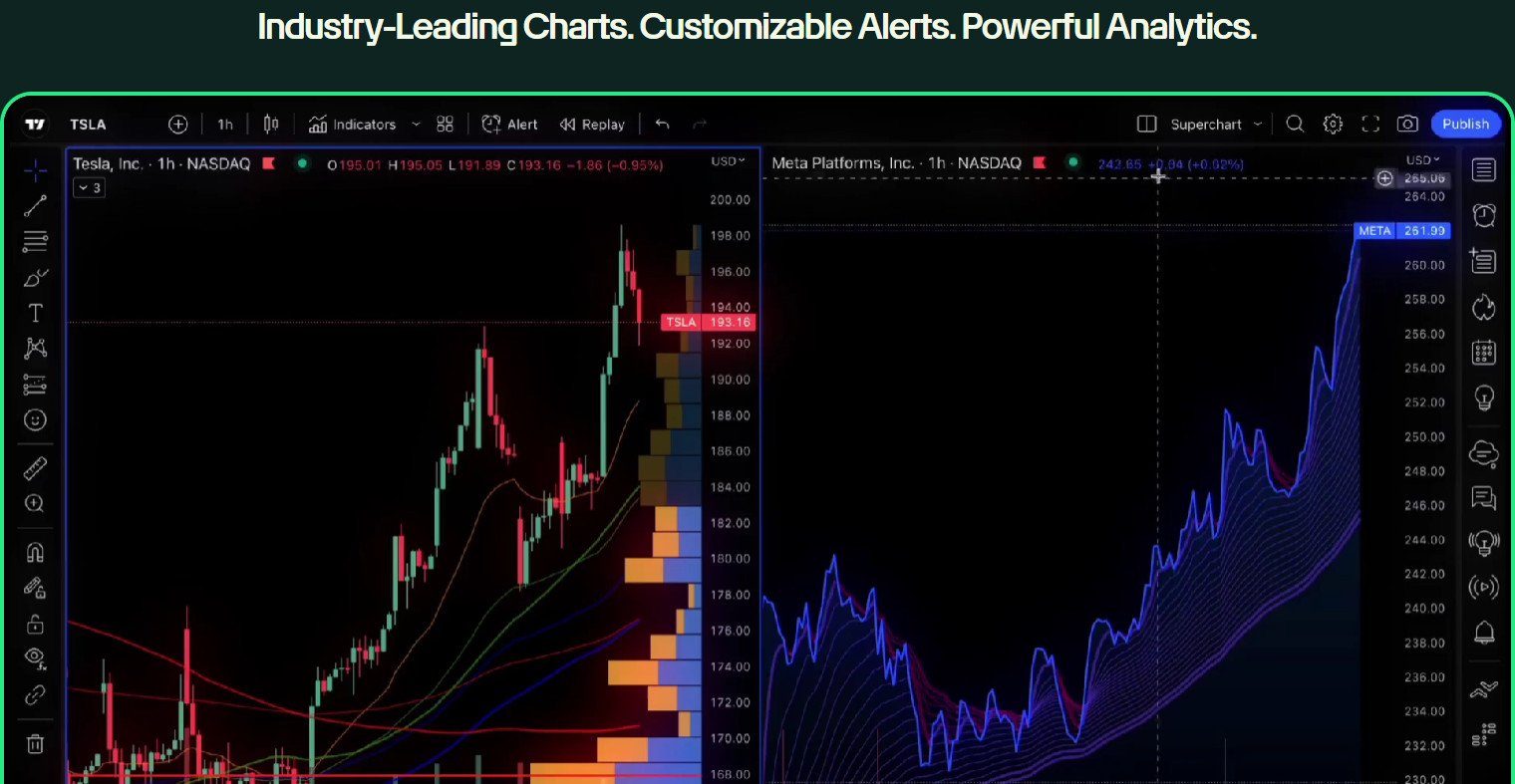

TradeZero stands out with a combination of flexibility and professional trading tools and platforms such as ZeroPro and ZeroWeb, whith quality real-time market data and multi-screen support. The firm is also integrated with TradingView, providing a seamless experience with industry-leading charts, customizable alerts, and powerful analytics, so ooverall we enjoyed the trading performance combined with platform capabilitites.

Overall, with commission-free trading on US stocks, ETFs, and options, 24/7 phone and live chat support, and tailored account types, the broker is a rather good choice for investors of different level and size, which we advise strongly to consider.

Consider Trading with TradeZero If:

| TradeZero is an excellent Broker for: | - Need a well-regulated broker.

- Suitable for professional traders and investors.

- Low fees and commissions.

- Access to robust proprietary trading platforms.

- Stock Trading and Investment.

- Excellent trading tools and trading technology.

- Offering popular financial products.

- Providing services worldwide.

- Great customer support and educational materials.

- Secure trading environment.

- For US, Canada, and international trading.

- Stock Trading and Investment.

- Short-term investors. |

Avoid Trading with TradeZero If:

| TradeZero might not be the best for: | - Who prefer to trade with popular trading platforms.

- Need diverse investment products.

- Who prefer international trading under a Top-Tier license. |

Regulation and Security Measures

Score – 4.7/5

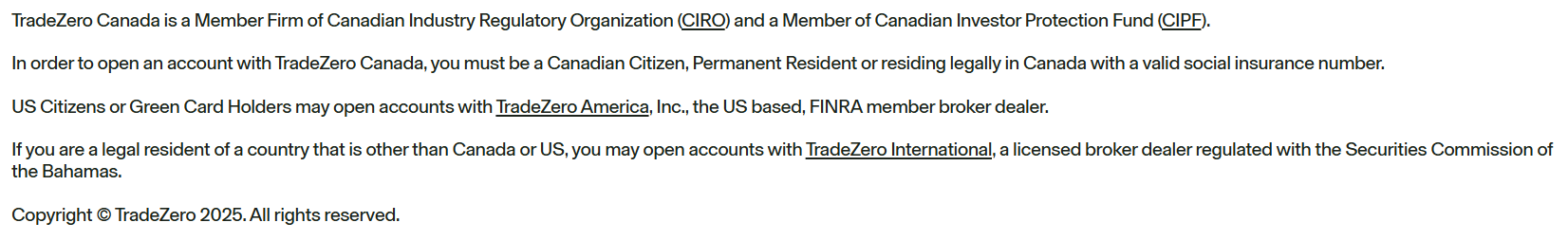

TradeZero Regulatory Overview

TradeZero offers services through its US-based, Canadian, and international entities. In the USA, the firm is regulated by the Financial Industry Regulatory Authority and is a member of the Securities Investor Protection Corporation, which safeguards customer funds and securities.

In Canada, the firm operates under the regulatory oversight of the Canadian Investment Regulatory Organization, which also enforces high standards of investor protection and compliance. This ensures that both US and Canadian clients trade under Top-Tier regulatory frameworks focused on transparency and investor security.

For international clients, TradeZero operates through its Bahamas-based entity, which is regulated by the Securities Commission of The Bahamas. While the SCB is a recognized regulatory authority, it is considered offshore and generally less stringent than regulators like FINRA or CIRO.

Therefore, international traders benefit from broader access and fewer restrictions, but should also be aware of the differing levels of investor protection and regulatory oversight across jurisdictions.

How Safe is Trading with TradeZero?

Trading with TradeZero is considered safe, particularly for clients using its US and Canadian entities. US clients also benefit from SIPC protection, which covers up to $500,000 in securities (including $250,000 in cash) in the event of broker failure.

The broker implements standard security measures like SSL encryption and two-factor authentication to protect user accounts. However, international clients trading through the Bahamas-based entity are subject to less stringent regulatory oversight.

While this allows for greater trading flexibility, it also comes with reduced investor protections compared to US or Canadian standards.

Consistency and Clarity

TradeZero has built a strong reputation in the trading community, especially for short selling and direct market access. The broker has won multiple industry awards, highlighting its strengths in the financial market.

Trader reviews are generally positive, praising its speed, leverage, and trading tools, though some traders have raised concerns about platform stability and high fees for locates. TradeZero is also active in the trading community through partnerships and event sponsorships. Overall, it offers great trading features; however, it may not suit everyone’s needs equally.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with TradeZero?

TradeZero offers a few account types to accommodate different trader profiles. These include Individual Accounts (cash or margin), suitable for beginner and active traders, Joint Accounts, which allow two or more individuals to share access and ownership, and Corporate Accounts for business entities, requiring higher minimum deposits and offering professional-level tools and support.

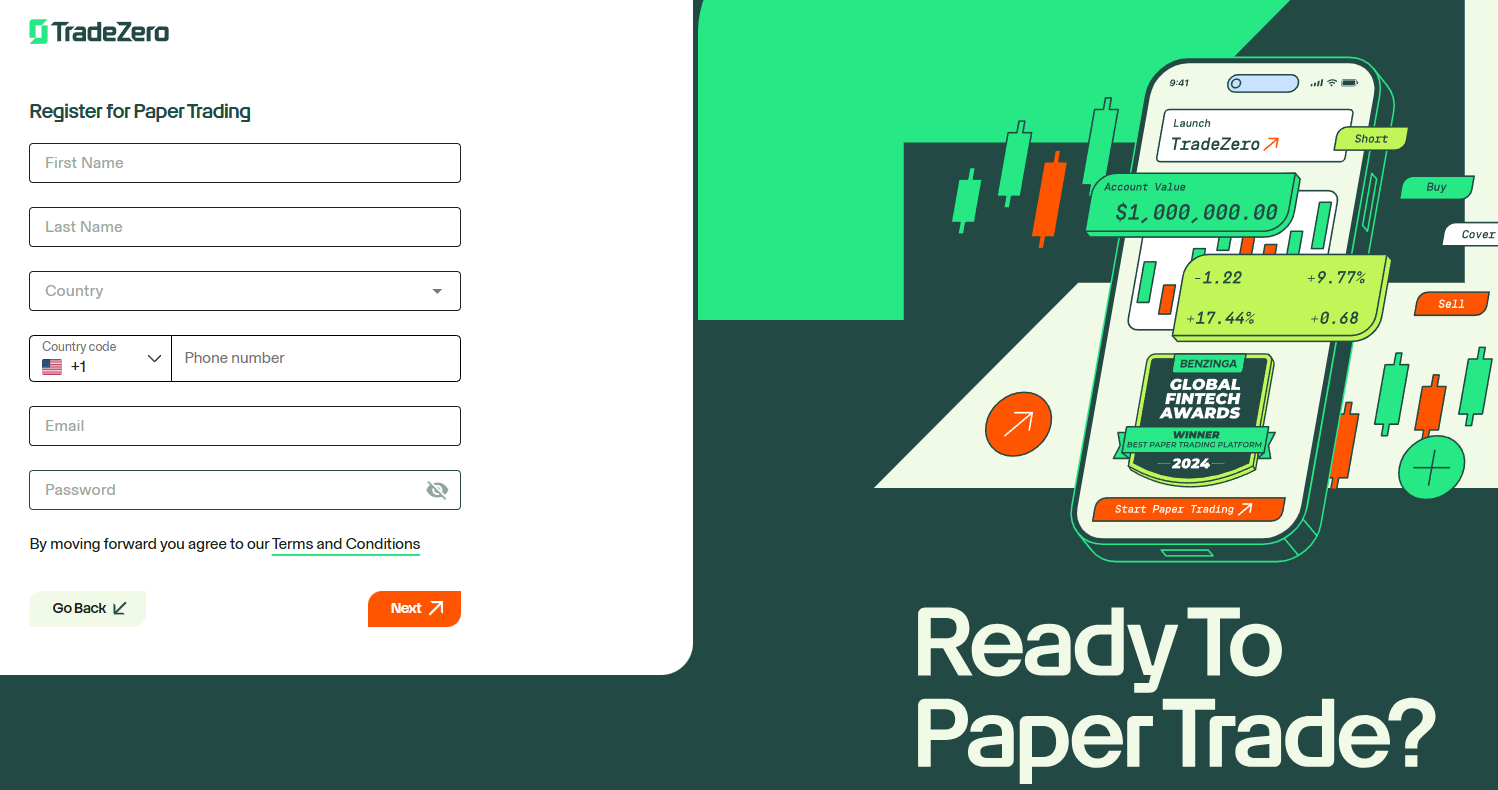

In addition, the firm provides a paper trading or demo account for those who want to practice strategies in a risk-free environment before committing to real capital.

Individual Accounts

TradeZero’s Individual Account is available as either a cash or margin account, with a minimum deposit starting from $500. The cash account allows trading with settled funds only, while the margin account provides access to leverage up to 1:6 intraday and short-selling capabilities.

This account type is suitable for both beginner and active traders. While basic platform access is free, advanced tools like ZeroPro or ZeroWeb require a monthly subscription fee.

Regions Where TradeZero is Restricted

TradeZero operates globally, but its services are restricted in certain regions and countries due to regulatory limitations, local laws, or political factors:

- North Korea

- Iran

- Syria

- Afghanistan

- Algeria, etc.

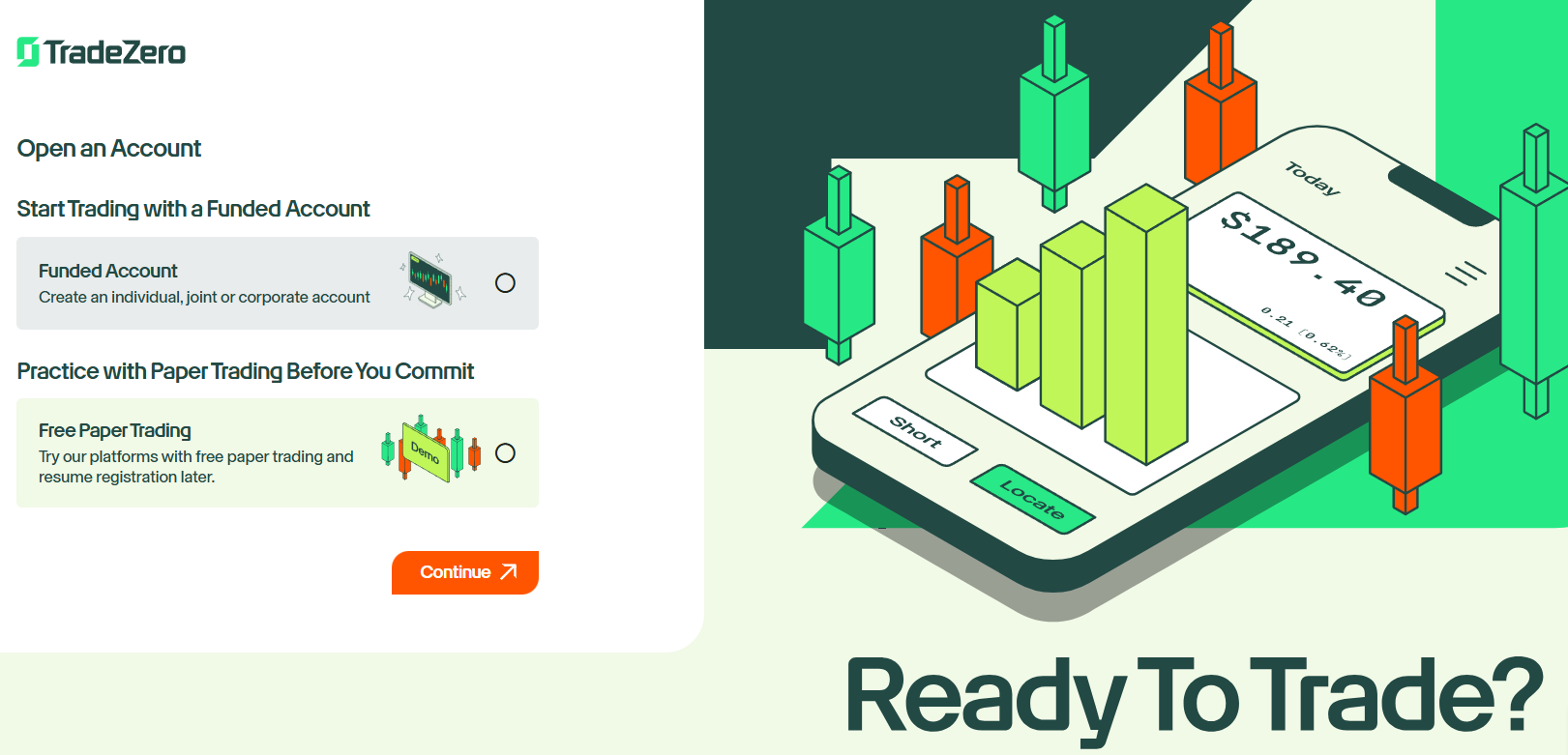

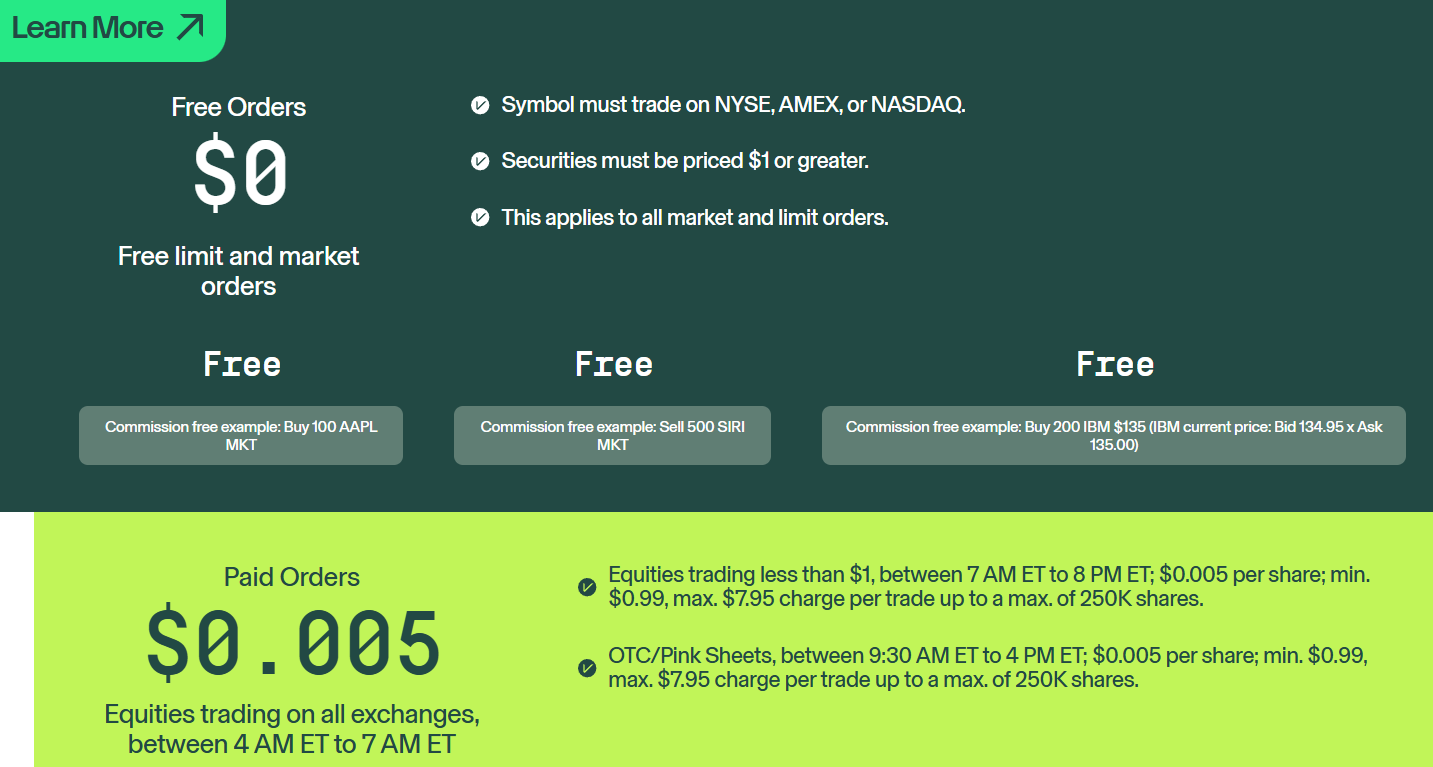

Cost Structure and Fees

Score – 4.5/5

TradeZero Brokerage Fees

TradeZero offers competitive brokerage fees, attractive to active traders and professionals. The broker provides commission-free trading on US stocks and ETFs when using qualifying limit orders, as well as no per-contract commission on options, though standard exchange and regulatory fees apply.

For trades that do not meet commission-free criteria, fees typically range from $0.005 to $0.009 per share. While basic platform access is free, advanced platforms like ZeroPro or ZeroWeb cost $59 per month.

Additional fees include charges for stock locates, overnight borrow fees, and wire transfers. Overall, TradeZero’s fee structure is cost-effective for high-volume traders but may be less appealing for low-frequency users due to additional charges.

TradeZero offers commission-free trading on US stocks and ETFs, provided the trade is placed as a qualifying limit order that adds liquidity.

Non-qualifying orders, such as market orders or those that remove liquidity, incur a fee ranging from $0.005 to $0.009 per share, depending on the stock price and trade volume. For options trading, the broker charges no base commissions per contract, but standard exchange and regulatory fees still apply.

TradeZero’s exchange fees vary based on the type of trade and asset. While qualifying limit orders on US stocks and ETFs are commission-free, non-qualifying trades, like market orders, incur fees starting at $0.005 per share.

Options trading has no base commission, but standard exchange and regulatory fees apply, typically around $0.42 to $0.59 per contract.

- TradeZero Rollover / Swaps

TradeZero does not offer traditional swap/rollover services, but it charges overnight borrowing fees for securities held short overnight.

The broker’s short rollover fees are transparent but variable. You pay based on actual borrow costs, not a fixed swap rate. Active short sellers should monitor the ONB calculator regularly, pay special attention to Thursday night outsized charges, and be prepared for potentially high costs on heavily shorted stocks.

How Competitive Are TradeZero Fees?

TradeZero’s fees are generally competitive, especially for active traders who rely on limit orders and advanced tools. The broker’s commission-free structure helps to reduce costs for high-volume users.

While additional fees can apply for platform access, market data, and certain services, TradeZero’s pricing remains favorable.

| Asset/ Pair | TradeZero Commission | Freetrade Commission | Vanguard Commission |

|---|

| Stocks Fees | From $0 | From $0 | From $0 |

| Fractional Shares | - | £2 | $1 |

| Options Fees | $0.42 | - | From $0 |

| ETFs Fees | From $0 | From $0 | $0 |

| Free Stocks | Yes | Yes | Yes |

TradeZero Additional Fees

In addition to trading commissions, TradeZero charges several extra fees that traders should be aware of. These include platform fees up to $59 per month for advanced tools, market data subscriptions, and withdrawal charges, such as $5 for ACH and up to $70 for international wire transfers.

Other fees may also apply for broker-assisted trades, account transfers, or paper statements.

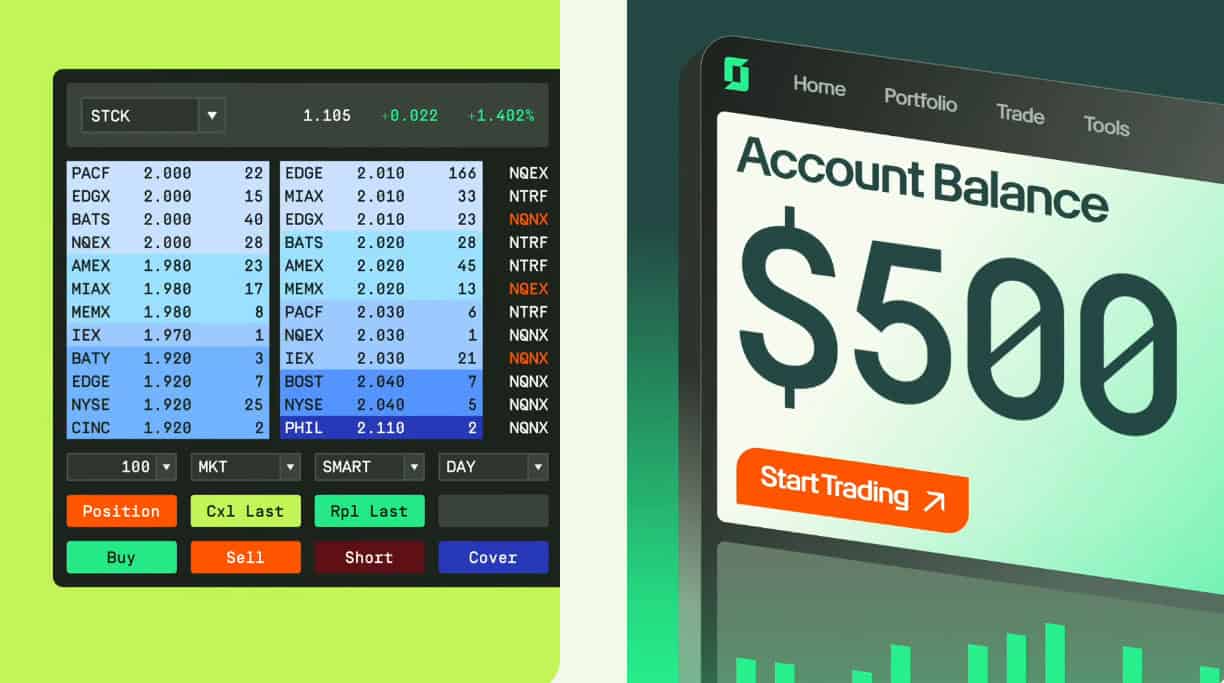

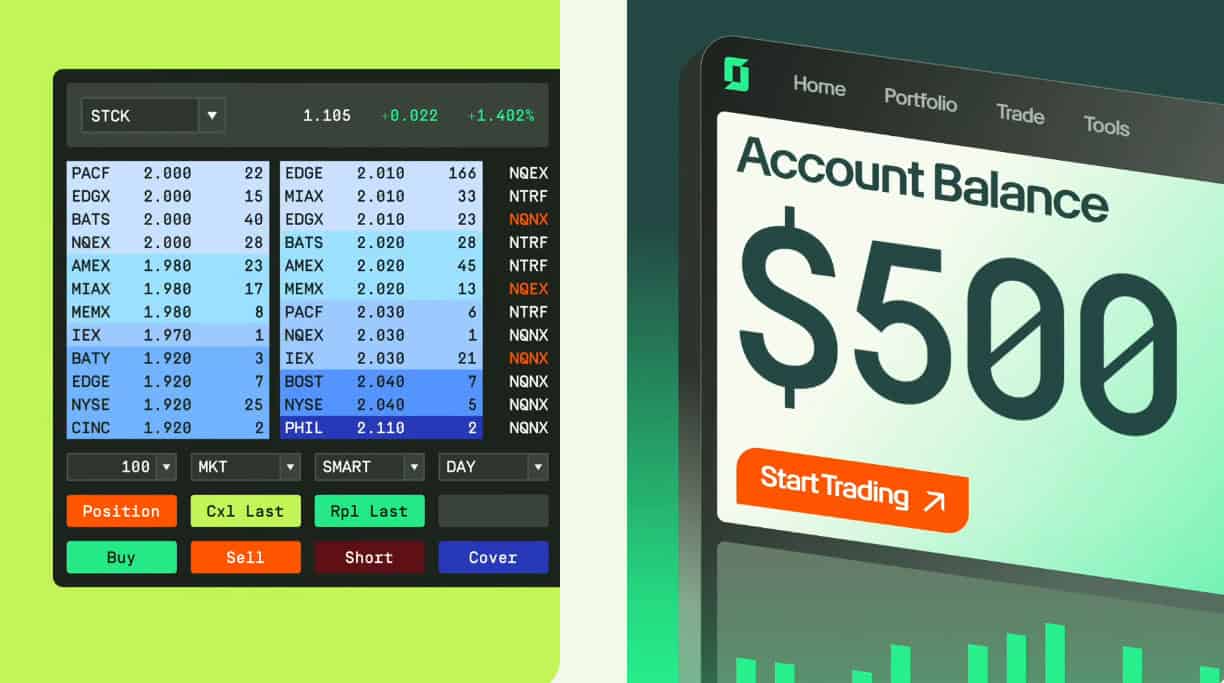

Trading Platforms and Tools

Score – 4.6/5

TradeZero offers a robust range of proprietary trading platforms and tools. These include ZeroPro, a desktop platform with advanced charting and Level 2 data, ZeroWeb, a browser-based platform with real-time trading features, ZeroFree, a basic platform ideal for casual users, and ZeroMobile, a user-friendly mobile app for trading on the go.

Additionally, the broker integrates with TradingView, allowing users to access professional-grade charts, alerts, and analytics within a familiar interface. This comprehensive platform offering supports fast execution and flexibility across devices.

Trading Platform Comparison to Other Brokers:

| Platforms | TradeZero Platforms | Freetrade Platforms | Vanguard Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

TradeZero Web Platform

TradeZero’s ZeroWeb is a browser-based trading platform that provides fully customizable layouts and supports real-time charting across multiple monitors, a highly valued feature for active traders.

Traders can manage dynamic watchlists, access Benzinga-powered news feeds, and handle portfolio positions and order entries with ease. Additional features include hotkeys, multi-language support, and fully synced notifications, making it a versatile web platform for traders who require flexibility without committing to a desktop app.

Main Insights from Testing

Testing ZeroWeb reveals a smooth and responsive trading experience through a web browser, with minimal setup required. The platform is intuitive and runs well without the need for downloads, making it convenient for traders who need flexibility across devices.

The platform supports essential trading functions effectively, with quick load times and stable performance during regular market hours.

TradeZero Desktop MetaTrader 4 Platform

TradeZero does not offer the MetaTrader 4 platform. Unlike many Forex-focused brokers, the broker’s technology is built around its proprietary platforms, along with integration with TradingView.

TradeZero Desktop MetaTrader 5 Platform

Similarly, TradeZero does not support MT5. The broker focuses on its trading platforms, instead of offering third-party platforms.

TradeZero MobileTrader App

ZeroMobile brings robust trading to users’ smartphones, offering features on the go. It includes real-time charting, dynamic watchlists, and live Level 1 data. The app also supports short selling with built-in locate tools, seamless integration with desktop platforms, and 24/7 live support via chat or phone.

Overall, the mobile app offers a powerful way to trade US stocks, ETFs, and short locates, ideal for traders needing flexibility, though it may not fully replace the desktop experience for some advanced users.

AI Trading

TradeZero does not currently offer any AI or algorithmic trading features such as automated bots or AI-driven strategies. All trading on its platforms is manual and requires the trader to enter orders and manage positions themselves.

Trading Instruments

Score – 4.4/5

What Can You Trade on TradeZero’s Platform?

TradeZero allows trading in three main asset classes: US Stocks, ETFs, and Options. The broker delivers coverage across major U.S. exchanges, along with OTC and pink-sheet stocks, and with extended-hours trading and direct market access.

The broker does not support Forex, futures, crypto, or mutual funds, ideal for equities and options-focused traders.

Main Insights from Exploring TradeZero’s Tradable Assets

Exploring TradeZero’s tradable assets reveals a strong focus on US equities, ETFs, and options, catering well to active stock and options traders. The broker offers solid tools and market access for these instruments, especially for those interested in short-selling and intraday strategies.

However, a key drawback is the limited range of investment products, as the firm does not support trading in asset classes like futures, cryptocurrencies, or mutual funds. This makes it less suitable for investors seeking a more diversified portfolio within a single brokerage platform.

Leverage Options at TradeZero

TradeZero’s margin accounts offer compelling leverage options for active traders. Users can access up to 1:6 intraday leverage, allowing them to control larger positions during market hours, with typical overnight leverage around 1:2.

Margin interest rates are competitive and variable. However, traders should be mindful that a higher multiplier strengthens both potential gains and losses, and additional fees like interest and locate charges may apply when positions are held overnight or short.

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at TradeZero

In terms of funding methods, TradeZero primarily supports bank transfers for deposits, offering both ACH using Wise, Revolut, and Equals Money, and Wire Transfers as the main funding methods.

TradeZero Minimum Deposit

TradeZero’s minimum deposit requirements vary by region. For US clients, a minimum deposit of $2,500 is required to open an account. In contrast, TradeZero International has a more accessible minimum deposit of $500 for both cash and margin accounts.

Withdrawal Options at TradeZero

TradeZero offers withdrawals via ACH and wire transfers. ACH withdrawals are available to US clients with a daily limit of $50,000 and a $5 fee per transaction.

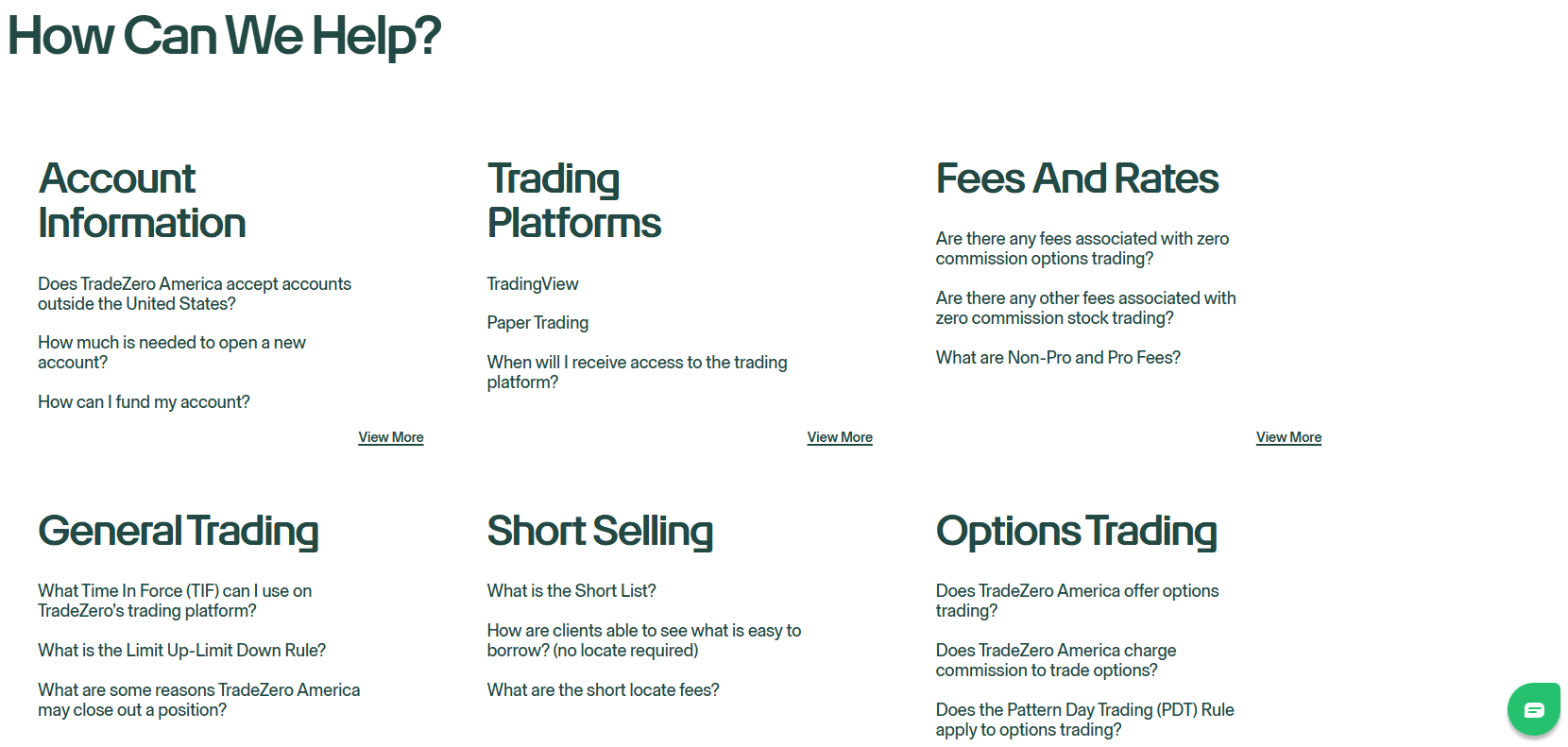

Customer Support and Responsiveness

Score – 4.5/5

Testing TradeZero’s Customer Support

TradeZero provides 24/7 customer support via phone and live chat for International clients. US, Canadian, and international clients can reach support teams that are knowledgeable about different regulatory environments.

The broker also offers a Help Center with detailed guides and answers to a range of common questions.

Contacts TradeZero

TradeZero offers multiple contact options for customer support across its different entities. US clients can be reached by phone at +1-877-487-2330 or via email at support@tradezero.us. TradeZero Canada provides support at +1-866-995-9585 and support@tradezero.ca, while international clients can contact +1-954-944-3885 or support@tradezero.co.

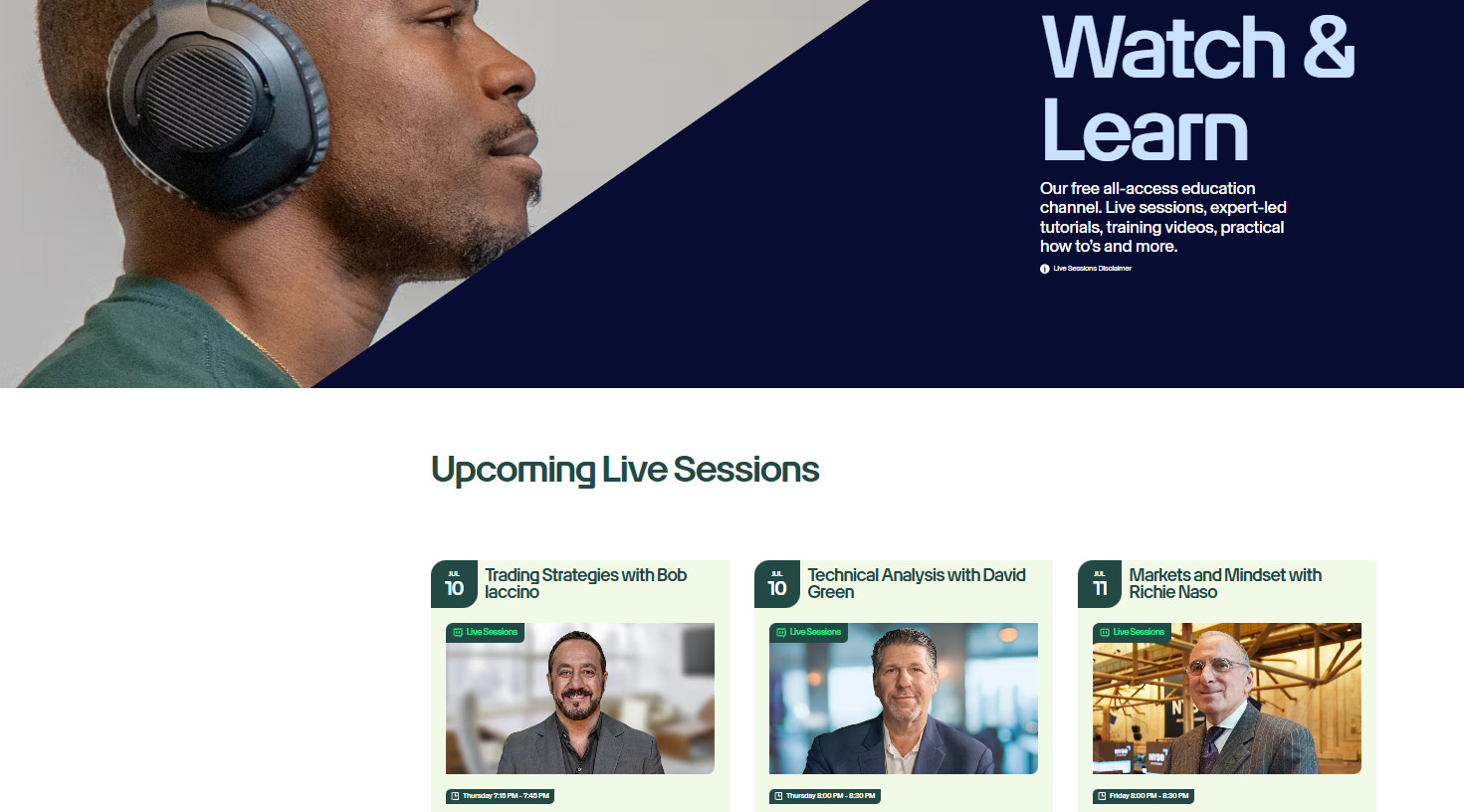

Research and Education

Score – 4.6/5

Research Tools TradeZero

TradeZero provides research tools both on its website and across its trading platforms.

- On the website, TradeZero’s integration with TradingView allows users to connect their accounts for access to advanced charting, over 400 technical indicators, strategy backtesting, and a robust stock screener, all directly through the TradingView platform.

- Within TradeZero’s trading platforms, users benefit from built-in tools like real-time Level 1 and Level 2 data, a short-locate tool for borrowing stocks, and a Benzinga news feed.

- Additionally, the paper trading available through the platforms allows users to simulate trades with virtual funds, ideal for strategy testing.

Education

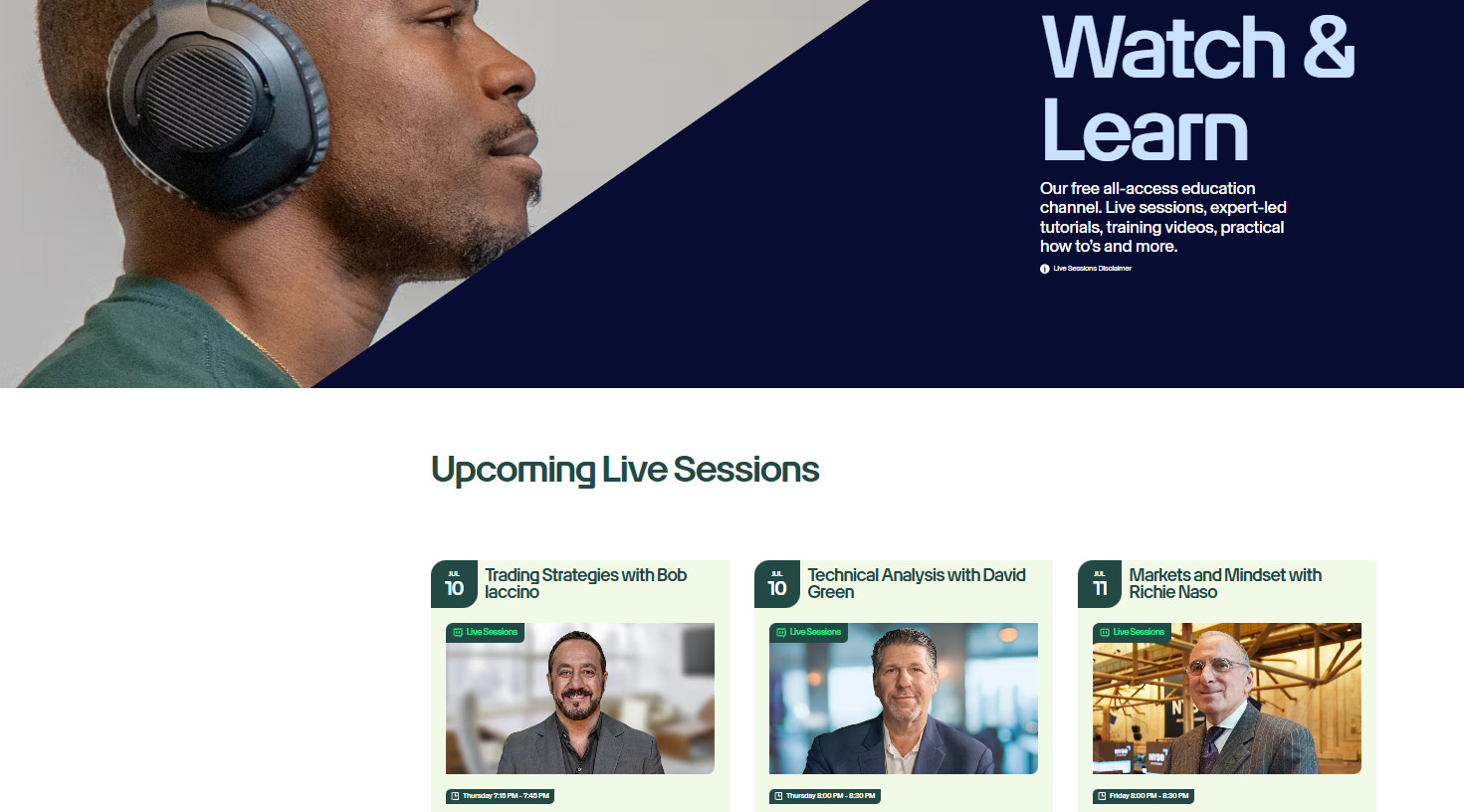

TradeZero offers a good level of educational materials to support both beginner and experienced traders. One of its key features is the DailyEdge, a daily market commentary that provides insights, trade ideas, and technical setups to help users stay informed and prepared.

The broker also hosts live sessions and webinars, where experts cover trading strategies, platform usage, and market analysis in real-time, allowing users to engage directly and ask questions.

Additionally, TradeZero’s blog serves as a valuable resource, offering articles on trading concepts, platform tips, and updates on market trends.

Portfolio and Investment Opportunities

Score – 4.5/5

Investment Options TradeZero

TradeZero provides a range of investment tools and solutions for active equity and options traders. These include advanced order routing, direct market access, and real-time data tools across its platforms. Traders can benefit from extended-hours trading, leverage through margin accounts, and short-selling capabilities.

While the broker does not offer traditional long-term investment products like mutual funds or retirement accounts, its tools are well-suited for those looking for self-directed trading solutions.

Account Opening

Score – 4.4/5

How to Open TradeZero Demo Account?

To open a free TradeZero demo or paper trading account, follow these steps:

- Visit the TradeZero website and navigate to the “Free Paper Trading” section.

- Fill out the short registration form with basic details like your name, email, and country.

- Choose a platform based on your preferences.

- Once registered, you will receive $1,000,000 in virtual funds to simulate trades and test strategies in a live-market environment.

How to Open TradeZero Live Account?

To open a live account with TradeZero, visit the official website and click on the “Sign Up” button, and complete the online application by providing your details, proof of identity, and proof of address.

You will also need to select your account type and upload the required documents for verification. Once your account is approved, fund it using an accepted method such as ACH or wire transfer. After funding, you can begin trading using any of TradeZero’s platforms.

Additional Tools and Features

Score – 4.3/5

In addition to its main trading tools, TradeZero offers several additional features to enhance the trading experience.

- These include hotkey functionality for faster order execution and multi-monitor support on desktop platforms for efficient workspace customization.

- The platform also provides real-time margin tracking, custom alerts, and detailed order history to help traders stay informed and manage risk.

- For short sellers, the broker’s locate and release feature allows users to reserve and return shares with flexibility.

Combined, these tools offer a more powerful and responsive trading environment for active traders.

TradeZero Compared to Other Brokers

Compared to its competitors, TradeZero stands out as a firm tailored specifically for active traders, offering strong platform functionality and short-selling tools.

While many other brokers provide a broader range of assets, TradeZero focuses on equities, ETFs, and options, which may appeal more to short-term traders than long-term investors seeking portfolio diversification.

However, the broker lacks futures trading and product variety available at brokers like Interactive Brokers or TD Ameritrade. In terms of customer support, TradeZero performs well with 24/7 phone and live chat and offers solid educational content, though not as extensive as industry leaders.

Overall, TradeZero is a strong choice for active equity traders but may not be ideal for those seeking long-term investment solutions.

| Parameter |

TradeZero |

Vanguard |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

WeBull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from $0 |

Futures contracts not available / Stock Commission from $0 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$1.50 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

No |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Low |

Low |

Average |

Low |

Average |

Average |

| Trading Platforms |

ZeroPro, ZeroWeb, ZeroFree, ZeroMobile, TradingView |

Proprietary trading platform, Mobile App |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform |

| Asset Variety |

Stocks, Options, ETFs |

Stocks, Options, CDs, ETFs, Bonds, Mutual Funds |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, ETFs, OTC, ADRs, Crypto, Forex, Shares, Futures |

| Regulation |

FINRA, SIPC, CIRO, SCB |

SEC, FINRA, SIPC, FCA, ASIC, Central Bank of Ireland |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, ASIC, SFC, MAS |

| Customer Support |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Limited |

Excellent |

Good |

Limited |

Good |

Excellent |

| Minimum Deposit |

$500 |

$0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker TradeZero

TradeZero is a well-regulated investment firm, offering commission-free trading on US stocks, ETFs, and options. Established in 2015, the broker provides access to proprietary trading platforms like ZeroPro, ZeroWeb, and ZeroMobile, as well as integration with TradingView for advanced charting and strategy tools.

Traders benefit from features such as direct market access, a short-locate tool, and up to 1:6 intraday leverage on margin accounts. TradeZero is regulated through multiple entities, including FINRA, CIRO, and the SCB, depending on the client’s location.

The broker focuses primarily on equities and options, with limited access to other asset classes. Overall, TradeZero is a strong choice for self-directed traders seeking low-cost, high-performance tools and short-term investment solutions.

Share this article [addtoany url="https://55brokers.com/tradezero-review/" title="TradeZero"]