TradeDay 2025 Review

-

Written by:

George Rossi -

Updated:

Leverage: —

Regulation: USA

Min. Deposit: $99

HQ: USA

Platforms: Tradovate, NinjaTrader

Found in: 2020

TradeDay Licenses:

- TradeDay — registered in USA company number 08878676

Advertising Disclosure

Written by:

George Rossi

Updated:

Leverage: —

Regulation: USA

Min. Deposit: $99

HQ: USA

Platforms: Tradovate, NinjaTrader

Found in: 2020

TradeDay Licenses:

TradeDay is a proprietary trading firm that offers a variety of services and features for traders interested in futures trading. TradeDay provides an opportunity for traders to be evaluated and get funded account those who pass the evaluation can get funded accounts up to $250,000. The firm retains a 10% share of the profits, while traders keep 90%. The evaluation process is based on traders demonstrating their ability to be profitable, manage risk, and maintain discipline.

TradeDay offers a an opportunity to engage in Real Trading almost with no Funds needed but to become a Funded Trader meaning trade with Company Funds. All that trader have to do is pass a Test or Challenge to obtain Funded Account and then trade with a Company Account as a Professional Trader, read more about Prop Trading here. Yet, read more about our finds below as there are some efficient risks you need to consider before engaging.

| TradeDay Advantages | TradeDay Disadvantages |

|---|---|

| Lower Profit Target | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| Low Entry Requierments | Only MetaTrader Platform |

| Free Trial |

TradeDay is recognized as a legitimate proprietary trading firm and is based in Chicago, United States. This is supported by the company’s numerous good reviews and feedback. However, potential traders should still conduct their own research and assess their risk tolerance before engaging with the firm

We checked the company legit information through the official website and did not find evidence for the TradeDay company to be a scam. Yet, since Prop Trading Firms are almost no regulated by the financial authorities it is hard to define Scam or True nature of the firm.

As our professional advise, it is best to learn well about Prop Trading, understand risks and choose Company with a good reputation also one operate for many years so the proposal is more stable. Yet, since you do not invest much money to trading but just pay subscription fees the potential losses still considered lower if compared to engaging into Real Trading with your own funds.

| Fees | TradeDay | FTMO | The Funded Trader |

|---|---|---|---|

| Minimum Account Size | $10,000 | $10,000 | $50,000 |

| Fee | $99 | €155 | $289 |

| Maximum Account Size | $250,000 | $200,000 | $400,000 |

| Fee | $750 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

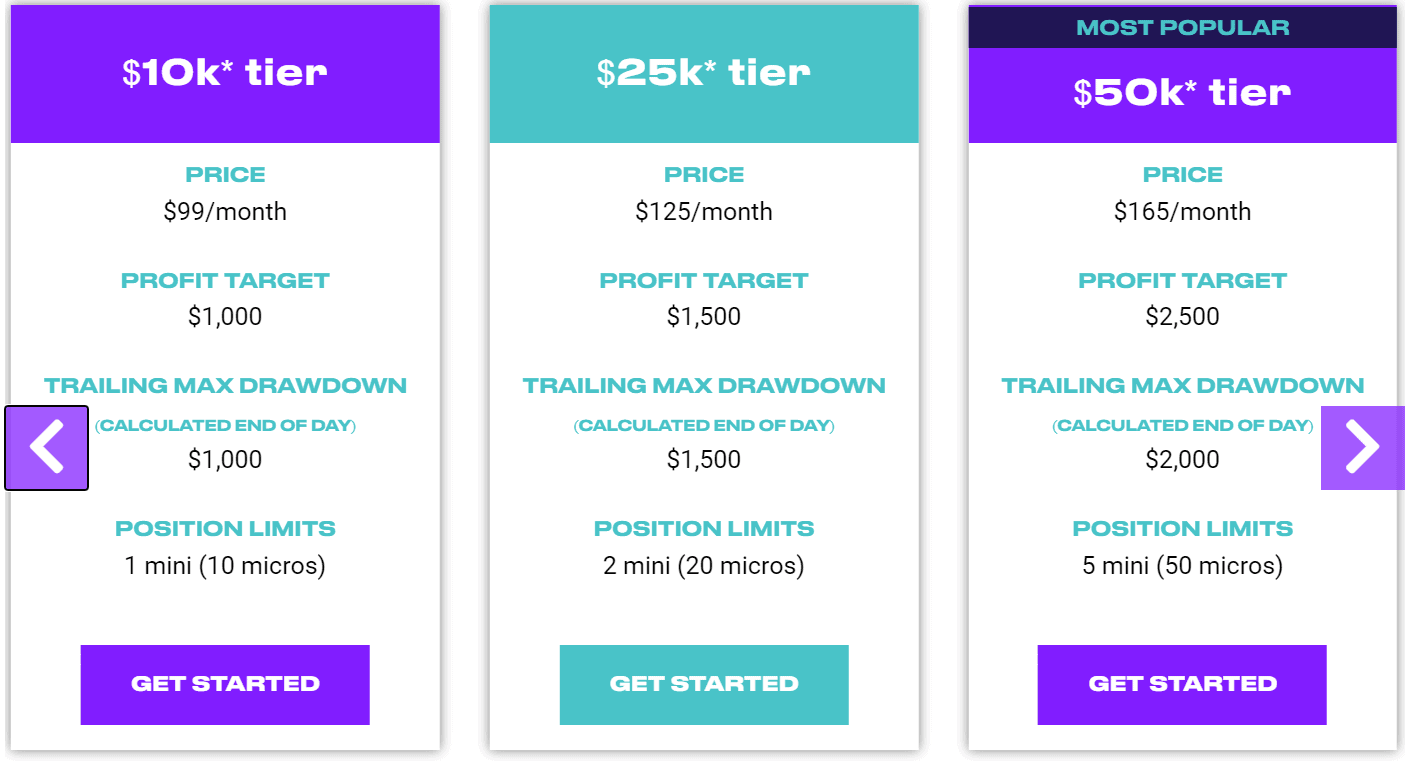

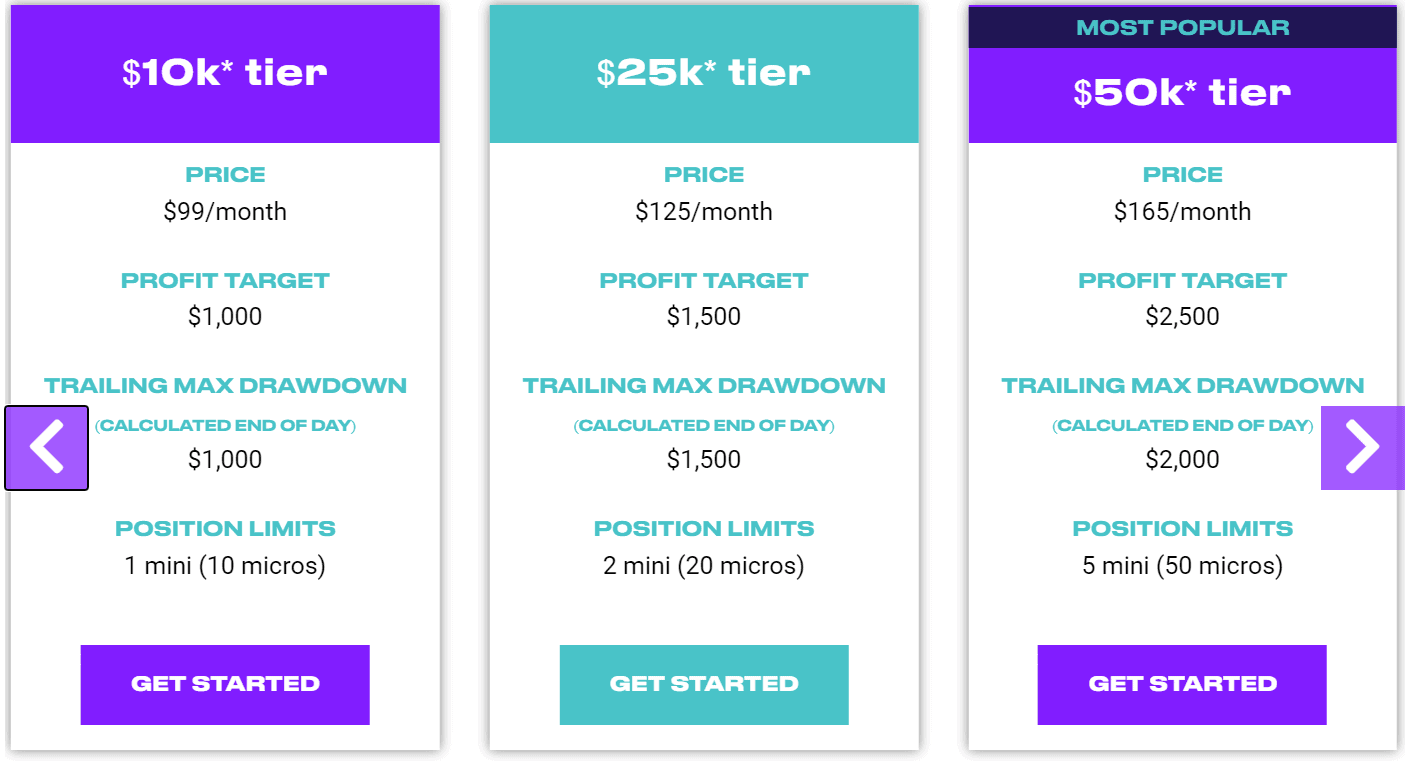

In the TradeDay evaluation process, the profit targets are set as percentages of the respective account sizes. These targets range from 4.8% to 10%, with higher account sizes generally having a lower percentage target. The aim is for traders to demonstrate their ability to achieve these targets while managing risk effectively

In TradeDay’s evaluation, maximum loss limits, or maximum drawdowns, vary with the account size, ranging from approximately 1.6% to 5%. These limits are set as trailing drawdowns, adjusting upwards with account balance growth but not downwards, to enforce effective risk management

There’s no set time limit for completing the evaluation, but traders need to trade for a minimum number of days. Also, positions cannot be held open overnight or over the weekend.

See detailed table with TradeDay Challenge conditions based on Account Size:

TradeDay offers a 14-day free trial for prospective traders. This trial allows individuals to explore the platform and its features without any financial commitment. During the trial period, traders can access the educational resources, trading platforms, and other tools provided by TradeDay, giving them a chance to evaluate the firm’s offerings and decide if it suits their trading style and goals

Once the test or the challenge is successfully passed trader will get his Funed Account set, which may typically take few business days to activate. It is important to note, that the account conditions and balance will be exactly as the one you qualify for in your test, in case you would like to change Account to higher grade there will be a need to pass test from the very beginning for the Account Balance you prefer to trade with.

At TradeDay once the targets achieved and Funded Account been granted, you will start trading on TradeDay Account with an 80% profit split which along the successful performance can be increased all the way up to 90% based on your performance, that we found in our evaluation quite attractive porposal.

At TradeDay, once traders qualify for and operate a funded account, they can withdraw their profits. The payout policy allows traders to keep the first $10,000 of profits made and then 90% of any profits thereafter. There are no restrictions on withdrawals, enabling traders to access their earnings.

TradeDay allows traders to withdraw profits via US bank wire (free), international bank wire ($15 fee), and crypto (Level 1 with $2.5 fee and gas fees, Level 2 free), with no restrictions on frequency and a $500 minimum withdrawal amount. Withdrawals are processed after daily trade reports at 4.30 pm CT

When assessing Account Conditions, we meticulously examine the Broker’s account preferences, including Platforms, Instruments, and Trading Costs. Equally important is verifying Leverage levels and Trading conditions, as certain Brokers may impose restrictions on strategies and disallow specific practices in Funded accounts. Failure to adhere to these conditions may lead to the loss of the Account, necessitating a reattempt of the assessment test. See the comprehensive breakdown below:

The firm specializes in futures trading and offers more than 50 instruments listed on exchanges like CME, CBOT, COMEX, and NYMEX. These include equity, currency, interest rate, energy, metal, agricultural, and micro futures.

TradeDay’s specific trading commission details are not publicly available as of my last update. Typically, proprietary trading firms set commissions based on the type of traded instruments, trade volume, and account types.

TradeDay does not provide additional leverage for its trading accounts. The firm operates with a 1:1 leverage ratio, which means traders can manage positions only up to the size of their funded account balance, without the use of extra leverage.

The key trading platforms supported by TradeDay include Tradovate, NinjaTrader, TradingView, and Jigsaw. These platforms are known for their robust features and are popular among traders for their advanced charting, analytics, and trading tools.

The company occasionally runs promotions offering TradeDay Coupons for discounts, which may also include TradeDay-specific discounts. However, it’s important to note that these conditions are typically temporary and subject to change. Therefore, it is advisable to verify the current offers upon signing in.

After thoroughly reviewing TradeDay, we find it to be a highly attractive opportunity for Funded Traders. The company offers competitive costs also free trial and provides various discounts with lower costs, presenting more opportunities for traders to engage with. This flexibility can significantly reduce expenses for traders.

However, it’s always wise to consider and compare proposals from other Prop Trading Firms. Some popular firms may offer similar conditions or cater better to specific trader preferences, such as offering a wider choice of instruments or platforms other than MetaTrader. Nevertheless, TradeDay boasts distinct advantages. Below, we’ve provided a selection of alternatives and a comparative table outlining TradeDay’s features against other companies.

No review found...

No news available.