- What is Tradeview?

- Tradeview Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Tradeview Compared to Other Brokers

- Full Review of Broker Tradeview

Overall Rating 4.4

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

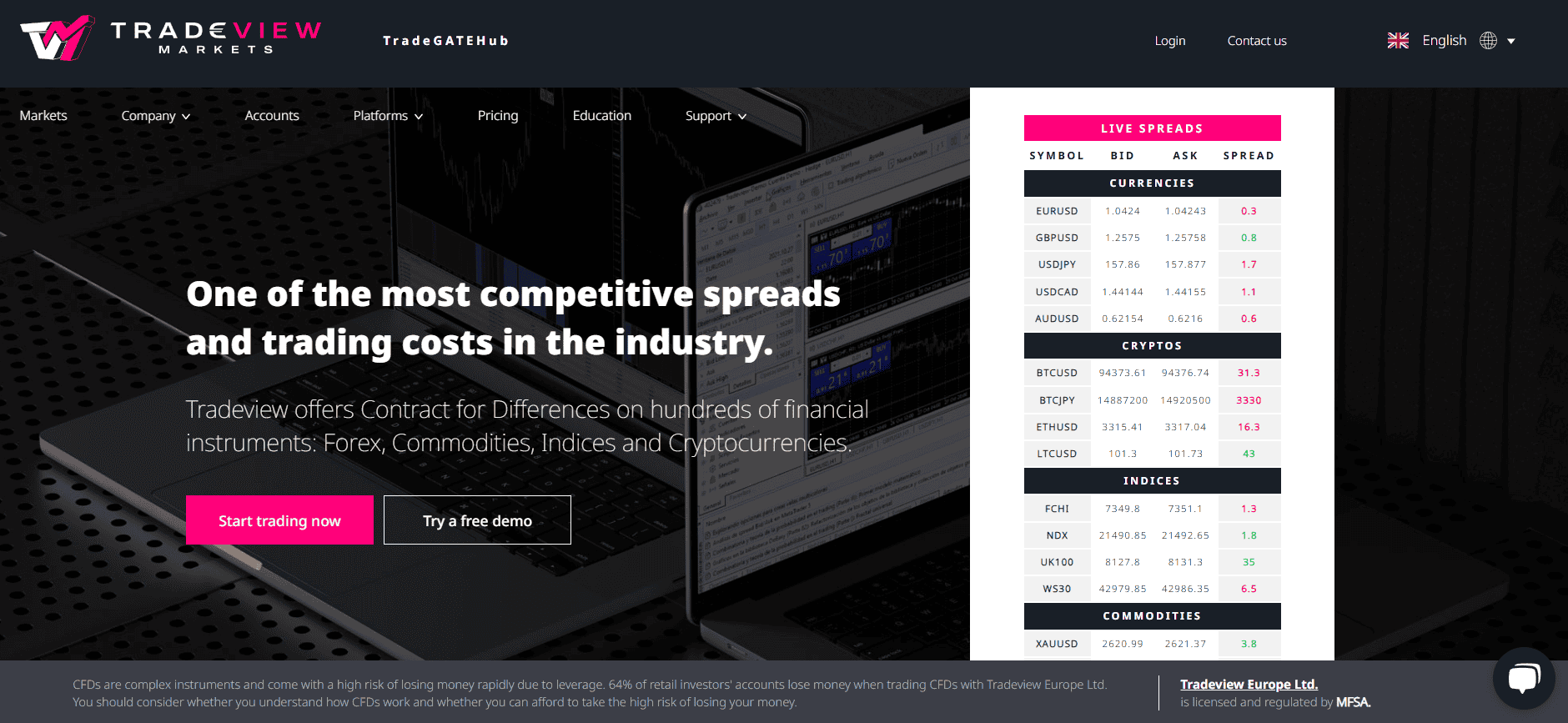

What is Tradeview?

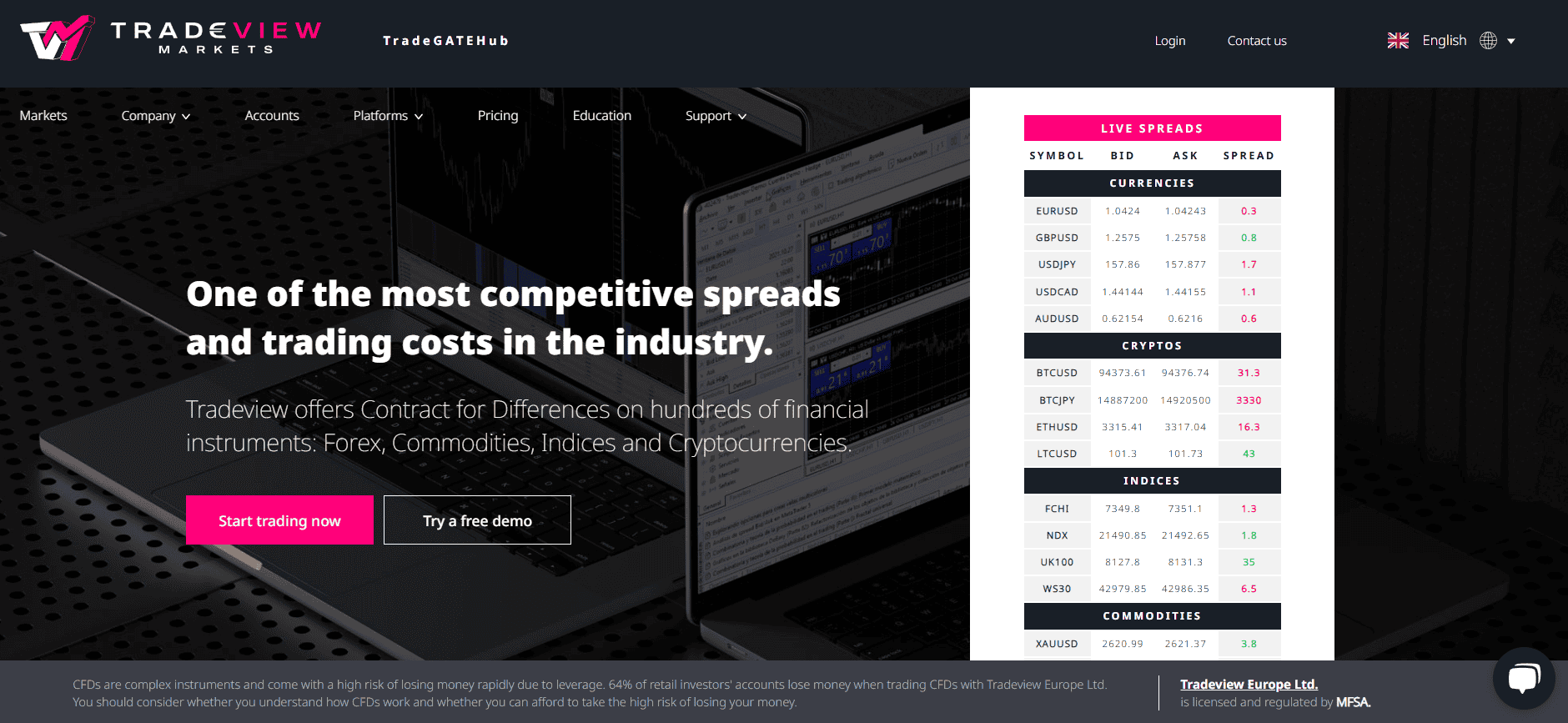

Tradeview is an innovative multi-asset broker committed to providing Direct Market Access (DMA) with competitive pricing, low spreads, and superior trading conditions for a diverse range of products, from Forex and CFDs to real stocks, and futures. With offices located in Malta, and the Cayman Islands as well as international regulations covering more than 100,000 clients worldwide, Tradeview offers a reliable way to explore global market opportunities.

Tradeview has been a front-runner in online finance for over 20 years, providing innovative trading platforms powered by cutting-edge technology. They excel in giving their clients secure accounts and multi-jurisdictional support as well as some of the most competitive spreads on the market.

Tradeview Pros and Cons

Tradeview is a reliable, digital brokerage with an impressive range of exceptional tools and instruments. Their MFSA license ensures security while providing access to CFDs as well as real stock exchanges. The research capabilities are outstanding and their educational materials are some of the best available, not to mention that they provide quick customer support.

Despite offering an array of excellent services, a few minor drawbacks are worth noting, such as the lack of 24/7 customer service and conditions that may differ depending on regulations. As well as international trading is done through offshore entities.

| Advantages | Disadvantages |

|---|

| Good Reputation and Strong Compliance | International trading is conducted through offshore entities |

| Worldwide coverage through entities in Malta, Cayman Islands, etc. | High minimum deposit |

| Forex and CFD instruments | Support not available 24/7 |

| Good quality trading technology | No Top-Tier license |

| Choice between MT4, MT5, and cTrader | |

| Low costs based on spread | |

| Quality customer support | |

Tradeview Features

Tradeview is a globally recognized online trading broker that offers a comprehensive range of features designed to provide traders with a user-friendly, and efficient trading experience across global financial markets. Here are the key features offered by Tradeview to consider when choosing a broker:

Tradeview Features in 10 Points

| 🏢 Regulation | MFSA, CIMA, FSC, FSA |

| 🗺️ Account Types | Individual, Joint, Corporate Accounts |

| 🖥 Trading Platforms | MT4, MT5, cTrader |

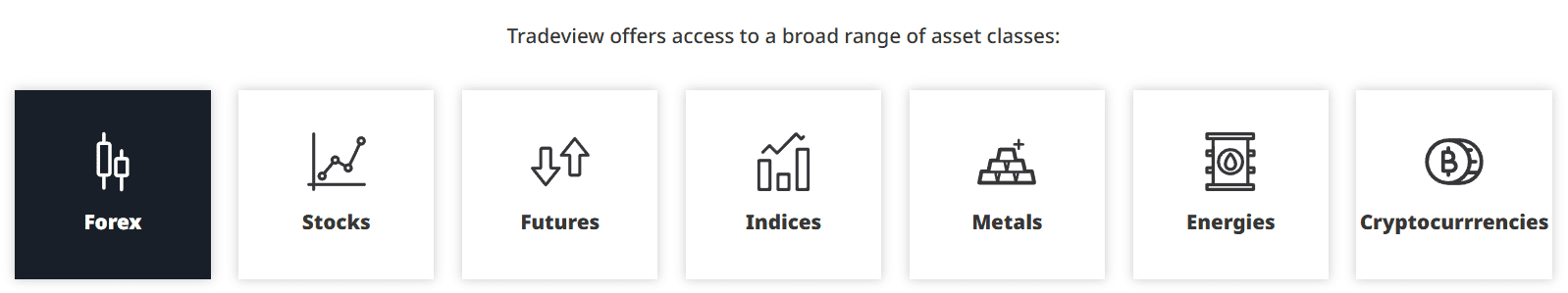

| 📉 Trading Instruments | Forex, CFDs, Stocks, Commodities, Indices, Cryptocurrencies, Futures, Metals, Energies |

| 💳 Minimum Deposit | $1000 |

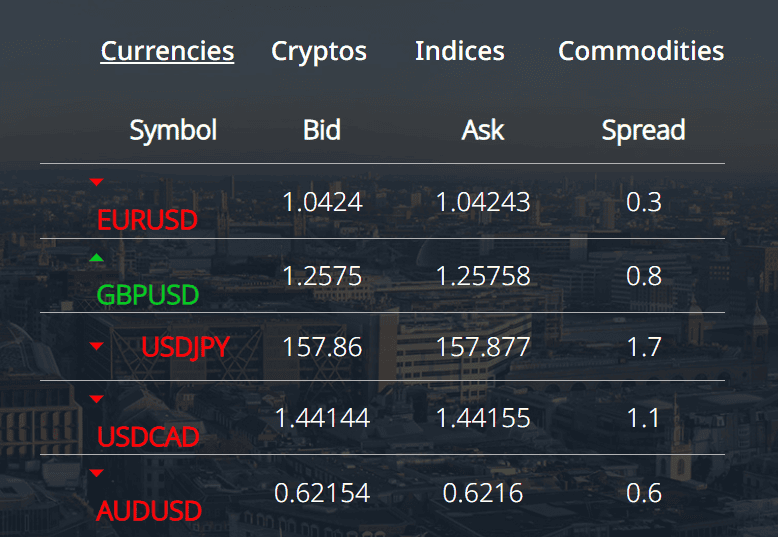

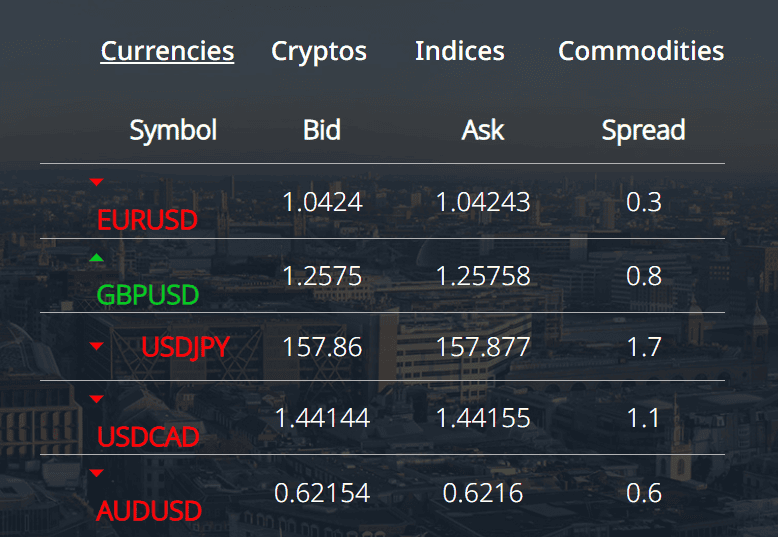

| 💰 Average EUR/USD Spread | 0.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP |

| 📚 Trading Education | TradeGATEHub, Surf's Up |

| ☎ Customer Support | 24/5 |

Who is Tradeview For?

Tradeview is designed for traders of all levels, offering a variety of trading platforms, transparent pricing, and a range of popular financial instruments. Based on our findings and Financial Expert Opinion Tradeview is Good for:

- Regular Traders

- Professional Traders

- Algorithmic or API Traders

- EAs running

- Copy Trading

- Scalping / Hedging Strategies

- Traders who prefer the MT4 or MT5 platforms

- For the cTrader Platform use

- Currency Trading and CFD Trading

- MAM/PAMM Trading

- Real Stock Trading

- Suitable for a Variety of Trading Strategies

Tradeview Summary

Our Tradeview Review concludes that the broker is a reliable trading provider that revolutionizes the trading experience allowing engaging in trading with the ECN model and quotes provided directly by the liquidity providers.

The broker offers various accounts with comprehensive features and different minimum deposit requirements that allow traders of different levels to start trading in Tradeview conveniently. Another distinguished advantage is that the broker instrument range also includes real stock exchange giving access to the world’s most popular companies’ shares.

55Brokers Professional Insights

Tradeview is a recognized broker that stands out for its Direct Market Access (DMA) model, offering transparent pricing, quite low spreads on popular instruments and fast execution speeds. What we like most is quite low spreads and multi-platform support, including MT4, MT5, and cTrader, so traders of all levels will find it technically comfortable along with advanced charting, algorithmic trading, and API access.

Tradeview mainly provides popular financial instruments, so flexibility is available for traders seeking portfolio diversification on most liquid products. However, the range is not so wide like thousands of products if to compare with other porposals. Also, one drawback is its relatively high minimum deposit requirement compared to competitors, which might deter smaller retail traders.

Additionally, while Tradeview is regulated, it lacks licenses from some of the most stringent financial authorities, which could raise concerns for risk-averse clients. Moreover, trading conditions may vary depending on the regulatory entity. Despite these drawbacks, Tradeview’s robust trading tools, competitive pricing, and commitment to professional trading solutions make it a strong choice for serious market participants.

Consider Trading with Tradeview If:

| Tradeview is an excellent Broker for: | - Looking for Low fees and spreads on popular instruments

- Need broker holding multiple licenses.

- Offering popular trading instruments.

- Looking for broker providing MT4, MT5, and cTrader trading platforms.

- Need broker with good trading tools and research.

- Broker suitable for beginners and professional traders.

- Prefer High Leverage access.

- Need Broker with Professional Education.

- Looking for broker with quality customer service.

- ECN trading and fast trading execution.

- Offering MAM/PAMM accounts. |

Avoid Trading with Tradeview If:

| Tradeview might not be the best for: | - Need broker holding Top-Tier license.

- Who prefer 24/7 customer support.

- Looking for a broker with a low minimum deposit requirement. |

Regulation and Security Measures

Score – 4.3/5

Tradeview Regulatory Overview

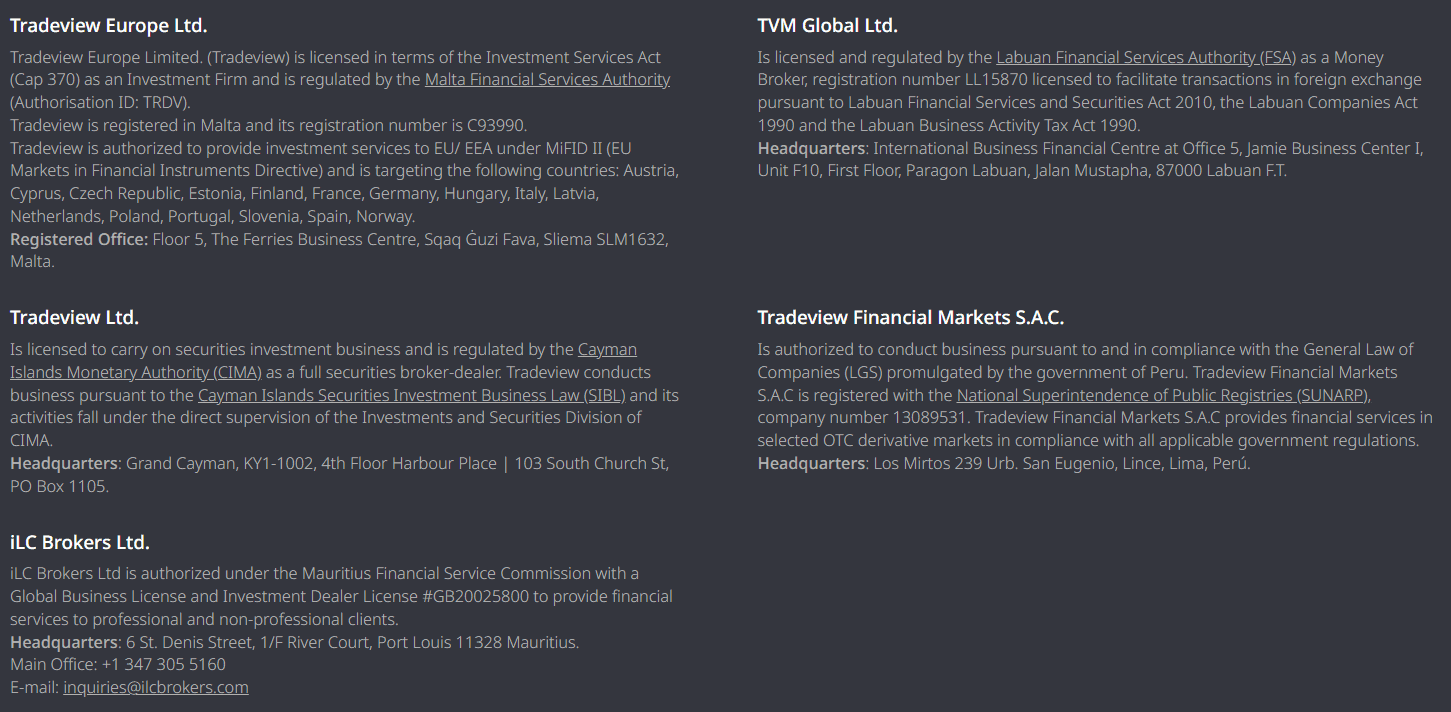

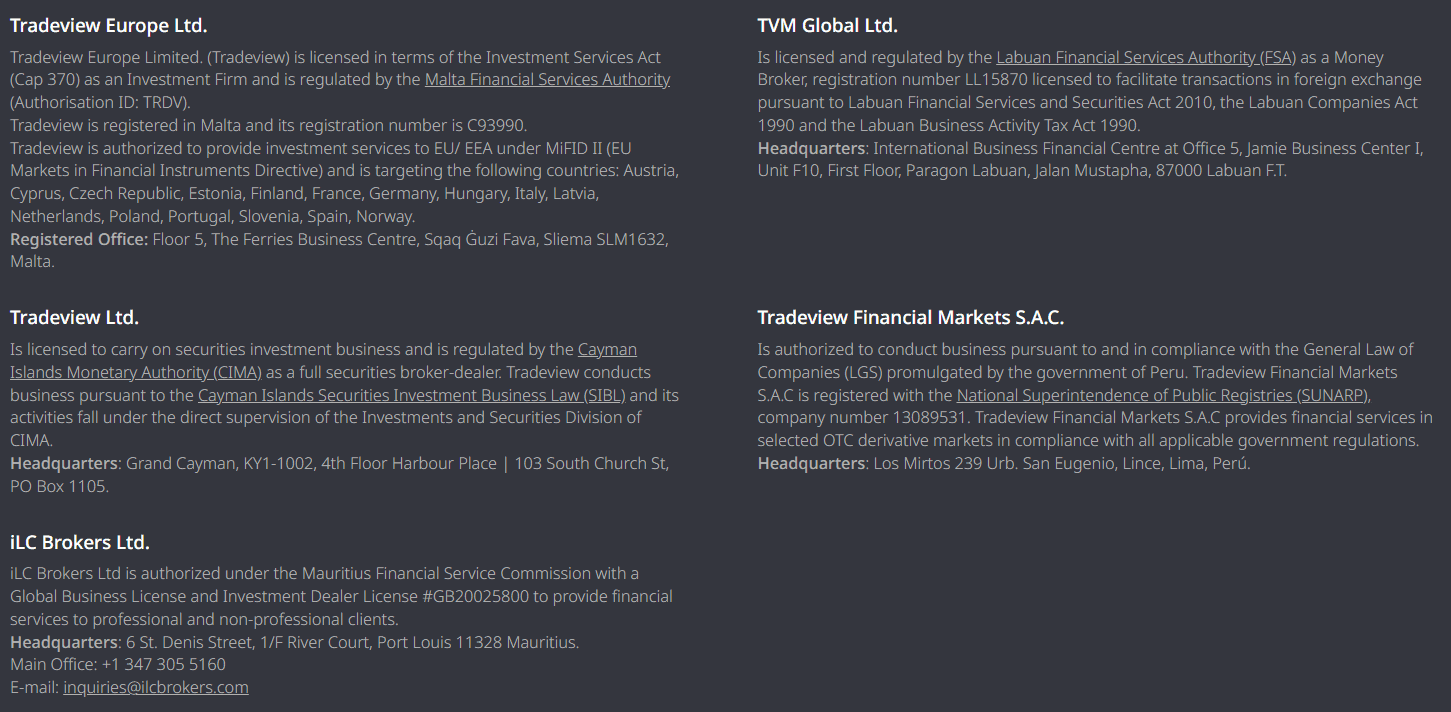

Tradeview Europe Ltd. is regulated by the Malta Financial Services Authority (MFSA), which is a member of the European Banking Authority (EBA), the European Securities and Markets Authority (ESMA), and the International Organization of Securities Commissions (IOSCO). Tradeview is authorized to provide financial services across multiple asset classes and is passported in the EU/EEA under MiFID II (EU Markets in Financial Instruments Directive).

Additionally, the broker serves several offshore entities in the Cayman Islands, Labuan, and Mauritius. As it is registered in offshore jurisdictions, Tradeview does not adhere to the same strict regulatory obligations as firms in more established financial centers. This may present a risk, so traders should thoroughly examine the trading conditions available in your region before making any investment decisions.

How Safe is Trading with Tradeview?

Tradeview is a safe and legitimate online broker, regulated by the European MFSA in Malta, and adheres to industry standards for secure trading. In addition to its security measures, it offers highly competitive conditions for traders worldwide.

Tradeview platforms also provide traders with comprehensive protection against the risks of negative account balances. Its cutting-edge margin watch features ensure that positions are swiftly closed if an account is at risk of going into the negative, maximizing security across all trades.

Consistency and Clarity

Tradeview has earned a solid reputation in the industry, backed by positive scores and reviews from traders. Its commitment to transparency, competitive trading conditions, and customer satisfaction has garnered trust from its global user base. Also, the broker is known for its active presence in the trading community and industry, including sponsorships of key events and collaborations that help solidify its position as a respected broker.

While Tradeview offers a diverse range of services, one drawback is its relatively high minimum deposit requirement, which may limit access for smaller retail traders. Additionally, although the broker is regulated in Malta by the MFSA, its offshore operations in regions like the Cayman Islands and Mauritius may raise concerns for risk-averse clients, as these areas are not subject to the same strict regulatory standards as more established financial centers. However, Tradeview’s overall reputation and active presence in the financial community position it as a reliable choice for serious traders.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Tradeview?

Tradeview offers a range of account types to suit different trading needs, including Individual, Joint, and Corporate Accounts. Individual Accounts are designed for single traders, providing access to a variety of financial instruments and trading platforms. Joint Accounts are ideal for two or more individuals who wish to trade together, sharing profits and losses. Corporate Accounts are tailored for businesses, allowing companies to manage trading activities under a corporate entity.

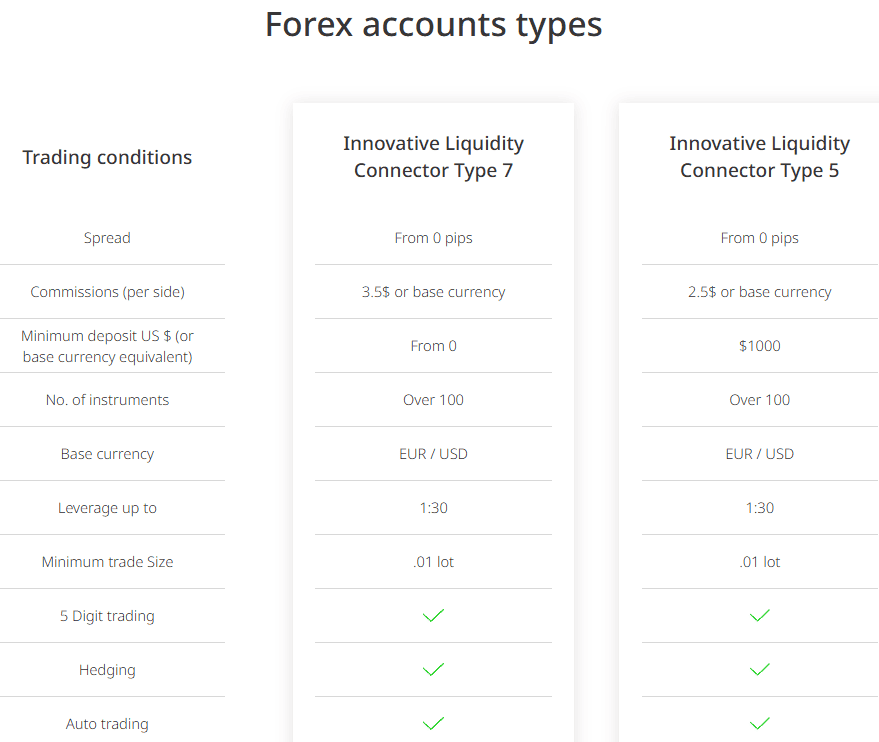

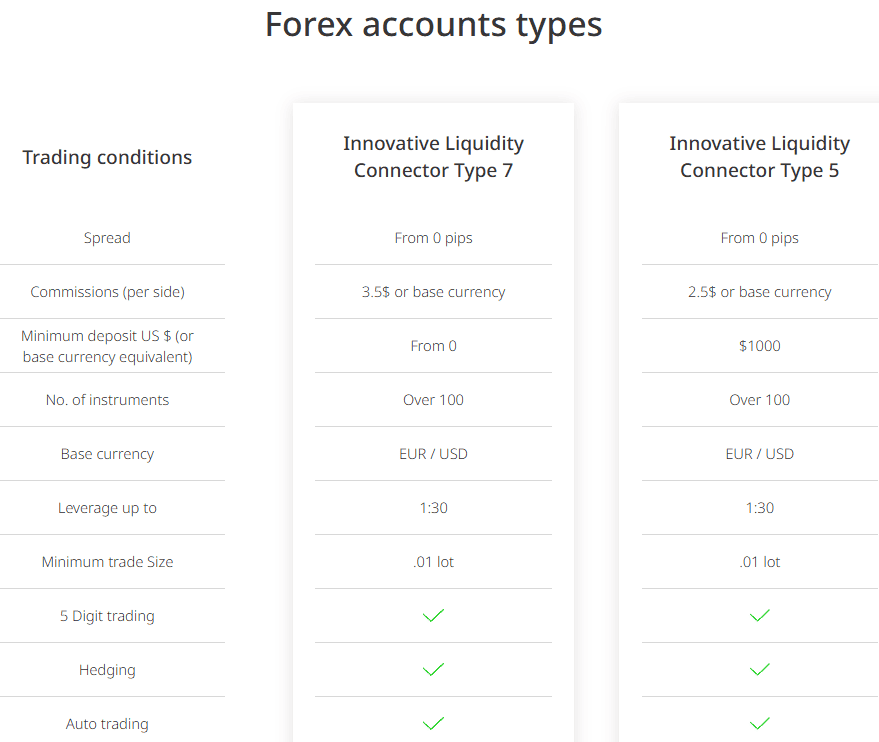

Additionally, Tradeview offers specialized Forex account types, such as the Innovative Liquidity Connector (ILC) Type 7 and ILC Type 5. The ILC Type 7 is suited for traders with deposits below $1,000, offering competitive spreads and fast execution through access to top-tier liquidity providers.

In contrast, the ILC Type 5 is designed for traders with deposits of $1,000 or more, providing enhanced trading conditions with tighter spreads and lower commissions, leveraging Tradeview’s advanced liquidity technology. These accounts are accessible through MetaTrader platforms, offering traders a wide array of tools and features to support their trading strategies.

In addition, you may always sign in for a Free Demo Account, so you can see trading conditions, simulate performance, and make your decision further.

ILC Type 7 Account

The Innovative Liquidity Connector (ILC) Type 7 account offers exceptional trading conditions tailored for traders with smaller deposits. This account type features spreads starting from 0 pips, allowing traders to take advantage of highly competitive pricing, particularly for popular currency pairs like EUR/USD.

The commission for this account type is $3.50 (or the equivalent in the base currency) per lot, providing cost-effective trading for those looking to minimize fees. With a minimum deposit requirement of just $0, this account type is accessible to traders of all experience levels. It supports trading with leverage up to 1:30, offering flexibility in position sizing, and allows for trading from as small as 0.01 lot. With access to over 100 trading instruments, including Forex pairs, commodities, and indices, the account provides a robust solution for those seeking competitive spreads, low costs, and a broad range of trading opportunities.

ILC Type 5 Account

The Innovative Liquidity Connector (ILC) Type 5 account from Tradeview is designed for traders with a minimum deposit of $1,000, offering a more enhanced trading experience compared to the Type 7 account. The commission for the Iaccount is $2.50 (or the equivalent in the base currency) per lot.

With leverage up to 1:30, this account offers greater flexibility for traders to manage their positions, while allowing trading from as small as 0.01 lot. With an initial deposit of $1,000, Tradeview’s Innovative Liquidity Connector provides ECN trading with zero markups and the lowest spreads in the industry.

Regions Where Tradeview is Restricted

Tradeview has certain regional restrictions in place due to regulatory requirements. As a result, the broker is not available to residents of some countries. These restrictions typically include regions where the broker is either not licensed or cannot comply with local financial regulations. Some of the regions where Tradeview is restricted include:

Cost Structure and Fees

Score – 4.6/5

Tradeview Brokerage Fees

Tradeview offers competitive brokerage fees, designed to suit both retail and professional traders. The fees are typically structured as either spread-based or commission-based, with trading available at nearly zero pips and no markups, complemented by a low commission of just $2.50 per standard lot.

Additionally, the broker maintains overall low funding fees, ensuring affordability in managing trading accounts. However, traders should be mindful of the rollover fee applicable when positions are held overnight. These fees, which apply to extending positions beyond the trading day without settling, are influenced by market volatility and can fluctuate. With its industry-leading trading conditions, Tradeview balances affordability and efficiency for a wide range of trading strategies.

Tradeview provides low spreads that cater to traders seeking competitive trading conditions. The spreads vary depending on the account type and the regulatory entity through which you trade. The average EUR/USD spread is as low as 0.3 pips, while the spreads for USD/EUR can start from 0 pips under specific account conditions, making it an excellent choice for cost-conscious traders.

Such tight spreads are particularly advantageous for scalpers and high-frequency traders who require minimal trading costs.

Tradeview offers a competitive commission structure designed to appeal to traders of all levels. The commission rates vary depending on the account type, with some accounts charging as low as $2.50 per standard lot for Forex trading. This low-cost commission model is particularly advantageous for high-volume traders and professionals who prioritize keeping trading expenses minimal.

Additionally, certain accounts integrate the commission into the spreads, offering flexibility in fee structures to suit different trading strategies. While the overall commissions are highly competitive, traders should review the specific terms for their account type and trading instruments to understand the full cost structure.

- Tradeview Rollover / Swaps

Tradeview applies rollover fees (or swaps) to positions held overnight, a standard practice in Forex trading to account for the interest rate differential between the two currencies being traded. These fees are calculated daily and can either be a credit or a debit to the trader’s account, depending on the direction of the trade and the prevailing interest rates.

The exact rollover rates vary and are subject to changes based on market conditions and volatility, so traders should monitor these fees regularly. For those trading larger volumes or holding positions long-term, rollover costs can accumulate and impact overall profitability.

How Competitive Are Tradeview Fees?

Tradeview’s fees are highly competitive, making the broker an appealing choice for cost-conscious traders. The combination of low spreads, minimal commission rates, and low funding fees ensures affordability for both retail and professional market participants.

However, some drawbacks include the relatively high minimum deposit requirement for certain accounts, which may deter smaller traders, and variable rollover fees, which can fluctuate based on market volatility and add to costs for positions held overnight. Overall, while Tradeview excels in providing cost-effective trading conditions, traders should carefully evaluate the fee structure relative to their trading style and account type.

| Asset/ Pair | Tradeview Spread | Trade.com Spread | XS Spread |

|---|

| EUR USD Spread | 0.3 pips | 1.9 pips | 1.1 pips |

| Crude Oil WTI Spread | 0 pip | 4 pips | 2.3 pips |

| Gold Spread | 3.8 pips | 0.6 pips | 2.1 pips |

| BTC USD Spread | 31.3 pips | 10.01 USD | 520 |

Tradeview Additional Fees

In addition to trading fees such as spreads and commissions, Tradeview may charge additional fees depending on the services used and trading activity. One notable fee is the rollover fee for positions held overnight, which varies based on market conditions and interest rate differentials.

Funded accounts that remain inactive for six months are subject to an inactivity fee of $50, encouraging active engagement with the platform. Deposit and withdrawal fees can also vary, depending on the payment method and currency used, with some methods incurring extra charges.

While these fees are generally in line with industry standards, traders should carefully review the terms associated with their account type and trading region to avoid unexpected costs.

Trading Platforms and Tools

Score – 4.7/5

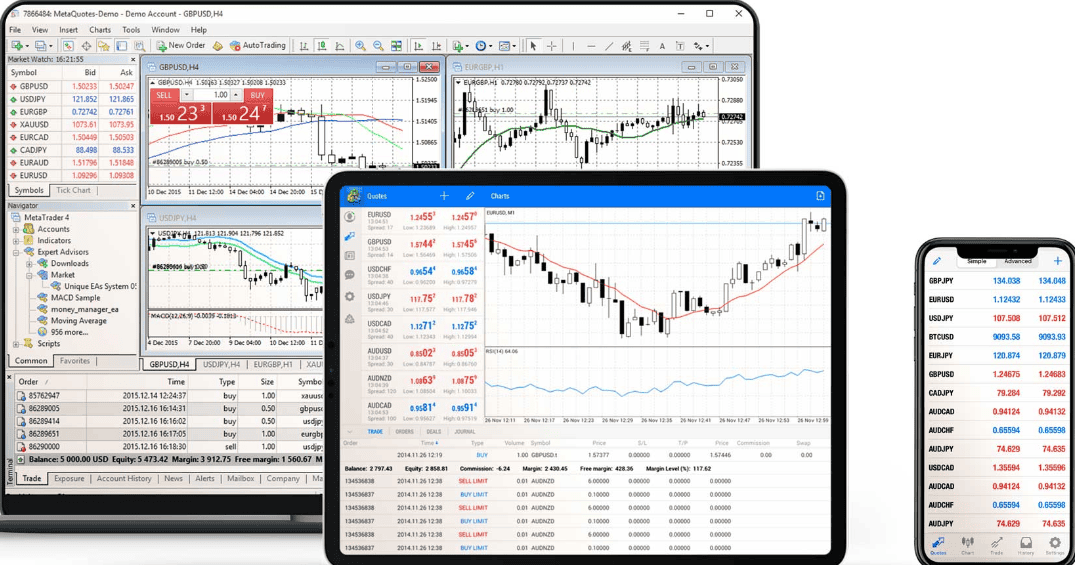

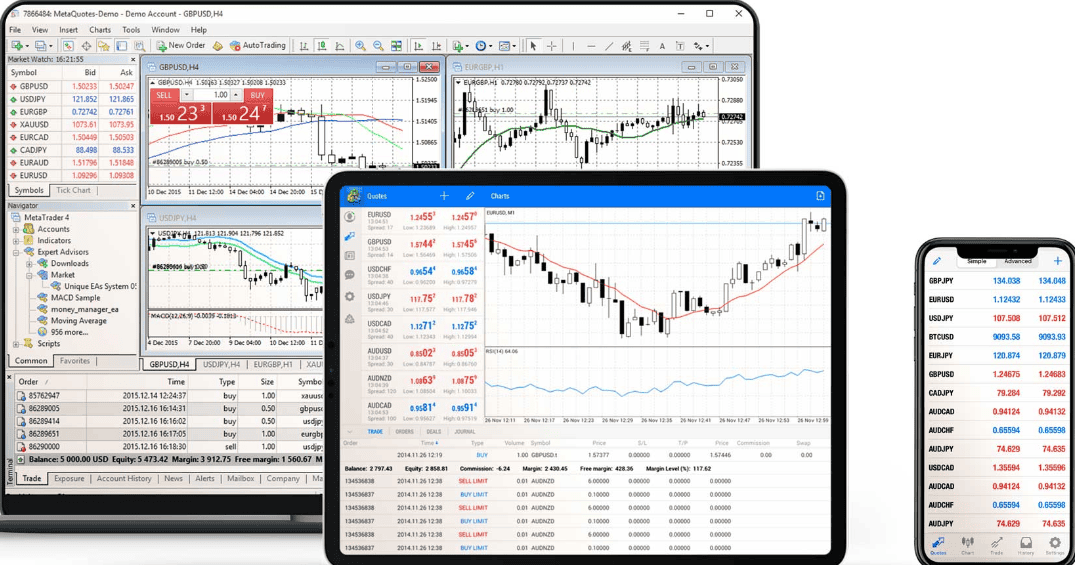

Tradeview offers a robust selection of trading platforms, including the widely recognized MT4 and MT5 platforms, both known for their good charting tools, expert advisors for algorithmic trading, and a wide range of technical indicators.

Additionally, Tradeview provides access to cTrader, a platform favored for its intuitive interface and superior execution capabilities, however, it is available exclusively through the CIMA-regulated entity. These platforms are complemented by innovative tools, offering seamless access to deep liquidity pools and highly competitive trading conditions.

Trading Platform Comparison to Other Brokers:

| Platforms | Tradeview Platforms | Trade.com Platforms | XS Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | Yes | No | No |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Tradeview Web Platform

Tradeview’s web platform provides traders with seamless access to the MT4 and MT5 platforms directly from their browsers, without requiring any downloads or installations. This web-based solution offers the full functionality of its desktop counterparts, including charting tools, real-time market analysis, and a variety of technical indicators.

The platform is optimized for speed and compatibility, ensuring a smooth trading experience across all major browsers and operating systems. With the ability to execute trades, manage positions, and analyze markets on the go, Tradeview’s web platform is ideal for traders who value flexibility and convenience. However, some features, such as automated trading through expert advisors (EAs), are more limited on the web version compared to the desktop platforms.

Tradeview Desktop MetaTrader 4 Platform

The MetaTrader 4 desktop platform is a feature-rich solution designed for traders seeking diverse tools and reliability. A standout addition is the Tradeview MAM plugin, which offers a simple, fast, and effective way for money managers to allocate trades across multiple accounts seamlessly.

The platform also integrates the Tradeview Copier, enabling traders to copy their trades directly into client accounts with ease. For those looking to replicate the success of others, the My FXbook AutoTrade feature provides access to hundreds of top-performing Forex traders, all vetted and approved by My FXbook. Additionally, the platform supports the development and execution of automated trading systems, written in MetaQuotes Language 4 (MQL4), allowing traders to implement sophisticated strategies.

Tradeview Desktop MetaTrader 5 Platform

The Tradeview MetaTrader 5 desktop platform offers a range of advanced features that enhance the trading experience for traders. With access to all major US exchanges, including Netflix, Apple, Amazon, and Facebook, MT5 allows traders to diversify their portfolios by trading equities in addition to forex and commodities.

The platform boasts a user-friendly interface, equipped with trading robots and copy trading tools, making it easy for traders to develop and execute personalized strategies. MT5’s high-performance infrastructure, powered by multiple servers, ensures fast execution and low latency, minimizing delays in trade execution. The integrated economic calendar provides real-time updates on macroeconomic events, helping traders stay informed and ahead of the market.

Additionally, with one-click trading, users can streamline their order placement, reducing execution time and slippage. MT5 also supports hedging in its account settings, allowing traders to manage risk by holding opposing positions on the same currency pair. These features make MetaTrader 5 a comprehensive and powerful trading platform suitable for all levels of traders.

Main Insights from Testing

Testing the MT5 platform reveals a robust and highly versatile trading tool that stands out for its enhanced charting capabilities, with more timeframes and order types compared to its predecessor, MetaTrader 4. It offers advanced technical analysis tools, such as additional indicators, drawing tools, and graphical objects, which make market analysis more precise.

The platform’s multi-asset capability, which extends beyond forex to include stocks, commodities, and indices, provides traders with the ability to manage a diverse portfolio. MT5’s multi-threaded strategy tester allows for backtesting trading algorithms on different instruments simultaneously, enhancing the evaluation of trading strategies. Additionally, the platform supports seamless integration with automated trading systems, offering traders a high degree of flexibility and control over their trading experience.

Tradeview Desktop cTrader Platform

The cTrader platform offers an intuitive solution for trading Forex and CFDs, providing ultra-fast execution and direct access to prices from over 52 liquidity providers via ECN connectivity. This enables traders to place multiple orders in milliseconds, optimizing trade execution.

cTrader’s advanced risk management tools offer flexibility, allowing traders to easily set and adjust parameters. The platform features premium graphics, including tick charts, for enhanced technical analysis. It also allows for complete customizability of layouts, indicators, and timeframes, enabling traders to tailor their workspace. Available through the CIMA-regulated entity, cTrader ensures a secure and compliant trading environment. Additionally, traders can benefit from personalized support from a dedicated Tradeview Markets agent, ensuring a seamless and efficient trading experience.

Tradeview MobileTrader App

The MobileTrader App offers a comprehensive and user-friendly solution for traders who want to manage their trades on the go. Available for both iOS and Android devices, the app is compatible with MT4, MT5, and cTrader, providing traders with flexibility in platform choice.

It offers real-time market data, allowing traders to monitor positions and execute trades easily from anywhere. The app supports a wide range of order types, including market, limit, and stop orders, and features advanced charting tools for detailed technical analysis. Traders can also set real-time price alerts and customize their interface for a tailored experience.

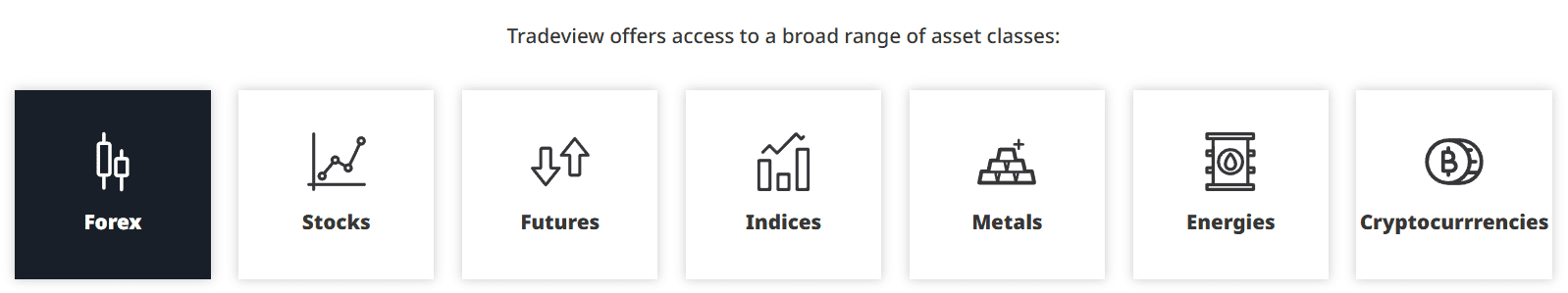

Trading Instruments

Score – 4.4/5

What Can You Trade on Tradeview’s Platform?

Tradeview offers a range of over 200 trading instruments through its Forex and CFD models, allowing traders to trade indices, metals, cryptocurrencies (Bitcoin, Litecoin, and Ethereum), energies, stocks, and futures. This provides vast and flexible opportunities for price speculation without the need for ownership of the underlying assets.

The broker is also known for providing access to real stocks, futures, and options exchanges, offering exposure to some of the largest stock markets in the world.

Main Insights from Exploring Tradeview’s Tradable Assets

Exploring Tradeview’s tradable assets reveals a diverse and flexible range of options for traders. You can trade popular currency pairs such as EUR/USD, USD/JPY, and USD/CAD around the clock, taking advantage of some of the lowest spreads in the industry through Tradeview’s Innovative Liquidity Connector.

The platform also provides access to real stocks of major companies like Apple, Netflix, Starbucks, and Tesla, along with ETFs tracking major indices like the S&P 500 and NASDAQ 100. However, the trading conditions and offerings can vary depending on the entity through which you are trading, so you should review the specific conditions before placing trades.

Leverage Options at Tradeview

Like most Forex brokers, Tradeview also offers leverage, which increases the potential of gains through its ability to multiply initial accounts balance. However, a multiplier should be used smartly as it increases the power of losses as well.

Tradeview Leverage levels depend on the instrument you trade and are defined by the regulatory restrictions together with your level of proficiency:

- European retail clients and those who trade with Malta Tradeview entities are eligible to use the leverage of 1:30 for major currencies, 1:20 for minor ones, and 1:10 for commodities due to ESMA restrictions.

- Yet, trading with the global offshore Tradeview branches you may access higher leverage ratios that go to a maximum of 1:400.

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at Tradeview

Tradeview deposit methods include multiple offerings from various providers that cover the needs of almost every client and are truly globally covered. The methods include:

- Credit/Debit Cards

- Bank Wire

- Skrill

- Neteller

- Fasapay

- Sticpay, and more

Tradeview Minimum Deposit

Tradeview requires different minimum deposit amounts depending on the account type. For the ILC Type 7 account, the minimum deposit is below $1,000, while for the ILC Type 5 account, the minimum deposit is $1,000 or more.

Withdrawal Options at Tradeview

Tradeview offers convenient withdrawal options, with funds released through the same method used for the initial deposit. This ensures security and consistency in the withdrawal process.

Notably, Tradeview does not charge any fees for withdrawals, making it a cost-effective choice for traders looking to access their funds. However, traders should note that withdrawal times may vary depending on the method used and the processing time of the financial institutions involved.

Customer Support and Responsiveness

Score – 4.6/5

Testing Tradeview’s Customer Support

Tradeview’s clients can take advantage of multichannel assistance 24/5 in multiple languages, including email and international telephone calls. It also provides a Live chat feature.

With their experienced customer support staff always ready to help, traders can take advantage of an invaluable asset that serves as a great boost for them.

Contacts Tradeview

Tradeview provides multiple contact options for customer support. For general inquiries or assistance, you can reach them via email at support@tradeview.eu. Additionally, for clients in the European Union, the broker offers phone support at +356 20311017.

Tradeview is committed to providing timely and effective assistance to ensure a smooth trading experience for its clients across various regions.

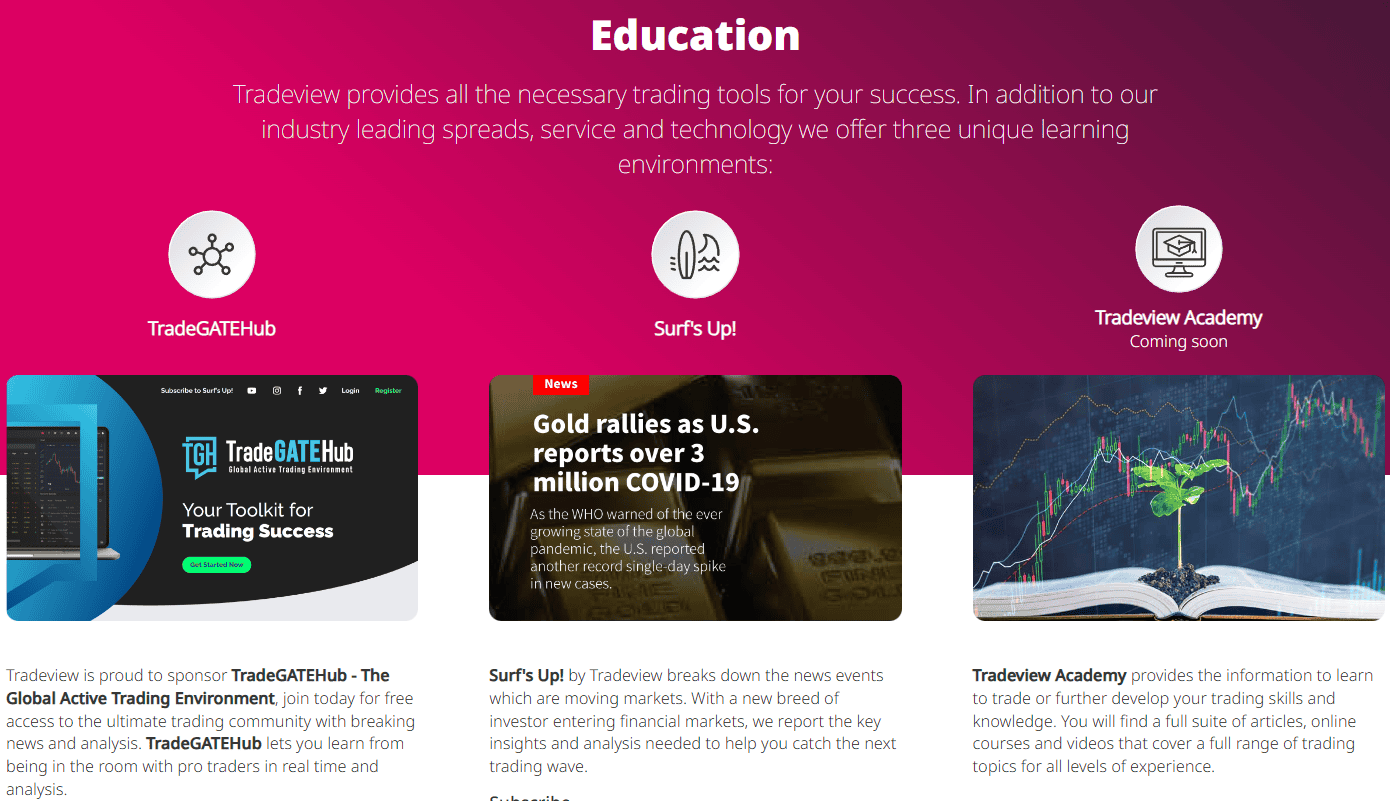

Research and Education

Score – 4.4/5

Research Tools Tradeview

Tradeview offers a suite of research tools across its website and trading platforms to enhance traders’ analysis and decision-making.

- On the website, traders can access real-time news feeds, an economic calendar, and market analysis, keeping them informed about key market events. Additionally, the website provides educational resources to help traders improve their skills.

- On trading platforms, such as MetaTrader 4, MetaTrader 5, and cTrader, traders can take advantage of advanced charting tools, multiple technical indicators, and drawing tools to analyze price action and market trends.

- The platforms also support algorithmic trading with EAs on MetaTrader and automated systems on cTrader. These platform-based tools allow traders to execute strategies with high precision and speed, giving them a complete trading experience.

Education

Tradeview Education Section provides essential trading tools to support traders’ success. The broker sponsors TradeGATEHub, the Global Active Trading Environment. Traders can join for free access to a comprehensive trading community, offering breaking news and analysis. TradeGATEHub allows traders to learn in real-time by engaging with professional traders and their analyses.

Surf’s Up! by Tradeview offers breakdowns of the key news events that are moving markets. This platform provides valuable insights and analysis to help traders navigate the evolving financial markets, especially with the new breed of investors entering the trading scene.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options Tradeview

While Tradeview’s primary focus is on Forex and CFD trading, it also offers a few investment options. These include real stock trading, allowing traders to invest in individual shares of prominent companies.

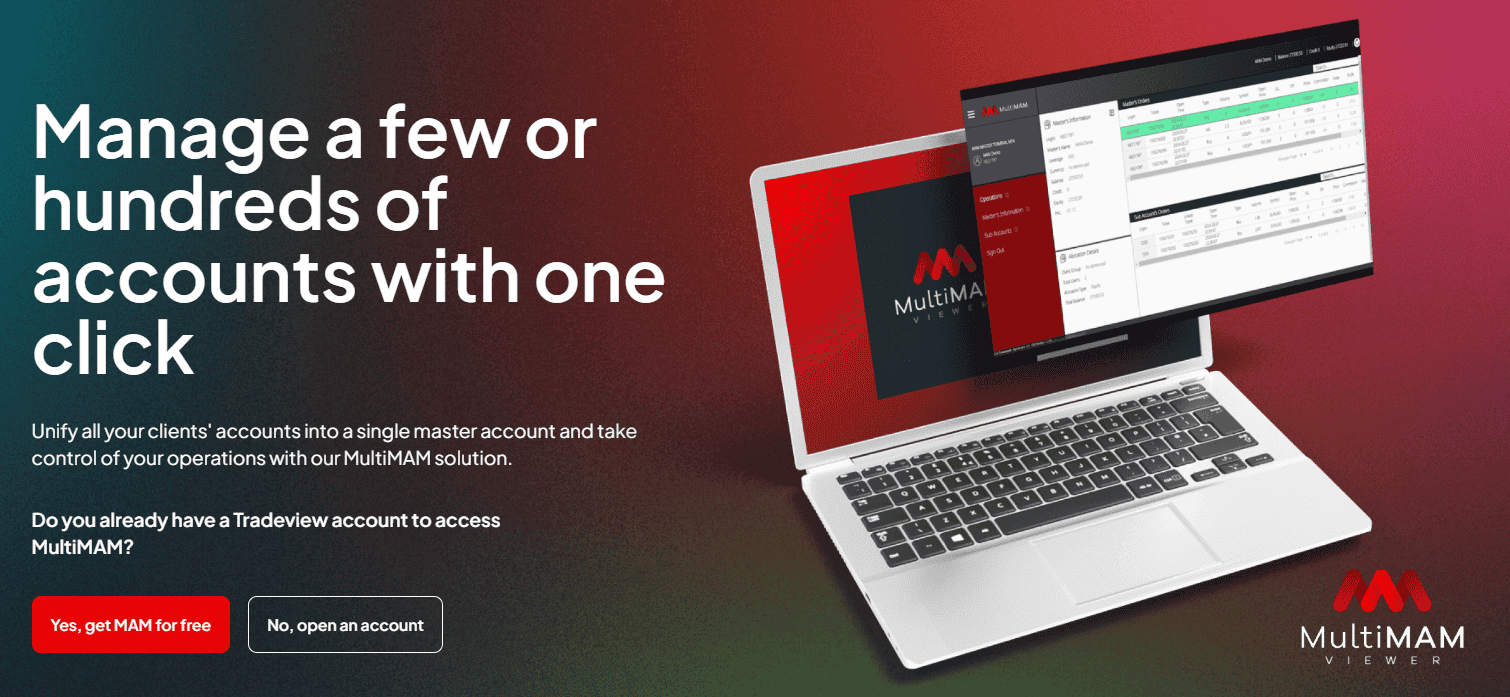

Additionally, Tradeview provides MAM and PAMM accounts for those looking to manage multiple accounts or invest in professional fund managers’ strategies. The broker also supports copy trading, enabling users to copy the trades of experienced traders as part of their investment strategy.

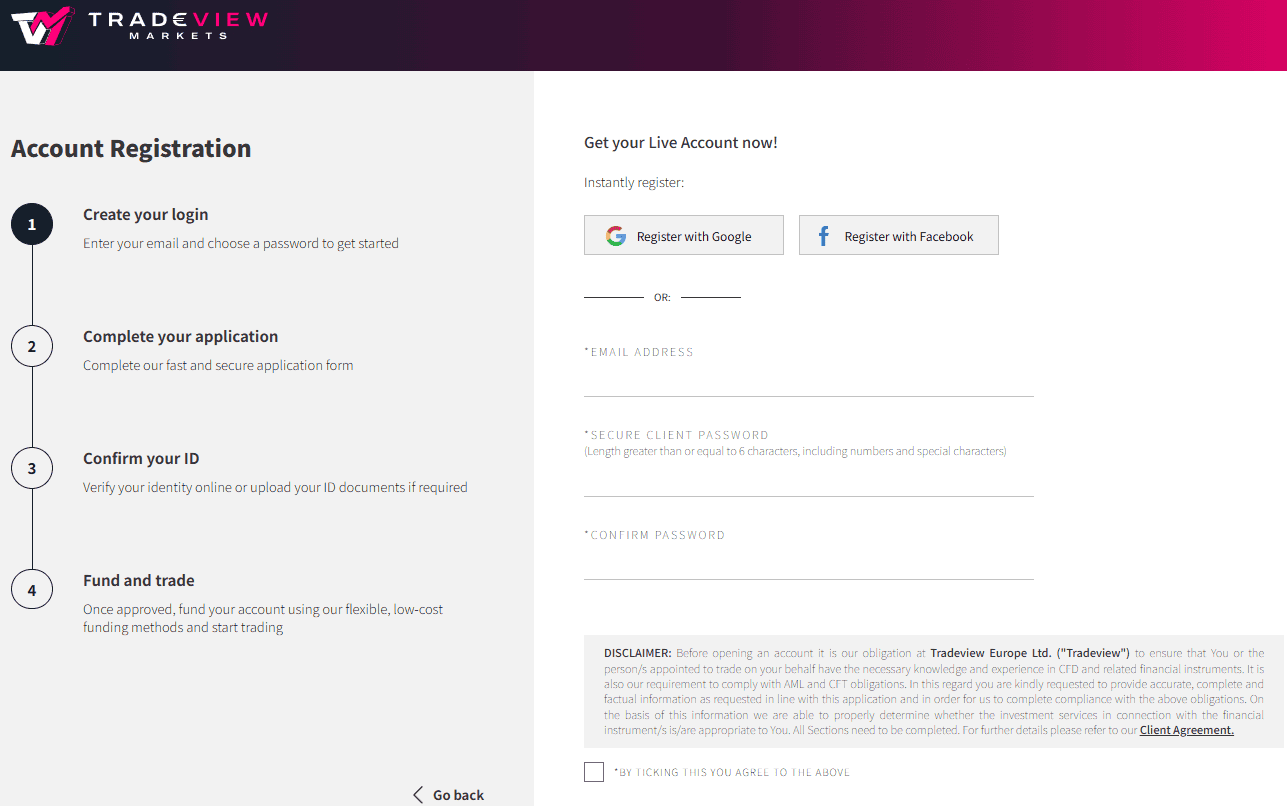

Account Opening

Score – 4.5/5

How to Open Tradeview Demo Account?

Opening a demo account with Tradeview is a great way to explore the platform, familiarize yourself with its features, and practice your trading strategies without risking real money. To open a demo account, follow these simple steps:

- Go to the official Tradeview website.

- Look for the “Try a Free Demo” option on the homepage and click on it.

- Provide the necessary information, including your name, email address, phone number, and preferred platform.

- Choose the type of demo account you wish to open, such as an ILC Type 7 or Type 5 account, based on your preference.

- Select the base currency and leverage options you prefer.

- Complete the registration by submitting the form. You may receive a confirmation email with your demo account credentials.

- If you have not already, download the trading platform you selected on your desktop or mobile device.

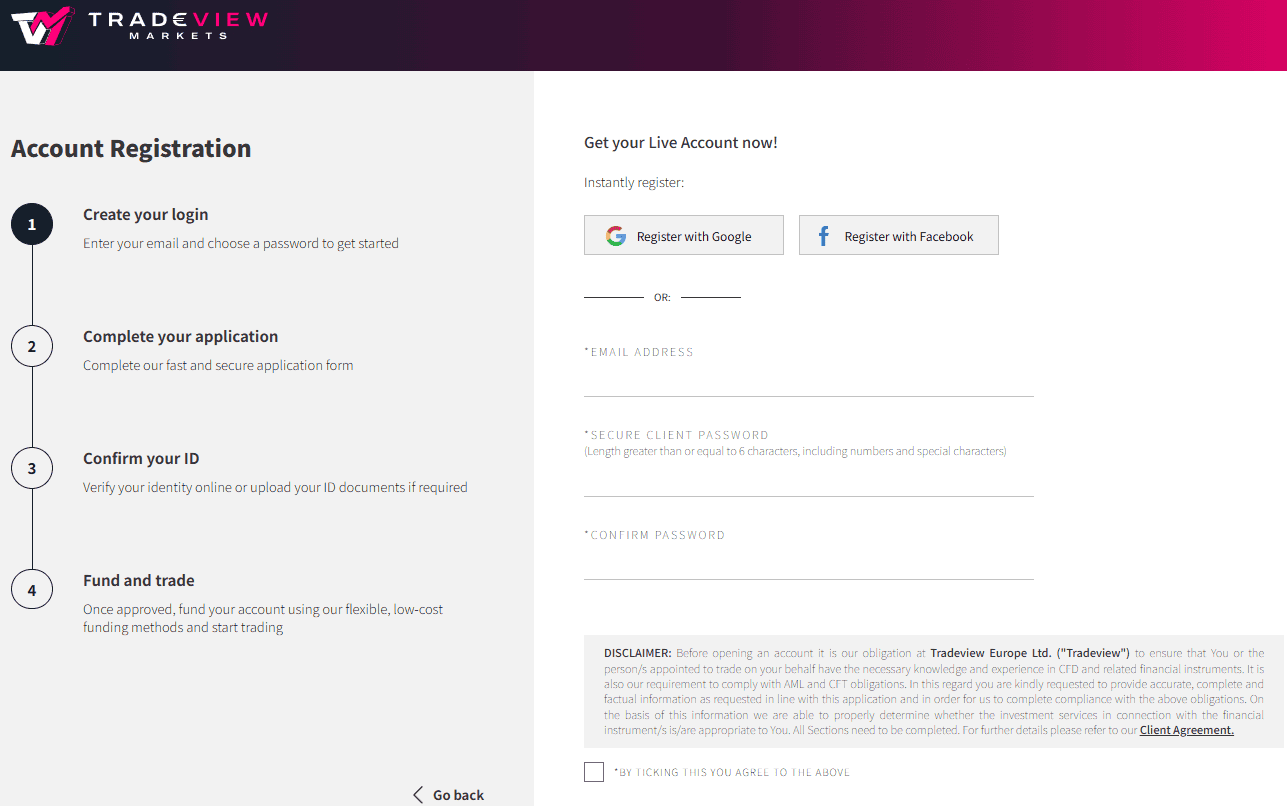

How to Open Tradeview Live Account?

Opening a live account with Tradeview is a straightforward process that allows you to start trading with real funds and access a range of financial instruments. To begin, visit the broker’s official website, select the “Start Trading Now” option, and then choose the account type.

You will be required to provide personal details such as your full name, email address, phone number, and residential address. Additionally, you will need to select the account type that suits your trading preferences, whether it is for Forex, CFDs, or other instruments.

After submitting your application, you may need to verify your identity by providing documents such as a government-issued ID and proof of address. Once your account is approved, you can fund it via various payment methods and begin trading on your chosen platform.

Additional Tools and Features

Score – 4.4/5

Tradeview offers a few tools and features to help traders manage their trades effectively.

- The broker provides access to automated trading through Expert Advisors on MetaTrader platforms, allowing users to execute trades based on predefined criteria without manual intervention.

- MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) systems are designed for money managers and investors. These systems enable users to manage multiple accounts from a single platform, allowing for efficient trade allocation and portfolio management.

- Tradeview also provides social trading tools, including copy trading, where traders can replicate the strategies of successful traders in real time.

- Also, the broker offers direct market access through its Innovative Liquidity Connector (ILC) technology, which allows traders to benefit from ultra-low spreads and high liquidity. These additional features give traders more flexibility and opportunities to optimize their strategies and improve trading performance.

Tradeview Compared to Other Brokers

Tradeview stands out in the competitive brokerage landscape due to its combination of low spreads, flexible account types, and cutting-edge platforms such as MT4, MT5, and cTrader. Tradeview’s commission-based accounts are attractive, offering $2.50 per standard lot, which is more affordable than some competitors that charge higher commissions for similar services.

However, Tradeview’s asset variety is smaller than that of some of the largest players, such as Markets.com, which offers over 2,200 instruments, or Forex.com, with its vast range of over 6,000 assets. Tradeview also offers solid regulation through the European authority MFSA, but some competitors, like Forex.com, have broader regulatory coverage with licenses across multiple regions, including the FCA and NFA.

While Tradeview excels with its low fees and superior liquidity access, it may not provide as expansive an asset variety or as many educational resources as brokers like Forex.com and Markets.com. Overall, Tradeview provides a strong proposition for traders seeking low costs and high-quality trading platforms. However, those seeking a wider range of tradable assets, more robust educational content, and research tools may find other brokers more suitable.

| Parameter |

Tradeview |

Markets.com |

Forex.com |

XS |

Axi |

Xtrade |

GMI |

| Spread Based Account |

Average 0.3 pips |

Average 1 pip |

Average 1.3 pips |

Average 1.1 pips |

Average 1.2 pips |

Average 2 pips |

Average 1 pip |

| Commission Based Account |

0.0 pips + $2.5 |

For Stocks Only ($1 per $1,000 trade) |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $7 |

No commissions, based on fixed spreads |

0.0 pips +$4 |

| Fees Ranking |

Low/ Average |

Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5, cTrader |

Markets.com Web, MT4, MT5, TradingView, Markets.com Social Trade App |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, Axi Trading App, Axi Copy Trading App |

Xtrade WebTrader |

MT4, MT5, GMI Edge |

| Asset Variety |

200+ instruments |

2,200+ instruments |

6000+ instruments |

1000+ instruments |

220+ instruments |

1,000+ instruments |

70+ instruments |

| Regulation |

MFSA, CIMA, FSC, FSA |

CySEC, FCA, ASIC, FSCA, FSC, FSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, FCA, CySEC, DFSA, FSA |

FSC, FSCA |

FCA, FSC |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Good |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$1000 |

$100 |

$100 |

$0 |

$0 |

$250 |

$25 |

Full Review of Broker Tradeview

Tradeview is a competitive broker offering popular trading platforms like MT4, MT5, and cTrader, known for their high-speed execution and customizability. With spreads starting at 0.3 pips and low commission rates of $2.50 per standard lot, the broker provides cost-effective trading conditions.

Tradeview is well-regulated by MFSA and offers over 200 tradable assets, including forex, stocks, indices, metals, and cryptocurrencies, making it suitable for forex and CFD traders. However, its asset range is somewhat smaller compared to other brokers.

The broker also provides useful tools like copy trading, MAM accounts, and liquidity connectors for fast execution. While Tradeview offers solid educational resources, such as TradeGATEHub and Surf’s Up! reports, its educational materials may not be as extensive as those offered by other brokers. Overall, Tradeview excels in low costs and high-quality platforms, but traders seeking a broader asset range, more comprehensive educational content, and research tools may find other brokers more suitable.

Share this article [addtoany url="https://55brokers.com/tradeview-review/" title="Tradeview"]